Derivative Pricing and Hedging on Carbon Market

Texte intégral

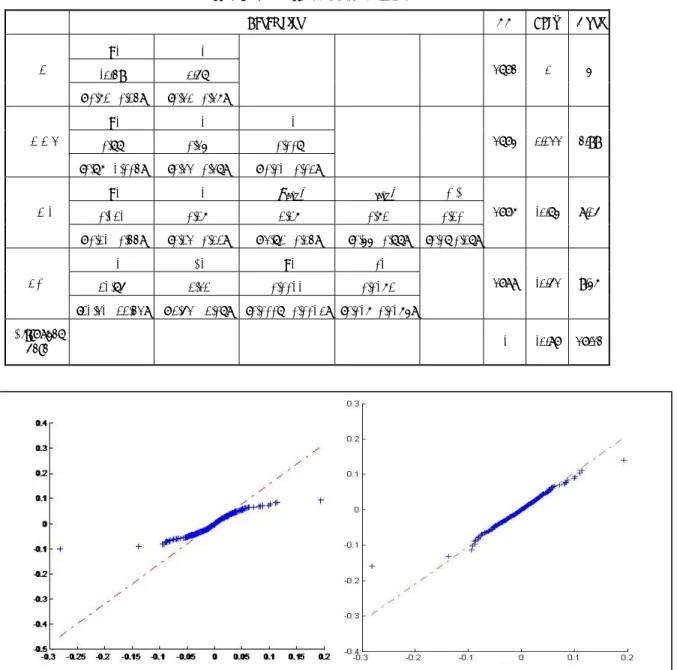

Figure

Documents relatifs

Land-use change and existing forests Timber products Reducing emissions from deforestation and forest degradation (REDD Afforestation and reforestation (AR) Improvements

We include the clumpy selection in order to ex- plicitly consider each branch of the classification tree that leads to the bar-feature question, but the threshold is deliberately

( مقر لودجلا 30 :) رادحنلاا ددعتملا رابتخلا ادأ ىلع يلخادلا قيوستلا داعبأ ريثأت نيلماعلا ء نايبلا ةبوسحملا (ةميق T ) رادحنلاا لماعم B ةيونعملا ىوتسم

In the present study, the effects of carbon dioxide on the electrical and dielectric properties of wheat gluten at 20% and 90% of relative humidity (usually found in food

• Bredin and Muckley (2011) have used the industrial production index computed by Eurostat to capture the influence of economic activity in their equilibrium model of phase II

They provide statistical evidence that two institutional events on April 2006, following the disclosure of 2005 verified emissions, and on October 2006, following the

Section 1 and 2 provide a detailed derivation of the hedging portfolio in a pure jump dynamics for the risky bond, whereas Section 3 deals with the more realistic case of a

Tous nos mobiliers sont livrés au 30 % de leur valeur au comptant — franco installés en votre appartement evec garantie — notre service de « crédit tous meubles » fera votre