Emerging Countries Sovereign Rating Adjustment using Market Information: Impact on Financial Institutions Investment Decisions

Texte intégral

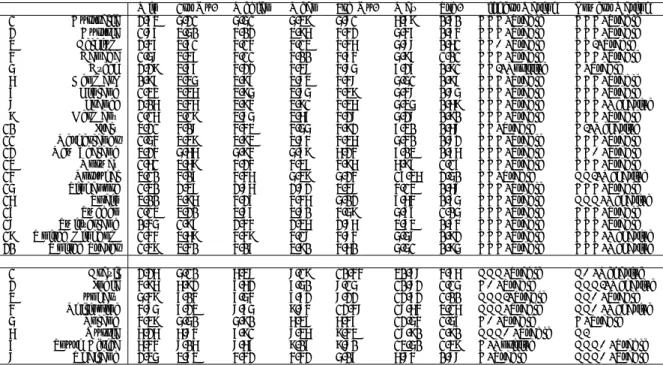

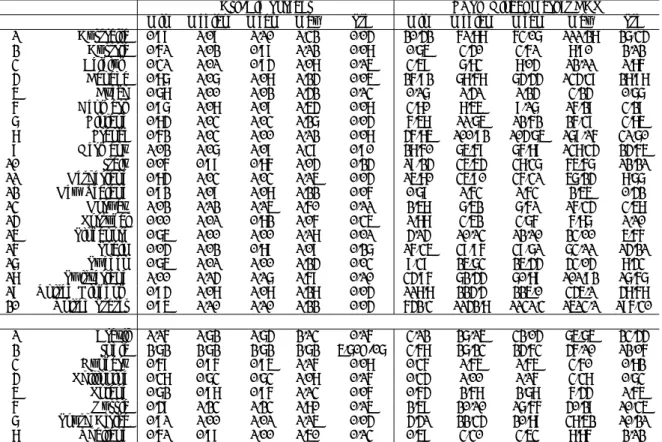

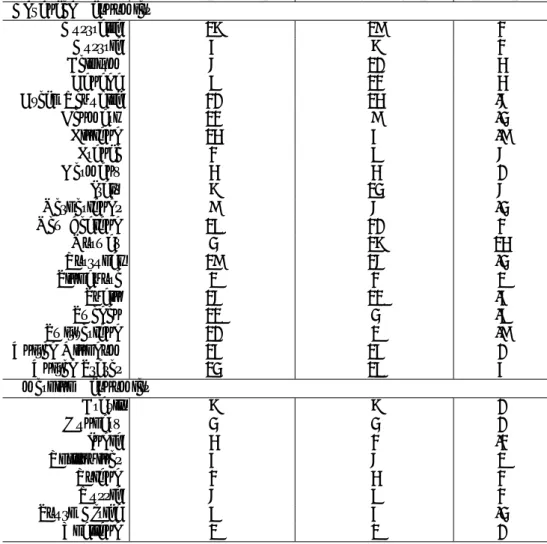

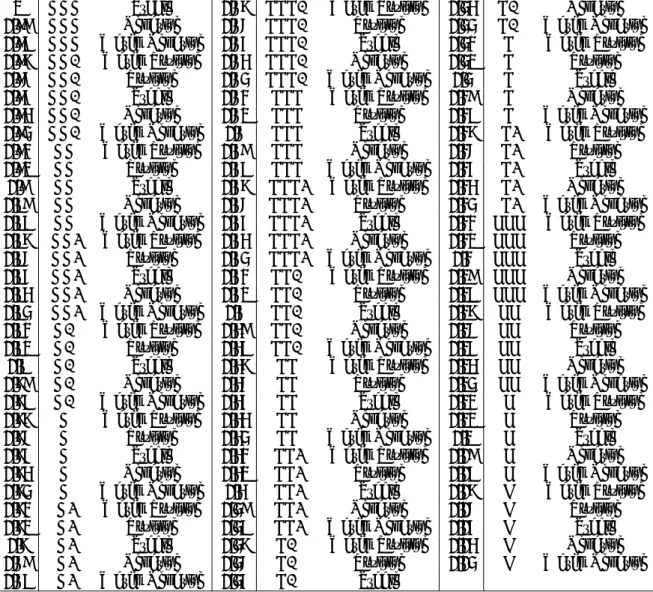

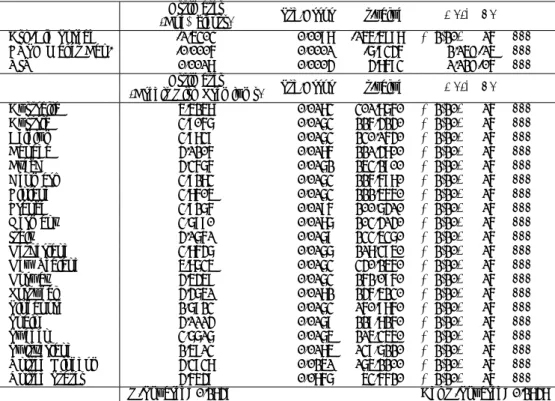

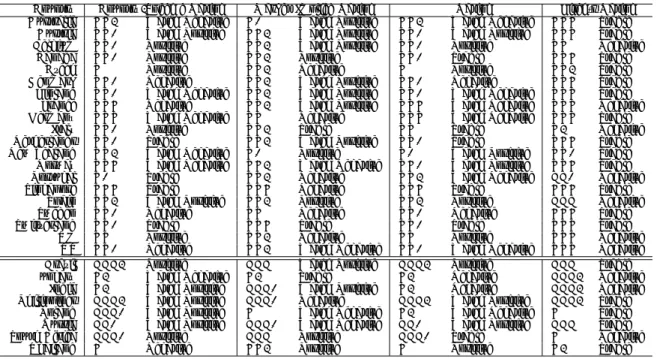

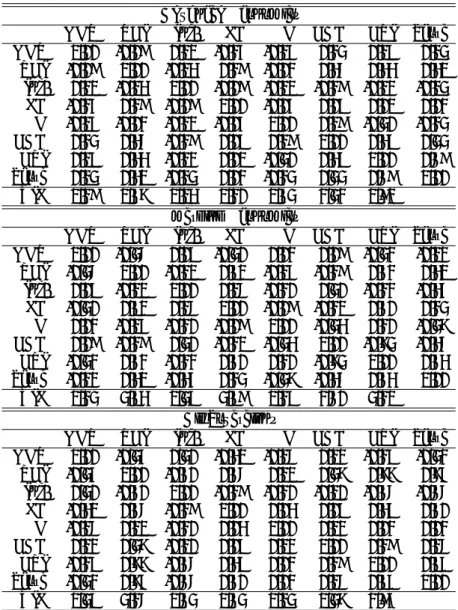

Figure

Documents relatifs

This article aims to pay more attention to the international sovereign CDS markets by providing additional evidence on their weak-form informational efficiency hypothesis and

Our group has contributed to the field of small molecule activation by extending this class of oxidative addition reactions with 3.1 to encompass insertion to N-H

L’accès à ce site Web et l’utilisation de son contenu sont assujettis aux conditions présentées dans le site LISEZ CES CONDITIONS ATTENTIVEMENT AVANT D’UTILISER CE SITE WEB.

Allerdings kann es sein, dass die Sponsoren welche während physischen Veranstaltungen durch ihren Werbestand sichtbar sind, den digitalen Anlass nicht unterstützen

In a process enterprise the key structural issue is… process standardization versus process diversity. There’s no one

A complete description of the model (Coppola et Al., 2003, Tomassetti et Al., 2003) is beyond the scope of this paper and we quickly describe here only a couple of aspects that

Puis, dans le chapitre 2 de notre travail, nous discuterons de la problématique en lien avec notre thématique qui sera la suivante : “Quelles sont les interventions infirmières

In addition, as small farmers’ market power is hindered by their lack of information on price levels and changes at different points of the marketing chain,