WORKING

PAPER

ALFRED

P.SLOAN

SCHOOL

OF

MANAGEMENT

DeterminantsofElectronic Integration inthe InsuranceIndustry:

An

Empirical TestAkbarZaheer and N. Venkatraman

Working

PaperNo.BPS

3330-91 Supercedes#BPS-3220

RevisedAugust 1991MASSACHUSETTS

INSTITUTE

OF

TECHNOLOGY

50MEMORIAL

DRIVE

CAMBRIDGE.

MASSACHUSETTS

02139

AkbarZaheer and N. Venkatraman

Workin2

Paper No.EPS

3330-91 RevisedAugust 1991 Supercedes#BPS-3220

Akbar

Zaheer

and

N.

Venkatraman

August

28, 1991Both authors contributed about equally. Please address correspondence to Professor N.

Venkatraman

at E52-537MIT

Sloan School ofManagement

Cambridge,MA

02139. (617) 253-5044; Bitnet: NVenkatr@Sloan.We

thank the Management in the 1990$ ResearchProgram and

the research consortium on Managing Information Technology in the Next Era(MITNE)

at the Centerfor Information Systerns Research, Sloan School ofManagement,

Massachusetts Institute of Technology, for financial support.

Our

particular appreciation toJohn Potteridge, Directory of Industry Affairs,

PIA

National for his support in the datacollection efforts and the principals in the independent insurance agencies for providing the data.

Determinants

of Electronic Integration

in theInsurance

Industry:

An

Empirical Test

Abstract

Electronic integration -- a

form

of vertical quasi-integration achievedthrough

the

deployment

of dedicatedcomputers

and communication

systems

between

relevant actors in the adjacent stages of the value-chain

~

isan important

concept to researchers in the information systems field since it focuseson

the role ofinformation technology in restructuring vertical relationships.

Drawing

on

theoretical

and

empirical researchon

transaction costs,we

develop

and

test amodel

of the determinants of thedegree

of electronic integration in thecommercial

segment

of the propertyand

casualty(P&C)

industry.Based

on

asample

of 120independent

agencies operatingunder

dedicated informationtechnology-mediated

conditions,

we

provide

empiricalsupport

for a generally-accepted proposition regarding the role of IT in influencing vertical relationships. Implicationsand

research extensions are identified toguide

further research in thisimportant

area.KeyWords:Information technology; vertical integration; electronic integration;

Introduction

This

paper

isconcerned

with the role of information technology ininfluencing the pattern of interfirm

arrangements

in a marketplace. It buildsfrom

the extensive

body

of researchon

the design of interfirm relationships that lie alonga

continuum from

markets to hierarchies (Williamson, 1985) to a specific contextwhere

such

relationships arefundamentally impacted

by

informationtechnology

(IT) applications (see for instance.

Cash

and

Konsynski, 1985; Keen, 1986; Johnstonand

Lawrence,

1988; Johnstonand

Vitale, 1988; McFarlan, 1984; Rockartand

ScottMorton,

1984; ScottMorton,

1991).While

there hasbeen

agrowing

interest in the role of IT to influence interfirm relationships, the research stream hasbeen

handicapped by

lack of rigorous theoretical articulations ofhow

and

why

IT influences these relationships (seeMalone,

Yates,and

Benjamin, 1986and

Gurbaxani

and

Whang,

1991 for exceptions) as well as empirical tests.To

address thisdeficiency, this

paper

adopts the transaction cost perspective (Williamson, 1975; 1985) to empiricallyexamine

the pattern of vertical relationshipsbetween

insurance carriersand

independent

agents^ that ismediated

by

dedicated IT applications.More

specifically,we

(a)develop

amodel

of electronic integration—

defined as a specificform

of vertical quasi-integration achievedthrough

thedeployment

of proprietary informationsystems

between

relevant actors in adjacent stages of the value chain-

and

(b) derive a set of its determinantsbased

on

the transaction costperspective that has

been

recentlyargued

tobe

relevant for settingsimpacted

by

IT applications (Bakosand

Treacy, 1986;Malone,

Yates,and

Benjamin, 1987;demons

and Row,

1988;Gurbaxani

and

Whang,

1991). Thismodel

is tested using datafrom

120 property

and

casualty(P&C)

agents interfacedwith

insurance carriersthrough

dedicated interorganizational informationsystems

(lOS)^ in the commercial lines segment. Subsequently,we

develop

implicationsand

directions for further researchTJieoretical Consideratiotis

We

develop our

theory as follows. First,we

provide a briefoverview

of the researchstream

on

the differentmechanisms

for organizationalgovernance

toargue

for conceptualizing electronic integration as a specificform

of quasi-integration that exploits IT capabilities. Subsequently,we

discuss the role oftransaction costs in vertical integration research

and

the specific influence of ITon

transaction costs to

develop

a set of determinants of electronic integration.Mechanisms

for OrganizationalGovernance

In

simple

terms, thetwo

traditionalmechanisms

for organizationalgovernance

are the firm (or the hierarchy)and

the market (Coase, 1937;Williamson,

1975)

~

where

a firm is defined in terms of those assets that itowns

or overwhich

ithas control

(Grossman

and

Hart, 1986; see also Pfefferand

Salancik, 1978)and

isengaged

in transactionswith

other firms in the market.The

firm coordinates the flow of materialsthrough

adjacent stages of a business processby

means

of rulesand

procedures

established within the hierarchy.The

market,on

the otherhand,

coordinates the

flow

of materialsbetween

independent

economic

entitiesthrough

the use of the price

mechanism

reflecting the underlying forces ofsupply

and

demand.

Taking

the firmand

themarket

aspure

forms, several intermediategovernance

mechanisms

have been

identified: long-term relational contracts (MacNeil, 1980; Stinchcombe, 1990), joint ventures (Harrigan, 1988), quasi-firms (Eccles, 1981),and

quasi-integration (Blois, 1972);more

generally,such

mechanisms

exemplify

non-classicaland

hybridforms

of contracting (Williamson, 1990).Collectively, these

mechanisms

areused

by

organizations tomaintain

control over the critical resources necessary for their success (Pfefferand

Salancik, 1978;Thompson,

1967). Vertical integration^ or hierarchical governance, hasbeen an

area of considerable research along multiple theoretical perspectives (see Perry, 1989 for aDeterminantsofElectronicIntegration.... 5

comprehensive

review),where

the transaction costmodel

(WilHamson,

1975, 1985) hasbeen

thedominant

perspective (Walker, 1988).Transaction Costs

and

Vertical IntegrationThe

transaction cost perspective contends that vertical integration is preferred overmarket exchange

when

thesum

of transactionand

production costs ofmarket

exchange

exceed those of hierarchy.The

critical determining condition for high transaction costs is the existence of transaction-specific assets (Williamson, 1975, 1985, 1989; Klein,Crawford,

and

Alchian, 1978) vdthin a broader context ofenvironmental

uncertainty, informationasymmetry due

tobounded

rationality,and

opportunism

in the presence of a limitednumber

of potential players in the marketplace.The

key

notion underlying this proposition is that behavioralconditions

(bounded

rationalityand

opportunism)

combine

with

environmental

conditions (small

numbers

exchange

and

uncertainty) to create highmarket

transaction costs.

The

genesis of these costs is the possibility of appropriation of quasi-rentsby

one

or the other partyfrom

the opportunistic reinterpretation ofunforeseen contingencies in

an

exchange

relationship. In order to avoid being 'held up' in thisway,

this perspective suggests a classic safeguard of internalization of the transactionthrough

vertical integration.Williamson

(1979; 1985) argues that asset specificity is amajor

determinant of transaction costs.He

contends that "thenormal presumption

that recurringtransactions...will be efficiently

mediated

by autonomous

market

contracting isprogressively

weakened by

asset specificity" (1979: p. 1548).The

basic proposition relating transaction costs togovernance

mechanisms

hasbeen

progressively refined with greater distinctionsamong

variousforms

of asset specificityand

increasing array of empirical research. For instance, constructs derivedfrom

thismodel

have been

adopted

as the determinants of:backward

integration(Monteverde

and

Teece, 1982; Masten, 1984; Masten,Meehan,

and

Snyder, 1989),forward

integration intodistribution (John

and

Weitz, 1988), preference for internal versus external suppliers(Walker

and

Poppo,

1991), sales force integration (Anderson, 1985;Anderson and

Schmittlein, 1984),make

versusbuy

incomponents

(Walker

and

Weber,

1984), contract duration (Joskow, 1987)and

joint ventures (Pisano, 1989).The

empiricalapproach

has generallybeen

one

of assessingwhether

theobserved

pattern ofrelationships

conforms

to predictionsfrom

the transaction cost reasoning; the resultshave

largelybeen

supportive.Electronic Integration

and

Transaction CostsRationale.

Within

thespectrum

of organizationalgovernance

mechanisms,

we

define electronic integration as 'a specificform

of vertical quasi-integration achievedthrough

thedeployment

of dedicated informationsystems

between

relevant actors in adjacent stages of the value-chain.' Further,

we

argue

that the transaction cost perspective that has served as adominant

theoreticalanchor

in vertical integration research has a central role inour

ability tounderstand

the nature of thisgovernance

mode

for the following reasons: costs are theorized to arise not onlyfrom

activities related to searching forand

gathering information in amarket

but alsofrom

writing, monitoring,and

enforcing contracts inan exchange

relationship. Since these costs are directly influenced

by

IT capabilities (Bakosand

Treacy, 1986;

demons

and

Row,

1989) there is a compelling logic to assess theimpact

of IT

on

modes

ofgovernance (Malone

et al, 1987;Gurbaxani

and

Whang,

1991).Malone

et al. (1987) classify theimpact

of IT into: electronic communication effects--through reduced

cost ofcommunication

whileexpanding

reach (timeand

distance); electronic brokerage effects—

increasing thenumber

and

quality of considerations ofalternatives, while decreasing the cost of transactions;

and

electronic (process) integration effects-

increasing the degree ofinterdependence

between

participantsinvolved in sequential business processes. Additionally, transaction costs are

DeterminantsofElectronicIntegration.... 7

capabilities of information processing,

which

can potentially mitigate the informationasymmetry between

the parties in theexchange

relationships.The

particularroleoffirm-specificlOS.Any

discussionon

the influenceofITon

the nature of business relationships

should

distinguish explicitlybetween

those applications reflecting acommon

electronic infrastructureand

those that are firm-specificand employed

to extend the scope of hierarchical governance.More

importantly, in theoretical terms, the

impact

of IT in a setting characterizedby

acommon

infrastructure (e.g.,ANSI

X.12 standards or industry-specific standards suchas those of the

Automotive

Industry ActionGroup,

AIAG)

is significantly differentfrom

a setting characterizedby

one

ormore

unique, proprietarylOS

(e.g.,the BaxterHealthcare

ASAP

network

or theAmerican

AirlinesSABRE

network). In theformer

case, there are strong competitive pressures to

move

toward

electronic market-likemodes

ofgovernance

given the potential reduction in transaction costs(Malone

etal, 1987)

and

benefits cannot be differentially appropriatedby

a firm since itscompetitors

have

relatively straightforward access to thesame

technologicalcapabilities.

However,

in the latter case, individual firmscommit

resources to create firm-specific IT-based capabilities for restructuring their relationships with relevant playersand

enlarging the scope of hierarchical governance.demons

and

Kimbrough

(1986) argue that competitiveadvantage

could resultwhen

the transaction costs arereduced

inan

asymmetricmanner.

Thus, it isentirely possible for the

deployment

of a unique, dedicated IT application toreduce

transaction costs for a

dyad

or a set ofdyads

relative to othermodes

ofexchange

available to competitors.

Extending

this logic,demons

and

Row

(1989)enumerate

aset of restructuring types that includes vertical integration

and

IT-enabled virtual integration. Indeed, their notion of virtualforward

integration as "the strategicnetwork

ofMcKesson

and

its customers achievemany

of the benefits of large chains withoutownership"

(page 345) is consistent with our conceptualization of electronicintegration. Similarly,

Gurbaxani

and

Whang

(1991) discuss the possibility of using firm-specific IT applications to illustratehow

IT can contribute to increasing the degree of vertical integrationby

expanding

the scope of a firm's activities.Conceptualization.

We

conceptualizethe degreeofelectronic integration as 'the level ofan independent

agent's dedication to a principalwhose

proprietarylOS

serves as the

primary

infrastructure for theconduct

of the business.' Thus, inour

conceptualization,

we

distinguishbetween

the principal --who

deploys

a proprietarylOS

toexpand

the scope of hierarchical controland

theindependent

agent --who

exercises a choice

between

accepting or rejecting the lOS.We

elaborateon

our

definition

by

applying

it tosome

of thewell-known

business relationshipsimpacted

by

proprietary lOS. Forexample,

in the case of Baxter'sASAP,

the principal refers to Baxter (previously,American

HospitalSupply

Corporation)who

deployed

theinterfacing system; the agent refers to the hospitals;

and

degree of electronic integration refers to Baxter's share of a hospital'spurchase

(given this proprietary infrastructure). Similarly, in the case of theSABRE

reservation system,American

Airlines is the principal, the

independent

travel agent is the agentand

thedegree

ofelectronic integration refers to the share of

American's

business within a pool of possiblebookings

of a travel agent.Our

Research

Model: Determinants

of Electronic Integration

AssetSpecificity

Asset specificity refers to the degree to

which

an

asset canbe redeployed

toalternative uses

without

sacrificing its productive value. This isan important

determinant

since it transforms the transaction context into a smallnumbers

bargaining situation.

Williamson

(1985)draws on

Polanyi's (1962) articulation of embeddedhuman

assetsand

Marschak's (1968) concept of unique assets to identify fourDeterminantsofElectronicIntegration.... 9

IT-mediated business relationships,

we

focuson

the business process asset specificity.This is important

because

the agent invests resources (timeand

money)

to exploitthe

system

functionalities to derive specificbusinesscompetences

from

thislOS

through lower

cost of information-exchange, faster response to inquiriesand

improved

service.More

specifically, business process asset specificity incorporates notions ofhuman

and proceduralasset specificities as discussed below.Human

asset specificity deals with the degree towhich

skills,knowledge

and

experience of the agent's personnel are specific to this

lOS-mediated

business process. This is consistentwith Anderson's

(1985) consideration of specializedhuman

knowledge

in sales operations given her focuson

the salesperson's role as an agent (versusan

employee); Masten, et al's (1990) conceptualization of specialized technicalknowledge

in ship building;and

John

and

Weitz

(1988)who

conceptualized

human

asset specificity in terms of the level of trainingand

experience specific to the product-line in distribution channels.

Procedural asset specificity refers to the degree of agent's

workflows

and

processes that are

customized

to exploitlOS

capabilities in accordancewith

the principal's requirements. This is consistentwith

the notion of organizational routines (Nelsonand

Winter, 1982)which

arehard

to alteronce

established;and

isparticularly relevant given the role of

lOS

infundamentally

impacting the business process. Ithasbeen

argued, for instance, thatproprietarylOS

such as theASAP

system

of Baxterembodies

"features built into the...system

tocustomize

thesystem

to a particular hospital's needs, in effect creating a procedural asset specificity in the relationships

between

thebuyer

and

seller"(Malone

et al., 1987;emphasis

added).We

draw

an analogy

here with the franchisingsystem

—

where

franchiseesare

sometimes

required tocommit

investments in transaction-specific capital,such

as renting land

from

the franchiser,making

it harder for the franchisees to(Williamson, 1985) since the incentives for the franchisee

have been

so structured as tomake

the termination of the relationshipmore

costly than itscontinuance

(Telser, 1981; Klein

and

Leffler, 1981). In the electronic interfacing context, the principal offers thelOS

bearingmost

of the initial costs to the agent. In return, the agent iscompelled

to invest in specific assets related to the customization of business processes, therebyimposing

on

the agent a certainexogenous

level of transaction specificity.These

investments in transaction-specific capital are the analog of the investments in landby

the franchiseesmentioned

above,and

render itmore costl}/for the agent to switch businessfrom the interfaced principal.

Thus, the

implementation

of a principal-specificlOS

createsnon-redeployable

specific assets (customized business processes

through

human

and

procedural asset specificities) that are costly to switch to alternative principals; consequently,market-based

exchange does

not provide anadequate

safeguard for the transaction-specific assets of the agent. Thus, v^e expect the agent to channelmore

business to the interfaced principal, ceteris paribus.We

formally hypothesize that:HI:

Asset specificity will bepositively related to the degreeof electronic integration.Trust

Trust is

an important

characteristic of interorganizational relationships.From

a transaction cost perspective, the focus hasbeen

on opportunism

—

defined as'self-interest seeking

with

guile' (Williamson, 1975, 1985). Indeed,Williamson

(1975) contrastsopportunism

with

"stewardship behavior",which

"involves a trust relation" (p.26). Trust is defined as 'the extent towhich

negotiations are fairand

commitments

are upheld'between

the parties in a relationship (Bromileyand

Cummings,

1991;Anderson and

Narus, 1990).We

argue

that trust canbe

viewed

as the obverse ofopportunism

(Jarillo, 1988), since it reflectsone

party's belief that itsDeterminantsofElectronicIntegration.... 11

(Anderson

and

Weitz, 1989).Such

aview

is in line with the theoretical reasoning in the negotiations literature (Pruitt, 1981) as well as the transaction cost perspective inwhich

trust isan

important determinant of long-term hierarchy-like relationships (Williamson, 1985; Aoki, 1990;Bromiley

and

Cummings,

1991).Beale

and

Dugdale

provide a succinctsummary

of the essential elements of trustamong

contractingbusinessmen:

[B]esides there being a

common

acceptance of certainnorms

within the trade, there

was

a considerable degree of trustamong

firms. Thiswas

particularly soamong

smaller firmswho

....frequently placed great trust in the fairness of one or

two

very large firms [E]venmore

important than the general reputationof the firm

was

the desire todo

business again with the otherparty..." (1975;

pp

47-48).Indeed

in this vein,from

an empirical point of view, trust hasbeen

demonstrated

to influence expectations of continuity (i.e. long-term relationships) asopposed

to short-term transactions akin tomarket exchange (Anderson

and

Weitz, 1989;

Dwyer,

Schurr,and

Oh,

1987).Extending such

conventionalarguments

for relating trust

and

hierarchy-like behavior to the specific context of IT-mediated exchange,we

contend

that trust isenhanced through

greater ease ofcommunication

between

the principaland

the agentunder

conditions of dedicated electronicinterfacing. Thus,

we

propose

the following hypothesis:H2: Trust will be positively related to thedegreeof electronic integration.

Reciprocal

Investment

Williamson

(1981, 1985) suggests that reciprocal investments in therelationship

by

the transacting parties offeran

alternative to vertical integration as ameans

of safeguarding specific assetsfrom

opportunism.

Specifically, this protective safeguard takes theform

of:"introduc(ing) regularities

which

supportand

signal continuityintentions. Expanding a trading relation from unilateral to bilateral

thereby to effect an equilibration of trading ha23rds..." (1981, p.183,

emphasis added).

One

form

of reciprocity is each party holding as 'hostage' a non-redeployabletransaction-specific investment, signalling a

commitment

to the continuation of the relationship (Williamson, 1985).To

the extent that the principalsand

the agents invest in specific resources to leverage IT capabilitiesand

restructure the nature of the transaction, this isan important determinant

of electronic integration. In empirical research, thiskey

construct has usuallybeen

neglected,with

the notable exception ofHeide

and

John

(1990).More

specifically, reciprocal investments are defined here as 'the extent towhich

the principal invests resources in the relationshipwith

the agent.' In this type of electronically-interfaced relationships, these refer to investments in theunderlying hardware,

softwareand communication

systems

as well as inproviding

customized

trainingand

support

to use the interfacing system. Since reciprocal investmentsmoderate

theneed

to safeguard assets, higher levels of reciprocal investmentsby

the other party to theexchange imply lower

extent of electronic integration or quasi-integration, ceteris paribus. Thus, the formal hypothesis is:H3:

Reciprocal investment will be negatively related to thedegree ofelectronic integration.Agent

SizeSize is

an important

variable in industrial organizationeconomics

(Scherer, 1980)although

its role in the transaction costframework

isambiguous

(Osborn

and

Baughn,

1990). Inour

research,we

expect that larger agentsmay

be

less dedicated to a single interfaced carrier than smaller agents. This isbecause such

dedicationwould

reduce

their ability to serve abroader

array ofmarket segments

and

customer

preferences (Stern

and

El-Ansary, 1977). Thus,we

introduce size as a control variableDeterminantsofElectronicIntegration.... 13

Methods

Research

SettingThe

propertyand

casuahy

(P&C)

insurance industry in theUSA

served as the setting for testing the research model. This industry iscomprised

oftwo

major

markets: (a) Ufe

and

heahh;and

(b) propertyand

casualty(P&C)

-- each with itsdistinctive set of products

and

channels of distribution.The

P&C

market

offers protection againstsuch

risks as fire, theft, accidentand

general liability.The

P&C

market

further breaks out into personaland

commercial

segments, theformer

covers individuals (automobile

and

homeowner

insurance forexample)

and

thelatter indemnifies

commercial

policy holders against general liabilityand

workers'compensation^.

The

distribution ofcommercial

lines occurs principallythrough independent

agents,

who

typically represent multiple carriersand

arecompensated

on

commission

terms.The

upstream

P&C

insurancemarket

consists of asmany

as 3600 insurance carriers. Conditions of high fragmentationand

low-cost entryand

exit result in intense price-based competitionand

accentuate the highly cyclical pattern of industry evolution.Approximately

300 carriershave

multiple offices^ but 20 to 30major

carriers account for about50%

of total industry revenues.Competition

in thedownstream

insurancemarket

(i.e.,among

insurance agencies) is also intensedue

to an increasedtendency

for bargain-huntingby

the insureds as well as agrowing

trendtowards

self-insuranceand

heightened competitionfrom

direct-writers. Volatile industry conditions are contributing toan

ongoing

consolidationamong

theagency

population

which

is accentuatedby

insurance carriers restructuring their operationsand

eliminating thepoorer-performing

agencies.Patterns of Electronic Interfacing

Common

electronic standards for policy information transferbetween

industry organization

ACORD,

and

in 1983 the Insurance ValueAdded Network

Services(IVANS)

was

established.However

the multipHcity ofagency automation

and

interfacing systems, as well as a

lukewarm commitment

to acommon

electronic infrastructureby

themajor

carriers,have prevented

IVANS

from

becoming

a true electronic market.Had IVANS

fulfilled its original role (of acommon

infrastructure electronic market),independent

agentswould

have

benefitted significantlyby

reducing

theirdependencies

on

anarrow

set of carriers,while

exploiting the fullbenefits of electronic brokerage effects.

Simultaneously, several leading

P&C

carriershave

deployed

proprietary interfacingsystems

tomore

tightly couple their business processeswith

those of theindependent

agentsand expand

theirdomain

of hierarchical control. This is akin towhat

Konsynski

and

McFarlan

(1990) labelan

'information partnership'which

can

confer benefits of scale

without

ownership.More

formally, thedeployment

of a proprietarylOS between

a focal carrierand

a set ofindependent

agents is aform

of'vertical quasi-integration' (Blois, 1972) that is rooted in IT capabilities. This is

specifically

termed

here as electronic integration that ismore

'hierarchy-like' (example: increased vertical referralsby

the agent to the interfaced carrier) than 'market-like' (example:spot-market

exchange).Data

Overview.

We

collected the required dataduring

Spring 1991by

means

of questionnairesmailed

to a stratifiedrandom

sample

of 400 electronically-interfacedindependent

agencieswho

aremembers

of the leading industry association, theNational Association of Professional Insurance

Agents

(PIA).Responses

were

received

from

120 agentswho

were

electronically-interfaced forcommercial

lines,representing

an

effective response rate of 30 percent.Assessment

ofnonresponse

DeterminantsofElectronicIntegration.... 15

Overton, 1977).

Within

this sample, themean

agency

size in terms of theannual

commercial

premium was

$4 million.Informant.

With

the objective ofminimizing

key-informant bias (Bagozziand

Phillips, 1982),

we

sought

to identifyknowledgeable

informant(s) as well as assess the feasibilityand

benefits of multiple informantsduring

the initialround

of interviews.As

most

agencies inour sample

areowner-managed,

we

chose theowner

asour

only informant sinceno

otherperson

has thevantage

point for providing the data relevant for this study. Thisapproach

is consistentwith

the generalrecommendation

to use themost

knowledgeable

informant(Huber

and

Power,

1985;Venkatraman and

Grant, 1986); as well as the research practice ofrelying

on

a single senior-level informant in studies involving small organizational units (see for instance. Daftand

Bradshaw,

1980). Inour

dataset, the averagenumber

of

employees handling commercial

lines withinan agency

isabout

five,implying

that it is appropriate to relyon

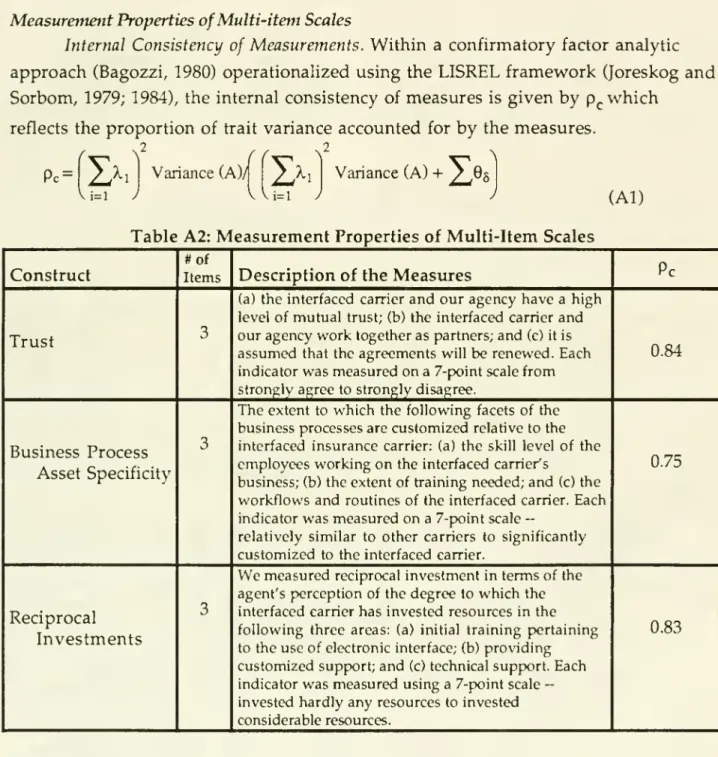

a single, senior-level informant.Measures

In the following paragraphs,

we

briefly describeour

approach

tooperationalizing the constructs

and

in theAppendix,

we

providesummary

results of themeasurement

properties of the multi-item scales as well as a matrix of zero-order correlationsamong

the indicators.Electronic Integration. Consistentwith

our

conceptualization ofelectronic integration as the degree of the agent's dedication to the interfaced principal (insurance carrier),we

operationalize it as the percentage of business (commercialpremiums) directed to the interfaced carrier through the proprietary electronic channel.

We

develop

a continuousmeasure

consistentwith

prior researchsuch

as: (a)John

and

Weitz

(1988),who

view

forward

integration as "percentage of direct sales to end-users" (p 345); (b)Masten

et al (1989),who

conceptualizebackward

integration as "the percentage ofcompany's

component

needs

produced under

thegovernance

ofthe firm" (p 269);

and

(c)Caves and

Bradburd

(1988)who

developed

a continuousmeasure

for vertical integrationbased

on

the share of industry outputs.We

assess theconvergent

validity of this single-item potentially falliblemeasure by

examining

its correlation

with

two

other indicators~

thenumber

of carriers that account for80%

of the agent's business as well as thenumber

of carriers thateach

account for at least2%

of the agent's business.The

values of the correlationswere

r=0.5847and

r=0.4788 both significant at p<.0l6.

Business ProcessAssetspecificity.

We

measured

business processassetspecificity in terms of the extent towhich

the following facets of the business processes arecustomized

relative to the interfaced insurance carrier: (a) the skill level of theemployees

working on

the interfaced carrier's business; (b) the extent of training needed;and

(c) theworkflows

and

routines of the interfaced carrier.Each

indicatorwas

measured on

a 7-point scale—

relatively similar to other carriers to significantlycustomized

to the interfaced carrier.Trust. Consistent

with

our

definition,we

operationalize trust using the following three indicators: (a) the interfaced carrierand

our

agency

have

ahigh

level of

mutual

trust; (b) the interfaced carrierand

our

agency

work

together as partners;and

(c) it isassumed

that theagreements

willbe renewed. Each

indicatorwas

measured on

a 7-point scalefrom

strongly agree to strongly disagree.Reciprocal investment.

We

measured

reciprocal investmentin terms of the agent's perception of thedegree

towhich

the interfaced carrier has invested resources in the following three areas: (a) initial training pertaining to the use of electronic interface; (b) providingcustomized

support;and

(c) technical support.Each

indicatorwas

measured

using a 7-point scale~

invested hardlyany

resources to invested considerable resources.Size. Size

was

operationalized in terms of the log of the total commercial linespremium

writtenby

the agency.DeterminantsofElectronicIntegration.... 17

Model

SpecificationOverview.

We

specify themodel

using the notations of structural equations that follow the estimation proceduresimplemented

in theLISREL7

program.

This analyticalscheme

operationalizes the analyticalmethods

proposed

by

Joreskogand

Sorbom

(for details, see Joreskogand

Sorbom,

1984;Hayduk,

1987). Thisapproach

allows the specification of

measurement

errors within abroader

context of simultaneously assessingmeasurement

propertiesand

structural relationships(Bagozzi, 1980).

One

of themain

advantages

of thisapproach

lies in its ability to statisticallycompare

the superiority ofcompeting

theoretical specifications (Bagozzi, 1980; Bagozziand

Phillips, 1982). Thus, while the use of the fit statistic alone as ameasure

ofmodel

acceptance hasbeen

criticizedby

several researchers, there isgeneral acceptance that

model

estimationsshould be based

on

comparison

of the theoretical specifications to alternative, plausible specifications within a nestedsequence (Anderson

and

Gerbing, 1988). Specifically, the superiority ofone

specification over another

competing

specification is givenby

the difference inx^

statistic (x^d),which

is asymptotically distributed as x^; these sequential chi-square difference tests are asymptoticallyindependent

(Joreskog&

Sorbom,

1984; Steiger, Shapiro,&

Browne,

1985).Within

this generalscheme,

Anderson and

Gerbing

(1988) suggestan

approach based

on

a set offive nested models.A

model,

M2

is considered nestedwithin another

model, Mi^

when

its set of freely estimated parameters is a subset of those estimated inMi

. In otherwords, one

ormore

parameters that are freelyestimated in

M]

are constrained inM2.

The

fivemodels

are as follows: (a) saturated model (Ms)—

where

all the parameters relating the constructs toone

another are estimated; (b) unconstrained model (M^) --which

specifies the 'nextmost

likely'unconstrained alternative specification; (c) theoretical model (Mf) --

which

representswhich

specifies the 'nextmost

Ukely' constrained alternative specificationwith

one

or

more

parameters

inMtare

constrained;and

finally, (e) null model(M^)

-

which

represents the null

model

with allparameters

relating the constructs toeach

other fixed at zero.Given

these specifications, the fivemodels

canbe

nested in asequence

as follows:

Mn

<

Mc

<

Mt

<

Mu

<

Ms

In practice, it is

adequate

tocompare

among

constrained, theoretical,and

unconstrained

models

sincecomparisons with

saturatedand

nullmodels

areusually satisfied along statistical criteria

(Anderson

and

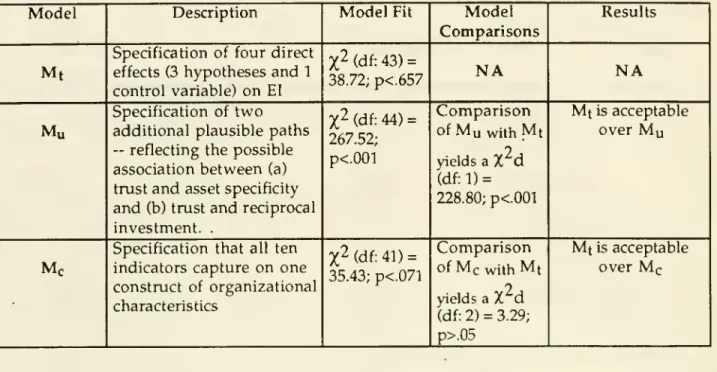

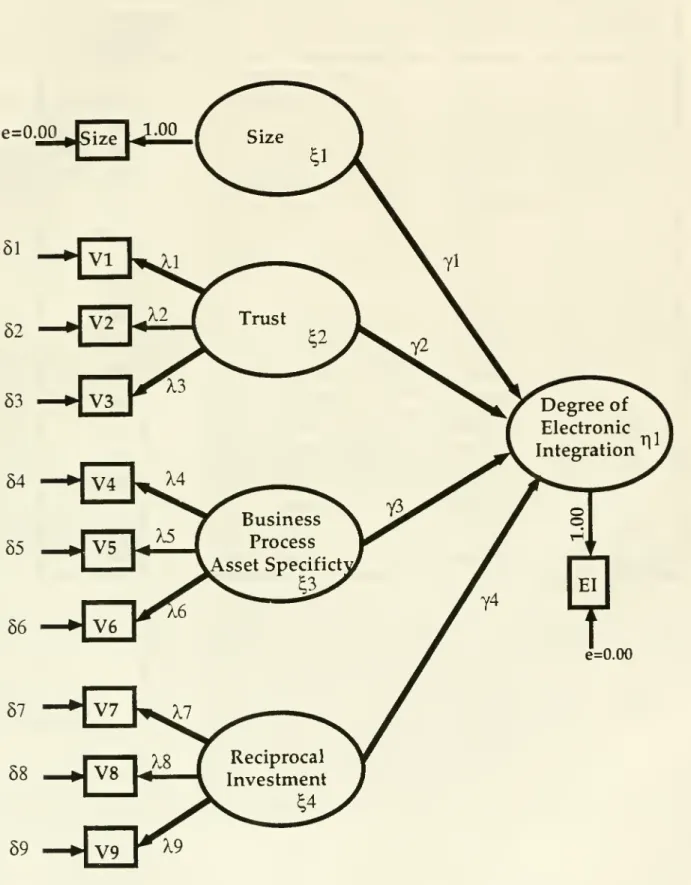

Gerbing, 1988). Specification of Models.We

specifythreemodels

as follows:Theoretical

Model (M^.

The

theoreticalmodel

specifies four direct effectson

EI-

three pertaining to thehypotheses

and

one

for the control variable.Unconstrained

Model

(MJ.

The

unconstrainedmodel

specifiestwo

additional plausible paths

~

reflecting the possible associationbetween

(a) trustand

asset specificityand

(b) trustand

reciprocal investment.The

theoreticalmodel had

constrained these paths tobe

zero,which

are unconstrained in this specification.Constrained

Model

(Mc).The

constrainedmodel

specifies that the eightindependent

indicators captureone underlying

construct of the agent's organizational characteristics (with thecorresponding

implication that the finer separation into the four constructs of asset specificity, trust, reciprocal

investment

and

size is spuriousand

unwarranted)

which

hasan

effecton

thedegree

of electronic integration.Results

Overview

Estimation of

Mt

usingLISREL7

yielded the following statistics:x^

(df: 43) = 38.72;p

<.657, indicating acceptable fit to the data. All theparameters

of theDeterminantsofElectronicIntegration.... 19

measurement

component

of themodel

indicate values in the acceptablerange

and

there are

no

offending estimates (such as: negative error variances).However,

as noted earlier, findingan

insignificantx^

does notimply

that there areno

bettermodels

given thesame

data. Indeed, following the logic ofAnderson

and

Gerbing

(1988),

we

estimate bothMc

and

Mu

as alternative constrainedand

unconstrained specifications respectively. Estimation ofMc

yielded the following statistics:x^

(df:44) = 267.52, p<.01, indicating

poor

fit to the data, while estimations ofMu

yielded the following statistics:x^

(df; 41)=

35.43^ p<.716, indicating acceptablefit to the data.Formal

Model

Comparisons

A

comparison

ofMt

withMc

indicates thatMt

is a better specification given that the difference inx^

for 1 degree offreedom

is 228.80, p<.01. Similarly, acomparison

ofMt

withMu

indicates thatMt

again provides a better fit to the data since the difference inx^

for 2 degrees offreedom

is 3.29, ns—

implying

that the theoreticalmodel,

Mt

withmore

degrees offreedom

is a better representation than the unconstrainedmodel

(seeAnderson and

Gerbing, 1988; Joreskogand

Sorbom,

1984 for additional discussions

on

model

comparisons). Table 1summarizes

theresults of testing the three models. Figure 1 represents the theoretical

model

that received strongest empirical support in this studyand

Table 2summarizes

theparameter

estimates corresponding to the theoreticalmodel

in Figure 1.(Insert Tables 1

and

2and

Figure 1 Here)Discussion

The

transaction cost perspective has served as thedominant

theoretical perspective in vertical integration research with particularemphasis

on

predicting the polarends

ofmarkets

and

hierarchies(more

commonly

referred asmake

versusbuy). In recent years, this perspective has

been

adopted

to explain intermediateFrazier,

and

Roth, 1990;Walker and

Poppo,

1991).Within

the researchstream

on

intermediate

forms

of governance, thisstudy sought

todevelop

and

test a researchmodel

of electronic integration-

aform

of vertical integration that exploits superior information processing capabilities --based

on

the transaction cost perspective.We

derived

our

rationale from: (a) prior use of this theoretical perspective to testvarious

forms

of organizationalgovernance

(Williamson, 1989) including vertical integration (Perry, 1989);and

(b) thecompelling

articulation of theimpact

of ITon

transaction costs

and

theconsequent

implications foreconomic

reorganization(demons

and

Row,

1989;Malone

et al, 1986;Gurbaxani

and

Whang,

1991).The

role of information technology in influencing the nature of business relationships hasgained

a significantamount

of acceptance in recent years, largelybased

on

anecdotal evidence (see for instance, McFarlan, 1984;Cash and

Konsynski,

1985;

Konsynski

and

McFarlan,

1990). Interestingly, such descriptionsinvoke

the logic of the transaction cost perspective using termssuch

as 'lock-in'and

'easy-to-do-business' but a systematic empiricalassessment

ofsuch

impliedhypotheses

hasbeen

absent. Thus,

our

empirical test is not only timely but also important.Our

theoreticalmodel

(Figure 1) received strong empiricalsupport

in the dataobtained

from

thesample

of 120independent

insurance agencies, each interfacedwith a focal carrier

through

dedicated lOS. First, the overallmodel was

found

to fitthe data very well

~

both in terms of absolute criterion (x^ valuesand

the associated p-values) as well as in terms of relative criterion(model

comparisons with

constrained

and

unconstrained models; see Table 1). Second, in terms of the specific hypotheses,HI

and

H2

~

relating business process asset specificityand

trust to thedegree

of electronic integration-

received strong empirical support.Both

coefficients

were

significant (72=

0.248, t=2.52 supportingHI;

and

73 = 0-31/ 1=3.267supporting H2).

The

third hypothesis, in contrast, received onlymarginal

support.DeterminantsofElectronicIntegration.... 21

weakly

significant (p<.10; one-tailed; less that the critical-value of 1.96 forLISREL

estimates to

be

significant).However,

collectively,we

conclude

that the theoreticalmodel

receivedadequate

empirical support indicating thatwe

have

aparsimonious

set of determinants of electronic integration that can serve as the basis for future empirical assessments. Thus, theprimary

contribution of thispaper

lies inproviding empirical support to a set of strong untested theoretical assertions relating to the role of information technology in influencing business relationships

from

a transaction cost perspective.It is particularly important to note that business process asset specificity

—

an

important conceptualization of asset specificity in a service sector like insurance

emerged

as a significant predictor of this intermediategovernance

mode.

This construct~

an important

empiricaldeterminant

in traditional transaction cost research~

has notbeen

a strong predictor in cases of intermediateforms

ofgovernance

(Klein, et al, 1990;Walker and

Poppo,

1991).Hence,

the strong resultobserved

here serves as a significant addition to thegrowing

body

of empirical findings in this area.In contrast to the

dominant

role of asset specificity, the level of empirical research attention to the role of trust hasbeen

somewhat

sporadic.Our

empirical resultsdemonstrate

theimportance

of trust in explaining the degree of vertical,quasi-integration.

We

contend

that the carrier's decision to offer electronicinterfacing

~

favorably consideredby

many

independent

agentsdue

to its efficiency benefits~

may

have an

important role to play in generating trust, but a useful area of extensionwould

be to assesswhether

the level of perceived trust is different across interfacedand

non-interfacedsamples

of insurance agents. Nevertheless,we

would

urge

that trust shouldbe

recognized asan

important construct in future research efforts.Reciprocal investment

~

as a counterbalance to asset specificity—

has recentlybecome

animportant

theoretical construct in researchon

distribution channelsand

interorganizational strategies. For instance,

Heide

and

John

(1988)found

this tobe

an important

construct in safeguarding assets;and

more

recently,Anderson and

Weitz

(1991)have

developed

amore

comprehensive

model

of buildingand

sustaining

commitment

in theexchange

relationships.Thus,

itwas somewhat

disappointing that this construct did not

have

a strong significant effect,although

the coefficient has the expected (negative) sign.

One

possible explanationmay

be that the strongassumptions

of efficiency ofgovernance

modes

in the transaction costframework.

As

Granovetter observed: "Beforewe

canmake

thisassumption

[of efficiency],two

further conditionsmust

be

satisfied: (i) well-definedand

powerful

selection pressurestoward

efficiencymust

be

satisfied;

and

(ii)some

actorsmust

have

the abilityand

resources to 'solve' the efficiency problem..." (1985; p.503).To

the extent that selection pressures for eliminating inefficientmodes

ofgovernance

areweak,

empirical resultsmay

notconform

to thenormative

theory.The

P&C

industry has recentlybeen

undergoing

a significant transformation characterizedby

widespread downsizing

by

the carriersand

significant consolidations in thenumber

of agentsby

asmuch

as25%

during

1980-1986''. Thus, data collected against

such

abackdrop

may

not support amodel

based

on

acomparative

statics efficiency perspectiveand

further research using thisconstruct is

needed

beforewe

can accept or reject this possible explanation.Research

Extensions1.Theory-constrauied versus theory-informed models.

Our

approachto thespecification of the research

model

of the determinants of electronic integrationwas

primarily constrained

by

extant theory in this area as well as the empirical research withinone

dominant

theoretical perspective: the transaction costframework.

ThisDeterminantsofElectronicIntegration.... 23

set of

hypotheses

on

anew

phenomenon

~

termed

as a 'theory-constrained'approach

tomodel

specification. Consequently, factors outside thedomain

of the underlying theory are explicitly excluded.Although

we

supported such

aparsimonious model,

another alternative is to identify abroader

set of factors that has the potential to explainand

/or predict thephenomenon

of interestfrom

severalcomplementary

theoretical perspectives—

termed

as a 'theory-informed'approach

tothe specification of research models.

Given

the relative recency of thephenomenon

of IT-induced transformation in

dyadic

business relationshipsand

lack of rigorous extant theories toguide

research in this area,one

attractive research extensionwould

be

todevelop

models

that subscribe to theoretical pluralism.Promising

set of theoretical concepts include: bargainingand

influence costs(Milgrom

and

Roberts, 1990); agent-theoreticarguments

(see for instance,Gurbaxani

and

Whang,

1991) as well as the resourcedependency

perspective (Pfefferand

Salancik, 1978).Such

an

approach

would

involve the specification of a larger set of constructs reflecting these theoretical perspectives in explainingand

predicting the degree of electronicintegration.

2.

Comparative

staticmodel

versusper-postdesign.An

importantextensionincorporating both theoretical

and

methodological considerations is astudy

where

itwould

be possible to test thesame

theoreticalmodel

acrosstwo

time periods for thesame

sample: before-and

after- electronic interfacing.By

collecting dataon

theindependent

and

dependent

variables attwo

time-periods,we

would

be

in a better position to recognize the temporalchanges

in the patternand

determinants of electronic integrationand

isolate theimpact

of the theoretically-specified determinants.3.

Use

of a controlgroupof non-interfacedagents.This studyadopted

a design,which

falls within the category of posttest only design(Campbell

and

Stanley, 1963).incorporating a control

group

of agents without the particularlOS

functionalities. Itwould

be

a logical extension toVenkatraman and

Zaheer

(1990)who

adopted

such a design tocompare

the effects of electronic interfacing but did notcompare

thecoefficients of determinants of quasi-integration across

two

samples:an

experimental

group

of agents operatingunder

conditions of electronic interfacingand

amatched

sample

of agents operatingunder

traditional business conditions.By

explicitly

comparing

the coefficients of determinants of quasi-integration across thesetwo

settings,we may

be

able to furtheradvance

the specific role of electronic interconnection in interorganizational relationships.Conclusions

Research

in the area of IT-induced interorganizational relationships is at critical crossroadstoday

as it attempts tomove

beyond

conceptualframeworks,

isolated case studies

and

untested assertions.Within

this general arena, thispaper

attempted

toprovide

empiricalsupport

for amodel

of electronic integrationbased

on

a transaction cost perspective.We

provide

generalsupport

for thetwo

traditional constructs—

namely:

business process asset specificityand

trust, while the third determinant, reciprocal investment,had

the expected sign butwas

onlyweakly

significant.

We

developed

implications for further research in thisimportant

area atDeterminantsofElectronicIntegration.... 25

References

Alchian, A. A. and H. Demsetz. (1972) "Production, information costs,

and

economic organization". American Economic Review, 62(5):777-795.Anderson, E. (1985). "The salesperson as outside agent or employee: a transaction cost analysis." Marketing Science, 4:234-253.

Anderson, E. and D.C. Schmitlein. (1984). "Integration of the sales force:

An

empirical examination". Rand Journal of Economics,15:3-19.Anderson, E., and B.Weitz. (1991), "The use of pledges to build

and

sustaincommitment

in distribution channels,"Working

Paper, Marketing Science Institute 91-114.Anderson, J.C

and

D. W.Gerbing (1988), "Structural equation modeling in practice:A

reviewand

recommended

two-step approach," Psychological Bulletin, 103 (May),411-423.Aoki,

M.

(1990). "The participatory generation of information rentsand

thetheory of the firm," in M. Aoki, B. Gustafsson,and

O.E. Williamson (eds.) The Firm asa Nexus of Treaties. London: Sage.Anderson, E., L.M. Lodish, and B.A. Weitz. (1987)."Resource allocation behavior in

conventional channels," journal ofMarketing Research, 24: 254-262.

Armstrong, J. S.,

and

T.S. Overton (1977), "Estimating nonresponse bias in mail surveys," Journal ofMarketing Research, 14,396-402.Bagozzi, R.P. Causal Models in Marketing,

New

York: Wiley, 1980.Bagozzi, R.P.

and

L.W. Phillips (1982). "Representing and testing organizational theories:A

holisticconstrual". Administrative Science Quarterly, 27:459-489.Bakos, J.Y. and M.E. Treacy (1986). "Information technology and corporate strategy:

A

research perspective."MIS

Quarterly,Junepp

107-119.Barrett, S.,

and

B. Konsynski (1982). "Inter-organization information sharing systems".MIS

Quarterly, SpecialIssue, 1982.Beale, H.,

and

T. Dugdale, (1975), "Contracts between businessmen: Planningand the use of contractual remedies," British Journal ofLaw

and Society,2,45-60.Blois, K.J. (1972) "Vertical quasi-integration" journal of Industrial Economics, 20,253-272.

Bromiley, P.

and

L.L.Cummings.

(1991). "Transaction costs in organizations with trust,"Working

Paper, Department of StrategicManagement,

Curtis L. Carlson School ofManagement,

University of Minnesota.Campbell, D.T. and J.C. Stanley (1963). Experimental and Quasi-experimental Designsfor

Research, Boston: Houghton-Mifflin.

Cash,J.I. and B. Konsynski, (1985), "IS redraws competitive boundaries, " Harvard Business

Review, 63 (2), ISA-Ul.

Caves, R.E.

and

R.M. Bradburd (1988). "The EmpiricalDeterminants of Vertical Integration", Journal ofEconomic Behaviorand Organization, 9:265-279.demons,

E. K.and

M.

Row

(1989), "Information Technologyand Economic

Reorganization." Proceedings of the 10th International Conference on Information

Systems. Boston, Mass:

December

1989.Clemons, E. K.

and

S.O.Kimbrough

(1986)."Information Systems, Telecommunications,and

their Effects on Industrial Organization, " Proceedingsof the Seventh International Conference on Information Systems, pp.99-108.

Coase, R. (1937), "The Nature of the Firm, " Economica, 4:386-405.

Daft, R.L., and P.J. Bradshaw, (1980), "The process of horizontal differentiation:

Two

Models," AdministrativeScience Quarterly, 25:441-484.

Dwyer, F.R., P.H. Schurr, and S. Oh. (1987)."Developing buyer-seller relationships," Journal

ofMarketing, 5V. 11-27.

Eccles, R. G. (1981). "The Quasi-Firm in the Construction Industry'" Journal of Economic Behaviorand Organization,2:335-357.

Etgar, Michael. (1976). "Effects ofadministrative control on efficiency of vertical marketing systems". Journal ofMarketing Research, 13:12-24.

Granovetter,

M.

(1985). "Economic actionand

social structure:A

theory ofembeddedness," American Journal ofSociology, 91(3): 481-510.Grossman,S.J.,

and

O.D. Hart, (1986) "Thecostsand

benefits of ownership:A

theory ofvertical and lateral integration, " Journal of Political Economy, 94, 691-719.

Gurbaxani, V.

and

S.Whang.

(1991). "The impact of information systems on organizationsand

markets," Communications of theACM,

January 1991.Harrigan, K.R. (1988). "Joint Ventures

and

Competitive Strategy, " Strategic Management/owrnfl/, 9:141-158.

Hayduk,

Leslie A. (1987), Structural equation modeling with LISREL. Baltimore: JohnsHopkins

Press.Heide, J.B.

and

G. John (1988)."The Role of Dependence-Balancing in SafeguardingTransaction-Specific Assets in Conventional Channels, " Journal ofMarketing, 52:20-35.

DeterminantsofElectronicIntegration.... 17

Huber, G.,and D.

Power

(1985). "Retrospective reports of strategic level managers" StrategicManagement journal,6: 171-180.

Jarillo, J.

C

(1988)."On

strategic networks". Strategic Management Journal, 9:31-41.John, G.,

and

B. Weitz (1988). "Forward integration into distribution:An

empirical test of transaction cost analysis". Journal ofLaw, Economics and Organization. 4:337-355.Johnston, H.R., and M.R. Vitale (1988) Creating competitive advantage with interorganizational information systems.

MIS

Quarterly,June, 153-165.Johnston H.R.

and

P.R. Lawrence (1988)."Beyond Vertical Integration—

theRise of the Value-Adding

Partnership, " HarvardBusiness Review,JulyAugust, pp.94-101. Joreskog, K. G. 1971. Statistical analysis ofcongeneric tests.Psychometrika, 36:109-133. Joreskog, K. G., and Sorbom,D. Eds. 1979. Advancesinfactoranalysis and structural equationmodels. Mass: AbtBooks.

Joreskog, K.G. and D.

Sorbom

(1984). Analysis of Linear Structural Relationships by Method ofMaximum

Likelihood. Chicago: National Education Resources.Joskow, P. (1987). "Contract duration

and

relationship-specific investments: empirical evidence from coal markets." American Economic Review 77:168-185.Keen,Peter

G.W.

(1986). Competing in Time. Cambridge,MA:

Ballinger PublishingCompany.

Klein, B. (1980), "Transaction costs determinants of 'unfair' contractual arrangements, "American Economic Review, 70, 356-362.

Klein, B., R.G. Crawford and A. A. Alchian (1978)." Vertical Integration, Appropriable Rents, and the Competitive Contracting Process, " Journal of

Law

and Economics,2\{2):297-326.

Klein, B., and K.B. Leffler.( 1981). "The role ofmarket forces in assuring contractual performance," Journal ofPolitical Economy, 89: 615-641.

Klein, S., G.L. Frazier, and V.J. Roth (1990),

"A

transaction cost analysismodel

ofchannel integration in international markets, " Journal ofMarketing Research, 27, 196-208.Konsynski, B.R., and

F.W

MacFarlan. (1990). "Information Partnership: Scale without Ownership. Harvard Business Review, September-October.Konsynski, B.R.,

and

A. Warbelow. (1989) "Cooperating to Compete:ModeUng

Interorganizational Interchange."

Mimeo.

Harvard Business School.Lawley,D. N. and Maxwell,A. E. 1971. Factor analysis as a statistical method. London: Butterworth.

Levy, D.T. (1985).

The

transactions cost approach to vertical integration:An

empirical investigation". ReviewofEconomics and Statistics. 67:438-445.MacNeil, I.R. (1980). The

New

Social Contract.New

Haven, CT: Yale University Press.Mahoney,

J.T. (1989). "The choice of organizational form: Vertical integration versus othermethods

of vertical control".Working

Paper No. 89-1622, College ofCommerce

and

Business Administration, University of Illinois at

Urbana-Champaign.

Malone, T. J., J. Yates and R. Benjamin. (1987). "Electronic markets

and

electronichierarchies". Communications of the

ACM.

30(6):484-497.Marschak,J. (1968). "Economics of inquiring, communicating, deciding," American Economic

Review,58: 1-18.

Masten, S. (1984). "The organization of production: Evidence from the aerospace industry". Journal of

Law

and Economics. 27:403-418.Masten, S.E., J.W.

Meehan

and E.A. Snyder (1989), "Vertical integration in theUS

Auto

industry" Journal of Economic Behavior and Organization, 12,265-273.

Masten, S.E., J.W.

Meehan

and E.A. Snyder (1991), "TheCosts ofOrganization" Journal ofLaw

Economics and Organization,Milgrom,

P and

J. Roberts, (1990)."Bargaining Costs, Influence Costs and the Organization ofEconomic Activity, " In J.E Alt and

K.H

Shepsle. Perspectives on PositivePoliticalEconomy. Cambridge, England:

Cambridge

University Press.Monteverde, K.

and

D. J. Teece. (1982). "Supplier svv^itching costsand

vertical integration in the automobile industry". Bell Journal ofEconomics, 13:206-213.Nelson, R.R. and S.G. Winter, (1982).

An

Evolutionary Theory ofEconomic Change, Cambridge,Mass: Harvard

Osbom,

R.N.,and

C.C. Baughn. (1990). "Forms of Interorganizational Governance forMultinational Alliances, " Academy ofManagement Journal, 33(3), 503-519.

Perry, M.K. (1989). Vertical Integration: Determinants

and

Effects" In R. Schmalanseeand

RD

Willig (Eds.) Handbook of Industrial Organization Vol. 1,Amsterdam:

ElsevierHolland. Chapter 4.

Pfeffer, J. and G.R. Salancik. (1978). TheExternal Control ofOrganizations.

New

York: Harperand

Row.

Pisano, G. P. (1989). "Using equity participation to support exchange: evidence from the biotechnology industry". JournalofLaw, Economics and Organization. 5(1):109-126.