Digitized

by

the

Internet

Archive

in

2011

with

funding

from

Boston

Library

Consortium

Member

Libraries

L

L5

Massachusetts

Institute

of

Technology

Department

of

Economics

Working Paper

Series

DEWE;

Adjustment

Is

Much

Slower

Than

You

Think

Ricardo

J.Caballero

Eduardo

M.R.A.

Engel

Working

Paper

03-25

July

21,

2003

Room

E52-251

50

Memorial

Drive

Cambridge,

MA

02142

This

paper

can be

downloaded

without

charge

from the

Social

Science

Research Network

Paper

Collection at

^SACHUSETTS

INSTITUTEAdjustment

is

Much

Slower

than

You

Think

Ricardo

J.Caballero

Eduardo M.R.A.

Engel*

July

21.2003

Absjract

In mostinstances, thedynamicresponseofmonetary andother policiesto shocksisinfrequentand lumpy.

The

sameholdsforthemicroeconomic responseofsome

ofthe mostimportanteconomicvari-ables,such as investment, labor demand,andprices.

We

show thatthe standard practiceofestimatingthespeed of adjustment of suchvariableswith partial-adjustment

ARM

A

proceduressubstantially over-estimatesthis speed. Forexample, forthe targetfederalfundsrate,we

find that the actual responsetoshocks is lessthan halfas fastastheestimated response. For investment, labor

demand

and prices,thespeed of adjustmentinferredfromaggregatesofasmallnumberofagentsislikely tobecloseto

instanta-neous. Whileaggregating acrossmicroeconomic unitsreducesthe bias (the limitofwhich isillustrated

by Rotemberg's widely used linear aggregate characterization of Calvo's model of sticky prices), in

some instancesconvergence isextremely slow. For example, evenafteraggregating investment across

all establishments in U.S. manufacturing, the estimateofits speed ofadjustment to shocks is biased

upward by morethan SOpercent. While thebias isnotas extremeforlabor

demand

andprices, it stillremainssignificantathigh levelsofaggregation. Becausethe biasriseswithdisaggregation, findingsof

microeconomicadjustmentthatissubstantiallyfasterthanaggregateadjustmentaregenerally suspect.

JEL

Codes: C22,C43,D2, E2, E5.Keywords: Speed of adjustment, discrete adjustment, lumpy adjustment, aggregation, Calvo model.

ARMA

process,partialadjustment,expected responsetime,monetarypolicy,investment, labordemand,sticky prices,idiosyncratic shocks,impulse responsefunction.

Wold

representation, time-to-build.'Respectively:

MIT

andNBER;

Yale UniversityandNBER.

We

aregrateful toWilliamBrainard,PabloGarcia,Harald UhligandseminarparticipantsatHumboldtUruversital.UniversidaddeChile(CEA)andUniversity ofPennsylvaniafor theircomments.

1

Introduction

The measurement

of thedynamic

response ofeconomic

andpolicy variables toshocksis ofcentralimpor-tance in

macroeconomics.

Usually,this responseis estimatedby

recoveringthespeedatwhich

the variableofinterest adjusts

from

a linear time-series model. In this paperwe

argue that, inmany

instances, thisproceduresignificantly underestimatesthesluggishness ofactualadjustment.

The

severity ofthis biasdepends

onhow

infrequent andlumpy

the adjustment ofthe underlyingvari-able is. In the case of single policy variables, such as the federal funds rate, or individual

microeconomic

variables, such as firm level investment, this bias can be extreme. If

no

source ofpersistence other thanthe discreteadjustmentexists,

we

show

thatregardless ofhow

sluggishadjustmentmay

be, theeconometri-cian estimating linear autoregressive processes (partial adjustmentmodels) will erroneously conclude that

adjustment isinstantaneous.

Aggregation across establishments reduces the bias, so

we

havethesomewhat

unusual situationwhere

estimatesofa

microeconomic

parameterusingaggregatedata arelessbiasedthanthosebasedupon

microe-conomic

data.Lumpiness

combined

with linearestimation procedures islikely togive the falseimpressionthat

microeconomic

adjustments is significantly fasterthanaggregateadjustment.We

alsoshow

that,when

aggregatingacrossunits,convergencetothecorrectestimate ofthespeedofad-justment isextremely slow. Forexample,forU.S. manufacturing investment,even afteraggregating across

all thecontinuousestablishments inthe

LRD

(approximately 10,000establishments), estimates ofspeed of adjustment are 80 percent higherthan actualspeed—

at the two-digit level the bias easilycan exceed400

percent. Similarly,estimating a

Calvo

(1983)model

using standard partial-adjustment techniques is likely tounderestimate thesluggishness ofpriceadjustments severely. This is consistentwith the recent findingsofBilsand

Klenow

(2002),who

reportmuch

slower speeds of adjustmentwhen

lookingat individualpriceadjustment frequencies than

when

estimating the speed of adjustment with linear time-series models.We

also

show

thatestimates ofemployment

adjustment speed experiencesimilarbiases.The

basic intuition underlyingourmain

resultsisthefollowing: Inlinearmodels,theestimatedspeedofadjustment isinversely related tothedegree ofpersistenceinthe data. That is.a largerfirstorder correlation

is associatedwith lower adjustmentspeed. Yetthiscorrelation isalways zeroforan individual series thatis

adjusted discretely (andhas i.i.d. shocks), sothat theresearcherwill conclude, incorrectly, that adjustment

is infinitely fast.

To

seethat thiscrucial correlation iszero,first notethat the productofcurrentand

lagged changesin the variableofconcerniszerowhen

thereisno adjustment ineither thecurrentor theprecedingperiod. This

means

that any non-zero serial correlationmust

come

from

realizations inwhich

the unitadjusts in

two

consecutive periods.But

when

the unitadjusts intwo

consecutive periods, andwhenever

itactsitcatchesupwith all accumulated shockssince itlastadjusted,it

must

bethatthe lateradjustmentonly involvesthelatestshock,which

is independentfrom

theshocks included in theprevious adjustment.The

bias falls as aggregation risesbecause the correlations at leads andlags ofthe adjustments acrossindividual units are non-zero. That is, the

common

components

in the adjustments ofdifferent agents atdifferent points in time provides the correlation thatallows us to recoverthe

microeconomic

speedofjustment.

The

largerthiscommon

component

is—

as measured, forexample, bythe variance of aggregate shocksrelativetothevariance of idiosyncraticshocks—

the fastertheestimateconvergestoitstruevalue asthe

number

ofagents grows. In practice,the variance ofaggregateshocks is significantly smallerthan thatofidiosyncratic shocks,

and

convergencetakesplaceatavery slowpace.In Section 2

we

study the bias formicroeconomic and

single-policy variables,and

illustrate its im-portancewhen

estimating the speed of adjustment ofmonetary

policy. Section 3 presentsour aggregationresultsandhighlights slow convergence.

We

show

the relevanceofthisphenomenon

forparametersconsis-tent with thoseofinvestment, labor,

and

priceadjustments inthe U.S. Section4 discussespartial solutionsand

extensions. It firstextends our results todynamic

equations withcontemporaneous

regressors, such asthoseusedinprice-wage equations,oroutput-gapinflation models. Itthen illustrates an

ARMA

method

toreducetheextentof thebias. Section 5concludes and isfollowed

by

an appendix withtechnical details.2

Microeconomic

and

Single-Policy Series

When

the task ofa researcher is to estimate the speed ofadjustment of a state variable—

or the implicitadjustment costs in a quadratic adjustment cost

model

(see e.g., Sargent 1978.Rotemberg

1987)—

thestandard procedure reducestoestimating variations ofthecelebrated partialadjustment

model

(PAM):

Ay,

=

X(y? ->,_,), (1)where

y and y* represent the actual and optimal levels of the variable under consideration (e.g., prices,employment,

orcapital),and

X

isa parameterthatcaptures the extent towhich

imbalances areremedied

ineach period.Taking firstdifferences

and

rearrangingtermsleadstothebestknown

form

ofPAM:

Ay,

=

(l-X)Ay,_!+v,,

(2)with v, =A.Ay*.

In this model,

X

is thought of as the speed of adjustment, while the expected time until adjustment(definedformallyinSection2)is(1

—

A.)/A. Thus,asA.convergestoone,adjustmentoccursinstantaneously,whileas

A

decreases, adjustment slowsdown.

Most

people understandthat thismodel

isonlymeant

tocapturethe first-orderdynamics

ofmore

real-istic but complicated adjustment models. Perhaps

most

prominentamong

the latter,many

microeconomic

variables exhibit only infrequent adjustment to their optimal level (possibly due to the presence of fixed

costs ofadjustments).

And

thesame

is true of policy variables, such as the federal funds rate set by themonetary authorityin responseto changes in aggregate conditions. In

what

follows,we

inquirehow

good

the estimates ofthe speed of adjustment fromthe standard partialadjustment approximation(2) are,

when

2.1

A

Simple

Lumpy

Adjustment

Model

Lety,denotethevariableof concernattimet

—

e.g.,thefederalfundsrate,aprice,employment,

orcapital—

andy* be its optimal counterpart.

We

can characterize the behavior of an individual agent in terms oftheequation: Av,

=S,(tf-y,-i),

(3)where

£, satisfies:Pr{L=l)

=

X. (4)Pr{^,=0}

=

1-X.

From

a modellingperspective,discreteadjustment entailstwo

basicfeatures: (i) periods of inactionfol-lowed

byabruptadjustmentstoaccumulated imbalances,and

(ii)increased likelihoodof anadjustmentwiththesizeoftheimbalance(statedependence).

While

thesecond featureiscentralforthemacroeconomic

im-plications ofstate-dependentmodels,itisnot neededforthe point

we

wishtoraise in thispaper. Therefore,we

suppress it.1

It follows from (4) that theexpected value of£,, isX.

When

h,t is zero, theagent experiences inaction;when

its value is one, theunit adjusts soas to eliminate the accumulated imbalance.We

assume

thath,, isindependentof (y*

-y,-i)

(this is the simplificationthatCalvo

(1983)makes

vis-a-vismore

realistic statedependent models) and therefore have:

E[Ay, |>>;.y,-i]

=

My,*-*-,),

(5)which

isthe analogof(1).Hence

X

represents theadjustmentspeed parametertoberecovered.2.2

The

Main

Result:(Biased)

Instantaneous

Adjustment

The

questionnow

arises asto whether,by analogy tothe derivationfrom

(1) to (2),the standard procedure ofestimatingAy,

=

(l-X)Ay,_,+£„

(6)recovers theaverage adjustment speed, X,

when

adjustment is lumpy.The

next proposition states that theanswer

to thisquestion is clearlyno.Proposition 1 (Instantaneous Estimate)

Let

X

denotetheOLS

estimatorofX

in equation (6). Let theAy*'sbei.i.d.withmean

and

varianceG

,'Thespecialmodel weconsider

—

i.e.,without feature(ii)—

isdue toCalvo (1983) andwasextendedbyRotemberg (1987)to showthat, witha continuumof agents,aggregatedynamicsare indistinguishablefrom those ofarepresentativeagent facing

quadraticadjustmentcosts. Oneofourcontributionsistogoovertheaggregationstepsinmoredetail,andshowtheproblemsthat

and

letT

denotethetimeserieslength. Then, regardlessof

the valueofX:plimy-^A.

=

1.

(7)

Proof See

Appendix

B.l. |While

theformal proof can be foundintheappendix, itisinstructive todevelopitsintuitioninthemain

text Ifadjustment

were smooth

insteadoflumpy,we

would

havetheclassical partial adjustmentmodel, sothatthe firstorder autocorrelation of observed adjustmentsis 1

—

A,therebyrevealing thespeed withwhich

units adjust. But

when

adjustment islumpy,the correlationbetween

this period'sand

thepreviousperiod'sadjustmentnecessarilyiszero,sothattheimpliedspeed of adjustment isone, independent ofthe truevalue

ofA.

To

seewhy

this is so, considerthe covariance ofAy, and Ay,_j, noting that, because adjustment iscomplete

whenever

itoccurs,we may

re-write (3)as:Ay,

=

&

£

Ay,*_,=

{ (8)

Ay?_*

=

\

otherwise

where

/, denotesthenumber

of periods since thelastadjustment tookplace, (asofperiod/)Table 1:

CONSTRUCTING THE

MAIN

COVARIANCE

Adjustint

—

)t Adjustint Ay,_i Ay, ContributiontoCov(Ay,

,Ay,-1

)

No

No

Ay,Ay,_,=0

No

Yes Ay,* Ay,Ay,_,=0

Yes

No

5t'oAy;_,

I-* Ay,Ay,_i=0

Yes

YessjbiAtfi,

I-* Ay;Cov(Ay,_,,Ay,)=0

There are fourscenariosto consider

when

constructingthe key covariance (see Table 1): Iftherewas

no adjustment in this and/or the last period (three scenarios), then the product of this and last period's

adjustment iszero, sinceat least

one

ofthe adjustmentsis zero. Thisleavesthecase of adjustmentsin bothperiods as the only possiblesource ofnon-zero correlation

between

consecutive adjustments. Conditional on havingadjustedbothin/and/—

1,we

haveCov(Ay,

,Ay,_,|

£,=£,_,

=

1)=

Cov(Ay,* , Ay,*_,

+

Ay,*_2+

••

+

Ay?.^

)

=

0,sinceadjustmentsinthisandthepreviousperiod involveshocksoccurringduringdisjointtimeintervals.

Ev-erytimetheunitadjusts,itcatches

up

withall previousshocksithadnot adjustedtoand

startsaccumulating shocks anew. Thus, adjustmentsat differentmoments

intimeareuncorrelated.2.3

Robust

Bias:Infrequent

and

Gradual Adjustment

Suppose

now

that in addition tothe infrequentadjustment pattern described above, once adjustment takesplace, it is only gradual.

Such

behavior is observed, forexample,when

there is a time-to-build feature ininvestment (e.g.,

Majd

and Pindyck (1987)) orwhen

policy isdesigned toexhibit inertia (e.g..Goodfriend(1987),

Sack

(1998), orWoodford

(1999)).Our

main

result here is that the econometrician estimating alinear

ARMA

process—

aCalvomodel

with additional serialcorrelation—

will onlybeable to extract thegradual adjustment

component

but not the source of sluggishnessfrom

the infrequent adjustmentcompo-nent. That is,again,the estimated speed of adjustmentwillbetoofast, forexactly the

same

reason as inthesimplermodel.

Let us modify ourbasic

model

so that equation (3)now

applies for anew

variable y, in place ofy,,with Ay, representing the desiredadjustment of the variable thatconcerns us, Ay,. This adjustment takes placeonly gradually, forexample, because ofa time-to-buildcomponent.

We

capture this pattern withtheprocess:

K K

Ay,

=

X

<bkAy,-k+

(!-]£

<h)Ay,.

(9)

k=] k=\

Now

there aretwo

sourcesof sluggishness inthe transmission ofshocks. Ay*, tothe observedvariable. Ay,.First, theagentonly acts intermittently,accumulating shocks inperiods with

no

adjustment. Second,when

he adjusts,he doessoonly gradually.

By

analogy with thesimplermodel, suppose theeconometrician approximatesthelumpy component

ofthe

more

generalmodel

by:Ay,

=

(l-k)Ay,-i+v,.

(10)Replacing(10) into (9),yieldsthefollowing linearequation interms oftheobservable. Ay,:

K+\

Ay,

=

£a*Ay,_

A.+

E,, (11)*=i with a\

=

<j)i+

l-A., ak=

to-O-XJfc-i,

k=

2,...,K, (12) «A'+1=

-(l-A.)<|>Ki ande,=

Ml-Z*Lj<MArf.

By

analogyto thesimplermodel,we

now

show

that the econometrician will miss thesource ofpersis-tence

stemming from

X.Proposition 2

(Omitted

Source

ofSluggishness)Let all the assumptions in Proposition 1 hold, with y in the role

of

y. Alsoassume

that (9) applies.with all rootsofthepolynomial 1

- Xf

=i<|)it^*

outside theunitdisk. Let a^.k

=

1K+\

denotetheOLS

Then:

plim-r^Ok

fa, k=

l,...,K(13)

phm

r^

<x>d K+i=

0.Proof

SeeAppendix

B.l.Comparing

(12)and

(13)we

seethatthe proposition simplyreflects the fact thatthe (implicit)estimateof

X

isone.The

mapping from

the biased estimates ofthea^s

tothespeed of adjustment isslightlymore

cumber-some,but theconclusionis similar.

To

see this, letus definethefollowing indexofexpected response timetocapturethe overall sluggishnessintheresponseof

Ay

toAy*:*>0

dAy,+k

dAy* (14)

where

E,[J denotes expectations conditional on information (that is, values ofAy

and Ay*)known

attime/. This indexisaweighted

sum

ofthecomponents

ofthe impulse responsefunction, withweights equal to thenumber

ofperiodsthatelapse until the corresponding responseis observed.3 Forexample, animpulse response with the bulk ofitsmass

atlow

lagshas a small value ofx, sinceAy

responds relatively fast toshocks.

It is easy to

show

(see PropositionsAl

andA2

in theAppendix)

that both for the standard PartialAdjustment

Model

(1)andforthe simplelumpy

adjustmentmodel

(3)we

havel-X

More

generally, forthemodel

with bothgradualand

lumpy

adjustment described in (9),the expected responsetoAy

satisfies:T

iLiWk

whilethe expected responsetoshocks

Ay*

isequal to:41-*

,lk=iWk

*

i-ZLi**

(15)

3

Notethat,forthemodelsathand,theimpulse responseisalways non-negativeand adds uptoone.

When

theimpulseresponsedoesnotadd uptoone, the definitionaboveneedstobe modifiedto:

t

_

S*>o*E,[^]

4

Let uslabel:

1-A

tlum

=

yItfollows that thatthe expected response

when

both sources of sluggishness are present is thesum

ofthe responsestoeach onetaken separately.We

cannow

statetheimplication of Proposition 2 for theestimated expected timeofadjustment,t.Corollary 1 (Fast

Adjustment)

Lettheassumptions ofProposition2 holdand

letxdenotethe (classical)method

ofmoments

estimatorforxobtainedfrom

OLS

estimatorsof

Ay,

=

^

akAy,_k+

e,.k=\

Then:

plimr

_„x

=

Xii„<

x=

xi,n+

xlum. (16)withastrictinequalityfor

X

<

1.Proof

SeeAppendix

B.l. |To

summarize, the linear approximation forAy

(wrongly)suggestsnosluggishness whatsoever, so thatwhen

this approximation is plugged into the (correct) linear relationbetween

Ay

and Ay, one source ofsluggishness is lost. This leads to an expected response time that completely ignores the sluggishness

caused

by

thelumpy component

of adjustments.2.4

An

Application:

Monetary

PolicyFigure 1 depicts the monthly evolution ofthe intended federal funds rate during the

Greenspan

era.5The

infrequent nature ofadjustment ofthis policy variable is evident in the figure. It is also well

known

thatmonetary policy interventions often

come

in gradual steps (see, e.g.. Sack (1998) andWoodford

(1999)).fitting the descriptionofthe

model

we

justcharacterized.Our

goal is to estimate bothcomponents

ofx, X| in and Xium. Regarding the former,we

estimateAR

processesfor

Ay

with anincreasingnumber

oflags,untilfindingnosignificantimprovement

inthegoodness-of-fit. This procedure is warranted since Ay, theomitted regressor, is orthogonal to the lagged Ay's.

We

obtainedan

AR(3)

process,with T|inestimatedas2.35 months.Ifthe

lumpy component

is relevant,the (absolute)magnitude

of adjustments ofAy

should increasewiththe

number

ofperiods since the last adjustment.The

longerthe inaction period, the larger thenumber

of shocks in Ay* towhich

yhas not adjusted,and hencethe larger the varianceofobserved adjustments.To

testthis implication oflumpy

adjustment,we

identified periods withadjustmentiny asthosewhere

theresidual fromthe linear

model

takes (absolute) valuesaboveacertainthreshold,M.

Next

we

partitioned5The

Figure 1:

Monthly Intended(Target)FederalFundsRate-9/1987- 3/2002

those observations

where

adjustment took place intotwo

groups.The

first group included observationswhere

adjustmentalso tookplacein thepreceding period,sothatthe estimatedAy

only reflectsinnovationsofAy* in

one

period.The

secondgroup

considered the remaining observations,where

adjustments tookplaceafteratleastone periodwith

no

adjustment.Columns

2 and 3 in Table 2show

the variances ofadjustments in the firstand second group described above, respectively, for various values ofM.

Interestingly, the variancewhen

adjustments reflects onlyone

shockis significantly smallerthan the variance ofadjustmentstomore

than one shock(seecolumn

4). Iftherewere no

lumpy component

at all (k=

1), therewould

be no systematic differencebetween

bothvariances, since they

would

correspond to arandom

partition ofobservationswhere

the residual is largerthan

M.

We

thereforeinterpretour findingsasevidencein favor ofsignificantlumpy

adjustment.6To

actuallyestimate the contribution ofthelumpy

component

tooverall sluggishness,we

need

toesti-mate

thefractionofmonths

where an adjustmentiny tookplace. Sincewe

onlyobservey,we

requiresome

additional information to determinethis adjustment rate. If

we

hada criterion to choose the thresholdM,

thiscouldbereadily done.The

factthattheFed

changesratesbymultiplesof 0.25 suggeststhatreasonablechoicesfor

M

arein the neighborhoodofthisvalue.Columns

5 and 6inTable 2report the valuesestimatedfor

X

andt/„m

for differentvaluesofM.

Forallthesecases,the estimated lumpinessis substantial.An

alternativeprocedureistoextractlumpinessfrom

thebehaviorofy, directly. Forthisapproach,we

used four criteria: First, if y, -£yt-\ andy,_]

—

y,_2 then an adjustment of y occurred at /. Similarly if a"reversal"

happened

at t, thatis,if y,>

y,_i andy,_i<

y,_2 (ory,<

y(_i andy,_i>

y,_2).By

contrast, if y,=

>v_i,we

assume

thatno

adjustmenttook place in period /. Finally, ifan "acceleration" took place atTable 2:

ESTIMATING

THE

LUMPY COMPONENT

(1) (2) (3) (4) (5) (6)

M

Var(Ay,|^=

ll

^_i

=

l) Var(Ay,|^=

1,^_,

=0)

p-valueA

xlum0.150 0.089 0.175 0.092 0.200 0.117 0.225 0.145 0.250 0.150 0.275 0.164 0.300 0.207 0.325 0.207 0.350 0.224 0.213 0.032 0.365 1.74 0.221 0.018 0.323 2.10 0.230 0.051 0.253 2.95 0.267 0.060 0.206 3.85 0.325 0.034 0.165 5.06 0.378 0.016 0.135 6.41 0.378 0.045 0.123 7.13 0.378 0.045 0.123 7.13 0.433 0.041 0.100 9.00

Forvarious values of

M

(seeColumn1),values reportedintheremainingcolumnsareasfollows.Columns2and3: Estimatesofthe varianceof Ay, conditionalonadjusting, for observationswhereadjustmentalsotook

place theprecedingperiod (column2)andwithnoadjustment inthe previous period(column3). Column4:

p-value,obtainedviabootstrap,forbothvariancesbeingthesame,againstthealternativethatthelatterislarger.

Column5:Estimates ofX.Column6: EstimatesofTjum.

t, so thatyt

—

y(_i>

y,_i—

»_?

>

(ory,—

>V-i<

y,-\—

yt-i<

0),we

assume

that yadjusted at r. Withthesecriteria

we

cansort156

out ofthe 174months

in oursample

into (lumpy) adjustment taking placeor not. Thisallows ustobound

the (estimated) valueofA.between

theestimatewe

obtainby assuming

thatno adjustment took place in the remaining 18 periodsand

that inwhich

all ofthem

correspond toadjustmentsfory.

Table 3:

MODELS

FOR

THE

INTENDED

FEDERAL

FUNDS RATE

Time-to-build

component

Lumpy

component

Tl t2 $3 T-lin

Kmn

''•max ^lum.min ^lum.max0.230 0.080 0.231 2.35 0.221 0.320 2.13 3.53 (0.074) (0.076) (0.074) (0.95) (0.032) (0.035) (0.34) (0.64)

Reported: Estimationofbothcomponentsofthesluggishness indexx. Data: Intended(Target)

FederalFundsRate,monthly, 9/1987-3/2002.Standarddeviationsinparenthesis,obtainedvia Delta

method.

Table 3

summarizes

ourestimates ofthe expected response time obtained with this procedure.A

re-searcher

who

ignores thelumpy

nature ofadjustments onlywould

considertheAR-component

andwould

infer a valueofx equal to2.35 months. Yetonce

we

consider infrequent adjustments, the correct estimate ofx is

somewhere between

4.48and 5.88 months.That

is, ignoring lumpiness (wrongly) suggests aresponsetoshocks thatis approximately twiceasfastasthe true response.7

Consistent with our theoretical results, the bias in the estimated speed of adjustment stems

from

the7

infrequentadjustmentof

monetary

policytonews.As

shown

above,thisbiasisimportant, since infrequentadjustment accounts forat least halfofthesluggishnessin

modern

U.S.monetary

policy.3

Slow Aggregate

Convergence

Could

aggregation solve theproblem

for those variableswhere

lumpiness occurs at themicroeconomic

level? In the limit, yes.

Rotemberg

(1987)showed

thatthe aggregate equation resultingfrom

individual actionsdrivenby

theCalvo-model

indeedconvergesto thepartial-adjustment model. Thatis,asthenumber

of

microeconomic

units goesto infinity, estimation ofequation (6) for theaggregate does yieldthe correctestimateofX,

and

thereforex. (Henceforthwe

return tothesimplemodel

withouttime-to-build).Butnotall is

good

news. In thissection,we

show

thatwhen

thespeed of adjustment isalready slow,thebias vanishesveryslowlyasthe

number

ofunits intheaggregate increases. Infact,inthecase ofinvestment even aggregatingacrossall U.S. manufacturing establishmentsisnotsufficient toeliminatethe bias.3.1

The

Result

Letus define the N-aggregate

change

attimet,Ayf,

as:^=ii><v,

where

Ay,, denotesthechange

inthe variableofinterestby unit iin periodt.Technical

Assumptions

(Shocks)Let Ay*

t

=

v^+

vf,,where

the absence ofa subindexi denotes an element

common

to all i (i.e, thatremains afteraveragingacrossall f's).

We

assume:1

.

thev^'s arei.i.d.with

mean

/^ andvarianceo

2A

>

0,2. the vj,'s areindependent(acrossunits,overtime, and with respecttothev^'s),identicallydistributed

with zero

mean

andvarianceoj>

0,and3. the 2^/s are independent (across units, overtime, and withrespect tothe v^'s

and

v^'s), identicallydistributed Bernoulli

random

variableswith probabilityofsuccessX G

(0,1]. |As

inthesingleunitcase,we

now

askwhether

estimating6tf

=

(l-X)Arf_

1+e

l, (17)yields a consistent (as

T

goes to infinity) estimate ofX,when

the truemicroeconomic model

is (8).The

followingproposition answersthisquestion

by

providing anexplicitexpressionforthebias asafunction ofthe parameterscharacterizingadjustmentprobabilities and shocks(X.fi^,

Ga

andG/) and,most

importantly,N.

Proposition 3 (Aggregate Bias)

Let

X

N

denotetheOLS

estimatorofX

in equation(17). LetT

denotethetime serieslength. Then, underthe TechnicalAssumptions.

plim^J."

-

X

+

i=-,

(18) 1+

A

ith Itfollowsthat:K

=

2^

V .\\

, (19) lim plimr_>00A

w

=

X. (20)N—

•<» Proof SeeTheorem

Bl

in theAppendix. ITo

see the source ofthebiasand

why

aggregation reduces it,we

beginby

writingthe first orderauto-correlation, pi,asanexpression thatinvolves

sums

andquotients of fourdifferentterms:^

Cov(A

3f

,Ay* ,)=

[/VCov(Ayi.,.Ayi.,-i)+

N{N

-

l)Cov(Ay

u

,Ay2 ,,_1)]//V2

Pl

Var(Ay?) [A/Var(Ay„)

+

/V(N-

l)Cov(Ay,.f,Ay2.,)]/iV 2where

thesubindex 1 and 2inAy

denotetwo

different units.The

numeratorof (21) includesA

7(bysymmetry

identical) first-orderautocovarianceterms, oneforeachunit, and

N(N

—

1) (also identical) first-order cross-covariance terms,one

foreach pair ofdifferent units.Likewise, the denominator considers

N

identical variance terms andN

(N

~

1) identicalcontemporaneous

cross-covariance terms.

From

columns

2 and 4 in Table 4we

observe that the cross-covariance terms underPAM

andlumpy

adjustment are thesame.8 Sincetheseterms will dominatefor sufficiently large

N

—

thereareN(N

—

1) ofthem,

compared

toN

additional terms—

itfollowsthatthebias vanishesasN

goestoinfinity.8

Thisissomewhatremarkable,since theunderlyingprocessesare quitedifferent. Forexample,consider thefirst-order

cross-covariance term. In thecase ofPAM,adjustmentsat alllags contributetothecross-covariance term:

Cov(Ay,,,,Ay2,,_1)

=

Cov(X£(1

-X)

kA/U

-k.*X0

-^'^-l-/)

*>o ;>o=

X

X2(l-X)w+,

Cov(AyI i,_Jt ,Aj5 il_1_l)5>

:u-*)

2/+ IBycontrast, inthe case of thelumpyadjustmentmodel,thenon-zerotermsobtainedwhencalculating thecovanance betweenAyj.,

and Ayij-1 areduetoaggregateshocksincluded both intheadjustmentofunit1 (in;)andunit2(inI

—

1). IdiosyncraticshocksTable4:

Constructing

the

First

Order

Correlation

(1) (2) (3) (4)

Cov(Ayi

ir,Ayiif_i)Cov(Ay

u

,Ay2.t-i) Var(Ay,,,)Cov(Ay

M

,Ay2i,)(1)

PAM:

^(l-XKoJ

+

of)&(i-*)<>3

nK+°;)

2-X°A

(2)

Lumpy

(fiA=

0):&(l-*)°5

°5

+

G/2-X°A

(3)

Lumpy

((iA7^0):-(1-X>2

&0-*K

°iW

+

^

tf2-X°A

However,

the underlying biasmay

remain significant for relatively large valuesofA

7.

From

Table4

itfollows that thebias forthe estimated first-orderautocorrelation originates

from

the autocovariance terms included in both the numerator and denominator.The

first-order autocovariance term in the numeratoris zero for the

lumpy

adjustment model, while it is positive underPAM

(this is the biaswe

discussed inSection 2).

And

even though thenumber

of terms with thisbiasisonlyN,

compared

withN(N

—

1)cross-covanance

terms withno

bias, themissing termsare proportional toG

A+

rj2, while those thatareincludedareproportionalto

g

a2,which

isconsiderably smallerinall applications. This suggeststhat thebias remainssignificant for relatively large values of

N

(more on this below)and

that this bias rises with the relativeimportanceof idiosyncratic shocks.

There

is asecond source ofbiasonceN

>

1,relatedtothe varianceterm Var(Ayi,) in thedenominator

ofthefirst-ordercorrelation in (21).

While

underPAM

thisvariance is increasing in A,varyingbetween

(when

A

—

0)andG

A+

a

2(when

A

=

1),when

adjustmentislumpy

thisvarianceattainsthelargestpossiblevalueunder

PAM, G

A+

o~2,independent oftheunderlyingadjustment speedA.Thissuggests thatthebiasismore

importantwhen

adjustmentisfairly infrequent.9Substitutingthetermsinthenumerator and denominatorof (21)

by

theexpressions inthe secondrow

ofareirrelevant as farasthecovarianceisconcerned.Itfollowsthat:

Cov[Ayi,,,Ay2 ,,-i|E,i,,

=

1,£2,1-1=

UuA^i]

=

min(lh,-l,/ 2,,-i)a^,and averagingover/], and/2,1-Lboth ofwhichfollow (independent) Poissonprocesses,

we

obtain:Cov(Ayi,„Ay2,,_1

)=

^(l-X)^,

(22)whichistheexpressionobtainedunderPAM.

9To

furtherunderstandwhyVar(A>'i,)canbesomuch largerinaCalvomodelthan withpartialadjustment,wecomparethe

contributionto thisvariance ofshocksthattookplacek periods ago, V^,.

For

PAM

wehaveVar(Ay„)

=

Var(£

X(l-X)*AyJf_k)

=

X2

£

(1-X)a

Var(AyJ,_,), (23)k>0 k>0

Table4, anddividing numerator and denominator by

N(N

-

1)X/(2—

X) leads to:1-X

Pl

=

n

-

?3fv

(24)This expressionconfirms our discussion. It illustrates clearly that the bias is increasing in

G//ga and

de-creasing inA.andN.Finally,

we

note that a value of/x^ 7^ biases the estimates of the speed of adjustment even further.The

reason for thisis that itintroduces a sort of"spurious" negative correlation in thetime series ofAyi,.Whenever

the unitdoesnotadjust, itschangeis,inabsolutevalue,below

themean

change.When

adjustmentfinally takesplace,pent-up adjustments are

undone

andtheabsolute change, on average,exceeds \ha\.The

product ofthese

two

termsis clearly negative,inducingnegative serialcorrelation.10Summing

up, the biasobtainedwhen

estimatingX

with standard partial adjustment regressions can be expected to besignificantwhen

eitherct^/g/,N

orX

is small, or |it.i| is large. Figure 2 illustrateshow

X

N

converges to X.

The

baseline parameters (solid line)are 11,4=

0, A.=

0.20.Ga

=

0.03and G/=

0.24.The

solid line depicts the percentage bias as

N

grows. ForN

=

1,000, the bias is above100%; by

the timeN =

10.000, it is slightlyabove 20%.

The

dash-dot line increasesOa

to 0.04. speedingup

convergence.By

contrast, thedash-dot line considersjxa=

0.10,which

slowsdown

convergence. Finally,thedotted lineshows

thecasewhere

X

doubles to0.40.which

alsospeeds up convergence.Corollary 2

(Slow Convergence)

The

biasintheestimatoroftheadjustment speedisincreasinginG/and

I/I41and

decreasinginOa

•N

and

X. Furthermore, thefour parameters

mentioned

above determine the biasofthe estimator viaa decreasingexpressionofK.' '

Proof

Trivial. I sothat ^PAM=X

2 (1_

x) 2* (02+o

2)Bycontrast, inthecase oflumpyadjustmentwehave

viunw

=

Fr{/i,,=Jk}VSff(Ay,il|/,/=t)

Pr{/,., =A-}[AVar(Ay,,|/„

=

1,1;,.,=

1)+

(I-X-)Var(Ay,,,|f,,r=

0,&=0)]=

\(\-\)

k-l[lk{<?A+<$)}.

VktismuchlargerunderthelumpyadjustmentmodelthanunderPAM.Withinfrequentadjustmenttherelevantconditional

distri-bution isamixture ofamassatzero (correspondingtonoadjustmentatall)andanormaldistribution withavariancethatgrows

linearlywithk(correspondingtoadjustmentint ). UnderPAM.bycontrast, V;, isgeneratedfromaanormaldistributionwithzero

meanandvariancethatdecreaseswithk.

We

alsohavethat/i,*^

further increasesthebiasduetothe varianceterm,see entry(3,3) inTable4."Theresultsfora/ andkmaynot holdif\nA\ islarge. Fortheresults toholdweneed

N

>

1+

(2-X)tiA2/\a2A.When

Ma=

uthisisequivalentto A'

>

1andthereforeisnot binding.Figure2:

BiasasafunctionofNforvariousparameterconfigurations

to en 180 160 140 120 S" 100 a °- 80 1000 2000 3000 4000 5000 6000 7000 8000 9000 10000 Numberofunits:N 3.2

Applications

Figure 2

shows

thatthebias in theestimate ofthe speed of adjustmentis likely toremain significant, evenwhen

estimatedwithveryaggregateddata. In thissectionwe

provideconcreteexamples based onestimatesforU.S.

employment,

investment,andpricedynamics.These

series areinterestingbecausethereisextensiveevidenceoftheirinfrequentadjustmentat themicroeconorruc level.

Letusstartwith U.S. manufacturing

employment.

We

use theparametersestimatedby

Caballero,Engel,andHaiti

wanger(

1997) withquarterlyLongitudionalResearchDatafile(LRD)

data. Table5shows

thatevenwhen

N

—

1,000,which

corresponds tomany

more

establishmentsthan in atypical two-digit sectoroftheLRD.

thebias remainsabove

40

percent. That is, estimated speeds ofadjustment atthe sectoral level are likelytobesignificantly fasterthanthe true speed of adjustment.The good

news

in thiscaseis thatforN

=

10,000,which

is aboutthesize ofthecontinuoussample

inthe

LRD,

thebiasessentiallyvanishes.The

results for prices, reported in Table 6, are based on the estimate ofX, Haand

04.from

Bils andKlenow

(2002), while a/is consistentwiththatfound inCaballeroetal (1997).,2The

tableshows

that theTogofromthea;computedforemploymentinCaballeroetal.(1997)tothatofprices,wenotethatifthedemandfacedbya

monopolistic competitivefirmisisoelastic,itsproduction functionisCobb-Douglas, anditscapital fixed(whichisnearly correct

athighfrequency),then (uptoa constant):

P*a

=

(w

i-flir)+

-°-l)1'iwhere p* andI* denote thelogarithms offrictionlessprice andemployment, w, anda,, are the logarithm of thenominalwage

andproductivity,anda^isthelaborshare. Itisstraightforwardto seethataslongasthe mainsourceofidiosyncratic varianceis

demand,whichweassume,a/.

~

(1—

a/Jo-/,..

Table 5:

Slow Convergence: Employment

Average

X

Number

of agents(N) 100 1,000 10.000Number

35 ofTime

200

Periods (T) 0.901 0.631 0.523 0.852 0.548 0.436 0.844 0.532 0.417 0.400Reported: averageof

OLS

estimates of X,obtainedviasimulations. Numberofsimulationschosentoensurethatnumbersreportedhaveastandard deviationless

than 0.002. Case T

=

°°calculatedfromProposition3. Simulationparameters:X:0.40,jxa

=

0.005.aA=

0.03,o/=

0.25.Quarterlydata,fromCaballeroetal.(1997).

biasremains significantevenfor

N

=

10,000. In thiscase,themain

reason forthe stubbornbias isthe highvalueof0/

/oa

Table6:

SLOW

CONVERGENCE:

PRICES

Average

X

100Number

ofagents(N) 1,000 10,000Number

60

ofTime

500

Periods (7) 0.935 (if)14 0.908 0.542 0.902 0.533 0.351 0.279 0.269 0.220Reported: average

OLS

estimatesofX, obtainedviasimulations. Numberofsimulationschosentoensurethatnumbersreportedhaveastandard deviationless

than 0.002. Case

T =

«*>calculatedfromProposition3. Simulation parameters:X: 0.22 (monthlydata,Bilsand Klenow, 2002),nA

=

0.003,aA=

0.0054, a,=

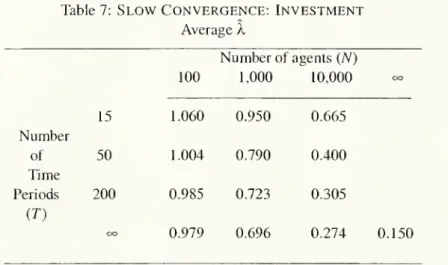

0.048.Finally, Table 7 reports the estimatesfor

equipment

investment, the most sluggish of the three series.The

estimate ofX,fi^ ar)d Oa<arefrom

Caballero,Engel,and

Haltiwanger(1995),and rj/ isconsistentwiththat found in Caballeroet al (1997).13

Here

the bias remainsvery large and significant throughout.Even

when

N —

10,000,theestimatedspeedofadjustmentexceedstheactualspeedbymore

than80

percent.The

,3

To go fromthe07computedforemploymentinCaballeroet al(1997)to thatofcapital,wenotethatifthedemandfacedbya

monopolisticcompetitive firmisisoelasticanditsproductionfunctionisCobb-Douglas,then07,.

~

a/.. .reasonsforthisisthecombination ofalowA.,ahigh\iA (mostlyduetodepreciation),and a largerj/ (relative to

a

A).Table 7:

SLOW

CONVERGENCE: INVESTMENT

Average

A.Number

ofagents(N) 15 100 1,000 10,000 OO 1.060 0.950 0.665Number

of 50 1.004 0.790 0.400Time

Periods200

0.985 0.723 0.305CO

OO 0.979 0.696 0.274 0.150Reported: averageof

OLS

estimatesof X, obtained via simulations. Numberofsimulationschosentoensurethatnumbersreportedhaveastandard deviation

lessthan 0.002. Simulation parameters: X: 0.15 (annualdata,fromCaballeroet

al, 1995),nA

=

0.12,aA=

0.056,07=

0.50.We

haveassumed

throughout that Ay* is i.i.d. Aside frommaking

the results cleaner, it should beapparent

from

thetime-to-build extensioninSection 2thataddingfurtherserial correlationdoes notchange

the essence of our results. In such a case, the cross correlations

between

contiguous adjustments areno

longer zero, but the bias

we

have described remains. In any event, for each of the applications in thissubsection, there is evidence that the i.i.d. assumption is not farfetched (see, e.g., Caballero et al [1995, 1997], Bilsand

Klenow

[2002]).4

Fragile Solutions:

Biased Regressions

and

ARMA

Correction

Can

we

fixtheproblem

whileremaining within the class oflineartime-seriesmodels?

In this section,we

show

that inprinciple thisispossible,butinpracticeitis unlikely (especiallyforsmallN).4.1

Biased

Regressions

So

farwe

haveassumed

thatthe speedofadjustment is estimated using only informationon

theeconomic

series ofinterest,y. Yetoften the econometrician can resort to aproxyforthe target y*. Instead of(2),the estimating equationis:

Ay,

-

( 1-

X)Ay,-1+

AAy,*+

e,,

(25)

with

some

proxyavailable forthe regressorAy*.Equation (25) hints at a procedure for solving the problem. Since the regressors are orthogonal,

A

in principle can be estimated directly

from

the parameter estimate associated with Ay*, while droppingthe constraint that the

sum

of the coefficientson

the righthand

side add up to one.Of

course, if theeconometriciandoes

impose

the latterconstraint, then theestimate ofA. will besome

weighted average ofan unbiased and a biased coefficient, and hence willbe biased as well.

We

summarize

theseresults in thefollowingproposition.

Proposition.4 (Bias with Regressors)

With the

same

notationand

assumptionsasin Proposition3, considerthefollowingequation:Ay?

=

fc Ayf_,+&iAy,*+e„

(26)where

Ay* denotes the average shock in periodt,£Ay*

;/7V.

Then, if(26) is estimated via

OLS, and

K

definedin (19),

(i)without

any

restrictionsonboand

h\:(ii) imposingbo

=

1—b].

u

plinij^^b]

=

A

+

In particular,for

N

=

1and

/1.4=

0:plimT_t

J

=

-^-(1-A),

(27) 1+

K

plimT_J>

x=

A, (28)X(l-X)

2{K

+

X)' i 1 !~

X

plimT^„b\

=

A

H—

.Proof

SeeCorollaryBl

in theAppendix.Of

course,inpracticethe"solution"aboveisnot veryuseful. First,theeconometricianseldom

observes Ay* exactly, and(at least) thescaling parameters need tobe estimated. In thissituation, the coefficientes-timate on the

contemporaneous

proxy for Ay* isno

longer useful for estimating A, and the latter must beestimated

from

theserialcorrelationoftheregression,bringingbackthe bias. Second,when

theeconometri-cian does observe Ay*, theadding

up

constraint typically is linked tohomogeneity and

long-run conditions,4

Theexpressionthatfollowsisaweighted averageof theunbiasedestimalorXandthebiased estimatorintheregression without

Av* asaregressor (Proposition 3).Theweight onthebiasedestimatorisXK/2(K

+

X),whichcorrespondstotheharmonicmeanofXand K.

that aresearcher often will bereluctant todrop(seebelow).

Fast

Micro - Slow

Macro?:

A

Price-

Wage

Equation

Application

Inan intriguingarticle, Blanchard (1987) reachedtheconclusionthat the speed of adjustment ofprices to costchanges is

much

fasteratthedisaggregate thantheaggregate level.More

specifically, hefound

thatprices adjustfaster to

wages

(and input prices) at the two-digit level than at theaggregate level. His studyconsidered seven manufacturing sectors and estimated equations analogous to (26), with sectoral prices in

theroleofy,and bothsector-specific

wages

and inputpricesasregressors(they*).The

classichomogeneity

conditionin thiscase,

which was imposed

in Blanchard'sstudy,isequivalentinoursetting tobo+

b\—

1 .Blanchard's preferred explanation for hisfinding

was

based on the slowtransmission of price changes through the input-output chain. This is an appealing interpretation and likely toexplainsome

of thedif-ference in speedofadjustmentat differentlevels ofaggregation.

However,

onewonders

how

much

ofthefindingcan be explained

by

biaseslikethosedescribedin this paper.We

do

notattemptaformaldecompo-sitionbutsimply highlight thepotentialsizeofthebiasin price-wageequationsfor realisticparameters.

Matching

Blanchard'sframework

tooursetup,we

know

that hisestimated sectoralA

is approximately0.18 whileatthe aggregatelevel itis0.135.15

Table 8:

Biased

Speed

of

Adjustment:

Price-Wage Equations

Average

A

Number

offirms(A7)

100

500

1.000 5.000 10,000 oo250

0.416 0.235 0.194 0.148 0.142 0.135No.

ofTime

Periods, T:oo 0.405 0.239 0.194 0.148 0.142 0.135

Reported: ForT

=

250, average estimateofXobtainedvia simulations. Numberof simulationschosentoensurethatestimatesreportedhaveastandarddeviationlessthan 0.004. For

T

=

°°: calculatedfrom(28). Simulation parameters:X:0.135andT

=

250(from Blanchard, 1987, monthlydata),nA=

0.003,aA=

0.0054 and07=

0.048asinTable6.Table 8 reportsthebias obtained

when

estimatingtheadjustmentspeedfrom

sectoralprice-wageequa-tions. It

assumes

that thetruespeed ofadjustment,A, is0.135,andconsiders various valuesforthenumber

offirmsin the sector.

The

tableshows

that forreasonable values ofN

there isasignificantupward

bias intheestimated value ofA,certainly

enough

toincludeBlanchard'sestimates.16,5

We

obtained theseestimatesby matching thecumulative impulse responsesreported inthe first two columnsofTable 8 in

Blanchard (1987) for 5, 6 and 7 lags. For the sectoral speeds we obtain, respectively, 0.167, 0.182 and0.189, while for the

aggregatespeedweobtain0.137.0.121 and0.146.The numbersinthemaintextaretheaverageX'sobtainedthisway.

16

Theestimated speedofadjustmentiscloseto0.18 for

N

=

1,000.4.2

ARMA

Corrections

Let us

go

back tothecase ofunobservedAy*.Can

we

fixthebias while remainingwithinthe class oflinearARMA

models? In the first part ofthis subsection,we

show

that this is indeed possible. Essentially, the correctionamounts

toaddinganuisanceMA

termthat "absorbs"the bias.However,

thesecondpartofthissubsectionwarnsthatthisnuisanceparameter needstobe ignoredwhen

estimating thespeed of adjustment. This is notencouraging, because in practice the researcher isunlikely

to

know when

heshouldorshouldnotdropsome

oftheMA

termsbefore simulating (ordrawinginferencesfrom)theestimated

dynamic

model.On

theconstructiveside,nonetheless,we

show

thatwhen

N

issufficiently large,even ifwe

do

notignorethenuisance

MA

parameter,we

obtain better—

although stillbiased—

estimates ofthespeed of adjustmentthan withthe simplepartial adjustmentmodel.

4.2.1

Nuisance

Parameters

and

BiasCorrectionLet usstart withthepositiveresult.

Proposition 5 (Bias Correction) Letthe Technical

Assumptions

(seepage

10)hold}1Then

Ayf

follows anARMA(l.l)

process with autoregressiveparameter

equal to 1—

X. Thus, adding anMA(1

) term to thestandardpartialadjustment equation(2):

Ayf

=

(l-X)Ayf

/_1

+v,-ey,_

lj (29)and

denoting byX

N

any

consistentestimatorof oneminus

the AR-coefficientin theequationabove,we

have

that:

plimT-00/v

=

X.The

moving

averagecoefficient, 9. isa "nuisance"parameter

thatdepends

onN

(itconverges tozeroasN

tendsto infinity), fa.

Oa

and

°"/- VM?havethat:Q=~{L-VL

2-4)>0,

with 2+ X(2-X)(K-\)

L

\-X

and

K

definedin(19).Proof

SeeTheorem

Bl

intheAppendix. I17

Strictly speaking, to avoid the case wherethe

AR

andMA

coefficientscoincide, we need torule out the knife-edge caseN

-1=

(2-\)n^/Xo^. Inparticular,whenma=

thisamountstoassumingN

>

1.

The

propositionshows

thatadding anMA(1)

termtothestandardpartialadjustment equationeliminatesthe bias. Thisrather surprising result is valid forany level ofaggregation.

However,

in practicethis cor-rection is notrobust forsmallN,

as theMA

andAR

coefficients are very similar in thiscase (coincidental reduction).18 Also, as with allARMA

estimation procedures, the time series needs tobe sufficiently long(typically

T

>

100)toavoidasignificant smallsample

bias.Table9:

ADJUSTMENT

SPEED

X:WITH AND WITHOUT

MA

CORRECTION

Number

of agents(N) 100 1,000 10,000 AR(1): 0.18 0.88 1.40Employment

ARMA(1,1):

0.65 1.29 1.47ARMA(1,1),

ignoringMA:

1.50 1.50 1.50AR(1):

0.11 0.88 2.72Prices

ARMA(1,1):

1.27 2.83 3.43ARMA(1,1),

ignoringMA:

3.55 3.55 3.55AR(1):

0.02 0.44 2.65Investment

ARMA(1,1):

0.77 3.92 5.29ARMA(1,1),

ignoringMA:

5.67 5.67 5.67Reported: theoretical value ofT, ignoring small sample bias (7"

=

°°). "AR(1)" and"ARMA(1,1)" refer to values ofx obtained from AR(1) and ARMA(1,1) representations.

"ARMA(l.l)ignoring

MA"

refersto estimate obtainedusing ARMA(l.l)representation,butignoring the

MA

term. Theresults inPropositions 3 and5wereusedtocalculate theexpres-sions forx.ParametervaluesarethosereportedinTables4,5and6.

Next

we

illustratethe extent towhich

ourARMA

correction estimatesthecorrect response timein theapplications to

employment,

prices, and investment considered in Section 3.We

beginby

noting that theexpected response timeinferredwithoutdroppingthe

MA

termis:191-X

9_

1-X

_

Tma

~~~T^e

<-

X~~

x'where

>

was

defined in Proposition 5, x denotes the correct expected response and xma the expectedresponsethatisinferred

from

a non-parsimoniousARMA

process(it couldbe anMA(«),

an AR(°°)or, inourparticular case, an

ARMA(

1,1)).The

thirdrow

in each ofthe applicationsin Table 9 illustrates themain

result.The

estimate ofx,when

thenuisance termisusedinestimation but

dropped

forx-calculations, isunbiasedinallthe cases, regardless ofthevalueofN

(notethatinordertoisolatethebiases thatconcern uswe

haveassumed

T

—

°°).18

For example,ifjiA

=

0,wehavethattheAR

andMA

termare identical forN

=

I.

19

SeePropositionAl intheAppendixfor aderivation.

The

firstand

secondrows

(in eachapplication)show

thebiased estimates.The

former repeatsourbasicresult while the latter illustratestheproblems generated by notdropping thenuisance

MA

term(Xma).The

bias fromnot dropping the

MA

term is smallerthan thatfrom

inferringx from the first orderautocorrela-tion,20yetitremainssignificantevenat fairlyhighlevelsofaggregation(e.g.,

N

=

1,000).5

Conclusion

The

practiceof approximatingdynamic

models withlinearones iswidespread and useful.However,

itcanleadto significantoverestimates ofthespeedofadjustmentof sluggishvariables.

The problem

ismost

severewhen

dealing with data atlow

levels ofaggregation or single-policy variables. For once,macroeconomic

data

seem

tobebetterthanmicroeconomic

data.Yet this paper also

shows

that the disappearance ofthe bias with aggregation can be extremely slow.For example, in thecaseofinvestment,thebiasremainsabove 80 percent even afteraggregatingacross all

continuousestablishments inthe

LRD

(N

=

10.000).While

theresearchermay

thinkthatattheaggregatelevel itdoesnotmattermuch

which microeconomic

adjustment-cost

model

generates the data, it does matter greatly for (linear) estimation of the speed of adjustment.What

happened

toWold's

representation, according towhich

any stationary, purely non-deterministic,process admits an (eventually infinite)

MA

representation?Why,

as illustrated by the analysis at theend of Section 4,do

we

obtain anupward

biased speed of adjustmentwhen

using this representation for thestochastic processat

hand? The problem

isthat Wold's representation expresses the variable ofinterest as a distributed lag (and therefore linear function) ofinnovations that are the one-step-ahead linear forecast errors.When

the relationbetween

themacroeconomic

variableofinterest and shocksis non-linear,asisthecase

when

adjustment islumpy. Wold's representation misidentifiestheunderlyingshock, leading tobiased estimatesof thespeed ofadjustment.Put

somewhat

differently,when

adjustment is lumpy, Wold's representation identifies the correctex-pectedresponse timetothe

wrong

shock. Also,and

forthesame

reason,the impulse responsemore

gener-ally will bebiased.

So

willmany

of thedynamic

systemsestimated inVAR

stylemodels, andthe structural teststhatderivefrom

such systems.We

arecurrentlyworking on theseissues.-°ThiscanbeprovedformallybasedontheexpressionsderivedinTheoremBI andPropositionAl intheappendix.

References

[1] Bils,

Mark

andPeterJ.Klenow,

"Some

Evidence

on the Importance ofSticky Prices,"NBER

WP

#

9069,July2002.

[2] Blanchard, OlivierJ., "Aggregate and Individual Price Adjustment,"Brookings Papers

on

Economic

Activity1,

1987,57-122.

[3] Box,

George

E.P., andGwilym M.

Jenkins,Time

SeriesAnalysis: Forecastingand

Control,San

Fran-cisco:

Holden

Day, 1976.[4] Caballero,RicardoJ.,

Eduardo

M.R.A.

Engel, and John C. Haltiwanger,"Plant-LevelAdjustment

andAggregate

InvestmentDynamics",

Brookings Paperson

Economic

Activity,1995

(2), 1-39.[5] Caballero, Ricardo J.,

Eduardo

M.R.A.

Engel, andJohn

C. Haltiwanger, "AggregateEmployment

Dynamics:

Buildingfrom

Microeconomic

Evidence",American

Economic

Review,87

(1),March

1997, 115-137.

[6] Calvo, Guillermo, "StaggeredPrices inaUtility-Maximizing

Framework,"

Journal ofMonetary

Eco-nomics, 12, 1983, 383-398.[7] Engel,

Eduardo

M.R.A.,"A

UnifiedApproach

to the Study ofSums,

Products,Time-Aggregation

andotherFunctions of

ARM

A

Processes",JournalTime Series Analysis,5, 1984, 159-171.[8] Goodfriend, Marvin, "Interest-rate

Smoothing

andPrice LevelTrend

Stationarity," Journal ofMone-tary

Economics,

19, 19987,pp. 335-348.[9] Majd,

Saman

and Robert S.Pindyck,"Time

toBuild,OptionValue,and InvestmentDecisions," Jour-nalof Financial Economics, 18,March

1987, 7-27.(1987).[10]

Rotemberg,

JulioJ.,"The

New

Keynesian Microfoundations," in O. Blanchardand

S. Fischer (eds),NBER

Macroeconomics

Annual, 1987,69-104.

[11] Sack, Brian, "Uncertainty, Learning, and Gradual

Monetary

Policy," Federal ReserveBoard

Financeand

Economics

DiscussionSeriesPaper34,August

1998.[12] Sargent,

Thomas

J., "Estimation ofDynamic

Labor

Demand

SchedulesunderRational Expectations,"Journal ofPolitical

Economy,

86, 1978.1009-1044.

[13]

Woodford,

Michael, "OptimalMonetary

PolicyInertia,"NBER

WP

#

7261,July 1999.d&y,+k [ de,

lk>okh

and x=

—

-= i./md

V'(l) __S*>i*V*

Appendix

A

The

Expected

Response

Time

Index:

x

Lemma

Al

(tforan

InfiniteMA)

Consider asecond

orderstationary stochasticprocessAy,

=

^Wk^t-k,

k>0with \\Iq

=

1, £*>()¥*<

°°'^

le £' '5 uncorrelated,

and

e, itncorrelated with Ay,_i,Ay,_2.... Assw/Me ?/i«r^M

—

Yk>o^VkZ hasallitsrootsoutside theunit disk.Define:

Ik

=

IThen:

Proof

ThatIk=

ty* istrivial.The

expressions forx then followfrom

differentiating *¥(z) andevaluatingatz=l.

IProposition

Al

(xforan

ARMA

Process)Assume

Ay,followsan ARMA(p.q):

P 9

Ay,

-Yj

fa&yt-k=

e,-

X

Qk£,-k-k=l k=\

where

$>{z)=

1—

Y,k=\<J*JtS*a,!^

®(z)—

1 ~~Sf=i6*z* 'iflve«// r/iefrroorroutsidethe unit disk. Theassump-tionsregarding theE,'sare the

same

as inLemma

A

1. Definexasin(30). Then:Proof Given

theassumptionswe

havemade

about theroots of<J>(z) and 0(z),we

may

write.0(L)

Ay

<=

*(Z)

E"where

L

denotes thelagoperator.Applying

Lemma

Al

with0(z)/4>(z) intheroleof*F(z)we

then have:'

©(i)

*(i)

"

1-zjLi**

i-iLi

6

*'Proposition

A2

(x for aLumpy

Adjustment

Process) ConsiderAy, inf/iesimplelumpy

adjustmentmodel

(8)and

x<te/inerf in (/4). 77ienx=

(1-

X)/X.212

'Moregenerally,ifthenumberof periodsbetweenconsecutive adjustmentsarei.i.d.withmeanm, thent

=

m—

1.Whatfollowsisthe particularcasewhereinterarrivaltimes follow aGeometricdistribution.

Proof dAy

t+k/dAy* isequaltoonewhen

theunit adjustsattimet+k,

nothavingadjustedbetween

timestand

t+

k—1,

andisequaltozerootherwise. Thus:/*

=

E,dAy

l+kdAy;

Prfe+*

=

1 , £,+*_,= ^

+ ,_2=

...=

&=

0}=

X(l-

X) k . (31)The

expressionforxnow

followseasily.Proposition

A3

(xfor aProcessWith

Time-to-buildand

Lumpy

Adjustments)

ConsidertheprocessAy

twithboth gradual

and lumpy

adjustments:ith

K

K

Ay,=

Yj

tyk&yt-k+

(1-

X

<WAy,,

A=l k=l ll-l k=0 (32) (33)where

Ay* is i.i.d. with zeromean

and

varianceO

2.

Definex by:

Then:

Zjt>o^E, SAy;

Si>oE

dby, +k3Ay,-Proof

Notethat:E, 9Ay,+k [ dAy;

3Ay

r+*9Ay,+jy

E

;e

' [d&yt+j dAyf kSB,

7=0Gt_j

Ay, +J Ay,*2,Gk-jH

Jt (34) ;=0where, from Proposition

Al

and

(31)we

have that theG

k are such that G(z)=

£*>o<j*z*=

l/Q>(z), andH

k=

X{\-

X) k. Define

H(z)

=

E*>ofl*Z* and I{z)=

G{z)H(z). Noting that the coefficient ofz* in theinfiniteseries I(z)is equalto7*in (34),

we

have:r(i)

g'(i) //'(i)sf

=1^

i-A

""

7(1)

"

G(l)

+

//(1)l-EJ^fe

A

B

Bias Results

B.l

Results

inSection 2

Inthissubsection

we

proveProposition 2andCorollary 1. Proposition 1 isaparticularcase ofProposition3,which

isprovedin Section B.2.The

notationand

assumptionsare thesame

asinPropositionA3.

Proof

ofProposition2and

Corollary 1The

equationwe

estimate is:Ay,

=

Y,

akA

yt-k+

v,. (35)*=i

whilethe true relation isthatdescribed in(32)

and

(33).An

argument

analogous to that given in Section 2.2shows

that the second term on the righthand

sideof(32), denoted byw, in

what

follows, is uncorrectedwith Ay,_£, k>

1. Itfollows that estimating (35) isequivalenttoestimating (32) with errorterm

*»

=

= (i-Efo&XAtf-*.

andtherefore:f 4>;.

ifk=l,2,-,K,

plimr_„<5it=

<[ ifk

=

K+l.

The

expression forpUm^^^t

now

followsfrom

PropositionA3.

|B.2

Results

inSections

3and

4

In thissection

we

prove Propositions3, 4,and 5.The

notation and assumptions arethoseinProposition 3.The

proofproceeds via a seriesoflemmas.

Propositions 3 and5 areproved inTheorem

Bl. whileProposi-tion4isprovedin Corollary Bl.

Lemma

Bl

Assume

X]and

Xjarei.i.d.geometricrandom

variables withparameter

X, sothatPr{X

=

k}=

X(l

-X)

k-\k=

1,2,3,... Then:m)

=

I

Vkrpf,]=

^.

Inparticular, theI,-,'s (defined in the

main

text)are allgeometricrandom

variables withparameter

X.Furthermore, /,.,

and

ljsareindependentifi^

j.Nextdefine,for anyintegerslargeror equal thanzero:

Ml

=(°.

fy

[