HAL Id: tel-02859555

https://hal.inrae.fr/tel-02859555

Submitted on 8 Jun 2020

HAL is a multi-disciplinary open access archive for the deposit and dissemination of sci-entific research documents, whether they are pub-lished or not. The documents may come from teaching and research institutions in France or abroad, or from public or private research centers.

L’archive ouverte pluridisciplinaire HAL, est destinée au dépôt et à la diffusion de documents scientifiques de niveau recherche, publiés ou non, émanant des établissements d’enseignement et de recherche français ou étrangers, des laboratoires publics ou privés.

Distributed under a Creative Commons Attribution - NonCommercial - NoDerivatives| 4.0 International License

implications

Louis Pascal Mahe, . University of Minnesota

To cite this version:

Louis Pascal Mahe, . University of Minnesota. An econometric analysis of the hog cycle in France in a simultaneaous cobweb framework and welfare implications. Economics and Finance. University of Minnesota, 1976. English. �tel-02859555�

An econometric

analysis

of

the

hog cyclein

France 'ina

simu]taneous cobweb frameworkand

welfare

imp'lications

Louis-Pascal MAHE (1)

-

May 1976-Dissertation

submittedfor

the

Ph.D. degreeat

the University

of

Minnesota(1)

I

wantto

thank many people who helpedne

in

various

waysduring

this

research

:

Pr

L.

Martin

and M.t{bel

who provided advicesat

various stagesi

researchfellows

at

the I.N.R.A.

andthe

financeninistry

withwhom

I

talked

several

times.

l4rs Leclainche deservesparticular

mentionfor

having acceptedto

type a

manuscriptnot

written in

her

mother langageoocuueNTArtoH Éiot'toutg nuRA'e neHNes

t'Iou l"nou, these diagrons on uhieh

uatiations

oùe"tine of

pz'iees,inte-rest

rates

ete...

aîe

rep?esented by upuards and douru'nrdszig-zag

Lines.I,lhile

I

uas annlysingthe

erises,

I

tried

seueraL timesto

ealeuLate thesepeaks and tnotqhs by

fittirq

irneguLaz'euwes,

andf

beLietsetlnt

the

essen-tiaL

Lausof

erises

eouLd bematherna-tieally

determined onthe basis

of

such euroes.I

stiLL

tlxL,nkthis

is

possibLegioen

suffieient

data"

..,

K.

MARXl

i

I

TABLE OF

CONTENTS

INTRODUCT ION

Chap.

1

-

A SHORT REVIEW 0F LIVEST0CK CYCLES THEORY1

-

Periodicity

2

-

Reversibility

andthe

natureof

the supply function3

-

Therelationships

between breedingstock and supply

Chap.

2

-

INVENTORY-SUPPLY INTERACTION AND ITSC0NSEQUENCES 0N THE SUPPLY FUNCTIoN

1

-

A supplyfunction

based oninventory-sales interaction

2

-

Partial

adjustment and adaptive expectations3

-

Supplyin

numbeis, supplyin

weights4

-

Dynamics andstability

conditions5

-

Simul taneousor

recursive

cobweb ?Biases resul

t'ing

from unappropriateestimation

procedureChap.

3

-

AN ECON0METRIC MODEL 0F THE HOGSUBSECTOR IN FRANCE

L

-

Generalsetting

of

the

French hogj ndu

stry

11

-

Production1,2

-

Consumption, pricesi3

-

Trade, EEC and policy

2

-

Dataavailable, implications for

specification

andpossible

biases21

- The

supply block22

-

Denand block 23-

Trade equation3

-

Empiricalresults

3i

-

Complete

model32

-

Prel iminary work on supply 33-

Structural

changes and supp'lyel a stic i

ti

es Pages 1 14 14 4 6 B 10 2T 23 25 29 4t 41 41 51 5B 62 63 66 69 70 7L 89 96Chap.

4

-

WTLFARE ANALYSIS 0F THE HOG CYCLE IN FRANCE1

-

tlelfare loss

in

a

simple cobweb2

-

Distribution

effects

3

-

l,lelfare

effects

of

fluctuations

.

in

a

more general model3L

-

Consumers'surp'lus and marketing margins behavior1

-

constant margins2

-

proportional

margins3

-

nonreversibility of retail

price fluctuations

32

-

Afirst

application

to

the

hogmarket Conclusion Appendix 4. CONCLUSION

*

x,É

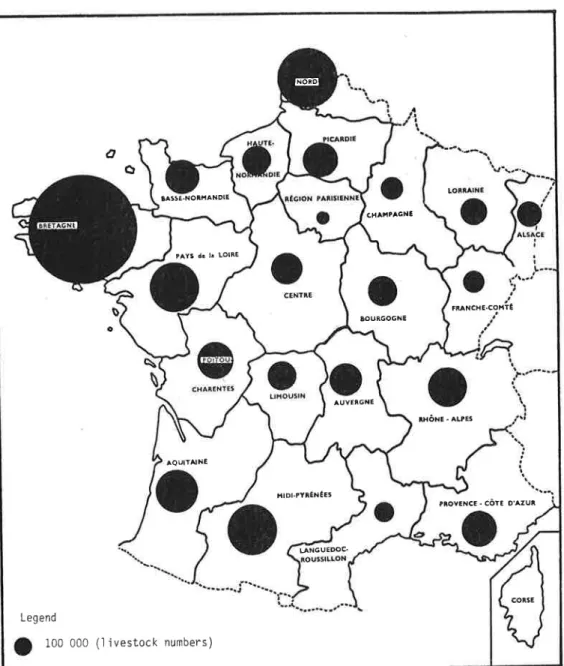

99 99 101 104 104 104 105 107 108 LT7 1 2 3 4 4 t20 t22 124 130Figure

2.1

-Figure2.2

-Figure3.1

-Figure3.2

-Figure3.3

-Figure3.4

-LIST OF

FIGURES

Cobweb

with current price effect

Specif

ication

b'ias from assuming mi stakenlya

recursive

cobwebConcentration

of

hog farming enterprises Mapof

feedgrains production

in

1974a)

Barl eyb)

CornLocation

of

hogproduction

in

France (1974)Variation

of

consumptionper

headfor

variouskinds

of

meat (1963-1973)Retail

meatprice

indexfor

main meats( 1e60-1e74)

Price

of

porkat

retail,

of

hogsat

farmlevel

and feederpigs

price

"Marketed" production and consumption

Relative

sharesof

countries

in

pork imports(te74)

Beef and

veal

retail

price

indices Margin behaviorActual

fitted

value,

supplyActual

andfitted

values

:

feeder pigs

priceActual

andfitted

values

:

demandActual

andfitted

values

:

farmretail

relation

Actual

andfitted

values

:

net

importsCross-cornel ogram

Unconstra'i ned regression

pages 26 34 45 49 50 48 53 54 56 57 59 68 B5 87 87 BB 8B B9 91 91 Figure Fi gure Fi gure Fi gure Fi gure Fi gure Figure Fi gure Figure Fi gure Fi gure Fi gure Fi gure

3.5

-3.6

-3.7

-3.8

-3.9

-3.10 -3.11-

3.n-3.13 - 3.14- 3.15- 3.163.I7 -IFi gu re Figure Fi gu re Fi gure Fi gure F 1 gure Fi gure Figure Fi gure Fi gure Fi gure Fi gure Fi gure Fi gure Fi gure Fi gure

3.18-

Constrained regression3.19-

Correlogram4.1

-

Symmetricalstationary

cobweb4.2

-

Distribution

effects

4.3

-

Constant margins and consumers'surplus4.4

-

Proportionnal margins4.5

-

Nonreversibjlity of

retail

prices4.6

-

Surplusdeviations

in

the

comp'lete model4,7

-

Implîcation

of

current price

effect

on we'lfare4.8

-

Slow adjustment andwelfare

effects

4

.9'

-

Constant margins andwelfare

'losses4.9 -

Equilibrium

pathS,

production4.10

-

Equilibrium

RathD,

consumption4.11

-

Equilibrium

pathP,

farmprice

4.LZ

-

Equilibrium

pathPi

retail

price

4.13

-

Producers'surplus-vagiationas

%of

equi-Iibriurn

receipt

(P1.Q1) x 91 93 100 103 105 106 107trz

t20 t22 124 L25 126 r27 t28 L29lr

)rLIST

OF

TABLTS

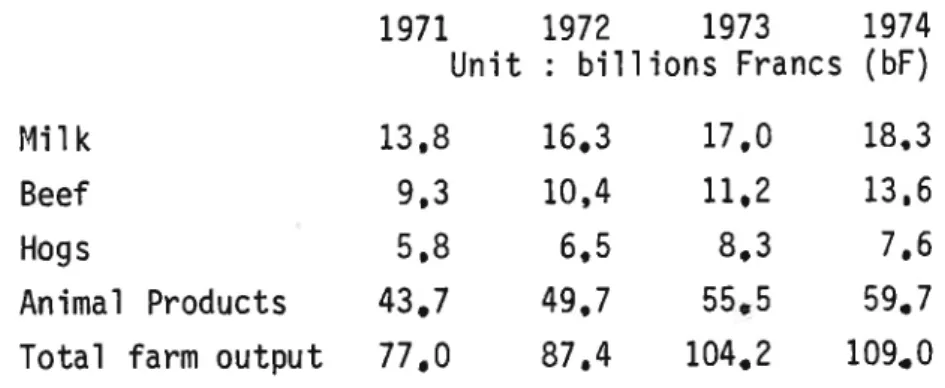

Table

3.1

-

Importanceof

hog productionin

the

grossfarm output

Table

3.2

-

Sizedistribution

and concentrationof

feeder pigs units

Table

3.3

-

Sizedistribution

and concentrationof

slaughter

hogsunits

Table

3.4

-

Evolutionof

the

shareof

productionaccor-ding

to

specialized

hog operationTable

3.5

-

Meat consumptionin

0CDE countriesTable

3.6

-

Relative

shareof

various meat product inthe

consumerfood

budgetTable

3.7

-

Some itemsof

the

trade

balancefor

French agricul tureTable

3.8

-

Total

pork meat producedin

EEC countriesTable

3.9

-

Self

sufficiency rate

in

EEC countriesfor

porkTable

3.10-

Break downof

the

production according tothe

type

of

buyerTable

3.li-

Marketed supplyelasticities

Tabl

e

3.12-

Some publ i shed estimatesof

supp'ly elasticity

for

hogswith

respectto

hogprice

Table

3.13-

Demandelasticities

Table

3.14-

Changein

demandelasticities

Table

3.15-

Shortrun

marketed supplyelasticities

estimates o1for

various specifications

Table4.1

- Time

series

of

surp'lus deviations)* pages BO B1 83 94 42 43 44 46 52 53 58 60 60 62 79

x)t

i19So much has been

written about'livestock cycle

theory

that

it

seemsbold

to

try

againbringing

some newlight

onthe subiect.

This

washowever

the

first

intention

of

mydissertation.

Twopoints

appearedto

meas deserving more

attention.

First

no economic modelof

livestock

supplyhas

ever

includeda

demographicalpart

expressed bya

dynamic completemodel

in

the

line of

human popu'lations. SinceI

had studiedthe

propertiesof

sucha

modelIjntented

to

analyse hog supp'lyin

theseterms'

byp'lug-ging

in

control

variables

related

to

supply behaviorof

hog producers.This

turnedout

to

be unfeasiblefor

lack

of

detailed

data

on inventoriesof

hogs onfarm

in

France, which were necessaryto

set

upthe

modelin

ademographjc framework. The

only data

available

overa

long

enough periodof

time,

concern slaughtered hogs.I

hadtherefore

to

give

upthis

approach,which would have

led

also

to

somepartjcular

estimation problems.The second

point

I

wantedto

studyin

a

systematic manner, wasthe implications

of

the relationship

betweeninventories

and slaughtered hogsat

eachpoint

i.n time,arelationship

which comes up natura'l'ly when the demographic approachis

used.Contrarily

to

myfirst

impressionI

found outthat

this

wasnot

really

a

newidea.

Some authors andparticularly

Foxttil

and

Reutlinger

[39],

have already analysed some aspectsof this

problemin

the context

of

a

formalized mode'|.Given

this

sjtuation,

the contribution

I

hopedto make on a moregeneral and moderately

theoretical

nature wasvery

s'lim,

and analternatjve

focus

of

mythesis

wasto

ana'lysethe pecularities

of

the

hogcycle

in

France andto

put the stress

onthe estimation

of

the

underlyingrelationshiPs,

âwork which had never been done

in

an econometric framevrork beforein

this

country.-2-The

fina'l

output

of

my researchis

half-way between thesetwo

objectives.

In

the

first

chapter

I

discussthe

twowell

known theoriesof

livestock

cycles

namelythe

cobweb andthe

harmonic motion model, a'longwith the

publishedformulation

of

the

inventory-supp'lyinteraction.

Inchapter

two,

I

attemptto

clarify

the relationships

betweenthe

varioustypes

of

supplyspecifications

usedin

hog models,in

particular

betweenrecursive

and simultaneousspecifications

and between models exp'lainingfirst

inventories

on farms and those:

explaining

directly

1 iveweight mar-keted by'laggedprice.

This

analysis

throws some newlight,

I

believe,

onthe

economicinterpretatjon

of

the

parameters estimated and essentia'l1ythe

supplyelasticity.

Thenext

step

is

to

formulateexplicitely

the consequencesof

the

inventory-supplyinteraction

onthe

dynamicsof

thecobweb and

the

stability

conditions.

Thethird

aspectof

this

addition

tothe

cobwebtheory

is

the analysis

of

its

implications

onestimation

pro-cedures, and ananalytical

discussionof

the

biases which mayarise

inboth

supplyand

demand when recursivenessis

unproper'ly assumed.Chapter

three gives

an accountof

the

empirical results

ofestimation

onthe

basisof

French hogindustry.

A'lthougha

complete market model wasestimated, including

demand, margîns,piglet

market, and imports,emphasis has been

put

onthe

supply andthe other

equations havenot

re-ceived so muchattention.

Someparticular

features

of

the

French hogjndus-try

and economic behaviorare

discussedin

the

light of

these empiricalresu I ts .

Chapter

four

dealswith

an attemptto

analysethe welfare

as-pects

of

cyc'lica1fluctuations.

The approachis

based on surpluses andfollows the

line of

welfare

analysesof

randomfluctuatjons

of

agricultu-ral

prices.

Anempirical

i'llustration

is

presented onthe

basis

of

theestimated model

of

chapterthree.

It

allows

to

give

anorder

of

magnitudeof

the efficiency loss

dueto

the fluctuations

alongwith the

resulting

djstribution

effects

bothin

the short

run

andin

the

long

run.

This

last

chapter

is

oneof

the

possib'leapp'lications

of

the

estimated model which makes useof

the theoretical

discussionof

specification

problems. Since-3-concept

of

surplus used must beconsistent

with

micro-economic foundations,it

is

necessaryto

discussthe

natureof

the

supp'ly we are dealing withbefore using

it

for

we'lfare analysis.)r

x)Ê

-4-Chap.

1

-

A SH0RT REVITW 0F LIVESTOCK CYCLTS THEORYBasically

two chemes have been proposedto

explajn livestock

cycles

:

the

cobweb andthe

harmonic motion. The cobweb theorem hasre-ceived considerable

attention

fromagricultura'l

economists, both froma theoretical

and anemp'irical

point

of

view.

FollowingLorie

[31],Larson [ZA] fras

recently

arguedthat

"The cobweb mode'l seemsto

be sointrjgu'ing,

and so persuasive,that

it

is

uncritically

accepted on meagergrounds". Then he goes

on

"there

is

a

basical'ly

different

model,wich

i

havetermed harmonic motion

that

providesa

morelikely

explanationof

the

hogcycle

and manyother

agricultural

production cyc1es".In a

reviewarticle

on boththeories

Mc Clementst34

criticises

Larson's

assertion

that

the superiority

of this

model is based on two mainissues

:

the periodicity

of

the

c.vcle andthe

reversibility of

the

supplyfunctions.

I

shall

reviewthe

discussionof

these problems andfollow

withthe

estimation

proceduredifficulties.

Butfirst

Iet

us presentbrief'ly

thetwo model s.

Cobweb

vs.

harrnonic motionIn

his classical

article

onthe

cobweb theorem,Ezekiel

fg,

p.

272_lstates

three conditions

for

the theory

to

berelevant

to

a

commodity(i)

where productionis

completely determined bythe

producers'response toprice,

underconditions

of

pure competition (where producer bases plansfor

future

production onthe

assumption presentprices

wi'11continue,

andthat

his

own production planswill

not

affect

the market)

;

(2)

wherepro-duction

cannotbeûranged,once plans are made;

and(3)

wherethe

price is

set

bythe

supp'ly avai I abl e .COBhIEB MODEL

(1.1)

demand

pt

(1.2)

supply a;=6+b

=C+dP

,b<0

at

t-t^l (1.3)equilibrium

qi

= Qtwhere rrr

is

the

time duration

of

the

production process. Asis

well

known,this

modelyields

a

cycle

with

period

2w,

and whichis

convergentor

di-vergent according

to

the

relative

slopesof

the

supply andthe

demand.Ezekiel was aware

of

the limitations

of

such a modelto

explain

agricultu-ral

cycles.

He discussedbrief'ly the

possibility of

a

nonzero

short-runelasticity

of

supply and mentionnedlag

of

farmers'

responseto

prices

whichcould

increase win

the

abovespecification.

Harmonic motion

differs

fromthe

cobwebin

the

behavioral as-sumptionwith

regardto

producers:

"Referenceto

a

supply curve might well be supp'lanted bya

decision

rube vrhich ishigly

conservative,

in

the

senseof

involving

little

explicit

pnediction

of

future

events.

Producers do notin

fact

decideto

producea

givenlevel

of

output

in

responseto

an expectedprice,

but

rather

decideto

changethe current rate

of

productionjn

res-ponseto

current prices,

or

current'level

of profits"

[29'p.

169].

HARMONIC MOTION P

t

=ô-b

,d>0

at

( 1.4)

demand (1.5)

producers'behaviordBt=c(p*-P)

drQi*

*

=*

Br(1.6)

production 'lag-6-(1.7)

c'learingwhere Ba

is

the

breedingstock

andF

is

the

equilibrium

price.

This modelgenerates

a

cycles

of

production andprices

of

4 w.1

-

Periodici'The

chief

difficulty

in

acceptingtle

cobweb asthe

explanationof

the

Hog cyc'le has beenthat

the

hog cyc'leis

usual'ly aboutfour

yearslong

(s1ight1y

less

in

somecountries),

whereas,in

viewof

the

i2

monthsproduction

period

for

marketlveight

hogs,the

cycle

should according tothe

cobweb theorern be twoyears'long"

Qg,

p.

l7?-1.It

is

a

fact

that

known hogcycles

havea

period

of

more than twoyears,

although one yearis

the

average production 1ag(1).

fne

period

is

about4 years

in

theUnited

States, but

it

varies

from 36to

40 monthsin

most European countries ansis

52 monthsin

the

Netherlands [ZO,p.144].

This

evidence g'ives supportto

l.arson's assertion

that

his

model isconsistent

with the

facts,

and heconsiders

that

the

arguments advancedto

reconcile

the

cobwebwith

observedperiodicity

are

not

very

convincing;

they are

based mostly ona

1agbet-ween

prices

and oroduction responseflS, p. 34.

l'lcClernents suggested mistakenly

that

Nerlove's

partial

adiustmenthypothesis

is

one wayto

a1ter the period.

"Depending onthe

speedof

adjust-ment

this

model can implycycles

of

more thantwice

the

production 1ag" f32,p.

145].

It

is

clear

howeverin

Nerlove's

artic'le

[SO,p.n[,

that

neither adaptive expectationsnor

partial

adjustment hypothesisalters

the

periodi-c'ity

s'incethe difference

equationof

pricesandquantities

is

still of

orderone.

0n1ythe

stabi'lity

domainis

en'larged dueto

the

fact

that

the

producers'short

run

reaction

is

less

thanthe

long run

supp'lyelasticity

would imp1y.(1)

Technical progress has reducedthe

productionlag,

andit is

nowapproa-ching

10 months.llle cannot

therefore

do awaywith

the

assumptionof

a

response 1ag'longer thanthe

nroduction 1agif

the

cobwebis

to

bethe

framework usedto

exnlain

the

hog cycle.Is

there

howevera great

difference

betweenthe

economics invol-vedin this

hypothesis andthe

one underlyingthe

mathematical formulatjonof

Larson ? There should be anintuitive

explanation,

based on economicanalysis

or

technology,of

the

fact

that

the

phase angle between priceand production

is

trvicethe

production 1ag. Larson doesnot give

such anexplanation,

hesays on1y,"First

there

is

a

shift of

90 degrees(i.e.

onefourth

of

the

period)

cause byprice

being equa'lto

the rate

of

changeof

plannedoutput,

and thenthere

is

a

further

shift

of

90 degrees caused bythe

fixed

production1ag"

Pg,p.

379].

Thesolution

of

the

differentjal

equation derived from model

(1.4)

to

(1.7)

given by Larson[tS,p.fZe]

is

(assuming bcm=

1), (1.8) (1.e) p1 = coS(+

*

.p)

e1 = coS(+

*

.q)

(ii)

p1 =coS

*

"Where,'if

eO and eOdiffer

byn

radians,

the

solutions

areconsistent

andthe

system isin

resonance".But equations

(1.8)

and(1.9)

solvedexplicitely

with

respectto

time,

havebuilt

in

animplicite

relationship

between g1 and pt_Zw.Taking

.p

= 0

and e.,=

'rTr

as

naquired by Larsonfor

resonnance weget

(1)nt

(i)

Q1 =cos

(m

*n)

(1)

Thereis a lot of

od.dnessin the

assumptions onthe coefficients

which-B-From

(i'i)

pt_z*

= cos# tt

-

2w)Pr-zu,=cosf*-tl

compared

to

(i)'it

implies

(1)

'Qt

=

pt-zu,.This relationships

comes fromthe

reduced formof

(1.4)

and(1.5),

but

the lag

connotorig'inate

in

the demand where adjustmentis

instantaneous.It

musttherefore

bebuilt

in

the"supp'ly"

equation,

which supposes,quite

similarly

to

what cobvreb usersdo,

that

there

is

a lag

betweenprice

changes and response tothem. l{oreoverthe

constraint

making resDonselag

equalto

the

production 1agis

quitestrong.

The mainobjection

to

Larson's modelis

that

the

underlying econo-mictheory

is

unclear.

His model maywell

representreality,

but

it

doesnot

explain

whythe

periodicity

is

4

times production 1ag. Thesuperiority

of

harrnonic motion overthe

cobwebis

opento

question,

at

least

on theperiodicity

point

of

view,

to

which Larsongives great tleight.

2

-

Reversibil it.y andthe nature

of

the

supply functionEzekiel's

exposition

of

the

cobweb theorem has beencriticized'

ma'in1y onthe

basisof

the

reversibility

of

the

supp'ly curveinvolved

[1'

6].

It

is

clear

that

the

domainof

application

of

the

cobwebis

in

the explanat'ionof

short

run

fluctuatjons.

Howeverthe

revers'ibility

impliedin

the

treatmentof

the theory

is

a

long-runcharacteristic.

From

this

observation,

Ackerman suggeststhat

producers'behaviorjs

better

expressed bysh'ifts

of

the short

run

normal supp'lycurves.

"Bet-weenthe

sharply

rising

market supply curve andthe very

s'low1yrising

longterm

supplycurve, there

exists,

accordinglY,for

some time fol'low'ingcultivation

year

a moderatelyrising

short

term normal supp'lycurve"

L1'p.15a].

This

would leadto

a

cobweb converging moreeasily

than assumedThis point

js

certainly

valid, for

it

is

alwaysa

delicatetask

to

inter-pret

supplyelasticity

estimatesin

the

light of

static

supplytheory

and consequentlyfor

po]icy

purposes. Thepartial

adiust-ment arguadiust-ment and Johnson'sfixed

asset

theoryp{

gPaiongwiththis

Iine

ofinterpretation.

Butthis is

morea

prob'lemin

supplytheory

thanin

cobwebtheory.

And whatit

changesin

the

latter is

mainlythe

stabjlity

condi-tions.

In

any case,while

the

supply curve has an economic basjsre-lated

to

the

equilibrjum

of

the

firm

andof

the industry,

it

is

not

sofor

Larson's equation(1.5).

The economicinterpretation

of

the

coeffi-cient

c

in

(1.5)

for

exampleis

not cJear.

Furthermore'an estimationprocedure has

not

been developedfor

the structural

equationsof

the model(1.4)

to

(1.7).

Empiricalverifications

put

forth

by Larson [Ze]' French andBressler

(1) or others

partman,16]

are

basedonly

onthe

pe-riodicity

argument usjngspectral

analysis

or

similar

techniques-This is

a rather

roundabout methodof

empirical verification.

In

the specification

of

equation(1.5) there

is

an interest'ingpoint

made by Larson,especially

for

the livestock

cycles

heactually

hadjn

mind.

It

js

the

assumptionthat

breeding decisionsare

made contjnuous'lyover

time.

Butthere

exists a constraint

on decisionsat

any po'intin

timewhich

is

not

takeninto

account.Altering the

breedingstock

81 cannot beachieved

without'influenc'ing

the

sales

of

femalesfor

slaughter

at

timet

because

the

stock

of

animalsin

the

whole herdat

t

is

fixed

by pastdec'i-sjons.

Thereforesales

Qat

t

donot

dependonly

onthe

breeding stockat

t -

wlike

in

equation(1.6)

but also

onthe

changein

Bat

the

sametime

t. If

this

hasljttle

relevanceto

cropsfor

which seeds countfor

a

very

small

fraction

of

the output,

it

is

a

genuinepart

of

livestock

product.ion andits

consequences shouldtherefore

beexplored.

tr'Je shalldo

this

within the

cobwebtheory

whereit

is

simpler asfar

as

interpre-tatjon

andestimation are

concerned.. WewilI

seethat

if

this

biologica](1)

Considered by Larson "most dramaticverification of the

model". The-10-constraint

is

accountedfor,

modification

of

the

supp'ly equationis

requi-red

with

aninterpretation

of

supply parameters going alongwith

it.

Ane-gatively

sloping

short run

supp'ly responsefollows,

which changes thedynamics

of

the

cobweb andthe

stabjlity

condjtions.

Apractical

conse-quenceof

this

point

of

viewis

that

the

modelloses

its

recursiveness and simultaneous equationsare

thenrequired

throughout.3

-

Therelationships

between breeding stock and supplySupply

theory

dealswith the

relation

betweenoutput

pricesand

quantjties

(1)

produced. However some studentsof

hog supply use far-rowings as dependentvariable

[tS]

while others

usequantities

marketedmeasured through

slaughter

ll,

26).

As data on farrow'ings andinvento-rjes

are

not available

in

manycountries

jncluding

France, we mayraise

the questionof

the relationships

betweenthe

twospecifjcations.To

be morespec'ific,one may wonder

if

the

supplyelasticity

derived fromthe

twospecificatjons

hasthe

same meaning.This

can be done bytrying

to

find

out

the

analytical

correspondence betweenthe

supplyspecified

asa

laggedprices

marketedquantities

relationshjpontheonehand, and supply specifiedas

a

laggedprices

-

inventories (or

farrowings)

relationship,

on theother

hand.The second

point

to

exploreis

the rationale

andthe

consequencesof

the relationships

between changesin

supplies

andin

the

breedingstock-Conceptual'ly

thjs

is not a

newidea.

Ezekiel

has al ready mentionned possi b1eshort

run

adiustmentof

the

supply,

and Breimyer[S,

p.Z]

gave anexplic'it

justificatjon

of

the

necessityto

study breedingstock

and supply changesjointly

:

"Whenprices

of cattle

are

high,

producershold

back stockfor

(1)

And moregenerally, of

course,with factor prices

and evenprices of

breeding. The supply

of

cattle

for

slaughter:is

reduced andprices

arepuÉhed

still

higher.

Inventoryof cattle

build up.

As progenyof

jncreasednumbers

of

breedingstock

reach slaughter age annual slaughterstarts

upward. Eventuellyit

increasesa

lot,

andit

reducesprices

to

a

pointthat

djscouragesfurther

expansionof

production and,later,

results

jn 1iquidation

of

inventorjes".

A new

step

was made by Reutlinger

[Ag] who gavethe

first

for-mulation

of

the

ideas expressed by Breimyer. He introducedthe

notion

ofdemand

for

cowinventories

whichis

mostly

influenced byoutput

prices,and showed

that

prices

lagged oneyear

havea

negativeeffect

on cowslaughter.

But hedid

not carry

the

argumentfar

enoughto

formulate theimplications

onstability,

specificatjons

bias

andestimation. This

maybe

the

reason why Hayenga and Hacklander]1,

p.

54{

were unableto

usethis

ljne of

analysis

to

explain

their

hog supplyfindings

wh'ich exhibiteda

negativeshort-run price

elasticity

:

"This

rather

stongnegative

sup-p1y responseis

quite

intrigu'ing,

since

it

differs

fromthe

response bycattle

feeders".

Even moreintriguing

is

the positive short

run

responsefor cattle, in

the

light of

later

results.

Tryfos

l+4 is

the

first

to

havetranslated Reutlinger's

modelinto

the

simultaneous equations frameworkin

a

systematic manner(1).

Hefound evidence supporting

the

jnfluence

of

inventory

variations

on thesuppljes

of

beef,

vea1, mutton andpork.

The model may be summarized asfol

I ow.A

biological

dynam'icrelationship,

(

1.10)

A,

= an+

at

lt_t

(1)

Dean and Heady[el

and Fox[tt]

had founda small

instantaneousprice

effect

onthe supply.

But theydid not

separatethe

two components ofshort-run

suppty;

changein

numbers, and changein

averageweight.

More-ver, they

found opposite signsfor the current price effect. It is

alsoquite surprising that neither Reutlinger nor Tryfos refer to Hildreth

andJarret's

book wherea formulation of the inventory

supplyinteraction is

explicitely given

andin a

formvery close to equation (1.13)

betow [-19,where :

(1.11)

with:

(1.12)

-L?-A,

is

the

quantity

of

livestock

avai'lableat

t

It-t

is

the

inventory

at

the

beginningof

the

period Desired Iivestock

inventorY'0

+b

1 b2P, current price

of

meat,bt

>C,

current price

of

feed,

bt

<Pt*

b

ri

ct

Parti

a'l

adiustment hYPothesi s'

0 0

Ir

-

Ir-1

=.

(IT

-

It-r)

,0<c<1

Tota'l

supply equation,(1.13) St=At-d (Ir- It-l)

whered

is expected

to

be c'loseto

one..

',Thusthe

mode'lcalls

for

the

simultaneousestimation

of

thefollowing

systemof

equations:"

(1.14) It =.

bo+

c

bt

Pt

+

c

b,

Ct

*

(1

-

c)

It-t

(1.15)

Sr

= u0+ (at

+ d)-dI

1

t

Empirical

results

confirmedthe

expectedsigns

of

the

functionsi.e.

positive

effect

of

price

oncurrent

inventory

and negativeeffect

of

curyent inventories

oncurrent

supply.

Tryfos'modelis

quite similar

to It

Reutlinger,s

specification

;

the

simultaneity

in

Tryfosrcase comes from makingdesired inventory

depend oncurrent price

insteadof

price

la9-ged by one

period

as

in

Reutl'inger's model .l^lhile

the

ideaof

inventory

changes has beenclearly

expressed andcorrectly

estimated in tlrepreviousmode'ls,the interpretation

of

thefunctions involved,

the

meaningof

parameterswith

referenceto

the

supplypart

of

the

cobweb,the

consequencesof

the specification

effor

made inusfnga

recursive

mode1, andthe

imp'lications onthedynamicsofthe cobweb havenot

beenclearly

stated.

This

is

whatI

wouldlike

to

show andil-lustrate

onthe

basis

of

the

hog industrSrin

France'x

-14-chap.

2

-

INVENToRY-SUPPLY INTERACTI0N AND ITS CoNSEQUENCES 0N THE SUPPLY FUNCTIONIn

this

chapter

I will

develop a modelof

hog supply along theline of

Reutlinger and Tr3rfos,but

I will

set

it

in

the

cobweb framework'so

that

the interpretation

of

the

various

specifications

used becomeseasier.

I will

also

showthat

this

model, where supply depends on currentprjce

andprice

lagged by wunits

of

time

(w=

productionlag),

takes a sinrple autoregressive form whenpartial

adiustmentor

adapt'ive expectationsare

assumed. The longrun

supp'lyelasticity

maythen

be derivedin

a

s'irnpleway

as

in

other

llerlove's

type

models.This

specification

is

part'icu1ar1yuseful

whenlittle

aggregationis

made overtime

e'g'

whenquarterly

dataare

used.The

current price

affects

both numbers and we'ightsof

anjmal sslaughtered

at

eachpoint

in

time.

Therelation

betweenspecification

jnnumbers and

live

weightjs

also

discussed'Then,

I

analysejn

a

formalized waythe

consequencesof

thecurrent

pr.iceeffect

onthe

dynamicsof

the

cobweb andthe

estimationpro-bl ems.

i -

A suppl.yfunction

based on j nventor.y-sales

interaction

Both Reut'linger and

Tryfos

sfrecified a

modelwith a

high levelof

aggregation overtime

byusing

annualdata.

I

usea

model where thedefine

the state

of

the

herd bya vector

Xa.whose componentsare

the

num-bers

of

individuals

jn

eachproperly

defined age and physiolog'ical classes.Then

there

is

a

dynamicrelationshio

betweenthe state

vectorsat

succes-sive points

in

tjme, name'lY,(2.r)

Where

the matrix

M, 'includes both demographic parameters(ferti-lity,

survival

rates

)

andcontrol variables

correspondingto

farmersdeci sions.

Now

if

wecan't

usethis

detailed

framework becauseof

incom-plete data,

we maystill

considerthe

dynamicalrelationship

between somecomponents

of

the state vector.

Considerthe

age groupof

individual s which may beeither

bredor

sold

for

slaughterat

time

t,

its

number de-pends onthe

numberof

females bred wunjts

of

time before.

Then ure maywrite

(1),

(2.2) H

t

=mB

t-w

xt

=Mt

xt-i

Where, H

is

total

numberof

individuals

(herd)

readyto

be bredor

slau-ghtered

at

t.

This

correspondsto

the

'lavailable

supply" ofReutl ï nger

is

the

numberof

females bredat

time

t-w.

It

correspondsap-prox'imate'ly

to

the

jnventory

demandof

Reutlinger

(Breedingstock).

is

a technical coefficient characteristic

of

the

species,for

hogs

it

lies

between 5 and 10 (savedpig'lets

per

litter).

t

B t-w

1) I do not

useReutlinger-Tryfos notations since, partly

dueto the

smal-ler

timeunit, the definition of variables relates to

narrower groupsof

animalsin the specification I

use. m-16-But

at

eachunit

of

time

we do havea technical

identity

cons-traint

relating

cument

supply andcurrent

breedingstock (inventory

demand).(2.3)

where,

St

is

the

marketed supplyni.e.

the

salesor

the

slaughteredani-mals (1).

This constraint

has beenstated

by Reutlingerwith Bt

-

Bt-t

instead

of

the

level

of

B,

but

forgotten

about by several authorssubse-quent'l

v

G).

Tryfos

relaxedthis

constraint

in

(1.14),

which seemsiusti-fied

only

bythe

high leve'l

of

aggregation overtime

(annua'ldata)

andover types

of

animals.Equations

(2.3)

and(2.2)

showthat

available supply'in

pre-determinedat

time

t,

by previous decisions made onBt_*.

However marketedsupply

is

not

fixed,

since decisions madeat

t

on BXwill

also

affect

mar-ketedsupply.

Let

us assumefor

the

moment immediate adiustmentto

currentprice,

andformulate

farmers'decisions.cr,O

+

aP,where

P,

is

basically

output

price,

but

may be generalised asa vector

ofoutput

price, factor

prices, substitutesprices.

Equations(2.4)

meansthat

when producers

think that

their

operation

becomes moreprofitable

they areready

to

increasetheir

ouptut,

andfor

doing sothey

increasetheir

pro-duction

capacity

Br.

(2.4)

maythen

be thoughtof

asa

factor

demandequa-(1)

Whenthere are various

typesof

animalssold for

meatin a

specieslike

beef, a vector identity

wouldsinplify Reutlinger's

formulation.(2) In particular, it is susprising that

Larson, whose model has somesimu-larities to Reutlinger's

one, and should includenaturally the constraint

(2.3), did not

discussthis question in his

1967article.

+

Ht=

Btst

Bt=

tion

whereoutput

price

plays the

maiorrole

(1).Combining

(2.4)

and(2.2)

weget

what should be considered in myopinion as

the true

supply equationin

livestock

models.(2.5)

Ht mcr' + moP,-"This

is

the relationship

betweenthe

avai'lab1e supplyat

t

andthe

laggedprice

which hasactually

inducedthis

livel

of

supp'ly,or

morerigorously

this

level

of

production.

Asthe

conceptof

supplyelast'ic'ity

refers

to

the

relative

variation

of

output

induced byprice variation,

whetherthis

output

is

sold

or

stocked bythe

fjrms,

the relevant

parameterto

evaluate supplyelasticity

should be mo.

Becuaseof

the

linear

form the supplyelasticity

should be estimatedat

mean valuesby

:(2.6)

o

= ITl0 :-PH

This

is

the

procedure used by Harlow[tS,

R.

39],

whose model explainedthe

farrowings

by laggedprice.

Available

supplyis

iust

m tjmesthe

farrowings and both modelsyie'ld the

samee1asticity

asfar

as

spec'i-fication

is

concerned(practica'l

prob'lems may leadto

d'ifferences).

However,several workers used marketed supply

St

asthe

dependentvariable,

becauseit

js

the

only available data [Kettunen,

26

].

Combining(2.3),

(2.4) and(2.5)

weget

the

marketed supply equation :Sr=Hr-Bt

St

=*o0

*

*oPt_*

-

c*g - oPt(1)

SinceBt

may be bothsold

andinvested,

outputprice influencing factor

demand

is actually

expectedprice tl, oppottunity cost is actually

Pawhich should

affect

Banegatively. Sorting out the

twoeffects is

arather frustrating task

as shown by Myerset al. in a slightly different

context, dealing with

averageweight Ea,

35].(2.7)

(2 .B)

-18-St

=o0

(m-1) + moPr-*-

*Pt,

which we maywrite,

St

= a0 *tlPt_"

*

n'Pt,

t1

t 0,

n0.

0Then one can see

that while

it

is

correct

to

assumerecursive-ness

in

Harlow's speci'Fication(2.5),

jt

is

nolonger

thecasewhen the explainedvariable

is

the

numberof

hogs marketed.This

has obviouslyestimation consequences which

will

be taken uplater

on

But suppose alsothat

(2.8)

werecorrectly

estimatedwith

respectto

n1,

i.e.

that

plim

ô1 =m

o

One wouldcalculate the

supplyelastic'ity

by,(2.e) P

= mCÈ=

S o1

Internal

consistencyof

the

modelimplies

H>

5,

and thereforethe

supplyelasticity is

overvalued byol

t

o.

This

is

actually

what someof

the

results

of

Kettunen show when he used successivel.vavailable

supplyand marketed supply as

the

dependentvariable

126,p.

481. Theprice

elas-ticity

of

marketed supply was0,25,

while the

result

with the "quantity

of

pork produced" as dependent

variable

was0,20.

Thedifference

(1)

is

notbig,

but

Kettunen quotesresults

of

an author who found 0,40for

marketed supplyelasticity.

There may beother

pecu'larities

whichalso

contributeto

explain the

difference.

I

donot

knowof

any American study which wouldallow

to

verify

th'is

comparison betweeno,

ando.

The above evidence doesnot

appear asa

dramaticverification

of

the analysis.

However, we can seeon

a

priori

basis

that

the

approx'imationof

oby

o,

is

not

really

far

away.The

relationsh'ips

on mean values mayhelp

to

evaluatethe

discrepancy.H=B+S

F=mE

B=S/m-1

m

m-T

S(1)

Thedifference

seems evensmaller in

viewof the

useof a recursive

mo-del,

whichimplies further overestimation,

aswill

be seemlater.

Hwhich

implies

the

relation

betweeno,

and og.1

6

Hm

S

m-1

Therefore

if

mis

close

to

5for

hogs,the

error

is

25 %,which

is non

inconsistent

with

Kettunenresutts

(1).

0f

courseif

dataon inventories are

available,

whichis

agreat

estimation

advantage aswill

be seemlater'

one canexplain

themarketed sypply by

current price

and lagged breedingstock,

as done by someauthors.

Combining (2.2),

(2.3)

and(2.4)

gives(2.10)

St

= m Bt-u, -cr'

-

cr, P,In Tryfos'notations,

assuming fu11 adjustment(c

=

1,

andd =

1),

the single

equation on marketed supplyis

written

as(2.11)

St

= â0*

(at

+

1)

It-t

-

b0-

blPt

-

bzCtThese equat'ions

(2.10)

and(2.1L)

make cl ear whycurrent

priceeffect

should be negative when marketed supplyis

explained by laggedinven-tories

andcurrent

price.

Fai'ling

to

take

the

inventory-supp'lyinteraction

hasled

some workersto

find their

results surprising

as already notedlZO,

p.

50;

L7;27; 35

].Now,

howto

derive

the

supplyelasticity

from

(2.10)

and(2.1I)

?

Onecould

get

the

rirarketed-supplyelasticity

otdefined

bV(2.9)

byestimating

(2.10).

(2.10)

hasthe

disadvantageof

addinga

nonlinearity

to

get the

product mo. But aswill

beseen'later (2.8)

leadsto

estimation

djfficulties

dueto

the

corre'lation

betweenPr-*

and Pa.Apparent'ly

Tryfos

did

not

seethe

a

priori

relationship

bet-weenthe

coefficient

of

laggedinventory

a1 andthe

cument

price

ef-(1)

rf

onedefines

o0=

-of,,.r,

approxima.t;t't.otî:.t".;":n:t

elasticitv

is

given

byot

+ oO sincem

o,i -ob = 5

tm-

1)

= mcr6 = o-20-fect

b,(1).

I

think

this

hasled

himto

give

improperdefinitions

to

theI

elasticities

derived

fromthe

two simultaneous equations(1.i5)

and (1.16) which becomes whend

=c

=

1r(1. 15' ) b1 bzct

(1.16')

St

= a0+

(at

+

1)

It-t -

11He

called

inventory

e'lasticity

the

parameter derived from(1.15'),

while

this

is

the true

supplyelasticity, in

the

usualdefinition

of

supply.

(1.15')

is

the

equivalent

of

(2.4)

which wouldgive the

elas-ticity

expressed as,For,

if

we assume again F = mEfrom

(2.2),

then

(2.6)

becomes :ir=bo+

Pt*

6 ott = 0! B Po

= lll0;

HPP

=ma*=0i=O"

mBB

0n

the

other

hand hecal'led

supplyelasticity

the

negativeshort

run

effect

derived from boththe

equations, presumablythe

expres-sion

db,

! .

But,

althrough

it

affects current

supply,

this

parameteris

in fact

ràt.t.a

to

inventory

demand and shou'ld beinterpreted

as

such andcertainly not

as

somethinglike

short run

supply.What

I

considerto

bea

misleadinginterpretation

of

the

para-meters

of

the

estimated equations ona

supplypoint

of

view,

may be seenagain

in

the

Reutlinger

-

Tryfos'models. Althoughthey both

introduced apartia'l

adjustment hypothesisin

their

mode'lthey

did not

try

to

derivelong run

elasticity

of

supply fromtheir

results,

whichthey rea1ly

were(1)

Probably becauseof

the

way hespeclfied

in

0,1,4')the

marketed supplyas

the difference

betweenavailable

supplyA,

and changein

inventoriesin

a position

to

do. But,

assjmi'lating

current price

effect

to

short

run supply response prevented themto

think

of

the

inventory

ecluations(2.4),

(2.5)

or

(1.15)

astrue

supp'lyfunctions,

with

bothshort

and long run aspects whenthe introduction

of

partial

adjustmentor

adaptiveexpecta-tions give

them an autoregressive form.2

-

Partial

adj ustment and adaPtive

expectationsSince decisions

are basically

made on breedingstock

it

is

natural

to

define the

"slow adjustment"at this'level.

The behavioral equation(2.4)

becomes now,(2.12) oo +

partial

adiustment hypothesis means,(2.13)

Bt

-

Bt_1=

I

(tT

-

tr-r)

,

o.< 1r<

1adaptive expectations imp1y,

OPT

Bi

(?.r4)

(Pi

-

PT_r) =o

(Pt

-

PT_l),0<û-<1

As

urell

known wheneither

oneof

the

two assumptionsis

intro-duced

alone

(e.g.

ç

+

L, û = 1) the

estimab'le equation takesthe

same form.If

bothare

introduced,

then one cannotidentifycp

and rp. Assuming Û=

1'we

get the

equation expressedin

observable variab'les,(2.15)

Br =1o0

+

(1

-

f)

Br-1 +

?oPrAgain,

in

Tryfos'casethe coefficient

of

Pt

(in

1.15as

in15)

is

whatjs

usually ca'lled

short

run

e'lasticity

whenmultiplied

byE

.

Thelong run

elastjcity

is

obtained bydividing byct.

The equation.15)

mayeasily

be expressedin

termsof

available

supplyor

production,2.

p/

-22-H,

= mBr-* gives(2.16)

Ha = mtgo' + m(1

-

?)

Bt_*_l

+ mgaPr_*This 'is

anunpractical

equation

to

estimate, but the

marketed supply equationis

muchnicer

to

both estimate andinterpret.

By using(2.15)

and(2.t6)

St Hr Bt

St

=goo

(m-

1)

+

(1

- q)

(tBt-,u-l

-

Bt-t)

+ mfoPg-y-

loPt

Using

the

relation

between Hr_, andBt-*_l

weget the

simp'le autoregressive marketed supply equation,(2.t7)

S,

=1o6

(m-

1)

+

(1

-

.f)

St-l *

mgaPr-"-

,foPtThis

equationincludes

bothpartial

adiustment andinventory-supp'ly'interaction

in

a

formclose

to

the

cobweb.In

this

equation mgawill

serve

to

calculate short

run

supp'lyelasticity,

mo'longrun

supplye]asti-city,

qo the

inventory

demandeffect.

But

it

should be notedthat

using 5instead

of

H means, assaid

before,

that

this

procedureoverstates

supplyelasticities

andyields

the marketed supplyelasticities

(SR and LR).Equation

(2.17)

takes aninteresting form, since,

althoughit

involves

price

lagged by wunits

of

time, the introduction

of

a

partial

ad-justment assumptionis

made byusing

the

dependentvariable

lagged byjust

oneunit

of

time.

This

wouldnot

be abviousif

onespecifies

supply behav'iordirectly

ona

marketed supply equationof

the

formSf

=f

(Pt-*)

jn

therecursive

case.

It

is

then temptingto

specify

partial

adiustmentwith

theproduction 1ag w as

a

unit

of

thime as,sr S

(si

-

st_*)

t-w=9'

which would

lead

to

an estirnable equationSt

=

f'

(St_w, Pt.Wwhere

the

coefficienf

of

Sa-,

would beinterpreted

as one minus theadjustment

coefficient

q'.

At

onetime

I

made such anattempt,

without any success. Kettunen hadalso

donethe

sameV6, p.

51], but the

coef-fjcient

wasvery

snall

(0,08)

andnot

significant.

The simple form givento

the

marketed supply equationwith

slow adiustment bythe

breed'ing stock-supplyjnteraction

seemsto

adda nice

coherenceto

the

averallsupply behavior

implied

bythe

model. Theresults turn out

to

beaccepta-ble

for

the

lagged nrarketed supply, ôS weshall

seelater

on.3

-

Supplvin

numbers, supplvin

weiqhtsAll

the

previous models have beenspecified

in

numbers. Butthe

relevant

variable

on marketequilibrium

is

theIiVeweight

marketed.Current

prices

havea positive

effect

on average carcass we'ights, as well known,ê.g.

Harlow[15,

p.

40].

Morerecently,

Myers, Havliceck andHen-derson

[34

,

35]

have provided uswith

a

more sophisticated modelof

short run

(1)

supply behavior.Basically,

they

considerthe

problemof

theprofitabilityofdelaying

the salesof

fattened

animals whenprices

arechanging. They expect

total

'live

weightat

time

t

to

dependpositively

oncurrent price

andnegatively

onthe

pnice expectedfor

the next

unit

oftime,

wherethe available

animalsat

t will still

bein

the

suitable

weight range

for

slaughter.

Thedifficulty is

that

expectedprices

dependheavily

oncurrent prices,

asthe

authors were avareof,

making impossibleto

separatethe

twoeffects.

It

seemsto

methat

they could have intro-ducedin

their

model one morefunction

based onthe

relationship

betweenhogs'age and

their

averageweight

;

they could

have thensorted

out

the(1)

Comparedto the

previousshort run elasticity this

problem".