HD28

.M414

no.3035-89

3 TDflO

Da5t,73TM

TBASEMB4I

:^y

WORKING

PAPER

ALFRED

P.SLOAN

SCHOOL

OF

MANAGEMEN

A

COMMODITY

LINKED

BOND

AS

AN OPTIMAL DEBT INSTRUMENT

INTHE PRESENCE OF

MORAL HAZARD

Antonio MelloandJohnParsons

WP

#3035-89-EFA- June 1989MASSACHUSETTS

INSTITUTE

OF

TECHNOLOGY

50

MEMORIAL

DRIVE

A

COMMODITY

LINKED

BOND

AS

AN OPTIMAL DEBT INSTRUMENT

INTHE PRESENCE OF

MORAL HAZARD

AntonioMello andJohnParsons

A COMMODITY

LINKED

BOND

AS

AN

OPTIMAL

DEBT INSTRUMENT

INTHE PRESENCE OF

MORAL HAZARD

AntonioMelloandJohnParsons*

June1989

Inthis paper

we

communicate two results. First,we

constructan exampleinwhichafirmstrictlyprefers to issue abondlinked tothepriceofacommodityasopposedto a fixed ratebond.

Thefirmwith afixed ratebond choosesasuboptimal investmentpolicybecause the outstanding

nominal obligation distorts the incentivesof theequity owners.

The

commodity linked bondresolvesthismoral hazard problem.

Second,

we

showthatinthepresence ofmoral hazard problems thetraditionalapplicationofcontingent claims valuation techniquesleadstoan incorrectvaluation of the therealassetsand

consequentlytoanincorrectvaluationof thefinancialliabilitieswrittenagainstthoseassets.

We

show

how

thetechniquecanbeadaptedto yield correct valuations.VisitingProfessor ofFinanceandAssistantProfessorof Finance,respectively,SloanSchool ofManagement,M.I.T.

This researchissupportedinpartby theProgramonInvestments, Finance,andContracts of theCenterforEnergyPolicyResearch,EnergyLaboratory, M.I.T.

2

TTie use ofcommoditylinked debt hasbeen advocated by Lessard (1977), primarilyas an

instrumenttoimproverisksharingbetweenlessdeveloped countriesthatare significantlydependent

upon commodityexportsandoutsideinvestors. Lessardalsonotedthattheimprovedrisksharing

wouldhave consequencesfor capitalbudgeting. However,hisargumentdid not focusuponthe

verydirectnatureinwhichacommoditylinkedbondcouldimprovethe equity owner'sincentives

tochoose the optimal investmentandoperatingstrategy. Lessard'ssuggestion hasbecomequite

popular,and there

now

existmany

proposalsforindexing oflessdeveloped country debtto thepricesof variouscommodities ordirectly toexportearnings. However,almostallof theliterature

continuestofocusupontheproblemofimprovedrisksharing. Thereisalmostnoattentiongiven

to theimproveduse ofthe real assets thatcanresultfrom the proper design ofcommoditylinked

debt. Inthispaper

we

focusexclusivelyonthechangesinuseof thereal assets.Our

analysisdemonstrates,therefore,

why

acommoditylinkedbondmay

bean optimal financing instrumentforaprojectinadeveloped countryas well asaprojectina lessdevelopedcountry. Itshouldbe

notedthatthegreatmajorityofcommoditylinkedbondshavebeenissuedindeveloped countries

and that

many

of theissues have beenmade

by industrial corporations involved in mining orprocessingthe relevant commodities asour analysiswould predict and in contradiction to the

predictionsofmost other explanations forthe existenceof these securities.

Our

analysis callsattention,moreover,tothefactthatthe optimalcommoditylinkedcontractmustbetailored tothe

particular setofreal assetsbeingfinanced.

In the traditional application of the contingent claim techniques it is assumed that the

investmentandop)erating decisionsof thefirmaregivenanddonot vary with the parameters of

the liabilitiessold against thefirm. Forexample,in Merton(1974) thestochasticprocessthat

3

against the firmisderived. Inrecentwork onthe valuationofrealoptions the contingentclaims

techniques areused to derive theoptimal investmentand operatingstratcgies--for example, in

Brennan and Schwartz(1985). Inthese models,however, the optimal investmentand operating

strategyisderivedunder theimplicitassumptionthatthefirmis

100%

equityowned. Itiscommon

tothen take the derived optimal investmentandoperatingstrategy asthe underlying determinant

of thestochastic processforthefirmvalueandtothen value the variousfinancialclaims against

thisvalue. However,undersomecircumstances thestructureoffinancialclaimssoldagainstthe

assetswillimpact the operatingdecisionsofthemanagementsothattheassumedstochasticprocess

forthefirmvaluedoes not infactobtaininequilibrium.

The

problemof moral hazard must beincorporatedintothecontingent claims models,and

we

showhow

thiscanbe done.1.

A

Contingent-Claims Analysis of aMineConsiderafirm thatownsaminethatcan operatefor a totalof threemoreyears.

To make

theproblemsimple

we

reduce themanagement'sdiscretion toa single decision:when

should theminebeabandoned.

When

themineisopenitmustproduceanamountqatzero averagecost.'Whilethemineisstillopen andoperatingtheownermust payaper periodmaintenancecostof

A. Atany pointintimetheminecanbeabandoned atzerocost,but itcannotbe reopened.

The

futurepriceof thecommodity,s,isarandomvariable.We

modelthepriceusing thebinomialmethoddescribedinCox,RossandRubinstein(1979). Accordingly, theprice attimet=0

isS;thepriceattimet

=

lcan takeon oneoftwovalues,uS anddS.The

priceattimet=2cantakeonthreevalues,uuS, udS, and ddS, althoughconditionalontherealizationof theprice att

=

l'

One

canalternativelyconsiderthecommoditypricegivenin thispapertobe thepricenet of the constant perunitaveragecost.4

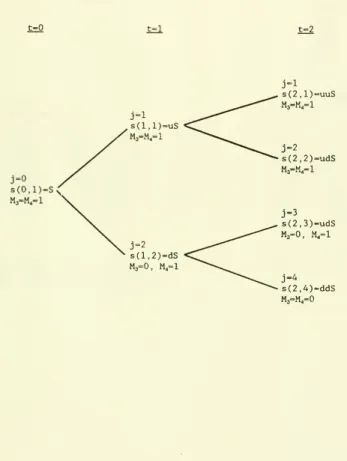

thereareonly twopossible realizationsat t=2. InFigure 1,

we

drawthetree that definesthepossiblepathsofprices. Becausethepayofftothefirmispathdependentinan important way,

when

we

constructa tree torepresent theunfoldingof uncertainty regardingpricewe

distinguishbetweenthenode attimet=2forwhich

s=udS

andwhichwasarrived at vias=uS

attimet=

landthenodeattimet=2forwhich

s=udS

andwhichwasarrived at vias=dS

attimet=

l. Forconvenience

we

denote the four nodesat t=2byj=

1,2,3,4;asimilarnotationisusedtodenotethetwonodesatt

=

l;andwe

maywritethepriceatanynodeass(t,j).[InsertFigure1 Here]

The

risk-freeinterest rateis r. The termstructureoffutures prices isdetermined by theconvenienceyield which

we

assumeto be proportionalto the currentprice of thecommodity,s(t,j)c:definingf(s)astheoneperiod future price itfollows inour modelthatf(s)=

s(t,j)(l+r-c).

A

vectorM

=

[m(0,l);m(l,l),m(l,2);m(2,l),m(2,2),m(2,3),m(2,4)] denotes an abandonmentstrategy,where m(t,j)

=

(= 1)meansthatthefirmabandons(continuestooperate) themineinperiodt

when

thepriceiss(t,j). Thereare 5undominatedstrategies:M, =

[0;0,0;0,0,0,0];M,

=

[1;1,0;1,0,0,0];M, =

[1;1,0;1, 1,0,0];M, =

[1;1,1;1, 1,1,0]; andM^

=

[1;1,1;1, 1,1,1]. Strategies 3and4aretheinterestingonesthatserveasthebasisof comparisons

made

in thispaper. InFigure1

we

havewrittentheabandonmentdecisionsateachnodeof the decisiontree forboth of thesestrategies.

The

reader should notethatunderstrategy3,iftheprice att=2isudS,whetherornot thefirmisoperatingdependsuponthepast historyofprice:iftheprice att

=

lwasuS,thenthemine wasnotabandoned andtheminewillalsonotbeabandonedatt=2; however,iftheprice

at t

=

l was dS,then the mine was abandoned andeven though the owner might wish tobe5

Itis

now

possible toderivethevalue of themine andto solve fortheoptimalabandonmentpolicy.

Our

exampleisessentially amuch

simplifiedcaseof thenaturalresourceproblemanalyzedinBrennan andSchwartz (1985)--allowingforthediscretizationof theprobleminour

example--and

we

solveourproblemaccordingtothelogicusedin thatpaper.Foranyarbitrarystrategy

M

itisastraightforward mattertoconstructthesetof cashflows thatwillbereceivedby thefirmateach pointintimeandcontingentupontherealizationof theprice: x(M,t,j). Thesecash flows are,however, contingentupontherealizationof thestochastic

price process and thedifficult problem is theproper discount to applyto these cash fiowsin

recognition of the particularrisk associatedwith each. Contingent claimsanalysis teaches us,

however,

how

touse thefuturesmarket combinedwith borrowingandlendingtoexactlyduplicatethesequenceofriskycash fiowsfrom themineunder any givenstrategy.

We

candetermine theamountof cashthatwouldbe necessarytoopena portfoliooffutures contractsandbondswhich,

when

properly rebalanced, perfectly replicates the cash flows from the mine. Under certainassumptionsabout thecompleteness of themarketin financialandreal assets,thismustalsobe

thevalue of themine underthat strategy.

Define K(M,t,j)astheamountoffuturescontracts that the firmholdsinperiod te{0,l}ifthe

priceisatnodej;anddefineB(M,t,j) as theamountofoneperiodbondspaying (1+r)inthe next

periodthatthefirmholdsinperiod t€{0,l}ifthepriceisatnodej. Foreverystrategy

M

=

l,...5theportfoliooffuturescontractsandbondsthatthefirmmustholdattimet=listhesolution to

the followingsetof equationswhichcanbe solvedpairwise:

x(M.2,l)

=

(u+c-r) K(M,1,1)+

(l+r) B(M,1,1),x(M,2,2)

=

(d+c-r) K(M,1,1)+

(l+r) B(M,1,1),x(M,2,3)

=

(u+c-r)K(M,1,2)+

(l+r) B(M,1,2),and6

Similarly,theportfoliooffutures contractsandbondsthatthefirm must holdattimet=0is the

solution tothe followingpairof equations, whichcan be solvedoncethe valuesfromthe previous

equationsare substitutedinaccordingly:

x(M,l,l)

=

(u+c-r)K(M,0,1)+

(1+r) B(M,0,1)-B(M,1,1),andx(M,l,2)

=

(d+c-r)K(M,0,1)+

(1+r) B(M,0,1)-B(M,1,2).Once

thisportfoliooffuturescontractsand bondsisopened,itcanberebalancedineach periodasdescribedby thesolution totheseequations sothatityields exactlythesamefreecash flowto

thefirm aswouldthemineoperated accordingtothestrategyM. Inordertostartthestrategy,

however, thefirmneedstopurchase theinitialportfoliooffuturesandbonds. Since thefutures

contractsrequirenocashoutlaysupfront,theinitialportfolio costsB(M,0,1)andthis,then,isthe

value of themineoperated accordingtothestrategyM.

Itis

now

astraightforward mattertochoose the optimalabandonmentstrategy forthemine:itissimplythatabandonmentstrategywhichyieldsthehighestvalueforthemine:

r

= max

B(M,0,1)andM' e argmaxB(M,0,1).M V

Itisalsopossible to findthe valueofthemineatany pointintimeas afunctionof therealized

priceof thecommodity,T(M',t,j)

=

x(M',t,j)+

B(M*,t,j).In constructingthisvaluation

we

have ignored thefactthat atsome pointintime andforsomerealizationofpriceandforsomearbitraryplannedabandonmentstrategythe firm might have

anegative cash accountandanegativevalue, i.e.,

we

have ignored theproblemof bankruptcy.Thisiseasyto resolve."

To

properly incorporate theproblemofbankruptcywe

mustspecifywhat happenstothefirm's7

assetsinthisevent.

We

assumefirstthatthe firmdoes not pay any dividendsatt=0andt=

l:allcashearnedisretainedandinvestedinanaccount earningthe riskless rateofinterest,r. Atthe

endof period t=2a liquidatingdividend is payed. At the beginning of eachperiod,given the

realizationof thepriceitis

common

knowledge whetherthefirmhasenoughcashtocontinuetooperateasplanned,thatiswhetheritcan cover the maintenancecost.A, out oftherevenuesto

be receivedthatperiodandout ofanyaccumulatedcash:ifitwillnot haveenoughcash,then the

firmisdeclaredbankrupt. Thefirm,lessanyaccumulatedcash,isassumedtobeliquidatedbysale

and theassumedsale priceisthe value ofthe firmatthat pointintimeandconditionalonthe

current realizedcommodityprice, andunder the assumption thatthefirm isoperatedfrom this

pointonaccordingtotheoptimalstrategy,T(M",t,j),derived above. Define Y(M,t,j)asthe balance

thatwould bein theaccount attheendofaperiod assuming anarbitraryabandonmentstrategy

M

andnobankruptcy;thisisthe retained earnings of thefirm,andatt=2itisthecashavailable fordistribution toequityholders:Y(M,0,1)

=

0.Y(M,1,1)

=

Y(M,0,1)(1+r)+

x(M,l,l),Y(M,1,2)

=

Y(M,0,1) (1+r)+

x(M,l,2),Y(M,2,1)

=

Y(M.1,1)(1+r)+

x(M,2,l).Y(M,2,2)

=

Y(M,1,1)(1+r)+

x(M,2,2),Y(M,23)

=

Y(M,1,2)(1+r)+

x(M,2,3),andY(M,2,4)

=

Y(M,1,2)(1+r)+

x(M,2,4).The

firmisbankrupt atthebeginningof period tgivena realizationof the commoditypriceifY(M,t,j)<0. Define u(M,t,j)e{0,l} asabinary operator,where

u=0

indicates that thefirmhas8

w(M,t,j)e{0,l} asabinary operator,where

w

=

l indicates thatthefirmwentbankruptattimetgiven the reahzation ofthecommodityprice. Define Z(M,t,j)astheactualbalance inthe cash

account of the firm, given theintended strategy

M

and thesaleof thefirmwhen

bankruptcyoccurs: Z(M,0,1)

=

x(M,0,l)u(M,0,l)+

T(M",0,l)w(M,0,l) Z(M,1,1)=

Z(M,0,1) (1+r)+

x(M,l,l)u(M,l,l)+

T(MM,l)w(M,l,l), Z(M,1,2)=

Z(M,0,1)(1+

r)+

x(M,l,2)u(M,l,2)+

T(MM,2)w(M,l,2), Z(M,2.1)=

Z(M,1,1) (1+r)+

x(M,2.1)u(M,2,l)+

T(M',2,l)w(M.2,l), Z(M,2.2)=

Z(M,1.1) (1+r)+

x(M,2.2)u(M,2,2)+

T(M',2,2)w(M,2,2), Z(M,2,3)=

Z(M,1,2) (1+r)+

x(M,2,3)u(M,2,3)+

T(M',2,3)w(M,2,3),and Z(M,2,4)=

Z(M,1,2) (1+r)+

x(M,2,4)u(M,2,4)+

T(M*,2,4)w(M,2,4).The

firmmay

be valued usingaportfoliohedgingstrategycomposedoffuturescontractsandriskless bonds as described earlier. The only correction that must be

made

to the hedgingalgorithmisa recognitionthat nocash flows actuallyleave the firm untiltheendof period2.

Again

we

define K(M,t,j)astheamountoffuturescontracts thatthefirmholdsinperiod te{0,l}ifthepriceisatnodej;and defineB(M,t,j) astheamountofoneperiodbondspaying(1

+

r)inthe next periodthatthefirm holdsinperiod te{0,l} ifthe priceisatnodej. Foreverystrategj'

M

=

l,...5theportfoliooffutures contractsand bondsthatthefirmmustholdattimet=listhesolution tothe followingsetofequationsthatcanbesolvedpairwise:

Z(M,2,1)

=

(u+c-r)K(M,1,1)+

(1+r) B(M,1,1),Z(M,2,2)

=

(d+c-r)K(M,1,1)+

(1+r) B(M,1,1),Z(M,2,3)

=

(u+c-r) K(M,1,2)+

(1+r) B(M,1,2),9

Z(M,1,1)

=

(u+c-r) K(M,(),1) + (1+r) B(M.0,1).andZ(M,1,2)

=

(d+c-r) K(M,0,1)+

(1+r) B(M,0,1).Once

thisportfoliooffuturescontractsand bondsisopened,and ifitisrebalancedasdescribedby thesolution tothese equations,ityieldsexactlythesamefreecash flowtothefirm aswould

themineoperated accordingtothestrategyM. Inorderto starttheportfolio,however, thefirm

needstohave cash in the amountB(M,0,1) and this, then,isthe value of the mineoperated

accordingtothestrategyM,V(M,0,1).'

InTable1

we

displaytheresultsofthismodelfor a particular setof inputvalues.The

readercan see that the optimal abandonment strategy is

#3

and that the value of the mine isV(M\0,1)=V(3,0,1)=$4.24.

[InsertTable1Here]

Att

=

landj=2,i.e.when

s(l,2)=dS, thefirmisfacinganunsurefuture:ifthepriceweretoincreasetoudS, itwouldbeprofitable forthe firm tooperate. Ifthepriceweretodecreaseto

ddSthefirmwouldchoosetoabandonthemineratherthanincurthe operatinglosses. However,

in order to keep this option alive, the firm must keep the mine open today and pay the

maintenancecostsA. Thiswouldbe equivalenttochoosingstrategy#4.

The

optionisvaluable:it isworth almost$0.54. However,thecostof the optionis $0.65,the difference betweenthe

currentearningson thecommodity andthemaintenancecostsofkeeping themineopen,andso

thefirm isbetter offabandoningthemineatt

=

l,j=2.' It

may

be the case that V(M,0,1)>

T(M,0,1), the value of thefirm calculatedin the previoussection. ThisisbecauseV

incorporates the possibilityof bankruptcy whileT

doesnot.V

>

T

when

theevent of bankruptcy takesthe assetsaway from a management teamthat is10

2.ValuingCorporateLiabilities

We

now

supposethatthe firmhasoutstandingabondwithapromisedpaymentatt=2,p.andwithnointermediatepaymentsdue. Thefirmisrestricted,however,againstpayingany dividends

until thebondispayed. Thefirm isallowed touse theaccumulated cashtopay any operating

expensesonthemineatt

=

l andt=2.The

accumulated balanceinthisaccountisusedatt=2topay offthe bond andthen the remainderispayed outas aliquidatingdividend.

No

otherliabilitiesexistor

may

becreated.The

definitionof the cashavailable tothefirmandthe eventsinwhich bankruptcy occursarechangedslightlyby the existence of the outstandingdebt. Define Y<((M,t,j)asthe balancethat

would bein thefirm'scashaccount attheendofaperiod assuming anarbitraryabandonment

strategy

M

and nobankruptcy;thisistheretained earningsof thefirm,andatt=2itisthecashavailable for distribution toequityholders:

Y,(M,0,1)

=

0, Y,(M,1,1)=

Y,(M,0,1) (1+r)+

x(M,l,l), Y<,(M,1,2)=

Y,(M,0,1) (1+r)+

x(M,l,2), Y,(M,2,1)=

Y,(M,1,1) (1+r)+

x(M,2,l) -p, Y,(M,2,2)=

Y,(M,1,1) (1+r)+

x(M,2,2) -p, Y,(M,2,3)=

Y,(M,1,2) (1+r)+

x(M,2,3) -p,and Y,(M,2,4)=

Y,(M,1,2) (1+r)+

x(M,2,4)-p.The

firmisbankruptatthebeginning of periodtifYXM,t,j)<0. DefineUd(M,t,j)andWj(M,t,j)asindicatorfunctionsfor abankruptfirmandforthe periodof bankruptcy,justasbefore. Define

Zd(M,t,j) astheactualbalanceinthecashaccount of thefirm,given the intendedstrategy

M

and thesaleof thefirmwhen

bankruptcyoccurs:11 Z,(M,ai)=x(M,0,l)u,(M,0,l) +T(M',0,l)w,(M,0,l) Z,(M,1,1)=Z,(M.O,l)(l+r) +x(M,l,l)u<,(M,l,l) +T(MM,l)w,(M,l,l), Za(M,l,2)=Z,(M,0,l)(l

+

r) +x(M,l,2)u,(M,l,2) +T(MM,2)w<,(M,l,2), Z,(M,2,1)=Z,(M,l,l)(l+r) +x(M,2,l)u,(M,2,l) +T(M',2,l)w,(M,2,l), Z,(M,2,2)=Z,(M,l,l)(l+r) +x(M,2,2)u,(M,2,2) +T(M*,2,2)w,(M,2,2), Z,(M,2,3)=Z,(M,l,2)(l+r) +x(M,23)u,(M,23) +T(M',2,3)w,(M,2,3),and Z,(M,2,4)=Z,(M,l,2)(l+r) +x(M,2,4)u,(M,2,4) +T(M*,2,4)w,(M,2,4).We

arenow

readytovalue firmwith debt outstandingand to directlyvalue the debtandequity claimsagainstthefirm. Thevaluation ofthe firmproceedsjustas before,usinga portfolio

hedgingstrategycomposedoffuturescontractsandrisklessbonds,Kd(M,t,j)and Bd(M,t,j):

Za(M,2,l)

=

(u+c-r) K,(M,1.1)+

(1+r) B,(M,1,1), Z,(M,2,2)=

(d+c-r) K,(M,1,1)+

(l+r) B,(M,1,1), Z<,(M,2,3)=

(u-rc-r)K,(M,1.2)+

(l+r) B,(M,1,2), Z,(M,2,4)=

(d+c-r)K,(M,1,2)+

(l+r) B,(M,1,2), Z,(M,1,1)=

(u+c-r)K,(M,0,1)+

(l+r) B,(M,0,1),and Z,(M,1,2)=

(d+c-r)K,(M,0,1)+

(l+r) B,(M,0,1).Bd(M,0,l)isthe valueof themineoperated accordingtothestrategyM,Vj(M,0,l).''

To

value thedebtandthe equity claimsagainstthefirmmerely requirescorrectly registeringthepayoffs toeach claimineachfinalrealizationof thecommoditypricepathandvaluingtherisky

" It

may

bethe casethatVj(M,0,l)>

V(M,0,1), the valueof thefirm calculatedwhen

thereis no debt outstanding. Thisis because the possibilityof bankruptcy

may

change the actualabandonment strategyimplemented with the real assets

when

these assetsaretaken from theoriginal management; and the set of events on which bankruptcy

may

occur will be differentdependingupontheactual sizeof the debtobligationoutstanding. Thisisone exampleof the'free

cashflow'argumentinfavorofa largeamountof debtthathasbeen

made

by Jensen(1986).Of

course,V,(M',0,1)=V(M',0,1).12

payoff using theappropriateportfoliohedgingstrategycomposedoffutures andrisklessbonds.

Theoutstanding corporatebondpromisingtopay patt=2has the followingactualpayoutsunder

strategy

M:

D,(M,2J)

=

pu,(M,2,j)+

Z<,(M,2,j)w,(M,2,j), j=

l,..4.The

firm'sequity has the followingpayoutsunderstrategyM:

E,(M,2,j)

=

(Z,(M,2,j)-p) u,(M,2j)+

max{Z,(M,2,j)-p,0}w,(M,2,j), j=

l,..4.To

value these claimswe

onceagain construct ahedgingportfoliooffuturesandriskJessbondsaccordingtothealgorithm usedtovalue the cashflowsof thefirm as awholegivenabove.

InTable 2

we

displaysomeof theresultsofthismodelforthesetof input valuesusedearlierinconstructingTable1,with the promised debtpayment p=$1.35att=2.

The

value of themineunderstrategy

#3

isV<,(3,0,1)=$4,242. Understrategy#3

andwiththissizeof debt outstandingthe firm never goes bankrupt.-

The

corporate debt is therefore riskless; its value isD<,(3,0,1)=$1.076. Thefirm'sequity hasavalue£^(3,0,1)=$3.166.

[InsertTable 2Here]

3.Moral Hazard andtheRevised Valuation ofCorporateLiabilities

Althoughthe totalvalue of the firmisless understrategy

#4

thanunderstrategy#3, thereader should notethatthevalue of the equityis higher,Ej(4,0,l)= $3.20

>

£^(3,0,1)=$3,166.Thisisbecause the outstanding debtobligationof the firmchanges thefinancial incentives facing

the equityownersin theeventthatthepriceislow. At t=l, j=2, theabandonmentoption is

worth $0.54 as

we

mentioned earlier, but costs $0.65 to keep alive. Keeping the optionaliveisnot worthwhileand themineshould be abandoned. However,the equityholderownsan

13

onadifferentpayoff:thereturns tothemineineach eventlessthenominal debtobligation. This

equitypayoff patternisriskierthanthe firmpayoff pattern so thattheoptionisvaluabletothe

equityowner even though itis not valuableto thefirm as awhole. Consequently, the equity

ownerchoosestooperateata lossatt

=

l,j=2inordertokeepalivethehopeofa largepayoffatt=2,j=3.

Itisthereforeincorrect tovalue the outstanding corporatebonds underthe assumptionthat

thefirmismanagedaccordingtostrategy

#3

aswasdoneinthe previoussectionand asisoftendone

when

varioustechniquesforcontingent claimspricingareappliedtovalue corporateliabilities.Theactual stochasticprocessthatthe valueofthe firm followsisnot independent of the nominal

obligations specifiedintheliabilitiesbecause these nominalobligations affecttheincentivesof the

equityowners.

One

cannot thereforefirstspecifyor derive thestochasticprocessforthe valueofthefirmandthendirectlycalculatethe value of anyarbitrary financialliabilitywrittenagainst that

firm.

The

usual method for valuing the contingent claims can be easily modified to correctlyincorporate the consequenceof moral hazard: the modification isasfollows. In general, itis

necessarytofirstspecifythe nominalobligationsoutstandingonthefirm,andthenitisnecessary

tovalue the equityunderallpossible strategies.

The

strategy thatwillbe chosenistheone whichmaximizes the returntothe equity given thosefinancialliabilities.

Once

thisstrategyischosenitbecomespossible tovalueallof thefinancialliabilitiesinequilibriumandpossible tovalue the firm

asawhole: Define

M'

e argmaxE,(M,0,1),andV; =

V,(M',0,1),D; =

D,(M',0,1),andE/

=

Ea(M\0,l).

Whilethismodificationisstraightforwardatthelevelof thelogicof the algorithm,infactit

14

solvedtodate. Itisnosimple matterto translatethisalgorithminto arobust valuationtechnique

thatiseasilyusablefor alarge classof problems. Nevertheless,itispossible touseittogainsome

insight into certainimportant questionsasisevidencedinthe nextsection.

4.

A

Commodity

LinkedBondasan Optimal DebtInstrumentConsideracorporate debtobligation inwhichthefirmpromisestopayattimet=2anamount

thatiscontingentupontherealized priceof thecommodity:p(2,j)

=

0.1231 s(2,j). Ifthisistheonly debt instrument outstanding on the firm, and assuming all other values as given forthe

previous example, then

we

can calculate the value of the firm, V', the value of this debtinstrument,D,', and thevalue of the equity, E,',using thehedgingportfolioconstructions used

above and acknowledging the moral hazard problem as discussed above.

The

results forabandonmentstrategies

#3

and#4

are displayedinTable3.[InsertTable3Here]

The

important thingto note isthat the optimalstrategyfor the equity holderswhen

theoutstanding liability isthis commodity linked bond is abandonment strategy#3, the first-best

abandonmentstrategy. The commoditylinkeddebtis,therefore,an optimal debt contract which

resolves themoral hazardproblemassociatedwithfixed ratedebtcontracts forthisfirm.

The

firmvalue

V;=

$4.24isgreaterthan thefirmvaluewhen

a fixedratedebt contractisused,V/=

$4.18.ThiscommoditylinkedbondisworthD,'= $0.98whichisthesameasthe value of thefixed rate

bond,D/, andtherefore

we

cansay thatthefirmvalueisincreasedby changing the type of debtcontract while holding constant the value of the debt outstandingatt=0.

The

value of the equityishigher

when

thefirmhas thecommoditylinkedbondoutstandingthanwhen

ithas thefixed rate15

The

commoditylinkedbond increases thevalue ofthe firmbychanging the equity owner'sfinancialincentives forabandonment

when

the priceof thecommodityislow. Withthecommoditylinkedbondoutstandingitisnolongerbeneficial forthe equity holdertokeeptheabandonment

optionopenatt=l,j=2 andtherefore the equity holderwillimplementthefirstbest strategy#3.

The

increaseinthefirmvaluethatfollowsfromthisaccruestotheequity.*Itisworthemphasizingthatthisresultcould notbeobtained using the conventional techniques

of contingent claimsanalysis,preciselybecause these techniquesdonot recognize the moral hazard

problemsassociatedwith variousfinancialliabilities. Thetechniquesthatdominateinvaluing the

varietyof contingent claimsthat

now

exist--forexamplethemodelsof Schwartz (1982)and Rajan(1988) developedforvaluingcommoditylinkeddebt-ignore the impactthatthe issuance ofagiven

type ofsecurity has onthe stochasticprocess whichdescribes thefirm'svalue. As mentioned

before,while thelogicof the algorithms iseasilyreconstructedtoincorporatethisproblem, the

mathematical machinery withwhich theoriginalalgorithms havebeeiisofruitfullyappliedisnot

soeasilyreconstructed. Even onceamethodisdevisedtovalueagivensetoffinancialliabilities,

acknowledging theproblemof moral hazard,amoresignificantproblemliesindevisingameans

bywhichto findtheoptimalsetoffinancialliabilities. Itistothesetasks that

we

intendtoreturninfutureresearchonthisproblem.

* Althoughtheparticularcommoditylinkedbond that

we

have analyzed here achieves thefirst-best,it isnot the uniquely optimalcommoditylinked instrument. Thereis alarge set of

commoditypricecontingentdebtsecurities thatwouldalsoachieve thefirst-best. In the caseat

hand, another debt instrument with an optionfeaturewouldhavealsoachieved thefirstbest. In

fact,one would not generallywant to

make

the payment duecontingent only upon the finalrealized price, as

we

havedonein the case of thecommoditylinkedbond usedinthisexample.One

wouldrather have thetotalvalue of the promisedpaymentcontingentuponthefullpath ofpricesinsuch afashionthat ithedgedthe totalvalue of production from the mine.

The

keycharacteristic ofany optimal debt contract forour problem would be that it would lower the requiredpaymentintheworstoutcome,s(2,4),sothatthe equity holderwouldnotbe temptedto

16

References

Brennan, MichaelandEduardoSchwartz,1985,"Evaluating NaturalResourceInvestmens,"Journal of Business.58:135-157.

Cox,J.,S.Ross and M.Rubinstein, 1979,"OptionPricing:

A

Simplified Approach," Journal ofFinancialEconomics, 7:229-63.

Jensen, Michael, 1986, "Agency Costs ofFree Cash Flow, Corporate Finance and Takeovers, AmericanEconomic Review, 76:323-29.

Lessard,Donald,1977,"Commodity-Linked BondsfromLess-DevelopedCountries:

An

Investment Opportunity?" Proceedings, Seminar on the Analysis of Security Prices, University ofChicago.

Merton, Robert,1974,"OnthePricingofCorporate Debt: the Risk Structure ofInterestRates,"

Journal ofFinance. 29:449-70.

Rajan,Raghuram,1988, "PricingCommodity BondsUsing BinomialOptionPricing,"PolicyPlanning and Research WorkingPaper,

The

WorldBank.Schwartz,Eduardo, 1982,"ThePricingofCommodity-LinkedBonds," JournalofFinance,

Figure 1: the Decision Tree and Associated Parameter Values

Table 1: Contingent ClaimValuations of the Firm

Model Input Parameters

s(0,l)= 10.00 u- 1.25 d- 0.80 r- 0.12 c= 0.12

A-

8.65 Model Results t.j s(t,j) f(t,j) V(l,t,j) V(2,t,j) V(3,t.j) V(4,t,j) V(5,t,j) 0,1Table 2: Fixed Rate Debt--Firm. Equity and Debt Values

Table 3: Commodity Linked Debt- -Firm. Equity and Debt Values

Model Input Parameters

s(0,l)= 10.00 u= 1.25 d- 0.80 r- 0.12 c= 0.12