%.

gJUL

26

1990WORKING

PAPER

ALFRED

P.SLOAN

SCHOOL

OF

MANAGEMENT

Determinants andEffectsof VerticalElectronic Integration: Test of

A

TransactionCostModelAkbar Zaheer and N. Venkatraman

Working Paper#3165-BPS June7,1990

MASSACHUSETTS

INSTITUTE

OF

TECHNOLOGY

50

MEMORIAL

DRIVE

CAMBRIDGE,

MASSACHUSETTS

02139

Determinants andEffects of Vertical Electronic Integration: Testof

A

TransactionCostModelAkbar Zaheer and N. Venkatraman

Working Paper#3165-BPS June7,1990

Telephone: (617) 253-3857 (617) 253-5044

Determinants

and

Effects ofVertical Electronic Integration:Test of

A

Transaction CostModel

Akbar

Zaheer

E52-509

MIT

Sloan School ofManagennent

Cambridge,

MA

02139.(617) 253-3857

and

N.

Venkatraman

E52-537

MIT

Sloan School ofManagennent

Cambridge,

MA

02139.(617) 253-5044

Bitnet:

NVenkatr@Sloan

June 7, 1990

Acknowledgements:

We

thank theManagement

in the 1990sResearch

Program

at the Sloan School, Massachusetts Institute ofTechnology,

for research support. Special appreciation to the insurancecompany

concerned

for theirgenerous

assistance with dataand

research sitesand

the principals in the agencieswho

provided

additional data. John Carroll,Michael

Cusumano,

Rebecca

Henderson,

Lawrence

Loh

and

SrilataZaheer

read earlier versionsand

made

Determinants

and

Effects of Vertical Electronic Integration:Test of

A

Transaction CostModel

Abstract

Vertical electronic integration

—

aform

of vertical integration achievedthrough

thedeployment

of dedicatedcomputers

and communication

systems

between

the relevant actors in the adjacent stages of the value-chain -- is importantto organizational researchers since it provides a

new

mechanism

formanaging

vertical relationships.Drawing

upon

research relating to transaction costs, a set ofhypotheses on

the determinants of the degree of vertical integrationand

its effectson

business efficiencv is tested in asample

of 143 insurance agentswho

areintegrated with

one

focal carrier via dedicatedcomputer-based

system.The

resultsdid not support the hypotheses, thus raising

some

theoretical issueson

the role ofthe transaction cost

model

in situations affectedby

informationtechnology

applications.

Key

Words:

Information technologv; vertical integration; electronicIntroduction

Recent

advances

in information technology (IT)—

including thedevelopment

of standards for connectivity, greatlyimproved hardware

price-performance

ratios,and

progress in the area of expert systems --have

made

iteconomically

and

technologically feasible toexchange

largevolumes

ofcomplex

informationbetween

firms withunprecedented

easeand

rapidity (see forexample.

Keen, 1986). In this context, the capability offered

by advanced

information technology tochange

the pattern of vertical relationships in a marketplace isan

important issue for both researchers

and

practitioners. In recent years, several papershave

focusedon

the generaltheme

thatwe

term

as electronic integrationamong

aset of

independent

firms that begins tochange

the basis of competition (Barrettand

Konsynski, 1982;

Cash and

Konsynski, 1985; Johnstonand

Vitale, 1988). Electronicintegr^'-ion is

viewed by

us as 'the integration of business processes oftwo

ormore

independent

organizationsthrough

the exploitation of the capabilities ofcomputers

and communication

technologies'.^We

see electronic integration as a specificform

of vertical integration (VI),where

the integrationmechanisms

relyfundamentally

on

functionalities offeredbv

advanced

information technologies. Thus,we

buildfrom

the extensivebody

of researchon

vertical integration, especially pertaining to the transaction costframework

(Williamson, 1975) to derive amodel

of vertical integration in the context of IT applications. This model,on

the determinantsand

effects of VI, istested

on

data collectedfrom

asample

of 143independent

agencies handlingproperty'

and

casualty lines of businesses in theUS,

who

are integratedthrough

a^ Electronic integration exploits the functionalities built into interorganizational information systems (lOS), butis distinctfromboth lOSand from the

common

technical platformof electronicdatainterchange (EDI) due toits particularfocusonbusinessarrangements. Foradedicated IT system. This

study aims

to contribute to theemerging

stream ofresearch in the area of electronic integration (e.g., Bakos, 1987;

demons

and

Row,

1989;

Malone,

Yates,and

Benjamin, 1987;Rotemberg

&

Saloner, 1989;Venkatraman

and

Zaheer, 1989).Theoretical Considerations

The

Role ofTransaction Costs in Vertical IntegrationResearch

Although

researchon

vertical integration hasadopted

multiple theoreticalperspectives (Perry, 1989), the transaction cost

model

(Williamson, 1975; 1985) is adominant

one

(Walker, 1988). In this perspective, the costs arisingfrom

informationasymmetry due

tobounded

rationalityand

environmental

complexit\\ togetherwith

opportunism

and

smallnumbers

exchange, are thekey

determinants of thedecision to select a certain

governance

structure. Thisframework

hasbeen adopted

to relate transactions cost (or its determinants) to the appropriateform

of thegovernance

structure in empirical research. For instance, research hasexamined

thedeterminants of

backward

integration(Monteverde

and

Teece, 1982; Masten, 1984)sales force integration

(Anderson,

1985;Anderson

and

Schmittlein, 1984),and

make

versus

buy

incomponents

(Walker

and

Weber,

1984) using theunderlying

conceptsfrom

the transaction costmodel.

Further, researchon

the pattern of verticalintegration (Levy, 1985) as well as its implications for contract duration (Joskow,

1987)

and

for joint ventures (Pisano, 1989) hasbeen

rooted in thisframework.

Transaction Costs

and

Information

Technology

Within

the transaction costmodel,

costs arisefrom

searchand

information-gathering,

and from

writing,monitoring

and

enforcing contracts inan exchange

relationship.These

costs, exacerbatedby

increased asset specificityand

environmental

complexity,determine

the transactional efficiency of a relationshipefficiency of

one governance

structure versus another at a different level of verticalintegration suggests the

most

appropriate location of the transaction.Efficiency is

compromised by

informationimpactedness

and

coordinationcosts (Williamson, 1975),

which

arefundamentally

influencedby

the capabilities ofcomputers

and advanced communication

technologies (i.e., informationtechnology). This has resulted in the

emergence

of a stream of researchon

theapplication of the transaction cost

model

for explaining the pattern ofgovernance

inthe

marketplace

affectedby

advanced

information technologies (Malone, Yates,and

Benjamin, 1987;

demons

and

Row,

1989).Malone

et al (1987)argue

that information technology reduces the costs ofcommunication

whileexpanding

the reach, in terms of thenumber

ofeconomic

agents that can be contacted. In otherwords,

there is reduction in search costs in themarketplace

through lower

transmission cost while reaching a highernumber

and

quality of alternative supnliers.

These

effects lead tolowered

costs of coordinationbetween

organizations in a market, thus reducing the transaction costs of exchange.Malone

et al suggest that thelowering

of transaction costs inmarket

modes,

relative to hierarchicalmodes,

may

lead toan

overall shiftfrom

hierarchies to markets.However,

it is not clear thatreduced

coordination costs alone canimpact

transactioncosts sufficiently to propel

governance

structurestoward market

modes.

In ananalysis of transaction costs, the possible counteracting influence of

an

increase in asset specificitymust

also be considered, asmust

the influence oftechnology

on

lowering

transaction costs within hierarchies.Thus,

we

derive a set ofhypotheses

on

the determinantsand

effects ofVI

rooted in the transaction cost

model,

and

empirically testthem

in asample

ofindependent

insurance agents electronically-interfacedthrough

a dedicated ITResearch

Model

In this section,

we

translate the general concepts discussedabove

to thespecific research setting.

We

describe the particular nature of vertical integrationand

identify its determinants

and

effectson

firm efficiency,and

develop

a researchmodel and

a set of testable hypotheses.The

researchmodel

reflectsour

attempt to incorporate relevant theoreticalconsiderations into the research setting, characterized

by

the use of a dedicated, proprietary electronic interfacing system (EIS)between

an insurance firm (i.e., focalcarrier)

and

severalindependent

agencies. Thissystem

hasbeen

installed at theagency

locationsby

the focal carrier (atno

cost to the agents). This enables greaterefficiency of

communication

with the focal carrier relative to other carriers as wellas

automated

policy processing,endorsements,

and

claimshandling

with

this carrier-- all carried out via electronic interfacing.

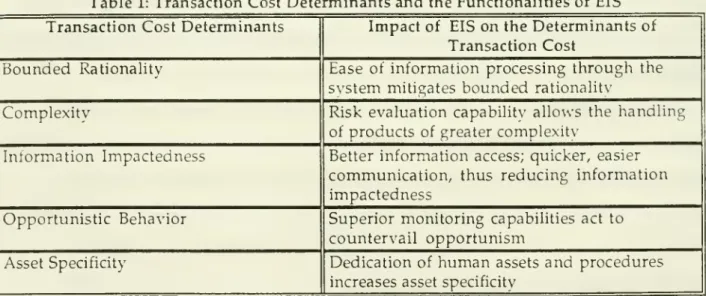

Table 1: Transaction Cost Determinants and the Functionalities of EIS

carrier (insurance

company)

and

the agency. Table 1 links the theoreticalframework

to the specific

system

functionalities.Degree

ofVertical IntegrationThe

question of the appropriate degree of vertical integration in thedistribution channel has

occupied

researchers inmarketing

(Sternand

El-Ansary,1977;

John

and

Weitz, 1988)and economics

(Perry, 1989).As

noted earlier,we

are interested inone

particularform

of vertical integration,namely

electronicintegration.

Following

Williamson

(1985)and

Thorelli (1986),we

recognize the existenceof

governance

mechanisms

betweenmarkets

and

hierarchies. Specifically, in theinsurance industry, these include: direct writers (i.e.,

independent

organizationsdealing exclusivelv with

one

carrier^) orindependent

agencies dealing withmultiple insurance carriers. In

most

cases, direct writershave

no

ownership

rightsof

renewal

over policies (Etgar, 1976).Some

major

insurance carriers rely largelyon

either direct writing agencies or

independent

agencies, while others use acombination

of both.The

choicesmade

by

the carriers in this regard arefundamental

to their business strategies. Thus, issues relating to the determinantsand

effects of vertical integration are important in this industry. Etgar (1976) tested the relative efficiency ofmore

and

less vertically integrated insurance agents, withefficiency expressed in terms of

reduced

duplication of activitiesand

theintra-system

speed

ofcommunication.

His studyfound

that themore

highly integrateddyads

were

generallymore

efficient.However,

it did not focuson

the role ofITapplications in vertical integration.

In the last decade, insurance carriers are increasingly exploiting information technology capabilities to

become

electronically interfacedwith

independent

-We

exclude thosedirect waters that are companyemployees since they are part of the hierarchy.agencies.

One

estimate is that in 1988, over25%

of allindependent

agencieswere

electronically interfaced

with

at leastone

insurance carrier^. In this study,we

consider a focal carrier

who

hasdeployed

a dedicated IT platform for interfacingwith a set of

independent

insurance agencies.The

specific capabilities available viathis interfacing include:

improved

information flows; bettermonitoring

and

controlcapabilities;

and

reduction in costs of administering the policy processing activities.Thus, this

form

of interfacing allows the focal carrier tobe

electronically integratedwith the agencies.

AssetSpecificity

Asset specificity is

one

of theprimary

sources of transaction costs since it transforms the transaction context into a smallnumbers

bargaining situation.Of

thevarious sources of asset specificity that

Williamson

(1985) identifies,human

asset specificity, exemplifiedby

specialized trainingand

learning, canbe

regarded as apotent

form

of asset specificity in a service industrysuch

as insurance.Anderson

(1985) considered specialized

human

knowledge

as aform

of asset specificity, while another manifestation ofhumans

asset specificity relates to the extent of carrier-specific procedures for electronic interfacing.John

and

Weitz

(1988) in their researchon

distribution channelsnoted

that the critical asset specificitv is the level oftraining

and

experience specific to the product-line, againemphasizing

human

asset specificity.Indeed, as

noted

by

Malone

et al (1987; p.492), in the case of thewell-known

American

Hospital Supply, there are "features built into theASAP

system

tocustomize the

system

to a particular hospital's needs, in effect creating a proceduralasset specificity in the relationships

between

thebuyer

and

seller" (emphasis added). Thus,we

expect this type of asset specificity tohave

a significant positive effecton

the

degree

of vertical integration. In other cases, the terminalsand

other peripheralscould be carrier-specific, thus

enhancing

technological asset specificity.However,

since the study focuses

on

only those agents that are interfacedwith

this particularsvstem, there is

no

variance in the technologicaldimension

of asset specificitv,and

we

focuson

thehuman

asset specificity.Since asset specificity is

one

of thekey

determinants of transaction costs,we

expect the carrier has

minimized

theimpact

of transaction costsby

having

amore

vertically-integrated relationship with agents with higher asset specificity. Formally,the hypothesis is:

HI:

Asset Specificity willbe

positively related to the degree of verticalintegration.

Product

Complexity

A

major element

of complexit}' in the transaction cost context is the level ofcomplexity of the

product (Anderson,

1985;Malone

et al 1987;Masten,

1984). Product complexity in the propertyand

casualty insurance context is differentbetween

personal lines

and

commercial

lines. Incomparison with

commercial

lines,personal lines are relatively standardized, partly

due

to regulation,and

partlydue

to intrinsic features (such as limitednumber

of optionson

auto insurance).The

commercial

lines segment,which

deals with businesses, has a multiplicity ofproducts

and

options,with

severalhundreds

ofthousands

of variations of coverage.Products of high complexity require

more

informationexchange

between

organizations or units involved in the transaction.As Malone

et al (1987) noted,"buyers of products with

complex

descriptions aremore

likely towork

with

a singlesupplier, in a close, hierarchical relationship.." (p.487). Theoretically,

due

to relatively high transaction costs,such

complexity asembodied

in thecommercial

lines'

product

ismore

efficientlyhandled

within a hierarchy than amarket under

10

H2: Product

complexity willbe

positively related to the degree of verticalintegration.

Trust

One

of themajor

underlying behavioraldimensions

in the transaction costperspective is

opportunism,

defined as 'self-interest seeking w^ith guile'(Williamson, 1975, 1985).

Williamson

(1975) contrastsopportunism

with

'stewardship behavior',

which

'involves a trust relation' (p.26). Trust is clearly theobverse of

opportunism

(Jarillo, 1988),and

a relationshipbased

on

a higher level oftrust will

be

less subject to potential opportunistic behavior thanone

with lower

levels of trust. Alternativelv,improved

possibilities formonitoring behavior

may

produce

results equivalent to raising the level of trust in a relationship.The

specific electronic interfacingsystem

contains the functionalitv ofmaintaining an 'audit trail' of the steps

through

which

new

businesswas

evaluatedand

underwrittenby

the agencv- Indeed,subsequent

to the installation of the svstem,the focal carrier has granted

underwriting

authority tomost

electronically-interfaced agents. This authority implies that agents are able tocomplete

the full circle ofquoting, underwriting

and

issuing policies entirelywithout

reference to the focal carrier. Agents,depending on

their sizeand

relationship with the carrier,have

different levels of underwriting authority granted to them.Agents

are auditedregularly to confirm their

adherence

tocompany

policies with respect to utilizationof the

underwriting

authority.We

propose

the following testable hypothesis:H3: Trust will be positivelv associated with the degree of vertical integration.

Size

Size has

been

aprominent

variable in industrial organizationeconomics

(Scherer, 1980)

and

has an effecton

vertical integration. In general,we

could argue a11

of a

downstream

service provider like anindependent

insurance agent, there arefew

reasons for large agents to be exclusively tied to a single insurance carrier (Sternand

El-Ansary, 1977). This is because such vertical integration couldweaken

their abilit}' to serve a variety ofmarket

segments. Thus, inour model,

we

specify size as acontrol variable

and

expect that the relatively larger agents are less likely to bevertically integrated. Thus,

H4:

Agent

size will be negatively related to the degree of vertical integration.Efficiency

and

ItsDeterminants

The

need

to use efficiency as animportant

construct hasbeen

recognized (Anderson, 1985) but it has rarelybeen

employed

in tests of the transactions cost theory. In theP&C

insurance business,with

a very largenumber

of firmsand

products of

low

differentiability, efficiencyimprovements

may

well be the drivers ofimproved

effectiveness.Improved

service efficiency canbe

viewed

as a surrogate forproduct

qualityand

beused

as a differentiatorby

improving

the level of service tocustomers (Etgar, 1976). Further, effectiveness can

be

realized in terms of a bettermarket

position or the ability to chargepremium

prices. In the followingparagraphs,

we

identify the theoretical reasons for relating a subset of thedeterminants of

VI

identified earlier to efficiency; in addition,we

relate VI to efficiency.Vertical Integration.

The

first hypothesisdevelops

the relationshipbetween

VIand

efficiency. Specifically, given that Etgar (1976)found

that a higher degree ofvertical integration

was

associated with higher efficiency in theUS

propertyand

casualty insurance industry,

we

propose

the following hypothesis:H5:

The

degree

of vertical integration willbe

positively associated withefficiency.

Size

and

Efficiency. Size effects play a role in determining the level of12

fixed assets.

Extending

this logic,we

treat it as a control variableand

expect that thelarger agents will, ceteris paribus, be

more

efficient than smaller ones. Thus, thehypothesis is:

H6:

Agent

size willbe

positively associated with efficiency.Complexity

and

Efficiency.Commercial

line policies, while beingorder-of-magnitude

greater in complexity than those of personal lines, are also typicallymuch

larger in terms ofpremium

volume.

This ismainly

due

to the size of risksassociated with

commercial

lines asopposed

to personal lines.We

expectcommercial

lines to exploit significant scaleeconomies

to realize a higher level ofefficiency. Thus:

H7: Product complexitv will be positively associated

with

efficiency.Methods

Research Design

Data.

One

of the strengths of this study lie in the use oftwo

independent

and

complementary

sources of data: questionnaireand

archival records of the focal carrier. Structured questionnaires reflecting themeasures

of thekey

constructswere

mailed

to all 321 agents of a focal insurance carrier thathad

deployed

a sophisticatedelectronic interfacing

system

in the marketplace as of July, 1988.Complete

datawere

obtained

from

143 electronically-integrated agents, representing a response rate of44.5%. This is considerably higher than the response rate of

20%

reportedby

Etgar(1978) in his study of the property

and

casualty' market.Supplementary

dataon

theactual

volume

ofcommercial

premiums

of the agentwith

the focal carrierwas

provided

by

the carrier.Informant.

A

major

area of controversy in researchon

organizational-levelphenomena

relates to the identification of appropriate 'informant'who

will provide dataon

the relevant organizational properties.We

recognize theneed

tominimize

13

Phillips, 1982).

Hence,

during interviewsconducted

with theindependent

agenciesas well as with the

marketing

managers

of the propertyand

casualtycompany,

we

sought

to identify theknowledgeable

informant(s) for eachagency

as well as assesswhether

multiple informantswere

necessary.However,

itbecame

apparent

thatmost

agencies areowner-managed;

accordingly,we

chose theowner

as themost

relevant informant.

We

alsodecided

that itwas

inappropriate to collect datafrom

anyone

else within theagency

sinceno

otherperson

has thevantage

point forproviding relevant data for this study. Thus,

our

approach

to data collection isconsistent with the general

recommendation

to use themost knowledgeable

informant(Huber

and

Power,

1985;Venkatraman

and

Grant, 1986); as well as theresearch practice of relying

on

a single informant in studiesdesigned

to collect datafrom

small organizational units (Daftand

Bradshaw,

1980).The

mean

insuranceagency had

a total personnel size of 26and

annual

commercial

premium

of $5.8million.

Measures

Vertical Integration.

As mentioned

earlier, the focal carrierengages

in awide

spectrum

ofgovernance

relationshipswith

its agents.These range

from

those ^vhoconduct

100%

of their business with products offeredby

this carrier to thosewho-handle

multiple carriersand

provide

a larger cross-section of products in themarketplace.

We

operationalize the degree of vertical integration as 'the percentageof

commercial

line business, in dollarpremium

terms,accounted

forby

the focalcarrier.' This operationalization is consistent with previous

approaches

to themeasurement

of vertical integration. For instance,John

and

Weitz

(1988)operationalize vertical integration as the percentage of sales to end-users as

opposed

to channel

members.

Similarly, Pisano (1989)measured

integration in terms ofeither direct equity investment or joint equity venture.

We

obtained dataon

the14

Asset

Specificity, Consistent withour

theory,we

focuson

human

assetspecificity.

The

complexityand

theunique

featuresembedded

in the specificelectronic interfacing

system

requires either dedicated personnel for dealingwith

the carrier or specialized training of operators. Further, effective exploitation of the IT capabilities requires higher levels of participation for planning

and

implementing

thenew, unique

procedures. Thus,we

operationalizedhuman

asset specificity in terms of threedichotomous

questionnaire items thatwere summated:

(a) the presence of a dedicated EIS operator, (b)

emphasis on

training for EIS operationand

(c) theinvolvement

of operators insystem planning

and

implementation.

Complexity.

This construct couldbe

measured

inmany

differentways.

One

isto focus

on

perceived complexity of theproduct

by

the insurance agent.Given

ourfocus

on

an organizational-level construct of complexity,we

decided tomeasure

this as 'the percentage ofcommercial

line business' since it is agood

surrogate for thelevel of complexity. This is further

augmented by

the fact that it iswidely

acknowledged

thatcommercial

lines aremore

complex

than personal lines.Level of Trust.

The

level of trust is operationalized as the extent ofunderwriting

authoritv given to the agent. Since this function isperhaps

themost

critical aspect of the insurance process,

and

was

thus far carried out onlyby

the carrier, the extent of underwriting authority delegated is an appropriatemeasure

forthe trust placed

by

the carrier with the agent.Four

levels ofunderwriting

authorityfrom

the questionnaire serve as themeasure.

Efficiency.

Output

peremployee

was

operationalized as thecommercial

linespremiums

peremployee,

ameasure

analogous

to salesvolume

peremployee.

Thismeasure

of efficiency is consistent with Etgar (1976)and

with standard engineeringtreatments of efficiencv as the ratio of

output

to input. Further, in an industry such15

agenc\'.

Whereas

thecommercial

premiums

specific to this focal carrierwere

obtainedfrom

the carrier's objective archival records, the totalcommercial

premiums

for theagency

as awhole were

calculatedby

applying the percentage ofcommercial

premiums

that the carrier represented for the agent, as reported in thequestionnaire.

The

number

ofemployees

was

obtainedfrom

agent-reported questionnaire data.Onlv

employees

engaged

incommercial

lines' businesswere

considered

with

no

attempt to split the topmanagement

group

(usually notmore

than

one

ortwo

persons) of the agent into personaland

commercial

lines. Size. Sizewas

operationalized asan

8-level categorizationbased

on

totalpremiums,

reportedby

agents in the questionnaire.Model

Specificationsand

AnalysisThe

equations for thetwo

sets ofhypotheses

--one

dealing with \Tand

theother dealing

with

efficiencv -- are as follows:VI = ao + ai Trust + a? Asset Specificity -i- a3

Complexity

- 34 Size + error (1)Efficiency = bo + b] VI + b?

Complexity

-1- b3 Size + error (2)Multiple regression

was

used

to test thehypotheses

following themodels

specified in equations (1)

and

(2).Results

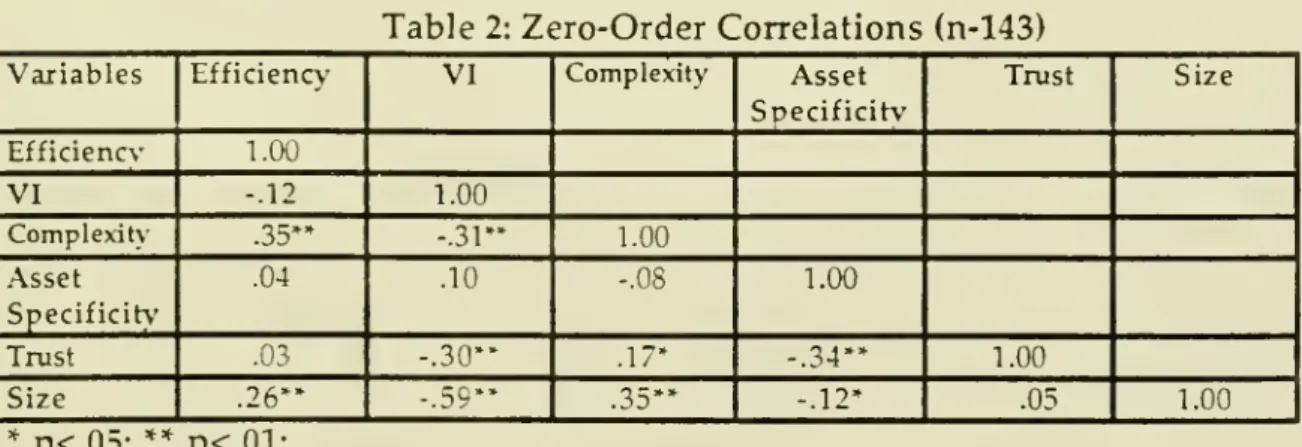

Table 2

summarizes

the zero-order correlationsamong

the variablesused

inthe models.

Table

2:Zero-Order

Correlations (n-143)16

Determinants

ofVI

Table 3

summarizes

the results of estimating equation (1).The

regressionmodel was

significant (F value: 23.36, p<.01),and

explained over40%

of the variancein VI. How^ever, it is

important

to highlight that thehypotheses

relating to asset specificityand

product

complexitywere

not supported. Further, trustemerged

significant in the direction opposite to theone

hypothesized,and

size -- introducedas a control variable --

emerged

as negativeand

significant {a.4 = -0.531; t-value: 7.48)determinant

of VI.17

finding can

be

explainedwhen

we

consider that underwriting authority is highlycoveted

by

agents (due to the controland

authority over the process of writingand

issuing insurance that it implies),

and

the focal carrier is likely to beemploying

it asan

incentive to agents to increase their business with the carrier.Agents

that alreadyhave

a high share of business with the carrier are less likely toneed

this incentive. In the discussion below,we

suggest that it is the monitoring capabilities of electronicintegration

which

enablesthem

to trusteven

the less vertically integrated agents.As

expected, sizeemerged

as a significant negativedeterminant

of verticalelectronic integration. It has

been

well-recognized that the relatively largerindependent

agents require awide

range

ofproduct

options within thecomplex

P&C

insurance marketplacewhich

are less likely to bemet by

theproduct range

of asingle insurance carrier (Stern

and

El-Ansary, 1977). Thus, this research furtherconfirms this relationships.

More

importantly, it appears thateven

within thesample

definedby

electronic interfacing capability, the general theoreticalexpectation of size

and

VIwas

supported, suggesting that the informationtechnology-mediated

exchange does

not alter the relationship of sizewith

VI.Determinants

of EfficiencyTable 4

summarizes

the results of estimating equation (2).The

regressionmodel

was

significant (F value: 7.95, p<.01),and

explained over15%

of the variancein efficiency. It is important to note that

we

were

notdeveloping

a fullmodel

ofefficiency, but focused

on

specifying the relationshipamong

the subset of variables(hypothesized to affect VI)

and

efficiency. Thus, the overallR2

is lessimportant

relative to the coefficients of the specific variables in themodel.

Product

complexity(b2 = 0.308; t-value: 3.61)

and

size—

introduced here as a predictor variable~

emerged

as positive

and

significant (b3 = 0.202; t-value: 2.02) determinants of efficiency. Thus,two

of the three coefficientsemerged

in the hypothesized directionand

statistically significant at p-levels better than .01.18

Table

4:Model

Estimation (Equation 2)19

relating to the transaction costs

framework

did not receive empirical support in thisstudy.

Table

5:Support

forHypotheses

20

Moreover,

in the context of vertical, electronic integration, theneed

fordeveloping specific assets

may

be reduced, or couldbe

standardized across all types ofagencies. For instance, the level of carrier-specific training required for electronic interfacing

may

be

bothlow and

standard acrossgovernance

modes

to influence thelevel of VI. Indeed,

we

speculate that sharply increased expertsystem

capabilities built into the interfacingsystem

could reducehuman

asset specificity at the level ofthe

agency with

a correspondinglyminimized impact

on

the level of vertical,electronic integration.

Lower

requirements of asset specificitymay

not convert the transacting situation into a smallnumbers

bargaining one,making

it relativelymore

attractive toconduct

the transactions in market-likegovernance modes.

Similarly,product

complexityhad

insignificant predictivepower

over thelevel of VL. This could

be

due

to the possibility that thecomplexity

inherent incommercial

lines canbe

efficientlyhandled through

sophisticated software, therebysimplifying the transaction

and

eliminatingsome

of the 'frictions' resultingfrom

dealing withcomplex

products in amarket

setting.Opportunism

toomay

be

attenuatedby

the increasedmonitoring

capability ofelectronic interfacing, given that the

system

has the functionality to record theprocess of

underwriting

—

which

can be,and

is, periodically audited. This 'audit trail'allows the focal carrier to delegate underwriting authority to electronically

integrated agencies irrespective of their specific level of integration. Indeed, the decentralization of

underwriting

authority couldbe an important

differentiator inthe marketplace to

induce

theagency

to shift its business to the focal carrier. Thiscould partially explain

why

the level of trustwas

found

tobe

negatively associatedwith VI: higher

underwriting

authority could be recently granted to those with asmaller share of the carrier's business to induce

them

to increase their level of21

distinguish

between

changes

in trustand

changes

in vertical integration,which

isan important area of further inquiry.

The

general theoretical case for the existence of substitutes for verticalintegration

was

first suggestedby

Blois (1972). Quasi-integration describes a situation inwhich

many

of the benefitsfrom

vertical integration accrue to a focal firmwithout

the firm incurring the costs associated withownership.

The

substantialtheoretical

development

of this idea in the industrial organizationstream

isreviewed

by

Mahoney

(1989)who

suggests that awide

range of vertical controloptions exist for firms to reap the benefits of vertical integration

without

incurring the full costs of ownership. Conceptually,from

the perspective of the transactioncosts

motives

for vertical integration, these theoreticaldevelopments imply

thattransactions costs in market-like

modes

may

be

controlledby

the use of certainformal

arrangements

and

mechanisms.

The

idea that the effect of "-he determinants of transaction costs in non-hierarchical relations can be mitigatedunder

certain conditions has recentlybeen

gaining conceptualand

empirical curreno.'. Jarillo (1988)noted

that thenetwork form

ofgovernance

between

firmswas

analogous

to Ouchi's (1980)concept of clans in a hierarchy. In

both

modes, opportunism

istempered,

thetime horizon is lengthened

and

transaction costs lowered.While

clans mitigate conditions of high uncertaintythrough

a strong organizationalculture, Jarillo suggests that trust relations can be purposefully forged

between

firms

engaged

in long-term relationships in anetwork governance

form.Game

theoretic concepts alsosupport

the notion of cooperativebehavior

inthe case of repeated

games

(Kreps, 1984); recurrentexchange

is similar toan

infinite horizongame.

Reputation effects alsomoderate

the incentive to22

While

the notion that transaction costs canbe reduced

inmarket

modes

due

to the influence of conditions such as formal

arrangements such

as verticalrestraints, long-term relationships, or trust relations appears to

be

estabUshed, thepresent

study

has in fact reached a stronger conclusion -- that transactions costsdeterminants

do

not differbetween

degrees of vertical integration. Indeed, in a recent study.Walker

and

Poppo

(1989)reached

a similar conclusion in astudy

of the transaction cost differencesbetween

two

types of suppliers -an

in-house profitcenter

and

a single-source supplier.Contrary

to theory, their resultsshowed

no

differences in transaction costs

between

thetwo

types ofgovernance

structures.They

suggest that organizational policies,such

as thoseused

todevelop

external suppliersand

manage

the supplier relationship, could account for the findings.The

potential managerial implications of the present findings are significant.Our

study

did not findany

differences in transaction cost determinantsbetween

differing degrees of vertical integration, suggesting that

market-modes

ofgovernance

may

be economically feasible in a context of vertical electronicintegration.

Where

a firm can lower transaction costs of the organizingmode

closer to the market, the firm can shift transactions out tomarket

modes

from

hierarchicalmodes.

Sincemarket

modes

theoreticallyhave

production costsadvantages

(Williamson, 1985), a firm that can

lower

transactions costsby

the use of electronic integrationmight

gain a competitiveadvantage

over firms thatcannot

orhave

notachieved similar reductions in transaction costs. In

such

a situation,companies

may

profitablv consider

more

'arms-length' relationships,and

avoid the explicitand

implied responsibilities that

underly

exclusive relationships.These

responsibilitiesinclude

support

in times of industrydownturns,

advertising subsidies,and

consulting

teams

sent outby

the focal carrier to help themore

vertically integratedagents

manage

their business better. Vertical integration in the context of23

this

mode

of organizing isemerging

rapidly inmany

markets

for dealingwith

bothupstream

and

downstream

integration, very little systematic research findingson

their role

and

effectshave been

forthcoming.However

we

caution thatmore

research is

needed

beforewe

candevelop

strong implications for managerial practice. Indeed,an

important area of future research is todevelop

a theoreticalmodel

of electronic integration that buildsfrom

theories of vertical integration butis differentiated along

key

characteristics ofIT-mediated

exchange.Limitations

We

enumerate

a set of limitations of thisstudy with

aview

to suggestingareas that could

be

improved

in future research efforts.Given

the infancy of theoreticaldevelopment and

empirical researchboth

in the context of transactioncosts

model

for vertical integration as well as its roleand

application for a particularform

of vertical integration,namely

vertical, electronic integration, theselimitations are not as serious as they

may

be in mr>remature

streams.First, the operationalization of the

measures could be

improved

to reflect theneed

for multi-item scales.However,

in this study,we

used

measures

that are (a)generally in line with the theoretical

arguments;

(b) consistent with prior research(e.g.,

Anderson,

1985; John&

Weitz, 1988);and

(c) appropriate for the specificindustry setting (i.e.,

measures

readilyunderstood

by

the respondents, assessedduring

pre-tests), thus mitigating potentialmeasurement

error.Second, the robustness of the results requires further corroboration in a

sample

of agents that are not electronically-interfaced. This could not be achieved inthe present

study

since themeasure

of asset specificitywas

intricately tied to thededicated

human

assets required to operate thesystem

and

was

not applicable in abenchmark sample

of non-interfaced agents.Finally, given that electronic interfacing is relatively

new

inmany

markets, a24

the

change

in the level of VI as well as its determinantsand

effects. This could help,for example, to

understand

the negative relationshipbetween

trustand

VI observed

in this study.Conclusions

This

paper developed

a set of hypotheseson

the determinantsand

effects ofvertical, electronic integration that

were

rooted in the transaction costframework

and were

tested in asample

of 143independent

insurance agencies in the propertyand

casualtysegment

of the insurance industry.The

resultsprovide

no

support

forthe transaction cost determinants, raising the possibility that the availability of sophisticated information processing capabilities could mitigate the transaction cost effects.

Some

explanations for the resultsand

issues for future researchwere

noted.Given

the consistently strong results for the transaction cost determinants inprior research, this set of results are particularly striking.

However,

partialexplanation could lie in the setting, namely: a particular

form

of integration.We

believe that the results

would

provide animpetus

todevelop

a contingencyview

ofthe role of transaction cost

framework,

especially in the context of informationtechnology. This is

because

theemerging

capabilities of information technology could bothenhance

and

mitigate the transaction cost determinantsand

amore

careful delineation of theunderlying

causesand

effects isan important

area of25

References

Alchian, A.A.

and

H.Demsetz.

(1972) "Production, information costs,and

economic

organization".

American

Economic

Review, 62(5):777-795.Anderson,

E. (1985). "The salesperson as outside agent oremployee:

a transactioncost analysis". Marketing Science, 4:234-253.

Anderson,

E.and

D.C. Schmitlein. (1984). ""Integration of the sales force:An

empirical examination".

Rand

Journal of Economics, 15:3-19.Bagozzi, R.P.

and

L.W.

Phillips (1982). "Representingand

testing organizationaltheories:

A

holistic construal. Administrative Science Quarterly, 27: 459-489.Bakos,

Yannis

}. (1987) Interorganizational information systems: Strategicimplications for competition

and

coordination.Unpublished

DoctoralDissertation,

MIT.

Barney, J.B.

and

W.G. Ouchi

(1986). (eds.) Organization Economics.San

Francisco: Jossey Bass.

Barrett, Stephanie,

and

Benn

Konsynski

(1982). "Inter-organizationinformation sharing systems".

MIS

Quarterly, Special Issue, 1982.Blois, K.J. (1972) "Vertical quasi-integration". Journal of Industrial Economics, 20, 253-272.

Cash, J.I.

and

B. Konsynski, (1985), "ISredraws

competitive boundaries,"Harvard

Business Review, 63 (2), 134-142.demons,

Eric K.and

Michael

Row

(1988), "InformationTechnology

and

Economic

Reorganization." Proceedings of the 10th InternationalConference on Information Systems. Boston,

Mass:

December

1989. Daft, R.L.,and

Bradshaw,

PJ. (1980),"The

process of horizontal differentiation:Two

Models,"

Administrative Science Quarterly, 25: 441-484.Etgar, Michael. (1976). "Effects of administrative control

on

efficiency of verticalmarketing

systems". Journal of Marketing Research, 13:12-24.Huber,

G.,and

D.Power

(1985). "Retrospective reports of strategic levelmanagers"

StrategicManagement

Journal, 6: 171-180.Jarillo, J. Carlos. (1988).

"On

strategic networks". StrategicManagement

Journal,26

John, G.,

and

B.Weitz

(1988)."Forward

integration into distribution:An

empiricaltest of transaction cost analysis". Journal of Law, Economics and Organization. 4:337-355.

Johnston, H.R.,

and

M.R. Vitale (1988) Creating competitiveadvantage with

interorganizational information systems.

MIS

Quarterly, June, 153-165.Joskow,

P. (1987). "Contract durationand

relationship-specific investments: empiricalevidence

from

coal markets."American

Economic

Review

77:168-185.

Keen,

PeterG.W.

(1986). Competing in Time.Cambridge,

MA:

BallingerPublishing

Company.

Konsynski, B.R.,

and

A.Warbelow.

(1989)"Cooperating

toCompete:

Modeling

Interorganizational Interchange."Mimeo. Harvard

Business School.Kreps, D. (1984). "Corporate culture

and economic

theory".Unpublished

manuscript, Stanford UniversityGraduate

School of Business.Levy, D.T. (1985).

The

transactions costapproach

to vertical integration:An

empirical investigation". Review of Economics and Statistics. 67:438-445.

Mahoney,

J.T. (1989)."The

choice of organizational form: Vertical integration versus othermethods

of vertical control".Working

Paper No.

89-1622, College ofCommerce

and

Business Administration, University of Illinois atUrbana-Champaign.

Malone,

T. J., J. Yatesand

R. Benjamin. (1987). "Electronicmarkets

and

electronic hierarchies".Communications

of theACM^

30(6):484-497.Masten,

S. (1984).'The

organization of production:Evidence from

the aerospaceindustry", journal of

Law

and Economics. 27:403-418.Monteverde,

K.and

D. J. Teece. (1982). "Supplier switching costsand

verticalintegration in the

automobile

industry". Bell Journal of Economics, 13:206-213.Ouchi,

W.G.

(1980). "Markets, bureaucraciesand

clans." Administrative Science Quarterly. 25:129-142.Perry,

M.K.

(1980). Vertical Integration:Determinants

and

Effects" In R.Schmalensee

and

RD

Willig (Eds.)Handbook

of Industrial Organization Vol.27

Pisano, G. P. (1989). "Using equity participation to

support

exchange: evidencefrom

thebiotechnology

industry". Journal of Law, Economics andOrganization. 5(1):109-126.

Rotemberg,

J.,and

G.Saloner (1989) "Information technologyand

strategicadvantage"

Unpublished

Manuscript,Management

in the 1990sResearch program,

MIT

Scherer, P.M. (1980). Industrial Market Structure

and Economic

Performance.Boston:

Houghton

Mifflin.Stern, L.

W.

and

A. I. El-Ansary.(1977). Marketing Channels.Englewood

Cliffs,NJ: Prentice Hall.

Thorelli, H.B. (1986).

"Networks:

Between

markets

and

hierarchies." StrategicManagement

Journal. 7:37-51.Venkatraman,

N.,and

J.H.Grant

(1986) "ConstructMeasurement

in StrategyResearch:

A

Critiqueand

Proposal,"Academy

ofManagement

Review, 11, 71-87.Walker,

Gordon

(1988), "StrategicSourdng,

Vertical Integration,and

Transaction Costs" Interfaces, 18: 62-73.Walker,

Gordon, and

Laura Poppo.

(1989). "Profit Centers, Single Source Suppliers,and

Transaction Costs."Working

Paper

89-19,Wharton

School, University ofPennsylvania.

Walker, G.,

and

D.Weber,

(1984),"A

TransactionCost

Approach

toMake

versusBuy

Decision" Administrative Science Quarterly, 29:373-391.Williamson, Oliver E. (1975). Markets

and

Hierarchies.New

York:The

Free Press.WilHamson,

OUver

E. (1985). The Economic Institutions of Capitalism.New

York:Date

Due

.spR.

2

1mi

MAY

2

419^

MIT LIBRARIES Dun I