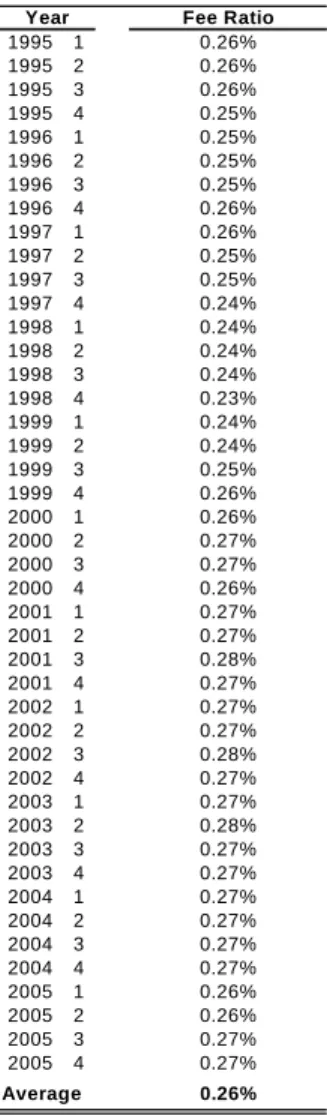

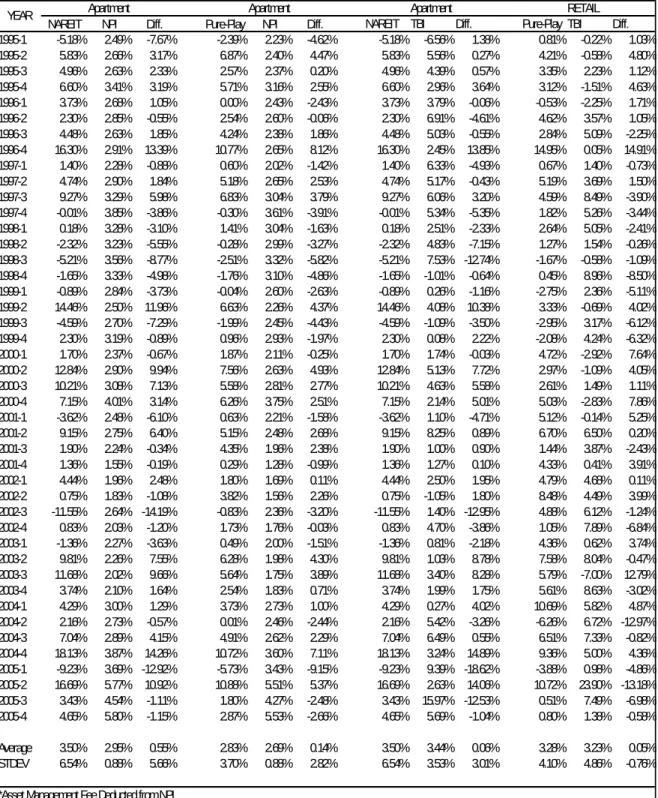

3.7 Treatment of Management Expenses and Fees

Private Market Index:

NPI returns include asset management that fees paid by investors. In this thesis, NCREIF

Fund Index – Historical. The Open End Diversified Core Equity Management Fee ratio was

used as an approximation of asset management fees and deducted from NPI and TBI

returns in each quarter.

Public Market Index:

REIT investment fees paid by the investors are approximated by Historical annual data of

Vanguard REIT Fund expense ratios. The annual returns were only available so the data

was spread out to approximate quarterly expense ratios, then deducted from Pure-Play

REIT returns.

Table 3. NFI-ODCE Management Fee Table 4. Vanguard REIT Index Fund Expense

Fee Ratio

1995 1 0.26%

1995 2 0.26%

1995 3 0.26%

1995 4 0.25%

1996 1 0.25%

1996 2 0.25%

1996 3 0.25%

1996 4 0.26%

1997 1 0.26%

1997 2 0.25%

1997 3 0.25%

1997 4 0.24%

1998 1 0.24%

1998 2 0.24%

1998 3 0.24%

1998 4 0.23%

1999 1 0.24%

1999 2 0.24%

1999 3 0.25%

1999 4 0.26%

2000 1 0.26%

2000 2 0.27%

2000 3 0.27%

2000 4 0.26%

2001 1 0.27%

2001 2 0.27%

2001 3 0.28%

2001 4 0.27%

2002 1 0.27%

2002 2 0.27%

2002 3 0.28%

2002 4 0.27%

2003 1 0.27%

2003 2 0.28%

2003 3 0.27%

2003 4 0.27%

2004 1 0.27%

2004 2 0.27%

2004 3 0.27%

2004 4 0.27%

2005 1 0.26%

2005 2 0.26%

2005 3 0.27%

Year

Expense Ratio

1995 1 0.09%

1995 2 0.09%

1995 3 0.09%

1995 4 0.09%

1996 1 0.09%

1996 2 0.09%

1996 3 0.09%

1996 4 0.09%

1997 1 0.06%

1997 2 0.06%

1997 3 0.06%

1997 4 0.06%

1998 1 0.06%

1998 2 0.06%

1998 3 0.06%

1998 4 0.06%

1999 1 0.07%

1999 2 0.07%

1999 3 0.07%

1999 4 0.07%

2000 1 0.08%

2000 2 0.08%

2000 3 0.08%

2000 4 0.08%

2001 1 0.08%

2001 2 0.08%

2001 3 0.08%

2001 4 0.08%

2002 1 0.07%

2002 2 0.07%

2002 3 0.07%

2002 4 0.07%

2003 1 0.06%

2003 2 0.06%

2003 3 0.06%

2003 4 0.06%

2004 1 0.06%

2004 2 0.06%

2004 3 0.06%

2004 4 0.06%

2005 1 0.05%

2005 2 0.05%

2005 3 0.05%

2005 4 0.05%

Year

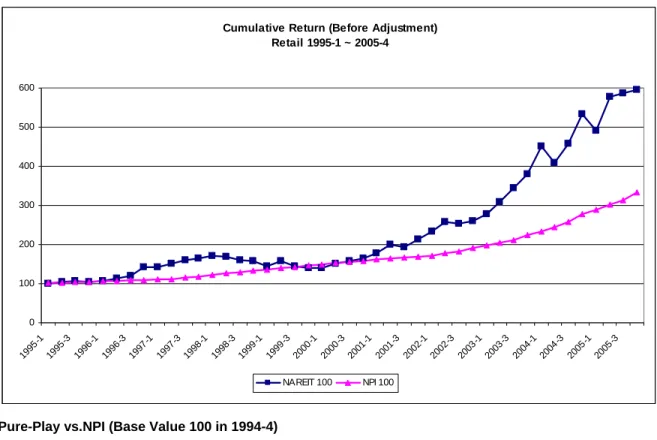

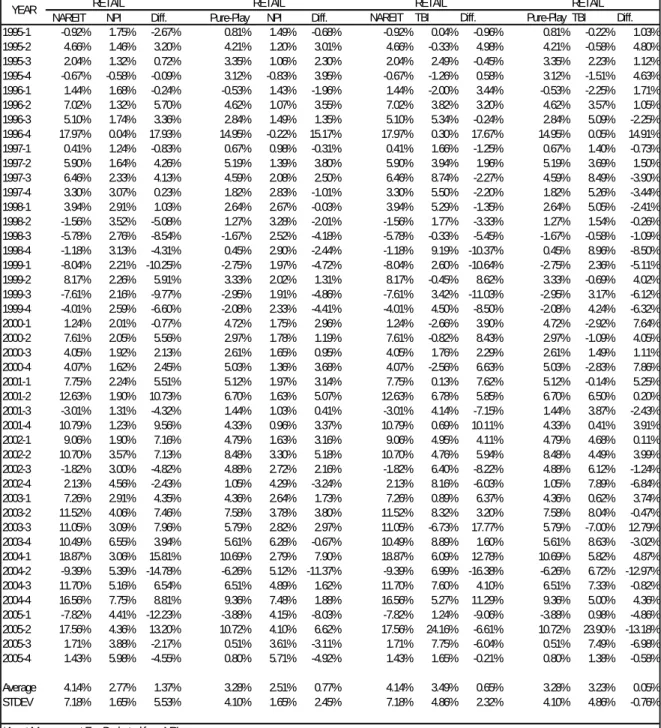

Figure 4. Retail Sector Return Performance Cobmparisons - Plots

NAREIT vs. NPI (Base Value 100 in 1994-4) Quaterly

Cumulative Return (Before Adjustment)

Retail 1995-1 ~ 2005-4

0

100

200

300

400

500

600

1995

-1

1995

-3

1996

-1

1996

-3

1997

-1

1997

-3

1998

-1

1998

-3

1999

-1

1999

-3

200

0-1

2000

-3

2001

-1

2001

-3

2002

-1

2002

-3

200

3-1

2003

-3

2004

-1

2004

-3

2005

-1

2005

-3

NAREIT 100 NPI 100

Pure-Play vs.NPI (Base Value 100 in 1994-4)

Cumulative Return (After Adjustment)

Retail 1995-1 ~ 2005-4

0

100

200

300

400

500

600

1995

-1

1995

-3

1996

-1

1996

-3

1997

-1

1997

-3

1998

-1

1998

-3

1999

-1

1999

-3

2000

-1

200

0-3

2001

-1

200

1-3

2002

-1

200

2-3

2003

-1

200

3-3

2004

-1

200

4-3

2005

-1

200

5-3

PurePlay 100 NPI 100

NAREIT vs. TBI (Base Value 100 in 1994-4)

Cumulative Return (Before Adjustment)

Retail 1995-1 ~ 2005-4

0

100

200

300

400

500

600

1995

-1

199

5-3

1996

-1

1996

-3

1997

-1

1997

-3

199

8-1

1998

-3

1999

-1

1999

-3

200

0-1

200

0-3

2001

-1

2001

-3

2002

-1

200

2-3

200

3-1

2003

-3

2004

-1

2004

-3

200

5-1

200

5-3

NAREIT 100 TBI 100

Pure-Play vs. TBI (Base Value 100 in 1994-4)

Cumulative Return (After Adjustment)

Retail 1995-1 ~2005-4

0

100

200

300

400

500

600

1995

-1

1995

-3

1996

-1

199

6-3

199

7-1

1997

-3

1998

-1

1998

-3

199

9-1

1999

-3

2000

-1

2000

-3

2001

-1

200

1-3

2002

-1

2002

-3

2003

-1

200

3-3

200

4-1

2004

-3

2005

-1

2005

-3

PurePlay 100 TBI 100

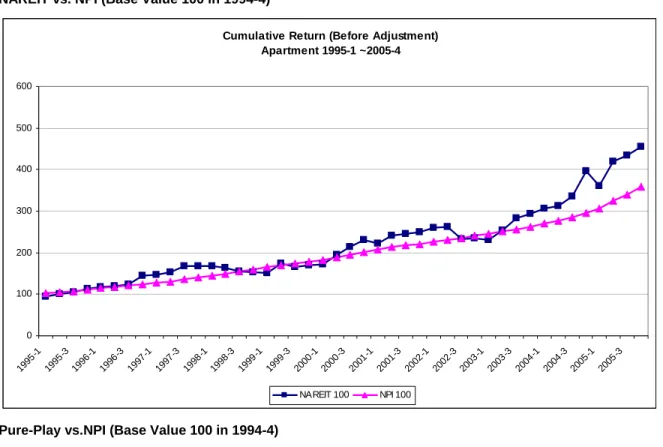

Figure 5. Apartment Sector Return Performance Comparisons – Plots

NAREIT vs. NPI (Base Value 100 in 1994-4)

Cumulative Return (Before Adjustment)

Apartment 1995-1 ~2005-4

0

100

200

300

400

500

600

1995

-1

1995

-3

1996

-1

1996

-3

1997

-1

1997

-3

1998

-1

1998

-3

1999

-1

1999

-3

2000

-1

2000

-3

2001

-1

2001

-3

2002

-1

2002

-3

2003

-1

2003

-3

2004

-1

2004

-3

2005

-1

2005

-3

NAREIT 100 NPI 100

Pure-Play vs.NPI (Base Value 100 in 1994-4)

Cumulative Return (After Adjustments)

Apartments 1995-1 ~ 2005-4

0

100

200

300

400

500

600

1995

-1

1995

-3

1996

-1

1996

-3

1997

-1

1997

-3

1998

-1

1998

-3

1999

-1

1999

-3

2000

-1

2000

-3

2001

-1

2001

-3

2002

-1

2002

-3

2003

-1

2003

-3

2004

-1

2004

-3

2005

-1

2005

-3

PurePlay 100 NPI 100

NAREIT vs. TBI (Base Value 100 in 1994-4)

Cumulative Return (Before Adjustment)

Apartment 1995-1 ~ 2005-4

0

100

200

300

400

500

600

1995

-1

1995

-3

1996

-1

199

6-3

1997

-1

1997

-3

1998

-1

1998

-3

199

9-1

1999

-3

2000

-1

2000

-3

2001

-1

200

1-3

2002

-1

2002

-3

2003

-1

2003

-3

200

4-1

2004

-3

2005

-1

2005

-3

NAREIT 100 TBI 100

Pure-Play vs. TBI (Base Value 100 in 1994-4)

Cumulative Return (After Adjustment)

Apartment 1995-1 ~2005-4

0

100

200

300

400

500

600

1995

-1

1995

-3

1996

-1

1996

-3

1997

-1

1997

-3

1998

-1

1998

-3

1999

-1

1999

-3

2000

-1

2000

-3

2001

-1

2001

-3

2002

-1

2002

-3

2003

-1

2003

-3

2004

-1

2004

-3

2005

-1

2005

-3

PurePlay 100 TBI 100

Figure 6. Office Sector Return Performance Comparisons – Plots

NAREIT vs. NPI (Base Value 100 in 1994-4)

Cumulative Returns (Before Adjustment)

Office 1995-1 ~ 2005-4

0

100

200

300

400

500

600

1995

-1

1995

-3

1996

-1

1996

-3

1997

-1

199

7-3

1998

-1

1998

-3

1999

-1

1999

-3

200

0-1

2000

-3

2001

-1

2001

-3

2002

-1

2002

-3

2003

-1

2003

-3

200

4-1

2004

-3

2005

-1

2005

-3

NAREIT 100 NPI 100

Pure-Play vs.NPI (Base Value 100 in 1994-4)

Cumulative Return (Before Adjustment)

Office 1995-1 ~2005-4

0

100

200

300

400

500

600

1995

-1

1995

-3

1996

-1

1996

-3

1997

-1

1997

-3

1998

-1

1998

-3

1999

-1

1999

-3

2000

-1

2000

-3

2001

-1

2001

-3

2002

-1

2002

-3

2003

-1

2003

-3

2004

-1

2004

-3

2005

-1

2005

-3

NAREIT 100 NPI 100

NAREIT vs. TBI (Base Value 100 in 1994-4)

Cumulative Return (Before Adjustment)

Office 1995-1 ~ 2005-4

0

100

200

300

400

500

600

1995

-1

1995

-3

1996

-1

1996

-3

1997

-1

1997

-3

1998

-1

1998

-3

1999

-1

1999

-3

2000

-1

2000

-3

2001

-1

2001

-3

2002

-1

2002

-3

2003

-1

2003

-3

2004

-1

2004

-3

2005

-1

2005

-3

NAREIT 100 TBI 100

Pure-Play vs. TBI (Base Value 100 in 1994-4)

Cumulative Return (After Adjustment)

Office 1995-1 ~ 2005-4

0

100

200

300

400

500

600

1995

-1

1995

-3

1996

-1

1996

-3

1997

-1

1997

-3

1998

-1

1998

-3

1999

-1

1999

-3

2000

-1

2000

-3

2001

-1

2001

-3

2002

-1

2002

-3

2003

-1

2003

-3

2004

-1

2004

-3

2005

-1

2005

-3

PurePlay 100 TBI 100

Figure 7. Industrial Sector Return Performance Comparisons – Plots

NAREIT vs. NPI (Base Value 100 in 1994-4)

Cumulative Retruns (Before Adjustment)

Industrial 1995-1 ~ 2005-4

0

100

200

300

400

500

600

199

5-1

199

5-3

199

6-1

199

6-3

199

7-1

19

97-3

199

8-1

199

8-3

199

9-1

19

99-3

200

0-1

2000

-3

200

1-1

200

1-3

200

2-1

200

2-3

20

03-1

200

3-3

2004

-1

200

4-3

200

5-1

200

5-3

NAREIT 100 NPI 100

Pure-Play vs.NPI (Base Value 100 in 1994-4)

Cumulative Return (After Adjustment)

Industrial 1995-1 ~ 2005-4

0

100

200

300

400

500

600

1995

-1

1995

-3

19

96-1

1996

-3

1997

-1

19

97-3

19

98-1

1998

-3

19

99-1

19

99-3

2000

-1

2000

-3

20

01-1

2001

-3

2002

-1

20

02-3

2003

-1

2003

-3

20

04-1

2004

-3

2005

-1

20

05-3

PurePlay 100 NPI 100

NAREIT vs. TBI (Base Value 100 in 1994-4)

Cumulative Return (Before Adjustment)

Industrial 1995-1 ~ 2005-4

0

100

200

300

400

500

600

1995

-1

1995

-3

1996

-1

1996

-3

1997

-1

1997

-3

1998

-1

199

8-3

199

9-1

199

9-3

200

0-1

200

0-3

2001

-1

2001

-3

2002

-1

2002

-3

2003

-1

2003

-3

2004

-1

2004

-3

2005

-1

2005

-3

NAREIT 100 TBI 100

Pure-Play vs. TBI (Base Value 100 in 1994-4)

Cumulative Return (After Adjustment)

Industrial 1995-1 ~ 2005-4

0

100

200

300

400

500

600

1995

-1

1995

-3

19

96-1

1996

-3

1997

-1

19

97-3

19

98-1

1998

-3

1999

-1

19

99-3

2000

-1

2000

-3

20

01-1

2001

-3

2002

-1

20

02-3

20

03-1

2003

-3

2004

-1

20

04-3

2005

-1

2005

-3

PurePlay 100 TBI 100