Beyond Ricardo: Assignment Models in International Trade

The MIT Faculty has made this article openly available. Please share

how this access benefits you. Your story matters.

Citation Costinot, Arnaud, and Jonathan Vogel. “Beyond Ricardo: Assignment Models in International Trade.” Annu. Rev. Econ. 7, no. 1 (August 2015): 31–62. © 2015 Annual Reviews

As Published http://dx.doi.org/10.1146/annurev-economics-080213-041435

Publisher Annual Reviews

Version Original manuscript

Citable link http://hdl.handle.net/1721.1/110280

Terms of Use Creative Commons Attribution-Noncommercial-Share Alike

Beyond Ricardo:

Assignment Models in International Trade

⇤

Arnaud Costinot

MIT and NBER

Jonathan Vogel

Columbia and NBER

March 2015

Abstract

International trade has experienced a Ricardian revival. In this article, we offer a user guide to assignment models, which we will refer to as Ricardo-Roy (R-R) models, that have contributed to this revival.

⇤Authors’ email addresses: costinot@mit.edu and jvogel@columbia.edu. We thank Pol Antr`as, Ariel

Burstein, Jonathan Dingel, Dave Donaldson, Samuel Kortum, Andr´es Rodr´ıguez-Clare, and Bernard Salani´e for helpful comments as well as Rodrigo Adao for excellent research assistance.

1 Introduction

International trade has experienced a Ricardian revival. For almost two hundred years, David Ricardo’s theory of comparative advantage has been perceived as a useful peda-gogical tool with little empirical content. The seminal work of Eaton & Kortum (2002) has shattered this perception and lead to a boom in quantitative work in the field, nicely surveyed inEaton & Kortum (2012). As part of this Ricardian revival, trade economists have also developed assignment models that incorporate multiple factors of production into Ricardo’s original model. In recent years, these models have been used to study a broad set of issues ranging from the impact of trade on the distribution of earnings to its mitigating effect on the consequences of climate change in agricultural markets. The goal of this article is to offer a user guide to these multi-factor generalizations of the Ricardian model, which we will refer to as Ricardo-Roy (R-R) models.

By an R-R model, we formally mean a trade model in which production functions are linear, as in the original Ricardian model, but one in which countries may be endowed with more than one factor, as in the Roy model. Total output in any given sector and country, say wine in Portugal, can thus be expressed as

Q(Wine, Portugal) =

Â

f

A(f , Wine, Portugal)L(f , Wine, Portugal),

where A(f , Wine, Portugal)denotes the productivity of factor f , if employed in the wine sector in Portugal, and L(f , Wine, Portugal)denotes the employment of that factor. When the number of factors in each country is equal to one, the R-R model collapses to the Ricar-dian model. Depending on the particular application, different factors may correspond to different types of labor, capital, or land, whereas different sectors may correspond to different industries, occupations, or tasks. But regardless of what the particular appli-cation may be, the key feature of R-R models is that factors’ marginal products, and hence marginal rates of technical substitution, are constant. As a result, comparative advantage—i.e., relative differences in productivity—drives the assignment of factors to sectors around the world.

The first part of our survey uses R-R models to revisit a number of classical questions in the field. Among other things, we discuss how cross-country differences in technolo-gies and factor endowments affect the pattern of international trade, as inCostinot(2009), as well as how changes in the economic environment—including opening up to trade— affect factor allocation and factor prices, as inCostinot & Vogel(2010). Answering these questions in the context of an R-R model requires new tools and techniques. Because

of the linearity of the production function, corner solutions in R-R models are the norm rather than the exception. Hence, the main issue when solving for competitive equi-libria is to characterize the extensive margin, that is the set of sectors to which a given factor should be assigned. Fortunately, standard mathematical notions and results from the monotone comparative statics literature, such as log-supermodularity andMilgrom & Shannon (1994)’s Monotonicity Theorem, are well suited to deal with this and other related issues. We briefly review these mathematical tools in Section2.

Compared to previous neoclassical trade models, R-R models offer a useful compro-mise. They are more general than Ricardian models, which makes them amenable to study how factor endowments shape international specialization as well as the distribu-tional consequences of trade, yet since marginal rates of technical substitution are con-stant, they remain significantly more tractable than general neoclassical trade models with arbitrary numbers of goods and factors. Predictions derived in such general models tend to be either weak or unintuitive. For example, the “Friends and Enemies” result of

Jones & Scheinkman (1977) states that a rise in the price of some good causes a dispro-portionately larger increase in the price of some factor; but depending on the number of goods and factors, it may or may not lead to a disproportionately larger decrease in the price of some other factor. A common theme in that older literature, reviewed byEthier

(1984), is that predictions in high-dimensional environments hinge on the answer to one fairly abstract question: Are there more goods than factors in the world?

In Section 3, we demonstrate that R-R models deliver sharp predictions in economies with large numbers of goods and factors. First, they offer variations of classical theorems— e.g., Factor Price Equalization, Rybczynski, and Stolper-Samuelson theorems—whose em-pirical content is no weaker than their famous counterparts in the two-good-two-factor Heckscher-Ohlin model. Second, R-R models offer new predictions regarding the impact of changes in the distribution of prices, factor endowments, or factor demands with no counterparts in the two-good-two-factor Heckscher-Ohlin model. These theoretical re-sults are useful because they open the door for general equilibrium analyses of recent phenomena that have been documented in the labor and public finance literatures, but would otherwise fall outside the scope of standard trade theory. These recent phenom-ena include changes in inequality at the top of the income distribution as well as wage and job polarization; see e.g. Piketty & Saez (2003), Autor, Katz & Kearney(2008), and

Goos & Manning(2007), respectively.

Section 4 presents various extensions of R-R models. We first introduce imperfect competition, as inSampson(2014). When good markets are monopolistically competitive `a laMelitz(2003), we show how the same tools and techniques can also shed light on the

relationship between firm heterogeneity, worker heterogeneity, and international trade. We also incorporate sequential production, as inCostinot, Vogel & Wang(2013), to study how vertical specialization shapes inequality and the interdependence of nations. We conclude by discussing a number of generalizations and variations of the basic linear production functions at the core of R-R models.

The last two sections focus on quantitative and empirical work. In Section5, we em-phasize parametric applications of R-R models using Generalized Extreme Value (GEV) distributions of productivity shocks. We draw a distinction between models that feature unobserved heterogeneity across goods, as in the influential Ricardian model ofEaton & Kortum(2002), and models that feature unobserved heterogeneity across factors, as in the more recent work of Lagakos & Waugh (2013), Hsieh et al. (2013), or Burstein, Morales & Vogel (2014). In both cases, we discuss how to conduct counterfactual and welfare analysis and highlight the key differences associated with these two distinct approaches. In Section 6, we turn to non-parametric applications of R-R models to agricultural mar-kets based on detailed micro-level data from the Food and Agriculture Organization’s (FAO) Global Agro-Ecological Zones (GAEZ) project. These non-parametric applications include empirical tests of Ricardo’s theory of comparative advantage (Costinot & Donald-son,2012), the measurement of the gains from economic integration (Costinot & Donald-son, 2014), and a quantitative analysis of the consequences of climate change (Costinot, Donaldson & Smith,2014).

R-R models are related to an older literature on linear programming in economics, see

Dorfman, Samuelson & Solow(1958). Since production functions are linear in R-R mod-els, solving for efficient allocations in such models amount to solving linear programming problems, an observation made byWhitin (1953) in the context of the Ricardian model.

Ruffin(1988) was the first to point out that multiple-factor generalizations of the Ricar-dian model may provide a useful alternative to Heckscher-Ohlin models with arbitrary neoclassical production functions. He offers a number of examples with two countries and two or three factors in which simpler theorems about trade, welfare, and factor pay-ments can be derived. A similar idea can be found inOhnsorge & Trefler(2007) who use the log-normal specification of the Roy model to derive variations of the Rybczynski and Heckscher-Ohlin theorems in economies with heterogeneous workers.

Though labor markets are not the only possible application of R-R models, it is an important one. Assignment models, in general, and the Roy model, in particular, have been fruitfully applied by labor economists to study the effect of self-selection on the dis-tribution of earnings as well as the assignment of workers to tasks; see e.g. Roy (1951),

Teulings(2005), andAcemoglu & Autor(2011). Sattinger(1993) provides an early survey of that literature that clarifies the relationship between the Roy model and other assign-ment models. Some of these alternative assignassign-ment models, such asBecker(1973),Lucas

(1978), andGaricano (2000), have also been fruitfully applied in an open economy con-text to study the effects of international trade and offshoring on heterogeneous workers or entrepreneurs; see e.g. Grossman & Maggi (2000), Kremer & Maskin (2006), Antras, Garicano & Rossi-Hansberg(2006),Nocke & Yeaple(2008),Monte(2011), andGrossman, Helpman & Kircher(2013). Like R-R models, these alternative assignment models can be thought of as very simple neoclassical models—in the sense that very strong assumptions on the complementarity between factors of production are imposed—which makes them well-suited to study economies with a large number of factors of production. The surveys ofAntras & Rossi-Hansberg(2009) andGaricano & Rossi-Hansberg(2014) in this journal as well asGrossman(2013) offer nice overviews of recent work in this area.

2 The Mathematics of Comparative Advantage

The premise of David Ricardo’s theory of comparative advantage is that some individu-als or countries are relatively more productive in some activities than others. In his famous example, England is relatively better than Portugal at producing cloth than wine. As-suming that labor is the only factor of production in each country and that technology is subject to constant returns to scale, the previous statement can be expressed as

A(Cloth, England)/A(Wine, England) A(Cloth, Portugal)/A(Wine, Portugal), (1) where A(·,·)denotes labor productivity in a given sector and country. According to in-equality (1), England has a comparative advantage in cloth and, if inequality (1) did not hold, it would have a comparative advantage in wine.

Now let us move beyond David Ricardo’s example and consider a world economy with any number of goods and countries. How would one generalize inequality (1) to formalize the notion that some countries may have a comparative comparative advantage in some sectors? A fruitful way to proceed is to assume that each country and sector can be described by a scalar, call them g and s, respectively. For instance, g and s may reflect the quality of a country’s financial institutions and the dependence of a sector on external financing, as inMatsuyama(2005); the level of rigidities in a country’s labor market and the volatility of sectoral productivity or demand shocks, as inMelitz & Cunat(2012); or more generally, the level of development of a country and the technological intensity of

a sector, as inKrugman(1986). In such environments, statements about the comparative advantage of high-g countries in high-s sectors can still be expressed as

A(s0, g0)/A(s, g0) A(s0, g)/A(s, g), for all s0 sand g0 g. (2)

Mathematically, inequality (2) implies that A is log-supermodular in(s, g). This partic-ular form of complementarity captures the idea that increasing one variable is relatively more important when the other variables are high and is intimately related to the notion of comparative advantage introduced by David Ricardo.

The previous idea easily extends to situations in which s and g are multi-dimensional. For any x, x0 2 Rn, let max(x, x0)be the vector of Rn whose ith component is max x

i,x0i ,

and min(x, x0) be the vector whose ith component is min xi,x0i . Given the previous

notation, a function g: Rn !R+ is log-supermodular if for all x, x0 2 Rn,

g max x, x0 ·g min x, x0 g(x)·g(x0).

Inequality (2) above corresponds to the special case in which x⌘ (s0, g)and x0 ⌘ (s, g0). If g is strictly positive, then g is log-supermodular if and only if ln g is supermodular. Accordingly, g is log-supermodular if and only if for all i and j, g is log-supermodular in xi, xj when regarded as a function of the arguments xi, xj only. If g also is twice differentiable, then the latter condition is equivalent to ∂2ln g

∂xi∂xj 0. If the above inequality

holds with a strict inequality, we say that g is strictly log-supermodular and if the above inequality is reversed, we say that g is log-submodular.

Most of our theoretical results build on three properties of log-supermodular func-tions:

Property 1.If g, h : Rn !R+are log-supermodular, then gh is log-supermodular.

Property 2. If g : Rn ! R+ is log-supermodular, then G(x i) ⌘ ´ g(xi, x i)dxi is

log-supermodular, where x i denotes the vector x with the ith component removed.

Property 3. If g : Rn ! R+ is log-supermodular, then x⇤

i(x i) ⌘ arg maxxi2Rg(xi, x i) is increasing in x iwith respect to the component-wise order.

Properties 1 and 2 state that log-supermodularity is preserved by multiplication and integration. Property 1 derives from the definition of log-supermodularity. A general proof of Property 2 can be found inKarlin & Rinott(1980). Since log-supermodularity is a strong form of complementarity—stronger than quasi-supermodularity and the single crossing property—Property 3 derives from Milgrom & Shannon’s (1994) Monotonicity Theorem. Note that in Property 3, x⇤

of x⇤

i(x i)is expressed in terms of the strong set order. In this case, both the supremum

and the infimum of the set x⇤

i(x i)are increasing in x i.

As we demonstrate next, log-supermodularity offers a powerful way to parametrize cross-country differences in technology, preferences, and endowments in order to study their implications for the global allocation of factors and the distribution of earnings.

3 The R-R Model

In this section we introduce our baseline version of the R-R model and derive cross-sectional and comparative static predictions in this environment.

3.1 Assumptions

Consider a world economy with many countries indexed by g 2 G ⇢ R3. The vector of country characteristics, g, comprises a technology shifter, gA, a taste shifter, gD, and

a factor endowment shifter, gL. These three variables capture all potential sources of

in-ternational specialization. Each country is populated by a representative agent endowed with multiple factors indexed by w 2 W ⇢ R. The representative agent has homoth-etic preferences over multiple goods or sectors indexed by s 2 S ⇢ R. All markets are perfectly competitive and all goods are freely traded across countries.1 p(s)denotes the world price of good s. Factors are immobile across countries and perfectly mobile across sectors. L(w, gL) 0 denotes the inelastic supply of factor w in country g and w(w, g) denotes the price of factor w in country g.

The defining feature of R-R models is that production functions are linear. Output of good s in country g is given by

Q(s, g) = ´

WA(w, s, gA)L(w, s, g)dw, (3)

where A(w, s, gA) 0 denotes the exogenous productivity of factor w in country g if employed in sector s and L(w, s, g)denotes the endogenous quantity of factor w used to produce good s in country g.2

1Free trade in goods will play the same role in an R-R model as in a standard neoclassical trade model.

It will be crucial for R-R versions of the Factor Price Equalization and the Heckscher-Ohlin Theorems, which rely on good prices being equalized around the world. It will play no role for predictions like the Stolper-Samuelson Theorem, which hold for arbitrary vectors of good prices. Like in the Ricardian model, trade costs can be easily incorporated into R-R models when productivity shocks are drawn from a GEV distribution, as inEaton & Kortum(2002). We discuss such parametric applications in Section5.

2There may be a continuum or a discrete number of factors in W. Whenever the integral sign “´ W”

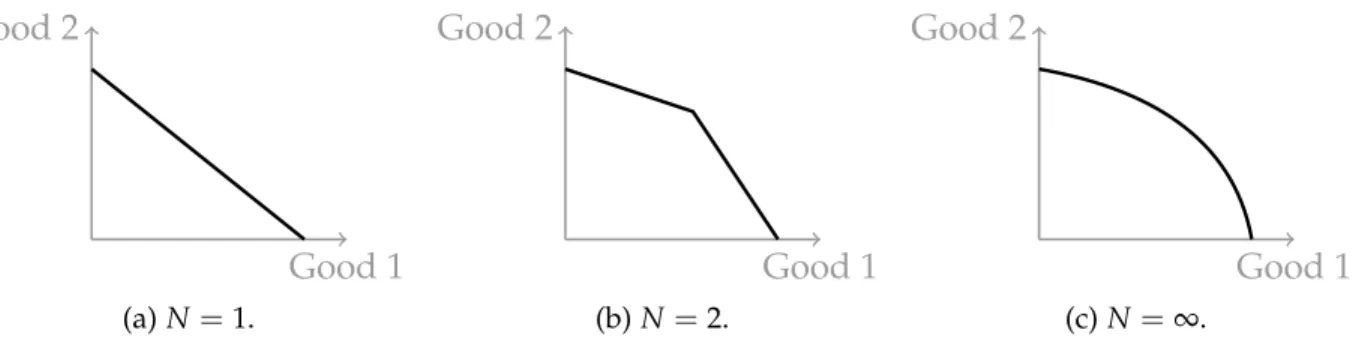

Good 1 Good 2 (a) N =1. Good 1 Good 2 (b) N=2. Good 1 Good 2 (c) N=•.

Figure 1: PPF in R-R model with 2 goods and N =1, 2, • factors.

The Ricardian model corresponds to the special case in which there is only one factor of production in each country. In this situation, the production possibility frontier in any country g reduces to a straight line; see Figure1a. In an R-R model more generally, countries may be endowed with multiple factors of production, leading to kinks in the production possibility frontier; see Figure 1b. As the number of factors goes to infinity, the production possibility frontier becomes smooth, as in a standard Heckscher-Ohlin or specific factor model; see Figure1c.3

This is an important observation. Holding the number of factors fixed, an R-R model with a linear production function is necessarily more restrictive than a standard neoclas-sical trade model. But the number of factors needs not be fixed. In particular, an R-R model with a continuum of factors does not impose more a priori restrictions on the data than a Heckscher-Ohlin model with two factors. To take an analogy from the literature on discrete choice models in industrial organization, assuming that a continuum of hetero-geneous consumers have constant marginal rates of substitution may not lead to different implications for aggregate demand than assuming a representative agent with a general utility function; see e.g. Anderson, de Palma & Thisse (1992). We come back to related issues in Section5when discussing parametric applications of R-R models.

appears, one should therefore think of a Lebesgue integral. If there is a finite number of factors, “´W” is simply equivalent to “ÂW.” Integrals over country and sector characteristics should be interpreted in a

similar manner.

3In an Arrow-Debreu economy, which R-R models are special cases of, one can always think of factors

located in different countries as different factors. In the absence of trade costs and cross-country differences in preferences, the closed economy of an R-R model with N factors is therefore equivalent to the world economy of a Ricardian model with N countries.

3.2 Competitive Equilibrium

In a competitive equilibrium, consumers maximize utility, firms maximize profits, and markets clear.

Consumers. Let D(p, I(g)|s, gD) denote the Marshallian demand for good s in country

g as a function of the schedule of world prices, p ⌘ {p(s)}, and the income of country

g’s representative agent, I(g) ⌘´

Ww(w, g)L(w, gL)dw. By definition of the Marshallian

demand, utility maximization requires the consumption of good s in country g to satisfy D(s, g) = D(p, I(g)|s, gD). (4)

Firms. For future reference, it is useful to start by studying the cost minimization prob-lem of a representative firm, which is a necessary condition for profit maximization. By equation (3), the unit-cost function of a firm producing good s in country g is given by

c(s, g) ⌘ min l(w,s,g) 0 ´ Ww(w, g)l(w, s, g)dw| ´ W A(w, s, gA)l(w, s, g)dw 1 .

The linearity of the production function immediately implies c(s, g) =min

w2W{w(w, g)/A(w, s, gA)}. (5)

In turn, the set of factors, W(s, g) ⌘ {w 2W : L(w, s, g) > 0}, demanded by firms pro-ducing good s in country g satisfies

W(s, g) ⇢arg min

w2W{w(w, g)/A(w, s, gA)}. (6)

Having characterized the unit-cost function of a representative firm, its profit function can be expressed as p(s, g)⌘maxq 0{p(s)q c(s, g)q}. Profit maximization then requires

p(s)c(s, g), with equality if W(s, g) 6=∆. (7)

Market clearing. Factor and good market clearing finally require ´ SL(w, s, g)ds = L(w, gL), for all w, g, (8) ´ GD(s, g)dg = ´ GQ(s, g)dg, for all s. (9)

To summarize, a competitive equilibrium corresponds to consumption, D : S⇥G!R+, output, Q : S⇥G !R+, factor allocation, L : W⇥S⇥G!R+, good prices, p : S!R+,

and factor prices, w : W⇥G!R+, such that equations (3)-(9) hold.

3.3 Cross-Sectional Predictions

In this section, we follow Costinot(2009) and focus on the cross-sectional predictions of an R-R model. Formally, we take good prices, p(s), as given and explore how factor allocation, factor prices, and aggregate output vary across countries and industries in a competitive equilibrium. Accordingly, demand considerations and the good market clearing conditions—equations (4) and (8)—play no role here.

3.3.1 Factor allocation

A central question in assignment models is: Who works where? In the context of an R-R model, one may be interested in characterizing the set of workers employed in partic-ular sectors or, conversely, the set of goods produced by particpartic-ular countries. To make progress on these issues, a common practice in the literature is to impose restrictions on technology that generate Positive Assortative Matching (PAM).

Assumption 1. A(w, s, gA)is strictly log-supermodular in(w, s)and(s, gA).

According to Assumption 1, high-w factors are relatively more productive in high-s sec-tors and high-g countries are relatively more productive in high-s secsec-tors. A simple example of a log-supermodular function is A(w, s, gA) ⌘ exp(ws) or exp(sgA), as in

Krugman(1986),Teulings(1995), andOhnsorge & Trefler(2007).4

By Property 3, Assumption 1 implies that arg minw2W{w(w, g)/A(w, s, gA)} is

in-creasing in s in any country g. Since the log-supermodularity of A in(w, s)is strict, one can further show that for any pair of sectors, s 6= s0, there can be at most one factor w0

such that w0 2 arg minw2W{w(w, g)/A(w, s, gA)} \arg minw2W{w(w, g)/A(w, s0, gA)}.

Combining the two previous observations, we obtain our first result.

PAM (I).Suppose that Assumption 1 holds. Then for any country g, W(s, g)is increasing in s. This is intuitive. In a competitive equilibrium, high-w factors should be employed in the high-s sectors in which they have a comparative advantage.

4The strict log-supermodularity of A(w, s, g

A)in(w, s)formally rules out the possibility that two

dis-tinct factors are perfect substitutes across all sectors. At a theoretical level, this restriction is purely semantic. If two workers only differ in terms of their absolute advantage, one can always refer to them as one factor and let the efficiency units that they are endowed with vary. This is the convention we adopt in this article. Since we assume the existence of a representative agent, the distribution of these efficiency units is irrele-vant for any of our theoretical results and is, therefore, omitted. At an empirical level, though, one should keep in mind that the distribution of earnings depends both on the schedule of prices per efficiency units, which we refer to as the factor price, w(w, g), and the distribution of these efficiency units.

We can follow a similar strategy to analyze patterns of international specialization. Let S(w, g) ⌘ {s : L(w, s, g) >0}denote the set of sectors in which factor w is employed in country g. Conditions (5) and (7) imply that the value of the marginal product of a factor

w in any sector s should be weakly less than its price,

p(s)A(w, s, gA)w(w, g), for all s, (10)

with equality if factor w is employed in that sector, w 2 W(s, g). Since s2 S(w, g)if and only if w 2 W(s, g), condition (10) further implies that

S(w, g) ⇢arg max

s {p(s)A(w, s, gA)}. (11) This condition states that factors from any country should be employed in the sector that maximizes the value of their marginal product, an expression of the efficiency of perfectly competitive markets.

Starting from condition (11) and using the exact same logic as above, we obtain the following prediction.

PAM (II).Suppose that Assumption 1 holds. Then for any factor w, S(w, g)is increasing in gA.

In a competitive equilibrium, there must also be a “ladder” of countries with high-g countries in high-s sectors. This is the prediction at the heart of many Ricardian models such as the technology gap model developed byKrugman(1986) as well as many models in the institutions and trade literature reviewed byNunn & Trefler (2014). As discussed inCostinot(2009), Assumption 1 is critical for such patterns in the sense that it cannot be dispensed with for PAM to arise in all economic environments satisfying the assumptions of Section3.1.5

An important special case in the literature is the case in which S(w, g) is a singleton. This corresponds to a situation in which each factor is only assigned to one sector. A sufficient condition for S(w, g) to be a singleton is that arg maxs{p(s)A(w, s, gA)} is

itself a singleton. Graphically, this situation arises when production occurs at a vertex of the production possibility frontier in Figure 1. As the numbers of factors and hence vertices increase, this restriction becomes milder and milder. If there is a continuum of factors, then S(w, g)must be a singleton for almost all w.6

5The symmetry between PAM (I) and PAM (II) should not be surprising. As already discussed earlier,

factors in different countries can always be defined as different factors in an Arrow-Debreu economy. Under this alternative interpretation, PAM within and between countries are two sides of the same coin.

6This is true regardless of whether there is a finite number of goods or a continuum of goods with finite

3.3.2 Factor prices

Conditions (5) and (7) also have strong implications for the distribution of factor prices within and between countries. Starting from condition (10) and noting that there must exist a s such that w 2 W(s, g)by factor market clearing, we obtain

w(w, g) =max

s {p(s)A(w, s, gA)}. (12) Now consider two countries with the same technology, gA =g0A, but potentially different

endowments and preferences. Equation (12) immediately implies w(w, g) = w(w, g0) ⌘ w(w). In other words, we always have factor price equalization (FPE), as originally noted byRuffin(1988) and summarized below.

R-R FPE Theorem.If there are no technological differences between countries, then factor prices are equalized under free trade, w(w, g) = w(w)for all g.

For all subsequent results, we restrict ourselves to an economy with a continuum of factors. As discussed above, this implies that S(w, g)is a singleton. Thus, the allocation of factors to sectors can be summarized by a matching function, M, such that S(w, g) = {M(w, g)}. In Section3.4, we will add the assumption of a continuum of goods.

Under the assumption of a continuum of factors, we can analyze the distribution of factor prices within each country by differentiating equation (12) with respect w. By the Envelope Theorem, we must have

d ln w(w, g)

dw =

∂ln A(w, M(w, g), gA)

∂w . (13)

Equation (13) is one of the key equilibrium conditions used in our comparative static analysis. Intuitively, if two distinct factors, w1 and w2, were to be employed in the

same sector s, then their relative prices should exactly equal their relative productivities, w(w1, g)/w(w2, g) = A(w1, s, gA)/A(w2, s, gA), or in logs,

Dlnw(w1, g) Dlnw(w2, g) =DlnA(w1, s, gA) DlnA(w2, s, gA).

Equation (13) expands on this observation by using the fact that reallocations of factors across sectors must have second-order effects on the value of a factor’s marginal product.7 zero under Assumption 1. So if the set of factors for which S(w, g)is not a singleton had strictly positive

measure, the set of goods to which they are assigned would have to have infinite measure.

7Here, we implicitly assume that w(·, g)is differentiable. In economies with a continuum of goods, this

property follows from assuming that A(w, s, g)is differentiable. In economies with a discrete number of

Finally, note that whereas equation (12) relies on perfect competition in good markets— through the first-order condition (7)—equation (13) does not. Condition (5) and factor market clearing alone imply that w(w, g) = maxs{c(s, g)A(w, s, gA)}. Starting from this expression and invoking the Envelope Theorem, we again obtain equation (13). This observation will play a central role in extending R-R models to environments with imper-fectly competitive good markets.

3.3.3 Aggregate output

We have already established that Assumption 1 imposes PAM. PAM, however, only im-poses a restriction on the extensive margin of employment, that is whether a factor should be employed in a sector in a particular country; it does not impose any restriction on the intensive margin of employment, and in turn, aggregate output.

To derive cross-sectional predictions about aggregate output, we now impose the fol-lowing restriction on the distribution of factor endowments.

Assumption 2. L(w, gL)is log-supermodular. For any pair of countries, g0

L gL, and factors, w0 w, such that L(w, gL), L(w, g0L)6= 0,

Assumption 2 implies

L(w0, g0L)/L(w, g0L) L(w0, gL)/L(w, gL).

According to Assumption 2, high-gL countries are relatively abundant in high-w factors.

Formally, it is equivalent to the assumption that the densities of countries’ factor endow-ments can be ranked in terms of monotone likelihood ratio dominance. Milgrom(1981) offers many examples of density function that satisfy this assumption including the nor-mal (with mean gL) and the uniform (on [0, gL]). This is the natural generalization of the notion of skill abundance in a two-factor model. Note that Assumption 2 also allows us to consider situations in which different sets of factor are available in countries g and g0.

In such situations, the highest-w factor must be in country g and the lowest-w factor in country g0.

Since S(w, g) is a singleton, employment of a factor w in a particular sector s must now be equal to the total endowment of that factor, L(w, gL), whenever w 2 W(s, g). Thus, output of good s can be expressed as

Q(s, g) = ´

W(s,g) A(w, s, gA)L(w, gL)dw. Theorem ofMilgrom & Segal(2002) provides a strict generalization of equation (13).

If there are no technological differences between countries, FPE further implies that the allocation of factors to sectors must be the same in all countries, W(s, g) ⌘W(s), so that the previous expression simplifies into

Q(s, g) = ´

W(s) A(w, s, gA)L(w, gL)dw. (14)

Using equation (14) together with PAM and Properties 1 and 2, which imply that log-supermodularity is preserved by multiplication and integration, Costinot (2009) estab-lishes the following Rybczynski-type result.

R-R Rybczynski Theorem. Suppose that Assumptions 1 and 2 hold. Then Q(s, g) is log-supermodular in(s, gL).

For any pair of goods, s s0, and any pair of countries with identical technology, gA =g0A, but different endowments, gL g0L, the previous property implies that

Q(s0, g0) Q(s, g0)

Q(s0, g) Q(s, g).

In other words, the country that is relatively more abundant in the high-w factors, i.e. country g0, produces relatively more in the sector that is “intensive” in those factors

un-der PAM, i.e. sector s0. This is akin to the predictions of the Rybczynski Theorem in a

two-by-two Heckscher-Ohlin model. Here, however, the previous prediction holds for an arbitrarily large number of goods and factors. If one further assumes that countries have identical preferences, gD =g0D, the Rybczynski Theorem above implies that high-gL

countries are net exporters of high-s goods, whereas low-gLcountries are net exporters of

low-sL goods, in line with the predictions of the two-by-two Heckscher-Ohlin Theorem, a point emphasized byOhnsorge & Trefler(2007).

As shown inCostinot(2009), one can use a similar logic to establish that aggregate em-ployment and aggregate revenue in a country and sector must also be log-supermodular functions of (s, gL). Using U.S. data on cities’ skill distributions, sectors’ skill

intensi-ties, and cities’ sectoral employment, Davis & Dingel (2013) provide empirical support for such predictions.

3.4 Comparative Static Predictions

The goal of this subsection is to go from cross-sectional predictions to comparative static predictions about the effects of various shocks on factor allocation and factor prices. We start by revisiting the Stolper-Samuelson Theorem, which emphasizes shocks to good

prices. We then turn to the consequences of factor endowment and taste shocks.8

Fol-lowingCostinot & Vogel (2010), we do so in the case of a continuum of both goods and factors: S = [s, ¯s] and W = [w, ¯w]. Under mild regularity conditions on productivity, endowments, and demand functions, this guarantees that the schedule of factor prices and the matching function are differentiable, which we assume throughout. Compara-tive static results in the discrete case can be found inCostinot & Vogel(2009).

3.4.1 Price shocks

Consider a small open economy whose characteristics g are held fixed, whereas coun-try characteristics in the rest of the world, which we summarize by f, are subject to a shock. Using this parametrization, a foreign shock to technology, tastes, or factor en-dowments simply corresponds to a change from f to f0. In a neoclassical environment,

foreign shocks only affect the small open economy g through their effects on world prices. To make that relationship explicit here, we now let p(s, f)denote the world price of good

sas a function of foreign characteristics f.

In line with the analysis with the analysis of Section3.3, we restrict ourselves to foreign shocks that satisfy the following restriction.

Assumption 3. p(s, f)is log-supermodular in (s, f).

For any pair of goods, s0 s, a shock from f to f0 fcorresponds to an increase in

the relative price of good s0, which is the good intensive in high-w factors under PAM. In

the context of the two-by-two Heckscher-Ohlin model, the Stolper-Samuelson Theorem predicts that the relative price of the skill-intensive good should lead to an increase in the relative price of skilled workers. We now demonstrate that in an R-R model, a similar prediction extends to economies with an arbitrary large number of goods and factors.

For the purposes of this subsection, and this subsection only, we let w(·, g, f) and M(·, g, f)denote the schedule of factor prices and the matching function in country g as a function of the foreign shock, f. Using this notation, we can rewrite equation (12) as

w(w, g, f) =max

s {A(w, s, gA)p(s, f)}.

Starting from the previous equation and invoking the Envelope Theorem, now with

re-8If one reinterprets goods as tasks used to produce a unique final good, as inCostinot & Vogel(2010),

spect to a change in f, we obtain

d ln w(w, g, f)

df =

∂ln p(M(w, g, f), f)

∂f . (15)

Since PAM implies that M is increasing in w, Assumption 3 further implies that d dw ✓ ∂ln p(M(w, g, f), f) ∂f ◆ = dM(w, g, f) dw ∂2ln p(M(w, g, f), f) ∂s∂f 0.

Combining the previous inequality with equation (15), we obtain the following Stolper-Samuelson-type result.

R-R Stolper-Samuelson Theorem. Suppose that Assumptions 1 and 3 hold. Then w(w, g, f) is log-supermodular in(w, f).

Economically speaking, the previous result states that increase in the relative price of high-s goods (caused by a shock from f to f0) must be accompanied by an increase in

the relative price of high-w factors (that tend to be employed in the production of these goods). The intuition is again simple. Take two factors, w0 w, employed in two sectors,

s0 s, before the shock. If both factors were to remain employed in the same sector after

the shock, then the change in their relative prices would just be equal to the change in the relative prices of the goods they produce,

ln w(w0, g, f0) w(w, g, f0) ln w(w0, g, f) w(w, g, f) =ln p(s0, f0) p(s, f0) ln p(s0, f) p(s, f) .

Hence, an increase in the relative price of good s0 would mechanically increase the

rela-tive price of factor w0. Like in Section 3.3.2, the previous Stolper-Samuelson-type result

expands on this observation by using the fact that factor reallocations across sectors must have second-order effects on the value of a factor’s marginal product.

Under the assumption that the small open economy is fully diversified, both before and after the shock, the previous result further implies the existence of a factor w⇤ 2 (w, ¯w) such that real factor returns decrease for all factors below w⇤ and increase for all factors above w⇤. In other words, a foreign shock must create winners and losers.

Intuitively, factor w must lose because it keeps producing good s, whose price decreases relative to all other prices. Conversely, factor ¯w must win because it keeps producing good ¯s, whose price increases relative to all other prices.

3.4.2 Endowment and taste shocks

We proceed in two steps. We first study the consequences of endowment and taste shocks in a closed economy. Using the fact that the free trade equilibrium reproduces the inte-grated equilibrium, we then discuss how these comparative static results under autarky can be used to study the effects of opening up to trade.

Consider a closed economy with characteristic g. A competitive equilibrium under autarky corresponds to(Da, Qa, La, pa, wa) such that equations (3)-(8) hold and the good market clearing condition (9) is given by

Da(s, g) = Qa(s, g), for all s and g. (16)

We start by expressing the competitive equilibrium of a closed economy in a compact form as a system of two differential equations in the schedule of factor prices, wa, and the

matching function, Ma.

Given PAM, the factor market clearing condition (8) can be rearranged as ˆ Ma(w,g) s Qa(s, g)/A⇣(Ma) 1(s, g), s, gA⌘ds= ˆ w w L(v, gL)dv, for all w, (17) From utility maximization and the good market clearing condition—equations (4) and (16)—we also know that

Qa(s, g) = Da(pa, Ia(g)|s, gD)

Substituting into equation (17) and differentiating with respect to w, we obtain after rear-rangements,

dMa(w, g)

dw =

A(w, Ma(w, g), gA)L(w, gL)

D(pa, Ia(g)|Ma(w, g), gD) . (18) In a competitive equilibrium, the slope of the matching function is set such that factor supply equals factor demand. The higher the supply of a given factor, L(w, gL), relative to its demand, D(pa, Ia(g)|Ma(w, g), gD)/A(w, Ma(w, g), gA), the “faster” it should

get assigned to sectors for markets to clear.

Costinot & Vogel(2010) derive a number of comparative static predictions in the case in which demand functions are CES:

D(p, I(g)|s, gD) = B(s, gD)p

#(s)I(g)

where B(s, gD)is a demand-shifter of good s and P(gD) = (´SB(s, gD)p1 #(s)ds)1/(1 #)

denotes the CES price index. In the rest of this article, we refer to an economy in which equation (19) holds as a CES economy. In such an economy, normalizing the CES price index to one, equation (18) can be rearranged as

dMa(w, g)

dw =

A1 #(w, Ma(w, g), g

A) (wa(w, g))#L(w, gL)

B(Ma(w, g), gD)´Wwa(w0, g)L(w0, gL)dw0 , (20)

where we have used pa(Ma(w, g)) = wa(w, g)/A(w, Ma(w, g), g

A), by conditions (5)

and (7), and Ia(g) = ´

Wwa(w0, g)L(w0, gL)dw0.

Equations (13) and (20) offer a system of two differential equations in(Ma, wa). The characterization of a competitive equilibrium is completed by the two boundary condi-tions, Ma(w, g) = s and Ma(¯w, g) = ¯s, which state that the lowest and highest factors should be employed in the lowest and highest sectors, an implication of PAM.

Given equations (13) and (20), one can study how shocks to factor supply and fac-tor demand, parametrized as changes in gL and gD, respectively, affect factor allocation, Ma(w, g), and factor prices, wa(w, g). As we did for technology and factor endowments,

we impose the following restriction on how demand shocks, gD, affect the relative

con-sumption of various goods.

Assumption 4. B(s, gD)is log-submodular in(s, gD).

Given equation (19), Assumption 4 implies that an increase in gD lowers the relative

demand for high-s goods.9 For any pair of goods, s s0, and countries, g0D gD, such

that B(s, gD), B(s, g0D) 6=0, we must have

D p, I(g)|s0, g0D /D p, I(g)|s, g0D D p, I(g)|s0, gD /D(p, I(g)|s, gD).

In this environment,Costinot & Vogel(2010) show the two following comparative static results about factor allocation and factor prices.

Comparative Statics (I): Factor Allocation. Suppose that Assumptions 1, 2, and 4 hold in a CES economy under autarky. Then Ma(w, g)is decreasing in g

D and gL.

Comparative Statics (II): Factor Prices. Suppose that Assumptions 1, 2, and 4 hold in a CES economy under autarky. Then wa(w, g)is log-submodular in(w, gD)and(w, gL).

Consider first an endowment shock from gL to g0L gL. By Assumption 2, this

cor-responds to an increase in the relative supply of high-w factors. In the new equilibrium,

9Assuming log-submodularity rather than log-supermodularity is purely expositional. This convention

this must be accompanied by an increase in the set of sectors employing higher-w factors, which is achieved by a downward shift in the matching function. Having established that the matching function must shift down, one can then use equation (13) to sign the effect of a change in relative factor supply on relative factor prices:

d2ln wa(w, g) dgLdw = dMa(w, g) dgL ∂2ln A(w, Ma(w, g), gA) ∂s∂w 0,

where the previous inequality uses dMa(w,g)

dgL 0 and

∂2ln A(w,Ma(w,g),gA)

∂s∂w 0 by

Assump-tion 1. As intuiAssump-tion would suggest, if the relative supply of high-w factors go up, their relative price must go down.

The intuition regarding the effect of a taste shock is similar. By Assumption 4, an in-crease in gD corresponds to a decrease in the relative demand for high-s goods. This

change in factor demand must be accompanied by factors moving into lower-s sectors, which explains why Ma(w, g) is decreasing in gD. Conditional on the change in the

matching function, the effects on relative factors prices are the same as in the case of a shock to factor endowments. If factors move into lower-s sectors in which low-w factors have a comparative advantage, low-w factors will be relatively better off.

As shown inCostinot & Vogel(2010), the same approach can be used to study richer endowment and taste shocks, e.g. shocks that disproportionately affect “middle” factors or sectors. While the economic forces at play are similar to those presented here, such ex-tensions are important since they allow for the analysis of recent labor market phenomena such as job and wage polarization, as emphasized byAcemoglu & Autor(2011).

To go from the previous closed-economy results to the effect of opening up to trade, we can use the fact that under factor price equalization, the free trade equilibrium repli-cates the integrated equilibrium. Hence in the absence of technological differences across countries, factor allocation and prices in any country g, M(w, g) and w(w, g), must be equal to those of a fictitious world economy under autarky, Ma(w, gw) and wa(w, gw),

with dMa(w, gw) dw = A1 # w, Ma(w, gw), gw A (wa(w, gw))#L(w, gwL) B(Ma(w, gw), gwD)´ Wwa(w0, gw)L(w0, gwL)dw0 , (21) d ln wa(w, gw) dw = ∂ln A(w, Ma(w, gw), gwA) ∂w . (22)

In the previous system of equations,gw

com-mon across countries, whereas gw

L and gwD are implicitly defined such that

L(w, gwL) = ´ GL(w, gL)dgL, B(s, gwD) = ´ G ´ Wwa(w, gw)L(w, gL)dw ´ Wwa(w, gw)L(w, gwL)dw P # 1(g)B(s, g D)dgD.

In the two-country case, one can check that if g g0, then gw 2 [g, g0]. This simple observation implies that the consequences of opening up to trade in country g are iso-morphic to an increase in gD and gL under autarky, with effects on factor allocation and

factor prices as described above. Trade will lead to sector downgrading for all factors, i.e. a downward shift in the matching function, and to a pervasive decrease in the relative price of high-w factors. The opposite is true in country g0. Like in the case of a closed

economy, the previous logic can also be used to study the effects of trade integration be-tween countries that differ in terms of “diversity,” as emphasized inGrossman & Maggi

(2000).

We conclude by pointing out that although we have presented the above compara-tive static results as closed economy results in an R-R model with a continuum of factors, they can always be interpreted as open economy results in a Ricardian model with a con-tinuum of countries, as inMatsuyama(1996) andYanagawa(1996). To do so, one simply needs to define factors in different countries as different factors. Under this interpretation, the previous results can be used, for instance, to shed light on the impact of growth in a subset of countries on patterns of specialization—as captured by the matching function— and the world income distribution—as captured by the schedule of factor prices.

4 Theoretical Extensions

The baseline R-R model presented above is special along two dimensions: good markets are perfectly competitive and production functions are linear. In this section, we relax these assumptions about market structure and technology and show how to apply the tools and techniques introduced in Section3to these alternative environments.

4.1 Monopolistic Competition

We first follow Sampson(2014) and introduce monopolistic competition with firm-level heterogeneity `a la Melitz (2003) into an otherwise standard R-R model.10 We focus on

10Other recent papers introducing monopolistic competition into an R-R model includeEdwards &

a world economy comprising n+1 symmetric countries and omit for now the vector of country characteristics g. Goods markets are monopolistically competitive and prefer-ences are CES over a continuum of symmetric varieties. There is an unbounded pool of potential entrants that are ex-ante identical. To enter, a firm incurs a sunk cost, fe > 0.

Entry costs and all other fixed costs are proportional to the CES price index, which we normalize to one. Upon entry, a firm randomly draws a blueprint with characteristic s from a distribution G. If the firm incurs an additional fixed cost f > 0, it can produce a differentiated variety for the domestic market using the same linear production function as in Section3.1,

q(s) =´

WA(w, s)l(w, s)dw,

where A(w, s)denotes the productivity of the firm if it were to hire l(w, s)units of factor

w 2 [w, ¯w]. We further assume that A(w, s)is strictly increasing in s so that s is an index of firm-level productivity. The production function in Melitz(2003) corresponds to the special case in which there is only one factor of production and A(w, s) ⌘ s. Finally, in

order to export, a firm must incur a fixed cost fx 0 per market and a per-unit iceberg

trade cost t 1.

Like in Section3.2, consumers maximize their utility, firms maximize their profits, and markets clear. The key difference is that firms have market power. Thus profit maximiza-tion now requires marginal cost to be equal to marginal revenue rather than price,

dr(q, s) dq = w(w) A(w, s), drx(qx, s) dqx = tw(w) A(w, s),

where r(q, s)and rx(qx, s)denote a firm’s revenue if it sells q >0 and qx >0 units in the

domestic and foreign markets, respectively. In contrast, the cost minimization problem of the firm is unchanged. Given the linearity of the production function, conditions (5) and (6) must still hold. Under Assumption 1, this immediately implies that we must have PAM in this alternative environment: high-w factors will be employed in high-s firms. Since high-s firms will also be larger in terms of sales and more likely to be exporters, as in Melitz(2003), R-R models with monopolistic competition therefore provide simple micro-foundations for the well-documented firm-size and exporter wage premia.11

11Yeaple(2005) provides an early example of a monopolistically competitive model with firm and worker

heterogeneity in which PAM arises under Assumption 1. Alternative micro-foundations for the firm-size and exporter wage premia based on extensions ofMelitz(2003) with imperfectly competitive labor markets can be found inDavidson, Matusz & Shevchenko(2008),Helpman, Itskhoki & Redding(2010), andEgger & Kreickemeier(2012), among others.

As discussed in Section3.3, since equation (5) still holds, we must also have w(w) = maxs{A(w, s)c(s)}. By the Envelope Theorem, this implies

d ln w(w)

dw =

∂ln A(w, M(w))

∂w ,

exactly as in the baseline R-R model. Combining the goods and factor market clearing conditions, which are unchanged, one can then use the same strategy as in Section3.4to show that

dM(w)

dw =

A(w, M(w))Lw(w) Dw(p, Ew|M(w)) ,

where Lw(w) denotes world endowment of factor w; Ew denotes world expenditure, which includes both spending by consumers and firms; and Dw(p, Ew|s)denotes world

absorption for s varieties. In short, the two key differential equations characterizing fac-tor prices and the matching function remain unchanged under monopolistic competition. Of course, one should not infer from the previous observation that monopolistically competitive models do not have new implications. In the present environment, world ab-sorption, Dw(p, Ew|s), depends both on the level of variable trade costs, t, as well as the

the fixed costs, fe, f , and fx, which determine the entry and exit decisions of firms across

markets. This opens up new and interesting channels through which trade integration— modeled as a change in t, fx, or n—may affect the distribution of earnings.

Let s denote the productivity cut-off above which firms choose to produce and sx denote the productivity cut-off above which they choose to export. Under the assumption that preferences are CES, one can then express world demand for s varieties as

Dw(p, Ew|s) = B

w(s, gw

D)p #(s)g(s)Ew

´

SBw(s0, gwD)p1 #(s0)g(s0)ds0,

where world demand characteristics, gw

D, and the demand shifter for s varieties, Bw(s, gwD),

are such that

gwD ⌘ (t, n, s, sx), Bw(s, gwD)⌘⇣1+nt1 #I[s

x,•)(s)

⌘

I[s,•)(s).

In the previous expression, I[s,•)(·)and I[sx,•)(·)are indicator functions that capture the selection of different firms into domestic production and export, respectively. Although the cut-offs s and sxare themselves endogenous objects that depend on fixed and variable trade costs through standard zero-profit conditions, it will be convenient to study how

trade integration shapes inequality in two steps: (i) treat the demand shifters, Bw, as functions of s and gw

D ⌘ (t, n, s, sx); and (ii) analyze how s and sx vary with t, f , and

fx.

To apply the results of Section3.4.2in this environment, one only needs to check that Bwis log-submodular in(s, t)and log-supermodular in(s, n), (s, s), and(s, sx), which is a matter of simple algebra. From our previous analysis, we then obtain that ceteris paribus, a decrease in trade costs, t, or an increase in the number of countries, n, and the productivity cut-offs, s and sx, should lead to an upward shift in the matching function and a pervasive increase in the relative price of high-w factors around the world.

This is an important difference between the models in Sections 3 and 4.1. Whereas trade integration in Section 3.4 leads to lead to opposite effects at home and abroad— because endowments and demand in the integrated economy lie in-between the endow-ments and demand in the two countries—selection effects `a la Melitz(2003) imply that trade integration—modeled as a reduction in trade costs or an increase in the number of countries—have the same effects on the distribution of earnings around the world. In-tuitively, if trade integration increases the relative demand for high-s firms everywhere, it must also increase the relative price of the high-w factors that are employed in these firms.

As alluded to above, the total effect of a change in variable trade costs or the number of countries is more subtle. In addition to their direct effects, they also indirectly affect entry and exit decisions, which is reflected in changes in s and sx. This last effect tends to work in the opposite direction: when variable trade costs fall, this lowers the export cut-off, sx, which then increases the relative demand of firms below that cut-off. Sampson

(2014) analyzes these countervailing forces and provides further extensions, including endogenous technology adoption as inYeaple(2005).

4.2 Vertical Specialization

Up to this point, we have focused on the implications of R-R models for trade in goods. Although these goods may be intermediate goods or tasks, the previous analysis abstracts from global supply chains in which countries specialize in different stages of a good’s pro-duction sequence, a phenomenon which Hummels, Ishii & Yi (2001) refer to as vertical specialization. Building on earlier work byDixit & Grossman (1982) andSanyal (1983),

Costinot, Vogel & Wang (2012) and Costinot, Vogel & Wang (2013) develop variants of R-R models with sequential production to study how vertical specialization shapes in-equality and the interdependence of nations. We now briefly describe their framework

and summarize their results.12

There is a unique final good whose production requires a continuum of stages s2 [s, ¯s]. At the end of each stage s, firms can use factors of production and the input from that stage in order to perform the next stage, s+ds. If firms from country g combine

Q(w, s, g) units of intermediate good s with L(w, s, g) units of factor w for all w 2 W, then total output of intermediate good s+dsin country g is equal to

Q(s+ds, g) = ˆ

WA(w, gA)min{Q(w, s, g), L(w, s, g)/ds}dw, (23)

where total factor productivity, A(w, gA), is such that

A(w, gA)⌘exp( l(w, gA)/ds). (24)

l(w, gA)can be interpreted as the constant Poisson rate at which “mistakes” occur along a given supply chain, as inSobel(1992) andKremer(1993). At any given stage, the likeli-hood of such mistakes may depend on the quality of workers and machines, indexed by

w, as well as the quality of infrastructure and institutions in a country, indexed by gA, but

is assumed to be constant across stages.

When l(w, gA)is strictly decreasing in w and gA, so that high-w factors and high-gA countries have an absolute advantage in all stages, there must be vertical specialization in any free trade equilibrium with more productive factors or countries specializing in later stages of production. Mathematically, PAM arises for the same reason as in earlier sections. By equations (23) and (24), the cumulative amount of factor w necessary to produce all stages from s to s in country g is equal to exp((s s)l(w, g)), which is log-submodular in both (w, s) and (s, g). Because of the sequential nature of production, absolute productivity differences are a source of comparative advantage.13

Once PAM has been established, competitive equilibria can still be described as a sys-tem of differential equations that jointly characterize the schedule of factor prices and the matching function. In a Ricardian version of this model—with only one factor of produc-tion per country—Costinot, Vogel & Wang (2013) use this system to contrast the effects of technological change in countries located at the bottom and the top of a supply chain. In a two-country version of this model with a continuum of factors, Costinot, Vogel &

12Yi(2003),Yi(2010), andJohnson & Moxnes(2013) offer examples of quantitative work using Ricardian

models with sequential production. The implications of contractual imperfections in such environments are explored inAntras & Chor(2013).

13Costinot, Vogel & Wang(2013) also study cases in which the rate of mistakes, and hence factor

produc-tivity, vary across stages. If the stage-varying Poisson rate, l(w, s, gA), is submodular in(w, s)and(s, gA),

Wang(2012) use a similar approach to analyze the consequences of trade integration be-tween countries with different factor endowments. While the effects of trade integration on the matching function are the same as in Section 3.4, sequential production leads to new and richer predictions about the effects of trade on inequality. Namely, standard Stolper-Samuelson forces operate at the bottom of the chain, but the opposite is true at the top.

4.3 Other Extensions

In the baseline R-R model as well as the previous extensions, factors of production are characterized by their exogenous productivity in various economic activities. In prac-tice, productivity may be neither exogenous nor the only source of heterogeneity among factors. The marginal product of labor may vary with the stock of capital; workers may have different preferences over working conditions; and workers may vary in terms of how costly it is for them to acquire skills. Fortunately, such considerations can all be incorporated into an R-R model.

As shown in our online Appendix, the tools and techniques of Section 3can be used to derive similar cross-sectional and comparative static predictions in economies with:

i. Factor complementarity, if output of good s in country g is given by Q(s, g) = F[Kagg(s, g), Lagg(s, g)|s, g],

where F(·,·|s, g) is a constant returns to scale production function; Kagg(s, g) and Lagg(s, g)denote the aggregate amounts of capital and labor, respectively, with

Lagg(s, g) = ˆ

WA(w, s, gA)L(w, s, g)dw.

ii. Heterogeneous preferences, if the utility of a worker with characteristic w receiving a wage wc(s, g)in sector s and country g is given by

V(w, s, g)⌘wc(s, g)U(w, s, gU),

where gU is a new exogenous preference shifter and U(w, s, gU) is strictly

log-supermodular in(w, s)and(s, gU).14

14When thinking about heterogeneity in preferences, a natural interpretation of s is location rather than

industry. In practice, different individuals may choose to live in different cities because they value their various amenities differently. With this interpretation in mind, R-R models also provide a useful framework

iii. Endogenous skills, if firms from country g need to pay S(w, s, gS) >0 in order to train a worker of type w in sector s—with learning costs proportional to the con-sumer price index—and S(w, s, gS)is strictly submodular in(w, s)and(s, gS).15

5 Parametric Applications

The two previous sections have derived a number of sharp cross-sectional and compar-ative static predictions, especially in economies with a continuum of goods and factors. In the data, however, one always observes a discrete number of factors and sectors. Fur-thermore, PAM never perfectly holds for these observed groups of factors and sectors; all factors are likely to be employed in all sectors, albeit with different intensity.

One way to bridge the gap between theory and data is to maintain the assumption that there is a continuum of factors or goods that are perfectly observed by consumers and firms, but add the assumption that the econometrician only observes coarser measures of these characteristics. Under these assumptions, there may therefore be unobserved het-erogeneity, from the point of view of the econometrician, within a given group of factors or goods.

A number of papers in the trade literature have followed the previous approach. The empirical content of such papers then crucially depends on the distributional assump-tions imposed on unobserved heterogeneity across goods or factors. By far the most com-mon assumption in the existing literature is to assume Generalized Extreme Value (GEV) distributions of productivity, as in the influential work ofEaton & Kortum(2002).16 Sec-tions 5.1 and 5.2 discuss the implications of GEV distributions of productivity shocks across goods and factors, respectively.

5.1 Unobserved Productivity Shocks across Goods

Consider first a R-R model with a discrete number of factors and countries and a contin-uum of goods. For notational convenience, true characteristics, which are perfectly

ob-to analyze the relationship between migration and trade, both within and between countries.

15This is the approach followed byBlanchard & Willmann(2013).

16This distributional assumption is standard in the analysis of discrete choice models in industrial

or-ganization, see e.g. McFadden(1974) andBerry(1994), as well as in the matching literature, see e.g.Choo & Siow(2006). Following the seminal work ofRoy(1951), numerous papers in the labor literature have focused instead on environments in which the distribution of worker skills is log-normally distributed, see e.g.Heckman & Sedlacek(1985). In the international trade literature,Ohnsorge & Trefler(2007) also impose log-normality.Liu & Trefler(2011) propose an alternative empirical approach based on linearized versions of the Roy model’s estimating equations.