WORKING

PAPER

ALFRED

P.SLOAN

SCHOOL

OF

MANAGEMENT

DETERMINISTIC CHAOS

INAN EXPERIMENTAL ECONOMIC

SYSTEM

John

D.Sterman

July, 1988WP #2040-88

MASSACHUSETTS

INSTITUTE

OF

TECHNOLOGY

50

MEMORIAL

DRIVE

CAMBRIDGE,

MASSACHUSETTS

02139

j;mJohn

D.Sterman

MIT.

LIBRARIES

"3

1 6 1988

Deterministic

Chaos

inan

Experimental

Economic

System

John D.

Sterman

Massachusetts Institute of

Technology

Sloan School ofManagement

Cambridge,

MA

02139

July 1988

The

contributions andcomments

of RichardDay,

ChristianKampmann,

Edward

Lorenz, Ilya Prigogine,

James

Ramsey, Rebecca

Waring, and particularly ErikAbstract

An

experiment with a simulatedmacroeconomic

system demonstrates that thedecision-making processes of agents can

produce

deterministic chaos. Subjectsmanaged

capital investment in a simple multiplier-accelerator

economy.

Performance, however,was

systematically suboptimal.

A

model

of the subjects' decision rule is proposed and related topriorstudies of

dynamic

decision making.Econometric

estimatesshow

themodel

is anexcellent representation of the actual decisions.

The

estimated rules are then simulated toevaluate the stability of the subjects' decision processes.

While

the majority of the estimatedrules are stable, approximately

40%

yield a variety ofdynamics

including limit cycles, periodmultiples, and chaos. Analysis ofthe parameter space reveals a

complex

bifurcationstructure. Implications for

models

ofhuman

systemsand

experimental studies ofeconomic

dynamics

are explored.1. Introduction: coupling nonlinear

dynamics and

experimental

economics

Recent

work

in the physical sciences hasshown

deterministic chaos to be acommon

mode

of behavior indynamic

systems, thus stimulating the search for chaosand

other highlynonlinear

phenomena

inhuman

systems. Indeed, there has been a near explosion ofmodels

and

empirical studieswhich

seek toshow

the relevance ofnonlineardynamics

and chaos insocial

and

economic

settings. Several journals have devoted special issues to chaos andmodels

ofnonlinear, disequilibriumdynamics

inhuman

systems.^ This robust literature canbe divided roughly into (1) theoretical

models

of nonlinear dynamics, and (2) empiricalstudies

which

seek evidence of chaos ineconomic

data.Theoretical studies include the

work

ofDay

(1982),Dana

and

Malgrange

(1984),Grandmont

(1985),Rasmussen

and

Mosekilde

(1988), Stutzer (1980),and

many

others (seenote 1).

A

survey of these studies suggests the following generalizations. First,many

standard models, both micro-

and macroeconomic,

when

modified to include realisticnonlinearities, can be

shown

to contain regimes ofchaos and other nonlinearphenomena

suchas mode-locking, period multiples, and quasiperiodicity.

Benhabib and

Day's (1981) studiesof such simple

models

leadthem

to "expect the possibility oferratic [chaotic] behavior forawide

variety ofdynamic economic models

involving rational decision-making with feedback."Subsequent

work

has borne out this conjecture-

the possibility ofchaos does notseem

todepend on

particular behavioral assumptions buton

more

fundamental properties.However,

most models

ofnonlineardynamics

have been purely theoretical, and have not involvedeconometric estimation of the parameters.

The

few

exceptionshave found

the estimatedparameters lie well outside the chaotic regime, e.g.

Candela

and Gardini (1986)and

Dana

andMalgrange

(1984).As

Day

and

Shafer (1985, 293) note,"Whether or not

we

can construct empirical models that offerconvincing explanation ofreal worldmacro activity [in terms of deterministic chaos] is an open question: most economists would probably

agree that

we

are as yet quite far from a definitive answer to it. Whatwe

know now...is that amongthe empirical phenomena that

we

can hope to explain...are stochasticlike fluctuations in economic data.Moreover,

we

need not expect thatexotic assumptions or bizarre model structures will be required"D-3976

The

relative simplicity and theoretical focus of themodels

is entirely appropriate to theearly exploration of

new

concepts and analytical tools.However,

the theoreticalwork

to dateleaves

unanswered

questions about the relevance of these models.Can

chaos arisefrom

thebehavior ofactual agents?

Do

the chaotic regimes in themodels

lie in the realistic region ofparameter space, or are they mathematical curiosities unrealized in actual

economic

systems?The

empirical literature has sought toanswer

these questionsby

searching forevidence of chaos in

economic

data. This literature is notable for the clever adaptation oftechniques originally applied in physical settings, such as the

Takens

(1985)method

forrecovering low-dimensional attractors

from

a single time series, the Wolf, Swift, Swinney,and

Vastano (1985) technique forestimation ofLyapunov

exponentsfrom

experimental timeseries, and the Grassberger-Procaccia (1983) correlation dimension.

The

results aretantalizingly suggestive but inconclusive.

Brock

(1986) demonstrates amethod

to test thehypothesis of chaos in

economic

data against explicit alternative hypotheses, but finds "thatthere is not

enough

information available in U.S. realGNP,

real gross private domesticinvestment,

and

Wolfer's sunspot series...to reject the null hypothesis that...[these serieswere] generated

by

anAR(2)

process."Chen

(1988) andBamett and

Chen

(1988),however, find evidence of

low

dimensional strange attractors insome

but not all measures ofU.S.

monetary

aggregates. Their conclusions are tempered, however,by

uncertainties suchas the sensitivity of the

methods

used to thenumber

of data points, thenumber

of points perorbit, the

(unknown) magnitude

and statistical character of process noise, and the(unknown)

magnitude

and character ofmeasurement

error[Ramsey and

Yuan

(1987)].Brock

(1986, 192) concludes "It is notenough

when

you

areworking

with short data sets to reportlow

dimension and positiveLyapunov

exponents tomake

the case for deterministic chaos in yourdata" (emphasis in original).

Ramsey,

Sayers, andRothman

(1988) have identifiedsignificant biases in calculations ofcorrelation dimension caused by small sample size and conclude "that while there is abundant evidence for the presence ofnonlinear stochastic

attractors of the type that have been discovered in the physical sciences."

The

prevalence ofchaos in themodels

butlow

power

of aggregate statistical testsmotivates a

complementary

approach basedon

laboratory experiments with simulatedeco-nomic

systems.The

pioneeringwork

of Smith (1982, 1986), Plott (1986),and

others hasdemonstrated that

many

economic

theories can be successfully tested in the laboratory. Thispaper applies these techniques to the investigation of chaos in

economic

systems. I reportthe results of an experiment with a simulated

macroeconomic

system, specifically amulti-plier-accelerator model. In the experiment, subjects play the role of

managers

of thecapital-producing sector of an

economy.

Each

time period theymust

make

a capital investmentdecision.

The

task ofthe agents is tomanage

acomplex

dynamic

system in disequilibrium, asystem with time lags, multiple feedbacks, and nonlinearities. I

show

that the behavior ofthesubjects is systematically suboptimal, suggesting the use of a

common

heuristic for decisionmaking.

A

model

ofthe subjects' decision rule is proposed.The

model

is wellgrounded

inthe literature ofeconomics, psychology, and behavioral decision theory.

Econometric

estimation

shows

the decision rule explains the agents' behavior well.Next

the estimateddecision rules are simulated, and it is

shown

that approximately40%

ofthe agents produceunstable behavior, including chaos.

The

parameter space of the system ismapped

and

shown

to contain a

complex

bifurcation structure.Thus

experimental evidence isadduced

that theactual decision processes of agents in a

common

economic

context can produce chaos.Limitations of the method, implications,

and

suggestions for future research are discussed.2.

The Model

The

experiment is basedon

a simplemodel

of the capital investment accelerator andis fully described in

Sterman

(1988a).The

model

creates a two-sectoreconomy

with acapital producing and

goods

producing sector.The

focus is the capital investment accelerator.Goodwin

(1951, 4) notes that the traditional acceleration principleassumes

...that actual, realized capital stock is maintained at the desired relation with output.

We

know inreality that it is seldom so, there being now too much and

now

too little capital stock. For this thereD-3976

4

industry....At the otherextreme there is an even more inescapable and effective limit. Machines, once made, cannot be unmade, so that negative investment is limited to attrition from wear.. ..Therefore

capital stock cannotbe increased fast enough in the upswing, nor decreased fastenough in the

downswing, so that atone time we have shortages and rationing of orders and at the other excess

capacity with idleplants and machines.

A

single factor ofproduction (capital plant and equipment) is considered.The

model

includes,however, an explicit representation ofthe capital acquisition delay (construction lag) and the

capacity ofthe investment

goods

sector.As

a result, orders forand

acquisition of capital arenot necessarily equal, and at any

moment

there will typically be a supply line ofcapital underconstruction. For simplicity, the

demand

for capital of the goods-producing sectorisexogenous, and there is

no

representation oftheconsumption

multiplier.The

model

allows forvariable utilization of the capital stock.Thus

productionP

is thelesser ofdesired production

P*

orproduction capacity C. Capacity is proportional to thecapital stock, with capital/output ratio k:

Pt

=

MIN(P*„Ct)

(1)Ct = Kt/K. (2)

The

capital stock of the capital sector isaugmented

by acquisitionsA

and diminishedby

depreciation D.

The

average lifetime ofcapital is given by x:Kt^l

=Kj

+(Aj-Dj)

(3)Dt =

Kt/T. (4)The

acquisition of capital by both the capital andgoods

sectors(A

andAG)

depends on

thesupply line ofunfilled orders each has accumulated (the backlogs

B

and

BG)

and the fractionofthe backlog delivered that period (J) (the suffix 'G' denotes a variable ofthe

goods-producing sector):

A,

= Bf4)t (4)AGt

=

BGt•(^, (5)<l>t

=

Pt/P*t (7)P*t = Bi

+BGt.

(8)unless the capital sector is unable to produce the required amount. Ifcapacity is insufficient

so that

P*>C,

<t)<land

shipments to each sector fall in proportion to the shortfall.Note

thatthe formulation for

<J) implies that

A+AG=P

at all times, ensuring that output is conserved.The

explicit representation ofthe construction supply line and the constrainton

productionmean

that the lag in acquiring capitalmay

be variable. It is easilyshown

that the averagecapital acquisition lag A=l/()). Normally, <\>=\ and

A=l

period. Ifcapacity is inadequate,however, <\> falls

and

A

lengthens as the backlogs of unfilled ordersgrow

relative to output.^The

supply lines of unfilled orders foreach sectorB

andBG

areaugmented

by ordersfor capital placed

by

each sector and emptiedwhen

those orders are delivered:Bui

=Bt

+

(Ot-Ai)

(8)BGt+i

-

BGt

+

(OGfAGt).

(10)Orders placed by the

goods

sector are anexogenous

input towhich

the subjects of theexperiment

must

respondby

ordering an appropriateamount

ofcapital for theirown

use:OGt

= exogenous

(11)Oj =

determined by subject. (12)Equations (1)-(12) thus define a third-order nonlinear difference equation system.

The

system has the interesting property that the nonlinear capacity utilization function ofeq.(1) divides the system into

two

distinct regimes, (^=\and

(}><1. Furthermore, the equilibriumpoint

P* =

C

lies exactly at the boundary. Considering each region in turn reveals interestingproperties of the

open

loop system.When

P*=P<C,

0=1,and

the system is linear:Kl+1

Bui

BGt.i

Bt

BGi

1 1OG,

(13)Excess capacity implies each sector receives the quantity ordered after

one

period.Note

thatthe system in this

regime

is always stable.The

capital stock is controllable via ordersO

(itD-3976

there is excess capacity, the goods-producing and capital-producing sectors are decoupled.

When

capacity is inadequate, however,P*>P=C,

(})<1,and

the system is nonlinear.Linearizing the system around the operating point (K, B,

BG)

anddefiningP*

=

B-i-BGand

^=

(K/K)/P* yieldsl-i.-L

T kP*B

kP*BG

kP* <t>=^

P* p* P* P* p*Kt

seminal

work

ofSmith

(1982) and Plott(1986).The

experimental protocol used here isdescribed in

Sterman

andMeadows

(1985) andSterman

(1987, 1988a).A

continuous timeversion ofthe

model

is developed and analyzed inSterman

(1985).For

the experiment it hasbeen converted to discrete time. Simulation

and

formal analysis confirm that the conversionto discrete time does not alter the essential

dynamics

of the system [Rasmussen,Mosekilde

andSterman

(1985),Sterman

(1988b)].The

experiment isimplemented on

IBM

PC-type

microcomputers.

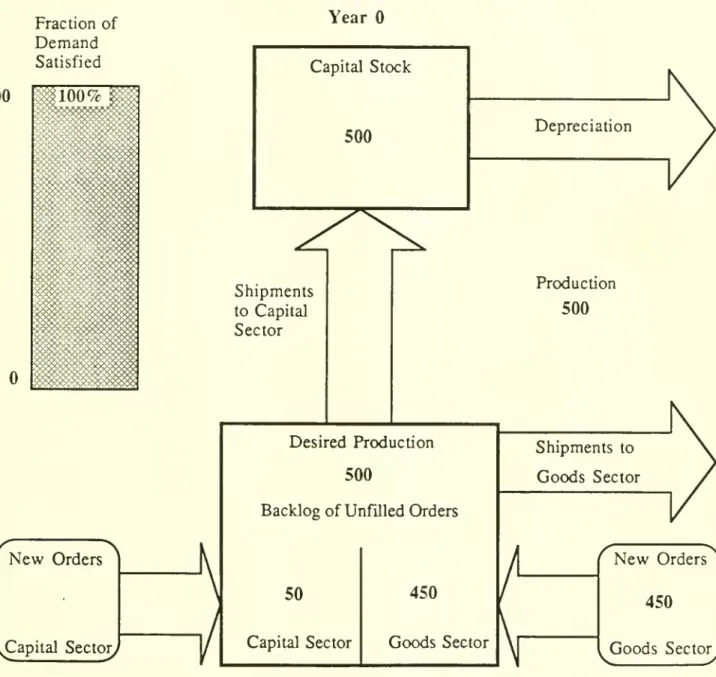

A

'game board' is displayedon

the screen and provides the subjects withperfect information. Colorgraphics and animation highlight the flows oforders, production,

and

shipments to increase the transparency of the structure (figure 1).^No

overt timepressure

was

imposed.The

parameters (k=1 andx=10)

were

chosen tominimize

thecomputational burden

imposed on

the subjects, while remaining close to the original values.The

subject population(N=49)

consisted ofMIT

undergraduate, master'sand

doctoralstudents in

management

and

engineering,many

with extensive exposure toeconomics and

control theory; scientists

and

economistsfrom

various institutions in theUS,

Europe, and theSoviet Union;

and

business executives experienced in capital investmentdecisions includingseveral corporate presidents

and

CEOs.

Subjects are responsible foronly

one

decision-

how much

capital to order.The

goalofthe subjects in

making

these decisions is tominimize

total costs.The

cost function orscore

S

is defined as the average absolute deviationbetween

desired productionP*

and

production capacity

C

over theT

i>eriods ofthe experiment:T

S-(})S|P*t-Cj.

(16)t=0

The

cost function indicateshow

well subjects balancedemand

and

supply. Subjects arepenalized equally for both excess

demand

and excess supply. Absolute value rather thanquadratic or

asymmetric

costs provide an incentive to reach equilibrium while minimizing theD-3976

used, in violation of Smith's (1982) protocol forexperimental microeconomics.

While

many

economists argue that significant performance-based rewards are necessary to establish

external validity, a

number

of experiments in preference reversal [Gretherand

Plott (1979),Slovic and Lichtenstein (1983)] suggest performance is not materially affected

by

rewardlevels. Similar experiments have found

weak

or even negative effects ofincentiveson

performance, though the further study is

needed

[Hogarth andReder

(1987)]. Otherexperiments in

dynamic

decisionmaking

suggest the results are robust with respect tosignificant variations in the experimental environment.

Sterman

(1988c) describes an experiment with a simulated production-distribution system inwhich

financial rewardswere

used. Like the

model

here, the experimental system contained multiple feedbacks,nonlinearities, and time lags.

Yet

despite large differences in the experimental cover story,information set, incentives, time pressure, and complexity of the underlying system, the

results strongly reinforce those of the present experiment and support the

same

decision ruletested here, suggesting the relative insensitivity of the subjects to incentives

and

thedynamic

structure ofthe system. Other studies ofdynamic

decisionmaking which

generallysupport the results here include

Brehmer

(1987)and

MacKinnnon

andWearing

(1985).4. Results

The

trials reportedbelow were

run for36

periods. Allwere

initialized in equilibriumwith orders of

450

units each periodfrom

thegoods

sector and capital stock of500

units.Depreciation is therefore

50

units per period, requiring the capital sector toorder50

unitseach period to compensate.

By

eq. (8) desired production then equals450

-f- 50, exactly equalto capacity,

and

yielding an initial cost ofzero. Orders for capitalfrom

thegoods

sectorOG,

the onlyexogenous

input to the system, remain constant at450

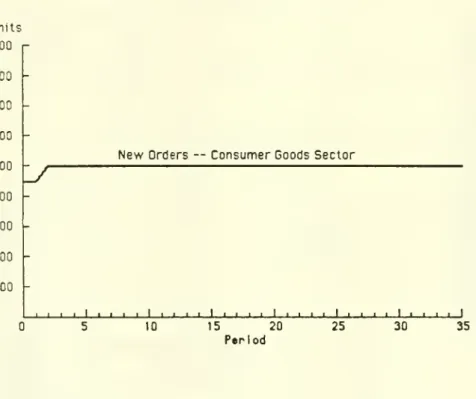

for the firsttwo

periods. Inthe third period

OG

risesfrom

450

to 500, and remains at500

thereafter (figure 2).The

stepinput is not

announced

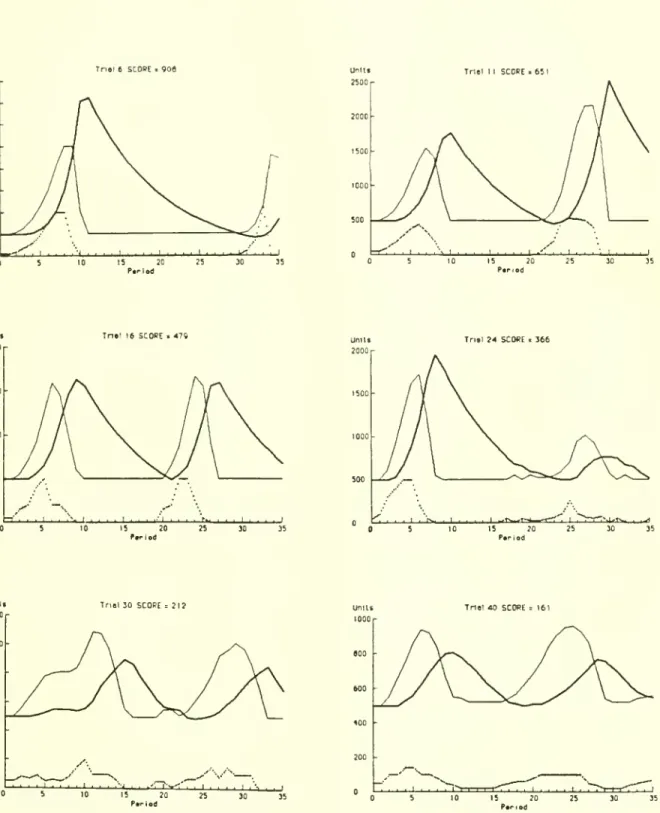

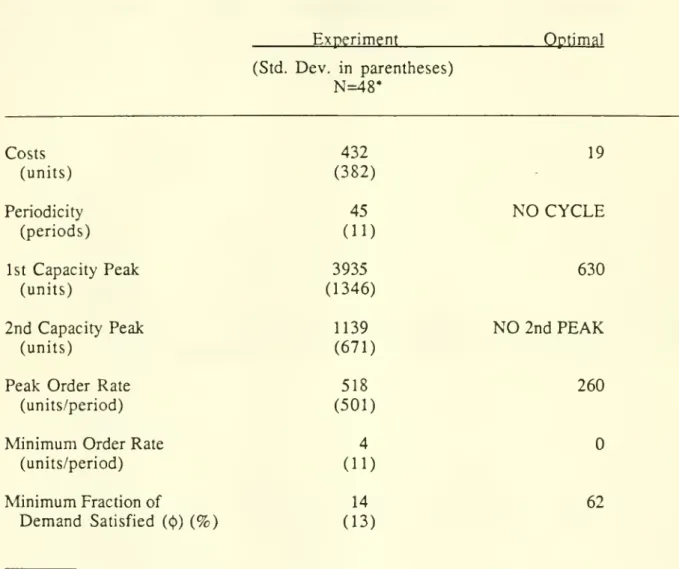

to the subjects in advance.Several trials representative of the sample are plotted in figure 3; table 1

summarizes

ordering 150 units in period 2.

The

increase in orders further boosts desired production,leading the subject to order still more.

Because

capacity is inadequate tomeet

the higherlevel of

demand,

unfilled orders accumulate in the backlog, boosting desiredproduction to apeak

of1590

units in period 6.The

fraction ofdemand

satisfied ({) drops to aslow

as52%,

slowing the

growth

ofcapacity and frustrating the subject's attempt to satisfydemand.

Faced

with high and rising

demand,

the subject's orders reach500

in the fifthperiod.Between

periods 7

and

8 capacity overtakesdemand.

Desired production falls precipitously as theunfilled orders are finally

produced

and delivered.A

huge

margin of excess capacity opens up.The

subject slashes orders after period 5, but too late. Orders placed previously continue toarrive, boosting capacity to a

peak

ofover 1600 units. Orders drop to zero,and

capacity thendeclines through discards for the next 12 periods. Significantly, the subject allows capacity to

undershoot its equilibrium value, initiating a second cycle ofsimilar amplitude and duration.

The

other trials aremuch

the same.While

specifics vary the pattern of behavior isremarkably similar.

As

shown

in table 1, the vast majority ofsubjects generated significant oscillations.Only 4

subjects(8%)

achieved equilibrium before theend

ofthe trial.5.

Proposed

decision ruleand

estimation resultsThe

qualitative similarity of the results suggests the subjects, though notbehav-ing optimally, used heuristics with

common

features.The

decision rule proposed herewas

used in the original simulation

model upon which

the experiment is based [Sterman (1985)]and

is a variant ofrules long used inmodels

ofcorporateand

economic

systems[Samuelson

(1939), Metzler (1941), Holt et al. (1960), Forrester (1961),

Low

(1980)].The

ruledetermines ordersfor capital

O

as a function ofinformation locally available to an individualfirm.

Such

information includes the current desired rate ofproduction P*, current productioncapacity C, the rate ofcapital discards

D,

the supply lineSL

oforders for capacitywhich

thefirm has placed but not yet received, and the capital acquisition lag A:

Ot=/(P*t,Ct,Dt,

SLt.At). (17)D-3976

10for the

adequacy

ofthe capital stockAC

and an adjustment for theadequacy

of the supply lineASL.

Accounting for the nonnegativity constrainton

gross investmentand

allowing for anadditive disturbance E yields:

Ot

=MAX(0,

Dt +

ACt

+ASLt

+ Et). (18)Each

of the three terms represents a separate motivation for investment.To

maintain the existing capital stock at its current value, the firmmust

orderenough

to replace discards.The

firm is

assumed

to adjust ordersabove

orbelow

discards in response totwo

additionalpressures.

The

adjustment for capitalAC

represents the response to discrepanciesbetween

the desired and actual capital stock.

The

adjustment for supply lineASL

represents theresponse to the quantity of capital in the supply line, that is, capital

which

has been orderedbut not yet received.

The

adjustment for capital isassumed

to be proportional to thegap between

desiredcapital stock

DK

and the actual stock. Desired capital is determinedfrom

the desired rate of productionP*

and the capital/outputratio k:ACt

=

aK(DKt

-Kt

)

(19)

DKt=KP*t

(20)The

adjustment for capital creates a straightforward negative feedback loop.When

desiredproduction exceeds capacity orders for capital will rise

above

discards until thegap

is closed.An

excess ofcapital similarly causes orders to fallbelow

replacement until the capital stockfalls to

meet

the desired level. Note, however, thatdue

to the capital acquisition lag thisnegative loop contains a significant phase lag element, introducing the possibility of

oscillatory behavior.

The

aggressiveness ofthe firm's response is determinedby

theadjustment parameter a^^.

The

adjustment for the supply line is formulated analogously. Orders are adjusted inproportion to the discrepancy

between

the desired supply lineDSL

and

the actual supply line:ASLt

=

asL(DSLt

- SLt ). (21)acquisition process such as orders in planning, orders in the backlog of the supplier,

and

orders under construction. In the experiment these are aggregated into the backlog of unfilled

orders B, thus

SL=B.

The

desired supply line is givenby

DSLt

= Dt

-At- (22)To

ensure an appropriate rate ofcapital acquisition a firmmust

maintain a supply linepropor-tional to the capital acquisition delay. Ifthe acquisition delay rises, firms

must

plan for andorder

new

capital farther ahead, increasing the desired supply line.The

desired supply line isbased

on

the capital discard rate-

a quantity readily anticipatedand

subject to littleuncer-tainty.

To

illustrate the logic of the supply line adjustment, imagine an increase in desiredcapital. Orders will rise

due

to thegap between

desired and actual capital stock.The

supplyline will fill. Iforders in the supply line

were

ignored (OgL=0), the firmwould

place ordersthrough the capital stock adjustment, promptly forget that these units

had

been ordered, andorder

them

again.The

supply line adjustment creates a second negative feedback loopwhich

reduces orders for

new

capacity ifthe firm finds itselfovercommitted

to projects in thecon-struction pipeline,

and

boosts orders if there are too few. It alsocompensates

for changes inthe construction delay, helping ensure the firm receives the capital it requires to

meet

desiredproduction.

OgL

reflects the firm's or subject's sensitivity to the supply line.The

decision rule in equations (18-22) is intendedly quite simple. Orders aredeter-mined on

the basis ofinformation locally available to thefirmitself. Information an individualfirm is unlikely orunable to have, such as the value ofthe equilibrium capital stock or the cost

minimizing solution to the nonlinear optimal control problem, is not used.

The

firm'sforecast-ing process is rather simple: capacity is built to

meet

currentdemand.

The

rule includesappropriate nonlinearity to ensure robust results: orders remain nonnegative even if there is a

large surplus ofcapital.

The

rule also expresses the corrections to the order rate as linearfunctions of the discrepancies

between

desired and actual quantities.Undoubtedly

theorder-ing rules offirms are

more

complex,and

otherwork

such asSenge

(1980) considers variousD-3976

12expansion ofthe

more

complex

underlying investment rule.A

large literature in psychologydocuments

the ability oflinear decision rules to provide excellentmodels

of decision-making,even

when

interactions areknown

to exist[Dawes

(1982),Camerer

(1981)].It is useful to interpret the rule in terms of the cognitive processes ofthe agents.

The

ordering rule can be interpreted as an

example

of the anchoring and adjustment heuristic[Tversky and

Kahnemen

(1974)]. In anchoring and adjustment, a subject attempting todetermine an

unknown

quantity first anchorson

aknown

reference point and then adjusts forthe effects of othercues

which

may

be less salient orwhose

effects are obscure.For

example, a firmmay

estimate next year's salesby

anchoringon

current sales and adjustingfor factors such as

macroeconomic

expectations, anticipated competitor pricing, etc. Studieshave

shown

anchoring and adjustment to be a widespread heuristic. Indeed, anchoring is socommon

thatmany

people use it inappropriately.Numerous

studieshave

documented

situations in

which

the adjustments are insufficient or inwhich judgments

are inadvertentlyanchored to meaningless cues [Hogarth (1987)]. In the experimental context, the capital

discard rate forms an easily anticipated and interpreted point ofdeparture for the

determination oforders.

Replacement

of discards willkeep

the capital stock of the firmconstant at its current level (assuming the capital acquisition delay remains constant).

Adjustments are then

made

in response to theadequacy

of the capital stock and supply line.No

assumption ismade

that these adjustments are in anyway

optimal or that firms actually calculate the order rate as given in the equations. Rather, pressures arisingfrom

the factoryfloor,

from

the backlogofunfilled orders and disgruntled customers, andfrom

corrmiitments toprojects in the construction pipeline cause the firm to adjust its investment rate

above

orbelow

the levelwhich would

maintain the status quo.For

agents in the experiment theinterpretation is parallel: replacing discards to maintain the status

quo

is a natural anchor.Adjustments based

on

theadequacy

ofthe capital stock and supply line are thenmade.

Again, there is

no

presumption that subjects explicitly calculate the adjustments using theThe

adjustment parametersa^

anda^^

reflect the firm's or subject's response todisequilibrium: large values indicate an aggressive effort to bring capacity

and

the supply linein line with their desired levels; small values indicate a higher tolerance for, ornegligence of,

discrepancies

between

desired and actual stocks. For both the real firmand

the subjects, thehypothesis that decisions are

made

via a heuristic such as theproposed

rule is motivated bythe observation that the complexity of determining the optimal rate of investment

overwhelms

the abilities of the

managers and

the time available tomake

decisions[Simon

(1982)].To

test the rule only thetwo

adjustment parametersa^

andOsl

need

be estimated.All other data required to determine orders are presented directly to the subjects.

Maximum

likelihood estimates of the parameters for each trial

were

found by grid search oftheparameter space, subject to the constraints

a^,

CgL

^

0-Assuming

the errors e are Gaussian white noise then themaximum

likelihood estimates of such nonlinear functions are given bythe parameters

which minimize

thesum

of squared errors.Such

estimates are consistent andasymptotically efficient,

and

the usual measures of significance such as the t-test areasymptotically valid [Judge et al. (1980)].

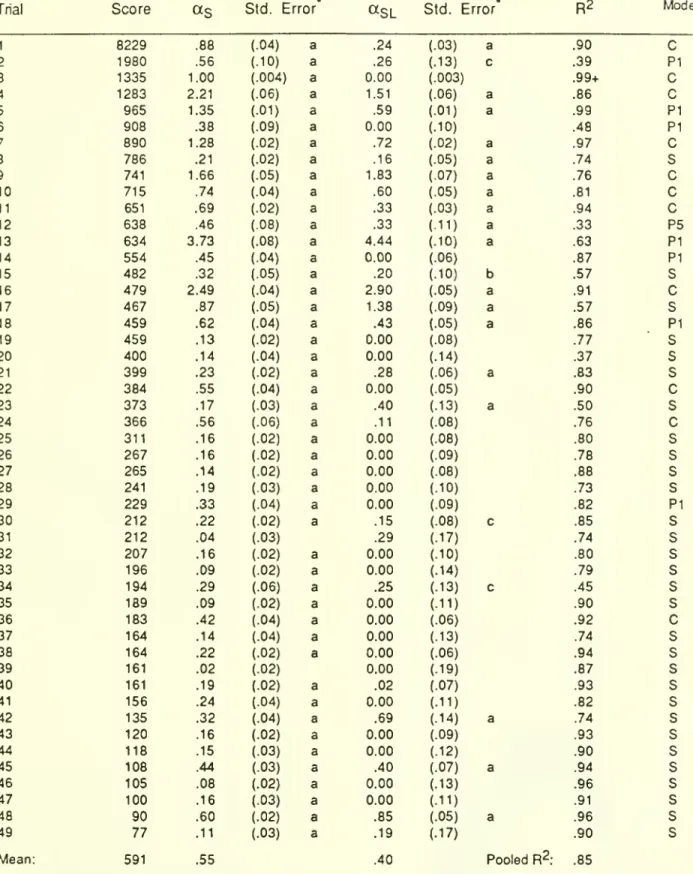

Estimates for

49

trials together with t-statistics are given in table 2.The

model'sability to explain the ordering decisions of the subjects is excellent.

R2

variesbetween

33%

and

99+%,

with an overallR^

for the pooled sample of 85%.'* All buttwo

ofthe estimates ofa^

are highly significant.The

supply line adjustment parameter is significant in22

trials,and

not significantly different

from

zero in 27.Of

course, zero is a legitimate value forQsl, andthe estimate of

a^L

for 23 subjects is zero.The

estimates ofa^L

rangefrom

to 4.4 while themean

95%

confidenceband

for the zero estimates is .17, less than4%

ofthe range ofa^L,indicating that the

23

zero estimates ofttjL are quite tight.6.

Simulation

of the estimated decision rulesThe

estimation results indicate that themodel

is agood

representation of thesub-jects' decision-making.

Sterman

(1988a) analyzes the estimated parametersand

identifiesD-3976

14One

ofthese is the tendency for subjects to give insufficient attention to the supply line, asindicated by the large

number

of small estimates for a^L-By

ignoring the supply line subjectscontinue ordering even after the construction pipeline contains sufficient units to correct any

stock discrepancy.

Such

overordering is a major source ofinstability in the closed loopsys-tem.

The

present concern, however, is the relationshipbetween

the estimated parametersand the regimes of behavior in the model.

Even

though the subjectsdo

notbehave

optimallyin disequilibrium,

one

might expect that their decision ruleswould

ultimately return thesys-tem

to alow

cost equilibrium. Simulation ofthe estimated rulesshows

this is not the case.The

rightmostcolumn

ofTable 2 indicates themode

of behavior producedby

simulation of the decision rule with the estimated parameters.

The

parameters estimated forthirty subjects

(61%)

are stable.Most

of these produceoverdamped

behavior of the capitalstock in response to the step input.

Seven

parameter sets produce limit cycles of period 1and one produces period 5.

The

parameterswhich

characterize eleven subjects(22%)

produce chaos. Inspection of table 2

shows

that the subjectswhose

parameters are stableperformed best in the task while those

whose

parameters produce periodic behavior or chaosgenerally

had

the highest costs.1-way

ANOVA

confirmed the relationship: the costsachieved by the subjects strongly

depend on

themode

produced by

simulation oftheestimated decision rule (p<.01

when

themodes

were coded

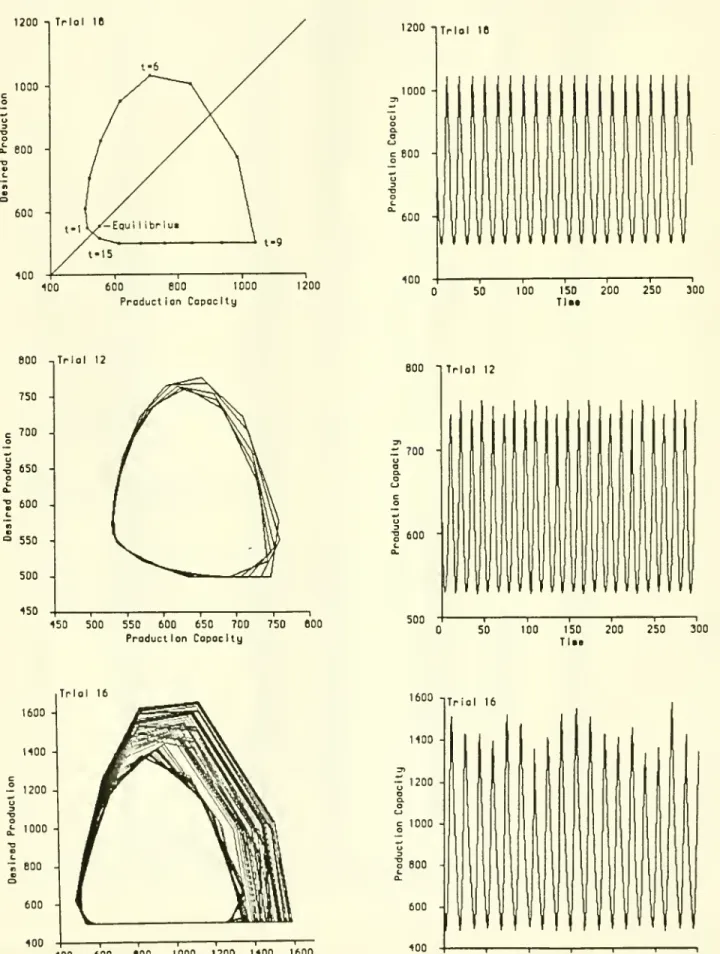

as stable, periodic, or chaotic).Figure 4

shows

timedomain

and phase portraits for simulations of several sets ofestimated parameters. In all cases the orbits are roughly egg-shaped, with clockwise flow.

To

explicate the dynamics, consider figure 4a,showing

theperiod 1 limit cycleproduced

bythe parameters of subject 18 (.62, .43;

R^

=

.86). In equilibrium desired productionmust

equalcapacity; the locus of such points is given by the 45° line.

Below

the line there is excesscapacity and the system is linear and stable;

above

it there is insufficient capacity and thesystem is highly nonlinear and unstable.

Given

the steady input ofordersfrom

thegoods

sector of

500

units, the equilibrium point for the system as awhole

lies at (555.55, 555.55).and

capital sectorgrow. Rising desired production induces additional ordersfrom

the capitalsector, causing rapid increase in desired production. Capacity, held

down

by

the inability ofthe capital sector itself to fill all orders and the consequentrationing ofoutput, lags behind.

As

capital stock grows, however,new

orders placed by the capital sector slow,and

thebacklog is shipped at an increasing pace. Desired production peaks at t=6. Capacity

now

grows

rapidly as the capital sector is increasingly able to fill orders.Between

t=7 and t=8capacity overtakes desired production,

which

falls rapidly since capacity isnow

largeenough

to deliver the entire supply line in

one

period.As

desired productionplummets,

capacityreaches its

peak

and

capital sector orders to fall to zero (t=9). Desired production is thensustained only by the

exogenous

demand

ofthegoods

sector (500 units/period).Deprecia-tion causes capital stock to decline slowly, until at t=15 capital stock has fallen to a level

low

enough

to cause the capital sector to placenew

orders.However,

thesenew

orders causedesired production torise,

and by

the next period capacity isonce

again insufficient to satisfydemand,

initiating the next cycle.The

dynamics

are thesame

for the period multiples andchaotic solutions, except that the trajectory does not close after

one

orbit.The

trajectories of chaotic systems are sensitive to initial conditions.The

routes ofnearby points through phase space diverge exponentially until the initial difference in the

positions balloons out to fill the entire attractor.

The

time average rate ofexponentialdivergence of neighboring points is given by the largest

Lyapunov

exponentL+

[Wolf

et al.(1985)]

which

may

be defined asL^=lim|log2|xI

(23)where

the separation vector x connects neighboring points in phase space.A

positiveexponent

means

nearby points divergeand

indicates chaos; a negativeexponent

denotesconvergence

of nearby points.Because

theLyapunov

exponents describe the long-termD-3976

16that average, including temporary reversals of sign. Nevertheless, a

rough

estimate ofL+

isgiven

by

the slope ofL^(t)t=log2|x| (24)

over long intervals.

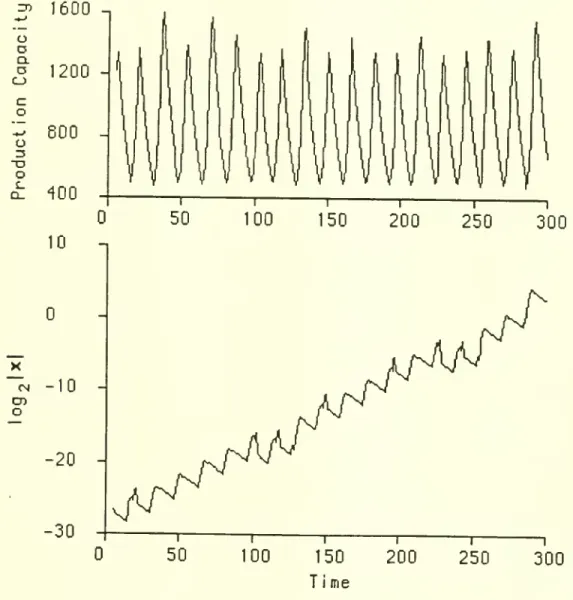

To

calculateL^(t)t for each of the estimated decision rules, productioncapacity

was

jjerturbed byone

part in a trillion in the 10,0(X)th period.The

separation vector|x|

was measured

in the two-dimensional space defined by production capacity and desiredproduction. Since desired capacity is the

sum

of thetwo

backlogs, this output space reflectsall three state variables in the system. Figure 5

shows

the evolution ofL^(t)t for theparameters of subject 16 after the perturbation.

The

phase plot for these parameters isshown

in figure 4.The

average slope of L^(t)t is clearly positive, indicating the system ischaotic.

The

magnitude

oftheLyapunov

exponent is approximately .1 bits/period.The

values ofL^

for the subjectswhose

decision rules are chaotic rangefrom

about .01 to .1 bits/period,with an average of about .04 bits/period.

The

magnitudes of the exponents determine the rate atwhich

information about thestate of the system, and hence the ability to predict its trajectory, is lost.

The

largemea-surement errors in

economic

systems[Morgenstem

(1963)] dictate severe limitson

pre-dictability in chaotic systems.

Thus

ifthe states ofthemodel

economy

were

known

with thenot unrealistic

measurement

error of about12%

(3 bits ofprecision), the averageLyapunov

exponent of .04 implies the uncertainty in the trajectory

would

grow

to fill the entire attractorafteronly about 75 periods, corresponding in the experimental system to roughly 5 orbits.

Additional precision buys little in additional predictability: cutting

measurement

error by afactor of

two would

delay the complete loss ofpredictability by less than 2 orbits.Of

coursethese calculations

assume no

external noise, perfect specification of the model, and perfectestimates ofthe parameters, and thus represent an upper

bound on

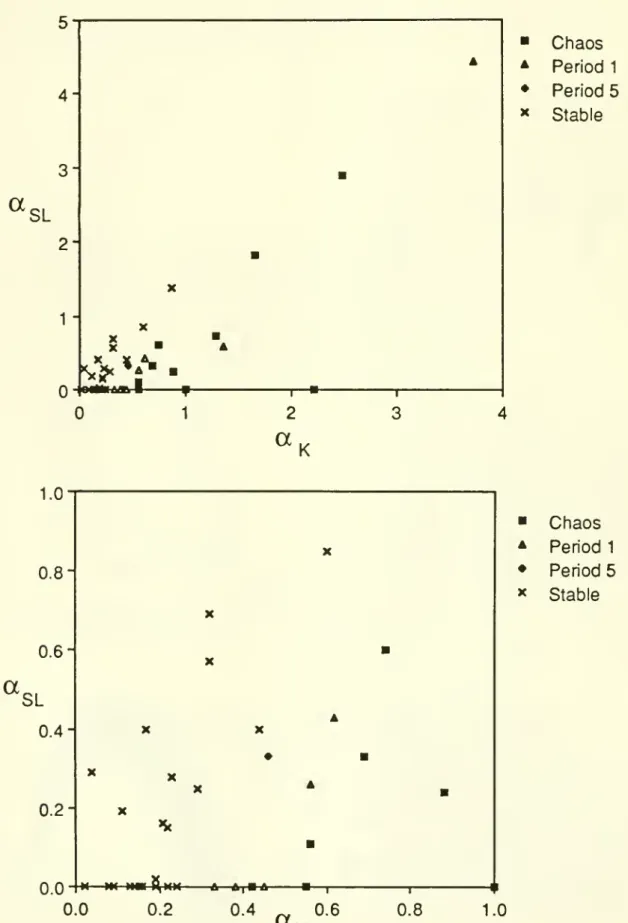

the prediction horizon.7.

Mapping

theparameter space

parameters. Figure 6 locates the

modes

of behavior of the estimated decision rules inparameter space.

The

estimated parameters are clustered in the region0<aK<l,

0<asL^l,

with the

few

outside this region falling approximately along the line cxsL=aK. Consistent withintuition, the stable decision rules are confined to the region

where

aj^ is small anda^L

islarge, while the chaotic decision rules generally involved aggressive stock adjustment

and

weak

supply line adjustment.More

aggressive attempts to correct the discrepancybetween

the desired

and

actual capital stock are destabilizing:by

orderingmore

aggressively thesub-ject induces a larger increase in total

demand,

thus exacerbating disequilibrium and encour-aging still larger orders in future periods. Conversely,more

aggressive response to thesupply line is stabilizing

by

constraining orders as the supply line fills.More

formally,a^

determines the gain of the oscillatory negative feedback loop while

ajL

controls thefirst-order, stabilizing supply line loop.

To

test this hypothesis the estimated parameterswere

regressed

on

the log of the cost function S. Costs provide a roughmeasure

ofinstability sincehigh costs indicate large excursions

from

equilibrium (standard errors in parentheses, trial 1deleted as an outlier):

ln(S)

=

5.3 -I-I.TOk-

l.lasL, R2=.43,F=16.8

(N=48). (25)(.13) (.33) (.30)

The

results are highly significant and confirm the overall relationshipbetween

the parametersand

stability.But

is the parameter space assmooth

as these results suggest?Figure 7

maps

the parameter space for0<aK^l

and0<asL^l

in steps of .005,representing over 40,CX)0 simulations.^ This region includes

86%

of the estimated parametersets, clearly

showing

that the fluctuating steady state solutions, including the chaoticsolutions, lie in the managerially meaningful region of parameter space.

The

resultingbifurcation structure is surprisingly structured. First, the

boundary

for the bifurcationfrom

fixed point to cyclic attractors appears to be a straight line, with stable solutions satisfying

asL

>

2.29aK

- .706,R2

= .99946 (N=42). (26)D-3976

18Rasmussen,

Mosekilde, andSterman

(1985)show

that the transitionfrom

local stability toinstability at the equilibriumjx)int involves a

Hopf

bifurcation. In the regionwhere

capacityis inadequate (<))<1) the linearized closed-loop system is oscillatory, but for small values of

a^

orlarge values of a^L. the eigenvalues lie inside the unit circle, producingdamped

behavior and a stable fixed-point attractor.

As

the parametersbecome

less stable (larger Oj^or smaller Csl) the eigenvalues cross the unit circle and the system produces expanding

oscillations.

These

fluctuations are ultimatelybounded by

the nonlinearities, particularly thenonnegativity constraint

on

ordersand

the flexible utilization ofcapacity in equation (1).Inside the region of fluctuating steady state solutions, several features are apparent.

Note

first the striations ofperiodic behaviorwhich

cut across the space at asomewhat

shallower angle than the stability/instability boundary.

The

bands are thicker near thetransition to stability and thinner

away

from

it. Second, note the several large regions inwhich

the periodic solutions are very sparse.Figure 8 magnifies the region .55<aK<.65,

.50<asL^.60

by a factor often in eachdirection.

Both

the chaotic regions and the bands of periodic behavior arenow

seen to containirregularly distributed islands ofother periodicities. Further magnification (not

shown)

reveals still

more

such islands.Such

irregularity is characteristic of the fractal boundariescommon

in the bifurcationmaps

ofmany

systems.Simple though the

model

is, it is capable ofgenerating awide

array ofcomplex

behaviors.

The

complexity of the parameter spaceshows

thateven

small errors in estimatesof the parameters

may

have large qualitative effectson

themode

of behaviorproduced

by thesystem. Indeed, the simulations here

do

not exhaust the possibilities. All the simulationsdescribed here involved

no

external forcing (goods sector orders for capitalwere

constant).Larsen, Mosekilde, and Sterman (1988) have

shown

that sinusoidal forcing ingoods

sectororders (mimicking the effects of the business cycle or othercyclical

modes

in theeconomy)

8. Discussion

It is

common

in the social sciences toassume

that decision-making behavior and thus thedynamics

ofhuman

systems are, ifnot optimal, then at least stable.These

resultsshow

that formal rules

which

characterize actual managerial decisionmaking

can produce anextraordinary range ofdisequilibrium dynamics, including chaos.

Such

complexity suggests strong lessons for modelers ofeconomic

and socialdynamics.

The

experimentshows

that the regimes of fluctuating steady-state behavior,including chaos, lie squarely in the middle ofthe realistic region ofparameter space. In

consequence

modelers can ignore nonlineardynamics

only at theirperil.Models

ofeconomic

and

socialdynamics

should portray the processesby which

disequilibrium conditions arecreated and dissipated.

They

should notassume

that theeconomy

is in or near equilibrium atall times nor that adjustment processes are stable.

Models

should be formulated so that theyare robust in extreme conditions, since it is the nonlinearities necessarily introduced

by

robust formulations that crucially determine the

modes

ofthe system [seeDay

(1984)].At

thesame

time anumber

ofquestions regarding the the generalization of the resultsto the real

world

and the practical significance ofchaosmust

be asked.Chaos

is asteady-state

phenomenon

which

manifests over very long time frames, butmany

policy-orientedmodels

are concerned with transientdynamics

and nearly all with time horizonsmuch

shorterthan those used in the analysis of chaotic dynamics.

For

example

the simulations herewere

run for 10,000 periods or more.

Over

such extended time horizons the parameters ofthesystem cannot be considered static but will themselves evolve with learning, evolutionary

pressures,

and

exogenous

changes in the environment.There

is evidence [Sterman (1988a),Bakken

(1988)] that subjects begin to learn within just afew

cycles, modifying theparameters of their ordering function. It appears that in the present experiment learning

slowly

moves

the subjectsaway

from

the chaotic region towards the region of stability.However,

the existence ofchaosmay

itselfhamper

learning.Even

though deterministicD-3976

20

changes in initial conditions or parameters.

Does

such 'randomness' slow the discovery ofcause and effect by agents in the

economy

and thus hinder learning or evolution towardsefficiency? Indeed, does learning alter the parameters ofdecision rules so that systems

evolve towards or

away

from

the chaotic regime?Some

argue that chaosmay

be adaptive. In a worldwhose

'fitness space' containsmany

local optima, a decision rule that produces chaos,by constantly exploring

new

pathways,may

help a system evolve faster than a stable,incremental decision

making

strategy [Prigogine and Sanglier (1987), Allen (1988)].Chaos

places an upperbound on

prediction, but is thatbound

a binding constraint insocial systems? Real social systems are

bombarded

bybroadband

noise, and it is wellknown

that suchrandom

shocks severely degrade predictability.Does

themagnitude

ofstochastic shocks

swamp

the uncertainty in trajectories causedby

chaos?How

does theexistence of chaotic regimes in a

model

influence its response to p)olicies, and thepredictability of thatresponse? Particularly troubling here is the potential for fractal basin

boundaries in both initial condition

and

parameter space. Policy interventions often implychanges in the parameters ofa decision rule or model.

How

can policy analysis be conductedif the "policy space" contains fractal basin boundaries? In such systems parameter changes

on

the marginmay

produce unpredictable qualitative changes in behavior, as illustrated by thefractal distribution of

modes shown

in figures 7-8. Therefore learning and experiencemay

nottransfer tocircumstances

which

differonly slightly. Learning often involves a hill-climbingprocedure of incremental

movement

towards a profit-maximizingpeak

in parameter space.How

well can agents negotiate that spacewhen

the landscape not only hasmany

localoptima but is fractal as well?

The

development

ofprinciples for policy design in such systemsis a major area for future research.

The

practical significance ofchaos and other nonlinearphenomena

in policy-orientedmodels

ofsocial andeconomic

behavior remains clouded whilethese questions are unanswered.

Some

of these questionsmay

be resolvedby

further9.

Conclusions

The

discovery ofnonlinearphenomena

such as deterministic chaos in the physicalworld naturally motivates the search for similar behavior in the world of

human

behavior. Yetthe social scientist faces difficulties in that search

which do

not plague the physicist, at leastnot to the

same

degree. Aggregate data sufficient for strong empirical tests simplydo

notexist for

many

of themost

important social systems. Social systems are not easily isolatedfrom

the environment.The

huge

temporaland

spatial scales ofthese systems, vastnumber

of actors, costs

and

ethical concernsmake

controlled experimentson

the systems themselvesdifficult at best. Finally, the laws of

human

behavior are not as stable as the laws ofphysics.Electrons

do

not learn, innovate, collude, or redesign the circuits inwhich

they flow.Laboratory experiments appear to provide a fruitful alternative. Since experiments

on

actual firms

and

nationaleconomies

are infeasible, simulationmodels

of these systemsmust

be used to explore the decision

making

heuristics of the agents.Such

experiments create'microworlds' in

which

the subjects face physical and institutional structures, information, andincentives

which

mimic

(albeit in a simplified fashion) those ofthe real world. It appears tobe possible to quantify the decision

making

heuristics usedby

agents in such experimentsand

explain theirperformance well. Simulation then provides insight into thedynamic

properties of the experimental systems.

These

results demonstrate that chaos can beproduced

by the decisionmaking

processes of real people.

The

experiment presented subjects with a straightforward task in acommon

and

importanteconomic

setting.The

subjects' behavior ismodeled

with a highdegree of accuracy

by

a simple decision rule consistent with empiricalknowledge

developedin psychology

and

long used ineconomic

models. Simulation ofthe rules produces chaos for asignificant minority ofsubjects.

Chaos

may

well be acommon

mode

of behaviorin social andeconomic

systems, despite the lack ofsufficient information to detect it in aggregate data.D-3976

22

Notes

1 Journal of

Economic

Theory,40

(1) 1986, Journal ofEconomic

Behaviorand Organization, 8(3),

September

1987;System

Dynamics

Review,

4, 1988,European

Journal ofOperationalResearch, 35, 1988. See also

Goodwin,

Kruger, and Vercelli (1984)and

Prigogineand

Sanglier (1987).

2. Conservation of output requires

P

=

A

+

AG.

But

A

+

AG

=

B(t)+

BG({)=

(})(B+

EG)

=(P/P*)(B +

BG)

= P.By

Little's law, the average residence time ofitems in a backlog is theratio ofthe backlog to the outflow, here given by

A

=

(B +BG)/(A

+ AG).

By

eq. 4-5, (B +BG)/(A

+

AG)

=

(B+

BG)/(B-(t)+

BG<t))=

1/<|).3. Disks suitable for

IBM

PC's and

compatibles, or for theApple

Macintosh, are availablefrom

the author.4.

Note

that the function 0=f(-) does not contain an estimated regression constant.Thus

the correspondence of the estimated and actual capital orders, notjust their variation around

mean

values, provides an importantmeasure

of the model's explanatory power. Since theresiduals e need not satisfy Zct

=

0, the conventionalR2

is not appropriate.The

alternativeR2

=

1 - Xct^ /ZO,2

is used (Judge et al. 1980). ThisR2

can be interpreted as the fraction ofthe variation in capital orders around zero explained by the model.

5.

Each

simulationwas

10,000 periods long.The

first8000 were

discarded in assessing thesteady state

mode

of behavior. 10 digit accuracywas

used.A

simulationwas assumed

to beReferences

Allen, P., 1988,

Dynamic

models

of evolving systems.System

Dynamics

Review,

4.Bakken,

B., 1988, Learning system structure by exploringcomputer

games, presented at the1988

InternationalSystem

Dynamics

Conference,San

Diego,CA,

July.Bamett,

W.

and

P.Chen,

1988,The

aggregation theoreticmonetary

aggregates are chaoticand

have strange attractors: an econometric application of mathematical chaos, in Bamett,Bemdt, and White

(eds.),Dynamic

Econometric

Modeling,Cambridge

University Press,Cambridge.

Benhabib, J. and R.

Day,

1981, Rational choice and erratic behavior.Review

ofEconomic

Studies, 48, 459-471.

Brehmer,

B., 1987,Systems

designand

the psychology ofcomplex

systems, inRasmussen,

J.and

P.Zunde

(eds). Empirical Foundations of Informationand

Software Science III,Plenum,

New

York.Brock,

W.,

1986, Distinguishingrandom

and

deterministic systems: abridged version. Journalof

Economic

Theory, 40, 168-195.Camerer,

C,

1981, General conditions for the success of bootstrapping models,Organizational Behavior and

Human

Performance, 27, 411-422.Candela, G.,

and

A. Gardini, 1986, Estimation ofa non-linear discrete-timemacro

model.Journal of

Economic Dynamics

and

control, 10, 249-254.Chen,

P., 1988, Empirical and theoretical evidence ofeconomic

chaos.System

Dynamics

Review,

4, 81-108.Dana,

R.,and

P. Malgrange, 1984,The

dynamics

ofa discrete version ofagrowth

cyclemodel, in Ancot, J. (ed.). Analysing the Structure of

Econometric Models,

MartinusNijhoff,

The

Hague.Dawes,

R., 1982,The

robust beauty ofimproper linearmodels

in decision making, inD-3976

24

Cambridge

University Press,Cambridge.

Day,

R., 1982, IrregularGrowth

Cycles,American

Economic

Review,

72, 406-414.Day,

R., 1984, DisequilibriumEconomic

Dynamics:

A

Post-Schumpeterian Contribution,Journal of

Economic

Behaviorand Organization, 5, 57-76.Day,

R., andW.

Shafer, 1985, Keynesian chaos. Journal ofMacroeconomics,

7, 277-295.Einhom,

H., D. Kleinmuntz, and B. Kleinmuntz, 1979, Linear regressionand

process-tracingmodels

ofjudgment. PsychologicalReview,

86, 465-485.Forrester, J. 1961, Industrial

Dynamics,

MIT

Press,Cambridge.

Goodwin,

R., 1951,The

nonlinear accelerator and the persistence of business cycles,Econometrica, 19, 1-17.

Goodwin,

R.,M.

Kruger,and

A. Vercelli, 1984, Nonlinearmodels

offluctuating growth,Springer Verlag, Berlin.

Grandmont,

J.-M., 1985,On

endogenous

competitive business cycles, Econometrica, 53,995-1046.

Grassberger, P.,

and

I. Procaccia, 1983,Measuring

the strangeness of strange attractors,Physica,

9D,

189-208.Grether, D.,

and

C. Plott, 1979,Economic

theory of choice and the preferencereversalphenomenon, American

Economic

Review, 69, 623-638.Hogarth, R., 1987,

Judgment

and Choice,2nd

ed., John Wiley, Chichester.Hogarth, R., and

M.

Reder, 1987, Rational Choice:The

contrastbetween economics

andpsychology. University of

Chicago

Press, Chicago.Holt,

C,

F. Modigliani, J.Muth,

H. Simon, 1960, PlanningProduction, Inventories, andWork

Force, Prentice-Hall,

Englewood

Cliffs, N.J.Judge et al., 1980,

The

Theory

andPractice ofEconometrics,Wiley,New

York.Larsen, E., E. Mosekilde, and J. Sterman, 1988, Entrainment

between

theeconomic

longwave

and othermacroeconomic

cycles, presented at theIIASA

Conferenceon

Low,

G., 1980,The

multiplier-acceleratormodel

of business cycles interpretedfrom

a systemdynamics

perspective, in J. Randers (ed.), Elements of theSystem

Dynamics

Method,

MTT

Press,Cambridge.

MacKinnon,

A., and A. Wearing, 1985, Systems analysis anddynamic

decision making, ActaPsychologica, 58, 159-172.

Metzler, L., 1941,

The

natureand

stability ofinventory cycles.Review

ofEconomic

Statistics,23, 113-129.

Morgenstem,

O., 1963,On

theAccuracy

ofEconomic

Observations,2nd

ed., PrincetonUniversity Press, Princeton.

Plott, C. R., 1986, Laboratory experiments in economics:

The

implications of posted priceinstitutions. Science,

232

(9May),

732-738.Prigogine, L,

and

M.

Sanglier, 1987,Laws

ofnatureand

human

conduct.Task

Force ofResearch Information

and

Study on Science, Brussels.Ramsey,

J.,and

H.-J.Yuan,

1987, Bias and error bars in dimension calculations and theirevaluation in

some

simple models,New

York

University.Ramsey,

J., C. Sayers,and

P.Rothman,

1988,The

statistical properties ofdimensioncalculations using small data sets:

some

economic

applications,RR88-10,

New

York

University

Department

ofEconomics.

Rasmussen

and

Mosekilde, 1988, Bifurcationsand

chaos in a genericmanagement

model,European

Journal ofOperational Research, 35, 80-88.Rasmussen,

S., E.Mosekilde

and J. Sterman, 1985, Bifurcationsand

chaotic behavior in asimple

model

oftheeconomic

long wave,System

Dynamics

Review,

1, 92-1 10.Samuelson, P. A., 1939, Interactions

between

the multiplier analysisand

the principle ofacceleration.

The Review

ofEconomic

Statistics, 21, 75-78.Senge, P., 1980,

A

systemdynamics

approach to investment function formulation and testing,Socio-Economic

Planning Sciences, 14, 269-280.D-3976

26

Slovic, P.

and

S. Lichtenstein, 1983, Preference reversals: a broaderperspective,American

Economic

Review,

73, 596-605.Smith, V. L., 1982,

Microeconomic

systems as an experimental science,American

Economic

Review, 72

, 923-955.Smith, V. L., 1986, Experimental

methods

in the politicaleconomy

ofexchange, Science, 234,(10 October), 167-173.

Sterman, J. D., 1985,

A

behavioralmodel

oftheeconomic

long wave.Journal ofEconomic

Behavior and Organization, 6, 17-53.

Sterman, J. D., 1987, Testing behavioral simulation

models

by direct experiment.Management

Science, 33 , 1572-1592.Sterman,J. D., 1988a, Misperceptions offeedback in

dynamic

decision making, OrganizationalBehavior and

Human

Decision Processes, forthcoming.Sterman, J. D., 1988b,Eteterministic chaos in

models

ofhuman

behavior: Methodologicalissues

and

experimental results.System

Dynamics

Review,

4, 148-178.Sterman, 1988c,

Modeling

managerial behavior: Misperceptions offeedback in adynamic

decision

making

experiment,Management

Science, forthcoming.Sterman, J. D.

and

D. L.Meadows,

1985,STRATEGEM-2:

amicrocomputer

simulationgame

ofthe Kondratiev Cycle, Simulation

and

Games,

16, 174-202.Stutzer, M., 1980, Chaotic

dynamics

andbifurcation in amacro

model.Journal ofEconomic

Dynamics

and

Control, 2, 353-376.Takens, P., 1985, Distinguishing deterministic and

random

systems, in Borenblatt,G,

G.looss, and D. Joseph (eds.). Nonlinear

Dynamics

and

Turbulence, Pitman, Boston. Tversky, A. and D.Kahneman,

1974,Judgment

under uncertainty: heuristicsand

biases.Science. 185 (27 September), 1124-1131.

Wolf, A., J. Swift, H. Swinney, and J. Vastano, 1985, Determining

Lyapunov

exponentsfrom

aFigure 1.

Computer

screenshowing

experimentaleconomy,

initial configuration.The

subject is about to enternew

orders for capital sector.Fraction of

Demand

SatisfiedYear

100

New

Orders ^Capital Sector; Capital Stock500

Shipments

to Capital Sector Desired Production500

Backlog ofUnfilled Orders

50

Capital Sector450

Goods

Sector Depreciation Production500

Shipments

toGoods

SectorV

New

Orders450

Goods

Sector,D-3976

28

Figure 2.

Exogenous

orders ofthegoods

sector.Each

trial begins in equilibrium. In period 2there is an

unannounced

step increase innew

orders placedby

theconsumer goods

sectorfrom 450

to500

units.Compare

against subjects' behaviorshown

in figure 3. Units 900 r 600 700 -600 -500 -100 -300 -200 100\y

New Orders

—

ConsumerGoods Sector' ' ' I L_I_J L.

10 15 20

Period

Figure 3. Typical experimental results. N.B.: vertical scales differ.

Desired Producrion Production Capacity Subject'sOrdersforCapital

Tnei6 SCORE•90S TntI

1I SCOCE.651 IS 20 Parlod Tn»l 16SCORE•*T> Tnil24 SCOREt366 Unit! 1200

D-3976

30

Table 1.

Summary

of experimental results.Experiment

Optimal

(Std.

Dev.

in parentheses)N=48*

Costs

Table 2. Estimated parameters and

mode

of behavior of simulated decision rulesD-3976

32

Figure 4. Simulation ofestimated decision rules.

Note

similarity to the experimental results(figure 3).

-D-3976

33Figure 5. Evolution oflog2|x|, the distance

between

two

neighboring trajectories, forsimulation with parameters of subject 16 (2.49, 2.90) after perturbation ofcapacity by factor of

vl2

10 in period 10,000.

The

largestLyapunov

exponent, given approximately by the averageslope, is positive, indicating that the

two

trajectories diverge exponentiallyand

the system ischaotic. ="

1600

-, CJ-10

-I eno

-20

--30

50

300

00

—

150

Time

200

250

300

D-3976

34

Figure 6.

Modes

of behaviorproduced

by simulation of the estimated parameters.Lower

graph magnifies area