Digitized

by

the

Internet

Archive

in

2011

with

funding

from

Boston

Library

Consortium

Member

Libraries

I

Dewey

B31

^415

-21

Massachusetts

Institute

of

Technology

Department

of

Economics

Working

Paper

Series

CONDITIONAL

EXTREMES

AND

NEAR-EXTREMES

Victor

Chemozhukov,

MIT

Working

Paper

01

-21

July

2000

RoomE52-251

50

Memorial

Drive

Cambridge,

MA

02142

This

paper

can

be

downloaded

without

charge

from

the

Social

Science

Research Network

Paper

Collection

atMASSACHUSEHS

INSTITUTE OFTECHNOLOGY

AUG

1 5 2001

Massachusetts

Institute

of

Technology

Department

of

Economics

Working

Paper

Series

CONDITIONAL

EXTREMES

AND

NEAR-EXTREMES

Victor

Chemozhukov,

MIT

Working

Paper

01-21

July

2000

Room

E52-251

50

Memorial

Drive

Cambridge,

MA

02142

This

paper

can

be

downloaded

without

charge

from

the

Social

Science

Research

Network

Paper

Collection

atCONDITIONAL

EXTREMES

AND

NEAR-EXTREMES

Victor

Chernozhukov^

Dept. of

Economics,

MIT,

E52-262F,

Cambridge,

MA,

02142

email:

vchern@mit.edu

Version:

May

10, 2001 First Version: October, 1998Abstract

This

paper

develops a theory of highand

low (extremal) quantile regression: the linear models, estimation,and

inference. In particular, themodels

coherentlycom-bine theconvenient, flexible linearity with the extreme-value-theoretic restrictions

on

tails

and

the general heteroscedasticity forms.Within

these models, thelimit lawsforextremal quantile regression statistics are obtained

under

the rank conditions (exper-iments) constructed to reflect the extremal or rarenature oftail events.An

inferenceframework

is discussed.The

results apply to cross-section (and possibly dependent) data.The

applications, rangingfrom

the analysis of babies' very low birthweights, (5,s) models, tail analysis in heteroscedastic regression models, outlier-robust infer-ence in auction models,and

decision-makingunder extreme

uncertainty, provide the motivationand

applications ofthistheory.Key

Words: Quantile

Regression

'©July 2000 V. Chernozhukov. Rights Reserved. This paperisa partof

my

Ph.D. dissertation at Stanford, completed in 2000. Iam

very grateful to Takeshi Amemiya, Roger Koenker,Thomas

MaCurdy, Mordecai Kurz, and also to Anil Bera, Stephen Portnoy,

Thomas

Sargent for advise andhelp;Pat Bajari, JosephRomano,Keith Knight, and JanaJureckova, fordiscussionsand from

whom

I learned a great deal; and also friends: IgorMakarov, Stijn Van Nieuwerburgh, Leonardo Rezende, Michael Schwarz, and Lei Zhang, and especially Han Hong, Robert McMillan, Sergei Morozov, and Len Umancev. I thank also the seminar participants at Brown, Caltech, Chicago,

CIRANO,

Duke, Mannheim, MIT-Harvard, Northwestern, Stanford,UCLA, UCSD,

University ofIllinois, Yale, and NeuchatelMay

2000 Conference on Recent Developments in Regression,CEME

2001 Conference, Conference on Economic Applications ofQuantile Regression in Konstanz, 2000, especially J.An-grist, D.Andrews, J. Altonji, M. Buchinsky, P. Christophersen, F. Diebold, G. Elliot, R. Engle,

B.Fitzenberger, C. Granger, J. Hahn, J. Hamilton, L. Hansen, M. Hallin, J.Heckman, G. Imbens, D. Jorgenson, T.Bollerslev, C. Manski, R. Matzkin, P. Phillips,J. Rust, R. Sherman, D. Strook, G. Tauchen, R. Tsay,J. Jureckova, and H.White. 1 alsothank JerryHausman, GuidoKursteiner,Ziad

Nejmeldeen, and Whitney Newey for suggestions that drastically improved the presentation of the

material; and also

Bo

Honore and Charles Manski for suggesting to look into modeling questionscarefully.

I gratefullyacknowledge thefinancialsupport provided by the Alfred P. Sloan Dissertation

Contents

1

Introduction

12

Econometric

Applications

33

Extremal

Quantilesand

Rank

Sequences

63.1 Extremal Conditional Quantiles 6 3.2 Linear Quantile Regression

Model

7 3.3Sample

Regression Quantile Statistics 7 3.4 Extremes, Near-Extremes&

Data

Scarcity 8 3.5 TailTypes, Support Types,and Classical Limits 93.6 Limit DistributionsofOrdinary

Sample

Quantiles 94

The

Extremal

Regression Quantile

Models

114.1

Model

1; Tail Homogeneity 114.2

Model

2: Congenial TailHeterogeneity 135

Asymptotics

under

Extreme Ranks

15

6

Asymptotics under

Intermediate

Ranks

20

7 Inference 23

A

Useful

background

27

A.l Point processes 27

A.2

Convex

Semi-ContinuousObjectives 27B

Proofs

for section 5,extreme

ranks

28B.l Detailsand definitions 28 B.2 Basic conditionsfor nondegenerate asymptotics 29 B.3 Limits in Models 1 and2 32

C

Proofs

for section 6,intermediate

ranks

33

C.l Basic conditionsfor a normallimit 33 C.2 Limits in Models1 and2 34

D

Properties

ofModels

1and

236

1

Introduction

Regression quantiles,

Koenker and

Bassett[48], represent a flexibleand

informativemethod

of regression analysis as they describe the conditional distribution ofthere-sponsevariable

Y

givencovariateX

,withoutimposing

rigiddistributionalassumptions.The

goal ofthispaper

is tomodel

and

make

inferenceon

the extremal {near-extreme high or low) regression quantile functions. In essence, they represent themodels

of the extremal values ofY

conditionalupon X.

For example, the near-extreme 0.1-th conditional quantile function describes the valuesbelow

which

Y

fallswith probability10%

given values ofX.

Modeling

high orlow conditional quantiles is motivatedby

many

examples.Some

include: (i) in micro- economics: (5,s)models

ofinvestment, inventory,employment

shortages; auction models, reservation

wage

equations; (ii) in finance, micro-and

macro-

economics: decision-makingunder

extreme

uncertainty,where

good

riskmea-sures are vital for the purposesofinsurance, safety-first resource allocation,

and

man-agement

ofrisks;and

many

others.The

ordinaryextremalquantiles, themodels

and

thesample

analogs,have been

themain

subject ofclassicaland

modern

extreme

value theory,which

formsan important

field ofapplied

and

theoretical statistics.'^The

theorywas

developedby

Von

Mises,Prechet, Fisher,

Gnedenko,

Smirnov, deHaan, and

many

others.The

ordinarysample

quantiles

have

an

immense

inference role, providing the estimators of the tail indexand

othertailfunctionals (Pickands[57],Hill[40],Dekkers

and

de Haan[21]).Analogous

motivations underliethe present analysis aswell.

Inthis

paper

we

study theextremal (highand

low)conditional quantiles- thelinear modelsand

thesample

regression analogs. In particular,themodels

coherentlycombine

convenient, flexible linearity with the extreme-value-theoretic restrictions

on

tailsand

thegeneral heteroscedasticity forms.

Within

these models, the limitlawsfor extremal quantile regression statistics are obtainedunder

the rank conditions constructed to reflectthe extremal or rare nature oftail events.The

goal is the practical,important

problem

ofmodelingand

making

inferenceon

the .3-thand

lowerand

.7-thand

higher regression quantiles, as well asconducting the tail inference, inthecommon

economic

data

sets.^{Our

target is not the "exotic" 0-th quantile.)The

rank conditionsapproximate

thedegreesof lack ofdataor extremality pertinent tothe inferenceabout

the quantiles ofinterest. Define rank r asthe quantile index r times thesample

size T.The

extreme

and

intermediaterank

conditions apply to the caseswhere

index t is extremal(e.g. .1, .2)and

is low(rissmall) or notlow {rislarge) relativetothesample

sizeT.^ Formally,the sequenceofthe quantileindex-samplesize pairs {tt,T) isan

extreme rank sequence if(i) Tr

\

0,TrT

-^k>

0,and an

intermediate rank sequenceif{ii) T-r

\

0,TtT

—

> GO.-Asoftoday, thousandsofpapers aredevotedto theextremevaluetheory.

Many

excellent booksgivesystematic treatments. Seee.g. [7], [64], [65], [52], [33], [34], [26], [73].

^Say with

T

<

3000, and typical number of regressors,5—10

and higher.Because

the principles (i)and

(ii) constructively exploit that the relevant data isformed

by the tail events and, oris scarce, they lead toa. asymptotic distributions that either fit the finite-sample distributions better or are

more

parsimonious than the conventional approximations,b.

important

tailinferences, basedon

the extremal regression quantiles.In evaluatingthese concepts, it is

important

to keep inmind

that these alternative sequences are designedto yield better approximations ingiven practicalproblems

with givensample

sizes,evenwhen

the quantile indexis not very low.And,

incase(a), it iscompletely irrelevant

whether

or notfuturesampling

will lead tosamples

conforming

tothese sequences or not.

The

concepts (i)and

(ii) are wellmotivated

by

theintellectualand

practical success oftheextreme

value theory,which

focusedon

theordinarysample

quantiles.The

con-cepts are also similar in spirittoother "alternative" asymptotics, e.g.,GMM

when

thenumber

ofmoment

conditionsislarge;weak

instrumentstheory,where

theinstrumentsare

weakly

correlatedwith the regressors; near-to-unit root theory; and, generally, the theory ofstatistical experiments.The

organizationand

contribution ofthispaper

is eis follows:1. Section 2

demonstrates

the relevanceoftheproblem

ineconomic

analysis.2. Section 3 introduces the principles ofextremality for the regression quantiles

-namely

that ofthe intermediateand extreme rank

sequences.3. Section 4 develops the

models

oftheextremal (low) conditional quantiles.They

coherently

combine

the linear functional forms with the extreme-value-theoreticre-strictions,

and

lead to non-degenerate,parsimonious

limit distributions.The

models

are distribution-free

and

flexible, allowingfor sophisticatedeffects ofcovariateson

theshape

oftheconditional distribution (the scale, kurtosis, skewness, etc.). Importantly, thesemodels

do not admitreductions to theclassicalone-sample

case (byremoving

the conditionalmean

and/or

scale).4.

Within

the formulated models, section 5 provides theasymptotic

limit theory for thesample

regression quantilesunder

theextreme rank

condition,tT

—

) fc>

0.^The

Hmit

is drivenby

a stochastic integral ofa "residual" function with respect to a Poisson pointprocess.5. Section6, using additionaltailrestrictions, providesthe

asymptotic

distributions of regression quantilesunder

the intermediaterank

condition,tT

—

>oo,r

-^ 0.The

limit is normal, with variance parsimoniously

determined

by

the tail indices. This enables a very practical inference. (In contrast, the conventional theory requires thenonparametric

estimatesofthe conditionaldensity functionsevaluated at the extremal quantiles). This provides aregressionanalogue

offairly recent results ofDekkers and

de Haan[21].

^This paper is not about t

=

0, the linear programming estimator (also called 'extremeregres-sion quantile'), considered in Feigin and Resnick[29], Portnoy and Jureckova[60], Chernozhukov[12],

Knight[47] within thelocation-shiftmodel(Covariatesonlyaffectthe locationbut not thescale,shape ortailofthe conditionaldistribution.) Theestimator, definedas

max

A''/3s.t. Yt<

Xtf),Vtand useful as aboundaryestimate, can't be used at all in the present context.We

look atdifferent estimators (high and lowregression quantiles) that have verydifferent asymptoticsand applications[t>

(Tisfinite); seeexamples 2.1-2.4,where thesupport is unbounded or "boundaries" depend on unobserved

6.

We

concludeby

discussingan

inference theoryand an

empiricalpaper

[15].Also relevant are the

works

of Smith[73], Tsay[75],and

references therein,who

develop themodels

of exceedances over high constant thresholds.The

parametric likelihoodof thePareto family is usedtodescribesuch data,and parameters

aremade

dependent on

regressors. It shouldbe

clear that the goals, models,and

methods

of this paper are quite different.Our

analysis should beviewed

ascomplementing

the studyofthe central rank regression quantiles, with the motivationstemming

from

thewide

use ofquantile regression in data analysis in econometricsand

statistics.2

Econometric

Applications

Quantileregression is a popular tool ineconometric applications. See

Abadie

et al.[l],Buchinsky[9], Chamberlain[ll],

Poterba

and

Rubin[61],and

thereviewofKoenker and

Hallock[50].

Our

results can beuseful inabout

any

such application,sinceourfocusisthe inference

about

highand

low conditional quantiles (say .7and

higherand

.3and

lower, in a typical data-set), recognizing the extremality

and/or

scarcity ofthe tailevents.

Important

inferencesabout

the tail shapes canbe

made

as well.There

aremany

examples,where

high or low quantiles are of particular interest. For example, Abreveya[2]and Koenker and

Hallock[50] characterize theeconomic

determinants of babies' verylow birth-weightsthrough

thenear-extremeconditional quantiles (.05and

below). Deaton[20]examines

food expenditure ofPakistanihouseholdsby

the.1-thand

.9 -th conditional quantiles.

The

following presents abriefdiscussion ofsome

others.Example

2.1(Determinants

of

Generalized

{S,s)Models.)

The

(5,s) theory is widely used in the firm-levelmicroeconomic

studies, including the analysis of durablegood

inventories,employment

shortages,and

investment in capitalgoods.Lumpiness

ofadjustments, amain

prediction, is welldocumented.

E.g.,Arrow

et al. [5], Scarf[71],Rust

and

Hall[37], Aguirregabiria[3], Caballero [10].Inthe (5,s) theory,afirm allowsastate variable Vj (capital stock,inventory) tofall

until itreaches a lower barrier, s{Xt), at

which

point the stock is replenished (jumps) toan

upper

barrier, S{Xt).Such

decisions are optimal in general settings (Halland

Rust[38]).

Xt

may

include pricesand

other variables that affect the firm's beliefsabout

future salesand

costs (e.g. industrial productionand

commodity

price indices, interest rates).Assume

that {Yt,Xt) areobserved for a cross-section offirms.Absent

unobserved

heterogeneity, s{Xt)and S{Xt)

are exactly theminimal and

maximal

con-ditionalquantiles ofYt, given A''^. Otherwise, s{Xt)and S{Xt)

arestill strongly related to the extremalconditional quantiles.To

address the unobserved heterogeneity, Caballeroand

Engel[10] introduce the stochastic barriers [s{Xt)—

Vt,S{Xt)+

et] withunobserved

time-and

firm- specificrandom

components

et,Vi.They

propose probabilisticadjustment

models

(hazardfunctions) to describethe evolutionofYt across firms

and

or times. Insuch models, the highand

low conditional quantiles also describe the probabilistic rules. For example, the inventory variable Yt isbelow

the .1-th conditional quantileonly with probability10%,

given A'(. Inferenceabout

such functions is exactly our area of focus.More

generally,

we

canmap

quantile functions intohazard

functions,and

vice-versa.de-Figure 1: (S,s) model with stochastic bands [s(.Y)

—

v,S{x)+

e], where &and

v are the unobserved firmand timespecificrandom

components. Panel (A):Data

on asinglefirmmay

be generated by discrete sampling from the time path of (Yi,Xt). E.g. Rustand

Hall[37].Panel (B);

Data

{Yi,Xi)may

be generatedasa cross-section of plants. E.g. [3],[10],terminants ofthe {S{x),s{x)) functions. Specifically,

suppose

that[s{Xt)-vt,S(Xt)

+

et]constitute the

adjustment

barriers, with Vt,et>

0,s(A'j)<

S{Xt)

a.s., so that the interval is non-empty.The

timingis continuous. IfYj hits the lowerbound

s{Xt) —Vt,it is adjusted to the

upper

bound

S{Xt)

+

et- Pairs {Yt,Xt) are the observeddraws

of different firms (or apanel, stationarity assumed). For brevity, let's focuson

s{X).Suppose

Vtand

et areindependent

ofXt,^ then for c>

0:P{Yt

<

s{Xt)-

c\Xt)=

EPiXt

-

s{Xt)< -c\Xt,c<

Vt)P(c

<

vt)+

EP{Yt

-

s{Xt)< -c\Xt,c>

Vt)P{c

>

Vt).By

constructionP{Yt

—

s{Xt)<

—c\Xt,c

>

vt)=

0. Additionally,impose

thefollowingtail

homogeneity

condition: for all c>

sufficiently closeto Uj:^PiYt

-

s{Xt)<

-c\Xt,c<

Vt)=

a{vt-

c). (2.1)Thinking

ofYt—

[s{Xt)—

vt] as a positive "duration" variable, (2.1) statesan

"ac-celerated failure time"model

for the tail (which ismore

generalthan

in [10]). (2.1)imposes

no

restrictionson

the central features of the conditional distribution of Yt,which

is reasonable, since the (5, s) theory does not relate the central features to the adjustment barriers. Forexample,

thesymmetry

or homoscedasticityassumptions

are unreasonable. This implies that for—

c lowenough

and

some

low

constant (p{c)P{Yt

-

siXt)<

-c\Xt)=

(Pic),or, equivalently, that for small r

>

QY,{r\Xt

=

x)=

s{x)-

c{t)This isreasonable, since S{X),s(x) incorporate thebarriercomponentthat depends on X.

Nev-ertheless, wecan allow e,vto bedependent on A'.

A

noteisavailableupon request.istheT-th conditional quantile ofYt given Xt- Therefore,s{x) equalsthelow (extremal) conditional quantiles

up

toan

additive constant. Notably, it isnotpossible toestimate s(x) offthe central features ofthe conditional distribution ofYt-, as discussed above.The

inferenceabout

Qy{t\X)

for low values of r is exactly our area of focus.The

analyticalexamples

ofRust and

Hall suggest that linear/polynomial functions are excellent descriptions of(s(x),5(x)) functions.Example

2.2 (TailAnalysis

inRegression

Models)

The

tailshape

(index) ofthe conditional distributionisimportant

inthe regression analysis. Forexample, the thick-tailed distributions favor theLAD

and

other estimatorsmore

than

theOLS.

Thus,

knowing

the tail index helps determine betterestimators.On

the otherhand, the tailshapes are

important

in describing the large insurance claims ([26]), the analysis ofthe long

and

shortterm

survivaland

durations ([49], [42]),and

financial data (e.g.Mandelbrot[54], Fama[28],

Kearns

and

Pagan[45], Danielssonand

de Vries[17]). In the non-regression setting, the tail index estimators of Hilland

Pickandshave

been

countlessly used in the empiricalanalysis.

However,

estimation ofthetail index in the presence of the shape heteroscedasticity (scale, skewness, kurtosis,and

other forms) islargely

an

open, difficult problem.Our

results allowone

to construct the regression analogs ofthe Pickandsand

Hill tail indexestimators, basedon

theextremalregression quantiles,which

specifically adapt tothe shape-heteroscedastic setting,and

are simple in practice. Section 7 off'ers adiscussion,and

[15] providesan

empirical application.Example

2.3(Decision

Making

under

Extreme

Uncertainty)

Risk is a keysubject ofnon-financial

and

financial decisions, insurance,and

regulation.Both

the firmsand

the regulators are seriously concernedabout extreme

risks- the tail events that canwipe

out capital, hinderingliquidity or solvency.An

important

branch

ofeconomics

literatureis devotedtosafety-first decisionmak-ing. See Roy[68], Telser[74], Pyle

and

Turnovsky[63], Bertail et al[8]and

others. In this approach, the decision-makers (firms, investors, regulators) solveeither:1.

max

z, or 2.max

/^(q),where

If (a) is therandom

payoff (e.g. private or public benefitsand

profits) to the decisiona

(technology, portfolio composition, buffer stocks, quality/quantity offood control); z is the safetymargin

or disaster level of the payoff; r is the probability of the disaster or of exceeding the margin, set tobe

small; fi is themean

of ^''((q);(5y,(a)(T|Xi) is the conditional r-th quantilefunction ofYt{a) given .Y(, the vector of variablesrepresentingthe currentstate. QYt(a)iT\Xt)

<

i is the conditional (extremal) quantile constraint,requiring the disaster probability tobe

small:P{Yt{a)

<

z\Xt)<

T. This presents a

problem

of inference concerning the conditionalextremal quantiles.Our

models

are flexible (central features ofthe distributiondo

not determine the tailfeatures)

and

specifically exploit the extremalityand

scarcity ofthe tail events. InChernozhukov

and

Umantsev

[15],we

apply the present results.Safety-first decisions are very

important

in the finance industry,where

quantiles (value-at-risk) are the requiredmeasures

ofthe high level infrequent risk, used to de-termine the capital requirementsand

other externaland

internal purposes. See [25],[56], [27], [35],

among

others, for asample

ofilluminating research as well as reviews.1%

or5%

of the time (.01-thand

.05-th quantiles). Again, this isaproblem

concerningthe conditional extremal quantiles.

Example

2.4(Simple

Robust

Inference

inBoundary-Dependent Models)

Parametric

boundary dependent

likelihoods, arising in themodels

ofjob searchand

auctions (see [16], [31], [23], [41], [36] for a

sample

ofremarkable works) take the form:L{Pn)

-

^in/(y<|A-,,7,/^)

• l(lt>

x[p),t

where

/(A','/3|.Y(,7,^)>

a.s.and

is finite. /?and

7

are theboundary and shape

parameters, respectively. Linearity ofthe

boundary

is not essential (seebelow). Likelihood procedures, e.g.ML,

estimate7

and

/? jointly.The

estimates$

are characterizedby

d

=

dim(A') constraints, Yt=

X[p,

where

Yt isamong

the extremal values ofYt, [23] and[41]. For example,mini^TYt

is theboundary

estimatein the no-regressor case. Therefore,having afew

outlierobservationsY°

(such thatY°

<

X[(i,) severely biasesand

rendersinconsistenttheestimatesofboth

P

and

7.The

outliersarise as misrecordingsofthe bidwith a lowprobability (notthe usual additivemeasurement

error) or bid mistakes. Bajari[6] offers a substantive analysis, suggesting outliers are responsiblefor drasticoverestimatesofthe

mark-ups

inprominent

auction studies.Suppose

thenumber

ofoutliersY°

isbounded

by

a constantK

,independent

ofT.Consider the r-th near-extreme regression quantile estimator x'/3(t) ofthe

boundary

x'P, with quantileindex r

= M/T,

M

~

InT. Asymptotically xi-> x'/?(r) passesabove

the outliers,

and

isT/

InT-rate-consistent. Substitute ^(t) intoL{P,^) and

estimate7

viaML.

The

resulting estimator of7

is efficient.Chernozhukov

and

Hong[14] offer an analysis.Although

we

focuson

thelinear boundaries, anon-linear extensionin thismodel

is straightforward. Regardlessly, the linearforms

include thepolynomial

and

piece-wise linear specifications,

approximating

thesmooth

parametricfunctions as wellas

we

like.3

Extremal

Quantiles

and

Rank

Sequences

This section defines the linear regression model, the

sample

regression quantiles, theextreme

and

intermediaterank

concepts forthese statistics,and

thetail types.3.1

Extremal

Conditional Quantiles

Suppose

Yt is the response variable in K,and Xt

are the conditioning variables inK^

.The

r-th conditional quantile functionQy{t\x)

is a function q{x) that satisfiesthe relationship

P{Y

<

q{X)\X)

=

r. For instance, (5y(.25|a:)and

Qy(.l|x) are the conditionalfirst quartileand

decile functions. Formally,Qy{T\x)=Fy\T\x),

where

Fy'(|x)

is the inverse of Fy-(|i).Our

focus is exclusivelyon

modeling

and

making

inferenceon

the extremal conditional quantile functions:Qy(t\x),

where r

is near 0.3.2

Linear Quantile

Regression

Model

In this paper

we

considerthe hnearmodel

for quantiles of interestI

Qy{T\x)=F-'{T\x)=x'^[T),

Vt€I,

(3.2)where

/?() isan

unknown

functionofr.Here

it is necessary that (3.2) holds for1=

[0,77],where??

>

0. (3.3)If T] is small, the linearity is

assumed

only for low quantiles,and

not necessarily for other quantiles.We

cissume thatX

has (oristrimmed

to) acompact

supportX.

The

model

(3.2)is implied, forinstance,by

theclassicallinear location-scalemodels

with

unknown

error distribution, butis considerablymore

flexible in thesensethattheshapeoftheconditional density

may

change

with the covariates.X

may

incorporate awide

array ofpolynomialand

other transformationsoftheobserved covariates.On

itsbasis, in section4,

we

develop themodels

with the extreme-value-theoretic restrictionson

the conditionaltails.Note

the approachestolinearmodeling.One

approach

assumes

linearityofasingle orfew quantiles (Buchinsky[9], Horowitz[43], Powell[62]).Another approach (Koenker

and Machado[51]) assumes

the linearity ofall quantile functions,I

=

[0, 1].The

"local inr

linearity"assumption

made

here is closer to thefirst approach.Despite convenience, having linearity for several r

may

posean

avoidable caveat (the curvesmay

cross). First,X

is often a transformation ofthe original covariates, sothe curvesare non-linearin theoriginalspace (see [49]). Second, givencompactness

of support

X,

the linearmodel

is always coherent.Take

a countable, possibly finite collection of non-crossing curves {x h^ x'P{Ti),iG J}

withdomain

X.

Definex

>-->x'/3(t) for other r

by

taking appropriateconvex

or linear combinations ofthese lines.By

construction, thefines crossonly outsideX.

This alsodefines theconditional c.d.f.3.3

Sample

Regression Quantile

Statistics

Suppose

we

have

T

observations {Yt,Xt}. In the no-covariates case thesample

r-th quantile P{t), is generatedby

solving theproblem

t=l

where

Pt{x)=

{t—

1{x<

0)) x.Koenker

and

Bassett[48]extended

theconcept tothe regression setting by solvingT

min

TpriVt-X^li).

(3.4)The

/?(r) that solves (3.4) has the equivarianceand

robustness properties oftheordi-nary sample

quantiles; inparticular, (i) regressionequivariance,(ii) scaleequivariance,(iii) equivarianceto (fullrank) lineartransformationsof

X,

(iv) invariancetopertur-bations ofy^t without crossingthe

hyperplane

x'${t).The

solutions x'${t) to (3.4) (if3.4

Extremes,

Near-Extremes

&

Data

Scarcity

We

view

thesample

regression quantiles as order statistics in regression settings. For a givensample

ofsize T, the r-thsample

regression quantile is seen here as therT-th

order statistic. Henceforth,

we

shall refertotT

as to the rankor order.Definition

3.1(Rank

Conditions)

The

sequenceofquantileindex-samplesizepairs {tt,T) is said to be:(i)

an extreme

rank sequence, ift-j-\

0,TtT

—

> A;>

0, (ii)an

intermediaterank

sequence, ifTt\

0,TrT

—

> oo,(ii) a central

rank

sequence, ifr is fixed,and

T

—

^ oo.Even

though

(i)and

(ii)make

rsample

size dependent, to simplifywe

write r instead of Tt-Because

principles (i)and

(ii) constructively exploit that the relevant data isformed

by the tailevents and, oris scarce, they lead toa. asymptotic distributions that either fit the finite-sample distribution better or, giA'en the

same

approximation

quality, aremore

parsimonious

relative to the conventionalcentralrank approximations (Koenker and

Bassett[48], Powell[62]) b. important tail inference procedures,based

on

thesample

regression quantiles.See

example

2.3and

section 7.Concepts

(i)and

(ii) are wellmotivated by

the intellectualand

practical success ofextreme

value theory,which

focusedon

the ordinarysample

quantiles.These

con-cepts are also similar in spirit to other types of "alternative" asymptotics, e.g.GMM

when

thenumber

ofmoment

conditions is large, or, generally, thetheory ofstatisticalexperiments.

In evaluating these concepts,it is

important

tokeep

inmind

that thesealternative sequencesare designedto yield practically betterapproximations

evenwhen

thequan-tileindex is not verylow.

And,

in case (a), it is completely irrelevantwhether

ornot futuresampling

will lead tosamples

conforming

tothese sequences.To

clarify (a), consider a simpleexample

withno

X.

Suppose, withan

i.i.d.sample

{Ut,t<

T =

200},we

wish to inferabout

the quantiles with indices r=

.025, r=

.1, r=

.2,r

=

.3.The

estimators are the order statistics (sample quantiles) [^(5),t/(20); t^(40)7 f^(60)-Suppose

the distribution F^. hasan

algebraic tailF^{x)

~

(—

a;)~^/^,^=

1 aisX

\

—00.

Figure 5compares

the conventional centralrank approximation

VT

{U^rT)-

F~^{t))-^

N

(0,r(l-

t)/f^{Fu(t))) , where fu=

F^,with the intermediate

rank

one: ariU^^r)—

F~^{t))—

>N{0,^^/{m~^

-

1)^),(4=

—

l,m

>

1), ot=

VrT/F'^irriT)—

F~^(t)),and

theextreme rank

approximation:T^^'^{U(rT)

—

F~^{t))—

> -fc~'/^—

r^'^^,where

Tk is agamma

random

variable with degree k(sum

ofk standard exponentials, section 3.6).Quality-wise, the extreme rank approximation,

which

exploits both the extremalityand

scarcity oftailevents, beatsthenormal

quiteconsiderably (displays A-C).Only

for a fairlynon-extreme

quantile, r=

.3, does thenormal approximation

achieve roughlythe

same

quality.At

thesame

time, the intermediate rank approximation,which

ex-ploits the extremalityofrelevant events, is very closetothecentralrank approximation

(displays D-F), but enjoys greater

parsimony

and

easeof inference.The

tail index^ is(seesection3.6). This

may

be preferred tothenonparametric

estimationof the density function evaluated at the low quantile (with the scarce tail data), as required in the central ranktheory. See [13] for aMonte-Carlo

regression example.3.5

Tail

Types,

Support

Types,

and

Classical

Limits

The

following definitions areimportant

in thesequel.Definition

3.2(Types

of

Support)

In viewoflinearity,we

say Fy{-\X) has:• finitesupport, if

Qy{0\X)

> —

oo,a.s.• infinite support, if

Qy{0\X)

=

—

oo, a.s.Definition

3.3 (TailTypes,

TailIndex,

Regular

variation)

Consider arandom

variable

U

with distribution function F^, with lower end-point Xf equal or—

oo.F^

hasthe tail of the extremal types 1, 2, or 3iffor [/

~

^ iff/g

—

> !]typel:(^

=

0)

: as «\

or-

oo, F„(f-|- x£(<))~

Fu(i)e"^,Vx

£ K, type 2: (^=

-)

:a.st\

-oo,

x'^Fuit)

~

Fu{tx),Vx

>

0,a

>

0, (35)type 3; (^

=

—

) : asi\

0,x"

Fu{t)~

F^itx),Vx

>

0,a

>

0.a

where

i{t)=

J

Fu{v)dv/Fu{t), fort>

x/, cf. [52].Enclosed

inthe brackets in (3.5)is the tail index(,,

which

determines thetail type.Equation

(3.5) defines type 2 distributions as regularly varying functions at-co

with index—1/^

=

—a,

(algebraicallyand

near- algebraically tailed at —00, inmore

intuitive terms). (3.5) also defines type 3 distributions as regularly varying functions at with index

—

1/^=

a

>

(algebraicallyand

near- algebraically tailed at a finiteend

point, takenas 0).The

type 1 classincludesexponentiallyand

near-exponentially taileddistributions. Forfuture reference, note these conditionsimply

thatthe quantile functionF^^{t)

is regularly varying at with index —(,. E.g. [26].Classes 1-3 contain

most

ofsmooth

distributions with rare exceptions. See [26].The

tail types determine the limiting distributions of order statisticsunder

extreme

and

intermediate ranks. In our setting, they willhave

asimilar role as well. Forlater comparisons, let us review the non-regression results.3.6

Limit

Distributions of

Ordinary

Sample

Quantiles

Extreme

Rank

Statistics. Consider the order statistics f/(i)<

...<

[/(jt)from

thei.i.d.

sample

Ui,...,Ut, distributed according to law Fu, with the lower end-point x/equal or —00.

The

extreme

value theory described the existenceand forms

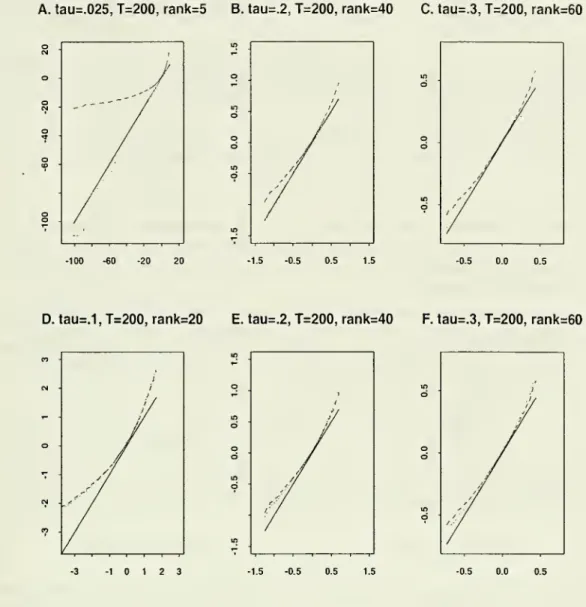

of the non-degeneratelimitlaws for the properly normalized orderstatistics:A.tau=.025,T=200, rank=5 B.tau=.2,1=200, rank=40 C.tau=.3,T=200, rank=60 o /' O / o

^'-/

o to/

/ / o o/

• -100 -60 -20 20 -0.5 0.0 0.5D.tau=.1,T=200, rank=20 E.tau=.2,T=200,rank=40 F.tau=.3,T=200,

rank=60

-3

-10

12

3 -0.5 0.0 0.5Figure 2: Displays

A-C: QQ-plot

ofExtreme

and

Central

Rank

Approximations.

The

dashedline "- - -"isthecentralapproximation, andthe dottedline " " istheextreme

rankapproximation.

The

true quantilesofthe exactsamplingdistributionaredepictedbythe solidline" ".

The

centralrankapproximationvariesfromverybadtobad

forlowquantilesT

=

.025 and r=

.2 and becomes comparable to the extreme rank approximation only at T=

.3. DisplaysD-F: QQ-plot

ofIntermediate

and

Central

Rank

Approximations.

The

dotted line " "now

denotes the intermediate rank approximation.The

theoreticalcentral andintermediate rankapproximations have approximatelythe

same

performance forT

=

.1,.2,.3, (usingm

—

2,1.5,1.25).The

practical advantage of the intermediate rankapproximation is the parsimony

and

eaise ofestimating nuisance parameters. [Replications=

10,000.99%

range.]For fixed k, thelimit laws oftype 1- 3, wereidentiiied in the literature as:

InTk, for type 1 tails,

Jfc

=

<—

r,.", for type 2 tails,for type 3 tails,

(3.6)

k '

with the canonical scalings given by:

type 1: ar type2: aj-type3: ar

lli[F-'{^)l

bj-yF-'ir)

' 6^=

0, b-r=

0. (3.7)Note

thatwhen

k=

I, thetype 1 lawin (3.6) iscalledGumbell,

type2- Frechet,type 3- Weibull. Typically, the results statethedistributionfunctions ofJk,

but

more

recent treatments formulate the results in theabove

form

(e.g.Example

4.2.5 in [26]),which

helps explain our results.

Intermediate

Rank

Statistics.One

ofmost

generaland

fairly recenttreatmentsoftheintermediate orderstatisticsisthe

work

ofDekkers

and

de Haan[21].Using

slightly stronger restrictions on the tails, discussed below, theyfound

that the limit laws are normal, but the limiting variance dependson

the extremal tail typesthrough

the tailindex ^, as A;

=

[tT] -^ oo(Theorem

3.1):/tT

Fu'{2t)-F-\t)

[/,(IrT}} F,\:\r))

N

0,e

(2-«-l)2

(3.8)The

scalinga-p can convenientlybe

replacedby

VtT/{U^2[tT])~

U^^rT]) without affect-ing the result,and

operationalizing the inference.4

The

Extremal

Regression Quantile

Models

Here

we

construct thelinearmodels

oflow (extremal)conditional quantiles,which

allow flexiblecovariateeffectson

thedistribution,and

coherentlycombine

thetailconditions leading to (i) non-degenerate asymptotic distributionsand

congenial inference proce-dures, (ii)good

approximations to thesampling

distributions,and

(iii) aframework

suitablefor inference

about

tails in shape-heteroscedasticmodels.4.1

Model

1:Tail

Homogeneity

Consider aprobabilityspace(fJ,

T,

P),possiblyindexedby

T.To

impose

aconstructivetail condition, define a reference error

term

asU = Y

-X'Pr,

(4.9)where

x i-> x'l3r is the reference line chosenso thatthe errorU

satisfiesthetailhomo-geneity condition (i) in

assumption

1.The

existence ofsuch a lineisan

assumption; theexamples below

highlight its constructive role.Inthe

bounded

support case, it is convenient to choose the referenceHne

asPr

=

,5(0), (4.10)sothat [/

=

y

—

X'P{0)

>

has the end-pointby

construction. (In theunbounded

support case, x'P{0)

=

—

ooand

is not suitable as areference line).Assumption

1(Model

1: TailHomogeneity)

In addition to linearity (3.2):(i) thereis areal-valued

U

and

referenceline x'Pr oftheform

(4.9)-(4.10)s.t.asz

\

—

oo (infinite support) or as z\

(finite support), uniformlyinx

€X.

Fu

is adistribution function with type 1,2, or3 tails.(ii) the support of

X

is (ortrimmed

to) acompact

subsetX

ofIR'*.(Hi) the distribution function

ofXt,

Fx

, with supportX

and

mean

px,

isnondegen-eratein W^.

The

firstcomponent

ofX

is 1.px

=

(1,0,...) w.l.o.g.Assumption

l-(ii), compactness, is essential; otherwise, thelimitsmay

change

de-pending on

the tail behaviorofX

. l-(iii) precludes non-degeneracies.Assumption

l-(i) requiresthetailsofthesuitablydefined errorterm

U

tobe

inthedomain

oftheminimum

attractionwhich

is fairlybroad

with rareexceptions (section3.5.) In this sense the

model

is distribution-free. l-(i) also requires the tail of the conditional distribution function ofU

tobe approximately independent

ofX.

This incorporates the case ofindependent

U

and

X

as strictly aspecial case. Indeed, l-(i)requires only that there is a reference error

U

in (4.9) such that the extremal (small) values of[/areapproximatelyindependent

ofA'. Thisallowsgeneralglobaldependence

of

U

on

X

, such asshape

heteroscedasticity.Example

4.1 (Classical linearmodel)

Suppose

the quantilefunction isQAr\X)=X'a-i-F~\T),

(4.11)which

corresponds to themodel

Y

=

X'a

-\-U, where

U

isindependent

ofX

and

e.g.EU

=

0. This clearly is a special case ofModel

1 with the reference linex'a. Yet thisexample

isnarrow and

"trivial" inthe sense that the extremalfeaturesaredetermined

by

the centralfeatures ofthe distribution,and

thereis "nothing toestimate" (allslope coefficients ^_i(r) equal a_i.)To

defend the "trivial" model, note it underliesmuch

ofthe (central) quantile regression inference,Koenker

and

Bassett[48],because

itoften plausiblyapproximates

the exact distribution ofregression quantiles, eventhough

themodel

itselfis unrealistic(Koenker

and

Hallock[50]).Example

4.2 Consider thebounded

support case.The

0-th quantile function isQy{0\X)

=

X'j3{0),which

is ourreference line X'(3r.By

assumption

l(i),P(Y

-

X'/?(0)<

l\X)~

Fu{l)=

Ti,asl\0,

which

implies that the paths of the extremal quantile functionsx

h^ x'P{ri) are ap-proximately parallel to that of a; i-> x'/3(0). Thismodel

is not "trivial" in the senseof

Example

4.1, because the extremal quantilesand

the reference line are determined only by the extremal features ofthe conditional distribution.The

model

does not re-strict other quantiles, allowing for general shape- heteroscedasticity. For example, a collection of quantilecurves {x !-> Qyiqlx),<? £C}

with the centralindicesC

may

have

complicated non-parallel paths, allowing for complicated effects of covariates

on

the conditional densityshape

(kurtosis, skewness,and

other effects), as in Figure 3.Con-sequently, this

model

does notadmit

reductions to non-regressionmodels

byremoving

a conditional location

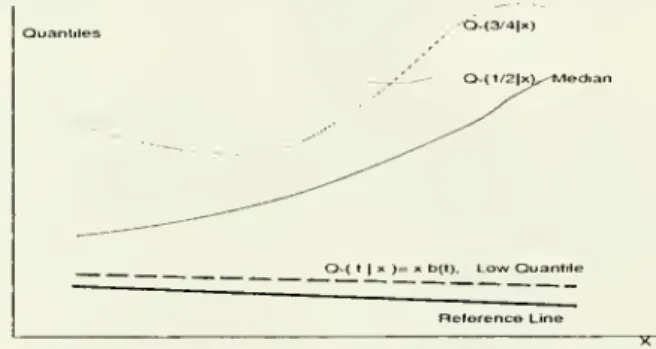

and

scalefrom

Y.Quantiles ..••6C(3/^|x) "~

--

l^--^—

-^

'^

0,(11X )= X b(t). LowOuanttle ReferenceLineFigure3:

Example

4.2: Extremalconditional quantilefunctionxi->x P{t) is approximately paralleltothereference linex >->x pr (equal tothemini-m£ilquantilex'P{0)in the

bounded

supportcase). Otherquantilefunctions are unrestricted, allowing for complicated forms ofglobalheteroscedastic-ity.

The

model does not admit the reduction to a non-regression model by removing the conditionalmedian

(ormean)

and/or scale fromY

variable.Example

4.3 Consider theunbounded

support. Forsome

referencelinex i->x'pr,by

assumption

l(i),P{Y

-

X'pr

<

l\X)~

Fu{l)=

Ti,a.sl\

-DO,which

implies that the paths of the extremal quantile functionsx

M- x'I3{ti) are ap-proximately parallel to that oix

i-^ x'Pr- Thismodel

is also not "trivial" in thesense ofexample

4.1, because the extremal quantiles aredetermined

onlyby

the extremal features ofthe conditional distribution.As

inexample

4.2, themodel

does notrestrictany

other features ofthedistribution,allowingforgeneralforms

of globalheteroscedcis-ticity.

Thus

it is irreducible to a non-regression model.Note

thatexamples

4.2and

4.3demonstrate

that the linear location-scalemodels

are neither implied

by

Model

1 nor implyModel

1.Thus Model

1 is ofitsown

nature, crafted to yield non-degenerate,parsimonious limits. Unlike thelocation-scalemodels,Model

1admitsgeneral global heteroscedasticity,allowingcovariatestoaffecttheshape

ofthe conditional distribution.

4.2

Model

2:Congenial

Tail

Heterogeneity

We

suggest amodel

that, while flexibly accounting for thedependence

ofthe tailon

covariates, exhibits simplicity, enabling an explicit, practical limit theory for

both

theextreme

and

intermediate ranksample

regression quantiles. 13Assumption

2

(Model

2:Congenial

TailHetrogeneity)

Suppose assumption

1holds, except l-(i) is replaced

by

the followingtail condition:Fy{z\x)

~

K{x)

Fu{z),asz\-ooorz\0,

(4.12)uniformlyin

x

£X,

Fy, has type 1-3 tails, K{-) isassumed

to be apositive continuous function onX, bounded

above

and

away

from

zero,normalized

so thatK{fix)

=

1 (or atany

otherreferencepoint x^ 6 X).Just like

Model

1,Model

2 is distribution-free, sinceF^

is notassumed

tobe

para-metric,

and

it allows the general (shape) forms of global heteroscedasticity. UnlikeModel

1,Model

2 allows for richer effects ofcovariateson

tails.The

imposed

tail conditionmay

seem

an

unconventionalway

to introduce het-eroscedasticity. Yet, inmany

regards, itismore

flexibleand

constructivethan

the con-ventional location-scalemodeling,asexplained below.The

proposed

modeling

strategyis

motivated by

the closure of thedomains

ofminimum

attractionunder

tail equiva-lence,and

is fully consistent withlinearity.Indeed,

Lemma

10,characterizes thismodel

in detail: (i) implicationsforthequan-tile coefficients ofthe linear model, (ii) limits of ratios ofspacings

between

the con-ditional quantile functions,and

(iii)many

other propertiesneeded

for inference.Im-portantly,

we

deduced

that the linearityassumption

and

(4.12)jointlyimply

that A'(-) canbe

represented as{e~^

"^ for type 1 tails,{x'c)°' for type 2 tails, (4.13) {x'c)~°' for type 3 tails,

where

fi'^c=

1 for type 2and

3 tails,and

/z'^c=

for type 1 tails. InModel

1,c

=

for type 1 tails,and

c=

(1,0,...)'=

e'j for type 2and

3 tails.We

call c thetailheterogeneity index. It

measures

the strength withwhich

X

shift the tails of error terms U.Note

that x'c>

uniformlyon

X

fortypes 2and

3by

assumption.It is plausible that (potentially) the non-parametric function K{-) in (4.12) is in fact a transformation ofthe linear index x'c

determined by

the tail index ^. Recall(,

=

(for type 1 tails)and

£,=

1/a

and

—

1/q

fortype 2and

3 tails,respectively. Thisassumption

leads to parsimonious, convenientlimits for regression quantiles.The

followingexamples

illustrate the model's flexibility.Example

4.4(Linear

Location-Scale

Model)

Assume

forX'j

>

a.s.Qy(r|x)

=

x'Q+

x'7-F-'(r),

(4.14) corresponding to the locationmodel

Y

=

X'a

-\-X'-yV, where

V

isindependent

ofA'^ and, say, has

mean

and

variance 1.Assume

F^

has the extremal tail type with ^^

0.Then

forthe reference linex'aand

U =

Y

—

X'a

=

X'-y-V

P{X'-f

V

<

l\X)~

(X'7)-^/^ -F^il), as /\

-co,

so the conditions of

Model

1 are satisfied withF^

=

Fy.The

location-scalemodel

imposes two

stringent restrictions: (i) the extremal features of the distribution arelargely

determined

by

the (central)locationand

scaleparameters: /3(t)=

a+7-F~^

(r),and

(ii) thecovariatesare limited toaffectonly the locationand

scaleofthe conditional distribution, precluding theshape

effects likeskewness

or kurtosis.Example

4.5Model

2 requires that forsome

reference line x'/J^P{Y

-

X'pr

<

l\X)~

K{x)

Fu{l), as/\

or-

cx),which

implies that the paths of the extremal quantile functionsx

M- x'P{ti) areno

longer parallel to that of x h-)- x'Pr-

(The

crossing of lines is precluded because theassumption

is consistent with linearity,Lemma

10). Thismodel

is not as restrictive asexample

4.4. First, the extremal quantiles (and the reference line) aredetermined

only

by

theextremal features ofthe conditional distribution. Second, themodel

allows for general global heteroscedasticity- the entireshape

ofthe conditional densitymay

change

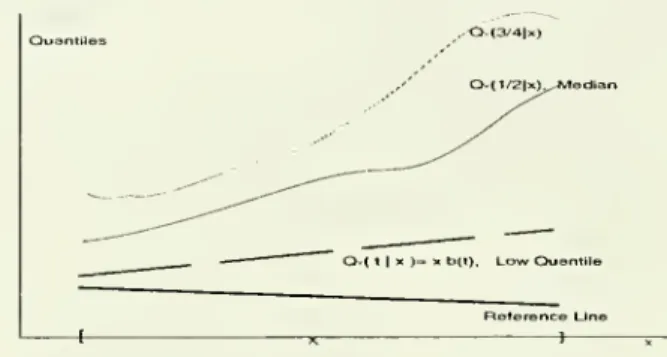

with covariates (scale, skewness, etc), including thetails.Figure 4:

Example

4.5. Extremal quantile functions x i-> x'/3{t) are no longerapproximatelyparEilleltothereferencelinex>->x'fir, over X, allow-ing the tail heteroscedasticity. Other quantile functions are unrestricted, allowing for complicated forms of global heteroscedasticity as well.The

extremalfeatures ofthemodel, including thereferencelines, arenot

deter-mined

bythecentral features.Thisdiscussion concludes the constructionofour models. In principle, itshould

be

possible to further relaxthe

modeling

assumptions, particularlyin thenonparametric

direction, but a

good

deal of caution isneeded

to assure the joint coherency of thetail conditions, functional

dependence

of the quantile curveson

regressors,and

non-degeneracy ofthe limit distributions.Note

that the obtainedmodels

are coherent, flexible,distribution-free, leadtonon-degenerate,parsimoniouslimit distributions,and

provide a convenient

framework

for inferenceabout

the tails.5

Asymptotics

under

Extreme Ranks

Recall that the

approximation

concept ofextreme

ranks requirestT —

> fc>

0.Here

we

state the distribution results forModels

1and

2and

explain their barest essence, while leaving proofsand

some

generalizations to the appendix.5.1.

A

Sketch.

First, obtain a finite-dimensional {fidi)weak

limitQco()

of the finite-sample, suitably scaled, objective functions {Qt{-)}-Qoo

is definedby

a pointprocessthat "counts" the "extremalevents."

Then,

the normalizedregression quantile statistic,Zx, an argmin

ofQt,

will convergein distribution toarandom

variable Zoo, theargmin

ofQoo,by

convexity of{Qt]

and

Qoo-For brevity,

we

confine our discussion to type 3 tails. Consider the statisticZr

=

ar{P{T)-l3{0)),

where

Ct- is the canonicalscaling in section 3.6, defined in terms ofthe function F,, inassumption

1 or 2.Zt

optimizes therescaledby

a^ objectivefunction in (3.4):T

Qt{z)

=

J2

('rPr[Ut-

X^z/a-r)-

a^rUt),

(5.15)where

Ut=

Yt-

A'j'/?(0)>

Q a.T\d z=

ar{l3-

I3r)-We

subtracted the"smoother"

X^j rUtCiT,

which

brings a key continuity propertyand

stabilizesQt-

Clearlythis does notaffect theargmin

Zr- [The"smoother"

fortype 1-2 tails ismore

involved;Lemma

1. Incidentally, theconventional central

rank

stabilizationby ^jPr(t/tar)

is bad, forit sends the objective to

+00,

let alone continuity.]Hence

T

Qt[z)

=

-TtX'z -

J2l{Utar <

X[z)

{Utar-

X'^z). (5.16)t=i

This function is convex. Notably, it is constructed as a continuous functional of the point process defined next.

The

fi-di distribution ofQt

is definedby

that of{Qt{zj),J

<

l] forany

finite (z_/,j<

/). Since A'—

>• /xx,and

tT —

> k (forj<

I) :T

Qt{zj)

=

-kn'xZj

-

^

l{UtaT

<

XtZj)[Utar

-

X[zj)+

Op(l). (5-17) t=iThe

limit behaviorofQt

is determinedby

the pointprocessN

that assignsmass

tomeasurable

setsA

by:r

N(^)

=

Y^

\{{arUt,Xt}

e A), forAcE=

[0,oo)x

X.

(=1

The

point processN

is ameasure

definedby

itsrandom

points (atoms) {aT.Ut,Xt,t<

T)

(See Definition A.l, B.l).We

find that Qt{-) isan

integralofa residual function with respect to the point process,which seems

tobe

special tothis problem.Point process theory is the bread-and-butter of

extreme

value theory,^ [26],and

isuseful here. Indeed, a Lebesgue-Stieltjes integral

f

gdN

ofN

with points{Xj}

is :j

9{x)dN{x)

=

Y^g[X,).

®Point process theorywasdevelopedbyKallenberg[44], Resnick(65] andothersinconsiderable

gen-erality. Applicationsare numerousin statistics. For example,Feigin and Resnick[29] approximatethe

constraintsofthelinearprogrammingestimators; alsoKnight[46] ;Emrechtset al.[26] andResnick[65]

show howpoint processes

may

be used inrelated applications, particularlytheexceedance processes,extremal processes,and record values.

Convergence

of such integrals, for continuousmaps

x M- g{x} that vanish outsidecompact

sets, metrizesweak

convergence of point processes (Definition A.2.)So

we

represent {Qt{zj),J

<

I) as an integralQt{zj)

=

-kn'xZj

+

[{I-

x'zj^dNil,!)

+

Op(l), (5.18)where

(/—

x'z)"" is the "residual" function.Lemma

2 proves {Qt{z),J<

l) \s a.continuous

map

of the point processN,

so itsweak

limit isdetermined

by

that ofN.

Notably, to obtain continuity for various tail types, the construction of point processN

requiresacarefulchoice oftheunderlyingtopologicalspaceE

(andadditional transformationsofQt

fortypes 1and

2).The

weak

hmit

(Def. A.2) ofN

inModel

2 is a Poisson processN,

Lemma

6: ooi=l

where

{Ji,Xi] arerandom

points defined as(j„

Xi,i>l)

^(A^'cLf

, Xi,z>l),

Vi=£i

+...+

£i, i>1,

(5.19)

where

{£i} are i.i.d. exponentialrandom

variables withmean

1, {Xi} are i.i.d. with lawFx

, distributed independently of {£i},and

c is the tail heterogeneity parameter.In

Model

1, becausec=

(1,0,...), a naturalsimplification occurs:A;'c=l,Vi.

(5.20)The

firstresult,explainedinLemma

6, isnotself-evident,while (5.20)isfairlyintuitive.Note

that N(.4)=

J2i<T ^iWTU(i),X^iy} € A),where

[/(,) is i-thrank

error,and

Xu\

isthe corresponding covariate. Vector [arU^i),!

<

q)—

> {t\''^,i<

q) (Section 3.6),and

is asymptotically independent oi

Xi

by Assumption

l-(i) inModel

1,which

explainsthe

form

of(5.19)and

(5.20) forModel

1. (This is nota proof).Lemmas

5-6 provide the proofforModel

2 (and 1by

implication) using the Kalenberg's theorem, Meyer's conditions,and

a series of compositionsand

transformations of a canonical Poisson process (Def. A.4 provides a background).We

concludethat thefidiweak

limit of{Qt}

is/CX)

(jf

-

x'z)~dN{j,x)

=

-kfjLxZ+

^(Ji

-

X[z)~

.

Therefore,

we

obtainby convexityLemma

1 intheappendix

(Theorem

5inKnight[46]) thelimit distribution forZt,

provided(5oo() has a uniqueargmin

a.s.and

is finiteon

an open non-empty

set (verified inLemma

2and

11).Hence

Or(/?(r)

-

/3(0))-^

Zoo=

argmin

Qoo(2)- (5.21)Finally,

Lemma

10shows

that ax(/3(0) -/?(r)) -> fc»c inModel

2 ( c=

ej=

(1,0,...)'in

Model

1) so thata^(4(r)-/3(r))

-k°C+

Zn

5.2.

Results

forModels

1and

2.The

above

discussion hopefully providedan

intuitive explanation ofthe foregoingformal results for

Models

1and

2(Theorems

1and

2).The

proofs areintheappendix.To

statetheresult,suppose

we

have

/sequences{Ti,i

<

1} such that t,T—

> ki, sowe

index thenormalizedregression quantile statistic as Zriki), forboth

T

<

ooand

T

=

oo. DefineZrik)

=

ar (/3(t)—

Pt—

br^i) , fortype 1 tails,Zrik)

=

ar (/3(r)-

Pr) , fortype 2&

3tails.Also define the centered statistic

Z^{k)=ar[p{r)-P{T)).

The

canonical constants {a-j-jbr) are defined in (3.7) interms

offunctions F^,which

are definedin

Assumptions

1and

2 along with the errorterm

Utand

Pr-The

key point process,N()

=

5I(<t ^{{ariUt-

6t),^Y(} € )weakly

converges (Def. A.2) toN(

)=

^i>i

l{{Ji,Xt} € •)by

Lemma

4-6, with points {Ji,Xi} defined as:(j„

Xi, i>

l)=

<(ln(rO

+

A'/c, Xi) fortype 1,(r7^/"A7c,

Xi) for type 2,i>l

(5.22) (rJ/^-Y/c, a;) fortype 3,where

{Ti,i>

1}=

{X!,<i^j'*—

1}! l^j) i^^^

i.i.d.sequence

of unit-exponential variables;{Xi}

isan

i.i.dsequence

withlaw Fx-

InModel

1, thedependence between

Ji

and

Xi naturally disappearsinview

ofassumption

l-(i):X-c

=

for type 1 tails,Vz,(5.23) -Y/c

=

1 fortype 2&

3 tails, Vi.Theorem

1(Extreme

Rank

Asymptotics

inModel

1)Suppose

Assumption

1and

that (a) {Yt,Xt} is

an

i.i.d. or stationary sequence, satisfying theMeyer

conditions,Lemma

6; (b) at leastone

component

ofX

is absolutely continuous, ifd

>

2.Then

as

tT

-^k,T

-^ oo, (k=

ki,...,ki), fora.e. k>

Zrik)

—

> Zoo{k)=

arginf—

kpi'^z+

I l{u,x'z)dN{u,x)\,

where

l{u,v)=

l(u<

v){v—

u),and

the distribution of points {Ji,Xi]

ofN

isdefined in (5.22)-(5.23). Furthermore, {ZT{ki),i<

l)-^

[Z^{ki),i<

l),Z^{k)

^

Z'^ik)=

Z^{k)

-

c{k),and

[Zj-{ki),i<

I)—

> [Z^{ki),i<

I),where

c{k)=

Ink

ei, for type 1,—k^~ei,

fortype2,