The stability of short-term interest rates pass-through in the euro area during the financial market and sovereign debt crises

Texte intégral

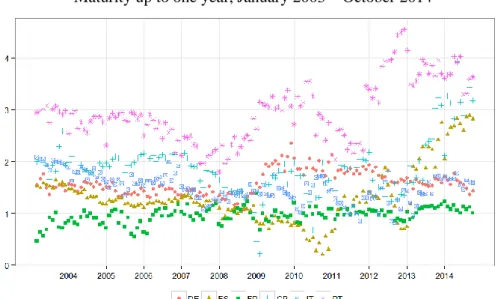

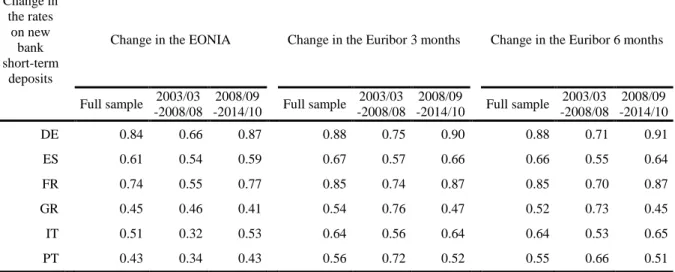

Figure

Documents relatifs

• Established under the Western Australian Future Fund Act 2012, with seed funding of $1 billion over. 2012-13 to 2015-16 from Royalties for Regions fund and

The paper examines the legal tactics and strategies that vulture funds pursued against Argentina and Greece before and after their debt restructurings and analyzes the

Accordingly, in our model, longer maturities favor larger movement of bond prices that mitigate the rise in public debt and hence the size of the fiscal consolidation that follows

For instance, a technology shock determines a negative correlation on the stock-bond market; a financial expectation shock a positive one and a sovereign risk shock an

Section 4 provides a critical overview of the three main policy and institutional reforms adopted by European Union governments in response to the crisis -- notably,

An ‘embedded liberal’ European monetary order suiting French interests and reflecting its economic ideas would have comprised the following four core elements: fixed,

Because of this WHO established the Centre for the Promotion of Environmental Planning and Applied Studies (PEPAS) in 1979. Located near Kuala Lumpur, in Malay- sia,

Before 2008 the idea that the government of a rich EU country can default could hardly be imagined, either because ‘naïve’ investors had faith in the ability of