1

CREDIT RATING AGENCIES, THE SOVEREIGN DEBT

CRISIS AND COMPETITION LAW

I. INTRODUCTION

II. OVERVIEW OF THE CREDIT RATING INDUSTRY

III. THE CASE FOR ANTITRUST INTERVENTION

A. The Prima Facie Features of Significant Market Power

1. Significant Market Power, Information Goods and Reputational Damage

2. The Structural Features of SMP

3. The Behavioral Performance of SMP

4. Alternative theories

5. Conclusions

B. Antitrust Intervention v. Sector Specific Regulation?

1. Background

2. Intrinsic Limits of Alternative Regulatory Remedies

a) Effectiveness Issues

b) Process Issues

3. The Advantages of Antitrust Intervention

IV. ANTITRUST INTERVENTION SCENARIOS

A. Theoretical and Factual Background

B. Collusion

C. Abuse of Dominance

1. Market definition

2. Dominance

2.1. Single firm Dominance

2.2. Collective Dominance

3. Abuse

D. Competition Advocacy

V. REMEDIES

A. Background

B. Remedies creating or assisting “competitive forces” external to the Oligopoly

C. Remedies seeking to reduce Risks of Ratings Errors

D. Remedies seeking to eliminate Coordination within the Oligopoly

2 CREDIT RATING AGENCIES, THE SOVEREIGN DEBT CRISIS AND

COMPETITION LAW

Nicolas PETIT∗

Abstract (EN): this paper demonstrates that there are both theoretical and practical reasons to scrutinize, and possibly regulate, the conduct of the credit rating agencies under European Union competition law.

Résumé (FR): cet article démontre, dans une perspective à la fois théorique et pragmatique, que les pratiques des agences de notation peuvent faire l’objet d’un contrôle, et le cas échéant, être régulées, sur le fondement du droit européen de la concurrence.

I. Introduction

The “Big Three” Credit Rating Agencies (“CRAs”) rank highly on the “most wanted” list of policy leaders in the Western world. Moody’s Investors Services (“Moody’s”), Standard & Poor’s (“S&P”) and Fitch Ratings (“Fitch”) are blamed for mistakenly downgrading sovereign States in the European Union (“EU”) and the United States (“US”), and in turn for plunging financial markets into a state of profound distress. With swelling interest rates, downgraded States have been brought even closer to the brink of default, as if CRAs’ pessimistic predictions (some talk of “prophecies”) were self-fulfilling.1 Calls for regulatory intervention against CRAs have thus escalated, with proposals as diverse as the creation of government-sponsored CRAs,2 the dismantling of the CRA oligopoly,3 or tougher controls on sovereign ratings.4 In addition, it has been reported that a number of private investors have been exploring opportunities to enter this market.5

∗ Professor, University of Liège (ULg), Belgium. Director of the Global Competition Law Centre (GCLC) College of Europe. Director of the Brussels School of Competition (BSC). Nicolas.petit@ulg.ac.be. The author is indebted to his assistant Norman Neyrinck, who provided great research assistance in the early preparation of this paper. Very many thanks also to David Henry, barrister, who thoroughly reviewed the present document and made useful comments. Unless stated otherwise, all views, opinions, interpretations and possible errors are mine, and shall not be attributed to the people who commented on this paper.

1

J. de Haan and F. Amtenbrink, Credit Rating Agencies, De Nederlandsche Bank Working Paper No. 278, January 2011, p. 6. who explain the phenomenon as follows: “downgrade to below the investment-grade

threshold often triggers immediate liquidation, leading to herd behaviour. This kind of behaviour may increase market volatility and may even cause a self-sustaining downward spiral of asset prices with potential negative effects for financial stability”.

2

Interview of M. Barnier, La tribune, Jeudi 7 Juillet 2011, available at http://ec.europa.eu/commission_2010-2014/barnier/docs/interviews/20110707_latribune_fr.pdf

3

Interview of V. Reding, Härte gegen Griechen aus Sorge um Italien, Die Welt, 11.07.2011, available at

http://www.welt.de/print/die_welt/wirtschaft/article13479660/Haerte-gegen-Griechen-aus-Sorge-um-Italien.html

4

For an overview, see J. Rega, “The Rating Game”, mLex Magazine, July September 2011, pp.34-36.

5

Deutsche Welle, “New European ratings agency slated to open next year”, 19.07.2011, available at

Interestingly, most proposals have focused on the adoption of a dedicated regulatory framework to address the issue. In contrast, only a few of them envision remedial action pursuant to the competition rules.6 This is surprising, given that the market for rating services exhibits a range of structural – oligopolistic structure – and behavioral – parallel conduct – features prone to antitrust scrutiny. In addition, the toolbox of antitrust agencies comprises flexible remedies which could be instrumental in regulating the CRA oligopoly.

Against this background, the present paper seeks to explore the possibilities for remedial intervention against the CRAs under the competition rules. To this end, it is divided in six parts. Following this introduction, Part II provides an overview of the credit rating industry. Part III demonstrates that there is a possible economic case for antitrust intervention against the CRAs. Part IV examines the doctrines of competition law that could be applied against CRAs. Part V reviews possible remedies. Part VI provides a conclusion. The below analysis is conducted on the basis of EU competition law. Subject to national legal idiosyncrasies, it applies mutatis mutandis to other competition law regimes.

II. Overview of the Credit rating industry

Definition – CRAs issue ratings to convey information on the ability of a debt issuer to repay its debt.7 Credit ratings help investors overcome the information asymmetry that exists between them and debt issuers. With the publication of specialized, independent and prospective assessments on debt issuers’ creditworthiness, CRAs reduce information costs, increase the pool of potential lenders/borrowers and promote liquidity on markets.8

Market participants – The credit rating industry is a global business controlled by only a few players.9 Whilst one can enumerate approximately 74 CRAs throughout the world, the three major CRAs, namely Moody’s, S&P and Fitch, account for 94% of the global market.10 Moody’s and S&P each hold a 40% market share. Fitch, which became the third important

6

D. Nelson, “EC sees no abuse in CRA actions, but monitors behaviour ‘every day’”, 12.07.2011, M-Lex. See however, Huw Jones, Lawmakers urge competition probe of raters, Reuters, 21.07.2011,

http://uk.reuters.com/article/2011/07/20/uk-raters-idUKTRE76J7R420110720 (about a call from the United Kingdom’s House of Lords' EU economic and financial affairs committee).

7

According to the International Monetary Fund (IMF): “A credit rating measures the relative risk that an entity

or transaction will fail to meet its financial commitments, such as interest payments and repayment of principal, on a timely basis”. See IMF, The uses and abuses of sovereign credit ratings, IMF Global Financial Stability

Report, October 2010, p. 88. 8

Ibidem, p. 86. 9

For a historical account of the evolution of the industry, see B. Cohen and B. G. Carruthers, “Credit, Classification and Cognition: Credit Raters in 19th-Century America”, October 20, 2009, available at

http://ssrn.com/abstract=1525626. 10

player in the early 2000s, is reported to control 15% of the market.11 Moody’s and S&P are US firms.12 Fitch is a majority-owned subsidiary of Fimalac, S.A., a French firm.13

Business model – Since the 1970s, most CRAs subscribe to the so-called “issuer pays” business model. Firms and governments that issue debt – or more precisely the banks that are commissioned to issue securities on their behalf – pay CRAs to rate their credit-worthiness. Ratings are subsequently disclosed to the public for free. In the past, the banks and the money market funds themselves carried out credit worthiness assessments.14 In a bid to cut costs, however, they progressively outsourced most, if not all, of their internal ratings activities to CRAs.

Credit rating grids typically distinguish between two general types of grade, namely “Investment grade” and “Non investment grade” (or “junk bonds”). Each CRA, however, uses a more accurate rating scale. A common feature to all of them is a reliance on a combination of alphanumerical characters to reflect the credit worthiness of debt issuers (see table below). Ratings are determined primarily using a 3-5 year time horizon – at least in case of S&P

Table 1 – Overview of the Credit Ratings Grids of the “Big Three” CRAs15

11

Hence, the expression the “Big Three”. OECD, Competition and Credit Rating Agencies, DAF/COMP(2010)29, 5 October 2010, p. 7.

12

Moody's is controlled by two US financial and investment companies, i.e. Berkshire Hathaway and Davis Selected Advisers. S&P is a division of the publicly traded McGraw-Hill Companies, a group active in the education, media and publication businesses.

13

J. Rega, “The Rating Game”, M-Lex Magazine, July September 2011, 34. Fimalac S.A. is active in financial markets, investments and real estate.

14

Faith in ratings, Wall Street Journal, 23 September 2008. 15

Investors that trade in financial products rely heavily on CRA ratings. Portfolio governance and prudential regulation obligations indeed require investors to hold financial products rated by CRAs.16 As a result, debt issuers have little choice but to request ratings from the CRAs in exchange for a price.17 Moreover, given investors’ constant quest for high quality and independent assessments, debt issuers typically solicit ratings from two or three CRAs.18 CRAs are thus commonly depicted as the “gatekeepers” of financial markets.19

In recent years, the “issuer pays” model has been in the line of fire. A popular analogy compares CRAs to teachers being paid by their students.20 For fear of losing business, CRAs would be reluctant to give poor grades to debt issuers.21 This conflict of interest was arguably at the core of the Subprime and Enron scandals, with junk bonds still assigned investment grades by CRAs days before the crisis began to unravel. That said, moving from the “issuer pays” to an “investor pays” business model appears unworkable in practice. This is because ratings are public goods. Once a rating has been disclosed to an investor, there is nothing – in particular in today’s state of technological development – to do to prevent the subsequent dissemination of the ratings (through the “talk of the town”, the press, leaks from the staff) to other investors. As a result, any investor contemplating to order a rating would eventually be discouraged to do so: (i) for fear that other investors will subsequently acquire the information for free; and (ii) anticipating that he will be able to free-ride on other investors’ rating orders.22

Occasionally, CRAs also issue unsolicited ratings based on publicly available information only. No consideration is provided by the debt issuer for such ratings.23 It is often advanced that CRAs issue unsolicited ratings with a view to increasing their customer base. Debt issuers that have been unwillingly rated might be incentivized to become customers of CRAs, so that their rating is based on more accurate data in the future.

16

OECD, p.57. 17

J. Hunt, “Credit rating agencies and the worldwide credit crisis: the limits of reputation, the insufficiency of reform, and a proposal for improvement”, Columbia Business Law Review, 2009, 1, pp. 109-209.

18

European Securities Markets Expert Group (ESME), The Role of Credit Rating Agencies ESME’s report to

the European Commission, June 2008, p. 3,

http://ec.europa.eu/internal_market/securities/docs/esme/report_040608_en.pdf

19

OECD, p.16. 20

J. Rega, supra. Other analogies can be drawn: the situation of CRAs is comparable to food/drugs safety agencies being remunerated by food and drug manufacturers.

21

On ratings, but also on other activities, such as consultancy services, etc. CRAs occasionally advise on the creation of financial products (e.g. securities), and can thus be reluctant to assign poor grades to products they have helped creating.

22

Current remedial proposals thus include for instance a fine-tuning of the “issuer pays” model or move towards “platform pays” model, where issuers can no longer choose their rating agencies.

23

Finally, CRAs also generate revenue from subscription fees for their publications or from consultancy and advisory services.24 CRAs for instance help debt issuers design financial products.

Regulatory framework – Since many years, the “Big Three” CRAs have enjoyed regulatory protection. In 1975, the US Securities and Exchange Commission (“SEC”) established the “national recognized statistical rating organizations” status (NRSROs), and grandfathered Moody’s, S&P and Fitch into such category.25 By virtue of specific legal requirements, debt issuers and other financial institutions active on US markets had to be rated by NRSROs.26 As a result, CRAs enjoying the NRSROs status became, and still are today, compulsory trading partners for very many US corporations. Similar pieces of legislation have been in force in the EU (such as the Basel II standardized approach for credit assessment).27 Interestingly, the number of appointed NRSROs increased over time.28 In 2010, there were ten NRSROs. That said, Moody’s, S&P and Fitch represent, by and large, the market standards.29

Sovereign debt – CRAs also rate sovereign States. Similarly to corporate ratings, the remuneration of sovereign ratings is not uniform. Not all countries have contractual relationships with the CRAs, and thus pay for ratings.30 In principle, countries pay for the ratings of the specific bonds they issue. But countries normally do not pay for the general, unsolicited ratings which are assigned to them by the CRAs.

Notwithstanding this, sovereign ratings exhibit significant differences from corporate ratings. They are due to the specific features of States in their position as borrowers. On the one hand,

24

Standard & Poor’s for subscribers only publication is The Outlook. It is published on a weekly basis

(http://www.spoutlookonline.com/); Fitch’s monthly publication is the Global Ratings Directory (http://www.fitchratings.com/jsp/corporate/ProductsAndServices.faces?context=2&detail=14); Moody’s issues several publications on a regular basis, most of which are available free of charge (http://www.moodys.com/sites/products/DefaultResearch/2007400000597716.pdf).

25

L. White, “The credit rating industry: an industrial organization analysis”, Prepared for the Conference on “Rating Agencies in the Global Financial System” to be presented at the Stern School of Business, 1 June 2001, 20 April 2011, p. 11 (http://www.antitrustinstitute.org/node/10356).

26

In the EU, CRAs play a similar role. “Based on the Capital Requirement Directive, the Committee of European Banking supervisors (CEBS) has issued non-legally binding guidelines on the recognition of external credit assessment institutions.” J. de Haan and F. Amtenbrink, op. cit.,, p. 7.

27

Patrick Van Roy, “Credit Ratings and the Standardised Approach to Credit Risk in Basel II”, ECB Working

Paper Series, N°517/August 2005.

28

During the 25 years that followed the creation of the NRSROs category, the SEC designated only four additional firms as NRSROs. However, mergers among the entrants and with Fitch caused the number of NRSROs to return to the original three by year-end 2000.

29

L. White, “The Credit Rating Agencies”, Journal of Economic Perspectives, Volume 24, Number 2, Spring 2010, pp. 217 and 222.

30

European Commission, Public Consultation on Credit Rating Agencies, 5 November 2010 p. 14 (http://ec.europa.eu/internal_market/consultations/docs/2010/cra/cpaper_en.pdf).

unlike firms, States cannot go bankrupt. States benefit from a monopoly on the legitimate use of violence and can thus coerce citizens to pay taxes.31 This makes sovereign debt a safe investment. On the other hand, unlike firms, States cannot be coerced to pay their debts (unless war is waged). Knowing this, States might just be unwilling to pay their debts. This makes sovereign debt a risky investment.

Against this background, the methodology employed to rate sovereign debt cannot be confined to a quantitative review of States’ finances. It must also embrace their willingness to pay.32 CRAs thus scrutinize a range of additional qualitative factors such as the State’s institutional strength, political stability, fiscal and monetary flexibility and economic vitality.33 This methodological peculiarity is the main distinctive feature between sovereign and corporate ratings.

III. The Case for Antitrust Intervention

A variety of specific regulatory remedies have been discussed to address the risks of errors, “cliff effects” and financial instability arising from CRAs’ sometimes ominous predictions. In contrast, policy makers have expressed little interest in antitrust intervention, although many of them have apportioned blame to the weak degree of competition that prevails in the industry. This section shows that there is a case to be made for antitrust intervention in the credit rating industry. First, CRAs exhibit prima facie features of significant market power (“SMP”), which is the main target of antitrust policy (A). Second, antitrust intervention has a number of intrinsic advantages over other remedial routes, and can tackle several issues which sector specific regulatory proposals fail to address (B).

A. The Prima Facie Features of Significant Market Power

1. Significant Market Power, Information Goods and Reputational Damage

Antitrust law combats SMP. Firms holding SMP (“SMP firms”) can profitably set prices at levels that significantly exceed costs. As a result, those customers whose reservation price is (i) inferior to the SMP firm’s price; (ii) and superior to the SMP firm’s costs are not served.

31

M. Weber, Politics as Vocation, in the Vocation Lectures, Hackett Publishing, 2004, who defines the State as “a human community that successfully claims the monopoly of the legitimate use of physical force within a given

territory”. In addition, in the globalized XXIth century economy, many States have become “too big to fail”

and a country’s default represents a great systemic risk for other States. Hence, government and international institutions are implicitly bound to rescue States on the brink of bankruptcy.

32

This factor reflects the risk of State default if the social/political cost of tax increases is too heavy. 33

Those factors lead CRAs to also hire groups of political scientists in addition to the usual teams of analysts. Moreover, it ought to be noted that a country’s debt repayment track record is an important indicator of willingness to pay. J. de Haan and F. Amtenbrink, op. cit., p. 10.

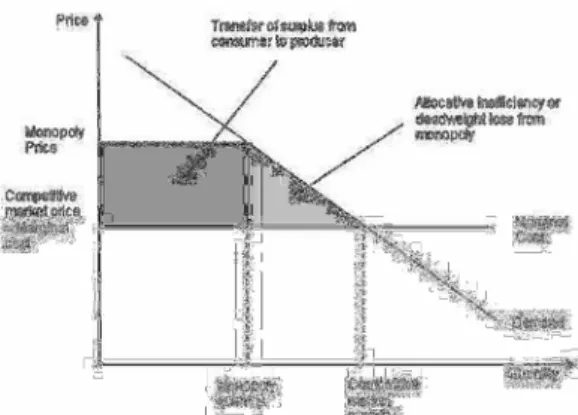

This is a problem because the SMP firm could render the share of demand that is not served better-off without itself being worse-off (i.e. make a loss).34 Hence, SMP firms may inflict allocative inefficiency on society – a situation referred to as a “deadweight loss” (see grey triangle below) – and thus represents a grave threat to economic welfare, and in particular consumer welfare.

SMP is often associated with situations of entrenched monopoly positions or of secret, organized conspiracies (e.g. cartels). Economists consider, however, that SMP can arise out of such polarised situations, particularly in situations of narrow oligopoly protected by barriers to entry/expansion. In certain concentrated markets, oligopolists can raise prices, simply because customers cannot sanction them by diverting orders towards other players.

Figure 1 – The allocative inefficiency of SMP

Besides the textbook depiction of SMP as the ability to engage in above-cost pricing, competition economists consider that SMP can take a variety of forms, such as output reductions, limitations in innovation and advertisement expenditures, deterioration of product/service quality, etc.35 Since the early 20th century, a plethora of economic studies have attempted to represent the multifaceted dynamics of competition and market power across industries.

With this background in mind, the economic literature on “information goods” provides a suitable framework for analyzing competition and market power in the credit rating industry. Put simply, an information good is a commodity whose main value is derived from the

34

Given that those firms can freely increase their profits through price hikes, they have little, if any, incentives to cut costs (productive inefficiency) or to innovate (dynamic inefficiency) to attract new customers.

35

P. Hofer and M. Williams, “Minding Your Ps and Qs : Moving Beyond Conventional Theory to Capture the Non Price Dimensions of Market Competition”, in L. Wu (Ed.), Economics of Antitrust: Complex Issues in a Dynamic Economy, NERA Economic Consulting (2007).

information it contains (e.g. press, software, books, etc.).36 Credit ratings fall squarely within such category of good: they convey information on the creditworthiness of issuers of financial products.

Importantly, information goods respond to specific competitive dynamics. First, on information markets, price is not the sole driver of competition. Suppliers compete almost equally, if not more, on the qualitative features of the information (e.g. accuracy, veracity, timeliness, etc.). And in the credit rating industry, market players compete predominantly on the accuracy of their valuations. As one observer puts it: “What investors want is forecast accuracy. At present they have no simple or straightforward way of doing that, (though large investors might do so by comparing the historical records of each of the large CRAs).”37

Second, information goods are experience goods. Customers cannot assess from the outset their ability to satisfy demand needs (textbook examples of experience goods include legal services, computer programmes, books, etc.).38 Hence, customers’ orders are often guided by reputation on those markets. According to many observers, this reputational feature is of particular relevance in the credit rating industry. S&P has been reported to claim that ‘‘reputation is more important than revenues’’.39

Forecast accuracy and reputation thus drive competition in the credit rating industry. In a hypothetically competitive industry, high forecast accuracy should build a good reputation (amongst investors) which in turn should grow market share (with issuers). By parity of reasoning, poor forecast accuracy should lead to reputational damage (amongst investors) which should eventually translate into loss of market share (with issuers) and possibly lead to market exit.40 In this sense, the CRA industry is a typical example of a “two-sided market”,

36

C. Shapiro and H. Varian, Information Rules, Harvard Business School Press, Boston, Massachusetts, 1999 seem to define information goods as “anything that can be digitized” and that is made the object of economic transactions (p.3).

37

C. Goodhart, “How, if at all, should Credit Ratings Agencies (CRAs) be Regulated?”, LSE Financial Markets

Group Paper Series, special paper 181, June 2008, p. 32

http://www2.lse.ac.uk/fmg/documents/specialPapers/2008/sp181.pdf. Adding that “So most investors fall back

on reliance on brand names, which reinforces oligopoly”.

38

OECD, p.7: “credit ratings are experience goods i.e. the quality of the rating is only revealed ex-post using a

large sample. Simply because a default does not occur it does not mean that a good rating should be given. Therefore reputation for quality built on a long track record is the crucial competitive advantage”.

39

See B. Becker and T. Milbourn, op. cit. and their references p. 5 (quoting also former executive vice president of Moody’s Thomas McGuire: ‘‘what’s driving us is primarily the issue of preserving our track record. That’s

our bread and butter’’).

40

The demise of the big auditing firm Arthur Andersen in the wake of the Enron bankruptcy in 2002 provides a very good illustration of this.

where reputation on one side of the market (investors) drives sales on the other side of the market (issuers).41

Now, in an industry subject to SMP, the virtuous circle of competition is broken. A CRA’s inability to provide accuracy in its forecasts, and the ensuing reputational damage it causes amongst investors does not translate into lower sales to issuers. This is because absent competition from actual or potential competitors, issuers have nowhere to divert ratings orders.

As will be seen below, there are grounds to believe that the credit rating industry is susceptible to situations of SMP.42 Beyond classic structural factors such as market concentration and barriers to entry/expansion, its track record in terms of ratings accuracy and reputational damage is consistent with the existence of SMP.

2. The Structural Features of SMP: Market Concentration and Entry Barriers

Several structural features of the credit rating industry support a suspicion of SMP. To start with, the credit rating industry is often described as a “shared”, “narrow” oligopoly.43 Market concentration is extremely high. Moody’s and S&P are reported to hold 80% of the market.44 Fitch has a market share of approximately 15%. With this, the Herfindahl-Hirschmann Index (“HHI”) lies at around 3400, a level which generally triggers the interest of competition authorities.45 Of course, those figures fail to reflect the existence of 74 CRAs across the world. However, most of those CRAs are not active on a global scale or simply rate specific products. Moody’s, S&P and Fitch are the sole global, multi-service CRAs.46

41

A two-sided market can be defined as an economic platform that has two distinct groups of user that provide one other with network benefits (e.g. payment card systems).

42

Subject to the various informational caveats that should apply to any verification of the existence of SMP. 43

OECD. pp.14 and 39. 44

OECD. p.12. 45

Assuming that one firm holds the remaining 5%, the upper bound of the HHI is 402 + 402 + 152 + 52= 3450. Assuming that 5 firms hold respectively 1% of the remaining 5%, the lower bound of the HHI 402 + 402 + 152 + 12 + 12 + 12 + 12 + 12 = 3430.

46

They have a uniquely broad product coverage, which makes them a priority point of reference for investors. See IMF, Box 3.1.

Reputation amongst investors

Sales achieved with issuers Forecast accuracy

Interestingly, some observers have even used the notion of “partner monopoly” to describe the CRAs’ market position.47 Since many issuers solicit two (or more) ratings, each of the “big three” CRAs often serves the entire market. Hence, the credit rating industry would comprise a series of partner, or adjacent, monopolies. In the words of economists, the ratings provided by the “big three” CRAs would not be substitutes for one another from the viewpoint of issuers. In this sense, issuers are in the same position as sellers of other services (e.g. hotels, restaurants, music artists, etc.) who seek to be referenced and rated in all available guides, directories, journals, etc. (e.g. gastronomic guides, tourist guides, music magazines, etc.).

Second, the credit rating industry is characterized by high barriers to entry/expansion. Those obstacles to entry/expansion have been abundantly documented in the economic literature and it would be beyond the scope of this paper to discuss them here. Without wading into too much detail, there are five types of barrier to entry/expansion that protect the “big three” from competition: (i) informational expertise, including the incumbent CRAs’ control over a wealth of strategic information on issuers, and the time needed for prospective entrants to acquire such information;48 (ii) brand loyalty towards incumbent CRAs in a market where experience matters;49 (iii) transaction costs savings achieved by issuers in dealing only with a few CRAs;50 (iv) investors’ cognitive limits, including their unwillingness to spend large resources to understand, interpret and compare many different rating standards; 51 and (v) regulatory obstacles in the US, Europe and Japan where only a limited number of CRAs (respectively 10, 4 and 5) are officially recognized as credit assessment institutions.52

47

V. Padelli, “A Cerberus stands at the Doors of the Financial System: a New Challenge for the Regulation Authorities”, mimeo, p.11.

48

IMF, p. 98 49

L. White, “The Credit Rating Agencies”, op. cit., p. 217. The market for credit analyses is one “where

potential barriers to entry like economies of scale, the advantages of experience, and brand name reputation are important features”.

50

K. Lannoo, op. cit., p. 2 “Rating agencies provide this information and thus provide huge savings in

transaction costs. However, not many ratings agencies can exist, as transaction savings would disappear”;

OECD, p. 7. “Corporate issuers build a trust relationship with one or two CRAs but are unwilling to be rated by

more. However building this relationship involves valuable executive management time”.

51

K. Lannoo, op. cit., p. 2: investors themselves might have some preference for a concentrated market because if “dozens of ratings agencies were active, market participants and policy-makers might fund many ratings for

each borrower and this would make it also difficult for borrowers to provide a clear signal to the market about their creditworthiness”. OECD, p.7: “Investors value comparability and consistency of ratings across geographical segments and instruments. Ratings from a given CRA provide a common standard to interpret risk. Investors are unwilling to spend large resources to interpret many different standards, all else equal, the larger the “ installed base” of ratings from a given CRA, the greater the value to investors”.

52

See IMF, 2010, Box 3.1. In addition, until 2006 in the US, the criteria used by the Securities and Exchange Commission (SEC) to designate new NRSROs remained opaque, and has thus possibly discouraged entry. L. White, “The Credit Rating Agencies”, op. cit., p. 217: “in creating the NRSRO designation, the Securities and

To a certain extent, the growth of Fitch as a third force in the early 2000s undermines somewhat the view that there are high barriers to entry on the market. However, it ought to be noted that (i) it took decades for Fitch to achieve its market position; (ii) Fitch is primarily perceived as a fringe player by investors;53 and (iii) in the recent financial crisis, Fitch has been the most seriously impacted CRA, which suggests that its market position remains quite fragile.54

3. The Behavioral Performance of SMP: Poor Rating Quality and Ineffective Reputational Discipline

The performance of the credit rating industry in recent years is also consistent with the distinguishing features of SMP. As explained previously, the forces that shape competition in the credit rating industry are closely linked with ratings accuracy and reputational issues.55 In a competitive industry, CRAs are supposed to fight for market share on the basis of ratings accuracy and reputation. CRAs strive to avoid ratings errors that undermine reputation, and trigger retaliation from customers who relocate rating orders to actual or potential competitors, sponsor entry or – although less probable – vertically integrate to internalize the ratings function. In contrast, in an industry subject to SMP, CRAs that make rating errors and

Exchange Commission had become a significant barrier to entry into the bond rating business in its own right. Without the benefit of the NRSRO designation, any would-be bond rater would likely remain small-scale. New rating firms would risk being ignored by most financial institutions (the “buy side” of the bond markets); and since the financial institutions would ignore the would-be bond rater, so would bond issuers (the “sell side” of the markets).” See also p.222: “In early 2003 the SEC designated a fourth “nationally recognized statistical rating organization”: Dominion Bond Rating Services, a Canadian credit rating firm. In early 2005 the SEC designated a fifth NRSRO: A.M. Best, an insurance company rating specialist. The SEC’s procedures remained opaque, however, and there were still no announced criteria for the designation of a NRSRO. Tiring of this situation, Congress passed the Credit Rating Agency Reform Act, which was signed into law in September 2006. The Act instructed the SEC to cease being a barrier to entry, specified the criteria that the SEC should use in designating new “nationally recognized statistical rating organizations,” insisted on transparency and due process in these SEC’s decisions, and provided the SEC with limited powers to oversee the incumbent NRSROs—but specifically forbade the SEC from influencing the ratings or the business models of the NRSROs”.

53

Bongaerts, D.G.J., Cremers, K.J.M. & Goetzmann, W.N. (2011). Tiebreaker: Certification and Multiple Credit Ratings. The Journal of Finance, forthcoming (reporting that Fitch plays the role of a “tie breaker” for investors when S&P and Moody’s achieve inconsistent ratings).

54

OECD, p.12. 55

For years, the threat of reputational damage has been perceived as a reliable disciplinary mechanism in the credit rating industry. The basic idea was then that “agencies have an overriding incentive to maintain a

reputation for high-quality, accurate ratings. If investors were to lose confidence in an agency’s ratings, issuers would no longer believe they could lower their funding costs by obtaining its ratings. As one industry observer as put it, “every time a rating is established, the agency’s name, integrity, and credibility are on the line and subject to inspection by the whole investment community””. Quite ironically, the comment then concluded:

“Over the years, the discipline provided by reputational considerations appears to have been effective, with no

major scandals in the ratings industry”. R. Cantor and F. Packer, “The Credit Rating Industry”, FRBNY

Quarterly Review, Summer-Fall 1994, p. 4. A similar view has been expressed by J. Coffee: “These

professionals develop “reputational capital” over many years and many clients that leads investors to rely on them, in part because investors know that the gatekeeper will suffer a serious reputational injury if it is associated with a fraud or unexpected insolvency”. J. Coffee, Testimony Before the Senate Banking Committee

On September 26, 2007 “The Role and Impact Of Credit Rating Agencies on the Subprime Credit Markets”, p. 1.

endure reputational losses face, however, no retaliation from customers and end up maintaining their market position and profits.56 In our model, CRAs can commit type I (unjustified downgrading or underrating) and/or type II (unjustified upgrading or overrating) ratings errors.

Against this background, the history of the credit rating industry provides some empirical evidence of SMP.57 With hindsight, the “big three” CRAs systematically failed to forecast, or underestimated, the severe financial events that have damaged the global economy over the past fifteen years.58 CRAs did not foresee the Asian crisis in 1997.59 They also failed to predict the high-profile corporate failures of Enron, WorldCom and Global Crossing.60 More recently, the CRAs still assigned an A rating to Lehman Brothers only a month before its collapse.61 And just days before the Subprime crisis unraveled, a large number of financial products which are now rated “junk” enjoyed the highest investment rates in the ratings of the various CRAs (see figure 2 hereafter).62

56

In the conventional SMP model described above, a firm could be said to hold SMP if, failing to satisfy market demand, it nonetheless achieved supra-competitive profits. Now, if we transpose this to the credit rating industry – where demand satisfaction is quality-driven rather than price-driven – a SMP situation should be deemed to arise when despite ratings errors and reputational losses, a CRA faces no change in its market position and profits.

57

Given the lack of data, we cannot review here the consequences of the recent, serious error of S&P, which decided to downgrade the US government rating despite a $2 trillion error.

58

In addition, CRAs have also been criticized for responding with a considerable time lag, i.e. ratings were not immediately downgraded once the problems in the sub-prime market became clear.

59

The CRAs later exacerbated the crisis when they downgraded the countries in the midst of the financial turmoil. Bank of England, p.8 (and references).

60

P. Deb, M. Manning, G. Murphy, A. Penalver and A. Toth, Whither the credit rating industry?, Financial Stability Paper No. 9 – March 2011, Bank of England, p.8 (and references). Enron was still rated investment grade until four days before it declared bankruptcy. Similarly, both WorldCom and Global Crossing were still rated investment grade not long before their respective failures.

61

A. J. Bahena, “What Role Did Credit Rating Agencies Play in the Credit Crisis?”, mimeo March 2010. 62

IMF, 2010, Figure 3.1.: over three quarters of all private-label residential mortgage backed securities issued in the United States from 2005 to 2007 that were rated AAA by S&P are now rated below BBB-, that is, below investment grade.

Figure 2 – 2010 rating of former AAA-rated mortgage backed securities

Without doubt, such type II errors inflicted reputational harm on the CRAs.63 Yet, unlike in a competitive market, they were without real consequences. Despite the Internet Bubble, Enron‘s bankruptcy and the Subprime crisis, the “big three” CRAs have maintained very significant and symmetrical market shares.64 Industry structure has remained stable, with little, if no, entry attempts. Finally, the “big three” CRAs have maintained large profits despite a small decline following the Subprime crisis in 2007 (see figure 3 hereafter).65

63

For instance, observers report that the stock price of Moody’s reacts negatively to rating actions that are perceived to indicate low rating quality . G. Löffler, “Can Market Discipline Work in the Case of Rating Agencies? Some Lessons from Moody’s Stock Price”, University of Ulm, October 2009, p. 19.

64

In relative terms, the various CRAs have achieved similar profits throughout the years, which indicate that market positions have remained very stable. See figure2.

65

Figure taken from P. Deb, M. Manning, G. Murphy, A. Penalver and A. Toth, op. cit. Forecasts also suggest that the “big three” CRAs’ profits should increase in upcoming years. See A. van Duyn, Rating agencies bullish on year ahead, Financial Times, 03.02.2011.

Figure 3 – CRAs profits66

Empirical evidence thus suggests that the reputational harm mechanism which should discipline CRAs in the event of ratings errors is ineffective.67 In our opinion, the key explanatory factor for this lies in the existence of SMP, and in the weak degree of competition that prevails on the market.68 Given the close identity of the “big three” CRAs’ ratings, as well as the need to rely on 2 or 3 ratings, it is futile for disgruntled users (investors and issuers) to threaten to divert ratings orders from one CRA to the other. Moreover, disgruntled users cannot threaten to sponsor new entrants or to vertically integrate in light of the high barriers to entry discussed above. Insulated from competition, CRAs can make senseless predictions without ever being sanctioned by users, who are wholly captive of their evaluations. In summary, the “big three” CRAs enjoy a classic “situational rent”, which is the paradigmatic example of SMP.

4. Alternative Theories

A number of studies have a different reading of the functioning of the credit rating industry. We review them in turn hereafter.

4.1. Ineffective Rules on Civil Liability generate Ratings Negligence

The view often holds sway that the problem of the credit rating industry does not originate in a lack of competition, but rather in the fact that CRAs are immune to civil (or criminal) liability in the event of rating errors.69 Insulated from such constraint, CRAs’ have little incentive to act with restraint and caution in their ratings.70

66

Source, P. Deb, M. Manning, G. Murphy, A. Penalver and A. Toth, supra p.8. 67

J. de Haan and F. Amtenbrink, op. cit., p.8. Many commentators share the view that the reputational mechanism currently fails to play its role: “it may be argued that CRAs must safeguard their credibility with

investors as their ratings would otherwise be of no value in the market. In this perspective CRAs must balance any short-term gain from satisfying the issuer with its long-run reputation in the market. Yet, it is doubtful whether the potential loss of reputation sufficiently restrains CRAs and can indeed function as an effective form of sanction.

68

Other observers agree that a lack of competition is the key factor preventing reputation from producing any kind of constraining effect on CRAs. See S. Utzig, “The Financial Crisis and the Regulation of Credit Rating Agencies: A European Banking Perspective”, ADBI Working Paper Series No. 188, January 2010, p. 6

“Self-regulation does not work effectively when the pressure of reputation as a controlling power exists only to a limited degree due to a lack of competition”. U. Blaubrock, “Control and Responsibility of Credit Rating

Agencies”, Electronic Journal of Comparative Law, December, vol. 11.3, 2007, p. 6 (http://www.ejcl.org) (“the

dominant agencies do not have to fear any significant qualitative cut-throat competition, with the consequence that the temptation exists to keep their resource input down.”).

69

F. Partnoy, “How and Why Credit Rating Agencies Are Not Like Other Gatekeepers”, Legal Studies Research Paper Series, Research Paper No. 07-46, May 2006, p. 61. Like the media, CRAs have long been protected from litigation for their opinions and analyses (except where a voluntary fraud could be evidenced). The Dodd-Frank Act passed in 2010 aimed at redressing this litigation privilege. Dodd–Frank Wall Street Reform and Consumer Protection Act, Pub.L. 111-203, H.R. 4173, SEC. 933; D. Martin and M. Franker, “Dodd-Frank Issue Brief: Requirements Affecting Credit Rating Agencies”, Council of Institutional Investors, April 2011, p. 2,

This, however, does not mean that there is no SMP. Rather, the lack of effective liability for rating errors further exacerbates the competition problem outlined above. In the credit rating industry, disgruntled users are deprived of both the economic – i.e. competition – and legal – i.e. civil liability proceedings – retaliation mechanisms available on most markets.

As things stand, at any rate, stronger liability rules are unlikely to ever alter the incentive structure of CRAs. In most jurisdictions, civil (or criminal) liability only kicks in at a certain threshold of negligence or willful misconduct. Hence, stronger liability rules can correct little but the crudest rating errors, and are wholly ineffective in eradicating less blatant mistakes (rating inaccuracies, inexpediencies, etc.). Moreover, CRAs’ immunity from civil (or criminal liability) is often justified on the ground of the right to free speech, which is protected by constitutional statutes.71

4.2. Competitive Entry degrades Ratings Quality

Overview of the Literature – Several economists make the counter-intuitive point that increasing competition in the credit rating industry is undesirable. BECKER and MILBOURN adduce empirical evidence that the entry of Fitch on the market caused a decrease in ratings quality through “ratings inflation” (upgrading of rated securities without any apparent justification).72 To explain this puzzling finding, the authors claim that the jolt of competition instilled by the entry of Fitch reduced the profitability prospects of incumbent CRAs. With weaker profitability forecasts, incumbent CRAs thus reduced investments in costly short term reputational activities, i.e. the production of high quality information (an “incentive to invest” problem).73 Alternatively, the authors argue,

perhaps more convincingly,

(

http://cii.org/UserFiles/file/resource%20center/publications/Dodd-Frank%20-%20Requirements%20Affecting%20CRAs.pdf). However, the current Republican majority is working on a Bill which would reinstate the prior legal regime. K. DRAWBAUGH, “Challenges to Dodd-Frank surface in Congress”, Reuters, 15 March 2011 ( http://www.reuters.com/article/2011/03/15/us-financial-regulation-debit-idUSTRE7273T120110315). In Europe, see European Commission, Public Consultation on Credit Rating Agencies, op. cit., p. 24. In the EU, work is currently under way to study whether it is necessary to introduce a civil liability regime to ensure that CRAs are liable for the damage caused by ratings errors. At the national level only one Member State has recently introduced a specific civil liability regime for CRAs: “In other Member

States there is ongoing discussion whether CRAs could be held liable vis a vis investors and in a third group of Member States civil liability of CRAs towards investors seems to be legally impossible”. More fundamentally

however, the culture of private enforcement is less widespread in the EU. Hence, the constraint that would be exercised by civil liability rules in the EU would probably be less effective than in the US.

70

OECD, p.16. 71

Under the First Amendment of the US constitution and Article 11 of the Charter of Fundamental Rights of the EU. Several rulings have actually accepted the idea that the CRA business is financial publishing and have validated the argument. Idem, p. 66.

72

B. Becker and T. Milbourn, “How did increased competition affect credit ratings ?”, Journal of Financial

Economics, 2011, forthcoming.

73

However, no quantitative evidence is advanced in support of this speculation (for instance, on investments in information), and the thesis rests on the wholly disputable theoretical assumption that reputational losses are of

that in line with increased competition, incumbent firms have sought to secure their customer base, and have thus increased their ratings to reflect issuers’ preferences rather than genuine credit quality (a “revenue bias” problem).74

BONGAERTS et. al. also rely on econometrics to show that the introduction of Fitch on the market has neither improved the quality of information nor reduced uncertainty. Rather, firms primarily use Fitch ratings to bypass the negative effects of regulatory requirements when their financial product has been rated by S&P and Moody’s at opposite sides of the investment grade boundary, and might as a result not be admissible for trading with certain financial institutions (a “certification” problem).

Finally, BOLTON et al. argue formally that a monopoly is preferable to a duopoly in the credit rating industry.75 This is because a duopoly provides more opportunities for the issuer to shop around and mislead trusting investors (a “ratings shopping” problem). This latter finding, however, has been discarded by recent studies, which show that ratings shopping does not happen where ratings are unsolicited and financial information is publicly available (for instance, in the market for corporate bonds).76 The ratings shopping hypothesis is thus only relevant in a subset of markets.77

Critical Assessment – On many counts, the above studies are marred by shortcomings.78 To name but a few, rather than devising ratings quality criteria, they rely on crude and imperfect proxies.79 Also, the representativeness of their findings is questionable,80 in particular because they do not deal with “ratings deflation” which is the new paradigm of the credit

lesser concern when there is competition. Alternative research suggests that several forces are at play, acting in diametrically opposed directions. “In fact, depending on parameters, ratings quality can be higher either under

monopoly or duopoly”. “Intuitively, the value of milking a reputation for current returns is higher for a

monopolist. This is a force that suggests that the monopolist would produce lower quality ratings. On the other hand, the value of maintaining reputation to gain future rewards is also higher for a monopolist, suggesting that a duopolist produces higher quality ratings”. H. Bar-Isaac and J. Shapiro, “Ratings Quality over the Business Cycle”, April 2010, pp. 20-21 (http://pages.stern.nyu.edu/~hbar-isa/HBJS_CRAcycle.pdf)

74

B. Becker and T. Milbourn, op. cit. 75

P. Bolton, X. Freixas, and J. Shapiro, 2008, “The Credit Rating Game” unpublished manuscript, p.38. In turn, rating shopping decreases the quality of ratings, through ratings inflation. V. Skreta and L. Veldkamp, 2009. “Ratings shopping and asset complexity: A theory of ratings inflation”, Journal of Monetary Economics, Elsevier, vol. 56(5), pages 678-695, July.

76

C. Spatt, “Discussion of ‘Ratings Shopping and Asset Complexity: A Theory of Ratings Inflation’”, (2009) Journal of Monetary Economics 56, 696-699; Beckers and Milbourn, op. cit., pp.8 and 9; Bongaerts, Cremers and Goetzmann confirm this empirically.

77

For instance, in structured products markets. 78

For instance, one cannot rule out collusion, tacit or explicit, between the three players on “ratings inflation”. 79

Those studies use ratings inflation and indexation with bond prices as proxies for ratings quality. However, they fail to reflect on the substance of what makes a “good” rating for investors: expediency, consistency across rated instruments, etc.

80

rating industry.81 Finally, those studies test an entry scenario with n+1 firms, but provide no guidance on an entry scenario with n +2; n + 3; and so on.

More fundamentally, the above theories are somewhat confusing. In fact, their authors argue in parallel that competition must generally be strengthened, and entry promoted, because it reduces oligopolistic rents and adds information on financial markets.82

Those conflicting pronouncements can nonetheless be reconciled. On close examination, what the above studies stress is that whilst competitive entry is a genuinely good thing, several industry-specific practices/regulations sabotage its welfare-enhancing effects and trigger inefficiency. PAGANO and VOLPIN provide ample evidence of this:83 the revenue bias problem arises primarily from the fact that CRAs are paid by issuers;84 the certification problem stems from regulatory instruments, which overly rely on credit ratings; the ratings shopping problem is caused by the fact that issuers need not disclose all their ratings, and can thus conceal poor ratings until they obtain a better one.

On top of this, the complexity of financial products, the protection of CRAs as official credit assessment institutions, and the lack of expertise of investors also contribute to ratings inflation dynamics.85

Public Policy Implications – In our opinion, the above works confirm that there is a competition problem in the credit ratings sector: the industry exhibits features which distort competition, in turning market entry – an efficient, good thing – into an inefficient and negative thing.86

81

Does the current cycle of “ratings deflation” corroborate or invalidate their findings? Also, is “ratings

deflation” a sign of high or low ratings quality under competition?

82

See IMF, p.98; Beckers and Milbourn, op. cit., p.10. According to the EU Commission, one of the main reasons for public authority intervention is to “increase competition in the rating market and increase the

number of ratings per instrument so that users of ratings will be able to rely on more than one rating for the same instrument”. Proposal for a Regulation of the European Parliament and of the Council on amending

Regulation (EC) No 1060/2009 on credit rating agencies {SEC(2010) 678} {SEC(2010) 679} /* COM/2010/0289 final - COD 2010/0160 */, point 4.3.2. On information wealth, one may also consider that if competition leads to lesser “vertical” investment from each CRA in information, it may be counterbalanced by a higher level of “horizontal” investment of all the CRAs in information.

83

M. Pagano and P. Volpin, “Credit Ratings Failures and Policy Options”, mimeo, October 2009. 84

This problem is further aggravated by the fact that issuers do not pay CRAs upfront for their rating, but rather payment is contingent on the content of the report.

85

V. Skreta and L. Veldkamp, op. cit.. M. Pagano and P. Volpin, op. cit., p.9. 86

The IMF said just this when it stated that “looking ahead, enhanced competition would be welcome, with a few

caveats […] measures should be taken to discourage such rating shopping, including requiring disclosure about any preliminary ratings.” IMF, p.98.

This implies that specific measures must complement possible interventions seeking to promote market entry (e.g. creation of new CRAs, be they public or private).87 In this context, because competition rules regulate business models that give rise to anticompetitive effects, it is not foolish to rely on such rules to address those market practices, such as the “issuer-pays” model, that prevent competitive entry from delivering efficiency. In parallel, sector specific measures can be targeted at regulatory frameworks which subvert the positive effects of entry.

To conclude, those that claim that competition is undesirable in the credit rating industry make a basic causation mistake, which is akin to prohibiting unfit, overweight persons from jogging, simply because it risks inflicting on them joint pain and other minor physical trauma. Jogging is good, but it only has health-improvement effects if carried out under a tailor-made training programme, complemented by suitable equipment and diet.

5. Conclusion

The credit rating industry displays symptoms of SMP. The three factors of “substantial market power” (also referred to as a “dominant position”) underlined in the Commission’s Guidance Communication on Article 102 of the Treaty on the Functioning of the EU (“TFEU”), are manifestly present: (i) large market position of incumbent firms; (ii) barriers to entry and expansion; (iii) lack of countervailing power.88 There is thus a patent competition problem in the credit rating industry. This problem is further compounded by the fact that several industry-specific features upset the efficiency-enhancing effects of competitive entry. At least conceptually, it is thus justified to rely on the competition rules to investigate the credit rating industry and, as the case may be, envision remedial intervention.

B. Antitrust Intervention v. Sector Specific Regulation? 1. Background

The CRAs’ repeated ratings errors, and their possible contribution to the exacerbation of market difficulties, are no longer disputed. There is today a broad consensus amongst stakeholders that something must be done to fix the market failures that beset the credit rating

87

Idem: “Enhanced competition would need to be combined with tougher measures against rating shopping”. 88

See Guidance Communication on the Commission’s enforcement Priorities in Applying Article 82 of the EC Treaty to Abusive Exclusionary Conduct by Dominant Undertakings, C(2009) 864 final, para. 12 and following.

industry.89 The question remains open however whether this should be done under sector specific regulatory instruments and/or under the competition rules. As explained previously, there is a good case for intervention under both sets of instruments.

In recent years, experts from all sides have toiled with devising sector specific regulatory proposals in relation to conflicts of interest (the flaws of the “issuer-pays” model), cliff-effects arising from portfolio governance and prudential regulations, transparency on rating procedures and methodologies, rules on official recognition as credit rating institutions, oversight ineffectiveness, civil liability regimes, etc.90

In contrast, however, stakeholders have been remarkably shy when it comes to antitrust intervention.91 Beyond high-level policy calls to dissolve the credit ratings oligopoly,92 very few competition-related remedies have been discussed. This is all the more unfortunate, given the intrinsic limits of regulatory approaches (2) and the comparative merits of competition enforcement (3).

2. The Intrinsic Limits of Sector-Specific Regulatory Remedies

Regulatory initiatives are fraught with effectiveness (a) and process (b) limitations. a). Effectiveness Issues

The adoption of sector-specific regulatory instruments may have unintended anticompetitive consequences. New regulatory obligations on CRAs may further shield existing market players from external competition, through the introduction of legal barriers to entry on prospective firms (e.g. search, advice and compliance costs).93

89

Although there are divergences in terms of approaches. Industry participants and sector-specific regulators seem, on the one hand, to support self regulation. On the other hand, policy representatives have voiced support for ambitious reforms which would lead to the adoption of mandatory sector specific regulatory instruments. 90

Over the last few years, numerous proposals have been made to adapt the regulatory framework for CRAs. Several improvements have been introduced in EU Regulation 1060/2009 and the US Dodd-Frank Act which introduce provisions regarding the registration of CRAs, conflict of interests, transparency. Regulation No 1060/2009, 16 September 2009 on credit rating agencies, OJ, 17 November 2009, L 302/1.

91

Whilst also recognizing that the lack of competition in the credit rating industry is a problematic issue. See IMF: “the significant increase over time in references to credit ratings in rules and regulations, combined with

limited competition, has affected the business model of CRAs by creating a more or less “guaranteed market” with few incentives to compete on the basis of rating quality”, p.94. “Looking ahead, enhanced competition would be welcome, although there are a few caveats”, p.98.

92

Commissioner Reding is reported to have supported “dismantl[ing] the rating agencies”. Attempts to achieve dissolution can take very many forms, through the dismantlement of the existing oligopoly into smaller pieces, or with the setting up of new agencies, be they public or private. A number of Member States (Poland, Germany) as well as the EU internal market Commissioner support the creation of an EU public agency.

93

K. Lannoo, Credit Rating Agencies. Scapegoat or free-riders ? ECMI Commentary No. 20/9, October 2008, p. 3: warning that: “Functional regulation for a sector that is as specific as rating agencies could lead to

undesirable side effects. It has been argued that it further strengthens the quasi-statutory role of these bodies, which may reduce their alertness. It reinforces the barriers to entry whereas the opposite should be done”.

But this is not all. Insofar as internal competition amongst the big three is concerned, new regulatory obligations may further chill competition through a deterioration of the oligopolists’ cost structure (e.g. compliance costs). More importantly, efforts to regulate rating procedures and methodologies may restrict flexibility and innovation in the assessment of information, and in turn reduce competition94

Finally, softer approaches which promote self-regulation, best practices and industry standards are ill-suited to solve competition issues. After all, when industry players agree to abide by common standards, they voluntarily reduce the scope for competition on the market. Competition specialists know all too well that beyond the anticompetitive effects of standardization processes, such collaboration creates opportunities for market players to meet and exchange sensitive information or to implement subtle boycott strategies. This is certainly a sensible consideration to bear in mind, given the strong stakeholder support for self-regulation in current policy debates. 95

b). Process Issues

The adoption of sector-specific regulatory instruments is subject to a major procedural downside. In the EU, regulatory reforms undergo a burdensome decision-making process where the various EU institutions each have a say. As a result, the passing of Directives or

94

L. White, “The Credit Rating Agencies”, op. cit., p. 223: “Regulatory efforts to fix problems, by prescribing

specified structures and processes, unavoidably restrict flexibility, raise costs, and discourage entry and innovation in the development and assessment of information for judging the creditworthiness of bonds. Ironically, such efforts are likely to increase the importance of the three large incumbent rating agencies.”

95

According to the Committee of European Securities Regulators (CESR) created by decision of the European Commission, the credit rating market should be ruled by industry standards more than by regulation: “CESR and

market participants believe that there is no evidence that regulation of the credit rating industry would have had an effect on the issues which emerged with ratings of US subprime backed securities and hence continues to support market driven improvement. (…) CESR therefore urges the Commission as an immediate step to form an international CRAs standard setting and monitoring body to develop and monitor compliance with international standards in line with the steps taken by IOSCO.” Committee of European Securities Regulators (CESR),

CESR’s Second Report to the European Commission on the compliance of credit rating agencies with the IOSCO Code and The role of credit rating agencies in structured finance, CESR/08-277, May 2008, p.3,

http://www.cmvm.pt/CMVM/Cooperacao%20Internacional/Docs_ESMA_Cesr/Documents/CESR_08_277.pdf

The European Securities Markets Expert Group (ESME) goes in the same direction and warns against the perverse effects of any undue regulation: “full formal regulation may be counter-productive as it might be seen

by users in the market place to imply a level of official endorsement of ratings which is neither justified nor feasible. ESME does not consider it is possible for regulators to put themselves in a position where they can give that level of endorsement. Even the SEC’s authority in the US does not extend to the regulation of the substance of the credit ratings. Our view overall is that the incremental benefits of regulation would not exceed the costs and accordingly is not recommended.” European Securities Markets Expert Group (ESME), The Role of Credit

Rating Agencies ESME’s report to the European Commission, June 2008, p. 22, (http://ec.europa.eu/internal_market/securities/docs/esme/report_040608_en.pdf). the EU Commission also acknowledges the risk there is that full regulation of the credit rating analysis market would send an undesirable signal to the market: “references to ratings in the regulatory framework should be reconsidered in light of their

potential to implicitly be regarded as a public endorsement of ratings and their potential to influence behavior in an undesirable way.” European Commission, Public Consultation on Credit Rating Agencies, op. cit., p. 5.