HD28

.M414 Dewey

WORKING

PAPER

ALFRED

P.SLOAN SCHOOL

OF

MANAGEMENT

^A

BEHAVIORAL SIMULATION MODEL OF FORECASTING AND PRODUCTION SCHEDULINGIN A DATACOMMUNICATIONS COMPANY,^ by John D.W. Morecroft WP-1766-86

MASSACHUSETTS

INSTITUTEOF

TECHNOLOGY

50MEMORIAL

DRIVECAMBRIDGE,

MASSACHUSETTS

02139D-3807

^A

BEHAVIORAL SIMULATION MDDEL OF FDRECASTING AND PRDDOCTION SCHEDULINGIN A DMACOMMUNICATIONS COMPANY

^

byJolin D.W. Morecroft WP-1766-86

D-3807

A

BEHAVIORAL

SIMULATION

MODEL

OF

FORECASTING

AND

PRODUCTION

SCHEDUUNG

IN

A DATACOMMUNICATIONS

COMPANY

by

John D.W. Morecroft

System

DynamicsGroup

Sloan School of

Management

Massachusetts Institute ofTechnology

Cambridge

MA

D-3807

A

BEHAVIORAL

SIMULATION

MODEL

OF

FORECASTING

AND

PRODUCTION

SCHEDUUNG

IN

A

DATACOMMUNICATIONS

COMPANY

Abstract

The

paper

describes a behavioral simulationmodel

of forecastingand

production scheduling in a datacommunications

company.

The

model

allowsyou

to think about the different 'players'whose

choicesand

actionsregulate orders

and

production.There

are business planners (who provideforecasts), factory schedulers, expediters,

customers

and

account

executives.

You

step into their shoes.You

examine

their responsibilities, their goalsand

incentivesand

the sources of information that attract their attention -- all with the intention of understanding the logic behindtheir choices

and

actions.Then

you

standback

from the detail and, with the help of diagramsand

simulations, you explorehow

the players interactand

cooperate,and

how

the factory balances supplyand demand.

D-3807

INSIDE

THE

FACTORY

Imagine youself as the

manager

of a factory thatproduces

workstations,PBXs,

keysystems and

other datacommunications equipment.Your

factoryhas

been

criticized recently for slow deliveries.The

delivery interval ofworkstations ranges from six

months

toone

year,much

longer than majorcompetitors.

The

problem

is not improving.You

begin searching for anexplanation.

Many

ideascome

to mind.One

could argue that the factory's long delivery intervals aredue

to errors in the sales forecast.You

could obviously run the factory betterand

make

deliveries on time if youwere

given accurateforecasts. But

you

realize that forecasts willnever

be

accurate,particularly in the

datacommunications

market

where

technology iscausing products

and

prices tochange

rapidly. Alternatively,one

couldargue

that the factory's long delivery intervals aredue

to inflexiblesuppliers

who

can't expedite partsand

materials if the factory suddenlyneeds

more. But, on reflection,even

thisargument

is not entirelyconvincing.

Suppose

forexample

that a largeshipment

of partsand

materials arrives unexpectedly,enough

tomake

50

extra workstations.What

would

youdo

with workstations,where would

yousend

them?

Let'ssay there are

100 customers scheduled

to receive a workstation this month.On

average

they've waited say eightmonths

for delivery, butnow

their

machines

are in the shipping dock, ready tobe

loaded onto a deliverydespite the eight

month

delivery interval, the factory cannot ship the 50extra workstations,

because

the orderbook

doesn'tshow

another 50 customerswho

are expecting to receive a workstation this month. Insteadit

shows

100 customers

who

are expecting delivery this month,and

several

hundred customers

who

are expecting delivery during the next twelve months. It's not a simple matter to ship the extra workstationsearly -- customers

must be

informed of early deliveries, somust

the salesand

field support organization. Moreover, the factory has to adjust theproduction schedule to account for early deliveries.

As

you

think about it, the factory'sproblem

is not with late deliveries (sincemost customers

receive their workstationson

the promised date) but, instead, with slow deliveries -- workstations are shipped on time,but the

agreed

delivery interval is too long!!You

seem

to be gridlocked.How

does

the factory get out of this delivery situation, and, perhapsmore

important,how

does

it avoidextended

delivery intervals in the firstplace?

To

help explore these questions a simulationmodel

hasbeen

developed of afactory, customers

and

account executives.The

model

allows you to thinkabout the different 'players'

whose

actionsand

choices regulate ordersand

production.There

are business planners(who

provide forecasts), factoryschedulers, expediters,

customers

and

account executives.You

step into their shoes.You

examine

their responsibilities, their goalsand

incentivesD-3807

and

the sources of information that attract their attention -- all with theintention of understanding the logic behind their choices

and

actions.Then

you

standback

from the detail and, with the help ofdiagrams and

simulations, you explorehow

the players interactand

cooperate,and

how

the factory balances supply

and demand.

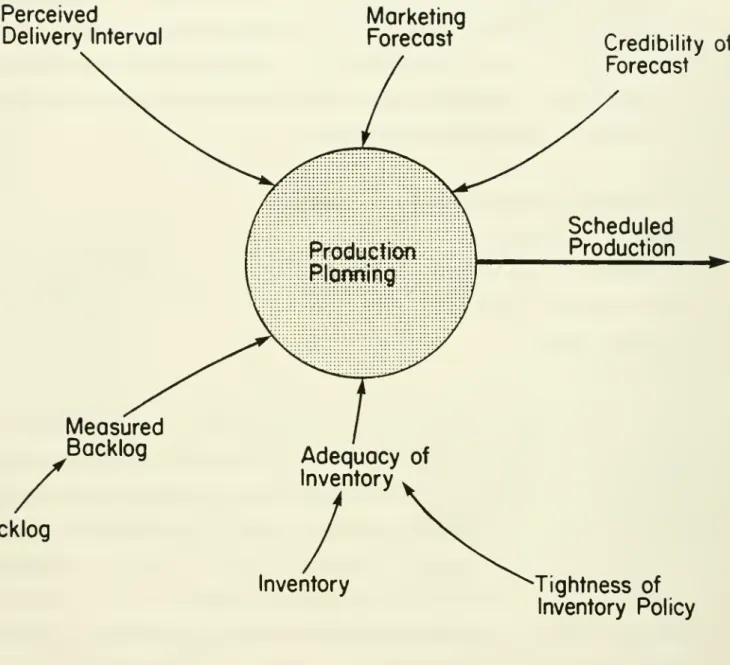

Production Planning

and

Factory SchedulingConsider

first production planning, which is a multilayer process thatconsolidates information from forecasters, from product

managers

and

from the factory. Figure 1

shows

the information entering the productionplanning policy.

An

important input is the market forecastbased

on the marketing staff'sbusiness plan.

The

business plan starts from an estimate of total industryvolume

for all classes ofdatacommunications

equipment.From

historicaldata

and

various businessassumptions (new

product introductions, pricechanges,

competitor actions,expected

delivery intervals), forecasterscompute

thecompany's expected

share of industry sales. Then, theymultiply industry

volume and

expected share to generate thecompany's

sales forecast by product line over a two-year planning horizon.

The

forecasting process is a logical exercise in gathering

and

processing market information. But as the forecast enters the factory, to beused

inproduction scheduling, it is modified by its

own

credibility (its reputation for accuracy in the factory), by pressures from inventory, delivery intervalPerceived Delivery Interval

Measured

Backlog

Backlog

Marketing

ForecastAdequacy

of Inventory Credibility of ForecastScheduled

Production InventoryTightness

of Inventory Policy ^-3Z3'=\BD-3807

and

backlog. Let's considereach

of these factors in turn in order to identify the peoplemost

responsible for modifying the forecastand

theirrationale for doing so.

Let's begin with the forecast credibility. It is quite

common

indatacommunications companies

for market forecasts to lack credibility atthe factories.

The

reasons are easy to understand.The

datacommunications market is in flux.New

products are introduced almost daily, priceschange

frequently,

new

competitors spring up. Factorymanagers

feel thatforecasters simply don't

know

the sales potential of a given product line(despite their elaborate forecasting methods)

and

therefore, forecasts are often pared-down, tobe

'on the safe side',and

particularly to avoid thevery visible inventory costs resulting from

excess

production.What

if the forecast is inaccurate?How

does

the factoryknow

of theerror,

what

source of informationwould

reveal the error,who

would be

responsible for adjusting the production schedule

and would

theyhave

the incentivesand

appropriate information tomake

the correct adjustment?Now

we

are getting into the heart of factory scheduling, stepping into theshoes

of the schedulers themselves.The

production schedule is defined over a rolling six-month horizon.One

can

envisage a planning chart, withboxes

marked

acrossa

page.The

(say workstations) scheduled for production in the current

month

(in factthe schedule

may

be

expressed inweeks

oreven

days, but itmakes

nodifference for this discussion).

The

extreme

right-handbox

shows

thenumber

of units scheduled for production sixmonths

from now.The

boxes

in-betweenshow

monthly scheduled production formonths

2 through 5.Each month

the planning chart is updated, the current month'sbox

"drops off the left-hand side of the chart,and

anew

box

'rolls in' on theright-hand side, rather like the steps on

a moving

escalator.The number

in the

new

box is the forecast of customer orders sixmonths

hence.The

scheduler assigns incoming customer orders to the appropriate box.To

understand the process, imagine that the factory is trying to deliver on a

three

month

interval.A

new

customer

order is received (say an order for aworkstation) which is

due

for installationand shipment

in threemonths

time.The

scheduler looks in the planning chart for the box correspondingto

month

3.He

finds a workstation that is scheduled for productionand

assigns the

customer

order to it.That

particular workstation isnow

'earmarked' for a customer and cannot be assigned again.

The

processworks

smoothly as long as the original forecastwas

accurate.But

what

happens

when

the forecast is low? Again the factory is trying todeliver on a three

month

interval.Based

on the forecast, 1 00 workstationshave

been

scheduled in the time slot threemonths

hence. But orders forD-3807

exactly as before, until the entire box is assigned.

Then

he assigns theremaining 'unexpected' orders to the next available

box

-- in otherwords

to a later time slot. Having

done

so, he then informs the salesforce thatworkstations are available only on an extended delivery interval.

Because

of the long production planning horizon, schedulers can almost always find anopen

production slot for anew

customer order.When

acustomer

orderhas

been

assigned a production slot, the scheduler hasdone

his job.So

schedulers,

who

are 'close' to thecustomer

order backlog,and

therefore the first people in thecompany

tosee

when

the forecast is too low,have

no incentive to argue for higher production, as long as production slots

remain open.

The

same

logicworks

in reverse.When

the forecast is optimisticand

production is scheduled in excess of

customer

orders, schedulers begin tofind early time slots for

new

customer

orders.So

a

scheduler mightreceive an order for

a

workstationdue

in three months, but finds he canassign it to an

open

production slot only twomonths

hence.The

schedulerhas

done

his job, so again, although heknows

the factory is producing thewrong

amount

(toomuch)

he has no

incentive toargue

for a lowerproduction plan.

However,

in this case, pressure to reduce the productionplan will eventually

come

from finished inventory. Ifcustomers

are unableto take

an

early delivery , then products awaitingshipment

willaccumulate

in finished inventoryand

signal a factorymanager

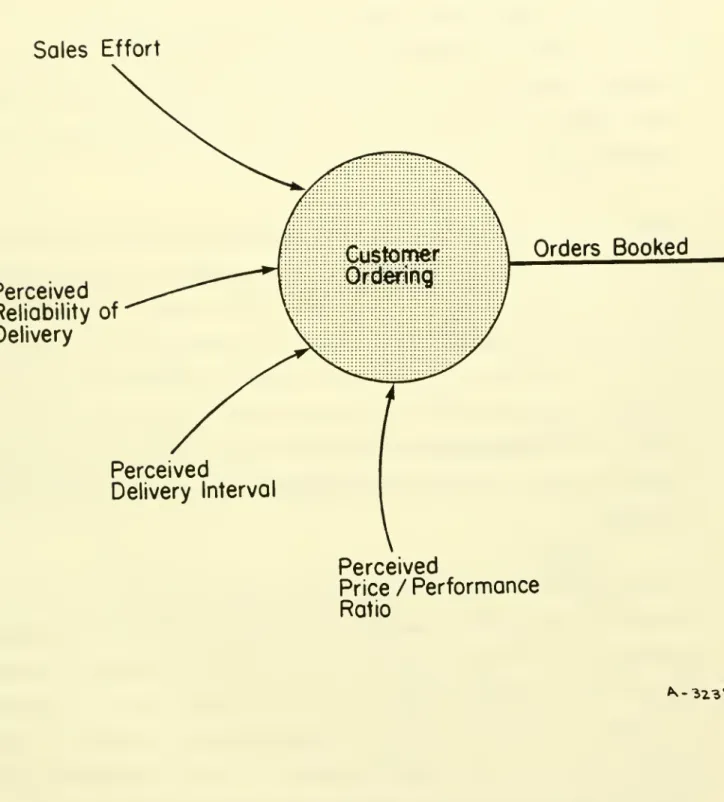

to curtailCustomer

OrderingFigure 2

shows

the influences oncustomer

ordering. Sales effort is theprincipal influence,

because customers must

learn about thecompany's

products before they will

even

consider purchase. Then,once

the customer isaware

of the product, traditional factors such as price/performanceand

delivery intervalbecome

important.Let's

suppose

for thesake

of simplicity that the price/performance of agiven product line is constant,

and

that sales effort (which you can think ofas

thenumber

of hours permonth

the salesforcespends

withcustomers) is constant.

How

do customer

orders vary withchanges

indelivery interval? Think

about

this question from the perspective ofaccount executives as they contact potential customers.

Suppose

thataccount

executiveshave

been

selling workstations on a threemonth

delivery interval.

Then

factory schedulersannounce

that the intervalmust

beextended

to five months.Account

executives can still sell workstationson the five

month

interval, but they will take longer to find acustomer

who

is willing to wait the extratwo

months.The

net effect is thatcustomer

orders decline as the interval rises,and

conversely, thatD-3807

11 Sales Effort Perceived Reliability of Delivery Perceived Delivery IntervalOrders

Booked

Perceived

Price /Performance

Ratio ^-^Z3tBDYNAMICS

OF

PRODUCTION

SCHEDUUNG AND

CUSTOMER

ORDERING

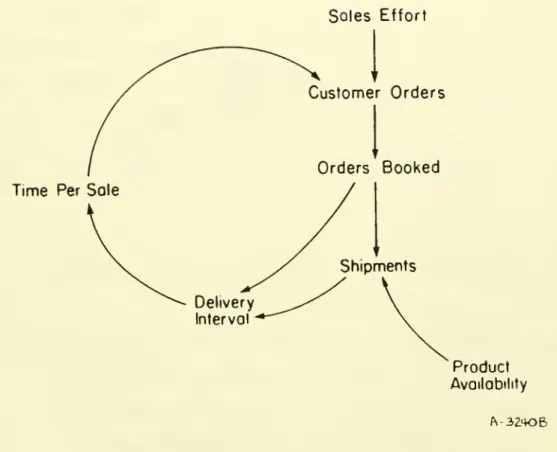

If

one

accepts that customers, plannersand

schedulersbehave

asdescribed above, then

how

do

they interact?To

answer

this question let's first visualize the feedback loops connecting the 'players'.There

are twoimportant loops.

Figure 3

shows

a negative feedback loop connecting customers' ordering tothe

company's

deliveries. Consider the loop's operation if product suddenlybecomes

less available (the factory shutsdown,

or there is atransportation strike).

Shipments

decline, causing delivery interval torise.

When

the delivery interval rises it takesmore

time for salespeopleto

make

a sale, so that, for any given sales effort,customer

orders declineand

the totalnumber

of ordersbooked

stabilizes.Here

is a self-regulatingdemand

mechanism

that brings customer orders into an exact balance withshipments.

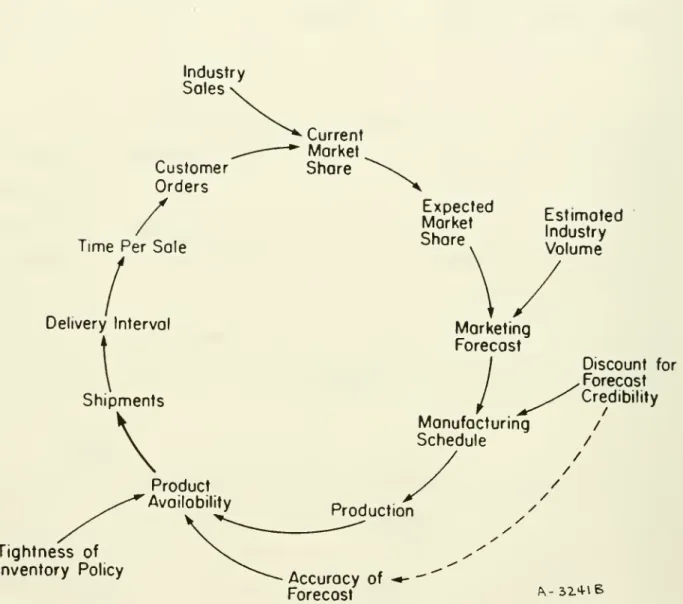

Figure 4

shows

a positive feedback loop connecting cutomers' ordering toforecasting, production scheduling

and

shipping. This loop can readilygenerate

self-fulfilling forecasts,as

the followingargument

shows.

Suppose

that production declinesdue

to a previously inaccurate forecast.A

decline in production quickly curtailsshipments (assuming

that the factorykeeps

very little finished inventory).When

shipments

fall, thedelivery interval rises, time per sale increases

and customer

orders fall.D-3807

13Time Per Sale

Delivery Interval Sales Effort Customer Orders Orders Booked Shipments Product Availability

Figure 3: Negative

Feedback Loop

Connecting Customers'Industry

Sales

Customer Orders

Time Per Sale

Current Market Shore Expected Market Stiare Estimoted Industry Volume Delivery Interval Shipments Product Availability Tightness of Inventory Policy Marketing Forecast Discount for Forecast Credibility Manufacturing / Schedule / / / / / Production y' k- 51+lB Accuracy of -*-Forecast

Figure 4: Positive

Feedback Loop

Connecting Customers'D-3807

15market share, as it is

based

largely on historical data.Because

expected share falls, the marketing forecast is further reducedand

so too is theproduction schedule

and

the production rate.The

initial product shortagetherefore feeds

back

to reinforce itself.In the real

system

the two loops are combined.We

can use simulation tounderstand

how

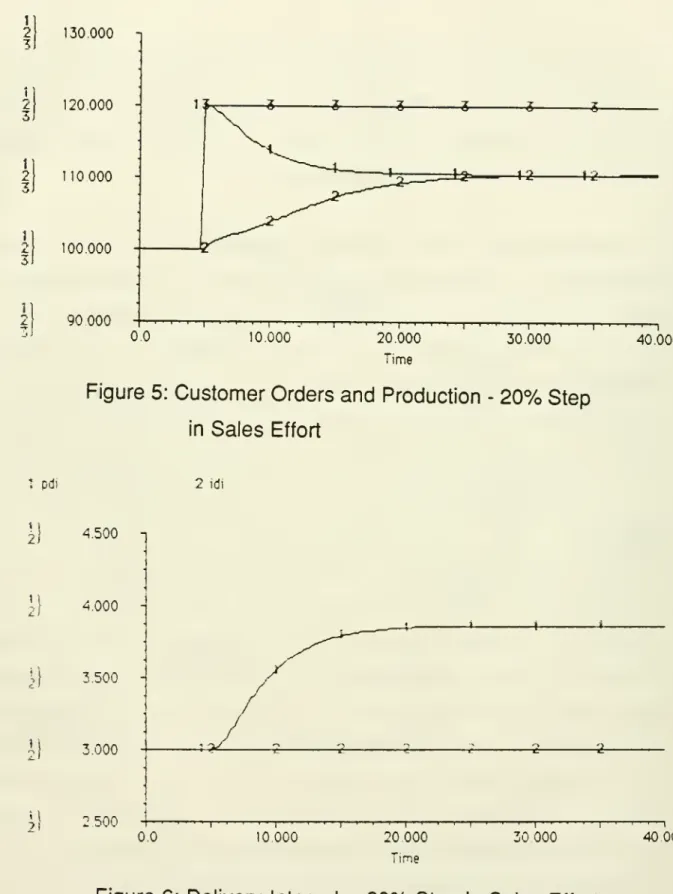

they operate. Figure 5shows

the system's response to aone

time twenty percent increase in sales effort (the reader should notethat, in the factory model, sales effort is 'exogenous' -- the

modeler

is free to set sales effort at any value he thinks appropriate. In this case,we

know, from the sales planning

and

controlmodel

described in D-3806, thatsales effort in a datacommunications

company

can vary widelydepending

on the terms of the compensationscheme.

So

a simulation experiment thatassumes

a large, twenty percent, increase in sales effort is certainly plausible).The

model

starts in equilibrium, withcustomer

orders (-1-)and

production (-2-) of 100 units per month.When

sales effort increases,orders (-1-) increase correspondingly to a

peak

of120

units per month.However,

as timegoes

by, orders (-1-) are graduallyeroded

until theysettle at a

new

equilibrium of110

units permonth

--an

increase of 10units a month, but only half the possible increase.

Meanwhile

production(-2-) increases slowly

and

steadily until it exactly equalscustomer

orders (-1-). But

why

are orders permanentlydepressed?

As

figure 6shows, the

immediate cause

is delivery interval (-1-) which rises from 3120.000

no000

100.000

90 000

Time

Figure 5:

Customer

Ordersand

Production -20%

Stepin Sales Effort 40.000 1 pdi 2 idi 2} 4.500 4000 3,500 3.000 ^} 2 500 40 000

D-3807

17willing to place an order

when

the interval is extended.But

why

doesn't the interval fallback

to threemonths once

the surge oforders has

passed?

To

answer

this questionwe

need

to look closely intothe 'mechanics' of forecasting

and

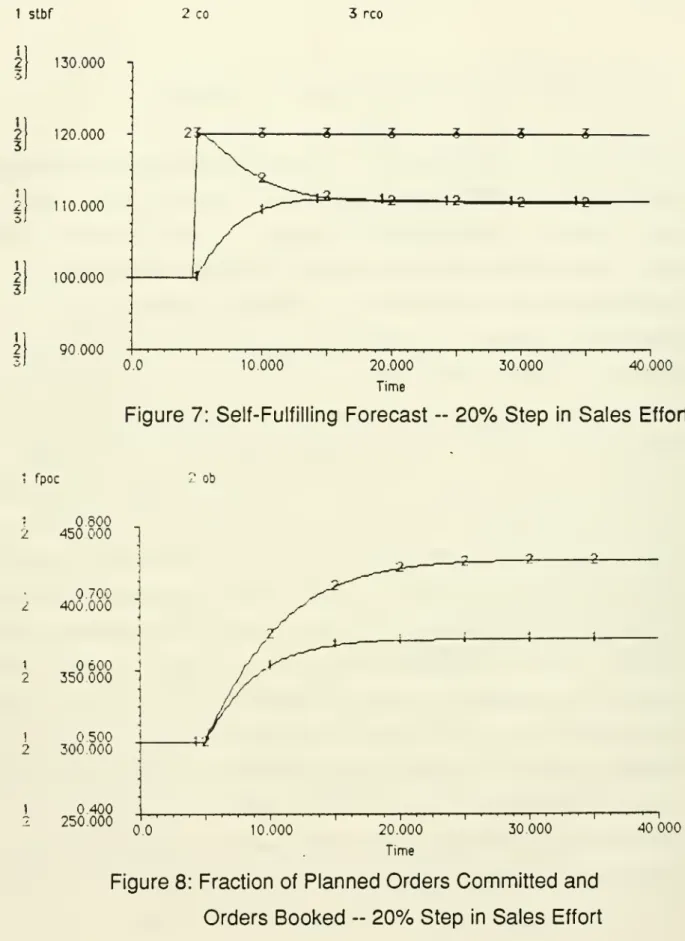

scheduling. Figure 7 provides part of thestory.

When

orders increase unexpectedly, the forecast increases too, but only gradually.As

customer

orders (-2-) decline (due to increased deliveryinterval), the forecast (-1-)

changes

course. Instead of continuingupward

toward reference

customer

orders (-3-), (the value thatcustomer

orderswould

achieve if delivery intervalwere

fixed at three months) ithomes

inslowly on the final

and depressed

value of orders. In other words, theforecast is self-fulfilling.

The

onlyway

out of this trap is to scheduleproduction in

excess

of the forecast. But there isno

pressure on the factory schedulers to do so. Figure 8shows

why.When

customer orders areunexpectedly high, the schedulers simply assign the

excess

orders to the earliest convenient slot in the pre-planned manufacturing schedule.So

thesurge of orders is

absorbed

byconsuming

a larger proportion of thepre-planned schedule (-1-) instead of expanding the schedule by adding

the

excess

orders to the forecast.As

a

result, ordersbooked

(-2-) risetoo high

-

higher than they should if deliveries are to remain competitive -- yet, at thesame

time, the illusion exists in the factory that thecustomers

are satisfied, sinceeach

customer

order isassigned

a1 2 3J 130.000 120,000 10.000 100.000 90.000 0.0 2J

N

4^ ^ 10 ID 10.000 20.000 Time -p-i r— 1 1 1 1 p 30.000 40.000Figure 7: Self-Fulfilling Forecast --

20%

Step in Sales Effort1 Tpoc 2 Ob 2 800 ^ 450 000 1 0,700 400.000 t 600 2 350 000 1 0.500 2 300.000 400 250.000 10.000 20.000 Time 30 000

Figure 8: Fraction of Planned Orders

Committed

and

OrdersBooked

--20%

Step in Sales EffortD-3807

19

agreed to.

The

illusion is easily sustained,because

the factorykeeps

thesalesforce up-to-date

on

the earliest time slots available in theproduction schedule, so salespeople tend to find

customers

who

aresatisfied with the factory's schedule.

SELF-SUPPRESSING

DEMAND

The

simulationsabove

show

that the factory's forecastingand

schedulingpolicies fail to regulate delivery interval

-

instead they allow theinterval to drift

upward

whenever

the forecast is too low.As

a result, the factory can inadvertently suppress orders for its growing product lines.To

understand

how, consider thecase

of anew

product linewhich

isattracting a growing proportion of sales effort. Think

back

to simulationsof the sales planning

and

controlmodel

in D-3806.Customer

orders cangrow

very quickly.They

can double in six months, notbecause

customersare

stampeding

to buy, but insteadbecause

the salesforce is anxious tosell! With

such

rapid salesforce-induced growth it'seasy

for the salesforecast to

be

too low, not just for aweek

or a month, but for sixmonths

or a

whole

year. With a low forecast, the factory's scheduling policiesallow delivery interval to drift upward.

The

interval will continue to driftupward

until it is highenough

to detercustomers

from buyingand

salespeople from allocating still

more

time to selling the product.Customer

orders will therefore stop growing.So

the interaction of factoryscheduling

and

salesforce time allocation will suppressdemand

for thePOLICIES

TO

CONTROL

DELIVERY INTERVAL

To

prevent the problem of self-suppressingdemand

the factoryneeds

tomanage

the delivery intervals of its different product lines, to ensure the intervals remain competitive.The

idea ofmanaging

intervals heremeans

more

thanimplementing

a special interval reduction program.Such

programs

typically occur onlywhen

intervals are so high that they attractsenior

management

attention.By

then theimage

of extended intervals isalready well-established with

customers

and

with the salesforce,and

many

potential ordershave

been

lost.Managing

intervalsmeans

establishing a routine policy, at the level of schedulers

and

planners, that rapidly detects systematic bias in the forecastand

compensates

for it byscheduling production in

excess

of the forecast.Two

possible interval control policies are describedand

simulated below.Monitoring

and

Control of Excess OrdersThe

first policy requires schedulers to monitorexcess

ordersand

usethem

to adjust the forecast.An

example

is helpful to explain.Suppose

the factory is planning production of workstations overa

six-month horizonand

isnow

delivering workstations withan

interval of threemonths

(competitive for the industry). In the currentmonth

the factory receives120

orders for workstations,due

for delivery threemonths

hence.The

scheduler looks at planned orders three

months

into the planning horizon.He

finds only100

workstations scheduled for thatmonth

-

100 being the forecast of orders generated threemonths

ago, at the start of the planningD-3807

21process. With the present procedure the scheduler puts the 20

excess

orders into next month's time slot

and

then informs the salesforce of theschedule change. With the

proposed

system

the scheduler would, in addition, count-up all excess orders (all orderswhose

scheduled deliverydate is greater than three

months

--20

in this case)and

communicate

thenumber

to production planners.Each month

the plannerswould add

the excess orders to the current month's forecast. ( This proceduremay seem

to result in double scheduling

because

the schedulers first assign the 20 excess customer ordersand

then the plannersadd 20

units of production tothe forecast. But in fact a customer order is scheduled once,

and

once

only,by the scheduler.

The

planners use the20 excess

orders as a guide forincreasing the forecast. Their concern is with planning the

volume

offuture production, not with scheduling individual

customer

orders).The

same

procedure could also beused

to reduce the production plan tocompensate

for a high forecast. In thiscase

the scheduler would count-upall planned orders in the time slots before

month

three thathave

notbeen

assigned a

customer

order.He

would

thencommunicate

thisnumber

of excess planned orders to production planners.The

planners would subtract theexcess

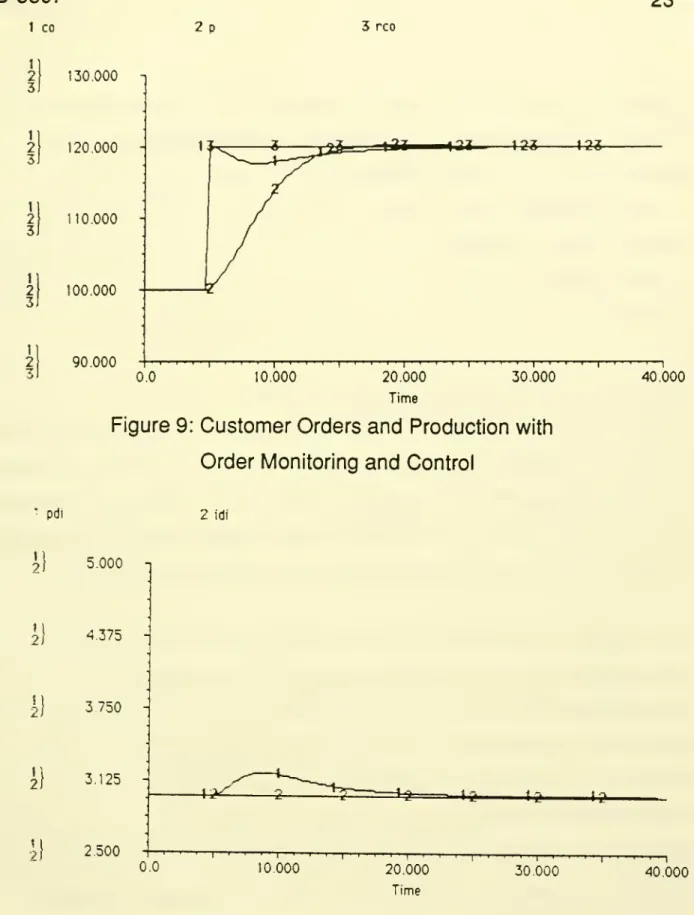

orders from the current month's forecast.Figure 9

shows

a simulation of the order monitoringand

control policy,with

a 20

percent increase in sales effort.The

reader shouldcompare

figure 9 with figure 5.

As

before,when

sales effort increases,customer

orders (-1-) increase correspondingly to

a

peak

of120

units per month.After the

peak

however, orders (-1-) decline only slightly,and

then settleat an equilibrium of

120

units per month. Meanwhile, production (-2-)increases slowly until it exactly equals

customer

orders.Figure 10 shows, that with the

new

policy in operation, delivery interval(-1-) stays close to three months, despite the surge of orders.

So

thefactory

no

longersuppresses

demand

due

toextended

intervals.The

improvement

in delivery performance occursbecause

plannersexpand

theproduction schedule

more

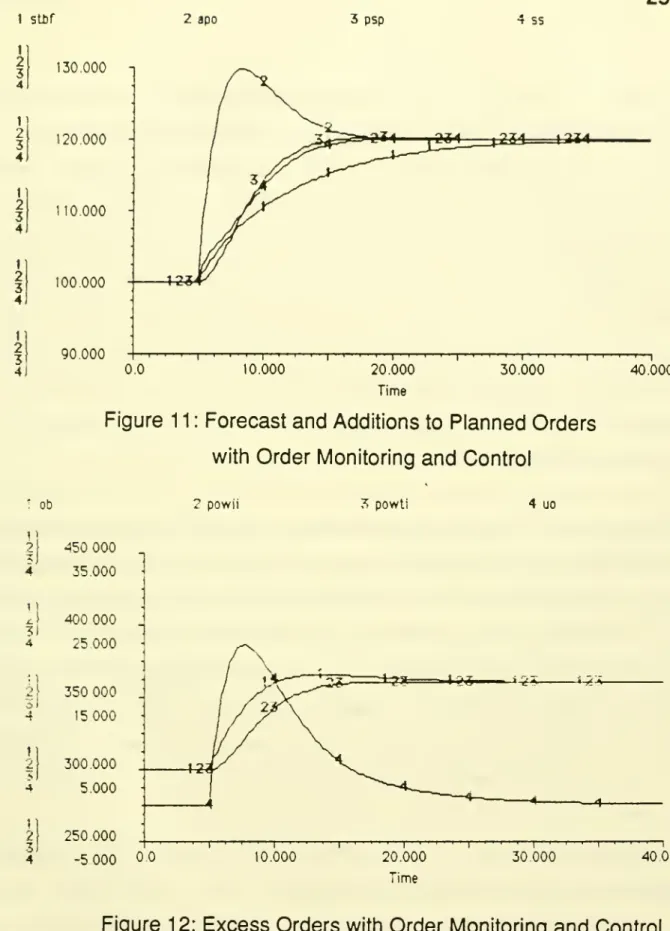

quickly than the forecast alone would suggest.Figure 1 1

shows

what

is happening.From

month

tomonth

5, the forecast(-1-) is steady at

100

units per month. Inmonth

5 (the timewhen

customer

orders increase) the forecast (-1-) starts to rise, but onlygradually

because

forecastersdo

not anticipate (by assumption) the stepincrease in sales effort that is causing the extra

demand.

By month

10, the forecast (-1-) has risen to 110 units permonth

(in other words, inmonth

10, forecasters are saying that, sixmonths hence

-- inmonth

16, orderswill

be 110

units per month). But production planners are planning toproduce

130

units permonth

inmonth

16 (-2-) --much

more

than theD-3807

23

1 CO 2p 3 rco \ 130.000 120.000 10,000 100.000 2 90.000 8T <aT 4^2 1-2«-0.0 10.000 20.000 30.000 40.000 TimeFigure 9:

Customer

Ordersand

Production withOrder Monitoring

and

Controlpdi 2 idi 5.000 2} 4375 2} 3 750 J) 3.125 21 2.500 0,0 ' ' I '

—

I—

<-10 000 -**^

IH —1 I—

'—

I—

I—

I—

I—

1—

I—

I—

I—

1—

I—

r—n—

1—I— , 20.000 30.000 40,000 Timeplans (-2-) continue to

exceed

the forecast up toand beyond month

20,though the discrepancy gradually diminishes. But

how

can the planners beconfident they are

making

the correct decisions? Figure 12 provides theanswer. Schedulers are tracking

excess

orders (-4-)and

reportingthem

weekly

to the planners. Inmonth

10 the schedulers reportmore

than 20excess

orders (-4-).So

the planners increase the monthly productionschedule (-2- in figure 1 1) by

20

unitsabove

the forecast.More

Finished Inventor/and

Inventorv ControlThe

factory can also regulate delivery interval by holding acomprehensive

finished inventory (or nearly-finished inventory)and

sending informationon the inventory level to production planners.

The

inventory is to be used as a buffer, to allow the factory to ship promptly regardless of whether weeklycustomer

orders correspond exactly to weekly production.You

might think that the idea of a buffer inventorycomes

straight fromthe textbook. But in fact it

does

not.The

crucial difference is that theproposed

buffer inventory isused

asa source

of information to tellproduction planners

when

customer

orders deviate systematically fromthe forecast. Traditional buffers are not

used

to detect systematic error in the forecast,because

plannersassume

that the differencebetween

customer

ordersand

forecast israndom

-- so a glut of orders thismonth

(relative to forecast) will be balanced by a corresponding shortfall next

D-3807

1 SU)f 2 apo 3 psp 4 ss 1 2 3 4J 130.000 120.000 no.ooo 100.000 90000 10.000 20.000 Time 30.000Figure 1 1 : Forecast

and

Additions to Planned Orderswith Order Monitoring

and

Control1 Ob powii ?> powli 4 uo 450 000 4 35 000 i 400 000 4 25000 ;1 2[ 350000 4 15 000 300.000 5.000 250 000 -5 000 10.000

25

40.000 30000 40,000 Timesystematic) error, then they install a buffer inventory to cover the

most

extreme

glut of ordersand

use the forecast alone for production planning.But in the fast-moving

datacommunications market

it's quiteeasy

forforecasts to

be

systematically low or high formonths

oreven

years at atime. In this situation,

movements

in the buffer inventory are crucialindicators of

whether

the factory's forecasts are optimistic orpessimistic.

The

inventory level is monitored frequently (say weekly),compared

with a standard (perhaps threemonths

worth of the average mixof shipments)

and

the discrepancy reported to production planners.The

planners shouldadd

a fixed proportion of the discrepancy (sayone

half) tothe

base 6-month

market forecast.Holding three

months

of finished inventory mightseem

like an expensiveproposition. But

one

shouldremember

what

the investment is intended tobuy

-

timely information onwhether

demand

(potentialcustomer

orders)is

exceeding

supply (planned production),whether

demand

is in exactbalance with supply, or

whether

it is lower than supply. For a product-linethat is growing faster than expected, information from

changes

in the buffer inventory can prevent thecompany

from suppressing itsown

orders.In this case the inventory's value to the

company

(per year) is equal to theproduct line's profit margin multiplied by potential annual growth in

volume

of sales.A

numericalexample

will illustrate. Let'ssuppose

theproduct line's profit margin is

$1000

(on a$5000

unit), that the industryD-3807

27

sales

volume

is1000

units per year. If thecompany

had

invested infinished inventory to stabilize its delivery interval, its orders

would

keep

pace

with the industry trend,and

reach1500

by year-end. Without the inventory, the factory inadvertentlysuppresses

demand,

socustomer

orders remain static at

1000

units per year.The

presence of the inventorycreates

500

extra orders,each

worth$1000

in profits, for a total benefitof $0.5 million over the year.

The

carrying cost of the inventory (assuming3

months

(0.25 years)coverage

and

a 10 percent interest rate) is only $0,125 million -- a quarter of the benefit! Of courseone

would want

tolook

more

closely at the benefitsand

costs in a real situation -- but thesimple calculation

above

gives the flavor. If self-suppressingdemand

is a real possibility fora

product-line with high growth potentialand

highmargin (high growth

and

margin tend togo

together) then it is quite easy for a return on finished inventory investment tobe

100,200

oreven 300

percent per year. (As a matter of interest, there is a general formula for

calculating return

on

inventoryinvestment

in situationswhere

self-suppressingdemand

is possible. If g is the industry growth potential,ppm

is the percent profit margin on the product-line, c is the inventory coverage-

expressed as a fraction of a year,and

i the interest rate, thenthe return on inventory investment is (((g*ppm)/(c*i))-1)*100).

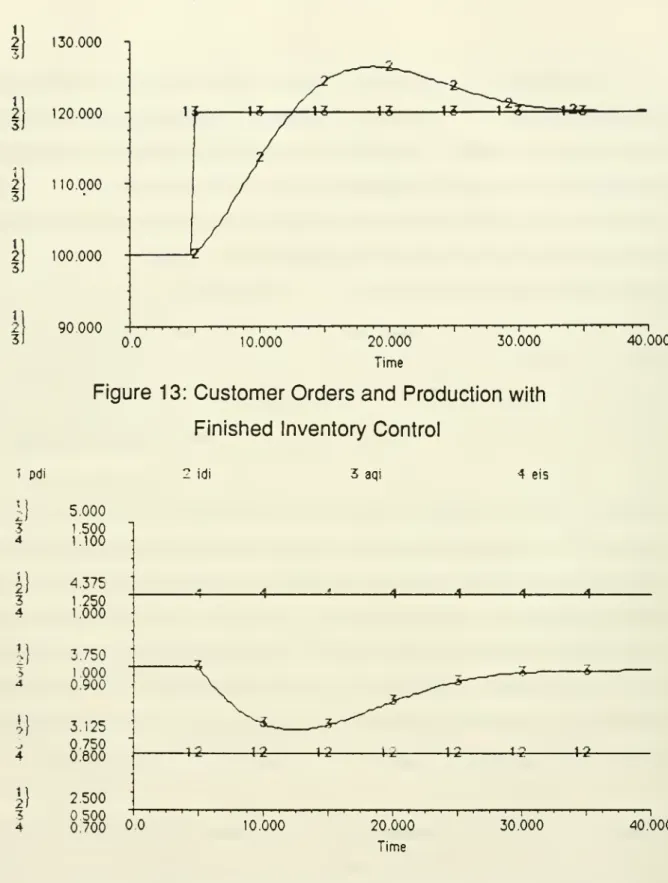

Figure 13

shows

a simulation of the finished inventory monitoringand

control policy, with a20

percent increase in sales effort.The

reader1] 2 11 2 3J 2 3J 1) 2 3 3) 130.000 120,000 110 000 100.000 90 000 H I

—

I I '—

I—

I—

'—

I >—

I—'—

' ' ' I—

''-I—

' I''''

I • • 1 0.0 10.000 20.000 30.000 40 000 TimeFigure 13:

Customer

Ordersand

Production withFinished Inventory Control

1 pdi i) 3 4 i] 3 4 I] 3 4

2 idi 3 aqi 4 eis

41 4 5.000 1.500 1.100 4.375 1 250 1.000 3.750 1 000 0.900 3.125 750 0.800 2500 500 . 0.700 00 -Hj--\

—

'—'—

'—

I •~ 10.000 -4-^2 1-3 i^«

1^ 1-3-20.000 Time — 1 1 1 1 1 1 . r— 30.000 40.000D-3807

29

increases,

customer

orders (-1-) increase correspondingly to 120 unitsper month.

Now

tnowever, orders (-1-) remain constant rather thandeclining. Meanwhile, production (-2-) increases slowly until it equals

customer

orders inmonth

12. Production (-2-) continues to grow,peaks

at about 125 units permonth

then gradually declines until it balances exactlywith orders.

The

production overshoot enables the factory to re-build itsdepleted finished inventory back to 3

months

worth of shipments.Figure 14

shows

that thenew

policy holds delivery interval (-1-) rocksteady at 3

months

--because

there isadequate

inventory onhand

toprepare

and

ship allcustomer

order in threemonths,

despite the unexpected surge of orders. In otherwords

the finished inventory acts as abuffer to insulate

shipments

from production. Figure 15shows

how

inventory also acts as a source of planning information for production planners. In

month

5(when customer

orders step-up) inventory (-1-)declines,

because

shipments

exceed

production. At thesame

timeauthorized inventory (-2-) begins to rise,

because

shipments

arenow

higherand

the factoryneeds

more

finished inventory in order to maintain3

months

coverage

of shipments.The

differencebetween

authorizedinventory (-2-)

and

actual inventory (-1-) is the signal that planners use to increase the production plan-

it's the analogy of excess orders in theorder control policy. Planners

add

half the inventory discrepancy to thesix-month forecast in order to

compute

planned production six-months ahead.The

simulationshows

that the planners' correction to the forecast(-4-) rises to a

peak

of20

units permonth

bymonth

12, declines to zeroby

month 27 and goes

slightly negativebetween

months 28 and

40. Withthe inventory control policy in effect, planners

expand

the productionschedule

more

quickly than the forecast alonewould

suggest -- just asthey did with the order control policy. Figure 16

shows

what

is happening.As

before, the short-term business forecast (-1-) rises slowly from100

to

120

units per month. Inmonth

10, forecasters are predicting thatcustomer

orders will be110

units permonth

in sixmonths

time. But inmonth

10, planners are preparing to produce 125 units permonth

(-2-) bymonth

16.They

justify the extra planned production on the basis of thefinished inventory shortfall. In fact, the shortfall tells

them

to planabove

forecast all the

way

frommonth

5 tomonth

25

of the simulation.The

D-3807

311 n 2 ai 3 cpi 4 cpoi

1

DOCUMENTATION OF THE

SALES

AND

PRODUCTION

SCHEDUUNG MODELS

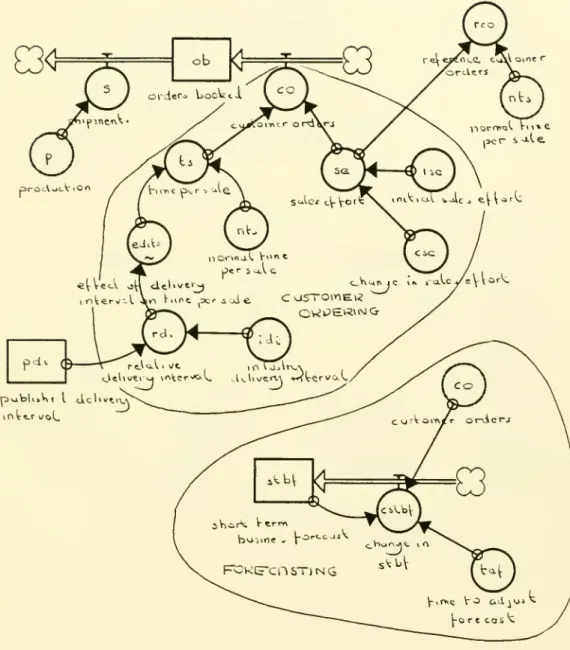

Policy Structure of the Sales

and

Production SchedulingModel

STELLA

Diagram

ofCustomer

Orderingand

Forecasting in theBase

Salesand

Production Scheduling Model (saps_base)STELLA

Diagram

of Delivery Interval in theBase

Sales and Production Scheduling Model (saps_base)STELLA

Diagram of Production Schedulingand

Expediting in theBase

Salesand

Production Scheduling Model (saps_base)STELLA

Equations fortheBase

Salesand

Production Scheduling Model (saps_base)STELLA

Diagram of Order Monitoring, Production Schedulingand

Expeditingin the Sales

and

Production SchedulingModel

withOrder Monitoring

and

Control (saps_ordmon)STELLA

Equations for the Sales and Production Scheduling Model withOrder Monitoring

and

Control (saps_ordmon)STELLA

Diagram ofCustomer

Orderingand

Forecasting in theSales

and

Production Scheduling Modelwith Finished Inventory Control (sapsjnvcon)

STELLA

Diagram

of Finished Inventory Controland

Shipping in theSales

and

Production Scheduling ModelD-3807

33DOCUMENTTATION

OF

THE SALES

AND

PRODUCTION SCHEDULING

MODELS

-CONTINUED

STELLA

Diagram

of Delivery Interval in theSales and Production Scheduling Model

with Finished Inventory Control (sapsjnvcon)

STELLA

Diagram of Order Monitoring, Production Schedulingand

Expeditingin the Sales and Production Scheduling Model with Finished Inventory Control (sapsjnvcon)

STELLA

Equations forthe Salesand

Production Scheduling Modelwith Finished Inventory Control (sapsjnvcon)

Description of

New

Structureand

Equations to Convert- .::::: Monufocturinq ; ;Production :::::::::::::::: irrrrrrT::::::: P'onninq ::;;:: ':::::::::::::::::::::::::::: Horizon ••••• EXPEDITING ::::::::::::::: :::::: Ai-ilite R

Figure17: Policy Structure of the Sales

and

D-3807

35

Figure 18:

STELLA

Diagram

ofCustomer

Orderingand

Forecasting in theBase

Salesand

Production Scheduling Model (saps_base)\r\rrr\ pVannt A orderi

Figure 19:

STELLA

Diagram

of Delivery Interval in theD-3807

37

Figure 20:

STELLA

Diagram of Production Schedulingand

Expediting inINIT(fpo) = stbf»mph 0.0 -> 0.800

Ob = Ob + CO - s 0.500 -> 0.850

INIT(ob) = 300 1.000 -> 1.000

n

pdi = pdi cpdi 1.500 -> 1.150INIT(pd1) = idi 2.000 -> 1.350

D

stbf = stbf + cstbf 2.500 -> 1.550 INIT(stbf) = CO 3.000 -> 1.825 aporstbf 3.500 -> 2.150O

CO = se/ts 4.000 -> 2.500O

cpdl = (edi-pd1)/tpdi 4.500 -> 2.900O

cse = .2 5.000 -> 3.500 cstbf = (co-stbf)/tafO

d1 = ob/pO

edi = (ob/fpo)*mphO

fp = .3O

fpoc = ob/fpoO

idi = 3O

ise = 7500 niph = 6 nts = 75 P = ss*fp+psp*(1 -fp)O

powil = fpo*(id1/mph) psp = fpo/mph rco = se/ntsO

rdi = pdi/idi s = pse = IF TIME <5 THEN ise ELSE (ise»(1+cse))

O

ss = ob/pdiC

taf = 6O

tpdi = 1ts = nts*edits

STELLA

Equations for theBase

Salesand

Production Scheduling Model (saps_base)D-3807

39

Figure 21:

STELLA

Diagram

of Order Monitoring, Production Schedulingand

Expediting in the Salesand

Production SchedulingModel

with Order Monitoringand

Control (saps_ordmon)fpo = fpo p + apo INIT(fpo) = stbf»mph lj Ob = ob + CO - s INIT(ob) = 300 Lj pdl = pdi + cpdi INIT(pdl) = idi stbf = stbf + cstbf INIT(stbf) = CO apo = stbf+(uo/tcuo) CO = se/ts

O

cpdi = (edi-pd1)/tpdi cse = .2 cstbf = (co-stbf)/tafO

cwos =O

di = ob/pO

edi = (ob/fpo)*mphO

fp= 3O

fpoc = ob/fpoO

idi = 3J

ise = 7500O

iwos = "j mph = 6O

nts = 75C

OS = fpo*fpocO

p = ss*fp+psp*(l-fp)O

powii = fpo*(idi/mph) C-' powti = fpo*(pd1/mph)*(1-wft)+fpo*(idi/mph)*wftC

psp = fpo/mphO

rco = se/ntsO

rdi = pdi /idirpo = os*wos+powti*(1-wos)

1 s = p

STELLA

Equations for the Salesand

Production Scheduling ModelD-3807

41se = IF TINE <5 THEN ise ELSE (ise*(1*cse))

Q

ss = ob/pdiO

taf = 6O

tcuo = 1O

tpdi = 1 ts = nts*editsO

uo = ob-rpoO

wft = 1O

wos = IF TIME < 40 THEN iwos ELSE (iwos*(1+cwos))edits = graph(rdi) 0.0 -> 0.800 0.500 -> 0.850 1.000 -> 1.000 1.500 -> 1.150 2.000 -> 1.350 2.500 -> 1.550 3.000 -> 1.825 3.500 -> 2.150 4.000 -> 2.500 4.500 -> 2.900 5.000 -> 3.500

STELLA

Equations Continued -- for the Salesand

ProductionFigure 22:

STELLA

Diagram ofCustomer

Orderingand

Forecastingin the Sales

and

Production SchedulingModel

with Finished Inventory Control (sapsjnvcon)D-3807

43

Figure 23:

STELLA

Diagram

of Finished Inventory Controland

Shippingin the Sales

and

Production SchedulingModel

Figure 24:

STELLA

Diagram

of Delivery Interval in theSales

and

Production SchedulingModel

D-3807

45

INIT(asl) = si

Hj fi = fi + p - si

INIT(fi) = co*8ic

Cj fpo = fpo + apo

-p

INIT(fpo) = stbf*mph ob = Ob + CO - s INIT(ob) = 300

Lj pdi = pdi + cpdi

INIT(pdi) = idi

n

slbf = stbf + cstbf INIT(stbf) = COO

9i = asi*aicO

aic = 3 apo = stbf+(uo/tcuo)+(cpoi*wic)O

aqi = fi/(ss*aic)O

casi = (si-asi)/tasO

CO = se/tsO

cpdi = (edi-pdi)/tpdiO

cpi = (ai-fi)/tcipO

cpoi = (ai-fi)/tcis cse = .2C

cstbf = (co-stbf)/taf ''_ cwos = di = ob/siO

edi = (ob/fpo)*mph*(1-wdi)+di*wdiC

fp = -3 ;~; fpOC = Ob/fpOC

idi = 3O

ise = 7500 iwos = 1O

mph = 6O

nts = 75 ~; OS = fpo*fpocSTELLA

Equations forthe Salesand

Production Scheduling Model1^ I

D-3807

47

O

p = (ss+cpi)*fp+psp*(1-fp) powii = fpo*(icli/mph) powti = fpo*(pdi/mph)*(1-wft)+fpo*{id1/mph)*wftO

psp = fpo/mphO

rco = se/nts rdi = pdi/idiO

rpo = os*wos+powti*(1-wos) '.0 s = sise = IF TIME <5 THEN ise ELSE (ise*(l+cse))

si = ss*eis ss = ob/pdl

C

taf = 6C

tas= 12O

tcip = 2 tcis = 2 tcuo = 1O

tpdi = 1O

ts = nts*edits IJ

uo = ob-rpo C' wdl = 1 wft = wic = 1wos = IF TIME < 40 THEN iwos ELSE (1wos*(1*cwos))

edits = graph(rdi)

!

eis = graph(aqi)0.0 -> 0.800 0.0 -> 0.0 0.500 -> 0.850 0.200 -> 0.950 1 000-> 1.000 0.400 -> 0.980 1.500 -> 1.150 0.600 -> 1.000 2.000 -> 1.350 0.800 -> 1.000 2.500 -> 1.550 1.000 -> 1.000 3.000 -> 1.825 1.200 -> 1.000 3.500 -> 2.150 1.400 -> 1.000 4.000 -> 2.500 1.600 -> 1.000 4 500 -> 2.900 1.800 -> 1.000 5.000 -> 3.500 2.000 -> 1.000

STELLA

Equations Continued -- for the Salesand

ProductionDEFINITION

OF

VARIABLE

NAMES

ai authorized inventory (systems)

aic authorized inventory coverage (months)

apo additions to planned orders (systems/month)

asi average shipments from inventory (systems/month)

aqi

adequacy

of inventory (dimensionless)casi

change

in average shipments from inventory(systems/month/month)

CO

customer

orders (orders for systems/month)cpdi

change

in perceived delivery interval (months/month)cpi correction to production from inventory (systems/month)

cpoi correction to planned orders from inventory (systems/month)

cse

change

in sales effort (dimensionless)cstbf

change

in short-term business forecast(systems/month/month)

cwos

change

in weight for orders scheduled (dimensionless)di delivery interval (months)

edi estimated delivery interval (months)

edits effect of delivery interval on time per sale (dimensionless)

eis effect of inventory on shipments (dimensionless)

fi finished inventory (systems)

fp flexibility of production (dimensionless)

fpo firm planned orders (systems planned)

fpoc fraction of planned orders committed (dimensionless)

id! industry delivery interval (months)

ise initial sales effort (hours/month)

iwos initial weight for orders scheduled (dimensionless)

mph

manufacturing planning horizon (months)nts normal time per sale (hours/system)

ob orders

booked

(orders for systems)OS orders scheduled (systems planned)

p production (systems/month)

pdi published delivery interval (months)

D-3807

49

DEFINITION

OF

VARIABLE

NAMES

-CONTINUED

powti planned orders within target interval (systems planned) psp production suggested by plan (systems/month)

rco reference

customer

orders (orders for systems/month)rdi relative delivery interval (dimensionless)

rpo reference planned orders (systems planned)

s shipments (systems/month)

se sales effort (hours/month)

si shipments from inventory (systems/month)

ss scheduled shipments (systems/month)

stbf short-term business forecast (systems/month)

tat time to adjust forecast (months)

tas time to average shipments (months)

tcip time to correct inventory for production (months)

tcis time to correct inventory for schedule (months)

tcuo time to correct unexpected orders (months)

tpdi time to publish delivery interval (months)

ts time per sale (hours/system)

uo unexpected orders (orders for systems) wdi weight for delivery interval (dimensionless)

wft weight for fixed target (dimensionless)

wic weight for inventory correction (dimensionless)

DESCRIPTION

OF PARAMETER

AND

STRUCTURAL

CHANGES

FOR

SIMULATION

SCENARIOS

Base

Run

(Model saps_base)The

base

run is described onpages

15 through 19 of the report.The

baserun uses the

model saps_base

-- a version of themodel

in which there isno feedback to production planning from orders booked,

and

in which thereis no finished inventory.

The

production plan (more specifically, additionsto

planned

orders) is therefore equal to the forecast.The

forecast isassumed

tobe

an exponentialsmoothing

ofcustomer

orders, with a smoothing constant (time to adjust the forecast taf) of 6 months.Monitoring

and

Control of Excess Orders (modelsaps_ordmon)

The

model

saps_ordmon

is thesame

as thebase

model, but withnew

equations to represent a policy of monitoring

and

control of excess orders.Simulations of the

model

are described onpages 20

through24

of thereport.

The

new

equations are described below.a). Additions to Planned Orders

apo

= stbf + uo/tcuo 1tcuo = 1 2

where:

apo

additions to planned orders (systems planned/month) stbf short-term business forecast (systems/month)uo unexpected orders (orders for systems)

D-3807

51In the

base

model, the additions to planned orders (apo) are equal to theshort-term business forecast (stbf). In other words,

when

plannersadd

new

production orders to the production schedule, theyadd

thenumber

oforders called for by the forecast (stbf). But,

when

they adopt the order monitoringand

control policy they alsoadd

a proportion of the unexpectedorders (uo) on top of the forecast.

When

the forecast is innaccurate, ormore

specifically,when

it is biaseddownward,

unexpected

ordersaccummulate

which are factored into the production plan asshown

inequation 1

.

b). Unexpected Orders

But

what

are unexpected ordersand

how

do

schedulers recognizethem?

Equations 3 through 9show

how.where:

uo = ob - rpo

rpo =

os*wos

+ powti*(1-wos)OS = fpo*fpoc fpoc = ob/fpo

wos

weight for orders scheduled (dimensionless)powti planned orders within target interval (systems)

pdi published delivery interval (months)

idi industry delivery interval (months)

mph

manufacturing planning horizon (months)wft weight for fixed target (dimensionless)

The

equations contain two switches -- weight for orders scheduled (wos)and

weight for fixed target (wft)which

allowone

tomake

differentassumptions

about the effectiveness of the order monitoringand

controlpolicy.

The

simulations described in the reportwere

obtained by settingwos

=and

wft = 1 -- a combination of switches that results in veryeffective order monitoring

and

control. With this combination, theequation for reference planned orders (rpo) reduces to:

rpo = fpo*(idi/mph)

So,

we

are saying in equation 3 that schedulers recognizeunexpected

orders (uo) by comparing orders

booked

(ob) with reference planned orders(rpo),

and

that they take as their reference point only the planned ordersscheduled

for production within the industry's delivery interval (thequantity fpo*(idi/mph).

If the parameter, weight for orders scheduled (wos), is set to 1, then the

model

saps_ordmon

becomes

equivalent to thebase

model.Under

thiscondition, the equation for reference planned orders (rpo) reduces to:

rpo = OS

But, as equations 5

and

6 show, orders scheduled (os) are those plannedorders that

have been

assigned tocustomer

orders -- in other words,D-3807

53and

in equation 1 additions to planned orders (apo) are equal to theshort-term business forecast (stbf) -- the

same

assumption

used

in thebase

model.(One

might ask,why

take the trouble to write equations forreference planned orders (rpo) if the numerical value of reference planned

orders (rpo) is zero.

The

answer

is that the equationsshow

the process bywhich schedulers

and

planners recognize excess orders -- the informationthey use to assess whether customers have ordered

more

than expected. Itturns out that in a

system

where

schedulershave

thefreedom

to assigncustomer

orders toany

open

production slot (a slot-planning system) it'sdifficult to recognize

excess

orders because, if the planning horizon islong enough, schedulers can always find

open

production slots).Finished Inventory Control (model

sapsjnvcon)

The

model

sapsjnvcon

is thesame

assaps_ordmon,

but with equationsadded

to represent finished inventory, production for inventory, shippingfrom inventory (in

saps_ordmon

shipping is equal to production)and

finished inventory control.The

new

equations are described below.a). Finished Inventory

and

Shippingufi = fi + p - si 1

INIT(fi) = co*aic 2

si = ss*eis 3

eis = graph(aqi)

4

where:

fi finished inventory (systems)

p production (systems/month)

si shipments from inventory (systems/month) CO customer orders (orders for systems/month)

aic authorized inventory coverage (months) ss scheduled shipments (systems/month)

eis effect of inventory on shipments (dimensionless)

aqi

adequacy

of inventory (dimensionless)Equation 1 states that finished inventory (fi) is increased by production

(p)

and reduced

byshipments

from inventory (si).So

productionand

shipments are no longer identical as they

were

in thebase

model and

insaps_ordmon,

but canmove

(somewhat)

independentlybecause

they areseparated by a level of inventory.

Equations 3 through 5 describe shipping. If there is

adequate

finishedinventory then

shipments

from inventory (si) are equal to the shippingschedule (ss).

The

factory can ship according to schedulebecause

there isadequate

product available -- in other words, the effect of inventory onshipments (eis) is neutral (takes a numerical value of 1).

The

key to thesuccess

of the finished inventory control policy is for the factory to holdenough

finished inventory that stockouts of high-volume items neveroccur.

By

preventing stockouts, the factory can maintain constant delivery intervalsand

so avoid the possibility of inadvertently suppressingcustomer

orders.The

following parameter values represent a no-stockoutD-3807

55

authorized inventory coverage aic = 3

months

effect of inventory on shipments eis = graph(aqi) such that

when

adequacy

of inventoryaqi = eis = aqi = 0.2 eis = .95 aqi = 0.4 eis = .98 aqi = 0.6 eis

=1.0

aqi = 0.8 eis = 1.0 aqi = 1.0 eis = 1.0 aqi = 1.2 eis = 1.0 aqi = 1.4 eis = 1.0 aqi = 1.6 eis = 1.0 aqi = 1.8 eis = 1.0 aqi = 2.0 eis=1.0

It is important that the effect of inventory on shipments (eis) remains at

the value 1, or very close to 1, over a wide range of values of finished inventory,

because

then the factory is always able to ship acording toschedule. If you study the graph function for the effect of inventory on

shipments

you'llsee

thatwhen

adequacy

of inventory is 1 --when

thefactory's finished inventory is exactly equal to the authorized inventory,

which is three

months

ofshipments

-- then the effect of inventory onshipments (eis) is also 1.

When

theadequacy

of inventory (aqi) falls--when

the factory's inventory is less than authorized -- the effect ofinventory on shipments (eis) stays very close to the value 1 . Only

when

theadequacy

of inventory reaches the value .2 --when

the factory's is onlyone

fifth of the authorized --does

the effect of inventory on shipmentssome

product linesand

therefore unable to ship according to schedule.The

reader should beaware

thatone

cannot arbitrarily specify theshape

of the effect of inventory on shipments (eis).

The

shape

depends

on theauthorized inventory

coverage

(aic)and

on the diversity of products the factory producesand

holds in finished inventory. If the factory producesmany

different products then it should plan to hold a lot of finished inventory (in other words, the authorized inventory coverage will be high,say 3 or 4

months

of shipments) to be sure of avoiding stock-outs,and

therefore to be sure that the effect of inventory

on

shipments remainsclose to the value 1.

On

the other hand, if the factory produces onlyone

product line, a stock-out can occur only

when

finished inventory is zero.So

the effect of inventory on shipments (eis) will remain at the value 1even

if the factory's authorized inventory coverage (aic) is onlyone month

or

one

week

of shipments.So,

when

using themodel

sapsjnvcon,

it is important to think carefullyabout the

shape

of the effect of inventory on shipments (eis)- how

itchanges

depending on the factory's authorized inventory coverage (aic) andon the assumptions

one

makes

about the factory'snumber

of product lines.For example, if

one were

to rerunsapsjnvcon

with authorized inventorycoverage reduced

to onlyone

month, instead of three, (and with theassumption

that the factoryproduces

several, say 10, different productD-3807

57shipments (eis) slope

more

graduallyupward

from the (0,0) point.One

would

find that, themore

gradual the slope, the less effective theinventory control policy

would

be in regulating delivery interval--because

the factory would stock-outmore

easily.b). Finished Inventory Monitoring

and

ControlTo

use

the finished inventory effectively for production planning, thefactory's

warehouse

must

monitor the differencebetween

finishedinventory

and

authorized inventoryand

report the difference to schedulersand

planners.The

schedulersand

planners use the information to adjust both current productionand

the production plan.The

equations to representthe monitoring

and

control of finished inventory areshown

below:apo

= stbf + (uo/tcuo) + (cpoi*wic) 6cpoi = (ai - fi)/tcis 7

p = (ss + cpi)*fp + psp*(1-fp) 8

cpi = (ai - fi)/tcip 9

where:

apo

additions to planned orders (systems/month) stbf short-term business forecast (systems/month) uo unexpected orders (orders for systems)tcuo time to correct unexpected orders (months)

cpoi correction to planned orders from inventory

(systems/month)

ai authorized inventory (systems)

fi finished inventory (systems)

tcis time to correct inventory for scheduling (months) p production (systems/month)

cpi correction to production from inventory

(systems/month)

fp flexibility of production (dimensionless)

psp production suggested by plan (systems/month)

tcip time to correct inventory for production (months)

Equation 6 states that

when

plannersmake

additions to planned orders theyadd

to the short-term busines forecast (stbf) a correction to plannedorders from finished inventory (cpoi).

They

make

a correctionwhenever

there is a reported differencebetween

authorized inventory (ai)and

finished inventory (fi) as

shown

in equation 7. (They alsoadd

to theshort-term business forecast (stbf) a correction for

unexpected

orders(uo)

-

but in the simulationsshown

in the report,unexpected

orders arealways zero

because

reference planned orders (rpo) are equal to orders scheduled (os)).Equation 8

and

9 state that schedulersmake

a correction to production(cpi)

based

on the reported differencebetween

authorized inventory (ai)and

finished inventory (fi). If finished inventory (fi) is lower thanauthorized (ai) they