Creating a Sustainable Business Model for the TV Industry

Strategic analysis on the Smart TV ecosystemBy MASSACHUSETS IN61WTUTE

Eileen J. Park OF TECHNOLOGY

Bachelor of Science

JUN

18

201

Ewha Women's University, 2003

LIBRARIES

MBA

Seoul National University, 2014

SUBMITTED TO THE MIT SLOAN SCHOOL OF MANAGEMENT IN PARTIAL FULFILLMENT OF THE

REQUIREMENTS FOR THE DEGREE OF

MASTER OF SCIENCE IN MANAGEMENT STUDIES

AT THE

MASSACHUSETTS INSTITUTE OF TECHNOLOGY JUNE 2014

0 2014 Eileen J. Park. All Rights Reserved.

The author hereby grants to MIT permission to reproduce and to distribute publicly paper and electronic copies of this thesis document in whole or in part in any medium now known or

hereafter created.

Signature redacted

Signature of Author:

/

' /MIT Slo'an School of Management May 9, 2014Certified By:

Signature redacted_

Michael A. Cusumano SMR Distinguished Professor of Management Thesis Supervisor

Accepted By:

Signature

redacted-Michael A. Cusumano SMR Distinguished Professor of Management Program Director, M.S. in Management Studies Program MIT Sloan School of Management

Creating a Sustainable Business Model for the TV Industry

ByEileen J. Park

Submitted to the MIT Sloan School of Management on May 9, 2014 in partial fulfillment of the requirements for the degree of

Master of Science in Management Studies

ABSTRACT

Over the past decades the revolution of electronic devices had a major impact in our everyday lives. The penetration of PCs and distribution of Internet made it easier to communicate with people around the world. The rise of smart phones changed many aspects of our everyday life, the impact ranging from alarm clocks to email consumption to video conference calls. The era of connected devices now trigger a radical change in an area that has not been disrupted over decades - the TV experience. By integrating the Internet into television sets, Smart TVs will allow consumers to use on-demand streaming media services, listen to Pandora Radio, access interactive media, use social networks, and download apps. In light of this industry change, several questions arise from the perspective of TV manufacturers. Can the Smart TV become a platform leader and create a sustainable ecosystem? What is the business model for TV manufacturers and how will they collaborate with other stakeholders? How will the smart TV create value for the customers and not get dis-intermediated? This thesis looks at factors that drive the industry change and identify challenges and opportunities to address. Overall, the thesis provides a strategic direction for television manufacturers.

Thesis Supervisor: Michael A. Cusumano

ACKNOWLEDGEMENT

I would like to express my sincere gratitude to Professor Michael A. Cusumano for his role as my

thesis supervisor. His lectures and insightful feedback on my work contributed to my learning and to a better end product. I would also like to thank Professor Andrei Hagiu of Harvard Business School who introduced me to the various aspects of platform strategy.

I am thankful to Min Lee at Samsung Electronics who helped me grow professionally and was

also willing to discuss his opinions and aspects on the Smart TV platform. I am truly grateful to Professor Namgyoo Park at Seoul National University for his guidance and support throughout the years. I would like to thank my friends and MSMS crew for their support and great teamwork, making my time at MIT memorable.

Most importantly, I would like to thank my wonderful family for their unconditional love, support and prayers. I would not be able to do this without them.

TABLE of CONTENTS

Contents Page

C H A PTER 1: Introduction ... 8...8

1.1 Research Background and Objectives ... 8

1.2 Research Approach...9

1.3 K ey Platform Concepts... 9

1.3.1 Platform D efinitions and D istinctions ... ... 9

1.3.2 Platform Leadership ... ... 9

1.4 Sum m ary of Chapters ... 10

C H A PTER 2: A nalysis of Sm art TV Ecosystem ... 10

2.1 D efinition of Sm art TV ... 10

2.2 Sm art TV Background ... 11.... I1 C H A PTER 3: Sm art TV Platform A nalysis ... 16

3.1 TV Industry Paradigm Shift...16

3.1.1 Content Providers ... 18

3.1.2 Broadcast/Cable Networks ... 18

3.1.3 N etwork operators (D istributors) ... 19

3.1.4 D evice M anufacturers ... 20

3.2 Sm art TV Platform Ecosystem ... 21

3.2.1 Sm art TV Industry Platform ... 21

3.2.2. Sm art TV Platform Ecosystem ... 23

3.2.3 Smart TV Ecosystem Overview ... 24

3.3 Sm art TV Platform Challenges...27

3.3.1 Control Over the Platform ... 27

3.3.2 Control Over the Content... 28

3.3.3 Control Over the Customer... 30

CHAPTER 4: Case Study - Strategic Direction for Samsung Smart TV ... 31

4.1 Sam sung Sm art TV Developm ent ... 31

4.2 Com petitive Landscape...32

4.2.1 Sony Bravia TV ... 33

4.2.2 LG Smart TV ... 34

4 .2 .3 G o o g le ... 3 4 4.2.4 Apple TV... 35

4.3 Sam sung's Platform Strategy...36

C H A PTER 5: Conclusion ... 41

LIST OF FIGURES

Figure Page

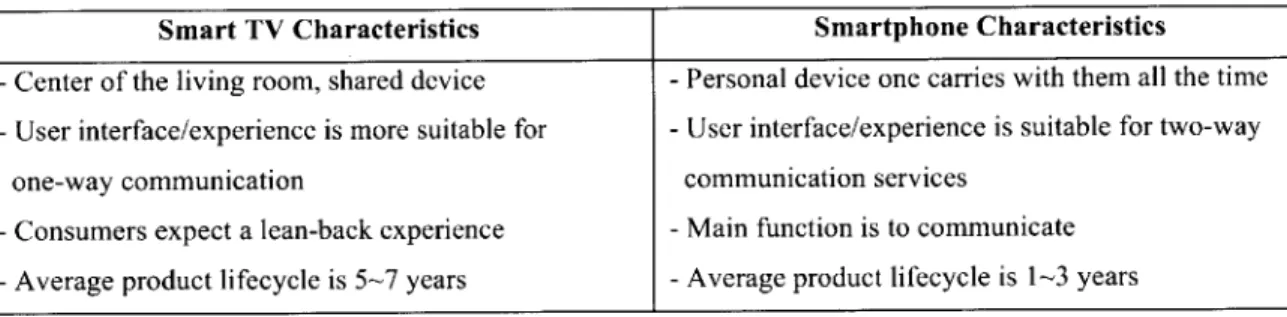

Figure 1: Smart TV and Smartphone Comparison...11

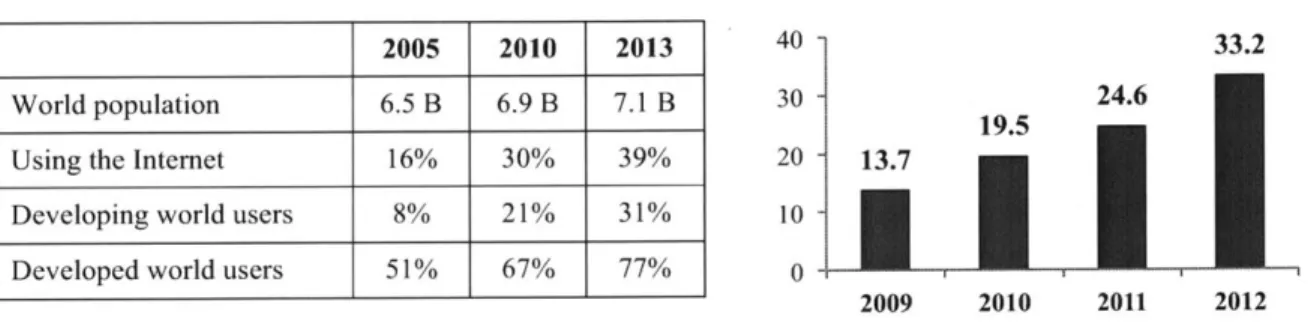

Figure 2: Internet Penetration R ate... 12

Figure 3: US Household (M) of 10Mbps+ ... 12

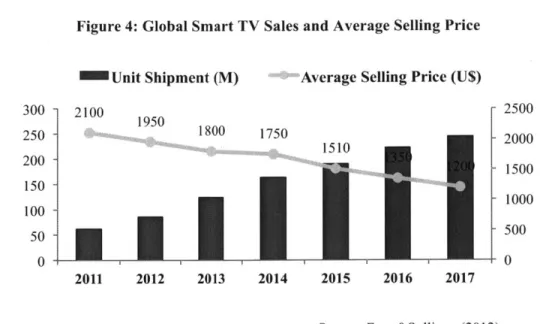

Figure 4: Global Smart TV Sales and Average Selling Price ... 14

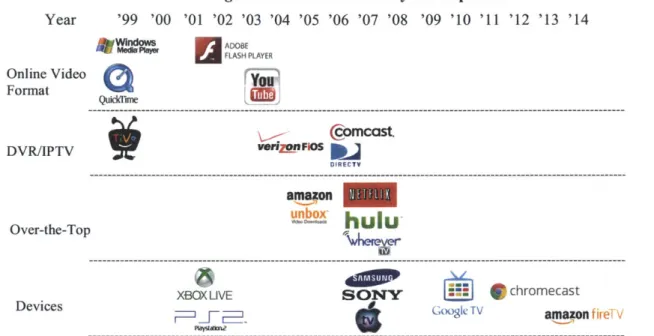

Figure 5: Smart TV Industry Development...16

Figure 6: Traditional TV Industry Ecosystem...17

Figure 7: Smart TV Trajectories of Industry Change...17

Figure 8: Pay T V N et A dditions... 19

Figure 9: Impact on Stakeholders with Consumer Adoption of IP-delivered Video Growth...21

Figure 10: Sm art TV Ecosystem ... 23

Figure 11: Smart TV Sales Forecast and US Market Penetration...24

Figure 12: Smart TV Players Strategic Moves...25

Figure 13: Sm art TV Platform s ... 27

Figure 14: Available Smart TV Video Content Apps n ... 29

Figure 15: TV-Internet Connections and Preference of Device for OTT Services...32

Figure 16: Global Smart TV Market Share ... 32

Figure 17: Streaming Device Market Share in US...33

Figure 18: Smart TV Alliance Members ... 34

Figure 19: Google's Business Model ... 35

Figure 20: Apple's Closed Ecosystem ... 36

Figure 21: Features used Once/per week by US Smart TV Owners ... 37

Figure 22: Ambidextrous Organization... 39

CHAPTER 1: Introduction

1.1 Research Background and Objectives

Over the past decades the revolution of electronic devices had a major impact in our everyday lives. The penetration of PCs and distribution of Internet made it easier to communicate with people around the world. The rise of smart phones changed many aspects of our everyday life, the impact ranging from alarm clocks to email consumption to video conference calls. The era of connected devices now trigger a radical change in an area that has not been disrupted over decades - the TV experience.

In the past, the TV industry moved along the S-curve through technological innovations from manufacturers. For example, in the 1980-99's CRT TV dominated the market and Sony was the leader. In early 2000, Plasma technology disrupted the market and Panasonic led this change. A few years later, the

LCD technology became mainstream and Samsung took over the market. After two years, the market

demand soared with the breakthrough LED technology, which led to slim, energy efficient TV sets. However, when the "Smart TV" concept was introduced to the market in 2010, this disruption was more of a feature innovation instead of a technological innovation - bringing the Internet to the TV through devices such as connected TVs, latest generation set top boxes, and connected game consoles.

Integrating the Internet to the TV undoubtedly is changing every segment of the TV industry from content, distribution and devices. The TV is transforming into a potentially powerful platform, therefore market players' must rethink their business models and build a distinctive competitive strategy to succeed in the battle for the living room. These markets require distinctive competitive strategies because the products are parts of systems that combine core components made by one company with complements usually made by a variety of companies. But the future of TV will lie in the hands of those who can change their thinking to master the business of next-generation TV, and not just the technology.

In light of this industry change, several questions arise from the perspective of the stakeholders of the Smart TV industry. Can the Smart TV become a platform leader and create a sustainable ecosystem? What is the business model for TV manufacturers and how will they collaborate with other stakeholders? How will the smart TV create value for the customers and not get dis-intermediated?

The objective of this thesis is to address the underlying challenges and opportunities that various stakeholders face in the Smart TV industry, especially in the case of a manufacture company.

1.2 Research Approach

- Apply core concepts of platform leadership and industry platforms to the current TV industry

* Analyze market trends and business models related to Smart TV ecosystem * Use case studies, interviews and consumer research to identify platform strategies * Review key issues the Smart TV ecosystem stakeholders are facing

- Suggest a platform-based strategy that TV manufacturers must adopt to create a sustainable business model within a platform-centric ecosystem

1.3 Key Platform Concepts

1.3.1 Platform Definitions and Distinctions

In this study, the term platform is adopted from the external (industry) platform defined by Gawer and Cusumano. Industry platforms are products, services or technologies that are similar to the former but provide the foundation upon which outside firms (organized as a 'business ecosystem') can develop their own complementary products, technologies, or services (Cusumano & Gawer, 2002). Industry platforms are defined as products, services or technologies developed by one or more firms, and which serve as foundations upon which a larger number of firms can build further complementary innovations, in the

form of specific products, related services or component technologies. There is a similarity to internal platforms in that industry platforms provide a foundation of common components or technologies, but they differ in that this foundation is "open" to outside firms. The degree of openness can vary on a

number of dimensions - such as level of access to information on interfaces to link to the platform or utilize its capabilities, the type of rules governing use of the platform, or cost of access (as in patent or licensing fees) (Cusumano M. A., 2012).

1.3.2 Platform Leadership

To identify the importance of the industry shifting from product-centric strategies to platform-centric strategies the study applies concepts such as 'The 4 Levers' which explains broad categories for platform leadership strategies, and 'Coring & Tipping' regarding strategies to create a platform or encourage a market to adopt your platform. (Cusumano & Gawer, 2002)

The 4 Levers: Firm Scope, Platform Technology, External Relations, Internal Organization - broad categories for implementing a platform leadership strategy

Coring & Tipping: "Coring" is the set of activities a company can use to identify or design an element (a technology, a product or a service) and make this element fundamental to a technological system as well

as to a market. It addresses to solve the problem - How to create a platform market where one does not yet exist? (e.g., solve an "essential" industry system problem).

"Tipping" is the set of activities or strategic moves that companies can use to shape market dynamics and win a platform war when at least two platform candidates compete. - How to encourage a market to adopt your platform when multiple platforms compete? (e.g. subsidies of one side)

1.4 Summary of Chapters

This thesis consists of five chapters and the following is the executive summary of the main chapters. Chapter 2: Focuses on analyzing the factors that brought upon the Smart TV era and the impact Smart TV has on the TV industry ecosystem.

Chapter 3: Analyzes the Smart TV platform, value chain and ecosystem. This chapter also illustrates each stakeholder's value proposition and business strategy. In addition, this chapter identifies Smart TV industry key issues on controlling the platform, content, and customers.

Chapter 4: Case study on Samsung's Smart TV strategy and future recommendations.

Chapter 5: Summary of Smart TV platform analysis and strategy with suggested framework on how to gain platform leadership in the Smart TV industry.

CHAPTER 2: Analysis of Smart TV Ecosystem

2.1 Definition of Smart TVA Smart TV is either a television set with integrated Internet capabilities or an add-on streaming device

for television that offers more advanced computing ability and Internet connectivity than a basic

television set (Hoelzel, 2014). Smart TVs allows the user to install and run more advanced applications or plugins/add-ons based on a specific operating system. For example, Smart TVs enables the user to browse the Internet, watch YouTube video clips, and download game applications from the television set. In more detail, the Smart TV can be placed into two categories, although the two share many characteristics. -Smart TVs: Television sets that contain a built-in Internet connection and often feature a proprietary

operating system, typically controlled by the manufacturers. These tend to be companies with a trajectory in the traditional TV market, such as Samsung, Sony, and Vizio.

-Streaming Devices: Televisions that lack independent "smart" features and dedicated Internet

connection can instead receive added features and Internet access through a streaming device that plugs into a TV. This can be a set-top box like Roku, or a thumb drive-sized device like Google's Chromecast. Although connected TVs were available to the market since 2007 the term 'Smart TV' was used since 2011 only after smartphones became mainstream. Using the Smart TV concept was an attempt from the television manufacturers to follow the footsteps of the mobile phone industry's success on the transition to smartphones. The manufacturers thought that customers who were familiar with the smartphone features would naturally understand the concept of Smart TV. Consequently, many features and user interfaces of the early Smart TVs resemble the features of a smartphone such as weather/stock feeds, web browser, and notepad applications. However, the aim of Internet connected TVs is not to nudge

consumers toward some unfamiliar behavior like searching Google on TV in their living room, but to enhance the everyday experience of watching television. The industry is learning that the smartphone and Smart TV are two distinct devices with different purposes and usages. Therefore, it is essential to

understand the main differences between the two industries.

Figure 1: Smart TV and Smartphone Comparison

Smart TV Characteristics Smartphone Characteristics

-Center of the living room, shared device -Personal device one carries with them all the time -User interface/experience is more suitable for -User interface/experience is suitable for two-way

one-way communication communication services

-Consumers expect a lean-back experience -Main function is to communicate -Average product lifecycle is 5-7 years -Average product lifecycle is 1-3 years

Source: Kwon, Digieco 2012

2.2 Smart TV Background

The growth of Smart TV can be discussed in mainly two perspectives: Technological factors and user behavioral factors. Both are correlated to each other since technological developments drive a change in the user's lifestyle and vice versa.

- Technological Factors

Throughout the past, new technology has proven that it can change the way we receive news and entertainment. Radio challenged newspapers in the early 1900s, and television challenged radio. Now, due to the proliferation of Internet and technological enhancements in bandwidth and codecs, the traditional television has its own competitor - the Smart TV. First of all, the increased access to Internet broadband across developed economies escalated the penetration rate of Smart TVs. In 2005 the world

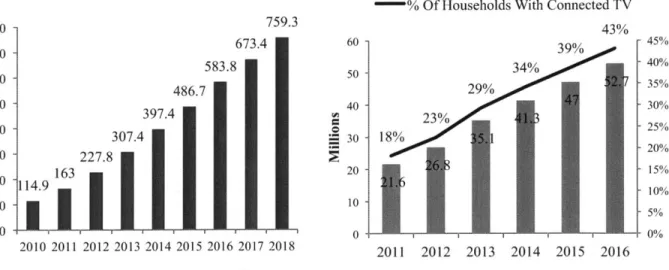

population was 6.5 billion and although globally only 16% were using the Internet, in the developed world 51% of users were it. By 2013 the number was up to 77%46, which indicates that most of the households are equipped to use a Smart TV. The increase in broadband speed also affects the spread of Smart TVs because broadband connection of up to 10Mbps enables users to easily stream video content online. The increase in global number of Smart TV sales reflect this development as 114.9 million units (2010) more than doubled to 307.4 million units (2013) with a 28% compound annual growth rate.

Figure 2: Internet Penetration Rate Figure 3: US Household (M) of 1OMbps+

2005 2010 2013

World population 6.5 B 6.9 B 7.1 B

Using the Internet 16% 30% 39%

Developing world users 8% 21% 31%

Developed world users 51% 67% 77%

40 - 33.2 30 - 24.6 19.5 20 - 13.7 10 0 2009 2010 2011 2012

Source: International Telecommunications Union Source: Parks Associate Estimate, 2009

Another driving factor was the technological enhancements in video content distribution such as Internet Protocol television (IPTV) where services are delivered using the Internet protocol suite over a packet-switched network such as a LAN or the Internet, instead of being delivered through traditional terrestrial, satellite signal, and cable television formats. Unlike downloaded media, IPTV offers the ability to stream the media in smaller batches, directly from the source. As a result, a client media player can begin playing a video clip before the entire file has been transmitted. This enabled video streaming over the Internet bringing services such as live television, time-shifted television (catch-up TV) and video-on-demand (VOD) directly to the living room.

A more impactful method is over-the-top-content (OTT), which also does not involve multiple system

operators (MSO) and uses an open Internet and unmanaged network open ecosystem. While IPTV network type is closed, proprietary network, accessed via a specific Internet service provider, OTT delivers content directly from the provider/content aggregator to the viewer using open network. OTT video streaming services provide the benefit of low cost and flexibility of content usage among devices, therefore services such as YouTube, Netflix and Hulu adopted this technology as an economical VOD delivery model. Most of these services were the killer applications for Smart TV and led users to stream content across multiple devices.

In addition, digital convergence and the decline of hardware prices positively affected the growth of Smart TVs. Info.org (Project, 2005) defines digital convergence as "the trend for various ICTs to become digital and for CTs to be based on packet switching and to operate over a common network

infrastructure." Digital convergence is the priming of underlying digital technology components and features, such as voice, texts, video, pictures, broadcasts, presentation, streaming media, global

connectivity and personalized services; the combination of all of these features and abilities from multiple electronic systems into a simplified, converged and computer-mediated communication system to enable individuals interact, play, communicate, collaborate and share information in many new ways. Based on digital technologies encompasses converged devices, such as smartphones, laptops, Internet enabled entertainment devices and set top boxes, converged applications (e.g. music download on PC and handheld) and converged networks (e.g. IP networks) (Yoo, 2011). This give ways for devices to bring the Internet to the television set through different paths. For example, game consoles such as Xbox or PlayStation not only provide gaming entertainment, but also work as an add-on Smart TV device that delivers video content and applications to your television. Blu-ray players function as high-definition video content players as well as set top box type Smart TVs.

This is related to the term N-screen (connected devices) as a "unified entertainment experience across several devices," (Hong, 2014) meaning that one can seamlessly switch between watching the same program on one's TV, tablet or smartphone, with the software adapting the programming to the various formats automatically. Although each device performs its own task and they have different internal architecture, the common thing they share is each of them serves the users whatever it is. Another thing they share among them is they are connected to Internet. Therefore, manufactures and content providers look for ways to optimize their products and services so that it will integrate standardized formats or features compatible to other devices. Therefore, the explosion of smartphones, tablets and laptops are all related to the penetration of Smart TVs, as users want a more seamless connected experience.

The decline in Smart TV prices also impact the adoption of Smart TVs making the technology relatively accessible to consumers. The global Smart TV market shows this trend as the average selling price for Smart TV declines with a compound annual growth rate of -9.3% as unit shipments increase with a 23.2% growth rate.

Figure 4: Global Smart TV Sales and Average Selling Price

Unit Shipment (M) -Average Selling Price (U$)

300 - 2100 - 2500 250 195 1800 1750 150-20 200 -- 1500 150 9 100 -- 10 50 -- 500 0 0 2011 2012 2013 2014 2015 2016 2017 Source: Frost&Sullivan (2012) User behavioral factors

As the core consumer segment for digital devices shift from Baby boomers and Generation X to Generation Y many user needs and values have changed. Baby boomers are people born during the demographic Post-World War II baby boom between the years 1946 and 1964 (Age 68 to 50) who enjoys a lean-back experience of a television. Generation X are people born in 1966 to 1976 (Age 48 to 38) who are familiar with Internet, and Generation Y are people born in 1977 to 1994 (Age 37 to 20) also called 'Millennials' (Werner, 2011). A survey done in 2010 by US Bureau of the Census illustrates that Generation Y account for 29% of the US total population. Researches also discovered that the annual income of Generation Y surpassed that of the Baby boomers in 2012, making Generation Y the lead consumer in the US.

Although characteristics of Generation Y vary by region depending on social and economic conditions, as education writer and speaker Mark Prensky defined, the key characteristic of generation Y is 'digital natives' meaning a person who was born during or after the general introduction of digital technologies and through interacting with digital technology from an early age, has a greater understanding of its concepts.

William A. Draves and Julie Coates, authors of Nine Shift: Work, Life and Education in the 21st Century, wrote that Millennials have distinctly different behaviors, values and attitudes from previous generations as a response to the technological and economic implications of the Internet. They found that 97% of these students owned a computer, 94% owned a cell phone, and 56% owned an MP3 player. They also found that students spoke with their parents an average of 1.5 times a day about a wide range of topics.

Other findings in the Junco and Mastrodicasa (Junco & Mastrodicasa, 2011) survey revealed 76% of students used instant messaging, 92% of those reported multitasking while instant messaging, 40% of them used television to get most of their news, and 34% of students surveyed used the Internet as their primary news source. The followings are some key characteristics of Generation Y that effect and drive

the growth of Smart TVs.

Generation Y characteristics that drive Smart TVs

-Higher purchasing power: Generation Y population have seen their parents work hard and then watched their pensions disappear, so now they anticipate enjoying life rather than saving. Gen Y's annual spending power exceeds $200 billion and they also influence another $50 billion in purchases. (Escalera, 2012) Especially, compared to the Baby boomers the Gen Y's are willing to invest in big-ticket items such as TV sets, game consoles and mobile devices.

-Accustomed to multi-tasking: The traditional TV set is still the most watched device for video content (average of 24 hours and 44 minutes/per week), however research from media tracking

institutes such as Nielsen illustrate a continuous decline in traditional TV viewership. Instead, Gen Y's are increasingly watching shows on non-traditional media (average 5 hours and 39 minutes online/ per week), but most often, they engage old media (TV) and new media (portable

devices) simultaneously in what's known as "the second screen." Researches show that 89% of the people surf the Web on their computer while watching television on a set. (Zigmond & Stipp,

2011) Therefore, it is inevitable for Smart TV manufacturers to incorporate Web features,

applications and increase the connectivity with portable devices to the traditional television set to sustain the position in the center of the living room.

-Used to on-demand, streaming content: Studies from Dan Zigmond and Horst Stipp show that Gen Y watches less live TV and more on-demand/streaming content through other devices such as DVRs, PCs and Smartphones. (Zigmond & Stipp, 2011) This disrupts not only the TV manufacturing industry, but also the broadcasting, advertising industry. Gen Y's are consuming content on new media and interacting with TV in innovative ways where conventional live TV may become obsolete. The industry must think of time-shift content, de-bundling of channels, and personalized advertisement models.

-24/7 connected: Some refer to Generation Y as 'the Facebook generation' implying that instead of getting a person's number, this generation would add you as a 'friend' on Facebook. (Westlake,

2008) Research from Nielson shows that 72% of this generation is on Facebook. This data

socializing online around television, which brings new opportunities to change the TV viewing experience from a one-way experience to an interactive two-way experience.

Both technological and user behavioral changes shape a new era for the TV industry opening new

business opportunities for multiple stakeholders in the value chain. Figure 5. illustrates how the Smart TV industry was shaped as the technology and user experience changed.

Figure 5: Smart TV Industry Development

Year '99 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14

U

ADOBE FLASH PLAYER Online Video Format @omcast. DVR/IPTV v nvnFOS DIRECTV amma4on Over-the-Tophulu

henV6VDevices XBOX LVE

SONY

chromecast

Googe V amazon f rei V

Source: Company Website

CHAPTER 3: Smart TV Platform Analysis

3.1 TV Industry Paradigm ShiftAs illustrated in Figure 5, 2007 was a revolutionary year for the TV industry. Netflix introduced over-the-top subscription offerings to the market by launching its on-demand Internet streaming service.

Broadcasting companies and content providers such as NBCUniversal Television Group (Comcast), Fox Broadcasting Company (21st Century Fox) and Disney-ABC Television Group joined together to create Hulu to offer their content via OTT. WhereverTV started free live streaming TV channels on the Internet making TV content more accessible. Hardware manufacturers such as Samsung, Sony, and LG launched the early Smart TVs and Apple launched AppleTV -- a set top box type Smart TV.

The main topic in 2007 Consumer Electronic Show (CES) and MacWorld was 'Content Portability' meaning that users can seamlessly watch their content anytime, anywhere on any device. Microsoft

founder, Bill Gates said, "The Internet is set to revolutionize television within five years, due to an explosion of online video content and the merging of PCs and TV sets". CBS CEO Les Moonves said, "Media companies' future is in content that extends to multiple platforms . The convergence of the Internet and TV is disrupting the video/television industry and has the potential to transform the entire ecosystem for every player-both established and those that are just emerging into this dynamic industry. The disruption can be explained by looking at the change in the business models of each player in the market. The traditional ecosystem for the TV industry consists mainly of six major stakeholders. It starts with the content owners such as TV, movie studios that create content based on the sponsorship they receive from programmers. The programmers such as large broadcast/cable networks aggregate contents

into program channels and receive the licensing fee from network operators while granting the rights to content. The network operator's main activity is to distribute the content to households through the television sets and receive a subscription fee from the end users. Advertisers take part in the system by paying ad fees to either programmers or network operators for an advertising slot embedding in the programming.

Figure 6: Traditional TV Industry Ecosystem

Content Broadcast Network Device End

Providers Networks Operators Manufacturers Users

Advertisers

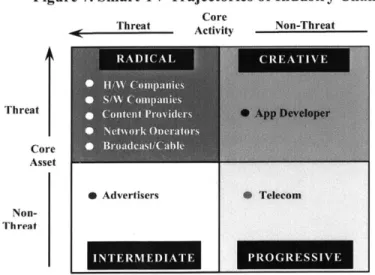

However, factors from 'Trajectories of industry change' (M.Mogahan, 2004) show that television industry is going through a radical change -- everything is up in the air. The followings are each stakeholder's core activities, assets and the threats they are facing.

Figure 7. Smart TV Trajectories of Industry Change

Core

Threat Activi Non-Threat

Threat Core Asset 0 Advertisers 0 Telecom Non-Threat

3.1.1 Content Providers

Content providers' core activity, the recurring actions your company performs that attract and retain suppliers and buyers, are mostly creating content and receiving sponsor from programmers or advertisers. The threat they face are now the multiple formats of content they have to deliver and how they would deliver it on various devices. This may also be an opportunity as the content providers gain more bargaining power over the programmers since they are open to creating their own direct-to-customer channels through applications, OTT services, and websites.

The core asset of content providers will be the creativity, excitement and knowledge of the content. This may maintain unthreatened for content providers in high demand, however, the de-bundling of channels and growing demand for d la carte puts low demand content in a tough position. For example, a

documentary show might not be as popular as 'Game of Thrones', but HBO bundles different genres in its programming and charges a flat-fee. If it were possible to charge a different fee per show,

documentary shows may not be able to survive. In addition, OTT services like Netflix are moving into the content creation space, investing and creating shows such as 'House of Cards' bringing upon new

competition.

3.1.2 Broadcast/Cable Networks

Broadcast/cable networks such as NBC, Fox, and CBS aggregate content from providers and receive an affiliate fee from the distributors, which is the main activity. This is threatened by Smart TVs and OTT services because the value of content decreases when programs are rebroadcasted through Internet for free. The content providers can bypass programmers and distribute content individually. In addition, there is an increase in the de-bundling of channels that puts a major threat on the profitability because a typical cable network strategy would be to develop one or two hit programs and fill the rest of the linear lineup with inexpensive content to maintain a relatively low cost. The hit programs attract network operators, making the channel a "must have" content granting the programmers the negotiation power to ask for fees. The rebroadcasting and de-bundling of channels risks the core activities of programmers.

Core assets such as control over content and programming television shows are also threatened due to the various distribution channels the ecosystem provides. The more content is distributed freely or de-bundled, the less power broadcast/cable networks have, therefore it is harder to charge a premium to distributors. This explains why NBC, ABC, CBS and Hulu have blocked Google TV-enabled devices from accessing their Web content since the Google TV launch in 2010. (Miller, 2010)

3.1.3 Network operators (Distributors)

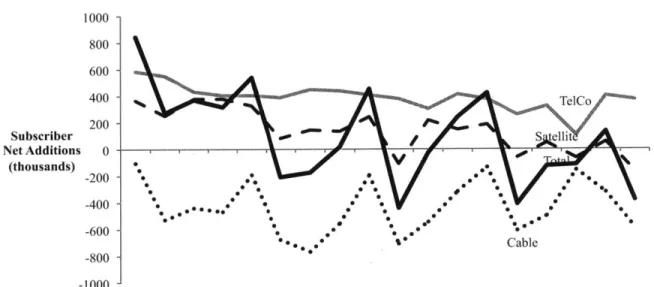

The network operators face the biggest challenge when it comes to disruption in the television industry because the core activities of network operators are to provide the infrastructure and service of video distribution network to users and charge a subscription fee. However, the threat is that people are "cord-cutting" pay TV and increasingly using the Internet content to replace the linear cable television model.

Research from Moffett Research in 2013 (Spangler, 2013) discovered the US pay TV sector as a whole

lost 316,000 subscribers for the 12-month period. Craig Moffett mentioned that, "Cord cutting used to be an urban myth. It isn't anymore." Meaning that there is a threat that distributors may lose their service user base to substitutes such as Nexflix, Hulu and Amazon Instant Video where consumers can enjoy watching d la carte individually tailored shows with a lower cost.

Figure 8. Pay TV Net Additions

1000 800 -600 400 TelCo 200 Subscriber - ... s tellit Net Additions 0 -(thousands) * V.. -200 - 0. 00 .0. 0., * ,0 .0, 0, 0 00 -400 - 0. *. e ,* . 0 0. 0. .00 * -600 - * -800 - Cable -1000 -1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13

Source: Bernstien Research

The core asset for network operators is their wide distribution network for millions of users. In addition, a large part of the network operator's asset is from advertisements. However, ever since the Smart TV emerged the other players in the industry have the opportunity to go through other distributors, which wdakens the control over the content. Therefore, programmers have a stronger negotiation power and start to request a higher affiliate fee for the content. Also, advertisers start to look at other media channels such

as social network services or Smart TV platforms. Network operators try to defend their core activities

and assets in order not to follow the steps of the music industry where companies such as Apple disrupted the market by de-bundling albums and creating a new platform for the users. For example, Comcast, Time Warner Cable and other distributors launched a 'TV everywhere' service that allows their subscribers to

access their respective content on digital platforms, including video on demand and live streaming of the channels themselves. (Lasar, 2009) This helps subscribers go through the service provided from operators and maintain revenue streams. The activities Comcast recently done illustrates the strategic position distributors are showing. For instance, in 2014 Comcast bided $45 million for Time Warner Cable so it will gain even more leverage over the country's market place for television, broadband Internet and phone services. (Comcast, 2014)

3.1.4 Device Manufacturers

Device manufacturers revenue stream is mostly from selling hardware with enhanced features and technologies that repeatedly attract end users. This model is threatened by the change in industry for both Smart TV set manufacturers and add-on device manufacturers. In general, the risk is that people are migrating from television sets and substituting it with other devices such as PCs, tablets and mobile phones. Specifically for set manufacturers the threat would be that add-on devices provide the end user to upgrade their conventional TV sets at a lower cost also providing most of the applications and services the set makers does, therefore the product life cycle for TV sets may extend to a longer period resulting in decreased sales. Research from eMarketer shows that in 2014 US market, the add-on Smart TV devices share was 53% and 47% came from Smart TVs. This indicates the television set manufacturers are under pressure. For add-on devices the threat is coming from network operating firms that have 110 million subscribers (Spangel, 2014) in the US and Comcast, DirecTV and Verizon are pushing into the hardware business with set-top boxes to lock-in customers through their services.

The core asset for hardware companies is the technological capability to create hardware innovations such as new backlight solutions, better design, and seamless connectivity. However, the Smart TV industry requires capabilities in creating a platform where software, user interface/user experience, and killer content become valuable assets. This is one of the reasons why players such as Google, Apple, and Amazon are readily joining the industry to create a platform.

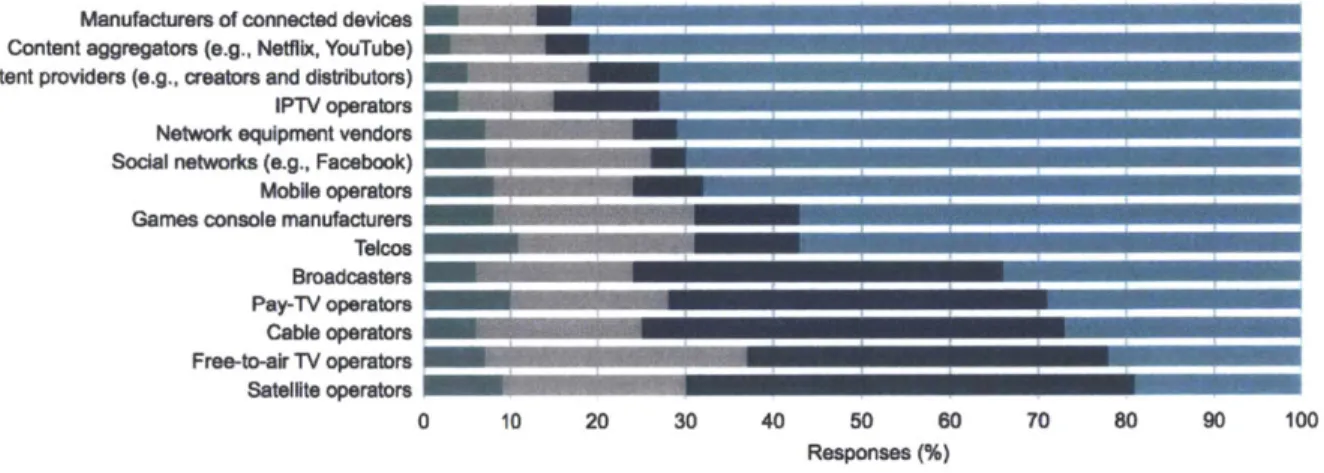

Surveys from Informa based on responses from TV, telecoms and Internet executives on Figure 9 suggest that broadcasters and network operators will have the biggest negative impact among the stakeholders in the next five years. Results indicate manufacturers of devices and online content aggregators are likely to be positively influenced. However, it is easy to see why types of company built on old business models might be threatened by new Internet players, but with a dynamic capabilities point of view there is no reason why any individual firm can't use the same technology to its advantage. The threat to the player's core activities and core assets pushes them to innovate and expand beyond their original business model creating new growth opportunities. TV expands into creating a platform and new stakeholders such as

telecommunication companies, web search engines, and portals enter the ecosystem. All members of the value chain are trying to have an increased role across the ecosystem to gain leadership over the platform, content and consumer.

Figure 9. Impact on Stakeholders with Consumer Adoption of IP-delivered Video Growth N Uncertain N Neutral U Negative M Positive

Manufacturers of connected devices Content aggregators (e.g., Netflix, YouTube) Content providers (e.g., creators and distributors)I

IPTV operators Network equipment vendors Social networks (e.g., Facebook) Mobile operators Games console manufacturers Telcos Broadcasters Pay-TV operators Cable operators Free-to-air TV operators Satellite operators 0 10 20 30 40 50 60 70 80 90 100 Responses (%)

Source: Informa Telecoms&Media 2012

Eventually, the future of TV will be in the hands of firms that rethink their core activities and core assets to master the business of next-generation TV, and not just the technology. This leads to firms' developing or reallocating the resources and capabilities to compete on the basis of platforms, and not only on products, requiring a different approach to strategy and business models.

3.2 Smart TV Platform Ecosystem

The television industry is no longer a horizontal value chain business relationship between the

stakeholders. Because of the Internet, it has evolved to a multi-sided platform with complex interactions among the players. The players do not develop stand-alone products, but are involved in an industry-wide platform. Therefore, there are potential differences in the strategy, implementation, business model and value capturing. It is important to understand the platform and ecosystem dynamics in order to develop an adequate strategy.

3.2.1 Smart TV Industry Platform

The Smart TV industry is evolving into a platform ecosystem where there is a platform, complements and network effects. Therefore, a new challenge is to compete in platform markets within and industry and to innovate through a broader "ecosystem" of partners and users not under any one firm's direct control. To understand the importance of creating a platform ecosystem for Smart TVs one must clarify the concept

of a platform. First of all, a Smart TV needs a broader application of strategies as it would not be an in-house "product platform" but would be an "industry platform". Cusumano (Cusumano & Gawer, 2002) defined an "industry platform" as the following:

1. Technology or set of components (or services) that creates a common place or foundation, 2. That brings together multiple parties beyond a single firm ("market sides") for a common

purpose,

3. Where value can increase exponentially as (a) more users and (b) more "complementary" products & services are added that make the platform more useful.

Smart TVs integrates the technology of running complete operating systems or mobile operating system software that provides a platform for application developers. This creates a commonplace or foundation for the users. In addition, Smart TV platforms or middleware have a software development kit (SDK) and/or native development kit (NDK) for apps so that third-party developers can develop applications for it, and an app store so that the end-users can install and uninstall apps themselves. This illustrates the purpose of bringing together multiple parties beyond a single firm to enhance the viewing experience. In the case of Smart TVs, the value can increase exponentially because the more viewers/users of the services leads to more complementary products/services and vice versa. For example, OTT content distributors such as Netflix and Hulu are offered in most Smart TVs because they are a killer application and most Smart TVs want the service available on their platform to attract more users. The more users they acquire, the likelihood of more complementary services such as Pandora and Skype will be added. Cusumano and Gawer (Cusumano & Gawer, 2002) identified two main differences between an in-house "product platform" and an "industry platform", which are essential to the success of becoming a platform leader for Smart TVs. Their definition of an industry platform is a foundation or core technology in a "system-like" product that had relatively little value to users without complementary products or services. The platform producer often depends on outside firms to produce the essential complements. In the case of Smart TVs, without complementary products or services such as applications, content or Internet services the devices will just be a dummy box sitting on your table. To facilitate other firms and user communities to adopt the platform technology and contribute complementary innovations, Smart TV manufacturers provide tool kits such as software development kit (SDK) so that content providers or application developers can easily access the technology and develop complementary services.

The second essential difference between a product and an industry platform is the creation of network effects. The smartphone industry demonstrated the power of network effects as Apple's iOS and Google's

Android operating system dominated the industry within a few years. However, unlike the smartphone industry Smart TV is still struggling to create a platform that will create powerful network effects and a win-win ecosystem structure.

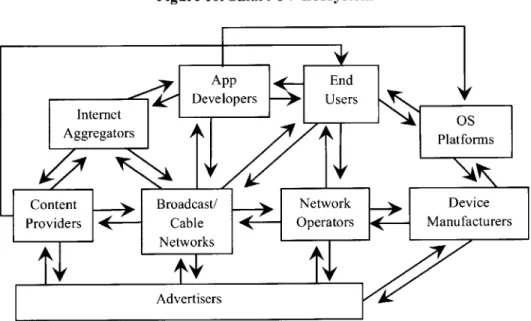

3.2.2. Smart TV Platform Ecosystem

As mentioned in Chapter 3, the traditional value chain of the television industry is disrupted due to the change in consuming video content and Internet connection to TVs. The relationship between

stakeholders in the ecosystem is no longer a sequence of activities, but a simultaneous web-like interaction.

Figure 10. Smart TV Ecosystem

App End S o r c : 1 D e v e lo p e r s E nUs e r s Aggregators TV 'y Platforms

Content Broadcast/ Network Device

Providers Cable Operators IneManufacturers

Networks

Advertisers

Source: 2011, Samsung Electronics Conference

New roles and players emerge in the Smart TV ecosystem as the TV expands to provide a platform from its conventional one-way broadcasting model. Smart TV becomes the focal device in the ecosystem based on the aggregation of applications, content and closeness to the end-user. Internet-based aggregator

influence broadcast/cable networks therefore the positioning of broadcast/cable networks has changed from a pure content aggregator to a distributor and creator. New business models such as applications and

OS platforms emerge to create a platform ecosystem, however it is crucial to find a tailored solution for

the TV industry because the TV market is fundamentally different from the smartphone market although the platform ecosystem looks similar. The biggest difference is that phones are communications devices and the applications do not affect the operation of a phone call, however, on Smart TVs the separation

from content prevents the development of a rich TV ecosystem. There needs to be an intimate relationship among the content provider, the content distributor, and the device.

3.2.3 Smart TV Ecosystem Overview

To get better insights on the dynamics of the ecosystem it is important to understand the current situation and stakeholder's strategic moves. The market potential of Smart TVs are huge based on data from Digital TV Research (2014) in total, there will be more than 759 million televisions connected to the Internet worldwide by 2018, more than doubling from 307.4 million at year-end 2013.

-Market Outlook

In the United States, Connected TVs will be in nearly 53 million American households by 2016,

accounting for 43% of all U.S. Globally, shipments of smart TVs will reach a tipping point in 2015, when they will overtake shipments of traditional TVs. It is clear that the growth of Smart TVs will be strong and there is an attractive market to reach. Many companies are now joining the market to take a part in the ecosystem not only because of growth in Smart TV devices. Although many users are migrating to other devices such as PC, tablets and mobile phones, the television still represents the largest consumer device market with a potential to grow even bigger.

800 700 600 500 400 300 200 100 0

Figure 11. Smart TV Sales Forecast and US Market Penetration

-% Of Households With Connected TV

759.3 43% 673.4 60 39% 45 583.8 5034% 40 486.7 29% 3 397.4 40 30 23 25 307.4 30 18% 227.8 20 163 20 15 114.9 10 1 0 - -0 50 0 03 2010 2011 2012 2013 2014 2015 2016 2017 2018 2011 2012 2013 2014 2015 2016

Source: Digital TV Research Source: eMarketer

0/

/%

First of all, research from Nielsen (2014) indicates that the advent of the web did not cut into TV time because the average daily TV viewing hours went from 4:06 hours (1991-1992) to 4:51 hours (2011-2012). In addition the average monthly media viewing, in hours are 145 hours for TV and 28.5 hours for Internet showing that many people still use TV for viewing media entertainment. Another attractive factor

is that 119 million people (41% of total) in the United States who own a TV set have at least 4 TVs in their household. Value wise, TV still represents the world's biggest advertising market encompassing roughly $350 billion in global TV ad spending, or 63% of all advertisement spending. (Cattaneo, 2013) TV is also the centerpiece of the world's most important entertainment markets, including TV, gaming, movies, and related services and infrastructure. In other words, Smart TV market has a large, captive audience, spending a lot of money on entertainment, and very attractive to advertisers. However, the living-room entertainment has tough gatekeepers as a small handful of giant media companies control live TV content, distribution, and advertising, and they are notoriously slow when it comes to technology innovation. In addition, there is no dominant Smart TV platform so the TV app system is reminiscent of the mobile app ecosystem before Apple debuted the iPhone App Store in 2008. Therefore, many companies are fighting to conquer the space in the living room. The market is fragmented with no main firm driving the industry; however strategic movements from each player illustrates insights on how the ecosystem is evolving.

-Competitive Landscape

As mentioned, the Smart TV platform is currently highly fragmented with various players trying to mark their territory and plant a flag in the center of the ecosystem.

Figure12. Smart TV Players Strategic Moves

Value

Creation Aggregation Distribution Consumption Chain

Music, movies, news, Provides the video Render content

sports, television distribution network 2-way IP communication

Activities programs, and video aggregation, scheduling, DTT/Cable/IPTV/IP/ Integrated media production, adoption to transcoding, presentation, Satellite/ 4G, ingestion (OTT/Linear)

conversion

web video LTE/Satellite through devices

Fox, BBC, Disney, MGG, Paramount, NFL, Warner

Borthers, Sony, BMG, ESPN, ABC, NBC,

Universal Discovery, HBO, FOX,

CBS, CNN, Amazon,

Google, BBC iPlayer,

H1un Netflix I tnivorml Cox, Time Warner Cable, Comcast, CableVision,

Verizon, AT&T, Dish Apple, Samsung, LG,

Sony, Google, Tivo, Roku. Microsoft Source: 2011, Accenture

Trends

r

Content owners or providers are launching Direct-to-Consumer services and are participating in the industry initiative such as Ultraviolet, which is organized by all major studios (except Disney), electronics manufacturers and retailers to enable buy-once and view anywhere service with digital lockers in return for a premium/up-charge. Firms such as BBC is pushing across the value chain to a distributor and OTT service by launching services such as iPlayer, an Internet television and radio service and software application that streams video clip content including whole TV shows. Content owners have more opportunities to distribute their content either directly through their channels or through OTT platform and VOD platforms.

This loosens the control from the aggregators, which might benefit the content providers but causes a risk in losing the relationship with aggregators. For example as Figure 11 shows, aggregators are also

expanding horizontally to gain more control over the ecosystem. In the case of Netflix, because killer content is so important they pay studios large amounts to attain hit content. For instance, Netflix was willing to pay $300 million (est.) per year for exclusive rights on Disney movies starting in 2016. However, the increasing cost of content does not create a sustainable business model for aggregators, therefore they readily invest in creating content independently. In addition, broadcast and cable networks

are offering content directly through their own websites and applications as a distributor. More recently Amazon expanded from a content aggregator, Amazon instant video, to a player in the consumption area

by launching Amazon Fire TV - an add-on streaming device.

Distribution operators are also moving along the value chain. For example, Comcast is prominent in the device business with their Xfinity TV box that has on-demand, pay-per view features and apps such as Facebook, Pandora, and newsfeeds. The compelling position they have is the 22.6 million subscribers (as of '14. 1Q) locked-in using their boxes. (Comcast, 2014) The US pay TV market is roughly 110 million

subscribers all providing services through their designated set-top boxes, which implies a huge threat on the device manufacturers. Currently distributor giants are providing the boxes bundled with the

subscription fee and profit from the total subscription fee rather than the value of the devices, but if they were to aggressively invest in the hardware business the competition would be fierce. Comcast is moving into the aggregation and content creation business by acquisition of firms such as NBC Universal, E! and MGM. Owning cable networks/content gives them leverage to negotiate with other cable networks for their channels. Comcast is also planning to expand vertically by announcing the merger with Time Warner Cable in February 2014 combining the top 2 US cable networks. The consolidation could help Comcast to compete with satellite providers like DirecTV, wireless phone companies like AT&T and new streaming services like Netflix.

Device manufacturers such as Samsung and Apple as well as OS providers such as Google and Microsoft have their own store-front for content distribution. Samsung uses the Smart Hub interface as a gateway to content, as Apple provides iTunes, Google Google Play, and Microsoft Xbox Store. Channel apps are individually offered in most devices, threatening the aggregation model and Boxee and Roku have developed set-top boxes that offer OTT video and live TV broadcast stations. Xbox Entertainment is aggressively looking for exclusive content partnership with Hollywood studios trying to attract more users on their Xbox Live Gold subscription program, which replicates the traditional cable network business model.

3.3 Smart TV Platform Challenges

Although all stakeholders in the ecosystem are rushing to create a common place for the Smart TV, no firm has "cored" or "tipped" the market mostly because within the ecosystem there are conflicting business models and ecosystems as well as many alternative paths to the TV. In 2011, former Apple CEO Steve Jobs said to the author of his biography, "'I'd like to create an integrated television set that is completely easy to use, it would be seamlessly synced with all of your devices and with iCloud.' No longer would users have to fiddle with complex remotes for DVD players and cable channels. 'It will have the simplest user interface you could imagine. I finally cracked it."' However, Apple still has not come up with a solution for the Smart TV ecosystem partially because there are so many stakeholders involved with different interests and because competitors are defensive on Apple disrupting the TV industry and controlling the content and consumers as it has done with the music and smartphone industry. This is not only a problem for Apple but it applies to all Smart TV platform players. There is three major challenges the ecosystem faces: Who will have control over the platform, content, and customer.

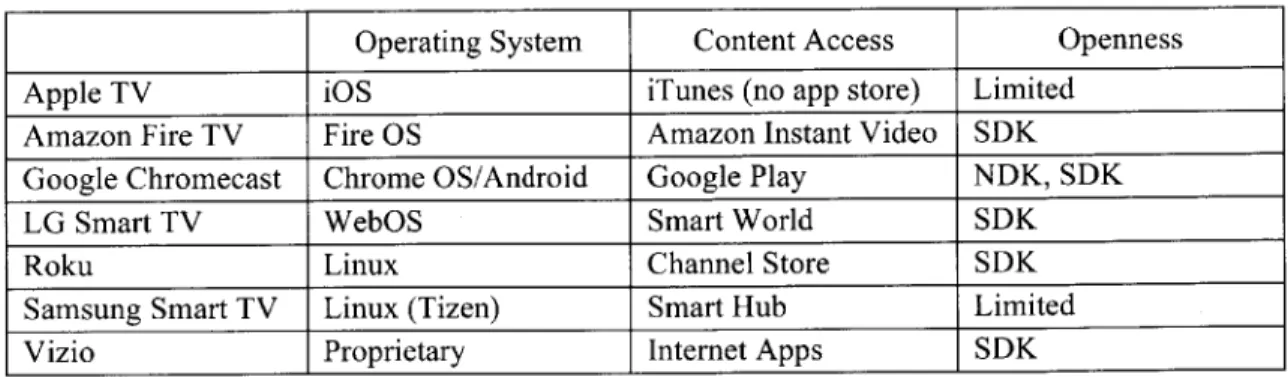

3.3.1 Control Over the Platform

The essential goal is for a firm to define and control the platform meaning that the platform will be the ultimate gateway for users in bringing Internet to the TV. Currently, the Smart TV ecosystem is so

complex and fragmented that each player has its own platform. The ecosystem for the Smart TV is dependent on content and apps need to be based on "host" video content. Therefore, cable boxes work for cable TV; satellite boxes work for satellite TV; and AppleTV boxes work with the iTunes store. As players compete for the living room each platform has a different operating system, user interface and user experience making it harder to create a common foundation for developers and content providers to

Figure 13. Smart TV Platforms

Operating System Content Access Openness

Apple TV 1OS iTunes (no app store) Limited

Amazon Fire TV Fire OS Amazon Instant Video SDK

Google Chromecast Chrome OS/Android Google Play NDK, SDK

LG Smart TV WebOS Smart World SDK

Roku Linux Channel Store SDK

Samsung Smart TV Linux (Tizen) Smart Hub Limited

Vizio Proprietary Internet Apps SDK

Source: Company Website

Top Smart TV manufacturers all use a dedicated operating system and each have their own content store. This divides the market into even smaller addressable markets for developers. As a result, it is difficult for app developers to be productive - time and cost wasted on coding, porting, testing for different platforms. This leads to an overall less productive ecosystem where compatibility and complementary products hamper the growth of the industry. There are some industry initiatives called 'Smart TV Alliance' (Smart TV Alliance, 2013) led by companies such as LG, Toshiba, and Panasonic to align on Web specifications (HTML5) and on audio, video specifications (DRM, Codec, Streaming, etc) so that it will reduce time and cost for application development. Although the attempt to create an industry standard platform for

developing apps is a step forward, the core tenet of integration with content is still missing. For example, a common social environment for sharing, discussing (and ultimately creating) TV programming will be impossible with multiple format platforms. Cases from the smartphone market show that a fragmented platform may result in lower quality, lower value apps. For example, Android maintained an open platform that boosted Android install base higher than Apple's, however Apple makes estimated $5.1 million in revenue per day from app store where Android makes $1.1 million per day. One of the reasons are that developers seem to prefer iOS because it is significantly less fragmented-78% of iOS users are running the latest version, compared to the roughly 50% of Android users on all versions of Android Jelly Bean. (Smith, 2014) Content providers and developers want a large installed base of devices before they create content for a platform. This may seem like a chicken-and-egg problem, but it is clear that the Smart TV platform is too fragmented for it to create a sustainable ecosystem.

3.3.2 Control Over the Content

Traditionally, the aggregators and network distributors mostly controlled the content. Content providers would receive an affiliate fee for the content rights and the aggregators would negotiate with advertisers on the allocation of ads in the programming and distributors would receive a subscription fee from the viewers. However, due to the content redistribution on Internet, de-bundling of channels and cord-cutting

of cable pay-tv, all players are fighting for the exclusive rights of the content and a vast majority of studios and even device manufacturers are positioning themselves to have higher control over content.

By looking at the top video apps available on Smart TVs we can see a conflict between businesses and

competition over content. For example, Amazon does not provide Amazon Instant Video services on Apple TV or Google Chromecast since they are competing with these companies in both the video content and device segment. By providing the competitors their services, they are reducing the incentive for consumers to buy Amazon Fire TV products. Netflix's business is based on subscription fee, so they would like as much exposure as possible making sure their services are available on every device. In addition, because Netflix has 44 million subscribers they have the negotiation power to persuade content providers to join their platform, and device manufacturers to preload their apps giving them more access to a larger subscription base. All Smart TV devices advertise their services with the number and quality of content they have available on their services. Therefore the partnership with content providers and cable channels are more interdependent than before.

Figure 14. Available Smart TV Video Content Apps

Apple Amazon Google LG Samsung

TV Fire TV Chrome Smart Roku3 Smart Vizio Xbox

TV_ FireTV cast TV TV

Netflix

Amazon Instant Video o 01

iTunes

Hulu Plus 0I

HBOGo 0 le

YouTube W 0I

Crackle o 0 W1

Showtime Anytime I III

WatchESPN b I

Pandora o or

Source: Company Website

HBO's hit show "Game of Thrones" highlights the importance of owning the rights of the content and controlling it as it refused to sell it's program as an individual channel, making it highly anticipated as a premium cable channel bundled in a subscription package. HBO is a very profitable part of Time Warner Inc.; therefore "Game of Thrones" was never sold as a subscription on iTunes as it airs, and never offered its content to Netflix. Cable realizes that HBO is a way to sell people and its valuable benefit made even

more attractive by the emergence of HBO GO app and smash hit originals. In Apr.2014 HBO and

Amazon signed a $300 billion extensive, multi-year agreement that brings many of the premium channel's greatest shows including The Sopranos, Six Feet Under, and The Wire to Amazon Prime Instant Video. (Stelter, 2014) The deal also includes "early" seasons of Boardwalk Empire and True Blood. Newer shows like Girls, The Newsroom and Veep will be made available to Prime subscribers, but not until three years after they've first aired on HBO. Even though hit series like Game of Thrones will not be on the list; this will be an advantage for Amazon over Netflix as HBO adds 17,00 new titles to Amazon through a single content licensing agreement and HBO receives $300 billion for content that was aired 3 years ago.

3.3.3 Control Over the Customer

The last challenge is who will control the access to the customer. As seen in Figure 12, all players in the ecosystem are expanding their role in accessing directly to the end-user. The logic behind it is simple --the less intermediates, --the less cost. Cable providers are providing apps and websites so users can stream video content on any device, but they still require a login with the user's cable subscription ID so they can control their subscription base. Firms such as Apple, Google, and Amazon each own a content/app marketplace, which gives them leverage in building an ecosystem around their platform using their own interface to seamlessly integrate users from their smartphone platform to their TV platform. However, with the current model there is a disproportionate share of revenue, profits and multiple monetization opportunities that make it difficult for customers to choose one single platform. The biggest challenge is to functionally integrate the apps and OTT services with television programming service and content being offered to the consumer. Creating a unified content portal for a simple search, navigation, discovery and social experience - that will enable personalized programming and advertising for the viewer is the optimal ecosystem. Problems between systems and proprietary standards make it that in order to access the ecosystem and earn the benefits of targeted advertising and interactivity, advertisers have to negotiate individual agreements with both television manufacturers and broadcasting distributors, a complex and costly process. Device manufacturers are having difficulty in finding a way to monetize their platform since the profit from content goes to the content providers or distributors, and because the platform is so fragmented the app market is still small to gain any influential network effect. Therefore, the profit of the apps is not beneficial. Even OTT service providers, such as Netflix are struggling to find a revenue growth factor as the prices of content rights increase, and the influence of network operators remain strong. Digital content creation, delivery, and monetization are complex multi-sided markets, like smartphone platforms and are very difficult for one firm to dominate.