Digitized

by

the

Internet

Archive

in

2011

with

funding

from

Boston

Library

Consortium

IVIember

Libraries

HB31

'DEWEV

.M415

'Massachusetts

Institute

of

Technology

Department

of

Economics

Working

Paper

Series

COMPETITION

AND

EFFICIENCY

IN

CONGESTED MARKETS

Daron

Acemoglu

Asuman

Ozdaglar

Working

Paper

05-06

February

16,2005

Revised:

January

20,

2006

Room

E52-251

50

Memorial

Drive

Cambridge,

MA

021

42

This

paper

can be

downloaded

withoutcharge from

theSocial

Science

Research

Network

Paper

CollectionatCompetition and

Efficiency

in

Congested

Markets^

Daron Acemoglu

Department

ofEconomics,

Massachusetts

Institute ofTechnology

Asuman

E.

Ozdaglar

Department

of ElectricalEngineering

and

Computer

Science

Massachusetts

Institute

ofTechnology

January

20,2006

Abstract

We

studythe efSciencyofoligopolyequilibria incongested markets.The

moti-vatingexamplesaretheallocation ofnetworkflows inacommunication networkor

oftrafficina transportation network.

We

showthat increasing competitionamong

oligopoUstscanreduceefficiency, measuredasthedifferencebetweenusers'

will-ingnesstopay anddelaycosts.

We

characterize atightbound

of 5/6onefficiencyin pure strategyequilibria

when

thereis zero latency at zero flow anda tightbound

of2v^

—

2withpositivelatencyatzeroflow. These boundsaretightevenwhen

thenumbersofroutesand ohgopohstsarearbitrarily large.*We

thankXin Huang,RameshJohari,EricMaskin,Eilon Solan, NicolasStierMoses,JeanTirole,JohnTsitsiklis,IvanWerning,

Muhamet

Yildiz, twoanonymousrefereesandparticipants atvarious1

Introduction

We

analyzepricecompetitioninthepresenceofcongestioncosts. Consider thefollowingenvironment: oneunit oftrafficcan use one of/ alternative routes.

More

trafficon

aparticular route causesdelays,exerting anegative (congestion) externality

on

existingtraffic.^ Congestioncosts arecaptured

by

aroute-specificnon-decreasingconvexlatencyfunction, li(•). Profit-maximizingohgopolists set prices(tolls) fortravel

on

each routedenoted

by

Pi.We

analyzesubgame

perfectNash

equilibria ofthisenvironment,where

for eachprice vector,p, alltrafficchooses thepaththathas

minimum

(delayplus toll)cost, li

+

Pi,and

oligopohstschoosepricestomaximize

profits.The

environmentwe

analyze isof practical importance for anumber

ofsettings.These

include transportationand communication

networks,where

additionaluse ofaroute (path) generatesgreatercongestionforall users,

and

markets inwhich

there are"snob"effects,so thatgoods

consumed by

fewer otherconsumers

aremore

valuable(seefor example, [53]).

The

key feature oftheseenvironments is the negative congestionexternalitythatusers exert

on

others. Thisexternalityhasbeen

well-recognized sincethe

work by

Pigou[40] ineconomics,by

[46], [57], [5]intransportationnetworks,and by

[36], [24], [23], [30] in

communication

networks.More

recently,therehasbeen

agrowingliterature that focuses

on

quantification of efficiency loss (referred to as the price ofanarchy) that results

from

externahtiesand

strategic behavior in different classes ofproblems: selfish routing (e.g., [25], [45], [10], [11], [39]

and

[15]); resource allocationby market mechanisms

(e.g., [22], [47], [31], [59]); network design (e.g., [3]);and

two-stagecompetitivefacilitylocationwithout congestioncosts

and

externalities(e.g.,[54]).Nevertheless, the game-theoreticinteractions

between

(multiple) serviceprovidersand

users, orthe effects ofcompetition

among

the providerson

the efficiency losshas notbeen

consideredinnetworks with congestion (externalities). This isan

important areafor analysis since in

most

networks congestion is a first-order issueand

(competing)profit-maximizingentitieschargepricesfor use. Moreover,

we

willshow

that thenatureofthe analysischanges significantly inthepresenceofpricecompetition.

We

provide ageneralframework

for the analysis of price competitionamong

ser-vice providers^inacongested(andpotentiallycapacitated)network,studyexistence of

purestrategy

and

mixed

strategy equihbria,and

characterizeand

quantifytheefficiencyproperties ofequilibria.

There

are foursetsofmajor

resultsfrom ouranalysis.First,

though

the equilibrium of traffic assignment without prices can be highlyinefficient (e.g., [40], [45], [10]), price-settingby amonopolist internalizesthe negative

externality

and

achievesefficiency.Second,increasingcompetitioncanincreaseinefficiency. Infact,changingthe

market

structure

from

monopoly

toduopoly

almost always increases inefficiency. This resultcontrastswith

most

existing resultsintheeconomicsliteraturewhere

greatercompetitiontendstoimprovethe allocation of resources(e.g. see Tirole [51]).

The

intuitionfor thisresult,

which

isrelated to congestion,is illustratedby

theexample

we

discuss below.^^

An

externalityariseswhenthe actionsofthe playerinagameaffectsthe payoff ofotherplayers.^We

useoligopolistandservice providerinterchangeablythroughoutthe paper.^Because,inourmodel,users arehomogeneous and have aconstant reservationutility,intheabsence

Third

and most

important,we

providetightbounds

on theextent ofinefficiencyinthepresenceofohgopohsticcompetition.

We

show

thatwhen

latency at zero flow(traffic)is equal tozero, socialsurplus (defined as the difference

between

users' willingness topay

and

the delay cost) inany

pure strategy oligopoly equilibriumis always greaterthan 5/6 ofthe

maximum

socialsurplus.When

latency at zero flow canbe positive,there isaslightlylower

bound

of 2\f2-

2«

0.828. Thesebounds

areindependent ofboththe

number

of routes, /, which couldbe arbitrarily large,and

how

these routesare distributed acrossdifferentoligopolists (i.e., ofmarketstructure). Simpleexamples

reachthesebounds.

Finally,

we

alsoshow

that purestrategy equilibriamay

fail to exist. This is notsurprisinginviewofthefactthat

what we

havehereisaversion ofaBertrand-Edgeworthgame

where

pure strategy equilibria do not exist in the presence of convex costs ofproductionorcapacity constraints (e.g., [14], [49], [7], [56]). However,in ourohgopoly

environment

when

latency functions arelinear,a purestrategyequilibriumalwaysexists,essentiallybecause congestionexternalities

remove

the payoff discontinuities inherentintheBertrand-Edgeworth game. Non-existence

becomes

anissuewhen

latency functionsare highly convex. In this case,

we

provethatmixed

strategy equilibria always exist.We

alsoshow

thatmixed

strategyequihbriacanlead to arbitrarilyinefficientworst-caserealizations; in particular, social surplus can

become

arbitrarily smallrelative to themaximum

socialsurplus,though

the average performanceofmixed

strategyequihbriais

much

better.The

followingexample

illustratessome

ofour results.Example

1 Figure 1shows

asituation similar to theonefirst analyzedby

Pigou[40]tohighlighttheinefficiency

due

tocongestionexternalities.One

unit oftrafficwilltravelfrom origin

A

todestinationB, using either route 1or route2.The

latency functionsare given

by

x^ 2

'i(a;)

=

y

,

k

(x)=

-X.Itisstraightforward to see that theefficientallocation [i.e.,onethatminimizesthe total

delay cost

^^hix^Xi^

isxf

=

2/3and

xf—

1/3, while the (Wardrop) equilibriumallocationthatequates delay

on

thetwo

pathsisx^^

k,.73>

x\ and

x^^

f« .27<

xf

.

The

sourceofthe inefficiencyisthateachunit oftraffic does notinternalizethe greaterincrease indelayfromtravel

on

route 1,sothere istoomuch

use ofthisrouterelativetotheefficientallocation.

Now

consider a monopolist controlhng both routesand

setting prices for travel tomaximize

itsprofits.We

show

below that inthis case, themonopolist will setapriceincludinga

markup,

Xil\(when

li isdiflFerentiable), whichexactly internalizes thecon-gestionexternality. Inotherwords,this

markup

isequivalent to thePigovian taxthatasocialplanner

would

setinorder toinducedecentralizedtraffictochoosetheefficiental-location. Consequently,in thissimpleexample,

monopoly

priceswillbe pf^^=

(2/3) -\rkand

p^^

=

(2/3^)-I-/c, forsome

constantk.The

resultingtraffic intheWardrop

equi-hbrium

will beidenticaltothe efficientallocation, i.e.,x'^^=

2/3and

x^^

=

1/3.l,(x)=x /3

1 unitof traffic

Figure 1:

A

two

link network with congestion-dependantlatency functions.Finally, consider a

duopoly

situation,where

each routeiscontrolledby

a differentprofit-maximizingprovider. Inthiscase,itcanbe

shown

thatequilibriumpriceswilltaketheform

pf^

—

Xj{l[+

/j)[seeEq.(20)inSection4],ormore

specifically,pf

^^

0.61and

p^^

^

0.44.The

resulting equilibrium trafficisx^^

ft; .58<

xf and

x^^

«

.42>

xf,which

alsodiffersfrom

theefficientallocation.We

willshow

thatthisisgenerally the casein the ohgopolyequilibrium. Interestingly, while in the

Wardrop

equilibrium withoutprices, there

was

toomuch

trafficon

route 1,now

there is too little traffic becauseof its greater

markup.

It is also noteworthy that although theduopoly

equilibriumis inefficient relative to the

monopoly

equilibrium, in themonopoly

equilibrium k ischosen suchthatallofthe

consumer

surplusiscapturedby

themonopolist,while in theoligopolyequihbriumusers

may

havepositiveconsumer

surplus.^The

intuition for the inefficiency ofduopoly

relative tomonopoly

is related to anew

source of(differential)monopoly power

for eachduopolist,which

theyexploitby

distortingthepatternoftraffic;

when

provider 1, controllingroute 1,charges a higherprice,itrealizesthatthis will

push

some

trafficfromroute1toroute2,raisingcongestionon

route2.But

thismakes

thetrafficusing route 1become more

"locked-in," becausetheiroutside option, travel

on

theroute2,hasbecome

worse.^As

aresult,theoptimalpricethateach duopolistcharges will include

an

additionalmarkup

over the Pigovianmarkup.

These

are Xil'2 for route 1and

xj^j for route 2. Since thesetwo markups

are generally different, they will distort the pattern oftraffic

away from

the efficientallocation. Naturally, however, prices are typicallylowerwith duopoly,so even

though

socialsurplus declines, userswillbebetteroffthanin

monopoly

(i.e.,theywillcommand

apositive

consumer

surplus).There

isalargehteratureon

modelsofcongestionboth

intransportationand

commu-nicationnetworks (e.g. [5], [38], [44], [33], [34], [45]).^ However, very fewstudieshave

^Consumersurplusisthe differencebetweenusers'willingness topay(reservationprice)andeffective

costs, Pi

+

Zi(Xj), and is thus different from social surplus (which is the difference betweenusers'willingness topay andlatencycost, li{xi),thusalsotakesintoaccount producersurplus/profits). See

[32].

^Using economicsterminology,wecouldalsosay that thedemandforroute1becomesmore

"inelas-tic". Sincethistermhaisadifferent meaninginthecommunication networksliterature (see[48]),we

do notuseithere.

®Someofthesepapersalsouse prices(or tolls)toinduce flow patterns that optimizeoverallsystem

investigated the implications ofhaving the "property rights" over routes assigned to

profit-maximizingproviders. In [4],Basar

and

Srikantanalyzemonopoly

pricingunderspecific assumptions on the utihty

and

latency functions.He

and

Walrand

[19] studycompetition

and

cooperationamong

internet service providersunder specificdemand

models. Issues ofefficientallocation of flows ortrafficacrossroutes

do

notariseinthesepapers.

Our

previouswork

[1] studiesthemonopoly problem and

containstheefficiencyofthe

monopoly

result, butnone

ofthe other results here.More

recent independentwork by

[3] buildson

[1]and

alsostudiescompetitionamong

serviceproviders. Usingadifferentmathematical approach, they providenon-tight

bounds on

theefficiency lossforthe case ofelastictraffic. Finally, incurrentwork, [2],

we

extendsome

ofthe resultsofthispapertoanetwork withparallel-serialstructure.

In the rest of the paper,

we

use the terminology of a (communication) network,though

all of the analysis applies to resource allocation in transportation networks,electricity markets,

and

other economicapplications. Section 2 describes the basicen-vironment. Section 3 brieflycharacterizesthe

monopoly

equilibriumand

establishesitsefficiency. Section 4 defines

and

characterizesthe oligopoly equilibriawithcompeting

profit-maximizing providers. Section 5containsthe

main

resultsand

characterizes theefficiency properties ofthe oligopoly equihbrium

and

providebounds on

efficiency.Sec-tion 6 providesatightefficiency

bound

when

theremay

bepositivelatencyatzeroflow.Section 7 containsconcluding

comments.

Regardingnotation,allvectors areviewedas

column

vectors,and

inequalitiesare tobeinterpretedcomponentwise.

We

denoteby

Mf^theset ofnonnegative /-dimensionalvectors. LetCibe aclosedsubset of[0,oo)

and

let/: Cjh->R

beaconvexfunction.We

use df{x) todenotethesetofsubgradientsof

/

atx,and

f~{x)and

f'^{x) todenotetheleft

and

rightderivatives of/at x.2

Model

We

consider anetwork with/parallel links. LetI =

{1,...,/} denotethesetoflinks.

LetXidenotethe total flow

on

linki,and

x=

[xi,...,xj]denotethe vector oflink flows.Each

link inthenetwork has a fiow-dependentlatency function /i(x,),which measuresthe traveltime (ordelay) asa function ofthetotalflow

on

linki.We

denotethe priceperunit flow(bandwidth)oflinki

by

Pi. Letp

=

[pi,...,p/]denotethe vector ofprices.We

are interestedintheproblem

ofroutingdunits offlow acrossthe /links.We

as-sume

thatthisisthe aggregateflow ofmany

"small" usersand

thusadopttheWardrop'sprinciple (see [57]) incharacterizingtheflow distributioninthenetwork;i.e.,the flows

arerouted along paths with

minimum

effective cost, defined as thesum

ofthelatencyatthe given flow

and

the price of that path (see the definition below).^We

alsoas-sume

that the usershave areservationutilityR

and

decidenot tosendtheirflowiftheeffectivecost exceedsthe reservationutility. This impliesthat user preferencescan be

induce optimalflows,withthe goal of choosingtollsfromthissetaccording tosecondarycriteria,e.g.,

minimizingthetotalamountoftollsor thenumberoftolledroutes; see[8],[21],[28],[27],and[20].

^Wardrop's principleisused extensivelyinmodellingtraffic behaviorintransportation networks,

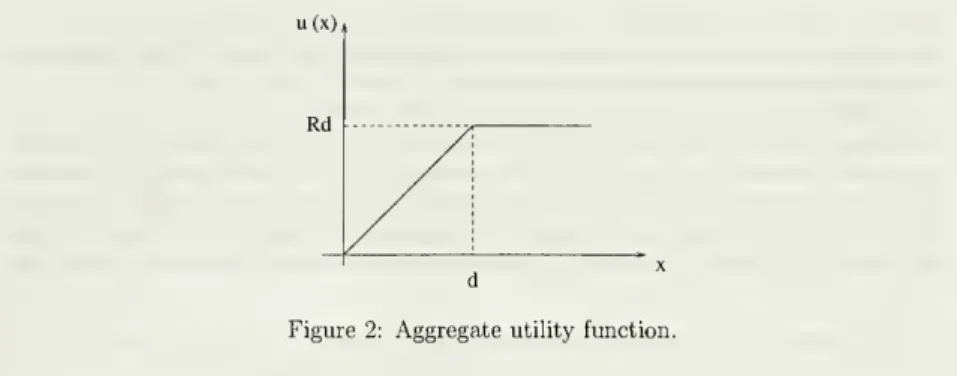

u(x)

Figure2: Aggregateutilityfunction.

represented

by

thepiecewise linearaggregateutilityfunctionu

(•)depictedinFigure2.^To

accountforadditional side constraintsinthetrafficequihbrium problem,includingcapacityconstraints

on

thelinks,we

use thefollowing definition ofaWE

(see[29], [26]).Lemma

1shows

that this definition is equivalent tothemore

standard definition of aWE

usedinthe literatureundersome

assumptions.Definition

1 For a given price vectorp

>

0,^equilibrium

(WE)

ifa vector

x

G

argmax

<.2_]{R~ki

xY'^)-p,)x,

is a

Wardrop

(1)

We

denotetheset ofWE

at a givenp by W{p).

Assumption

1 For eachi£

Z, the latencyfunction kconvex, nondecreasing,

and

satisfies /,(0)—

0.[0,oo) 1-^ [0,do] isclosed,^°

The

assumptionofzerolatencyatzeroflow, i.e.,/j(0)=

0,imphes

thatalllatencyisdue

to flow oftraffic,and

there arenofixedlatencycosts.^^ It isadoptedto simplify thediscussion, especiallythe characterization ofequilibriumpricesin Proposition9 below.

A

trivialrelaxation ofthis assumption to ^,(0)=

L

for all ie

2

forsome

L

>

willhave

no

effecton

any

ofthe results in the paper. Allowing for differential levels of^Thissimplifyingassumptionimpliesthatallusers are "homogeneous" inthe sense thattheyhave

thesamereservationutility,R. Theanalysisbelowwillshowthat the value ofthisreservationutility

R

hasnoeffecton anyoftheresultsaslong asitisstrictly positive.We

discuss potentialissues inextendingthisworktouserswithelasticand heterogeneousrequirementsintheconcludingsection.

^Since the reservationutilityof users

isequal toR,wecanalso restrictattention topi<

R

foralli. Throughoutthepaper,weusep> and p £[0,

RY

interchangeably.'''Forafunction /:R"i—»(—00,00],wesay that /isclosedifthelevel set{x\f{x

<

c)}isclosedforevery scalarc. NotethatafunctionisclosedifandonlyifitislowersemicontinuousoverR"(see

[9],Proposition1.2.2).

''Thisassumption would be agood approximationtocommunication networks where queueingdelays

/j(0) complicates the analysis, but has littleeffect onthe

major

results. This caseisdiscussedinSection6,

where

we

provideaslightlylower tightbound

forthe inefficiencyofohgopoly equihbria withoutthisassumption.

Another

feature ofAssumption

1 isthatit allowslatency functions tobe extendedreal-valued, thus allowingfor capacityconstraints. Let Ci

—

{xE

[0,oo) | li{x)<

oo}denote the effective

domain

of/,.By

Assumption

1, Cjis a closed interval of theform

[0, b]or[0,oo). Let

bd

—

sup^^,^, x.Without

lossofgenerahty,we

canadd

the constraintXi

6

Ciin Eq. (1). Usingthe optimality conditionsforproblem

(1),we

seethata vector^WE

£i^J^ isa

WE

ifand

onlyifJ^iei

^T^ —

^^'^'^thereexistssome

A>

suchthatK

EiGi

^^^

~d)

=

and

foralli,R

-

kixf"^)-Pi

<

A ifxf"^-

0, (2)=

AiiO<xf'^

<bc„

>A

ifxr^

=

6c,.When

the latency functions are real-valued[i.e.,Cj=

[0,oo)],we

obtainthe followingcharacterization ofa

WE,

which

isoftenusedasthedefinition ofaWE

intheliterature.This

lemma

states that in theWE,

the effective costs, defined as li{xf^^)+

pi, areequalized

on

alllinkswithpositive flows.Lemma

1 LetAssumption

1 hold,and assume

further that Ci—

[0,oo) forall iG

T.Then

anonnegativevector x*£

W{p)

ifand

onlyifli{x*)

+

Pi—

mm{lj{x*)+

pj},V

iwithX*>

0, (3)j

kix*)

+

Pi<

R,V

z withX*>

0,iei

withX^jgjS;*

=

dliminj{lj{xj)+

Pj}<

R-Example

2 belowshows

that condition (3) in thislemma

may

not holdwhen

thelatency functions arenotreal-valued.

The

existence, uniqueness,and

continuityprop-ertiesofa

WE

arewell-studied (see[5], [12], [50]).We

provideherethestandard proofforexistence,basedonestablishingtheequivalence of

WE

and

theoptimalsolutions ofaconvexnetwork optimization problem, which

we

willrefertolater inour analysis.Proposition

1(Existence

and

Continuity)

LetAssumption

1hold. Forany

pricevector

p

>

0, the set ofWE,

W{p),

is nonempty. Moreover, the correspondenceW

:M^

^

R^

isupper semicontinuous.Proof.

Given any

p>

0,consider the followingoptimizationproblem

maximize^>o

^

\iR

-

Pi)xi-

j li{z)dz\ (4)subject to 2_.^i

^

d.Inviewof

Assumption

(1)(i.e.,liisnondecreasingforall i), itcan beshown

that theobjective function of

problem

(4) is convexoverthe constraintset,which

isnonempty

(since

G

Ci)and

convex. Moreover, thefirstorder optimalityconditions ofproblem

(4),whichare alsosufficientconditionsforoptimality,are identical to the

WE

optimalityconditions [cf. Eq. (2)].

Hence

a flow vectorx^^

E

W{p)

ifand

onlyifitis an optimalsolution of

problem

(4). Since the objective function ofproblem

(4) is continuousand

theconstraintsetiscompact,this

problem

hasan optimalsolution,showingthatW{p)

isnonempty.

The

fact thatVF

isan upper

semicontinuous correspondence at everyp

follows

by

usingtheTheorem

oftheMaximum

(see Berge [6], chapter 6) forproblem

(4).

Q.E.D.

WE

flows alsosatisfyintuitivemonotonicitypropertiesgiveninthe followingpropo-sition.

The

prooffollowsfrom

the optimalityconditions [cf.Eq. (2)]and

isomitted(see

[I])-Proposition

2(Monotonicity)

LetAssumption

1 hold. For a givenp

>

0, letP-j

=

\PiWj-(a) For

some p

<

p, letx£

M^(p)and x E W{p).

Then,J^iei^^—

Yliei^i-(b) For

some

pj<

pj, letx E W{pj,p^j) and x E

W{pj,p-j).Then

Xj>

Xjand

Xi<

Xi,foralli

^

j.(c) For

some

X

C

I,supposethatpj<

pj foralljE

I

and

pj=

pjfor allj^

X,and

letX

eW{P)

and

x E W{p).

Then

Yljei^j—

X^ief^j-For agiven price vectorp, the

WE

need not be unique in general.The

followingexample

illustratessome

properties oftheWE.

Example

2 Consider atwo

linknetwork. Letthe total flowhed=

1and

thereserva-tionutility

be

i?=

1.Assume

that the latency functions are givenby

liix)

—

MX]

=

< , . 3^

'^

'\ oo otherwise.

At

the price vector (pi,P2)—

(1,1), the set ofWE,

W{p),

is givenby

the set of ahvectors (xi,2;2) with

<

x^<

2/3and

X^^Xj<

1.At any

price vector (pi,P2) withPi

>

P2=

1,W{p)

isgivenby

all (0,X2) with<

X2<

2/3.This

example

also illustratesthatLemma

1 need not holdwhen

latencyfunctionsare not real-valued. Consider, for instance, the price vector (pi,P2)

=

(1—

e,1—

ae)for

some

scalara>

1. In thiscase,theuniqueWE

is(xi,X2)=

(1/3,2/3),and

clearlyeffective costs

on

thetwo

routes are notequalized despitethefactthattheyboth

havepositive flows. This arises because the path with the lower effective cost is capacity

constrained, sono

more

trafficcanuse that path.Under

further restrictionson

the/,,the followingstandardresultfollows(proofProposition

3(Uniqueness)

LetAssumption

1 hold.Assume

further that k isstrictly increasingover C^. For

any

price vectorp>

0, the set ofWE,

W{p),

is asingleton. Moreover,the function

W

:R^

i—>M^

iscontinuous.Since

we

do

notassume

thatthelatency functions are strictlyincreasing,we

needthe following

lemma

inour analysis to dealwithnonuniqueWE

flows.Lemma

2 LetAssumption

1hold. Fora givenp

>

0,definethesetJ={i€l|3x,

X e

W{p)

withXij^Xi}. (5)Then

kixi)

=

0,V

ie

J,V

x G Wip),

Pi

=

Pj,V

i, jei.

Proof.

Considersome

iG

2"and

x € W{p).

Sincei 6X, thereexistssome x 6

W{p)

suchthatXi

^

Xi-Assume

withoutlossofgeneralitythat x,>

Xj. Therearetwo

cases to consider:(a) If Xk

>

Xk for all k j^ i, then X^jsi^j>

X^iei-^J' whichimphes

that theWE

optimality conditions[cf. Eq. (2)] forx hold with A

=

0.By

Eq. (2)and

Xj>

x,,we

haveli{xi)

+Pz<

R,li{xi)+Pi>R,

which

togetherimply thatli{xi)=

li{xi).By

Assumption

1 (i.e., kis convexand

^.(0)

=

0),it followsthatli{xi)=

0.(b) IfXk

<

Xk forsome

k,by

theWE

optimahtyconditions,we

obtaink{Xi)

+

Pi<

IkiXk)+

Pk,k{ii)

+Pi>

lk{xk)+Pk-Combining

the above withXi>

Xiand

x^<

x^,we

see that li{xi)=

k{xi),and

hi^k)

=

hi^k)-By

Assumption

1, this shows that li{Xi)—

(and also thatPi

=Pk)-Next

considersome

z, jG

2".We

willshow

thatpi

=

pj. Since iE

I, thereexistX, XE.

W{p)

suchthatXt>

Xi.There

arethree cases to consider:• Xj

>

Xj. IfXk>

Xk for all k^

i,j, thenX^^Xm <

d, implying thattheWE

optimalityconditionsholdwithA

=

0. Therefore,we

havek{xi)

+

Pi<

R,lj{xj)

+

pj>

R,which

togetherwithli{xi)=

lj{xj)=

imply thatPi=

Pj.• Xj

=

Xj. Since j€

X,by

definition theremust

existsome

otherx^W{p)

suchthatXj

^

Xj. Repeating theabovetwo

stepswith Xj instead of Xj yields the desiredresult.

Q.E.D.

Intuitively, this

lemma

states that ifthere exist multipleWEs,

x,x E

W{p)

suchthatXi

^

Xi,thenthe latency function/,must

belocallyflataround

Xi (andXi).Given

the assumptionthat/j(0)

=

and

the convexityoflatency functions, thisimmediatelyimpliesli{xi)

=

0.We

nextdefinethesocialproblem

and

the socialoptimum, which

istherouting(flowallocation) that

would

be chosenby

aplanner that hasfullinformationand

fullcontroloverthenetwork.

Definition 2

A

flow vectorx^

is asocialoptimum

ifit isan

optimalsolution of thesocialproblem

m£iximizej:>o

y^iR

—

li{xi)jXi (6)iei

subject to

y.

^i^

d-Inviewof

Assumption

1,thesocialproblem

has a continuousobjectivefunctionand

a

compact

constraintset,guaranteeingthe existence ofasocialoptimum,

x^. Moreover,usingthe

optimaUty

conditionsfora convexprogram

(see [9],Section4.7),we

seethata vector

x^ E

R^

is asocialoptimum

ifand

only if^^^jxf

<

dand

there existsasubgradient gi.

e

dli{xf) foreachz,and

aA'^>

suchthat A'^(^jgjxf

—

d)—

Qand

for each2,

R

-

k{xf)-

xfgi^<

A^ ifxf

=

0, (7)=

A^

ifO<xf<bc„

>A^

iixf=

bcrForfuture reference, fora given vectorx

€

Mf^,we

definethe value of the objectivefunctioninthe socialproblem,

S{x)

=

Y,iR-l^[x^))Xi,

(8)asthe socialsurplus,i.e., the difference

between

users' willingnesstopay and

the total3

Monopoly

Equilibrium

and

Efficiency

In this section,

we assume

that amonopoUst

service providerowns

the / linksand

chargesaprice ofpiper unit

bandwidth on hnk

i.We

considered arelatedproblem

in[1] foratomicusers withinelastic traffic (i.e.,theutilityfunction ofeachofa finite set

ofusers is a step function),

and

with increasing,real-valuedand

differentiablelatencyfunctions. Here

we

show

that similarresultsholdforthemore

generallatency functionsand

thedemand

model

considered inSection2.The

monopolist setsthe prices tomaximize

his profitgivenby

n(jD,x)

^^p,Xi,

where x €

W{p). Thisdefinesatwo-stagedynamic

pricing-congestiongame,where

themonopolist sets pricesanticipating the

demand

ofusers,and

given the prices (i.e., ineachsubgame),userschoosetheirflow vectorsaccordingto the

WE.

Definition 3

A

vector(p^^,x^^)

>

is aMonopoly

Equilibrium(ME)

ifx^^

G

W{p^'^) and

liip"'^^,x'^^)

>

n(p,x),V

p

>

0,V

X GW

(p).

Our

definition oftheME

isstronger thanthestandardsubgame

perfectNash

equi-libriumconceptfor

dynamic

games.With

aslightabuseof terminology,letus associatea

subgame

perfectNash

equilibrium with the on-the-equilibrium-path actions of thetwo-stagegame.

Definition

4

A

vector (p*,x*)>

isasubgame

perfect equihbrium(SPE)

ofthepricing-congestion

game

ifx*£ W{p*) and

for allp

>

0, there exists x EW

(p) suchthat

n(p*,x*)

>

n(p,.T).The

followingpropositionshows

thatunderAssumption

1,thetwo

solutionconceptscoincide. Sincethe proofis not relevantfor therest oftheargument,

we

provide itinAppendix

A.Proposition 4

LetAssumption

1 hold.A

vector {p'^'^^,x'^^) isanME

ifand

onlyifitisan

SPE

of the pricing-congestiongame.Sincean

ME

(p*,x*) isan optimalsolution ofthe optimizationproblem

maximizep>o,x>o

^^Pi^i

(9)iei

subject to x

E W{p),

itis easierto

work

withthan anSPE.

Therefore,we

useME

asthe solutionconceptinthispaper.

The

precedingproblem

has an optimalsolution,which

establishes the existenceofan

ME.

Moreover,we

have:Proposition

5 LetAssumption

1hold.A

vectorxisthieflowvectoratanME

ifand

onlyifit isa social

optimum.

Moreover, if(p,x) isan

ME,

thenfor all iwithXi>

0,we

havepi= R

—

k{xi).This proposition therefore establishes that the flow allocation at an

ME

and

thesocial

optimum

are the same. Itsproofis similar toan

analogousresult in [1]and

isomitted.

In addition to the socialsurplus defined above, it is also useful to definethe

con-sumer

surplus,asthedifferencebetween

users'wilhngnesstopay and

effectivecost,i.e.,^j^^ {R

—

k{xi)—pi)xi(see[32]).By

Proposition5, it isclearthat eventhough

theME

achievesthesocial

optimum,

allofthe surplusiscapturedby

themonopohst, and

usersare just indifferent

between

sendingtheirinformationornot (i.e.,receiveno

consumer

surplus).

Our major

motivation for the study of oligopolistic settings isthat they providea betterapproximation to reality,

where

there istypically competitionamong

serviceproviders.

A

secondary motivationisto seewhether anoligopolyequilibriumwillachieveanefficient allocationlikethe

ME,

whilealsotransferringsome

orallofthe surplus totheconsumers.

4

Oligopoly

Equilibrium

We

suppose thatthere areS

serviceproviders, denote the set of serviceprovidersby

«S,

and assume

that eachserviceprovidersE

S

owns

a different subset X, of thelinks.Serviceproviderscharges apricepiperunit

bandwidth on

linki EIs-Given

thevectorof prices of links

owned by

other service providers,p_s=

[Pili^is^ ^^^ profit of serviceprovidersis

^s{Ps,P-s,x)

^

^PiXi,

ieis

for X

e

W{ps,p-s),where

Ps=

\pi]ieis-The

objective ofeachserviceprovider, like themonopolist in theprevioussection,is to

maximize

profits. Becausetheir profitsdepend on

theprices setby

other serviceproviders, each service provider forms conjectures about the actions ofother service

providers, as well asthebehaviorofusers, which,

we

assume, they do accordingtothenotion of

(subgame

perfect)Nash

equilibrium.We

refer to thegame

among

serviceproviders asthe price competitiongame.

Definition 5

A

vector [p'-'^,x^^)>

isa(pure strategy) OligopolyEquilibrium(OE)

if

x°^

€

W

(p°^,p?f

)and

forallseS,

n,(p?^,pef,xO^)

>

n,(p3,pef,x),vp,

>

0,vx

G

w{p,,p'^f). (lo)We

refertop°^

astheOE

price.As

forthemonopoly

case,there isa close relationbetween

apurestrategyOE

and

a pure strategy

subgame

perfect equiUbrium.Again

associating thesubgame

perfectequilibriumwith the on-the-equilibrium-pathactions,

we

have:Definition 6

A

vector {p*,x*)>

isasubgame

perfectequilibrium(SPE)

ofthe pricecompetition

game

ifx* €W

(p*)and

there exists afunctionx

:R^

i->R^

such thatx{p)

e

W

(p) for allp

>

and

foralls eS,n,(p:,pl„a;*)>n,(p„pl„x(p3,plj)

Vp, >0.

(11)The

followingproposition generalizesProposition4and

enables us towork

withtheOE

definition,whichismore

convenientforthesubsequentanalysis.The

proofparallelsthat ofProposition4

and

isomitted.Proposition

6 LetAssumption

1hold.A

vector {p'-'^,x^^)isan

OE

ifand

onlyif itis

an

SPE

ofthe pricecompetitiongame.The

pricecompetitiongame

isneitherconcave nor supermodular. Therefore,classicalargumentsthat areusedto

show

the existence of apurestrategyequilibriumdo not hold(see[16], [52]). Inthenextproposition,

we

show

thatfor linearlatency functions, thereexistsapurestrategy

OE.

The

proofisprovidedintheappendix.Proposition

7 LetAssumption

1hold,and assume

furtherthat the latency functionsarelinear.

Then

the pricecompetitiongame

hasapurestrategyOE.

The

existence result cannot be generalized to piecewise linear latency functions ortolatency functions

which

are linear over theireffective domain, as illustratedin thefollowingexample.

Example

3 Consideratwo

linknetwork. Letthe total flowhe d=

1.Assume

that thelatency functions are given

by

I I \ n 1 f \

Jo

if0<x<5

for

some

e>

and

5>

1/2,withtheconventionthatwhen

e=

0, l2{x)=

ooioi x>

5.We

firstshow

that thereexists no purestrategy oligopoly equilibrium forsmall e(i.e.,thereexists

no

purestrategysubgame

perfectequihbrium).The

followinglistconsidersallcandidateohgopolyprice equilibria (pi,P2)

and

profitable unilateral deviations foresufficientlysmall, thusestablishingthenonexistenceofan

OE:

1. Pi

=

P2=

0:A

small increase in the price of provider 1 will generate positiveprofits,thusprovider 1has an incentive to deviate.

2. Pi

—

P2>

0: Letx

bethe flow allocation at theOE.

IfXi=

1,thenprovider 2-hasanincentive to decreaseitsprice. Ifxj

<

1,thenprovider 1hasan

incentivetodecreaseitsprice.

3.

<

pi<

P2: Player 1has anincentive to increaseitspricesinceitsflow allocationremainsthesame.

4.

<

P2<

Pi'- For esufficientlysmall, theprofit function of player 2, givenpi, isstrictlyincreasing asafunction ofp2, showingthat provider 2 has

an

incentive toincreaseitsprice.

We

nextshow

thatamixed

strategyOE

alwaysexists.We

defineamixed

strategyOE

asamixed

strategysubgame

perfectequilibriumofthe pricecompetitiongame

(seeDasgupta and

Maskin, [13]). Let5"

be the spaceofall (Borel) probability measureson [0,/?]". Let Is denote the cardinality ofT^, i.e., the

number

of links controlledby

serviceproviders. Let/i^

€

B'^be aprobabilitymeasure,and

denotethe vectoroftheseprobabilitymeasures

by

/j,and

the vector of these probabilitymeasures excluding sby

Definition 7 {/j,*,x*{p))isa

mixed

strategy OligopolyEquilibrium(OE)

ifthefunctionx*{p)

G

W

(p) foreveryp G

[0,RY

and

/ Us{ps,p-s,x*{ps,p-s)) d{iil{ps)

X

fl*_^{p_s))JlO,R]'

>

/ Us{Ps,P-s,X*{Ps,P-s))d{fls{Ps) XP'ls(P-s))JlO,R\'

foralls

and

fig€ B^\

Therefore,a

mixed

strategyOE

simplyrequiresthat therebe noprofitable deviationtoadifferentprobability

measure

foreach ohgopoUst.Example

3(continued)

We

now

show

thatthe following strategyprofile is theunique

mixed

strategyOE

for theabovegame when

e—

> (amixed

strategyOE

alsoexists

when

e>

0,butitsstructureismore comphcated and

lessinformative):(

0<P<R{l-S),

fxi{p)=l

1-M«

R{l-S)<p<R,

{ 1 otherwise, (0<P<R{l-S),

M2(P)=<

1-^

R{l-S)<p<R,

I 1 otherwise.otherwise.Notice that ^i has

an

atom

equalto 1—

5 ati?.To

verifythat this profileis amixed

strategy

OE,

let n'be

thedensity offj.,with the conventionthatfj,'=

oowhen

thereisan

atom

atthatpoint. LetMi

—

{p \ji'^(p)

>

0}.To

establish that {111,^2)isamixed

strategy equilibrium, itsufficesto

show

thatthe expectedpayoff to playeriisconstantfor all Pi

G

Mi when

the other player choosesp_i accordingto ;U_j (see [37]). Theseexpectedpayoffs are

n

{pi IiJL-i)=

/ Iii{pi,p-i,x {pi,p-i))dii-i(p_i)

.

(12)

The

WE

demand

x{pi,p2) takes the simple form of xi {pi,P2)=

1 if Pi<

P2and

xi {pi,P2)

=

l—

5iipi>

p2-The

exactvalue of xi (pi,P2)=

1whenpi

=

p2isimmaterialsincethisevent

happens

withzero probability. It isevidentthat the expressionin (12)is constant for allp,

€

Mj

fori=

1,2 given /^iand

112 above. This establishes that{111,112) is a

mixed

strategyOE.

Itcan alsobeverifiedthat there areno

othermixed

strategyequilibria.

The

next proposition,which

is proved inAppendix

B, estabUshes that amixed

strategy equilibriumalwaysexists.

Proposition

8 LetAssumption

1hold.Then

the pricecompetitiongame

hasamixed

strategy

OE,

(/x°^,x°^(p)).We

next providean explicitcharacterization ofpure strategyOE.

Though

ofalsoindependentintei'est, these results are

most

usefulforus to quantify theefficiency lossofoligopolyinthenextsection.

The

followinglemma

shows that an equivalent toLemma

1 (which requiredreal-valued latency functions) also holds with

more

general latency functions at the purestrategy

OE.

Lemma

3 LetAssumption

1hold. If(79°^,x"^^) isapurestrategyOE,

then/,(x°^)+pf^

=

min{L(xf^)

+

pf^},Vzwithxf^>0,

(13)/i(xf^)+pf^

<

R,Viwithxf^>0,

(14)^xp^

<

d, (15)with E,:ei^z°^

=

^ifminj{/j(x^°^)+

Pj}<

R.Proof. Let (p°^,x'^^) bean

OE.

Since x°-^G W{p°^),

conditions (14)and

(15) followbythe definition ofa

WE.

Considercondition(13).Assume

that thereexistsome

i,jG

I

with

xf

^>

0,x°^

>

suchthatUsingtheoptimahtyconditionsfora

WE

[cf.Eq. (2)],thisimpliesthatxf^

=

be,-Con-siderchanging

pf^

topf

^+

eforsome

e>

0.By

checkingthe optimality conditions,we

seethat

we

can chooseesufficientlysmallsuchthatx°^

G

W{pf^

+

e,p^f).Hence

theserviceprovider that

owns

linkicandeviate topf

^

+

eand

increaseitsprofits,contra-dicting thefactthat (p'^^,x'^^) isan

OE.

Finally,assume

to arrive at acontradictionthatminj{/j(x?^)4-Pj}

<

R

and Yliei^?^

<

d. Usingthe optimality conditionsforaWE

[Eq. (2)withA

=

since^j^ixf^

<

d],thisimpliesthatwe

must

havexf^

—

bd

for

some

i.With

asimilarargument

to above, a deviation topf^

+

e keepsx'-'^ asaWE,

and

ismore

profitable,completingthe proof.Q.E.D.

We

needthe following additionalassumptionforourpricecharacterization.Assumption

2Given

apurestrategyOE

(p*^^,x^^),ifforsome

ie

I

withxf^ >

0,we

haveli{xf^)—

0, thenX^—

{i}.Note

thatthisassumptionisautomaticallysatisfiedifalllatency functions arestrictlyincreasingorifallserviceproviders

own

onlyonelink.Lemma

4

Let (p°^,a;°^) be a purestrategyOE.

LetAssumptions

1and

2 hold. LetHa

denotethe profit of serviceprovider sat (jP^,x'~'^).(a) IfUs'

>

forsome

s'6

5,thenfls>

forallsE

S.(b) If

n,

>

forsome

se

<S,thenpf

^x°^

>

foralljE

Is-Proof.

(a) For

some

j£

Jy,defineK

=

p'^^+

lj[x^^),whichispositive since Hgi>

0.Assume

Hg

=

forsome

s. ForkE

Xg, considerthe price pk=

K

—

e>

iorsome

smalle

>

0. Itcan be seenthat attheprice vector {pk,p?.k), thecorrespondingWE

linkflow

would

satisfy Xk>

0. Hence,serviceprovider shasanincentive todeviate topk at

which

hewillmake

positiveprofit,contradictingthe factthat {p'~'^,x^^) isa purestrategy

OE.

(b) Since lis

>

0,we

havep^x^

>

forsome

m

E

X^.By

Assumption

2,we

canassume

withoutlossofgeneralitythat Imix^^)>

(otherwise,we

aredone). Let jE

Xgand

assume

to arrive at acontradiction thatpf^xf^

=

0.The

profit ofserviceprovider satthe purestrategy

OE

can bewritten asn^

=

n^

+

p,PE OE

where

Da denotestheprofitsfromlinksotherthanm

and

j. Letp'^

—

K—lm{x^^)

for

some K.

Considerchangingthe pricesp^^ and

p^^

suchthatthenew

profitisf[g

=

Us

+

iK-

UxZ^

-

e))(x°^-

e)+

e{K

-

l,{e)).Note

thate units of flow aremoved

from linkm

to link j suchthat the flows ofother links

remain

thesame

atthenew

WE.

Hence,thechangeintheprofitisn,

-

n,

=

iUx^^)

-

Uxl^

-

e))x^^+

6(/„(x°^-

e)-

Z,(e))).Since /^(a;^^)

>

0, ecan be chosensufficientlysmallsuchthattheaboveisstrictlypositive, contradictingthefactthat {jp^,x'-'^) isan

OE.

Q.E.D.

The

followingexample

showsthatAssumption

2 cannotbe dispensed withfor part(b) ofthis

lemma.

Example

4

Consider athreehnk

network withtwo

providers,where

provider 1owns

links 1

and

3and

provider2owns

link2. Letthe total flowbe

d=

1and

the reservationutilitybei?

=

1.Assume

that the latency functions are givenby

^1(xi)== 0, ^2 (2^2)

=

2:2, h{x-i)=

ax-i,for

some

a>

0.Any

pricevector (pi,P2,P3)=

(2/3,1/3,6)with6>

2/3and

{xi,X2,X3)=

(2/3, 1/3,0) isa purestrategy

OE,

so^3X3=

contraryto part (b)ofthelemma. To

see

why

thisisanequilibrium, notethatprovider 2isclearlyplayingabest response.Moreover,in thisallocationIIi

=

4/9.We

canrepresentany

deviation of provider 1by

(pi,P3)

=

(2/3-5,2/3-ae-5),

for

two

scalarseand

5,whichwillinduceaWE

of(xj,X2,X3)=

(2/3+

6—

e,1/3—

5, e).

The

correspondingprofitofprovider1 atthisdeviationisHj=

4/9—

^^<

4/9,estab-lishingthat provider1is alsoplayinga bestresponse

and

we

haveapurestrategyOE.

We

next establish that, under an additional mild assumption, a purestrategyOE

willneverbeatapoint of non-differentiability of the latency functions.

Assumption

3There

existssome

sE

S

such that k is real-valuedand

continuouslydifferentiablefor alli

£

X, .Lemma

5 Let (p^-^,x°^)

be anOE

with min^{pf^

+

lj{x°^)]<

R

and pf

^xf

^

>

for

some

i. LetAssumptions

1,2and

3 hold.Then

where

lf{x^^)and

l~{xf^) arethe rightand

left derivatives ofthe functionU atxf^

respectively.

Since theproofof this

lemma

islong,itisgiveninAppendix

C.Note

thatAssumption

3cannot be dispensed within this

lemma.

Thisisillustratedinthenext example.Example

5 Consideratwo

Hnk

network. Letthe total flowhe d=

1and

thereserva-tion utilitybe/?

=

2.Assume

that thelatency functions aregivenby

^^(^^^^^(^)

=

\2(x-i)

otherwise.Itcan beverifiedthatthe vector (pf^,p^^)

=

(1, 1), with(xf^,x^^)

=

(1/2,1/2) isapurestrategy

OE, and

isat a point of non-differentiabihtyfor bothlatency functions.We

next provideanexplicitcharacterization oftheOE

prices,whichis essential inourefficiency analysisinSection 5.

The

proofisgiveninAppendix

D.Proposition

9 Let{p°^,x'^^) beanOE

suchthatpf^xf^

>

forsome

ie

1. LetAssumptions

1,2,and

3 hold.a)

Assume

thatmiuj{p^^

+

/j(x°^)}<

R. Then,for allsG

5

and

i€

2s,we

haver xf^/^(xf^), ifl'^{x°^)

=

forsome

j^

Z„

??""={

a:P^/'(xp^)

+ _^iM^4^,

otlierwise. (^6)b)

Assume

thatmiiij{p°^

+

lj{xf^)}=

R. Then, forallsG

5

and

i GXj,we

have

pr

>

^'^i^i^?'')- (17)Moreover,ifthere exists

some

iG

I

suchthat Z^=

{i} forsome

sG

5,thenpf^<xf^/,n:rf^)

+

^

^ 1 • (18)Ifthe latency functions li are all real-valued

and

continuously differentiable, thenanalysis of

Karush-Kuhn-

Tuckerconditionsfor ohgopolyproblem

[problem (82) inAp-pendixD] immediatelyyieldsthe followingresult:

Corollary

1 Let(p°^,x°^)

bean

OE

suchthatpf^xf^

>

forsome

iG

I. LetAs-sumptions1

and

2hold.Assume

alsothatkisreal-valuedand

continuouslydifferentiablefor alli. Then, forall s

G

5

and

i€ls, we

haveif/;(x°^)

=

Oforsomej ^J,

otherwise.

(19)

Thiscorollary alsoimpliesthatinthe

two

linkcasewithreal-valuedand

continuouslydifferentiablelatency functions

and

withminimum

effective cost lessthan R, theOE

pricesare

P?^-xf^{l[ixn

+

l2ixr))

(20)asclaimedinthe Introduction.

5

Efficiency

of

Oligopoly

Equilibria

This section contains our

main

results, providing tightbounds on

the inefficiency ofoligopolyequilibria.

We

take asourmeasure

ofefficiencythe ratio of thesocialsurplus oftheequilibriumflow allocation to thesocialsurplus of the social

optimum,

S{x*)/S{x^),where

x' refers tothemonopoly

or the oligopoly equilibrium [cf. Eq. (8)]. Section 3established that the flow allocation at a

monopoly

equilibrium is asocialoptimum.

Hence, in congestion

games

withmonopoly

pricing, there isno

efficiency loss.The

following

example

showsthatthisisnotnecessarilythe casewitholigopolypricing.Example

6 Consider atwo

linknetwork. Let thetotal flowbe d=

1and

thereservationutilityhe

R=

1.The

latency functions are givenby

3

/l(x)

=

0, l2{x)=

-X.The

uniquesocialoptimum

forthisexample

isx'^=

(1,0).The

uniqueME

(p^^,x'^^)is x'^'^

=

(1,0)and

p^^

=

(1,1).As

expected, the flow allocations at the socialoptimum

and

theME

arethesame.Next

consideraduopolywhere

eachofthese links isowned by

adifferent provider. UsingCorollary 1and

Lemma

3, itfollows thattheflow allocation atthe

OE,

x'-'^,satisfies/,(x?^)

+

x?^[/;(xf^)+

Ux^^)]

=

kix^)

+

x^Ux^)

+

Ux^'')]-Solvingthistogetherwith

xf ^

+

X2^

=

1 showsthat the flow allocation at theuniqueohgopoly equilibrium is x'~^^

—

(2/3,1/3).The

social surplus at the socialoptimum,

the

monopoly

equilibrium,and

the oligopoly equilibrium are givenby

1, 1,and

5/6, respectively.Before providinga

more

thoroughanalysis oftheefficiencyproperties oftheOE,

thenextpropositionprovesthat, asclaimedintheIntroduction

and

suggestedby

Example

6, achange in the

market

structure frommonopoly

toduopolyin atwo linknetworktypicallyreduces efficiency.

Proposition 10

Consider atwo

link network where eachhnk

isowned by

adiffer-ent provider. Let

Assumption

1 hold. Let {p^^,x'^^) be a pure strategyOE

suchthat

pp^xp^

>

forsome

i€

J

and

min^{pf'^

+

lj{xf^)}<

R. If Z'i(xf^)/xf^^

/^(x°^)/x^^,then S(xO^)/S(x^)

<

1 .Proof.

Combining

theOE

priceswiththeWE

conditions,we

havehix?")

+

x?^{l[ix?^)+

Ux2^))

^

hix^'^)+

xr{l[{xr)

+

Ux^)),

where

we

usethefactthatmiuj{p°^

+

l]{x'^^)}<

R. Moreover,we

canuse optimalityconditions (7)toprovethata vector (xf ,xf)

>

isasocialoptimum

ifand

onlyif/i(xf)

+

xf/'i(xf)=

hixl)+

xf/^(xf).Sinceri(xf^)/xf^

^

/^(x^^)/xp^,theresult follows.Q.E.D.

We

next quantify the efficiency of oligopoly equilibriaby

providing atightbound

on

theefficiency loss incongestiongames

witholigopolypricing.As we

haveshown

inSection4, such

games

do not always have a purestrategyOE.

Inthe following,we

firstprovide

bounds on

congestiongames

thathave purestrategyequilibria.We

next studyefficiencyproperties of

mixed

strategyequilibria.5.1

Pure

Strategy

Equilibria

We

consider pricecompetitiongames

thathave purestrategy equilibria(this setincludes,butissubstantially larger than,

games

withlinearlatency functions, see Section4).We

consider latency functions thatsatisfy

Assumptions

1,2,and

3. LetCi

denotethesetoflatency functionsfor which theassociated pricecompetition

game

has apurestrategyOE

and

the individual k's satisfyAssumptions

1,2,and

3.^^We

refertoan element ofthe set

Cj

by

{li}iei-Given

a parallellinknetwork with/Unks

and

latency functions{k}iei

S

-C/i IstOE{{li}) denote the setofflow allocations at anOE.

We

define theefficiencymetricat

some

x'^^G

OE{{li})asPV

x°^-T

l(x°^\x°^

where x^

isasocialoptimum

giventhelatency functions{li}i^jand

R

isthe reservationutility. In other words, our efficiency metric is the ratio ofthe social surplus in an

equihbriumrelative tothe siurplus in the social

optimum.

Following the literatureon

the "price ofanarchy",inparticular [25],

we

are interestedintheworstperformanceinan

oligopolyequihbrium,sowe

lookfora lowerbound on

inf inf^ r,{{U},x°^).

{'Oe£/

^oB^OEau))

We

firstprovetwo lemmas, which

reduce theset oflatency functions thatneedtobe considered in

bounding

the efficiency metric.The

nextlemma

allows us to use theoligopoly price characterization giveninProposition 9.

Lemma

6 Let {p'-'^,x^^)be

apurestrategyOE

suchthatpf^xf^

=

foralliG

Z.Then

x'~'^isa socialoptimum.

Proof.

We

firstshow

thath{xf^)

=

for alliel. Assume

that lj{x^^)>

forsome

;

€

1. Thisimphes

thatx^^

>

and

thereforepf^

=

0. Since lj{xf^)>

0, itfollowsby

Lemma

2thatforallx E

W[p),we

haveXj=

xf^. Considerincreasingpf^

tosome

small e

>

0.By

theupper

semicontinuityofW{p),

it follows that there existssome

e

>

sufficientlysmallsuchthatforallx6 W{e,p^^),

we

have\xj—

x^^\<

5forsome

5

>

0. Moreover,by

Proposition 2,we

have, for allx

€

W{e,p?.f), Xi>

xf^

foralli7^ j. Hence, theprofitofthe provider that

owns

linkjisstrictlyhigher at price vector{e,p^f) thanatp*^^,contradictingthefactthat

(p°^,x°^)

isanOE.

Clearly

xf^

>

forsome

jand

hencemin^gijpf^

+

k{x^'^)}=

pf^

+

lj{xf^)=

0,which

impliesby

Lemma

.3thatJ^tei^?^

=

d,. Using/j(xf^)=

0,and

G dU{xf^)

forall2,

we

haveR

-

kixf^)

-

xf

^5,.=

i?,V

iG

J,for

some

gi^€

dli{xf^). Hence,x°^

satisfiesthe sufficientoptimahty

conditions for asocial

optimum

[cf Eq. (7) withX^=

R],and

theresultfollows.Q.E.D.

The

nextlemma

allowsus toassume

without loss of generality thatRYliei^f

~

Y^iei^i(^i)^f

>

s-iidEiei^?^

=

dm.

thesubsequentanalysis.Lemma

7 Let {kjieiG

£/.Assume

that^^Moreexplicitly,Assumption2impliesthatifany

OE

(p'^'^,x'^^) associatedwith{li}iei hasxf^ >

andhixf^)

=

0,thenJ^=

{i}.either (i) Yliex^i(^f)^i

~

^^iei^f

^'^^some

socialoptimum

Xs, or (ii)E^eI^?^

<

^forsome

x°^

e0^{{h}).

Then

everyx°^

G

0E{{1,}) isasocialoptimum,

implyingthat rj{{li},x'^^)—

1.Proof.

Assume

that^i^xh{xf)xf

—

R^^i^jxf.

Sincex^

is asocialoptimum

and

everyx'-'^

G

OE{{k})

isafeasiblesolution to thesocialproblem

[problem(6)],we

have=

Y.^R -

k{xf))xf> J2iR -

h{x?''))xf'^,V x°^

€ O^iik}).

lei lex

By

the definition ofaWE,

we

havexf^

>

and

i?-

kixf^)

>

pf^

>

(wherepf^

istheprice oflinkiatthe

OE)

foralli. Thiscombined

with the precedingrelationshowsthat

x°^

is asocialoptimum.

Assume

nextthat Yl^^jxf^ <

dforsome

x'^^G

OE{{li}). Letp'-^^bethe associatedOE

price.Assume

thatp^^x'^^>

forsome

j€

I

(otherwisewe

aredone by

Lemma

6). Since

X^iei^?^

^

'^'^^

haveby

Lemma

3 thatminjgjjpj+

lj{x^^}=

R. Moreover,by

Lemma

4,itfollowsthatPjxf^>

foralliG

I. Hence,forallsG

5, ((pf^)iei,,a;°^)is

an

optimalsolution oftheproblemmaximize((p.).g^^,:c) y^^PiXj

subject to Pi

+

li{xi)=

R,V

iG

Xs,pf^

+

liix,)^R,

^lils.

Y.xO^<d.

Substitutingfor (p^ieis inthe above,

we

obtainmaximizex>o 2_^

(^

~

^i{^i))^iieis

subject to x^

&

Ti,M

i^I^,

^xf'Kd,

where

Tj=

{xj |pf^

+

li{xi)=

R}

iseitherasingleton or a closedinterval. Sincethis

isaconvex problem, using the optimality conditions,

we

obtainR

-

k{xf^)-

xf^gi,=0,

V

IG

X„ V

sG

5,where

gi^Gdli{xf^).By

Eq. (7), itfollowsthatx°^

is asocialoptimum.

Q.E.D.

This

lemma

implies that in findingalowerbound on

the efficiencymetric,we

canrestrict ourselves, without loss of generality, to latency functions {k}

G Cj

suchthatY^i&ik{xf)xf

<

RJ2iei^i

forsome

socialoptimum

x'^,and Xliei^?^

=

d for allx*^^

G

OE{{li}).By

thefollowinglemma,

we

canalsoassume

that YLiei^f~

'^•Lemma

8 Forasetoflatency functions{/,},gi,letAssumption

1hold. Let[p'~'^,x^^)be an

OE

and x^

bea socialoptimum.

Then

E-P'^E

Proof.

Assume

to arrive at acontradiction thatYliei^i -^ Yliei^i- Thisimpliesthat

x^^

>

Xj forsome

j.We

alsohave lj{x^^)>

lj{Xj). (Otherwise,we

would

havelj{xj)

—

l'j{Xj)=

0, whichyields acontradictionby

the optimalityconditions (7)and

thefactthat Yliei^f"^^)- Usingthe optimality conditions(2)

and

(7),we

obtainR

-

l,{xf^)-

pf

>R-

lj{x^)-

x^gi^,for

some

gi^€

dlj{Xj).Combining

the preceding with lj{xf^)>

lj{xj)and

p^^

>

xf'^lj{Xj'^) (cf.Proposition9),

we

seethatxf-l-ixf-Xx^g,,

contradicting

x^^

>

Xjand

completingthe proof.Q.E.D.

5.1.1

Two

Links

We

firstconsider a parallel linknetwork withtwo

linksowned by two

serviceproviders.The

nexttheorem

provides atightlowerbound

of5/6on

r2{{li},x'-'^) [cf. Eq. (21)].Startingwiththe two-linknetworkisuseful

two

reasons: first, thetwo-linknetworkavoidsthe additional layer ofoptimizationoverthe allocation of links to service providers

in characterizingthe

bound on

inefficiency;and

second,we

willprovethe resultforthegeneral case

by

reducingittotheproofofthe two-linkcase.Although

thedetails of theproofofthetheorem

are involved,thestructureisstraight-forward.

The

problem

offindingalowerbound

onr2{{k},x'-^^)isan

infinite-dimensionalproblem,sincetheminimizationisoverlatency functions.

The

prooffirstlower-boundsthe infinite-dimensional

problem by

theoptimalvalue ofafinite-dimensionaloptimiza-tion

problem

usingtherelationsbetween

the flows at socialoptimum

and

equihbrium,and

convexityofthe latency functions. Itthenshows

thatthe solutionwillinvolveoneofthe linkshaving zero latency. Finally, usingthisfact

and

the price characterizationfrom

Proposition 9, itreducestheproblem

of characterizing thebound on

inefficiencytoa simple minimization problem, withoptimalvalue 5/6.

An

intuitionfor thisvalueisprovidedbelow.

In the following,

we assume

withoutloss ofgenerality thatd—

1. Also recallthatlatency functionsin

C2

satisfyAssumptions

1,2,and

3.Theorem

1 Consider atwo

link networkwhere

each link isowned by

a differentprovider.

Then

r2{{k},x^^)

>

^,V

{kh=,,2e

C2,x^^

G O^iik}),

(22)and

thebound

istight,i.e.,thereexists {li}i=i,2€

^2and

x°^

G

OE{{li}) that attainsthelower

bound

inEq. (22).Proof.

The

prooffollowsanumber

ofsteps:Step 1:

We

are interestedinfindinga lowerbound

fortheproblem

inf inf r2({U,a:°^). (23)

Given {/j}

E

£2, letx°^

£ OE{{li})and

let x"^ be asocialoptimum.

By

Lemmas

7and

8,we

canassume

thatJ2i=i^?^

—

IZi=i^f—

^- ^^^^implies that there existssome

i such thatx^^

<

xf. Since theproblem

issymmetric,we

canrestrict ourselvesto {li]

€ £2

such that x'^^<

xf, i.e.,we

restrict ourselves to {li} G£2

such thatxf^

<

xf

—

eforsome

e>

0.We

claiminf inf r2({/.},x°^)>infrOf(6), (24)

where

we

defineproblem

(E^) asOF, ^

R

-

hy?'^-

hy?'^r2,t (e)

=

mmimize

,s, (,sy>o_

g g_

g g (Ei^-^fyf-^fyf

subject to If<yf{lfy,

i=

l,2, (25) li<y?^li, i=

l,2, (26) 'f+

yfaf)'=

^f+

yfOf)', (27) ^f+

yf(/f)'<i?, (28) 2h

+

i[{y?''-yl)<if,

(30)y2'"^>yf

+

e. (31)E:

Vi=

1, (32)+

{Ohgopoly

Equihbrium

Constraints}t, t=

1,2.Problem

(E')canbe viewedasafinitedimensionalproblem

thatcapturestheequilib-rium and

thesocialoptimum

characteristics oftheinfinitedimensionalproblem

given inEq. (23). Thisimpliesthat instead ofoptimizingoverthe entire functionk,

we

optimizeover the possible values ofli{-)

and

dli{-) atthe equilibriumand

the socialoptimum,

which

we

denoteby

li,l^,lf,(if)' [i.e., {if)' isavariablethat representsallpossibleval-ues ofgi^ Gdli{yf)].

The

constraints oftheproblem

guaranteethat these valuessatisfythenecessaryoptimality conditionsfora social

optimum

and

anOE.

In particular,con-ditions (25)