The MIT Faculty has made this article openly available. Please share

how this access benefits you. Your story matters.

Citation Townsend, Robert M. “Accounting for the Poor.” American Journal of Agricultural Economics 95, no. 5 (August 12, 2013): 1196–1208.

As Published http://dx.doi.org/10.1093/ajae/aat022

Publisher Oxford University Press

Version Original manuscript

Citable link http://hdl.handle.net/1721.1/96165

Terms of Use Creative Commons Attribution-Noncommercial-Share Alike

T.W. Schultz Lecture Accounting for the Poor

Robert M. Townsend

Elizabeth & James Killian Professor of Economics Massachusetts Institute of Technology

Department of Economics 50 Memorial Drive, Room E52-252c

Cambridge, MA 02142 Ph: (617) 452-3722

rtownsen@mit.edu

Financial support from the National Institute of Child Health and Human Development (NICHD), the National Science Foundation (NSF), the John Templeton Foundation, and the Consortium on Financial Systems and Poverty at the University of Chicago through a grant from the Bill & Melinda Gates Foundation is gratefully acknowledged.

Economists and other social scientists have long tried to understand the nature of poverty and how poor people make decisions. T.W. Schultz, a Nobel Laureate, former professor of economics at the University of Chicago, and former president of the American Economic Association, spent his career working in development and agricultural economics. In his 1980 Nobel Prize acceptance speech, Schultz suggests that there is some accounting for the behavior of the poor in agriculture. “Farmers, the world over, in dealing with costs, returns, and risks are calculating economic agents. Within their small, individual, allocative domain they are fine-tuning entrepreneurs, tuning so subtly that many experts fail to recognize how efficient they are,” (Schultz 1980, p. 644).

Accounting for the Poor

The notion of “accounting for the poor,” as in the title of this paper, refers to a number of aspects of measurement. The first involves the millions of poor people in the world and their contributions to the economy. In many economies, when added up, the contributions of poor populations are a substantial part of Gross Domestic Product (GDP). Thus, one has to account for them. There is a countervailing view, though, that while there may be many poor people, they do not really contribute much in terms of value-added, and the larger source of economic activity is from manufacturing and industrialization. This turns out to be a false assumption, and we do need to take the poor into account. The second meaning of the title is literal: Creating financial accounts for the poor, and doing it well. That is, to assemble an appropriate set of accounts of the poor. The third and final meaning of the title addresses concerns that economists are not able to account for the

behavior of the poor, as if poor people follow some alternative norms or are not

maximizing. As Schultz suggests in the quote above, his view—and the view taken here —is the opposite: Namely, we can and should use standard economic theory in

combination with data.

Poor People Drive Growth and Total Factor Productivity (TFP)

I now address each one of these meanings in more detail. First, the poor add up to big numbers. In Thailand, we can see the importance of small, proprietary income at the macroeconomic level. If we look at the fraction of their contributions to national income from 1970 through 2003, proprietary income was the single largest component until only recently (figure 1). Proprietary income includes proprietors, such as farmers, who were particularly important earlier in Thailand’s history. But another piece is non-farm proprietary income, the so-called “small” people who run small or medium enterprises. No individual business amounts to much, but when one adds them all up formally, it turns out to comprise a large portion of GDP. The pieces of national income that are traditionally or stereotypically thought to be important, in contrast, make up a smaller portion of national income. Wage and salary income became important only within the last decade in Thailand, and corporate profits—the “big” firms—made up very little. This analysis for Thailand is typical of data in developing countries.

Insert Figure 1 here

If we look at TFP, a metric commonly used by macroeconomists to measure productivity, or the contribution to GDP beyond factor inputs, we can compare simulated output from a model that takes a stand on small business with the Solow residuals from actual, aggregated data (Jeong and Townsend 2007). Specifically, TFP is simulated using a model estimated on micro data, which allows individuals to choose their most

productive occupations, something that is facilitated by an expanding financial

infrastructure. If one puts estimated parameters and the expanding financial infrastructure into the model, one can simulate and track about 78 percent of growth in TFP between 1970 and 1995 (figure 2). Thus, to summarize, from a macroeconomic standpoint— TFP—the innovation and growth in Thailand derives from relatively poor people making these occupation transitions. While they may seem trivial on a small scale, we see their impact nationally in both GDP and TFP.

Insert Figure 2 here

The Poor and Financial Accounting: Households as Corporate Firms

To “account for the poor,” in the sense of creating the financial accounts, requires adequate data. The primary data used here is from a project I lead, which has gathered data in Thailand for more than 15 years. An annual survey in both rural and urban areas contains a sample of more than 3,000 households scattered across 200 villages, towns, and even city neighborhoods. A complementary monthly survey, ongoing for more than 180 months, is fielded for more than 700 households across a subset of 16 villages. The

questionnaires for these surveys are quite detailed, which makes the idea of accounting for the poor a reality.

Households, including the poor households engaged in agricultural work described by Schultz, can be thought of as businesses through the lens of formal

corporate financial accounting. We can then apply the same concepts that economists use to study performance and liquidity for medium and large corporate firms. As Angus Deaton indicates, “The only way to obtain … [these] measures is by imposing an

accounting framework on the data, and painstakingly constructing estimates from myriad responses to questions about the specific components that contribute to the total” (Deaton 1997, p. 29). While creating such accounts is a tedious exercise, it is really the only way to understand how all of the individual responses add up to the line items needed in the accounts, at both the individual and larger, aggregated level.

Thus, using the monthly data, we have created the income statement, balance sheet, and statement of cash flow for hundreds of households, over 150 months (Samphantharak and Townsend 2009). With these accounts, one can look at both liquidity and asset management. In any month, a household has consumption expenses, investment expenses, and income. If consumption and investment are larger than income, the difference is a deficit, D, (often the result of seasonal variation) and the household must “finance” the deficit somehow, by using the stock of cash they have, drawing down savings accounts, borrowing, or receiving gifts and transfers from other households. The

sum of these “financing mechanisms,” the F’s, seen in the accounts add up to the total deficit, as follows:

1a …

Likewise, surplus is saved via various mechanisms. One can also do a

variance/co-variance decomposition and quantify which objects are used the most and which are used the least.

1b 1 , , ⋯ ,

The accounts can also differentiate issues of smoothing and liquidity from rates of return. When a firm goes bankrupt, there is always the question of whether the firm mismanaged its liquidity or whether it went bankrupt because it was not productive. This difference can be explored only if one is able to distinguish liquidity, using cash flow from rates of return, the latter using an accrual notion of income.

Financial accounts help make asset management clear. Net savings on the accrued income statement plus gifts mean a household’s wealth will increase, and net worth will also increase. A mechanical relationship links the income statement (a flow) to the balance sheet (a picture of the assets and the liabilities at one point in time), so we can actually see portfolio management.

With these measurements in place, we can explore changes in household net worth over time, stratifying initially by where each household is in the cross-section. The results are surprising. While we might expect to see relatively poor households with few assets and low net worth, households in the lowest quartile have a growth in net worth of 22 percent per year (Pawasutipaisit and Townsend 2011, table 1). Alternatively, growth in net worth for the highest quartile, those with the most assets initially, is just 1 percent per year. Though an emerging market with GDP growth of 4 to 5 percent per year, these

measurements bring out the creation of wealth at the individual level, and the fact that it is heterogeneous. That is, wealth growth is quite strong for the asset-poor in the sample and high relative to other, richer households.

Insert Table 1 here

Growth in net worth is a combination of savings rate, productivity, and assets level. Using the following equation, overall savings, S, is equal to the savings rate (as a fraction of income) times the return on assets (ROA), scaled by the initial level of assets, A. That is, for each household i:

2a .

If this expression for savings is substituted into the growth of net worth and divided by the initial net worth, we see that the proportional growth of net worth (controlling for gifts, G) has to do, clearly, with the savings rates and return on assets:

2b ∆ .

Indeed, in the data there are correlations between the growth of net worth and savings rates, typically positive and significant, particularly if one averages up not only for a given household over all the months but also over the years of the survey. This confirms and quantifies the theory that savings rates do matter, and savings rates are contributing to the growth of net worth for Thai households. Even more obvious in the data, though, is the correlation between the growth of net worth and the return on assets. By any measure (province, month, year, whole sample averages, etc.), these correlations are always substantial—50, 60, 70 percent for the most part—and statistically significant.

Thus, a large source of increasing wealth is due to how households are deploying their assets, and many of the poor are doing this quite well, in the sense of getting a high rate of return on their existing assets. There is something intrinsic to the household; that is, some households are simply more productive than other households. Whatever the reason, it is persistent. If we look at the relationship between ROA in the first half of the sample and in the second half of the sample, we see that household data points lie very close to the 45 degree line, indicating a near-exact relationship over time.

Looking more closely at the households in the upper quartile with a high ROA, we see that they are investing in their businesses and their farms. This supports the earlier point about economic theory and behavior: These households are very self-aware that

their wealth is increasing as a result of their productive enterprises and are acting in ways that reflect this knowledge. Of course, there are households with lower rates of return but who still have an increase in net worth. The behavior of these households is different. They are not investing in household enterprises, but rather accumulating savings through either cash savings at home or deposits in a bank. This is, of course, a wise decision if the rate of return on a business is not all that great.

It is worth noting that within Thailand, there is variation in ROA and the growth of net worth among provinces. In Buriram, one of the northeastern provinces, the

correlation between ROA in the first half of the sample and the second half of the sample is lower. When we looked more closely at what these households are doing, we found that this was an area in which the landscape was literally being transformed by

urbanization. What had previously been separate villages had agglomerated into one town and urbanized. These households were also changing occupations over the period, and the data show they did so to achieve higher rates of return. The underlying story though is, again, one of maximization and self-aware, rational behavior.

If we pool together individual households, we can think more broadly and over a longer term about the whole life cycle. This allows us to explore how households are thinking about their situation as they age and what they are doing. Although we have been able to track households in the Thai data for 15 years, obviously this does not represent a household’s entire lifetime; households vary in age. Thus, we piece together

these individual 15-year accounts, averaging across households of a given age, to plot consumption, income, and savings over a typical life cycle.

Here again, we see disparities among regions. For example, in the central region, near Bangkok, average income is consistently above consumption and net savings is positive, i.e., net worth is increasing (figure 3). This illustrates a classic picture of the life cycle where net worth starts lower, as one is young and just starting a career, and

increases to a peak at about 60 years of age. As one ages, productivity drops;

consumption is then at the level of income or even exceeding it, and the household begins running down its wealth. In contrast, in the northeastern region, an area that remains predominantly involved in agricultural production, average consumption is consistently above income, and net savings is negative across all ages (figure 4). These households are reliant on incoming gifts and remittances. The net result is that net wealth increases over time as the number and amount of gifts received increases by age. While this does not look like a standard life cycle diagram, it exposes an alternate strategy. Namely, within the same household, we see overlapping generations: Aging parents and children who are now farming or have migrated to Bangkok and are sending gifts back. The economy is growing and net wealth is going up, so there is not a need to run down assets from financial savings. The contrast is interesting, but in both cases there is no evidence that these households, on average, are making mistakes.

Insert Figure 3 here

Insert Figure 4 here

Risk Sharing & Village Networks

I return to T.W. Schultz and his thoughts on how economic theory can—and should— be applied to development. “This branch of economics has suffered from several intellectual mistakes. The major mistake has been the presumption that standard economic theory is inadequate for understanding low-income countries, and that a separate economic theory is needed… Fortunately, the intellectual tide has begun to turn. Increasing numbers of economists have come to realize that standard economic theory is just as applicable to the scarcity problems that confront low-income countries as to the corresponding problems of high-income countries,” Schultz suggests (1980, p. 640).

Not only can one think about individual behavior relative to economic theory, it is also possible to think about the behavior of entire communities. Work in India from a study on risk and insurance (Townsend 1994) shows the fluctuations in income across time. I often refer to this as the Rocky Mountain graph, in that the peaks in income almost conceal the valleys that lie behind it. For a village in India over the period 1976 to 1984, we see that fluctuations in income are quite erratic, with few aggregate shocks visible (figure 5). Alternatively, the consumption diagram is akin to Kansas, remarkably flat over time (figure 6). Within this community, the households who are fortunate enough to have high income are sharing risk with and lending these resources to the less fortunate households.

Insert Figure 5 here

Insert Figure 6 here

The risk sharing seen in the graph of consumption does not imply that there exists an egalitarian society where everyone has the same level of consumption. In fact, what is not visible here is the presence of a small tilt in the consumption diagram. A household’s consumption is stabilized around its own mean. Some households have lower means than others, but everyone is a beneficiary of some kind of communal level smoothing, almost as if the village had Arrow-Debreu complete securities (with the traditional trading of assets substituted for other village risk-sharing mechanisms). This can be thought of as a risk-sharing benchmark. Consumption should move in the presence of an aggregate shock, and the aggregate risk should be shared. After controlling for this aggregate, idiosyncratic income shocks should be shared as well though they will dissipate to zero when pooled. Thus, after controlling for aggregate shocks, household consumption should not move at all with household-specific income. The risk-sharing equation below fro the growth of household consumption explores this relationship.

3

, ,

In this example, β, the coefficient on the growth of aggregate consumption, is determined to be close to one, and γ, the coefficient on the growth of idiosyncratic income, is not zero as it should be but it is very close to zero. The benchmark standard does quite well.

The exact mechanisms of risk sharing at the village level can be better understood using the Thai data, which displays similar Rocky Mountain and Kansas pictures. As a starting point, a census prior to the start of the monthly data provided a map of

households who are related by blood or marriage. Then detailed transaction data collected in subsequent monthly surveys can be used to map active networks that illustrate the interconnectedness of households in financial transactions, including gifts and loans. The two maps in figures 7 and 8 show that a large number of households are connected, either related to each other or conducting financial transactions with one another (or both).

Insert Figure 7 here

Insert figure 8 here

Now we return to the benchmark risk-sharing regressions, to compare the

sensitivity of consumption to income. We can determine whether the effect of income is mitigated by being in a network of financial transactions among households or by having family in the village. For consumption smoothing, research suggests that participation in a financial network via gifts and loans is quite helpful. In terms of smoothing cash flow to protect investment, having kin within the village (or nearby) is beneficial (Kinnan and Townsend 2012).

In interviews, the households themselves articulate an awareness of lending and borrowing networks. The data also shows clearly the transactions; the shadow money

market is quite visible in the data. One can see when loans are due and observe

borrowing and lending transactions among households with a 12-month seasonal pattern. Both rise and fall together. The point is that many households are borrowing to repay loans or taking out bridge loans. For example, if a household has a long-term loan due, perhaps from a formal sector lender, and the household is having a low-income year, it borrows in the village money market from friends or relatives. Now the household has a short-term loan that can be used to pay off the long-term loan. The cycle continues: The household’s credit is still good, and it can borrow again from the source of the prior long-term loan and use these funds to pay off the short-long-term loan. We thus see millions of baht, or hundreds of thousands of dollars, circulating in the village money market.

The benchmark standard described can also be used to measure how well villages as a whole are doing in terms of labor supply. Though labor supply may be thought of as an individual, if not a household, response to try to earn money to compensate for having a bad year in agriculture or business, this does not account for networks. Labor supply in Thai villages is more akin to leisure sharing or co-working, where labor exchanges are common (Bonhomme et al. 2012). In villages in the northeast, for example, individuals will work on someone else’s plot and then the individual will reciprocate. Money does not change hands, so individuals are basically exchanging labor. What the data show is that when one group of households is working hard, it is likely all of the households are working hard. Groups of households are sharing the burden, just like they were sharing consumption. Individuals respond as they should to wages. But the effect of idiosyncratic income, or non-wage income, is mitigated so that the net effect on these households’

shock is small; the participation margin change for a one standard deviation shock in non-wage income is less than 5 percent, and the sensitivity of hours to non-non-wage income is smaller.

Another consideration is the rate of return on assets, not just at the individual level but also at the community level. In the capital asset pricing model, a standard financial model, project investments that have returns that co- move with the market are less valuable projects because an individual cannot hedge with them; thus, they require a higher expected return.

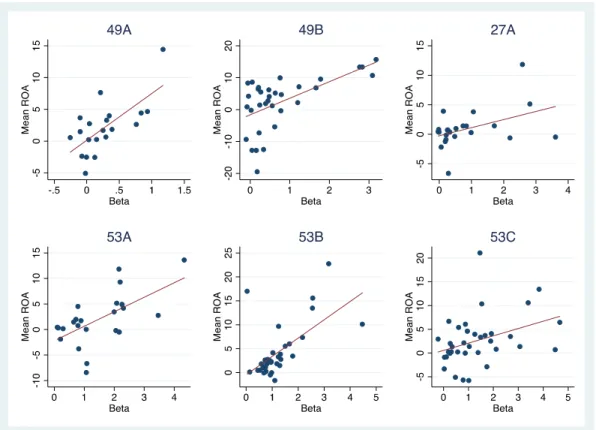

The diagrams in figure 9 illustrate the correlation between β, the correlation of household rates of return with village averages of return, and the expected return on assets. Informal village economies rival the U.S. and perhaps even do better than what individuals can do via formal financial markets.

Insert figure 9 here

Of course, village networks are not perfect. Figure 10 shows the marginal product of capital versus the interest rate, and indicates that the marginal product of capital varies inversely with the level of wealth (Pawasutipaisit and Townsend 2011). As discussed earlier, households with the lowest wealth have high rates of return (measured in this case through the estimation of a production function as the marginal product of capital), and relatively well-off households have low rates of return. In principle, if markets were perfect, the benchmark standard would suggest that the marginal product of capital should be equalized across the households, after adjusting for risk. It is clear that this is

not the case, so in this respect, at least, these village money markets do not work nearly so well.

Insert figure 10 here

Figure 11 shows what is predicted about the relationship between rates of return and assets through the lens of models with explicit obstacles to trade (Karaivanov and Townsend 2012).

Insert figure 11 here

To elaborate, there can be good reasons why one would not expect to see the financing of investment. When there is moral hazard, full insurance is problematic. If an individual knows his consumption is going to be protected against fluctuations in income by his friends and relatives, there would be less incentive to work hard. The expectation of a bailout is present. With that in mind, the individual has to take on more risk and may limit investment. Or, again in terms of financing investment, to the extent that an

individual could deny repayment, that kind of limited commitment would reduce loans and move an individual to something closer to self-financing.

Karaivanov and Townsend (2012) find, again, that in urban areas, the

combination of data (consumption, income, investment, and capital stock) shows that the weight of the evidence is toward a moral hazard regime. In the village-level data, even when using both consumption and investment data, a savings-only or very limited

financial regime fits best, as good sharing in consumption is outweighed by poor investment; that is, money is not flowing to the more productive households.

Implications for Policy

In Transforming Traditional Agriculture, Schultz (1964) illustrates how farmers in poor countries maximize the return from their resources, acting rationally in response to government policy. Governments in these countries often artificially set low prices on crops and tax farmers heavily; in response, farmers were less likely to innovate. Indeed, this is a theme across several of Schultz’s books: Rural poverty persists in poor countries because government policy in those countries favors urban dwellers.

In Thailand, this also rings true. Policy often emanates out of Bangkok, and people who live in the capital sometimes have a view that poor people in rural areas need handouts, at best. There is a general lack of awareness of the successful strategies that poor households are adopting and the subsequent increases in their net worth. This represents another obstacle, and in Schultz’s mind, is quite an important one.

If we looked at Thailand in terms of the evolution of the financial system, both commercial banks and the government bank, the Bank for Agriculture and Agricultural Cooperatives (BAAC), are expanding over time, especially so for the government bank and somewhat less so for the commercial banks (Assuncao, Mityakov and Townsend 2012). Figure 12 shows BAAC and commercial bank expansion over time, from 1986 to 1996. Though both have increased, BAAC has moved relatively more out of Bangkok and the Central area.

Insert figure 12 here.

Even this level of aggregation conceals what is happening at the local level. In the patterns mapped out in figure 13, a stylized map in which the dots represent villages and the numbers represent per capita income. If banks were profit-maximizing, we would anticipate them moving to high-income areas to mobilize savings and make loans.

However, the BAAC has a different mandate given the altruistic nature of its charter. The diagrams show how the banks enter markets sequentially, over time. We see the

commercial banks end up in very well-connected, high-income areas, and the BAAC branches end up on the periphery.

While this may seem like an appropriate strategy, given that the government created the BAAC to service the poor and commercial banks are generating profits in the high-income areas. We have been modeling this, but that model at estimated parameters tells a different story. Overall, location decisions and strategies have created a distortion. Even if the BAAC is interested in overall financial access, and it weights the services being provided by the commercial banks the same as its own services, the banks are going to play a Nash Equilibrium in terms of where to locate, without commitment to future expansion paths. That is, the government bank cannot announce in advance the path that it is going to follow, and instead it reacts to what commercial banks are doing. Likewise, commercial banks are going to anticipate where the BAAC is going to go. Collectively, these decisions generate the observed pattern of bank location. Politically, it looks successful, in the sense that farmers are getting serviced by government banks.

However, in fact, the arrangement is not Pareto optimal. Low wealth households in newly urbanizing areas are under-served.

Insert figure 13 here

I take this as an example of what Schultz had in mind. It is not that the urban residents and the Thai government are ignoring poor people, but rather they have created this populist program that brings some distortions and is not helping as much as it could. Schultz studied Germany and Japan in the period post-World War II and was amazed at how quickly these countries recovered, concluding that a healthy and highly educated population drove growth (Schultz 1964). This was part of his work on the concept of human capital for which he is so well known.

Of course, it was not that the government could not intervene; the idea was that the government can help people, but it needs to help people to help themselves.

Education and health are ways to keep people strong and productive, and Schultz considered that to be a big part of growth.

To summarize, we see that the poor make up a significant part of the economy, often innovating and even driving TFP growth. They can be viewed through the lens of corporate financial accounts and better understood through economic theory, not just as individuals one at a time but also as entire urban communities and villages. The

for investment, and obstacles created by the regulatory political economic financial infrastructure Poor populations should be given every opportunity to integrate financially into the rest of the economy, and to manage their money accordingly. This would result in improvements in human capital, wealth and net worth, and overall well-being.

References

Assuncao, J., S. Mityakov, and R. M. Townsend.2012. Ownership Matters: The Geographic Dynamics of BAAC and Commercial Banks in Thailand Working paper.

Bonhomme, S., P. A. Chiappori, R. M. Townsend, and H.Yamada. 2012. “Sharing Wage Risk.Working paper, Massachusetts Institute of Technology.

Deaton, A.1997. An Analysis of Household Surveys, A Microeconometric Approach to Development Policy. Baltimore and London: The World Bank, Johns Hopkins University Press.

Jeong, H., and R. M. Townsend. 2007. Sources of TFP Growth: Occupational Choice and Financial Deepening. Economic Theory Special Edition Honoring Edward

Prescott. 31. no. 1: 179-221.

Karaivanov, A., and R. M. Townsend. 2012. Dynamic Financial Constraints: Distinguishing Mechanism Design from Exogenously Incomplete Regimes. Working paper.

Kinnan, C., and R. M. Townsend. 2012. Kinship and Financial Networks, Formal Financial Access and Risk Reduction. The American Economic Review. 102. no. 3: 289-93.

Kotlikoff, L. 2001. Essays on Saving, Bequests, Altruism, and Life-Cycle Planning. Cambridge: MIT Press.

Pawasutipaisit, A., and R. M. Townsend. 2011. Wealth Accumulation and Factors Accounting for Success. Journal of Econometrics. 161. no. 1: 56-81.

Samphantharak, K., and R. M. Townsend. 2009. Households as Corporate Firms: An Analysis of Household Finance Using Integrated Household Surveys and Corporate Financial Accounting. Cambridge: Cambridge University Press. Schultz, T. W. 1964. Transforming Traditional Agriculture. Chicago: University of

Chicago Press.

Schultz, T. W. 1980. Nobel Lecture: The Economics of Being Poor. The Journal of Political Economy. 88. no. 4: 639-51.

Townsend, R. M. 1994. Risk and Insurance in Village India. Econometrica. 62. no. 3: 539-91.

Figure 1. Distribution of national income in Thailand, 1970 – 2003 Thailand: Distribution of National Income (1970-2003p)

0.0 10.0 20.0 30.0 40.0 50.0 60.0 70.0 1 970 1 972 1 974 1 976 1 978 1 980 1 982 1 984 1 986 1 988 1 990 1 992 1 994 1 996 1 998 2 000 2 002 year Corporate Profit (1970-1990) Corporate Profit (1980-2003) Wage&Salary (1970-1990) Wage&Salary (1980-2003) proprietor's income (1970-1990) proprietor's income (1980-2003) Nonfarm income (1970-1990) Nonfarm Income(1980-2003) nonfarm proprietor wage Corp profit Thailand: Distribution of National Income (1970-2003p)

0.0 10.0 20.0 30.0 40.0 50.0 60.0 70.0 1 970 1 972 1 974 1 976 1 978 1 980 1 982 1 984 1 986 1 988 1 990 1 992 1 994 1 996 1 998 2 000 2 002 year Corporate Profit (1970-1990) Corporate Profit (1980-2003) Wage&Salary (1970-1990) Wage&Salary (1980-2003) proprietor's income (1970-1990) proprietor's income (1980-2003) Nonfarm income (1970-1990) Nonfarm Income(1980-2003) nonfarm proprietor wage Corp profit

Figur Sourc re 2. TFP gr ce: Jeong an rowth in Th nd Townsend hailand, 197 d (2007), figu 70 - 1995 ure A1.

Table 1. Growth of Net Worth by the Initial Wealth Distribution (%)

Source: Pawasutipaisit and Townsend (2011).

Initial Wealth 1st quartile 2nd quartile 3rd quartile 4th quartile

Figure 3. Flows (average income, savings, consumption, and gifts) and stocks (net assets financed by savings and other means) in Thailand, central region.

Figure 4. Flows (average income, savings, consumption, and gifts) and stocks (net assets financed by savings and other means) in Thailand, northeast region

Figur avera Sourc re 5. Comov age), Aurep ce: Townsen vement of h palle nd (1994), fig household in gure 1(a)

Figur from Sourc re 6. Comov m village ave ce: Townsen vement of h erage), Aure nd (1994), fig household co epalle gure 3(a)

Figure 8. Kinship relationships in a Thai village, Sisaket province

Figure 9. Network as market in Thailand

Remarks: Horizontal Axis = Beta; Vertical Axis = Expected Return. Each graph

represents each of the networks. We treat each network as the market. From left to right and from top to bottom are networks from Lopburi (Networks 49A and 49B), Buriram (27A), and Sisaket (53A, 53B, and 53C).

Figur inter Sourc re 10. Marg rest rate. ce: Pawasuti ginal produc ipaisit and T ct of capital Townsend (20 l as a functi 011), figure on of capita 14.

Figur Note re 13. Simu : Commercia lation of ga al bank (red) me for com ) x BAAC (g mmercial ban green) nks and BAAAC