Competition and private R&D investment

Texte intégral

Figure

Documents relatifs

(d) establishment of a link with the community to facilitate utilization of services by those in need. The most sensitive area for effective intervention seemed

[r]

economics of (open) innovation and technology policy French editorial houses, e-book, business model, value chain, technological investment strategies, digital

We shall carry out our study of value distribution of a quasi- regular mapping of a noncompact Riemannian n-manifold M into a compact Riemannian n-manifold ~V

the operator (0.1) is accurately described, and the problem of the behaviour of Af(a) is reduced to the one concerning the spectrum of the operator generated

BENEOICICS, M., Positive harmonic functions vanishing on the boundary of certain domains in R "+x, Proceedings of Symposia in Pure Mathematics Vol.. DOMAR, Y., On

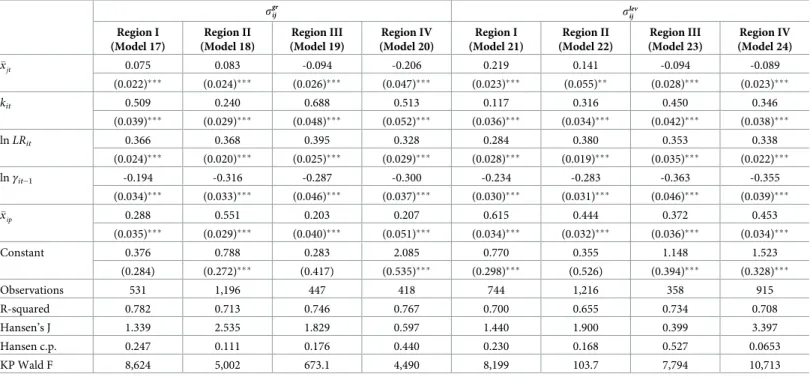

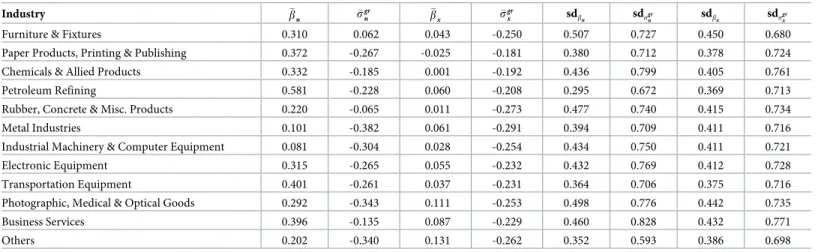

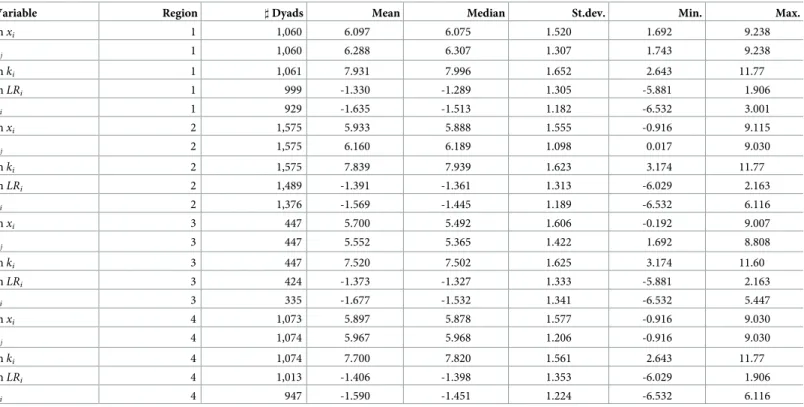

Our main performance variable is computed from the private funding of R&D that we define as the difference between the total R&D expenditures on the one hand and the sum

Part 3: word formation Part 6: cross-text multiple matching.. Part 2 report: