Digitized

by

the

Internet

Archive

in

2011

with

funding

from

Boston

Library

Consortium

Member

Libraries

HB31

J1415

DEWEY

Massachusetts

Institute

of

Technology

Department

of

Economics

Working

Paper

Series

CRISES

AND

PRICES

Information

Aggregation,

Multiplicity

and

Volatility

George-Marios

Angeletos

Ivan

Werning

Working

Paper

04-43

December

15,2004

Room

E52-251

50

Memorial

Drive

Cambridge,

MA

02142

Thispapercan bedownloadedwithout charge fromthe

SocialScience Research Network PaperCollectionat

MASSACHUSETTSINSTITUTEj

OFTECHNOLOGY

FEB

1 2005Crises

and

Prices

Information

Aggregation,

Multiplicity

and

Volatility*

George-Marios

Angeletos

Ivan

Werning

MIT

andNBER

MIT,NBER

andUTDT

angeletOmit.edu iwerningOmit.eduFirst draft:

January

2004.This

version:December

2004.Abstract

Many

argue that crises- suchascurrency attacks, bankrunsandriots- can bedescribedastimesofnon-fundamental volatility.

We

argue thatcrises arealsotimeswhen

endogenoussources ofinformation arecloselymonitoredandthusan importantpart ofthephenomena.

We

studytherole ofendogenousinformationin generatingvolatilitybyintroducing afinancialmarketina coordinationgamewhere agentshave heterogeneousinformationaboutthefundamentals. Theequilibrium priceaggregates

information withoutrestoring

common

knowledge. In contrast tothe casewithex-ogenousinformation, wefindthatuniqueness

may

notbe obtainedas aperturbationfrom

common

knowledge: multiplicityisensuredwhenindividualsobservefundamen-talswithsmall idiosyncraticnoise. Multiplicity

may

emergealso inthefinancial price.When

the equilibriumisunique,itbecomes moresensitivetonon-fundamentalshocksasprivate noiseisreduced.

JEL

Codes: D8,E5, F3,Gl.Keywords: Multipleequilibria, coordination, global games, speculative attacks,

cur-rencycrises,bankruns,financialcrashes,rationalexpectations.

*Forusefulcommentsandsuggestions,wethankDaronAcemoglu,ManuelAmador,V.V.Chari,Christian Hellwig,PatrickKehoe, BalazsSzentes,andseminarparticipantsatMIT, Stanford,UCLA,

UC

Berkeley,Duke, the Minneapolis and ChicagoFederal Reserve Banks, theMinnesota SummerWorkshop, andthe

1

Introduction

It'sa love-hate relationship,economistsare atonce fascinatedand uncomfortable with

mul-tiple equilibria.

On

the onehand, economic and political crises involve large and abruptchangesin outcomes, but oftenlack obviouscomparable changes in fundamentals.

Com-mentatorsattributeanimportantroleto

more

orlessarbitraryshiftsin'market sentiments'or'animal spirits',and modelswith multipleequilibriaformalizetheseideas.

On

the other hand,modelswith multipleequilibriacanalsobe viewedasincompletetheoriesthat should ultimatelybe extendedalongsome

dimensionto resolvetheindeterminacy.The

first view is represented by a large empirical and theoretical literature.On

the empiricalside,Kaminsky

(1999), forexample, documentsthat thehkelihoodofeconomiccrises is affected by observable fundamentals, but that a significant

amount

of volatilityremainsunexplained.

On

thetheoreticalside,modelsfeaturingmultipleequilibriaattempttoaddress suchnon-fundamentalvolatility.

Bank

runs, currencyattacks,debtcrises,financialcrashes, riotsandpoliticalregimechangesaremodeledasacoordinationgame: attackinga

regime -suchasa currencypegorthebanking system

-

isworthwhileifandonlyifenoughagentsare alsoexpectedto attack.1

Morris and Shin (1998, 2000) contributeto the secondviewby showingthat a unique equilibriumsurvives insuch coordinationgames

when

individualsobservefundamentalswith smallenoughprivate noise.2The

resultismoststrikingwhen

seenasa perturbationaroundthe original common-knowledgemodel, which isridden withequilibria.

Most

importantly,their contributionhighlights theroleoftheinformation structureindeterminingand

char-acterizingthe equilibriumset.

The

aim of thispaper istounderstand the roleofinformationin crises.We

focusontwo distinct forms ofnon-fundamental volatility: the existence ofmultiple equilibria and

the sensitivity of a unique equilibrium to non-fundamental disturbances.

We

argue thatconsideringendogenousinformationiscrucialforthesequestions.

Information istypically treatedexogenouslyin coordinationmodels, butis largely

en-dogenous in most situations of interest. Financial prices and macroeconomic indicators

convey information regarding others actions and theirinformation. During times ofcrises

suchindicators aremonitoredintenselyand appeartobe an importantpartofthe

phenom-ena.

As

an example, consider the Argentine 2001-2002crisis, whichincluded devaluationofthe peso, sovereign-debt default, andsuspension ofbank payments. Leadingup tothe

crisisthroughout 2001,bankdepositsand the peso-forwardratedeterioratedsteadily. Such

1

See.forexample, Diamondand Dybvig (1983), Obstfeld (1986,1996), Velasco (1996), Calvo (1988),

CooperandJohn(1988),ColeandKehoe(1996).

2

variableswere widely reportedby news media andinvestor reports,andwerecloselywatched bypeoplemakingcrucialeconomicdecisions.

These observations lead usto introduceendogenous sourcesof public information in a coordinationgame. In ourbaselinemodel, individualsobservetheir privatesignalsandthe

price of afinancialasset.

The

rational-expectations equilibrium price aggregates disperseprivateinformation, but avoidsperfectrevelationbyintroducingenoughnoise inthe

aggre-gationprocess, as in

Grossman

andStiglitz (1976). Thus,noneofourresultsaredrivenbyrestoring common-knowledge.3

The

maininsight toemergeisthat theprecision ofthe endogenous publicinformationincreaseswith theprecision ofthe exogenousprivateinformation.

When

privateinformationis

more

precise, individuals' assetdemands

aremore

sensitiveto theirinformation.As

aresult,the equilibriumpricereacts

more

sensitivelytofundamentalvariables,thusconveyingmore

preciseinformation.This resulthas important implicationsforthedeterminacyofequilibria,asa horse-race

between private and public information emerges.

An

increase in the precision ofprivateinformation makes coordination

more

difficult as individuals relymore on theirown

dis-tinct information. However, theconsequent increase intheprecision ofendogenous public

informationfacilitates coordination. Thisindirect effect typicallydominates, reversingthe

limiting result: multiplicity is ensured

when

individualsobserve fundamentals with smallenoughprivate noise.

Uniqueness therefore can not be attained as a small perturbation around

common-knowledge.

To

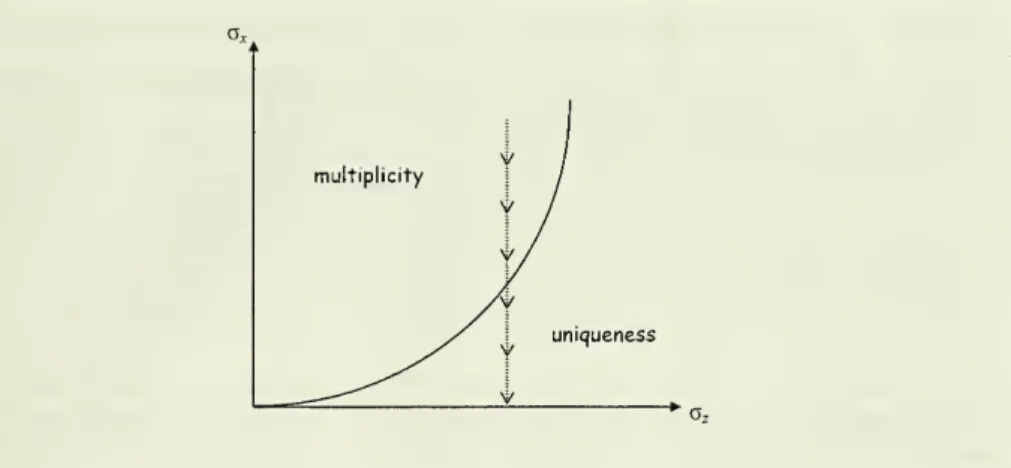

illustrate thispointFigure 1 displays the regions ofuniqueness andmulti-plicityinthespaceofexogenouslevelsofpublic andprivate noise (<7Eandax, respectively).

Multiplicityisensured

when

eithernoiseissufficientlysmall. Inthissense,public andpri-vatenoise actsymmetrically. Incontrast,

when

informationisexogenous,less public noisefacilitates multiplicity, but less private noise contributes towards uniqueness. Moreover, with endogenousinformation, equilibriaoutcomes arecontinuous withrespect to

informa-tionparameters. In contrast,withexogenousinformation,thelimiting resultdiscussedabove

illustratesasharpdiscontinuity.

Interestingly, multiplicity

may

emerge, not only with respecttotheprobability ofregimechange, but also in the asset price. This occurs

when

the asset's dividend depends on theendogenous aggregate activity in the coordinationgame, which one can interpret alsoas ashort ofinvestmentgame. Different equilibriumprices arethen sustained bydifferent

expectationsaboutthe aggregatesizeofattack/investment,andthereforeaboutthe dividend

3Atkeson

(2000)hasalreadypointedoutthat perfectly revealing assetmarketswouldrestore equilibrium

uniqueness

multiplicity

Figure 1:

a

x measures the exogenous noise in private information and <r £ the exogenous publicnoise intheaggregationofinformation.ofthe asset,which inturnare possible onlythanks tothecoordinatingroleprices playin

thefirstplace.

Inregionswherethe equilibrium isunique,

we

are able toperform comparativestatics.We

findthata reductioninexogenousnoiseincreasesthesensitivity oftheregimeoutcometonon-fundamentaldisturbances.

When

theasset'sdividendisendogenous, a reductioninnoise

may

alsoincrease the non-fundamentalvolatility in thefinancial price. Since theseresults parallel the determinants ofequilibrium multiplicity,

we

conclude that lower noiseincreases volatility forboth formsofvolatility.

We

alsostudy a separatemodelmotivatedbythebank

runandriotsapplications. Inthismodelthereisnofinancialmarket. However,informationisendogenousbecause individuals

observe a public noisysignal ofothersactions.

An

advantageisthatthismodelallowsustostudyendogenous informationwith aminimal modification oftheMorris-Shinframework.

The

modelshares themain

insights and results forequilibrium multiplicity obtainedwiththefinancial pricemodel.

Thispapercontributestothe real-expectationsliteratureby examiningthecoordinating

role of financial prices anditsimplicationsfor volatility. In

Grossman

andStiglitz (1981),wherethedividendoftheassetisexogenous andtherearenocomplementaritiesin real

in-vestmentchoices,the equilibriumpriceisuniqueandislessvolatilethe lower thenoise inthe informationstructure. Thisisbecauseinthatframeworkprices merelyconveyinformation abouttheunderlying fundamentals,whichhelpsevery individual figureouthis bestchoice without regardto

what

other agents are choosing. In the presence ofcomplementarities,instead, financialpricesserve alsoa coordinatingrole: they help agents coordinatetheir real

investment choicesbyimproving theability ofeach agent topredict whatother agents do.

And

it isthiscoordinatingrolethatexplainswhy

multipleequilibriaandhighvolatilitymay

emergealso intheprices.4Our

workbuilds on Morris-Shin andunderscores theirgeneraltheme thatmultiplicityor uniqueness depends onthe information structure. Within such a framework, our aim

is to understand the effect ofendogenous sources of public informationsuch as financial

pricesandotherindicators ofaggregateactivity. Angeletos,

HeUwig

andPavan (2003,2004)alsoendogenize information,but notthroughinformation aggregationas here. Instead,they considerthesignalingeffectsofpolicy interventionsandtheflow ofinformationinadynamic

globalgame.

RelatedisMukherji, TsyvinskiandHellwig(2004),

who

consider acurrency-crisesgame

and allow financial prices to directlyaffect the coordination outcome. In particular, they

focuson

how

multiplicity oruniqueness dependson whetherthecentralbank'sdecision todevalue istriggeredbylargereserve losses or high interestrates. Tarashev (2003) also

en-dogenizesinterest rates inacurrency-crisesmodel, but does notinvestigatethe implications

forequilibriummultiplicity.

Finally,

we

sharewith ChariandKehoe

(2003) the motivationinexaminingtheroleofinformation in generating non-fundmentalvolatility, but

we

focus on coordination ratherthanherding. Indeed,

we

bring closerthe global-games and social-learning approachestocrisesbyallowingendogenouspublicsignalsaboutothers' activity,butavoid informational cascadesby assumingthat noagentis "big". Building againonMorris-Shin,

we

alsoshow

how

coordinationmay

helpunderstand highnon-fundamentalvolatilityeven with auniqueequilibrium.

The

restofthepaper isorganizedas follows.We

describethebasic modelinSection2andreview theexogenousinformationbenchmark. Section3incorporates thefinancialasset

and examinesmultiplicity of equilibria. Section 4examinesthe determinantsof volatilityas

acomparative staticalong auniqueequilibrium. Section5studiesthemodelwith adirect

signal ofaggregateactivity. Section6concludes.

BarlevyandVeronessi (2004) consideraGrossman-Stiglitz-likeeconomywhich admitsmultiple

rational-expectationsequilibria,butthe source of multiplicityisverydifferent. In theirmodel,there areno

comple-mentaritiesinrealinvestmentchoices (thedividendofthe assetisactuallyexogenous) andthe pricedoes

not playanycoordinatingrole like inour framework. Multiplicity instead originatesinthe non-linearity of the inferenceproblemfacedby uninformedtraderswhentheyinteract with informedandless risk-averse agents.

2

The

Basic

Model: Exogenous

Information

Beforeendogenizing public information,

we

review thebasicmodelwithexogenousinforma-tion.

Actions

and

Payoffs. Thereisastatus quo andameasure-one continuum of agents,indexedbyi £ [0, 1].

Each

agenticanchoosebetweentwoactions, eitherattackthestatusquo(oj

=

1)ornot attack(a2=

1).The

payofffromnot attackingisnormalizedto zero.The

payofffromattackingis 1

—

c>

ifthestatus quois abandoned and—

cotherwise, wherec 6 (0,1) parametrizes thecost of attacking.

The

statusquois inturn abandonedifand onlyifyl>

6,whereA

denotes themassofagents attackingand9representstheexogenous fundamentals,namelythe strengthofthestatusquo. Itfollowsthatthe payoffofagentiisU(a

i,A,6)=

al(R(A,6)-c)

(1)where

R

(A,9) denotes theregimeoutcome,withR =

1 ifA

>

9andR

=

otherwise. Interpretations. Inmodelsofself-fulfillingcurrencycrises(Obstfeld, 1986, 1996;Morrisand Shin, 1998), a "regime change" occurs

when

a sufficiently large mass ofspeculatorsattacksthecurrency, forcingthecentralbanktoabandonthepeg; 9then parametrizes the

amount

offoreignreserves ormore

generallytheabilityandwillingness ofthecentralbank

tomaintain thepeg. Inmodels ofself-fullingbankruns,onthe otherhand, a "regime change" occurs once a sufficiently large

number

of depositors decide to withdraw their deposits,forcingthe

bank

tosuspenditspayments; 9then parametrizes theliquidresourcesavailabletothebankingsystem.5

Throughoutthe paper,

we

focusoncrisesasthemain

interpretation ofthemodel. Otherapplications, however, are also possible. For example, one could interpret the model as

an

economy

with investment complementarities, inwhicha;=

1 represents undertake aninvestment,

A

theaggregatelevelofinvestment, and9theexogenousproductivity.In short, the key property ofthe payoff structure

we

consider is that it introduces acoordination motive:

U

(1,A,9)—

U

(0,A,9) increaseswith A,meaning thattheindividualincentive totakeoneactionincreaseswith the

mass

ofotheragentstaking thesame

action.Indeed,

when

9iscommon

knowledge, bothA =

I andA =

is an equilibriumwhenever9 € (#, #]

—

(0,1].The

interval (9,6] thus represents the set of"criticalfundamentals" forwhich agentscancoordinateonmultiple coursesofactionunder

common

knowledge. Information. Following Morris-Shin,we

assume 6 is notcommon

knowledge. IntheOtherrelated interpretations include debtcrises andfinancial crashes (Calvo, 1988; Coleand Kehoe,

1996;Morris andShin, 2003, 2004). Finally,Atkeson (2000) interprets themodelasdescribingriots: the potentialriotersmayormaynotoverwhelmthe police forceinchargeofcontainingsocialunrestdepending

beginning of the game, nature draws 6 from a given distribution, which constitutes the

agents'

common

prior about 9. For simplicity, this prior is assumed to be an (improper)uniform over the entire real line.6 Agent i then receives a private signal Xj

=

9-f-0"x^, whereo~xisapositive scalarand^ ~

AA(0,1)isidiosyncratic noise,i.i.d. acrossagentsand independentof9. Agentsalsoobserveanexogenous publicsignalz=

9+

a.v,where az isapositive scalarandv

~

Af(0,1)iscommon

noise,distributedindependentlyofboth9and£.The

information structureisthusparametrized parsimoniouslybyaxand az,thestandarddeviations ofthetwo noises; or equivalently by

a

x=

o~

2 and

a

z=

o~~ 2, theprecisions of

privateandpublic information.

Equilibrium

Analysis.We

focus on monotone equilibria, that is, equilibria inwhichan agent attacksifand onlyifhis private signal is sufficiently low.'

Thus

suppose that,givena realization z ofthe public signal, an agent attacksifand only iftherealizationx

of hisprivate signalislessthan a thresholdx*(z).

The

sizeofthe attackisthen A(9,z)=

<1>

(

v

/q^(x*(z)—

9)) andisdecreasingin6. Itfollowsthatregimechangeoccursifandonlyif9

<

9*{z),where9*(z) istheuniquesolution toA(9,z)—

9, orequivalentlyx*(z)

=

9*{z)+

^-\9*

{£)). (2)The

posterior ofthe agent about 9 isNormal

withmean

aa*x

+

-ar a z and precision ctx+

oc z, wherea

x—

a~ 2 anda

z=

a~

2denote, respectively, theprecision ofprivate and publicinformation. Itfollowsthattheagentfindsitoptimaltoattackifandonlyifx

<

x*(z),

wherex*(z) solvetheindifferenceconditionPr[9

<

6*(z)\x,z]=

c, orequivalently$

[V^+cZ

(e*(z)-

^

zx*{z)

-

^-z))

=

c. (3)Substituting(2) into(3) givesa singleequationin 6*(z) :

Hence, anequilibriumissimplyidentifiedwith asolution to (4).

A

solution to (4) alwaysexist andisuniquefor all z ifand onlyifa

z/^/ax~

<

V2n, or

equivalently o~x

<

a2

z^/2n. (See

Appendix

for adetailed derivation.)We

conclude that theThisassumptioniswithoutanyseriouslossof generality:bylettingthecommonpriorbeuninformative,

webiasthe results againstmultiplicity.

7

This is without seriouslossofgenerality fortwo reasons. First, when themonotoneequilibrium is

uniqueandtheinformationisexogenous,astandardargumentof iterrated deletion of stronglydominated

strategiescanbe usedtoshowthat there arenoothernon-monotoneequilibriaeither. Second,toprove the existence ofmultiple equilibriaandtheconvergencetocommon-knowledgeoutcomes witheitherexogenous

Figure2:

a

x anda

z parametrize thenoise in private andpublicinformation; uniquenessisensuredforaxsmallenough.

equilibriumisuniqueifand onlyiftheprivate noiseissufficientlysmall.

Proposition

1 (Morris-Shin) Inthegame

withexogenous information, the equilibriumisuniqueifandonlyifax

<

a^y/2/K.This result is illustrated in Figure 2, which depicts the regions of (o~x,az) for which

the equilibrium isunique. For any az

>

0, uniqueness in ensuredby letting o~x>

suf-ficiently small. In the limit as ax—

> 0, the incomplete-informationgame

approaches thecommon-knowledge

game,inwhichtherearemultipleequilibria;yet,the equilibriumoftheincomplete-information

game

remainsuniqueand actuallyasymptotestoasituationwhere the regime outcome becomes independent of e. In other words, not only sunspots ceasetomatter,but all non-fundamentalvolatility-thevolatility of

A

orR

conditional on9 -vanishes.Corollary 1 Inthe limit aso~x

—

>0, there is a unique equilibrium,inwhichA

((9,z)—

> 1 if<

6 and A{9,z) -* if6>

0, where6=

1-

c.Thisresultisintriguing,asitmanifests asharpdiscontinuity ofthe equilibriumsetaround

o~x

=

: a tiny perturbationaway

fromperfect information obtains aunique equilibrium.The

key intuition is that disperse private information serves as an anchor for individualbehavior: itlimitstheabilityto forecast eachothers'actions andthereby tocoordinateon multipleequilibria.

Indeed,

when

allagentsshare thesame

informationabouttheunderlying fundamentals,they canperfectly forecast each others' actions inequilibriumand cantherefore perfectly

coordinateoneithereverybodyor

nobody

attackingwhen

6G (6,6}.But when

agentshaveheterogeneous informationabout the fundamentals, eachagentfacesuncertainty regarding otheragents'beliefsabout9andtheir actions. Foranygivenprecision ofpublicinformation, the higher theprecision oftheagents' privateinformation,the

more

heavilyagents conditiontheir actionsontheir

own

privateinformation,andthus theharderitisforother agentstopredict their actions.

When

a

xis sufficiently smallrelative to a., thisanchoring effectofprivateinformationis strong enoughthat the abilityto coordinateonmultiple coursesof

action totallybrakes

down

andauniqueequilibriumsurvives. Finally, asa

x—

> 0,theprivatesignal

become

infinitely precise relative to the publicsignal, inwhichcaseagents ceasetoconditiononthe publicsignaland byimplicationthesensitivityofequilibriumoutcomesto

theshocke vanishes.

3

Endogenous

Information

I:Financial

Prices

The

resultsreviewedabovepresumethattheprecisionofpublicinformationremainsinvari-ant whilechanging theprecision ofprivateinformation. This, however,

may

notbepossiblewhen

the public information consists of financial prices that endogenously aggregate thedisperse privateinformationinthe population.

To

capture the role of prices as achannel ofinformation aggregation,we

modify the environmentas follows. Therearenow

twostages. Instage1,agents tradea financial assetwhosedividenddependsontheunderlyingexogenousfundamentals and/ortheendogenous outcomeofStage2. Stage2inturnislikethe

benchmark

regime-changegame

oftheprevioussection, exceptforthat the publicsignal is

now

thepricethat clearedtheasset market instage 1.

Thisframework opens

up

new

modelingchoicesregardingthespecificationofthe asset'sdividendandthepreferencesoverrisky payoffs.

We

guide our choiceswithaneye towardstractability: to isolatetheeffectsofinformation aggregationfrom any directpayofflinkages

between thetwo stages,

we

assumethat preferences are separable between thefirst-stageportfolio choiceandthe second-stage attacking decision;8 and topreservenormality ofthe

informationstructure,

we

model stage1 along theCARA-normal

framework ofGrossman

and Stiglitz (1976, 1980)andHellwig (1980).

3.1

Model

Set-up

Timing,

information,and

payoffs.The

game

startsagainwith naturedrawing 8 froman improper uniformoverR.

Each

agentihas a givenendowment

ofwealth Wiandreceivesan exogenousprivate signal Xi

=

9+-cXx^.The

distribution ofw-iisarbitraryandthenoise£;isA/"(0, 1),i.i.d. across agents,andindependentof9.

In stage 1,agents caninvest theirwealtheither inarisk-lessasset orarisky asset.

The

riskless asset isin infinitelyelastic supply, it costs 1 inthe first stage, and itdelivers 1 in

thesecondstage.

The

risky asset,onthe otherhand,costsp inthefirststageanddelivers/inthe second.

The

agent enjoys utility from final-stage consumption and has constant absolute riskaversion

(CARA).

The

payofffromtheportfoliochoiceisthusV

(c)=

—

exp(—7c) /7,wherec

=

w —

pk+

fk

is consumption, k denotes investment in the risky asset, and 7>

is the coefficient ofabsoluterisk aversion.

The

net supply ofthe risky asset is given byan unobserved

random

variableK

(e)=

crse,where £

~

jV(0,1) is independent of both the fundamentals and the private noise and a£ parametrizes the exogenous noise in theaggregation process.

The

unobserved shock e can also be interpreted as thedemand

of'noisetraders' and its role is to introduce noise in the information revealed by financial

pricesaboutfundamentals.

In stage 2, agents chose whether to attack or not.

The

the status quo is abandoned(R

=

1)ifandonlyifA >

9andtheagent'spayofffromstage2isU(a,A,9)=

a(R

(A, 6)—

c),

as inthe

benchmark

model.The

regime outcome, theasset'sdividend,andtheagents'pay-offsare realized attheendofstage2.9

Asset.

What

remains to closethe modelis thespecification oftheasset's dividend/.We

are interested intwoalternatives:the case that/isdeterminedmerelybytheunderlyingeconomic fundamentals9; andthe case that / isafunctionoftheendogenousactivity

A

ofthe coordinationstage.

What

we

wishto capturewith the latter case isenvironments wherethe coordinationgame

issome

shortofaninvestmentgame

whichalsodeterminesassetreturns. For example, imagine agents have the optionto invest in anew

sector (or adopt anew

technology), the dividend oftheasset dependsontheprofitability of this sector, andthenew

sectorisprofitable onlyifenoughagentsinvest.

Equilibrium. Because ofthe

CARA-normal

specification, thedemand

for the riskyassetisindependentofwealth.

The

individual'sdemand

kin stage1 andactionainstage9Given

the separability of payoffbetweenthetwostages,onecould reinterpret themodelasiftheagents

whomoveinstage1weredifferent thanthe agentswhomoveinstage2, providedofcourse thatthelatter

observe thepricethat clearedtheassetmarketinstage1

2 arethus functionsof(x,p) alone. Since thereisacontinuumofagents,the corresponding aggregatesarefunctionsof (9,p).

The

equilibriumprice,ontheotherhand, isa functionoftheexogenousstate(0,e)~.

We

thusdefineDefinition 1

A

rational- expectations equilibriumisapricefunction P(9,e),individualstrate-giesk(x,p) anda(x,p) for investmentandattacking, and correspondingaggregates K{Q,p) andA(9,p), suchthat: (i) instage1,

k(x,p)

=

argmaxE

[V((f—

p) k) \ x,p] (5)K(9,p)

=

I k(x,p)d$(^—)

(6)K(9,P(9,e))

=

K(e)

(7)(ii) instage2,

a(x, p)

=

argmax

E

[ U(a, A(9,p),6) \ x,p] (8)A(0,p)=

fa(x,p)d$(—

-)

(9)The

interpretation ofthese conditionsisstraightforward. Condition(5) and (9) requiresthat an agent's investment take into account the information contained in their private

informationand prices,whereascondition (7)imposes marketclearing inthe assetmarket. Note that (5)- (7) define astandard rational-expectations equilibriumfor stage 1, whereas

(8)-(9) defineastandardPerfect Bayesian equilibriuminstage2. Finally, with

some

abuseofnotation,

we

letR

(9,e)= R

(9,A

(9,P

(9,£))) denote the equilibriumregimeoutcomeasafunctionoftheexogenousstate(9,e)

.

3.2

Exogenous

dividend

We

consider first the case that the dividend / depends onlyon the exogenous economicfundamentals9.

To

preserveNormality,we

let /=

/(9)=

9.We

start the characterization of the equilibrium with stage 1 (the financial market).Thankstothe

CARA-Normal

specification,theexpectedutilityoftheagent reducestoE{V(c)\x,p}

=

V((E[f\x,p}-p)k-lV

&r[f\x,p}k2)The

FOC,

whichisbothnecessaryandsufficient, impliesthattheoptimaldemand

fortheassetis

E[f\x,p]-p

k(x,p)

=

r, 10iVax\f\x,p]

where /

=

9.We

proposethattheposterior of 9conditionalon x,phasmean

Sx+

(1—

S)pand precision a, for

some

8 G (0,1) anda

>

0. It fohowsthat k(x,p)=

(Sa/j)(x—

p)and therefore K(8,p)

=

(8a/j)(9—

p). In equilibrium, K(9,p)=

K

(e),which gives themarket-clearingprice asp

=

9—

(Sa/j)~a

E e, orequivalentlyP(9,e)

=

9-o

pe (11)where

a

p=

(5a/-y)~1a

E isthestandard deviationofthepriceconditionalon9.

The

observa-tion of

p

isthereforeequivalenttothe observationofaNormal

signalabout 9withprecisiona

p=

a~

2. Moreover, x and

p

areindependent and therefore9\x,p~

JV(Sx+

(1—

5)p, a),

£

=

&

x/a, anda

=

^

-(-a

p, whichverifiesourinitialguess. Solvingfora,8, and

a

p,

we

geta

=

a

x (l+

a

xa

E/^y2),8=

1/(1+

a

xa

e/j2

), and

a

p=

a

ea^/7 2.Thatis,theprecision ofthe

publicinformation revealedbythepriceisanincreasing functionofboththeprecisionthe

aggregation processandtheagents'primitive privateinformation. Equivalently,

a

p

=

ja

eal, (12)whichtogetherwith (11) completes the characterizationofstage 1.

Next, consider stage 2 (the coordinationstage). Given (11), thecontinuation

game

instage2isisomorphictothe

benchmark

game

ofSection2,exceptforthefactthatthe publicsignalisz

=

p

=

P

(9,e) andhencea

z=

a

p.The

following arethusimmediateimplicationsof our earlier analysis in Section 2: first, the agent's strategy is a(x,p)

=

1 ifand

onlyifx

<

x*(p), the aggregate attack isA

(6,p)=

$

(a/o^(x* (p)—

6)), andthe regime isabandonedifand onlyif9

<

9*(p);second,the thresholdsx*(p) and9*(p) aregivenbythesolutionto(2)and(4)once

we

replacezwithp anda,witha

p; third,thesolutionisuniqueifandonlyifandonlyifax

<

ap^/2n.Using then (11),we

conclude that the equilibriumisuniqueifandonlyif<J2 e

u

x>

j

2

(2ir)~1^2

.

Proposition 2 Inthe economywith f

=

f(9), there aremultiple equilibria ifand onlyifo~2.o\

<

7

2(27r)-1/2. There arethen multiplestrategies, a(x,p), attacksA(9,p) and regime

outcomes,

R

(9,p),forthecoordinationstage, but the asset demands, k(x,p) andK

(9,p),andtheprice function, P(9,e), arealways uniquely determined.

Note

how

thisresultcontrastswith Proposition1:when

publicinformationisexogenous,asufficientlylow

a

x ensures uniqueness; butwhen

the public information isendogenous asFigure3:

With

endogenouspublicinformation,asa

xdecreases, o~zalsodecreases;multiplic-ityisthereforeensuredforsufficientlysmall

a

x.inthe presentmodel, asufficientlylow

a

x ensuresmultiplicity. Thisisbecausemorepreciseprivateinformation

now

impliesmore

precisepublicinformation,indeedataratehighenoughthat theagents' ability topredicteachothers'actions increases as theirinformation improves. Figure3 illustratestheresult inthe (ax,a.) space: unlikeFigure2, as

a

x decreases,a

z alsodecreasesandfastenoughthatthe

economy

necessarily entersthe regionof multiplicity.Uniqueness canthereforenotbeseenasa smallperturbation

away

fromcommon

knowl-edge.

As

it was earlier illustrated in Figure 1,when

eithera

x or ae is small enough, theprecision oftheendogenouspublicinformationissufficientlyhigh that multiple coursesof

ac-tioncanbesustainedinthe coordinationstage. Moreover, thecommon-knowledge outcomes

canactuallyberecoveredas as eithertypeofnoise vanishes.

Corollary2 Considerthe limit asax

—

> for giveno~ E, orthe limit as o~ s—

> for giveno~x. There exists an equilibrium in which R(9,s)

—

» whenever9 £ {9,6), as well as anequilibrium in which

R

(9,e)—

»1 whenever9€ (0,9). In every equilibrium, P(9,e)—

9forall (9,e).

3.3

Endogenous

dividend

We

now

consider the case thatthe payoffofthe assetisdetermined bytheoutcome ofthe coordination stage.To

preserve Normality,we

now

let /=

f (A)=

—^~

1(A).The

assetthuspays

more

the lower thesizeoftheattack,whichwe

couldinterpret asasituationwhere"attack"

means

refrainingfromsome

shortofinvestment.We

startagain the equilibriumanalysiswith stage1. Guessing (andlaterverifying)that agentsusemonotone

strategies instage2 such that a(x,p)=

1 ifand onlyifx<

x*(p) forsome

threshold x*(p) ,we

havethatA

(8,p)=

$

(y^fx*

(p)—

#]) and therefore /=

s/a^[9

—

x*(p)]. Hence, ifthe agentsposterior about 9 isNormal

(whichwe

verify later),so is /. It follows that the individual optimal

demand

for the asset is againas in (10).Substituting /

=

y/a^[9—

x*(p)] intothelatterandletting7=

7^/0^ andp

+

x*(p) (13)we

canrewritetheoptimaldemand

ask=

(E[9\x,p]—

p) / (^fVax[9\x,p\). Likeinthe previoussection,

we

then propose E[#|x,p]=

Sx+

(1—

5)p andVar[0|x,p]=

a. It follows thatK

(9,p)=

(5a/7))(9

—

p) andthereforemarketclearingimpliesp

=

9-

T

^-=e.

(14)Hence, provided that thereis a one-to-one

mapping

between p andp, the observationofp

isequivalent tothe observation ofa

Normal

signalabout 9withprecisiona

p=

(5a/^)2a

eandtherefore 9\x,p~J\f(8x

+

(1—

5)p,a) with5=

a

x/(qx+

a

p) anda

=

a

x+

a

p. Solvingford,a,and

a

pgivesa

p=

a

Ea

x/^f=

a

ea

x /'j2

,orequivalently

ap

=

ja^l-

(15)Next, consider stage2.

The

threshold9*(p) solves 9— A

(9,p); equivalently,x*(p)

=

8*(p)+

^-\9*(p)).

(16)The

thresholdx*(p),onthe otherhand,solves Pr[9<

9*(p)\x,p]=

c; equivalently,$

(v^T^

(>(P)-

5fe^(p)

"

sfep))

=

c

(17)Theseequationsaretheanaloguesof(2) and(4) inthe

benchmark

game. However,oncewe

substitute (13) and (16) into (17),

we

get auniquesolution for 9*(p) :*(P)

-

*

(y^

$_1C1-

c)-

S=fe?)

> (18)inwhichcase(16) implies alsoauniquex*(p). Hence,unlike eitherthebenchmark

game

orthecase ofthe previoussection,the strategyofthe agentsinthe coordination

game

andtheregimeoutcomearealways uniquelydeterminedasfunctionsoftherealized price.

To

complete theanalysis,we

needtodetermine themapping

between p andp, that is,the equilibriumprice

mapping

p=

P(9,e). Using(13), the aggregatedemand

fortheassetis

K(9,p)

=

j{6-^=p-x*(p)).

(19)Sincex*(p) isuniquely determined,

K

(9,p) is alsouniquely determined (andsimilarly fork(x,p)). Moreover, for any9, K(9,p) iscontinuous inp, K(9,p)

—

> oo asp—

*—

oo, and K{9,p)—

*—

ooasp—

>-foo. ItfollowsthatK

(9,p)—

e,orequivalently (13),alwaysadmitsasolution; thatis,a market-clearing pricep

=

P

(9,e) exists forany9 ande. However,themarket-clearingpriceneednot alwaysbeunique. Notethat 9*(p) andx*(p) aredecreasing

inp, whichinturnimplies theasset'sdividend, /

=

yfaZ\9—

x*(p)], isitselfincreasinginp.As

aresult,thedemand

fortheassetcanbenon-monotonic. Indeed, (16)and (19)imply*»{^}--^-,(.-<0)}

andtherefore

K

(9,p)isgloballydecreasinginpifandonlyif^fa^jav>

y2ft, orequivalentlya

lax>

72/\/27r. Ifinstead o\(j\<

j

2/\/2x, the aggregatedemand

for the asset is non-monotonicandthereisanon-emptyinterval(p\,p~2)such that(13) admits asinglesolutionwhenever p ^ (pi,p2)butthreesolutionswhenever

p

E (pi,p%).Different selectionsfromthese

solutionsthensustain differentmappings between p andp,thatis,differentequilibriumprice

functions

P

(9,e).

Proposition 3 In the economy withf

—

f(A), there are multiple equilibria ifandonlyifo\a\

<

72(27r)-1/ 2. There are thenmultiple pricefunctions P(9,e), but the assetdemands

k(x,p),

K

(9,p),the strategya (x,p), andtheattackA

(9,p) arealways uniquely determined.Inthemodelofthe previoussection,the dividendwasa functionof 9aloneandtherefore

thepriceplayed theroleofasignalabouttheexogenousfundamental.

As

aresult,indeter-minacy emergedforthestrategies andthesizeofthe attackinthe coordinationstage, but

not fortheprice clearingthe assetmarket. Here, instead, the dividenddepends on

A

andtherefore thepriceplaystherole ofan anticipatory signalabout theendogenoussizeofthe

attack.

A

particular price realizationcoupledwithan agent's privateinformationthenpinsdown

auniqueposterioraboutthesizeoftheattack, inwhichcasetheagent'sbest responseisofcourse unique. This explains

why

the strategies instage2areuniquelydetermined.In stage 1, onthe other hand, differentlevelsofthepriceare associatedwithdifferent

expectationsaboutthesize ofthe attackand thereforeaboutthedividend ofthe asset: in

equilibrium,a higherprice signalsa higher dividend.

When

thiseffectisstrongenough,itcanoffsetthe usual negative payoffeffectoftheprice- namelythatahigherprice

means

ahighercost ofobtaining theasset- and

may

thereforeinduce thedemand

fortheassettoincreasewith the price. This non-monotonicity ofthe asset

demand

introduces thepossibility formultiple market-clearingprices. Finally,thepositiveeffectofthepriceisstronger

when

a

pishigher, fora higher

a

pincreasesthesensitivity oftheagents'actions instage2tothepriceandtherefore ofthe dividendtothe price. This explains

why

multiple equilibrium pricesexist for forsmalllevelsof noise.

To

further understandwhy

multiplicity emerges in the price and not in the strategyofthe agents, it helps to consider fora

moment

the no-noisegame

(ax=

a

£=

0).The

exogenoussignalisthenx

=

9andthe equilibriumprice isp— —^~

1(A) andthereforean

agentlearns perfectly9byobservingx and

A

byobservingp. Clearly,the agentthenfindsitoptimaltoattackifandonlyif

A

>

9, orequivalently x< $(—

p),whichmeans

thathisstrategyisuniquelydeterminedasa functionofx andp. However,the equilibrium valuesof

p

andA

arenot uniquely determined. Instead, forevery9£ (9,9],both(p,A)=

(oo, 0) and(p,A)

=

(—oo,1) canbesustainedin equilibrium.In conclusion, small noise

now

ensures multiplicity inboth theasset priceand theco-ordinationoutcome: different equilibriumpricefunctions resultto different realizations of

theprice and thesizeofthe attackforthe

same

9 ande and therefore to differentregimeoutcomesaswell.

What

ismore, the no-noise (orcommon-knowledge) outcomes are once againobtainedasthenoise vanishes.Corollary 3 Considerthe limit aso~x

—

> for given<x £, or the limit asa

e—

> for givenax. There is anequilibriuminwhichR(9,e)

—

*1 andP(9,e)—

>—

oo whenever96 (9, 9), as wellasanequilibriuminwhichR(9,e)—

>1 andP(9,e)—

>-co

whenever9£ (9,9).3.4

Discussion

Although the property that theprecision ofendogenous publicinformation increases with

theprecision of exogenousprivate informationis likelytobevery robust,

how

strongthiseffect is and whether it can overturn the direct effect of private information

may

dependonthedetails ofthechannelthrough whichprivate informationis aggregated. Indeed,the

resultthatmultiplicityisensuredfor smallax relies ontheprecision ofpublicinformation

increasing ataratehigherthanthe squareroot oftheprecision ofpublicinformation. That

wasthe case inthe twospecifications

we

considerabove (as evidentin (12) and (15)) butneednotbetrueingeneral.

We

now

provideanexample whichillustrates thispossibility.To

this aim,we

modify stage 1 as follows.The

agent is assumed to be risk neutral andface a quadraticliquidity/transaction cost for investing intheriskyasset.The

indirectutilityfromtheportfolio choiceisthus givenby

V(c)

=

c=

w-pk-^k

2+

fk (20)where thescalark

>

parametrizes the liquidity/transaction cost.We

consider againtwocases forthe dividend,exogenousand endogenous.

Proposition

4

SupposeV

isgivenby (20).(i)

When

f—

9, the equilibrium pricefunctionP

is always unique, whereas theequilib-riumregimeoutcome

R

isuniqueifandonlyifax is either sufficientlysmall orsufficientlyhighrelative to a£.

(ii)

When

f=

—

$

-1(v4), there are multiple equilibriaifand only ifo~x and/or ae aresufficiently small. Multiplicity then emerges in both the regime outcome

R

and the pricefunctionP.

Here,unliketheearlier

CARA-normal

cases, theincrease intheprecision ofpublicinfor-mationgeneratedby anincrease intheprecision of privateinformationisnot always strong enoughtooffset thedirect effectoftheprivateinformation

when

the payoffofthe assetisexogenous. Thisisbecause the slopeof individual

demand

on theexpected dividend isin-dependentoftherisk inthe dividend,whichimpliesthattheprecision ofpublicinformation

increaselesswithprivateinformationthan

when

theslopeitselfincreaseswithmorepreciseinformation(lessrisk).

When

thedividenddependsonlyon9,theanchoringeffectofprivateinformation dominates, thus ensuring uniquenessfor axsmallenough.

When,

however, the dividendoftheassetdepends onthesizeoftheattack,thefactthatthesensitivity ofthesizeofthe attackandtherefore ofthe dividenditselftothefundamental

increases astheagents'informationimproves compensatesforthelack ofsuch asensitivity

inthe

demand

fortheasset.As

aresult,coordinationonce againbecomeseasier asprivateinformationbecomes morepreciseandmultiplicityreemergesforsmallenoughnoise.

These exampleshighlightthatthedetailsofthe processofinformation aggregation

mat-ter.

They

also suggestthat the coordinating effect of pricesislikely tobe strongerwhen

agents are risk averse and

when

the dividend ofthe traded assets dependdirectly onthe coordinationoutcome. InSection5,we

willconsideranalternative channelofinformationaggregation,namelyadirectsignalaboutothers'activity.

We

willfindthatthe coordinatingeffect of this endogenoussignal isonce again strongto deliver multiplicity

when

eithero~xoro~z aresmall enough. Inwhatfollows,

we

continue to focusonthemore

interestingcasethat theprecision ofpublicinformationincreasesfastenoughwith theprecision of private

information.

4

Noise

and

Volatility

We

now

investigatetheroleoftheinformationstructure fornon-fundamentalvolatility,thatis, thevolatilityofthe regimeoutcome

R

(orthesizeofthe attackA)conditionalon

9.In general, thereare twosources ofnon-fundamentalvolatility: volatilitygenerated by

the shock e

when

the equilibrium is unique; and volatility generated by payoff-irrelevantvariables (sunspots)

when

there are multiple equilibria and agents use these sunspots tocoordinatetheirbehavior.

With

exogenousinformation, multiplicitydisappearswhen

agents observethefundamen-tals withsmall idiosyncratic noise.

By

implication, thereisnosunspotvolatilitywhen

axis small enough.

What

ismore, as o~x—

> 0, the size ofthe attack and by implication the regimeoutcomebecome

independent ofe.Hence,allnon-fundamentalvolatilityvanishesasa

x—

>0.On

the other hand,non-fundamentalvolatilityismaximizedwhen

az—* forgiveno~x, as in thiscasethe

common-knowledge

outcomesareobtained.With

endogenousinformation, theimpactof private noiseonvolatilityisquitedifferent.A

sufficientlylargereductionineithero~xoro~ecanincrease volatilitybyensuringmultiplicityand therefore introducing

more

sunspot volatility. Corollaries 2 and3 indeed imply thatsunspot volatility is maximized

when

either noise vanishes: as ax—

> ora

£—

> 0, the regime can either collapse or survivefor anygiven 9 € (9, 9], purely as a functionofthesunspot.

What

ismore, sunspotvolatilitycanshow up

in prices aswell:when

thedividendisendogenous, the equilibriumpricecan bearbitrarilylowor arbitrarily highforanygiven

9e

{9,9}.The

propertythat, withendogenous information,less noisemay

increase volatilitydoes notrely onthe existenceofmultiple equilibria.As we show

next,when

the equilibriumisunique,areductionin eithero~xoro~ s

may

increasethesensitivity oftheregimeoutcome andtheassetpricetotheexogenousshockeand

may

therefore resulttohighernon-fundamentalvolatility.

4.1

Regime

Volatility

In equilibrium, the regime is abandoned

(R

=

1) ifand only if9<

9*[p), but pin turn

depends on9, sincep

=

P

(6,e).To

expressthe equilibrium regime outcome asa function ofthe exogenousvariables 9ande, note that, as long asthe equilibrium isunique, 9*(p)

iscontinuously decreasingin

p

andP

(9,e) is continuouslyincreasing in 9. ItfollowsthatR

(9, e)=

1 ifandonlyif9<

9(s),where9(e) istheuniquesolution toe

=

6*(P(9,e)).We

can thusexaminethenon-fundamentalvolatility ofthe regime outcome by examiningthesensitivityof9(e) toe.

Considerfirstthecasethedividendisexogenous(/

=

/(9)). Usingtheresults ofSection3.2,

we

gete(£)

=

$(ip

+

-2—

£}

(2i)whereip

=

y/l+

1/(^a^)^

1

(1

-

c). Itfollowsthat39

_

<t>{§-\9))de -ya£a2x

(22)

and therefore, for anygiven 9, a reduction in a£ or ax increases the slope of 9(e) with

respect to e.

By

implication, 9 satisfies asingle-crossing property with respect to ax ora

£: let £o be the unique value of e for whichd9/da

e=

or equivalently 89/dax=

0;forany s\ and e^ such that e\

<

Eq<

£2,we

still have that d\9(s2)—

9(e{)\/a£<

andsimilarly 3|^(e2)

—

9(ei)\/ge<

0. Inthis sense, a reductionineithertype ofnoiseincreasesnon-fundamentalvolatility.

A

similar result holdswhen

the dividend isendogenous (/=

/{A)). Indeed, (21) and(22) continuetoholdif

we

replace7

with7=

ja

x.We

conclude thatProposition 5 Less noise implies

more

non-fundamental volatility evenwhen

theequilib-rium is unique: for anygiven 9, a reduction in

a

e ora

x increases the slope of 9(e) withrespecttoe.

Our

earlier resultsregarding equilibriummultiplicitycanthusbe viewed as an extreme reincarnationoftheaboveresult.When

thenoiseissufficientlysmall,volatilitycan behigh,not only because theoutcomeisverysensitivetotheexogenousnoise, butalsobecause the outcome can depend onarbitrarysunspots.

4.2

Price

Volatility

We

next examine the comparative statics of the volatility of prices.To

emphasize the implicationsforvolatilitythat donot derivefrommultiplicity,we

firstfocus againoncase that the equilibriumisuniqueorthat therearenosunspots.When

thedividendis exogenous,we

have/=

9,p

=

/

—

ape, anda

p

—

^a

za\.When

instead the dividendisendogenous,

we

have /=

"3?-1

[A)

=

(9—

x*)/ax,p=

f"—

(o-p/ax)e,

and ap

=

7cr£0"^.Ineither case,we

canwritetheequilibriumprice asthesum

ofthedividend andthesupplyshockappropriatelyweighted:V

=

/-

(l<yeo\)e (23)Keeping /constant,thevolatilityoftheprice clearlydecreases witha reductionineither

a

xor

a

6. Butwhat

aboutthevolatilityofthedividenditself?When

the dividend is exogenous, / is independent of e.The

impact ofnoise is then exactlylike in Grossman-Stiglitz: a reductionin eithero~x oraeimplies lowervolatility inequilibriumprices.

When

insteadthe dividend is endogenous, / depends on e, because agents' actions inthe second stagedepend ontheprice, whichinturndepends ontheshocke. Moreover, for

essentiallythe

same

reason that a reductionin noiseincreasesthe sensitivity oftheregimeoutcometotheshocke, a reductioninnoise increasesthesensitivityof/ one.

As

aresult,the overall impactofnoiseonthevolatilityof pricesis

now

ambiguous: ontheonehand,less noisereducesthevolatilityoftheprice foranygivenvolatilityofthe dividend; onthe

otherhand,lessnoise increasesthevolatilityofthe dividenditself.

The

secondeffectindeeddominatesinsome

cases.An

exampleisillustrated inFigure??,whichdepicts

P

(9,e) fordifferentvaluesof eanda given9.The

solidlinecorrespondstoarelativelyhigho~x,thedottedonetoanintermediateax,andthedashed onetoarelatively

lowax. (Inallcases,however,

a

xishighenoughthatthe equilibriuminunique.)The

effectof

a

xonthesensitivity ofP

(9,e) to eisnon-monotonic: it ishighestwhen

axiseitherhighor low.

A

similarpictureemerges ifwe

considertheimpactofae.We

thus conclude:Proposition 6

When

the dividendis exogenous, thevolatilityof the price conditional on9necessarily decreaseswitha reductionin eitherax oro~ E. But

when

the dividend dependsonthe coordinationoutcome, areductionin eithernoise

may

increase pricevolatility.5

Endogenous

Information

II:Observable

Actions

In the analysis so far,

we

have assumed that agents observe a signal generated from adifferentstagethanthe coordinationgame.

We

now

examinethecasethattheinformationis generated within the coordination game. In particular,

we

assume away the financialmarketandletthe agents observe a noisy publicsignalabouttheaggregateactivity ofother agentsinthecoordinationgame.

We

first consideramodel wherethesignalisaboutothers' contemporaneousactions. Inthis case, our equilibrium concept isnovel andunavoidably atthe crossroads of

rational-expectationsand

game

theory.We

latershow

that thesame

resultscan be obtained inadynamicvariant of thismodel, inwhichthe populationisdivided intotwogroups: 'early'

movers,

who

have onlyprivateinformationaboutthefundamentals, and'late' movers,who

can alsoobserve a public signalabouttheearly movers' activity.

The

equilibrium conceptisthen standard game-theoretic.

5.1

Model

set-up

Thereisnoassetmarketand,except,fortheendogenouspublicsignal,the

game

isidentical tothebenchmarkmodelanalyzedinSection2. Allagents

move

simultaneouslyafterobservingprivate signalsaboutthe fundamentalsanda publicsignalaboutthesizeoftheattack.

The

private signals areagainx

—

9+

o~x£,whereasthe publicsignalisy

=

s(A,e)where

s:[0,l]xR-^l

ande isnoise, independentof 9 and £.To

preserveNormalityofthe information structureand obtain closed-form solution,

we

let s(A,e)=

§~

l(A),

+

a£eands

~

jV(0,1).10

The

exogenousinformation structureisthen parameterizedbythepair ofstandard deviations (<xx,cr£).

Sincetheinformation ofeach agent includes asignal about otheragents' actions, the equilibriumconcept

we

defineisahybridofaperfectBayesian equilibriumandarational-expectationsequilibrium.

Definition 2

A

rational-expectationsequilibriumco?isistsofan endogenoussignaly=

Y(9,e),anindividual attack strategya{x,y), andanaggregateattackA[9,y), thatsatisfy:

a(x,y)

=

argmax

E

[ U(a,R(9,y)) \ x, y} (24)

a€[0,l]

A(6,y)

=

fa(x,y)d$(—)

(25)y

=

s(A(9,y),e) (26)forall (9,e,x,y) €

M

4, where R{9,y)=

1 ifA(9,y)>

9 andR{9,y)=

otherwise. Thisconvenient specificationwas introduced byDasgupta(2001)inadifferentset-up.Condition(24)

means

thata(x, y)istheoptimal strategyfortheagent,whereascondition(25)

means

that A(9,y) is simply the aggregate across agents.The

fixed-point relationintroducedby(26) isthe rational-expectations feature ofourcontext: thesignaly

must

be generatedbyindividual actions,whichinturn are contingentony.5.2

Equilibrium

analysis

We

focus againonmonotone

equilibria, inwhich an agent attacksifandonlyifx<

x*(y)andthestatus quoisabandonedifandonlyif9

<

9*(y).A

monotone

equilibrium isthusidentifieswith atriplet offunctionsx*,9*, andY.

Giventhat anagent attacksifand onlyifx

<

x*(y),the aggregate attackisA{9,y)=

$

(y/a^(x*(y)—

6)}.Itfollowsthattheregimeisabandonedifandonlyif9<

9*(y),where9*{y) solvesA(9,y)

=

9, orequivalentlyx*(y)

=

8*(y)+

^-

1(9*(y)). (27)Condition(26),onthe otherhand,impliesthatthesignalmustsatisfyy

=

y/a^[x*(y)—

9]-a

Ee, orequivalentlyx*{y)

-a

xy=

9-

<rxa

Ee. (28)Notethat(28) isa

mapping

betweenyandz=

9—

a

xa

ee. Define the correspondencey(z)

=

{yeR\x*(y)-a

xy

=

z}.

(29)We

will latershow

that y(z) isnon-empty and examinewhen

itissingle-or multi-valued.Now

take any function Y(z) that is a selection from this correspondence-

that is, such that Y(z) Gy(z) for allz-

and letY(9,e)=

Y(9

—

a

xa

Ee).Any

suchselectionpreserves normalityoftheinformationstructure.Indeed, the observation of y

=

Y{9,e) is then equivalent to the observation of z=

9—

oxo-s= Z

(y), whereZ

(y)=

x*(y)—

axy. Therefore, itis asifthe agents observe aNormal

publicsignalabout9withprecisiona

z=

a

xa

E,or equivalentlyaz

—

axa

£. (30)The

precision ofendogenouspublicinformationisthus once again increasingintheprecisionofexogenousprivateinformation.

For theindividual agentinturnto finditoptimaltoattackifandonlyifx

<

x*(y),itmust bethatx*(y)solvestheindifferenceconditionPr(9

<

9*(y)\x,y)=

c, orequivalently$

(v^T^I

(<r(y)-

^x*

(y)-

-^-Z

(y)))=

c. (31)Using

Z

(y)=

x*(y)—

axyandsubstituting x*(y)from (27),we

get9*(y)

= $

(-^r-y

+

J^hr*-

1(i-

c)), (32)

\a

x+

a

z \a

x+

a

z Jwhich together with (27) determines unique 6*(y) and x*(y). Hence, the strategy ofthe agents a(x, y) andtheaggregate attack

A

(9,y) areuniquelydetermined.We

finallyneedtoexaminethe equilibriumcorrespondence y(z). Recall thatthisisgivenbythesetofsolutions tox*(y)

—

o~xy=

z. Using (27) and(32),thisreducestoF(y)

=

^(-^—y

+

A)+-

l=(--^—y

+ A\=z,

(33)where

A

=

\Jaxj(ax-fa

2)$_1

(l

—

c). NotethatF{y) iscontinuousiny,and F(y)—

»-co

as y

—

> +oo, and F(y)—

+co

as y—

> -co, which ensures that 3^(z) is non-empty andthereforethat anequilibriumalwaysexist. Next, note that

sign {F'(y)}

=

-signI1-

-^=<p(^^y

+

Aj

>andthereforeF(y) isgloballymonotonicifandonlyif

a

z/\fa^<

v

27r,inwhichcasey(z)issinglevalued. Ifinstead

a

zj's

fa

x~

>

y/2n,thereisanon-emptyinterval (z,z)such that y(z)takesthree valueswheneverz£ (z, z).Different selectionsthen sustaindifferentequilibrium

signalY.

Using

a

z=

a

£a

x,we

conclude that multiple equihbria surviveaslongas eithersourceofnoiseissufficiently small.

Proposition 7

A

monotone rational-expectations equilibrium existsforall (crx,a£) andis unique ifand onlyifo\ox

>

l/\/27r. //o\o~ x<

l/\/27r, the equilibriumstrategya andaggregate attack

A

remainunique, but there are multiple signalfunctionsY.Interestingly,

when

multiplicityarises, itiswithrespect toaggregateoutcomes butnotwithrespect to individualbehavior.

To

understandthis result,consider the no-noiselimit(o~x

—

aE=

0), inwhichcasex=

9 andy=

^

1(A). Clearly,the agentfinds itoptimalto

attackifandonlyifx

<

3>(y),whichuniquelydetermines the equilibrium strategya(x, y)forthe agent. However, for every9 G {9,9}, both (y,A)

—

(—oo,0) and (y,A)—

(+oo,1) canbesustained as equilibria.

When

a

xando~ £ arenon-zero,thesame

natureofindeterminacy remains: thebehaviorofthe agentisuniquelydeterminedfor anygivenx andy,butthere can bemultiple equilibrium value fory andA

foranygivenrealizationof 9 ande. Inthissense,themultiplicityhereissimilartotheone

we

encounteredinSection3.3,when

agentstraded afinancial assetwhosedividend depended onthesizeoftheattack.

Finally, the

common-knowledge

outcomes are once again obtained as either source ofinformationbecomesinfinitely precise, and thereforesunspot volatilityismaximized

when

the noisevanishes.

On

theother, theMorris-Shin limit canbeobtainedifthe endogenouspublicsignalbecomesinfinitelyimprecise, inwhichcaseit isasiftheendogenoussignalwere

notavailable.

Corollary 4 (i) Considerthe limit as either

a

x—

> oro~ e—

>0. Thereexistsanequilibrium, in which R(9,e)—

> whenever9 G (9,9], as well asan equilibriuminwhich R(6,e)—

> 1whenever9G (9, 9].

(ii) Considerthe limit as

a

£—

> oo. Thereis a unique equilibrium inwhichR

(9, e)—

>1whenever9

<

9 andR

(9,e) —> whenever9>

9, where9=

1—

c.5.3

Non-simultaneous

signal

The

analysisabovehasassumedthat agentscanconditiontheirdecision toattackon anoisyindicator ofcontemporaneous aggregate behavior.

We

now show

that ourresults extendtoasimpledynamic modelinwhich noagent has informationabout contemporaneous actions ofotheragentsandthereforeastandard game-theoretic equilibrium concept (namely

PBE)

can beused.The

populationisdividedintotwogroups,'early' and 'late' agents. Early agentsmove

first,onthebasis of theirprivateinformationalone. Late agents

move

second, onthebasisof their private information as well as a noisy publicsignal about the aggregate activity

ofearly agents. Neither group can observecontemporaneous activity, but lateagentscan

conditiontheirbehaviorontheactivityofearly agents.

Let ji G (0,1) denote the fraction of early agents, Ai the aggregate activity of early

agents, and

A2

the aggregate activity of late agents.The

signal generatedbyearly agentsandobserved onlybylateagentsisgivenby

y^Q-^AJ+e,

(34)where e

~

A/"(0,o~l) is independent of 9 and £. Early agents can condition their actionsonlyontheir privateinformation, whereaslateagentscanconditiontheiractions alsoony\.

Finally,theregimechangesifandonlyiffiAx

+

(1—

ji)A2>

9.We

lookforperfectBayesianequilibria inwhichthe strategyofthe agentsinmonotonicintheir privateinformation. Sincelateagentscanconditiontheirbehavioronyx butearly

agentsnot, amonotoneequilibriumisascalarx\ 6

R

and apair offunctionsx2 :K

— R

and9*

:

R

—

> (0,1) suchthat: an early agent attacks ifand only ifx<

x\; alate agentattacksifandonlyifx

<

x\(y\)\and

the regimeisabandonedifandonlyif9<

0*(y1).Insuchanequilibrium,the aggregate attackof earlyagentsisA\(9)

= $

(s/q^[x±—

#]) .Itfollowsthatyx

=

<1>_1

[Ax (9))+e

=

yfa^[x\—

9]+e.Hence,inequihbrium, the observationofyx isequivalent tothe observationof

1

a,

which is apublic signal with precision

a

z=

ctEa

x (equivalently, with standard deviationaz

=

cr£

a

x),likeinthesimultaneous-signalmodel.Since yx and z have the

same

informationalcontent,we

can equivalently express the strategy ofa lateagent as a function of z instead of yx and replace the functions x2(yx)and 8*(yx) with x2(z) and 9*{z).

The

aggregate attack of late agents is thenA

2(9,z)=

$

[s/a^[x2(z)—

6]) and the overall attackfrom both groups isA

(9,z)=

\iAx(9)+

(1—

pi)A2(9,z). It followsthat theregime changesifand onlyif9

<

9*(z), where9*(z) solvesA(9*(z),z)

=

9*(z),orequivalentlyM

$

(Vc£[*J-

9*(z)})+

(1-

/.)$(yfe[z*2(z)-

6*(z)\)=

9*{z). (35)Next, considerthe optimal behavior ofthe agents. Since therealization of zis

known

to late agents, their decision problemislike inthe

benchmark

model: the thresholdx2(z)solvesPr[9

<

9*(z)\x2(z),z]=

c,or equivalently$

{s/^(5x*2(z)+

(l-S)z-

9*(z)))=l-c,

(36)where5

—

a

x/(ax+

a~) anda

=

a

x+

a..Earlyagents, onthe otherhand, donot observezandtherefore faceadoubleforecastproblem: theyareuncertainaboutboththefundamental

andthesignal

upon

whichlateagentswillconditiontheirbehavior.The

thresholdx* solvesPr[9

<

9*(y)\xl\=

c, orequivalentlyf

*

{^T

x [x\-

9*(z)})^l<t>(V5T

[x{-

A)dz=

\-

c, (37)wherea^

=

a

xa

e/(l+

a

e).u

A

monotone

equilibriumis therefore ajoint solution to (35)-(37).We

can reduce thedimensionalityofthesystembysolving (35) for x^(z):

x*2(z)

=

9*(z)+

-Lsr

1 (V(z)+

-JL-

{8\z)- $

(,/S

[x*-

6T(*)])}).

Substitutingtheaboveinto (36)

and

using5=

a

x/(ax+

a

z) anda

=

a

x+

a

z,we

obtain:r(r(z),x*)

=

5(z), (38) where r(<9,xO

=

—%e

+

*-

2 fe+

-r—

{e-§

(^

[x * -0])} g(z)=

yjl+

Q

z/ax$

_1(1

—

c)—

(az/y/a^)z, anda,=

Q

£a

x.We

conclude thatanequilib-riumisajointsolution of (37)and (38) fora thresholdx|

G

R

anda function9*:R

—

»(0,1).Let

C

denote thesetofpiecewisecontinuousrealfunctionswithrange a subsetof[0, 1].For anygiven function 9* G C, (37) always defines auniquex\

G

R. For given x\G

R,on the otherhand, (38)may

admit a unique or multiple solutions in 9* G C, depending on(ftu

a

E,fi). Differentsolutions to (38) forgivenx\representdifferentcontinuationequilibriafor the

game

between late agents definedby

a fixed strategy for the early agents.The

questionof interest,however,isthedeterminacyofequilibriumintheentiregame.

In theappendix

we show

that,when

(38) admits aunique solution for every x\ G R,thefixed pointof (37)-(38) is alsounique.

On

the other hand,when

(38) admits multiplesolutions for every x\

G

R,we

prove that (37)-(38) alsoadmits multiplefixed points. Thisprovides us with the followingsufficient (butnot necessary) conditionsforuniqueness and

multiplicity:

Proposition 8 (i) Thereexistsa unique equilibriumif

i 1 ,

ai<7x

>

, (1—

u)(ii) There existmultiple equilibriaif

u

Toseethis,notethat z

=

8—axe=

x—£—axe.sothat z\x~

TV(0,a\+

crxoV). Thatis.conditionalonx, zisdistributednormal withprecisiona.\