A comparative analysis of apartment REITs in US and China: an examination of challenges and opportunities

By

Zixiao Yin

Bachelor of Architecture Master of Urban Planning Tsinghua University (2016)

Submitted to the Department of Urban Studies and Planning in partial fulfillment of the requirements for the degree of

Master in City Planning

at the

MASSACHUSETTS INSTITUTE OF TECHNOLOGY

February 2019

© 2019 Zixiao Yin. All Rights Reserved

The author here by grants to MIT the permission to reproduce and to distribute publicly paper and electronic copies of the thesis document in whole or in part in any medium now known or hereafter created.

Author_________________________________________________________________

Department of Urban Studies and Planning January 15,2019

Certified by _____________________________________________________________

Professor David Geltner

Department of Urban Studies and Planning Thesis Supervisor

Accepted by_____________________________________________________________

Associate Professor P. Christopher Zegras Chair, MCP Committee

A comparative analysis of apartment REITs in US and China: an examination of challenges and opportunities

By

Zixiao Yin

Submitted to the Department of Urban Studies and Planning

On January 15, 2019, in partial fulfillment of the requirements for the degree of Master in City Planning

At the

Massachusetts Institute of Technology

ABSTRACT

During the past 2 years, Real Estate Investment Trusts (REITs) and the push to develop more rental housing in China have drawn lots of attention. REITs are expected to provide multiple capital channels for the development of rental apartments without continuously leveraging up the real estate industry, as traditional financing methods did. The mechanism of equity REIT can help cultivate and accelerate the formation of a sustainable rental housing market in China.

This thesis explores the opportunities and obstacles for REITs to work in the rental housing market in China by exploring the reasons for introducing REITs in the Chinese real estate market from a macro and historical perspective; by examining some cases of the newly issued REIT-like companies in China; and by reviewing the framework and system of REITs in US markets so as to draw lessons for China from a comparative perspective.

This thesis finds that equity REITs are still very immature and are not widely accepted by mass investors in China. The thesis puts forward three suggestions for apartment REITs in China: to streamline the REIT structure and avoid excessive complexity and opacity; to promote information transparency and regulated disclosure mechanism; to encourage and protect equity REIT investors by constraining REITs from taking on too much debt. Finally, the thesis concludes that REITs, as shown by US experience, should be regarded as a great opportunity to cultivate Chinese investors’ confidence in the stock market with its very simple and plain-vanilla structure. With the Chinese government’s strong ambition to increase housing affordability and to deleverage the economy, we foresee continuous legislative breakthroughs and more systematic improvements in the REIT field.

Thesis Supervisor: David Geltner Title: Professor of Real Estate Finance

ACKNOWLEDGEMENTS

The pursue of my graduate study at MIT is driven by my deep desire of expanding my view of the world. My sincere thanks go out to Dr. Yu-hung Hong and Prof. Lei Shao, without their encouragement, I would not have the chance to have these eye-opening and rewarding time at MIT. While studying at MIT, the REIT concept attracted me a lot as an interesting investment vehicle that fits the emerging rental housing section of China’s real estate sector. My working experience and the current heated discussions on the transformation of Chinese real estate market make REIT topic become a natural selection for my Master thesis research.

In addition, my thesis aims to examine an investment vehicle that is still at its very early stage in China. The US REIT experience, both theoretical and practical, is of great reference value for China. In the process of unraveling US REIT experience, I would like to thank my thesis advisor, Professor David Geltner, for his unreserved knowledge sharing, guidance and patience. Also, without his generous reference, it would be impossible for me to talk to the senior REIT practitioners to see the whole picture of the industry.

I am grateful for the encouragement, guidance and generosity of Mr. Paul Adornato who spent many hours to speak and meet with me during my research. The thesis talk was just a great start of many. My related project GeoREIT would have been simply inconceivable without Paul’s unreserved help along the way. I would also like to thank the following people wholeheartedly.

Prof. Siqi Zheng, MIT Center of Real Estate Mr. Saurabh Jalori (STAG Industrial) Mr. Hong Fan (Morgan Stanley)

Mr. Jim Wang (Bohai Huijin Securities Asset Management)

Mr. Benchong Zhang (Bohai Huijin Securities Asset Management)

Finally, my deepest appreciation and love go to my family for their continuous support, care and encouragement during my 2006-2009 academic years at MIT.

CONTENT ABSTRACT ... 3 ACKNOWLEDGEMENTS ... 5 LIST OF FIGURES ... 9 LIST OF TABLES ... 10 Chapter1. Introduction ... 11

1.1 Research question and my motivation ... 11

1.2 Methodology ... 12 1.2.1 Case studies ... 12 1.2.2 Literature Review... 13 1.2.3 Interviews ... 14 1.2.4 Comparative Analysis ... 15 1.3 Research Structure ... 16

Chapter 2. How can REIT support rental housing theoretically and mechanically? ... 18

2.1 What is a REIT? ... 18

2.1.1 Portfolios of income-producing properties ... 18

2.1.2 Define the type of REIT focused on in this paper... 19

2.2 REIT valuation ... 20

2.3 REITs in the US real estate investment industry ... 21

2.4 The mechanisms through which REITs serve the rental housing market. ... 23

2.4.1 Requirement of Income-producing ... 23

2.4.2 Liquidity and Accessibility ... 24

2.4.3 Professional management ... 26

Chapter 3. The opportunities for rental apartment and REITs in China from a macro background perspective ... 28

3.1 The motivations to promote the rental housing market ... 28

3.1.1. The circular relationship among land leasing, real estate construction and the economy ... 29

3.1.2. The obstacles of the development of rental housing. ... 30

3.1.3. The current requirements to develop rental apartments. ... 31

3.2 The policy preferences for rental apartment and REITs ... 33

3.2.1 Increase the land supply for rental apartment ... 33

3.2.2 Explore multiple financing vehicles for rental apartment... 35

Chapter 4. The current landscape of institutional rental apartments in China and its implication for REITs ... 37

4.1 The business models and the comparative advantages of varied operators ... 37

4.2 The financing toolkit ... 42

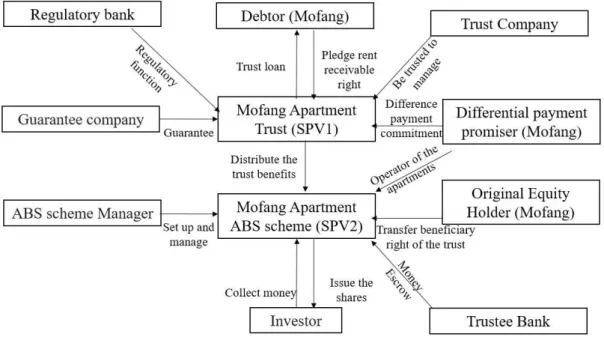

4.2.1 Rental Income Asset-Backed Securities (ABS) ... 43

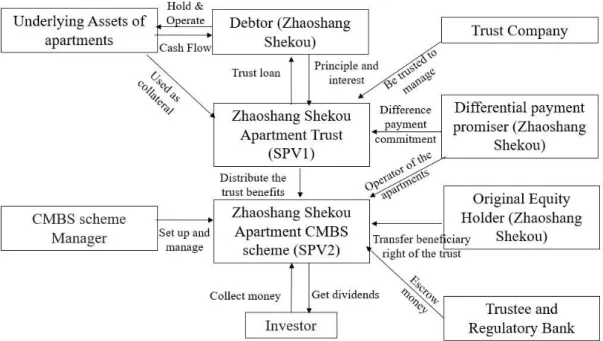

4.2.2 Commercial mortgage-backed securities (CMBS) ... 45

4.2.3 Asset-Backed Note (ABN) ... 46

Chapter 5. Case studies for Apartment “REITs” in China ... 47

5.1 The Xinpai Apartment “REITs” ... 47

5.1.2 The particularity of the assets. ... 48

5.1.3 The design of the deal structure ... 50

5.1.4 The preparations for going public in the future ... 52

5.2 The Poly Rental Apartment REITs... 53

5.2.1The company profile ... 53

5.2.2The particularity of the assets ... 53

5.2.3 The design of deal structure ... 55

5.2.4 Preparation for growing package and going public ... 57

5.3 Observations ... 58

Chapter 6. Apartment REITs in the U.S. ... 59

6.1 The evolution of REITs in the U.S. ... 59

6.1.1. REITs in the 1960-80s ... 60

6.1.2 The 1990s REIT boom ... 62

6.1.3 1997-2008: Consolidation, specialization and the collapse ... 64

6.1.4 The development of REIT post 2008 ... 66

6.2 Case study- Equity Residential ... 68

6.2.1 The brief introduction and the development history ... 69

6.2.2 Corporate Management ... 71

6.2.3 Reporting and Disclosure ... 74

Chapter 7. Conclusion and final thoughts ... 78

7.1 Streamline the REIT structure and avoid excessive complexity and opacity ... 78

7.2 Increase the reliability of REIT valuation by promoting information transparency ... 79

7.3 Reducing the investment risks of equity REITs by constraining REITs from taking on too much debt ... 80

Bibliography ... 82

Appendix 1 Relevant policies to promote rental housing and apartment REITs in China (2015/1 to 2018/5)... 84

Appendix 2. A Timeline of Sam Zell’s Career ... 87

LIST OF FIGURES

Figure 1 Real estate investment system in US. ... 22

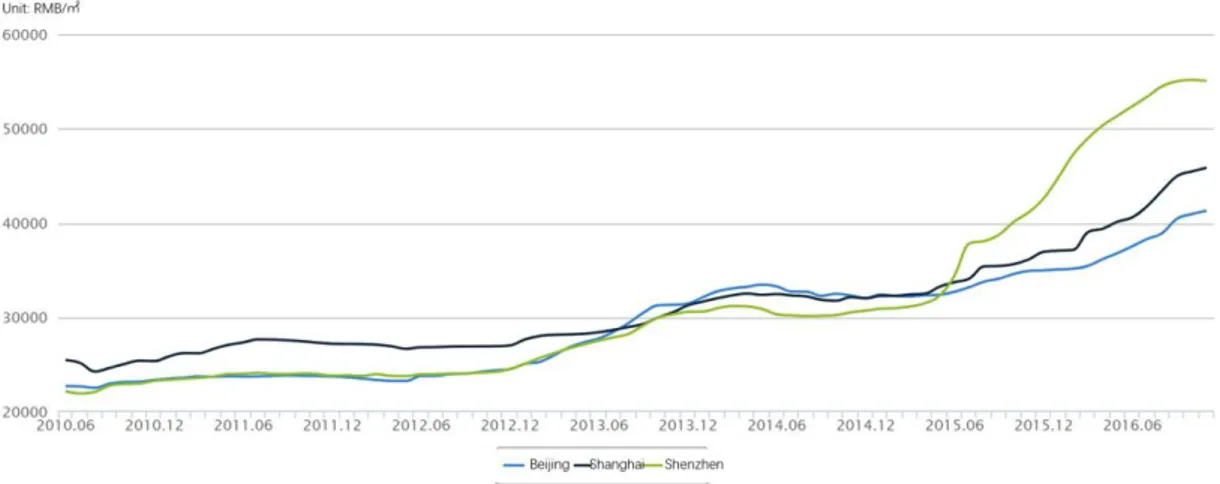

Figure 2 Average housing price in Beijing, Shanghai, Shenzhen (2010-2016) ... 32

Figure 3 Comparative advantages of different groups of rental apartments operators .. 41

Figure 4 The deal structure of rental income ABS issued by Mofang Apartment. ... 44

Figure 5 The deal structure of apartment CMBS issued by Zhaoshang Shekou ... 46

Figure 6 A comparison of the building of 2013 and of today ... 49

Figure 7 Deal structure of Xinpai Apartment REIT scheme... 50

Figure 8 Deal Structure of Poly REIT scheme ... 56

Figure 9 Market capitalization of Equity REITs and Mortgage REITs (1971 to 2017). 60 Figure 10 Market Capitalization and Number of Equity REITS 1971-2017 ... 64

Figure 11 Percentage of total shares held by institutional investors by year and asset type ... 65

Figure 12 Supply growth by year and property sector. ... 68

Figure 13 Equity Market Capitalization of Equity Residential ... 70

Figure 14 Geographic distribution of Equity Residential portfolio 2017 ... 71

Figure 15 Equity Residential’s and the Operating Partnership’s corporate structure .. 72

Figure 16 Median Household Income vs. Median Home Price in US 2017 ... 73

Figure 17 A snapshot of EQR’s properties’ book value disclosure ... 76

Figure 18 Equity Residential’s web interface for investors ... 88

Figure 19 Equity Residential’s property’s website interface ... 88

LIST OF TABLES

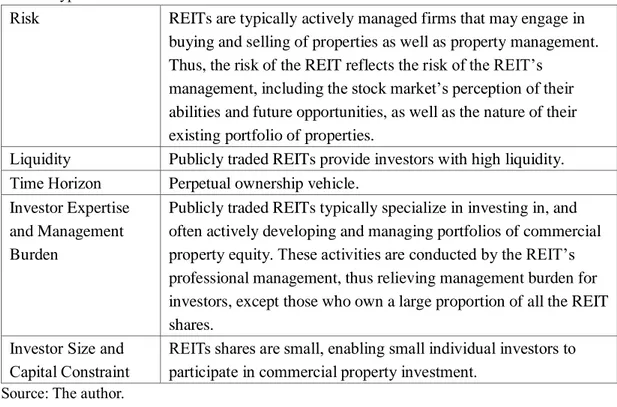

Table 1 Typical concerns and constraints that investors have. ... 21

Table 2 Typical concerns and constraints that investors face. ... 23

Table 3 Business modes of different types of rental apartment companies ... 37

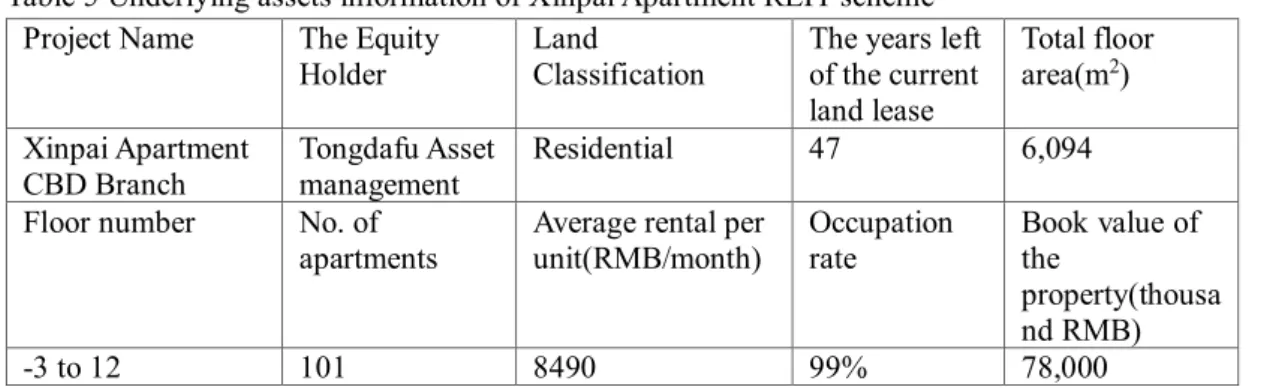

Table 4 Financing schemes issued by rental apartment companies (2017/01-2018/02) . 42 Table 5 Underlying assets information of Xinpai Apartment REIT scheme ... 48

Table 6 Tranche information of Xinpai Apartment REIT scheme... 52

Table 7 Underlying assets information of Poly REIT scheme ... 54

Table 8 Tranche information of Poly REIT scheme ... 57

Chapter1. Introduction

The present chapter points out the research question and describes the general background of the issue. Methodologies and the research structure are described here.

1.1 Research question and my motivation

As early as 2008, an official report published by the People’s Bank of China (PBC) titled “China's Financial Market Development Report” (2007) introduced the concept of Real Estate Investment Trust (REIT) publicly in China for the first time. It was also the first time the government in China called for "the initiation of REIT products at the appropriate time" in official publications.

However, what happened after 2008 was not what many scholars and financial experts expected. In the nearly 10 years from 2007 to 2016, barely any successful REIT have been issued or traded, nor were any detailed and developed policies guiding REITs published by the authorities.

In June 2016, the General Office of the State Council issued "Several Opinions on Accelerating the Cultivation and Development of the Rental Housing Market." The "Opinions" sent the signal that the government in China, for the first time in the past decades, switched its focus from building housing for sale and rapid urbanization to the cultivation and development of the rental housing market.

Subsequently, a series of favorable policies and documents supporting the development of rental housing were issued by the central and each level of government. These policies have provided strong political support to the rental housing sector from two aspects: by increasing the accessibility of land for rental apartments and by tapping a broader source of capital for the development of rental apartments. During the past 2 years, REITs, together with the advocacy for the development of rental housing in China, have drawn lots of attention.

One important reason that REITs have been mentioned frequently in official documents and conferences in the past 2 years are their distinctive trait as equity investments. REITs are expected to provide multiple capital channels and sources for the development of rental apartments without continuously leveraging up the real estate industry as the traditional financing methods did. Theoretically, the mechanism of REIT can help cultivate and accelerate the formation of a sustainable rental housing market in China.

In China, so far there is not a specific law for REITs, nor have any publicly listed REITs been successfully issued. Though a specific law is absent, many real estate companies and operators have started their own explorations to build REIT-style schemes within

legal limits.

Can REIT in China live up to these expectations? What are the critical factors that incentivize the Chinese government to promote the rental housing sector now? If REITs do help to finance the sector, what were the government’s concerns that led them not to promote or promulgate REITs since 2008 when they first floated the idea? This paper will answer these questions and explore both the opportunities and obstacles for REITs to really work in the rental housing market in China by:

Exploring the reasons for introducing REITs recently as socio-technical innovations in the current Chinese real estate market from a macro and historical perspective;

Examining some cases of the newly issued REIT-like companies in China.

Reviewing the framework and system of REITs in US markets so as to draw lessons for China from a comparative perspective.

1.2 Methodology

This thesis employs four types of research methods: literature review (including internet based investigation), interviews, case studies, and comparative analysis (which itself is based on literature review, interviews and case studies).

1.2.1 Case studies

Although no REITs are publicly traded in the Chinese stock market, the recent discussions seem to unanimously agree that the several financing schemes of apartment buildings in 2017 have strong potential to be transformed into public-listed REIT in the future, based on the design of the deal structure, the management of the schemes and the investment characteristics of the products.

In most discussions and articles currently, these projects are cited as “REIT Similar” because they have similar characteristics to public listed REITs, such as pooling together capital of relatively small shares, investing in equity, providing professional management.

But still, these schemes are cited as “REIT Similar” because so far no REIT is publicly listed or traded in mainland China. All the existing “REIT Similar” projects in China, without being directly traded in public stock market, are just trying to mock the deal structure and the mechanisms through which US public apartment REITs finance rental apartments. In this thesis, I refer to all "REIT Similar" projects in the Chinese context simply as “REITs.” REITs in the US context are referred to as publicly listed REITs.

Washington DC, I gained ground-level knowledge and experience with REITs. One of the teams the author worked with undertook underwriting of the Xinpai apartment REIT, widely regarded as the first equity REIT in mainland China. The case is analyzed in this paper to illustrate the factors that support the successful issuance of Xinpai apartment REIT as well as the implications of the obstacles and opportunities faced by the other rental apartment operators in China.

Another Chinese “REIT Similar” case that is analyzed in this paper is the one issued by Poly Real Estate Development, a state-owned development company. The scheme represents the first shelf-registered apartment REIT, and is also the first REIT case issued by a state-owned enterprise (SOE). The case shows well how the “visible hand” of the government is actively supporting the issuance of apartment REITs and the importance of political support in the process of the formation of REITs in China currently.

1.2.2 Literature Review

The “Real Estate Finance” course at MIT taught by Professor David Geltner enabled me to frame the functioning mechanisms of the real estate finance world. Besides the knowledge of the financing structure of individual physical asset, the course is helpful to understand the interactive relationship between the asset market and the capital market. The textbook Commercial Real Estate Analysis & Investment1 presents the essential concepts, principles, and tools for the analysis of commercial real estate both at the level of individual assets and the level of macro industry and secondary market. The book also illustrates a brief history of commercial real estate investment history in the Unites States, which provides important guidance for the 6th chapter of this paper.

Ralph L. Block depicts in his book2 the development history of REITs in the United States with a focus on REITs’ performance as investment products. He analyzes the returns of REITs by comparing them with other types of investment vehicles and provides a step-by-step guidance for building a REIT portfolio and risk management. The book explains the pros and cons of REIT as an investment product and offers technical guidance for REIT investors.

Su Han Chan’s book3 contributes to this paper with its detailed description of the origins and evolution of REITs in the U.S. before 2000s. It also discusses in depth the

1 David M. Geltner, Norman G. Miller, Jim Clayton, and Piet Eichholtz. Commercial Real Estate Analysis & Investment. 2nd Edition., 2006.

2 Block, Ralph L. Investing in REITs: Real Estate Investment Trusts. Third Edition., 2006. 3 Chan, Su Han, John Erickson, and Ko Wang. Real Estate Investment Trusts: Structure, Performance, and Investment Opportunities. Financial Management Association Survey and Synthesis Series. Oxford; New York: Oxford University Press, 2003., 2003.

reasons behind the historical ups and downs of REITs in the U.S. and their correlation with the real estate market fundamentals as well as the capital market. From these discussions many comparative lessons could be drawn for China where the potential impact of the introduction of public REIT on real estate market needs much scrutiny. Dave Levy’s paper1 revisits the fundamental reasons behind the tax schemes of modern REITs in the U.S. by reviewing the initial introduction of the corporate tax and the historical development of REITs. Though the paper is more focused on the tax policy debate of REITs, the background knowledge about the early days of REITs, such as why the REITs needed the tax legislation in 1960s and how REITs were perceived differently from C corporations are very helpful to understand the structural difference between REITs and other types of companies.

Jim Clayton, Michael Giliberto, Youguo Liang, and Frank J. Fabozzi’s works2 depict the shifting real estate fundamentals and the capital market landscapes over the evolution of REITs. Their works provide empirical observations about the interaction between the real estate cycles and the trends of capital flows. Their works also

examine the links between real estate, REIT and capital market from an empirical aspect.

Much REIT research looks at the historical performance of REITs by comparing REITs with other traditional and alternative investments. They help to connect REITs’ performances with a broader range of factors such as interest rates, global capital flows, mortgage supply and fundamental real estate cycles. These combinations are very enlightening to understand the development of REIT within a big picture.

Specifically, Richard Waldron’s research3 provides insights of how REIT as a type of financial innovation has been formed and how history, politics and geography have influenced their development. Though Waldron’s research is set up in the Irish post-crisis context, his observations are very compelling to China where the leverage level of the real estate sector is perceived to be very high, and one of the goals that REITs are expected to achieve is to provide a sustainable capital source for the rental apartment sector while deleveraging the overall Chinese real estate market.

1.2.3 Interviews

The main interviewee of this paper is Mr. Paul Adornato, who has built his successful career in REIT industry over the past 20 years. He witnessed and participated in the

1 Dave Levy, Nick Giano, and Kevin Jones. “Modern REITs and the Corporate Tax: Thoughts on the Scope of the Corporate Tax and Rationalizing Our System of Taxing Collective Investment Vehicles.” University of Chicago, 2015.

2See Bibliography.

3 Waldron, Richard. 2018. "Capitalizing on the State: The political economy of Real Estate Investment Trusts and the ‘Resolution’ of the crisis." Geoforum 90, 206. Supplemental Index, EBSCOhost

underwriting of US REIT IPO (Initial Public Offerings) boom in 1990s and has shared with the author many front-tier stories of the era.

The interviews are very instrumental for us to document the development history of modern REITs in US. Specifically, Mr. Adornato’s narrative provides a valuable source for Chapter 6, the nuts and bolts of US REIT experience.

1.2.4 Comparative Analysis

Comparative analysis plays a very important role in this paper. There are at least two comparisons that are needed here. First, the vertical comparison, which is the comparison within a country across different times. We will focus on China and the US: What changes have taken place in its housing rental market before and after the introduction of REITs? Second is the horizontal comparison across countries: Has either country derived rental housing development from REITs? The answer to both questions is “no.” That is, REITs may not appear to have a major impact on rental housing development. But through the explorations of these questions, we may gain some insight about the possibilities.

The development history of the REIT industry in the U.S. is examined in this paper to make comparisons with the development of REITs in China. As the country that "invented" the REIT, the U.S. can provide valuable reference both from the aspect of academic studies and from practical experience. Most research is built on the basis of the relatively mature and efficient capital and real estate markets in the U.S., while both are relatively underdeveloped in China. Although the conclusions about how REIT interacts with the rental asset market and capital market may not be applied directly to China, the empirical observations and methodologies are instrumental and enlightening to explain some of the emerging phenomena in China.

The affluent historical experience of the U.S. makes it a good reference. To make the comparisons more systematic and well structured, the observations of the interaction between U.S. REITs and rental housing sector help us gain insights from the interactive process between the asset market and capital market, and they are also the important questions that Chinese REIT schemes need to focus on. Investment and management expertise is also a critical factor to build a regulated and organized rental apartment market. In China, institutional apartment operators are relatively scarce and the REIT industry is still at its early stage, the expertise to operate and manage rental apartments and REITs is noteworthy to address and research in advance.

1.3 Research Structure

With the combination of the methods above, the paper is structured in a way that starts from developing the claim that REIT can support the rental housing market by examining the theoretical mechanisms. The paper than tests the assumption through empirical data analysis and specific case studies. Finally, by examining the US historical experience and current practical experience of apartment REIT operation, the paper points out several suggestions for the REIT development in China. To draw the conclusions in an organized, comprehensive and evolutionary fashion, the paper is divided into 7 chapters.

The present chapter points out the research question and describes the general background of the issue. Methodologies and the research structure are described here.

The second chapter envelopes and establishes the links between REITs and the rental apartment sector from the theoretical perspective. By explaining the fundamental structure and evolution of REITs, readers can understand the mechanisms that enable REITs to support the rental market not only by tapping a broader capital source but also by adjusting the business model of real estate industry. The chapter also explains the specialty of REIT by putting it into the US real estate investment system. The concepts and descriptions that are examined in this chapter are summarized mainly through a review of the literature.

The third chapter describes the macro environment of real estate development in China currently and how this macro factor influences the development of REITs as well as rental apartment sector. The chapter tries to build a two-sided observation about the macro environment on the current stage.

The first side is about the motivations. What are the driving forces that stimulate the Chinese government’s promotions on rental apartment development as well as the advocacy of REITs? As mentioned before, it is not the first time that REITs came into the attention of the government's decision-making level. In the midst of the current wave of REITs advocacy, it is necessary to reflect on how REITs, promoted together with the rental housing sector, fit into the current stage of the real estate market. The chapter gathers data and relevant reports from 2008-2018 to examine the evolution of attitudes and reactions of the government and markets towards the rental apartment sector as well as REITs. Besides, the chapter also pictures the dynamic relationships of developers, buyers and tenants and real estate investors in the same period.

The other side is about the favorable policies, driven by the motivations above, that have been published and implemented so far. The section further discusses the sub-level mechanisms that transform these political support into straightforward driving forces

for the growth of rental apartment sector and the development of REITs in China.

The fourth chapter examines how the rental apartment sector has responded to these changes of the macro environment, which including the advancement of political support and the evolutional fundamentals of real estate market. Specifically, the chapter summarizes the emerging types of rental apartment operators in China and the financial toolkits that are accessible to them, such as rental income asset based securities (Rental Income ABS), commercial mortgage based securities (CMBS), and asset based notes (ABN). Through examining these vehicles and the cases they were applied, the specialties of REITs—both advantages and limitations—can be drawn from a comparative view.

Building on the previous macro-level analysis, the fifth chapter dives down to the micro-level to look into two domestic Chinese REIT cases. By comparatively reviewing the case of Xinpai Apartment REIT and Poly Real Estate Development REIT, the chapter illustrates the representative deal structure of current REITs in China, how REITs are utilized in practice and how they are expected and planned to serve the rental apartment sector in the future. Besides, through the scrutiny of the underlying assets and the scheme terms, the specialty and advantage of issuing REIT instead of other products such as CMBS, rental income ABS will be discussed. Finally, the issuers of the two cases have varied characteristics. One is issued by a small-size private company and the other is by a large scale state-owned company. This comparison provides an interesting view on how their strategies of REITs issuance are differentiated and adjusted according to the varied resources they possess. Generally, the chapter illustrates how the political willingness and the visible hand of the government are actively promoting the formation of apartment REITs and the influence in practice.

The sixth chapter focuses on the U.S. experiences. The chapter examines the interaction between REITs, the U.S. fundamental real estate market and capital market from a historical and evolutional view. It is described in this chapter about the macro-economic background and real estate market environment when REIT was initiated in the US. Besides, the chapter tracks how the regulations and structures of REITs have been adjusted to the changing macro environments over the time. Specifically, the chapter looks into the case of Equity Residential, one of the largest apartment REITs in US, to illustrate the nuts and bolts of US apartment REITs.

The final chapter draws conclusion for the paper. The chapter summarizes three aspects that Chinese REIT policy makers need to pay special attention to. Besides, I also conclude with some thoughts on the future development of public REITs in China.

Chapter 2. How can REIT support rental housing

theoretically and mechanically?

To establish the links between REITs and rental apartment sector, this chapter defines REITs and explores the mechanisms that REITs support rental housing from the theoretical perspective.

2.1 What is a REIT?

Let us begin by considering the essence of what a REIT is, and by describing the various different types of REITs that exist at the broad-brush level.

2.1.1 Portfolios of income-producing properties

REITs, or Real Estate Investment Trusts, are companies that own or finance income-producing real estate in a range of property sectors. Similar to mutual funds, REITs provide all investors the chance to own valuable real estate, present the opportunity to access dividend-based income and total returns, and potentially help communities grow, thrive and revitalize.

By definition, an equity REIT is a company that, as its principal business, buys, manages, renovates, maintains, and occasionally sells real properties. Many are also able to develop new properties when the economic conditions are favorable. A mortgage REIT is a REIT that makes and holds loans and other bond-like obligations that are secured by real estate collateral. Hybrid REITs own both properties and mortgages.

In the US, all the above three types of REITs exist, but in practice, even mortgage REITs typically behave like equity rather than debt. This is in part because mortgage REITs tend to be highly leveraged, so the debt on the liability side of their balance sheets largely offsets the debt-like characteristics on the asset side. This is the reason why Geltner says that ‘in essence, REITs are equity products1’. In the sixth chapter of this paper, which mainly focuses on experience of the U.S., the REITs referred to, if not explained specifically, are publicly-listed equity REITs.

REITs possess portfolios of income-producing properties of various categories, ranging from office, retail facilities, apartment buildings, industrial parks to health facilities, and etc. All of these types have specific advantages, risks, idiosyncrasies, and cycles that set them apart from the others. But the basic working mechanisms are the same

1 David M.Geltner, Norman G. Miller, Jim Clayton, and Piet Eichholtz. Commercial Real Estate Analysis &

across varied underlying property types: capital pooled from multiple investors is used to finance real estate development or acquisition, daily operation, value adding and other real estate investment activities. The future cash flows generated by the underlying assets are then paid back to the investors through dividends.

In the US, a qualified REIT needs to meet the following criteria to ensure that it has enough liquidity and qualifies for corporate tax exemption:

• Invest at least 75 percent of its total assets in real estate

• Derive at least 75 percent of its gross income from rents from real property, interest on mortgages financing real property or from sales of real estate

• Pay at least 90 percent of its taxable income in the form of shareholder dividends each year

• Be an entity that is taxable as a corporation • Be managed by a board of directors or trustees • Have a minimum of 100 shareholders

• Have no more than 50 percent of its shares held by five or fewer individuals, also known as ‘50/5’ or ‘five-or-fewer’ rule

2.1.2 Define the type of REIT focused on in this paper

Technically and legally, a REIT in the US does not need to be publically traded, though it requires “broad ownership”. A REIT must have at least 100 equity investors (owners) and comply with the “five-or-fewer” rule.1 Whether or not a REIT is publicly traded, it can be otherwise classified using many criteria, including investment style, asset class, and shareholder-level characteristics.

Although many of the issues discussed in this article are applicable to all types of REITs, this paper focuses primarily on publicly traded equity REITs for two reasons. First, this type of REIT has been at the epicenter of the policy discussions and practical explorations in China addressed in this paper. Second, publicly traded equity REITs account for more than 94% of the total public REIT market capitalization. Mortgage REITs are excluded because they account for a very small fraction of the industry and cannot well represent the equity essence and the other investment characteristics of REITs.

The reasons for the attention to publicly listed REITs in China are multiple. Not only because they can facilitate liquidity, information efficiency and transparency for the rental apartment sector, but also because publicly listed REITs can create a high degree of accessibility for small-scale investors by the instrument of stock market. In China, the public trust and confidence in the stock market is historically lower than that of

1 David M.Geltner, Norman G. Miller, Jim Clayton, and Piet Eichholtz. Commercial Real Estate Analysis &

direct real estate investment. Building a robust public REIT system may not only benefit the real estate sector but also cultivate public trust in the stock market.

In summary, all the REITs-related concepts and descriptions in the rest of this paper, if not explained specifically, refer to publicly listed REITs.

2.2 REIT valuation

The valuation of REITs could be analyzed from two perspectives: REITs as collections of assets or REITs as streams of cash flows.

Viewed as a stream of future cash flows, the valuation of a REIT is not so different compared to the valuation of other types of stocks. However, due to the dividend payout requirement of REITs, shareholders of REIT companies care more about the future dividends amount than those of non-REIT companies that have huge corporate-retained earnings and small payout ratios. The formula for the cash flows valuation is below, where E represent the current value of the firm’s equity, DIVt refers to the annual dividends expected to be distributed by the REIT in year t, and r refers to the stock market’s required long-run total return expectation for investments in the REIT shares.

Alternatively, REITs can be uniquely treated as collections of physical capital. Given a well-functioning primary real estate market, the value of a REIT can be estimated by the value of property assets that it holds. Notice that the value of the total properties includes both the equity and debt components. It is thus necessary to subtract the value of the REIT’s current liabilities and adjust for any non-asset-based value the REIT might have, such as property management services, to reach the net asset value (NAV) of the REIT.

By either method, the valuation of a REIT fundamentally reflects the income generating capacity of the properties it holds as well as the property management capacity of the REIT company. But the valuation methodology or philosophy has to be adjusted within different geographical and cultural contexts. For example, the house ownership rate in China is higher than that in US, which research has explained as due to cultural differences. The cap rates in some tier one cities in mainland China, Hong Kong and Singapore are generally lower than US and European cities. These indicators need to be adjusted before investors look into REITs in foreign countries and make judgements about whether a REIT is over or undervalued.

2.3 REITs in the US real estate investment industry

The US has the longest history of the development of publicly traded equity REITs, and probably has the most mature REIT sector in the stock market of any country. By looking at the role of REITs in the US real estate investment industry, one can get a brief view of REITs’ characteristics as investment vehicles.

The word ‘industry’ refers to purposeful work and diligence, and in economics, the term is used to refer to a branch of economic activity or trade. Investors in the real estate investment industry need to decide not only the prices at which they are willing to trade for the real estate assets, but also their preferences for risk-taking. Geltner has summarized in his book a list of investment elements to show the major constraints and concerns that affect most investors, particularly investors in the real estate markets:

Table 1 Typical concerns and constraints that investors have.

Risk The possibility that future investment performance may vary over time in a manner that is not entirely predictable at the time when the investment is made.

Liquidity The ability to sell and buy investment assets quickly without significantly affecting the price of the assets.

Time Horizon The future time over which the investor’s objectives, constraints, and

concerns are relevant. Investor Expertise

and Management Burden

How much knowledge, ability, and desire the investor has to manage the investment process and the investment assets.

Investor Size How “big” the investor is in terms of the amount of capital in need of investment

Capital Constraint Whether the investor faces an absolute constraint on the amount of capital he or she has available to invest, or can obtain additional capital relatively easily if good investment opportunities are available.

Source:David M. Geltner, Norman G. Miller, Jim Clayton, and Piet Eichholtz. Commercial Real Estate Analysis & Investment, 3rd Edition, P126

Investors are heterogeneous in terms of different investment objectives and constraints, which lays the foundation for a market in investment products. The investment industry matches heterogeneous investors with heterogeneous productive assets.

In contrast to other industries, the major traditional market for trading real estate equity is the property market in which the underlying physical assets are directly traded. Although the property market is a private market, this is a highly developed and well-functioning asset market. In private markets, other investment products exist besides the direct trading of real estate. Equity investment products include Limited

Partnerships, Private REITs, etc. Commercial Mortgages have long been well known and they provide investors with a finite-lived, contractually fixed cash flow stream. In the 1990s, the ‘securitization revolution’ of commercial real estate saw a tremendous development of a second-level of investment products in the US: the REITs and CMBS. REITs are essentially equity products, whereas CMBSs are characterized by debts. By the early 2000s, REITs had grown to represent important shares of the major commercial investment property market sectors with particular dominance in the regional shopping mall sector and significant exposure in major US cities. In his book, Geltner provides a chart that summarizes the real estate investment system in US.

Figure 1 Real estate investment system in US.

Source:David M. Geltner, Norman G. Miller, Jim Clayton, and Piet Eichholtz. Commercial Real Estate Analysis & Investment, 3rd Edition, P131

REITs, in the same manner as the other investment products or vehicles, add value by matching and connecting sources and uses of capital. They enable small investors to participate in commercial property investment by offering small shares. Additionally, being publicly traded fulfills the investors’ appetite for liquidity. Finally, unless the investor purchases a large proportion of all the REIT shares, the investor will have little management burden because REITs are typically managed actively by the company’s professional management teams. The table below depicts how the characteristics of REITs speak to varied concerns and constraints of real estate investors.

Table 2 Typical concerns and constraints that investors face.

Risk REITs are typically actively managed firms that may engage in buying and selling of properties as well as property management. Thus, the risk of the REIT reflects the risk of the REIT’s

management, including the stock market’s perception of their abilities and future opportunities, as well as the nature of their existing portfolio of properties.

Liquidity Publicly traded REITs provide investors with high liquidity. Time Horizon Perpetual ownership vehicle.

Investor Expertise and Management Burden

Publicly traded REITs typically specialize in investing in, and often actively developing and managing portfolios of commercial property equity. These activities are conducted by the REIT’s professional management, thus relieving management burden for investors, except those who own a large proportion of all the REIT shares.

Investor Size and Capital Constraint

REITs shares are small, enabling small individual investors to participate in commercial property investment.

Source: The author.

2.4 The mechanisms through which REITs serve the rental

housing market.

To understand how REITs can potentially support the rental market, we need to first trace back to the basic mechanisms of REITs from a theoretical perspective. The following chapters provide practical cases and empirical evidence to further testify these mechanisms and assumptions. Here, we introduce three fundamental factors. First, REITs need to generate on-going income, and rental apartments do that. Second, public REITs provide liquidity for their investors, and are accessible to a broad group of investors including small investors, hence, can attract capital for building rental apartment properties. Third, REITs need to, and have the scale and specialization to enable them to, provide skilled professional operational management of rental properties. We elaborate on these three points below.

2.4.1 Requirement of Income-producing

The set-up of REITs’ underlying properties needs to be income-producing, as do ‘commercial properties’ in the US context. The opposite of commercial property is owner-occupied home. By this definition, the commercial residential properties in China are very scarce.

residential sector has been particularly unified in the past decades. Almost all of them are merchant builders who sell or pre-sell the residential units to individual buyers. Even though an individual property owner may not be the ‘occupier’ of the unit later on because she will possibly lease it out to collect rental income from a tenant, this is the owner’s individual choice and the property is still essentially a merchant unit. There’s no existing data source to measure the percentage of owner-occupied and tenant-occupied units within a residential building. The heterogeneous status of different units in the same building, and the blurred boundary between ‘owner occupation’ and ‘income-producing’ in China make it hard to classify these residential units as owner-occupied or commercial properties.

Second, there are indeed rent-only buildings for residential use in China, but it is not accurate to classify these buildings as ‘commercial’ because the owners of these buildings are mostly not-for-profit or state-like institutions, such as universities, government, or state-owned enterprises. The residential buildings owned by these institutions are ‘leased’ to their students or employees at a highly discounted rate compared to market average level or even free. Apparently, these properties serve as a type of “pay-in-kind’ benefit to a target group of people rather than a commercial investment.

The above two reasons show the scarcity of commercial properties in the residential sector in China. The developers of these residential buildings get their profit by once-off capital gain rather than rental income. Obviously, apartment REITs do not have a solid and board fundamental in China given this landscape of residential sector. It also explains why REITs naturally come into public attention when the national government supports rental housing. For those entrepreneurs and investors who bet on the prosperity of rental housing in China, REITs provide them with a well-tailored financing channel.

2.4.2 Liquidity and Accessibility

Besides REITs, there are a number of ways investors can choose to hold or invest in real estate, such as direct individual ownership, private partnership, and holding shares of traditional property companies which develop and operate real estate. But let’s consider how these other ways compare to REITs in terms of liquidity and accessibility (of the investment to a broad range of investors).

Investors like liquidity, real estate investors are no different in this. However, liquidity has been a major constraint or concern in traditional real estate investment due to the high transaction cost. Property assets may need a long time to sell at a less discounted value, compared to publicly traded stocks and bonds. The process of selling a single piece of real property may be very time-consuming and risky for individual property owners. For example, in a traditional individual ownership of a residential unit, the owner needs to spend a lot time negotiating with the intermediaries, advertising or showing her property to potential buyers. Brokers provide these services on behalf of

the property owners but charge fees. Some online platforms both in US and China are trying to build the direct connection between buyers and sellers, and charge less for intermediary services. But the counterparty risks and other concerns still largely exist and keep transaction costs high.

The issue of transaction cost is manifested in other forms of ownership, too. In private partnership, for example, although the partnership terms may make it theoretically possible for one partner to transfer her shares to another partner without the underlying property being sold, in practice it often doesn’t proceed smoothly because of the unmatched demands of selling and buying among the several partners. Similarly, in private REITs, the shares of the sponsors are not traded in public markets, thus the shares cannot be quickly sold at the shareholder’s will.

Compared to others, public REITs stand out by their high liquidity and low transaction cost through public trading in the stock market.

Furthermore, the requirements of REITs embody the concerns of REITs’ accessibility to small investors. The rules of ‘Having no more than 50 percent of its shares held by five or fewer individuals’ and ‘Having a minimum of 100 shareholders’ (together known as 5/50+100 rule) were designed to make sure that a REIT is widely held in order to encourage its accessibility to small investors. In the Section 6.1.2, we describe how the rules were modified later on to allow pension fund investment in the 1990s. The original founding idea for REITs reflects the emphasis on accessibility of REITs for small investors.

Besides the initial founding ideas, publicly listed REITs make investing in real estate possible for a broader range of investors who has access to stock markets. The securitization process gathers properties into a package and divides the REIT shares into a small size which enables small individual investors to participate in commercial property investment. This process greatly increases the accessibility of investing in real property and gives investors the liquidity to move capital in and out of the investment so that they can respond to news and perceived opportunities.

The fact that REITs stand out by their high liquidity and accessibility through trading publicly in the stock market builds a distinctive channel between capital markets and the income yielding property market. The rental apartment, as a type of income producing property, naturally fits with the criteria required by being the underlying asset of a REIT. In this case, rental properties, by making use of REITs, have advantages in tapping into broader capital sources pooled by individual investors compared to merchant property builders1. Thus, the liquidity and accessibility of apartment REITs serve specifically to the group of rental housing investors and operators, and contributes to the development of rental housing sector.

2.4.3 Professional management

Former managing partner of Ernst & Young's Real Estate Group, Stan Ross, defined REITs by saying: "They are really operating companies that lease, renovate, manage, tear down, rebuild and develop from scratch." This explanation points out another important element of a REIT - a sophisticated, skilled management team who has the ability to manage and grow the REIT's cash flows.

In this sense, when investors buy stocks of a REIT, they are not only buying the company’s underlying real estate assets, they are also investing in a business. The REIT company’s role is more than to exchange the large block of real estate assets into accessible stock. They also contribute their expertise in managing and operating real estate, as well as creating value and taking advantage of new opportunities in the market.

Some research1 has demonstrated the value of such expertise quantitatively with historical performance data. REIT management teams have typically grown the REIT’s cash flows by 4-6 percent annually—and sometimes much more. Adding a 5 percent dividend yield to capital appreciation of 4-6 percent, resulting from a 4-6 percent annual increase in operating cash flow, provides for total return prospects of 9-11 percent.

In China, a clear legal and administrative guidance for governing residential tenancy has long been absent. This absence undermines the quality of rental housing services significantly and thus creates market opportunities for the institutional apartment operators to capture value by competing for more professional and reliable apartment services.

The importance of management expertise is amplified by REITs. Because of the fact that REIT investors are actually buying a bundle of underlying assets and management expertise, competition for efficient property management will naturally motivate the operators to provide better services to attract tenants and build up tenants’ loyalty. Accordingly, it’s fair to predict that the overall rental housing market can be cultivated in a more customer-friendly and regulated way.

Furthermore, REIT as an equity product requires stable and sustainable income generation to pay back investors, thus it is not designed to serve the “merchant developers”. Thus the introduction and promotion of REITs is exclusively beneficial to the investors and companies who pursue profitable opportunities from holding properties. The REITs companies will stay highly vigilant to the factors such as the real estate market’s cap rates, housing price movement, the cost of their capital, the market landscape of investment return, etc. These factors are constantly monitored by REITs

to help the investors capture potential investment opportunities, and evaluate the specific options to sell, buy or hold.

In summary, REIT management teams not only contribute property management expertise but also sophisticated financial skills. This attribute effectively links and coordinates the asset market and the capital market. Presumable results accordingly are that REITs can help to tap a very large capital market which can flow into the rental apartment sector. Besides, with financial support and sophisticated management teams, REITs can help make better use of existing assets with a better management capacity.

Chapter 3. The opportunities for rental apartment and

REITs in China from a macro background perspective

As early as 2003, Hong Kong, the Asian financial hub and the special administrative region of the People’s Republic of China, enacted its REIT code. The first H-REIT, “The Link REIT”, came to the market in 2005 with asset types of Retail and Car Park. As, the first H-REIT, The Link was sponsored by the Hong Kong Housing Authority, securitizing the 151 shopping centers and 79,000 parking spaces that were owned and managed by the government. It was a major push from the government to initiate the H-REIT market.

Despite the fact that mainland China has borrowed experience of developing the real estate market and land leasehold system mostly from Hong Kong, the mainland did not push forwards the formation of REIT until 2008. After years of market anticipation, on April 10th 2008, the People’s Bank of China (PBC) published its policy blueprint for the Chinese Financial Industry, titled “China’s Financial Market Development Report (2007)”. It is in this white paper that, for the first time, the PBC called for ‘the initiation of REIT products at the appropriate time’.

In 2016 to 2018, seen from the frequently issued polices with regard to REITs, it seems that the “appropriate time”, at least from the government perspective, may have arrived. It has been almost a decade since REIT was introduced in 2008. This chapter analyzes the recent changes of the macro Chinese real estate market and examines the reasons behind the series of favorable policies published for rental housing, as well as the reasons for the current promotion of REITs. A summary of all the relevant polices and important conferences in China during 2016-2018 is attached in Appendix 1.

3.1 The motivations to promote the rental housing market

In the past decades, real estate construction in China has been rapidly growing under the strong wave of urbanization. Meanwhile, the development of the rental apartment sector has been relatively stagnant. While the reasons for the country’s rapid urbanization are complex, as drivers such as economic structure, policy emphasis, demographic change are mingled, this section mainly focuses on how the real estate sector has been one of the most important driving forces of the urbanization process. Finally, the obstacles faced by the rental apartment sector compared to the more successful merchant properties sector are explained.

3.1.1. The circular relationship among land leasing, real estate

construction and the economy

To understand why the real estate sector can play an important role in stimulating the local economy and the government’s motivation to promote real estate construction activities, the perception of the model of “land finance” is very critical.

Not every piece of land in China is privately owned. While the land in the rural areas are collectively owned by the “Rural Collectivity”, the land in urban areas is “state-owned” and can be leased out to the private sector, represented by the local government, for a specific time as regulated by constitutional law. The terms for different land use vary, and 70 years is the duration for a residential land lease.

Leasing out land to developers provides the local government an important, if not fundamental, channel of fiscal revenue. Meanwhile, with the state-wide advocacy for urbanization, the developers benefited significantly from the highly accessible development and construction loans from banks. The merchant builders get cheap loans from banks with the almost riskless collaterals of the land lease, as well as the merchant properties that will be built in the future.

Under the “land finance” model, the capital flow is such that it starts from individual savings in banks, and is then borrowed by the developers to finance the land lease and construction. Part of the capital then flows to the government’s public account to fund further infrastructure projects and improve the urban environment. In essence, it’s the build-and-sell model that largely accelerates the capital circulation. This is because developers are generally using high leverage to finance construction and the only source for them to pay down the debts is the revenue from selling the properties to individuals, which is collected much faster than rental income.

The government’s income through land leasing is used to fund infrastructure projects and to prepare more land for leasing, thus fulfilling the circulation to stimulate the expansion of the urban areas. What’s more, the expansion also coincides well with the willingness of the government. In China, a fast growing “concrete forest” is generally perceived as a straightforward and conspicuous means of demonstrating the local government’s achievement.

From the state level, real estate construction is a special type of economic activity for its extensive industrial and financial links. In 2011, real estate investment accounted for a quarter of total fixed asset investment (FAI) in China.1 The real-estate-dependent

1 Ahuja, Ashvin, Alla Myrvoda, and Department International Monetary Fund. Asia and Pacific. 2012. The spillover effects of a downturn in China's real estate investment. [electronic resource]. n.p.: Washington, D.C.: International Monetary Fund, Asia and Pacific Dept., 2012., 2012. MIT

construction industry accounts for 7% of GDP by itself, and it also creates significant final demand in other domestic sectors; it has among the highest degrees of backward linkages, particularly to mining, manufacturing of construction material, metal and mineral products, machinery and equipment and consumer goods, as well as real estate services. All of these factors strengthen the macro-level motivation to develop the real estate sector and construction industry.

3.1.2. The obstacles of the development of rental housing.

Then why does the rental apartment sector lag behind merchant housing construction?

To illustrate this, we need to trace back to the role that rental apartments play in the urbanization process and see how it functions differently compared to the merchant properties.

The functioning of the land finance model, which is explained above, relies heavily on the support of the banks which provide development and construction loans. The banks evaluate the risk of the loans and price the loans using the quality of the collaterals as the primary source. In an economic environment where the demand for buying an apartment is constantly strong, driven by the large population inflow from rural areas, the banks have enough reasons to justify the loans borrowed by the real estate development sector.

Fundamentally, the demand for buying apartments in urban areas is the critical factor that supports the land finance model. As urban industries grow, a large number of laborers are attracted and they normally have a strong desire to settle in the city. This preference may be based on some unique conditions in China. As the gap between rural and urban areas is becoming more apparent regarding social welfare, wage level, infrastructure quality and many other aspects, the meaning of ‘living in cities’ is becoming a symbol of better quality of life and even higher social status in China.

In comparison to the strong demand of owning an apartment in cities, rental apartments can only fulfill the basic demand for accommodation but cannot provide the other economic, investment and social effects that house ownership offers.

From the economic perspective, as explained before, both local and central governments have the intention to leverage the economic development and urbanization process with construction activities. One can argue that rental apartments can also stimulate construction activities. But the competitive advantage of rental apartments is very limited for two reasons. On one hand, the longer investment duration of rental apartments and lower return rates make them less attractive for banks that have the alternative to issue construction and development loans for merchant builders. On the other hand, the government, with its desire of further expansion of cities, has few

reasons to favor rental housing instead of merchant property construction when the latter can immediately help to collect the fiscal income that is needed for infrastructure development from lump sum apartment purchases.

From the investment perspective, owning a residential unit has long been an investment option that is widely accepted by Chinese families. This is not to argue that buying houses in China is a preferable investment everywhere. Actually, an over supply of residential units has been observed in some less developed cities in China. There is significant literature on Chinese “ghost cities” resulting from a vulnerable industrial structure, inadequate population growth, limited job opportunities, overinvestment in the real estate sector, etc. A report by the IMF1 summarizes the reasons for the potential overinvestment in the real estate sector in China as follows: “in the underlying structural features of the economy, namely low real interest rates in a high growth environment, the under-developed financial system (offering few alternative assets) and a closed capital account, foster the enthusiasm in real estate investment.” Indeed, with the few alternative assets for investment, merchant properties provide the investment value that rental apartments do not possess.

Finally, from the social perspective, in many cities, owning an apartment within the city gives rural migrants a higher chance to transform their ‘Hukou’ into an urban ‘Hukou’, which helps the migrants get better social welfare and gives them the sense of being a homeowner rather than a rural migrant. These social and psychological factors are also the reasons behind the booming of merchant property construction and cannot be achieved by rental apartments.

3.1.3. The current requirements to develop rental apartments.

As illustrated before, geographical factors matter a lot when studying the Chinese real estate market. This section mainly focuses on first-tier cities where most of the recent successfully issued rental apartment REITs have exposure.

Both the real estate market fundamentals and the policy preferences bring about the opportunities and requirements for the development of rental apartments.

Seen from real estate market fundamentals, the boom of the real estate sector in the past decades has been significantly supported by aggressive borrowing both by home buyers and by housing enterprises. Some research2 has shown the different influence that the

1 Ahuja, Ashvin, Alla Myrvoda, and Department International Monetary Fund. Asia and Pacific. 2012. The spillover effects of a downturn in China's real estate investment. [electronic resource]. n.p.: Washington, D.C.: International Monetary Fund, Asia and Pacific Dept., 2012., 2012. MIT Barton Catalog, EBSCOhost

2 Guo, Ye, Wenbin Xu, and Zhiyuan Zhang. "Leverage, Consumer Finance, and Housing Prices in China." Emerging Markets Finance & Trade 52, no. 2 (March 2016): 461-474.

leverage level has had on different groups of cities. It is observed that the leverage level has the strongest influence in the first-tier cities where the housing price has been increasing dramatically in the past decade. According to data from CREIS, the average price/m2 in Beijing, Shanghai and Shenzhen, from June 2010 to June 2016, has increased by 65%, 59%, 136% respectively.

Figure 2 Average housing price in Beijing, Shanghai, Shenzhen (2010-2016)

Source: CREIS database.

In a typical real estate cycle, rents and property values begin to rise as the economy and demand for space expands; at a certain point, new building accelerates to take advantage of the higher values; the market becomes overbuilt, but new construction continues to come online because of the time lag in construction; values fall due to oversupply. However, in the first-tier cities of China, a sharp fall of housing prices in these cities could hardly be expected. It is widely acknowledged that the housing demand has not been fulfilled and will be continuously robust due to the stable population inflow to these cities. These cities have strong attractiveness to the migrants all across the country because of their mature and comprehensive economic structure.

Tier one cities like Beijing, Shanghai and Shenzhen have developed into a stage where knowledge-intensive and technology-intensive industries play more important roles in supporting fiscal income compared to land finance. With limited land resource, the new wave of competition among these cities is to retain and attract sophisticated labor who have skills and techniques that support knowledge intensive industries. Human capital is the most valuable resource to the sustainable development of an economy. Accordingly, one priority issue that needs to be solved is the accommodation of these talents.

Responding to the fevered housing purchase, some policies, such as increasing the down payment level or raising mortgage interest rates, are published subsequently. These policies aim to control the leverage level of real estate sector. These new policies limit the accessibility of construction loans, increase the down payment level and decrease the total scale of housing loans to prevent the housing sector from over leveraging.

Besides the regulations on the leverage level, restrictive policies have been published simultaneously to limit the supply of traditional residential land while providing a separate channel for rental housing land supply. The goal is to suppress home purchases as well as stimulate demand for rental housing via the cross-elasticity of demand.

3.2 The policy preferences for rental apartment and REITs

In the past several years, the instructive direction of the government has diverged from the promotion of merchant housing construction with high leverage level that has posed risks to market sustainability and financial stability. Meanwhile, the central government has issued a series important documents and policies to cultivate and promote the development of rental sector. This session examines the policies that have been subsequently issued in the past two years favoring rental apartment sector as well as REITs.

In general, the polices and documents have provided support to the rental housing sector from two aspects: increasing the accessibility of land for rental apartments and tapping a broader source of capital, i.e. financial support, for the development of rental apartments. The financial support category is where REIT is put forward and is regarded as an important vehicle that should be largely developed.

3.2.1 Increase the land supply for rental apartment

The land resource in China is usually regarded as an important vehicle to help fulfill the country’s macro-level strategy and help implement relevant policies. This is also the case in the current wave of promoting rental apartment.

3.2.1.1 The rural collective land

As described previously, land in China is either owned by the state or by rural collectives. Theoretically, only the state-owned land, i.e. urban land is subjected to the zoning guidelines whereas the functions of rural land are decided by the rural collectives, which are formed by the local rural people. In practice, this duality of land creates some difficulties in regulating land uses and real estate market functioning. For example, though forbidden by law, many collective-owned land in the edge of urban areas are used to build the so-called “Small Property Rights Housing” (SPRH), which are usually sold to non-indigenous buyers at discounted prices compared to those merchant apartments nearby which are built on the state-owned land and are fully certificated.