HD28

.M414

f\0.3^30

THE

ECONOMICS

OF INFORMATION

TECHNOLOGY:

EXPLAINING

THE

PRODUCTIVITY

PARADOX

Geoffrey

M.

Brooke

April

1992

CISR

WP

No.

238

Sloan

WP

No.

3430

Center

for

Information

Systems

Research

MassachusettsInstitute of Technology Sloan School of

Management

n

MassachusettsAvenue

THE

ECONOMICS

OF INFORMATION

TECHNOLOGY:

EXPLAINING

THE

PRODUCTIVITY

PARADOX

Geoffrey

M.

Brooke

April

1992

CISR

WP

No.

238

Sloan

WP

No.

3430

©1992

G.M.

Brooke

Center

for

Information

Systems Research

Sloan School

ofManagement

M.I.T.

LIBRARIES

JUL

16 1992

THE

ECONOMICS

OF INFORMATION

TECHNOLOGY

Explainingthe Productivity

Paradox

ABSTRACT

The

pastfortyyears have seen dramatic advancesInthetechnologyofinformationprocessing,and

itswidespread adoption bears testimony tothe adventof the 'information society'.However,

theeconomic

implications ofthistransition

remain

tosome

degree obscure, since there is little evidence that thenew

technology has ledto clearimprovements

in productive efficiency. Indeed, during the past twenty years the United States'economy

has sufferedfrom

a decliningrate of productivitygrowth,despitesharply acceleratinginvestmentincomputer-based

systems.Severalattempts have

been

made

toresolve this'productivity paradox',yetnone

hasproved entirely satisfactory. In thiswork,we

propose anew

explanation of the paradox,and

presenteconomic

evidencein it5 support.The

central

argument

isthatinformationtechnologyhas altered theeconomies

ofproductioninfavorof differentiated output,and

that ourmethods

of productivitymeasurement

tend to discoimt the benefits of greater productvariety.

The

vahdity of this reasoning is demonstrated by an empirical study of the United States' privateeconomy,

covering the forty-year periodfrom

1950 to 1989. Despite these results, however,we

conclude that declining productivitygrowth is not merely an accountingfiction, sinceour currenteconomic

system isrelativelyI.

INTRODUCTION

Is

America

losing its position of global pre-eminenceand

entering a period of inexorableeconomic

decline?During

the pasttwo

decades,much

attention hasbeen drawn

to the signs of America's relativeeconomic

weakness

—

a falling share ofworld output, growing tradeand

fiscal imbalances, stagnating real incomes,and

a persistently low rate of productivity growth.The

growing intensity of international competition is exposinginefficiencies in

many

American

corporations,and

is taking a relentless toll of their workers, factoriesand

markets. Distressed by declining living standards

and

by the uncertainty of theireconomic

future,many

Americans

lookback to the post-waryears as atime of unrivalled prosperitythat neithertheynortheir children shall ever see again.With

the steadydownward

drift of the last twentyyears, the general outlookseems

imremittingly bleak. Yet itisbelied, in

some

ways, bythe promise of a strangenew

world which isslowlyemerging

fromtheshadow

of the old.Reflecting

on

America'seconomic

record, severalobservers havebeen

puzzled bythe factthat the recentperiod of lagging productivity growth has alsobeen

a time of rapid innovationand

technical advance. Farfrom

shelteringfrom

the windsofchange,American

industry has eagerly invested innew

technologies,and

especiallyinthose associated with the processing of information. Furthermore,this paradoxical pattern

-

oftechnological innovationand economic

retardation-

hasbeen

observed inmany

nations that have followed theAmerican

example,and

has ledsome

critics toquestionthe abilityof thenew

tectmologytogenerate aneconomic

return.Is this

new

world—

a world of information—

onewhich

confounds our traditional presumption that technological progressand

productivitygrowth go hand

inhand?

If so, arewe condemned

to accept an ever-growingburden

ofinformation, whichencumbers

oureffortsto improveeconomic

performanceand

torespondto agile

new

competitors in the global market-place?Or

mightwe

not be better advisedtothrow

offthe yoke ofinformation technology,and

return tothe triedand

trustedways

thatwere

the foundation of past successes?It isourpurpose here toaddressthese questions, with the

aim

ofexplaining the originsand

nature ofourcurrenteconomic

predicament. In particular,we

shall explain the underlying cause of America's decUning rate of productivitygrowth,and

shall also suggest(1)why

this declinebecame

noticeable after 1973, (2)why

itpersists to the present day,and

(3)why

thisexperience hasbeen

shared bymany

of the world's developed economies.More

generally, our analysismay

provide the basis for a deeper understanding of the productive role of information,and

thus of theeconomic

system that willdefme

the shapeand

substance of thenew

America.II.

EXPLAINING

THE

PRODUCTIVITY

PARADOX

The

quarter-century following theSecond

World

War

ranksasaremarkable periodineconomic

history.Buoyed

byrisingcapitalinvestment, increasingly

open

internationalmarkets,stableexchange ratesand

avarietyof other factors,many

of the industrial nations enjoyed an unprecedentedimprovement

in the general welfare ot their citizens.Although

many

influences contributed to this improvement, its ultimate basiswas

a sustained rise inthe productivity of the resources

employed

within the generaleconomic

system.Each

successive year, these resourceswere

able togenerate higherand

still higher levels of output: in theAmerican

case, relative to theamount

ofeffort required from the average worker, the nationaleconomy

produced

some

}%

more

every year-

providing benefits such as higher real wages, better social services and, in general, amore

equitable distribution of income.After 1973, for reasons which have since

been

much

debated, this era of steadyeconomic

progresscame

to an end. America's average rate of producti\ity growth fell from 3*^ to l^c perannum, and

a similar declinewas

observedin

many

nationsatacomparable

stage ofeconomic

development.However,

while theAmerican

growthrate has

remained

at thisrelativelylow level, in othereconomies

—

especiailvin those ofits majorinternational competitors-

productivity growth has regainedmuch

(though not all) of the lost ground. In consequence, .America's position in global trade has steadilyweakened,

leading to diverse forms ofeconomic

hardshipand

agrowing concern that the

downward

trend—

or productivity slowdown'—

may

signal apermanent

loss of productive efficiency.Leading Explanations ofthe

Slowdown

Prompted

by these considerations, severalprominent

economists have attempted to analyze the causes of .America's post-1973 decline. For example, attention hasbeen

directedat changes inkeyeconomic

inputs (e.g.,risingenergy prices, deteriorating laborquality, reducedcapital investment, etc.) that

may

haveundermined

the productive capabilities of the nationaleconomy.

However,

although several of these factors have clearly contributed toa general falling-offin the rate of productivitygrowth, neitheralone norincombination havetheybeen

able toexplam

a major proportion of the total decline.This inconclusiveevidencehas lent supporttoanalternative argument",which proposesthat it isneitherinferior

nor

more

costly inputs, but a structuralchange in theeconomic

system itself, that isthe rootcause ofAmerica's productivity problem.The

essential reasoningis thatthe high levelsof productivitygrowth experiencedbetween

1948

and

1973 allowed the pattern ofeconomic

activity to shiftaway from

capital-intensive, high-productivity sectors (such as manufacturing) toward labor-intensive, low-productivity sectors (such as those providing informationand

other services). Prior to 1973, the size of the formerwas

suchthatits productivity gainswere

sufficient to

overcome

anyshortfall intheperformance

of the latter:butasthe manufacturingsector shrank, and the services sectorbecame

economically predominant, a dechne in the productivity of the total system was, inthe end, inevitable.

The

theme

of structural change has alsobeen

evident in the writings of thosewho

have studied America's growing reliance on information technology. Since there appears tobe littledirect evidence thattheenormous

technological investment of the past twenty years has served to arrest theeconomy's

downw£u-d slide (thephenomenon

that isnow

known

as the productivity paradox), it is proposed that thenew

technology has contributed to - indeed, hasbeen

a central cause of-

the steady shift toward service-intensiveeconomic

activities. In consequence,

some

have seen cause to doubt theeconomic

value of information technology, claiming that it has allowed the services sector to develop an inefficient, fixed-cost infrastructiu-e that inhibitscompetition

and

the productive re-deployment ofcapitaland

labor resources..As an explanation of the 'productivity slowdown', the thesis relating structuralchange, services

and

information technology does have a certain plausibility: theAmerican

economy

of the 1990s is clearly quite different, as'por example. Denison(1982) andBaily(1986).

TTiistakes avanetyofforms - see.e.g., Baumol(1967);Thurow(1981);Tyler(1981);Jonscher(1983);Baumol,Blackman

&

Wolff

(1985).

'flaily

&

Chakrabani (1988); Baily&

Gordon (1988); Loveman(1988);Roach (1988,1991); Bemdt&

Momson

(1992).regards the importance ofinformation

and

services,from

its predecessor ofthe 1950s. Yet despite the primafacie evidence in its favor, the service-economy

argument

leaves certain questions unanswered.Whv,

forexample, have

more

(and. perhaps, better) services been preferred to higher productivitv growth ?And

why,in particular, have services been preferred if

laggmg

productivity leads to stagnating real incomesand

to a generally lower standard of living?To

these objections, several responses are possible.One

retort might be that the shift to services has in fact raised living standards, not lowered them: it isonly the intangible nature ofmany

service outputs that prevents accuratemeasurement

ofthe associated gain in welfare.On

this basis, the productivityslowdown' is largely a fiction ofcrude accounting,and

we

aremuch

better offthan the nationaleconomic

statistics suggest.A

related propositionmight bethatAmerica,incommon

withotheradvanced economies, hasseen amaturingofconsumer

tastes, manifested by a declining

market

for basiccommodities and

a risingdemand

for sophisticated (yetmore

costly) service products.

We

might perhaps be persuaded ofthis,were

we

not atthesame

tune confronted bytheAmerican

consumer's undiminished appetite for tangible, non-service products.As

is well icnown, during the past decade the international trading position of the United States has noticeably deteriorated,owing

in themain

to the popularity of imported goods: onlv an insignificant proportion of this growing deficit can be attributed to an increasedconsumption

ofservices . Furthermore,services are in fact onlyasmallcomponent

of fmaldemand:

most

service outputs are provided as intermediate inputs to the goods-producing sectoP. In this context, the 'serviceeconomv'

seems,tosome

extent, an illusion:and

the efficient productionof physicalgoodsstillappearsto be the real foundation of

economic

success^.Forthisreason,

we

would

arguethat the national productivityshortfall reflectsanunderlyingeconomic

weakness, not merely inaccuratemeasurement

or changing tastes. Indeed, whatever the basis of calculation (provided itis applied consistently across countries), any nation

whose

rate of productivity growth falls significantly behind the rates achieved by its majoreconomic

rivals, willfmd

its ability tocompete

in global markets progressivelycompromised.

Our

primary need, therefore, is to understandwhy

a real decline in productivity growth hasaccompanied

theemergence

of a society inwhich goods, servicesand

information appear tobe co-ordinate inthe

economic

process.To

this end, however,we

must

first explain the extent to which the decline is, in fact,attributable to a rise in the productionof

unmeasured,

service-related outputs.The

Meaning

and

Measurement

ofProductivityAt

themost

elementary level, our concern with productivitygrowth

stemsfrom

our interest in reducing the sacrifice thatmust

bemade

in the present ifwe

are toenjoy the benefits ofconsumption

in the future.With

this in mind, productivityisoften

defmed

as theratioof 'outputsconsumed'

to resourcesexpended': the outputs comprisingthe variousgoodsand

servicesthatare purchased by consumers,and

the resources (orinputs) being the materials, energyand

human

effortthatare usedintheirproduction. Inpractice, thisproductivityratiotakesmany

particular forms, butforourpresentpurposeswe

shallconcentrateon

an importantvariantknown

astabor productivity, or "output per hour'. This ratio relates themonetary

value of finaldemand

(i.e.,consumer

piuchases, businessand

government

investment,and

net exports) tothenumber

ofhoursspentatwork

(by those^Cf.Quinn (1988. p.39,Table6).

Jonscher(1983. p.17)estimatesthat

85%

of theoutputof the information' sectorisreturnedtothegoodssector. Duchin(1988,p. 79,Table 1)provides similar data forotherindustneswithin the servicessector.Baumol.Blackman

&

Wolff(1989.Chapter6)arguethattheservices-sector'sgrowingshare of the nationalproductreflects achangeemployed

in production),and

is a tundamental indicator of the wealth-generating capacity of a nation's labor force.Turning

now

to the question ofmeasurement,

the calculation of labor productivity clearlydepends on

the accurateestimaUon

of both output'and

hours at work'.Although

the latter variable presents anumber

ofdifficulties of its own.

we

shall not dwell on these since our current focus is the changing nature ofeconomic

outputs, given the trend toward service-intensive production. Concentrating therefore on themeasurement

of output,we

may

observe that the variable is expressed inmonetary

terms,and

thus is subject to the distortions of price inflation. Clearly, to obtain a reliablemeasure

ofeconomic

output and its fluctuations over time, it isessential toeliminate sucheffectssince they are often verylarge relative toanyrise in the true productivitylevel.

Inpractice, the

problem

ofprice inflation is solved by examining,within eacheconomic

sector, the year-to-year change in product pricesand

then discounting, fromone

year to [he ne.xt. any increase in price that does not correspond to a change in product specification'. For e.xample, if thesame

model

of car is priced at $10,000in the first year

and

$10,200 in the second, then the extra $200 is discounted as pure inflationand

the price of the car, expressed in constant dollars, remains at S10.(X)0.However,

if in the second year the specificationof the car is altered to include a $200 radio as standard equipment, then no defiation procedure is applied (the radiobeing regarded as a qualityimprovement) and

real output rises by $200.Over

the years, thismethod

of quahty- adjusted price deflation has beenemployed

with considerable success.Itsuffers

however from

anacknowledged

deficiency, inthat no allowanceismade

forquahtyimprovements

whichare not directly associated with a production cost. For example, instead of installing a radio as standard equipment, a car manufacturer

may

offer achoice ofradios, thusallowing the customer to satisfy a preferencefor a radio of

some

particular type.From

our present perspective, this deficiency is important becausemany

service-related

improvements

are ofprecisely this type: they arise, notfrom

any tangible change in the nature of theproductitself, butfrom

the provision of additional services thatmake

the productmore

convenient,more

accessible, or generally

more

valuable to the individual consumer.At

this stage it is vital to note that the discoimting of indirect-service benefits is not thesame

as themis-measurement

of intangible service outputs.To

elucidate tfiis point,we may

observe that the output ofmany

service industries

and

professions-

law. medicine, finance, entertainment,pubhc

administration, educationetc.-

is largely intangibleand

hence not susceptible ofmeasurement

in anyquantitative sense. Clearly, any rise inthe

consumption

of such services will tend to aggravate themeasurement

difficulty,and

render estimates of productivity growth all themore

suspect. Yet it is also clear thatwhere

a servicecomponent

is included, indirectly, as part of a non-service product, the effecton

outputmeasurement

will be equally unfortimate. although theremay

be little apparent change in the relative consimiption ofgoods

and

services.The

significance ofthis last point lies inthe following. Ifwe

canshow

that, after 1973and

for certain reasons, therewas

a substantial rise in the 'indirect-service' element of production, thenwe

may

conclude thatunmeasured

(i.e., improperly deflated) output has increased as a proportion of the national product, without there being anyunwarranted

shift (from goods to services) in the pattern of finaldemand.

We

may

thenattribute the actual

growth

of the services sector to a greater use ofindirect inputs to the productive process,and

explain the role ofinadequatemeasurement

in the post-1973 decline inAmerican

productivitygrowth.Our

next task therefore is toexamine

the nature of this indirect-service element-

to whichwe

shall applytheterm productdifferentiation

-

and toexplore its connection with information, recallingour earUer concern thatinformation technology has apparently

done

httle to restore America'seconomic

performance to its post-warheights.

^

Product Differentiation

and

VarietyIn

common

usage,productdifferentiation refers to any activity that serves to distinguish a product from othersin the

same

generalmarket.From

the producer's viewpomt. differentiationis desirable because itincreases the attractions of hisown

product relative to the offerings of competitors,and

so allows for a higher priceand

a widerprofit margin.The

discriminatingconsumer

alsogains however,in thatthe differentiated productismore

closely suited to the peculiarities of his situation or taste. In this context, then, it

seems

clear that the differentiation processisone which causesthe product to incorporate service' as a native characteristic: indeed, the productbecomes

more

ser\'iceable. being of greater utihty in relation to its final apphcation.Now

itisevident that certainformsofdifferentiationinvolve atangiblealteration to the product-

acarisclearly distinguished by the inclusion of a radio—

and

in these cases the fact of differentiation presents nountoward

difficulties in relation to output

measurement.

Again, certain other forms imply anintangible product change-

a carmay

be differentiated by its greater reliabiUty. forexample

-

but, as regards the accuracy of price deflation, thisproblem

has always existed (andmethods

of dealing with it have, if anything,improved

durmg

recent years).

However,

there is a further sort of differentiation that, while undoubtedly distinguishing theproduct

from

othersand

enhancing its general appeal, leaves ittruly unchanged.How

is it possible to create distinction without difference? It is best to illustrate this matter by referring to asimple example, taken

from

an advertisement publisheddurmg

September

1990 in a Minneapolis newspaper.The

advertisement, placed by a retailingcompany

operating a chainofdepartment

stores,promotes

the sale of the chain'sown

brand ofmen's shirts.A

particular feature of the advertisement is a small table (reproducedin Figure 1 below) that shows, for shirts keptin stock, the various combinations

(marked

by anV)

ofnecksizeand

sleeve length.The

purpose of the table is to advertise the width of the firm's product range (recently extended to fifty sizes),and

thus its ability to serve a verybroad

spectrum ofcustomers ('In yoiu" sizeand

49 others, too').general conditions of sale remain

quae

unchanged. Indeed, even for thosewho

(owine to their bodilv dimensions) were previouslybeyond

the boundaries of the market, the product has not altered, but merelybecome more

accessible. Yet it is undeniable that the fact of differentiation has created a real distinctionbetween

this retailerand

its competitors.The

questionwe

must

pose is, therefore,how

has thisbeen

achievedwhen

the product itself is no different?The

answer, of course, lies in the concept of product vanety-

the presence, within a general class of product, of multiple yet distinct variations that reflect differences inconsumer

characteristicsand

preferences.A

widervariety ofproduct implies that these differences

may

bemore

closelyaccommodated,

to the greatersatisfaction of thosewhose

individual needs or tastes are therebymore

precisely addressed. Since there is no essentialchangein the productitself, thereis

no

lossofvalue tothosebuyerswho

were

content with the original offering, for (ifnot inclined to adjust their purchasing habits) theymay

direct theircustom

much

asbefore.The

benefit of increased variety to the producer therefore, is that it serves to attractnew

customers without risking the desertion of the old..At this pomt,

we

should perhaps note that product varietyis amuch

broaderand

more

pervasivephenomenon

than our simple

example

may seem

tosuggest.The

general notion ofvarietyappliesnot onlyto sizesofproduct, but also to innumerable other features-

color, style, flavor, texture, shape, packaging, etc.-

as well as to the locationsand

times at which the product is sold. Furthermore, althoughwe

tend to think of variety in the context of current choice, itmay

also extend over time-

that is,where

multiple product variations (e.g., of fashionable clothing) are offered during a single season or year.Returning

now

to the question ofoutputmeasurement and

productivitygrowth, itseems

clear that the degreeof variety is an important, yet entirely indirect, aspect ofproduct value. .Any increase in the prevailing extent ofproduct varietywill therefore imply a general rise in the indirect service' element ofproduction, although a cursory examination of individual products

may

reveal little of the broader trend.As

a result, the process of price deflation will tend to discount theeconomic

contribution of greater varietyand

product choice,and

measures

of national outputwill be systematically understated-

aswill be the rate of productivity growth*. .Atthe

same

tune, asmore

resources are devoted to supplying the indirect services associated with amore

variedand complex

productive system, there will be a rise in thenumber

ofservice workers, without there being anymarked

alteration in the composition (goods versus services) of finaldemand.

Is our

argument

valid? Clearly this depends, directly,on

theanswer

to one central question: has there, during the past two decades,been

any unusual increase in the degree of product variety,and

if so,why?

Productdifferentiation is not a

new

phenomenon, and

outputmeasurement

has always sufferedfrom

its effects: rising levels ofvarietyhavebeen

common

formuch

ofthepresent century.Why

thenshouldthesecircumstances have changed, sosuddenly, after 1973?What

evidence is there that such a change actually occurred?These

questions willbe addressed in the following sections, in brief,we

shall propose that recent advances inour technologyofinformationprocessing,by significantlyreducing the informationcostsassociated with greater differentiation

and

product variety, have facilitated an extraordinary increase in the general diversity of oureconomic

output.We

shall then submit evidence to this effect,drawn from

the post-war experience of the United States. Finally,we

shallreview the hmitations of ouranalysis,and examine

the extent towhich, despite theshortcommgs

of currentmeasurement

procedures, the post- 1973 'productivityslowdown' remainsareal,and

profoundly disturbing,

phenomenon.

Production Costs

and

Information ProcessingIn our discussion thus far,

we

have concentrated on theproblem

ot product differentiationand

the difficultiesit creates in relation to the deflation of

economic

output.However,

we

have given rather less attenuon to thequestion of

how

greater differentiationand

variety affect production costs; to a large extent,we

have sunplyassumed

that indirect costswould

rise as resources are diverted to the provision of built-in' services. Yet forthis to occur across the entire spectrum of

economic

activity, itseems

reasonable to suppose that these costs have, forsome

reason,become

less in relation to the additional utilities that greater variety affords.Our

tasknow

isto explain the origin and nature ofthis change in production costs,and

todemonstrate its effectson

the workings ofoureconomic

system.Firstly, it is well

known

that formany

industrial firms, the cost per unit of production varies according to the scale of output: in general, as the scale increases,and

largervolumes

are produced, so the average cost of producingeach unit tendstofall. Thiscircumstance, oftendescribed bythe phraseeconomies

ofscale, suggests thatcompeting

firms will produce in the largestpossible quantities, inorder tominimizetheir overall unit costs. Indeed, themethod

of 'mass production' thatemerged from

the technical advances of the industrial revolutionwas

based, toa greatextent,on

thisvery principle.The

result, in termsofeconomic

organization, hasbeen

thedevelopment

of discrete industries, in which a few giant firmsdominate

the total process of productionand

distribution.Economies

ofscale are nothowever

the only force that determinesthe leveland

character of productive output.Although

costs might be lowerwhen

quantities are larger, so too is thenumber

ofdifferent products that can be produced, since each takes its share of a finite market. Thus, as the scale ofproduction increases, a point is reachedwhere

the advantage of lower cost is outweighed by thedemand

forsome

measure

of productdifferentiation

and

variety. Firmswill not, therefore, uicrease theiroutput tothe competitivemaximum,

butwillsettle at a smaller scale,

where

thedemand

for a differentiated product balances, through the higher price thatit

commands,

thesomewhat

higher unit costs that the firmmust

incur in its production.This state of balance will not

however

be of any great duration, since costsmay

be reduced still further by combining, within the boundaries of a unified enterprise, the production ofmany

individual fuTns.These

additional savings arise from the fact that differentiated products, although distinct, are also insome

degreerelated:

combined

production therefore allowsmany

of thecommon

expenses to be shared, so reducing the 'overhead' cost associated with each unit of output.These economies

of scope, so called, describe the costadvantages of multi-product operation,

when

compared

to a system in which differentiated production isundertaken by

many

single-product firms. Their consequence, clearly, is to reduce the cost penalty that is incurredwhen

economies

ofscale are sacrificed in the interests ofgreater differentiationand

variety.Now

it mightseem

that the benefits of scopeeconomies

would

encourage a great concentration ofeconomic

activity,

and

the elimination ofmany

smaller single-product firms:and

to aconsiderable e.xtent thishas in fact occurred, aswe

noted earher.However,

the process of concentration is carried only so far. because the advantage ofsharing productive resourcesamong

differentiatedoutputs isoffsetbyanother,vitalfactor:theneed

to process information.Whenever

resources,ofanydescription, aresharedamong

severaldifferent uses, itbecomes

necessaryto collect,store, transmit

and

in a general sense, process, information. Thisneed

arises because resources can be shared onlybydividing them,insome

fashion, into partsand

thenallocatingeach part to a particularuse. Information serves to maintain the associationbetween

partsand

uses-

an association that, being of a temporaryand

variable nature,makes

resource-sharing economically efficient.There

aremany

examples from

everydaylife thatillustratethefundamental connectionbetween

resource-sharingand

information processing. Library shelves aresharedamong

books, which in turn are sharedamong

readers:its catalogue

and

circulation records maintain ihe requisite links.A

telephone network is sharedamong

>ubscribers.and itsbillinginlormation

shows

the temporaryassociationsestablishedbv eachcall. In theextreme.a firm

may

be considered asnothingmore

than anelaborate resource-sharingmechanism,

itsaccounts retlectinghow

equity capital, borrowings and sales revenues havebeen

sharedamong

various productive uses.The

notion that inlormation processing andresource-sharing are inextricablyrelated leads naturally to a further consideration, that information processing is nothing other than the price that is paid for theimprovement

ineconomic

etficiency thatcomes

with thesharmg

of productive resources. It follows therefore that the e.xtent of such sharingwill be limitedby the cost ofthe associated information activity.Where

information processing isslow

and

costly, resources will be sharedamong

comparatively few uses; should these costs fall however,many

more

will find a place.If

we now

return to the question of the multi-product firm,and

its ability to achieveeconomies

of scope bycombining

the production of differentiated outputs, it will be clear that this ability is constrained by the information costs thataccompany

the combination process.Any

decline in the cost of information processing tends,therefore, toloosenthis constraint, leadingthe multi-product firmto an even broader scope of operation.Initially, this greater breadth

may

be reached by absorbing (viamerger

or acquisition) the activities ofsingle-product firms,or those of multi-product firms ofnarrower scope.

However,

ifinformationcostscontinuetofall,the opportunities tor absorption will quickly dimimsh,

and

the firm will e.xtend its scope through internal diversification(i.e., by introducmgnew

productsand

further variationsofestablished products).As

this process continues,and

asthe general turmoil ofcompetitionbecomes

more

pronounced, bothabsorption andextensionwill occur simultaneously, leading to (1) a concentration of productionwithin large multi-product firms^ (2) a rapid rise in the general level of product differentiation

and

variety.Here

then, in thisone

factor-

the cost of information processing-

itseems

we may

have found a key to the long-standing puzzle of declining productivity growth. Ifwe

canshow

(1) that information costs have indeedbeen

sharply reduced, (2) that this occurred during the years after 1973,and

(3) that the reduction has beenaccompanied

by an unusual increase in the e.xtent ofproductvariety, thenwe

shall have evidence that supports our contentionthatthe productivityslowdown'is, in part,attributable toarise in theproductionofindirect(and henceimmeasured)

serviceoutputs. Beforewe

undertake thisdemonstration however, it isnecessarytoexamine

why

and

how

information costsmay

have fallen during the period in question.Information Technology: Its

Development

and Economic

ImplicationsItis widely

known

that the post-waryears havebeen

atimeofdramatic progressinthetechnologyofinformation processing. Yet thedevelopment

of technologies for this general purposebegan

much

earUer ,and

some

remarkable inventionsbear testimonytothe fact: the telegraph (1837), the telephone(1876),wireless telegraphy

(1895), radio(VX)6)

and

television (1923).Although

all ofthese were in widespreaduse before themost

recentera.

and

thereforemay

appear to have little bearingon

theproblems

with whichwe

are directlyconcerned, inrealitythey have

been

an integral part of the general shifttoward

a service-intensiveeconomy.

For this reason,it is instructive tobegin by considering

how

theproblem

ofinformation processingwas

addressed inthese early systems.Firstly, an important characteristic shared by all the technologies

we

havementioned

was

the use ofelectricity tocommunicate

information. Thisrepresented a departurefrom

historical practice, since priortechmques

hadNote that concentration will be limited bythe extent ofscope economies, beyond which small single-product firmswill lend to

dominate economic activity.

relied

on

sight, hearing or on the transportation olsome

physical object (such as paper, amessenger

etc.).Although

electricalmethods overcame

these natural constraints,and

made

possible the rapid transmission ofinformation over great distances, the nature ot the

medium

tended to define theway

in which various types of informationwere

earned. Inthe case ol the telephone, radioand

television,mformation was

carriedinanalogue form,sincethecontinuouswaveforms

associated withsound and

visioncould be translateddirectly(by'analogy') into the electromagnetic waves used for electrical transmission. Telegraphy, however, required thecommunication

of discretesymbols (numbers,letters etc.) ratherthan continuouswaves: successive symbolswere therefore transmitted \n digital form, by varying the electromagneticwave

in ways that generated distinct and recognizable patterns.Although

the telegraph,and

hence digital transmission,was

the first technology of electrical communication, during the late nineteenthand

early twentieth centuries itwas

rapidly overtaken by analogue devices (the telephone,etc.). Nonetheless, itled tothedevelopment

ofsome

fundamentalideasconcerningefficientmethods

ofcommunication

using patterns, represented inmost

systems bysequencesofbinarydigits, orbits.The

notion thatinformation could be systematicallyencoded

in sequencesofsuch digits, while not ofanygreatsigmllcance tothe telegraphitself,didhowever

become

invaluable inthe conte.xtofanother invention,whose

operation relied entirelyupon

the concept ofdigital information.In itsoriginal form, the electronic

computer

-

as itsname

implies-

was

conceivedas amachine

forperforming mathematical computations. Its earliest applicationswere

of a purely numerical nature, uivolvingcomplex

calculationsrequiredformilitaryand

scientificpurposes.However,

thecomputer

soonbecame

ageneral-purpose device, capableofprocessinginformation in almost any form,owing

tothe purely digitalcharacter ofits design.Although

ostensibly functioning as an automatic calculator, in practice thecomputer

was

simply an elaboratecommunications

network, basedon

the digital coding technique used for the transmission of information byelectrical means.

Since its introduction (circa 1950), the technological

development and

universal diffusion of the electroniccomputer

have accelerated, asitwere

without pause.The economic

imphcationsofthisphenomenon,

however, cannot be appreciated until the nature of information in general,and

of digital information in particular, isproperly understood. It is not our purpose here to

meet

this requirement in full, but beforewe

proceed it willbe valuable to return briefly to ourdiscussion of information processing

and

resource sharing, in order to shedmore

Lighton

their underlying relationship.We

suggested earlier that resource sharing is achieved by division-

that is, by dividing the resource into parts(these being sub-divisions in space or time)

and

then associating each part withsome

determinate use. This association 'requiresan actofinformation, or a logicalcoupling(and,subsequently, decoupling)oftwoor

more

discrete entities.

To

achieve this, the entities (a part of a resource,and

its associated use)must

each be represented in logical form, asmust

be the nature of their association (e.g., its duration, cost or limitations).Each

logical form, in turn,must

be distinct (since the partsand

uses are discrete), leading ultimatelytothe idea that thee.xtent ofresource sharing will be limitedby (1) the supply ofdistinct logicalforms,and

(2) the costof theircouphng and

decoupling.The

importanceof the computer's digitalmodus

operandimay now

bemade

clear, since it is the essence of the digitalmethod

that information (such as discrete symbols) be represented by distinct logical forms - i.e., by sequences of binary digits that correspond to unique patterns of variation in the electromagnetic wave.Any

device, therefore, that facilitates the generation, storage, manipulation or transmission of these sequenceswillincrease the supply of logical forms,

and

likewise reduce the cost of coupling and decoupling. This willmake

possiblenot only

more

associationsbetween

more

entities,butalsomore

types ofassociation:resourcesmay

thus bemore

finely dividedamong

various uses,and

the divisionmay

itselftakemore

particular forms.The

processwill eventually lead to

more

extensive and intricate resource-sharing arrangements,and

so to an increasmelv elaborateand

complex

productive system"'.We

havenow

explamed.m

essence,why

and

how

thedevelopment

olthe electroniccomputer

hasbrought about a significant reduction in the cost of information processing, andwe

have linked this to our earlierargument

encompassing

resource-sharing,economies

of scope, product differentiation and variety. .A question remains, however, as towhy

the effects offalling information costs did notbecome

evidentduring the decadespreceding 1973-

atimewhen

productivitygrowthremained

strong,despite thegrowinguse ofcomputer

technology.How

canwe

account for this twenty-year delay.'Our

answer to this question requiressome

preliminary explanation of the history ofcomputer

design and manufacture ". Since thecomputer

was

conceived as a digital device, it reliedon electrical circuits to represent the various digits required for information encoding. In the very earliest machines, these circuits were constructed from electro-mechanical relays, but thesewere

soon replacedbyvacuum

tubes, which-

having nomoving

parts-

greatly increased the speedand

reliability of computation. After 1950 however,vacuum

tubes were themselves replaced by sohd-state transistors (miniature electricalcomponents

made

from silicon) whichwere

much

smallerand

lighter, and which could be manufactured in large batches (and hence atmuch

lowercost) by

means

of photolithography..As time progressed, the transistor's size

and

cost advantages allowedcomputer

design tobecome

increasingly sophisticated. Thistrendwas

retlected in the growing complexityof the underlying circuitry, which required the inter-connection of a risingnumber

of discrete electrical components. Eventually, the high cost ofassemblingcu^cuits containing hundreds of thousands of elements led to the invention (1959) of the integrated circuit

—

acomplete electrical circuit etched in a minute chip" of silicon.

During

the followingdecade,circuits constructed from individual transistorswere

steadily replacedby integrated circuits, asimproved

designand

manufacturing techniques enabled the integration of ever-greaternumbers

ofelements.Despite its very considerable benefits, the integrated circuit

was

subject to an important limitation, in that its functionswere

defmed

entirely by its physical structure. In consequence, eachnew

apphcation required the designand

manufacture ofa differentcircuit,implying low-volume productionmethods and

thusa relativelyhigh cost per circuit. .As the density of integrated circuits-

and hence their range of applications-

gradu2dly increased, so too did the difficulty of manufacturing a growing diversity of specialized circuits. Paradoxically, however, higher circuitdensitiesalsomade

possible the invention of the micro-processor,or'computer ona chip'- an integratedcircuitthat containedall the essentialsofa computer'scentral processingunit. Since the micro-processor could execute mslructions (by

mampulating

sequences of binarydigits), it could be manufactured enmasse

as a standard productand

then beprogrammed

to perform a varietyof specialized fimctions.Although the first micro-processor (the Intel 4<X)4)

was

introduced during 1971, its rangeand

capacitywere

sufficientonlyfor relativelyprimitiveappUcations.

Some

improvements were

evidentinitsimmediate

successor,the 8(X)8 (1972), but it

was

the 8080 model, introduced during 1973. that revealed the micro-processor's true potential. Usinga micro-processor asa central processingunit,the micro-computer—

smaller andlesspowerful than other computers, butmuch

lesscostly-

appeared during 1975and

grew

rapidly in numbers, allowingmuch

larger scales of production

and

somuch

lower unit costs. .At thesame

time, circuit densities continued to increase, providing greater speed, capacityand

functionahty.The

combined

effect of these two trends (largervolumes

and

higher densities)was

a steepand

sustained decline in overall information costs-

a decline that continues to the present day.Pulley6l Braunsiein i1984) provide an exampleofthisprocess.

Our accountisdrawn largely from Braun

&

Macdonald (19781. and Denouzos&

Moses(1979).Reflecting once

more

on

the question oteconomic

growth, itmay seem

almost mcredible that a minute device, smaller than a frngernail. could have initiated the chain of eventswe

havebeen

at pains to describe.However,

the true significance of the micro-processor lay not in its size, nor indeed in its actual function, but in itsdemonstration of the efficiency of the underlying fabrication process. Before the era of large-scale circuit integration,

computer

production required the manufacture and assembly ofmany

individualcomponents

(whether

vacuum

tubes, transistorsor integrated circuits);after 1970.methods

ofmass

production could be usedto produce multi-purpose components, suitable tor

many

applicationsand

formany

types ofcomputer

system. Thiswas

true not onlyforthe processingunitsusedin micro-computers,butformanv

other kinds ofcircuit(such as those used incomputer memories)

that reliedon

large-scale integration tecfiniques to achieve theeconomic

benefits ofmass

production.We

havenow

completed

our analysis of the computer's effecton

the cost of information processing, and have explained, by reviewing the computer's technological evolution,why

this effectbecame

noticeable after 1973, rather than before.By

so doing,we

have developed in full our explanation ofthe recent decline in America'srate of productivity growth, and of the

manner

in which this decline is associated with the growing use of informationtechnology. Furthermore,from

thegeneralityofour reasoningitis buta short steptoconclude that thesame

phenomenon

willbe found, not onlyin the United States, butin all nationsthat have taken advantage of thenew

technology. .At this stage, then, it remains but to beshown

that the record ofhistory supports our interpretation of the case, and that mattersdo

indeed stand aswe

have presented them.To

this purpose,we

shall

now

bring forward evidence that, while not constituting final proof, yet givessubstance to the logic ofour general argument.III.

WEIGHING THE

EVIDENCE:

THE

UNITED

STATES,

1950-

1989Although

we

have dealt with the subject atsome

length, our explanation of the "productivity paradox' is in factremarkablysimple.

We

propose that recent (post-1973) advances incomputer

technologyhave greatly reduced the cost of information processing, so providingeconomies

of scope that have stimulated greater productdifferentiation

and

variety. Sincevarietyand

choice areprovided as indirect services, theircontributiontooutputis discounted by current

methods

of price deflation, leading to a decline in themeasured

rate of productivity growth.This brief

summary

suggests that, ifwe

are to demonstrate the validity of our analysis,we

must

focus our attentionon

the behavior, pre- and post-1973, ofthree keyvariables: (1) the costof information processing, (2) thelevelofproductdifferentiation,and

(3)therate ofproductivitygrowth. Furthermore,we

shouldexpect these variables tobe inversely related, in that falling information costs should be followedby a rising level ofproductdifferentiation

and

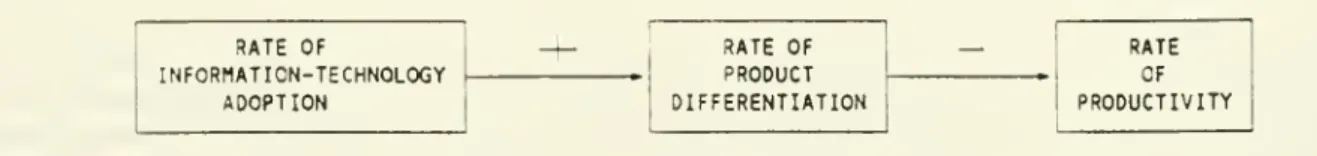

by a falling rate of productivity growth.The

diagramshown

in Figure 2 illustrates the essentials ofthis reasoning.COST OF INFORMATION PROCESSING LEVEL OF PRODUCT DIFFERENTIATION RATE OF PRODUCTIVITY 3R0UTH

Figure 2. LogicalVariables

and

RelationsAlthough

Figure 2 clearly represents the logical structure ofour argument, it is not ideally suited to empirical investigation,and

for this reason hasbeen

modified as follows. Firstly, the 'cost of information processing' isreplaced by the adoption of information technology', reflecting the supposition that the use of information technologywill rise tothe extent that it reduces information processing costs: the virtue ofthis exchange being

the

more

tangible nature ofthe variable. Secondly, in the interestsof consistency, eachvariable is expressedasa rate of change, causing the first variable to

become

the rate of information technology adoption',and

the second, the 'rate of product differentiation'. For a similar reason, the 'rate of productivity growth' (the proportional change in output per unit of input,from

one period to the ne.xt) is replaced by the rate of productivity' (the rate of output per unit of input, during a given period).The

result of these modifications isshown

in Figure 3 below. In brief, the figure suggests that anyincrease inthe rate of information-technology adoption will be

accompanied

by an increase ( + ) in the rate of productdifferentiation,

and

a correspondingfall (-) inthe rate ofproductivity. Furthermore, although this isnotshown

in the figure,we

should expect these changes to occur after 1973, rather than before.RATE OF INFORMATION-TECHNOLOGY ADOPTION RATE OF PRODUCT DIFFERENTIATION RATE OF PRODUCTIVITY

Figure 3. Empirical Variables

and

RelationsWe

shallnow

present, insummary

form, themethods

thatwere

usedto evaluate the system of relationsshown

The

Research Methodology

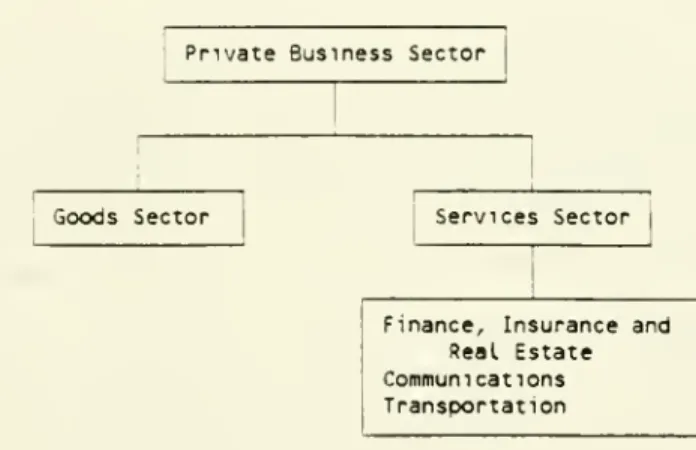

Firstly,the general approach was econometricin nature, involvingthe collection andanalysis of time-series data for eachofthe three variables, across slxsectors ofthe United States'

economy.

The

sectorswere

chosen from those definedby theBureau

ofEconomic

Analysis(BEA)

following the Standard Industrial Classification,and

used by the

Bureau

ofLabor

Statistics(BLS)

for the purposes of reporting national productivity statistics. In this scheme, the largesteconomic

aggregate is the pnvaie business sector(some

77%

of 1987 Gross National Product, orGNP),

this being in turn sub-divided into agoods-producingsector(21%

ofGNP)

and

aser\'ices-providing sector

(50%

ofGNP).

The

goods and

services sectors are themselves sub-divided into industries, butowing

to inconsistencies in the data sources, the analysis included only three industries (finance, insuranceand

real estate;communications:

transportation) within the services sector. Figure 4 illustrates the relationshipsbetween

the variouseconomic

sectors.Private Business Sector

Goods Sector Services Sector

Finance, Insurance and Real Estate Communications Transportation

Figure 4. Hierarchy of

Economic

SectorsWithin each of the six sectors, the data for each variable consisted of forty annual observations covering the period

from

1950 to 1989. For consistency,and

to eliminate the effects ofpopulation growth, changing habitsetc.. the di'/isor (hours at

work)

in the productivity variablewas

applied to each of the other two variables. Ineffect, therefore, for each sector the data set comprised

measures

of (1) the rate of information-technology adoption, (2) the rate ofproduct differentiation, (3) the rate of output,and

(4) hours at work.We

now

turnto the process of datacollection.The

data relating tothe rateofinformation-technology adoptionwere

takenfrom

theBEA

IndustryInvestmentData

Tape, a standardcomputer

tape that provides abreakdown

of the United States' capital investment by (1) industry of ownershipand

(2) type of capital. In the main, information-technology capital is classified either ascommunication

equipment' or as 'office,computing

and

accounting

machines

(OCAM),

but since the former type is concentrated in thecommunications

industryand

is used to provide aservice (e.g., telephony) toother adopting' industries, theanalysis included only the lattertype

(OCAM).

Regarding the use of the

OCAM

investment data,there are twodifficulties that deserve mention. Firstly, since the data are classified by industn,' of ownership, rather than bv industry of use.many

distortions have been introduced by the growing popularity ofcomputer

Icasmg (which mcreased. as a proportion of totaJcomputer

investment,from

less than 10<~?; in 1982 tomore

thanWr.

in 1989'^).Computer

leasing is acomplex

phenomenon,

andwe

found nomethod

of correctingthese distortions: notehowever

that the effects of leasing activityare significant only duringthe final years of the period,and

are lessmarked

at higher levels ofanalysis.Secondly, the

OCAM

data representmonetary

values, not physical quantities,and

are given in both historical (current) dollars and constant (1982base) dollars. At first glance it mightseem

preferable to use the constant-dollar series,whichremoves

the effectsofprice infiationand

hencereflectsthe 'true' levelofcapitalinvestment. In the case ofOCAM.

however, since 1985theBEA

has used an hedonic price index for deriving the constant-dollarestimates,and

the post-1982advances incomputer

technologyhave causedthese estimatestodiverge very widely from the current-dollarfigures. For example, in 1989.when

total current-dollarOCAM

investmentwas

S45 billion, the constant-dollar" equivalent

was

$125 billion. For this reason, the current-dollar series (with general inflation representing a nominal technical change'component) was

used to represent the rate of information-technology adoption.Our

secondvariable, the rate of product differentiation,was

represented by the annualnumber

ofapphcationsfor

trademark

registration submittedto the United States' Patent andTrademark

Office(PTO).

Although

not all forms of product differentiation are associated with formal trademarking, ameasure

of this nature doesencompass

those thatare ofamore

generaleconomic

significance.Trademarks

haveseveral furtheradvantages, since they are widely used to distinguish all kinds of goodsand

services, reflect actualcommercial and

tradingactivity,

and

have been(sincetheLanham

Actof1946) a standard,stable featureof theeconomic

system.Again

however, certain difficukies

were

evident,and

these meritsome

briefdiscussion.Firstly, there

were

two reasonswhy

trademark

applications, rather than registrations,were

usedtorepresent the differentiation variable: (1) there is a considerable delay-

asmuch

as four years-

between

the filing of atrademark

applicationand

itseventualregistration; (2) thenumber

oftrademarksregisteredinanyyeardepends

very largelyon

thePTO's

budgetaryand

staffing position, which fluctuates according to the level of funding provided by the federal government. Secondly, although data relating to themore

recent years of our study period (1975and

later) couldbe obtained directlyfrom

thef^O,

forthe earlieryears itwas

necessarytoderive supplementarydatafrom The Trademark

Registerofthe UnitedStates. Thirdly,we

should note that the 1946Act requiredmarks

tobe used incommerce'

beforean applicationforregistrauonwould

be considered bythePTO;

from 16th

November,

1989theTrademark

Revision Actof 1988 allowed theFTO

to accept applicationswhere

onlyan'intent to use' isexpressed(resultinginasurge of applicationsand

hence a shghtupward

bias inourdata for 1989).Data

relating to the rateof productivity (the thirdvariable in theschema shown

in Figure 3) were derivedfrom

the standardBLS

estimates, whichare basedon

theBEA's

analysis ofGNP

by 2-digitSIC

industry.Note

that theBLS

provides estimates ofboth outputand

(independently,from

itsown

sources) hours at work. Itshouldalso be noted that, since

government

activitieswere

excludedfrom

the other datasets (i.e.from

those relatingto information-technology adoption

and

product differentiation), the outputand

hours of fee-for-servicegovernment

enterpriseswere

subtractedfrom

the corresponding (outputand

hours) figures for the private business'and

'services-providing' sectors."TTiese liguresarcdenved fromsurveysconducted bythe Computer Dealersandlessors.Association. Inc.

Data

Analysisand

ResultsAftercollection, the datawere analy7ed both graphicallyandstatistically. In the interestsofbrevity, and because the analysis revealed verysimilar patterns in eachof the

economic

sectors, only themost

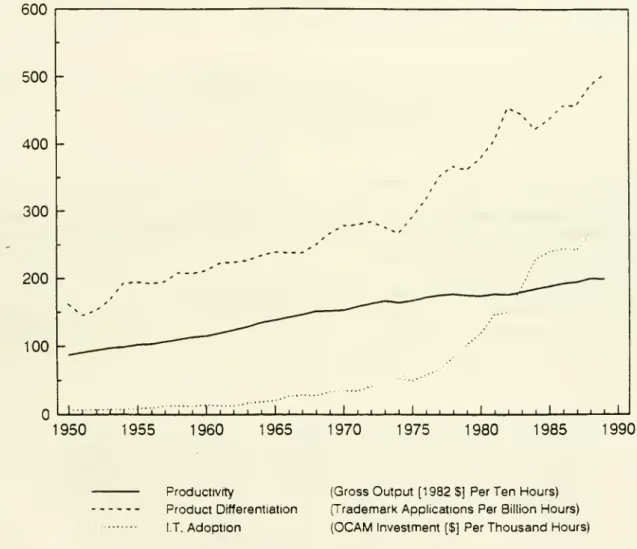

general results (those for theprivate business sector) will be presented here.To

this end. Figure 5 shows, for the private business sector, the forty-year trends (scale-adjusted) in each of the three variables.600

500

-400

300

200

100

I ^••^^^^•'^rrr

7

i i i I t 1 ' ' ' '1950

1955

1960

1965

1970

1975

1980

1985

1990

Productivity (GrossOutput [1982$] PerTen Hours) ProductDifferentiation fTrademarkApplicationsPer BillionHours)

I.T.Adoption

(OCAM

Investment[$] PerThousand

Hours)Figure 5. Information Technology, Product Differentiation

and

Productivity: Private Business Sector, 1950-

1989ReferringtoFigure5, the interactions

between

the three time-seriesreflect, veryclosely, theset of relationships impliedbytheschema

ofFigure3.Taken

broadly, the periodbetween

1950and

1973isone

of rapid productivity growth,accompamed

by relatively slowgrowth

in product differentiationand

information-technology adoption. After 1973 however, the situation is completely reversed, there being clear evidence of slowing productivity growthand

asudden

acceleration in both information-technology adoptionand

product differentiation.The

statistical significance of the trends shov,n in Figure 5was

tested by estimating the parameters of thefoUowine econometric model;

D, (1)

(2)

where

a and (i represent the structural parameters of the model. Iyear

-

1950) and:0, 1, 2 40 (i.e.. r

=

calendarD.

'nt

rate of product differentiation in yearf

rate ofinformation-technology adoption in year I rate of productivity in year t

random

error in year f (:i=

1, 2).In equation (1), the rate ofproduct differentiationD, is represented as a linearfimction of timef

and

the rateof information-technology adoption /, with a

random

errorcomponent

U][ . In equation (2), the rate ofproductivityP, is likewise a linear function oftimet

and

the rate ofproduct differentiationD, .The

time trendf serves to

remove

the effect of anycommon

upward

drift over time,and

thus concentrates the analysison

differential fluctuations

aroimd

a linear trend.The

estimation procedurewas

basedon

the two-stage least-squares regression technique, the two equations inthe

model

being subject to joint estimation.To

counter the effects of autocorrelation, each of thedependent

variables D^and

/',was

specified as asecond-order autoregressive process.The

results areshown

in Figure b.The

resultsshown

in Figureftclearlysupportthe implications derivedfrom thegraphicalanalysis.The

estunates ofparameter a-^ indicate asignificantly positive relationshipbetween

the rateofinformation-technology adoption and the rate of product differentiation: likewise, the estimates of parameter /?•, indicate a significantly negativerelationship

between

the rate ofproductdifferentiationand

the rate of productivity.However,

these are general relationships that hold over the wholestudy period; in order to evaluate the significance ofchangesbetween

the pre- 1973 and post-1973 periods, the analysiswas

refined by specifying an inter-period model:D,

p^ ^

P.t

-P^D^

^ p^ (D,-

0,3) X^ ^«„

(3)

(4)

The

notation in these modified equations is thesame

as that in equations (1)and

(2) above, except that;23

D

23rate of information-technology adoption in year 23 (1973) rate ofproduct differentiation in year 23 (1973)

1 iff

>

23otherwise.

The

dummy

variable X^serves to separate the differential effect ofthe rate ofinformation-technology adoption/,

on

the rate ofproduct differentiation D, into two separate components: a first-periodcomponent,

0:3and

a second-periodcomponent

(a-^ + a^).The

parameter a^ therefore represents thechangeinthe differential effectbetween

the firstand

second periods. Likewise, the parameter P^ represents the inter-period change in the differential effect of the rate of product differentiation D^ on the rate of productivity/', .Note

that in otherrespects, the analytical structure

and

estimation procedurewere

thesame

for both the full-periodand

inter-period models.

The

estimates of the parameters of the inter-periodmodel

areshown

in Figure 7.The

resultsshown

in Figure 7 revealno

significant post-1973 change (a^), in the relationshipbetween

the rateof information-technology adoption

and

the rate of product differentiation: this is entirely consistent svith our theoretical position, which suggests a constant positive associationbetween

these two variables.On

the other hand, after 1973 there isclearly a significant negative change (fi^) inthe relationshipbetween

the rateof productdifferentiation

and

the rate of productivity, implying that the generally negative associationbetween

these variables, although of no significance (/?•,) during the earlyyears(when

the rate ofdifferentiationwas

probably too low to have any noticeable affect on productivity growih), suddenly intensified after 1973, supporting ourargument

that the productivityslowdown

ofthe pasttwo decades isdue toan unusual accelerationm

the degree of product differentiation and variety.rv.

CONCLUSION

Taken

as a whole, the empirical evidence lendssome

plausibility to our interpretation of America's recenteconomic

history,and

to our assertion that the post-1973decline in productivitygrowthmay

be traced to a rise in the productionofindirect (andthusunmeasured)

service outputs.We

should notehowever

thatourempiricaJ analysis does not indicatehow

much

of the total declinemay

be attributedto this change in the composition of the national product:we

have merelydemonstrated

thatsome

influenceseems

tobe present. Clearly, amore

conclusive analysis

would

require the inclusion of other variables (such as energy prices, labor qualityetc.) thathave also taken their toll.

.Although the scope ofour investigation is thus

somewhat

narrow and open

toquestion,we

would

propose that amore

important issueis itsmeaning and economic

implications. In our originaldiscussion ofthe problem,we

suggested that the decelerating growth rate reflects an underlying weakness,

and

is not solely the product of inadequatemeasurement and

statistical oversight. Yet, tothis point,we

have argued that slower productivitygrowth

is indeed the consequence of a failure to account for the intangible benefits of greater varietyand

freedom

of choice.What

thenis the nature ofthis underlying weakness', andhow

is it relatedto the hypothesis that ourmeasurement

procedures ignore the contribution of indirect services ?The

answer tothis question is that indirect servicesmay

be providedwith greater or lesser efficiency,and

that theAmerican economic

system is comparatively ill-suited to thisnew

form

of productive endeavor. It is thiscircumstance that explainswhy, quiteapart

from

anyhistoncalchanges inits productivityrecord(with whichwe

have thus far

been

concerned), the United States'economic

performance has notmatched

that of its international rivals, even during the pre-1973penod

of 'rapid' productivity growth^'*. In this respect, the 'productivity slowdown' of the pasttwo

decades represents, not merely an accounting failure, but a real deterioration in long-run productive efficiency.The

basis of thisominous

claim,and

its implications foreconomic

policy, will be the subject ot future work. Clearly, there can beno

retreatfrom

the 'information society'and

its technologicalmethods

of production: our questmust

betounderstandhow

thesemethods

might havealtered ourcanon

ofeconomic

efficiency.A

revision ofsuch preceptsmay

entail a transition tonew

forms of enterprise, tonew

waysof orgemizingeconomic

activity,and

perhaps tonew

public institutions-

better suited,we

may

hope, to the challenges of thecoming

century.' Baumol. Blackman

&

Wolff(1989,p.88) illustratethemagnitudeofthis shortfalldunngthepenod 1950- 1979.