II I

III

1 1 II II I 1 13

9080

02617 9306

W: , iwiiiM\'-wx\\y,HB31

.M415

no.

04-26

2006b

li

If"

Digitized

by

the

Internet

Archive

in

2011

with

funding

from

Boston

Library

Consortium

Member

Libraries

,

UfcWt

HB31

.M415

Ac.04-Massachusetts

Institute

of

Technology

Department

of

Economics

Working

Paper

Series

The

Economic

Impacts

of

Climate

Change:

Evidence

from

Agricultural

Profits

and

Random

Fluctuations

in

Weather

Olivier

Deschenes

Michael

Greenstone

Working

Paper

04-26

July

2004

Revised:

January

2006

Revised:

August

2006

Room

E52-251

50

Memorial

Drive

Cambridge,

MA

02142

This

paper

can

be

downloaded

without

charge from

the SocialScience

Research

Network

Paper

Collection atMASSACHUSETTS

INSTITUTEOF

TECHNOLOGY

The

Economic

Impacts

ofClimate

Change:

Evidence

from

Agricultural

Profitsand

Random

Fluctuations

inWeather*

Olivier

Deschenes

University

of

California,Santa

Barbara

Michael

Greenstone

MIT

and

NBER

Previous

Version:January

2006

This

Version:August

2006

We

thank

the lateDavid

Bradford

for initiating aconversation

thatmotivated

this paper.Our

admiration

forDavid's

brilliance asan economist

was

only

exceeded

by

our

admiration

forhim

as a

human

being.We

are grateful for the especially valuable criticismsfrom

David Card and

two

anonymous

referees.Orley

Ashenfelter,Doug

Bernheim,

Hoyt

Bleakley,Tim

Conley,

Tony

Fisher,

Victor

Fuchs,

Larry

Goulder,

Michael

Hanemann,

BarrettKirwan,

Charlie Kolstad,Enrico

Moretti,Marc

Nerlove,

Jesse Rothstein,and

Wolfram

Schlenker provided

insightfulcomments.

We

are also grateful forcomments

from

seminar

participants atCornell,Maryland,

Princeton, University

of

Illinois atUrbana-Champaign,

Stanford, Yale, theNBER

Environmental

Economics

Summer

Institute,and

the"Conference

on

Spatialand

Social Interactions inEconomics"

at the Universityof

California-Santa Barbara.Anand

Dash,

ElizabethGreenwood,

Ben

Hansen,

BarrettKirwan,

Nick

Nagle,

and

William

Young

provided

outstanding researchassistance.

We

areindebted

toShawn

Bucholtz

at theUnited

StatesDepartment

of

Agriculturefor

generously

generatingweather

data for this analysisfrom

theParameter-elevation

Regressions

on

Independent Slopes

Model.

Finally,we

acknowledge

The

Vegetation/Ecosystem

Modeling and

Analysis

Projectand

theAtmosphere

Section,National

Center

forAtmospheric

Research

foraccess to the TransientClimate

database,which

we

used

to obtain regional climatechange

predictions.Greenstone

acknowledges

generous

funding

from

theAmerican

Bar

Foundation,

theCenter

forEnergy and

Environmental

PolicyResearch

atMIT,

and

theCenter

for

Labor

Economics

atBerkeley

for hospitalityand

supportwhile

working on

this paper.Deschenes

thanks

theUCSB

Academic

Senate

for financialsupport

and

the Industrial Relations Section atPrinceton University for their hospitalityand

supportwhile

working on

this paper.The

Economic

Impacts

ofClimate

Change:

Evidence

from

Agricultural

Output and

Random

Fluctuations

inWeather

ABSTRACT

This paper measures the

economic

impact ofclimatechange

on

US

agricultural landby

estimating theeffect ofthe

presumably

random

year-to-year variation in temperature and precipitationon

agriculturalprofits.

Using

long-run climatechange

predictionsfrom

theHadley

2Model,

the preferred estimates indicate that climate change will lead to a $1.3 billion (2002$) or4.0%

increase in annual profits.The

95%

confidence interval rangesfrom

-$0.5 billion to $3.1 billionand

the impact is robust to awide

variety ofspecification checks, so large negative or positive effects are unlikely. There is considerable heterogeneityinthe effectacross the country withCalifornia'spredictedimpact equalto-$0.75 billion (or

nearly

15%

ofstate agricultural profits). Further, the analysis indicates that the predicted increases intemperature

and

precipitation will have virtuallyno

effect on yieldsamong

themost

important crops,which

suggest that the small effect on profits are not due to short-run price increases.The

paper alsoimplements

the hedonic approach that is predominant in the previous literature and finds that itmay

beunreliable, because it produces estimates ofthe effect ofclimate change that are extremely sensitive to

seemingly

minor

decisions about the appropriate control variables, sample and weighting. Overall, the findings contradict the popularview

that climatechange

will have substantial negative welfare consequences fortheUS

agricultural sector.Olivier

Deschenes

Department

of

Economics

2127 North

HallUniversity

of

CaliforniaSanta

Barbara,C

A

93

106-92

1 email: olivier(5)econ.ucsb.edu

Michael

Greenstone

MIT,

Department

of

Economics

50

Memorial

Drive,E52-391B

Cambridge,

MA

02142

and

NBER

Introduction

There is a

growing

consensus that emissions of greenhouse gases due tohuman

activity will lead to higher temperatures and increased precipitation. It is thought thatthese changes in climate will impacteconomic

well-being. Since temperature and precipitation are direct inputs in agricultural production,many

believe that the largest effects will be in this sector. Previous research on climatechange

is inconclusive about the signand magnitude

of its effect on the value ofUS

agricultural land (see, forexample,

Adams

1989;Mendelsohn

et. al 1994and

1999; Kelly, Kolstad,and

Mitchell 2005; Schlenker,Hanemann,

and

Fisher (henceforth,SHF)

2005,2006).Most

priorresearchemploys

either the production function or hedonic approach to estimate the effect of climate change.'Due

to its experimental design, the production function approach providesestimates of the effect of weather

on

the yields of specific crops that arepurged

of bias due to determinantsofagricultural outputthat arebeyond

farmers' control(e.g.,soilquality). Itsdisadvantageisthat these estimates do not account forthe full range of

compensatory

responses to changes in weathermade

by

profitmaximizing

farmers. Forexample

in response to a change in climate, farmersmay

alter theiruseoffertilizers,change

theirmix

ofcrops,oreven decide touse theirfarmlandforanotheractivity(e.g.,ahousing complex). Since farmeradaptations arecompletelyconstrainedin theproduction function

approach,itis likely toproduceestimatesofclimate

change

thatarebiaseddownwards.

The

hedonic approach attemptstomeasure

directly the effect ofclimateon

land values. Its clear advantage isthatifland marketsare operating properly, prices will reflectthepresentdiscounted value ofland rents into the infinite future. In principle, this approach accounts for the full range of farmer

adaptations.

However,

its validity rests on the consistent estimation of the effect of climate on land values. Since at least the classicHoch

(1958and

1962) andMundlak

(1961) papers, it hasbeen

recognized that

unmeasured

characteristics(e.g., soilqualityandthe optionvaluetoconvertto anew

use) are important determinants ofoutput and land valuesin agricultural settings." Consequently, the hedonic approachmay

confound

climate with other factorsand

the sign andmagnitude

ofthe resulting omittedvariables biasis

unknown.

In light ofthe importance ofthe question, this paper proposes a

new

strategy to estimate theimpact of climate

change

on the agricultural sector.The

most

well respected climatechange

models

predict that temperatures

and

precipitation will increase in the future. This paper's idea is simple—

we

exploit the

presumably

random

year-to-year variation intemperature andprecipitationto estimatewhether1

Throughout "weather" refers to temperature and precipitation at a given time and place. "Climate" or "climate

normals"refers to a location'sweather averaged over longperiodsoftime. 2

Mundlak focused on heterogeneity in the skills offanners, but in Mundlak (2001), hewrites, "Other sources of

agricultural profits are higherorlower inyears thatare

warmer

and

wetter. Specifically,we

estimatethe impacts of temperatureand

precipitation on agricultural profitsand

then multiplythem by

the predictedchange

in climatetoinfertheeconomic

impactofclimatechange

in thissector.To

conducttheanalysis,we

compiledthemost

detailedand comprehensive

dataavailabletoform

a county-level panelon agricultural profitsandproduction, soilquality, climate

and

weather.These

dataare used to estimate the effect of weather on agricultural profits

and

yields, conditionalon

county and stateby

year fixed effects. Thus, the weather parameters are identifiedfrom

the county-specific deviations in weather aboutthe county averages afteradjustment forshockscommon

to allcounties in astate. Put another

way,

the estimates are identifiedfrom

comparisons ofcounties within thesame

state thathad

positive weather shocks with ones thathad

negative weather shocks, after accounting for their averageweatherrealization.Thisvariation is

presumed

to be orthogonaltounobserved determinants ofagricultural profits, soitoffersa possible solution to theomitted variables bias

problems

thatplague the hedonic approach.The

approach's primary limitation is that farmers cannot

implement

the full range ofadaptations in response to a single year's weatherrealization. Consequently, its estimatesmay

overstate thedamage

associatedwith climate

change

or, putanotherway, bedownward

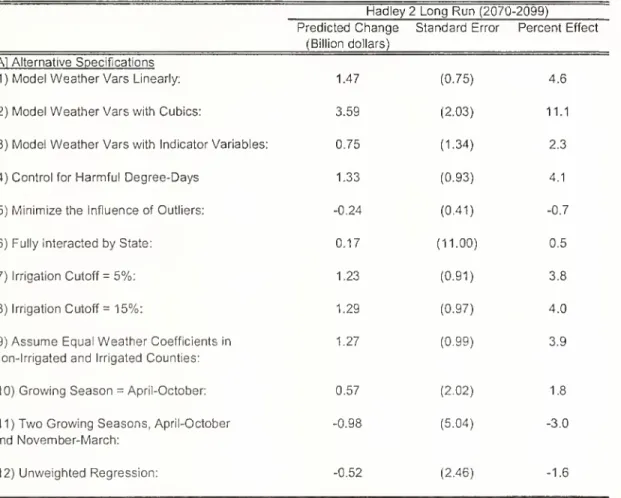

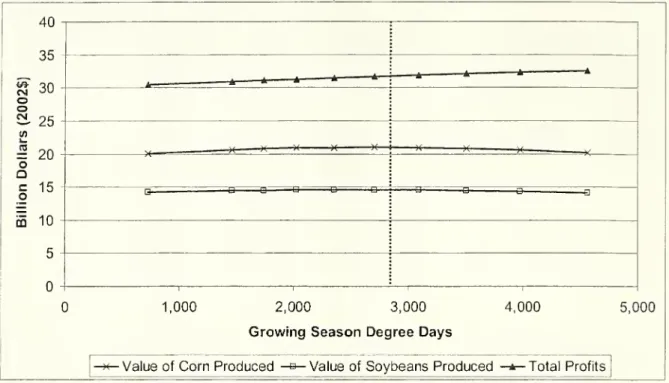

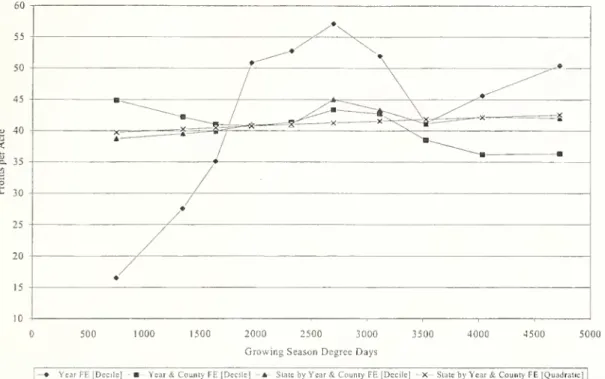

biased.Figures

1A

and

IB

summarize

the paper's primary findings.These

figuresshow

the fittedquadratic relationships

between

aggregate agricultural profits,the value ofthe corn harvest,andthe value of the soybean harvest withgrowing

season degree-days (1A)and

total precipitation (IB). (Thesemeasures

of temperatureand

precipitation are the standard in theagronomy

literature.)The

key featuresoftheseestimates are that they areconditioned

on

county fixedeffects, so the relationships are identifiedfrom

thepresumably

random

variation in weatheracross years within a county.The

estimating equationsalso include state

by

year fixedeffects.The

vertical linescorrespond tothe national averagesofgrowing

season degree-daysandprecipitation.

The

average county ispredictedtohave

increasesof roughly 1,200degree-days

and

3.0inches duringthegrowing

seasonThe

striking finding is that all ofthe response surfaces are flat over the ranges ofthe predictedchanges in degree-days

and

inches. If anything, climate change appears to be slightly beneficial for profitsandyields. This qualitativefindingholdsthroughoutthebatteryoftestspresented below.Using

long-run climatechange

predictionsfrom

theHadley

2Model,

the preferred estimates indicate that climatechange

will lead to a $1.3 billion (2002$) or4.0%

increase in annual agriculturalsectorprofits.

The

95%

confidence intervalrangesfrom

-$0.5 billion to $3.1 billion so large negative or positive effects are unlikely.The

basic finding of an economically andstatistically small effect is robustto a

wide

variety of specification checks including adjustment for the rich set of available controls,and implementing a procedure that

minimizes

the influence of outliers. Additionally, the analysis indicates that the predicted increases in temperature and precipitation will have virtuallyno

effect onyields

among

themost

important crops (i.e., corn for grain and soybeans).These

crop yield findingssuggestthatthesmall effectonprofits isnotduetoshort-run price increases.

Although

the overall effect is small, there is considerable heterogeneity across the country.The

most

striking finding isthat Californiawill be substantiallyharmed by

climatechange. Its predicted loss in agricultural profits is$750

million,and

this is nearly15%

of current annual profits in California.Nebraska

(-$670 million), North Carolina (-$650 million) are also predicted to havebig losses, while thetwo

biggestwinners are SouthDakota

($720million) and Georgia ($540million). It is importantto notethatthese state-level estimatesare

demanding

ofthe dataandtherefore lessprecisethanis ideal.The

paper also re-examines the hedonic approach that is predominant in the previous literature.We

find that estimates ofthe effect ofthebenchmark

doubling of greenhouse gasses on the value of agricultural land rangefrom

-$200 billion (2002$) to$320

billion (or-18%

to29%), which

is an even wider range than has been noted in the previous literature. This variation in predicted impacts resultsfrom

seeminglyminor

decisionsabout the appropriate control variables, sample,and

weighting. Despiteitstheoreticalappeal,

we

conclude thatthe hedonicmethod

may

beunreliable in this setting.3The

paper proceeds as follows. Section I provides the conceptualframework

for our approach.Section II describes the data sources

and

providessummary

statistics. Section III presents theeconometric approach and Section

IV

describes the results. SectionV

assesses themagnitude

of ourestimates ofthe effect ofclimate

change

and

discusses anumber

of important caveats to the analysis.Section

VI

concludes thepaper.I.

Conceptual

Framework

A.

A

New

Approach

to ValuingClimateChange

In this paper

we

propose anew

strategy to estimate the effects ofclimate change.We

use a county-levelpaneldatafile constructedfrom

the Censuses ofAgricultureto estimatethe effectof weather on agricultural profits, conditional on county and stateby

year fixed effects. Thus, the weather parameters are identifiedfrom

the county-specific deviations in weather about the county averages after adjustment forshockscommon

to all counties in a state. This variation ispresumed

tobe orthogonal tounobserved determinants ofagricultural profits, so it offers a possible solution to the omitted variables bias

problems

thatappeartoplaguethehedonic approach.3

Recent research demonstrates thatcross-sectional hedonic equations appear misspecified in a variety ofcontexts

This approach differs

from

the hedonicone

in afew key

ways. First, under an additive separability assumption, its estimated parameters are purged of the influence of allunobserved

timeinvariant factors. Second, it is not feasible to use land values as the dependent variable oncethe county

fixed effects are included. This is because land values reflect long run averages of weather, not annual

deviations

from

theseaverages,and

there isno timevariationinsuchvariables.Third, although the dependent variable is not land values, our approach can be used to

approximatethe effectofclimate

change on

agricultural land values. Specifically,we

estimatehow

farm profitsareaffectedby

increases intemperatureand

precipitation.We

then multiplytheseestimatesby

the predictedchanges inclimateto inferthe impact onprofits. Since thevalue ofland is equal tothe presentdiscounted stream ofrental rates, it is straightforward to calculate the

change

in land valueswhen

we

assume

thepredictedchange

inprofits ispermanent and

make

an assumption aboutthediscountrate.B.

The

Economics of Using Annual

Variation inWeather

toInfer theImpactsof

ClimateChange

There are

two economic

issues that couldundermine

the validity of using the relationshipbetween

short run variation in weatherand

farm profits to infer the effects ofclimate change.The

firstissue is that shortrunvariation in weather

may

leadto temporary changes in prices thatobscure the true long-run impact of climate change.To

see this, consider the following simplified expression for theprofits ofarepresentative fannerthat is producing agiven crop andis unable to switch crops in response to shortrun variationin weather:

(1

)

n

=

p(q(w))q(w)-

c(q(w)),where

p, q,andc,denoteprices,quantities,and

costs, respectively. Pricesand

totalcostsare afunction of quantities. Importantly, quantities are a function of weather, w, because precipitation and temperature directly affect yields.Since climate

change

is apermanent

phenomenon,

we

would

like to isolatethe longrunchange

in profits. Considerhow

the representativeproducer'sprofitsrespond toachange

in weather:(2)

dn

Idw

=

(dpIdq) (dqIdw)

q+

(p-

5c/dq)(Sq/dw).The

first term is thechange

in prices due to the weather shock (through weather's effecton

quantities) multiplied

by

the initial level ofquantities.When

thechange

in weather affects output, thefirstterm is likely to differ inthe short

and

longruns. Consider aweathershock thatreduces output(e.g., (i.e.,dq

Idw

<

0). In the short run supply is likely to be inelasticdue

to the lagbetween

planting andharvests, so (dp I 3q)short Run

<

0. This increase in prices helps to mitigate the representative farmer's lossesdue

tothe lowerproduction.However,

the supply ofagriculturalgoods

ismore

elastic in the longrun as other farmers (or

even

new

fanners) will respond to the pricechange

by

increasing output.Consequently, itis sensible to

assume

that(dp I <3q)Lonto-zero.

The

result isthat thefirsttermmay

bepositiveintheshortrun but small, or zerointhelongrun.The

second term in equation (2) is the differencebetween

price and marginal cost multiplied bythe

change

inquantities duetothechange

inweather. Thistermmeasuresthechange

inprofitsdue

totheweather-induced

change

in quantities. It is the longrun effect ofclimatechange

on

agricultural profits(holding constantcrop choice),andthis isthetermthat

we

would

like to isolate.Although

our empirical approach relieson

short run variation in weather, there are severalreasonsthat it

may

bereasonabletoassume

thatourestimates are largelypurged

ofthe influence ofpricechanges (i.e., the first term in equation (2)).

Most

importantly,we

find that the predicted changes inclimate will

have

a statistically and economically small effecton crop yields(i.e., quantities) ofthemost

important crops. This finding

undermines

much

ofthe basisforconcerns about shortrun price changes.Further the preferred econometric

model

includes a full set of stateby

year interactions, so itnon-parametrically adjusts forall factors that are

common

across counties within astateby

year, such ascropprice levels.

4

Thus, the estimates will not be influenced

by

changes in state-level agricultural prices. Interestingly,thequalitative results aresimilarwhetherwe

control foryearorstateby

yearfixed effects.5The

second potential threat to the validity of ourapproach is that fanners cannot undertake thefull range of adaptations in response to a singe year's weather realization. Specifically,

permanent

climate

change

might causethem

to alter the activities they conduct on their land. For example, theymight switch crops becauseprofits

would

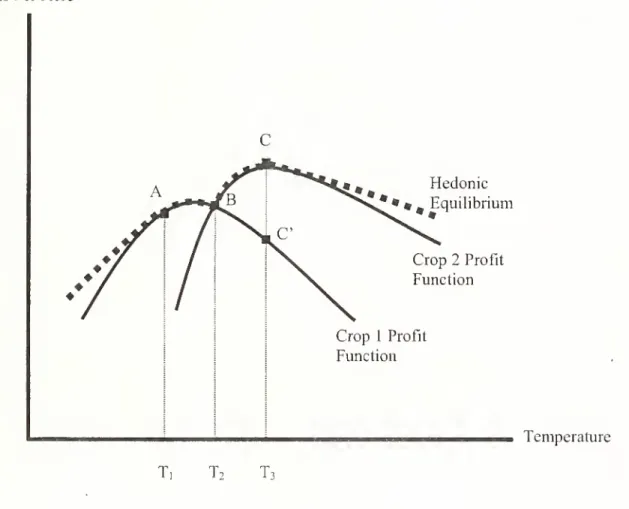

behigherwith analternativecrop.Figure 2 illustrates this issue. Profitsper acre are

on

the y-axis and temperature is on thex-axis. Forsimplicity,we

assume

that the influence ofprecipitation andall otherexogenous

determinants (e.g., soil quality)ofprofitsperacrehave been successfully controlled oradjusted for.The

Crop

1and

Crop

2 Profit Functions reveal the relationshipbetween

profits per acre and temperaturewhen

these crops are chosen. It is evident that crop-specific profits vary with temperatures. Further, the profit-maximizing crop varies with temperature. For example,Crop

1maximizes

profitsbetween

T)and

Ti,Crops

1and

2produce identical profits at Ti

where

the profit functions cross (i.e., point B), andCrop

2 is optimal attemperatures

between

T

2andT

3.The

hedonic equilibrium is denoted as the broken line and it represents the equilibrium4

If production in individual counties affects the overall price level, which would be the case ifa few counties

determine crop prices, or there are segmented local (i.e., geographic units smaller than states) markets for

agricultural outputs,then thisidentificationstrategywill notholdprices constant. Production ofthemostimportant

crops isnotconcentratedina small

number

ofcounties,sowe

thinkthisisunlikely. For example,McLean

County,Illinois and

Whitman

County,Washington are the largest producersof cornand wheat, respectively, but they only accountfor0.58%

and 1.39%oftotalproduction ofthese cropsintheUS.5

We

explored whether itwaspossible to directlycontrolfor local prices. TheUSDA

maintainsdatafiles oncropprices at the state-level, but unfortunately these data files frequently have missing values and limited geographic

coverage. Moreover,thestatebyyear fixedeffectsprovideamoreflexible

way

tocontrolfor state-levelvariationin price,becausethey controlforallunobservedfactors thatvaryatthestatebyyearlevel.relationship

between

temperature andprofits. Inthe longrunwhen

farmers can freelyswitchcrops, they will choose to operate along the hedonic equilibrium because it reveals the crop choices thatmaximize

their profits. It is

formed

by

the regions of each crop's profit functionwhere

that crop produces the highestprofitsoverallpotential usesofthatland.Consider a

permanent

increase in temperaturefrom

T) toT

3. If farmers are able to switchproduction

from

crop 1 to crop 2, then their profits can be read off the y-axis at point C.However,

farmersthatare unabletoswitch crops willearn profitsof

C.

Thus, the long-runchange

inprofits isC

-A,

but in the short run the difference isC

-

A,which

is adownward

biased estimate ofthe long-run effect. Itisnoteworthythat ifthenew

temperatureis>

T| and<

T

2,then the farmer's short-runand

long-runprofitsareequal becausethe hedonic equilibriumandthecrop 1 profitfunction areidentical.

This paper's empirical strategy relies

on

year-to-year variation in weatherand

thus it is unlikelythat farmers are able to switch crops

upon

a year's weather realization.The

import forthe subsequentanalysis is that our estimates ofthe impact ofclimate

change

may

bedownward

biased, relative to the preferred long-run effect that allows for alleconomic

substitutions. Ifthe degree ofclimatechange

is "small," however, our estimates are equal to the preferred long-run effect.One

final note is that in response to year-to-year fluctuations, farmers are able to adjust theirmix

ofinputs (e.g., fertilizerand

irrigatedwaterusage), so thesubsequent estimates are preferableto productionfunction estimates that

do

notallowforanyadaptation.

II.

Data

Sources

and

Summary

StatisticsTo

implement

the analysis,we

collected themost

detailedand comprehensive

data availableon

agriculturalproduction, temperature, precipitation, andsoilquality. This section describes these data

and

reports

some

summary

statistics.A.

Data

SourcesAgriculturalProduction.

The

dataon

agricultural productioncome

from

the 1978, 1982, 1987,1992, 1997,

and

2002 Censuses

of Agriculture.The

operators of all farms and ranchesfrom which

$1,000 or

more

ofagricultural products areproduced and

sold,ornormallywould

havebeen

sold, duringthe census year are required to respond to thecensus forms. For confidentialityreasons, counties are the

finestgeographicunitof observation inthesedata.

In

much

of the subsequent regression analysis, county-level agricultural profits per acre of farmland is the dependent variable.The

numerator is constructed as the differencebetween

the market value of agricultural products sold and total production expenses across all farms in a county.The

2002-dataarethebasisforthe analysis.

The

denominatorincludes acresdevotedtocrops, pasture,and

grazing.The

revenuescomponent

measuresthe grossmarket value before taxes ofall agriculturalproducts sold orremoved

from

the farm, regardless ofwho

received thepayment. Importantly, it doesnot includeincome

from

participation in federal farmprograms

, labor earnings off thefarm (e.g.,income from

harvesting adifferentfield),or

nonfarm

sources. Thus,itisameasure

oftherevenueproduced

withtheland.Total production expenses are the

measure

of costs. It includes expendituresby

landowners,contractors, and partners in the operation ofthe farm business. Importantly, it covers all variable costs

(e.g., seeds, labor,

and

agricultural chemicals/fertilizers). It also includes measures of interest paid ondebts

and

theamount

spent on repair and maintenance ofbuildings,motor

vehicles,and

farmequipment

used forfarm business. Itschieflimitation is that itdoes not account forthe rental rate ofthe portionof

the capitalstock thatisnotsecured

by

a loan, soitisonly a partialmeasure

offarms' costofcapital. Justaswith therevenue variable,the

measure

of expensesis limitedto thosethatare incurred inthe operationofthefarmso,forexample, any expenses associatedwith contract

work

forotherfarms isexcluded.7 Thismeasure

ofprofits per acre is asubstitute forthe idealmeasure

oftotalrent peracre, soitisinstructiveto

compare

the two. Since separate information on rental land isunavailable in the Censuses,we

used tabulationsfrom

the 1999

AgriculturalEconomics

andLand

Ownership Survey

to estimate themean

rent per acre (calculated as the "cash rent for land, buildings,and

grazing" dividedby

the "acres rented with cash"8) as roughly$35

(2002S).The

mean

of agricultural profits per acre in theCensus

sample

is about$42

(2002$), soagricultural profits per acre appear tooverstate the rental rate modestly. Consequently, itmay

be appropriate to multiply thepaper's estimates oftheimpact ofclimatechange

on profitsby

0.83 (i.e.,theestimatedratioofrent to profits) to obtain awelfare measure.In our replication of the hedonic approach,

we

utilize the variableon

the value of land andbuildingsasthedependent variable. Thisvariable isavailablein allsixCensuses.

Finally,

we

usetheCensus

datatoexamine

the relationshipbetween

thetwo

most

important crops(i.e., corn for grain and soybeans) yields and annual weather fluctuations.

Crop

yields aremeasured

astotalbushels of productionper acres planted.

SoilQualityData.

No

study ofagricultural productivitywould

be complete withoutdata on soil6

An

exception is that it includes receipts from placing commodities in theCommodity

Credit Corporation loanprogram. Thesereceiptsdifferfromother federalpaymentsbecause farmersreceive theminexchangeforproducts.

7

TheCensuses contain separate variables forsubcategoriesof revenue (e.g.,revenuesduetocrops and dairysales),

but expenditures are not reported separately for these different types ofoperations. Consequently,

we

cannot provideseparatemeasures ofprofitsbythese categoriesandinstead focus ontotal agricultureprofits.8

The

estimate ofacresrentedwith cashincludes someacreswheretherentisa combination of cashanda shareofthe output. Consequently, the measure ofrental rate per acre is an underestimate, because the cash rent variable

does not account forthe valueofpayments in crops. Kirwan (2005) reports that

among

rental land where at leastpart ofthe rent is paid in cash, roughly

85%

ofthe rental contracts are all cash with the remainder constitutingquality, and

we

rely on the National Resource Inventory(NRI)

forourmeasures

ofthese variables.The

NRJ

is a massive survey of soil samplesand

land characteristicsfrom

roughly 800,000 sites that isconducted in

Census

years.We

follow the convention in the literature and use anumber

ofsoil quality variables as controls in the equations for land values, profits, and yields, includingmeasures

of susceptibility to floods, soil erosion (K-Factor), slope length, sand content, irrigation,and

permeability.County-level measures are calculated as weighted averages across sites used for agriculture,

where

theweight is the

amount

ofland thesample

represents in the county.Although

these data provide a richportrait ofsoil quality,

we

suspect that they are not comprehensive.Our

approach is motivatedby

thispossibility of

unmeasured

soil qualityand

otherdeterminantsofproductivity.Climate

and

Weather

Data.The

climate data are derivedfrom

the Parameter-Elevation Regressions on Independent SlopesModel

(PRISM).

9 Thismodel

generates estimates of precipitationand

temperature at 4 x 4 kilometers grid cells for the entireUS.

The

data that are used to derive these estimates arefrom

the National ClimaticData

Center'sSummary

oftheMonth

Cooperative Files.The

PRISM

model

isusedby

NASA,

theWeather

Channel,and

almostallprofessional weatherservices. It isregardedasone ofthe

most

reliableinterpolation proceduresforclimaticdataon asmallscale.This

model

anddata areusedtodevelopmonth

by

yearmeasures

ofprecipitationand

temperature forthe agriculturalland ineachcounty forthe1970

-

2000

period. Thiswas accomplished by

overlayinga

map

ofland uses on thePRISM

predictions for each grid celland

thenby

taking the simple averageacross all agricultural land grid cells.

To

replicate the previous literature's application ofthe hedonic approach,we

calculated the climate normals as the simple average of each county's annualmonthly

temperature and precipitation estimates

between

1970 andtwo

years before the relevantCensus

year. Furthermore,we

followthe convention inthe literature andinclude the January, April, July,and

Octobermean

asindependent variables intheanalysis(Mendelsohn

et. al 1994and

1999;SHF

2005).Although

themonthly

averagesmay

be appropriate for a hedonic analysis of property values, there are bettermethods

formodeling

the effect of weather on annual agricultural profits.Agronomists

have

shown

that plantgrowth

depends

on the cumulative exposure to heat and precipitation during thegrowing

season.The

standardagronomic

approach formodeling

temperature is to convert dailytemperatures into degree-days,

which

represent heating units(Hodges

1991; Grierson 2002).The

effect ofheat accumulation is nonlinear since temperaturemust

beabove

a threshold for plants to absorb heatand

below

a ceilingasplants cannot absorb extraheatwhen

temperature istoo high.These

thresholds orbases vary across crops, but

we

joinSHF

(2006)and

follow Ritchie andNeSmith's

(1991) suggestedcharacterization forthe entire agricultural sector

and

use a base of 46.4° Fahrenheit (F) and a ceiling ofPRISM

was developed by the Spatial Climate Analysis Service at Oregon State University for the National.Oceanic andAtmosphericAdministration. Seehttp://www.ocs.orst.edu/prism/docs/przfact.html forfurtherdetails.

89.6°

F

(or 8°and 32° C). Ritchieand

NeSmith

also discuss the possibility ofatemperaturethreshold at93.2°

F

(34°C),above

which

increases intemperature areharmful.We

explore thispossibility below.We

use daily-level dataon temperatures to calculategrowing

season degree-daysbetween

April1 st

and

September

30lh. This period covers thegrowing

season formost

crops, except winterwheat

(USDA,

NASS

1997).The

degree-days variable is calculated so that a day with amean

temperature:below

46.4°F

contributes degree-days;between

46.4°F and

89.6°F

contributes thenumber

of

degrees Fabove

46.4 degree-days;above

89.6°F

contributes 43.2 degree-days.The

growing

season degree-dayvariableisthen calculated

by

summing

the dailymeasures overthe entiregrowing

season.Unfortunately, the

monthly

PRISM

data cannot beusedto directly developameasure

ofgrowing

season degree-days.

To

measure

these degree-day variables,we

used daily-level data onmean

dailytemperature

from

the approximately 8,000 operational weather stations located in the U.S. during oursample

period.These

datawere

obtainedfrom

theNational ClimaticData

Center "CooperativeSummary

ofthe

Day"

Files.The

construction ofthe sample used is described withmore

details in the appendix.Our

use ofdaily datato calculate degree-days is an importantimprovement

over previouswork

that hasestimated

growing

season degree-days withmonthly

data and distributional assumptions (Thorn 1966;SHF

2006). Finally, in the specifications that use the degree-days measures of temperature, the precipitationvariable istotal precipitationin thegrowing

season,which

ismeasured

with thePRISM

dataasthe

sum

ofprecipitationacross thegrowing

seasonmonths

inthe relevant year.Climate

Change

Predictions.We

relyontwo

setsofpredictionsabout climatechange

todevelop our estimates of its effects onUS

agricultural land.The

first predictions rely on the climatechange

scenario

from

the l slIPCC

report associatedwith adoubling of atmosphericconcentrationsofgreenhouse gasesby

the end ofthe 21s1 century(IPCC

1990;NAS

1992). Thismodel assumes

uniform increases (acrossmonths and

regions oftheUS

andtheir interaction) of5°F

intemperatureand

8%

in precipitationandhasbeen usedextensively in theprevious literature

(Mendelsohn

et al. 1994and

1999;SHF

2005).The

second set of predictions isfrom

theHadley

Centre's 2ndCoupled Ocean-Atmosphere

General Circulation

Model, which

we

refer to asHadley

2 (T. C. Johns et al. 1997). Thismodel

ofclimate is comprised ofseveral individually

modeled components

—

the atmosphere,the ocean, and seaice

—

which

are equilibratedusinga"spinup"process.The Hadley

2model

and an emissions scenario areused to obtain daily state-level predictions for January

1994

throughDecember

2099.The

emissionsscenario

assumes

a1%

per yearcompounded

increase in both carbon dioxide andIS92A

sulphate aerosols,which

implies an increase in greenhouse gas concentrations to roughly 2.5 times current levels by theend

ofthe21s'century. Thisemissions assumptionisstandard andtheclimate changepredictionis in themiddle ofthe range ofpredictions.

From

these daily predictions,we

calculate predictedgrowing

further details).

10

We

focus onthe"medium

term"and

"long run" effectson

climate,which

are definedas averagesof

growing

seasondegree-daysand

precipitationover2020-2049 and

2070-2099.B.

Summary

StatisticsAgricultural Finances, Soil,

and

Weather

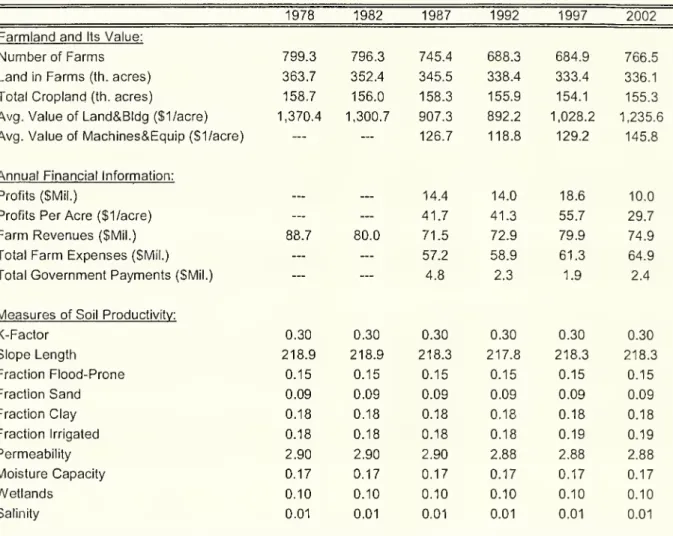

Statistics. Table 1 reports county-levelsummary

statistics

from

the three data sources for 1978, 1982, 1987, 1992, 1997,and

2002.The sample

iscomprised

of a balanced panel of 2,268 counties."Over

the period, thenumber

of farms per countyvaried

between 680

and 800.The

totalnumber

ofacres devotedto farming declinedby

roughly 7.5%.At

the

same

time, theacreage devotedto croplandwas

roughlyconstantimplying thatthedeclinewas

dueto reducedland forlivestock, dairy,and

poultry farming.The

mean

average valueoflandand

buildingsperacre ranged

between

$892 and

SI, 370 (2002$), with thepeak and

trough occurring in 1978and

1992, respectively.12 (All subsequentfigures arereportedin2002

constantdollars, unlessnotedotherwise.)The

second panel details annual financial information about farms.We

focuson

1987-2002,since complete data is only available for these fourcensuses.

During

this period themean

county-levelsalesofagricultural productsranged

from $72

to$80

million.Although

itis not reported here, the shareofrevenue

from

crop products increasedfrom

43.7%

to47.9%

inthis period with the remaindercoming

from

the sale oflivestockand

poultry.Farm

productionexpensesgrew from $57

million to$65

million.The

mean

countyprofitsfrom

farmingoperationswere

S14.4million, $14.0million, $18.6million, $10.0million or $42, $41,

$56 and

$30

per acre in 1987, 1992, 1997,and

2002

respectively.These

profitfigures

do

not includegovernment

payments,which

are listed atthebottom

ofthispanel.The

subsequentanalysis ofprofits also excludes

government

payments.The

third panel lists themeans

of the availablemeasures

of soil quality,which

are key determinants oflands' productivity in agriculture.These

variablesare essentiallyunchanged

across years since soiland

land types at a given site are generally time-invariant.The

small time-series variation inthese variables is due to changes in the composition ofland that is used forfarming. Notably, the only

measure

ofsalinityisfrom

1982, sowe

usethismeasure

forall years.Climate

Change

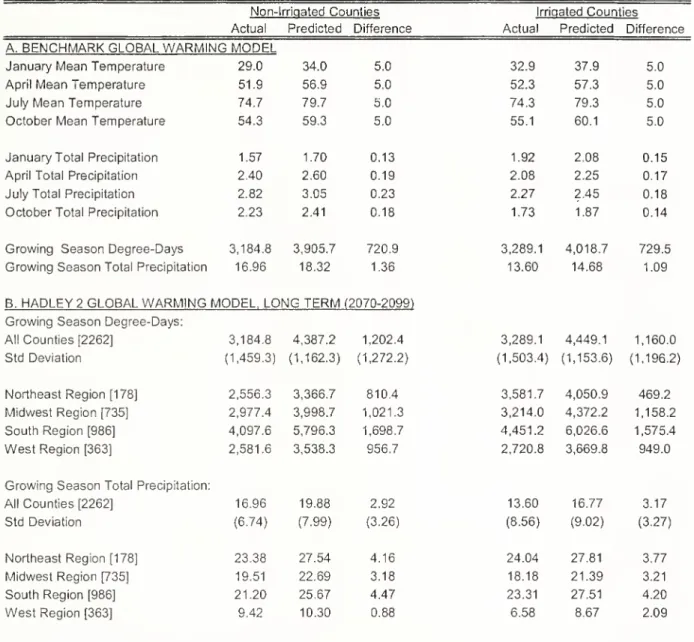

Statistics. PanelsA

and

B

of Table 2 reporton

the predictions oftwo

climatechange

models. All entries are calculated as the weighted average across the fixed sample of 2,268The

Hadley Centre has released a 3rd climate model, which hassome

technical improvements overthe 2nd one.We

do notuseit for thispaper's predictions, becausedaily predictions are notyetavailable on a subnational scaleoverthecourseoftheentire21s'centuryto

make

state-levelpredictionsaboutclimate.

" Observations from Alaska and Hawaii were excluded.

We

also dropped all observations from counties thathadmissing valuesforoneormoreyearsonany ofthesoilvariables,acres offarmland, acres ofirrigated farmland,per

capita income, population density, and latitude at the county centroid. The sample restrictions were imposed to

provideabalancedpanelofcountiesfrom 1978-2002 forthesubsequentregressions.

All entries are simple averages over the 2,268 counties, except "Average Value ofLand/Bldg (1$ acre)" and,

"ProfitperAcre(l$/acre)",whichareweightedbyacresoffarmland.

counties,

where

the weight is thenumber

ofacres offarmland.The

"Actual"column shows

the1970-2000

averages of each ofthe listed variables. There are alsocolumns

for the predicted values ofthe variables and the differencebetween

the actualand

predicted values. Finally, all ofthe information isprovided separately for non-irrigated

and

irrigated counties.We

define a county as irrigated if at least10%

ofitsfarmlandisirrigated, andthisdefinition isused throughoutthe remainder ofthepaper.Panel

A

reportson thebenchmark

globalwanning

model from

the l slIPCC

report,which

predictsuniform (acrossseasonandspace) increases of5°

F

and8%

inprecipitation.We

mimic

previousresearchand

focus on January, April, July, and October. There are also entries forgrowing

season degree-daysand

totalprecipitation.Panel

B

reports on the longrun predicted effectsfrom

theHadley

2 GlobalWarming

model

forgrowing

season degree-days and precipitation. This information is listed forthe country as awhole and

for each ofthe

Census

Bureau's four regions.The

model

predicts amean

increase in degree-days of roughly 1,200by

the end of the century (i.e., the2070-2099

period).The most

striking regional difference isthe dramatic increase in temperature in the South. Its longrun predicted increase indegree-days of roughly 1,700

among

non-irrigated counties greatly exceeds the approximate increases of810, 1,000,and

960

in the Northeast,Midwest,

and West, respectively.The

overall average increase ingrowing

season precipitation in the long run is approximately 3.0 inches, with the largest predicted increase in the Southand

smallest increase in the West. There is also substantial intra-regional (e.g., atthe state level) variation in the climate

change

predictions, and thisvariation is used in the remainder ofthe paperto inferthe

economic

impacts ofclimatechange.Weather

Variation Statistics. In our preferred approach,we

aim

to infer the effects ofweatherfluctuations on agricultural profits.

We

focus on regressionmodels

that include county and year fixedeffects and county and state by year fixed effects. It

would

be ideal ifafter adjustment forthese fixedeffects, the variation in the weather variables that remains is as large as those predicted

by

the climatechange models

usedin thisstudy. In thiscase,ourpredictedeconomic

impacts willbeidentifiedfrom

thedata, ratherthan by extrapolationdue tofunctional

form

assumptions.Panel

C

ofTable 2 reports on themagnitude

ofthe deviationsbetween

counties' yearly weather realizationsand

theirlongrun averages after taking out year(row 1) and state-by-year fixed effects(row2). Therefore, it provides an opportunity to assess the

magnitude

ofthe variation ingrowing

season degree-daysand

precipitation after adjustment forpermanent

county factors (e.g.,whether

the county is usually hot orwet)and

national time varying factors(e.g.,whether itwas

ahot orwet

yearnationally) orstate-specific time-varyingfactors (e.g.,whether it

was

ahot orwet

yearin aparticularstate).Specifically, the entriesreport the fraction of county

by

yearobservations withdeviations at least as largeas theone

reported in thecolumn

heading, averaged overthe years 1987, 1992, 1997,and

2002.For example, the

"Removed

State*YearEffects" degree-daysrow

indicates that24.5%,

9.3%,and

2.2%

of county by year observations haddeviations larger than 400, 800, and 1,200 degree-days, respectively.

The

correspondingrow

forgrowing

season precipitation reports that62.3% 35.3%

and18.1%

of thecounty

by

yearobservationshad

deviations larger than 1.0,2.0,and3.0 inches, respectively.Temperature

and

precipitation deviations of the magnitudes predictedby

the climatechange

models

occurinthe data. This is especially true ofprecipitationwhere

more

than 18%

ofcountyby

yearobservations

have

a deviation larger than 3 inches,which

roughly equals the predicted increasefrom

thelongrun

Hadley

2 scenario.The

impactofthescenario'smean

increaseof about 1,200degree-days could be non-parametrically identified, although itwould

come

from

just2.2%

ofobservations.However,

5%

of annual county observations have deviations as large as 1,000 degree-days. Finally, it is noteworthy

that differencing out stateweather shocks does not substantially reducethe frequency oflarge deviations, highlightingthatthere areimportantregional patternstoweathershocks.

III.

Econometric

StrategyA.

The

Hedonic

Approach

This section describes the econometric

framework

thatwe

use to assess the consequences ofglobal climatechange.

We

initiallyconsiderthe hedoniccross sectionalmodel

thathas beenpredominant

in the previous literature

(Mendelsohn

et. al, 1994, 1999;SHF

2005, 2006). Equation (3) provides astandardformulationofthismodel:

(3) yct

=

X

ct'P+

£j 0i f(W

ic)+

sct, sct= a

c+

uct,where

yc, isthe value ofagricultural landperacrein countyc inyeart.The

tsubscript indicates that thismodel

could be estimated inany

year forwhich

data is available.X

ct is a vector of observabledeterminants of farmland values,

some

ofwhich

are time-varying.The

last term in equation (3) is the stochastic error term, ect, that is comprised of a permanent, county-specificcomponent,

a

c,and

anidiosyncraticshock,ucl.

W

icrepresents aseriesofclimate variables forcountyc.We

followMendelsohn

etal.(1994) and let iindicate one ofeight climaticvariables. In particular,thereare separatemeasures

of temperatureand

total precipitation in January, April, July, and October, so there is one

month

from

each quarter oftheyear.

The

appropriate functionalform

for each of the climate variables isunknown,

but in ourreplication ofthe hedonic approach

we

follow the convention in the literatureand

model

the climaticvariables with linear and quadratic terms.

As

emphasized by

SHF

(2005), it is important to allow theeffect of climate to differ across non-irrigated and irrigated counties. Accordingly,

we

include interactions ofall theclimate variablesandindicators fornon-irrigated andirrigatedcounties.The

coefficient vector 9 is the 'true' effect ofclimate on farmland values and its estimatesare usedto calculate the overall effect ofclimatechange

associated with thebenchmark

5-degree Fahrenheitincrease in temperature and eight percent increase in precipitation. Since the total effect

of

climatechange is a linear function of the

components

of the 9 vector, it is straightforward to formulateand

implement

tests ofthe effects ofalternative climatechange

scenarioson

agricultural land values.13We

will report the standard errors associated with the overall estimate of the effect of climate change.

However,

the total effect of climate change is a function of 32 parameter estimateswhen

the climate variablesaremodeled

withaquadratic,soitisnot surprisingthatstatistical significance iselusive.Consistent estimation ofthe vector 9, and consequently ofthe effect ofclimate change, requires

that

E[f,(W

ic) ec,|

X

ct ]=

for each climate variable i. This assumption will be invalid if there areunmeasured permanent

(ac) and/or transitory (ucl ) factors that covary with the climate variables.To

obtain reliable estimates ofG,

we

collected awide

range ofpotential explanatory variables including allthesoil quality variables listed inTable 1, aswell asper capita

income

and populationdensity. 14We

alsoestimate specificationsthatinclude statefixedeffects.

There are three further issues about equation (3) that bearnoting. First, itis likely that theerror terms are correlated

among

nearby geographical areas. For example, unobserved soil productivity isspatially correlated, so the standard

OLS

formulas for inference are likely incorrect. In the absence ofknowledge on

the sourcesand

the extentofresidual spatialdependence

in land value data,we

adjustthestandard errors for spatial

dependence

of anunknown

form

following the approach ofConley

(1999).The

basic idea is that the spatialdependence

between

two

observations will decline as the distancebetween

the counties increases.15Throughout

the paper,we

present standard errors calculated with theEicker-

White

formula that allows for heteroskedasticity of an unspecified nature. In additionwe

also13

Since

we

use a quadratic model for the climate variables, each county's predicted impact is calculated as thediscretedifference in agricultural land values at thecounty's predicted temperatures and precipitationafterclimate

change anditscurrentclimate(i.e.,theaverage overthe 1970-2000period).

14

Previous research suggests that urbanicity, population density, the local price ofirrigation, and air pollution concentrations areimportantdeterminantsofland values (Cline 1996; Plantinga,Lubowski, andStavins2002;

SHF

2005, 2006;Chay

and Greenstone 2005). Comprehensive data on the price of irrigation and air pollution concentrations are unavailable.15

More

precisely, theConley(1999) covariancematrix estimatorisobtainedbytakingaweighted average ofspatialautocovariances. The weights are given by the product ofBartlett kernels in two dimensions (north/south and

east/west), which decline linearly from 1 to 0. The weights reach

when

one ofthe coordinates exceeds apre-specified cutoff point. Throughout

we

choose the cutoff points to be 7 degrees of latitude and longitude,correspondingtodistancesof about500miles.

present the

Conley

standarderrors forourpreferred fixed-effectmodels.Second, it

may

be appropriate to weight equation (3). Since the dependent variable iscounty-level farmland values per acre,

we

think there aretwo complementary

reasons to weightby

the squareroot of acres of farmland. First, the estimates of the value of farmland

from

counties with largeagricultural operations will be

more

precise than the estimatesfrom

counties with small operations,and

this weight corrects for the heteroskedasticity associated with the differences in precision. Second, the

weighted

mean

ofthedependent variableis equaltothemean

valueof farmland peracre inthecountry.Mendelsohn

et al. (1994, 1999)and

SHF

(2005) both use the square root ofthe percent ofthecounty in cropland and the square root oftotal revenue

from

crop sales as weights.We

elected not toreport theresultsbased

on

these approaches in themain

tables, since the motivation forthese weightingschemes

is less transparent. For example, it is difficult to justify the assumptions about thevariance-covariance matrixthat

would

motivatetheseweights asasolutiontoheteroskedasticity. Further, althoughtheseweights

emphasize

the counties that aremost

important to total agricultural production, theydo

soin an unconventional

manner-B.

A

New

Approach

One

ofthis paper's primary points is that the cross-sectional hedonic equation is likely to bemisspecified.

As

a possible solutionto thisproblem,we

fit:(4) yc,

=

a

c+

y,+

X

c/p+

1| 8; fi(Wict)+

u

ct.There

are anumber

of important differencesbetween

equations (4)and

(3). For starters, the equationincludes afull setof countyfixed effects,

a

c.The

appealofincluding thecounty fixed effects isthattheyabsorb all

unobserved

county-specific time invariant determinants of the dependent variable.16The

equationalso includes yearindicators,yt,that controlforannual differences inthe dependentvariable that

are

common

across counties.Our

preferred specification replaces theyear fixedeffects withstateby

yearfixedeffects (yst).

The

inclusion ofthe county fixed effects necessitatestwo

substantive differences inequation (4),relative to (3). First, the dependentvariable, yct, is

now

county-level agricultural profits, instead oflandvalues.17 This isbecause land valuescapitalize longruncharacteristicsofsites and, conditional

on

countyfixed effects,annual realizations of weather shouldnot affectlandvalues.

However,

weather does affect farm revenuesand expendituresand

theirdifferenceis equalto profits.Second, it is impossible to estimate the effect ofthe long run climate averages in a

model

with6

Interestingly, the fixed effects model was first developed by

Hoch

(1958 and 1962) andMundlak

(1961) toaccountforunobserved heterogeneityinestimatingfarm productionfunctions.

17

Kellyetal. (2005)estimate the cross-sectional relationshipbetween agricultural profitsandclimate.

county fixed-effects,becausethere is

no

temporalvariationinW

jc. Consequently,

we

replace the climatevariables with annual realizations of weather,

W,

ct.We

follow the standardagronomic

approach andmodel

temperatureby

usinggrowing

season degree-days, defined with abase of 46.4°F

and

aceiling of89.6° F. Similarly,

we

model

the effect ofprecipitationon agricultural profitsper acreby

usinggrowing

season precipitation.

Once

again,we

let the effects ofthese variables differ across irrigated and non-irrigated counties. Further,we

model

them

withquadratics.The

validity of any estimateofthe impactofclimatechange

basedon equation(4) rests cruciallyon

the assumption that its estimation will produce unbiased estimates of the 6vector. Formally, the consistency of each 0, requires E[f,(Wict)u

ct|X

ct,a

c, yst]= 0.By

conditioning on the countyand

state byyear fixed effects, the 0,'s are identified

from

county-specific deviations in weather about the county averages aftercontrolling forshockscommon

to all counties in a state. This variation ispresumed

tobe orthogonal to unobserved determinants ofagricultural profits, so it provides a potential solution to the omitted variables bias problems that appear to plague the estimation of equation (3).A

shortcoming of this approach is thatall the fixed effects are likely tomagnify

the importance ofmisspecification due tomeasurement

error,which

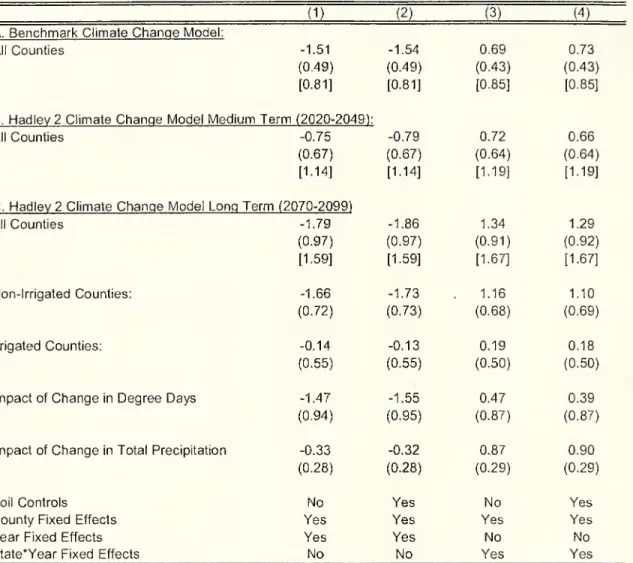

generally attenuates the estimated parameters.IV.Results

Thissection isdivided into threesubsections.

The

firstprovidessome

suggestive evidence on the validity ofthe hedonic approach and then present resultsfrom

that approach.The

second subsection presents resultsfrom

the fitting of equation (4) to estimate the impact of climatechange

on theUS

agricultural sector. It also probes the distributional consequences ofclimatechange

across the country.The

third andfinal subsection estimates theeffect ofclimatechange on

cropyieldsforcorn for grainand soybeans, thetwo most

important cropsinthe agricultural sectorinterms ofvalue.A. Estimates ofthe

Impact

of ClimateChanges

from

theHedonic Approach

Does

Climate Varywith Observables?As

theprevious section highlighted, thehedonicapproach relies on the assumptionthatthe climate variables are orthogonal to the unobserved determinants ofland values.We

begin byexamining

whether these variables are orthogonal to observable predictors offarmvalues.

While

this is not aformal testofthe identifyingassumption, there areat leasttwo

reasons that itmay

seem

reasonable topresume

that this approach will producevalid estimates ofthe effects ofclimatewhen

the observables are balanced. First, consistent inference will notdepend

on functionalform

assumptions on the relations

between

the observable confounders and farm values. Second, theunobservables

may

bemore

likely tobe balanced (Altonji,Elder, andTaber

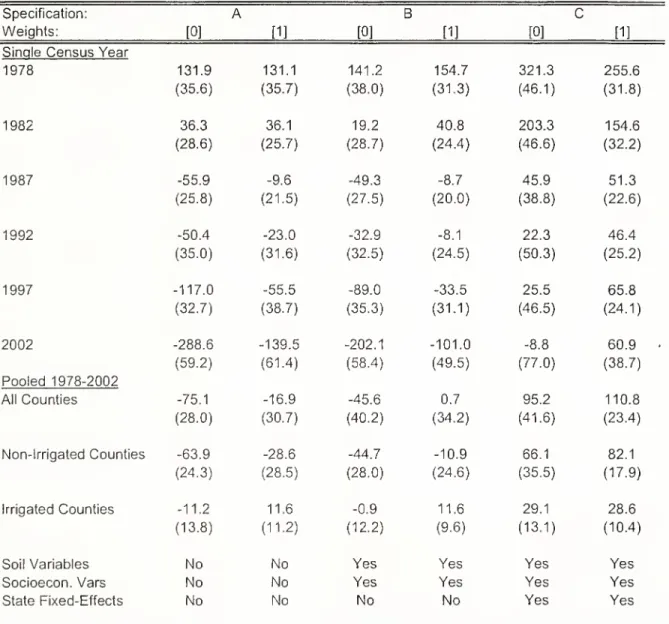

2000).Table 3

shows

the associationbetween

theJulytemperatureand

precipitationnormals (calculatedfrom

1970-2000) and selected determinants offarm values. Tables with the full set of determinants offarm

values and the temperature and precipitation normals of othermonths

are reported in the onlineappendix. Panel

A

(B) reports themeans

of county-level farmland values, soil characteristics,and

socioeconomic

and

locational attributesby

quartile ofthe July temperature (precipitation) normal.The

means

are calculated with datafrom

the sixCensuses

but are adjusted foryear effects. For temperature (precipitation), quartile 1 refers to the counties with the coldest temperature (least precipitation).The

fifth

column

reports F-statisticsfrom

tests that themeans

are equal across the quartiles. Since there aresixobservations per county, thetest statisticsallows forcounty-specific

random

effects.A

value of2.37 (3.34) indicates that the null hypothesis can be rejected at the5%

(1%)

level. Ifclimatewere randomly

assignedacross counties, there

would

be veryfew

significantdifferences.It is immediately evident that the observable determinants of farmland values are not balanced

across the quartiles of weather normals: All ofthe F-statistics

markedly

reject the null hypothesis ofequality across quartiles. In fact, in our extended analysis reported in the online appendix, the null hypothesis ofequalityofthe

sample

means

oftheexplanatory variables across quartiles canberejected atthe

1%

level in 11 1 ofthe 112 cases considered.18

In

many

cases the differences in themeans

are large, implying that rejection ofthe null is notsimply due tothe

sample

sizes. For example, the fractionofthe land that is irrigatedand

the populationdensity (a

measure

ofurbanicity or ofthe likelihood of conversion to residential housing) in the countyare

known

tobe important determinants ofthe agriculturalland values,and

theirmeans

vary dramatically across quartiles ofthe climate variables. In fact, the finding that population density is associated with agricultural land valuesundermines

the validity ofthe hedonic approach toleam

about climatechange

because density has

no

direct impacton

agricultural yields. Overall, the entries suggest that theconventional cross-sectional hedonic approach

may

be biaseddue

to incorrect specification of the functionalform

oftheobserved variablesand

potentiallyduetounobserved

variables.Replication of

SHF

(2005)Hedonic Approach.

With

these results in mind,we

implement

the hedonic approach outlined in equation (3).We

beginby

replicating the analysis ofSHF

(2005) using theirdatabasedon

the 1982Census

of Agricultureand

programs,which

they provided.We

follow their proposed approach and use a quadratic in each ofthe 8 climate variables.Although

the point oftheir paper is that pooling irrigatedand

non-irrigated counties can lead to biased estimates of climateparameters inhedonic models, they onlyreport estimatesbased

on

specifications that constrain theeffect18

We

also divided the sample into non-irrigated and irrigated counties,where a county is definedas irrigated if at least10%

ofthe farmland is irrigated and the other counties are labeled non-irrigated.Among

the non-irrigated(irrigated)counties, the nullhypothesisofequalityofthesamplemeansoftheexplanatoryvariablesacross quartiles.

canberejectedatthe

1%

levelfor 111 (96)ofthe 112covariates.ofclimate to be the

same

in both sets ofcounties.Based

on

this approach, the aggregate impact ofthebenchmark

scenario increases of 5 degrees Fahrenheit in temperatures and8%

in precipitation on farmland values is -S543.7 billion (2002S) with cropland weights or $69.1 billion with crop revenueweights. Exceptfor a

CPI

adjustment, these estimatesare identical tothoseinSHF

(2005).To

probe therobustness ofthese results,we

re-estimate the hedonicmodels

usingtwo

alternativesets ofcovariates.

The

first dropsallcovariates, exceptthe climate variables, whilethe second adds statefixed effects to the specification used

by

SHF.

The

state fixed effects account for allunobserved

differences acrossstates (e.g., soil quality and stateagriculturalprograms).

The

simple specificationthat only controls for the climate variables produces an estimate of-$98.5 billion with the cropland weightsand

$437.6billionwith thecrop revenueweights.The

specificationthatadds state fixedeffects producesestimatesof -$477.8billion

and

$1,034.0 billion.The

latterfigureseems

implausible, sinceitis nearly aslargeastheentirevalueofagriculturallandandbuildingsinthe

US, which

was

$1,115billionin 2002.As

discussedpreviously, ourview

isthatthesetwo

sets of weights haveno

clearjustification. In our opinion, the appropriate approach is to weightby

acres of farmland. Re-estimation oftheSHF,

climate variables only, andSHF

plus state fixed effects specifications with the reconstructed version ofthe

SHF

data fileproduces estimatesof $225.1 billion, -$315.4 billion, and-$0.6 billion. Consequently,the

SHF

findings appearto also berelated tothe choice ofweights. Itseems

reasonable toconclude thatthe application ofthe hedonicapproachto the

SHF

datafailsto producerobust estimates ofthe impact ofclimate

change

even with a single year of data. In our view, the fragility or non-robustness of this approachisnotconveyed

adequately intheir article orinMendelsohn

et al.(1994).19New

Hedonic

Estimates. Table 4 furtherinvestigates the robustness ofthe hedonic approachby

conducting our

own

broader analysis.To

this end,we

assemble ourown

samplesfrom

the1978-2002

Censuses

ofAgriculture.We

maintain thesame

quadratic specificationin each ofthe 8 climatevariables.There

aresome

important differencesbetween

our approachand SHF.

First,we

fit regressionsthat allow the effects ofclimate

on

farmland values to vary in irrigated and non-irrigated counties. In addition, the regressions allow for intercept differences across irrigated and non-irrigated counties but constrain all other parameters to be equal in thetwo

sets ofcounties. Second,we

report standard errors fortheestimatedimpacts. Third,we

do not truncate the county-specific estimatedimpactsatzero.The

entries inTable 4 reportthepredicted changes in land values inbillions of2002

dollars (and their standard errors in parentheses) from thebenchmark

increases of 5 degrees Fahrenheit intemperatures and

8%

in precipitation.These

predicted changes are based on the estimated climateparameters