Digitized

by

the

Internet

Archive

in

2011

with

funding

from

Boston

Library

Consortium

IVIember

Libraries

'IB31

!,M15

)DEWEY

01

Massachusetts

Institute

of

Technology

Department

of

Economics

Working

Paper

Series

THE

6D

BIAS

AND

THE

EQUITY

PREMIUM

PUZZLE

Xavier

Gabaix

David

Laibson

Working

Paper

02-01

Jurie

2001

Room

E52-251

50

Memorial

Drive

Cambridge,

MA

021

42

This

paper

can be downloaded

without

charge from

the

Social

Science

Research Network

Paper

Collection at\V'

Massachusetts

Institute

of

Technology

Department

of

Economics

Working Paper

Series

THE

6DBIAS

AND

THE

EQUITY

PREMIUM

PUZZLE

Xavier

Gabaix

David Laibson

Working

Paper

02-01

June

2001

Room

E52-251

50

Memorial

Drive

Cambridge,

MA

021

42

This

paper can be

downloaded

without

charge from

the

Social Science

Research Network

Paper

Collection atThe

6D

bias

and

the equity

premium

puzzle

Xavier

Gabaix

David

Laibson

MIT

Harvard

Universityand

NBER*

Current

Draft:June

24,2001

First Draft:

August

15,2000

Abstract

Ifdecision costs lead agents to update consumption every

D

periods, then econometricianswillfindan anomalously lowcorrelationbetweenequity returnsandconsumptiongrowth (Lynch

1996).

We

analytically characterize the dynamic properties of an economy composed ofcon-sumers

who

have such delayed updating. In our setting, an econometrician using an Eulerequation procedure would infer a coefBcient ofrelative risk aversion biased up by a factor of

6D. Hence with quarterly data, ifagents adjust their consumption every

D

=

4 quarters, the imputed coefficientofrelative risk aversion willbe 24 times greater than the truevalue. Highlevelsofrisk aversion impliedbythe equity

premium

andviolationsofthe Hansen-Jagannathan boundsceasetobe puzzles.The

neoclassical modelwith delayed adjustment explainsthecon-sumption behaviorof shareholders. Oncelimitedparticipationistakenintoaccount, themodel

matches mostproperties ofaggregate consumptionand equityreturns, including

new

evidencethatthe covariancebetween \n{Ct+h/Ct) and Rt+i slowlyriseswith h.

Keywords:

61?,bounded

rationality, decisioncosts, delayed adjustment, equitypremimn

puzzleJEL

classification:E44

(financial marketsand

themacroeconomy),

Gl

(general financialmar-kets).

'Gabaix:DepartmentofEconomics,

MIT,

Cambridge,MA

02142,xgabaix@mit.edu. Laibson:DepartmentofEconomics, HarvardUniversity, and

NBER,

CambridgeMA

02138, dlaibson@harvard.edu.We

thankBenBernanke, Olivier Blanchard, John Campbell, James Choi, Karen Dynan, George Constantinides, John

Heaton, Robert Lucas, Anthony Lynch, Greg Mankiw, Jonathan Parker, Monika Piazzesi,

Ken

Rogoff,James Stock,

Jaume

Ventura, Annette Vissing, and seminar participants at Delta, Insead, Harvard, MIT, University of Michigan,NBER,

andNYU

for helpful comments.We

thank Emir Kamenica, GuillermoMoloche, Eddie Nikolovaand Rebecca Thorntonfor outstandingresearcheissistance.

iMSSACHUSEnsTNS

111UTE OFTEGHMntOGYWAR

7

2002

1

Introduction

Consumption

growth covaries only weakly with equity returns, which implies that equities are not very risky. However, investors havehistoricallyreceived avery largepremium

for holdingequities.For twenty years, economists have asked

why

an asset with little apparent risk has such a largerequired return.'

Grossman

and Laroque

(1990) argued thatadjustment costs might answer the equitypremium

puzzle. If it is costly to change consumption, households will not respond instantaneously to

changes in asset prices. Instead,

consumption

will adjust with a lag, explainingwhy

consumption

growth covariesonlyweakly withcurrent equityreturns. In the

Grossman

and Laroque

framework, equities are risky, but that riskiness does notshow

up

in a highcontemporaneous

correlationbetween consumption growth

and

equity returns.The comovement

is only observable in the long-run.Lynch

(1996)and

Marshalland Par«kh

(1999)have simulateddiscrete-timedelayedadjustments modelsand

demonstrated that these models can potentially explain the equitypremium

puzzle.^In light ofthe complexity ofthese models, both sets ofauthors used numerical simulations.

We

propose a continuous-timegeneralization ofLynch's (1996) model.Our

extension providestwo

new

sets of results. First, our analysis is analytically tractable;we

derive a completeana-lytic characterization of the model's

dynamic

properties. Second, our continuous-timeframework

generates effects that are

up

tosix times larger than those in discrete time models.We

analyze aneconomy

composed

ofconsumerswho

update

theirconsumption

everyD

(asin Delay) periods.

Such

delaysmay

be

motivatedby

decision costs, attention allocation costs, and/or mental accounts.^The

core ofthe paper describes the consequences of such delays. Inaddition,

we

derive a sensible value ofD

based on a decision cost framework.The

"61? bias" is our key result. Using datafrom oiu: economy, an econometrician estimating thecoefficientofrelative riskaversion(CRRA)

fromtheconsumption

Euler equationwould

generatea multiplicative

CRRA

bias of6D.

For example, if agents adjust theirconsumption

every Z)=

4quarters,

and

the econometrician uses quarterly aggregates in his analysis, theimputed

coefficient of relative risk aversion willbe

24 times greater than the true value.Once we

take account ofthis

6D

bias, theEuler equationtests areunableto reject the standardconsumption

model.High

equity returns

and

associated violations of theHansen-Jagannathan

(1991)bounds

cease tobe

puzzles.

The

basic intuition for this result is quite simple. If households adjust theirconsmnption

every

D

>

1 periods, thenon

average only^

households will adjust each period. Consider onlythe households that adjust during the current period

and assume

that these households adjustconsumption

at dates spread uniformly over the period. Normalize the timing so the currentperiod is the timeinterval [0, 1].

When

a household adjusts at time iG

[0,1], it can only respondtoequity returns that havealready

been

realizedby

timei. Hence, thehouseholdcanonly respondto firaction i ofwithin-period equity returns. Moreover, the household that adjusts at time i can

only change

consumption

for the remainder of the period. Hence, only fraction (1—

i) of this'For theintellectualhistoryof thispuzzle,seeRubinstein(1976), Lucas(1978),Shiller(1982), Hansen and Single-ton (1983), Mehraand Prescott (1985), and Hansen and Jagannathan (1991). Foruseful reviews see Kocherlakota

(1996)and Campbell (2000).

-See also related work by Caballero (1995), He and Modest (1999), Heaton and Lucas (1996), Luttmer (1995),

and Lynch and Balduzzi (1999).

See Gabaix and Laibson (2000b) for a discussion ofdecision costs and attention allocation costs. SeeThaler

period's

consumption

is affectedby

the change at time i.On

averagethe households that adjustduring the current period display a covariance

between

equity returnsand consumption growth

that isbiased

down

by

factor/I

1

/ t{l -i)di

=

-.The

integral is taken from to 1 to average over the uniformly distributed adjustment times.Since only fraction -^ ofhouseholds adjust in thefirst place, the aggregate covariance

between

equityretiu-ns

and consumption growth

isapproximatelyg--^ as large asitwould be

ifallhouseholdsadjusted instantaneously.

The

Eulerequationforthe instantaneous adjustmentmodel

impliesthatthe coefficient of relative risk aversion isinverselyrelated to the covariance

between

equity returnsand consumption

growth. Ifan

econometrician used this Euler equationtoimpute

the coefficient of relative risk aversion,and

he used datafrom

our delayedadjustment economy, hewould impute

a coefficient ofrelative risk aversion that

was

6D

times too large.In section 2

we

describe our formal model, motivate our assumptions,and

present our keyanaljrtic finding. In section 2.2

we

providean

heuristic proofof our results for the caseD

>

1.In section 3

we

present additional results that characterize thedynamic

properties of ourmodel

economy. In section 4

we

close ourframework by

describinghow

D

is chosen. In section 5we

consider the consequences ofour

model

formacroeconomics

and

finance. In section 6we

discussempirical evidence that supports the

Lynch

(1996)model and

our generalization.The

model

matches

most

ofthe empiricalmoments

of aggregateconsumption

and

equity returns, including anew

testwhich

confirms the6D

prediction that the covariancebetween

\n{Ct+h/Ct)and

Rt+i shouldslowly rise with h. In section 7we

conclude.2

Model

and

key

result

Our

framework

is a synthesis of ideasfrom

the continuous-timemodel

ofMerton

(1969)and

thediscrete-time

model

ofLynch

(1996). In essencewe

adopt Merton's continuous-time modelingapproach

and

Lynch's emphasison

delayedadjustment.^We

assume

that theeconomy

hastwo

linear production technologies: a risk free technologyand

arisky technology (i.e., equities).The

risk free technology has instantaneous return r.The

returns from the risky technology follow a geometric diffusion process with expected return r

+

ttand

standarddeviation a.We

assume

thatconsumers

holdtwo

accounts: achecking accountand

abalancedmutual

fund.A

consumer's checking account is used forday

today

consumption,and

this account holds onlythe risk free asset.

The

mutual

fundis used to replenish the checking accountfrom

time to time.The

mutual

fund is professionallymanaged

and

is continuously rebalanced so that d share of themutual

fund assets are always invested in the risky asset.^The

consumer

is able to pick 9.^ Inpractice, the

consumer

picks amutual

fund that maintainsthe consumer's prefered value of6.We

call6 the equity share (in the

mutual

fund).Every

D

periods, theconsumer

looks at hermutual

fundand

decideshow much

wealth towithdraw

from themutual

fund to deposit in her checking account.Between

withdrawal periods—

i.e., from withdrawal date t to the next withdrawal date t+

D

—

theconsumer

spendsfrom

SeeCalvo(1983), Fischer (1977),andTaylor(1979)forearlierexamplesofdelayedadjustmentinmacroeconomics. This assumption can be relaxed without significantly changing the quantitative results. In particular, the

her checking account

and

does not monitor hermutual

fund. Fornow we

takeD

to be exogenous.Following aconceptual approach takeninDuffie

and Sun

(1990),we

latercalibrateD

witha decisioncost

model

(see section 4). Alternatively,D

can be motivated with a mental accountingmodel

ofthe type proposed by Thaler (1992).

Finally,

we

assume

that consumers have isoelastic preferencesand

exponential discountfunc-tions:

Uu

=

Etr

e-f^^~'^ {n^-^

)

^^-Here i indexes the individual

consumer

and

t indexes time.We

adopt the following notation. Let Wit represent the wealth in themutual

fund at date t.Between

withdrawaldates,wn

evolves according todwit

=

Wit ((^+

0'K)dt+

Oadzt),where

2j is aWiener

process.We

cannow

characterize the optimal choices ofour consumer.We

describe each date at which the

consumer

monitors—

and

in equilibriumwithdraws

from—

hermutual

fund as a "reset date." Formalproofs of allresults are provided in the appendix.Proposition

1On

the equilibrium path, thefollowing properties hold.1.

Between

reset dates, consumption grows at afixed rate -{r—

p).2.

The

balance in the checking account just after a reset date equals the net present value ofconsumption between reset dates, where the

NPV

is taken with the risk free rate.3.

At

reset date t, consumption is 0,,.+=

aw^T—, wherea

is a function ofthe technologypara-meters, preference parapara-meters,

and

D.4-

The

equity share in the mutualfund

isNote

that 0^^.+ represents consumption immediately after resetand

w^t- represents wealth inthe

mutual

fund immediately beforereset.Claim

1follows fromthepropertythatbetween

resetdatesthe rate of return tomarginalsavingsis fixed

and

equal to r.So

between reset dates theconsumption

path grows at the rate derived inRamsey's

(1928) original deterministic growth model:-

=

-(''-P)-c7

Claim

2 reflects the advantages of holding wealth in the balancedmutual

fund. Instantaneousrebalancing of this fund

makes

it optimal to store 'extra' wealth—

i.e., wealth that isnot neededfor

consumption between

now

and

the next reset date—

in themutual

fund.So

the checkingaccount is exhausted between reset dates.

Claim

3 follows from the homotheticity ofpreferences.Claim

4imphes

that the equity share is equal to thesame

equity share derivedby

Merton

(1969)in his instantaneous adjustment model. This exact equivalence is special to our institutional

(see Rogers 2001 for numerical examples in a related model).

Note

that the equity share isincreasing in the equity

premium

(vr)and

decreasing in the coefficient of relative risk aversion (7)and

the variance of equity returns (cr^).Combining

claims 1-3 resultsimphes

that the optimalconsumption path between

dater and

date

T

+

D

is Cit=

ae~i ' w^^-and

the optimal balance in the checking account just afterreset date r is

T+D

Cis^ ^(^-^)(is

=

/T+

D

l^r-p)is-r)-ris-r)^

Claim

3 implies that at reset dates optimalconsumption

is linear in wealth.The

actual valueof the propensity to consume, a, does not matter for the results that follow.

Any

linear rule—

e.g., Hnear rules of

thumb

—

will suffice. In practice, theoptimal value ofa

in ourmodel

willbe

close to theoptimal marginal propensity to

consume

derivedby

Merton,a

=

^+fl-i

r+

7

\^77

V 27CT^^Merton's value is exactly optimal in our

framework

when

D

=

0.2.1

Our

key

result:the

6D

bias

In our economy, each agentresets

consumption

at intervals ofD

units of time. Agents are indexedby

their reset time iG

[0,D).Agent

i resetsconsumption

at dates {i,i+

D,i

+

2D,

...}.We

assume

that theconsumption

reset times are distributed uniformly.*^More

formally, thereexists a

continuum

ofconsumerswhose

reset indexes i aredistributeduniformlyover [0,D). Sotheproportion ofagents resetting their

consumption

in any time interval oflengthAt

<

D

isAt/D.

To

fixideas, supposethatthe unit oftimeisa quarterofthecalendaryear,and

D

—

4. In otherwords, thespan oftime

from

^ to t+

1 is one quarter ofayear. SinceD

=

4, eachconsumer

willadjust her

consumption

once every four quarters.We

will often choose the slightly non-intuitivenormalization that a quarter ofthe calendar year is one period, since quarterly dataisthe natural

unit oftemporal aggregation with

contemporary

macroeconomic

data.Call Ct the aggregate

consumption between

t—

1and

t.Ct

Ji=0 LJs=t-l

Cisds

ld^.

Note

thatjg:^i_i(ksds is per-period

consumption

forconsumer

i.Suppose

that an econometrician estimates7 and

f3 using aconsumption

Euler equation (i.e.,the

consumption

CAPM). What

will the econometrician inferabout preferences?Theorem

2 Consideran

economy

with true coefficient of relative risk aversion 7. econometrician estimates the Euler equationSuppose

an

Et-iP

Ct Ct-i—

rm

1for two assets, the risk free bond

and

the stock market. In other words, theeconometncian

fits {3and

7

tomatch

the Euler equation above for both assets.Then

the econometrician willfindr6D7

forD>1

^'\

3(T3^H^7

for0<D<1

^'^

plus higher order terms characterized in subsequent sections.

Figure 1 plots

7/7

as a function ofD.The

formulae for the cases<

Z?<

1and

D

>

1 are takenfrom

Theorem

2.Insert Figure 1 about here

The

two

formulae paste at the crossover point,D

=

1. Convexity of the formula belowD

=

1,implies that

7/7

> 6D

for all values ofD.

The

case of instantaneous adjustment (i.e.,D

=

0)is of

immediate

interestsince it has been solved alreadyby

Grossman,

Melino,and

Shiller (1987).With

D

=

the only bias arises from time aggregation ofthe econometrician's data, not delayedadjustment by consumers.

Grossman,

Melino,and

Shillershow

that time aggregation produces abias of

7/7

=

2, matching our formula forD

—

0.The

most

important result isthe equation forD

>

1,7

=

6D7,

which

we

call the6D

bias. For example, ifeachperiod {t to t+

1) is a quarterof acalendar year,and consumption

is reset everyD

=

4 quarters, thenwe

get7

=

247.Hence 7

is overestimatedby

a factor of24. Ifconsumption

is revised every 5 yearsthen

we

haveD

=

20,and 7

=

I2O7.Reset periods of four quarters or

more

are not unreasonable in practice. For an extreme case, consider the 30-year-old employeewho

accumulates balances in aretirement savings account(e.g., a 401(k))

and

fails to recognize any fungibility between these assetsand

his pre-retirementconsumption. In this case, stock

market

returns will effectconsumption

at a considerable lag{D

>

120 quarters for this example).However, such extreme cases are not necessary for the points that

we

wish to make.Even

with a delay of only four quarters, the imphcations for the equity

premium

puzzle literature aredramatic.

With

a multipUcative bias of 24, econometricallyimputed

coefficients of relative riskaversion of50 suddenly appearquite reasonable, sincethey imply actual coefficientsof relative risk

aversion ofroughly 2.

In addition, our results

do

notrely on the strong assumptionthataU

reset rules aretime-and

not state-contingent. In

Appendix

B

we

incorporate the reahstic assumption that all householdsadjust immediately

when

the equitymarket

experiences a large (Poisson) shock. In practice, suchoccassional state-contingent adjustments only slightly modify our results.

We

can alsocompare

the6D

bias analytically to the biases thatLynch

(1996) numericallysimulates in his original discrete time model. In Lynch's framework, agents

consume

everymonth

and

adjust their portfolio everyT

months. Lynch's econometric observation period is the unionof

F

one-month

intervals, soD

—

T/F.

InAppendix

C

we

show

thatwhen

D

>

I Lynch'sframework

generates abiaswhich isbounded

belowby

D

and

bounded

aboveby

6D. Specifically, an econometricianwho

naively estimated the Euler equation with datafrom

Lynch'seconomy

would

find a bias of7

6F^

7

"

^

{F

+

l){F

+

2)^

Holding

D

constant, thecontinuous timelimit corresponds toF

—

> oo,and

for this case7/7

—

6D.

The

discrete time casewhere

agentsconsume

at every econometric period corresponds toF

=

1,implying

7/7

=

D, which

canbe

deriveddirectly.Finally, the

6D

biascomplements

participation bias (e.g., Vissing 2000,Brav

et al 2000). Ifonly a fraction s of agents hold a significant share of their wealth in equities (say s

=

|), thenthe covariance

between

aggregateconsumption

and

returns is lowerby

a factor s.As

Theorem

8 demonstrates, this bias combines multiplicatively with our bias: ifthereis limited participation,

the econometrician will find the values of

7

inTheorem

2, dividedby

s. In particular, iorD

>

1,he will find:

7

=

—

7. (4s

This formula puts together three important biases generated

by

Euler equation (andHansen-Jagannathan) tests:

7

willbe

overestimated because of time aggregationand

delayed adjustment (the6D

factor),and

because of limited participation (the 1/s factor).2.2

Argument

forD

>

1In this section

we

present a heuristic proof ofTheorem

2.A

rigorous proof is provided in theappendix.

Normalize a generic period to

be

one unit of time.The

econometrician observes the return ofthe stock market

from

to 1:2 Jo

where

ristherisk-freeinterest rate, ttisthe equitypremium,

a"^ isthe variance of stockreturns,and

2: is a

Wiener

process.The

econometrician also observes aggregateconsumption

overthe period:Ci

Ji=0

Us=0

qds

Idi.

As

iswell-known,when

returnsand consumption

areassumed

tobe

jointly lognormal, thestandard Euler equation implies that*TT

(6)

cov

(\n^,lnRi)

We

willshow

thatwhen

D

>

1 themeasured

covariancebetween consumption growth

and

stock

market

returns ccw(lnCi/Co,lnjRi) willbe

QD

lowerthan

the instantaneous covariance,^£,-1

p{^y'Rt

=

1 with R^=

e*'""""''^"'"''''^"". The a subscripts and superscripts denote asset-specificreturnsandstandarddeviations. As Hansen and Singleton (1983) showed,

,2 „2~

ki3

+

Ma-7(/^.

-y

+7y)

-70-"=

0. Ifweevaluatethis expressionfor therisk-free asset andequities, wefind that,7r

=

^cov (In—

;

,InRt

cov{dlnCt,dlnRt)/dt, that arisesin the frictionless

CCAPM.

As

iswell-known, in the frictionlessCCAPM

'*'

~

cov{d\nCt,d\nRt)/dt'

Assume

that each agentconsumes

one unit in period [—1,0].^So

aggregateconsumption

inperiod [—1,0] is also one:

Co

=

1- SinceInCi/Co

—

C\/Cq

—

1,we

can writecot; I In

—,

In/?! I~

cot;(Ci,lni?i) (7) rD 1=

/cov{C^lMRl)—di

(8)with Cii

=

Jq Cisds the time-aggregatedconsumption

of agent i during period [0, l].First, take the case

D

=

1.Agent

ie

[0,1) changes herconsumption

at time i. For s G [0, i),she has

consumption

Cis=

au'ir-e^ ,where

t=

i—

D.

Throughout

thispaperwe

useapproximationstoget analyticresults. Lete=

max(r,p, 6tt,a^,a^9 ,a).When

we

use annual periods e willbe

approximately .05.'" For quarterly periods, e will beap-proximately .01.

We

can express our approximation errors in higher orderterms ofe.Since consumption in period [—1,0] is normalized to one, at time t

=

i—

D,

a

times wealthwill be equal to 1, plus small corrective terms;

more

formally:aw,^-

=

l+

0<o{Ve)

+

0{£)aw,r+

=

l+

0<o{V^)

+

0{£).Here

0{£) represents stochastic or deterministictermsoforder£,and

0<o(\/£) represents stochasticterms that

depend

onlyon

equity innovations thathappen

before time 0.Hence

these stochasticO<o(\/^) terms are all orthogonal to equity innovations during period [0, l].

Drawing

togetherour lasttwo

results, for sG

[0,i),-

{l+

0{e)){l

+

OM^e)

+

0{e))=

l+

0<o{V^)

+

0{e).Without

lossof generality, set 2(0)=

0.So

theconsumer

z'smutual

fund wealth at datet=

i"is

=

[1+

eaz{i)+

0<o(Ve)

+

0{e)] [l+

O<o(v^)

+

0(e)]=

l+

eaz{i)+

0<o{V£)

+

0{e)The

consumer

adjustsconsumption

at t=

i,and

so for sG

[?,1] sheconsumes

—(r—p)(s—i)

^

[1+

{€)] [1+

eaz{i)+

O<o(v^)

+

0(e)]=

l+

6az

{i)+

0<o{y/i)+

0{£)Thisassumption need not holdexactly. Instead, consumption must beunity up to O<o{\/e)

+

0(e)terms. See notation below.'"For a typical annual calibration r

=

.01, p=

.05, Stt=

(.78)(.06),a^=

(.16)^, (7^0^=

(f^^

=

(3^)^

.andThe

covariance ofconsumption

and

returns for agent i iscov{Cii,\nRi)

=

/ cov{cis,\nRi)ds

Jo

=

Ods+

cov(l+0az(i)+O<Q{^/e)+O{€),oz{l)

+

r+

Tr-^]ds

=

I

9a^cov{z{i),az{l))+

o(6^^'^) ds-

ea^i{l-i)

Here

and

below~

means

"plus higher order terms in e."The

covariance contains the multiplicative factor i because theconsumption

change reflectsonly return information

which

is revealedbetween

dateand

datei.The

covariance contains themultiplicative factor (1

—

i) because the change inconsumption

occurs at time i,and

thereforeaffects

consumption

for only the subinterval [i, 1].We

often analyze "normalized" variancesand

covariances. Specifically,we

dividethemoments

predicted by the

6D

model by

themoments

predictedby

thebenchmark

model

with instantaneousadjustment

and

instantaneousmeasurement.

Such

normalizations highlightthe "biases" introducedby

the6D

economy.For the case

D

=

1, the normalized covariance of aggregateconsumption growth

and

equityreturns is 1 /"^ 1 I

:^cov{Ci,lnRi)

=

/ —-^cov{Qi,Ri)-1 z(l—

i)di=

—

L

/o 6which

is the (inverse of the) 61? factor forD

—

1.Consider

now

the caseD

>

I.Consumer

i6

[0,D) resets herconsumption

at t—

i.During

period one (i.e., t

G

[0,1]) only agentswith iG

[0, 1] will reset their consumption.Consumers

withi

G

(1,D] will notchange their consumption, so theywill havea zero covariance, cov{Cii,Ri)=

0.Hence,

1 ,^

„

, ri(l-z)

ifiG[0,l]

For

D

>

1 the covariance ofaggregateconsumption

isjust1/D

timeswhat

itwould be

ifwe

had

D=l.

^^cov{\nCi/Co,Ri)

^

/^cov{Qi,Ri)-—-^<^uuyiiiK^l/K^l),lllj

—

I --^i^uu\^y^^i,llij—

1 /l 1

The

QD

lower covariance of consumption with returns translates into a%D

highermeasured

1)we

getccw(lnCi/Co,lni?i)

=

CRRA

7. Since 9= -^

(equation 1)we

get6D7

The

Euler equation (6) thenimpHes

7

=

61)7as anticipated.

Several properties ofourresultshouldbe emphasized. First, holding

D

fixed,the bias in7

doesnot

depend

on either preferences or technology: r,tt,a,p, 7. This independence propertywill applyto all of the additional results that

we

report in subsequent sections.When

D

is endogenouslyderived,

D

itself willdepend on

the preferenceand

technology parameters.Forsimplicity,the derivationabove assumesthatagents withdifferentadjustmentindexesi have

the

same

"baseline" wealth at the start ofeach period. In the long-run this wealth equivalencewill not apply exactly. However, ifthe wealth disparity is moderate, the reasoningabove will still

hold approximately.^^ Numerical analysis with 50-year adult lives implies that the actual bias is

very closeto

6D,

the value itwould

haveifall ofthe wealth levelswere identical period-by-period.3

General

characterization of

the

economy

In this section

we

provide a general characterization of thedynamic

properties of theeconomy

described above.

We

analyze four properties of our economy: excess smoothness ofconsumption

growth, positiveautocorrelation of

consumption

growth, lowcovariance ofconsumption

growthand

asset returns,

and

non-zero covariance ofconsumption

growthand

lagged equity retiurns.Our

analysisfocuseson

first-order effects withrespect totheparameters r, p, 6it, a'^, g'^9 ,and

a. Call e

=

max(r,p,9-k,a^,a^9^,a).We

assume

e tobe small. Empirically, e~

.05with aperiodlength ofa year,

and

e~

.01 with aperiod length ofa calendar quarter. All the results thatfoUow

(except one^^) are proved with 0{e^''^) residuals. In fact, at thecost of

more

tedious calculations,one can

show

that the residuals are actually 0{e^).^^The

followingtheorem

is the basis of this section. All proofs appear in the appendix.Theorem

3The

autocovariance ofconsumption growth at horizon h>

can be expressedcav

(ln^±*-,ln^)

=^Vr(P,ft) +

0(e^/2J

0)

where

T{D,

h)=

^

[d{D+

h)+

d{D

-h)-

d{h)-

d{-h)],

(10) ''More precisely, it is only important that the average wealth of households that switch on date t not differ significantly from the average wealth ofhouseholds that switch on any date s G [t

—

D,t+

D]. Toguarantee thiscross-date averagesimilaritywecouldassumethateachreset intervalendsstochastically. Thisrandomnessgenerates

"mixing" betweenpopulationsofhouseholds thatbegin lifewith different reset dates.

''Equation 12 isproved toorder O(-yi), but with more tedious calculationscan beshown tobe 0{e).

One follows exactly the Unes of the proofs presented here, but includes higher order terms. Calculations are

availablefromthe authorsupon request.

^(^)

=

Ef!l^|^+^-2|^

(11)rj 2-5!

i=0 ^ ^

and

( )

=

i/^l -.I is the binomial coefficient.The

expressions aboveare validfor non-integer values ofD

and

h. Functionsd[D)

and T{D,

h)have the following properties,

many

ofwhich

willbe

exploited in the analysis that follows^''.dec''

d{D)

=

|l?|/2for |D|>2

d(0)

=

7/30T{D,

h)~

i/Z? for largeD

T{D,h)

>0

r{D,h)

>0iSD

+

2>h

T{D,

h) is nonincreasingin hr(D,0)

is decreasing inD,

butr{D,h)

ishump-shaped

forh

>

0.r(0,/i)

=

for /i>

2r(0,0)

=

2/3r(o,i)

=

i/6Figure 2 plots d(Z)) along with asecond function

which

we

will use below.Insert Figure 2 about here

3.1

T{D,0)

We

beginby

studying the implications of the autocovariance function,r{D,

h), for the volatility ofconsumption growth

(i.e,by

setting h=

0). Like Caballero (1995),we

alsoshow

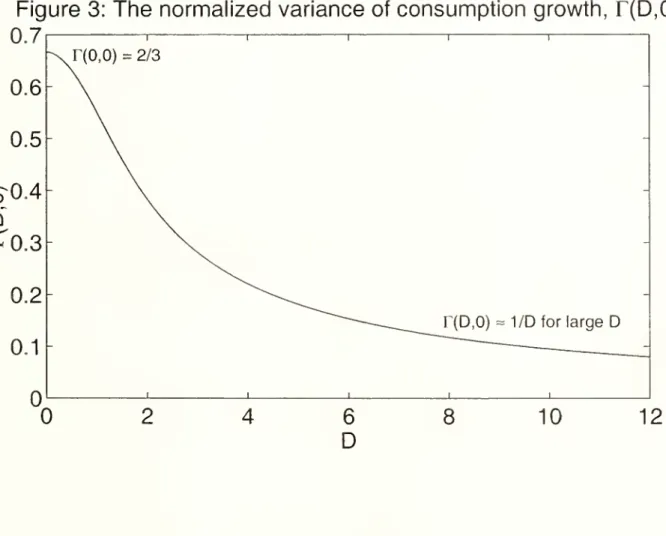

that delayed adjustment induces excess smoothness. Corollary4 describes our quantitative result.Corollciry

4

In the frictionlesseconomy

{D

=

0), var{dCt/Ct)/dt=

o^Q^. In our economy, withdelayed adjustment

and

time aggregation bias,'"'•"°^f;f'-'

=r(D.o)<2/3.

The

volatility ofconsumption,a

9 r{D,0), decreases asD

increases.The

normalized variance ofconsumption, r(L',0), is plotted againstD

in Figure 3.Insert Figure 3 about here.

For

D

=

0, thenormalizedvarianceis2/3,well belowthebenchmark

value of1.The

D

=

casereflectsthe bias generated by time aggregation effects.

As

D

rises above zero, delayed adjustmenteffects also appear. For

D

=

0,1,2,4,20 the normalized variance takes values .67, .55, .38, .22,and

.04. For largeD,

the bias is approximately 1/D.Intuitively, as

D

increases,none

ofthe short-run volatility of theeconomy

is reflected incon-sumption

growth,sinceonly1/D

proportionofthe agents adjustconsumption

inany

singleperiod. Moreover, thesize oftheadjustments onlygrows with VID. So the totalmagnitude

ofadjustmentisfalling with

l/\/^ and

the variance falls with 1/D.3.2

r{D,

h)with

h>0

We

now

consider the properties of the (normalized) autocovariance functionr(D,

h) for h=

1,2,4,8. Figure 4 plots these respective curves, ordered from

h

=

1on

top to ^=

8 at thebottom.

Note

that in thebenchmark

case—

instantaneous adjustmentand

no time-aggregationbias

—

the autocovariation ofconsumption growth

is zero.With

onlytime aggregation effects, theone-period autocovariance is r(0,1)

=

1/6,and

all /i—period autocovariances withh

>

1 arezero.Insert Figure 4 about here. 3.3

Revisiting

the equity

premium

puzzle

We

can also state a formaland

more

general analogue ofTheorem

2.Proposition

5 Suppose that consumers reset their consumption every h^ periods.Then

theco-variance between consumption growth

and

stock market returns at horizon h will he0a'^h

cov{\nC[t,t+h]/C{t-h,t]MR[t^t+h])

=

-^+0{^^^^

where,

D

=

ha/h,and

j

6D

forD>1

^^

~

\

3(lJ)+D^

/-^0<D<1

The

associated correlation iscorr(In

q,,^„/q,_,„,

h.i?[,,+„)=

^^^^^^j^^^y/^

+

^

{^'^') (12)

Inthe

benchmark model

with continuoussamphng/adjustment,

the covariance is just cov{d\nCt,d\nRt)/dt

=

9a^.Moreoever, in the

benchmark model

with continuoussamphng/adjustment,

the covariance at hori-zon hisjustcovilnC[t,t+h]/C[t-h,t]A^Rlt,t+h])

=

^cr^^-So the effect introduced by the

6D

model

is capturedby

the factor -g^,which

appears in Propo-sition 5.We

compare

thisbenchmark

to the effects generatedby

our discrete observation, delayedad-justment model.

As

the horizonh

tends to +00, thenormahzed

covariancebetween consumption

growth

and

asset returns tends to0a'^h 1

_

1_

1h^

b{ha/h)Oa^h

~

6(0)~

2'which is true for anyfixed value ofha- Thiseffect is

due

exclusively to time aggregation. Delayed adjustment ceases to matter as the horizonlength goes to infinity.Proposition 5 covers the special case discussed in section two: horizon h

=

\,and

reset periodha

=

D

>\.

For this case, the normalized covariance is approximatelyequal toea^ 1 1

b{D)0a'^ 6D'.

Figure5 plots the multiplicativecovariance bias factor l/b{ha/h) as a function ofh, forha

=

1.In the

benchmark

case (i.e., continuous samplingand

instantaneous adjustment) there isno

bias;the bias factor is unity. In the case with only time aggregation effects (i.e., discrete

samphng

and

ha

=

0) thebias factor is l/b{0/h)=

1/2.Insert Figure 5 about here.

Hence, lowlevels of

comovement

show

up

most

sharplywhen

horizons arelow. ForD

>1

(i.e.,ha/h

>

1), the covariancebetween

consumption

growthand

stock returns isQD

times lower thanone

would

expect in themodel

with continuous adjustmentand

continuous sampling.We

now

characterizecovariancebetween

currentconsumption growth

and

lagged equityreturns.Theorem

6

Suppose thatconsumers

reset their consumption every ha= Dh

periods.Then

thecovariance betweenlnC[j_t_(.i]/C[t_ij]

and

lagged equity returns \nRuj^s^t+s2] (^'^<

52<

Ij will hecai;(lnqt,t+i]/qt-i,t],lni2[t+s,,t+«,i)=^<72v(L>,si,S2)

+

0(£3/2) (13)with

y^D^,^^,^^^

<s,)-e{s,)-e[s,^+D)

+

e[s,-,D)

^^^^ wherey

-4—

for \x\>

1The

following corollarywill be used in the empirical section.Corollary 7 The

covariance between lnC[5+;j_is.^/,]/C[s_i_s] ^"'^ lagged equity returns Ini^rg^s+i] will beC[s+h-i,s+h] ,„

„

>i

_

^^2e{l

+ D)-e{l)-e{l-h + D)+e{l-h)

\s-l,s]

cot- I In

—^

i,lni?[3,,+i]j=

ea

^

In particular,

when

h> D

+

2, cov{\nC[s+h-i,s+k]/C[s~i,s]A^Rls,s+i])—

^cr^/ one seesfullIn practice,

Theorem

6 ismost

naturally appliedwhen

the lagged equity returns correspond tospecific lagged time periods: i.e., S2

=

si+

1, si=

0,-1, —2,....Note

thatV{D,

81,82)>

iff S2>

—D

—

1. Hence, the covariance inTheorem

6 is positiveonly at lags through

D

+

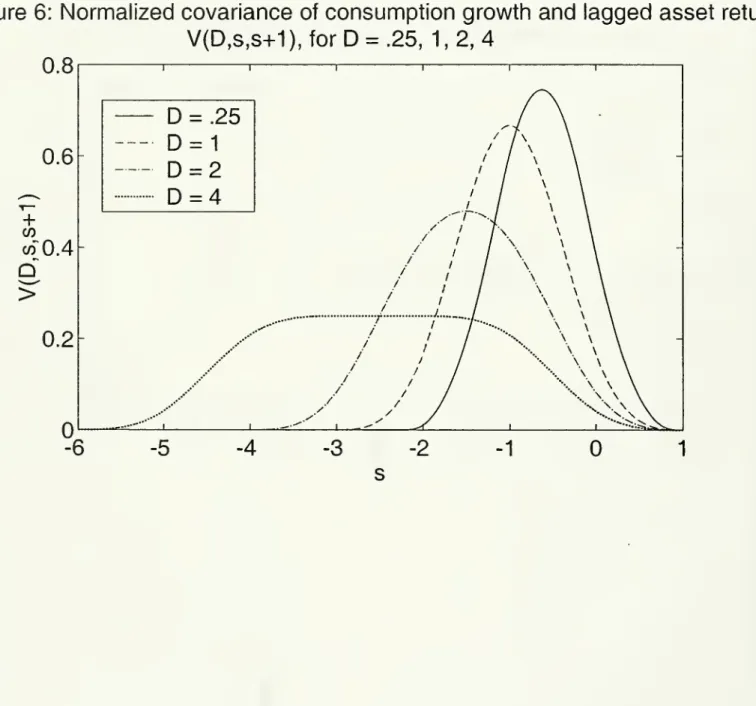

1.Figure 6 plots the normalized covariances ofconsumption growth

and

lagged asset returns fordifferent values of D. Specifically,

we

plotV{D,s,

8+

1) against s for Z?=

.25, 1,2,4, from right to left.Insert Figure 6 about here.

Considera regressionof

consumption

growthon

some

arbitrary (large)number

oflaggedreturns,\nCt+i/Ct

=

J2^s^^^t+i+s.

s=s

One

should find,p^

=

ev{D,s,8

+

\).Note

that thesum

ofthe normalized lagged covariances isone,q^

Y1

ctw(lnqt,t+i]/C|t_i,£],ln/?|(+s,j+s+i])=Y^

V{D,s,8

+

l)=

l.s=—00 s=—00

This implies that the

sum

ofthe coefficients will equal the portfolio share of the stock market,15E

^^=

^- (1"^)s=-D-l

3.4

Extension

to

multiple

assets

and

heterogeneity

inD.

We

now

extend theframework

to the empirically relevant case ofmultiple assets with stochasticreturns.

We

also introduce heterogeneity in D's.Such

heterogeneitymay

arise becausedifferent D's apply to different asset classesand

becauseD

may

vary across consumers.Say

that there are different types ofconsumers I=

1,...,n;and

different typesof asset accountsm

=

l...nm-Consumers

of type / exist in proportion pi (X^iP;—

1)^^^

look at accountm

everyDim

periods.The

consumer

has wealthwim

investedin accountm,

and

has an associated marginalpropensity to

consume

[MFC),

aim- Inmost

models theMFC's

willbe

thesame

for all assets,but for the sake ofbehavioral realism

and

generalitywe

consider possibly differentMFC's.

For instance,

income

shocks could have a lowD

=

I, stockmarket

shocks a higherD

=

4,and

shocks to housing wealth a.D

=

40.^^ Accountm

has standard deviationam, and

shocksdz^. Call

Pmn

=

cov{dznt,dzmt)/dt the correlation matrix oftheshocksand

amn

—

Pmn^rn<^n theircovariance matrix.

'^This is truein a world withonly equities andriskless bonds. In general, it's more appropriate to usea model

withseveralassets, includinghumancapital,as in thenext section.

'^This example implies different short-run marginal propensities to consume out ofwealth windfalls in different asset classes. Thaler (1992) describes one behavioral model with similar asset-specific marginal propensities to

consume.

Totalwealth inthe

economy

is^imPi'^im and

totalconsumption YLumPi^imWim-

A

usefuland

natural quantity is

^Ira

=

^F^ (J-OJA

shock dzjnt in wealth accountm

will get translated atmean

interval^

^i

PiDim

intoaconsump-tionshock

dC/C

=

Yl,i^imdz-mt-We

can calculatethe secondmoments

ofour economy.Theorem

8 In theeconomy

described above,we

have,ccw{\nCt/Ct-i,lnR^t^^^t^^^^)

=

Yl^imOmnV{Dim,si,S2)

+

o{e^f^^

(19)and

cav{lnCt+h/Ct+h-iMCt/Ct-i)

=

^

e/m^Pm'^mm'riAm,

Dum',h)

+

O

(e^/^) (20)1,1',m,m'

with

T{D,

D',h)=

-^

[d{D+

h)+

d(Z?'-

h)-

d(D'-

D

-

h)-

d{h)\ (21)and

V

defined in (14), d defined in (11).The

function T{D,t), defined earher in (10), relates toT{D,D',t)

by

T{D,D,t)

=

r{D,t).Recall that

V{D,0,

1)=

l/h{D). So a conclusion from (19) is that,when

there are several t3rpesof people

and

assets, the bias that the econometricianwould

find is theharmonic

mean

of theindividual biases b{Dim), the weights beinggiven

by

the "shares of variance."As

an application, consider the case with identical agents (n;=

1, / is suppressed for this example)and

different assets with thesame

MPC, Om

=

a. Recall thatV{D,0,

1)=

l/b{D). So,the bias

7/7

will be:Hence, with several assets, the aggregate bias is theweight

mean

ofthebiases, themean

beingtheharmonic mean, and

the weight of assetm

being the share ofthe total variance thatcomes from

this asset. This allows us, in

Appendix

B, to discuss a modification of themodel

with differentialattention to big shocks (jumps).

These

relationships are derived exactly along the lines ofthe single asset, single typeecon-omy

ofthe previous sections. Expression (19) is the covariancebetween

returns, Ini?^,^ ^ ,—

(T„Z|J_|_^

j^-s 1

+

O

(e),and

the representation formulafor aggregate consumption.InCt/Ct-i

=

Y,^mcrm

[

a(i)z[r_i+,_p„,,_i+,jciz+

0{e^^^), (23)where

a{i)=

(1—

\i\) . Equation (23) can also be used to calculate the autocovariance (20) ofconsumption, ifone defines:

r{D,D',h)=

/ a{i)a{j)cov {z[t_i+i_j^^t_-^+,^,zn_-i_^j+h-D',t-i+j+h])Ti—j-

(24)Ji,je[-i,i]

^

J^(26) 3.5

Sketch

of

the

proof

Proofsofthe propositions appearintheappendix. In thissubsection

we

provideintuition forthosearguments.

We

start with the following representation formulaforconsumption

growth.Proposition

9We

have,/I

1

InCt+i/Ct

^9a

a{^)z^t+,^D,t+^]^di+

0{e). (25)Note

that the order ofmagnitude

of9af_^a{i)zu_^.i_pt+i]^ is theorder ofmagnitude

ofcr, i.e.O(v^).

Assets returns can

be

represented as In i?|(+sj f+g^]=

<Jz^^_^.g^^^s^^+

0(e). Sowe

getcot;(ln^,ln/?[3+3,,3+^2])

/I

(^j

a{i)cov(2|t_!+,_£,,£_i+j],2[s+3j,s+s2]) -^

+

0(e^^^)/I

di

a{i)X{[t

-1+i-

D,t-l +

i]n[s+

si,s+

S2])—

(27)-1

^

'

+0(e3/2).

Here

A(7)isthe length (theLebesgue

measure)ofinterval I. Likewiseonegetscot'(lnCh+t/C/i+(_i,lnCt/Ct_i)=

9^a^f

I

a{i)a{j)\{[h+

t-\

+

i-D,h+t-\+i]f^[t-l+j-D,t-l+j])^-^+o(e^l'^y

The

bulkofthe proofisdevotedto theexplicit calculation ofthis last equationand

equation (27).4

Endogenizing

D

Until now,

we

haveassumed

thatD

is fixed exogenously. In this sectionwe

discusshow

D

ischosen,

and

provide aframework

for calibratingD.

Becauseofdelayed adjustment, the actual

consumption

path will deviatefrom

the "first-best"instantaneously-adjusted

consumption

path. In steady-state, the welfare loss associated with thisdeviationis equivalent, using

a

money

metric, to a proportional wealth loss ofAc

where'^Ac

=

^E'[

—

;-I

+

higher order terms. (28)Here

AC

is the differencebetween

actualconsumption

and

first-best instantaneously adjustedconsumption. Ifthe asset is observed every

D

periods,we

haveAc

=

\-i9^o''~D+

O

(e^) . (29)Thisisa second-orderapproximation. SeeCochrane (1989) fora similar derivation.

Equations (28)

and

(29) are derived in the appendix.We

assume^^ that eachconsumption

ad-justment costs q proportion of wealth, w.

A

sensiblecalibration ofqwould be

qw

=

(l%)(annual consumption)=

(.01)(.04)ti;=

(4 •10""*)it;.The

NPV

of costs as a fraction of current wealth isq'^n>o^~'^^^

implying a total cognitivecost of

A

=

^-The

optimalD

minimizesboth consumption

variability costsand

cognitive costs, i.e.D*

=

argminAc

+

Ag.D*

=

argmin

--iO^a^D

+

^—

^rD

4 1-

e-P^

so-70

G

=

qp -pD QP (1-

e-pDy

Qp (ePO/2_

e-P^/2)'4sinh2^

and

we

find for the optimalD

D*

-

arg sinhP

A

f±

6a

y

7p

QP 2^2^0^a

(30)when

/9 Z? -C 1.We

make

the following calibrationchoices: g=

4•10"'*, ct^=

(0.16)^,7

=

3,p

=

0.01, tt=

0.06,and

9—

n/{-ya'^)=

0.78. Substitutinginto our equation forD,

we

find Z)~

2 years.This calibration implies that

D

values of at least 1 year (or 4 quarters) are quiteeasy to defend.Moreover, our formula for

D*

ishighlysensitivetothevalue of6. Ifaliquidityconstrainedconsumer

has only a small fraction ofher wealth inequities

—

becausemost

ofher wealth is in other formslike

human

capital orhome

equity—

then the value ofD

will be quite large. If=

.05 because of liquidity constraints, thenD*

~

30 years.Note

that formula (30)would

work

for other types ofshocks than stock market shocks.With

several accounts indexed

by

m,

peoplewould pay

attention to accountm

at intervals of lengthDr, ^

U QrnP

(31)

''This wouldcomefrom autilityfunction

U =

E

I-9E'

1— »r

„l-71-7

-dsifthe adjustment to consumption are madeat dates (Ti)^^^.

A

session of consumption planning at time t lowerswith

qmWm

representing the cost of evaluating asset tti,and

Om

generahzed as in equation (18).Equation (31)

impHes

sensible comparative staticson

the frequency ofreappraisal.Thus

we

get amini-theory ofthe allocation ofattention across accounts.'^

5

Consequences

for

macroeconomics

and

finance

5.1

Simple

calibrated

macro model

To

draw

together themost

important implications ofthis paper,we

describe asimplemodel

oftheUS

economy.We

use ourmodel

to predict the variability ofconsumption

growth, theautocorre-lation of

consumption

growth,and

the covariance ofconsumption growth with equity returns.Assume

theeconomy

iscomprisedoftwo

classes ofconsumers:stockholdersand

non-stockholders.The

consumers thatwe

model

in section 2 are stockholders. Non-stockholdersdo

not have anyequity holdings,

and

insteadconsume

earnings fromhuman

capital. Stockholders have aggregatewealth St

and

non-stockholders have aggregate wealth Nt- Totalconsumption

is given by theweighted

sum

Ct^a{St

+

Nt).Recall that

a

is the marginal propensity to consume.So,

consumption

growth can bedecomposed

intodC/C

=

sdS/S

+

ndN/N.

Heresrepresentsthewealthofshareholdersdividedby thetotalwealthofthe

economy

and

n

=

1—

s

represents the wealth of non-shareholders divided

by

the total wealth of the economy.So

sand

n

are wealth shares for shareholdersand

non-shareholders respectively.We

make

the simplifyingapproximation that s

and n

are constant in the empirically relevantmedium-run.

Using a first-order approximation,

\n{Ct/Ct-i)

=

sln{St/St-i)+

nln{Nt/Nt-i).Ifstockholdershaveloadinginstocks 9, theratioof stock wealthto totalwealthinthe

economy

is.

=

s9. (32)To

calibrate theeconomy

we

begin with the observation thathuman

capital claims about 2/3 ofGDP,

Y. In this model,human

capital is the discoimted net present value of laborincome

accruing to the current cohort of non-stockholders.

We

assume

that the expected duration ofthe remaining working lifeof a typical worker is 30 years, implying that the himian capital of the

current work-force is equal to

/30

2 2fl

-

e-^°'')H

=. /e-^'-y

dt=

-^^—^

'-Y~

17F,7o 3 3r

' SeeGabaix andLaibson (2000a,

b) for abroadertheoretical and empirical analysis of attentionallocation.

" Thisisata givenpointintime.

A

majorreasonfornon-participationisthatrelativelyyoungagentshavemostoftheirwealthinhumancapital,againstwhich they cannot borrowtoinvest inequities(seeConstantinides,Donaldson and Mehra 2000).

where

Y

isaggregateincome. Capitalincome

claims 1/3ofGDP.

Assuming

that it has theriskiness (and thereturns) of the stock market, theamount

ofcapital isK

=

—^

—

tF

~5y

3(r

+

7r)so that the equity share oftotalwealth is

By

assuming that all capital is identical to stockmarket

capital,we

implicitly increase thepre-dicted covariance

between

stock returnsand consumption

growth.A

more

realisticmodel would

assume

amore

heterogeneous capital stock,and

hence a lower covariancebetween

stock returnsand consumption

growth.In this

model

economy,we

work

with data atthe quarterly frequency.We

assume a

=

.16/\/4,IT

—

.06/4, r=

.01/4,and 7

=

3, so the equity share (equation (1) above) is 6*=

-k/{"fu'^)=

.78.Then

equation (32) implies s=

.28. In other words,28%

of the wealth in thiseconomy

isowned

by

shareholders. All of stockholders' claims are in either stock or risk-free bonds.To

keepthingssimple,

we

counterfactuallyassume

that A'^and

S

are uncorrelated.We

have to take a standon

the distribution ofD'

s inthe economy.We

assume

thatD

valuesare uniformly distributed

from

toD

=

120 quarters (i.e., 30 years).We

adopt this distribution to capture awide range ofinvestment styles.Extremely

active investors will have aD

value closeto 0, while passive savers

may

put their retirement wealth in aspecial mental account, effectivelyignoring theaccumulating wealth until after age 65 (Thaler 1992).

We

are agnosticaboutthe truedistribution of

D

types,and

we

present thisexample

for illustrative purposes.Any

wide

range ofD

valueswould

serve tomake

our key points.To

keep the focuson

stockholders,we

assume

that non-stockholders adjust theirconsumption

instantaneously in response to innovations in labor

income

—

i.e., at intervals of length 0.Theorem

3 implies that thequarterly volatility of aggregateconsumption growth

is.al

=

n2r(0,0)a%

+

O'a^

[

f

_

T{D, D'

,0)^

J JD,D'e\0,D]

D

We

assume

that the quarterly standard deviation ofgrowth

inhuman

capital is ai\/=

.01.^^Our

assumptions jointly imply that

ac

=

.0063.^^Most

of this volatilitycomes from

variation in theconsumption

of non-stockholders. Stockholders generate relatively httleconsumption

volatility because they represent a relativelysmall share oftotalconsumption

and

because they only adjustconsumption

everyD

periods. This adjustment rulesmooths

out the response to wealthinnova-tions, since only fraction -^ ofstockholders adjust their

consumption

duringany

singleperiodand

the average adjustment is of

magnitude

VD.

Our

model's implied quarterlyconsumption

volatility—

ac

=

0.0063—

lies below itsempiri-cal counterpart.

We

calculate the empiricalac

using the cross-country panel dataset createdby

"'Wecalibrate

a^

frompost-War

U.S.dataon wagegrowth. From1959-2000thestandarddeviationofper-capitareal wage growth at the quarterly frequency has been .0097 (NationalIncome and Product Accounts, Commerce

Department, BureauofEconomicAnalysis). Ifwages follow arandom walk, then thestandard deviationofgrowth

inhuman capital,aif , willequal thestandard deviationin wagegrowth.

--Figure 3 plots the function r(D,0). Note that r(0,0)

=

2/3 and that r(r»,0)~

l/r>.for large D. In theCampbell

(1999).^'^We

estimateuc

—

0.0106by averaging acrossallofthe countriesinCampbell'sdataset: Australia,

Canada,

France,Germany,

Italy, Japan, Netherlands, Spain, Sweden,Switzer-land, United

Kingdom, and

U.S.^'' Part of the gapbetween

our theoretical standard deviationand

the empirical standard deviationmay

reflectmeasurement

error, which should systematicallyraise thestandard deviation ofthe empirical data. In addition,

most

ofthe empiricalconsumption

series include durables,

which

should raise the variability ofconsumption

growth(Mankiw

1982).By

contrast, theUS

consumption

data omits durablesand

for theUS

we

calculateac

=

0.0054,closely matching our theoretical value.

Next,

we

turntothefrrst-orderautocorrelationofconsumption

growth, applying againTheorem

3:

Pc

=

corr(lnCt/Ct-i,lnCt-2/Cf_i)dDdD'

{oir'

n^ol,V{Q, 1)+

e^a^

f f

_

Y{D, D'

, 1)-J Jd,D'€[0,D]d'

Using our calibration choices, our

model

impliespQ

=

0.34.'^^ This theoretical prediction lies well abovethe empirical estimate of —0.11, foundby

averaging across the country-by-countryautocor-relations inthe

Campbell

dataset.Here

too, bothmeasurement

errorand

theinclusion ofdurables are likely to bias the empirical correlations down. Again, theUS

data, which omits durables,comes

much

closer tomatching

our theoretical prediction. In theUS

data,Pq

=

0.22.We

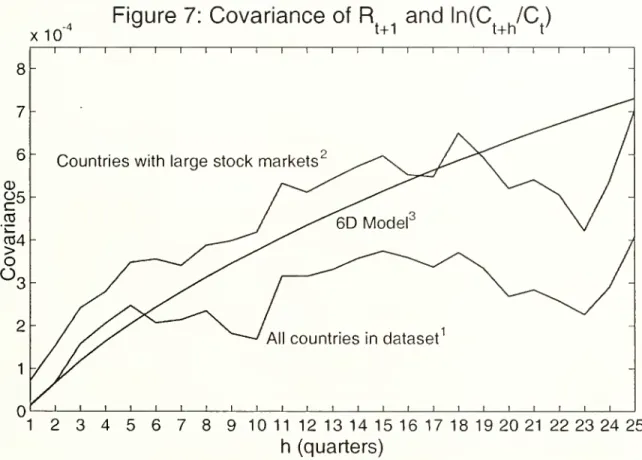

turnnow

to the covariationbetween

aggregateconsumption

growthand

equity retiu^nscov{lnCt/Ct-i,lnRt).

We

findcov{\nCt/Ct-u\nRt)

=

ea^

/_

y(D,0,

1)-=-=

0.13 10Jd€\o.d]

D

assuming

that in the short-run theconsumption

growth ofnon-stockholders is uncorrelated withthe

consumption

growth ofstockholders.The

covariance estimate of 0.13• 10~^ almostmatches

theaveragecovarianceinthe

Campbell

dataset, 0.14-10"''. This time, however,theU.S. data doesnot "outperform" the rest ofthe countries in the

Campbell

dataset. For the U.S., the covarianceis 0.60 • 10~^. However, all of these covariances

come

much

closer to matching ourmodel

thanto

matching

thebenchmark model

with instantaneous adjustment/measurement.The

benchmark

model

withno

delayed adjustment predictsthat the quarterly covariancewill be 60'^~

50• 10~^.What

would

an econometrician famihar with theconsumption-CAPM

hterature conclude ifhe observed quarterly data from our

QD

economy, but thought he were observing data from thebenchmark economy?

First, he might calculate,^

=

1000' cov{\iiCt/Ct-i,\nRt)

~

and

concludethat thecoefficient ofrelative riskaversion is over one-thousand. Ifhe werefamiliar with thework

ofMankiw

and

Zeldes (1991), he might restrict his analysis to stockholdersand

calculate,

cm;(ln

St/St-i,m

Rt)23

We

thank JohnCampbell forsharing thisdatasetwith us."We

use quarterly data from the Campbell dataset. Thequarterly databegins in 1947 for theUS, and beginscloseto 1970 formostoftheother countries. Thedataset endsin 1996.

"The

respectiveeffectsaren^(j^r(0,1)=

.077•IQ-* and6^(7^

/d.d'61o,dir(^.-D',

1)^^^ =

.048 10^^Finally, ifheread

Mankiw

and

Zeldescarefully, hewould

realizethathe shouldalsodo

acontinuous time adjustment (ofthe type suggestedby

Grossman

et al 1987), leading to another halving ofhisestimate. But, after all ofthishard work, he

would

stillend

up

with a biased coefficient of relativerisk aversion: 300/2

=

150. For this economy, the true coefficient ofrelative risk aversion is 3!These

observations suggest that the literature on the equitypremium

puzzle shouldbe

reap-praised.

Once

onetakes account ofdelayed adjustment, highestimates of7 no

longerseem

anom-alous. Ifworkers in mid-life take decades torespond to innovations in their retirement accounts,

we

should expect naive estimates of7

that are far too high.Defenders oftheEuler equation approach might arguethat economists can go

ahead

estimatingthe valueof

7 and

simply correct those estimates forthe biases introducedby

delayed adjustment.However,

we

do

not view this as a fruitful approach, since the adjustment delays are difficult toobserve or calibrate.

For an active stock trader,

knowledge

ofpersonal financial wealthmay

be updated

daily,and

consumption

may

adjust equally quickly.By

contrast, for the typical employeewho

invests in a 401(k)plan,retirementwealthmay

be

initsown

mental account,^^and

hencemay

notbe

integratedinto current

consumption

decisions. This generates lags of decades ormore

between

stock pricechanges

and consumption

responses.Without

preciseknowledge

ofthe distribution ofD

values, econometricians willbe

hardpressed to accuratelymeasure 7

using the Euler equation approach.In

summary,

ourmodel

tells us that highimputed 7

values are notanomalous

and

that high frequency properties ofthe aggregate data canbe

explainedby

amodel

with delayed adjustment. Hence, the equitypremium

may

notbe

a puzzle.Finally,

we

wishto notethat our delayed adjustmentmodel

iscomplementary

tothetheoreticalwork

ofother authorswho

have analyzed the equitypremium

puzzle.^^Our

qualitative approachhas

some

similarity with the habit formation approach (e.g., Constantinides 1990,Abel

1990,Campbell

and Cochrane

1999). Habit formationmodels

imply that slow adjustment is optimalbecause households prefer to

smooth

thegrowth

rate (not the level) ofconsumption. In our%D

model, slow adjustment isonlyoptimal becausedecisioncostsmake

highfrequency adjustment tooexpensive.

6

Review

of related

empirical

evidence

In this section,

we

reviewtwo

types of evidence that lend support to our model. In this firstsubsection

we

review survey evidencewhich

suggests that investorsknow

relatively littleabout

high frequency variation in their equity wealth. In the second subsection

we

show

that equityinnovations predict future

consumption

growth.6.1

Knowledge

of equity

prices

Consumers

can't respond to high frequency innovations in equity values if they don't keep closetabs

on

the values of their equity portfolios. In this subsection,we

discuss survey evidence thatsuggests that

consumers

may

know

relatively little about high frequency variation in the value oftheir equity wealth.^*

We

also discuss related evidence that suggests that consumersmay

not-''SeeThaler (1992).

-^For otherproposedsolutions tothe equitypremiumpuzzleseeKocherlakota(1996), BernartziandThaler(1995),

and Barberisetal (2000).

![Figure 1: Ratio of estimated y to true y 30 1 1 1 ^ >-25 _ ^^ . 1- ^^ 2 20 - ^^ >- ^y^ CD ^^ |15 For D<1 ratio is /^For D>1 ratio is 6D CO -10(13 6y/[3(1-D)+d2] y^ ratio en - ^^ - 2-n """^ r r 1 12 3 4 5](https://thumb-eu.123doks.com/thumbv2/123doknet/13808295.441608/47.837.49.746.291.746/figure-ratio-estimated-true-cd-ratio-ratio-ratio.webp)

![Figure 5: Multiplicative covariance bias factor 1/b(1/h) 0.5 1 1 1 1 1/b(1/h)^1/2 for large h 0.4 - ^^^—^^^ 0.3 - ^-^^^ 0.2 For h<1 1/b(1/h)=h/6 /For h>1 / 1/b(1/h)=[3(1-1/h)+(1/h)^]/6 0.1 / 1 1 1 1 3 h](https://thumb-eu.123doks.com/thumbv2/123doknet/13808295.441608/51.837.33.693.311.796/figure-multiplicative-covariance-bias-factor-large-lt-gt.webp)