Architecting a Valuation System for R&D Investments

by

Mitzi Ann M. Mori

B.S. Computer Science and Engineering, California State University, Long Beach, 1988

Jacqueline Y. Tyson

M.S. Electrical Engineering, Penn State University, 1993 B.S. Electrical Engineering, North Carolina A&T State University, 1990

SUBMITTED TO THE SYSTEM DESIGN AND MANAGEMENT PROGRAM IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF

MASTER OF SCIENCE IN ENGINEERING AND MANAGEMENT

AT THE

MASSACHUSETTS INSTITUTE OF TECHNOLOGY

FEBRUARY 2002

2001 Mitzi Ann M. Mod and Jacqueline Y. Tyson. All rights reserved.

The authors hereby grant to MIT permission to reproduce and to distribute publicly, paper and electronic copies of this thesis document in whole or in part.

Signature of Author 2 MitziAnnM.Mon

System Design and Management Program Signature of Author

Jacc elined. Tyson System Design and Management Program

Certified by

Janice A. Klein Thesis Supervisor Senior Lecturer, School Of Management

Certified by

James M. Utterback

Thesis Supervisor

David J. McGrath jr. Professor of M/nagement and Innovation, School Of Management Corporate Sponsor

Tom A. Kavassalis Manager of Strategy & Planning, XIG, Xerox Corporation

Accepted by

Steven D. Eppinger Co-Director, LFM/SDM GM LFIV Ko or of Management Sience and Engineering Systems Accepted by

MASSACHUSES OTECHNOLOGY TNSTITUTE C Co-Director, LFMISDM

Blank----Architecting a Valuation System for R&D Investments

by

Mitzi Ann M. Mori

Jacqueline Y. Tyson

Submitted to the System Design and Management Program in Partial Fulfillment of the Requirements for the Degree of Master of Science in Engineering and Management

at the Massachusetts Institute of Technology, January 2002

Abstract

In an era of intense competition and limited resources, companies continually make critical investment decisions with the expectation these decisions will pay off sometime in the future. One investment area in most companies involves technology. So, given current

budget constraints and limited human resources, what technologies should be invested in?

The VERDI framework has the potential to provide a standard process to assess early-stage technologies. Value does not always equate to monetary worth. The meaning of value changes just as a technology transforms and progresses through its maturity cycle. Companies need to recognize that they attain more than just a monetary return on technology investments.

This thesis provides the background information on the composition of a firm; an explanation of the technology maturity cycle; foundations in technology strategy; explanation of

commonly practiced methods for valuing technology and the basis for understanding the importance of intangible assets and their role in valuing early-stage technology. The thesis consists of six sections, Section 1, introduction to the problem and composition of the firm; Section 2, a literature overview, containing the bulk of the background material; Section 3, the valuation methods that have been practiced or are in practice at Xerox, including

introduction to resource-based view; Section 4, the VERDI framework, explanation of the adaptation of RBV to the framework; Section 5, the proposed application of the framework at Xerox, VERDIX, including details on committee make up, infrastructure, and a detailed example; and Section 6, the summary, including next steps and further research.

Blank----Acknowledgements

We would like to thank our thesis advisors, Janice Klein and James M. Utterback for their guidance, helpful comments, and supportive attitude during the thesis process. Our gratitude is extended to our corporate advisor, Tom Kavassalis whose

knowledge, experience and insights were invaluable to us during the writing of this thesis. A special thank you to the SDM staff, our SDM colleagues, and our

company, Xerox Corporation, especially our respective local management for supporting us throughout the two-year program. In addition, we extend heartfelt thanks to our families and friends for their undying support, encouragement, understanding and patience.

Mitzi Ann and Jacqueline

There are some very extraordinary people I would like to express my gratitude toward who encouraged and supported me throughout the SDM experience. The first is my husband and friend, Craig Goldenson, who has been a source of

continuous support and positive energy these past two years; my parents, Mitsuru and Carol Ann Mori, for their unending encouragement and for providing a strong foundation on which I have been able to build upon to better myself; Mike G. Salfity, my mentor and friend, who believed in my abilities and encouraged me to apply for the SDM program. And to my thesis partner Jacqueline, to whom I am indebted to, for her dedication, team spirit and hard work during these past two semesters as we have worked and at times struggled on thesis, but I am most grateful for her

enduring friendship and sense of humor.

Mitzi Ann

I would like to thank my parents, Colleen and James Tyson, who have always

encouraged me in all of my endeavors. I appreciate your love and support. Thank you, Joel A. Kubby, for being interested in my continued development and

encouraging me to apply to the SDM program. And to Mitzi Ann, my thesis partner, for her commitment, thoughtful insights, and tireless efforts during the summer and fall sessions on our thesis. I am grateful for your friendship. "Trust in the LORD with all thine heart; and lean not unto thine own understanding. In all thy ways

acknowledge him, and he shall direct thy paths" (Proverbs 3:5-6 KJV). Thank you God for directing my path.

Blank----Table of Contents

A b stra c t ... 3 Acknowledgem ents ... 5 Table of Contents... 7 L ist o f F ig u re s ... 1 1 L ist ... 1 3 Section 1: Introduction... 15 O v e rv ie w ... 1 5 Com pany Overview ... 18Com pany Values, M ission and Vision Statements... 18

Thesis Outline ... 20

Section 2: Literature Overview ... 23

The Charter of ... 23

Marketing and Finance in Support of R&D... 24

The Im portance of Valuing Early Stage R&D Technology ... 27

Technology Maturity Cycle ... 27

Technology Strategy ... 28

Dom inant Designs... 30

Technology S-Curves... 31

Technological Discontinuities... 32

R&D Project Portfolio ... 34

Patent Portfolio ... 36

Current Methods Used in Valuation ... 39

Return on Investm ents...40

Net Present ue ... 40

Internal Rate of Return... 41

Expected Com m ercial Value... 42

Options / Real i n ... 44

Sum m ary... 46

Intangibles ... 49

Im portance of Intangible Assets... 50 Types of Intangibles... 52 Intellectual Capital... 52 Hum an Capital ... 54 Structural Capital... 55 Value Extraction... 55

W ays of Valuing Technology ... 59

Maxim izing Value from Patent Portfolio ... 59

Recognizing a Radical Innovation... 62

Sum m ary... 64

C o n c lu s io n ... 6 6 Section 3: The Xerox R&T Valuation Process... 69

O rganizational Structure ... 69

Process Context ... 70

Valuation Process... 71

Resource-Based View ... 75

Foundation of the VERDI Framework... 76

Section 4: VERDI Fram ework ... 77

The Filtering Process... 79

VERDI Methodology ... 81

Governance ... 82

Required Inform ation ... 85

Adaptation of the RBV Method for Technology Assessment ... 87

Definitions ... 87

Technology Stage... 90

Technology Assessm ent... 91

Section 5: Proposal for VERDIX... 95

O v e rv ie w ... 9 5 Xerox's Values ... 95

Xerox's Vision and Mission Statements ... 96

Mem bership... 97

M e e tin g s ... 1 0 1 Supporting IT Infrastructure ... 103 Valuation Process ... 106 S c o rin g ... 1 0 9 Assessment Questionnaire ... 110 In im ita b ility ... 1 1 0 D u ra b ility ... 1 14 A p p ro p ria b ility ... 1 15 E xte n s ib ility ... 1 16 Competitiveness ... 116 Market Attractiveness ... 118 Assessment Outcome ... 120

Illustration using tone r/man uf actu ring process A ... 121

In im ita b ility ... 1 2 1 D u ra b ility ... 12 5 A p p ro p ria b ility ... 12 6 E xte n s ib ility ... 12 6 Competitiveness ... 127 Market Attractiveness ... 129 Recommendations ... 131 Section 6: Summary ... 137 F utu re W o rk ... 14 0 B ib lio g ra p h y ... 14 1 R e fe re n c e s ... 14 3

Blank----List of Figures

Figure 1: Generic Company Structure... 18

Figure 2: Marketing Support... 25

Figure 3: Elements of a successful strategy ... 29

Figure 4: Technology "S-Curve"... 32

Figure 5: Popularity of Project Selection & Portfolio Methods ... 35

Figure 6: Value Hierarchy... 36

Figure 7: Corporate Value Model ... 39

Figure 8: Determining the Expected Commercial Value... 42

Figure 9: Solution Methods and Option Calculators ... 45

Figure 10: Financial methods comparison... 47

Figure 11: Relationship of Intangibles ... 51

Figure 12: Intellectual Capital of the Firm... 53

Figure 13: Human Capital and Intellectual Assets... 54

Figure 14: ICM Preferences by Company Type ... 56

Figure 15: Sources of Valuation and Conversion Mechanisms... 56

Figure 16: A Model of an IC Company ... 58

Figure 17: Corporate Decision Model for Investing in Intellectual Property... 60

Figure 18: 2x2 Patent Map... 60

Figure 19: Patent Funnel Map... 61

Figure 20: Patent Value Model... 62

Figure 21: A Radical Innovation Hub... 63

Figure 22: Xerox Corporation - Organizational Structure ... 69

Figure 23: R&T spending distribution ... 71

Figure 24: Portfolio Balance ... 73

Figure 25: Example of a bubble chart... 74

Figure 26: Embryonic to Growth inside R&D Lab... 77

Figure 27: Filtering of an Idea ... 79

Figure 28: VERDI Methodology... 81

Figure 31: Example of the VERDIX committee membership...97

Figure 32: askOnceT M Interface ... 1 04 Figure 33: S um m ary M atrix ... 120

Figure 34: Toner/manufacturing process A Summary Matrix...131

Figure 35: Inimitability Assessment ... 133

Figure 36: Competitiveness Assessment ... 133

Figure 37: Market Attractiveness Assessment ... 134

Figure 38: VERDIX Assessment ... 134

List of Tables

Table 1: Characteristics of R&D as a function of technological maturity ... 27

Table 2: Significant Characteristics of the phases of innovation ... 30

Table 3: Value Hierarchy Levels ... 37

Table 4: Knowledge Workers, 1900-1999 ... 50

Table 5: Types of Knowledge ... 53

Table 6: Management for Value Extraction ... 55

Blank----Section 1: Introduction

Overview

From the time we are children we are taught the importance of saving for the future. Many of us have vivid memories from the day we opened our first interest bearing savings account and were awarded the responsibility for its

maintenance. We remember the excitement of watching it grow over the years, and at that time we may not have fully appreciated the idea of compounding interest, but we understood money put into savings today grew into future earnings tomorrow. Not much has changed since then; today investments are made in the hopes of attaining greater value in the future.

Often, as illustrated in the previous example, returns on investments are valued or measured in terms of the money earned or gained. However, other forms of value exist for investments, for instance donating one's time to a volunteer

project, where the reward is not necessarily monetary, but instead is the sense of accomplishment or providing service. The art world holds many examples where both non-monetary and monetary value is received. For instance, the painter takes a blank canvas and applies paint to create a scene or a portrait, producing a completed painting, which can be sold at an art gallery. To the patron who buys the painting they purchase it for the "emotional value", for the love of the painting, and though they may understand that in the future the painting may be worth more (may appreciate in value), it is not the driver behind making the purchase. In this instance the art is valued both in terms of non-monetary and monetary terms.

In one specific area, marble sculpting, the artist views the raw material both as what it is and as a potential for "what it could be". To many of us, we would just see a slab of marble, but for the artist they can see its future, they see the

artist, and the early-stage technology, the slab of marble. Like the artist, the company has the required skills and tools to develop the early-stage technology into its final form. Sculpting is similar to technology in that the final form is not fully presented at the onset of the process, it is slowly revealed over time as the sculpture evolves from its rough shape to a more refined and completed figure. Technology like art is transformed over time.

In for-profit companies, investments and their returns are measured in monetary terms, including R&D investments. Because monetary returns are important the value of R&D investments are primarily based on financial models. R&D

investments usually consist of projects in various stages of progress. Some of these projects are actually technologies, which are under development. Like a project, a technology develops and matures over time. During this maturity process more information and data is available, reducing the uncertainty

surrounding it. As more information is known, this progression permits for more accurate predictions to be made for its application and potential market

appreciation, which allows for the use of financial methods in establishing its value. Much research has been conducted in the area of valuing technology during this latter stage of maturity and after its commercial application.

Technology matures and the valuation process associated with each of the maturity levels is different. This is a key correlation many firms consider, but do not adequately account for. The time span between when an investment in a technology is made, to when a monetary return may be realized is not a standard

fixed amount of time. Like the technologies themselves, the time frame will vary from one to another, and the rate in which they pass through each maturity stage will differ as well. Sufficient consideration of the dynamic nature of this process is needed in order for the firm to be able to create a process to value the

Our interest is in valuing technology before it's been commercialized, and even before it has reached a mature state. Because technology changes over time, in the early stages very little is known about it, including its possible applications, which means there is a lot of uncertainty surrounding it. Since little information is known, the use of financial methods alone is inadequate to assess the value of early stage technology. The thesis explores work performed in the area of R&D valuation and examines the effect of technology maturity on these methods. It examines how value changes as the technology changes over time.

The thesis is meant to offer engineers, scientists and managers who are

interested in valuing R&D activities in the early-stages with an understanding and a framework to assist them. Enough background has been supplied making this work comprehendible for managers without a technical background. Additionally, this is suitable material for an entry-level engineer or scientist with no exposure to common business practices.

Company Overview

In setting the background for the research work conducted in this area, it is first important to provide a brief overview of company structure, its vision, mission and strategies. Figure 1 illustrates a company structure that is functionally

organized. At the top of the company is the corporate office; at the next level are the major business units (BU) and other business groups that provide support.

Corporate

R&D Marketing Sls Finan ce Manufacturing BU 1 ..-. BU n

Figure 1: Generic Company Structure

Company Values, Mission and Vision Statements

The values of a firm are the beliefs held collectively by the employees who make up the company. The vision and mission statements are based on the values of the company. The purpose of the vision statement is to establish an

understanding of the future of the company, the "where" and "what" the company wants to be in the future. The intent of the mission statement is to explain at a high level, what steps are necessary for the company to achieve its vision. The mission statement defines what the company will do, and allows for each organization within the company to create their own mission statement to aid the firm in achieving its vision.

The strategies of the company are put into place to support the mission

statement of the company. The business strategy is broadly stated allowing the individual organizations that make up the firm to create the specific strategies to support their mission statement and help achieve the corporate vision.

The technology strategy complements the business strategy and provides direction to the technical communities within R&D. The patent and project portfolio strategies and their management are part of the technology strategy. The technology strategy helps each group in the R&D organization to align their objectives to the organization's mission to aid the company in meeting its

Thesis Outline

Section 2, contains the literature overview that covers important areas needed to provide the background information on understanding the valuation practices currently used. It provides an understanding of the charter of R&D, technology

maturity, marketing and finance. Financial models are introduced, briefly described, and their advantages and disadvantages listed. This section

introduces intangible assets and their importance in the valuation process. Lastly it concludes with our findings that a new framework needs to be established to value early stage technology.

Section 3 details the methods and practices used at Xerox Corporation. This section includes current practices as well as methods that have been tried in the past. It provides an explanation of the current practices, why they are used and the deficiencies of each. Introduces the resource-based view perspective (RBV) and proposes how this method will be used in the new framework created to assess early-stage technology.

Section 4 provides the new framework, VERDI (Valuing Early-stage R&D

Investments). Details how RBV was adapted to assess early-stage technologies. The framework is defined in its entirety, including the infrastructure required, the committee and the governing regulations. This section ties together the concepts introduced in Section 2.

Section 5 is an example application of the VERDI framework, a proposal for use at Xerox Corporation. It details the extent of how the framework needs to be customized for a company, like Xerox, to adopt and use it. The customized framework, VERDIX (\aluing Early-stage R&D Investments at Xerox) is

presented in detail. Included is the composition of the committee, the process by which they will conduct themselves and the assessment criteria used. The

section concludes with scoring the assessment and making recommendations. While a proposal for application of the framework is outlined, it has not been

Section 6 is the summary that recaps the intent of the thesis. It includes what specific application the authors would have liked to perform, and the next steps that should be taken to prove the framework can assess early-stage

technologies. Also it provides a suggestion for further research that could perform a side-by-side comparison of the various assessment techniques discussed in the thesis.

Blank----Section 2: Literature Overview

The Charter of R&D

The introduction briefly outlined the structure of a corporation, its foundation, vision, mission, and strategies. For the purpose of this work, it is necessary to elaborate on how the corporate strategy impacts the charter of the R&D

organization, which is to identify and develop technologies to support current and future products, and/or create the potential for external opportunities.

The R&D organization defines the technology strategy ensuring proper alignment to the overall business strategy. Contained within the technology strategy are the IP (intellectual property, i.e., patents, trademarks, etc.) and R&D project portfolio strategies. So, the project and patent portfolios are governed by the overall technology strategy.

All strategic decisions are made in the hopes of improving the future of the

company, but the decisions involving R&D "are difficult because they are usually made in the face of many uncertainties

-. The time between the decision point and the point at which the cash register starts ringing is typically long and filled with unknowns;

. The R&D process is inherently uncertain (without uncertainty there would be no R&D); no one knows whether and when R&D will succeed, nor the level of that success;

. The markets to be served are most uncertain at the time R&D projects are commissioned; and

Successful R&D often takes a company into unfamiliar areas requiring partnerships, alliances or acquisitions, and new ways of doing business." (Matheson, 1998, p.8)

Corporate establishes direction; marketing provides information on customer needs, market trends, competition, and etc.; and finance, provides the tools which underpin the assessment within both the R&D project and patent portfolio processes. More specifically, the portfolio decision-making processes synthesize this information to enable the company to strive toward its overall mission.

Marketing and Finance in Support of R&D

One primary support function in the company is the marketing group. Their job is to identify and understand customer needs and to provide this information to the company, enabling it to profitably produce products and services to meet these needs, to retain current customers, in addition to attracting new customers. (Ariely, 2000; Kotler, 1999, p.3)

In order to identify and understand these needs, the marketing group must obtain information on the customers. The marketing group amasses a large amount of data to help them understand customers' wants and needs. There are three

main types of data collection, internal, intelligence, and market research data. Internal data comes from within the company; data is usually housed in the internal databases maintained by the various organizations of the company. Intelligence data contains publicly available information on competition and market trends, the process of collecting and analyzing this data is marketing intelligence. Finally, market research is a formalized study to gather specific data for a certain market situation. (Kotler, 1999, p.100-101) Since the market place is dynamic, this data collection is an on-going activity.

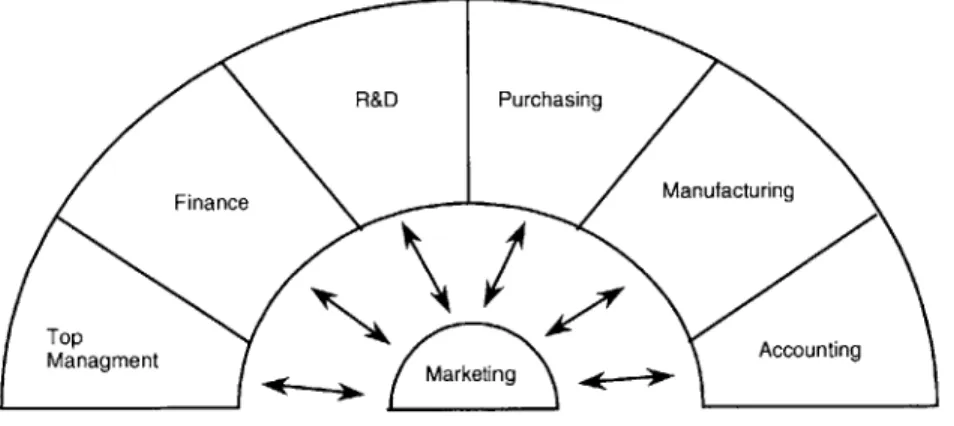

Marketing can be defined as "the process by which decisions are made in a totally interrelated changing business environment on all the activities that facilitate exchange in order that the targeted group of customers is satisfied and the defined objectives accomplished." (Hisrich, 2000, p.3) The relationship of marketing to other groups in the company is best illustrated in the Figure 2.

R&D Purchasing

Finance Manufacturing

Managment Accounting

ManamentMarketing

Figure 2: Marketing Support

Source: (Kotler, p.65)

Another support function in the company is the finance group. "Finance is the application of a number of financial and economic principles to maximize the wealth or overall value of a business" (Gropelli and Nikbakht, 2000, p. 3). Their

job is to manage the cash within the company as well as track its assets. The

finance group supports the business operations and yearly budgeting activities of each organization. This allows each organization to understand its current level of spending at anytime during the year. In addition, they look for opportunities to increase capital and for the best opportunity to invest capital to increase value. So, how is value assessed?

The word valuation traditionally means the monetary worth of an item a company has rights to or owns. Financial (economic) methods are a means of quantifying this monetary value. This includes the valuation of physical assets as part of the annual reporting process, and the use of Generally Accepted Accounting

Principles (GAAP) to ensure uniform reporting.

We have shared how the organization must interact to achieve its desired

objective, but it is just one part of a bigger picture. More importantly, intellectual capital (i.e. human capital, intellectual assets) is the foundation of an

assets. Our work will address how intangible assets factor into valuing early stage R&D investments. We begin by addressing why it is so important to value early stage R&D investments.

The Importance of Valuing Early Stage R&D Technology

In order to understand the importance of valuing early stage R&D technology, it is essential to understand that technology changes with time. We start by defining the technology maturity cycle.

Technology Maturity Cycle

In order to discuss the technology maturity cycle, a definition of technology is

needed. Roussel, et al "view technology as the application of scientific and engineering knowledge to achieve a practical result" (Roussel, et al, 1991, p. 13). The phrase, "achieving a practical result" implies technology moves through a

cycle (process), and ultimately it approaches a limit at some point in time.

Table 1: Characteristics of R&D as a function of technological maturity Adapted from Source: (Roussel, 1984, p. 30), Research Management

Table 1 represents characteristics of R&D as a function of technology maturity. For our purposes, we define the technology maturity cycle using three stages

-(1) embryonic, (2) growth, and (3) mature. In the embryonic stage, the attributes

of the idea/technology are documented and studied to determine its viability before further development can occur. If it passes the first phase, it enters the growth stage. In this phase, further studies are conducted to prove the

technology is reliably repeatable and all its characteristics fully studied and understood. Having passed the second phase, it enters the mature stage, where it is tested to determine where it will be most useful. Upon successful completion

of the third phase, the technology is mature enough to leave the confines of R&D and enter the product development organization'.

Progressing technology through these three stages is the primary output of an R&D organization. The ability to successfully compete requires innovations be incorporated into new products/services produced by the business units (BU's) of the firm for delivery to the marketplace. Technology maturity is an element of something much broader, innovation. Innovation is described as "a connected process in which many and sufficient creative acts, from research through

service, couple together in an integrated way for a common goal" (Morton, 1971,

p. 3). Implied in this process is timeliness. If a product fails to reach the market

in the predicted time or is pre-empted by competition, the expected growth may not be sufficient to warrant the investment. While the company expects its innovations will be included in new products/services, the reality is some are not.

Regardless of inclusion, the innovation process has positive results in

organizational learning and may provide other benefits such as patents or the potential for licensing. So, how is this value (benefit) determined?

Technology Strategy

Investing in early stage R&D has the potential to create significant long-term value for the company. If successful commercialization takes place within the

"right" market window, the firm has the potential to reap the benefits (early profits) of being the first-mover. "In some industries, a first mover may be in a position to enjoy temporarily high profits from its position. It may be able to contract with buyers at high prices during early scarcity of a new item, for example, or sell to buyers who value the new technology very highly." (Porter,

1985, p. 188)

1 In this definition, the R&D organization matures the technology to a point where it can be developed into a

Given monetary gains are essential for companies to survive, a strategy which enables them to achieve this objective is needed. So, what are the elements of an effective strategy? "Effective strategies rest on three foundations: 1) value creation, 2) organizational capability, and 3) competitive understanding" as shown in Figure 3 (Henderson, 2001, Lecture 1).

I--- I I -

-,What technologies I 'Ho

should we invest | |val

in? Mark s Ival

I II

---

'ation

'--T

Organizational

Competitive

Capability

Understanding

---I-:How shall we IHc

,support innovation |ca

'across the firm? 'va

I I I--- -- -- -- -- ---- I. --v will we deli--veri ue across the ie chain? ---iwshall we pture the lue we create?

Figure 3: Elements of a successful strategy

Adapted from Source: (Henderson, 2001, Lecture 1)

Value creation requires a decision on what technologies the company should invest in. This decision can be tied to managing the innovation process within the company and begins with an assessment of the technology (dominant

designs, S-curve, etc.), and the nature of the market (Moore and Christensen) (Lim, 2001). The tools are used to 1) assess where the technology is with

respect to the competition, and 2) investment in incremental technology alone will not maintain a company's competitive edge.

Dominant Designs

In Utterback's work, he defines three phases fluid, transitional, and specific of industrial innovation (Utterback, 1996, p. 92). Table 2 provides significant characteristics in the three phases of industrial innovation.

Fluid hase Transitional phase Specific phase

Innovation Frequent major product Major process changes Incremental for product and with

changes required by rising demand cumulative improvements in

productivity and quality

Sources of innovation Industry pioneers; product Manufacturers; users Often suppliers

users

Products Diverse designs, often At least one product design, Mostly undifferentiated,

customized stable enough to have standard products

significant production volume

Production Processes Flexible and inefficient, Becoming more rigid, with Efficient, capital intensive, and

major changes easily changes occurring in major rigid; cost of change high

accommodated steps

R&D Focus unspecified because Focus on specific product Focus on incremental product

of high degree of technical features once dominant design technologies; emphasis on

uncertainty emerges process technology

Equipment General-purpose, requiring Some sub-processes Special-purpose, mostly

skilled labor automated, creating islands of automatic, with labor focused on

automation tending and monitoring

equipment

Plant Small-scale, located near General-purpose with Large-scale, highly specific to

user of source of specialized sections particular products

innovation

Cost of process change Low Moderate High

Competitors Few, but growing in Many, but declining in Few, classic oligopoly with

numbers with widely numbers after emergence of stable market shares

fluctuating market shares dominant design

Basis of competition Functional product Product variation, fitness for Price

performance use

Organizational control Informal and Through project and task Structure, rules, and goals

entrepreneurial groups

Vulnerabilities of To imitators, and patent To more efficient and higher- To technological innovations

industry leaders challenges; to successful quality producers that present superior product

product breakthroughs substitutes

Table 2: Significant Characteristics of the phases of innovation

Source: (Utterback, 1996 p. 94-95)

Taking a closer look at R&D, the following characteristics exist: " "Fluid - focus unspecified because of high degree of uncertainty

* Transitional - focus on specific product features once dominant design emerges

* Specific - focus on incremental product technologies; emphasis on process technology" (Utterback, 1996, p. 94-95)

Successful integration of early stage technology can provide the impetus for a dominant design. "A dominant design in a product class is, by definition, the one

that wins the allegiance of the marketplace, the one that competitors and

innovators must adhere to if they hope to command significant market following. The dominant design usually takes the form of a new product (or set of features) synthesized from individual technological innovations introduced independently in

product variants" (Utterback, 1996, p. 24).

Typically, before a dominant design many competitors are in the market space. However, once a dominant design emerges, a number of competitors exit the market. This can amount to significant market advantage to those firms still remaining. So, the dominant design perspective is helpful in assessing the technology, and in comparing where the technology is compared to incremental and non-incremental technology. Also, it gives a visual representation as to which phase in the industrial innovation process the company resides.

Technology S-Curves

Another mechanism to assess the stages of technology is the technology S-curve. Foster's S-Curve is a mechanism that can be used to determine the technological position of a firm relative to its position in the industry. While

knowing the exact position is difficult, one can use this to help forecast where the firm should be to remain a player. As such, we recommend the S-curve be used as more of a descriptive tool than a prescriptive tool (Henderson and Lim).

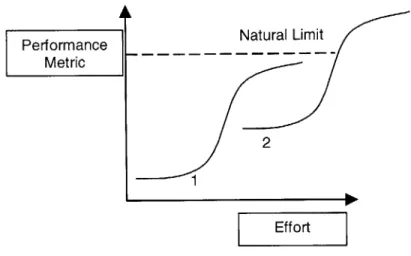

It is also useful to get a handle on when the firm is approaching the

natural/physical limit of a technology (See Figure 4), because as the technology reaches its physical/natural limit, more effort ("money") is required to make incremental improvements. In simple terms, there is a significant cost to making these improvements, resulting in smaller gains.

Performance Natural Limit Metric

2 1

Figure 4: Technology "S-Curve"

Adapted from Source: (Henderson, 2001, Lecture 2)

Managing the transition between S-curves is a critical strategic task: sticking with an old S-curve can be disastrous (Henderson, 2001, Lecture 3).

Technological Discontinuities

"The Innovator's Dilemma" by Clay Christensen asserts that customers don't

understand discontinuities. A discontinuity is a breakthrough innovation that advances by a large margin the technological performance of an industry

(Christensen, 1997). Often, in its earliest embodiment, the performance is below that of the sustaining technology as shown by the second S-curve in Figure 4. "Value is created when new technology is matched to customer need. But customer needs change: as the technology evolves existing customers develop

new needs, and in addition the technology may appeal to new kinds of customers, with new kinds of needs" (Henderson, 2001, Lecture 3).

This perspective can help a firm understand its technology position as it relates to others in the industry. Christensen sites a number of examples (i.e. disk drive) of how companies in certain industries could not make the leap from incremental to discontinuous technological advances. Incremental advances do not enable the company to benefit from discontinuous technological advances (Christensen,

1997). This is further evidence for the importance in knowing how to value early

stage R&D.

We have stated a company cannot maintain its competitive advantage by solely making incremental improvements to current technology. These incremental improvements often don't provide the highest margins on the investment and consequently, the company must invest in new technology in the hopes of creating long-term value. Therefore, it is imperative to know how to value early stage technology (potential disruptive technology) as a means to capitalize on these investments.

R&D Project Portfolio

The R&D project portfolio is a collection of on-going projects in various stages of technology development and having varying levels of risk. The R&D projects are

managed in a portfolio to maintain a certain risk balance. The portfolio is

dynamic. As projects progress through the development cycle, decisions need to be made to determine which projects will remain in the portfolio, which will be abandoned and if applicable which will be added. (Balachandra, 1989, p.19) It should be noted that these projects, though listed, as independent entities in the portfolio are usually dependent. For example, three of the projects may be required to integrate at their point of maturity to form a subsystem that will be used in a product.

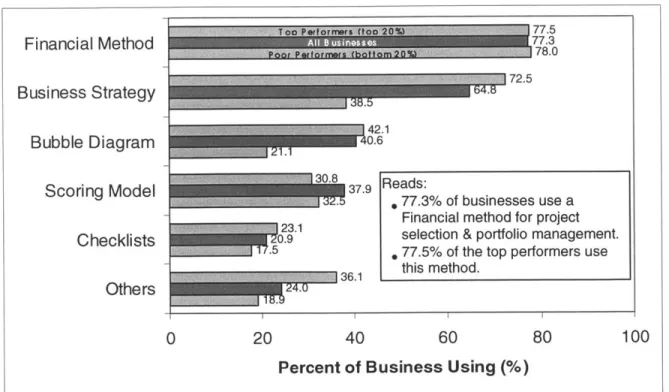

The following chart indicates methods used for selection of projects and for managing the portfolio process. R. G. Cooper et al cooperatively with the Industrial Research Institute (IRI) published results from an "R&D portfolio

management best practices study: method used & performance results achieved" (Cooper et al, 1998). One conclusion from this benchmarking study follows.

"Economic models are the most popular project selection tools (Figure 5). They are familiar to managers, and they are accepted for other types of investment analysis in the business - for example, for capital expenditure decisions. But they do have limitations. The toughest project selection decisions lay in the first

few gates of the process when relatively little is known about the project. And it is here that traditional economic approaches suffer the most, because they require considerable financial data that are quite inaccurate" (Cooper et al,

Financial Method Business Strategy Bubble Diagram Scoring Model Checklists Others

Percent of Business Using (%)

Figure 5: Popularity of Project Selection & Portfolio Methods

Source: (Cooper et al, 1998)

77.5 77.3 1 78.0 72.5 1 42.1 40.6 Reads: . 77.3% of businesses use a Financial method for project selection & portfolio management. 77.5% of the top performers use this method. 137.9 36.1 40 0 20 60 80 100 23.1

Patent Portfolio

Companies want to obtain the maximum benefit from their patents. The most obvious use is to incorporate the patents into successful opportunities. A framework that many companies are trying to successfully incorporate into their overall strategy is the idea of extracting the maximum value from their patent portfolios for monetary returns. This is not a new idea, but has become

increasingly more strategic in nature given the rewards that certain companies have had in aggressively using their IP portfolios. A primary example is IBM, who currently receives $1.5 billion in revenue annually from licensing of its intellectual property. (Davis & Harrison, 2001, p.2)

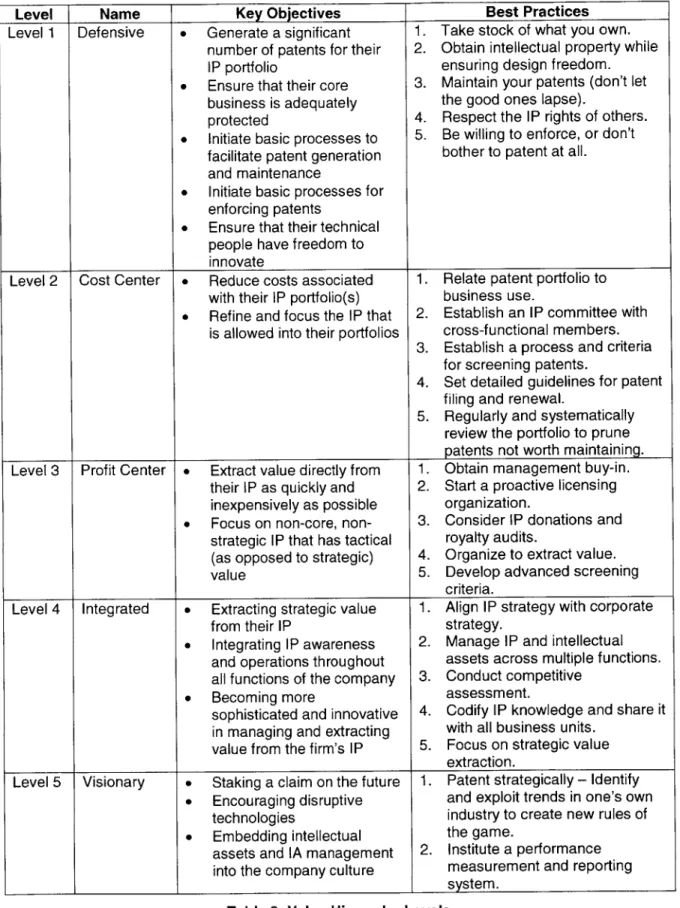

A study conducted on how various companies' extracted value from their IP

portfolio yielded the Value Hierarchy. It's a pyramid that has five levels, and each level represents what the company expects to receive in terms of value from its IP portfolio. It is important to understand, that the levels build upon one another. (Davis & Harrison, 2001, p.12) Figure 6 shows the Value Hierarchy and Table 3 provides a description of each level in the pyramid and the best practices to achieving each level.

Visionary

Integrated

Profit Center

Cost Center

Defensive

Figure 6: Value Hierarchy

Level Name Key Objectives Best Practices Level 1 Defensive * Generate a significant 1. Take stock of what you own.

number of patents for their 2. Obtain intellectual property while IP portfolio ensuring design freedom. * Ensure that their core 3. Maintain your patents (don't let

business is adequately the good ones lapse).

protected 4. Respect the IP rights of others. * Initiate basic processes to 5. Be willing to enforce, or don't

facilitate patent generation bother to patent at all. and maintenance

* Initiate basic processes for enforcing patents

* Ensure that their technical people have freedom to innovate

Level 2 Cost Center & Reduce costs associated 1. Relate patent portfolio to with their IP portfolio(s) business use.

* Refine and focus the IP that 2. Establish an IP committee with is allowed into their portfolios cross-functional members.

3. Establish a process and criteria for screening patents.

4. Set detailed guidelines for patent filing and renewal.

5. Regularly and systematically review the portfolio to prune patents not worth maintaining. Level 3 Profit Center o Extract value directly from 1. Obtain management buy-in.

their IP as quickly and 2. Start a proactive licensing inexpensively as possible organization.

0 Focus on non-core, non- 3. Consider IP donations and strategic IP that has tactical royalty audits.

(as opposed to strategic) 4. Organize to extract value. value 5. Develop advanced screening

criteria.

Level 4 Integrated 0 Extracting strategic value 1. Align IP strategy with corporate from their IP strategy.

* Integrating IP awareness 2. Manage IP and intellectual and operations throughout assets across multiple functions. all functions of the company 3. Conduct competitive

" Becoming more assessment.

sophisticated and innovative 4. Codify IP knowledge and share it in managing and extracting with all business units.

value from the firm's IP 5. Focus on strategic value extraction.

Level 5 Visionary 0 Staking a claim on the future 1. Patent strategically - Identify * Encouraging disruptive and exploit trends in one's own

technologies industry to create new rules of * Embedding intellectual the game.

assets and IA management 2. Institute a performance into the company culture measurement and reporting

__ system. Table 3: Value Hierarchy Levels

The Value Hierarchy is a tool that "allows companies to understand where they are in their awareness of IP as a business asset, and to create a way for them to articulate where they want to be, and then identify the best practices to allow them to get there." (Davis & Harrison, 2001, p. 11) It's also important to understand not all companies need to strive to be at level 5, and that many

companies are actually engaging in activities from several different levels. (Davis

Current Methods Used in Valuation

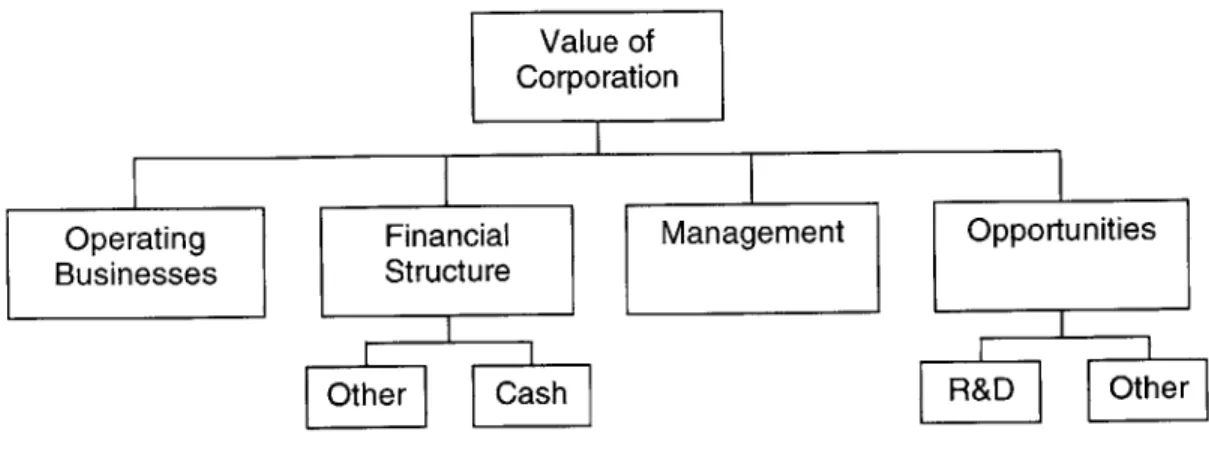

Let's look at value using the Corporate Value Model in Figure 7. "Corporate value is derived from four elements: its operations or business units, its financial structure (assets and liabilities), its management, and its opportunities.

Value of Corporation

Operating Financial Management Opportunities Businesses Structure

Other Cash R&D Other

Figure 7: Corporate Value Model

Source: (Boer, 1999, p. 17)

The independence of a company's operations from its financial structure is now widely accepted in the science of valuation. The most common valuation approaches determine the value of the operating businesses based on their

earnings or cash flow, subtract the liabilities, and add back the value of any non-operating assets" (Boer, 1999, p. 17). These do not account for the future value a company can receive based on investments made at a particular point in time. For example, an R&D investment has the potential to create value in the future. So, how can we measure the value (return) of this type of investment?

Return on Investments

Investments are made on the premise the outcome will be of greater value than the initial amount invested. A common method to value an investment is to calculate the return on investment (ROI). This calculation can be performed

before, during or after the investment has been made. The base formula is earnings divided by the investment. If the calculation is attempted before the outcome of the investment is known, than the earnings become a discounted cash flow. Net present value and internal rate of return are two of the most common methods.

Alternatively, other methods exist to forecast the potential monetary returns on an investment. Two methods in use today are expected commercial value and options (real options).

Though other methods exist, we provide a short description of NPV (Net Present Value), IRR (Internal Rate of Return), ECV (Expected Commercial Value) and Options. Following the description is a comparison among these methods.

Net Present Value

"The net present value (NPV) is defined as the present value (PV) of a project's future cash flow minus the initial investment (1) in the project" (Gropelli and

Nikbakht, 2000, p. 151).

NPV = PV - I

If the project has a negative NPV, the cost of the project is more than what it will

be worth, so the decision would be not to invest. However, the investment is recommended for projects with an NPV greater than or in some cases equal to zero.

Internal Rate of Return

"The internal rate of return (IRR) is a measure of the rate of profitability, and the discount rate that makes the NPV equal to zero" (Gropelli and Nikbakht, 2000, p.

159). In other words, "it provides a percentage figure that indicates the relative

yield on different uses of capital" (Riggs, 1982, p. 119).

IRR = (FV/PV)l/" - 1

FV = future value PV = present value

N = number of investments

One major weakness of these methods is using a current snap shot in time. Both methods produce a result that is the discount cash flow value of "today", and do not account for "tomorrow" or anytime out in the future. In reality, the farther out the more difficult it is to estimate. Another shortcoming is using a constant discount rate over the project duration, this leads to inaccuracies because in reality the discount rate fluctuates just as inflation and interest rates do. Finally, neither of these takes into consideration the technology or market success

factors. Technology success and a certain level of market success are implied to create the future cash flow earnings.

ECV and Options take into account time and the success factors (technology and

market). These are an improvement over simple NPV and IRR since uncertainty in both technology and market success can be refined as more information is attained.

Expected Commercial Value

"The ECV method seeks to determine the value or commercial worth of projects (see Figure 8) and is one of the more well-thought financial models" (Cooper et al, 1998). "It uses decision-tree analysis, breaking the project into decision stages - for example, Development and Commercialization". The benefit of decision-tree analysis is it defines the various possibilities with probabilities of each occurring. "This method also approximates real options theory, and thus is appropriate for handling higher risk projects" (Cooper et al, 1998).

Commercial Success

PCs

Technical

Success Launch Yes

Pts $C

No

$ECV Development Yes

Commercial Failure

Technical Failure

$ECV = [(NPV * Pcs - C) * Pts - D]

$ECV = Expected commercial value of the project

$ Pts = Probability of technical success

$PCs= Probability of commercial success (Given technical success) $D = System development costs remaining in the project

$C = Commercialization (launch) costs

$NPV = Net present value of projects future earnings (discounted to today)

Figure 8: Determining the Expected Commercial Value

Source: (Cooper et al, 1998, p. 165)

Unlike NPV, ECV recognizes technology investments are not always one-time investments, but are traditionally made in increments over time. In addition, it takes into account technology and market success factors. However, in order to calculate ECV, the formula requires calculating the expected NPV, and suffers

Cooper et al revealed in their best practices survey, "in spite of their theoretical rigor, financial models (NPV and ECV) yield the worst portfolios of projects, not because the models are wrong, but because the input data were so much in error" (Cooper et al, 2001, p. 5). In essence, the outcome is only as good as the assumptions.

Options / Real Options

One of the most prevalent uses of options is in the stock market. For example, many employees are given stock options as part of their compensation

packages. Stock options are presented in a document stating the maximum number of shares that can be purchased, the exercise price and expiration date of the options. These options are call options and allow the employee to

purchase stock at the price stated in the document within the specified time. Options are not permanent and need to be exercised before their expiration date

because once they expire they are worthless. The idea behind stock options is the opportunity for large gains; it allows the employee to decide when in the future (bounded by the options expiration date) to exercise the options to gain the

most value. For a call option, the employee wants to exercise the options when the exercise price is much less than the market share price.

"A real option is the extension of options pricing theory for managing real

(non-financial) assets." (Amram & Kulatilaka, 1999, p. vii) The real options approach

is not always needed, and when there are no options present, traditional tools are sufficient. Real options are beneficial when "uncertainty is large enough that it is sensible to wait for more information; value seems to be captured in

possibilities for future growth options rather than current cash flow; and there will be project updates and mid-course strategy corrections." (Amram & Kulatilaka,

1999, p.24)

"The following inputs are the only information you need to value a real option: . The current value of the underlying asset

. The time to the decision date, which is defined by the features of the investment

. The investment cost or exercise price . The risk-free rate of interest

. The volatility of the underlying asset

. Cash payouts or non capital returns to holding the underlying asset" (adapted from Amram and Kulatilaka, 1999, p. 37)

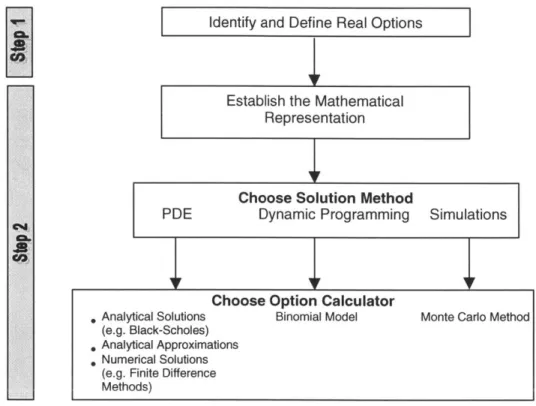

Figure 9, is a representation of the real options process and solutions methods and option calculators.

laI

1*o

J4

.9 co)

Identify and Define Real Options

Establish the Mathematical Representation

Choose Solution Method

PDE Dynamic Programming Simulations

4I

4,

4'

Figure 9: Solution Methods and Option Calculators

Source: (Amram and Kulatilaka, 1999, p. 108)

The "real option" approach addresses risk and uncertainty, because levels of uncertainty are dealt with in relation to time. (Amram & Kulatilaka, 1999, p.14)

Flexibility exists with this approach in that managers can change their investment decisions when things don't turn out as planned. "Every good manager knows that many decisions are best taken later rather than sooner, thereby allowing us to observe how conditions actually evolve before committing ourselves to capital expenditures" (Verity, 1999, p. 1).

Choose Option Calculator

* Analytical Solutions Binomial Model Monte Carlo Method

(e.g. Black-Scholes) , Analytical Approximations

. Numerical Solutions (e.g. Finite Difference Methods)

Though Merck has been using options thinking since the mid 1990's (Nichols, 1994, p.88-99), the options approach for valuation is not widely used.

Pharmaceutical companies invest heavily in R&D, and "options thinking" is a good method to apply over the course of this industries commercialization

process. "In the words of the company's CFO Judy Lewent "When you make an initial investment in a research project, you are paying an entry fee for a

right...To me all kinds of business decisions are options" (Nichols, 1994, p.

88-99).

One of the shortcomings of the Real Options approach is the complexity in using it. "Although the option valuation model vastly increases our ability to value financial and non-financial assets, it remains a model. Our experience is that model risk, caused by poor model framework, fails to capture the key drivers of option value and is the largest potential source of an error in the real options

approach.. .Framing a model requires trade-offs. Novice users of the real options approach tend to include too many sources of uncertainty in the model

framework, increasing the potential for tracking error." (Amram & Kulatilaka, 1999

pp.60-61)

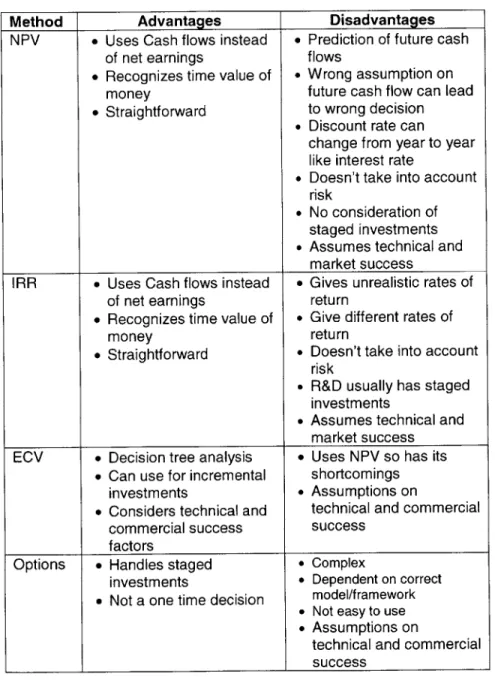

Summary

Each method discussed above has its benefits and shortcomings. Our major findings in the analysis of current financial methods are as follows:

. NPV is more applicable in assessing the expected value of a technology in

its mature stage rather than in its earlier stages.

. NPV and IRR rely on the prediction of future cash flows. However, no one

can predict the future with a high degree of accuracy. Also, these

methods don't take into account uncertainty and risk. In most instances, more risky investments equate to higher returns if successful.

. The ECV method requires calculating NPV, so the same shortcomings apply. It also relies on predictions of technical and commercial success.

. To be effective, real options must account for all possible outcomes. In addition, it relies on assumptions. The outcome is only as good as the assumptions.

Method Advantages Disadvantages

NPV * Uses Cash flows instead e Prediction of future cash of net earnings flows

" Recognizes time value of * Wrong assumption on

money future cash flow can lead " Straightforward to wrong decision

. Discount rate can

change from year to year like interest rate

* Doesn't take into account risk

* No consideration of staged investments . Assumes technical and

market success

IRR 9 Uses Cash flows instead e Gives unrealistic rates of of net earnings return

" Recognizes time value of * Give different rates of

money return

" Straightforward * Doesn't take into account risk

* R&D usually has staged investments

* Assumes technical and market success ECV * Decision tree analysis * Uses NPV so has its

9 Can use for incremental shortcomings investments * Assumptions on

* Considers technical and technical and commercial commercial success success

factors

Options * Handles staged e Complex

investments * Dependent on correct * Not a one time decision model/framework

* Not easy to use . Assumptions on

technical and commercial success

Figure 10: Financial methods comparison

"Traditional concepts of return on investment (ROI), such as pay-back period, discounted cash flow, net present value and internal rate of return, can be

applied with increasing degrees of precision along the new product development sequence. A rough estimate can be made after comparing the proposed

can be made at the conclusion of the quantitative confirmation research, and a best estimate can be made after the final production model of the product and marketing mix have been designed." (Bacon and Butler, 1998, p. 127)

Our conclusion is if used in isolation, these methods are inappropriate to value technology in its earlier stages.

Intangibles

Intangible assets have been around for a long time. Even before the accounting system was implemented, merchants and traders were reliant on their

reputations for the well being of their business. Their reputation influenced their customers in ways such as attracting or dissuading potential business. It's reasonable to argue most people would prefer to do business with a fair and honest merchant rather than one they thought of as dishonest. Though these merchants may not have associated a monetary value to their reputation, they knew it added value to their business. The question is, if intangible assets have been around so long, and we knew they were valuable, why are they so

important now? To answer this, we first need to define in more detail intangible assets and then examine the emergence of their importance.

What is an Intangible Asset?

Simply stated an intangible asset is a "claim to future benefits that does not have a physical or financial (a stock or a bond) embodiment." (Lev, p.5) In the

example above, the intangible asset was reputation. Today, we can think of many companies that have strong reputations and brands, for instance Coca Cola or Disney. The terms intangibles, intellectual capital and knowledge assets

are often used to refer to intangible assets. Three major linkages of intangibles exist and are characterized by their relation to the generator of the assets:

discovery (innovation), organizational practices, and human resources. Product innovations are an example of intangibles generated from discovery and are usually produced from a company's R&D organization. Intangibles created by organizational practices, relate to better, smarter and different ways of doing business. And those produced from human resources are generally created by unique personnel policies. (Lev, pp. 6-7)

We define intangible assets as nonphysical sources of value (claims to future benefits) generated by innovation, unique organizational processes or human

create corporate value and economic growth. (Lev, p7; Sullivan, p.17; Boulton,

p.30)

Importance of Intangible Assets

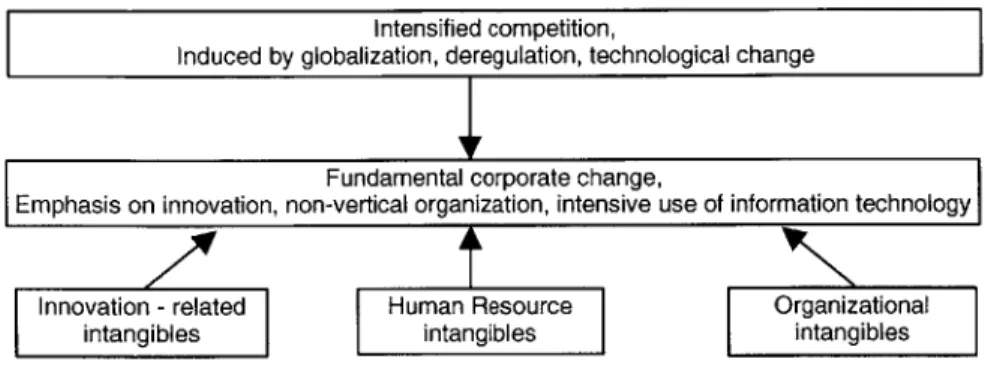

So, why are they so important now? As quoted by Alan Greenspan, the U.S. Federal Reserve Chairman, "virtually unimaginable a half-century ago was the extent to which concepts and ideas would substitute for physical resources and human brawn in the production of goods and services." (Boulton, 2000, p xv)

Recently in a speech given at the Washington Economic Policy Conference of the National Association for Business Economics, Washington, D.C. on March

27, 2001, Greenspan stated, "over time, and particularly during the last decade

or two, an ever-increasing share of GDP has reflected the value of ideas more than material substance or manual labor input". These statements are backed

by the increase of knowledge workers in the workforce. As proof of this, Table 4

shows the increase of knowledge workers in the U.S. workforce over the past century. Year 1999 1990 1980 1970 1960 1950 1900

Knowledge Workers Propo (millions) Emplo 7.6 5.6 3.7 2.6 1.6 1.1 0.2

Table 4: Knowledge Workers, 1900-1999

Source: (Lev, 2001, p.15) rtion of all

yment

(%)

5.7 4.7 3.8 3.3 2.3 1.9 0.7There are two related economic factors behind this - the first is intense business competition brought on by globalization and the second is information

technology. "These two fundamental developments have dramatically changed the structure of corporations and have catapulted intangibles into the role of the

major value driver of businesses in developed economies." (Lev, 2001, p.9), see Figure 11.

Intensified competition,

Induced by globalization, deregulation, technological change

Fundamental corporate change,

Emphasis on innovation, non-vertical organization, intensive use of information technology

Innovation - related

intangibles

Human Resource intangibles

Figure 11: Relationship of Intangibles

Adapted from Source: (Lev, 2001), Intangibles: Management, Measurement and Reporting Organizational intangibles

Types of Intangibles

A number of intangibles have been identified as interacting with one another to

create the intellectual capital of a firm. The identification of these capitals has come about by the models developed around intellectual capital. There are two

primary areas of focus, "one is to help understand and discuss how an

organization might develop intellectual capital; and the other is to understand intellectual capital so value may be extracted and used by the organization." (Stewart, 1998, p.76-77) Teece has also identified value can be captured from knowledge and competence. (Teece, 1998)

In valuing R&D investments, our emphasis is in the area of value extraction. The main drivers in extracting value are the three 'capitals' intellectual, human and structural capitals.

Intellectual Capital

Intellectual capital is essentially the knowledge of the company, both tacit and codified, and "is the sum of everything everybody in a company knows that gives it a competitive edge", (Sullivan, 2000; Stewart, 1999). The knowledge of a company is equated to 'capital' because it "brings to the foreground the

brainpower assets of the organization, recognizing them as having a degree of importance comparable to the traditional land, labor, and tangible assets." (Sullivan, 2000, p.4)

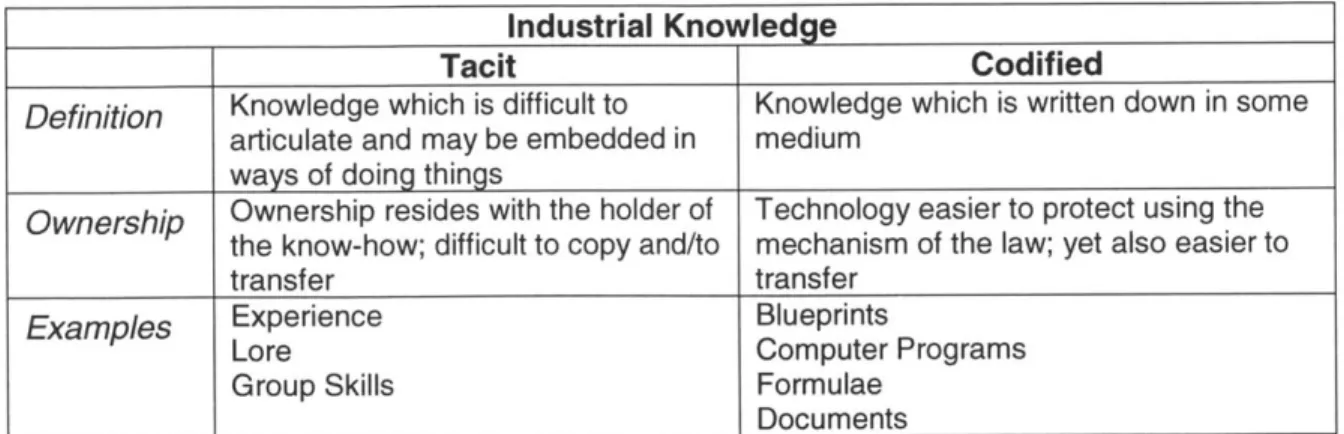

Codified knowledge is knowledge that has been captured in some form of communication medium, i.e., electronic, documentation, etc. Tacit knowledge resides with an individual and is often a skill, ability or classified as 'know-how'. (Sullivan, 2000) The difference between tacit and codified knowledge is best defined and depicted in Table 5, below.