Digitized

by

the

Internet

Archive

in

2011

with

funding

from

Boston

Library

Consortium

Member

Libraries

working paper

department

of

economics

Convergence

in

International Output

massachusetts

institute

of

technology

50 memorial

drive

Convergence

in

International

Output

Andrew

B.Bernard

Steven

N.Durlauf

Convergence

in

International

Output

1Andrew

B.Bernard

Department

ofEconomics

M.I.T.

Cambridge,

MA

02139

Steven

N.Durlauf

Department

ofEconomics

Stanford

University Stanford,CA

94305

May,

1993

*We

thank Suzanne Cooper,Chad

Jones, and PaulRomer

for useful discussions.The

authorsalsothankparticipants at the

NBER

Summer

Workshop

onCommon

ElementsinTrends and Fluc-tuations,seminarsat Cambridge,Oxford, and LSE, and3anonymous

referees forhelpfulcomments.The

Center for Economic Policy Research provided financial support. Bernard gratefullySummary

This

paper

proposesand

testsnew

definitions ofconvergenceand

common

trends forpercapita output.

We

define convergence for agroup

ofcountries tomean

that each countryhas identical long-run trends, either stochastic or deterministic, while

common

trends allowforproportionality ofthe stochastic elements.

These

definitions lead naturally tothe use ofcointegration techniques in testing. Using century-long time series for 15

OECD

economies,we

reject convergence but find substantial evidence forcommon

trends. Smaller samples ofEuropean

countries also reject convergence but are drivenby a

lowernumber

ofcommon

stochastic trends.1

Introduction

One

of themost

striking features of the neoclassicalgrowth model

is its implication forcross-country convergence. In standard formulations ofthe infinite-horizon optimal

growth

problem, various turnpike theorems

show

that steady-state per capita output isindepen-dent ofinitial output levels. Further, differences in

microeconomic

parameters willgener-ate stationary differences in per capita output

and

will not imply differentgrowth

rates.Consequently,

when

one

observes differences in per capita outputgrowth

across countries,one

must

eitherassume

that these countrieshave

dramatically differentmicroeconomic

characteristics, such as different production functions or discount rates, or regard these

discrepancies as transitory.

Launched

primarilyby

the theoreticalwork

ofRomer

(1986)and Lucas

(1988),much

attention has

been

focusedon

the predictions ofdynamic

equilibriummodels

for long-termbehavior

when

variousArrow-Debreu

assumptions are relaxed.Lucas

and

Romer

have

shown

that divergence in long-termgrowth

can be generatedby

social increasing returns toscale associated with

both

physicaland

human

capital.An

empirical literature exploringconvergence has developed in parallel to the

new

growth

theory.Prominent

among

thesecontributions is the

work

ofBaumol

(1986),DeLong

(1988),Barro

(1991)and

Mankiw,

Romer,

and

Weil (1992). This research has interpreted afinding ofanegative cross-sectioncorrelation

between

initialincome

and growth

rates as evidence in favor ofconvergence.The

useof cross-section results toinfer the long-run behavior of nationaloutput ignoresvaluable information in the time series themselves,

which

can lead to a spurious finding ofconvergence. First, it is possibleforaset of countries

which

are diverging to exhibit thesortofnegativecorrelation described

by

Baumol

et al. solong asthemarginalproduct of capitalis diminishing.

As shown

by Bernard

and

Durlauf (1992),a

diminishing marginal productofcapital

means

that short-run transitionaldynamics and

long-run, steady-state behaviorwill be

mixed up

in cross-section regressions. Second, the cross-section procedureswork

with the null hypothesis that

no

countries are convergingand

the alternative hypothesisthat all countries are,

which

leaves out a host ofintermediate cases.In this paper

we

propose anew

definitionand

set oftests ofthe convergence hypothesis.Our

research differsfrom most

previous empiricalwork

in thatwe

test convergence in anexplicitly stochastic

framework.

If long-run technological progress contains a stochastictrend, or unit root, then convergenceimplies that the

permanent components

in output arethe

same

across countries.The

theoryofcointegration provides a natural settingfortestingcross-country relationships in

permanent

outputmovements.

Our

analysis,which

examines

annuallogreal output per capitafor 15OECD

economiesfrom

1900 to 1987, leads totwo

basic conclusionsabout

international output fluctuations.1First,

we

find very little evidence of convergence across the economies. Per capita outputdeviations

do

notappear

to disappear systematically over time. Second,we

find that thereis strong evidence of

common

stochastic elements in long-runeconomic

fluctuations acrosscountries.

As

a result,economic growth

cannot be explained exclusivelyby

idiosyncratic,country-specific factors.

A

relatively small set ofcommon

long-run factors interacts withindividual country characteristics todetermine

growth

rates.Our

work

is related to studiesby

Campbell and

Mankiw

(1989), Cogley (1990),and

Quah

(1990)who

have

explored patterns of persistence in international output. Usingquarterly post-1957 data,

Campbell and

Mankiw

demonstrate

that 7OECD

economiesexhibit

both

persistenceand

divergence in output. Cogley,examining

9OECD

economiesusing a similar data set to the

one

here, concludes that persistence is substantial formany

countries; yetat the

same

time he arguesthatcommon

factors generatingpersistence implythat "long run

dynamics

prevent output levelsfrom

divergingby

toomuch."

Quah

findsa lack of convergence for a

wide

range of countrieson

the basis of post-1950 data.Our

analysis differs

from

this previouswork

in three respects. First,we

directly formulate therelationship

between

cointegration,common

factors,and

convergence,which

permits oneto distinguish

between

common

sources ofgrowth and

convergence. Second,we

attempt

todetermine

whether

there are subgroups ofconverging countriesand

therebymove

beyond

the all or nothing

approach

of previous authors. Third,we

employ

different econometric techniquesand

data setswhich

seem

especially appropriate for the analysis of long-term'The countries are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Italy,

growth

behavior.The

spirit ofour analysis hasmuch

incommon

withwork

by Pesaran, Pierseand

Lee (1993)and

Lee, Pesaran,and

Pierse (1992),who

study multisector output persistence forthe

US

and

UK

respectively.These

papers derivemethods

tomeasure

the long run effectsofa shock originating in one sector

on

all sectors in theeconomy.

While

the focus of thatresearch has

been

on measuring

persistence rather than convergence, a useful extensionof the current

paper would

be the application of the multivariate persistencemeasures

tointernational

data

toboth

provide additional tests of convergence as well as to provide aThe

plan of thepaper

is as follows: Section 2 provides definitions of convergenceand

common

trends using a cointegrationframework.

Section 3 outlines the test statisticswe

use. Section 4 describes the data. Section 5 contains the empirical results.

The

evidencefrom

the cross-country analysis argues against the notion of convergence for the wholesample. Alternatively there

do appear

to be groups of countries withcommon

stochastic elements.2

Convergence

in

stochastic

environments

The

organizing principles ofourempiricalwork

come

from employing

stochasticdefinitions forboth

long-termeconomic

fluctuationsand

convergence.These

definitions relyon

thenotions of unit roots

and

cointegration in time series.We

model

the individual output series as satisfyingEquation

2.1:a(L)Y

i<t=

m

4

£i,i (2.1)where

a(L) hasone

rooton

the unit circleand

£1){ is amean

zero stationary process.This formulation allows for

both

linear deterministicand

stochastic trends in output.The

interactions of

both

types of trends across countriescanbe formalizedintogeneraldefinitionsofconvergence

and

common

trends.Definition

2.1.Convergence

inper

capita outputLog

per capita outputs in countries 1,. ..,p converge if1. Yi

tt,

•.-lYpj satisfy Equation 2.1,

2. /x,

=

fij Vi,j, 3. Yitt,.

-,Y

Ptt are cointegrated with a cointegrating matrix, /3', such that

0'

=

[/„_!,-e

p_i] (2-2)where I

p-\ is a

p—\

identity matrixand

ev-\wop-lxl

vectorofones.Definition

2.2.Common

treadsin per capitaoutputLong-run

logpercapita outputs in countries l,...,p aredetermined bycommon

trends if2.

m

=

fijV

i,j, 3. yj.t,...,

Y

p j are cointegrated.The

first definition gives us a formal definition ofconvergence. Ifcountries are to attain thesame

long-rungrowth

rates withoutput levels separated onlyby

astationary difference,then they

must

satisfy Definition 2.1.Each

seriesmust

contain thesame

time trendand

becointegrated with every other series with the cointegrating vector (1,-1).

However,

ifagroup

ofoutput series does not satisfy Definition 2.1, but instead satisfiesthe

weaker

Definition 2.2, then output levels willbe

cointegrated but the stochastic trendsfor the

group

will not be equal. It willremain

true thatpermanent

shocks will be relatedacross countries. This is the natural definition to

employ

ifwe

are interested in thepos-sibility that there are a small

number

of stochastic trends affecting outputwhich

differ inmagnitude

across countries.The

role oflinear deterministic trends in our analysis is straightforward. If countries'outputs contain linear trends, then long-run levels

and growth

rates will be equal only ifthose trends are identical across all countries.

Thus

both

convergenceand

common

inany

group

require that all countries have thesame

linear trend. In practicewe

will find thatoutput for all countries in our

sample

is wellmodeled by a

stochastic trend.2Our

definitionofconvergenceis substantiallydifferentfrom

thatemployed by

Baumol

etal.

who

have

defined convergence tomean

that there isa

negative cross-section correlationbetween

initialincome

and

growth, thereby inferring long-run output behaviorfrom

cross-section behavior.

Our

analysis studies convergenceby

directlyexamining

the time seriesproperties of variousoutput series,

which

places the convergence hypothesis inan

explicitlydynamic and

stochastic environment.One

potential difficulty with the use of unit root tests to identify convergence is thepresence of a transitional

component

in the aggregate output of various countries.Time

series tests

assume

that the data are generatedby an

invariant measure, i.e. thesample

moments

ofthedata

are interpretable as populationmoments

fortheunderlying stochasticprocess. Ifthecountriesinour

sample

startat different initial conditionsand

areconvergingto, but are not yet at a steady state output distribution, then the available

data

may

begenerated

by

a transitional law ofmotion

rather thanby an

invariant stochastic process.Consequently, unit root tests

may

erroneouslyaccept ano

convergence null. Simulations inBernard and Durlauf

(1992) suggest that the size distortions are unlikely to be significant. Results are available upon requestfiom the authors.3

Output

relationships across countries

3.1

Econometric methodology

In order to test for convergence

and

common

trends,we

employ

multivariate techniquesdeveloped

by

Phillipsand

Ouliaris (1988)and

Johansen(1988)Let j/i

tt denote the log per capita output level ofcountry i

and

Z?y,if the deviation ofoutput incountry i

from

output in country 1, i.e. j/ijt-

y,->t.Y

t is defined as then x

1 vectorofthe individual output levels,

AY

t as thefirst differenceofY

t,DY

t as the(n-l)xl

vectorofoutput deviations, Z?j/,,t,

and

ADY

t the first differences of the deviations.The

starting point for the empiricalwork

is the finding that the individual elementsofthe per capita output vector are integrated of order one. It is then natural to write a

multivariate

Wold

representation ofoutput asAY

t=

n

+

C(L)e

t. (3.1)As shown

by

Engleand Granger

(1987),ifthep

output series arecointegratedin levels withrcointegrating vectors then

C(l)

is ofrankp—r

and

thereisa

vectorARMA

representation.A

first test for thenumber

oflinearly-independent stochastic trends hasbeen

developedby

Phillips

and

Ouliaris (1988)who

analyze the spectral density matrix at the zero frequency.A

second test isdue

toJohansen

(1988, 1989)who

estimates the rank of the cointegrating matrix.For a vector ofoutput series, convergence

and

common

trendsimpose

different restric-tionson

the zero frequency of the spectral density matrix ofAY

t,f^y(0)-Convergence

requires that the persistent parts

be

equal;common

trends require that thepersistent partsof individual output series be proportional. In a multivariate

framework,

proportionalityand

equality ofthe persistent parts corresponds to linear dependence,which

is formalizedas a condition

on

the rank ofthe zero-frequency spectral density matrix.From

Engleand

Granger

(1987),ifthenumber

ofdistinct stochastic trends inY

t islessthan

n, then/Ay(0)

isnot offullrank. Ifall

n

countries areconverginginper capitaoutput, then /^dk(0),,,=

Vt, or equivalently, the rank of

/ady(0)

is 0.On

the other hand, if several output serieshave

common

persistent parts, the output deviationsfrom

abenchmark

countrymust

all have zero-valued persistentcomponents.

Spectral-based procedures devised

by

Phillipsand

Ouliaris permita

test for complete convergenceas well as the determination ofthenumber

ofcommon

trends forthe 15 outputseries.

The

testsmake

use of the fact that the spectral densitymatrix

offirst differencesstochastic trends in the data

and n

is thenumber

ofseries in the sample. This reductionin rank is captured in the eigenvalues of the zero frequency ofthe spectral density matrix.

If the zero frequency matrix is less than full rank, q

<

n

then thenumber

of positiveeigenvalues will also be q

<

n.The

particular Phillips-Ouliaris testwe

employ

is abounds

test that

examines

the smallestm

=

n

—

q eigenvalues to determineiftheyare close to zero.We

usetwo

critical values for thebounds

test,C\

=

0.10^

and

Ci

=

0.05.These

criticalvalues assess the averageof the

m

smallest eigenvalues incomparison

to the average ofallthe eigenvalues.

The

first critical value, Cj, ism

x

10%

of the average root.The

secondcritical value, C?, corresponds to

5%

ofthe total variance.For the

Johansen

testswe

impose

some

additional structureon

the output series.We

assume

that afinite-vector autoregressiverepresentation existsand

rewrite theoutputvectorprocess as,

£Y

t=

T(L)&Yt

+

nYt-i+ii

+

et (3.2)where

and

T,

=

-(A

t+1+

...-A

k), (t=!,...,*-!),

ll

=

-(I-A

l-...-A

k).II represents the long-run relationship of the individual output series, while

T(L)

tracesout the short-run

impact

of shocks to the system.We

are interested only in the long-runrelationships,

and

thus all the testsand

estimates ofcointegrating vectorscome

from

thematrix, II,

which

can be written asII

=

a(3' (3.3)with

q

and

0,p x

r matrices of rank r<

p. /? is the matrix of cointegrating vectors, as /3'Yt-kmust

be stationary inEquation

3.2.However,

/? is not uniquely determined; adifferent choice of

a

satisfyingEquation

3.3 willproduce

a different cointegrating matrix.Regardless of the normalization chosen, the rank of II is still related to the

number

ofcointegrating vectors. If the rank of II equals p, then Yt is a stationary process. If the

the

rank

of II is<

r<

p, there are r cointegrating vectors for the individual seriesin

Y

tand

hence thegroup

of time series is being drivenby

p—r

common

shocks. If therank ofII equals zero, there are

p

stochastic trendsand

the long-run output levels are notrelated across countries. In particular,

from

Definition 2.1, for the individual output seriesto converge there

must be

p—

1 cointegrating vectors of theform

(1,-1) orone

common

Two

test statistics proposed byJohansen

to test the rank of the cointegrating matrixare derived

from

the eigenvalues of theMLE

estimate ofII. Ifn

is offull rank, p, then itwill have

no

eigenvalues equal to zero. If, however, it isoflessthan

full rank, r<

p, then itwill

have

p—r

zero eigenvalues.Looking

at the smallestp-r

eigenvalues the statistics arep p

trace

=

T ]T

A,;«

-2ln(Q;r,p)

=

-T

^

/n(l-

A,) (3.4)«=r+l i=r+l

and

maximum

eigenvalue= TA

r+1 ss—

2ln(Q;r,r+

1)= —

Tln{\

—

A

r+i) (3.5)The

trace statistic tests the null hypothesis that the rank ofthe cointegrating matrix is ragainst the alternative that the rank isp.

The

maximum

eigenvaluestatistic teststhe nullhypothesis that therankis r against the alternative that therankis

r+1.

Critical values forthe asymptotic distributions of

both

statistics are tabulated inOsterwald-Lenum

(1992).4

Data

The

data used in the empirical exercise are annual log realGDP

per capita in 1980in-ternational dollars.

The

series runfrom

1900-1987for 15 industrialized countries with theGDP

datadrawn

from

Maddison

(1989)and

the populationdata

from

Maddison

(1982).Population for 1980-1987

comes from IFS

yearbooks.The

populationdata

as published inMaddison

(1982) are not adjusted toconform

tocurrent national borders, while the

GDP

data

are adjusted. Failure to account for borderchanges canlead to large

one

timeincome

per capitamovements

aspopulation is gained orlost. For example,

GDP

per capita in theUK

jumps

in 1920 withouta

correction for theloss ofthe population of Ireland in that year.

To

avoid these discretejumps we

adjust thepopulation to reflect

modern

borders.3The

GDP

data set also has a fewminor

problems.The

year-to-yearmovements

during thetwo

world wars forBelgium

and

duringWWI

forAustriaare constructed

from

GDP

estimates ofneighboring countries.5

Empirical

results

on

convergence

and

cointegration

In testingforconvergence

and

common

trends,we

use threeseparate groupingsof countries:all 15 countries together, the 11

European

countriesand

finally a subset of 6European

3

This type of gain or loss affects Belgium, Canada, Denmark, Fiance, Italy, Japan, and the

UK

at least once. Ifterritory, and thus population, are lost by countryX

in year Ti, we adjust earlier years by extrapolating backward fromT\ using the year-to-year population changes ofcountry X.countries

which

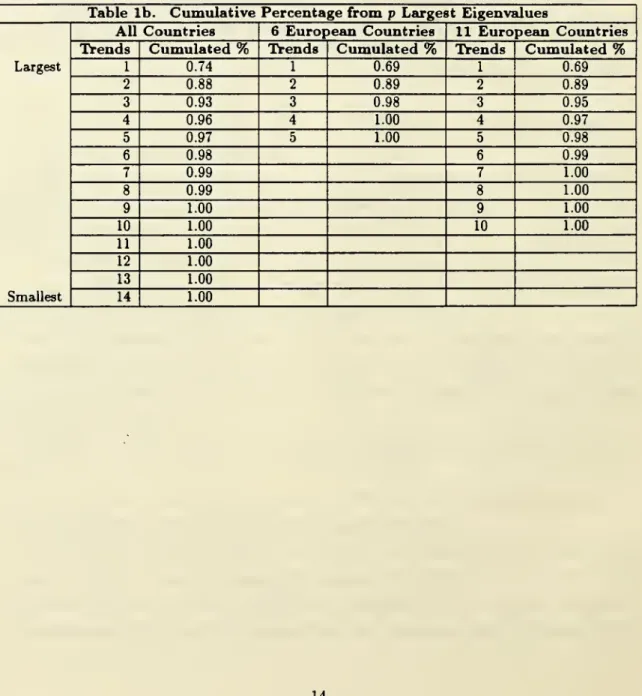

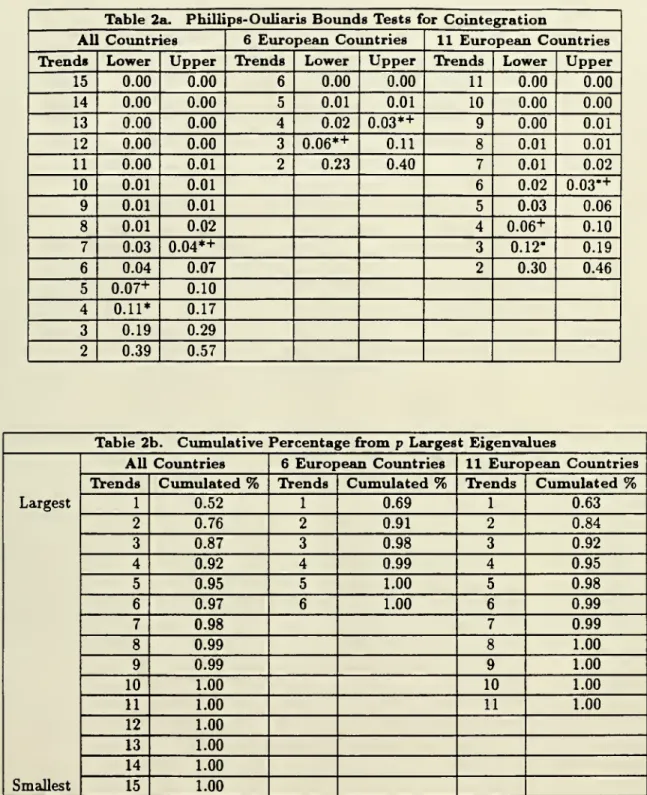

exhibit alarge degreeof pairwise cointegration.4 Resultsfrom

thePhillips-Ouliaris procedures

on

convergenceand

common

trends are in Tables 1and

2 respectively.Results using the

Johansen

methods

are in Table 3.We

initially test for convergence in the 15 countrygroup

by performing thePhillips-Ouliaris

bounds

testson

the first difference ofoutput deviations,ADY

t , having subtractedoff the

US

output. If countries converge, thenwe

would

expect to find 1 distinct root inoutput levels

and no

roots in the deviationsfrom

abenchmark

country. If idiosyncratictrends

dominate

for every country, thenwe

would

expect to findn

distinct roots forn

countries in the levels. Ifthe

number

ofsignificant roots liesbetween

these extremes, thisindicates thepresence of

common

trends in internationaloutput.As

an

alternativemeasure

ofthe

number

ofcommon

trends,we

look at the cumulative percentage ofthesum

oftheroots. Ifthe first

p

<

n

largest roots contribute95%

ormore

ofthesum,

thenwe

concludethat there are

p

importantcommon

stochastic trends for the block.5Table 1 presents the Phillips-Ouliaris

bounds

tests for convergenceand

the cumulativesums

of the eigenvalues for the groupsmentioned

above.6 Ifthe lowerbound

on

the largestroot is greater

than

the critical levelwe

can cannot reject theno

convergence null.Ad-ditionally, if the largest root acounts for less than

95%

of the total variancewe

concludethat there is

more

than one

stochastic trend for the group. Table 2 presentstwo

differenttests for the

number

ofcommon

trends in each group. First, iftheupper

bound

is less thanthe critical value for a given p,

we

can reject the null hypothesis that there arep

ormore

distinct roots. If the lower

bound

is greater than thesame

critical value thenwe

cannotreject the hypothesis that there are at least

p

distinct roots.We

also look for thenumber

ofeigenvalues that account for

95%

ormore

of the total variance.The

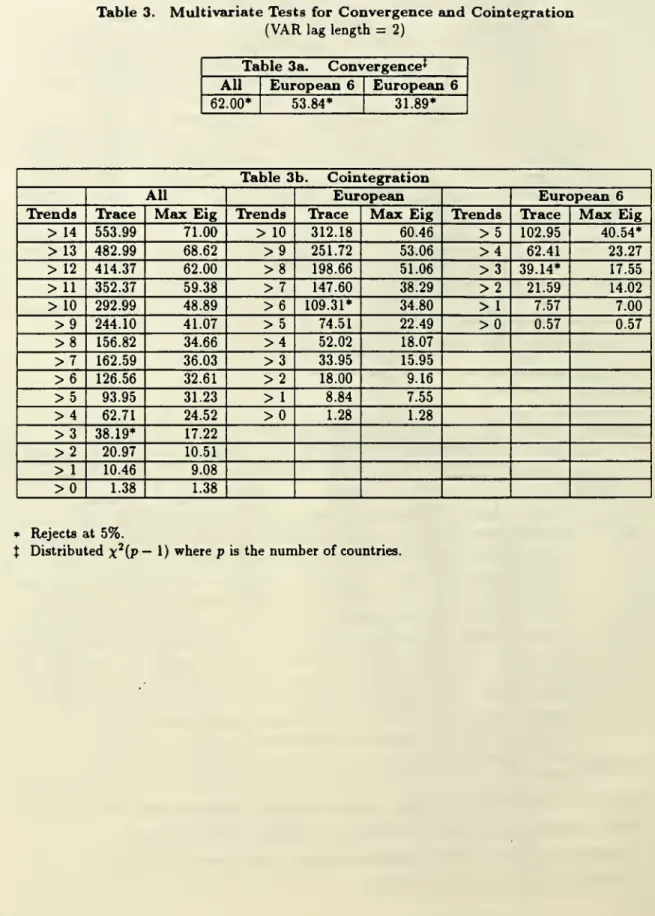

multivariate resultsfrom

theJohansen

traceand

maximum

eigenvalue statisticson

convergence

and

cointegration are presented in Tables3a

and 3b

for aVAR

lag length of2.7

The

two

statistics give different estimates of the cointegrating vectors; themaximum

eigenvalue test is often not significant for

any

number

of cointegrating vectors. Test resultsare presented for null hypotheses

on

number

ofcommon

trends rangingfrom

1 to 15.The

evidenceon

convergence is quite striking. For all test statisticsand

in all threesamples the convergence hypothesis fails.

The

direct convergence test in Table 1 cannotreject theno-convergencenullfor

both

critical levelsas thelargest eigenvalue isstatistically*The 6 European countries are Austria, Belgium, Denmark, France, Italyand the Netherlands. Bernard

(1991) findscointegration in 10of 15 pairs. 5

Cogley (1990) uses asimilar measure.

6

K, thesizeofthe Daniell windowwaschosen to be

T

'6, or 27for our sample.

7

different

from

zero for all three groupings. Additionally,both

the traceand

themaximum

eigenvalue statistics reject convergence in every

group

in Table 3a.Having

failed to find evidence for convergence, or a single long-run trend,we

turn to the test for thenumber

ofcommon

trends.The

Phillips-Ouliaris statistics for the fifteencountry

sample

and

critical valueC\

(= ^)

reject the null hypothesis that there are 7 ormore

distinct rootsand

cannot reject the null that there are at least 4 distinct roots.With

the alternative critical value of

5%

of thesum

of the eigenvalues,Ci,we

again reject for 7or

more

distinct rootsbutnow

cannot rejectfor at least 5. This leads us to posit that thereis

a

largecommon

stochasticcomponent

over the sample.The

six largest roots account for96.7%

ofthe total, coinciding with the resultsfrom

thetest statistics.On

the other hand,the largest root accounts for barely

50%

and

the largesttwo

roots forabout

75%

of totalvariance,

which

argues against the existence ofjusta

singlecommon

factor, as is requiredfor convergence.

The

Johansen

trace statistic rejects 12 or fewer cointegrating vectors atthe

5%

leveland

13 or fewer at the10%

level for the entire fifteen country sample. Thisimplies that there are only

two

or three long-run shocking forces for theentire group.The

maximum

eigenvalue statistic does not reject forany

number

of trends.Taking

all 11 oftheEuropean

countries as a group,we

reject the null hypothesis thatthere are 6 or

more

trendsand

cannot reject that there are at least 4 trends with theC2

statistic

and

that there are at least 3 trends with theCI

statistic.The

Johansen

tracestatistic rejects 5 or

more

trends, while themaximum

eigenvalue test again cannot reject forany

number

ofcointegrating vectors.These

results suggest that there areon

theorderof 4-5 long-run processes driving output in the

European

countries.Turning

to the results for the sixEuropean

countries,we

reject the null that there areare4 or

more

distinct trends withboth

theC\ and

Ci

critical valuesand

cannot reject thenull that there are at least 3, again with

both

values.97.8%

of thesum

comes from

thethree largest eigenvalues. Using

MLE

statistics, the smaller sixEuropean

countrygroup

rejects2 or

more

trendswith the tracestatisticand

5ormore

with themaximum

eigenvaluetest.

6

Conclusions

This

paper

attempts toanswer

empirically the question ofwhether

there is convergence inoutput per capita across countries.

We

first construct astochastic definition ofconvergence basedon

the theoryof integrated time series.Time

series forper capita outputofdifferentcountries canfailtoconverge only ifthe persistent parts of thetimeseries aredistinct.

Our

analysis of the relationship

among

long-term outputmovements

across countries revealslittle evidence of convergence. Virtually all of our hypothesis tests cannot reject the null

hypothesis of

no

convergence.On

the other hand,we

find evidence that there is substantialcointegration across

OECD

economies.The number

of integrated processes driving the 15countries' output series appears to be

on

the order of 3 to 6.Our

results therefore implythat there is

some

set ofcommon

factors which jointly determines international outputgrowth.

7

References

Barro, R. (1991).

"Economic

Growth

in a Cross Section of Countries." Quarterly Journal ofEconomics,

106, 407-443.Baumol,

W.

(1986). "ProductivityGrowth,

Convergence,and

Welfare:What

theLong-Run

Data

Show."

American Economic

Review, 76, 1072-1085.Bernard, A. (1991). " Empirical Implications ofthe

Convergence

Hypothesis."Working

Paper, Center for

Economic

Policy Research, Stanford University.Bernard, A.

and

S. Durlauf. (1992). "Interpreting Tests of theConvergence

Hypothe-sis."

Working

Paper, Center forEconomic

Policy Research, Stanford University.Campbell,

J. Y.and

N. G.Mankiw.

(1989). "International Evidenceon

the Persistence ofEconomic

Fluctuations." Journal ofMonetary Economics,

23, 319-333.Cogley,T. (1990). "InternationalEvidence

on

The

SizeoftheRandom

Walk

in Output."Journal ofPolitical

Economy,

98, 501-518.DeLong,

J. B. (1988). "ProductivityGrowth,

Convergence,and

Welfare:Comment."

American

Economic

Review, 78, 1138-1154.Engle, R. F.

and

C.W.

J. Granger. (1987). "Cointegrationand

Error-Correction:Representation, Estimation,

and

Testing." Econometrica,55, 251-276.Johansen, S. (1988). "Statistical Analysis of Cointegration Vectors." Journal of

Eco-nomic

Dynamics

and

Control, 12, 231-54.(1991). "Estimation

and

Hypothesis TestingofCointegration VectorsinGaus-sian Vector Autoregressive Models." Econometrica, 59, 1551-1580.

Lee, K.,

M.

Pesaran,and

R. Pierse. (1992). "Persistence ofShocksand

their Sources inaMultisectoral

Model

ofUK

Output Growth."

Economic

Journal, 102,(March)

342-356.Lucas, R. E. (1988).

"On

theMechanics

ofEconomic Development."

Journal of Mone-taryEconomics,

22, 3-42.Maddison,

A. (1982).Phases

of Capitalist Development. Oxford,Oxford

University Press... (1989).

The

World

Economy

in the 20th Century. Paris,Development

Centreofthe Organisation for

Economic

Co-operationand Development.

Mankiw,

N.G.,D.

Romer,

And

D. Weil. (1992)."A

Contribution to the Empirics ofEconomic Growth."

Quarterly Journal ofEconomic,

107, 407-438.Ostewald-Lenum,

M.

(1992). "A

note with Quantiles oftheAsymptotic

Distributionof the

Maiximum

Likelihood CointegrationRank

Test Statistics." Oxford Bulletin ofnomics and

Statistics. 54, 3, 461-472.Pesaran, M., R. Pierse,

and

K. Lee. (1993). "Persistence, Cointegration,and

Aggrega-tion:

A

Disaggregated Analysis of theUS

Economy."

Journal ofEconometrics, 56, 57-88.Phillips, P.C.B.

and

S. Ouliaris. (1988). "Testing for Cointegration Using PrincipalComponents

Methods."

Journal ofEconomic

Dynamics

and

Control, 12, 205-30.Quah,

D. (1990). "International Patterns ofGrowth:

Persistence inCross-Country

Disparities."

Working

Paper,MIT.

Romer,

P. (1986). "Increasing Returnsand

Long

Run

Growth."

Journal of PoliticalEconomy,

94,1002-1037-Summers,

R.,and

A. Heston. (1988)."A

New

Set of InternationalComparisons

ofRealProduct and

Price Levels Estimates for 130 Countries, 1950-1985."Review

ofIncome and

Wealth, 34, 1-25.

Table

la. Phillips-OuliarisBounds

Tests forConvergence

Bounds

Tests**All

Countries

6European

Countries

11European

Countries

Trends

Lower

Upper

Trends

Lower

Upper

Trends

Lower

Upper

<1

1.60+ 3.09<1

0.68+ 1.32<1

0.29+ 0.46Ifthe upper

bound

is below the critical valuefor the largest root, reject null ofno convergence.Ifthelower

bound

isabovethecriticalvalueforthelargest root,cannotreject nullofnoconvergence.+

Significant for critical value of0.05.** These statistics are calculated on the vector of first differences of

GDPi

— GDPk.

Forall

countries, the

US

is subtracted off. Forthe 6 European countries, France issubtracted off. For the 11 European countries, France is subtracted off.Table

lb.Cumulative

Percentage

from

p Largest EigenvaluesLargest

Smallest

All

Countries

6European

Countries

11European

Countries

Trends

Cumulated

%

Trends

Cumulated

%

Trends

Cumulated

%

1 0.74 1 0.69 1 0.69 2 0.88 2 0.89 2 0.89 3 0.93 3 0.98 3 0.95 4 0.96 4 1.00 4 0.97 5 0.97 5 1.00 5 0.98 6 0.98 6 0.99 7 0.99 7 1.00 8 0.99 8 1.00 9 1.00 9 1.00 10 1.00 10 L 1.00 11 1.00 12 1.00 13 1.00 14 1.00 14

Table

2a. Phillips-OuliarisBounds

Tests forCointegration

All

Countries

6European

Countries

11European

Countries

Trends

Lower

Upper

Trends

Lower

Upper

Trends

Lower

Upper

15 0.00 0.00 6 0.00 0.00 11 0.00 0.00 14 0.00 0.00 5 0.01 0.01 10 0.00 0.00 13 0.00 0.00 4 0.02 0.03*+ 9 0.00 0.01 12 0.00 0.00 3 0.06*+ 0.11 8 0.01 0.01 11 0.00 0.01 2 0.23 0.40 7 0.01 0.02 10 0.01 0.01 6 0.02 0.03"

+

9 0.01 0.01 5 0.03 0.06 8 0.01 0.02 4 0.06+ 0.10 7 0.03 0.04*+ 3 0.12* 0.19 6 0.04 0.07 2 0.30 0.46 5 0.07+ 0.10 4 0.11* 0.17 3 0.19 0.29 2 0.39 0.57Table

2b.Cumulative

Percentage

from

p LargestEigenvalues

Largest

Smallest

All

Countries

6European

Countries

11European

Countries

Trends

Cumulated

%

Trends

Cumulated

%

Trends

Cumulated

%

1 0.52 1 0.69 1 0.63 2 0.76 2 0.91 2 0.84 3 0.87 3 0.98 3 0.92 4 0.92 4 0.99 4 0.95 5 0.95 5 1.00 5 0.98 6 0.97 6 1.00 6 0.99 7 0.98 7 0.99 8 0.99 8 1.00 9 0.99 9 1.00 10 1.00 10 1.00 11 1.00 11 1.00 12 1.00 13 1.00 14 1.00 15 1.00

Ifthe upper

bound

is below the critical value, reject nullofP

ormore

distinct roots. Ifthe lowerbound

is above the criticalvalue, cannot reject null ofat leastP

distinct roots.• Significant atO.lOm/n,

n

is thenumber

of countries,m

isthenumber

of roots=

0.+

Significant at5%

of thesum

of theroots.Table

3. Multivariate Tests forConvergence and

Cointegration

(VAR

lag length=

2)Table

3a.Convergence*

All

European

6European

662.00* 53.84* 31.89*

Table

3b.Cointegration

All

European

European

6Trends

Trace

Max

EigTrends

Trace

Max

EigTrends

Trace

Max

Eig>

14 553.99 71.00>

10 312.18 60.46>5

102.95 40.54*>13

482.99 68.62>9

251.72 53.06>4

62.41 23.27>

12 414.37 62.00>8

198.66 51.06>3

39.14* 17.55>

11 352.37 59.38>7

147.60 38.29>2

21.59 14.02>

10 292.99 48.89>6

109.31* 34.80J>

1 7.57 7.00>9

244.10 41.07>5

74.51 22.49>0

0.57 0.57>8

156.82 34.66>4

52.02 18.07>7

162.59 36.03>3

33.95 15.95>6

126.56 32.61>2

18.00 9.16>5

93.95 31.23>

1 8.84 7.55>4

62.71 24.52>0

1.28 1.28>3

38.19* 17.22>2

20.97 10.51>

1 10.46 9.08>0

1.38 1.38 * Rejects at 5%.t Distributed

x

2(p—

1) wherep

is thenumber

of countries.7'5

79

16

MIT LIBRARIES DUPL