Digitized

by

the

Internet

Archive

in

2011

with

funding

from

Boston

Library

Consortium

Member

Libraries

•&&m

(!

7

ADOPTION OF TECHNOLOGIES UITH NETWORK

EFFECTS:

An

Empirical Examination

of theAdoption of Automated Teller Machines

Garth Saloner

and

Andrea Shepard

No. 577April 1991

massachusetts

institute

of

technology

50 memorial

drive

Cambridge,

mass.

02139

ADOPTION

OFTECHNOLOGIES

WITH

NETWORK

EFFECTS:

An Empirical

Examination

of theAdoption of Automated Teller Machines

Garth Saloner

and

Andrea Shepard

JUL

1 8 1991 RfeO.*ADOPTION

OF

TECHNOLOGIES

WITH

NETWORK

EFFECTS:

An

Empirical

Examination

of

the

Adoption

of

Automated

Teller

Machines*

Garth

SalonerStanford University

and

Andrea

Shepard

Massachusetts

Institute ofTechnology

Current Version: April 9, 1991

ABSTRACT

The

literatureon

networks

suggests that thevalue ofanetwork

is positively affectedby

thenumber

ofgeographically dispersed locations it serves (the"network

effect")and

thenumber

ofitsusers (the "production scale effect").We

show

that as aresulta firm's

expected time

untiladoption

of technologieswith

network

effects declinesin

both

usersand

locations.We

provide empirical evidenceon

theadoption

ofautomated

tellermachines by banks

that is consistentwith

this prediction.Using

standard

duration models,we

find that a bank's date ofadoption

is decreasing inthe

number

ofitsbranches

(aproxy

for thenumber

of locationsand

hence

for thenetwork

effect)and

the value ofits deposits (aproxy

fornumber

ofusersand

hence

for

production

scale economies).The

network

effect is the larger ofthetwo

effects.*

We

would

like tothank

Timothy

Hannan

and

John

McDowell

for generouslyallowing us to use their data,

Stephen

Rhoades

and

Lynn

Flynn

at theBoard

ofGovernors

for providing Federal Reserve data,Keith

Head

and

Christopher

Snyder

for research assistance,

Robert Gibbons,

Nancy

Rose,and

JulioRotemberg

forseveral helpful discussions,

workshop

participants atHarvard

and

theNBER

foruseful

comments,

the National ScienceFoundation (Grant

IST-8510162), theSloan

Foundation,

and

theTelecommunication

Businessand Economics

Program

atMIT

forfinancial support.1.

Introduction

With

the proliferation of information technology over the past several decades,net-works have

become

increasingly important.Examples

include banks'automated

teller machines, airlines'

customer

reservation systems,and

thegrowing

network

of facsimile machines. In such networks, the value to each individual orfirm ofpartic-ipating increases

with

network

size.Network

effects,and

demand-side economies

of scalemore

generally,have been

shown

in theory tohave

implications for a variety ofimportant

economic

activities including technology adoption, predatory pricing,and

product

preannouncements.

1There have

not, however,been

any attempts

totest econometrically for the effects of

networks

on

thesephenomena.

2In this

pa-per

we

constructand

apply a test fornetwork

effectson

theadoption

by banks

ofautomated

tellermachines

(ATMs).

For telephone systems,

which

areperhaps

the bestknown

example

ofatechnol-ogy with important network

effects, there aretwo

types ofeffects. First, the benefit of the technology toan

individual user increases in thenumber

of telephones, i.e.,in the

number

oflocationsfrom which

thesystem can be

accessed.This

size effectalso exists, for

example,

in retail distributionnetworks

where

consumer

benefitin-creases in the

number

of outlets atwhich

thegood

is available. Second, the benefit increases in thenumber

of peoplewho

areon

the system: as thenumber

of peoplewho

make

and

receive calls increases, each individualcan

communicate

with

more

people.

This second

effect is the source ofnetwork

externalitiesbecause

each

new

user confers

a

benefiton

all other users.In the case of

ATMs

thenetwork

effect is of the first type.A

cardholder isbetter off the larger the

number

ofgeographically dispersedATMs

from

which

shecan

access her account.The

convenience of access to one's accountwherever one

happens

tobe

means

that the value of theATM

network

increases in thenumber

ofATM

locations it includes.A

bank

can

increase itsnetwork

sizeby

adding

more

ATMs

to its proprietarysystem

and

by

linking itsnetwork with

thenetworks

of1

See, for

example,

Katz and

Shapiro (1986)and

Farrelland

Saloner (1985,1986).2

Several case studies

have

been conducted

to confirm the relevance of the the-ories.For example,

David

(1985) argues thatdemand-side economies

explain theother banks. In the early days of

ATM

adoption studied here, interbanknetworks

were

quite rare for a variety of technicaland

institutional reasons.As

a result the value of thenetwork

to depositorswas

increasing in thenumber

ofATM

locationsin their bank's network.

Because

differences in banks' post-adoptionnetwork

sizewould

generatedif-ferent valuations to their depositors, the value of

adopting

an

ATM

system

would

be

higher forbanks

expecting tohave

larger proprietarynetworks

in equilibrium,all else equal.

Because

new

technologies diffuse graduallythrough

an

industry, itis

common

and

reasonable to expect those firms that value the technologymore

toadopt

earlier. Ifeither thecost ofadoptingan

ATM

network

ofa given size fallsovertime

(becausebanks and/or

suppliershave

alearningcurve) or the benefit rises overtime

(because depositors learnabout

the value ofATMs

orATMs

perform

more

functions),then

banks with

a relatively higher valuation of the technology atany

point intime

willadopt

relatively early.A

reasonable version ofthenetwork

effects hypothesis, therefore, is thatbanks

expecting to

have

a largernumber

of locations in equilibrium willadopt

sooner.To

test this hypothesis

we

proxy

unobservableexpected

network

sizeby

thenumber

ofbranches

abank

has.Branches

are agood

proxy

forexpected network

sizebecause

they

are themost

common

location forATMs,

they are the lowest-cost locations,and

because

legal restrictions limitedplacement

outsidebranches

during thesample

period. Further,

commentary

in the trade pressand

casualempiricism

suggest thatbanks

eventually placeATMS

in most, if not all, branches.Accordingly

we

focuson

the likelihood thatbanks adopt

as a function of thenumber

ofbranches

theyhave.

The

net value ofan

ATM

system

to abank

also willbe

affectedby

thenumber

of its depositors towhom

ATMs

are valuable.Because

there are fixed costs ofadoption,

economies

of scale in productionmean

that a bank's propensity toadopt

will increase in the

number

of these depositors. Indeed, earlier studies ofATM

adoption

by

Hannan

and McDowell

(1984, 1987) find thatbank

size, asmeasured

by

total assets, isan important determinant

oftime

of adoption.We

confirm

these results

by

including ameasure

of sizemore

directly related to thenumber

ofwe

are able to separate thenetwork

effectfrom

the scaleeconomies

effect.Controlling for variation in the

number

of depositorsand

other heterogeneity,we

find that increasingnetwork

size increases the probability of early adoption.When

evaluated at thesample

mean,

the estimated probability that abank would

have adopted

in the first nine yearsATMs

were

available is 17.1 percent.Adding

a single

branch

increases this probabilityby

at least 5.7 percent (to 18.1 percent)and

perhaps

by

asmuch

as 10 percent. In comparison,adding

enough

depositorsto equal

an

average sizedbranch

increases the adoption probabilityby

4.3 percent.The

strongnetwork

effect is robust to specificationand

toremoving

large outliers.In section 2,

we

discuss the determinants ofATM

adoptionand

develop a test fornetwork

effects. In Section 3we

briefly discuss the statisticalmodels

used.The

data used

toimplement

thesemodels

are discussed in Section 4,and

in Section 5we

presentour

results. Section 6 providessome

concludingcomments.

2.

Network

Effects

and

ATM

Adoption

In this section

we

develop aframework

for considering a bank'sadoption

decision.While

thisdiscussion does not identifystructuralparameters, it does provideinsight into the relationshipbetween network

sizeand

a bank's propensity toadopt

ATMs

that guides the empirical analysis. In particular,

we

focuson

distinguishing theeffect of

network

sizefrom

the effect ofthenumber

ofend-users.In our context, end-users are the bank's depositors

and

the relevantmeasure

of

network

size is thenumber

of physical locations atwhich any

given depositorcan

carry outa

transaction.While

each user is largely unaffectedby

thenumber

ofother users of the

same

network, each user is better off the greater thenumber

of outletsfrom

which

shecan

access the network. Feasible locations forATMs

include the bank'sbranches

and

may

also includesome

non-branch

locations.3To

simplifytheanalysis

and

be

consistent with thedata

availableforempirical work,we

assume

that if a

bank

decides toadopt

ATMs

it willbe

optimal for it to installATMs

inall feasible locations

and

make

thesystem

accessible to all its depositors.3

As

discussedin asubsequent section,placingATMs

outsideof existingbranches

We

startwith

banks

endowed

with a set of characteristics including itsdepos-itors

and

feasibleATM

locations.Throughout

the analysis,we

treat thesecharac-teristics as predetermined, focusing

on

the adoption decision conditionalon

bank

characteristics.

With

thenumber

of depositorsand

potentialnetwork

size prede-termined, abank

decideswhether

toadopt

an

ATM

system

ofa fixed size to servea fixed

number

of depositors and, if so,when.

The

bank's decision,depends

on

the flow of benefitsand

costsfrom

adoption.We

begin

by

considering the "benefit side",and

in particular, the benefits toan

individual user. In the theoretical literature

on network

effects,an

end-user's per period benefits are frequently representedby

a+

b(N),where

a represents the "stand-alone" benefitfrom

the technologyand

b(N)

represents thenetwork

effect.4The

"stand-alone" or"network

independent"component

ofthe user's benefit is thatwhich

the user obtains regardless ofthe sizeofthe network.Thus,

amight

representthe utilitythat a depositor receives

from

havingan

ATM

installed at thebranch

she"usually" uses: the depositor

may

get superior service simplyby

substituting theautomated

teller for thehuman

one

duringnormal

business hours,and

willbe

able to lengthen the period duringwhich

shecan

transact at thatbranch

by

substitutingan

after-hoursATM

for adaytime

teller.The

network

effect term, b(N), increases inN

which measures

the size of thenetwork

(JV>

1).The

variableN

then represents thenumber

of other locationsfrom

which

a depositoris able to accessher accountfrom

an

ATM.

IfthoseATMs

arelocated at existing

branches

the benefits they provide are oftwo

kinds. First, they provide the benefits discussedabove

of substitutingmachines

for tellersand

after-hours

use fordaytime

use. Second,by

standardizing depositor identificationand

account

access procedures the existence ofan

ATM

inbranches

otherthan

theone

at

which

the user hasan

accountmay

make

it easier for the userto transact at those branches. IftheATMs

are not locatedat existingbranches, theyeffectively increasethe

number

ofbranches

(for the subset oftransactions thatcan

be performed by an

ATM).

54

See Farrell

and

Saloner (1986) for example.5

In this setting a

probably

depends

on

N.

The

valueofhaving

an

ATM

at one'sThe

aggregate per period value of theATM

network

to a bank's depositors ifthere are

n

ofthem

is n[a+

b(N)]. In generalone

might

expect the per periodbenefits to increase with calendar time as the

number

of serviceswhich

ATMs

provide increase. In

what

followswe

suppose

that benefitshave

growth

factor g,where

g>

1.The

flow of benefits that the bank's users derivefrom an

ATM

during

period t is therefore [a

+

^N^g*.

Assuming

that the per-period increasein revenuesto the

bank

is proportionalto theper-period benefitsto the depositors (inparticular if the bank's revenues are A times the benefit to depositorswhere

A<

1),then

thepresent value of the bank's revenues (evaluated at time

T) from adopting an

ATM

at

time

T

are:oo

J]An[a

+

6(iV)]^

T+t (1)<=o

where

8 is the discount factor.Note

that these benefits are increasing inboth n

and

N.

6We

turnnow

to the "cost" side ofthe analysis. Inmaking

itsadoption

decision,the

bank must

considerboth

variableand

fixed costs.The

variable costs aremainly

supplies (such as film) that are incurred with each transaction.

Because

we

assume

that each depositor

makes

thesame

number

of transactions, the variable costs are proportional to thenumber

of depositors. For simplicity,we assume

that thevariable costs are incorporated in A so that \n[a

+

b(N)]glrepresents the benefit

net of variable cost in period < to a

bank

that hasadopted

an

ATM.

The

fixed costs include the cost ofmaking

alterations tobranches

toaccom-modate

ATMs,

expenses related to adapting the bank'scomputer

software to theATMs,

the cost of purchasing or leasing theATMs

themselves, the cost of service tomaintain

the distinctionbetween

stand-alone effectsand

thenetwork

effect ofadditional locations in

what

follows. For simplicitywe

suppress thedependence

ofa

on

N

in the notation. If this effect isimportant

it will reduce thenetwork

effectmeasured

in the empirical work.6 For reasons discussed

at length later (principally that

banks

did not shareATM

networks

in the 1970s),we

assume

thatbank

A's depositors areunable

to usebank

B'sATMs.

ThereforeN

represents only the bank'sown

ATM

locations. Ifsuch networks were

sharedand

if abank

thereby obtainedsome

benefitsfrom

theadoption

ofATMs

by

other banks, theremight

be

an

externality in banks'adoption

decisions. In

our

case,where

each bank'snetwork

benefits areindependent

ofother banks' actions,no

externality is involved.Hence

theterm "network

effect".and

the cost of marketing.Many

of these costs, such as the cost ofpurchasing

or leasing

ATMs

or of installingthem,

depend

on

N.

Others, such as software ormarketing

costs, are"system

costs"and

are arguablyindependent

ofN.

We

de-note the present value of the cost of adopting

an

ATM

system

inN

locations attime

T

asC(N,T)

=

S(T)

+

JVc(T),where S(T)

represents thesystem

costsand

c(T) represents the cost per location.

A

typicalassumption

in the literatureon

the

adoption

of technology,and

one which

we

make

as well, is that the fixed cost ofadopting

the technology,C(N,T),

declines overtime

as the suppliers'and/or

the banks' experience

with

the technology accumulates.The

net present value ofa

bank's profitsfrom adopting

ATMs

at timeT

is therefore:oo

II

=

^

A«[a+

b(N)]6tgT+t-

C(N,

T).<=o

A

bank

with

n

depositorsand

N

locations earns higher profitsfrom adopting

at

time

T

than

from

waiting until timeT +

1 if:A*

T

f

+

«*>'

-C(N,T)

>

if**'*

1*?

KN)]

-

C(N,T

+

1)), 1—

og V 1—

Og tAnto

+

W-^,,^

1-

og i.e., if Xn[a+

b(N)]gT

> C(N,T) - 6C(N,T

+

1). (2)The

assumptions

that variable profitsgrow and

the cost ofadoption

declines overtime

implies that everybank

eventually finds it profitable toadopt

ATMs.

This

allows us to focus

on

when,

ratherthan

whether,adoption

takes place.Provided

the rate of decline of the cost of

adopting

decreases over time, the smallestT

thatsatisfies

Equation

(2) is the optimal time to adopt.7There

aretwo

interesting polar cases ofEquation

(2).The

first iswhere

C(N,

T)

is constant overtime

so thatgrowth

is the only factor in thetiming

ofadoption. In that case

Equation

(2) reduces to:Xn[a

+

b(N)]gT

1-8

>

C(N),

7

A

similarmodel

of the optimaladoption

time (butwithout

network

effects) isi.e., the

bank

adopts assoon

as the net present value of variable profitsassuming

no

further

growth

exceeds the cost ofadoption. Since costsdo

not declinewith time

in this case there isno

point to waiting: future per-period profits willbe

higherthan

today's,

and

ifadoption

would be

profitable with astream

of profits equal to thisperiod's, the

bank

should adopt.The

second

polarcaseiswhere

thereisno growth

(g=

1)and

theonlytemporal

effect is the declining cost of adoption over time.Then

Equation

(2)becomes

\n[a

+

b(N)]> C(N,T) - SC(N,T

+

1).The

right-hand-side ofthis expression isthe cost-saving

from

delaying adoptionby one

period,and

thebank

adopts

assoon

as that cost saving is less

than

the (constant) per-period variable profit.The

general case(Equation

(2)) is acombination

of thesetwo

effects.The

bank

adoptswhen

the per-period variable profits exceed the cost-saving ofwaitingan

additional period.Each

period adoptionbecomes

more

tempting both because

per-period variable profits are higher

and

because the cost ofadoption

is lower. In thismodel

n

enterson

the left-hand-side of (2) only, i.e., it increases thebenefits (net of variable costs)

and

does not affect fixed costs.As

isapparent

by

dividing (2)

by

n, the bank's net benefit per depositor is constant, but total costsdecline in n; there are production side

economies

of scale inATM

systems.As

aresult of these scale economies, the bank's profit

from an

ATM

system

is increasing in n. Therefore,adoption

occurs earlier the larger thenumber

of depositors.In the empirical work,

we

are interested primarily in testing for anetwork

effect

and

assessing itsmagnitude.

This requires separating the effect of variationin

network

sizefrom

the effect ofvariation innumber

ofdepositors.One

simple testfor

network

effects is to estimate the effect of variation inN

holdingn

constant.However

correctly interpreting the result is complicatedby

the cost-side effects.The

overall effect ofN

on

the timing of adoption isambiguous

since it affectsboth

the left-and

right-hand-sides of (2).The

left-hand-side of (2) is increasingin

N

because

of thenetwork

effect.However,

the right-hand-side also increases8

The

assumption

that fixed costs are nota

function ofn

is violatedifusage

levelsvary across locations, particularly if

banks respond

to usage variationby

varyingthe

number

ofATMs

across locations. MultipleATMs

per locationwas

perhaps

less

common

in the early days ofATM

adoption studied herethan

it isnow.

Iffixed costs increase in n, the sign of the overall effect ofn

is, in principle,ambiguous.

with

N.

To

see this recall thatC(N,T)

=

S(T)

+

Nc(T),

so that theright-hand-side of (2) is [S(T)

-

S(T

+

1)]+

N[c(T)

-

c(T

+

1)].Two

banks with

differentnumbers

of locations enjoy thesame

benefits in terms of reduction in thesystem

costs if they wait;

however

thebank

withmore

locations reaps the reduction inthe location specific costs at

more

locations.Thus,

holdingn

constant,banks with

more

locations willadopt

earlieronly ifthenetwork

effectoutweighs

this cost effect.Consequently a

test thatmeasures

the effect ofN

on adoption

propensities, holdingn

constant, isimmune

to false positives, but will tend to understate thenetwork

effect

and

may

yield a false negative.An

alternativeway

to get at thenetwork

effect is to holdn/N

=

v constantrather

than

n, that is, to hold constant thenumber

of depositors per locationand

increase the

number

of locations. Dividing (2)by

n

gives:M

„+

KN)] >

md-^+di

+

[cm-^T+i^

n

vHolding

v constantremoves

thedownward

biasfrom

the additional location-specificcost.

However, because

increasingN

while holding v constantadds

both a

locationand

v depositors to the network,an

upward

bias is introduced.The

term

involvingS

isnow

decreasing inn

because

system

costs are spread overmore

depositors.Thus

ifbanks with

more

locations (holding v constant) arefound

tohave

a higher propensitytoadopt

this couldsimplybe

due

to increasingreturns to scale insystem

costs

and

notdue

to thenetwork

effect. This test, then, will overstate thenetwork

effect

and

can

yield false positives but not false negatives.In

summary,

examining

the propensity toadopt

holdingn

constant understates theimpact

of thenetwork

effect, while holdingn/N

constant overstates it.As

described in Section 5,

we

test for the presence ofa network

effectby

holdingn

constant,

then

use thesetwo

assessments tobound

themagnitude

of theimpact

ofthe

network

effect.The

size of thenetwork

effect willbe

closer to theupper

bound

estimate if location-specific costs are

more

important

than

system

costs.We

have

assumed

thus far that thereisno

variationin the valuationofan

ATM

network

among

banks with

thesame

number

of depositorsand

ATM

locations. In practice, however, this is unlikely tobe

the case. Forexample,

some

banks might

Alternatively, the benefits of after-hour

banking might be

greater forsome

banks,such

as those situated in the suburbs,than

for others. In this case,among

thebanks

with a givennumber

of depositorsand

locations, thebanks

forwhom

suchidiosyncratic benefits are the greatest will

adopt

earliest while the others wait.To

take account of such differencesamong

banks, let et- (E(ei)

—

0) representthe deviation of the per period profits of

bank

ifrom

themean

profit ofbanks with

the

same

number

of depositorsand

locations. In this case the net present value ofa

bank's profitfrom adopting

at timeT

is:and

Equation

(2)becomes:

e,

>

C(N,

T)

-

SC(N,

T

+

1)-

\n[a+

b(N)]gT

, (3) i.e.,banks with

idiosyncratically large net benefitsadopt

early while others wait.The

smallestT

;=

T(n,

N,

e;) that satisfies (3) is the optimaladoption

date for theith bank.

In general the rate of adoption

may

change

over time.This

depends on

how

the cost or benefits of adoptionchange

over timeand

on

how

e; is distributed.To

see this, useEquation

(3) to define:e*i(n,

N, T)

=

C{N,

T)

-

6C(N,

T +

1)-

Xn[a+

b(N)]gT

. (4)Then

e*(n,N,T)

is the e; of thebank

withn

depositorand

N

locations that isjustindifferent

between adopting

and

not adoptingat time T.Then

theprobabilitythat abank

with

n

depositorsand

N

locations adopts in periodT

(i.e., thehazard

rateat period

T)

is:H[e*(n,N,T

+

l)]-H[e*(n,N,T)}

l-H[e*(n,N,T)}

' l°Jwhere

H(-) is the cumulative distribution function for e. If, asassumed

above, the benefits ofadopting

relative to costs increase over time, the right-hand-sideof equation (4) decreases with T. Therefore

even

if e is uniformly distributed so that thenumerator

of (5) is constant over time, thedenominator

declines in T.As

a result,

more

banks

find it profitable toadopt

each periodthan

did the periodbefore.

Moreover,

if e, isnormally

distributed, say, then in the early periodswhen

theNormal

density isan

increasing functioneven

more

banks

find it profitable toadopt each

periodthan

the period before so that thistendency

is reinforced. Forboth

of these reasonswe

expect to find positive durationdependence

in thehazard

rate.

3.

Estimation

Models

Equation

(4) implies thatadoption

time, conditionalon

a bank's observable charac-teristics, is arandom

variable.The

choice ofan

estimationmodel

involves choosinga

distribution foradoption

dates. In addition,because

our

observations ofadoption

times are right-censored, the estimationmodel must

accommodate

censoring.The

strategy

we

follow is to estimatestandard

duration models.These

models

easilyincorporate censored observations

and

yield readily interpretablereduced

form

pa-rameters.9

The

durationmodel

which

is themain

focus ofour

analysisassumes

that thetime

untiladoption

forbank

i conditionalon

its characteristics follows aWeibull

distribution. Let Xibe

the vector ofobserved characteristics forbank

iand

/?

be

theunknown

coefficients.Then

theprobability thatbank

iadopts

beforetime

T

is given by:For

convenience,we

make

the standardassumption

that ip^x'^)can

be

written asAn

attractive feature of the Weibull distribution is that thecomputation

ofthe effects of the covariates

on

adoption probabilitiesfrom parameter

estimates isrelatively simple.

The

hazard

rate is (l/f)ip(x'i(3)t

1~1/~t

.

Under

theassumption

that ^(x'jP)

—

ex <P, the estimated coefficients are simply the effect ofx

on

the logof the

hazard

rate.The

Weibull distribution allows thehazard

rate for a givenbank

tochange monotonically

over time. This probability increases, declines, or is9

For a discussion of duration

models

in general, see Kiefer (1988),and

foran

overview

of applying these techniques to technology diffusion, seeRose

and Joskow

(1990).

constant as

7

is less than, greater than, or equal to one.10For

reasons discussed inSection 2,

we

expect to find7

<

1.The

Weibull, however, constrains thehazard

rate intwo

potentiallyimportant

ways. First, it requires that durationdependence be monotonic.

A

standard

em-pirical regularity in diffusionstudies is

an

initially increasing then declininghazard

rate. Since

we

have data on

only the early years of the diffusion process forATMs,

it

seems

likely that a functionalform

that allows a monotonically increasing ratewill

be

adequate. Nonetheless, amore

general functionalform

is a useful checkon

the

Weibull

results. Second, the Weibull (incommon

with

the othermembers

ofthe family of proportional

hazard models)

constrains the relativehazard

rates ofany

two

banks

tobe

constant over time. Forexample,

the ratio of thehazard

rateof a

bank

with

many

depositorsand

many

locations to thehazard

rate of abank

with

many

depositorsand

one

location isassumed

tobe

time invariant.Suppose,

however, that the date ofadoption conditionalon

bank

characteristics isNormally

distributed.

Then

this ratiomight be

relatively large earlyon

and

decline overtime.

This

couldhappen

because, with aNormal

distribution, the densityfunc-tion of the

many-location

bank

can

be

declining while the density function for thesingle-location

bank

is increasing.To

test the results for sensitivity to the constraintsimposed

by

the Weibull,we

estimate a durationmodel

inwhich

the underlyingadoption

date distributionis

assumed

tobe

log-logistic.The

log-logistic distribution allows anon-monotonic

hazard

rateand

allows relativehazard

rates tochange

over time. Itapproximates

a

model

inwhich

the log of adoption dates isNormally

distributed. For the log-logistic, the probability thatbank

i hasan

adoption date earlierthan

T

is given by:1_

Ii

+

ti/7^(x;/?)J'10

The

Weibull

is

a

generalization of the exponential distributionused

in theHannan

and McDowell

(1984, 1987) analysis. It collapses to the exponentialwhen

7

=

1.Although

theyassume

a time invariant underlyinghazard

rate,Hannan

and

McDowell

usetime

varying covariates so that thehazard

ratecan

change

asbank

characteristicschange

over time.We

have

chosenan

alternativeapproach

ofallowing the

hazard

rate tobe

a function of t directlyand

using each bank's 1971characteristics.

With

this approach,bank

characteristics are necessarily exogenous.where

we

assume

again that i/>(x't(3)

=

exp(x[/3).The

hazard

rate isl

+

^lx'ipph

For

7

lessthan

1, this functionalform

hasan

underlyinghazard

function thatinitially increases

and

then decreases over time. If7

is greaterthan

orequal to one,the underlying

hazard

function has negative durationdependence.

For

both

distributions, the likelihood function for observationson

m

banks

is:m

Y[f(x'

ip,T,

7

)d

<[l-F(x'

ip,T

n

)] 1-

diwhere

d

isan

indicator variable equal toone

ifthe firm adoptsand

/(•) (F(-)) is the density function (cumulative distribution function) for theWeibull

or log-logisticdistribution.

The

firstterm

is the contribution to the likelihood of a firmobserved

to

adopt

attime

T; thesecond

term

is the contribution of a firm failing toadopt

prior to

time

T

afterwhich

it isno

longer observed.Both

thesemodels

assume

a distribution foradoption

times conditionalon

bank

characteristics. If these parameterizations fit thedata

badly, the coefficientestimates

may

be

adversely affected.We

thereforecompare

theseparametric

es-timates to results

from

anonparametric (Cox)

partial-likelihood estimator.This

estimatormakes

no assumption about

the underlyingdistribution ofadoption

times,but

insteaduses the proportionalhazard

model

assumption

that the ratiosofhazard

rates for

any two banks

aretime

invariantand

estimates the relative probabilities.4.

Data

Testing the hypothesis that

network

sizematters

given thenumber

of depositorsrequires variables that capture

network

size,number

of depositors,and

date ofadoption.

This

section describes these variables as well as variablesused

to controlfor other

bank

characteristics thatmight

affectadoption

probabilitiesand

be

cor-relatedwith

the variables ofinterest. Descriptive statistics for the variablesused

inthe analysis

appear

inTable

1.The

data

base includes informationon

adoption

dates,bank

characteristicsand

state regulations.

Because adoption

is presumptivelymore

likely inurban

areas,the

sample

was

restricted tocommercial banks

operating in acounty

thatwas

part ofan

SMSA

orhad

a population center of at least 25,000 in 1972.This

subset of allcommercial banks

in operationbetween

1971and

1979was

further restricted toconform

to the availableadoption

dataand

to capturevariationinnetwork

size.The

finalsample

includes allcommercial

banks

that satisfied the geographic criterion in1971

and

that existedthroughout

the 1971-1979sample

period.The

adoption data

come

from

surveys of allcommercial

banks conducted by

the Federal Deposit Insurance

Corporation

in 1976and

1979.The

1976

survey asks the year thebank

first installed at leastone

ATM.

The

1979 survey askswhether

thebank

has installedan

ATM

by

the 1979sample

date.Combining

these surveysgives a date offirst

adoption

forbanks

adopting prior to1977

and

identifiesbanks

adopting between 1976

and

1979.Year

of adoption for these later adopterswas

collected

by

asupplementary

surveyconducted by

Hannan

and

McDowell

(1987).n

The

date ofadoption

is the year thebank

first installed at leastone

ATM.

Because

the surveys cover onlybanks

existing at the survey dates, consistency requires thatour

sample be

restricted tobanks

existing in 1976and

1979. Sincewe

use 1971characteristics data, the

sample

also is restricted tobanks

in existenceby

1971.The

adoption data were

merged

withdata

on

firm characteristicsmaintained

by

the Federal ReserveBoard

in theReport

ofConditionand Income and

theSum-mary

of Deposits.These

sourceshave

detailed balance sheetand

othersummary

information

on

allcommercial

banks

operating in theUnited

States. In particular,they contain the best available information

on

number

of depositorsand

network

size as well as information

used

to control forother dimensions ofbank

heterogene-ity.

In the 1990s

ATMs

arecommonly

linked in regionaland

national networks. For at leastsome

ATM

transactions then, the relevantnetwork

size isnow

the sizeof the interbank network. In the 1970s, however, interbank connections

were

un-11

The

raw

surveydata

and

thesupplementary

informationon

lateradopterswere

generously given tousby

Hannan

and

McDowell.

Our

sample

hasbeen

constructedto

be

roughly consistentwith

theirs. Despite their efforts,adoption

dates are notavailable for

87 banks

known

tohave

adopted

and

otherwise consistentwith

thesample

definition.Except

where

otherwise noted, thesebanks have

been

dropped

from

the sample.common.

Many

of the earlymachines were independent

units; theywere

not fullyconnected with

the bank'sdata

system, let alonean

interbank system. Further,in the early seventies

ATM

producershad

not yet achieved a technologicalstan-dard

thatwould

make

machines

compatible. Legal issueswith

respect to sharedATMs

alsoslowed

thedevelopment

of interbank networks. Interstatebanking

was

not

permitted

in this periodand

many

state's regulated thenumber

and

location ofbank

branches.Allowing

interbanknetworks

would

clearly affect the existingregulatory regimes,

and

sharingwas

delayed while regulators decidedhow

itshould

be

managed.

Stateand

federal rulingson

interbanknetworks

have

reflectedboth

a concern

that large, singlebank

systems might

reinforce themarket

dominance

of

banks

already largeand

a countervailing concern that cooperativearrangements

among

banks might

create collusive pricing.12The

combination

ofpotential orac-tual legal constraints

and

therudimentary

state of thenew

technologymeant

that interbanknetworks were

notimportant

in the 1970s.As

a result, thenetwork

sizerelevant to a cardholder

was

the size ofher bank's proprietary network.13For these single

bank

networks, the relevantnetwork

size is thenumber

ofATM

locations the firmexpected

tohave

in equilibriumwhen

making

theadoption

deci-sion.This

number,

however, is inherently unobservable.Even

if thedata

reportedthe

number

ofATM

locations for eachbank

in each year, thesenumbers would

notnecessarily include the

planned

equilibriumnumber.

14We

therefore use thenumber

ofbranches

abank

has(BRANCH)

as aproxy

forexpected network

size.BRANCH

12

For a review of the law

on

interbank networks, see Felgran (1984). 13If

banks

anticipated thatATM

networks

would

ultimatelybe

interlinked, thiswould

ofcourseaffect theirestimatesofthe net present value of benefits inEquation

(1).

However, provided

that in the 1970sbanks

believed thatsuch

interlinkingwould

notoccur

until the 1980s, such benefitswould

be

irrelevant to thetiming

of

adoption

decision representedby Equation

(2).However

the analysis in Section2 ignores possible competitive

advantages

thatmight

accrue tobanks

thatadopt

early.

For

example,

iffirms that pioneerinterbanknetworks

are able to extractsome

of the rentsfrom

the creation of such networks,and

ifbanks with

many

branches

who

adopt

early are well-positionedin the competition toform

interbank networks, thosebanks

would

have

an

added

incentive toadopt

early.We

hope

to considersuch

competitive incentives to adopt,which

are largely ignored in this paper, infuture work.

14

In fact, the

data

do

not report thenumber

ofATM

locations.Nor

is thenumber

ofATMs

installed systematically available.is

an

excellentproxy

ifbanks

typically place at leastone

ATM

ineach

branch

and

place relatively

few

orno

ATMs

elsewhere.Banks

tend to placeATMs

in branches for several reasons. Installingand

maintaining

ATMs

on

the premises of existing branchesmay

be

less expensivethan

at off-premise locations.

Consumers

alsomay

-at least in the earlydays

ofATM

use covered in this study -have

feltmore

comfortable usingmachines

locatedwhere

they could get assistance with usage problems. Further, the legal status of

off-premise

placement

was

unresolved for a substantial portion of thesample

period.State regulatory agencies

and

legislatures controlwhether

off-premiseplacement

is allowed for state chartered banks. For national banks, off-premise

placement

is controlledby

theComptroller

ofthe Currency. In 1979, theComptroller

ruled thatoff-premise

placement by

nationalbanks

would be

allowed.15Some

state authoritiesacted to allow off-premise

placement

prior to the Federal rulingand

some

tied state regulations to the Federal standard. Still othershad

not yet issued regulations foroff-premise

placement

by

1979.16 Until off-premiseplacement

was

authorized, thenumber

ofbranches

was

aclearupper

bound

on network

size.Even

when

off-premiseplacement

was

allowed, on-premiseplacement

was

more

common.

Commentary

inthe trade press during this period suggests that

banks

eventually placeATMs

inmost

branches

so that thenumber

of branches is also agood

lowerbound.

Because

states regulate branching, the distribution of branches perbank

willvary across states. In

some

states, branching is not allowed;banks can have

no

more

than

a singlebanking

office.Because

there isno

variation innetwork

size inthese states,

banks

in these states are not included in the sample.17As

a result,the

2293

banks

in thesample

are distributed over the 37 states inwhich

multiplebranches

were

allowed in 1971.Among

these states, 19 placedno

restrictionson

15

This

rulingmeant

that the Federalgovernment no

longerhad

an

interest inregulating

ATMs.

As

a result, nationaldata

on

ATMs

were

not collected after 1979.16

Most

states regulate off-premiseplacement

insome

fashioneven

where

it is allowed. Forexample, banks

may

be

required to get approval foreach

off-premise location or to share off-premise locationswith

rival banks.17

In principle, these single

branch

banks can be

included in the analysis topro-vide additional information

on

the effect of variation in thenumber

of depositorson

adoption

probabilities.But

includingthem

does not substantively affect theparameter

estimates.the

number

or location ofbranches.We

refer to these states as "unrestricted".The

remaining

18 stateshad

some

limitationon

thenumber

or location of branches.Banks

in these "limited" statesmay

be

required to restrictbranching

to, say,a

single

county

or to refrainfrom

placing abranch

in a smallcommunity

alreadyserved

by

a competitor.18Ideally, the

n

inEquation

(1)would

be

implemented

as thenumber

ofdeposi-tors for

whom

ATM

transactionshave

value.A

closeproxy

might

be

thenumber

ofdepositors

with

personal checking accounts.However,

there areno data

availableon

thenumber

of accounts ofany

type.19The

next bestproxy

is total depositsby

customers

who

would

usean

ATM.

Thisproxy

might

be

affectedby

variation in thesize of accounts across banks.

The

closest availableproxy

is"demand

depositsby

individuals, partnerships,

and

corporations"(DEPOSITS).

DEPOSITS

specificallyexcludes

time

and

savings deposits (certificates of depositsand

savings accounts,for

example)

and

other less liquid holdings, as well as deposits held for otherbanks

or the public sector, but includes

commercial

demand

accountseven

though

theseaccounts

probably

do

not generateATM

demand.

The

extent towhich

DEPOSITS

is a

good

proxy

forn

depends

on

how much

variation there is in the proportion ofindividual accounts in

DEPOSITS

across banks.Four

additional variables areused

tocontrol for other factors thatmight

affectadoption:

wage

in the area(WAGE),

laborexpense

peremployee

(WB/L),

the averagenumber

ofbranches

perbank

in the state(PROPBR),

and

product

mix

(PRODMDC).

The

wage

variable is included to control for variations inATM

valuearising

from

variations in labor cost. Iftellers aremore

expensive, technology thatcan

substitute for tellers shouldbe

more

attractive. In this case, higherwages

should

promote

ATM

adoption.On

the other hand, the wage, asa

measure

ofaverage

income

in the bank's area,may

alsobe

correlatedwith

the average size 18The

data used

to classify states with respect to

branching

regulationswere

provided

by

theConference

of StateBank

Supervisors.Two

stateschanged from

limited to unrestricted regulation during the

sample

period.Because

substantivechanges

inbranching

regulationsmight change adoption

behavior, observations forbanks

in these states are treated as censored at the date of change.19

The

only

data

on

number

ofaccountscome

from

the FunctionalCost

Analysisreports.

These

data

are not publicly available in disaggregateform

and

cover onlya

very small,nonrandom

sample

of banks.of checking accounts. If people with higher

income

typically hold largerdemand

deposits, theWAGE

variablemay

pickup some

variationinthe relationshipbetween

DEPOSITS

and

thenumber

ofcustomers forwhom ATMs

are of value.The

wage

used

is the averagemanufacturing

wage

for 1977.20The

bank's laborexpense

peremployee

is total expenditureson

salariesand

benefits divided

by

thenumber

of employees.There

issome

evidence that thisvariable is high in concentrated markets,

presumably because

of rent sharingwith

employees

(Rhoades

1980). In that case,banks

with high values ofWB/L

may

be

more

likely toadopt because

theycan

extract a larger share of the resultingconsumer

value (i.e., theyhave

higher As inEquation

(1)than

banks

in less con-centrated markets).On

the other hand,WB/L

might

capture variation in themix

ofbanks' employees. It is possible, forexample, that a

bank

with

a relatively high value forWB/L

has fewer relativelylow-wage

tellersand

more

relativelyhigh-wage

commercial

accountmanagers

or investment advisors.A

high valueofWB/L

might

therefore indicate a low proportion of individual depositors and, therefore, a

low

propensity to adopt.

The

variablePROPBR

is included to absorb variation in statebranching

reg-ulations.

Within

the limit category there is substantial variation in the severity ofthe

branching

restrictions.As

a result, the averagenumber

ofbranches

perbank

in limit states varies

from

lessthan

2 tomore

than

8.21Increasinglyrestrictivebranching regulationssuggest that thestand-alone value

of

adoption

(a inEquation

(1))might

be

higher.The

reason for this is that adepositor at a

bank

with, say, a singlebranch

hasno

substitute for visiting that bank's single location duringnormal

business hours.By

contrast, a depositor ata

multi-branchbank

may

at leastbe

able to substitute a transaction duringnormal

20

As

reported in the Cityand County

Data

Book.

21

Wisconsin

banks

average lessthan

1.5. branches per bank,and

branching

isallowed only within the

same

county

as the bank'smain

officeand

then

only ifthere is

no

otherbank

operating in that municipality or within three miles of theproposed

branch.New

York, in contrast, hasmore

than

eightbranches

perbank

and

allows statewidebranching

except thata

bank

cannot

branch

in atown

with

apopulation

of50,000 or less inwhich

anotherbank

has itsmain

office.The number

of

branches

perbank

is a statewide averagebased

on

all thebanks

in the state, notjust those in

our

sample.hours

atanother

branch

for a transaction at her usual branch. Or,more

generally,banks

whose

depositorswould

feel constrained if they could onlybank

at theirusual

branch

duringdaytime

hoursmight

findit in theirinterests toopen

additional branches. Sincerestrictedbanks

are unabletoopen

asmany

branches

astheywould

like, they

might

more

readily turn toATMs

as away

to relievea

tightlybinding

constraint.

As

a result, since a lower value ofPROPBR

indicates amore

restrictiveregulatory

environment,

PROPBR

shouldhave

a negative effecton

adoption.There

is,

however,

a potentially offsetting competitive effect. If abank

operates ina

state in

which

there aremany

multi-branch competitors,competition

may

push

abank

toadopt

earlierthan

itwould

if it faced a less competitiveenvironment.

Inthat case,

PROPBR

might be

positively correlatedwith

adoption. In unrestrictedstates the regulatory effect should

be

absent so thatPROPBR

should reflect thecompetitive effect.

We

therefore expect a positive coefficient there. In the limitedstates,

however,

both

effectsmight be

present. If the regulatory effectoutweighs

the competitive effect in those states, the coefficient willbe

negative.Finally, following

Hannan

and

McDowell

(1984)we

include aproduct

mix

vari-able,PRODMIX,

which

we

measure

as the ratio ofDEPOSITS

to thesum

of all deposits.The

denominator,

therefore, includes all timeand

savings depositsand

deposits held for the public sector as wellas the

commercial

and

individualdemand

depositsappearing

in the numerator.22 Since in the 1970sATMs

were used mainly

for transactions involving checking accounts,

banks

whose

total deposits includea larger share of individual

and

commercial

demand

depositsmight have

a higherdemand

forATM

services. In that casePRODMIX

would

have

apositive coefficient.Table

1 presentssummary

statistics for the entiresample

ofbanks

inmulti-branching

statesand

for the limitedand

unrestricted subsamples.The

averagebank

has

over $36 million inDEPOSITS.

As

might

be

expected,banks

in statesthat

do

not restrictbranching

are largeron

averagethan

thosein stateswith

limited branching.As

a

result, there aremany

more

banks

in the 18 limited statesthan

inthe 19 unrestricted states.

The

size distribution ofbanks

isskewed

to the right: the22

Alternative

product

mix

ratioswere used

inunreported

regressions, including the ratio ofDEPOSITS

to the bank's total assets.The

resultswere

substantivelyunaffected.

largest

banks have

DEPOSITS

over $5,000 million, but only 22banks have

deposits over$500

million,and

75 percent of thebanks have

DEPOSITS

under

$16 million.While

the averagebank

acrossboth

regulatory regimes has slightlymore

than

sixbranches, the averageunrestricted

bank

has three times asmany

branches

as the average limited bank.This

variation is also reflected in thePROPBR

variable thatreports the average

number

ofbranches forallbanks

inthe state.The

PROPBR

val-ues are

somewhat

lowerthan

thesample

averages forBRANCH

because

PROPBR

includes

banks

operating only in less denselypopulated

areasexcluded

from

thesample. Like

DEPOSITS,

BRANCH

isskewed

to the right: thebank

with

themost

branches

(WellsFargo

in California) has 1013 branches, but the next highestnumber

is 443,and

75 percent ofthebanks have

fewerthan

five branches.Because

the

DEPOSITS

and

BRANCH

variableshave

similarlyskewed

distributions, thereis

much

less variation in the average forDEPOSITS

perBRANCH

across regimes.The

limitedbranching

stateshave banks

that average $5 million perbranch

versus$3.6 million in unrestricted branching states.

The

adoption

rate during thesample

period is 17-19 percentand

is higher inunrestricted states.

Among

adopting banks, the average time untiladoption

is 5.5years

with

unrestrictedbanks

adopting earlierthan

limitedbanks

(4.7 versus 5.7).5.

Results

In this section

we

present the empirical evidence for anetwork

effecton

adoption

rates.

To

develop theargument,

we

focus initiallyon

the relationshipbetween

thenumber

ofdepositors, as proxiedby

DEPOSITS,

and

the propensity toadopt

early.Next, the

main

results are presentedby

introducing thenumber

ofbranches

as aproxy

forexpected network

size.These

results are first presented as estimatesfrom

a

Weibull

specification.To

test forrobustness tofunctionalform, theWeibull

resultsare

then

compared

toestimatesbased

on

theCox

partial-likelihoodand

log-logisticforms. Finally, the possibility that the observed relationship

between

number

ofbranches

and

propensity toadopt

is simplyan

order statistic effect is addressed.Weibull

estimates of the relationshipbetween

adoptionand

number

ofdepos-itors are reported in

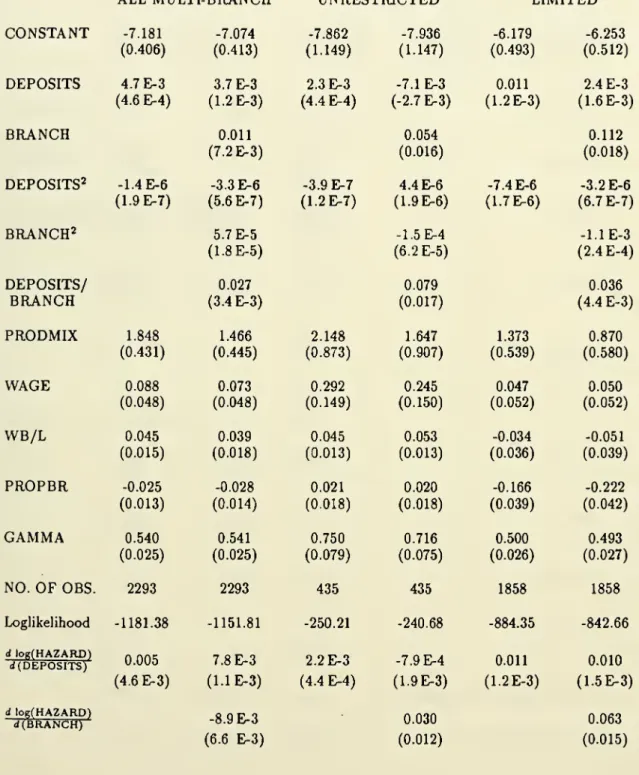

Table

2.Pooled

estimates forbanks

in all states permitting multiplebranches

and

separate estimatesforbanks

inlimitedand

unrestricted statesare reported.

The

results are consistentwith

the findings ofHannan

and

McDowell:

the coefficientsimply

that the log of thehazard

rate isan

increasing,concave

func-tion of

DEPOSITS.

The

estimates are precise,and

the pattern is consistent acrossregulatory regimes.

As

reported at thebottom

of the table, these estimatesimply

that increasing

DEPOSITS

by

$1 millionabove

thesample

mean

leads toabout

an

0.5 percent increase in thehazard

rate in the pooled regression.The

increase ismore

marked

in limitedthan

unrestricted states,perhaps because

banks

in limitedstates

have

much

smallerDEPOSITS

on

averageand

the log of thehazard

rate isconcave

inDEPOSITS.

23When

BRANCH

is included in the regressions it is entered as a quadraticto allow it to

have

a curvatureindependent

ofDEPOSITS.

As

suggestedby

themodel

in Section 2,we

also includeDEPOSITS/BRANCH

to account forlocation-specific costs of installing

ATMs.

The

signon

DEPOSITS/BRANCH

should

be

positive,

and

if location-specific costs are high relative to thesystem

fixed costs, this coefficientmight

capture a large share of the effect ofDEPOSITS.

For

thepooled

regression, the coefficientson

theBRANCH

terms

imply

thatadding a

branch

has - at best -no

effecton

the adoption rate.The

derivative ofthelog ofthe

hazard

ratewith

respect tobranch

is negativewith

a largestandard

error.The

estimates forbanks

in unrestricted states, however, tell a very different story.The

branch

derivative is positive in this regime. But, including theBRANCH

variables

changes

the sign of theDEPOSITS

derivative: theapparent

effect ofan

increase inDEPOSITS

holdingnumber

of branches constant is toreduce

theadoption

rate.This

counterintuitive resultand

thepoor showing

ofBRANCH

inthe

pooled

regressionappear

tobe

the results ofnear colinearityofDEPOSITS

and

BRANCH

in the unrestricted states.The

correlation coefficientbetween

BRANCH

and

DEPOSITS

forbanks

inunrestricted states is .98. Apparently,

when

branching

is unrestricted,banks

add

depositors

by adding

branches.The

effect ofnear colinearity is reflectedin thelargeincrease in the

standard

errorson

theDEPOSITS

coefficientswhen

BRANCH

isadded. In (unreported) regressions includingonly linear

DEPOSITS

and

BRANCH

23

All reported derivatives areevaluated at the