Digitized

by

the

Internet

Archive

in

2011

with

funding

from

Boston

Library

Consortium

IVIember

Libraries

working paper

department

AGGREGATE DEMAND AND SUPPLY DISTURBANCE

Olivier

Jean Blanchard

Danny

Quah

by

Olivier Jean Blanchard and

Danny

Quah

*February 1988.

*

Both

authors are with the Economics Department,MIT,

and theNBER.

We

thank Stanley Fischer,Julio Rotemberg, and

Mark Watson

for helpful discussions, and theNSF

for financial assistance.We

are also grateful for thecomments

of participants at anNBER

Economic Fluctuations meeting, and for the hospitality oftheMIT

Statistics Center.by

Olivier Jean Blanchard and

Danny

Quah

EkonomicB Department,

MIT.

February 1988.

Abstract

We

decompose

the behavior ofGNP

and unemployment into the dynamic effects oftwo types of shocks: shocks that have a permanent effect on output and shocks that do not.We

interpret the£rst as supplyshocks, thesecond as

demand

shocks.We

£nd

thatdemand

disturbanceshave abump

shaped effecton both output andunemploy-ment; the effectpeaks aftera yearandvanishes after two to three years.

Up

to ascaJefactor, thedynamic

effecton unemployment ofdemand

disturbancesis amirrorimageofthaton output.The

effectofsupplydisturbanceson outputincreasessteadilyovertime, toreach a

peak

after twoyearsand a plateau after five years. "Favorabie" supply disturbances

may

initially increaseunemploy-ment.

Thb

is followed by a decline in unemployment, with a slow return over time to its originalvalue.

Whilethisdynamiccharacterizationisfairlysharp, thedataarenot as specificasto the relative

contributions of

demand

and supply disturbances to output fluctuations. Wis find that the timeseries ofdemand-determined output Buctuations haspeaks and troughs which coincide with

most

ofthe

NBER

troughsandpeaks. But variancedecompositions of output at various horizons giving the respective contributions ofsupply anddemand

disturbances are not preciselyestimated. Forinstance, at aforecast horizon of fourquarters,

we End

that, under alternative assumptions, theIntroduction.

In response to an innovation in

GNP

of 1%, one should revise one's forecastby more

Ihan1%

over long horizons. This fact isdocumented

by Campbell andMankiw

{1987a), building on earlierwork

by Nelsonand Plosser (1982).

What

doesthis statistical factmean

formacroeconomics? Iftherewere only onemain

typeofdisturbancein the economy, its implications would be clear; all

we

would need to dowould

be to findwhat

thosedisturbances are, and

why

theirdynamic

effects have the shape characterized byCampbell

andMankiw.

But

if, as is likely,GNP

is affected by more than one main type of disturbance, say by aggregatedemand

and by aggregate supply disturbances, the interpretation becomesmoredifficult. In thatcase, the univariate

moving

average representation of output is a combination of the dynamic response of output to each ofthe two disturbances. Clearly, knowing only the aggregate effect does not allow us to recover those two

responses.

Campbell

andMankiw

show

that their estimated univariate representation forGNP

is equally consistent with, forexample, eitherwhite noise productivitygrowth andsmall, short-lived, effectsofdemand

disturbances on

GNP,

orinstead, with serially correlatedproductivity growthand larger, serially correlated,effects of

demand

disturbances.We

are interested in investigating the dynamic effects ofdisturbances that have only transitory impacton output as well as ofdisturbances that havepermanent impact. Studies that impose strict

random

walkbehavior in the

permanent component

are necessEirily incapable ofaddressing this issue (andwe

feelstronglythat this is the interesting characterization to obtain). Allowing the permanent

component

to have richserialcorrelation however destroysidentification to aprofound extent:

Quah

(1988) showshow

any generaldifference stationary process can always be decomposed into permanent and transitory

components

wherethe

components

are orthogonal at allleads and lags, and such that the varianceofthe first difference ofthepermcinent

component

is arbitrarily close to zero.To

proceed, onemust

eitherimpose additional a priorirestrictionson the response ofoutput to each ofthe disturbances, oruse information from time seriesother than

GNP,

andestimate a multivariaterepresen-tation.

The

first approach hasbeenfollowedin Clark (1987a), andWatson

(1986)among

others. Thispaperako

been taken in Clark (1987b), Campbell andMankiw

(1987b), and Evans (1986); our approach differsmainly inits choice ofidentifyingrestrictions. Notsurprisingly,

we

findourrestrictionsmore

appealingthantheirs.

Our

approach isconceptually straightforward.We

eissume that thereare twokinds ofdisturbances.We

assume that neither has a long run effect on unemployment.

We

assume however that the first has a longrun effect on output while the second does not. These assumptions are sufficient to just identify the two

typesof disturbances, their time series and theirdynamic effectson output and unemployment.

WhUe

the disturbances are defined bythe identification restrictions,we

believethat they can be givena simple economic interpretation.

We

think of the disturbances that have a long run effect on output asbeing mostly productivityshocks.

We

think of the disturbancesthat have no such longrun effect as beingmostly non-productivity-induced

demand

disturbances.We

find this interpretation useful and reasonable,as wellas supported by the results of the paper. Forshort, (and

we

hope, not too misleadingly)we

refer tothese types ofdisturbances as aggregate supply and aggregate

demand

disturbances respectively.Under

these identificationrestrictionsand thiseconomic interpretation,we

obtain the followingcharac-terization of fluctuations:

demand

disturbances have ahump

shaped effect on both output andunemploy-ment; theeffect peaks after a year and vanishesafter two to three years.

Up

to ascale factor, the dynamiceffect on

unemployment

ofdemand

disturbances is a mirror image of that on output.The

effect of supplydisturbances on output increases steadily overtime, toreach a peak aftertwoyears and aplateau Eifter five

years. "Favorable" supply disturbances

may

initially increase unemployment. This is followedby

a declinein unemployment, with a slowreturn over time to its originalvalue.

While this

dynamic

characterization is fairly sharp, the data are not as specific as to the relativecontributions of

demand

and supply disturbances to output fluctuations.On

the one hand,we

find thatthe time series ofdemand-determined output fluctuations, that is the time series of output constructed by

puttingallsupply disturbance realizations equalto zero, haspeaks and troughswhich coincide withmost of

the

NBER

troughs and peaks. But,when we

turn tovariance decompositionsofoutput atvarious horizons,we

findthattherespectivecontributionsofsupply anddemand

disturbancesare notpreciselyestimated. For4

of

demand

disturbances rangesfrom 30 to 80%.The

paper has five sections. Section 1 discusses identification. Section 2 discusses our economicinter-pretation of the disturbances. Section 3 discusses estimation. Section 4 characterizes the

dynamic

effectsof

demand

and supply disturbances on output and unemployment. Section 5 characterizes the relativecontributions of

demand

and supply disturbances to fluctuations in output andunemployment.

1. Identification.

We

assume that there are two types of disturbances affectingunemployment

and output.The

first heis nolong run effect on either

unemployment

or output.The

second has no long run effect on unemployment,but

may

have a long run effect on output.We

assume further that these disturbances are uncorrelated atallleads and lags. These restrictions in effect define the two disturbances. As indicated in the introduction,

and discussed at length in the next section,

we

refer tothe first asdemand

disturbances and to the secondas supply disturbances.

We

now

discusshow

these restrictions identifj- the two disturbances and theirdynamic

effects. LetY

and

U

denote the logarithm ofGNP

and the level of unemployment, respectively. As will be clear below,our assumptions imply that the first difference of

Y

,AY,

and the level ofunemployment, U, have a jointlystationary bivziriate autoregressiverepresentation:

D{L)Xt

=

vt, where D(0)=

I and E{vtvl)=

n

(l)where

X

denotes the2x1

vector\AY

U]'.The

matrix polynomial in lag operatorsD{L)

is of order n,with all determinantal roots outside the unit circle.

The

white noise bivariate vector sequence t; is seriallyuncorrelated, with v

=

[vy vu] •Under

our assumption that there are two types ofdisturbances in the economy,demand

and supply,equation (1) is the reduced form of a

model

which describes the dynamic effects of those disturbances onoutputand unemployment.

The

vectorvcomprisesreducedformdisturbances, whichare linearcombinationsofthese

demand

andsupply disturbances.By

specifying the reduced form as above,we

have already imposed anumber

of restrictions on theunemplojTnent; this implies in turn that neither ofthe two types ofunderlying disturbances has a long run

effecton unemployment.

By

contrast,since itisthe firstdifference andnot thelevelofoutputwhichappearsinequation (1),

we

have allowed both reducedformdisturbances, andthusbothdemand

and supply, tohavea long run effect on the levelofoutput.

The

only restriction thatwe

have not yet imposed is thatdemand

disturbances haveno longruneffect on output. This isthe key assumption thatwill allowus to identifythe

demand

and supply disturbances, and to recover interpretable dynamics from the reduced form.We

now

show

how

it is used.The

first step is to obtain the moving average representation of the reduced form. Multiplying bothsides ofequation (1) by

D[L)~^

gives:Xt

=

C{L)vt, where C(L)=

D{L)-\

so that C{0)=

I. (2)On

the other hand, the moving averagerepresentation corresponding toourdemand

and supply disturbancemodel

is:Xt

=

A{L)ct (3)where Ct is the vector of

demand

and supply disturbances, Cf=

[cdt e.t] , with e^t being thedemand

disturbanceande,t the supply disturbance. Giventhe assumptionthat

demand

andsupply disturbancesareuncorrelated,

we

can without lossofgenerality take the covziriancematrixofe tobe theidentitymatrix.The

condition that

demand

disturbances haveno long run effect on output implies that aii(l)=

in equation(3). In words, the coefficients on current and lagged

demand

disturbances in the output growth equationmust

sum

to zero.We

now show

that our modelis just identifiedfrom the estimated reduced form.Combining

equations(2) and (3) gives:

Xt

=

A[L)et=

C{L)vt, where C(0)=

/, and E[vtv't)=

CI.Thus, our

model

isjust identified ifand onlyifthere exists a unique matrixS

such that Set=

^t andSS'

=

n, and A{L)=

C[L)S

and aii(l)=

0.The

first conditionstates that5

is a square root ofthe covariance matrixofthe reducedform disturbances:6

column

of S. This is the fourth restriction neededfor identification. That restriction is given explicitly by:<:ii(l)sii

+

ci2{l)s2i=

0.There always exists a unique matrix

S

that satisGes these restrictions.''^Identification is thus achieved by using a long runrestriction. This raises a knotty technical issue. It

is well-known that, in the absence of precise prior knowledge of lag lengths, inference and restrictions on

asymptotic behavior of the kind

we

are interested in here is delicate.^More

precisely, viewed in terms ofFourier transforms, the restriction immediately above operates on a zero measure interval of the range of

frequencies, and so is especially suspect. It is easy howeverto generalize this restriction to one that applies

to

some

5-neighborhood of frequency zero, and then to perform estimation in the frequency domain.By

imposing that the restriction holds overa frequencyband,

we

would be using anoveridentifyingrather thanjust identifying restriction.

Under

appropriate regularity conditions,we

canshow

that our results are thelimit of the results fromfrequency domain estimation, as S tends to zero.

In

summary,

our procedure is as follows.We

first estimate the reduced form, equation (l), and deriveits

moving

average representation, equation (2).We

then construct the matrix S, and use it to recover themoving

average representation of thedemand

and supply disturbance model, equation (3).^

The

proof is as follows. First obtain the Choleski factorization ofCl.

Then

any matrix .S is anor-thonormal transformationof the Choleski matrix.

The

restrictionon the firstcolumn

imposed by aii(l)=

determines the orthonormal transformation uniquely, up to column sign chcinges. This is the

method

we

actually use to construct S.

See for instance Sims (1972).

We

are extrapolating here from Sims's results which assume strictlyexogenous regressors.

We

conjecture that similar problems arise in theVAR

case. If anything, one wouldInterpreting residuals in smalldimensionalsystems as "structural" disturbances is always perilous, and our

interpretation ofdisturbances assupply and

demand

disturbajices is noexception.We

discussvariousissues in turn.Grantingour assumption thatthe

economy

is affected by two main types of disturbances, productivityand non-productivity-induced

demand

shocks, onemay

reasonably argue that evendemand

disturbanceshavelong runeffectson output: changes in the subjectivediscountrate,orchanges infiscal policy

may

wellaffect the saving rate and the longrun capital stock and output.

The

presence of increiising returns, and oflearning bydoing, also raises the possibilitythat all

demand

shocksmay

havesome

longrun effects.Even

iftheydonot, their effects throughcapitalaccumulation

may

besufficientlylong lasting to beindistinguishablefrom truly permanent effects in the sample.

We

believe thatdemand

shocksmay

well have such long runeffects on output.

To

the extenthowever that the long runeffects ofdemand

shocks are smallcompared

tothat of supply shocks, a proposition

we

consider reasonable, our decomposition is "nearly correct" in thefollowing sense: in a sequence ofeconomies where the sizeof the long run effect of

demand

shocks becomesarbitrarilysmallrelativeto that ofsupply, the correct identifyingscheme approaches that which

we

actuallyuse. This is

shown

in the technical appendix. This proposition is the ajialogue in our context to the "near identification" proposition in traditional approachesto identification.Granting our assumption that the

economy

is affected by twomain

types of disturbances, one withpermanent

effects on output, the other only with transitory effects, alternative interpretations are possible:following Prescott (1987), one might instead view the

economy

as being affected by two types of supplydisturbances,

some

withpermanent andsome

with transitory effectsonoutput.Our

identifyingassumptionswillthenidentify thosetwodisturbances. Whilethisisnot ourprefered interpretation,

we

shall brieflydiscuss ourresults underthat alternative interpretation below.This raises a final set ofissues constituting problems inherent in estimation and interpretation ofany

low dimensional

dynamic

system. Suppose that, there are in factmany

sources of shocks, each ofthem

having different

dynamic

effects on output and unemployment. Clearly, if there aremany

supply shocks,8

with permanent and

some

with transitory effects on output, and ifthey all play an equally import2int rolein aggregate fluctuations, our decomposition is likely to be meaningless.

A

more

interesting case is that inwhich aUormost supply shocks havepermanenteffects onoutput, and allor

most

demand

shockshaveonlyatransitoryeffectonoutput.

One

might hopethat, in this case,ourprocedure is able todistinguish correctlythe

dynamic

effectsofdemand

disturbancesfromthose ofsupplydisturbances. This isunfortunately nottruein general.

We

show

this explicitly in the technical appendix, wherewe

establish necessary and sufficientconditions for this separation to occur.

From

the reasoning in the technical appendix,we

also see thatthere are important sets of circumstances under which our procedure does correctly identify the different

effects of

demand

and supply. Roughly speaking, the different components in output andunemployment

must

bear a stabledynamic

relation to each other, across the individualdemand

disturbances and across theindividualsupply disturbances.

Thus

ifthere isonly one supplydisturbance, and thereis a stableproduction function confronting the differentdemand

disturbances, ourprocedure correctly isolates thedynamic

effectsof

demand

and supply disturbances. This particular set ofconditionswe

find to be not at allunreasonable.To

summarize, our interpretation ofshocks is subject to various caveats.We

believe it neverthelesstobe reasonable, and to be supported by the results presented below.

We

now

briefly discuss the relation ofour paper to otherson thesame

topic.We

first examinehow

ourapproachrelates tothe business-cycle-versus-trend distinction :

Following estimation,

we

can construct two output series, a series reflecting only the effects of supplydisturbances, obtained by setting allrealizations ofthe

demand

disturbances to zero, and a series reflectingonly theeffectsof

demand

disturbances, obtainedbysettingsupplyrealizations tozero.By

construction,thefirstseries, the supply

component

ofoutput,willbe non-stationary while the second, thedemand

component,is stationary.

By

construction also, the two series are uncorrelated.A

standard distinction in describing outputmovements

is the "business cycle versus trend" distinction.Whilethereisno standard definitionofthese components, thetrendisusually takento be that partofoutput

that would realize, were all prices perfectly flexible; business cycles are then taken to be the dyncimics of

actual output around its trend. ^

It is tempting to associate the first series

we

construct with the "trend"component

of output and the second series with the "business cycle" component. In our view, that association is unwarranted. If pricesare in fact imperfectly flexible, deviations from trend will arise not only from

demand

disturbances, butalsofrom supplydisturbances: business cycles willoccur dueto both supply and

demand

disturbances. Putanother way, supply disturbances will affect both the business cycle and the trend component. Identifying

separately business cycles and trend is likely tobe difficult, asthe twowillbe correlated through theirjoint

dependence on current and past supply disturbances.

With

this discussion in mind,we

now

review the approachesto identification used byothers.Campbell and

Mankiw

(1987b) assume the existence oftwo types ofdisturbances, "trend" and "cycle"disturbances, which are assumed to be uncorrelated. Theiridentifying restriction is then that trend

distur-bances do not affect unemployment.

The

discussion abovesuggests that this assumption of zero correlationbetween cycle and trend components is unattractive; iftheir two disturbances are instead reinterpreted as

supply and

demand

disturbances respectively, the identifying restriction that supply disturbances do notaffect

unemployment

is equally unattractive.Clark (1987b) also assumes the existence of "trend" and "cycle" disturbances, and also assumes that

"trend" disturbances do not affect

unemployment

but allowsfor contemporaneouscorrelation betweentrendandcycle disturbances. While thisis an improvementoverCampbell and

Mankiw,

it stillseverely constrainsthe

dynamic

effectsof disturbances on output andunemployment

in ways that are difficult to interpret.The

paper closest to ours is that ofEvans (1986). Evans assumes two disturbances, "unemployment"and "output" disturbances,which can be reinterpreted assupply and

demand

disturbances respectively.By

assuming the existenceofareducedform identicaltoequation (1) above, he alsoassumes that neithersupply

nor

demand

disturbanceshavea long run effect on unemployment, butthat bothmay

have a longruneffecton thelevelofoutput. However, instead ofusing the longrun restriction that

we

use here, he assumes thatsupply disturbances have no contemporaneous effect on output.

We

find this restriction less appealing as away

ofachieving identification; it should be clear howeverthat our paper builds on Evans' work.imperfect information, this would be the path of output, absent imperfect information. In models with

nominal rigidities, this would be the path of output, absent nominal rigidities. In models that assume

market clearing and perfect information, such as Prescott (1987), the distinction between business cycles

10

S.

Estimation.

One

final problem needs to be confronted before estimation.The

representationwe

use in equation (l)assumesthatboth the levelof

unemployment

and the first difference ofthe logarithmofGNP

are stationaryaround given levels.

The unemployment

data suggest however a small secular increase inunemployment

over the post

war

period in the US. This raises anumber

ofissues.One

possibility is that, in fact,unemployment

is permanently affectedby

either supply ordemand

disturbances, or by both. This might occur iffor example the

economy

were characterized by the type ofhysteresiB studied by

Summers

and coauthor (1986).* This would require an altogether different modelingapproach.

We

do not consider it further here.A

second possibility is that there are, in addition todemand

disturbances, two types of supplydistur-bances.

The

first, which might include changes in productivity, has long run effects on output but not onunemployment.

The

second, which might include changes in the composition of the labor force, changes insearch technology and so on, does have long run effects on unemployment. If this is the case, one strategy

wouldbe to postulatethe existence ofthose three disturbances, onefrom

demand

and two from supply, andcharacterizetheir

dynamic

effects. This issubstantiallymore

difficultthanwhat

we want

to do.A

short cut,acceptable ifequilibrium

unemployment

drifts slowlythrough time, isto allowfor a deterministic time trendin unemployment. This is

what

we

do below, by first regressingunemployment

on a linear time trend andusing the residuals to estimate equation (1).

The

estimated time trend implies an increase in equilibriumunemployment

of 3.6% over the postwar

period. Aswe

find this estimate to be high,we

report three setsofresults, those obtained removing this estimated trendfrom

unemployment

(whichwe

shallcall the "trendremoved" casebelow), those obtainedremoving a trendwith slope equalto half oftheestimated value ("half

trend removed"), and those obtained not removing any trend ("no trend removed").

We

estimate equation (l) using quarterly dataforrealGNP

and the aggregateunemployment

ratefrom1950-2to 1987-2.

We

presentthe results ofestimation allowingforeightlags.(We

performedestimation withtwelve lags with little difference Ln the results.

We

also experimented with estimating the system omittingthe first fiveyears, as the

Korean

War

eraseems anomalous. Again, the empiricalresults remain practicallyunchajiged.)

The

system is the same as that estimated by Evans, with alonger sample;we

referthe readerto Evansfor a description ofthe characteristics ofthe estimated autoregressive system..

We

directly turn tointerpreting the dynamiceffects ofsupply cind

demand

disturbances.4.

Dynamic

effects ofdemand

and

supply

disturbances.The dynamic

effects ofdemand

and supply disturbances are reported in Figures 1 and 2. These figurescorrespond to the case where half of the estimated unemployment trend is

removed

fromunemployment

before estimation of the jointprocess.^

The

corresponding figures for the other two cases are for the mostpartsimil2ir, and are givenin theAppendix. Differencesbetween the three setsof results willbepointed out

in the text.

The

upper part of Figure 1 gives point estimates of the dynamic effects of ademand

disturbanceon output and unemployment.

The

scale for the logarithm of output is given on the left, the scale forunemployment

on theright. Similarly, the lower part ofFigure 1 givespointestimates ofthedynamic

effectsofa supply disturbance on

Y

and U. Figure 2 again provides pointestimates ofthedynamic

responses, butnow

with one standard deviation bands around those estimates.®Demand

disturbances have ahump

shaped effect on output and unemployment. Their effects peakafter 2 to 4 quarters, depending on the treatment ofthe

unemployment

trend.The

effects ofdemand

thendecline tovanish after8 to 14 quarters.

The

size of theeffect on outputis largest inthecasewhen

the trendin

unemployment

is fullyremoved.The

responses in output andunemployment

are mirror images ofeachother;

we

return to this aspect of theresults below after discussing the effectsof supply disturbances.These dynamiceffects are consistentwith a traditioneJview ofthe dynamic effectsofaggregate

demand

on output and unemployment, in which

movements

in aggregatedemand

buildup

until the adjustment ofprices and wagesleads the

economy

backto equilibrium.Supply disturbances have an effect on the level of output which cumulates steadily over time.

The

We

have chosen to present the figures for this case in the text not becausewe

like it best but simply because the results are -not surprisingly- in between those ofthe two other cases.More

precisely, these figures give the square root ofmean

squared deviations from the point estimatein 1000 bootstrap replications. Thus, the bands need not be and indeed are not symmetric. In every case,

entire pseudo-histories are created by drawingwith replacement from the empiricaldistribution ofthe

VAR

mnovations. These calculations were performed using a combination ofRATS

and S on aSun

workstationresponses

to

demand

CDd

CNJd

C\Jd

to--0.5

10

20

30

40

responses

to

supply

m

d

LOd

LO10

20

30

40

output

response

to

demand

output

response

to

supply

CMo

^

CMq

?\

LO COo

>

'l CD ' \'^d

q

^

v.\

o

-;. \ C\Jd

-w

\

IT) > •\

d

\ /• \ ^ C\J 1 1 1 1 1 1 1 1 1q

d

o

/• • •/•

'•...

/• ^V, 1- ' /• /^-

_

• ^ ,' / / / / 1 , 1 1 1 . J 1 u10

20

30

40

10

20

30

40

unempi

response

to

demand

unempi

response

to

supply

o

d

CMd

d

CDd

CMd

o

d

CMd

d

10

20

30

40

10

20

30

40

12

peak response is about two to three times the initial effect aind tiikes place after eight quarters.

The

effectdecreases tostabilize eventually at twothirds of its peak value.

The

dynamic response inunemployment

isquite different: a positivesupply disturbance (thatis, asupply disturbance thathas a positivelongruneffect

on output)

may

initially increaseunemployment

slightly. Ifthis increase occurs, the effect is reversed aftera few quarters, and

unemployment

slowly returns to its originalsteady state value.The dynamic

effects ofa supply disturbance on

unemployment

are largely overby about five years.The

response ofunemployment

and output Eire suggestive of the presence of rigidities, both nominaland real. Nominal rigidities can explain

why

in response to a positive supply shock, say an increase inproductivity, aggregate

demand

does not initially increase enough tomatch

the increase in output neededto maintain constant employment;real

wage

rigidities can explainwhy

increases in productivitycan lead toa decrease Ln

unemployment

after a few quarters, which persists until real wages have caught up with thenew

higher levelof productivity.Figure 1 alsosheds interestinglighton the relation betweenchangesin

unemployment

and outputknown

as Okun's Law. In our sample, a regression of annual percentage changes in output on annual changes in

unemployment

yields acoefficient of-2.4, the absolutevalue ofwhich isknown

as Okun's coefficient.Under

our interpretation,this coefficient isa mongrelcoefficient, as thejointbehavior ofoutput and

unemployment

depends on the type of disturbance affecting the economy. In the case of

demand

disturbances. Figure 1suggests that there is indeed a tight relation between output and unemployment.

The

absolute value ofthe implied coefficient is roughly equal to 2, lower than Okun's coefficient. In the case ofsupply disturbances,there is no such close relation between output and unemployment. In the short run, output increases,

unemployment

may

riseorfall; inthe long run, outputremainshigherwhereas by assumptionunemployment

returns to its initial value. In the intervening period,

unemployment

and output deviations are ofoppositesign, and the absolute value of the implied coefficient is close to 4, higher in absolute value than Okun's

coefficient. That the absolute value of the coefficient is higher for supply disturbances than for

demand

disturbances isexactly

what

we

expect. Supplydisturbances arelikelyto affect the relation between outputand employment, and to increase output with little or no change in employment.

two disturbances

we

have isolated were in fact both supply disturbances, the first having only temporaryeffects, the second havingpermanent effects, and that all marketscleared under perfect information.

What

interpretation could be given to the djTiamic responses given in Figure 1?

Temporary

productivitydistur-bances shouldlead tostrong intertemporalsubstitutioneffectson labor supply, and thisclearly couldexplain

the behavior of output and

unemployment

in the upper part of Figure 1.As

permanent disturbances toproductivitycumulateovertime, this could explain the dynamiceffects ofthe disturbanceson output in the

lower part of Figure 1.

The

anticipation ofhigher productivity later would induce workers, in reaction toapositive innovation in productivity, to intertemporally substitute

away

from currentwork

towardwork inthe future; thiswould explain the initial increase and the subsequentdeclinein unemployment. Thus, in the

absence ofmore information, the dynamiceffects presentedin Figure 1 are clearly susceptible to alternative

Output

fluctuations

absent

Demand

CO C\J COo

CO CO r-* CO ->;};o

1950

1960

1970

1980

1990

CDO

CMO

o

CDO

Output

fluctuations

due

to

Demand,

Unemployment

fluctuations

absent

Demand.

1950

1960

1970

1980

1990

Unemployment

fluctuations

due

to

Demand,

CO OJ

o

C\J CO1950

1960

1970

1980

1990

14

5. Relative contributions of

demand

and

supply

disturbances.Having

shown

thedynamic

effects of each type of disturbance, the next step is to assess their relativecontribution to fluctuations in output and unemployment.

We

do this in two ways.The

first is informal,and entails a comparison of the historical time series of the

demand component

of output to theNBER

chronology of business cycles.The

second examines variance decompositions of output andunemployment

in

demand

and supply disturbances at various horizons,a.

Demand

distwrbcinceB andNBER

buBiness cycles.PYom

estimation ofthejoint processfor output and unemployment, and our identifying restrictions,we

can

compute

thedemand

componentsofoutput and unemployment. These are the time paths ofoutput andunemployment

thatwould have obtainedin theabsenceofsupply disturbances. Similarly, bysettingdemand

innovations to zero,

we

can generate the time series of supply components in output and unemployment.From

the identifying restriction thatdemand

disturbances have no longrun effect on output, the resultingseries of the

demand

component

in the level of output is stationary.By

thesame

token, both thedemand

and supply components of

unemployment

are stationary.The

time series corresponding to the "half-trend removed" case ispresented in Figures 3 (output) and4 (unemployment).

The

upper panel presents the historical supply component, the lower panel presents thehistorical

demand

component. Superimposed on these time series are theNBER

peaks and troughs. Peaksare

drawn

as verticallines above the horizontal axis, troughs as vertical lines below the axis.Allthreeassumptions about the trend in

unemployment

yield qualitativelysimilarresults.The

demand

component

is quite large, approaching5%

on each side ofthe origin. (Thedemand

component

is larger onaverage in the "trend removed" case.)

The

peaks andtroughsofthedemand component

in outputmatchclosely theNBER

peaks and troughs.The

tworecessions of 1974-1975 and 1979-1980 deserve specialmention.Our

decomposition attributesthem

in about equal proportions to adverse supply and

demand

disturbances. This is bestshown

by giving the73-3 73-4 74-1 74-2 74-3 74-4 75-1 Cd -0.1 0.2 -0.8 0.9 -1.4 -1.2 -3.0 e. -1.6 -0.1 -1.0 -1.1 -1.4 0.4 1.2 79-1 79-2 79-3 79-4 80-1 80-2 Cd -0.7 1.1 0.3 -0.4 -0.4 -3.1 e. -0.6 -2.0 0.5 -0.9 0.9 -0.9

The

recession of 1974-75 istherefore explainedby aninitial string ofnegativesupply disturbances, and thenof negative

demand

disturbances. Similarly, the 1979-80 recession is first dominated by a large negativesupply disturbance, and then alarge negative

demand

disturbance. Without appearing to interpret everysingle residual,

we

find these estimated sequences ofdemand

andsupply disturbances quite plausible.It

may

also simply be that the supply disturbances of these two periods were different from typical supply disturbances, such as changes in productivity, which dominate the sample.They

had a strongershort-run contractionary effect, with both declines in output and increases in unemployment.

As

a result,they

may

lookmore

likedemand

disturbancesunderouridentification restrictions, andarethereforeclassifiedas

demand

disturbances.^Notice that the supply component in output, presented in the upper panel in Figure 3, is clearly not a

deterministic trend. It exhibits slowergrowth in the late 1950's, as wellas in the 1970's.

Figure 4 gives the supply and

demand

components in unemployment (the time trend is added backto the supply component).

Unemployment

fluctuations due todemand

correspond closely to those in thedemand

component

ofGNP.

This is consistentwith our earlier finding on the mirror imagemoving

averageresponses of

unemployment

and output growthtodemand

disturbances.The model

attributes substantialfluctuation in

unemployment

to supply disturbances, again with increases in the late 1950's and aroundthetime ofthe oil disturbances ofthe 1970'e.^

This suggests extending the analysis to incorporate information from another variable.

That

variablewould be chosen so that it itself is likelyto react differently to supply and

demand

disturbances. Obviouscandidates wouldbe the price level orthe relative price ofraw materials. In Blanchard and

Watson

(1986), evidencefromfourtimeseriesisusedto decomposefluctuations intosupplyanddemand

disturbances. Therethe recession of1975 is attributed in roughly equal proportions to adverse

demand

andsupply disturbances, that of 1980 mostly todemand

disturbances. In view of those results,we

reestimated the model, leaving out 1973-1 to 1976-4.The

estimated dynamic effects ofboth demeind and supply disturbances were nearly identical to those described above.By

construction, the supplycomponent

ofunemployment

is close to actualunemployment

for the firstfew observations in the sample. Thus, the large decreasefrom 1950 to 1952in the supply

component

simplyreflects the actual

movement

inunemployment

in this period. In light of this,we

re-estimated the model from 1955-2 through the end ofour sample.We

found little change in the empiricalresults.16

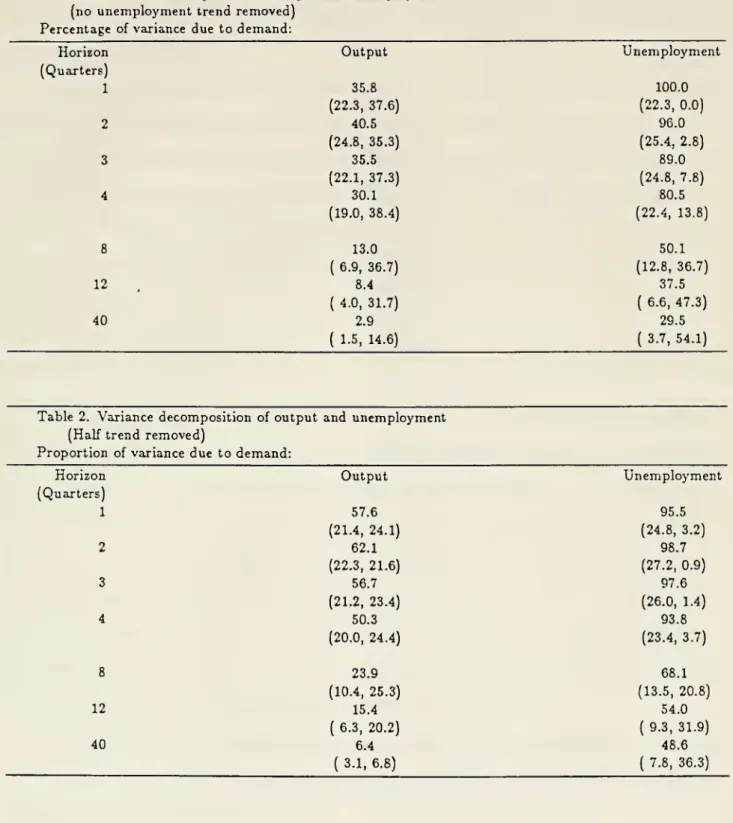

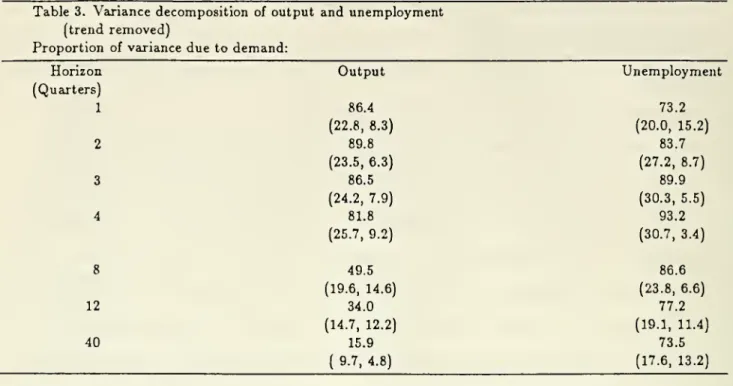

b. Variance decompositions.

While the above empirical evidence is suggestive, a

more

formal statistical assessment can be given bycomputing variance decompositions for output and

unemployment

at various horizons.Tables 1 through 3 give those variance decompositions, under the three alternative assumptions about

the

unemployment

trend. Thesetables havethe following interpretation. Define the k quarter-aheadforecasterror in output as the difference betvifeen the actual value of output and its forecast from equation (1) as

of k quarters earlier. This forecast error is due to both unanticipated

demand

and supply disturbances inthe last k quarters.

The number

for output at horizon k,k=

1,...,40 gives the percentage ofvariance ofthe /c-quarter ahead forecast error due to demand.

The

contribution of supply, not reported, is given byone hundred minus that number.

A

similar interpretation holds for thenumbers

for unemployment.The

numbers

in parentheses are standard deviations.°The

results are given for all three assumptions about theunemployment

trend, as there are important differences across these alternative hypotheses.Our

identifying restrictions impose only one restriction on the variance decompositions, namely thatthe contribution ofsupply disturbcinces to the variance of output tends to unity as the horizon increases.

All other aspects are unconstrained.

Two

main

conclusions emerge from these tables.First, the datado not give a precise answerastotherelativecontributionof

demand

and supply distur-bances tomovements

in output at short andmedium

term horizons.The

results vary with the treatmentofthe

unemployment

trend: the relative contributionofdemand

disturbances, fourquarters ahead, rangesfrom30%

(no trendremoved) to82%

(trend removed);eight quarters ahead, it stillranges from13%

to 50%.The

reason for this

may

be seen by comparing Figure 1 with the corresponding Figures in the Appendix, derivedunder alternative assumptions about the

unemployment

trend. While they are qualitatively similar, theeffects of

demand

disturbances are smaller, and the effects ofsupply disturbances are stronger and quicker,in the "no trendremoved" case.

Even

for a given assumption about trend, the standard deviation bands are large. For example, inthe "half trend removed" case, the one standard deviation

band

on the relative contribution ofdemand

(no

unemployment

trend removed)Percentageofvariance dueto demand:

Horizon (Quarters) 1 2 3 4 8 12 40 Output 35.8 (22.3, 37.6) 40.5 (24.8, 35.3) 35.5 (22.1,37.3) 30.1 (19.0, 38.4) 13.0 ( 6.9, 36.7) 8.4 ( 4.0, 31.7) 2.9 ( 1.5, 14.6)

Unemployment

100.0 (22.3, 0.0) 96.0 (25.4, 2.8) 89.0 (24.8, 7.8) 80.5 (22.4, 13.8) 50.1 (12.8, 36.7) 37.5 ( 6.6,47.3) 29.5 ( 3.7, 54.1)Table 2. Variance decomposition ofoutput and unemployment

(Half trend removed)

Proportion ofvariance due to demand:

Horizon (Quarters) 1 2 3 4 8 12 40 Output 57.6 (21.4, 24.1) 62.1 (22.3, 21.6) 56.7 (21.2, 23.4) 50.3 (20.0, 24.4) 23.9 (10.4, 25.3) 15.4 ( 6.3, 20.2) 6.4 ( 3.1, 6.8)

nemployment

95.5 (24.8, 3.2) 98.7 (27.2, 0.9) 97.6 (26.0, 1.4) 93.8 (23.4, 3.7) 68.1 (13.5, 20.8) 54.0 ( 9.3, 31.9) 48.6 ( 7.8, 36.3)Table 3. Variance decomposition ofoutput and

unemployment

(trendremoved)

Proportion of variance due todemand:

Horizon Output

Unemployment

(Quarters) 1 86.4 73.2 (22.8, 8.3) (20.0, 15.2) 2 89.8 83.7 (23.5, 6.3) (27.2, 8.7) 3 86.5 89.9 (24.2, 7.9) (30.3, 5.5) 4 81.8 93.2 (25.7, 9.2) (30.7, 3.4) 8 49.5 86.6 (19.6, 14.6) (23.8, 6.6) 12 34.0 77.2 (14.7, 12.2) (19.1, 11.4) 40 15.9 73.5 [17.6, 13.2)

disturbances four quarters ahead ranges from

30%

to 75%. Eight quarters ahead, it stillranges from14%

to 49%. At longer horizons, the contribution of

demand

disturbances goes to zero by construction; it istypically small afterfour years.

The

secondmain conclusion is that the contribution ofdemand

disturbances tounemployment

is moresubstantial and more precisely estimated, at short and

medium

term horizons. In all three cases,demand

disturbances contribute between

80%

and90%

of the variance ofunemployment

four quarters ahead; theircontribution, eight quarters ahead, varies between

50%

to 87%.The

one standard deviationband

in the"halftrend removed" caseranges from

60%

to98%

fourquarters ahead, andfrom55%

to89%

eightquartersahead. There is considerable uncertainty as tothe relative contribution of

demand

and supply disturbancesat long horizons.

6.

Conclusion.

We

have assumedthe existence oftwotypes ofdisturbances generatingunemployment

and output dynamics,the first typehavingpermanenteffectsonoutput, thesecond having only transitoryeffects.

We

have arguedthat these two types of disturbances could usefully be interpreted as productivity and non-productivity

induced

demand

shocks respectively, or,for short, as supply anddemand

shocks.Under

that interpretation,we

have concluded thatdemand

disturbances have ahump

shaped effect on output andunemployment

which disappears after approximately two to three years, and that supply disturbances have an effect on

output which cumulates overtime to reach a plateau afterfiveyears.

We

have also concluded thatdemand

disturbances

make

a substantial contribution to output fluctuations at short andmedium

term horizons;however, the data do not allow us to quantify this contribution with great precision.

Our

identifying restrictions allow us to ask interesting questions ofthedynamic

effects of disturbancesthat have permanent effects. These questions cannot be addressed by studies that restrict the permanent

component

to be apurerandom

walk.While

we

find thissimple exercise tohave been worthwhile,we

also believe that furtherwork

isneeded,especially to validate andrefine our identification ofshocks as supply and

demand

shocks.We

have inmind

18

supply components of

GNP

with a larger set of macroeconomic vaxiables. Preliminary results appear to confirm our interpretation of shocks.We

find in particular the supplycomponent

ofGNP

to be strongly positively correlatedwith realwagesathigh tomedium

frequencies,whilenosuchcorrelationemergesforthedemand

component.^"The

second extensionistoenlarge thesystem toone infourVciriables,unemployment,

output, prices and wages. Thiswould re-examine the empirical questionsin Blanchard (1986), by using the

long run identification restriction developed in this paper. This extension appears important; one would

expect that

wage

and price data will help identify more explicitly supply anddemand

disturbances.The

methodology and results will be described in a future paper.The

statement in the text refers tothe

sum

of correlations from lags -5 to+5

between the supply innovation derived in this paper and the innovations inreal wages obtained from univariateARIMA

estimation.TechnicalAppendix

This technicalappendix discusses further and establishes the claims

made

in the section oninterpreta-tion.

First,

we

asserted in the text that our identification scheme is approximately correct evenwhen

bothdisturbances have permanent effectson the levelofoutput, provided that the long-run effect of

demand

onoutput is small.

We

now

prove this.The

first element of the model, output growth, has the moving average representation indemand

andsupply disturbances:

AV;

=

aii(L)edt+

ai2(i)e,<where aii(l) is the cumulative effect on the level of output

Y

of the disturbance ej.The

moving averagerepresentationC{L), together with theinnovation covariancematrix fl, isrelatedtoour desired interpretable

representation through

some

identifying matrix S, such that:SS'

=

n, and A{L)=

C{L)S.The model

is identified by choosing a unique identifying matrix S. In the paper,we

selected the uniquematrix

S

suchthat aii(l)=

0.Let the long-run effect ofthe

demand

disturbance be 6 instead, where 6>

without loss of generality.For eachS, thisimplies adifferentidentifyingmatrixS(S). Let |S'((5)-.S(0)|

=

maxy,*: (5'y*:((5)-

5'yfc(0)) ; thismeasuresthe deviation in the implied identifying matrix from that which

we

use. Since the approximationis thus seen to be a finite-dimensionalproblem, any matrix

norm

willinduce thesame

topology,which isallthat is needed to study the continuity properties of our identification scheme. All of the empirical results

vary continuously in

S

relative to this topology. Thus, it is sufRcient toshow

that|5'(<f)

-

5(0)1—

as ,5—

0.Inwords,ifan

economy

has long-runeffects indemand

that aresmall but different fromzero, ouridentifyingscheme which incorrectly assumes the long-run effects to be zero nevertheless recovers approximately the

20

We

prove this as follows. Since both 5(0) and S(6) are matrix square roots of Cl, there exists anorthogonal matrix

V

[6) such that:S(6)=S(0)V(S),

y/hereV[S)V(Sy

=

I.Then

the long-run effectofdemand

is the (1, 1) element in the matrix;A{1;6)

=

C(l)S{6)=

C{l)S(0)V(6).But

recall that the elements of the first row of C(l)5(0) are respectively, the long-run effects ofdemand

and of supply on the level of output,

when

the long-run effect ofdemand

is restricted to be zero.Thus

for any V{S), thenew

implied long-run effect ofdemand

is simply the long-run effect ofsupply (under our identifying assumption that the long-run effect ofdemand

is zero) multiplied by the (2,2) element of theorthogonal matrix V[6). As 6 tends to eero, the (2,2) element of V{6) tends continuously to zero as well.

But, up to a column sign change, the unique

V

[S) with (2,2) element equal to zero is the identity matrix.This establishes that S[6)

—

» 5(0), element by element. Hence,we

haveshown

that \S[S)—

5(0)|—

» as S-* 0. Q.E.D.Next,

we

turn tothe effectsofmultipledemand

and supply disturbances: Suppose that there is z. pd"x1vectorof

demand

disturbances fdt, and a p, x 1 vectorofsupply disturbances f,t, so that:\Ut

J-

V^2:(L)'B22(Lyj

{f,tj

where B-jk are column vectors of analytic functions; Bji has the

same

dimension as /j, Bj2 has thesame

dimension as /,, and Bii{z]

=

(1—

z)Pii{z), forsome

vector of analytic functions fin.Each

disturbancehas a different distributed lag effect on output and unemployment.

Since our

VAR

method

allows identification of only asmany

disturbances as observed variables, it isimmediate that

we

will not be able to recover the individual components of /=

(/^ /^)'.To

clarify the issues involved,we

provide an explicit example where our procedure produces misleadingresults. Supposethatthereisonlyone supply disturbanceand two

demand

disturbances: fdt=

{fdi,t,affects only unemployment.

The

supply disturbance affects both output and unemployment. Formally,assume that the true model is:

An

unrestrictedVAR

representationcorresponding to this data generating process is found by applying thecalculations in

Rozanov

(1965)Theorem

10.1 (pp. 44-48). (A slightlymore

readable discussion of thosecalculations

may

be found in EssayIV inQuah

(1986).)The

implied moving average representationis:1 1

-(^

^'V")"'

^-'-'-It is straightforward to verify that the matrix covariogram implied by this

moving

average matches that ofthe true underlying model. Further, the unique zeroof the determinant is 2, and consequently lies outside

the unit circle. Therefore this moving average representation is, as asserted, obtained from the vector autoregressive representationofthe true model.

However,this

moving

average does notsatisfyouridentifyingassumption thatthe"demand"

disturbancehas onlytransitoryeffectsonthelevelof output.

We

thereforeapplyouridentifyingtransformationtoobtain:This

moving

average representation iswhat

we

would recover if in fact the data is generated by the threedisturbances [fdi, jd2> /.)• Notice that while the supply disturbance /, affects both output growth and

unemployment

equally and only contemporaneously,we

would identify e, to have a larger effect on outputthan on unemployment, together with a distributed lag effect on output. Further a positive

demand

dis-turbance, restricted to have only a transitory effect on output, is seen to have a contemporaneous negative

impact on unemployment. In the truemodelhowever,no

demand

disturbances affect output andunemploy-ment

together, either contemporzmeously or at any lag. In conclusion, a researcherfollowing our bivariateprocedure is likely to be seriouslymisled

when

in fact the true underlyingmodel

is driven by more than twodisturbances. Havingseen this,

we

ask underwhat

circumstanceswill this mismatchin thenumber

of actualand explicitly modeled disturbances be benign?

22

Theorem:

LetX

be a bivariate stochastic sequence generated by(i.)

X,

=

5(L)/t ;(ii.) ft

=

(fat f',t)'. with /d pd X 1, /. p. X 1 ;(iii.) Eftft-k

=

I if A;=

0, and otherwise ;(v.) B,,{z)

=

[\-z)p,,[z);

(vi.) pii, B21, B12, B22 are column vectors ofanaJyticfunctions;

Pn

and B21 Pd x 1, -^12 aiid ^22 P« X 1 ,'fvii.j

55*

isfuiiranJc on \z\=

1, wiiere* denotescomplex conjugation followed by transposition.Then

there exists a bivariatemoving

averagerepresentation forX, Xt=

A[L)et, such that:(viii.) A[z)

—

{ ^^, I ^^1

\ ], **'j"ti

°ni

^12) ^121) '^22 scalar functions, detyl^

for all \z\<

1;y021(2] 022(2)/

(ix.) 011(2)

=

(1—

z)qii(2), with Qii analytic on \z\<

1; and(x.) Ct

=

\ I, EtfCt-k

=

Iifk

=

Q, and is otherwise. \e.t JIn the bivariate representation, e^ is orthogonal to f,, and t, is orthogonal to fd, at aJiieads and Jags

ifand onlyifthere exists a pairofscalarfunctions 71, 72 such that:

B21

=

li. •/i5ii,622

=

I2 B12.Conditions (i.) - (vii.) describe the true data generating process fortlie observeddata in output growth

and unemployment. There axe pj

demand

and p, supply disturbances; (v.) expresses the requirementthatdemand

disturbances have only transitory effects on the ievei of output. Condition (vii.) is a regularitycondition that allows the existence of a

VAR

mean

square approximation.The moving

average recoveredby our

VAR

procedure is described by (viii.) - (x.): theTheorem

guarantees that there always exists such arepresentation.The

second part oftheTheorem

establishes necessary andsufficient conditionsonthe underlying modelsuch that the bivariate identification procedure does not inappropriately confuse

demand

and supplyin output growth and unemployment axe sufficiently similcir across the different

demand

disturbances, andacross the different supply disturbances. This doesnot

mean

thatthe dynamic responsesin output growthand

unemployment

acrossdemand

disturbances must be identical or proportional, simply that they differup

to a scalar lag distribution.Thus

even though in general a bivariate procedure is misleading, there are important and reasonablesets ofcircumstances under whichour techniqueprovides the "correct" answers. Forinstance, suppose that there is only one supply disturbance but multiple

demand

disturbances. Suppose further that each ofthedemand

components in the level of output has the same distributed lag relation with the correspondingdemand

component

in unemployment. This cissumption is consistentwith our 'production function'-basedinterpretations below.

Then

our procedurecorrectly distinguishes thedynamiceffects ofdemand

andsupplycomponents in output and unemployment.

Proof

ofTheorem: By

(i.) - (vs.), thematrixepectriLldensityofX

isgiven bySx{i^)=

5(z)5(z)*|, .j.By

reasoninganalogous to that in pp.44-48 inRoianov

(1965), there exists a 2 x 2 matrixfunction C, eachofwhose elements are analytic, with det

C

^

for \z\<

1, andSx

=

CC

on \z\=

1. This representsX

as amoving

average in unit variance orthogonal white noise, obtainable from itsVAR

mean

squareapproximation.

However

such amoving

averageC

need not satisfy the condition that the first (demand)disturbancehave only transitoryimpact on the levelofoutput (condition (ix.)).

Form

the2x2

orthog-onaJmatrix

M

whose second columnis the transpose of the Brstrow

ofC

evaluatedatz=

1, normalized tohavelength 1, as a vector. Then

A

=

CM

provides themoving

average representation satisfying (viii.) - (x.).For thesecond part ofthe Theorem, notice that

A

has been constructed so that on \z\=

1:|1

-

zHaiip

+

lai^r=

|1-

^r^li (^li)'+

B[, {B[,)' ;(1

-

z)aiia*i+

aisa'j=

(l-

z)^[^ (B^J*

+

B[^(S^J*

;ksiP

+

|a22|2=

5^1 (S2i)*+

5^2(522)*.Fore<f to be orthogonalto/,, ande, to be orthogonalto f^ at allleadsandlags, itisnecessaryandsufficient

tiat on \z\

=

1:(a.)

\a,,\^=P[AP[S;

24

(c.) aiiaji

=

fi'ii[B2S

;(d.) 012022

=

-012 (-^22) >(f.) \a22?

=

B!,^(B'^^y.Considerrelations (a.), (c), and (e.). Denoting complexconjugation of

B

by B, the triangle inequalityimplies that:

j=i y=i

where the inequality is strict unless B21 is a complexscalarmultiple of

Pn

for each z on \z\=

1. Next, bythe Cauchy-Schwasz inequality,

again y/ith strict inequality except

when

B21 is a complex scalar multiple ofPn,

for each z on \z\=

1.Therefore:

|aiia2il^

^

lo^iil^ • ^22^, on \z\=

1,where the inequality is strict except

when

B21 is a complex scalar multiple of fin on |r|=

1. But tiiestrictinequalityis a contradiction as

an

and 022 axe just scaiar/"unctions.Thus

(a.), (c), and (e.) can besimultaneously satisSedifandonlyifthereexists

some

complexscalarfunction')i{z) such that B21=

7i-^ii-A

similar argument applied to (b.), (d.), and (f.) shows that they can hold simultaneously ifand

only ifthere exists

some

complex scalar function ')2(^] such that B22=

72 Bi2- This establishes the Theorem.responses

to

demand

CDO

d

CMo

10

20

30

40

responses

to

supply

LO LOd

LOd

LO10

20

30

40

responses

to

demand

Ln

o

o

o

uno

LO * • _ \ /• \ / \ / S f0.1

0.0

-0.1-0.2

-0.3

-0.4

-0.5

-0.6

10

20

30

40

in LO CJo

o

LOO

responses

to

supply

LO10

20

30

40

References

Blanchard, Olivier, "Wages, Prices, and Output:

An

Empirical Investigation,"mimeo

MIT,

1986. Blanchard, Olivier andMark

Watson, "Are businesscycles allalike?" in"The

American business cycle;continuity and change", R. Gordon ed,

NBER

and University ofChicago Press, 1986, 123-156.Cochrane, John,

"How

big istherandom

walkcomponent inGNP

?", forthcoming Journai ofPoliticalEconomy

1988.Campbell, J.Y. and N.G. Mankiw, 'Are Output Fluctuations Transitory?" Quarteriy JournaJof

Eco-nomics,

November

1987, 857-880.Campbell, John and N. Gregory Mankiw, "Permanent and transitory components in macroeconomic

fluctuations",

AER

Papers and Proceedings,May

1987, 111-117 (b).Clark, P.K. , "The Cyclical

Component

inUS

Economic Activity," Quarter/y Journai ofEconomics,November

1987, 797-814 (a).Clark, Peter, "Trendreversioninrealoutputandunemployment",forthcoming Journai of Econometrics,

1987 (b).

Evans, George, "Output and

unemployment

in theUnited States", mimeo, Stanford, 1986.Nelson, CharlesandCharles Plosser, "Trends£ind

random

walksinmacroeconomic timeseries". Journal ofMonetary

Economics, September 1982, 10, 139-162.Prescott, Edward, "Theory aheadofbusiness cyclemeasurement".Federal Reserve

Bank

of Minneapolis QuarterlyReview, Fall 1986, 9-22.Quah, Danny, "Essays in

Dynamic

Macroeconometrics", Ph.D. dissertation, 1986, Harvard University.Quah, Danny, "The RelativeImportance ofPermanent and Transitory Components: Identification and

Some

Theoretical Bounds," mimeo,March

1988,MIT.

Rozanov,

Yu

A., StationaryRandom

Processes, 1965, San Francisco: Holden-Day.Sims, Christopher, "The role ofapproximate prior restrictions in distributed lag estimation". Journal

ofthe American StatisticalAssociation,

March

1972, 169-175.Summers,

Lawrence and Olivier Blanchard, "Hysteresis and EuropeanUnemployment",

Macroeco-nomics Annual, 1986, 15-78.

Watson, Mark, "Univariate detrending methods with stochastic trends". Journal of

Monetary

Date

Due

G-^-e'^

''lu^