Chinese Mortgage Backed Security Pricing Model by

Shalin Chen Bachelor of Science, 2013

Peking University

Submitted to the Program in Real Estate Development in Conjunction with the Center for Real Estate in Partial Fulfillment of the Requirements for the Degree of Master of Science in Real Estate Development

at the

Massachusetts Institute of Technology September, 2017

C2017 Shalin Chen All rights reserved

The author hereby grants to MIT permission to reproduce and to distribute publicly paper and electronic copies of this thesis document in whole or in part in any medium now known or hereafter created.

Signature of Author

Signature redacted

Certified by_

Center for Real Estate July 28, 2017

Signature redacted

Waltet Torous

Senior Lecturer, Department of Urban Studies and Planning Thesis Supervisor

Accepted by

Signature redacted

Prof ert Saiz /

Daniel Rose Assoc' essor of Urban Economics and Real Estate, De of Urban Studies and Center for Real Estate

MASSACHUSETTS INSTITUTE OF TECHNOLOGY

SEP 13 2017

LIBRARIES

Chinese Mortgage Backed Security Pricing Model by

Shalin Chen

Submitted to the Program in Real Estate Development in Conjunction with the Center for Real Estate on July 28, 2017 in Partial Fulfillment of the Requirements for the Degree of Master of Science in Real Estate

Development ABSTRACT

When it comes to financial innovations, Mortgage Backed Security (MBS) has the advantages of scattering risk, increasing liquidity, and lowering the financing costs. However, there are a few obstacles to developing a mature MBS market, among which the pricing of MBS is the vital one. Reasonable pricing will not only lead to the success

of MBS issuance, but also pave the way for the China's MBS development in the future.

This paper first introduced the definitions and development of MBS, and reviewed studies on the Subprime Crisis from the MBS prospective. This paper then discussed the MBS products, issuance procedures, and pricing principles. In particular, it analyzed the key factors of MBS pricing which affected the cash flow of MBS, and the methods to calculate the cash flow considering prepayment behavior.

Based on China's capital market and the differences between Chinese and American capital markets and residential loan markets, this paper explored the appropriate pricing model for China's MBS market, and selected Static Cash Flow Yield method to price the MBS products in China. A simulation case was priced using SCFY.

In the final section, the author gave some predictions about the development of MBS in China, including improving the primary and secondary mortgage market and the intermediary service system, and furthering interest rates

liberalization.

Thesis Supervisor: Professor Walter N. Torous Title: Senior Lecturer, Center for Real Estate

Acknowledgements

My deepest gratitude is to my thesis advisor, Dr. Walter Torous. Thank you for all your help. Not only has your expertise in the field of securitization broadened my horizon, but your course of Securitization of Mortgages and Other Assets has shown me the first look of MBS pricing, which is the exact reason why I was motivated to write this thesis.

I would also like to thank to all my professors and classmates. Thanks for teaching me so much knowledge and sharing with me so much life wisdom. You have all made my learning experience here rewarding, and I could not have been a better person without any of you.

I am also grateful to Professor Albert Saiz for giving me support and guidance as my academic advisor. I would also like to thank Ms. Tricia Nesti for having made my entire learning in the program so convenient.

TABLE OF CONTENTS

Abstract

Acknowledgement Chapter 1 Introduction

1.1 Background

1.2 Definition and concepts Chapter 2 MBS Market

2.1 Market introduction

2.2 Origination and development of MBS

2.3 The Subprime Mortgage Crisis from MBS prospective Chapter 3 Mortgage Backed Securities Product

3.1 The basics of Mortgage Backed Security 3.2 Classification of MBS

3.3 The issuance procedure of MBS Chapter 4 Pricing Model

4.1 Principles of MBS pricing

4.2 Key factors analysis of MBS pricing 4.3 Cash flow calculation

4.4 Comparative analysis of pricing models 4.5 Model Analysis and Comparison Chapter 5 MBS in China

5.1 Chinese MBS market 5.2 Key Pricing Factors

5.3 Suitable Pricing Model of MBS for China Chapter 6 Pricing Model Simulation

6.1 Model Assumption 6.2 Pricing Analysis

6.3 Evaluation of Pricing model

Chapter 7 China's MBS development prediction Appendix

Chapter 1 Introduction 1.1 Background

As the financial innovation, Mortgage Backed Security (MBS) is the main components of Asset

Backed Securities and one of the most important products in fixed income market, which has

large market scale, diverse product types and different investors. MBS products grow fast in

developed real estate and financial market. On the one hand, MBS allow banks to diversify risk

to resell the mortgage and exchanging the cash on the asset side of the bank. On the other hand, MBS broaden the investment to investors in capital market.

1.2 Definition of MBS and securitization

According to the definition of Pietro Veronesi: "Mortgage Backed Securities are collateralized by pools of residential and non-residential mortgages and sold to investors who then receive claims to the mortgages coupons". Mortgage Backed Securities are one special type of Asset Backed Securities. The collateral of MBS is the residential and non-residential mortgage. The cash flow comes from the rent of underlying property, which is influenced by term structure of interest rate, corresponding prepayment behavior and so on so forth.

The securitization is "the process through which financial institutions pool similar assets in a portfolio and sell the portfolio to investors. Investors purchasing the portfolio of assets receive claims on the cash flows generated by the assets in the portfolio." The essential of securitization

is simple: risk spreading. The institutions want to sell asset, which is too risky to those

institutions, to investors who are able to bear risk and willing to pursue higher return. However, since those assets have low liquidity and too concentration, those institutions create specific firm, called Special Purpose Vehicle (SPV) and SPV raises money from invertors and buys the

between institutions and quasi-governmental agencies such as Freddie Mac or Fannie Mae.

When originator sell their mortgage to investors, they exchange for cash. They also sell to those

agencies in exchange for MBS. In addition to MBS, other assets that could be securitized are

indicated in Table 1.1.

Table 1.1 Securitized Assets

Market Collateral

Residential Mortgage Backed Securities

(RMBS)

Commercial Mortgage Backed Securities

(CMBS)

Assets Backed Securities (ABS)

Collateralized Debt Obligations (CDO)

Collateralized Loan Obligations (CLO)

Residential Mortgage

Commercial Mortgage

Other receivables except mortgage, such as

credit cards, auto loans and so on so forth

Non-investment Bonds, Credit Default

Swaps

Chapter 2 MBS Market 2.1 Market Introduction

Until 1980s, fixed income markets were dominated by government debt securities, such as

T-bills, T-notes and T-bonds and other municipal bonds. Today, the treasury is still important

component of fixed income market but no longer the only dominant fixed income investment

because of the growth of other fixed income products such as MBS. Table 2.1 presents the size

of fixed income markets as of the Q4 2016. The first part of the table lists the traditional fixed

income markets, including U.S. treasury debt, municipal debt, federal agency securities and the

money market. The total size of these traditional debt markets is around $ 20.5 trillion. The next

part presents the size of the mortgage backed securities and asset-backed securities markets. In

particular, the mortgage backed securities market stands as a $8.9 trillion market, which is

slightly larger than U.S. corporate debt.

Table 2.1 Size of U.S. fixed income market (Q4 2016)

Market Market Value

U.S. Treasury Debt 13,908.2

U.S. Municipal Debt 3,833.7

U.S. Federal Agency Securities 1,971.7

U.S. Money Market 884.9

Mortgage Backed Securities 8,921.2

Asset Backed Securities 1,336.8

As to the size of MBS, the figure 2.1 presents the issuance and outstanding of Mortgage Backed

Securities(MBS) and Asset Backed Securities (ABS). The total issuance of MBS and ABS is

$2.2 trillion in 2016, which increase 9.3% from 2015 ($2.0 trillion). The non-agency ABS and

MBS issuance fell by 11.7 percent and 94 percent respectively while Agency volumes for 2016

rose 15.8 percent in 2016. Meanwhile the Outstanding volume of MBS and ABS grew slightly to

$10.25 trillion.

Figure2.1 U.S. fixed income market growth

4000 15000

3000

200 10000

1000 5000

01 0

" Non-Agency MBS 5 Non-AgencyABS N Non-Agency MBS * Non-AgencyABS

" Agency MBS & CMO U Agency MBS & CMO

Securitization Issuance Securitization Outstanding

2.1.1 The Main Player in the MBS market

In general, there are two type of MBS products. One is Agency MBS and another one is

non-agency MBS. Agency MBS are those issued by governmental or quasi-governmental agencies.

The vital three main players in MBS markets are one governmental agency and two

quasi-governmental agencies which are presented below:

Ginnie Mae: Ginnie Mac is a states-owned corporation which is formed by the U.S. congress in

1968. The full title of Ginnie Mae is Governmental National Mortgage Association (is also called GNMA). The main responsibility of Ginnie Mae is guarantee the timely payments of

RMBS backed by loans made through the Federal Housing Administration (FHA) program, the Office of Public and Indian Housing (PIH) program, and the Department of Veteran Affairs

(VA) Home Loan program. Ginnie Mae does not make or purchase loans, nor does it buy, sell, or issue securities. Instead, it only guarantees MBS that are issued by approved private lending

2

institutions, which pool loans and issue RMBS. MBS issued by Ginnie Mae are considered as

risk free securities because they have the explicit backing of the U.S. government and there is no

default risk.

Fannie Mae: Federal National Mortgage Association (FNMA). Initially created in 1938 as a government agency, it changed in 1968 into a shareholder-owned company, although with a

Federal charter, until the credit crisis of 2007-2009 forced the U.S. Government to place Fannie Mae in conservatorship (that is, an effective nationalization). As does Ginnie Mae, Fannie Mae

provides credit guarantees on mortgage loans that are securitized through Fannie Mae. As opposed to Ginnie Mae, Fannie Mae also maintains a large mortgage portfolio and issues debt to

finance its portfolio. By directly operating in the secondary market, Fannie Mae provides

liquidity in the mortgage market, which in turn allows banks to grant mortgages to individual

homeowners at more convenient rates than otherwise possible. Fannie Mae issued its first

mortgage backed security in 1981. Since then, Fannie Mae has become one of the largest agency issuers of MBS.3

Freddie Mac: Freddie Mac was chartered by the government in 1970 in order to stabilize U.S. residential mortgage markets and expand opportunities for homeownership and affordable rental housing. Freddie Mac follows the same business model as Fannie Mae.4

2 Ginnie Mac Annual Report, 2006

3 Introduction to Fannie Mac, 2007 4 Freddie Mac Annual Report, 2006

Both Fannie Mae and Freddie Mae should also be considered as risk free securities since the U.S.

government will rescue and subsidize those two agencies if they are trapped in financial trouble.

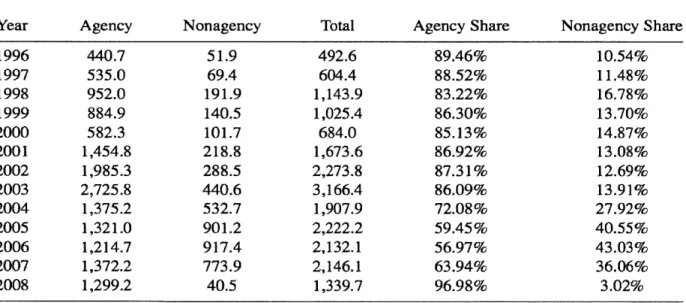

In addition to the three government institutions, residential mortgage backed securities are also

issued by other institutions. Table2.25 shows the issuance of mortgage backed securities between 1996 and 2008. Although the largest share of RMBS is issued by government- sponsored

agencies, non-agency mortgage backed securities issuance share increased over time up to 2007.

This large increase in the private label market parallels the acceleration in U.S. house prices that

occurred from 2000 to 2006. Part of the reason for the increase in the private label markets is that government-sponsored agencies have restrictions on the type of mortgages they can take on.

Table 2.2 Agency and Non-agency market share

Agency Share 89.46% 88.52% 83.22% 86.30% 85.13% 86.92% 87.31% 86.09% 72.08% 59.45% 56.97% 63.94% 96.98% Nonagency Share 10.54% 11.48% 16.78% 13.70% 14.87% 13.08% 12.69% 13.91% 27.92% 40.55% 43.03% 36.06% 3.02% Year 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 Agency 440.7 535.0 952.0 884.9 582.3 1,454.8 1,985.3 2,725.8 1,375.2 1,321.0 1,214.7 1,372.2 1,299.2 Nonagency 51.9 69.4 191.9 140.5 101.7 218.8 288.5 440.6 532.7 901.2 917.4 773.9 40.5 Total 492.6 604.4 1,143.9 1,025.4 684.0 1,673.6 2,273.8 3,166.4 1,907.9 2,222.2 2,132.1 2,146.1 1,339.7

2.1.2 Primary and Secondary Mortgage Market

Primary Mortgage Market Secondary Mortgage Market

Households Primary Mortgage guaranty Insurance market

Normal Special guaranty

[Savgs buyer buyer insurance

secondary market guaranty insurance

Ginnie Mae L ife Insurance Mortgage Securitizationjof

FHA FHA & VA

o E -.--- - +

... Fannie Mae

W MVA

Freddie Mae Investment Banks profit

Mortgage N mortgage____________

Normal mortgage securitization Private Other Investors

Mortgage Lender

Savings and Loans Mutual Saving Banks Associations Banks

2.2 Origination and Development of MBS

As the most active financial innovation, Mortgage backed securities originate from U.S. In 1970,

the Government National Mortgage Association (GNMA or Ginnie Mae) guaranteed and issued

the first residential mortgage backed security. Meanwhile, with the development of other two

quasi-governmental agencies (Fannie Mac and Freddie Mac), MBS market grows gradually.

As the United States is the headstream of MBS, its securitization can be traced back to the 1930s.

In the 1930s, the Great Depression caused the rapid recession of economy and dramatic growth

of unemployment rate. The brittle real economy put the financial market in jeopardy, as well as

lending market. During the period from 1930 to 1939, there are more than 1700 Saving and

Credit Agencies bankrupted due to unavailable to get the loan back. The devaluation of

depositors' deposits at those agencies was more than one third. For alleviate this situation, U.S.

government stepped in and took a series of intervene measure and action. Firstly, they

established a SMF (Secondary Mortgage Facility), after which, FHLBs (Federal Housing Loan Banks) was established in 1932. FHLBs includes regional federal housing loan banks whose

functions are providing liquidity when the mortgage agencies in the inner system is short for liquidity. In 1934, the United States Congress passed NHA (National Housing Act of 1934) to support primary market. Under the authorization of this act and other relevant acts, FHA (Federal

housing Authority), which supports housing loan insurance for medium or low income families

and VA (U.S. Department of Veterans Affairs), which supports free accommodation for veterans, were set up. The establishment of These institutions and implement of NHA only not

objectively improved the security of housing loan resulting stimulated the growth of housing demand and consumption and improved a good development of primary mortgage market, but

also set up a foundation for the development of secondary mortgage market.

In 1938, secondary mortgage market began to form with the establishment of Fannie Mac. It was

set up with capital contribution from the government as part of the new deal. The corporation's

purpose is to expand the secondary mortgage market by securitizing mortgage s in the form of

MBS. It became one of the biggest capital resource of housing loan in the U.S at that time. In

1944, the authority of Fannie Mac enlarged to loan guarantee. The core principle of it was to stimulate house-purchase through buying mortgage from bank. Loan institutions sold their mortgage to Fannie Mac for releasing their capital in the depression age so as to increase their

liquidity as well as to shift their credit exposure and interest rate risk, which undoubtedly provide

role of final borrower, which was an important character in the forming of secondary mortgage

market.

After the World War Two, the U.S. economy was entering a stable and rapidly-developing stage.

1950s to the end of 1960s was so-called the golden decade. A good economic circumstance and

urbanization stimulated house consumption and mortgage demand, which made real estate

finance an unprecedented prosperity. During this period, private enterprises like GNMA

(Government National Mortgage Association), FHLMC (Federal Housing Loan Mortgage

Company), Lehman Brothers, and Solomon Brothers established one after another and thrive

secondary mortgage market. These governmental and private securitization intermediaries

bought mortgage loans launched by housing mortgage loan institutions, or transferred mortgage

loans of primary institutions into small shares of security by securitization and sold them to

investors, which enormously improved the liquidity and development of secondary mortgage

market. After two decades of prosperity, U.S. suffered from the stagflation confronting the

pressure of inflation and rising of interest rate uncertainty. To provide liquidity, decrease credit

exposure, and rejuvenate real estate financial market, in 1970, Ginnie Mae (GNMA) separated

from Fannie Mac and launched MBS, which has the governmental credit guarantee. That became

the first mortgage-backed security in the world. Afterwards, Freddie Mac and Fannie Mac

laughed their standard MBS in 1971 and 1980, prospectively. In 1983, Freddie Mac issued the

first collateralized mortgage obligation. In 1983, Freddie Mac issued the first collateralized

mortgage obligation. In 1984 the government passed the Secondary Mortgage Market

Enhancement Act to improve the marketability of private label pass-throughs, which declared

nationally recognized statistical rating organization AA-rated mortgage-backed securities to be

federally charted banks (such as federal savings banks and federal savings associations),

state-chartered financial institutions (such as depository banks and insurance companies). The Tax

Reform Act of 1986 allowed the creation of the tax-exempt real estate mortgage investment

conduit (REMIC) special purpose vehicle for the express purpose of issuing pass-throughs. The

Tax Reform Act significantly contributed to the savings and loan crisis of the 1980s and 1990s

that resulted in the Financial Institutions Reform, Recovery and Enforcement Act of 1989, which

dramatically changed the savings and loan industry and its federal regulation, encouraging

mortgage origination.

2.3 The Subprime Mortgage Crisis from MBS prospective 2.3.1 The background and timeline of Subprime Mortgage Crisis

From 2001 to 2005, the Fed cut interest rate to stimulate growth after the dot-com bubble. As the

result, real estate market has experienced more than 5 years' prosperity in loose monetary policy.

The prosperous real estate market stimulated the development of the subprime mortgage market.

A subprime mortgage is the mortgage that is normally issued by a lending institution to borrowers with low credit ratings (borrowers with credit score below 620 points or lack of

income statement or heavy debt). As a result of the borrower's lower credit rating, a traditional

mortgage is not offered because the lender views the borrower as having a larger-than-average

risk of defaulting on the loan. Lending institutions often charge interest on subprime mortgages

at a rate that is higher than a traditional mortgage in order to compensate themselves for carrying

more risk. Interest rate cut encourage borrowers to assume risky mortgages in the anticipation

that they would be able to quickly refinance at easier terms. From 2002 to 2006, the proportion

total subprime mortgage is approximately $600 billion to $860 trillion. Figure 2.2 below shows

the bursting of origination of the subprime mortgage.

Figure 2.2 Origination of subprime mortgage 23.5% $700$70-Subprime share of entire 2.%22.7%

600 mortgage market 2_.9% D Securitized 500 U Non-securitized 8.3% 400 10.6% 10.1% 1 10.4% 7.1% 74% 300 9.5% 9.8% 200 100 1.7% 0 '96 '97 '98 '99 '00 '01 '02 '03 '04 '05 '06 '07 '08

The risk accumulated while the subprime mortgage boomed. When credit market is tightening

and real estate market confront the inflection point, the crisis began. From June 2004, the Fed

has risen the interest rates 17 times. The federal fund rate raise from 1% to 5.25% which makes

the payments of subprime mortgage increase 30% to 50% if the subprime mortgage borrowers

chose flexible interest rate. In addition, housing prices started to drop moderately. In 2006-2007

in many parts of the U.S. Borrowers start being unable to refinance. In mid-2007, even though

the economy seemed to be in good shape, the economy showed the unexpected high default rates

on loans, especially subprime mortgage market. On July 19, 2007, Fed Chairman Ben J.

Bernanke testified to the Senate that losses on securities tied to subprime mortgages could range

Below is the timeline of Subprime Crisis in 2007 to 2008. Timeline of Subprime Crisis

Date Event

Fed announces investigation on subprime mortgages, due to July 17, 2007 increase in defaults 87% year to year.

July 24, 2007 Countrywide reports losses due to high defaults.

FOMC unscheduled meeting. Fed injects $35 billion through open market operations. Fed announces it will take $19 billion in MBS August 10, 2007 through 3-day repo agreements at Fed funds rate. Secondary

market for mortgages evaporates, pushing Countrywide and Washington Mutual into deeper trouble.

August 17, 2007

September 18, 2007 Fed cuts Fed funds target rate and discount rate by 150 bps to October31,2007 4.25% and 4.75%, respectively through 4 FOMC meetings.

December 10, 2007

Fed starts Term Auction Facility (TAF) designed to provide December 12, 2007 liquidity to banks. Fed lends money to banks accepting a wide

range of collateral.

January 22, 2008 Fed cuts Fed funds target rate and discount rate by 125 bps to 3.00% and 3.50%, respectively through 2 FOMC meetings just in January 29, 2008 7 days.

March 7, 2008 Fed boosts size of TAF to $100 billion.

Fed expands securities lending program, under the Term Securities March I L, 2008 Lending Facility (TSLF), which lends up to $200 billion of

Treasury securities to primary dealers for up to 28 days (instead of overnight) by pledge of other securities including MB S .

March 16, 2008 Bear Steams collapses. JP Morgan Chase agrees to acquire it for $2/share.

March 16, 2008 March 17, 2008

Fed cuts Fed funds target rate and discount rate by 100 bps to 2.00% and 125 bps to2.25%, respectively through 3 FOMC meetings.

April 30, 2008

Fannie Mae and Freddie Mac placed under government September 7, 2008 'conservatorship'.

September 14, 2008 Merrill Lynch merges into Bank of America.

September 15, 2008 Lehman Brothers defaults on its commercial paper as it goes bankrupt ($613 billion debt).

September 16, 2008 Government bails out American International Group (AIG) with a

$85 billion package.

September 17, 2008 Lehman Brothers bought separetly by Barclays and Nomura Bank.

Fed starts Asset-Backed Commercial Paper Money Market Mutual September 19, 2008 Funds Liquidity Facility which provides liquidity to banks holding

asset backed securities.

September 26, 2008 Washington Mutual is acquired by JP Morgan Chase.

October 3, 2008 Wachovia merges into Wells Fargo Bank.

2.3.2 The Role of MBS in Subprime Mortgage Crisis

In U.S., although the development of subprime mortgage market was fast, the volume of

subprime mortgage was merely 23.5% of the total housing mortgage loan. It is not the dominant

products in mortgage market. The reason of world-spreading of subprime crisis was mainly

because of the high leverage effect in securitization production based on subprime mortgages. In

U.S., 70% of housing mortgage loan has realized its securitization, by utilizing the technology of asset securitization, a series of asset securitization products like MBS, ABS, CDO were formed

and wall street has been creating new securitization products until Subprime Crisis. These asset securitization products on one hand provided liquidity for the supply of subprime mortgages, which promoted the rapid development of U.S. secondary mortgage market, on the other hand spread the credit exposure to other field of financial industry such as investment banks, funds and so on so forth.

Another important reason is the moral hazard. By using the technology of asset securitization, originator sold mortgage loan to the SPV so as to move the debt record from the balance sheet of

bank. In U.S., lending institutions on the secondary mortgage market sold the high-risk subprime mortgage, which separated the credit risk of the bank. Even if it broke the contract, the lending institutions wouldn't take the responsibility because it had transferred the risk to investors. Meanwhile, in term of MBS, the profits of originators are merely related to the amount of loan

rather than the quality of loan. All of these would cause lending institutions' behaviors against commercial ethics, such as loosing lending standard just for profit, declining of supervision after

lending loan and so on so forth. However, the financial supervision departments were not fully in

place, the information of underlying collaterals are not open and transparent enough. The lack of

attention on the quality of mortgage also stimulated the enlargement of subprime loan market, which also caused the severe declination of the quality of mortgage, and accumulated the risk of

subprime crisis.

At last, excessive and multiple securitization also made the risk of subprime crisis enlarged. In

prosperous times, under the strong prospect of high interest income, the subprime mortgage with

a low credit and high profit become popular investment goods of investment institutions

especially of hedge fund, and the characteristic of hedge fund was high leverage. When housing

price went down, leverage effect caused the severe shrink of MBS price. Those MBS investors sold Subprime products and hold cash resulting cause panic in capital market. Security index went down. Some investment bank, hedge fund which are primary investors of subprime products went bankruptcy.

2.3.3 Reference for China

With the spreading out of subprime crisis, there were doubts on structural financing products in

China. Therefore, in 2008, China suspended the MBS issuance.

Annual issuance of asset-backed securities in China

2CA _______ ___ ____ -. 300 250 200 150 100 50 0 _______________________ ________________________________________________________ _____________ -4 2005 2006 2007 2008 2009 2010 2011 2012 2013 -U-RMB Deals 100 90 80 70 60 50 40 30 20 10 0 2014

However, what we could notice from above pages is that the fundamental reason of crisis was

not the risk of securitization tool nor the problem of underlying collateral of MBS, but the

overuse of securitization and leverage without risk management. MBS, whose asset was based

on subprime mortgage loan, made the cash flow depending on subprime mortgage more

dependent on the rising of underlying collateral, which is obviously against the demand of asset

securitization on a stable and predictable money flow. Well-operated securitization of MBS will

realized on proper benefit share of cash flow among different subjects, as well as the share of

interest and risk, which could promote the development and prosperity of secondary mortgage

market. However, all of these were founded on good credit of underlying asset. On the contrary,

if there happened an over-accumulation of credit risk and the interruption of cash flow, risk

would be multiplied through the leverage effect of asset securitization products, and spread to other institutions by it. That is to say, it would cause the risk transition from mortgage to fixed income market, so as to cause overall financial crisis. The subprime crisis occurred under this system. Those originators lowered the barriers of credit, over securitized without proper risk management. Meanwhile governmental institutes didn't pass any acts to control the overuse of the securitization. Financial institutions' loss was the severe shrink of the value of subprime mortgage, which further lead to a loss of confidence and made the subprime crisis spread out. In China, the selected pilot banks issued MBS in 2005. At the beginning of the practice of Chinese mortgage backed security, the selected pilot banks were careful about this new financial innovation and esteem normal mortgage as basic assets in securitization and treat the quality of credit pool strictly. Meanwhile, Chinese Central Bank has strict requirements on information disclosure of MBS. After Subprime Crisis broke out, CBRC (China Banking Regulatory Commission) published regulation to strengthen the management and verification of MBS. Hence the subprime crisis wouldn't hurt the new secondary mortgage market China but let securitization business suspended for more than 2 years. Even though Chinese secondary mortgage market didn't hurt in the Subprime Crisis, we should learn the lesson from it. We should understand MBS products and how the securitization work while we use the MBS to provide the liquidity to financial market.

Chapter 3 MBS Product

3.1 The Basics of Mortgage Backed Security 3.1.1 Cash Flow

The core principle of mortgage backed security is the cash flow analysis of underlying mortgage.

Stable cash flow is the premise of securitization, the price of MBS is based on the predictable

cash flow. But due to the cash flow of a MBS will be influenced by some micro factors such as

default and prepayment and some macro-economic such as housing price and interest rate to

show the unpredictable cash flow. Therefore, the originator put a lot of mortgage with same

nature in a SPV in order to get stable cash flow. According to the law of large numbers in

statistics, the whole MBS cash flow will have a relatively stable and predictable default rate and

prepayment rate as long as there are enough mortgage loans with same nature. Putting enough

mortgage with same nature in a SPV could predict the cash flow of MBS accurately and price the

value of MBS.

3.1.2 Tranching

Tranching refers to the originator reallocates the MBS mortgage in order to issue the MBS

products successfully. For MBS, the nature of tranching is to restructure the risk and profit of

mortgage, divide different credits and terms based on different cash flows and establish senior

and subordinate structure. The MBS after tranching can meet the various demands of different

investors and ensure the benefits of each participating party.

3.1.3 Risk Isolation

The risk isolation aims to isolate the bankruptcy risk and MBS. On the one hand, the sale of the

underlying asset by the originator to SPV isolates the risk of collaterals and the credit risk of

with self risk status. Hence, the investors will only undertake risks they are willing to. On the other hand, the originator transfers the risk of mortgage that it holds to the MBS investors by the and disperses self risks. Risk isolation improves the efficiency of capital operation, reduces the whole risks of market and brings profits to all participants of mortgage backed securitization. 3.1.4 Credit Enhancement

The principle of credit enhancement is improving the credit rating of MBS. Since the collateral of SPV are not all high-quality assets, the originator upgrades the credit rating of MBS through credit enhancement in order to improve the MBS quality and attract more investors as well as reduce the financing costs. The credit enhancement is classified into external credit enhancement and internal credit enhancement. The internal credit enhancement is accomplished through the design of subordination, the senior/subordinated security structure. Subordination is to split a deal into senior and subordinated interests. Payment are allocated through a waterfall structure which allows the allocation of principal and interest to tranches with different degree of seniority. Loss are separate prioritization schedule, with the subordinated tranches being impacted in reverse order of priority. This process can reduce the credit risk of senior security and lift its credit rating), the overcollateralization, excess spread, Reserve Fund are also

belonging to internal credit enhancement. There are two ways of overcollateralization, first way is issuing less bonds than loans. Second way is using interest to pay down the bond more quickly than the collateral backing the deal. The excess spread is the difference between the interest rate received on the underlying collateral and the coupon on the issued security. It is typically one of the first defenses against loss. Even if some of the underlying loan payments are late or default, the coupon payment can still be made. In the process of "turboing", excess spread is applied to

outstanding classes as principal7.A reserve account is created to reimburse the issuing trust for losses up to the amount allocated for the reserve. To increase credit support, the reserve account

will often be non-declining throughout the life of the security, meaning that the account will

increase proportionally up to some specified level as the outstanding debt is paid off. The modes

of external credit enhancement include surety bonds, monoline insurance, letter of credit, cash

collateral account. Surety bonds are insurance policies that reimburse the MBS for any losses.

MBS paired with surety bonds have ratings that are the same as that of the surety bond's issuer.

Monoline insurance is insured or guaranteed by a third party. Monoline issuer "wrap" individual

tranches or securities and provide a promise to reimburse the trust for losses up to a specified

amount. Deals can also include agreements to advance principal and interest or to buy back any

defaulted loans. With a letter of credit (LOC), a financial institution - usually a bank - is paid a fee to provide a specified cash amount to reimburse the MBS-issuing trust for any cash

shortfalls from the collateral, up to the required credit support amount. With a cash collateral

account (CCA), credit enhancement is achieved when the issuer borrows the required credit

support amount from a commercial bank and then deposits this cash in short-term commercial

paper that has the highest available credit quality. Because a CCA is an actual deposit of cash, a

downgrade of the CCA provider would not result in a similar downgrade of the security.

3.2 Classification of MBS

The MBS is classified into Pass-Through, CMO and SMBS according to the different treatments of cash flow and payment structures.

3.2.1 Mortgage Pass-Through Securities

7 Fixed Income Sectors: Asset-Backed Securities A primer on asset-backed securities, Dwight Asset Management Company 2005

The Mortgage Pass-Through is the original and basic form of MBS. The cash flow produced by

the underlying assets is resold to investors based on the shares of investors in order to transfer

the security risks as well as pay the principal and interest. Therefore, the cash flow of

Pass-Through can totally represent pro rata ownership of an underlying pool of mortgage. The

mortgage constituted of Pass-Through should have same features, which refer to the similar term and interest structures. The ownership of mortgage loan after securitization is sold during the

securities issuing, which is exclude of the balance sheet of issuer, and the risk of underlying

assets after securitization is also transferred to the investors totally. The credit rating systems

make the Pass-Through have a higher credit rating, but since the cash flow of principal and

interest totally depends on the cash flow of mortgage portfolio with a risk of prepayment and

default, and the investors are accepting the same risks and same interest payment, which cannot

satisfy the different risk preference of different investors.

3.2.2 CMO

In order to satisfy different preferences of investors to risks and profits, the CMO appears. CMO

designs the securities into different tranches according to the period, risks and profits preferences

of investors, that is reset the principal and interest of underlying assets for paying the cash flow

to meet the preferences of different investors. At the same time, the CMO divide underlying assets into different tranches according to the period and interest, which is paying the interest semi-annually for each tranche and returning the principal at the maturity date of each tranche, dispersing the risk of prepayment in some extent.

The division of underlying asset based on period and risks by CMO makes it possess the advantages that Pass-Through Securities do not have: dividing the underlying assets based on period and risks disperses the whole risks of original underlying assets. Investors with different

preferences can buy securities with different risks and period based on their own demands. It

reduces the financial costs and makes CMO possess more stable cash flow at the same time. It

overcomes the disadvantages of pass-through securities. Different with Pass-Through Securities, the securitized underlying assets is still belonging to the issuer in CMO, reserved in the balance

sheet of issuer. The tranching make the CMO provide more products based on different periods,

risks and profits for investors with different preferences in order to meet the demands of

investors. A classical CMO can be divided into A, B, C, and Z, the first three types can receive

regular interest payment from underlying securities, that is after the interest payment of A, all

payment received is used to pay the interest securities of B, and so on. For Z type, it will not

receive interest before the payment of all other security interests, which belongs to the accrued

interest accumulated bond, similar with a zero coupon bond.

3.2.3 SMBS

SMBS refers to split into the principal-only strips and interest-only strips of MBS. Stripped MBS derive their cash flows either from principal payments or interest payments on the underlying mortgages, unlike conventional MBS where cash flows are based on both principal and interest payments. Stripped MBS are very sensitive to interest rate changes. There are some

fundamental differences between principal-only strips and interest-only strips. Principal-only

strips consist of a known dollar amount, but the payment timing is unknown. They are sold to investors at a discount -which is based on interest rates and prepayment speed -on face value. Interest-only strips generate high levels of cash flow in the earlier years and substantially lower cash flows in the latter years.

Table 3.1 Comparison among MBS products

Pass-Through Securities CMO Stripped MBS

payment Pro rata Sequence Uneven distribution

Maturity Uncertain(based on the Partial certainty (Senior Uncertain (according

experience) tranche is easy to estimate) to the prepayment)

Cash flow Relative unstable Relative stable unstable

Stability

liquidity Good Good Good

Credit rating AAA to A Most tranches are AAA Most are AAA

investors Traditional mortgage Capital market investors and Hedge fund investors

participants mortgage market investors

Financing cost low Lowest Low

The Pass-Through securities would make the investors confront major risks due to the simple

design, unstable cash flow and uncertainty of maturity date, which limits the investment of

investors with narrow investment scope, investors are mainly participants of traditional mortgage

market; Stripped MBS reallocates the mortgage portfolios based on different principal and

interest and pays to different security investors, the uncertainty of cash flow and maturity date makes the investors of Stripped MBS possess high risks, especially hedge fund investors. But comparing with these two products, CMO occupies a large investment market because of its

stable cash flow and certainty of maturity date, the investors can select different securities under

makes different tranches receive different profit rate, which can meet the investment demands of investors, and at the same time, its stable cash flow and low funding cost makes CMO more popular in MBS issuers, therefore, it can be said that CMO gives considerations of both supply

and demand sides of secondary mortgage market, it is an alternative of Chinese mortgage backed

securitization.

3.3 The issuance procedure of MBS

The important processes of procedures are introducing as follows, which are mainly involving

commercial banks, SPV, intermediaries (generally refer to issuer), etc.

originator

Mortgage pool 0, server

SPV trustee Credit Rating Securitized issuer Credit Asset Enhancement investors

3.3.1 Asset Portfolios

Banks select collateral mortgage with stable cash flows to form asset portfolios, and reallocate

the structure of asset portfolios to establish an asset pool. The assets selected to the asset pool

should possess regional dispersibility and similarity on the intended use, rate and maturity and so

on so forth.

3.3.2 Asset Sale

Those banks make a deal of asset pool with SPV to sell the mortgages to SPV in order to realize

the risk isolation of issuer and securitization transactions, upgrade the credit rating of securities

and reduce the financing costs.

3.3.3 Credit Rating and Credit Enhancement

The credit of MBS is the key factor of success of issuance of Mortgage Baked securitization.

High credit rating will have low issuing cost. Moreover, the investors will make decisions

according to the credit rating. The analysis components of credit rating includes: analysis of loan

credit, cash flow status, etc. SPV performs credit enhancement at the same time of credit rating

to attract more investors and reduce the financing costs of SPV.

3.3.4 Securities Issuance

After the credit enhancement of SPV, the maturity, scale and price of securities are determined, the investment banks as a lead underwriting issuer sell securities to organizations and individual investors, after receiving the income of securities insurance, SPV will pay to issuers based on contract price.

3.3.5 Management after original issuance

SPV will entrust specialized agencies to manage the asset pools, such as AMC, to be responsible for the collection and recording the payments produced by asset collateral in order to pay the

profit to investors during semi-annually. Generally, original debtors pay the principal and interest to servicer, the servicer deposits it into a collection account which is managed by a trustee, then the receiver pays the principal and interests to investors.

Chapter 4 Pricing Model 4.1 Principles of MBS pricing

The process of mortgage backed security is a process of transmitting mortgage loan into

securities which can be traded in the capital markets. The value of MBS depends on the current

value of cash flow produced from the underlying collaterals (mortgage loan) in the asset pools in

future. Therefore, the analysis of cash flow produced by the mortgage loans is the core of MBS

pricing. The MBS pricing process involves two aspects: calculation of cash flow and selection of

discount rate. The cash flow of mortgage loans is influenced by the prepayment of borrowers,

and the selection of discount rate involves the term structure of interest rate.

The term structure of interest rate refers to various yields that are currently being offered on bonds of different maturities. It enables investors to quickly compare the yields offered on

short-term, medium-term and long-term bonds. It is the relationship of the interest of capital with

same nature but different terms and the YTM in a certain time point, the key research point is the

relationship of spot interest rate and forward rate. The spot interest rate is the interest rate level

of a certain period in future calculated from the current time point, it is the YTM of Zero Coupon

Bond; forward rate refers to the interest rate level between two certain time point in future,

determined by a series of spot interest rates. In the term structure of interest rate, the interest is

not an unchanging constant; the predictable interest rate fluctuations will influence the spot

interest rate and the forward rate. Therefore, when comes to the consideration of term structure

of interest rate, the discount rate of MBS is also not a constant, but discount the cash flow of MBS based on a series of forward rates as yield rates. After analyzing these two main aspects of

MBS pricing, we can get a basic idea of MBS pricing: the price of MBS equals to the sum of presents value of cash flow in each period within maturity.

CF1 CF2 CF

P

~ ++(1 + ri) (1 + ri)(1 + f2) (1 + ri)(1 + f2) ... (1 + fn)

P=Pricing of MBS

CFt=cash flow in t period

r1=spot rate in 1st period

ft=forward rate in t period

n=periods to the maturity

4.2. Key factors analysis of MBS pricing

The term structure of interest rate and prepayment behaviors are two key factors influencing its pricing. these two factors determine the MBS discount rate and cash flow. The term structure of interest rate depends on capital market. The prepayment behaviors involves more macro factors and micro factors.

4.2.1 prepayment behavior

The prepayment refers to the prepayment behavior of borrower that the principal repayment

surpasses the repayment specified in the contract, including partial prepayment and full

prepayment. "Partial prepayment" refers to the capital paid by the borrower exceed the planned payment amount monthly, therefore, the mortgage loans will be cleared off in advance of the original amortization schedule, if the mortgage loan is cleared off, then it is considered as "full prepayment". The occurrence of prepayment will make the MBS cash flow unstable and bring in risks for investment, therefore, it is an important influencing factor of MBS pricing. The reasons for prepayment are summarized to three types below:

First, the influence of interest to prepayment. The change of market interest rate will push the

borrower to make the decision of prepayment. When the market interest rate decreases, the

borrowing cost of borrower relatively increases, the borrower will have the motivation of

prepayment and refinancing under a relatively low interest rate when the spread of mortgage rate

and original contract rate exceeds re-financing cost, that is the prepayment rate is the function of

contract rate and current rate. Under such conditions, investors have to re-invest under a low rate, which cannot realize the initial predicable cash flow of investment and bring the loss of capital,

such risk produced by the prepayment is also known as "Contraction Risk". when the market rate

increases, the borrowers of mortgage loans under the floating rate articles confronts higher

payment pressure, which will also trigger the motivation of prepayment.

Second, the overall level of economic activities has an important affection on the prepayment of

MBS. Under a healthy and stable economic growth, the personal income increases. On the one

hand, the paying capacity of citizens improve, on the other hand, the migration chance of labors

and the movement of facilities is greatly increased, which lead to the lifting of housing turnover

rate, along with the increasing of prepayment rate. But the conditions is opposite during the

economic depression.

Third, the house owner cannot undertake the repayment obligations and therefore breach the

contract due to some reasons. Under such conditions, the property will be sold, and the money

from sales is used for prepaying the loans. If the mortgage loans have insurance, the insurance

company will also clear off the mortgage balance and thus produce the prepayment behavior.

Finally, other factors, such as house damage, the insurance will be used for paying the mortgage

balance if the damage is within the scope of insurance, and other factors such as seasonal factor,

4.2.2 Prepayment Rate

4.2.2.1 The Experience Index of Federal Housing Administration (FHA)

This is a method for predicting prepayment rate established by FHA based on the actually occurred prepayment information for decades. Based on the great FHA database of residential

mortgage loans prepayment conditions, we can predict the probability of mortgage loans to be

cleared off in all years.

4.2.2.2 Conditional Prepayment Rate (CPR)

Conditional Prepayment Rate (CPR) gets the prepayment rate based on the basic conditions of past prepayment conditions and current and future economic status predictions for a certain mortgage loan. Assuming the remaining principal of a portfolio is prepaid within the remaining terms each month, the CPR method calculates the prepayment rate according to the mortgage balance remained. CPR is an annual rate, the monthly prepayment rate calculated based on it is

called Single Monthly Mortality (SMM), the SMM assumes that each borrower will has a probability of prepayment in each payment period. The following formula links CPR and SMM.

(1 - CPR) = (1 - SMM)'2

Therefore,

1

SMM = 1 - (1 - CPR)T2

Meanwhile, there is a common formula of SMM:

actual payment - scheduled principal - scheduled interest

SMM =

ourtstanding loan - scheduled principal

Given a SMM, we can calculate the corresponding monthly prepayment according to:

Prepayment for month t=SMM*(beginning mortgage balance for month t- scheduled principal payment for month t)

4.2.2.3 Public Securities Association Standard Prepayment Model

The establishment of PSA is to simplify the prepayment experience of FHA, therefore, it has the same disadvantages with FHA; but the simple and direct indicators make it become a common method for setting prepayment rate. The PSA principle has the following assumptions:

month CPR 1 0.2% 2 0.4% 3 0.6% 29 5.8% > 30 6.0%

During the first 30 months, the prepayment rate CPR reduces at the speed of 0.2% monthly, from the staring of the 30th month, the CPR keeps at 6% each month. The prepayment rate of above example is 1 00PSA. Slower or faster prepayment speeds are referred to as some percentage of PSA. For example, 50 PSA means one-half the CPR of 100 PSA, which means the prepayment rate is 0.5 time that of 100% prepayment rate. 300 PSA means three times the CPR of 100 PSA, which represents that the prepayment rate is 1.5 times that of 100% prepayment rate.

Above three methods are all static analysis for prepayment rate, where the PSA prepayment standard has become a relatively popular indicator for predicting the prepayment rate. 4.3 Cash Flow Calculation

The value of MBS depends on the cash flow of mortgage loans within future different periods in asset pools, since the prepayment behavior leads to the stable cash flow in future, thus the

determination of cash flow should consider the prepayment behavior of residential mortgage loans. The mortgage rate adopts fixed rate if the repayment method of residential mortgage loans in asset pools is constant payment mortgage.

4.3.1 Cash Flow without Considerations of Prepayment Behaviors

Supposing: MBo=Mortgage Loan

MP =monthly payment

MBt=Balance in month t

i =Mortgage interest rate

Pt =Principal payment in month t

It =interest payment in month t

According to Annuity formula:

MPi=MP2=...=MPn MBo=1 P2 MPn 1+j (1+i)2 (1+i)n n (1+i) -1 MBt- MPt MPt+1 .+MPn_- MBo+ +

S(1+i)t (1+i)t+l ' (1+i)n (1+i)n-l

t- 1

Pt=MBt-.I-MBt= MBo i (1+0 n (1+i) -1

It=MPt-Pt= MBo= MB -(1+i) (1+i~n-1

4.3.2 Cash Flow with Considerations of Prepayment Behaviors Supposing: PPt =prepayment in month t

SMMt =SMM in month t CFt =cash flow in month t

Therefore: PPt =SMMt(MBt.1-P)

CFt =Pt+It+PPt

4.4 Comparative Analysis of Pricing Models 4.4.1 Static Cash Flow Yield (SCFY)

Static Cash Flow Yield (SCFY) refers to the discount rate when MBS future cash flow discount equals to its current market price. Anticipation of securities future cash flow is conducted based on estimated prepayment rate under conditions that interest rate remains unchanged within securities holding period. Anticipation of prepayment rate is based on historical statistics analysis. In the U.S, CPR or PSA prepayment model is generally used. Static cash flow rate of return can be worked out with the following formula.

n

CFt P (1 + i)t

t=1

Supposing: P =MBS price

CFt=Cash flow in month t i =Yield To Maturity

As a basic tool for MBS pricing method, SCFY has a principal advantage, that is, to calculate MBS value simply by assuming estimated prepayment rate. SCFY also has two disadvantages. On the one hand, it ignores term structure of interest rate, namely, SCFY discounts all cash flow with single discount rate, regardless of the fact that discount rates of various maturities may differ, as is reflected in yield to maturity curve. On the other hand, SCFY has ignored cash flow fluctuation in different interest rate. In order to overcome the first disadvantage, Static Spread is included in term structure of interest rate for consideration.

To consider term structure of interest rate, Static Spread use the discount rate by adding a static spread to the different discount rates in different time of treasury bonds. Therefore, the advantage of Static Spread over SCFY is the former has taken term structure of interest rate into

consideration. The formula of Static Spread is as follows: n

CFt = (1 + rt + rss)t

Supposing: rt=interest rate of zero coupon bond r,,=static spread between

Static Spread has ignored the prepayment behavior caused by different interest rate, which in turn affects cash flow and rate of return. Static Spread method fixes MBS's price with the whole yield to maturity curve.

4.4.3 Option-Adjusted Spread (OAS)

When Static Spread price MBS, assuming that refinancing rate remains unchanged during the entire period, certain prepayment behavior is defined, each term of cash flow is discounted according to corresponding term structure of interest rate of treasury bond, the sum of present value of each cash flow term is the price of MBS. Possible trends of fluctuation of interest rate have been ignored as well as the possible change of prepayment behavior caused by term structure of interest rate. Option Adjusted Spread (Dynamic Pricing) not only regards possible trends of fluctuation of interest rate, but also consider corresponding prepayment anticipations. The prepayment of MBS implies the investors sell a call option to housing mortgage loan borrower, while this option enforcement is affected by interest rate, that is to say, the option enforcement will be different according to varied interest rate, leading to different cash flow. Option Adjustment Spread considers all possible interest rate paths as far as possible. Since all

possible interest rate paths are considered, almost all embedded options enforcement status has

been taken into account. By working out the average of security value, we can get security value

with embedded options. The security value is its price.

4.4.4 Quantitative method

quantitative method conducts quantitative analysis on MBS's pricing factors by quantitative

statistics. Having quantified interest rate, housing price, season, and overall economic conditions

of prepayment interest rate, using econometric model to regression and work out prepayment

rate, then apply the estimated result to MBS's pricing model. For instance, Goldman Sachs Group model is as following:

Monthly prepayment rate=refinancing incentive* seasonality factor*function of seasoning

*burnout

Refinancing incentive refers to difference between existing interest rate and contracted interest

rate, seasonality factor means seasonal factor, function of seasoning further considers monthly

factor in given season, and burnout considers actual current interest rate path. A disadvantage of

the model is that it's descriptive without concrete model analysis formula.

4.5 Model Analysis and Comparison

As a basic tool for MBS pricing method, SCFY has various advantages, including fewer assumed

conditions, concise principle and easy to calculate. Just make assumption of prepayment rate and

select appropriate discount rate, and you can price MBS. Regarding its disadvantages, as a static

pricing method, its setting of prepayment rate is relatively simple, fails to consider term structure

of interest rate and its influence on prepayment behavior, which leads to prepayment rate being

inaccurate and non-effective in reflecting it's influence on MBS cash flow. Meanwhile, in choice

single discount rate has ignored figures in different terms on YTM curve, the longer MBS term

is, or the more precipitous yield curve slope appears, the bigger MBS estimated deviation will

be.

Static Spread has considered the disadvantages of SCFY mentioned above, it has improved

SCFY in choice of discount rate and introduced Static Spread to consider MBS risk premium

part, thus reflecting the degree where yield curve of MBS exceeds yield curve of treasury bond.

But, Static Spread implies that refinancing rate remains unchanged during the entire period,

which ignores impact of different interest rate on prepayment behavior and impact of discount

rate change on MBS.

OAS method utilizes technology to study borrower's repayment behavior and arrives at the conclusion that MBS price changes with economic variables like interest rate and housing price.

This type of model turns out good adaptability in times of substantial economic environment fluctuation, it can well capture the changes environment brings to borrower's behavior and has

become an effective pricing method in U.S. The disadvantage of OAS method lies in the

computing process is complicated. Meanwhile, a large number of parameters are involved in interest rate model and prepayment model to be based upon during computing process, choice of

parameters has become a crucial factor for MBS estimating accuracy. The most important is that, OAS pricing is done under conditions of market-oriented interest rate, thus it's not applicable to MBS pricing under restrict financial regulating system, like Chinese capital market.

Quantitative method conducts quantitative analysis on MBS price influencing factors by

quantitative statistics. By means of statistical method, it estimates prepayment or default rate

from historical data. Quantitative method emphasizes statistic research on borrower's payment behavior of loan asset pool, it is based on the assumption that borrower's interruption behavior in

future can be predicted by historical data, namely, believing the economic behavior in the past

will be continued in future. The result coincides with historical data, but in a new economic

environment, especially tremendous change in economic status that is inconsistent with historical

experience, these models turned out poor. Consequently, when market characteristics are inconsistent with historical pattern, the method may bring remarkable model risks.

Chapter 5 MBS in China 5.1 Chinese MBS market

5.1.1 China's mortgage market development

The mortgage market of China is generally developed with the reform of the Chinese housing

system. In April 1980, the State Council of China put forward the idea of housing

commercialization. First, a few pilot cities were carried out in the whole country. Those cities

changed the property rights of the house which was public ownership to quasi-private ownership,

and sold the house to the individuals in the form of commercialization, and the individuals

obtained the quasi-private property right of the residential house (the right to use for 70 years). In

1988, the Chinese central government deployed a plan for the reform of the urban housing system which housing allocation in kind was stopped. The main form to obtain house is to buy

house by individual after 1988 gradually.

In 1998, The people's Bank of China issued "individual housing loans management practices".

Mortgage business has a legal basis and commercial banks then started housing mortgage loans

business. At the end of 2015, according to the people's Bank of China statistical data, the amount

of individual housing loans issued by commercial banks is about 14 trillion RMB which equates

to $2 trillion USD, the major market share is controlled by four major commercial banks, including China Construction Bank, ICBC, Bank of China and Agricultural Bank of China. The

individual housing loans of the four banks accounted for 65% (9.1 trillion RMB) of the total

market share of all individual housing loans.

5.1.2 China's MBS development

On February 21, 2002, the people's Bank of China issued "China Monetary Policy Report of