Designing For Cost In An Aerospace Company by

Elizabeth Hammar

B.S.E., Mechanical and Aerospace Engineering Princeton University, 2008

Submitted to the MIT Sloan School of Management and the Department of Aeronautics and Astronautics in Partial Fulfillment of the Requirements for the Degrees

of

Master of Business Administration and

Master of Science in Aeronautics and Astronautics MASSACHUSETTS NY in conjunction with the Leaders for Global Operations Program

at the

JUN

Massachusetts Institute of Technology

JU

814

June 2014

LIBRRIES

© 2014 Elizabeth Hammar. All rights reserved

The author hereby grants to MIT permission to reproduce and to distribute publicly paper and electronic copies of this thesis document in whole or in part in any medium now known or

hereafter created. Signature of Author..

S

ignature

redacted

MIT Sloan School of Management Department of Aeronautics and Astronautics May 9, 2014

Signature redacted-

9 0

Certified by ...

Brian L. Wardle Associate Professor, Department of Aeronautics and Astronautics

Signature redacted

Thesis SupervisorC ertified b y ...

Roy Welsch Professor of Statistics and Management Science and Director CCREMS, MIT Sloan School of Management

Signature redacted

Thesis Supervisor A ccep ted by ...Paulo C. Lozano Associate Professor of Aeronautics and Astronautics Chair, Graduate Program Committee

Signature redacted

A ccep ted by ... ... Maura Herson Director, MBA Program MIT Sloan School of Management

This page has been intentionally left blank

Designing For Cost In An Aerospace Company by

Elizabeth Hammar

Submitted to the MIT Sloan School of Management and the MIT Department of Aeronautics and Astronautics on May 9, 2014 in partial fulfillment of the requirements for the degrees of Master of

Business Administration and Master of Science in Aeronautics and Astronautics

Abstract

Companies take different approaches, and achieve different degrees of implementation, in

designing products for cost. This thesis discusses Target Costing and its application at The Boeing Company. Target Costing is a design for cost framework that is widely used by auto manufacturers, but is still less widely used in the aerospace industry. This thesis observes the current state at The

Boeing Company and provides recommendations for full implementation of Target Costing. Through research into best practices at companies that have implemented Target Costing, this thesis identifies five key enablers: culture, organizations involved, process, tools, and market. Additionally, this thesis discusses a potential barrier to implementation: organizational politics. Based on a project to implement a price visibility tool and on three value engineering case studies, this thesis identifies The Boeing Company's state relative to full scale Target Costing and provides recommendations for The Boeing Company to achieve full implementation of Target Costing through the use of the five key enablers.

Thesis Advisors: Brian L. Wardle

Associate Professor, Department of Aeronautics and Astronautics Roy Welsch

Professor of Statistics and Management Science and Director CCREMS, MIT Sloan School of Management

This page has been intentionally left blank

Acknowledgements

I would like to thank The Boeing Company for sponsoring my Leaders for Global Operations internship. In particular, I would like to thank Amanda Taplett for being such a supportive sponsor and the entire 787 PSE Factory and Supplier Management for standards teams for being so

welcoming and for providing the resources that enabled this project to be successful.

I would also like to thank the Leaders for Global Operations (formerly Leaders for Manufacturing) program. The past two years at MIT have been a truly transformational experience, and one I expect to draw from for years to come.

I would like to thank my parents for their support and encouragement, and my partner, Jeanna, who motivated me to do more than I thought possible.

Finally, I thank my advisors Professor Wardle and Professor Welsch for their input and support with this project.

This page has been intentionally left blank

Contents

A bstract ... 3

A cknow ledgem ents ... 5

List of Figures ... 9

List of T ables ... 9

1 Introduction ... 11

1.1 Problem Statem ent ... 11

1.2 Purpose of Study ... 12

1.3 A pproach and M ethodology ... 13

1.4 T hesis R oadm ap ... 13

2 B ackground and D evelopm ent Context ... 15

2.1 A irplane M anufacturers and A irline Industry ... 15

2.2 B oeing Com m ercial A irplanes ... 17

2.3 B oeing program developm ent process ... 19

3 T arget Costing B est Practices ... 21

3.1 B enefits of T arget Costing ... 21

3.2 H igh Level Process ... 21

3.3 O rganizations Involved ... 33

3.4 T echniques for Estim ating Costs ... 36

3.5 U S V ersus Japanese Com panies ... 4 1 3.6 Im plem entation ... 4 1 3.7 Final T houghts ... 44

4 Study at T he B oeing Com pany ... 45

4.1 Standards Cost and A vailability Tool ... 45

4.2 Pilots ... 46

4.3 Pilot results ... 47

4.4 Case Studies ... 50

5 R ecom m endations ... 55

5.1 T hree Lenses ... 55

5.2 Five K ey Enablers of T arget Costing ... 55

5.3 Culture ... 57 5.4 O rganizations Involved ... 59 5.5 Process ... 60 5.6 T ools ... 6 1 5.7 M arket ... 63 5.8 Politics ... 64

6 Conclusion and N ext Steps ... 67

6.1 Conclusion ... 67

6.2 O pportunities for Im provem ent ... 68

6.3 A reas for Further Research ... 68

R eferences ... 69

A ppendices ... 73

A ppendix 1 - B oeing 777 Payload-Range Graph ... 73

A ppendix 2 - B oeing 787 Sections ... 74

A ppendix 3 - Standards T ool Pilot M etrics ... 74

List of Figures

Figure 1-1: Cost Committed During Six Phases of Aircraft Development [3] (Adapted by Kaufmann [4 ]) ... 1 2

Figure 2-1: Commercial Airplanes in Use (Adapted from Belobaba et al. [5])... 16

Figure 2-2: New Narrowbody Airplanes (Adapted from Belobaba et al. [5]) ... 17

Figure 2-3: BCA Organizational Structure...18

Figure 2-4: Boeing Product Development Process... 19

Figure 3-1: Target Costing Process (Adapted from Ansari et al. [10] and Cooper & Chew [8])...23

Figure 3-2: Value Index Chart of a Pencil Sharpener (Ansari et al. 1997 [10]) ... 27

Figu re 3-3 : 7 7 7 P rogram Success [15]...29

Figure 3-4: Reduction of Cost with Design Iterations ... 30

Figure 3-5: Product Development and Cost Reduction Timeline ... 33

Figure 3-6: Cost Estimating During the Development Process ... 37

Figu re 3 -7 : P ro d u ct C o m plexity ... 4 2 Figu re 4 -1 : P ilot P roject Selection ... 4 8 Figure 4-2: Price Pattern for a Family of Bolts ... 51

Figure 5-1: The Five Key Enablers of Target Costing ... 56

Figure 5-2 : H ow to Ch ange Culture...58

List of Tables

T ab le 2 -1 : B o ein g - K ey F acts ... 1 8 Table 3-1: Involvement of Resources In Cost Allocation Activities ... 27Table 3-2: Techniques for Cost Reduction Over Development Cycle (Adapted from Ansari et al., 1 9 9 7 [1 0 ]) ... 3 2 Table 3-3: Responsibilities of Organizations During Product Development... 34

Table 3-4: Feature Based Costing Example Features ... 38

Table 3-5: A Sample of Cost Estimating Tools ... 40

This page has been intentionally left blank

1 Introduction

Designing for cost is not a new concept, but companies take different approaches to achieving design for cost. This paper explores Target Costing, which is a product development framework that ensures development focuses on the lifecycle cost of the product. The core concept of Target Costing is that the development team sets a lifecycle cost target based on market conditions, and the development team must reach that cost target.

Target Costing has proven to significantly reduce product lifecycle costs without diminishing the technical capabilities of the product. This framework is being used increasingly by manufacturing companies around the world, and is now used throughout the auto manufacturing industry. Target Costing originated in Japan, and by 1999, 100% of Japanese auto manufacturers had employed Target Costing [1].

Although Target Costing has proven successful in the auto industry, it has not been widely adopted in the aerospace industry. This paper investigates best practices in Target Costing and studies how Target Costing could be implemented at Boeing Commercial Airplanes (BCA).

1.1 Problem Statement

The importance of addressing cost early in the design cycle has been well established. Researchers agree that 70 to 80% of avoidable cost is built in during concept design phase [2]. Roskam

investigated cost impact specifically during aircraft development and was able to further delineate the cost committed during various phases of aircraft development. Figure 1-1 lays out the cost committed (i.e., our ability to impact cost) during six phases of aircraft development, from conceptual layout to final disposal of the product. Roskam determined that 65% of cost is

committed during the upfront planning and conceptual layout phase, and by the time designs are released, 95% of costs are committed. This means that any company relying on continuous improvement for cost reduction after manufacturing begins is only able to impact 5% of the product cost. These companies must learn to address cost early in the development cycle.

Figure 1-1: Cost Committed During Six Phases of Aircraft Development [3] (Adapted by Kaufmann [4]) 100% - 85%-80% -0 t--65% 60% 0 40% L. E 20% 0%

Phase 1 Phase 2 Phase 3

Planning and Preliminary Detail Design Conceptua Design and and

Design System Development Integration

Phase 4 Phase 5 Phase 6

Manufacturing Operation and Disposal

and Acquisition Support

Cost is becoming a more important factor for aerospace companies like The Boeing Company, with the threat of new entrants into the large commercial airplane manufacturing industry and

customers that are becoming more and more cost-sensitive. While The Boeing Company can continue to differentiate its product from competitors like Airbus through technical excellence, market pressures will force The Boeing Company to address cost more aggressively.

1.2 Purpose of Study

This research aims to determine a methodology that would enable aerospace companies to infuse cost considerations into their design processes. Since Target Costing is a framework that has been proven to work in the automotive industry, this research focuses on best practices for Target

Costing and determines where those best practices make sense for the aerospace industry given the differences and similarities between the two industries.

The goals of this study are two-fold. The first goal is to determine Target Costing best practices that are applicable to the aerospace industry. These best practices come from a variety of industries, but since Target Costing is mature in the automotive industry and the aerospace industry has many similarities to the automotive industry, this is our industry of focus. The second goal is to develop specific recommendations for Boeing Commercial Airplanes based on a combination of these best practices, infrastructure observed to be in place at The Boeing Company, and gaps identified at The Boeing Company.

1.3 Approach and Methodology

The approach of this study will mirror its goals. This study will start by establishing general best practices in Target Costing. This research will be completed through a combination of literature review and interviews with individuals both inside and outside The Boeing Company. The resources interviewed within The Boeing Company are working-level design and manufacturing engineers, as well as analysts within the Supplier Management organization. Those interviewed outside The Boeing Company comprise people who have implemented or seen successful Target Costing at companies other than The Boeing Company. This study will specifically leverage lessons learned from the automotive industry since this industry bears many similarities with the

aerospace industry.

The study then uses case studies and results from piloting a price visibility tool at The Boeing Company to determine what infrastructure The Boeing Company has in place to support those best practices previously identified. The conclusions drawn will be based on anecdotal evidence from the combination of case studies, interviews, and piloting the price visibility tool at The Boeing Company. The study will use those same results and case studies to develop recommendations for The Boeing Company to enable it to adopt the Target Costing framework.

While this study focuses on specific recommendations for The Boeing Company, the best practices and recommendations may be applicable to any company within the aerospace industry.

1.4 Thesis Roadmap

This thesis begins by providing background information on The Boeing Company and the industry it belongs to. This information will provide the context needed to understand the need for Target Costing and to understand how aerospace companies like The Boeing Company develop a new product. It is necessary to understand the airplane program development process and timing to understand how Target Costing might fit in to the process.

The next chapter will identify best practices in Target Costing. These best practices come from a combination of literature review and interviews and are intended to be industry agnostic. These best practices represent the ideal Target Costing framework at a company that has successfully implemented and matured its Target Costing processes.

The next two chapters will explore the infrastructure in place at The Boeing Company to support the ideal Target Costing framework and to identify any gaps between The Boeing Company and

those best practices. These sections will use a project to implement a cost visibility tool and case studies to determine The Boeing Company's position relative to Target Costing best practices. Finally, this thesis will lay out recommendations for Target Costing. This paper will provide recommendations based on observations from Boeing Commercial Airplanes, however, these recommendations should be relevant to other aerospace companies, as well as companies outside the aerospace industry.

2 Background and Development Context

The airplane manufacturing industry is dominated by a few large companies. Airplane

manufacturing has large barriers to entry since airplane design and manufacturing has a long learning curve, large capital investment requirements, and customers who are unlikely to purchase airplanes that do not have a proven safety record.

2.1 Airplane Manufacturers and Airline Industry

The commercial airplane manufacturing industry can be separated into three major segments: small narrowbodies, narrowbodies, and widebodies. The Boeing Company and Airbus dominate the narrowbody and widebody markets, while the small narrowbody market is dominated by

Bombardier and Embraer. Airplane manufacturers typically face a tradeoff between payload (how much weight can be carried by the airplane) and range (distance the airplane can fly). Appendix 1 illustrates this payload-range tradeoff for the Boeing 777 family of airplane.

Since airplane manufacturers face this payload-range tradeoff, we can segment the market

according to these features. Figure 2-1 illustrates the commercial airplanes currently in use, and the segments they belong to. When airplane manufacturers offer a new product, they will typically target an area of this chart where there is a gap. For example, Airbus' new A380 allows a higher payload than any other airplane in production. Since airlines have different payload and range needs based on their routes and demands, they will look for the airplane that will most closely suit their needs.

Figure 2-1: Commercial Airplanes in Use' (Adapted from Belobaba et al. [5]) Widebodles 600500 - 400- 300-200 -100 - 0-0 3 10000 1 RANGE (KM) 20000

While Embraer and Bombardier have historically produced only small narrowbodies, they have more recently started producing airplane closer to large narrowbodies in terms of both payload and range. Figure 2-2 below highlights the newer airplane being produced by these manufacturers. While pilot licensing regulations in the past limited airlines' ability to operate airplanes in this

range, those regulations have been loosened and have allowed Bombardier and Embraer to creep towards the large narrowbody market. While they have not yet made any overt moves into the market, their movement towards larger airplanes might be concerning for both The Boeing Company and Airbus.

1 Aircraft manufacturer key: 7*7 = Boeing; A3** = Airbus; MD** = McDonnel Douglas (now owned by The Boeing Company); CRJ* = Bombardier; E1** = Embraer

Figure 2-2: New Narrowbody Airplanes (Adapted from Belobaba et al. [5]) 757-300 200 A321 M 757-200 0 737-900ER 1_ A32~ 737-800 (150 C130 737-700 0Clio 7374100 Z 717 E95 1 1319 100 *E190 1318 CRJ-900* E175 CRJ-700 M M M E170 50 CRJ-200A ME145 S E135

Green = new entrants 0

0 1000 2000 3000 4000 5000 6000 7000 8000

RANGE (KM)

In addition to the threat from Bombardier and Embraer, The Boeing Company and Airbus face new entrants such as Comac in China and the United Aircraft Corporation in Russia. While mainstream airlines have not yet started placing orders with either of these new entrants, they present a very real threat in the near future.

Even in the duopoly between Airbus and The Boeing Company, Airbus has been aggressively capturing market share from The Boeing Company. In a recent press release, Airbus claimed to have surpassed The Boeing Company in terms of open orders [6].

In addition to the potential for increased competition, airplane manufacturers must deal with the fact that airlines are becoming more and more cost sensitive. The combination of decreased passenger traffic due to the great recession and increasing fuel prices has put pressure on the airlines. With low cash reserves, the airlines are becoming more and more cost-sensitive, and with large expenditures such as airplanes, airlines do not have the appetite for larger upfront

investments if they will not see the return for years to come.

2.2 Boeing Commercial Airplanes

Boeing Commercial Airplanes is the commercial aviation division of The Boeing Company. The Boeing Company (Boeing) is the world's largest manufacturer of commercial jetliners and military

aircraft combined. The Boeing Company also produces network and space systems, and global services and support [7].

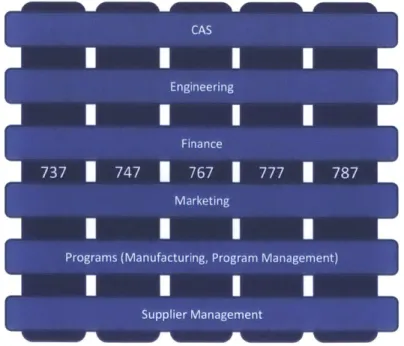

Boeing Commercial Airplanes comprises five programs of in-production airplanes: 737, 747, 767, 777, and 787. Boeing Commercial also offers aftermarket services and support (e.g., maintenance, spares, modifications, and training) through Commercial Aviation Services (CAS). Boeing

Commercial primarily serves airlines throughout the US and abroad. Table 2-1 below highlights some key facts about The Boeing Company and Boeing Commercial.

Table 2-1: Boeing -Key Facts

The Boeing Company Boeing Commercial

Headquarters Chicago, IL Puget Sound, Washington

Revenue $81.7 billion $49.1 billion

Employees 173,781 84,778

Boeing Commercial is organized into airplane programs, and those organizations that support the airplane programs. Commercial Aviation Services, Supplier Management, Finance, and Marketing are all separate organizations with support organizations for each of the programs. The

organizational structure relevant to this study is illustrated in Figure 2-3 below.

Figure 2-3: BCA Organizational Structure

Boeing Commercial operates in an industry with very long lead times. The 787 program, for example, was launched April, 20042, and the first 787 was delivered in September, 20113. If we ignore the time invested prior to program launch, The Boeing Company had to sustain the program for seven and a half years before the first airplane was delivered and The Boeing Company could begin recognizing revenues. Because of these lead times, The Boeing Company must take a large risk with each new airplane program.

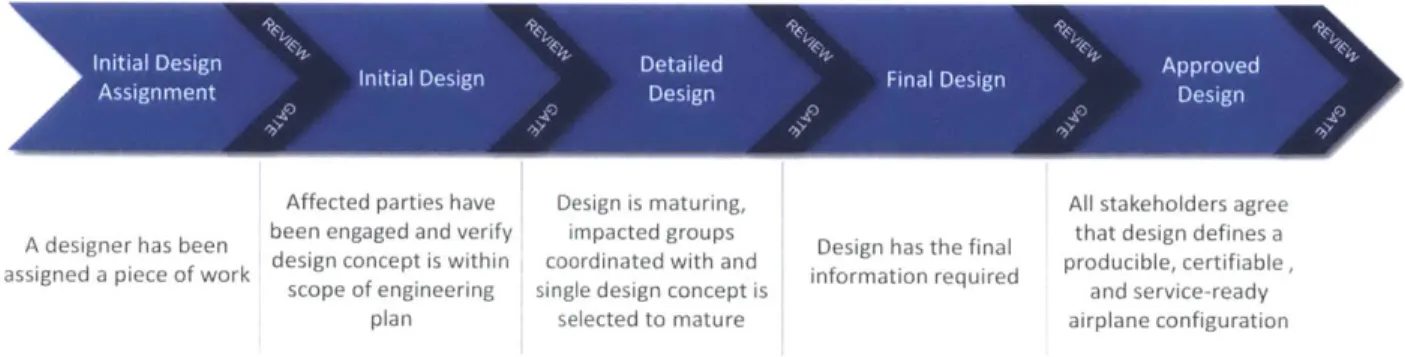

2.3 Boeing program development process

Boeing Commercial follows a standard product development process. New products begin with an initial design assignment, followed by design phases that become increasingly detailed with each phase. The Boeing Company's product design process is illustrated in Figure 2-4. This figure illustrates the process that occurs during detailed design up to the point when drawings are released to manufacturing. During each phase of design, design engineers coordinate with other stakeholders. This coordination must occur with anyone who might be impacted by the design or who has an impact on the design (e.g., other design engineers, stress analysis, weight analysis, etc.). Once each design phase is complete, the design must pass a design review before the engineer can begin work on the next phase of design.

Figure 2-4: Boeing Product Development Process

k Initial Design Detailed Approved

Assgnm ntInitial Desig D sgn Final Design Dsg

Affected parties have Design is maturing, All stakeholders agree A designer has been been engaged and verify impacted groups Design has the final that design defines a assigned a piece of work design concept is within coordinated with and Desi n requinal producible, certifiable, scope of engineering single design concept is information required and service-ready

plan selected to mature airplane configuration

Since an airplanes cannot be designed by one design team alone, The Boeing Company splits its design teams by airplane section (Appendix 2 illustrates these sections for the 787) and by component type (e.g., systems, structures, propulsion). Due to the complexity of airplanes, this development process requires significant communication between design teams.

2 According to the Boeing Logbook: http://www.boeing.com/boeing/history/chronology/chron17.page

2.3.1 Development of the 787

The 787 was developed conjointly between The Boeing Company and its partner companies. These partner companies were responsible for not just the "build" portion of product development, but also for much of the initial design work. In many cases, the selected partner was responsible for the majority of the design work, with The Boeing Company providing inputs and oversight. These partners were awarded major statements of work, typically covering an entire section of the airplane, as described above.

3 Target Costing Best Practices

Target costing is being used increasingly by manufacturing companies around the world. Target Costing originated in Japan, and by 1999, 100% of Japanese automotive manufacturers employed Target Costing [1]. As discussed in Section 1.1, in the aerospace industry, 95% of a product's lifecycle cost is determined by the time designs are released for production. Because of this, costs

must be addressed earlier in the product development cycle. Target Costing has provided manufacturing companies, and in particular automotive manufacturing companies, with a framework that allows them to address costs early.

This section will discuss best practices in Target Costing based on a combination of literature review and interviews. Where possible, research was focused on the aerospace industry and the automotive industry since automotive design and manufacturing bears many similarities with the aerospace industry, and Target Costing is more widely used in the automotive industry. This section will describe individual process steps as well as tools and techniques that should be employed. It will also discuss some key considerations and potential barriers that an aerospace company like The Boeing Company might face.

3.1 Benefits of Target Costing

Many production-heavy industries have adopted Target Costing, including manufacturers of cars, cameras, and heavy machinery [8]. In one study, all firms with medium to high Target Costing maturity reported reduced costs, retained or added features and functionality, faster non-recurring design, reduced new product risk, and improved intrafunctional communications [9]. It is

important to note that companies that implemented Target Costing did not trade off quality and functionality for cost. While Target Costing focuses on reducing lifecycle costs, all companies were able to simultaneously improve quality and increase functionality of their products. Separate research also shows that companies without good cost estimates during conceptual design are more likely to have programs behind schedule with higher development costs than those companies that know detailed costs throughout the development cycle [2].

3.2 High Level Process

One guide on Target Costing notes, "a well-designed target costing system integrates all three elements of the strategic triangle: quality, cost, and time" [10]. Aerospace companies have

traditionally focused primarily on quality (technical requirements) and time (schedule), with cost considered only after the first two have been met. While quality and time are important factors to

prioritize, the ideal Target Costing process balances all three factors. According to the same guide, the key principles of Target Costing are [10]:

" Price-led costing

" Customer focus

* Focus on design of products and processes

" Cross-functional teams

* Lifecycle cost reduction * Value chain involvement

Figure 3-1 illustrates the ideal Target Costing process. The product's features, target selling price, and target cost should all be determined independent of historical costs. The target selling price should be based on the customer's willingness to pay, not historical production costs of similar products. The target cost should also be independent of historical costs. The target cost should be equal to the selling price minus a target profit. This target profit will be determined by leadership and will be based on company goals as well as competitive forces. Once this target cost has been set

for the product, the target cost can be allocated to the material or component level. This exercise requires a cross-functional team since all stakeholders possess subject matter expertise that is important to determining reasonable costs.

Once target costs have been allocated down to the material or component level, the development team is challenged to close the gap between expected costs based on historical costs and the target costs that were just set. While this step is illustrated below as a single step, this is where a lot of the work happens. While the "concept design" and "detailed design" phases of product development have been compressed in the figure above for the purpose of highlighting the Target Costing

process, we can infer that this step will dominate the majority of the product development timeline.

Figure 3-1: Target Costing Process (Adapted from Ansari et al. [10] and Cooper & Chew [8])

Product Definition Concept Detailed Production

Design Design

Based on customnera ucinae

otn

cndoiosto hstrca cs

It is important to note that the Target Costing process is not strictly sequential. The process is iterative, and design decisions can be revisited at any time [4]. As the team performs the design work to meet technical requirements, schedule, and cost, they may have to make tradeoffs, which would change some of the requirements determined earlier in the process.

While it is understood that tradeoffs may be necessary, the most important rule of Target Costing is that only products that have met their target cost will actually be produced [11]. While the act of setting targets is a step forward for many companies, this alone will not impact product costs. If target costs are not adhered to, the process becomes ineffective. Products that will not meet their target costs must be abandoned. When determining whether to cancel a project, it is important for the management team to consider which costs are sunk and which are not. The team should consider the NPV of continuing with the project versus not, understanding that some costs may already be sunk. Cancelling a project should only be a last resort, and should only be used once all other tradeoffs and design improvements have been considered.

Target Costing should also involve a multi-disciplinary team at every stage of the process. Every process step should include Engineering, Finance, Manufacturing, Marketing, and Supplier Management. These organizations must coordinate throughout the Target Costing process, and should be held equally accountable for both setting target costs and achieving them.

While the benefits of Target Costing are clear, implementation of Target Costing requires far more effort and discipline than is required of traditional costing [1]. Target costing requires high effort

activities that involve multi-disciplinary teams and a lot of coordination, but the organization will achieve significant results in terms of value and creative thinking [9]. Any company wishing to implement Target Costing must understand this additional effort and be willing to invest fully in the process.

Now that the high level process and some key considerations are understood, the following sections will discuss each process step in more detail.

3.2.1 Desired Product Features

The first step in the Target Costing process is to define the product and the desired product

features. These features should be based on customer requirements and the segment of the market that the company is targeting. The focus on this phase is on the customer, rather than on the details of technical design. The Boeing Company demonstrated its ability to design to customer

requirements with the 777 [10]. Through customer workshops and customer feedback, The Boeing Company was able to identify features the customers valued to incorporate into the 777 (e.g., larger stow bins, quick interiors reconfiguration capabilities).

During this phase, the "nice to have" versus the "need to have" should be identified [8]. The development team should work with the customer to identify how much they value particular features, and should use rough order of magnitude (ROM) estimates to determine which features to include in the new product [9]. For example, The Boeing Company had a large accumulator

designed for the 777 to ensure the parking brake would hold for 12 hours. After discussions with the customer, The Boeing Company discovered that customers never left an airplane parked for that long, and if they did, they had the airplane "chocked up, or on jacks". This allowed The Boeing Company to design a smaller and far less costly accumulator onto the 777 [12].

This first process step must involve the entire multidisciplinary team. Marketing will have the best understanding of customer wants and needs, and Finance and Engineering will be required to create ROM estimates that will be used to determine which features to include in the product. It is important to involve Engineering, Manufacturing, and Supplier Management so they understand where customer requirements are coming from. Manufacturing and Supplier Management may have important input for the ROM estimates as well.

3.2.2 Target Selling Price

Once the product features have been determined, the team must set the target selling price. This target selling price should be independent of cost, and should be based on the specific market

segment that the company is targeting [8]. The price should be based on customer input

(customer's willingness to pay) and the competitive market conditions (i.e., are there competitors with similar products?). The customer's willingness to pay will be based on the proposed features of the new product, so the target selling price relies on a clear definition of the proposed product features from the prior Target Costing process step.

While many companies have traditionally used cost-plus to determine cost, this is not a

recommended approach because it does not consider the customer. As with product definition, customer focus is very important here. For a product to be successful, the team must fully understand what customers are willing to pay for and how much they are willing to pay. If the selling price is too high, there won't be enough demand for the product, and if the selling price is too low, the company will have a lower profit margin.

3.2.3 Target Product Cost

The target cost should be based on the selling price and the required profit margin set by company leadership. Target cost is the total lifecycle cost of a product, and should be calculated using the simple equation:

Target Cost = Selling Price - Profit Margin

Note that historical costs and cost estimates are not in the target cost equation. Target costs should be based on customer features and desired profit margin rather than historical costs.

When determining the target profit margin, it is important to establish targets that are realistic. One method of checking profit targets involves comparing the target profit with the profit margins of previous products [10]. The profit margins of previous products will provide a good "gut check" of the profit margins being set for the new product. The target costs are also a reflection of the competitive market in which the product will sell. The required profit margin should reflect the capabilities of the most effective competitors [13]. If the target profit is lower than the most effective competitor, the company is not operating as efficiently as its competitor, and if the profit target is too high, it is likely unrealistic.

Finally, when setting the expected profit margins remember to consider lifecycle costs [10]. For products requiring a large non-recurring investment upfront, the team must remember to consider revenues for the product throughout its production life. Additionally, if the selling price is expected

to change over the products lifecycle, this must be taken into account when establishing the product's target cost.

3.2.4 Target Cost to Material or Component Level

Once the target cost has been set, the team must allocate the target cost down to the component level. It is important that costs be broken down to the individual design team level [1]. In order for individual design teams to be held accountable to their cost targets, the cost targets need to be flowed all the way down to their level.

Allocation of cost to different sections / components should be done using a combination of:

* Historical / expected costs: historical and expected costs must be tracked down to the

component level, and form the basis for understanding how much different components cost under current conditions

" Subject matter expertise: Engineering, Manufacturing, and Supplier Management will

have intuition and expertise to identify where cost reduction is feasible, and where it will be extremely difficult. The team cannot simply take historical costs and apply a 10% cost reduction across the board [8]

" Quality Function Deployment (QFD): QFD analysis should be used to determine target

costs at the component level. QFD analysis determines the cost that should be assigned to each section / component by assessing them in terms of their value to the customer. Each feature/function of the product can be mapped to the components that impact that feature. Figure 3-2 provides an example of the mapping for a pencil sharpener. A pencil sharpener's appearance is primarily impacted by its casing and the drawer, whereas its ability to sharpen pencils is impacted mainly by the motor and by the blades. In Figure 3-2, the customer highly values the functionality provided by the drawer, whereas the customer knows that pretty much every pencil sharpener can cut as well as the next so does not value the blades highly. By mapping this "relative importance" to the relative cost of each

component, the team can identify where costs should be reduced and where features could be enhanced.

Figure 3-2: Value Index Chart of a Pencil Sharpener (Ansari et al. 1997 [10]) 50 Reduce Cost 40 Motor U) 30 Casing M 20 Blades 1 Drawer 10 Enhance 0 -- -0 10 20 30 40 50 Relative Importance

This process of allocating costs must be done by a cross-functional team. Design leaders from each section of the product must be involved in the decision-making process or they will not feel responsible and accountable for their cost targets [4]. Engineering leads will be relied upon to identify where product costs reductions can reasonably be achieved, but they will require input from Manufacturing and Supplier Management. Marketing resources provide customer insights and estimate the value customers place on various features and functionality. Finance provides the cost estimates. Table 3-1 illustrates each organization's involvement in the cost allocation activities described above.

Table 3-1: Involvement of Resources In Cost Allocation Activities

Supplier

Activity Engineering Finance Manufacturing Marketing Manage

Management

Historical / Expected Cost X x x x

Subject Matter Expertise X x x

QFD X x x

3.2.5 Current Production Costs

In parallel with target cost determination, current production cost information should be gathered. These production costs should represent lifecycle costs and should be gathered down to the

component level. These current production costs will help determine the expected cost of the new product, wherever there are similarities between current / previous products and the new product. It is important to note, the current production costs should not impact the target cost. Target cost should be kept independent of current production costs at this point.

3.2.6 Expected Costs

Using current production costs, Finance should work with Engineering, Manufacturing, and Supplier Management to estimate the lifecycle costs of the new product. Finance can use

similarities in the products to exploit historic costs, and should use parametric estimates (estimates based on high-level features like weight, using regressions of previous product costs) as well as input from Engineering, Manufacturing, and Supplier Management to estimate the cost of the new product where there are dissimilarities. In the aerospace industry, parametric estimates have proven to work well for estimating the entire airplane cost, but are less accurate for individual sections / components [14]. We will discuss cost estimating techniques in further detail below. These expected costs will most likely be higher than the target costs, but will indicate the expected costs of various components of the new product. These cost estimates will be an input for allocating target costs to the material / component level.

3.2.7 Closing the Cost Gap

Once current cost estimates are understood and target costs have been established, the product development team will be challenged to close the gap between expected cost and the cost target. This will be the real challenge for the team. Actual cost reduction activities are the most expensive and time-consuming for companies [9]. The design engineers will be challenged to reduce costs while continuing to meet other requirements.

The success of these activities hinges on a multi-disciplinary team approach. Since target costs were set by the entire team, the entire team must be held accountable for achieving those targets [4]. The benefits of cross-functional teamwork for cost reduction were demonstrated with the Boeing 777 program. The 777 program created teams comprising resources from Engineering, Manufacturing, Materiel (Supplier Management), Customer Service, Quality, and Finance. The members of these cross-functional teams were collocated to facilitate communication [15]. These cross-functional teams were able to achieve reductions in recurring product cost and a reduction in change, error and re-work as demonstrated in Figure 3-3 below.

Figure 3-3: 777 Program Success [15]4

F*-77? pvc

M

77?Iq

MonFige 17. 777 oga sucest

Figure 17. 777 Program Succams

Coot,

S I~owving ftcuffft

777 process Pr*-777 procew

Figure 18. Program Cost Comparison-777 Process Vermus Pra-777 Process

Closing the cost gap may require trade-offs. Some trade-off decisions may include: * Functionality

* Trading cost targets between components / sections

* Trading cost targets for cost components (e.g., spend more upfront in R&D to save more in production costs)

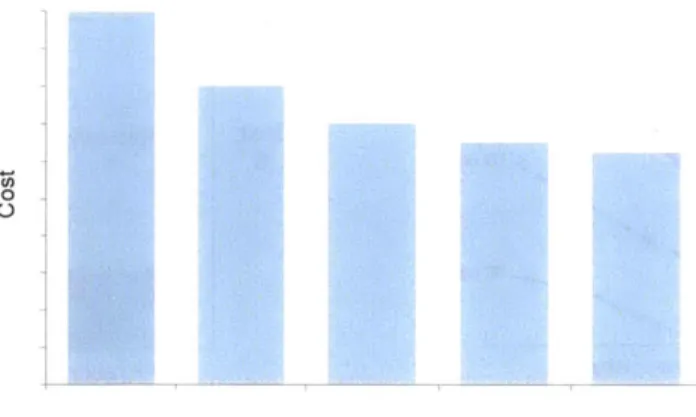

In order to effectively assess these tradeoffs, engineers must get used to thinking in terms of business cases. In aerospace, a typical tradeoff is weight versus cost. Since the customer values a lower-weight airplane, we should assign value to any weight reduction engineers might be able to achieve in their design. Similarly, engineers may be able to reduce costs significantly by increasing weight a little. When aerospace companies prioritize weight over cost as a blanket rule, an increase in weight would never be allowed. Instead, the team must pre-define a weight versus cost tradeoff [14] so that engineers can determine if a design change that impacts weight really makes sense. Cost reduction efforts will be an iterative process, and savings will be diminishing [11]. Figure 3-4 provides an illustrative pattern of cost reduction we can expect to see. It is important to note, that a lot of the changes will be minor improvements, not major innovations [1]. This process of cost reduction will look a lot like continuous improvement, except that it will occur earlier in the product development timeline.

4 Black bars indicate non-recurring cost

Ch,w~

Figure 3-4: Reduction of Cost with Design Iterations

Design Iteration

As mentioned above, tradeoffs may be necessary between design groups and cost targets may need to be traded between components to ensure the total product cost meets the cost target. While individual design teams may be tempted to stop cost reduction effort as soon as their component meets the target cost, they should not stop looking for cost savings until the entire product has met its cost target.

Engineers and managers must be careful with design iterations. Every time a team has to go through design iterations, the team has increased the non-recurring design costs of the products. The expectation is that the cost savings the team will achieve will be at least as great as the additional upfront cost incurred. Teams should only choose to go through additional design iterations as long as the expected recurring savings are at least as great as that additional development cost.

Finally, as discussed above, only products that meet their cost target should be produced. If a product cannot meet a minimum NPV set by management, it should be abandoned. This should only be used as a last resort option once all other cost-reduction possibilities have been explored.

3.2.7.1 Cost Components

Target Costing relies on having a full understanding of lifecycle costs of the product. While the temptation is to just consider the upfront non-recurring design activity and recurring production costs, other cost components contribute significantly to the cost of the product. Profitability can only be determined if all costs are considered along with all revenues associated with the product. Total lifecycle costs include [10] [14]:

. R&D, design, and test and evaluation 30

* Manufacturing and acquisition * Sales and marketing

* Distribution * Service

* Operations and support * Disposal

Cost of capital (including depreciation) is an important cost component that needs to be included in Target Costing calculations [11]. Such costs will typically fall under development and

manufacturing, and will include buildings, machinery, and IT assets.

Manufacturing and acquisition costs are often over-emphasized during design [10], and sales and marketing are often considered fixed overhead costs. In reality, all costs are variable, and the team must understand how they can impact cost when setting cost targets. With cross-functional teams, the Marketing organization is involved in development throughout, so this issue should be

addressed.

3.2.7.2 Techniques for Cost Reduction

Closing the cost gap will not occur naturally and companies will typically need to employ cost reduction techniques to meet their target costs. Several formal techniques have been proven effective for reducing cost during design, including [2] [9] [6] [16]:

* Value engineering / value analysis * Tear-down analysis

* Quality Function Deployment (QFD) * Design for "x" (DfX)

* Cost Deployment Flowcharts

* Working with suppliers to improve capabilities, identify areas where they can reduce costs * Change to design, or features

* Accept higher start-up costs for larger savings later

Table 3-2 illustrates which techniques should be used to reduce cost in each cost category over the development lifecycle. In addition to the strategies listed above, companies should use long-term agreements with suppliers to foster cooperation of the supplier and get future cost reduction guarantees [9].

Table 3-2: Techniques for Cost Reduction Over Development Cycle (Adapted from Ansari et al., 1997 [10])

R&D, design, and test and evaluation

Manufacturing and acquisition

- Multi-year product plan: trade-off features, accept high one-time costs for future cost reduction

- Cost deployment flowcharts

- Reverse engineering / tear-down analysis

- Reverse engineering / - Value engineering - Value engineering tear-down analysis - QFD - Design for

- Trade-offs - Supplier value manufacturing and

- QFD engineering assembly - Supplier benchmarking - QFD - Supplier value engineering - Negotiation with supplier

Sales and marketing

Distribution Service Operations and support Disposal - Benchmarking - QFD - Trade-offs - QFD - Trade-offs - QFD - Trade-offs - QFD - Trade-offs - QFD - Value Engineering

- Design for distribution

- Coordination with suppliers

- Value Engineering

- Design for maintenance

- Value Engineering

- Design for use

- Value Engineering

- Design for disposal

- QFD

- Value Engineering

- Design for distribution

- Coordination with suppliers

- Value Engineering

- Design for maintenance

- Value Engineering

- Design for use

- Value Engineering

- Design for disposal

- QFD

Each component should have its cost broken out into the categories indicated in Table 3-2. These catagories will ensure total lifecycle costs are addressed and will help focus discussion on those components driving cost in particular categories. Japanese firms, with mature Target Costing processes, use detailed cost tables to determine costs of individual components [11]. These cost tables contain granular cost information on every component, which enables them to quickly identify cost drivers and aid cost reduction efforts.

A lot of the work will be workshop based. The techniques listed above will enable the teams to identify the areas and components where cost is high, but the teams will need to work together to brainstorm ways to reduce costs. Here, the diverse backgrounds of multi-funtional teams will be critical, since the success of the workshops will hinge on the team's ability to come up with creative solutions. The workshops will require a lot of upfront preparation so that they can be focused and they will require an owner to ensure they are productive.

32 Value analysis Continuous improvement - Value analysis - Continuous improvement - Value analysis - Continuous improvement - Value analysis - Continuous improvement - Value analysis - Continuous improvement

3.2.8 Design Release and Production

Product designs should only be released for production if technical requirements, schedule, and cost targets have all been met. Leadership must be held accountable to all three components, and this accountability must be flowed down to the lowest level engineer. Every engineer must know what their targets are; if they don't know their targets, it would be unreasonable for them to be held to them. In order to achieve this, the development team must be able to allocate targets to the individual design teams.

3.2.9 Continuous improvement

Continuous improvement is a well-established framework used in manufacturing companies. Continuous improvement should be a continuation of Target Costing. The tools and methodologies used in Target Costing to close the cost gap are the same as those used in continuous improvement. The biggest difference between the two is timing. Any company that has introduced continuous improvement has the tools and processes available to them to implement Target Costing.

Companies often rely almost entirely on continuous improvement to realize cost reduction, but as discussed above, by the time continuous improvement starts to affect the product, the majority of costs have been committed. Target Costing efforts need to be incorporated in the design stage of product development, followed by continuous improvement once production begins. Figure 3-5 illustrates the activities that should occur during the product development lifecycle.

Figure 3-5: Product Development and Cost Reduction Timeline

Target Costing

Continuous Improvement

-3.3 Organizations Involved

As discussed above, Target Costing is a cross-functional process. Organizations involved in Target Costing include Engineering, Finance, Manufacturing, Marketing, and Supplier Management. Suppliers should be included in discussions and design decisions, and should be considered as another organization within the company. Table 3-3 below lays out the key responsibilities of each organization during product development.

Table 3-3: Responsibilities of Organizations During Product Development Engineering Finance Manufacturing Marketing Supplier Management Suppliers

Perform design work to drive lifecycle cost down Provide SME input to aid financial estimating

Provide SME input into areas where cost reduction is possible and into Quality Function Deployment (QFD) Cost Engineers should be dedicated to the cost of parts (function like weight engineers)

Create estimates on cost based on input from other organizations Provide historical cost to the material / component level

Identify cost-drivers (i.e., what Engineering should focus on from a cost perspective) Identify ways to reduce manufacturing costs

Provide SME input into Quality Function Deployment (QFD) Provide SME input to aid financial estimating

Provide customer insights for product definition and tradeoff decisions Provide customer insight for Quality Function Deployment (QFD)

Coordinate with engineering to create solutions to changing customer requirements Identify ways to reduce marketing costs

Provide input on new suppliers / technology available Provide SME input to aid financial estimating Benchmark suppliers

Identify ways to reduce cost through redesign or contract change Provide input on new manufacturing techniques / technology available Identify ways to reduce cost

Agree to cost targets set and find ways to hit those cost targets

While Target Costing is a team effort across the organizations listed above, many Japanese

companies with established Target Costing processes created a separate business unit dedicated to Target Costing [10]. It is the responsibility of this organization to provide enough cost information to the design team early enough in the design cycle so they can make cost-based decisions [2]. All organizations involved in the Target Costing process will have accountability for their cost targets, but this dedicated organization must ensure implementation of and adherence to the process.

3.3.1 Role of Supplier Management

Supplier Management will be held to cost targets set by the product development team. Since Supplier Management is held accountable for target cost set by the team, Supplier management should be involved in setting the target [17]. Supplier Management should be included as early as the product definition phase, and should continue to be involved throughout the development process since Supplier Management can provide high-level input into what features or sourcing strategies drive costs [1]. Supplier Management can also provide insight into new manufacturing techniques and technologies that might be available to suppliers. In one study, eight of eleven companies using Target Costing included Supplier Management during product definition [9]. Additionally, Supplier Management is typically involved in continuous improvement activities; since continuous improvement is really a continuation of Target Costing activities, Supplier Management should be just as involved in Target Costing [4].

Supplier Management should have a close working relationship with Engineering [17] [9]. Decisions that design engineers make can impact supplier requirements, so there needs to be a feedback loop to design engineers. When the design team makes a design decision, they need to understand how they are driving cost. Additionally, since the sourcing and negotiation process is extremely lengthy, Supplier Management will need to be kept aware of design decisions so that they can be incorporated properly in any agreements with suppliers. By keeping Supplier Management in the loop, the design team will also identify early on when design decisions will force the company to single-source (e.g., a patented sub-component). Single-sourcing can drive significant costs because, with no competition, the supplier has the ability to inflate prices.

By involving Supplier Management early, companies are able to leverage new supplier capabilities in product design. In some cases, suppliers are chosen early in the development process. As one Boeing engineer pointed out, when suppliers have been determined early, the design team should be aware of the capabilities and limitations of those suppliers since certain design features can increase cost significantly for one supplier and not impact cost for another.

Target Costing is dependent upon supplier involvement and supplier agreement to cost targets. The most difficult aspect of Target Costing can be getting suppliers to buy-in [18]. Supplier Management must be able to create incentives for the suppliers that will ensure their cooperation. Target Costing can also provide a framework that will enable the team to discuss both justification and need for target costs with its suppliers [16]. Suppliers must believe that the project will be canceled if target costs are not met [9]. This is one of the most powerful incentives the team can give suppliers to meet their own targets. Unless this is a real threat, suppliers will have very little incentive to play along.

While Supplier Management must create the incentives and penalties to ensure supplier

cooperation in the Target Costing process, Supplier Management must also ensure that supplier margins are not eroded. Suppliers will be weary of Target Costing because they may see it as a process that does nothing but erode their profits (this does not need to be the case). The product development team must treat suppliers like partners, and ensure that all involved understand the common goals [10] [8]. The team needs to recognize that successful Target Costing depends on successful implementation by the suppliers. The team must enable and support suppliers in their implementation to ensure the success of Target Costing. Manufacturing companies are recognizing the value of this longer-term approach to supplier relationships and squeezing suppliers for

immediate savings is losing credibility [1]. In other words, companies are moving towards long-term cost reduction relationships over short-long-term savings.

It is important for Supplier Management to recognize situations where suppliers might take advantage to increase their own revenue. Complex, long lead time engineering projects will incur design changes. Suppliers tend to offer great introductory rates, but will capitalize on these changes, and this is where they make their profits [19]. Supplier Management must set up the relationship and contract that ensures the company's profits are not diminished by supplier fees as changes occur.

3.4 Techniques for Estimating Costs

It is very important that costs are known and considered during every step of the product

development process. Since the accuracy of cost estimates tend to be low during product definition and conceptual design, cost is often given low priority [19]. Cost estimates typically have a -30% to +50% accuracy during conceptual design, and this improves to -5% to +15% during detailed design phase [20]. Since 65% of cost is committed during conceptual design (as discussed in Section 1.1), it is incredibly important to understand costs, even at a high level. Design engineers have historically focused on technical specifications during conceptual design [10], but they need to start factoring in cost at this point as well.

Various cost estimating methodologies are appropriate at different stages of product development. Bottom-up estimates are typically used when the design concepts are new and the user wants to eliminate unknowns [19], and parametric / historical cost estimates are used for products that are similar to previous products. Parametric estimating is typically done at the early stages of

development. It is an excellent predictor of costs when the Cost Estimating Relationship (CER) is reasonable, data is accurate, and assumptions are clear [2]. As the team moves through the

development cycle, it should shift from using parametric estimates to more bottom-up approaches [19]. Figure 3-6 illustrates the various cost estimating methods that should be used during each phase of product development.

Figure 3-6: Cost Estimating During the Development Process Actual costs Supplier Quotes Feature-based (CAD) Feature-based (cost tables) Neural networks/ a)L_ fuzzy logic Parametric estimates Historical data

CERs for parametric estimates need to be clearly identified, and validated regularly (i.e., the team needs to compare estimates to actual to determine accuracy of the CERs). Aerospace companies typically use factors such as weight and material [19] for their CERs. While these CERs work well at an airplane level, they start to break down at the more granular levels (e.g., weight is not a good

CER for estimating the cost of systems). CERs should include design cost as well as manufacturing cost components. Companies should use statistical analysis to ensure their CER is based on features that well define cost [19]. When developing CERs, companies must:

* Understand the design process

* Do not mix dissimilar products for CER development * Use as many data points as possible

* Break out cost by cost component * Use common sense and experience * Do not use too many variables [21]

Once CERs have been developed, the design team needs to be educated about the cost drivers [19] [11]. Although the team may not be able to identify costs with a high degree of accuracy, they can still use historical costs and subject matter expertise from engineers and suppliers to determine features and functionality that tend to increase cost. This information could be shared through actual historical costs, or through more qualitative graphs that provide engineers with an indication

of cost drivers. This information is important to share with engineers so they can make more informed design decisions.

Companies are increasingly using neural networks and fuzzy logic to determine costs during early phases of product development. Neural networks and fuzzy logic have proven to provide more accurate cost estimates, particularly where suitable CERs have not been identified [2]. While weight-based CERs provide good, early cost estimates for airframes, for example, estimating costs for systems is a little more difficult. Neural networks can quickly identify cost patterns and

determine more accurate cost estimates based on other parameters. Fuzzy logic can handle uncertainty and imprecision when traditional, deterministic cost models don't handle this as well. Fuzzy logic is particularly applicable when human decision-making is core to the downstream process [22]. For these reasons, neural networks and fuzzy logic can provide enhanced capabilities to traditional parametric cost estimates early in the development process.

As the team moves towards detailed design, and creates part-level specifications, feature-based estimates can be used. Feature based costing (FBC) has been used increasingly by a leading European aerospace manufacturer [2]. FBC makes sense to use both during concept development and during detailed design. Any component can, at a high level, be described as a combination of features. Table 3-4 illustrates some example features that can be used to describe individual parts. Since these high level features are typically known during concept development, a company could use a feature-based cost table to estimate the cost of the end product.

Table 3-4: Feature Based Costing Example Features

Feature Type Examples

Geometric Length, Width, Depth, Perimeter, Volume, Area

Attribute Tolerance, Finish, Density, Mass, Material, Composition Physical Hole, Pocket, Skin, Core, PC Board, Cable, Spar, Wing

Process Drill, Lay, Weld, Machine, Form

Assembly Interconnect, Insert, Align, Engage, Attach Activity Design Engineering, Structural Analysis, Quality

Since FBC at this level uses cost tables, current and historical costs must be tracked to the part level. The features of those parts must also be tracked to ensure the team can associate features to costs. While cost tables must be used during early design phases, CAD-based FBC should be used once engineers work on detailed design, with 3D CAD drawings of their parts. Many tools exist in the

marketplace, which can integrate with CAD programs like CATIA, so engineers can get accurate should-cost estimates for the parts they are designing. We will discuss these tools in more depth in the next section.

As designs become more hardened, supplier quotes and actual costs can be used to track costs. As Figure 3-6 illustrates, cost estimating techniques become more accurate further along the

development timeline. Since all estimating is based on assumptions, it makes sense to include a risk assessment with estimates at every stage of the process [2]. This risk assessment can be as simple as reporting cost estimates as expected ranges (e.g., high, expected, low).

Some of the techniques described above require significant setup and tools to be in place in order to be effective. The next section will describe some of the cost estimating tools that are currently used by manufacturing companies.

3.4.1 Tools

The cost estimating process requires comprehensive IT systems and significant cross-functional coordination [1]. During every phase of product development, tools are needed to help create cost estimates and central databases are needed to store the cost estimates so that Finance can

aggregate costs to the product level. This section describes some cost estimating tools currently in the marketplace. This is not an exhaustive list of all tools available, but is intended to provide an indication of what functionality is available.

aPriori: provides manufacturing cost estimates of parts and assemblies using CAD files. Users can drop the CAD file into aPriori, define a couple of parameters, and see price [23]

Costimator: provides manufacturing cost estimates based on parametric estimates, feature-based, or individual operations required to manufacture part [24]

COSYSMO: a parametric systems engineering cost model, which is used in various industries including aerospace [25]. It is being incorporated into systems like PRICE-H and SEER. [19] Geometric: provides manufacturing cost estimates of parts using CAD files. Users must manually define tolerances and other features, but the tool provides tips for features that tend to increase or decrease cost [26]

PRICE-H: provides parametric estimates based on a database of costs from other products. Both estimates on recurring part costs and program management are included. Enables

![Figure 1-1: Cost Committed During Six Phases of Aircraft Development [3] (Adapted by Kaufmann [4]) 100% - 85%-80% -0 t--65% 60% 0 40% L](https://thumb-eu.123doks.com/thumbv2/123doknet/14723169.570997/12.918.243.659.163.485/figure-cost-committed-phases-aircraft-development-adapted-kaufmann.webp)

![Figure 2-1: Commercial Airplanes in Use' (Adapted from Belobaba et al. [5]) Widebodles 600500 - 400- 300-200 -100 - 0-0 3 10000 1 RANGE (KM) 20000](https://thumb-eu.123doks.com/thumbv2/123doknet/14723169.570997/16.918.172.730.165.496/figure-commercial-airplanes-use-adapted-belobaba-widebodles-range.webp)

![Figure 2-2: New Narrowbody Airplanes (Adapted from Belobaba et al. [5]) 757-300 200 A321 M 757-200 0 737-900ER 1_ A32~ 737-800 (150 C130 737-700 0Clio 7374100 Z 717 E95 1 1319 100 *E190 1318 CRJ-900* E175 CRJ-700 M M M E170 50 CRJ-2](https://thumb-eu.123doks.com/thumbv2/123doknet/14723169.570997/17.918.114.794.135.518/figure-new-narrowbody-airplanes-adapted-from-belobaba-clio.webp)

![Figure 3-1: Target Costing Process (Adapted from Ansari et al. [10] and Cooper & Chew [8])](https://thumb-eu.123doks.com/thumbv2/123doknet/14723169.570997/23.918.105.806.152.456/figure-target-costing-process-adapted-ansari-cooper-chew.webp)

![Figure 3-2: Value Index Chart of a Pencil Sharpener (Ansari et al. 1997 [10]) 50 Reduce Cost 40 Motor U) 30 Casing M 20 Blades 1 Drawer 10 Enhance 0 -- -0 10 20 30 40 50 Relative Importance](https://thumb-eu.123doks.com/thumbv2/123doknet/14723169.570997/27.918.265.637.152.416/figure-pencil-sharpener-ansari-reduce-enhance-relative-importance.webp)

![Figure 3-3: 777 Program Success [15]4](https://thumb-eu.123doks.com/thumbv2/123doknet/14723169.570997/29.918.95.767.115.393/figure-program-success.webp)

![Table 3-2: Techniques for Cost Reduction Over Development Cycle (Adapted from Ansari et al., 1997 [10])](https://thumb-eu.123doks.com/thumbv2/123doknet/14723169.570997/32.918.102.790.156.640/table-techniques-cost-reduction-development-cycle-adapted-ansari.webp)