Long-term dynamics of investment decisions in electricity markets with variable renewables development and adequacy objectives

Texte intégral

Figure

Documents relatifs

By using the dynamic programming method, we provide the characterization of the value function of this stochastic control problem in terms of the unique viscosity solution to a

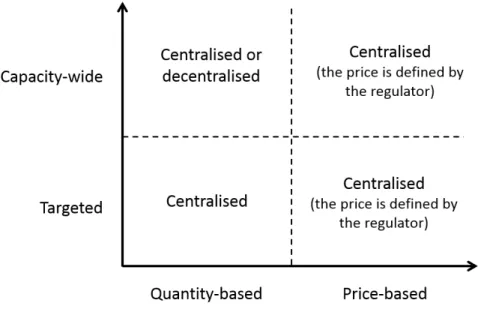

Three investment incentive mechanisms, reliability options, forward capacity markets and capacity payments are analyzed and compared with the benchmark design,

agrées avec les fournisseurs et clients externes) sont respectées, et que les ordonnancements induisent des incompatibilités entre les différents centres de

In our search for improved non-invasive pH probing at subcellular level, we recently developed a series of cell permeable α-aminophosphonates with pKa ranging 2–8 and showing a

Dans le deuxième chapitre, notre objet d’étude étant l’état de l’enseignement de la grammaire, nous situons d’abord l’objet de recherche dans son contexte sociohistorique

Le circuit présenté sur la Figure 28 permet de commander l’émission de la lumière rouge et infrarouge par les LEDs ainsi que la réception de flux lumineux par le phototransistor,

Considering an industrial site with electricity generation assets, considering interactions with the spot markets (sales and purchases) and taking into account operational

In the new steady state, type 3 rather than type 1 agents play speculative strategies (although type 1 agents do not change their trading behavior, indirect trade in the R2