Case Study of Cape Wind:

Identifying Success and Failure Modes of Offshore Wind Projects

ARCHIVES

By OFAS C;VkOW

Pierre Dennery

JUN

24

2015

Master of Science in Management

LIBRARIES

HEC Paris, 2015

LBRAR

_ESSUBMITTED TO THE MIT SLOAN SCHOOL OF MANAGEMENT IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF

MASTER OF SCIENCE IN MANAGEMENT STUDIES

AT THE

MASSACHUSETTS INSTITUTE OF TECHNOLOGY JUNE 2015

2015 Pierre Dennery. All rights reserved.

The author hereby grants to MIT permission to reproduce and to distribute publicly paper and electronic copies of this thesis document in whole or in part

in any medium now known or hereafter created.

Signature of Author:

Signature redacted

MIT Sloan School of Management May 8, 2015

Certified by:

Signature redacted

Henry Birdseye Weil Senior Lecturer Thesis Supervisor

Accepted by:

Signature

redacted-Michael A. Cusumano SMR Distinguished Professor of Management Program Director, M.S. in Management Studies Program MIT Sloan School of Management

Case Study of Cape Wind:

Identifying Success and Failure Modes of Offshore Wind Projects

By Pierre Dennery

Submitted to MIT Sloan School of Management on May 8, 2015 in Partial Fulfillment of the requirements for the Degree of Master of Science in

Management Studies.

ABSTRACT

Cape Wind was supposed to become the first offshore wind farm in the United States. In

2015, more than 10 years after its inception, a single turbine has yet to be produced and the

project is at a dead end. Facing a strong local opposition, it has suffered numerous setbacks that eventually led to huge delays affecting its timeline. Understanding what happened in this particular project and what could have been done differently could help the industry go forward with new plans to develop offshore wind in the United States. In this paper, we have built a System Dynamics model to simulate the dynamics of support, opposition, financial certainty and technology that can affect an offshore wind farm during its approval process. We show that contrary to a common idea, the relatively lower environmental awareness fifteen years ago was not a major cause for the to date failure of Cape Wind. Rather, it is the level of advocacy against the project at its beginning that has the most impact on its overall timeline. Major efforts should therefore be devoted to defuse the most vehement opponents right from the beginning, rather than trying to convince more people to support it. We also show that changes in plans during the approval process to increase its NPV can have a strong impact on the project timeline. Lastly, contrary to our hypothesis, we see that a regulatory framework doesn't necessarily mean a faster approval process.

Thesis Supervisor: Henry Birdseye Weil Title: Senior Lecturer

Acknowledgments

This thesis wouldn't have been possible without the support and inspiration of the many people I have had the chance to meet here at MIT.

First, I would like to sincerely thank my thesis advisor Professor Henry Birdseye Weil for his benevolent support throughout the year. Not only that, he has also been a great source of inspiration during my research.

I would also like to appreciate Professor John Sterman for giving me guidance prior to the

project and Katherine Dykes for sharing her expertise on wind energy.

Lastly, my gratitude goes to MIT as an institution and a community for introducing me to the fascinating environmental, economic and social issues of Energy Transition through its classes, conferences, and club activities.

Table of Contents

T he case for offshore w ind ... 8

Early developm ents ... 8

The benefits of w ind ... 11

Risks and criticism ... 14

The benefits of offshore w ind ... 17

Latest and future innovation ... 17

T he C ape W ind Project ... 18

Birth of the project ... 18

Initial Plan ... 19

H urdles ... 19

Current state ... 22

Identifying success and failure modes of large energy projects ... 23

Lack of regulatory fram ew ork ... 23

Failure to secure key local support ... 24

Location ... 24

M odel and D iscussion ... 25

C ausal Loop diagram ... 25

D efining variables ... 27 M odel overview ... 32 Sim ulations ... 35 D iscussion ... 43 C onclusion ... 45 A ppendix: E quations ... 47 B ibliography ... 50

Figures and Tables

Figure 1: Evolution of rotors sizes and power output from 1980 to 2010 ... 9

Figure 2: Blade pitch control...10

Figure 3: Market expansion self-reinforcement loops...11

Figure 4: Wind Resource Potential in the United States (Schwartz et al.)... 12

Figure 5: Life-cycle emissions of different energy technologies (Schlomer et al.)...12

Figure 6: US Deployment & Cost for Land-based Wind: 1980-2013 (US DOE 1)...14

Figure 7: Turbine power curve (Wan)...15

Figure 8: Causal loop diagram of support and financial dynamics ... 26

Figure 9: TableA ... 27

Figure 10: View 1 - Dynamics of support... 32

Figure 11: View 2 - Dynamics of legislative process ... 33

Figure 12: View 3 - Dynamics of technology and financing ... 33

Figure 13: View 4 - Dashboard ... 34

Figure 14: "Base Case" Public Opinion...35

Figure 15: "Base Case" Lobbying ... 36

Figure 16: "Base Case" Financing...36

Figure 17: "Base Case" Permits timeline...37

Figure 18: "Base Case" NPV and Technology cost...37

Figure 19: "No Tech Change" Scenario Key Parameters... 38

Figure 20: "No Tech Change" Scenario Permits Timeline ... 38

Figure 21: "Eco-friendly" Scenario Key Parameters ... 39

Figure 22: "Strong Advocacy" Scenario Permits Timeline ... 40

Figure 23: "Targeted Opposition Diffusion" Scenario Key Parameters ... 40

The case for offshore wind

Early developmentsThe first electricity-generating wind turbines were designed concomitantly in Europe and the US in the late 1800s'. Soon, farmers across the United States adopted the technology, motivated by the lack of energy distribution systems. In the 1930s, wind turbines were a common sight in the Midwest, as attested by Dorothea Lange's iconic pictures of the Dust Bowl. Until the 1970s, most wind turbines remained very small with capacities of ranging from 10 to 100 kilowatts (Kammer), due to wind energy lack of competitiveness versus cheap fossil fuels. Even though a successful attempt was made to build the first megawatt turbine in 1941 with the Smith-Putnam Turbine, it broke less than 2 months after inauguration and was never repaired (McCaull).

Troubled energy markets in the 1970s, nuclear incidents, as well as growing concerns for the protection of the environment under Nixon led to a renewed interest for wind energy in Europe and the US. In Denmark, the first 2 megawatts turbine was built in 19782. In the US, the federal

government - through the Department of Energy -began funding NASA research for improving

wind turbines efficiency. The program made considerable technological breakthroughs still in use today and achieved huge scaling: the first 4 megawatts turbine was developed in 1982 and held the record for 20 years (Linscott). In 1980, the World's first wind-farm project came out of

the ground in New Hampshire3.

The 1980s and the 1990s saw further enhancement and up scaling of wind energy technology, making it ever more affordable: larger rotors to expand the area swept by the blades and higher towers to help reach areas of stronger and more constant wind (figure 1), improvement of blade pitch control including hydraulic systems and slewing drives (figure 2), product diversification

1 Energy.gov, «History of wind energy ), n.d. Web. 29 Apr. 2015

http://energy.gov/eere/wind/history-wind-energy

2 Frei, M., «Wind energy: Opportunities and Challenges >, n.d. Web. 29 Apr. 2015

http://www.cas.umn.edu/assets/pdf/Wind%20Energy%200pportunities.pdf

3 UMass, «Wind Energy Center Alumni , n.d. Web. 29 Apr. 2015

with the advent of hot and cold air turbines, and early development of offshore wind were some of the factors contributing to this improvement. The common wind energy converter capacity rose from less than 100 kilowatts on average in the 1980s to close to 1 megawatt at the end of the 1990s (Kammer).

Figure 1: Evolution of rotors sizes and power output from 1980 to 2010

140 0 0 - 120 100

2

80-40 - 20-A 600 50kW 01 1980 1985Source: International Energy Agency (IEA)

1990 1995 2000 2

* Moss production

APrototypes

005 2010

Figure 2: Blade pitch control

Being able to adjust the pitch angle of a turbine broadens the range of wind speeds at which the wind turbine can be operated. When the wind is low, a smaller pitch can be used to maximize the energy produced. When the wind is strong, adjusting to a larger pitch allows the turbine to turn without over speeding. This is referred to as 'furling". Above survival speed, a stalling system will ensure that the turbine doesn't get damaged.

Full Low High Feathered Pitch Pitch 90

Beside technological breakthroughs, market trends also had a great impact on the development of the industry in the late 90s. The sole expansion of the market created self-reinforcing loops

(Figure 3) primarily leading to a decrease in costs. States such as California pioneered tax incentives for renewables energy with tax credits of up to 55% (Kammer). Finally, progressive grid integration offered more competitive returns for wind farm developers as it broadened the demand for such energy.

Figure 3: Market expansion self-reinforcement loops

Suppliers competition Suppliers

Cheaper supply

Costs Incentive to develop Development of -.-- Installed Capacity

new projects + Wind Farn

Learning + Learning curve effect

CR)

ScalingP

Economics of scale Manufacturing capacity

The benefits of wind

Wind is widely considered as one of the most promising renewable energy. Wind is ubiquitous, and can be found almost everywhere in the United States, with varying levels of intensity (figure 4). It is one of the cleanest: a study from the Intergovernmental Panel on Climate Change (Schlkmer et al.) estimates its lifecycle greenhouse gas emissions (including direct emissions, infrastructure and supply chain emissions, biogenic C02 emissions and methane emissions) per kWh to range from 7 g to 56 g of C02 eq/kWh for onshore wind and 8 g to 35 g for offshore wind. The median estimate for onshore and offshore wind production ranges from 11 to 12 g of

C02 eq/kWh. This is lower than any other energy source (figure 5). Solar power median

estimates range from 27 g of C02 eq/kWh for concentrated Solar Power to 48 g of C02 eq/kWh for photovoltaic. Hydropower lifecycle emissions are double that of wind while geothermal's are more than three times higher. Nuclear is the only source of energy that can compare with 12 g of

Figure 4: Wind Resource Potential in the United States (Schwartz et al.)

we PemIes wew S4m as

Cis. VWi- 0s I uavka T sib IWWI

p hos salid ecum dI-sdIy u iD

Figure 5: Life-cycle emissions of different energy technologies (Schl6mer et al.)

Direct emssions Infrastructure & supply Biogenic CO. emissions Metn essions Lifecyle emissions

Options Dtrect ermssins chain emissions and albedo effect Onhln ambes ons

Min/Median/Max Typical values Mm/Median/Ma

Currently Commercially Available Ti-chologies

Coal-PC 670/760870 9.6 0 47 740/820/910 Gas-Combired Cyde 350/370/490 1.6 0 91 410/490/650 Bioass-coifrsg n.. - - 620/740/890-Biomas-dedcaed . i 210 27 0 130/230/420 Geotheral 0 450 0 6.0/38179 Hydropower 19 0 88 1.0/24/2200 Nudeas 0 18 0 0 3.7/12/110

Coinntrated Solar Power 0 29 0 0 8.8/27/63

Solar PV-rooftop 0 42 0 26/41/60 Soiar PV-utity 0 66 0 0 18148/180 Wind onshore 0 15 0 0 7.0/11/56 Wind offshire 0 17 0 0 8.0/12/35 Pe-commercial Tenologies CCS-Co0-a xyiUei 14!76,110 17 67 1001160/200 CrS-Coai-pC 951120140 28 a 68 1901220/250 (CS---C GCC 100120f150 9.9 0 62 1701200/230 CCS-G Cyc-Comined Cyd 30/57/98 8.9 0 110 94/170/340 ocear 0 17 0 0 5.611728 000 4at 30-S TA.64 74 WT dI 4 Gee 40 TA- 74 $C3 -1 . RNO 801 M-1M I.$- " * ? A M T 0111111is se sW1000 "_ 2411. 5? $ON' wo, 60*0 WO a*$*"* 1.7-54

!1100 forow2t% VW *n46rOf a W 00a*nSf

= Mkakoaft! low W00A1de by

S 1 "111. 1 1 T't asoru"WIC

eewwwoneon fi ewtIvanmIs040 folftsr #*s

IAI seaon seasidn~sig mn4

Wind is also cheap relative to other renewable energies. Depending on the weighted average cost of capital used for the calculations, low/median/high estimates for onshore wind vary from

35/59/120 USD2010/MWh to 92/160/300 USD2010/MWh. It is significantly higher for offshore

wind with estimates ranging from 80/120/180 USD2010/MWh to 160/240/350 USD2010/MWh but

still lower than rooftop photovoltaic [74/150/180 USD20l0/MWh, 250/490/600

USD2010/MWh] or concentrated solar power [110/150/220 USD20l0/MWh, 220/320/480

USD201O/MWh]. Accounting for a carbon tax of 100 USD2010/tCO2eq, 10% WACC and a high

capacity utilization, onshore wind is cheaper than coal, combined cycle gas (51/84/160

USD2010/MWh vs. 97/150/210 USD2010/MWh and 69/120/200 USD201o/MWh) and comparable to

nuclear (45/99/150 USD201o/MWh). Without a carbon tax, offshore wind remains more

expensive than coal but only by a slight margin (110/170/250 USD2010/MWh vs 97/150/210

USD201o/MWh) (Schlimer et al.).

However, this is only a static vision of costs by energy sources. The cost of kWh from wind has steadily decreased over the past 35 years (figure 6) from 55 cents/kWh in 1980 to 6 cents/kWh in 2012. The slowdown in prices decrease around 2002 followed by a rebound is due to the upward fluctuations of oil prices that had an impact on installation and manufacturing cost for wind farm projects. 2012 prices for kWh are comparable to 2002 prices for kWh though oil prices are more than five times higher (1 10$/barrel in 2012 vs. 19$/barrel in 2002). This hints at large cost savings over the period to compensate for this increase. According to a recent study by investment bank Lazard (Lazard) on the US energy market, wind is now cheaper than any other source of energy with an unsubsidized levelized cost of 37 to 81 USD/MWh of electricity generated. With subsidies, the cost of wind energy ranges from 14 to 67 USD/MWh, compared to 61 to 87 USD/MWh for Gas Combined Cycle, the cheapest conventional energy source in the

Figure 6: US Deployment & Cost for Land-based Wind: 1980-2013 (US DOE 1) $70 ?f $40 U LU 0-U LU

11111

11.1111

5 Wind Trhnot ies Office LCOE: tdrd Rource ;Ced & Financing

erms (Excudes PC) C 40 30 > 20 20k) 201K

* Wind Market LCQE in Good to Excellent Wind Resource Sites (Excludes PT()

It is not yet clear today whether subsidies for renewable energies will be extended when they expire, but wind seems to have reached a point when it no longer needs them to be cost-efficient compared to conventional fossil fuels.

Risks and criticism

At the time Cape Wind was going through its approval process, the main argument against wind energy was its cost. In the early 2000s, the technological breakthroughs and the cost saving from operational efficiency were not yet sufficient for wind energy to compete with fossil fuels, let alone offshore wind. Today, offshore wind remains significantly more expensive than onshore wind and most fossil fuels. According to the Lazard's levelized costs of energy analysis (Lazard), offshore energy is twice as expensive as the highest estimate for onshore wind (162 USD/MWh). This is comparable to Integrated Gas combined cycle and cheaper than diesel

generators and conventional gas only. The cost of capital is two to three times higher than onshore wind (4,300 USD/MWh to 1,200-1,800 USD/MWh).

The second most common argument' against wind energy is its variability and unreliability. Effectively, there are uncertainties regarding the generation of electricity by wind turbines: the strength of the wind blowing on a given day and the energy generation from a given turbine. Though we can predict quite accurately the amount of wind on a given day based on meteorological observations, it does not make it a reliable resource, as it is not correlated with the grid's load curve. Wind varies on day-to-day, month-to-month and year-to-year bases. Most inconveniently, wind is highly volatile on shorter time frames. It can change direction or strength within minutes. Because of the turbines capacity constraints, this has a great impact on the overall energy generation. Low winds as well as very strong winds will cause the turbines to stop working (figure 7). Changes in direction also lead to stark changes in efficiency. In order to maintain a sufficient quantity of electricity input into the grid throughout a day or a month, it is therefore required to keep a certain number of power generators that can ignite rapidly enough to respond to a sudden shortage of wind. These generators are usually conventional fossil fuel plants as nuclear plants are very expensive to shut down and hydropower isn't reactive enough for this purpose. Opponents to wind energy therefore argue that it is neither economical nor green because of its reliance on secondary fossil fuel plants.

Figure 7: Turbine power curve (Wan)

Bellow 3 m/sec, there is not enough wind for the turbine to produce energy. The output increases from 0 kW at 3 m/sec to 1500 kW at 15 m/sec and then stays constant up to 22.5 m/sec. Above

0 1600 1400 1200 1000 B00 600 400 200 0 5 10 15 20 Wind Speed at 814 (m/s) 25 30

As previously stated, wind is ubiquitous. However, states are unequally gifted with wind resources, and the best spots are usually located far from large areas of population. In the US, most of the wind is concentrated in the Midwest, far from both the East and the West Coast (figure 4). This entails large investments in transmission lines to move the electricity to where it is needed.

Lastly, public perception of wind energy remains tainted by various concerns. There are some local environment concerns, as wind turbines need significant grid connection infrastructures that can affect the local environment during their construction. Residents have complained about the visual impact of the turbines, a growing concern proportional to that of the turbines size. They have also reported health issues related to the noise produced by the rotation of the blades. Combined together, these factors are believed to affect the property value of residents, which is why the strongest opposition to wind farm projects is often local. From an environmental point of view, wind turbines have caused bird deaths in the past, especially when they are located on avian migration routes. Lastly, military officials have raised a concern about the possible interference of turbines frequencies with airport radars (Zhang).

The benefits of offshore wind

Offshore wind, despite its higher cost, addresses some of the issues that are raised with onshore wind. The best winds are to be found on coastal areas (Pacific, Atlantic and Great Lakes). Not only are they stronger and steadier than those of the Midwest, but also they are closer to the cities where electricity is consumed, given that nearly 40 percent of the US population lives in a

4

coastal county .

Offshore wind also resolves most of the public perception problems linked with onshore wind. They are far enough from the coastline to not be heard by residents, making it easier to scale up. And they have little to no visual impact depending on their distance from the shore.

Latest and future innovation

While turbines design and electricity outputs are still following a learning curve, three secondary innovations could have even greater impact on the cost and reliability of wind energy.

The first one is purely financial. The cost breakdown of wind farms indicates that maintenance costs are relatively small compared to cost of debt and cost of equity (20% vs. 80%)5. Moreover, cost of debt is substantially lower than cost of equity. Therefore, promoters try to raise as much debt as possible. However, banks are weary of lending money for projects with very high revenue volatility. Insurance policies - developed by start-ups such as Resurety6 - that guarantee

operators a floor revenue when weather conditions are adverse, diminish the overall risk of investments and make it possible to add debt during the construction phase, reducing the overall cost of the project.

The development of smart grid technologies that collect instantaneous information on the demand and production of electricity throughout the day would also prove crucial to increase the value of wind energy, by reducing its downsides through better prediction and broader

' NOAA, «The U.S. Population living at the Coast >, n.d. Web. 29 Apr. 2015,

http://stateofthecoast.noaa.gov/population

5 Milborrow (2013), «Turbine advances cut O&M costs , Wind Energy Monthly, Web. 29 Apr.

2015, http://www.windpowermonthly.com/article/1183992/turbine-advances-cut-o-m-costs

integration. In Denmark (Kempener et al.), smart grid technologies have made it possible for wind to reach a 30% penetration rate, the world's highest.

Lastly, a lot of research efforts have been put in developing large batteries that would enable to store energy when the wind is blowing and release it when needed. Boosted by the proliferation of smartphones and electric cars more recently, lithium ion batteries have been envisaged to play that role. But the raw material needed to make them remains expensive (Lazard). Researchers have therefore been trying to develop batteries using other more abundant elements. At MIT, professor Sadoway and his research team have been working on an aluminum-magnesium battery capable of storing energy at just a fraction of today's cost. The first real scale tests for these batteries are scheduled to be held in 20157.

The Cape Wind Project

Birth of the project

At the turning of the millennium, Jim Gordon - a Boston entrepreneur who had founded Energy

Management Inc. in the 1970s and had successfully developed the business thanks to its early adoption of natural gas-fired power plants - decided to sell all his existing assets. He would use the proceeds of the sale to finance what he viewed as a revolutionary project for New England and the United States: building the first ever offshore wind farm in the United States off the South coast of Cape Cod (Vietor).

Offshore wind had just celebrated its tenth birthday anniversary in July 2001 (Rock) and was already widespread in Northern Europe. Denmark, Sweden and the Netherlands had completed several projects. The British Wind Energy Association had negotiated a set of guidelines with the Crown Estate for the future development of offshore farms (British Crown Estate). There was no such regulatory framework in the US, but Jim was confident he would quickly obtain approval and support. Massachusetts was a liberal state with an above average awareness for environment-related issues, and Cape Cod's taxpayers had been complaining about air pollution generated by

7 Chesto (2014), "Cambridge company's battery may give grid a boost", Boston Globe, Web.

http://www.bostonglobe.com/business/2014/12/30/cambridge-based-battery-maker-charged-for-manufacturing/Iz5kS7khBgBJ5 SolLSKHtI/story.html

coal and oil fueled power plants (Whitcomb et al.). In the summer, sanitary threshold were regularly passed.

Initial Plan

The initial project for Cape Wind was very ambitious at the time. Located in the Nantucket sound, off the south coast of Cape Cod near Mashpee, and north of Martha's Vineyard and Nantucket Island, it included 150 Siemens 2.8 megawatt wind turbines producing up to 420

megawatts (nameplate capacity) and an average of about 160 megawatts8. Had it been completed

before 2012, it would have been the largest offshore wind farm in the world. As a comparison, Middelgrunden (Larsen), completed in 2000 in Denmark, had a nameplate capacity of only 40 megawatts, more than 10 times lower than Cape Wind. Still in Denmark, Horns Rev, which was

completed in 2002, set a new record with a nameplate capacity of 160 megawatts9. Jim Gordon

expected Cape Wind to start generating power in 20049.

Hurdles

By no means had Jim Gordon anticipated the battles that were awaiting him. Affluent residents

of Cape Cod south shore and the islands quickly became aware of the project and objected to it. The farm was close enough to the islands for it to be seen from the shore (Whitcomb et al.). They feared it would ruin the views of Nantucket sound as well as hinder navigation in the area, which was at the time a good spot for yachting. By doing so, it would decrease their properties value. They also advanced historical arguments, stating that the "Nantucket Sound was a national treasure worthy of protection" (Whitcomb et al.). As early as 2001, they created the Alliance to Protect Nantucket Sound (The Alliance), comprising both Democrats such as Robert Kennedy

and famous Republican supporters such as industry mogul Charles Koch0. Its stated purpose

8 Cape Wind (2001), «New England's EMI plans 420 MW Nantucket wind farm >, Web. 29

Apr. 2015, http://www.capewind.org/article/2001/10/31/579-new-englands-emi-plans-420-mw-nantucket-wind-farm

9 Hornsrev, Web. 29 Apr. 2015, http://www.homsrev.dk/en

10 Seelye (2013), «Koch Brother Wages 12-Year Fight Over Wind Farm , NYT, Web. 2 Apr.

2015

was to support the long-term preservation of Nantucket Sound". They would become Jim

Gordon's fiercest opponents, filling more than 25 lawsuits and lobbying against Cape Wind.

Because the farm was to be developed in federal waters, but at the same time needed near-shore infrastructures, Cape Wind had to get approval from both federal and state and local jurisdictions.

At the federal level, the project needed approval from the US Army Corps of Engineers

(USACE) (US DOE 2). A permit application was submitted right from the beginning in 2001.

The USACE requested that an environmental impact study be conducted prior to giving its approval (US DOE 2). Starting in early 2002, data was collected and then discussed during heated public reviews, often opposing supporters of both sides. In November 2004 (US DOE 2), the USACE made available their draft Environmental Impact Statement (EIS). It seemed that Cape Wind had just obtained approval at the federal level. But, due to a change of legislation brought about by the 2005 Energy Policy Act and the amendments to the Outer Continental Shelf

Lands Act, the Department of the Interior - and no longer the USACE - would have authority to

issue permits and leases for this kind of project. Cape Wind would have to go through the whole process again, waiting for the newly competent Minerals Management Service (MMS) to issue

its own EIS (US DOE 2). Being subject to its own rules - specifically the National

Environmental Policy Act - the MMS determined that further investigations should be made and

that an independent contractor should conduct the surveys.

Concomitantly, Cape Wind was seeking approval from state legislators for its near-shore infrastructures. In May of 2005, the Massachusetts Energy Facility Siting Board (MEFSB) approved the transmission lines route project (MESFB). The Alliance challenged the decision but the Massachusetts Supreme Court upheld it in 200612. Though it secured approval from the Massachusetts secretary of Energy and Environmental Affairs (MEPA) in March of 200713

" Save our Sound, Web. 29 Apr. 2015 http://www.saveoursound.org/about us/mission/

12 Cape Wind, n.d. «Litigation History of Cape Wind Web. 29 Apr. 2015,

http://www.capewind.org/sites/default/files/downloads/Litigation%20History%20of'%/2OCape%2 OWind%2OMay%202%202014.pdf

13 Cape Wind, n.d. «Cape Wind Timeline , Web. 29 Apr. 2015

(contested by the Alliance and upheld in 2008), Cape Wind was then denied a Development of regional Impact (DRI) approval by the Cape Cod Commission (CCC) in October of 2007

(MESFB), asking for further environmental study.

By that time, the Minerals Management Service had finally finished drafting its own EIS (the

second after the USACE's). Once made public, the draft received more than 42,000 comments from opponents. Cape Wind would have to wait another year (January 2009) before the MMS made public its final EIS. As the final hurdles were being removed, Jim Gordon's efforts finally paid off at the State level in May 2009 when the MEFSB decided to overturn the CCC's decision

by issuing a super permit (MESFB). The Alliance appealed but the Massachusetts Supreme Court

upheld the decision in August 201013. During that period, opponents raised a new challenge asking the Department of Interior if Nantucket Sound was eligible to become a national park

(11/18/09). The National Park Service ruled it out in January 2010 (US DOI).

Approval from the Federal Aviation Association came in May 201014. There were fears that the wind turbines could interfere with the radio signals of a nearby military airbase but these concerns were dismissed. However, final approval was only granted in August of 201215 as a court of appeals for the District of Columbia had overruled the decision in October 2011 (Barnstable vs. FAA).

In the aftermath of the first approval by the Federal Aviation Association, the Alliance filed a lawsuit on the basis of the Endangered Species Act. Environmental impact, including potential risk for migrating birds linked to the wind turbines blades, was a major concern during the approval process. The case would finally be settled four years later, with the DC Circuit

16 affirming the FAA No Hazard Determination

14 Seelye (2010), «Massachusetts: FAA clears Wind Farm , New York Times, Web. 29 Apr.

2015, http://www.nytimes.com/2010/05/18/us/18brfs-FAACLEARSWIN_BRF.html

15 FAA n.d. Press Release, Web. 29 Apr. 2015

https://www.faa.gov/news/press _releases/news story.cfm?newsld= 13819

16 Brookes (2014), «Cape Wind wins long list of court decisions , Cape Cod Today, Web. 29

Apr. 2015, http://www.capecodtoday.com/article/2014/03/15/24515-Cape-Wind-wins-long-list-court-decisions

The lease was finally signed with Secretary of Interior Salazar in October 201017. In November, the Massachusetts Department of Public Utilities approved the Power Purchase Agreements

made by Cape Wind with utility provider National Grid'8. In January 2011, the EPA gave its

final green light to the project after the USACE issued a Section 10 permit (EPA).

With the permitting process finally completed, the developers would be able to focus their efforts on securing project finance. They would have to go through other legal battles though, as opponents tried to contest the Power Purchase Agreements, arguing that they would raise electricity prices for customers. The Massachusetts Supreme Court upheld these agreements in December 201118 and May 201419.

Where Jim Gordon's original plans were to start generating electricity by 2004, Cape Wind eventually had to wait 10 more years to be able to pass to the financing phase.

Current state

After years of litigation, the path for Cape Wind seemed to have been cleared. Jim Gordon had signed contracts with Utility companies National Grid and Eversource, which would have respectively bought 50%20 and 25% of Cape Wind's energy output. Expecting to raise the necessary funds by end of 2014, the production of wind turbines was supposed to start early

2015. But, as Energy Management Inc. failed to raise the money by the contract's deadline, and

17 Cape Wind (2010), << First U.S. offshore wind farm lease is signed by Secretary Salazar, issued to Cape Wind , Web. 29 Apr. 2015, http://www.capewind.org/article/2010/10/06/1090-first-us-offshore-wind-farm-lease-signed-secretary-salazar-issued-cape-wind

18 Reuters (2012), «Massachusetts OK's Cape Wind/NSTAR power purchase pact , Web. 29

Apr. 2015, http://www.reuters.com/article/2012/11/26/us-utilities-capewind-nstar-idUSBRE8AP17P20121126

19 Cape Wind (2014), «Federal Judge Dismisses Lawsuit against Cape Wind , Web. 29 Apr. 2015, http://www.capewind.org/node/1748

20 National Grid, n.d. «National Grid and Cape Wind Sign Power Purchase Contract , Web. 29

subsequently terminated construction contracts, National Grid and Eversource unilaterally terminated the contract.

Until further negotiations, the project is suspended. But Jim Gordon has already pledged to keep on fighting, stating that the delays Cape Wind went through because of litigation were force majeure and therefore not valid reasons for termination2 2. Late February, he organized a rally in

Boston and, with the help of a Cambridge's based organization2 3, gathered nearly 100,000

signatures for a petition asking Marcy Reed of National Grid to reinstate the contract. Meanwhile, the first offshore wind farm has started construction in Rhode Island.

Because it went through so many obstacles, Cape Wind is a good example that can help us identify success and failure modes of renewable energy projects. We hypothesize that lack of regulatory framework, rallying national support at the expense of securing key local support, and controversial choice of location were the main shortcomings in the project.

Identifying success and failure modes of large energy projects

Lack of regulatory framework

When looking at the litigation history of Cape Wind, it is striking to see the lack of regulatory framework for these kinds of projects. In some sense, Cape Wind made a precedent for the future. Two elements in particular have caught our attention: the fact that the competent

21 Abel (2015), «More doubt is cast on Cape Wind plan , Boston Globe, Web. 29 Apr. 2015

http://www.bostonglobe.com/metro/2015/01/24/cape-wind-terminates-additional-contracts-casting-more-doubts-project-viability/voEIRKmjXziMT5HAoM41KN/story.html

22 Abel (2015), «Cape Wind's future called into question , Boston Globe, Web. 29 Apr. 2015

http://www.bostonglobe.com/metro/2015/01/08/legal-wrangling-horizon-for-cape-wind-after-major-utilities-pull-out/kIEXaT5x4lkfUplijpdtsL/story.html

23 Crimaldi (2015) « Cape Wind vows to move project forward , Boston Globe, Web 29 Apr.

2015

http://www.bostonglobe.com/metro/2015/03/01/cape-wind-vows-continue-work-project/aeFotet5lyA5BSKgHqfngK/story.html

24 Kuffner (2015) «R.I. officials mark start of first offshore wind farm in U.S. , Providence

Journal, Web. 29 Apr. 2015

http://www.providencejoumal.com/article/20150427/NEWS/150429334/13748http://www.provi dencejournal.com/article/20150427/NEWS/150429334/13748

administrations to give authorization evolved throughout the project (the EIS was first drafted by the USACE and ended having to be redone by the MMS) and that there was no public tender for the attribution of the construction sites. The latter weakened the reputation of the project, giving its opponents the opportunity to denounce cronyism and suspicious contracts. The former might have been a source of delay for the approval process by giving additional time for opponents to file lawsuits. Though this cannot be imputed to Jim Gordon, he might have derisked the project

by starting with a smaller scale wind farm, laying the regulatory foundations for a future

extension.

Failure to secure key local support

From the beginning of the project, it seems that Jim Gordon abandoned efforts to convince local residents of Cape Wind south shores and the islands to rally his project. Instead, Cape Wind's communication's strategy was more targeted at the general public. In August 2007 for example,

Cape Wind was featured in Jason Jones' daily show2 5

. The show was heavily pro-Cape Wind,

picturing its opponents as super-rich - not-in-my-backyard - WASP coveting their privileges. It

also made fun at the allegation of visual impact of the project. Though these efforts might have helped raise awareness of the project on a national scale, we believe it did little more than antagonize the existing sides. Another possible path would have been to secure local support first; targeting key influencers with aligned political agenda and turning them into heralds for the project. Most of the containment efforts against the project came from the people who would have been most affected by the project. We hypothesize that the marginal benefit of convincing

one of them largely exceeded that of rallying support from Californian residents.

Location

The choice of location for the project was driven by a rigorous analysis of estimated costs,

revenues and environmental impacts of the project (DOE 2). Installing the wind turbines farther

from the shore was not a viable economic option, as it induced increased costs from installing turbines in deeper grounds and longer expansive High Voltage Direct Current transmission lines.

25 Cape Wind, n.d., «Daily Show, Jason Jones 180 -Nantucket ,

Web. 29 Apr. 2015 http://www.capewind.org/video/daily-show-j ason-j ones- 180-nantucket

However, Jim Gordon assumed that he would encounter less resistance for his project in a liberal state rather than in a more conservative state. This however was not necessarily true. Wind energy has seen most of its development in conservative Midwest states, where large energy production sites such as oil and shale gas rigs as well as refineries are commonly sighted in the landscape. Southern Atlantic coal dependant coastal states could have been an easier first target.

Model and Discussion

Causal Loop diagram

The goal of our model is to identify the drivers of success or failure of gaining approval and raising funds for a large offshore wind project. In order to do so, we started by building a simple causal loop diagram to evidence the reinforcing loops that exist between public support and the financing process of a large clean energy project (figure 8). It excludes the particular dynamics of public support and the details of the financing process. We can identify two powerful reinforcing loops: the "follow the tide" and "abandon ship" loops. As the project gathers ever more regulatory support, investors have more financial certainty and start comitting capital to the project. These investments are a signal that the project will eventually be completed and is inevitable. To be on the winning side, some former opponents rally the project. Regulators then consciously or inconsciously follow the tide of public opinion. "Abandon the ship" is the exact opposite loop, where opposition manages to slow the regulatory process, leading to less financial certainty for potential investors. Because of that, they withdraw from negotiations or make public statements against investing in the project, sending a negative signal to the general public. As the project future looms, former advocates start questioning it and support further wanes.

Figure 8: Causal loop diagram of support and financial dynamics

Support Opposition

Follow the tide Reguoaco sfp4r Abandon ship

PrOmohtiOnl 01f

+ renewable energies

AdTcanical crtaie

Adasageou s Technical concerns / Change of

p a a t techn o lo g y

Market Cheap money Financial certainty

conditions

Costs

Availability of financing

Secondary but no less powerfull loops are the "Promotion of Renewable Energies", "Cheap money" and "Technical concerns". As support grows for the project, so does regulatory support like in the previous loops. This leads to more legislation in favor of renewable energies, such as subsidies or obligation for grid operators to favor green energies over conventional ones. The result of that is more advantegeous Power Purchase Agreements; therefore better expected revenues and more financial certainty. This then feeds back into more support. More financial certainty also leads to better availability and cost of financing, as more institutions are willing to fund the project and therefore compete for it. By reducing the cost of capital, it then feeds back into the financial certainty of the project thanks to increased Net Present Value. On the other side, if technical certainty for the project decreases because of exposed misestimates or increased constraints on the project, financial certainty decreases, fostering more opposition, and raising new regulatory barriers that will further increase constraints on the project and ask for more reviews its technical aspects. It is interesting to note that while the adoption of a new technology for cost purposes increases the financial certainty of the project, it can also reduce it by forcing the promoter to conduct new studies and impact estimates, triggering the technical uncertainty

loop.

--This simple causal loop diagram gives us a sense of the dynamics around the project. In order to be able to simulate different paths to securing approval and financing, we need to define input variables and build a working System Dynamics model.

Defining variables Output variables

Final Approval: a 0/1 variable indicating if the project has gained regulatory approval

Financial certainty: a variable indicating if the project is able to secure financing. Financing is

considered secured when Financial certainty equals 1.

We stop running the model when both variables reach 1. The final outcome is the Time it took from Design to Construction. We want to test for a set of input variables to see which ones affect Time of the project the most.

Input variables

Each of these 4 variables is set with an initial value and evolves during the simulation.

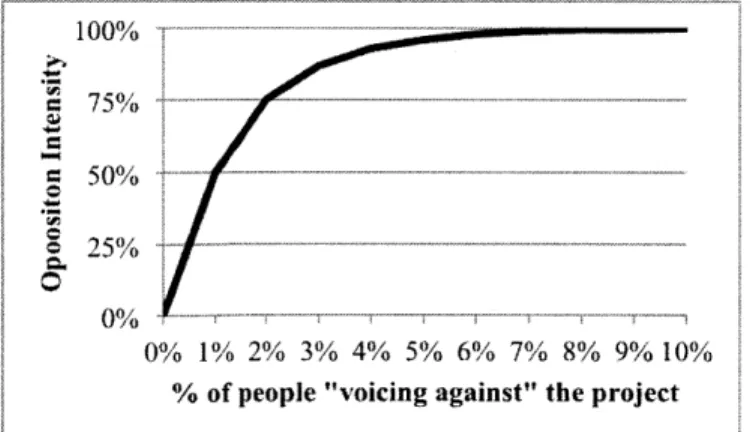

TableA, TableF: tables representing the marginal intensity of a 1% change in voicing opposition

or support

Figure 9: TableA

A very small minority of vehement opposition can suffice to generate a strong lobbying

movement. This is what we have tried to incorporate into our model with a diminishing marginal lobbying curve. With 1% "Voice Against", the intensity of the lobbying is 50% of its theoretic

maximum. With 2%, this increases to 75%, etc. Above 10%, we consider that additional

opponents have no impact on lobbying.

100%

50%

75% ---- --- ... ... - ---...

0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 10%

Init Strongly Against, Init Strongly in Favor: The initial proportion of residents actively advocating against or for the project

Initial percentage in favor: The initial proportion of residents in favor of the project including

"Voice in favor", "In favor" and "Lean in favor" (see below). Initial percentage against is equal to 100 - Initial percentage in favor. We start with 0 "In favor" and 0 "Against"

Legislation in place: a 0/1 variable indicating if the legislation is already in place. When equal 0, the three approval processes occur in sequence, indicating a trial and error approach. When

equal to 1, the legislator already knows the extent of the approvals needed and several processes can start at the same time. The overall theoretical procedure time is the same in both cases though (27 months, or 3 times 9 months)

Change technology: a 0/1 variable indicating if we choose to change technology after the

second one becomes more profitable.

Ramp end time against, Ramp end time for: the time it takes for opponents and advocates of

the project to reach 100% of their respective lobbying efficiency.

Computation variables

The next set of variables is variable that change during the simulation and are used to calculate our output variables.

Voice against, Voice in favor: a dimensionless variable indicating the percentage of the local

population who advocate against or for the project.

Against, In favor: a dimensionless variable indicating the percentage of the local population

who have a strong opinion against or for the project, but who do not actively participate in the debates.

Lean in Against, Lean in favor: a dimensionless variable indicating the percentage of the local

population without a definitive opinion against or for the project

Become against, become in favor: the rate at which people "leaning in favor" / "leaning

CA, CF: the rate at which people "leaning against" / "leaning in favor" change to "Against" / "In

favor"

CVA, CVF: the rate at which people "Against" or "In Favor" become advocates for their cause,

in percentage/Month. Both can be positive or negative.

IntensityA, IntensityF: a dimensionless value between 0 and 1 indicating the strength of public

opposition or public support for the project. IntensityA is 0 if nobody is strongly opposed to the project and 1 if everybody is.

LobbyingA, LobbyingF: a dimensionless value between 0 and 1 indicating the overall strength

of lobbying against / in favor of the project.

Time remaining to get permit i: the number of months remaining to get permit i.

Procedure i slowing rate: the speed at which opposition manages to delay the approval process. Adoption of new Technology: 3 extra months added at time t =50 to each procedure if we

decide to adopt the new technology.

Expected remaining time for approval: the theoretical remaining time for approval at a given

moment, taking into account the procedure slowing rate. Expressed in Months.

Net Present Value of project: a financial indicator of the value of the project, in USD.

Availability of financing: a dimensionless variable between 0 and 1 indicating the attractiveness

of the project. It is also called Financial certainty.

Investment cost: the investment cost for the wind farm, in USD. It is based on the desired

capacity and the technology adopted at time t.

EfficiencyA and EfficiencyF: a dimensionless variable indicating the level of organization of

each camp from 0 to 1 that affects the power of their lobbying efforts.

Settings variables

These are variables that we don't test during our simulation. We try to calibrate them to make the model as close to reality as possible.

WACC: the weighted average cost of capital -used as our discount factor in our NPV calculation. We have set it to 0.009 per month for an annualized 11% (Kopp).

Change time: the average time in months it takes for someone leaning on one side to change to

the other side when lobbying is at its maximum. The stock of people leaning on one side is depleted following a first order delay. We have set it to 6 months.

Change time strong: the average time in months it takes for someone "against" or "in favor"

one side to become and advocate when lobbying is at its maximum. We have set it to 12 months

SPT and SPT all: standard procedure time of one procedure and standard procedure time of the

whole approval process. "SPT" is 9 months when there is no regulatory framework and 27 months otherwise. "SPT all" is always 27 months.

Procedure i completion rate: the speed it takes for a procedure to be completed. As we have

defined the procedure as a number of months, this variable is dimensionless and equal to 1.

Cost of tech 1 and 2: we simulate a scenario with 2 available technologies. The first one is

cheaper than the other one in the beginning but its cost reduction potential is lower than the other one. They are expressed in USD/MW. Tech 1 starts at 6,000,000 USD/MW and Tech 2 starts at

8,000,000 USD/MW.

Ti and T2 min cost: the minimum theoritical costs for technology 1 and technology 2. They are

expressed in USD/MW. 5,000,000 USD/MW and 4,000,000 USD/MW. (Lazard)

Cost reduc pot 1 and 2: the cost reduction potentials of technology 1 and 2, corresponding to

the difference between the cost of technology and the minimum cost of technology for each one. They are expressed in USD/MW.

Speed 1 and 2: the speed of cost reduction for each technology.

T1 and T2 cost reduction: the cost reduction of each technology every month, determined by the cost reduction potential and the speed of cost reduction. It follows a first order delay function. Expressed in USD/MW/Month.

Desired Capacity: the desired actual capacity (by opposition to nameplate capacity) of the wind

farm, in MW. We set it to 160 MW, the desired capacity of Cape Wind.

Cost of MWh and MWMonth: the costs associated with operating and maintening 1MW of

power during one hour or one month.

Monthly OM: the costs associated with operating and maintening the wind farm.

Price of MWh and MWMonth: the price the wind farm can expect to sell its MWh or

MWMonth to the utility grid.

Subsidies per MWh or MWMonth: the additional revenues the farm can expect for 1 MWh or MWMonth of power sold.

Monthly expected returns: the overall revenues the farm can expect during one month, in

USD/Month.

Base NPV: a base NPV to which the actual NPV is compared in order to give an indication of

Model overview

Our model is made of 4 different views. Equations for each variable can be found in appendix.

Figure 10: View I - Dynamics of support

Ramp End Time For

Initial per in fav

EfficiencvF

* niy ,Change time Strong

Against 2t Voice.Against rCA tableA i t LobbyingA Le an Against

/

Z Effic icyA cntage Borin aor Become again.t

Ramp End Time Again

RD

Lean In FavorLobbyingF

tabeF CFu

IntensityF

Voice in Favor In Favor

Cie

Finacialcert nty Cbhange time Strong>

--- Lob ingA

kst W_

I

Figure 11: View 2 - Dynamics of legislative process

Proced. 2 Procedure 3

rProcedure Io in te loing rate

slowing rate s g

Tiermiigt ime reann to Time remaining to gperritrI get pennit 3

Procedure 2 Procdure 3

Procedure 1 otrt cop ompletion rate

rocomptetion rate

Icompetio rat

- *Final Approval

Figure 12: View 3 - Dynamics of technology and financing

Expected remaining time for approval

Al> Availability of Financial certainty financiny

Base NPV

a Prsent Value of Project +

WACC

cost reduc pot 1 4V-- tI min cost

speed I

Cost of tech 1

ii cost reduction N

Desired capacity -- htinvestment cost

Cost of tech 2

t2 cost reduction

speed 2

cost reduct pot 2 - t2 min cost

Cost of NVh Cost of MWMonth Monthly OM costs Monthly expected return. Subsidies per Subsidies per MWh Price of MWmonth Price of MN%

ap ETm C1 A,l t " 12 a-0 p nt wl, Itt t!R C t " On u i aslat-A ic Cfst if MWi--Su xdispr MlWl, JC (o Lobbying 5 0 0 36 72 108 144 Time (Month) lx .n.A: C nr. LN tC -Intensity of lobbying .5 0 0 36 72 108 144 Time (Month) ntinA : nnrnt IntnsjynJ a m -- ~~ -~~ ~ ~~- ~ - ~~~ Permits 0 Month 0 dmn -0 3 6 72 108 144 Time (Month) 1=4 rn n N nnk tcurvea Tt-u rcsnartn V) rz 'aruit 2: Curni'WZA

in rnin i Curu

Fppavc' rmn-g rs lwpp,,At Climm. Fral Appnv': Curmia

Voice Lean Decided

9 60 40

." 2 ~ 20

0 s

0 36 72 108 144 0 36 72 108 144

0 36 72 108 144 Time (Month) Time (Month) Time (Mont

V Fcam C rt -L n Ti. -me (Monh)

Cu r = 1" ir-- --- Lwm:c ra --- ~-Apnecra m NPV 900 M 450 M 0 0 48 96 144 Time (Month) Ne prrnn Valhne dnpr -n: (%r% In'nvm a-t : C-n ---. Cost of technology 4M 3M 2 M 0 36 72 108 144 Time (Month) CO ast 1-gh I : Cunrm Ct nina C-h 2: OC-n-nt Financial certainty .5 0 0 36 72 108 144 Time (Month) Fitnncial cuainy D w m II Cu 0 ,0 Cu en

Simulations

Base case scenario: our base case scenario is not supposed to reflect the exact dynamics of the

actual project but tries to approximate them. In this scenario, we assume that advocates of the project had a head start compared to opponents and managed to organize their lobbying structure in 6 months, compared to 12 for opponents. We estimate a conservative first split of 2% "Voice against", 48% "Lean Against", 48% "Lean In Favor" and 2% "Voice in favor". Legislation is not in place but a change in technology occurs during the project.

Figure 14: "Base Case" Public Opinion

Voice Lean Decided

9 60

0 36 72 108 144 0 36 72 108 144

Time (Month) Time (Month) 0 36 72 08 44 Evolution of public opinion: overall, as time goes on, opinions get more polarized. There is a decrease in people leaning on one side and an increase in both decided and advocates. The rapid increase in people leaning in favor of the project is related to the difference in time to organize for both parties (6 months vs. 12 months). After that period, they both reach cruise mode and the gap is reduced. It takes more than seven years for the population of residents voicing against the project to start decreasing. The change in technology after month 50 gives a new boost to opposition, as the financial certainty of the project is reduced due to new studies having to be conducted.

Figure 15: "Base Case" Lobbying

Lobbying

Intensity of lobbying

0 0

0 36 72 108 144 0 36 72 108 144

Time (Month) Time (Month)

Lobbying: Lobbying rapidly increases for both advocates and opponents in the beginning as

efficacy reaches 100% for each. It then stabilizes over the whole period, with a slight boost for opponents when technology is changed. Both lobbying against and intensity of lobbying against start to decline quickly after year 10, when few regulatory obstacles remain for the project to be granted approval (follow the tide loop).

Figure 16: "Base Case" Financing

Financial certainty

S.5

S 36 2(M4

0 36 72 108 14

Time (Month)

Financial cranty : Curent

Financial certainty: financial certainty progressively increases as the project is advancing

through its regulatory process and NPV of the project is decreasing from declining technology costs. It increases faster in the first year because opposition lobbying is not yet in place to slow the process. After month 50, financial certainty drops abruptly because of the added time the new technology adds on the regulatory process. In the end, as the voicing opposition vanishes, financial certainty increases more rapidly (follow the tide loop). It should be noted that we haven't incorporated PPA in our model for simplicity purposes. Loosing the PPA is what finished Cape Wind, but it is not represented here as financial certainty doesn't drop at the end.

Figure 17: "Base Case" Permits timeline

Permits

30 Month I dnn O Month, 0 dtnin _____________L_____ 0 36 72 108 144 Time (Month)T--e renA~g pe.-rm -nt :- CurventM

iL Aph I

Cr dnl

Permits and approval: The overall process takes more than 14 years. Permit 1 is obtained faster

than Permit 2 as some of it is processed at a time when the opposition is not yet organized. The technology change largely increases the overall delay. Permit 3 is obtained rapidly at the end as the opposition is vanishing. There is a flexion point in the Process of obtaining permit 2: when the proportion of people voicing against the project starts decreasing, lobbying against the project decreases and Permit 2 processing speed starts increasing again. The marginal importance of people stopping to voice against the project increases as the proportion diminishes because of the intensity table.

Figure 18: "Base Case" NPV and Technology cost

NPV

Cost of technology

900 M 4 M 2 M 600 M 0 36 72 108 144 Time (Month)Time (Month) c 1e:ca'

NPV: the NPV of the project increases because of the declining cost of technology. When the project leaders adopt the new technology, they make a significant gain in NPV When the project gains approval, NPV stands around $850 million.

No technology change scenario: in this scenario, we only assume that we stick with technology one throughout the project.

Figure 19: "No Tech Change" Scenario Key Parameters

Voice Lean Decided

20 60 50

25

0 0

0 36 72 108 144 0 36 72 108 144

0 3 6 M2 T1 (L T4 4

Time (Month) Time (Month)0 36 7 10 14

____- ~Time ~W (Month) NPV 80D M 700 M 600 M 0 48 96 144 Time (Month) Nv Pram ue xrq C-z-n-. Cost of technology 4 M 3 .M 2 M 0 36 72 108 144 Time (Month) Cca a I cu Financial certainty 0 0 36 72 108 144 Time (Month)

Financial ce.ainy : Cami

Evolution of public opinion: compared to the previous scenario, the overall trends in public opinion are similar but opposition decreases more rapidly. Around month 50, voicing opinion is already declining and the absence of a boost from technology change accelerates its fall. Similarly, lobbying against decreases well before and financial certainty reaches 100 just after 96 months. The NPV of the project at approval is significantly lower than in our base case scenario

though (~$ 750 M) because the cheaper technology has not been adopted.

Figure 20: "No Tech Change" Scenario Permits Timeline

Pennits

30 Month I dmnl 0 0 0 36 72 108 144 Time (Month) Tile rrai mit I CurentTe prmit 1: Current

EX e d rA .. rrl: C vr

Final Appr0v :Currerl Month dmnl

Overall, permits are obtained almost twice as fast as in our base case scenario (around 8.5 years), even though only a third of the theoretical time (9 months) is removed. The project is at a tipping

point around month 50, about to accelerate. In this case we let the acceleration take place

whereas we delay it in the base case.

Eco-friendly scenario: in this scenario, we start with a greater proportion

favor of the project (60% compared to 50% in the base case)

Figure 21: "Eco-friendly" Scenario Key Parameters

30 0 0

Permits

7 -,-N-0 36 72 108 144 Time (Mornb) lxrnp- i't ps1Crm\< 'F:n, Lrrrt CU mma Month dmn Month dmnI of people leaning in 0 36 72 108 144 Time (Month)With a 20% gap between people originally leaning in favor of the project and people originally leaning against the project, the overall duration of the project is only reduced by 20 months. As we can see on this graph, that is because the original gap is rapidly closed because lobbying against the project has a greater impact than lobbying in favor as the pool from which it can move people is higher. This is the balancing loop represented in figure 8.

Lean

0

K

Strong advocacy scenario: in this scenario, we increase the proportion of people advocating for

the project by 25% from 2% to 2.5% in the beginning

Figure 22: "Strong Advocacy" Scenario Permits Timeline

Permits

30 0 0 Month dmnI Month dmnI 0 36 72 108 144 Time (Monh)Tim rmmz permit Iur: k

T11e r i permit 2 Cur - - -

-Tme -emiras prmit 3 Curzew.

. n . n. g Im n r : n al : CarL --

-Firal A-prav,-: Current d:-n

Similarly, the overall duration of the project is only reduced by around 2 years. The reason behind it is that the additional advocates have a much smaller marginal contribution to lobbying than the base ones, and therefore don't impact public opinion as much.

Targeted opposition diffusion scenario: in this scenario, we decrease the proportion of people

advocating against the project by 25% from 2% to 1.5% in the beginning Figure 23: "Targeted Opposition Diffusion" Scenario Key

Permits

30 Month

I dmnl

0 36 72 108 144

Time (Month)

Tim reaing ageFpemit I Currmn o

Th. 'raermit I Currin1 \ .

E r r. prm aCrirni, EpI ~rimi ~..un~gtiM

0 0

Month

dml