3

9080

03149

0581

HB31

.M415

Digitized

by

tine

Internet Arciiive

in

2011

with

funding

from

Boston

Library

Consortium

IVIember

Libraries

HB31

*'^'^

.^

Massachusetts

Institute

of

Technology

Department

of

Economics

Working

Paper

Series

The

Age

of

Reason:

Financial

Decisions

Over

the

Lifecycle

Sumit Agarwal

John DriscoU

Xavier

Gabaix

David

Laibson

Working

Paper

07-March

15

2007

Room

E52-251

50

Memorial

Drive

Cambridge,

MA

02142

This

paper can be

downloaded

withoutcharge from

the SocialScience

Research

Networl<Paper

Collection atThe

Age

of

Reason:

Financial Decisions

Over

the

Lifecycle

Sumit

Agarwal,John

C.Driscoll, Xavier Gabaix,and David

Laibson*CurrentVersion:

March

19,2007

Abstract

Thesophistication of financial decisions varieswithage:middle-agedadultsborrowat lowerinterestratesand payfewerfeescomparedtoboth youngerandolder adults.

We

documentthispatterninten financialmarkets. Themeasuredeffectscan notbe explained by observedriskcharacteristics.Thesophistication of financial choicespeaksatabout age 53inourcross-sectional data. Ourresultsare consistentwiththehypothesisthat financial sophisticationrisesand thenfallswithage,althoughthe patterns thatweobserverepresent

amixofageeff'ectsandcohorteffects. (JEL:Dl, D4, D8, G2,J14).

Keywords: Household finance,behavioralfinance, behavioral industrial organiza-tion,aging, shrouding, autoloans,credit cards,fees,

home

equity,mortgages.*Agarwal: Federal ReserveBankofChicago,sagarwal@frbchi.org. Driscoll: FederalReserve Board, john.c.driscoll@frb.gov. Gabaix: MIT,Princetonand

NBER,

xgabaix@princeton.edu. Laibson: Har-vardUniversityandNBER,

dlaibson@harvard.edu. Gabaix andLaibson acknowledge support fromthe NationalScienceFoundation(Human

andSocialDynamicsprogram). Laibson acknowledgesfinancial supportfromtheNationalInstitute on Aging (ROl-AG-1665). Theviews expressedin thispaperare thoseoftheauthorsand donot represent the policies or positionsoftheBoardofGovernors ofthe Federal ReserveSystem or the FederalReserve BankofChicago.We

thank DavidCutler, Timo-thySalthouse,Fiona Scott-Mortonandparticipants at the InstituteforFiscal StudiesandtheNBER

(Aging group)fortheircomments.1

Introduction

Performance tends torise

and

then fallwithage. Baseball playerspeak in their late20s (Fair 2005b,James

2003). Mathematicians, theoretical physicists,andlyric poetsmake

theirmost

importantcontributions aromid age30 (Simonton 1988). Chess players achieve their highestrankingintheirmid-30s (Charness and Bosnian 1990). AutocraticrulerslikeQueen

ElizabethI aremaximally effective in theirearly 40' (Simonton1988). Authorswritetheir

most

influentialnovelsaroundage 50(Simonton 1988).^The

presentpaperstudiesan activitythatisrelevant totheentire adult population: per-sonalfinancialdecisionmaking.Most

financialproductsare complex anddifficultto under-stand. Fees areshroudedand

the true costs of afinancial servicesarenoteasilycalculated.Making

the bestfinancial choices takesknowledge, intelligence,and

skill.This paper

documents

cross-sectional variationinthe prices that peoplepay forfinancial services.We

find thatyounger adultsand older adultsborrowat higherinterestratesand

pay

more

feesthan middle-agedadults controUingforallobservablecharacteristics, including measuresofrisk.The hump-shaped

patternoffinancialsophisticationispresentinmany

markets.We

study interestratesinsixdifferentmarkets: mortgages,home

equityloans,home

equitycreditlines,auto loans, personal credit cards,

and

small businesscredit cards.We

study the failure to optimally exploit balance transfercreditcard offers. Finally,we

studythreekinds ofcredit cardfees: latepayment

fees, cash advance fees, and over limit fees. All ofthe evidence available to us implies ahump-shaped

patternof financialsophistication, withapeakinthe early50s.Age

effects provideaparsimonious explanationforthehump-shaped

pattern offinancial sophistication.We

hypothesize that financial sophistication depends on a combination of analyticabilityand

experientialknowledge. Researchoncognitiveaging implies that analytic ability follows a declining (weakly) concave trajectory after age 20.We

hypothesize that experientialknowledge follows an increasingconcave trajectory due to diminishingreturns.Adding

together these two factors implies thatfinancial sophistication shouldrise and thenfallwithage.

Cohorteffects

may

alsoexplainsome

oftheeffectsthatwe

observe. Differences in educa-tional levelsmay

explainwhy

older adults arelessfinanciallysophisticatedthan middle-aged adults. Naturally, such educationeffects willnot explainwhy

young

adults (aroundage 30) are lesssophisticatedthan middle-aged adults. Additionalwork

needstobedonetoidentify'Whatabouteconomists?Tothe bestofour knowledge, onlyNobel(Memorial) Prize winnersseemtohave beenstudied.Weinberg andGalenson (2005)findthat "conceptual" laureatespeakatage43,and

therelativecontributions ofageeffects

and

cohorteffects.The

paper hasthe following organization. Section2discussesevidenceoncognitiveperfor-mance

fromthepsychologyliterature. Section 3 describes the basic structuretothe empirical sections.The

next ten sections present results for interest rates onsix different financial products, threedifferentkinds of creditcardfeepayments,and onthe use ofbalancetransfer credit cardoffers. Section 14 usesalltensetsof resultstoestimate the ageofpeak sophistica-tion. Section 15 discusses other findingsontheeffectsofagingand

thedifficulty inseparately identifyingageeffectsand

cohorteffects. Section 16 concludes.2

Aging

and

cognitive

performance: Results

from

medical

and

psychological

research

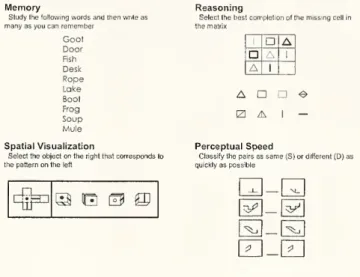

Analytic ability can be measured in

many

different ways, including tasks that measurememory,

reasoning,spatial visualization,and

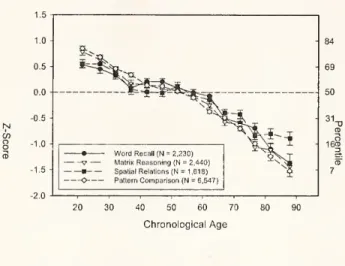

speed(seeFigure1).Analyticperformance shows a strong age patternincross-sectionaldatasets. Analyticperformanceisnegatively correlated withageinadultpopulations (Salthouse2005and

Salthouse forthcoming): onaverage analytic performance fallsbytwotothreepercentofone standard deviation^ withevery incremental year ofageafterage20. Thisdeclineisremarkablysteadyfromage20 to age 90 (seeFigure2).

The measured

age-related decline in analytic performance results from both age effects and cohort effects, but the panel datathat is available implies thatthedechne is primarily driven by ageeffects (Salthouse, Sclu-oederand

Ferrer2004).'^ Medicalpathologies represent' one importantpathway

for age effects. For instance, dementia isprimarily attributable to Alzheimer's Disease(60%)and

vascular disease (25%).The

prevalence ofdementiadoubles witheveryfive additionalyears oflifecycleage(Fratiglioni,De

Ronchi, Agiiero- Torres, 1999). Age-drivendeclines inanalytic performancearepartially offsetbyage-driven increases in experience. Ifgeneral taskperformanceisa function of both analyticabilityandexperiential knowledge,thengeneraltaskperformanceshouldfirstincreasewithage (aspeopleaccumulatemore

earlylifeexperience),and

thendecline (as experience saturates).'' Figure 3illustrates thismechanism.The

currentpaperteststhehypothesis that general taskperformanceshould followahump-shapedpatternwithage.

We

focusonfinancialdecision-making. Because ourfinancialmarket'Thisisastandard deviation calculatedfromtheentirepopulationof individuals. ''SeeFlynn(1984)fora discussionofcohorteffects.

''

SupposeAnalyticPerformance(AP)

=

a—faxage,andExperience=

c-I-dxage,whiletotalperformanceMemory

study the followingwords andthienwriteas

manyasyoucanremember

Goat Door Fish Desk Rope Lake Boot Frog Soup Mule SpatialVisualization

Select the objecton theright thatcorrespondsto

the patternontheleft

cfa

Q B g

Reasoning

Select thebestcompletion of the missingcell in

the matrix !

n A

D

A

1A

1A

D

O

!Z1A

I—

PerceptualSpeedClassify thepairsassame(S) or different(D)as

quicklyas possible

Figure 1: Four

IQ

testsusedtomeasurecognitiveperformance. Source:Salthouse (forthcom-ing)-dataspana short

number

ofyears,we

areunabletodecompose

the relativecontributions of ageandcohorteffects.3

Overview

We

document

aU-shaped

curveinfinancial "mistakes" over the lifecyclein ten separate contexts:home

equity loansand

linesof credit; autoloans; creditcard interest rates; mort-gages; small business credit cards; creditcard latepayment

fees; creditcard over limit fees;creditcardcashadvancefees;

and

use ofcreditcardbalancetransferoffers.We

diagnose mistakesinthree forms: higherAPRs

(interest rates);higherfeepayments;and

suboptimaluse ofbalancetransferoffers.For eachapplication,

we

conductregression analysisthatidentifiesageeffectsandcontrols for observable factors that mightexplain patterns offeepayments

orAPRs

byage. Thus, unless otherwise noted,ineachcontextwe

estimate a regressionofthe type:(1)

F —

a

+

/3X Spline{Age)+

-yx Controls+

e.Salthouse Studies-MemoryandAnalyticTasks 1.5 1.0 -0.5 -0.0 -0.5 --1.0 --1.5 -2.0 V-

—

MatrixReasoning(N =2.440) SpatialRelations (N =1,611 PatternComparison(N = 6,547) 69 50 CD leS 7 20 30 40 50 60 70 80 CiironologicalAgeFigure2:

Age-normed

resultsfrom fourdifferentcognitivetests.The

Z-score represents the age-contingentmean,measured

inunits ofstandarddeviationrelativeto thepopulationmean.More

precisely, the Z-scoreis (age-contingentmean

minus populationmean)

/ (population standarddeviation). Source: Salthouse (forthcoming).Cognitive capital Task Performance Experiential capital

Performance

Analytic capitalAge

Figure3: Hypothesizedrelationbetweengeneral taskperformanceandage. Analytical capital declines with age and experiential capital increasewith age. Thisgenerates the hypothesis thatgeneral taskperformance (whichusesboth analytical

and

experientialcapital)firstrisesisa vector of control variables intended tocapturealternativeexplanationsineachcontext(for example, measuresofcredit risk),

and

S'pline{Age) is a piecewiselinear function that takesconsumer

age asitsargument(withknotpointsatages30, 40, 50,60and

70).^We

thenplot thefittedvaluesforthe splineonage. Regressions are eitherpooledpanel orcross-sectional, dependingonthe context.Each

sectiondiscussesthenatureofthe mistake,brieflydocuments

the datasets used, and presents the regressionresultsand graphs byage.We

providesummary

statistics forthedata sets intheAppendix.4

Home

Equity

Loans

4.1

Data Summciry

We

use a proprietary panel dataset from a large financial institution that issuedhome

equity loans

and

home

equitylinesofcredit nationally.Between

March and December

2002, the lender offered amenu

ofstandardized contracts forhome

equity credits.Consumers

couldchoose betweenacreditloan

and

line;betweenafirstand

secondlien;and

couldchoose to pledge differentamounts

ofcollateral, withtheamount

of collateral implying a loan-to-value(LTV)

ratio ofless than 80 percent, between 80 and 90 percent,and

between 90 an 100 percent) Ineffect, the lender offered twelvedifferent contractchoices. For 75,000 such contracts,we

observe the contract terms, borrower demographic information (age, years at currentjob,home

tenure),financialinformation (incomeand

debt-to-incomeratio), andrisk characteristics (credit(FICO)

score, andLTV).

We

alsoobserveborrowerestimates oftheir housevaluesand

the loanamount

requested.4.2

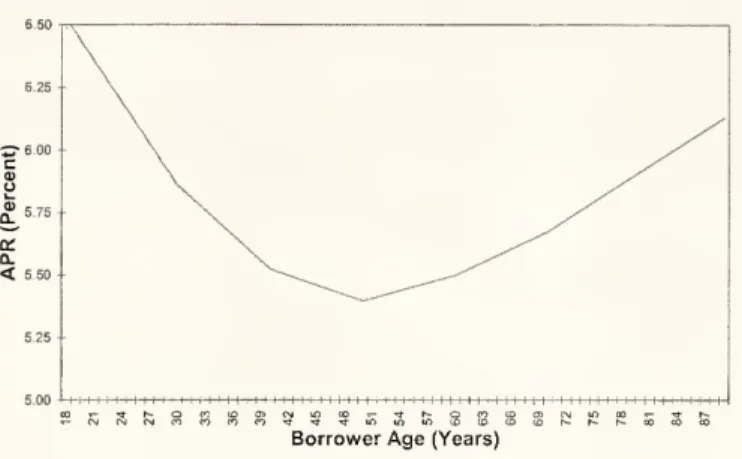

Results

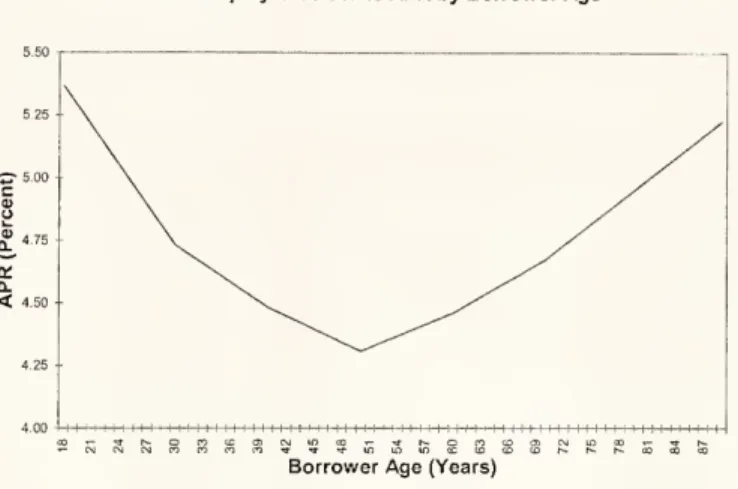

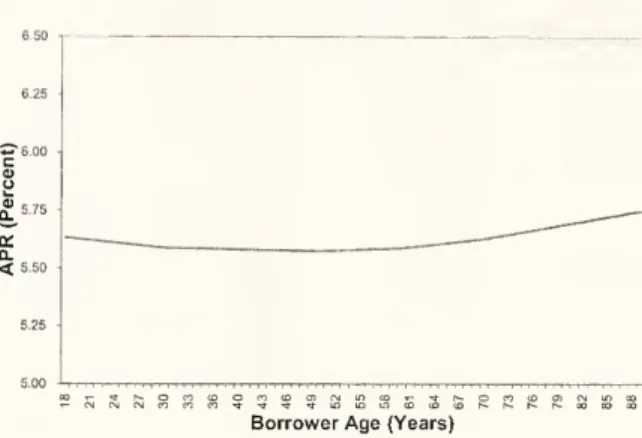

Table1reportstheresultsofestimating regressions of

APRs

(interest rates)onhome

equity loansona splinefor ageandcontrolvariables.As

controls,we

useallvariables observable to thefinancialinstitution thatmightaffect loanpricing, includingcredit risk measures, house andloancharacteristics,and

borrowerfinancialand demographiccharacteristics.The

control variablesall have theexpectedsign,and most

arestatisticallysignificant, althoughsome

ofthem

lackeconomicsignificance,perhapssurprisingly soinsome

cases.The

measureof credit risk, the logoftheFICO

score (lagged threemonths

because it isonly updated quarterly), comes instatistically significant but witha negligiblemagnitude.Our

understanding from discussionswithpeoplewho

work

intheindustryisthatfinancialinstitutionsgenerally use the'""Forinstance, inTable 1, the "Age30-40" splineis: max(30,min(40, /Ige)),the "Age

<

30" spline isHome

EquityLoanAPR

byBorrowerAge

Borrower

Age

(Years)Figure4:

Home

equityloanAPR

by

borrower age.The

figureplotsthe residualeffectofage, aftercontrollingforother observablecharacteristics,suchaslog(income)and

credit-worthiness.FICO

scoretodetermine whethera loanofferismade, butconditionalontheofferbeingmade, donot use the score to dorisk-based pricing.The

results here, andfor theotherconsumer credit products discussed below, are consistentwiththishypothesis.Loan

APRs

dodepend stronglyontheabsenceofafirstmortgage (reducing theAPR),

and whetherthepropertyisa second

home

ora condominium.The

absenceofafirst mortgagereduces the probability of default andraises theamount

thatmight be recovered conditionalon adefault. Secondhomes

andcondominiums

are perceivedasbeingriskierproperties.Log

incomeandlogyearson

thejobalsohavelargeand

negativeeffectsonAPRs,

asexpected, sincetheyindicatemore

resources available topayofftheloan,

and

perhaps lessrisk inthelatter case.The

largest effects onAPRs

come

fromdummy

variablesforLTV

ratios between80and90 percent and forratiosgreaterthan 90percent. ThisisconsistentwithdifferentLTV

ratioscorresponding todifferentcontract choices.Even

aftercontrollingforthesevariables,we

findthattheagesplineshavestatisticallyand

economicallysignificant effects. Figure 4 plots thefittedvaluesonthe splineforagefor

home

equity loans.

The

linehas apronounced U-shape, withsome

youngerand

olderborrowers paying100 basis pointsmore

than borrowersintheir late fortiesandearlyfifties. Forthisand

the nine otherstudies,

we

presentinsection 14.2a formaltest fortheU-shape,whichthedata willpass.Home

Equity

Loan

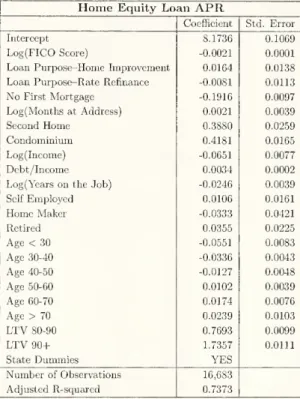

APR

Coefficient Std. Error Intercept 8.1736 0.1069

Log(FICO

Score) -0.0021 0.0001LoanPurpose-Home Improvement 0.0164 0.0138 Loan Purpose-RateRefinance -0.0081 0.0113

No

FirstMortgage -0.1916 0.0097 Log(Months atAddress) 0.0021 0.0039 SecondHome

0.3880 0.0259Condominium

0.4181 0.0165 Log(Income) -0.0651 0.0077 Debt/Income 0.0034 0.0002 Log(YearsontheJob) -0.0246 0.0039 SelfEmployed 0.0106 0.0161Home

Maker -0.0333 0.0421 Retired 0.0355 0.0225 Age<

30 -0.0551 0.0083 Age30-40 -0.0336 0.0043 Age40-50 -0.0127 0.0048 Age50-60 0.0102 0.0039 Age60-70 0.0174 0.0076 Age>

70 0.0239 0.0103LTV

80-90 0.7693 0.0099LTV

90-t- 1.7357 0.0111State

Dummies

YES

Number

ofObservations 16,683 Adjusted R-squared 0.7373Table 1:

The

firstcolumn

gives coefficient estimatesfor a regressionoftheAPR

ofahome

equity loanona splinewithage asitsargument,financialcontrol variables

(Log(FICO)

credit risk score,income,and

the debt-to-income-ratio),and

other controls(statedummies,adummy

forloansmade

forhome

improvements,adummy

forloansmade

forrefinancing,adummy

for nofirstmortgageonthe property,months

atthe address, yearsworked onthejob,dummies

for self-emplyed,retiree,orhomemaker

status,and

adummy

ifthepropertyisacondominium).Home

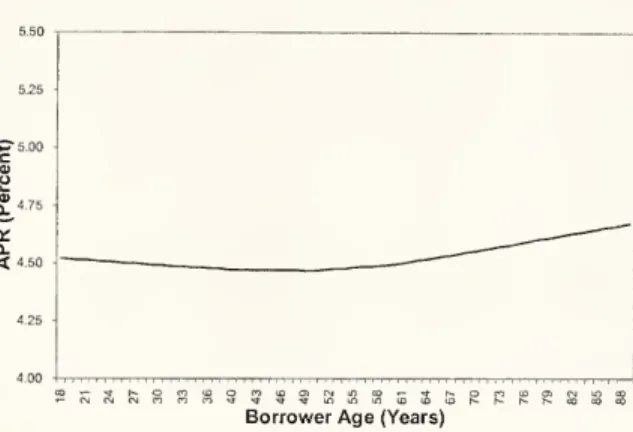

EquityCreditLineAPR

byBorrowerAge

Borrower

Age

(Years)Figure5:

Home

equity creditlineAPR

by borrower age.^The

figureplots the residualeffect ofage, aftercontrolling for other observablecharacteristics, such aslog(income) and credit-worthiness.5

Home

Equity

Lines of

Credit

5.1

Data

Summary

Data

arethesame

as describedinthe previoussection.5.2

Results

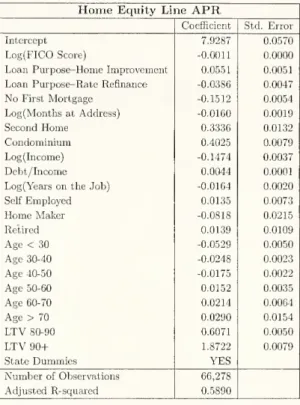

Table2reportstheresultsof estimating regressions of

APRs

on

home

equitylinesof credit on asplineforageand

thesame

control variables usedforthehome

equity loans regression.The

control variableshavesimilareffectsonhome

equitylineAPRs

asthey didforhome

equity loanAPRs.

Fitted valuesontheagesplines,plottedinFigure5,continue tohavethe

same

pronounced U-shape, withsome

youngerand

older borrowers again paj'ing 100 basis pointmore

than borrowersin their late fortiesandearly fifties. , .5.3

One

Mechanism: Borrower

Misestimation

of

Home

Values

The amount

of collateralofferedbytheborrower,asmeasured bythe loan-to- value(LTV)

ratio, is an important determinant ofloan

APRs.

HigherLTVs

imply higherAPRs,

sinceHome

Equity Line

APR

Coefficient Std. Error Intercept 7.9287 0.0570

Log(FICO

Score) -0.0011 0.0000Loan Purpose-Home Improvement 0.0551 0.0051 Loan Purpose-RateRefinance -0.0386 0.0047

No

FirstMortgage -0.1512 0.0054 Log(MonthsatAddress) -0.0160 0.0019 SecondHome

0.3336 0.0132Condominium

0.4025 0.0079 Log(Income) -0.1474 0.0037 Debt/Income 0.0044 0.0001 Log(YearsontheJob) -0.0164 0.0020 SelfEmployed 0.0135 0.0073Home

Maker -0.0818 0.0215 Retired 0.0139 0.0109Age

<

30 -0.0529 0.0050 Age30-40 -0.0248 0.0023 Age40-50 -0.0175 0.0022 Age50-60 0.0152 0.0035 Age60-70 0.0214 0.0064 Age>

70 0.0290 0.0154LTV

80-90 0.6071 0.0050LTV

90+

1.8722 0.0079 StateDummies

YES

Number

ofObservations 66,278 Adjusted R-squared 0.5890Table2: Tliefirst

column

givescoefficientestimatesfora regression of theAPR

ofahome

eq-uitylinesofcrediton a sphne withage asitsargument,financialcontrol variables(Log(FICO)

credit risk score, income,

and

the debt-to-income-ratio),and

other controls (statedummies,

a

dummy

forloansmade

forhome

improvements, adummy

forloansmade

for refinancing,adummy

fornofirstmortgage onthe property,months

atthe address, yearsworked onthejob,dummies

forself-employed, retiree, orhomemaker

status,and

adummy

iftheproperty is acondominium)

.

the fraction ofcollateralislower. Atthisffnancial institution,borrowersestimatetheir

home

values,

and

askfora creditloan orhnefallingintooneofthree categoriesdepending onthe impliedLTV.

The

categoriescorrespond toLTVs

of80percent orless;LTVs

ofbetween80and

90 percent;and

LTVs

of90percent orgreater.The

financialinstitutionseparatelyverifies thehousevalueusinganindustry-standard methodology.Loan

pricingdependson

theLTV

category theborrower falls into, and noton thespecific valuewithin that category; that is,

aloanwithan

LTV

of60has thesame

interest rateas a loanwith anLTV

of70, holding borrowercharacteristicsfixed.^

Iftheborrowerhasoverestimatedthe value of the house, so that the

LTV

isin facthigher thanoriginallyestimated, thefinancialinstitutionwilldirectthebuyertoadifferentloanwith a higherinterestratecorrespondingtothehigherLTV.

Insuchcircumstances, the loanofficeris alsogiven

some

discretionto departfromthefinancial institution'snormalpricingschedule to offer a higher interest rate than he or she would haveto aborrowerwho

had

correctly estimated theLTV.

Iftheborrower has underestimatedthevalue of the house,however, the financialinstitutionneednotdirectthebuyertoaloanwitha lowerinterestratecorresponding to the actual lowerLTV;

itmay

simply choose toofferthe same, higherinterest rate, for a lower-riskloan.'^Since the

APR

paiddepends on the category theLTV

falls in, andnot theLTV,

home

value misestimation only leadsto higher interestrate

payments

if itcausesLTVs

tochange in such away

that the loanmoves

intoa differentcategory. If, incontrast, theborrower's estimatedLTV

wereequal to 60,butthe trueLTV

were70, theborrowerwouldstillqualify for the highest quality loan categoryand

wouldnotsufferan interestratepenalty.We

define a RateChanging

Mistake(RCM)

tohave occurredwhen

a borrower'smisestimationofhouse value causes achangeinLTV

categoryand

potentiallyachange ininterestrate paid.^We

find that, on average,making

anRCM

increasestheAPR

by 125 basis points forloansand 150 basis pointsforlines (controllingforothervariables,butnotage).Ifthe probability of

making

a rate-changingmistakeisU-shaped withage,thena regression ofAPR

onage conditioningonnothaving anRCM

shouldshow

a nearlyflatpattern.^We

haveverified thispracticein our datasctbyregressing theAPR

on boththe leveloftheLTV

anddummy

variables forwhethertheLTV

falls intooneofthe threecategories. Onlythecoefficients onthedummy

variableswerestatisticallyandeconomicallysignificant."^Notethatevenifthefinancial institution'sestimateofthe truehouse valueisinaccurate,that misestimation

willnotmatterfortheborroweraslongasotherinstitutionsusethesamemethodology.

*Specifically,

RCMs

occurwhentheborrower's estimationof hisorherhouse valueissuch that theLTV

is lessthan80,whilethe trueLTV

isbetween80and90; ortheestimatedLTV

islessthan 80andthe trueLTV

isgreaterthan90;ortheestimated

LTV

isbetween80and90,but the trueislessthan80; ortheestimatedLTV

isbetween80and90,but the trueLTV

isgreaterthan90; orthe estimatedLTV

isgreaterthan90,but the trueLTV

islessthan80; ortheestimatedLTV

isgreaterthan90,but the trueLTV

isbetween80and90. ^Bucksand Pence (2006) present evidence that borrowersdonot generally have accurate estimatesof theirhousevalues.

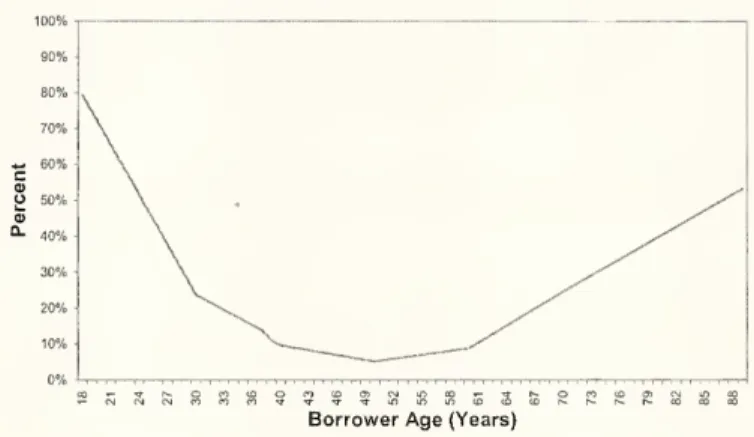

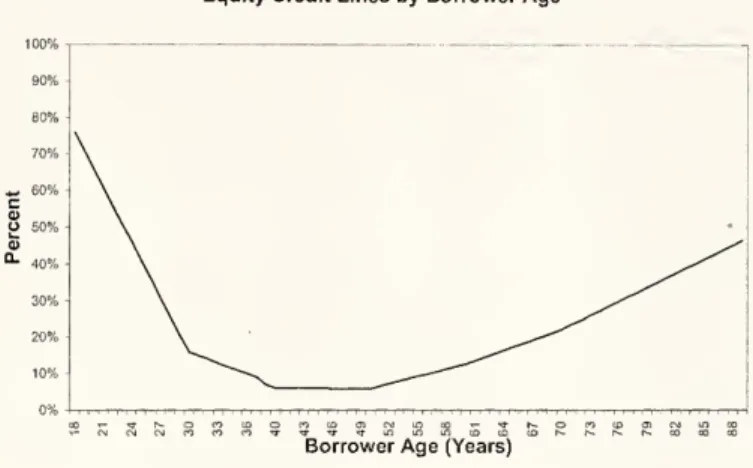

PropensityofMakingaRate-ChangingMistakeon

Home

EquityLoansbyBorrower

Age

Borrower

Age

(Years)Figure 6: Propensityof

making

aRateChanging

Mistakeonhome

equity loansby borrower age.We

define aRate

Changing

Mistaketohave occurredwlien a borrower'smisestimation ofhousevaluecausesachangeinLTV

categoryand

potentiallya changeininterestratepaid (see the textforafulldefinition).The

figureplotsthe residualeffect ofage, aftercontrolling forotherobservablecharacteristics,suchaslog(income)and

credit-worthiness.PropensityofMakingaRate-ChangingIVlistakeon

Home

Equity Credit LinesbyBorrower

Age

90% 80% 70%

\

^

60% C V O 50% -a> '^ 40%-\

.

30%\

^^^

20%\

'^^^^^^

10%^"^-^

^^^--^'^^^

0%Borrower

Age

(Years)Figure 7: Propensity of

making

a RateChanging

Mistake onhome

equity credit linesby

borrowerage.

We

defineaRate

Changing

Mistaketohave occurredwhen

a borrower's mises-timationofhousevahiecausesachangeinLTV

categoryand

potentiallyachangein interest ratepaid (seethe textfor a fulldefinition).The

figureplotsthe residualeffect ofage, after controllingforotherobservablecharacteristics,suchaslog(income) andcredit-worthiness.Home

EquityLoanAPRs

forBorrowersWho

DoNotMakea Rate-ChangingIVIistal<eBorrower

Age

(Years)Figure8:

Home

equity loanAPRs

forborrowerswho

donotmake

a rate-changing mistake.The

figureplotsthe residualeffectofage, aftercontrollingforotherobservablecharacteristics, suchaslog(income) andcredit-worthiness.Figures 6

and

7 plots the probabilityofmaking

a rate-changingmistakebyageforhome

equity loansand

home

equitylines,respectively.The

chartsshow

U-shapesforboth. Borrow-ers atage 70havea 16(19)percentagepoint greaterchanceofmaking

amistakethan borrowers at age 50 forhome

equity loans (lines); borrowersat age 20have a 35(41) percentage point greaterchance ofmaking

a mistake than borrowers at age 50.The

unconditional average probability ofmaking

a rate-changingmistakeis24percentforloansand

18percentforlines.Figures 8

and

9plotthefittedvaluesfromre-estimatingthe regressionsintable3,butnow

conditioningontheborrowernot

making

anRCAi.The

plotsshowsonlyslightdifferences inAPR

paidbyage.The

APR

differenceforahome

equity loanforaborrowerat age70 over aborrowerat age50has shrunk from36 basis points to 8 basis points;forahome

equityline ofcredit, it has slnrunkfrom 28 basis points to 4 basis points. For aborrower atage20, theAPR

differenceover aborrowerat age50 hasshrunk to 3basis pointsforhome

equity loans and3basispointsforhome

equitylinesofcredit.This disappearanceofthe ageeffectisconsistentwiththecostofan

RCM

calculatedabove andthe additional probabilityofmaking

anRCM

byage. Forexample,a70-year old has a 16 and 19 percent additionalchanceofmaking

anRCM

forloans anlines. Multiplyingthisby the averageAPR

cost ofanRCM

forhome

equitylinesand

loans of150and 125 basis points, respectively, gives an expected inAPR

paid of26and

23 basis points. ThesedifferencesHome

EquityCreditLineAPRs

forBorrowersWho

DoNot Mal<e aRate-Changing MistakeBorrowerAge(Years)

Figure 9:

Home

equity credit lineAPRs

for borrowerswho

do notmake

a rate-changing mistake.The

figure plots the residual effect ofage, after controlling for other observable characteristics,suchaslog(income)and

credit-worthiness.are,veryclosetotheestimateddifferencesof36-8=28 basispointsfor lines

and

28-5=23basis pointsfor loans.6

Credit

Cards

6.1

Data

Summary

We

use aproprietarypanel datasetfroma large U.S.bank

thatissuescredit cardsnationally.The

dataset contains a representativerandom

sampleofabout 128,000 credit card accounts followedmonthlyovera36month

period(fromJanuary 2002 throughDecember

2004).The

bulk ofthe data consists of the

main

billing information listed on each account's monthly statement, includingtotalpayment, spending, credit limit,balance, debt, purchasesandcash advance annualpercent rates (APRs), andfeespaid. At a quarterly frequency,we

observe each customer's credit bureau rating(FICO)

and a proprietary (internal) credit 'behavior' score.We

havecreditbureau data aboutthenumber

ofothercreditcards heldby

theaccount holder,total credit card balances,and

mortgagebalances.We

have dataontheage,genderand

incomeofthe accountholder, collected atthe timeofaccount opening. Furtherdetailson

the data, includingsummary

statisticsandvariable definitions, are availablein the dataCredit

Card

APR

Coefficient Std. Error Intercept 14.2743 3.0335 Age<

30 -0.0127 0.0065 Age30-40 -0.0075 0.0045 Age40-50 -0.0041 0.0045 Age50-60 0.0023 0.0060 Age60-70 0.0016 0.0184 Age>

70 0.0016 0.0364 Log(Income) -0.0558 0.0803 Log(FICO) -0.0183 0.0015Home

Equity Balance 0.0003 0.0022 MortgageBalance -0.0000 0.0000Number

ofObservations 92,278 Adjusted R-squared 0.0826Table 3: This table givescoefficient estimates for a regression oftire

APR

ofa credit card ona splinewithage asitsargument,financialcontrol variables(Log(FICO)

credit risk score, income, totalnumber

of cards, totalcard balance,home

equity debt balanceand

mortgage balance).appendix.

6.2

Results

Table 3 reports the results ofregressing credit card

APRs

on a spline with age as the argumentand

other controlvariables.As

controls,we

again use informationobservedbythe financialinstitutionthatmay

influencetheir pricing.As

before,we

findthatcreditscoreshave verylittle impacton creditcardAPRs.

APRs

rise withthe totalnumber

ofcards, though theeffectisnot statistically significant. Othercontrols, including thetotalcard balance, log income,andbalancesonother debt,donothave economicallyorstatisticallysignificant effects oncreditcardAPRs.

Figure??plotsthefittedvaluesonthe splineforage.

A

U-shapeispresent,thoughmuch

lesspronounced thaninthe case of

home

equityloans.7

Auto

Loans

7.1

Data

Summary

We

usea proprietarydatasetofautoloans originatedatseveral largefinancialinstitutions thatwerelateracquiredby anotherinstitution.The

datasetcomprisesobservationson 6996 loans originatedforthepurchaseofnew and

usedautomobiles.We

observe loan characteristics includingtheautomobilevalueandage,theloanamount and

LTV,

themonthly payment,theCreditCard

APR

byBorrowerAge

Borrower

Age

(Years)Figure10: Credit card

APR

by borrowerage.The

figureplotsthe residualeffectofage, after controllingforotherobservablecharacteristics,suchaslog(income)and

credit-worthiness.contractrate,

and

thetimeof origination.We

alsoobserveborrowercharacteristicsincluding credit score,monthly

disposableincome,and

borrowerage.7.2

Results

Table4reports theresultsofestimating a regression of the

APR

paidon autoloansona splinewithageastheargument andcontrolvariables.FICO

credit riskscores againhavelittleeffectontheloan terms. Higherincomeslower

APRs

and

higherdebt-to-incomeratios raise them, though themagnitudes ofthe effects are neglige.We

alsoinclude car characteristics, such astypeand

age, as one ofus has found those variables to matter forAPRs

inotherwork

(Agarwal,Ambrose

and Chomsisengphet, forthcoming)-thoughwe

note that thefinancial institutionsdonot conditiontheirloanson suchvariables.We

alsoinclude loanageand

statedummies.

Figure 11 plots thefitted values

on

the splinefor age.The

graph again shows arather pronounced U-shape.Auto Loan

APR

CoefRcicnt Std. Error Intercept n.4979 1.3184 Age<

30 -0.0231 0.0045 Age30-40 -0.0036 0.0005 Age40-50 -0.0054 0.0005 Age50-60 0.0046 0.0007 Age60-70 0.0031 0.0017 Age>

70 0.0091 0.0042 Log(Income) -0.3486 0.0176 Log(FICO) -0.0952 0.0059 Debt/Income 0.0207 0.0020 JapaneseCar -0.0615 0.0270 European Car -0.0127 0.0038 LoanAge 0.0105 0.0005 CarAge 0.1234 0.0031 StateDummies

YES

Quarter

Dummies

YES

Number

ofObservations 6,996 AdjustedR-squared 0.0928Table4: Thistable givescoefficientestimatesfroma regressionofthe

APR

ofan autoloanona splinewithageasitsargument,financialcontrol variables(Log(FICO)

creditriskscore,income,and

the debt-to-income-ratio),and

other controls (statedummies,dummies

for whetherthe carisJapaneseorEuropean,loanageand

carage).AutoLoan

APR

byBorrowerAge

Borrower

Age

(Years)Figure11:

Auto

loanAPR

by borrowerage.The

figureplots the residualeffect ofage, after controllingforother observablecharacteristics, suchas log(incQme)and

credit-worthiness.8

Mortgages

8.1

Data

Summary

We

usea proprietarydatasetfroma largefinancial institutionthat originatesfirst mort-gagesinArgentina.The

datasetcovers 4,867owner-occupied,fixedrate,firstmortgageloans originatedbetweenJune 1998and

March

2000,and observed throughMarch

2004.We

observe theoriginalloanamount,theLTV

and

appraisedhousevalueatorigination,andtheAPR.

We

alsoobserveborrowerfinancialcharacteristics (includingincome, second income,yearsonthe job,wealthmeasures suchassecond house ownershipandcarownership

and

value),borrower riskcharacteristics (Veraz score(acreditscore similar tothe U.S.FICO

score)and

mortgagepayments

asapercentageofafter-taxincome),and borrower demographiccharacteristics(age, genderand

maritalstatus).8.2

Results

Table5reportsresultsof regressingthemortgage

APR

ona splinewithageasanargument andcontrolvariables.As

controls,we

again use variables observable to thefinancialinstitution thatmay

affectloanpricing,includingriskmeasures(credit score,income,mortgagepayment

asa fraction ofincome, and

LTV),

andvariousdemographicand

financialindicators(gender, maritalstatus, adumiriyvariableforcarownership,and

several others; thesecoefficientsare not reported to save space).The

coefficients onthe controls areagain of the expectedsign andgenerally statistically significant,thoughofsmallmagnitude.The

coefficientsontheagesplineare positivebelowagethirty, thennegativethroughage 60and

positivethereafter. Figure12 plotsthefittedvaluesonthe splineforage.The

graph again generallyshowsaU-shape, though behaviorforyounger borrowersisratherdifferent.9

Small Business Credit

Cards

9.1

Data

Summary

We

usea proprietary datasetofsmall business creditcard accounts originatedat several large institutions that issued suchcards nationally.The

institutionswere later acquired by asingle institution.The

paneldatasetcovers 11,254 accounts originated betweenMay

200and

May

2002.Most

ofthe business are very small,owned

by asingle family, and have no formal financialrecords.The

data sethas all information collected at the time ofaccount origination, including the borrower's self-reported personal income, yeai^s inbusiness of the firm,and

borrowerage. Quarterly,we

observe theaccountcreditbureauscore.Mortgage

APR

Coefficient Std. Error Intercept 12.4366 4.9231 Age<

30 0.0027 0.0046 Age30-40 -0.0023 0.0047 Age40-50 -0.0057 0.0045 Age50-60 0.0127 0.0093 Age60-70 0.0155 0.0434 Age>

70 0.0234 0.0881 Log(Income) -0.2843 0.1303 Log( CreditScore) -0.1240 0.0217 Debt/Income 0.0859 0.2869 LoanTerm

-0.0114 0.0037 LoanTerm

Squared -0.0000 0.0000Loan

Amount

-0.0000 0.0000LoantoValue 0.1845 0.0187 YearsontheJob -0.0108 0.0046 Second

Home

0.1002 0.1014 Auto 0.1174 0.0807 AutoValue 0.0000 0.0000 Gender(l=Female) 0.0213 0.0706 Married -0.0585 0.0831Two

Incomes -0.1351 0.1799 Married withTwo

Incomes -0.0116 0.1957 Employment: Professional -0.0438 0.1174 Employment:Non-Professional 0.0853 0.1041 Merchant -0.1709 0.1124Bank

Relationship -0.2184 0.1041Number

ofObservations 4,867 AdjustedR-squared 0.1004Table5: Thistablereports theestimatedcoefficientsfroma regression ofmortgage

APR

ona splinewithage asitsargmnent and

financialand

demographiccontrolvariables.Mortgage

APR

byBorrowerAgeBorrower

Age

(Years)Figure12:

APR

for Argentine mortgages by borrowerage.The

figureplotsthe residualeffect ofage, after controlling for other observablecharacteristics, suchas log(income)and

credit-worthiness.9.2

Results

Table6reports theresultsofregressingthe

APR

forsmall businesscreditcardsonasphne with age as theargument

and control variables.As

with individual credit card accounts,we

control forthePICO

score of the borrower, the totalnumber

ofcards,card balance,and

cardlimit.

We

alsoincludedummy

variablesforyears inbusiness, and expectAPRs

tobe decreasing in this variable. All controls variables are statisticallysignificant and have the expectedsign, thoughonly thedummies

foryearsinbusinesshavesubstantialmagnitudes.APRs

aredecreasingintheageoftheborrowerthrough age60, andincreasingthereafter. Figure13 plotsthefittedvaluesonthe splinefor age.The

graph showsapronounced U-shape.10

Credit

Card

Fee

Payments:

Late

Fees

10.1

Overview

Certaincreditcard uses involve the

payment

ofafee.Some

kindsof feesareassessedwhen

termsofthecreditcard agreementareviolated. Otherkinds are assessedforuse ofservices. Inthe next threesections,

we

focusonthree importanttypes offees: late fees,over limitSmall Business Credit

Card

APR

Coefficient Std. Error Intercept 16.0601 0.6075 Age<

30 -0.0295 0.0081 Age30-40 -0.0068 0.0040 Age40-50 -0.0047 0.0038 Age50-60 -0.0017 0.0055 Age60-70 0.0060 0.0209 Age>

70 0.0193 0.0330 YearsinBusiness1-2 -0.5620 0.1885 YearsinBusiness2-3 -0.7463 0.1937 YearsinBusiness3-4 -0.2158 0.1031 YearsinBusiness4-5 -0.5100 0.0937 YearsinBusiness5-6 -0.4983 0.0931 Log(FICO) -0.0151 0.0008Number

ofCards 0.1379 0.0153Log(TotalCardBalance) 0.0000 0.0000 Log(TotalCardLimit) 0.0000 0.0000

Number

ofObservations 11,254 Adjusted R-squared 0.0933Table6: Thistablereportstheestimatedcoefficients froma regression of the

APR

forsmall business credit cardson

aspline with the business owner's age as itsargument

and other control variables(dummies

for j^ears inbusiness,log(FICO)credit risk score,number

ofcards, total card balance,and totalcardlimit).SmallBusinessCreditCard

APR

byBorrowerAge

Borrower

Age

(Years)Figure 13: Small business creditcard

APR

by borrowerage.The

figure plots the residual effect ofage, after controlling for other observable characteristics, such aslog(income) and credit-worthiness.

fees, and cash advancefees.-^°

We

describe thefeestructureforour datasetbelow.1.

Late

Fee:A

late fee ofbetween $30and

$35isassessediftheborrowermakes

apayment

beyond

theduedateonthecreditcard statement. Iftheborrowerislatebymore

than 60days once, orbymore

than 30days twicewithin ayear, thebank

may

alsoimpose 'penaltypricing' byraisingtheAPR

to over 24 percent.The bank

may

alsochoose to report latepayment

tocreditbureaus, adverselyaffecting consumers'FICO

scores. Iftheborrower does not

make

a latepayment

duringthe sixmonths

after thelastlate payment,theAPR

willrevert toitsnormal (thoughnotpromotional)level.2.

Over

Limit

Fee:An

overlimit fee, alsoofbetween $30 and$35, is assessedthe firsttime theborrower exceedshis orher credit limit.

The same

penalty pricing asinthe late feeisimposed.3.

Cash

Advance

Fee:A

cash advance fee ofthe greater of 3 percent of theamount

advanced,or$5,isleviedforeach cash advanceonthecreditcard. Unlike thefirsttwo fees,this feecanbeassessed

many

times permonth. Itdoes not cause the impositionof penaltypricingon purchasesor debt. However,theAPR

on cash advancesistypically greaterthanthaton pmxhases,and

isusually 16percent ormore.Payment

ofthesefeesmay

be viewedas mistakesinthatfeepayment

may

beavoidedby smalland

relatively costlesschangesinbehavior.We

use thesame

dataset as thatusedfor thecreditcardAPR

casestudydiscussedabove.10.2

Results

Table 7 presents panel regressionsfor each typeoffee. In eachof the threeregressions,

we

regressadummy

variableequal to oneifafee ispaid thatmonth

ona splineforageand

controlvariables;hencethecoefficientsgivethe conditionaleffectsoftheindependentvariables onthe propensity to payfees.

The

control variablesdiffer fromthose of the precedingsix examples, sincenow

we

wish to control for other things that mightaffect thepropensity topay

afee, which arenot necessarily thesame

asthingsthatmightleadborrowerstodefault orotherwiseaffecttheirborrowingterms. "BillExistence" isadummy

variableequaltooneifabill wasissued lastmonth; borrowerswillonlybeeligibletopay alate fee ifabill was issued. "BillActivity" isa

dummy

variableequal tooneifpurchases or paymeiatsweremade

Othertypesof feesincludeannual,balancetransfer,foreign transactions,and pay byphone. All ofthese

fees are relatively lessimportanttoboththe-bankandthe borrower. Fewissuers(themostnotable exception beingAmericanExpress) continuetocharge annualfees,largely asaresultofincreased competitionfornew borrowers(Agarwaletal.,2005). Thecardsinourdatadonothave annualfees.

We

study balancetransferbehavior using a separate datasetbelow. Theforeign transactionfeesandpayby phonefeestogether comprise

lessthan three percentofthetotal fees collectedbybanks.

onthe card; borrowerswillonlybeeligibleto payoverlimit orcashadvancefeesifthe card wasused. "Log(Purchases)" isthe log of the

amount

purchased onthe card, indollars;we

would expectthat the propensity topayoverlimitandcashadvancefeeswould beincreasing with the

amount

ofpurchases."Log(FICO)"

isthecredit risk score,and

"Log(Behavior)" isaninternalriskscore createdbythe

bank

topredictlateand

delinquentpayment beyond

that predictedbytheFICO

score. Higherscoresmean

lessrisky behavior.The

scores arelagged threemonths

because they are only updated quarterly.We

would expect the underlying behaviorleading to lowercredit riskscoreswouldlead tohigherfeepayment. "Debt/Limit"isthe ratio of the balance ofcreditcarddebttothecredit limit;

we

would expectthathaving lessavailablecreditwould raisethepropensity topayoverlimit fees,and

possibly otherfees.For late fee payments,

column

one ofthe table, all control variables have the expected signsand

arestatistically significant, though they arealso small in magnitude. Note thatsome

control variablesmay

partlycapturetheeffectsofage-related cognitive declineonfees.Forexample,ifincreasingage

makes

borrowersmore

likelytoforgettopayfeesontime,that would bothincreasethe propensity topaylate fees anddecreasecredit and behaviorscores.Hence

theestimatedcoefficientsonthe agesplinesmay

understatesome

age-related effects. Coefficientsontheagesplinesareuniformlynegativeforsplinesthroughage50, negative orweaklypositiveforthe splinebetweenage 50and60, andpositivewithincreasing slopefor splinesaboveage50.The

top line in Figure 14 plotsfitted valuesfor the age splinesfor the late feepayment

regression.

11

Credit

Card

Fee

Payments:

Over

Limit

Fees

The

secondcolumn

ofTable7 presents regressionresults forthe overlimitfee,onthesame

controls

and

agesplines asforthelatefee. Results arevery similar to thoseforthelatefee.The

bottom

lineinFigure14 plots fittedvaluesfor theage splines forthe overlimit feepayment

regression.12

Credit

Card

Fee

Payments:

Cash

Advance

Fees

The

secondcolumn

ofTable7 presents regressionresults forthe cash advancefee, onthesame

controlsand

agesplinesasforthelatefee. Results arevery similar to thoseforthelate feeand

overlimitfee.The

middlelineinFigure 14 plotsfittedvaluesfortheagesplines forthecashadvancefeepayment

regression.Late

Fee

Over

Limit

Fee

Cash Adv.

Fee

Coeff. Std. Err. Coeff. Std. Err. Coeff. Std. Err. Intercept 0.2964 0.0446 0.1870 0.0802 0.3431 0.0631 Age

<

30 -0.0021 0.0004 -0.0013 0.0006 -0.0026 0.0011 Age30-40 -0.0061 0.0003 -0.0003 0.0001 -0.0004 0.0002 Age40-50 -0.0001 0.0000 -0.0002 0.0000 -0.0002 0.0000 Age50-60 -0.0002 0.0000 -0.0002 0.0000 -0.0003 0.0000 Age60-70 0.0004 0.0002 0.0003 0.0001 0.0004 0.0000 Age>

70 0.0025 0.0013 0.0003 0.0001 0.0004 0.0000 BillExistence 0.0153 0.0076 0.0104 0.0031 0.0055 0.0021 BillActivity 0.0073 0.0034 0.0088 0.0030 0.0055 0.0021 Log(Purchases) 0.0181 0.0056 0.0113 0.0023 0.0179 0.0079 Log(Behavior) -0.0017 0.0000 -0.0031 0.0012 -0.0075 0.0036 Log(FICO) -0.0016 0.0007 -0.0012 0.0003 -0.0015 0.0005 Debt/Limit -0.0066 0.0033 0.0035 0.0013 0.0038 0.0012 Acct. FixedEff.YES

YES

YES

Time

FixedEff.YES

YES

^ES

Number

ofObs. 3.9Mill. 3.9Mill. 3.9Mill.Adj. R-squarcd 0.0378 0.0409 0.0388

Table7: Thistablereportscoefficients-froma regression of

dummy

variablesforcreditcardfeepayments on

asphneforage, financialcontrol variables (log(FICO) credit risk score,internalbank

behaviorriskscore,debtoverlimit)and

other control variables(dummies

forwhether abillexistedlastmonth, forwhetherthecardwas usedlastmonth,dollar

amount

ofpurchases, account- andtime-fixed effects).FrequencyofFeePaymentbyBorrowerAge 0.35 0,33

S

0.31 c o £0.29 g_0.27 2*0.25-C as 30.23 -CTi

0.21 -O d)0.19 -u. 0.17 0.15LateFee OverLimitFee

"

Cash AdvanceFeeBorrowerAge(Years)

Figure 14: Frequencyoffee

payment

by borrower age.The

figureplots the residualeffect ofage, aftercontrollingfor other observable characteristics, suchas log(income) and credit-worthiness.13

'Eureka'

Moments:

Balance Transfer Credit

Card

Usage

13.1

Overview^

Creditcard holders frequently receiveoffersto transfer account balancesontheircurrent cards to a

new

card. Borrowers paysubstantially lowerAPRs

onthe balances transferred to thenew

card fora six-to-nine-month period (a 'teaser' rate). However,new

purchaseson thenew

cardhavehighAPRs.

The

catchisthatpayments onthenew

cardgofirsttowardspaying

down

the (low interest) transferred balances,and

only subsequently towards payingdown

the (highinterest) debt accumulated fromnew

purchases.The

optimalstrategyforborrowers,is tomake

allnew

purchasesontheir old creditcardand

tomake

nonew

purchases withthenew

cardto which balances havebeentransferred.We

hypothesize thatsome

borrowerswill figure this out beforemaking

anypurchases with thenew

card.Some

borrowersmay

notinitially understandthe optimal strategy, andwill onlyfigureitoutbyobservingtheir (surprisingly) highinterestcharges.Those

borrowerswillmake

purchasesfor oneormore

months, then havea 'eureka'moment,

after whichtheywill implementtheoptimalstrategy.Some

borrowers willneveridentifytheoptimalstrategy.13.2

Data

summary

We

usea proprietarypaneldatasetfromseverallargefinancial institutions, lateracquired by asingle financial institution, thatmade

balancetransfer offers nationally.The

dataset contains 14,798 accounts which accepted suchoffers over theperiod January 2000 tliroughDecember

2002,The

bulkofthedataconsists ofthemain

bilhng informationlistedon each account'smonthlystatement, includingtotal payment,spending, credithmit, balance, debt, purchases and cash advance annual percent rates (APRs), and feespaid.We

also observe theamount

ofthe balance transfer, the start date of the balance transfer teaser rateoffer,theinitialteaser

APR

onthebalancetransfer,and

theenddateofthebalancetransferAPR

offer.

At

aquarterly frequency,we

observeeachcustomer'screditbureaurating(FICO)

and a proprietary(internal)credit 'behavior'score.We

havecreditbureau data aboutthenumber

of other credit cards held by the accountholder, total credit card balances,

and

mortgage balances.We

have data on the age, genderand

income ofthe account holder, collected at thetime ofaccount opening. Furtherdetails onthe data, includingsummary

statisticsand

variabledefinitions, are availableinthedata appendix.

13.3

Results

About

onethird ofallcustomerswho

make

abalancetransferdo no spending onthenew

card, thusimplementing the optimalstrategyimmediately. Slightly

more

than onethirdof customerswho make

a balance trairsfer spend everymonth

duringthe promotional period, thus never experiencing a "Eureka"moment.

Figure15 plots thefrequencyofEureka

moments

foreachage group.The

plotofthosewho

never experience a "Eureka"

moment-that

is,who

neverimplementtheoptimalstrategy-is a pronounced U-shape byage.The

plot ofthosewho

implementthe strategyimmediately isa pronouncedinverted U-shape byage. Plots fortheothermonths

arerelativelyflat.Table8 reports theresults ofa regression of a

dummy

variablefor everhaving aEurekamoment

ona spline for age and controls for creditrisk (log(FICO)), education, genderand

log(income).-''. Creditriskisincluded becausehigher scores

may

be associatedwithgreater financialsophistication. Similarly,we

would expect borrowers withhigherlevelsofeducation tobemore

likelytoexperienceEurekamoments

The

coefficientsontheage splineimplythatyoung

adultsand

older adults arelesslikelytoexperienceEurekamoments.

Figure16 plotsfittedvalues forthe agesplines.

Note

that, unlike the otherfigures, higher values indicatea smaller propensity tomake

mistakes."Although wereportan

OLS

regressionforeaseininterpretingthecoefficients,wehavealsorun theregressionFraction ofBorrowersinEachAge GroupExperiencinga EurekaIVloment,byiVIonth

50% ---MonthOne --- MonthFour NoEureka MonthTwo MonthFive MonthThree MonthSix 40%

\^,.

----"''-^^

30%;.--'^^^

20% 10%,..___

0% 18to24 25to34 35to44 45to64 Over 65BorrowerAgeCategory

Figure15: Fraction ofborrowersineachagegroupexperiencingspecific delays. Forexample, thedashed-bluelineplotsthe fraction ofborrowersexperiencingnodelay to aEureka

moment.

Thesesophisticatedborrowersrepresenta large fraction ofmiddle-aged households

and

amuch

smaller fraction ofyounger

and

olderhouseholds.Propensity

ofEureka

Moment

Coefficient Std. Error Intercept Age<30

Age30-40 Age40-50 Age50-60 Age60-70 Age >70Some

HighSchool HighSchoolGraduateSome

College Associate'sDegree Bachelor'sDegree Graduate log(FICO) log(Limit) log(Income) 0.2587 0.0134 0.0019 -0.0001 -0.0029 -0.0035 -0.0083 -1.6428 -0.6896 -0.4341 -0.2439 0.3280 0.6574 0.0102 0.0120 -0.0044 0.0809 0.0026 0.0005 0.0000 0.0009 0.0008 0.0072 0.9570 0.8528 0.8944 0.4537 0.5585 0.3541 0.0019 0.0022 0.0067Number

ofObservations Adjusted R-squared 3,622 0.1429Table8: Thistablereportsestimatedcoefficientsfromapanel regressionoftlie

month

inwhich theborrowerdid nomore

spendingonthebalance transfercard (the 'eurekamoment')on

a splinewithageas itsargument

and

other controlvariables.14

Quantifying the

Performance

Pecik

14.1

Locating

the

Peak

ofPerformance

Visual inspection of the agesplines fortheten case studies suggests thatfinancialmistakes areata

minimum

inthelate fortiesorearlj' fifties.To

estimate theminimum

more

precisely,we

re-estimateeachmodel,replacingthesplinesbetween40and50and

50and

60withasingle splinerunningfrom40 to60, andthesquareofthatspline.Inotherwords,

we

runthe following regression,whereF

istheoutcome

associated respec-tivelywith eachofthe 10studies:(2)

a

-(-/?X5'p/me(A(/e)4jg^[4o60]

+

7x Controls+

e+a

X Spline(A5e).45e6[40,60]+

^'Spline(^5'e)A3eel40,60]•

Here Spline{Age)isa piecewiselinearfunction that takes

consumer

ageasitsargument(with knotpoints atages 30,40, 60and 70). Spline{Age)j^gg^i^QQQ-^ representsthesplinesoutside ofthe[40,60] age range, whileSpline {Age) y^^^^QQQ^ isthelinearsplinewithknot points atasalogitandfoundsimilar results.

PropensityofEver ExperiencingaEureka

Moment

by BorrowerAge

Borrower

Age

(Years)Figure 16: Propensity ofeverexperiencing a eurelca

moment

by borrower age.The

figure plotsthe residual effect ofage, aftercontrolling forother observable characteristics, such as log(income), education,and

credit-worthiness.40

and

60. Hence, foragebetween 40and60,the aboveformulationisjust:F =

Controls+

a xAge

+

bxAge^

The

peak

ofperformanceisthevalue that minimizestheabovefunction, i.e.(3)

Peak

=

-a/

(26)We

calculatetheasymptotic standarderrorsonPeak

using the deltamethod,sothat s.e.{Peak)isthestandarderrorassociatedwith thelinearcombination:

—

l/(26)-(Coefficientonage)+

a/(26^)-(CoefHcientonage^).

In Table 9,

we

report the location ofthe 'age ofreason': the point at which financial mistakesareminimized.The

mean

age of reasonappearsto beat 53.3years.The

standard deviation across studiesis4.3 years.Formalhypothesis testing (Hq: a

+

25x53=

0)showsthatonly the location of theEurekamoment

isstatisticallydifferentfrom53years. Interestingly,theEurekataskisarguable themost

"difficult" task,i.e. themost

cognitively intensive one. Itmakes

sense that thepeak age for that taskwould beearlierthantheother tasks. Sincewe

donot havea rigorous measureAge

ofPeak Performance

Standard Error

Home

EquityLoans-APR

55.85 4.24Home

EquityLines-APR 53.30 5.23Credit

Card-APR

50.31 6.02Auto

Loans-APR

49.63 5.03Mortgage-

APR

61.75 7.92Small Business Credit

Card-APR

56.04 8.01 CreditCardLate Fee 51.94 4.87 CreditCard OverLimitFee 53.97 5.02 CreditCardCash AdvanceFee 54.82 4.89Eureka

Moment

45.81 7.93Averageofthe 10 Studies 53.34

Table9;

Age

atwhichfinancialmistakes areminimized,foreachcasestudyofthe "difficulty"ofatask,the interpretation of the Eurekacaseremainsspeculative.

14.2

Formal

Test of

a

Performance

Peak

EffectTable9allows usdoaformal test forapeakeffect. Inregression (2), the nullhypothesis ofa peakeffect is: (i) 6

>

0,and

(ii)Peak

=

—a/

(26) 6 [40,60]. Togetherthese conditions imply thatmistakesfollowaU-shape, withapeakthatisbetween40and60 years ofage.Forcriterion(i),

we

note that theb coefficientsare positiveforall10studies. For9 ofthe 10 studiesbissignificantly differentfromzero (thecreditcardAPR

studyistheexception).-'^ For criterion (ii),Table9shows that apeak inthe 40-60agerangecannotberejectedforalltenstudies.

15

Discussion

and

Related

Work

Age

effects offera unifiedparsimoniousexplanationforour findingsinall ten casestudies. However,our cross-sectional evidencedoesnot definitivelysupportthisinterpretation. In the currentsection,we

reviewsome

possible alternativeexplanations.Some

resultscouldbedrivenby unobservedvariationindefaultrisk. For instance, the U-shapeofAPRs,

couldbeduetoaU-shapeofdefaultbyage.We

test thisalternativehypothesis byregressingdefault rates onagesplines for creditcards, autoloans,andhome

equity loansand

creditlines.We

plot fittedvaluesin Figure 17.None

ofthegraphs isU-shaped.On

the contrary,

home

equity loansandlinesshow

apronouncedinverted-U-shape,implyingthat'*To savespace,weonly report thet—statisticsassociatedwith theb coefficients. FollowingtlieorderofTable

9,theyare:2.20, 4.55, 7.80, 8.77, 17.05, 1.61, 4.57, 2.91, 3.08, 2.67.

Percent DefaultingbyBorrower

Age

8,00%

- -CreditCards ——AutoLoans HE-Loans

™„, HE-Lines ArgentinaMortgage '^'"^^"^-Small Business

700%

-^-

\

6,00%"-'^

"'"'--.,

4,00% «_—.-"

300% u™^ ,.^^---"'-""^' "'"^^^^^^^^^^^^""•^^.^ .^.u-v—«"'""''*''*°*^'" "" '^^^^^^^S^*!r^ 2,00% 1,00%^^

..^-^ 000%^

Borrower

Age

(Years)Figure17: Defaultfrequencyby borrowerage.

The

figureplotsthe residualefi'ectofage, after controllingforotherobservablecharacteristics,suchas incomeand

credit-worthiness.the

young

andoldhave lower defaultrates. Credit cards and autoloansalsoshow

a slight invertedU-shape. Hence, Figure17 contradicts the hypothesis thatour resultsare drivenby anunmeasured

defaultrisk. Also,notethatage-dependent defaultriskcould not explain the observedpatternsincredit cardfeepayments

orsuboptimaluseofbalancetransfers.Some

ageeffectscouldbe generatedbyage-variationintheopportunitycost oftime[Aguiarand

Hurst2005]. However, suchopportunity-costeffectswouldpredictthatretireesmake

fewer mistakes, whichisnotwhat

we

observeinthe data.The

presence ofage effects might also be interpreted as evidence forsome

kind ofage discrimination.We

believe this to be unlikely, for two reasons. First, firms avoid age discriminationfor legalreasons. Penaltiesforage discrimination fromthe FairLending Act are substantial (as would bethe resulting negativepublicity). Second, theU-shaped pattern showsup

in contexts such as feepayments

and misuse ofbalance transfer offers in which discriminationisnot relevant (sinceallcard holdersfacethesame

rules).15.1

Related

Work

Other authorshavestudied theeffectsofagingonthe use offinancial instruments. Ko-rniotisand

Kumar

(2007) examine theperformance ofinvestors froma majorU.S. discount brokeragehouse.They

usecensusdatatoimpute educationlevelsand data fromtheSurveyofHealth, Aging

and

RetirementinEurope

to estimate amodel

ofcognitive abilities.They

findthat investors withcognitive declinesearnannual returnsbetween3-5percentagepoints lower on arisk adjustedbasis. In a related paper,

Zinman

(2006) reports that older adults aremore

likelytoborrowathighinterestratesoncreditcard accounts, while simultaneously holdingliquid assets inlow-interestbank

accounts.Intheir

work on

financial hteracy, Lusardiand

Mitchel findevidence consistent with an inverse-Ushapeoffinancial proficiency. Lusardiand

Mitchell (2006)finda declineinfinancial knowledgeafterage50. Lusardiand

Mitchell (2007)also findaninverseU-shapeinthemastery ofbasicfinancialconcepts, suchastheabilitytocalculatepercentages or simpledivisions.After

some

ofour presentationsother researchershave offered tolook forage patterns of financialmistakesintheirown

datasets. LuciaDunn

has reported to us that theOhio

State Survey on credit cards shows a U-shaped pattern ofcreditcardAPR

terms by age (Dunn, personal communication). Fiona Scott-Morton has reported thatin herdatasetof indirect autoloans (loansmade

by banksand

financecompaniesusing the dealerasanintermediary;see Scott-Mortonetai,2003), loanAPR

termsshow

aU-shapedpattern(Scott-Morton, personal communication).

A

relationship between earningand

performance has been noted inmany

non-financial^ contexts. Survey datasuggests that labor earningspeak aroundage50(GourinchasandParker, 2002) orafterabout30 years of experience(Murphy

and Welch, 1990). Thisisconsistentwith ourhypothesis thateconomic performancedepends on both analyticabilities andexperience. Turning to purely noneconomic domains, thereis aliterature onestimatingperformance peaksinprofessionalathleticsand

other competitiveareas. Fair (1994, 2005a,2005b)estimates theeffectsofage declinesinbaseballand

chess,among

othersports.James

(2003) estimates theage ofpeak performanceinbaseball tobe29.A

burgeoningliterature inpsychology and economicsreportssystematic differencein "ra-tionality" between groupsof people. Benjamin,Brown and

Shapiro(2006) findthat subjects withhighertest scores,orlesscognitiveload,displayfewerbehavioralbiases. Frederick (2005) identifies ameasure of "analytical IQ": people with higher scores oncognitive abilitytasks tend to exhibitfewer/weaker psychologicalbiases. While this literatureis motivated by ex-perimentaldata (whereit iseasier tocontrolfor unobservables),we

rely onfielddatainour paper. Similarly, Massoud, Saunders and Schnolnick (2006) find thatmore

educated peoplemake

fewer mistakesontheir credit cards.A

number

ofresearchers have writtenabout consumercredit card use.Our work most

closely overlaps with that of Agarwal et al. (2005),

who

useanother largerandom

sample ofcredit cardaccounts toshow

that,onaverage, borrowers choosecreditcard contracts that minimize their total interestcosts net offeespaid.About

40percent ofborrowersinitially choosesuboptimal contracts. Whilesome

borrowers incurhundredsofdollars ofsuchcosts,most

borrowers subsequentlyswitch to cost-minimizing contracts.The

resultsofourpapercomplement

those ofAgarwal

et al. (2005), sincewe

find evidence of learning to avoidfeesand

interestcostsgiven a particular card contract.Several researchers havelooked at theresponse ofconsumers to low, introductoi'y credit cardrates ('teaser' rates),

and

atthe persistence of otherwise highinterest rates. Shuiand Ausubel (2004)show

that consumersprefer creditcard contractswith lowinitialrates for a shortperiod oftimetooneswithsomewhat

higher ratesfora longer period of time,evenwhen

thelatter is expost,

more

beneficial.Consumers

alsoappear 'reluctant'to switch contracts. DellaVignaand Malmendier

(2004) theorize thatfinancialinstitutionsset theterms ofcredit cardcontracts toreflectconsumers'poorforecastingabilityovertheirfutureconsumption.Bertrand et al. (2005) find that randomized changes in the "psychological features" of

consumer

credit offers affect adoptionrates asmuch

asvariations inthe interestrateterms. Ausubel(1991) hypothesizes thatconsumersmay

beover-optimistic,repeatedly underestimat-ingthe probability thattheywillborrow,thus possibly explaining thestickinessofcredit card interest rates.Calem and

Mester (1995) use the 1989 SurveyofConsumer

Finances (SCF) to argue that information barriers create high switching costs for high-balance credit card customers, leadingto persistence ofcreditcardinterest rates,and

Calem,Gordy and

Mester (2005) use the 1998and

2001SCFs

toarguethatsuchcosts continue tobeimportant. Kerrand

Dunn

(2002) usedatafromthe 1998SCF

toarguethathavinglargecreditcard balances raisesconsumers' propensity to searchfor lower creditcard interest rates. Kerr andDunn

(2004) use

SCF

datatoarguethatbanksofferbetterlendingtermstoconsumerswho

arealsobank

depositors,and

aboutwhom

thebank

wouldthushavemore

information.Other authors have usedcreditcarddatatoevaluate

more

generalhypotheses about con-sumption. Agarwal, Liuand

Souleles (2004) usecreditcarddatatoexamine

theresponse of consumersto the2001 tax rebates. Grossand

Souleles (2002a) usecreditcarddatatoargue that default rates roseinthemid-1990sduetodeclining default costs, ratherthana deterio-ration in the credit-worthiness of borrowers. Gross andSouleles (2002b) findthat increases incredit limitsand

declinesininterestrates leadtolargeincreasesinconsumer

debt. Ravina (2005) estimates consumption Eulerequations for creditcard holdersand

findsevidence for habit persistence.15.2

Some Open

Questions

forFuture

Resecirch

Our

findingssuggest several directionsforfuture research.First,itwould beuseful tostudyageeffects inother decisiondomains.

We

havepresented a simpleprocedureforthis: (1) identifythe generalshapeofageeffects,asin (1),using controlsand agesplines; (2)estimate a linear-quadraticformtolocalizethepeakofperformance,as in

(2)-(3).

Second,it

may

bepossible todevelopmodelsthat predictthe location ofpeak performance. Thereisagrowing consensusthat analytically intensiveproblemsareassociatedwith youngerpeak

ages-think aboutmathematics(seeSimonton

1988,Galenson2005,andWeinberg and Galenson 2006). Analogously,problemsthat aremore

experientially-relevanthaveolderpeak ages. Forinstance, Jones(2006)findsthatthepeakageforscientistshasdrifted higherinthe twentieth century.More

knowledgenow

needstobeaccumulatedtoreach the cuttingedgeof thefield.In our last case study,

we

found thatwhat

isarguably themost

analyticallydemanding

task- deducing the best

way

to exploit "interest-free" balance transfers-isassociated with theyoungestage ofpeak

performance. Itwould beusefultoknow

ifthisassociationbetween analyticallydemanding

problemsand

young

peakagesisgeneral.Third, it would be useful to identify cost-effective regulations that would help improve financial decisions. Forceddisclosureis notitselfsufficient, since disclosing costsin thefine printwillhavelittleimpact ondistracted

and

boundedlyrationalconsumers.^'^Good

disclo-surerules willneedtobeeffectiveevenforconsumers

who

donot take thetimetoread thefine print orwho

havelimitedfinancialeducation.We

conjecture thateffectiveregulationswould produce comparableand

transparent products.On

the otherhand,such homogenizationhas thedynamic

costthatitmay

createaroadblockto innovation.Fourth, studying cognitive lifecycle patterns should encourage economists to pay

more

attention tothe market for advice. Advice markets

may

not functionefficientlybecause of informationasymmetriesbetweentherecipientsandthe providers ofadvice (Dulleckand Ker-schbamer2006). It isparticularlyimportanttostudythe advicemarketforolderadultswho

are