Digitized

by

the

Internet

Archive

in

2011

with

funding

from

Boston

Library

Consortium

Member

Libraries

Massachusetts

Institute

ot

Technology

Department

of

Economics

Working

Paper

Series

DOES COMPETITION

REDUCE

COSTS?

ASSESSING

THE IMPACT OF

REGULATORY

RESTRUCTURING

ON

U.S.

ELECTRIC

GENERATION

EFFICIENCY

Kira

Markiewicz

Nancy

Rose

Catherine

Wolfram

Working

Paper 04-37

November

2004

RoomE52-251

50

Memorial

Drive

Cambridge,

MA

02142

This

paper

can

be

downloaded

without

charge

from

the

Social

Science

Research

Network

Paper

Collection

athttp://ssrn.com/abstract=6

1828

MASSACHUSETTS

INSTITUTEOF

TECHNOLOGY

DEC

7200^

Does

Competition

Reduce

Costs?

Assessing the

Impact

of

Regulatory Restructuring

on

U.S. Electric

Generation

Efficiency

Kira

Markiewicz

UC

Berkeley,Haas

School

of Business

Nancy

L.Rose

MIT

and

NBER

Catherine

Wolfram

UC

Berkeley

and

NBER*

November

2004

*markiewi(a),haas.

berkeley.edu.nrosefajmit.edu,wolfram@haas.berkelev.edu. Roseacknowledgessupport

fromthe

MIT

CenterforEnergy and EnvironmentalPolicyResearchandtheHooverInstitution.We

thankparticipantsatthe

NBER

ProductivityProgramMeeting,theNBER

10Summer

InstituteMeeting,the UniversityofCaliforniaEnergyInstitutePOWER

conference,andtheMIT

CenterforEnergy and EnvironmentalPolicyResearchconference, as wellasseminarparticipantsatHarvard,MIT,UC

Berkeley,UC

Davisand Yalefor theirsuggestions.We

are particularly grateful forthe detailedcomments onearlier draftsprovided by Al Klevorick,Mark

Roberts,CharlesRossmanandJohannesVan

Biesebroeck.We

alsothankTom

Wilkeningforassistanceincodingrestructuringpolicycharacteristicsacrossstates.Does

Competition

Reduce

Costs?

Assessing

the

Impact

of

Regulatory Restructuring

on

U.S.

Electric

Generation

Efficiency

Kira

Markiewicz

Nancy

L.Rose

Catherine

Wolfram

Abstract

Although

theallocativeefficiency benefitsof competitionarea tenetofmicroeconomic

theory,therelation

between

competitionand

technical efficiencyis lesswellunderstood. Neoclassicalmodels

ofprofit-maximizationsubsume

staticcost-minimizing behaviorregardless of marketcompetitiveness, butagency

models

of managerial behaviorsuggest possiblescopeforcompetitiontoinfluencecost-reducingeffortchoices. Thispaperexplores the empiricaleffectsof competitionontechnical efficiencyinthecontextofelectricityindustryrestructuring.

Restructuringprograms adopted by

many

U.S.statesmade

utilitiesresidualclaimantstocost savingsand

increasedtheirexposuretocompetitive markets.We

estimate theimpactofthesechanges

on

annualgeneratingplant-levelinputdemand

fornon-fuel operatingexpenses, thenumber

ofemployees

andfuel use.We

findthatmunicipally-ownedplants,whose owners were

forthe

most

partunaffectedbyrestructuring, experiencedthesmallest efficiency gainsoverthe pastdecade. Investor-ownedutilityplantsinstates thatrestructuredtheirwholesaleelectricity marketshad

thelargestreductions innonfueloperatingexpensesandemployment,

whileinvestor-owned

plants innonrestructuringstates fellbetween

these extremes.The

analysisalsohighlightsthesubstantiveimportanceoftreatingthe simultaneityofinputandoutput decisions,

which

we

do throughaninstrumental variables approach.JEL

Codes:

L

11,L43,

L5

1,L94,

D24

Keywords:

Efficiency, Production,Competition,

Electricity restructuring, ElectricEconomistshave long arguedthatcompetitiongeneratesimportant efficiencybenefits foran

economy. These

generally focuson

allocative efficiency;theimplicationsof competitionfortechnical efficiencyare less clear. Neoclassical

models

ofprofit-maximizationsubsume

static cost-minimizingbehaviorby

all firms,regardlessof marketcompetitiveness.1Agency

models, however, inrecognizing the interplayofasymmetricinformationwiththe separationofmanagement

andcontrol, suggest possible deviationsfrom

cost-minimization byeffort-aversemanagers. These

models

may

imply arole forcompetitioninconstrainingmanagerialbehavior,by rewardingefficiency gains

and

confrontingless-efficientfirms withthechoiceofcost reductiontotheleveloftheirlower-cost counterparts orexit; see Nickell(1996)fora brief discussionofsome

ofthesetheoreticalarguments. Theiractualrelevanceisultimatelyanempirical question.

Thispaperassesses theeffectof competition ontechnicalefficiencyusingdata

on

the U.S.electricgenerationsector.

The

pastdecadehaswitnessedadramatictransformationofthis industry. Until themid-1990s, overninety percentoftheelectricity intheUS

was

soldby

vertically-integratedinvestor-ownedutilities(IOUs),

most

operatingasregulatedmonopolistswithintheirserviceareas. Today, non-utilitygenerators

own

roughly aquarterofgeneration capacitynationwide,andIOUs

inmany

statesown

onlya smallfractionoftotalgenerating capacity andoperateinapartiallyderegulatedstructure thatreliesheavily on market-basedincentives orcompetition.

While

studiesofstate-level electricityrestructuringsuggestpoliticiansmay

have been motivatedinlarge partby

rent-seeking(e.g.,White, 1996, and Joskow, 1997),many

proponentsofrestructuringarguedthatexposingutilitiestocompetitive,market-basedoutcomes

would

yieldefficiency gainsthatcouldultimatelyreduce electricitycosts andretailprices. Research

on

otherindustriessuggests productivity gains associatedwithderegulation(e.g., OlleyandPakes, 1996,

on

telecommunications andNg

andSeabright,2001,on

airlines) and withincreased competitive pressurecausedby

factorsotherthan regulatory change(e.g.,Galdon-Sanchez

and Schmitz, 2002,on

ironoremines).2The

considerablebody

ofacademicwork

on

electricityrestructuring withinthe U.S.and abroadhas thus farfocusedon assessing theperformance ofcompetitivewholesalemarkets, with

1

Theimplicationof competitionfordynamicefficiencythroughinnovationisthesubjectof anextensive

theoreticalandempiricalliterature ineconomics,datingatleastfrom Schumpeter's 1943 classic

particular attention tothe exerciseof market

power

(see forexample

Borenstein,Bushnelland

Wolak,

2002

andJoskow

andKahn,

2002).While

many

ofthecostsofelectricityrestructuringhave beenintensively studied, relativelylittleefforthas

been

devotedtoquantifyingany expost operating efficiency gainsofrestructuring, althoughafew

studies(e.g.,Knittel, 2002) have analyzedefficiencyeffectsofvarious incentive regulations in this sector.3 Thisstudyprovides thefirstsubstantialanalysisofearlygeneration efficiency gains ofelectricityrestructuring.As

such,itcontributestothebroad

economic

debateon

theroleof competitionintheeconomy

and

isofdirectpolicy relevanceto statescontemplatingthe futureoftheir electricity restructuring programs.

The

resultsofthiswork

indicate thatplant operatorsmost

affectedby

restructuringreducedlaborand nonfuelexpenses,holding output constant,

by

roughly5%

ormore

relativetootherinvestor-owned

utility(IOU)

plants,andby 15-20%

relativetogovernment-and cooperatively-ownedplants,

which were

largely unaffectedby

restructuring incentives. Thesemay

beinterpretedasthe

medium-run

efficiency gainsthatJoskow

(1997, p. 214)posits"may

beassociatedwithimprovingthe operatingperformance ofthe existing stockofgeneratingfacilitiesandincreasing the productivityoflaboroperating thesefacilities."

Our work

alsohighlightstheimportanceof treatingthe simultaneity ofinputand

output choice. Failingtorecognizethatshocksto input productivitymay

inducefirmstoadjusttargetedoutput leadstooverstatementofestimated efficiencyeffects, insome

casesby

afactoroftwo

ormore.While

endogeneity concernshave beenlongrecognizedinthe productivityliterature,oursisone ofthefirststudiesofelectricgenerationtocompensateforthis. Finally,

we

explore thesensitivityoftheestimated efficiencyimpacttothechoiceofcontrolgroupto

which

restructuredplants arecompared, anddiscuss theissuesinvolvedindeterminingtheappropriate counterfactual.

2

Some

hintofthispossibility in electricityisprovidedbyPrimeaux(1977),who

comparedasample ofmunicipally

owned

firmsfacingcompetitiontoamatchedsample ofmunicipallyowned

firms inmonopolysituations and foundasignificantdecreaseincostsper

kWh

forfirmsfacingcompetition.3

One

exceptionisHiebert (2002),who

uses stochasticfrontierproductionfunctionstoestimate generation plantefficiencyover 1988-1997.One

setof independentvariablesheincludesisindicatorsforregulatory ordersor legislativeenactment ofrestructuringreformsin 1996 andin1997. Whilehefindssignificantreductionsin

mean

inefficiency associatedwithrestructuring lawsin1996forcoalplants,hefindsno effectsforgasplants,norfor either fueltypein1997. Ourworkuses alongertimeperiod,richercharacterizationofthe restructuringenvironmentanddatingof reformsconsistentwiththeU.S. Energy

Information Administration,and analternativetechnologyspecificationthatallowsformore complex productivityshocksandtreatspossible inputendogeneitybiases. Joskow(1997)describes thesignificant

laborforcereductionsthataccompaniedrestructuringinthe

UK,

asthe industrymoved

from state-ownedmonopolytoaprivatized,competitive generation market,althoughthesemixrestructuringand

The

remainderofthepaperis organizedasfollows: Section 1 describes existingevidenceonthecompetitiveeffectsofefficiency,anddiscusses

how

restructuringmightalterelectricgenerationefficiency. Section2 detailsourempirical

methodology

fortestingthesepredictions,anddescribes our strategyforidentifying restructuringeffects.

The

dataaredescribedinSection3.Section4reportstheresultsofthe empiricalanalysis, andSection 5 concludes.

1.

Why

Might

Restructuring AffectGenerator

Efficiency?Exit

by

less-efficientfirms isawell-understoodefficiencybenefitofcompetition: asoutputshifts from(innately)higher-costfirmstolower-costcompetitors thetotalproductioncostforagivenoutputleveldecline. Olleyand Pakes (1996) provideempirical evidenceofthis

phenomenon

in theirplant-levelanalysisofthemagnitude and source ofproductivitygainsintheU.S.telecommunications equipmentindustryover 1974-1987.

They

findsubstantial increasesinproductivity associated withthe increasedcompetitionthatfollowedthe 1984divestiture

and

deregulationinthissector,andidentifytheprimary sourceofthesegainsasthere-allocationof

output

from

lessproductivetomore

productive plants acrossfirms. Ina similarvein, Syverson (2004)finds thatmore

competitivelocalmarkets intheconcrete industryareassociatedwith highermean,lessdispersion,and

higherlower-boundsinplant productivity, effectsheattributes totheexitofless-efficientplantsinmore

competitiveenvironments.The

existingevidenceon

whether competitionalso leadstocostreductionsthroughtechnical efficiency gainsby

continuingproducersandplantsisrelativelysparse. Nickell(1996)usesapanel of

670

U.K. manufacturingfirmstoestimateproduction functionsthatinclude controls forthecompetitiveenvironmentsin

which

firms operate.He

findssome

evidenceof reducedproductivitylevelsassociatedwithmarket

power

andstrongsupportforhigher productivitygrowthrates in

more

competitive environments. Concerns abouttheability ofcross-industry analysistocontroladequatelyforunobservableheterogeneity acrosssectorsmay make

sector-specificevidencetighterandmore

convincing.4A

notableexample

istheGaldon-Sanchez

and

Schmitz (2002)studyoflabor productivity gainsat ironoreminesthatfaced increased

competitive pressurefollowingthe collapseofworldsteelproduction intheearly 1980s.

They

findunprecedentedratesoflabor productivity gains associatedwiththisincreaseincompetitive 4

A

numberofstudieshave analyzedefficiencygainsfollowing regulatoryreforminvariousindustries; see, forexample,Bailey's(1986) overview and Parketal.(1998) onairlines. Unfortunately,inmany

casesitisdifficult todisentangledirectregulatoryeffectsonefficiency(e.g.,operatingrestrictionsimposed

ontrucking firms orairlinesbyregulators inthosesectors)fromtheindirect effectsof reduced

pressure, "drivenbycontinuing mines,producingthe

same

productsand

using thesame

technologyastheyhadbefore the 1980s" (Galdon-Sanchez and Schmitz, 2002,p. 1233).5 Severalfeaturesofthe electricgeneration sector

make

itanattractivesubjectfortestingpotentialcompetitiveeffectsontechnicalefficiency.6 First,generationtechnologyisreasonablystableand well-understood anddataon productioninputs andoutputsattheplant-levelare readilyavailable

toresearchers. Thishas

made

electricgenerationacommon

applicationfornew

productionand

costfunction estimation techniques, datingatleasttoNerlove(1963). Second,policyshifts over

arelativelyshortperiodhaveresulted inadramatictransformationofthemarket for electric power.

Through

the early 1990s, theU.S.electricity industrywas

dominatedby verticallyintegratedinvestor-ownedutilities(IOUs).

Most

operatedasregulatedmonopolists overgeneration,transmission,

and

distribution ofelectricitywithintheirlocalizedgeographicmarket,thoughthere

was

some

wholesalepower

tradedamong

utilities orpurchasedfroma small butgrowing

number

ofnon-utilitygenerators. Pricesgenerallywere

determinedby stateregulatorsbasedon accountingcostsofserviceatthefirmlevel.

By

1998,everyjurisdiction(50 statesandtheDistrictof

Columbia)

had

initiatedformalhearingstoconsiderrestructuring their electricity sector,andby

2000, almosthalfhad approvedlegislationintroducingsome

form of competitionincludingretailaccess.7 Thisprovidesbothtimeseriesand geographicvariation incompetitive

environments. Third, staticand

dynamic

efficiencyclaims bolsteredmuch

ofthepolicyreform;measuringthese benefitsisavitalprerequisitetoassessing the

wisdom

ofthesepolicies. Ithaslongbeen arguedthat traditionalcost-of-service regulationdoesrelativelywellinlimitingrentsbutlesswellinprovidingincentivesforcost-minimizingproduction; seeLaffontandTirole (1993).

Under

pure cost-of-serviceregulation,regulator-approved costs oftheutilitiesarepassed directlythroughtocustomers,andreductionsinthe costofservice yieldatmost

short-termprofits until ratesarerevisedto reflectthe

new

lowercostsatthenextratecase.8Given

asymmetric information

between

regulatorsandfirms, inefficientbehaviorbymanagers

that raises operationscostsabove

minimum

costlevelsgenerallywould

bereflectedinincreasedrates5

Ng

andSeabright(2001)estimate cost functionsforapanelofU.S.andEuropeanairlinesover1982-1995,and concludethatpotentialgainsfromfurther privatizationandincreasedcompetition

among

Europeancarriersare substantial,thoughthey point outthatthebest-measuredcomponentofthesegains

relates toownershipratherthanmarketstructure differences.

6

Understandingpossible reallocationofoutput acrossplantsishampered bytheexitofplantsfrommost availabledatabases

when

they are soldtonon-utilityowners.7

IntheaftermathofCalifornia'selectricitycrisisin2000-2001,restructuringhasbecomelesspopularand

many

stateshave delayedorsuspendedrestructuringactivity,includingsixthathadpreviously approved retailaccesslegislation. SeeUS

Energy Information Administration(EIA),2003.and passed throughtocustomers.

Joskow

(1974) and Hendricks (1975) demonstratethat frictionsincost-of-serviceregulation, particularlythosearisingfromregulatorylag(time

between

price-resetting hearings),may

providesome

incentivesatthemarginforcost-reducingeffort. Their impactgenerallyis limited,however,apartfromperiodsofrapidnominalcostinflation(seeJoskow, 1974).

This systemledeconomiststoarguethatreplacing cost-of-service regulationwith

higher-powered

regulatory incentiveschemes

orincreasedcompetitioncouldenhanceefficiency.9Over

the 1980s andearly 1990s,

many

stateutilitycommissions

accordinglyadoptedsome

form ofincentiveregulation.

The

limitedempiricalevidenceavailableonthesereforms,which modify

pricesettingwithin the regulated

monopoly

structure,suggestsmixed

results. Knittel (2002) studiesa varietyofincentive regulations inusethrough 1996, andfinds thatthose targetedatplantperformanceorfuelcost

were

associatedwithgainsinplant-levelgenerationefficiency.10More

generalreforms, suchas pricecaps, rate freezes,and revenue-decoupling programs, typicallywere

associatedwithinsignificantor negative efficiency estimates,allelse equal.Restructuring,incontrasttoincentiveregulations,fundamentally

changed

theway

plantowners

earn revenue.

At

thewholesale level,plantsselleitherthroughnewly

created spotmarkets orthrough long-termcontractsthatarepresumably based

on

expectedspotprices. Inthe spot markets, plantowners

submitbids indicating theprices atwhich

theyarewillingto supplypower

fromtheirplants. Dispatchorderisset

by

thebids, and,inmost

markets, the bidofthemarginalplantispaidtoallplantsthataredispatched. High-costplants willbeforced

down

inthe dispatchorder, reducinglikelyrevenue. Plant operatorsthatreducecosts

move

higherinthedispatchorder, increasing dispatchprobability, andincrease theprofitmargin

between

own

costsand

theexpectedmarketprice.

Most

restructuringprogramsalsochanged

theway

retailrates are determined andtheway

inwhich

retailcustomersareallocated." Retailaccessprogramsin8

Ratesareconstantbetweenratecases,apartfromcertainspecificautomatic adjustments(suchas fuel

adjustmentclauses),sochangesincostwouldnotbereflected in rates untilthenextratecase.

9

See,forexample,LaffontandTirole, 1993,foratheoretical justification,orJoskowand Schmalensee,

1987,foranappliedargument.

10

Knittel uses

OLS

andstochasticproductionfrontiertechniquestoestimateCobb-Douglasgenerating plantproduction functions incapital,labor,andfuelforapaneloflargeIOU

plantsover 1981-1996. Hisresultsfromfirst-differencedmodels,whichimplicitlyallowfor plant-levelfixedefficiencyeffects,

suggest gainsontheorderof1-2%associatedwiththese reforms.Equationsthatdonotallow forplant fixedeffectssuggest

much

largermagnitudes.Stateshave useda varietyof approachesto linkretailratesunderrestructuringtowholesaleprices inthe market. Overthe shortterm,moststatesdecoupledutilityrevenuefromcostsbymandatingretailrate freezes,oftenatlevelsdiscountedfrompre-restructuringprices.

Some

states,suchasPennsylvania,areaggressively tryingtoencourageentrybycompetitiveenergysuppliers,

who may

contractdirectlywith retailcustomers.combination withthe creationofthe

new

wholesalespotmarketsmay

increase theintensityofcost-cuttingincentives, leadingtoevengreatereffortto

improve

efficiency.While

themost

significantsavingsfrom

restructuringare likely tobeassociated withefficientlong-runinvestmentsin

new

capacity, theremay

beopportunitiesformodest

reductionsinoperatingcostsofexistingplants(seeJoskow, 1997). Thispaperattemptsto

measure

the extentofthatpossible

improvement

forthe existingstockofelectricitygenerating plantsintheU.S.The

implicit null hypothesisisthat,beforerestructuring,operatorswere

minimizingtheir costs, giventhecapital stock availableintheindustry.Under

thenull,thereshouldbeno

changein plant-levelefficiencymeasures associatedwithrestructuring activity.We

discussbelow

ourmethod

forestimating plant efficiencyandidentifying deviationsfromthishypothesis. Assessingtheeffectsofrestructuring requiresspecificationof

how

generatingplantswould

havebeenoperated absent the policy change. Constructingthiscounterfactualiscrucial, butdifficult.

2.

Empirical

Model

Fora single-outputproductionprocess, productive efficiencycan beassessed

by

estimatingwhether aplantis

maximizing

outputgivenitsinputs and whetheritisusing the bestmix

ofinputsgiventheirrelative prices. Productionfunctionsdescribe thetechnologicalprocess of transforminginputstooutputs

and

ignore thecosts ofthe inputs;a plantisefficientifitisontheproduction frontier. Cost minimizationassumesthat,giventhe inputcosts,firmschoosethe

mix

ofinputsthatminimizesthe costsof producingagiven levelofoutput.

A

plantcouldbe producingthemost

output possible fromagiveninputcombination,butnotminimizingcostsif,for instance, labor

was

cheaprelativetomaterials,yet the plantusedalot ofmaterialsrelativeto labor.Even

ifthe firmwere

producingthemaximum

output possiblefrom itsworkersand materials, itwould

notbeefficientifitcouldproducethesame

levelofoutputlessexpensively bysubstituting laborformaterials.We

explore theimpactofrestructuringon efficiencyby

specifying a production functionandthen deriving the relevant input

demand

equations impliedbycostminimization.

We

adopttheconventionofrepresenting generating plant output(Q)by

thenetenergythegeneratingunitsproduce over

some

period(measuredby

annual megawatt-hours,MWh,

inour data), achoicethatisdiscussedinfurther detail inthedata sectionbelow.While

amultitudeofstudiesofelectricplantproductivity

model

thisoutputasa functionofcurrentinputs, often usinga

Cobb-Douglas

production or costfunction, the characteristicsofelectricityproductionarguethatissensitive to importantinstitutional characteristicsofelectricityproductionthathave

been

largelyignoredintheearlierliterature.

First,observedoutputingeneralwillbethelesseroftheoutput the plantiscapable ofproducing, givenits availableinputs,

and

the output calledforbythesystemdispatcher.Because

thesystemdispatcher

must

balancetotalproductionwithdemand

ateachmoment,

thegap between

probable(Q

p

)andactual

(Q

A

)outputforagivenplantiwillbe afunctionof

demand

realizations,the setofotherplantsavailablefordispatch,andplanti's positioninthedispatchorder.12

Second, whilefuel inputsarevariedinresponsetoreal-timedispatching

and

operationalchanges,other inputstoaplant'sproduction aredeterminedinadvance ofoutputrealizations. Capital

typicallyischosenatthetimeofaunit'sconstruction(orretirement),andatthe plantlevelis

changed

relativelyinfrequently.From

themanager'sperspective, itmay

be considereda fixedinput. Utilitieshirelaborandsetoperatingandmaterialsexpendituresinadvance, based

on

expected

demand.

While

thesecanbeadjustedoverthemedium-run,

staffing decisionsaswellasmost

maintenanceexpenditures arenottied toshort-run fluctuationsinoutput.We

thereforetreattheseas set in advance ofactualproduction, and determiningatarget levelof probable

output,

Q

p.Finally,whilelabor, materials,andcapital

may

betosome

extentsubstitutable toproduceprobableoutput, thegenerationprocess generallydoesnotallowthese inputstosubstitute for fuel intheshort-run.

Given

thisdescriptionofthetechnology,we

positaLeontief productionprocessforplantiinyeartofthefollowing form:

Q

lt A=

min[g(Eit,T

E ,eit E ),Q

it p(K

i;L

it,M

it,T

p ,£it p )-exp(£it A ))]where

Q

A isactualoutputandQ

pisprobableoutput; inputsaredenotedby

E

forenergy(fuel)input,

K

for capital,L

for labor,andM

formaterials;T

denotesparametervectors,andzdenotes unobserved(totheeconometrician)mean

zero shocks. SeeVan

Biesebroeck (2003)forthe derivationofa similarproduction functionheusestomodel

automobileassembly plant production.12

Random

shockstoaplant'soperations, suchasunexpected equipmentfailuresorequipmentthat lastslonger than expected,willcauseittoproducelessormorethanitsprobableoutputfromasetofavailable

As

notedabove,fuelinput decisionsaremade

in realtime, afterthemanager

hasobservedany shocksassociatedwiththeplant'sprobableoutputproductivity,EjtP

,theactualoperationofthe plant,£it

A

,andtheplant's energy-specific productivityinthe current period,£it E

. Probable

output,

Q

p,is incontrastdeterminedbyinput decisionsmade

inadvance ofactualproduction.We

assume

that capital,measured

by

thenameplategenerating capacityoftheplant,isfixed.14Labor

andmaterialsdecisionsaremade

inadvance ofproduction, butaftertheleveland

productivityoftheplant's capital isobserved. Thisreflectsthequasi-fixityofthese inputs over

time: staffingdecisions and maintenanceplansaredesignedtoensurethatthe plantis available

when

itisdispatched,basedon

the targeted outputQ

p.The

errorterm£it p

incorporates productivityshocksthat

we

assume

areknown

tothe plantmanager

inadvance of schedulinglaborandmaterialsinputs,butarenotobservabletotheeconometrician.

We

allowactualoutputto differ

from

probableoutputbya multiplicativeshock exp(£itA

),

assumed

tobeobservedatthetimefuelinputchoices are

made

but notknown

atthetime probable outputisdetermined. This shockwould

be, forexample, negativeifageneratingunitwere

unexpectedlyshutdown

duetoamechanical failure,or positiveifthe plant

were

runmore

intensivelythan anticipated, asmight bethecaseifa

number

ofplantsahead ofitintheusual dispatchorderwere

unavailable ordemand

realizations

were

unexpectedlyhigh.We

model

probableoutput(Q

p)withaCobb-Douglas

functionoflaborandmaterialsandembedding

capital effects inaconstant(Q

(K)) term. Thisyieldsthe specification:(PF1 )

Q

lt P<

Qo(Ki)-(Lity

L -(Mit)™- exp(£l p )Inpreliminaryanalysis,

we

estimated theparametersoftheproductionfunction,includingterms thatallowedfor differential productivityunderrestructuring.Those

resultssuggestedproductivity gains associatedwithrestructuring.

The

work

reportedhereimposes anadditionalconstraint,based oncost-minimization,toestimate input

demand

functions,andisolatepossiblerestructuring effects

on

eachmeasured

input.A

cost-minimizingplantmanager,facingwages

W

lt andmaterial pricesS;t ,would

solvefortheoptimal inputstoproduce probableoutputQjtP by:

13

Infact,overa shorttimeperiod,maintenance andrepairexpenditureswillbeinverselyrelatedtooutput sincetheboilerneedstobecoolandthe plantofflineformost major work.

We

dealwiththispotentialsimultaneitybiasbelow.

14

Theempirical analysis defines a

new

plant-epoch,/',wheneverthereare significantchangesincapacity, sothatwithineachplant-epoch, capacityisapproximatelyconstant.min

W,

,-Lj,+

Si t-Mi , s.t.&

t p<

Qo(K,)-(Lit) YL -(MjO^-expfe

t p ) Lj„M

ityielding the followingfactor

demand

equations:(LI)

L

it=

(X,Y L Qit P)/W

it(Ml)

Mi^^Q/yS;,

where

X,is theLagrangianontheproductionconstraint.We

observeactualoutput,Q

itA

=

Qit Peit

A

,ratherthan probable output,

Q

itp

.

Making

thissubstitution andtaking logsof bothsides,(LI)becomes:

(L2) ln(Lit)

=

oo+

ln(Qit A )-

£it A-ln(

W

;, )where

oto=

ln(X.yL). Iftherearedifferences acrossplants,overtime,or across regulatoryregimesinthecoefficientsoftheproductionfunction(yL)orinthe

shadow

valueoftheprobableoutput constraint (X),orifthereismeasurement

error inlaborusedattheplant,thisequationwillhold witherror.As

we

areparticularly interested inchangesininputdemand

associatedwith restructuring,we

expand

the subscriptitto irttoinclude plantiinyear/,and

regulatoryrestructuringregimer, andre-write(L2)as:

I5 (L2') ln(Lirt)

=

ln(Qirt A)-ln(W

irt)+

ai L+

5t L +cpr L-

Eirt A+

Eirt Lwhere

a; Lmeasures aplant-specific

component

oflabordemand,

5,L

captures year-specific differencesinlabor

demand,

cprL

capturesrestructuring -specific shiftsinlabor

demand,

andEirtL measurestheremainingerrorinthelabor inputequation.

a

isnow

subsumed

intheplant-specificdemand,

a;L

.

Note

that<prL

picks

up

mean

residualchangesin labor input fora plantina restructuredregimerelative to that plant overallandtoallotherplantsatthesame

pointintime. Itcouldreflectsystematicchangesinthemarginalproductivity oflabor(yL), intheshadow

valueoftheavailabilityconstraint(X)orinoptimizationerrors.I6

15

Notethat

many

plant-leveldifferences,suchas capital stock,andmany

time-varyingshocks,suchastechnology-neutral productivity shocks,dropoutofthisequationthroughthe conditioningonoutput choice.

16

Ifthereweresystematic differencesinthe relationof probable andactualoutput acrossrestructuring,yr L

may

also reflectthechangeinmean

£irt . Since e^

reflectsshocks unobservablebythefirmwhen

settingplannedoutput, itseemsplausiblethatthesebe

mean

zeroinexpectation,buttheirrealizationscould be nonzerointhe restructuringsample

we

observe.Similarly, equation

(Ml)

becomes:(M2)

ln(M

irt)=

ln(Qrt A )-

ln(Srt)+

a;M

+

5tM

+

q>rM

-£irt A

+

£ „tM

which

isdirectlyanalogousto(L2').We

model

theenergycomponent

oftheLeontief productionfunction,which

will ingeneralholdwithequality, as: (PF2)

Q

irt A=

g(Eirt,Y E ,£ E )Assuming

that g(«)ismonotonicallyincreasinginE,we

can simplyinvertittogetanexpressionfor

E

intermsof Q.Note

thatthe priceoffueldoesnot enterintothedemand

forfuelexceptthrough thelevelofoutput the plantisdispatchedtoproduce. Forconsistencywiththe other inputspecifications,

we

specifya log-logrelationship:(El) InCEirt)

=

yQ E -ln(Qirt)+

cpr E+

a, E+

5E+

£irt Ewhere

asbefore,theplant-specificerror, OjE the year-specificerror, 5tE

,andthe restructuring-specific term,cpr

E

,capture systematicchangesinthe efficiencywith

which

plantsconvert energyto electricity—

thatis,changesinplantheatrates—

across plants,overtime,or correlatedwithrestructuringactivity,respectively.

We

confronttwo

importantendogeneity concernsinestimating the basic inputdemand

equations,(L2'),

(M2)

and(El).The

firstisthepossibility thatshocks(£irtL

£in

M

,£in E

) inthe input

demand

equationsmay

becorrelatedwithoutput. Ifoutput decisionsaremade

afteraplant'smanager

observestheplant's efficiency,

managers

may

increaseplannedoutputin responseto positive shocksto aninput'sproductivity, orreduceplannedoutputinresponsetonegative shocks. This behaviorwould

inducea correlationbetween

the errorinthe inputdemand

equationand observedoutput.

Though

one cancontroldirectly forplant-specificefficiency differencesandforsecular productivityshocksinagivenyear,idiosyncratic shocksremain asourceofpossiblebias. Second,theestimatesmay

besubjecttoselection biasifexitdecisionsaredrivenby

unobservedproductivity shocks. Inthiscase,negativeshocks couldleadtoplantshutdown, implyingthatthe

errors forobservations

we

observewillbedrawn from

a truncateddistribution. Neitheroftheseproblems isuniquetooursetting, andtheyhave beenraisedin

many

earlierpapers.17Considerfirstthesimultaneity issue.

We

faceapotentialsimultaneityproblem if,for instance,amalfunctioningpieceof equipment reducestheplant's fuel efficiency, leading theutilityto reduceitsoperationofthatplantand consequentlytouselessfuel. There

may

bedeviationsfrom predeterminedemployment

andmaterials budgetscausedby

unanticipatedbreakdowns

thatrequireincreaseduseoflaborandrepairexpendituresandresult inloweroutput.

A

positive efficiency shocktoaninputmay

leadmanagers

torunthatplantmore

intensivelyovertheyear,increasingoutputaswellasinputuse.

A

varietyofmethods

havebeen usedtoaddressthisconcern.18

We

choosetouse aninstrumental variablesapproach,using ameasure

ofstate-level electricitydemand

asaninstrumentforplant output. Thisis likelytobehighly correlatedwiththe

amount

ofoutput a plantwillbecalledto provide,but uncorrelated,for instance,withhow

efficientlyanindividualplant'sfeedwater

pumps

areworking. This approachislikely tobe particularlyeffective fortheenergy equation,giventheresponsivenessof energyinputchoicestodemand

fluctuations in realtime,andforidentifyingexogenous

output fluctuationsatnon-baseloadplants,

which

aremore

stronglyinfluencedby marginal swings indemand.

Itmay

be lesspowerfulinidentifying variationinexantelaborand maintenancechoices, dependinginpart onthe extenttowhich

plantmanagers

anticipate statedemand.

19We

thereforeexplore thesensitivityof ourresultstoalternativeinstruments.

The

potentialselectionissueismore

difficulttoaddress.The

plantsinoursampleseem more

stablethan those studiedin

many

othercontexts (especially seeOlley andPakes, 1996), suggestingthatthe selectionproblem

may

besomewhat

lesssevere for electricgeneration.However,

plantexitincreases inrestructuringregimes, typically notbecausethe plantisretiredbutbecausedivestitures

remove

theplantsfromthereporting database.To

theextentthatthedivestituresare

mandated by

the restructuringlegislation,thisshouldnot createselectionproblems. But withoutbetterinformation

on what

determinesdiscretionarydivestitures,we

have17

Nerlove (1963)providesanearlydiscussionofsimultaneity biasinproductionfunctions. Olleyand Pakes (1996) propose astructuralapproachtoaddressing simultaneity,whichiscomparedto alternatives in

Grilichesand Mairesse(1998). Ackerberg andCaves(2003)discussthisissueandcomparetreatments

proposed by Olley and Pakes (1996) and Levinsohn andPetrin (2003). While

many

papershaveestimated productionorcostfunctionsfor electricgeneratingplants,fromtheclassicanalysesinNerlove(1963)andChristensen andGreene(1976)toveryrecentworksuchasKleitandTerrell(2001) andKnittel (2002),

electricity industrystudies typicallyhavenottreated eithersimultaneityorselectionproblems.

18

Seethereferencescited innote 17, supra.

19

A

furtherdrawbackto thisinstrumentisthatwe

measuredemand

onlyatthestate, ratherthan plantlevel,whichmeansthat

we

donotuse the cross-plant variation within astatetoidentifyoutputcoefficients.no direct

way

toassesstheirimpacton

theresults.One

indirectway

toassess thesignificanceof potential selectioneffectsistocompare

resultsfortheunbalancedpanelwe

useinmost

of ourwork

tothosefora panelofplants thatcontinuetooperatethroughtheend

of oursampleperiod,for

which

potentialselectioneffects are likely tobemost

severe. Substantial differences acrossthoseresults

may

suggest theneedtomore

carefullytreatpotentialselection biases.Identificationstrategy

There issubstantialheterogeneity acrossplants,utilitiesandstates,

and

theeconomic

environmentin

which

utilitiesoperatehaschanged

considerablyovertime. Inaddition,restructuring isnot

randomly

assigned acrosspoliticaljurisdictions—

earlierwork

suggeststhatitisstrongly correlatedwithhigher thanaverageelectricityprices inthecross-section.20

Fortunately,

we

haveinthissectoradatabaserich in variation. Therearethousands ofgenerating plantsoperatedby

hundreds ofutilitiessubjecttoregulationby

dozensofpoliticaljurisdictions eachsetting theirown

legaland

institutionalenvironment. Paneldataon

thecostsand

operationsofthese plantsare available,with

some

recentexceptions,fromwellbeforeanyrestructuringuntilthepresent.21 Thisallows ustoconstruct

benchmarks

thatwe

believe controlformost

ofthepotentially confoundingvariation.

The

plant-specific effects, {oiiN

},measurethe

mean

useofinputN

atplant;relativetoother plantsinthe sample.These

effectsmay

beassociatedwithdifferencesinplanttechnology type andvintage,ownership(governmentv.privateutilities),andtime-invariantstateeffects.The

year-specificshock, {5t

N

},measuresthe efficiency impactofsector-levelshiftsovertime,suchas

seculartechnologytrends,

macroeconomic

fluctuationsorenergypriceshocks. Restructuringeffectson plantproductivitycorrespondtoa non-zero{(pr

N

}.

The

heterogeneity inthetimingandoutcomes

ofstate-levelrestructuringactivity allowthe datatodistinguishbetween

temporalshocks andrestructuring effects.

While

allstates held hearingson

possiblerestructuring,theearliest

was

initiated in 1993andthelatestin 1998. Thereisconsiderablevariationintheoutcome

ofthose hearings,as well,withjustunderhalf thejurisdictions(23 statesandtheDistrictof

Columbia)

enactingrestructuring legislationbetween

1996and 2000.22The

remainder20

Thesignificant roleofsunkcapital costs inregulatoryratemakingmeansthathighpricesdonot necessarily imply highoperatingcosts forgenerationfacilitieswithin astate,however. SeeJoskow(1997)

foradiscussionofthe contributorstopricevariationacrossstates.

Costdata are not publicly availableforplants

owned

byexemptwholesalegenerators,includingthose acquiredfromregulatedutilities.22

We

collectedinformationonstaterestructuringlegislationfromvariousEnergyInformationAdministrationandNational Associationof RegulatoryUtilityCommissionerspublicationsandstate

considered

and

rejected,orconsidered and simplydidnotacton, suchlegislation. Thisvariation allows ustouse changesinefficiencyatplants in states thatdidnot pass restructuringlegislation to identifyrestructuring separatelyfrom

secularchangesinefficiencyofgenerationplantsovertime.

Itispossiblethatplantsinthiscontrolgroupalsoaltered theirbehavior overthe post-1

992

period. Thiscouldbe

due

perhapstothe introductionorintensificationofincentive regulation withinstatesthatdid notenactrestructuring, tothe expectationofpotentialrestructuringthatdid not occur, orspilloversfromrestructuringmovements

inotherstates(e.g. ifregulators updated theirinformationaboutthecostsnecessarytorunplantsofacertain type, ormulti-stateutilitiesoperatingunderdifferingregimes

improved

efficiencyofalltheir plants,notjustthoseinrestructuringstates).

To

theextentthisoccurs,our comparisonwillunderstate themagnitude of any efficiencyeffectofrestructuring.We

thereforeconsider asecondcontrolgroup, consistingof cooperatively-ownedorpublicly-owned

municipaland federal plants,which

forconveniencewe

will refer toas"MUNI"

plants,althoughthegroupisbroaderthanstrictly implied

by

this label.An

extensiveliteraturehasdebatedtherelativeefficienciesofprivate andpublicownership in thissectorundertraditional regulation,with

somewhat mixed

results.We

abstractfrom

thatby allowingforplant-specific effects thatabsorbanylevelsdifferencesininputuse acrossownershiptype. Restructuring generallyalteredthe competitiveenvironmentonly forprivateinvestor-ownedutilitieswithin astate,leaving thoseforpublicly-and cooperatively-ownedutilitiesunchanged.23 Thissuggests

that

MUNIs

may

provideasecondbenchmark

againstwhich

tomeasure

changesinefficiency associatedwithrestructuring.We

adopta parameterizationthatmeasures {cprN

} relativeto publicly-ownedplantsduring the periodthatinvestor-ownedutilitiesareatriskofrestructuring,

definedas 1993 forward.

Using

N

todenoteinput(labor,nonfuelexpenses, orfuel),andPRICE

N todenotethe relevant input price(noneforthefuel equation),we

haveinput use equation11 : (11) ln(Nirt)=

ln(Qirt A )-\n(PRICE

N in)+

yMUNI

it+

a, N+

5t N+

<pir N-eirt A

+

e,rt Npublicutilitycommissionwebsites. Since 2000,noadditionalstateshave enactedrestructuringlegislation,

andseveralhave delayedorsuspendedrestructuringactivity inresponsetotheCaliforniacrisis.

Withtheexception ofArizonaand Arkansas,whichincludedgovernment-ownedutilities inrestructuring

programs.

This specificationimplicitlyprovides

two

"non-treatmentgroups"towhich

investor-owned plantsinrestructuringregimesmay

be compared: investor-ownedplants innon-restructuringregimes (with the restructuringeffect

measured

by

cprN

),andpublic-and cooperatively-owned

plantsover 1993-1999(with the restructuringeffect

measured

by

cprN -y).

3.

Data

&

Summary

StatisticsThe

analysisin thispaperisbasedon

annualgeneratingplant-level dataforU.S.electricutilities.Plantsarecomprised ofatleastone,buttypically several, generatingunits,

which

may

beadded

toorretiredfromserviceoverthe several-decadelifeofatypical generatingplant.

While

an idealdatasetwould

allowustoexplore efficiency atthegeneratingunitlevel, inputsotherthan fuelarenot availableatthe generatingunitlevel,and some, suchasemployees,arenotevenassignedtothe unitlevelastheyaresharedacrossunitsattheplant.24

We

thereforeuse aplant-year asanobservation.

The

FederalEnergy

RegulatoryCommission

(FERC)

collectsdataforinvestor-ownedutilityplantsannually inthe

FERC

Form

1, andtheEnergy

InformationAdministration(EIA)

and RuralUtilities Service

(RUS)

collectsimilardataformunicipally-ownedplantsandrural electriccooperatives,respectively.

These

dataincludeoperatingstatisticssuchas sizeoftheplant, fuelusage,percentageownershipheld

by

theoperatorandotherowners,number

of employees,capacityfactor, operatingexpense,yearbuilt, and

many

otherplant-level statistics.Our

basedatasetincludesalllargesteam and

combined

cyclegas turbine(CCGT)

generating plants forwhich

data

were

reportedtoFERC

orEIA

overthe 1981 through 1999period.25We

excludedsmallerplants,definedasthosefor

which

gross capacityexceeded 100megawatts

forfewerthan threeofoursampleyears.

We

alsoexcluded approximately 1,500 observationswhere

datawere

missing,anddroppedseveralhundredobservationsbasedonregression diagnosticteststoscreenfor outliersor

undue

influence. FurtherdetailsonthedataareprovidedintheAppendix.We

follow the literature incharacterizingoutputbythetotal energyoutputofthe plantovertheyear, measured

by

annualnetmegawatt-hours ofelectricitygeneration,NET

MWhs.

Thisisanimperfect choice. Outputis, in reality,multidimensional,although

most

dimensions arenot24

Some

labormay

beshared across multipleplants,thoughassignedtooneparticularplantinourdata.Thiswillleadinducemeasurementerror,particularly intheplantemploymentvariable.

25

One

unfortunateconsequence ofrestructuringisthatavailabledataonplantssoldbyutilitiesto non-utilitygenerators areextremelylimitedafterthesale,duetochangedreportingrequirements. Thismeans thatplantswill be excludedfromthe datasetaftersuchsales.recorded inthe plantdata. For example,generating plants

may

alsoprovidereliabilityservices (such asspinningreserves,when

the plant standsreadytoincrease outputatshortnotice), voltage supportand

frequencycontrol.While

theproductionprocess varies considerably across thesedifferentoutputs,onlynet generationiswell

measured

inthedata.26 Moreover,electricityoutput isnot ahomogenous

product.Because

electricityisnon-storable,electricityproducedat5PM

on

thefirstFridayinJulyisa separateoutputfromelectricityproducedat

5AM

onthesecondSunday

inMarch. Firmsmust

decidehow

tobalancethecostsassociatedwithtakingtheirplantdown

todo maintenanceagainstthe probabilitythata poorlymaintainedplantwillfail duringpeak

demand

hours,and

theavailabilityoftheplantmay

be an important modifier ofoutputquality.

Changes

in incentivesassociatedwithrestructuringmay

have alteredfirms' assessments ofthesetradeoffs, althoughtheexpecteddirectionoftheeffectsistheoreticallyambiguous.27 Hourlyoutput pricesand

outputfrom

individualplantsmight allowustobetterassessthis. Lacking suchdata,we

relyon

asingleoutputdimension,butacknowledge

its limitations.We

haveinformationon

threevariableinputs.The

first,EMPLOYEES,

isacountoffull-timeemployees

attheplant.The

second,NONFUEL

EXPENSE,

includesallnon-fuel operationsandmaintenanceexpenses,suchasexpenses forcoolants, maintenancesupervision

and

engineeringexpenses. Thisvariableis lessthanidealasa

measure

ofmaterials,bothbecauseitreflectsexpendituresratherthanquantities,

and

becauseitincludes thewage

bill fortheemployees

countedin

EMPLOYEES,

althoughthatexpenseisnot separately delineatedinourdata.As

NONFUEL

EXPENSES

includes payrollcosts(notseparatelyidentified),boththisandEMPLOYEES

will reflectchangesin staffing. 28The

thirdinputisfueluseby type offuel(tonsof coal,barrelsofoil,andmcf

ofnaturalgas).We

convertfuel intoBTUs

using the reportedannual plant-specificBtu

contentof eachfuel toobtaintotalBTU

inputatthe plantforeachyear.Inputpricespose achallenge.

Wages

inparticularmay

beendogenous

tothefirmandits perceived regulatoryenvironment. Hendricks (1975) suggeststhatutilitiesmay

bargain less 26Theinputsrequiredtoproduceagivenlevelof energy

(MWh)

from aspecificplantalso willdepend on whethertheplantrunscontinuouslyor intermittentlyandonitsaveragecapacityutilization. Startingaplant frequently and runningitatlowcapacityutilizationratestypicallyusemoreinputs(particularly fuel)

per

mwh

generated thandoes running aplantcontinuouslyatitsratedcapacity.27

Forinstance,undertraditionalregulation,utilities

may

havefaced strongpoliticalincentivestoavoidblackouts orbrownouts,leadingto investmentingreatercapacityto increase reservemarginsandingreater

maintenanceresourcesto increase plantreliability.

On

theotherhand,competitive firmsproducing inrestructuredwholesale markets

may

faceevenstronger incentivestobeavailablewhen demand

peaks becausethisiswhen

pricesare highest.28

Theelasticityof

NONFUEL

EXPENSES

withrespecttoEMPLOYEES

isabout.5inourdata,broadly consistentwithourbackoftheenvelopecalculationssuggestingthatlabor costs areroughlyhalfofthe totalnonfuel operating budget.aggressivelyoverinputpricessuchas

wages

during periods inwhich

highercostscould bereadilypassed

on

to customers throughhigher regulatedprices,andmore

aggressivelywhen

the firmwas

likelytobethe residualclaimanttocost savings. Inotherindustries,regulatoryreformhassometimes beenassociatedwithsubstantialreductionsinwages,suggesting rent-sharing

underregulation(seeRose, 1987,

on

thetruckingindustry). Thesesuggestthatobservedwages

may

notbeexogenous

tothefirm,andmay

notreflectthe opportunity costtomanagers

ofthemarginalunitoflabor.

We

addressthisby

usingstate-levelaveragewages from

industrieswith workersofsimilarskillsandtraining topower

plant operators, including natural gasdistribution, petroleumrefiningand hazardous wastetreatmentfacilities,denotedasWAGE.

Thisreflectsopportunitywages, andavoidsconfoundingthe

employee

pricemeasurement

withany changesin recordedwages

duetochanges inlabor force compositionat utilities associatedwithrestructuring orchangesinwage

bargaining.We

do nothave plant-oreven firm-specificindicesforthe materials pricesthatcompriseNONFUEL

EXPENSES.

Our

empiricalmodel

ofNONFUEL

EXPENSES

thereforecorrespondstoaninputdemand

equationwithconstantpricesanda pricecoefficientofone.

The

finalinputisthecapitalstockoftheplant,which

we

measure byplantcapacityandvintage.Our

datarecord the plant capacityinmegawatts.We

combine

thiswith informationon

unit retirementstodefine plant-epochs.Each

plantis assigned auniqueidentifier.Any

timethe capacityofthe plantissignificantlychanged,or thereisanidentifiable unitadditionorunitretirement,

we

createanew

identifierandassociatednew

plant-specificeffect. Thisallowscapitalchangestoaltertheunderlyinginput efficiencyoftheplant.

We

include controlsfortwo

other plantcharacteristics thatmay

varywithinplant-epochand leadtochangesin inputuse.

The

firstisplantAGE

inyears,datedfromtheinstallationdateofthe oldestoperatinggenerating unitattheplant: as plantsagetheymay

become

lessefficientor require additional inputsforagivenlevel ofoutput.The

secondisthe additionofa flue-gas desulfurizationsystem, orFGD

(also calledscrubber),toreducesulfur-dioxideemissionsinsome

coal plants.

FGD

affectstheenvironmentaloutput,unmeasured

by\n{NET

MWhs).

We

supplementthe operational plant datawith information onstate-levelrestructuringactivity. For each state,we

have identifiedthedateatwhich

formal hearingson

restructuringbegan, theenactmentdatefor legislationrestructuringthe state'sutilitysector, ifany, theimplementation

dateforretailaccess underthat legislation,and

some

associated aspectsofrestructuringsuchasratefreezes

and

mandatorydivestitureofgeneration. Testingforrestructuring-specificshocksrequiresa determinationof

how

tomatch

thisinformationwithfirm decisions:when

were

plant operators inagivenstatelikelytohavebegun

respondingtoapolicychange? Consultationswithindustryparticipants

and

readingsoftheseeventssuggestthatutilitiesoftenactedinadvance of finaloutcomes.The

legislativeandregulatoryprocess leadingup

to staterestructuring typicallylasteda

number

ofyears,allowingutilitiesto anticipatethecoming

change,and

altertheir behaviorinadvance. For example, Boston Edison's10-K

filedinMarch

1994discussedMassachusetts'considerationofrestructuring, stating

"The

Company

isrespondingtothecurrentandanticipatedcompetitive pressurewitha

commitment

tocostcontrol andincreased operating efficiencywithoutsacrificingqualityofserviceorprofitability"(p. 6).29

Utilities

may

havebegun

tophaseininputchanges, especially those involving laborandparticularly unionizedworkers. Moreover,aspolicychanges

were

discussed,rateswere

frozeninmany

states,either explicitlyby

policymakers

orineffectby

implicitPUC

decisionsnottohearnew

rate cases,enablingutilitiestocapture thesavingsfromincremental cost reductions.30

In thiswork,

we

allowrestructuring effects tobeginwiththeopening of formalhearingson

restructuring.

The

primaryvariableofinterest,RESTRUCTURED,

isanindicatorvariablethatturns

on

withthestartofformalproceedingsina statethateventuallypassedrestructuringlegislation.

31

A

secondvariable,RETAIL

ACCESS,

indicatesthestartofretailaccessforplants inthe fourstates that

implemented

retailcompetitionduringthesample.32 Table 1 reportsthenumber

ofplants inour databaseeach yearthatwere

in states thathad

RESTRUCTURED

and

the29

Ina 1993articleoutlining

PECO's

costsavingaccomplishmentsandstrategiesforthefuture,Chairmanand

CEO

Joseph Paquettediscussed restructuringoftheutilityindustryandwasquotedas stating,"we

have beenfocusingonourstrategicplanstoenhance ourabilitiesto satisfyourcustomer needs by

becomingmorecompetitive."

PECO

initiativescited inthearticleincludedimprovingthe cost effectivenessofalloperations.One

particularaccomplishment notedwasthereductionintotal employment from 18,700to 12,900.30

As

notedearlier,someofthese changesmay

havealsoaffectedutilitiesinnon-restructuringstates. For example,thenumberofutilityratecasesdroppeddramaticallyinthe 1990s,implyingthatmany

ormost utilitiesmay

have beenshort- ormedium-runresidual claimantstocostreductions. Knittel(2002)identifiesanumberofincentive regulationsadoptedinvarious jurisdictions during the 1990s.

Many

ofthefuel-relatedregulations(modifiedpass-throughclauses,heatrateandequivalentavailabilityfactor

incentiveprograms)werestrongly correlatedwithultimaterestructuring.

Some

ofthebroaderregulations (e.g.,pricecapsand revenue decoupling programs)werealmostorthogonaltoeventualrestructuring.31

The

RESTRUCTURED

variableisbasedon whetherastatehad passedlegislationasofmid-2001, althoughintheaftermathoftheCaliforniaelectricitycrisis,therehasbeennoadditionalrestructuring,andsomedelays orsuspensionof plannedrestructuringactivity.

32

While

RESTRUCTURED

indicatesapprovalofretailaccesslegislation,thespecifiedphase-inofretail accesswasoftenslow. Onlyfive statesimplementedretailaccessduringoursampleperiod: RhodeIslandin1997,California,Massachusetts,and

New

Yorkin 1998,and Pennsylvaniain 1999(U.S.EIA,2003). Becausewe

have novalidobservationsonRhode

Island plants in 1997orbeyond,retailaccesseffectswillbedeterminedbythe4states implementingin 1998or 1999. Divestiturerequirementsin Californiaand

Massachusettsfurtherreducesthepost-retailaccesssample ofplants, asinvestor-ownedplantsinthose

stateswerelargelydivestedby 1999.

number

ofplantsinstatesthathadstartedretailaccess by 1999.33 Ifutilitiesdidnotresponduntilrestructuringlegislationor regulation

was

enactedandthepolicy uncertainty resolved,RESTRUCTURED

willunderestimatethetrue effectby

averaginginnon-responseyears.To

evaluatethispossibility

we

introduceathirdvariable,LAW

PASSED,

anindicatorequaltoone beginningintheyearthestatepasses restructuringlegislation.34 Similarly ifactualimplementation ofretailaccess andtheassociatedwholesalemarket reforms isimportantto

efficiencygains,itwillbereflectedinanincrementaleffectof

RETAIL ACCESS. To

examine

municipally-ownedplantsoverthe restructuringtimeperiod,

we

define the variableMUNI*POST

1992,equaltooneforallmunicipally-ownedplants

from

1993, thefirstyearforwhich

RESTRUCTURED

isone,through 1999.The

finalcolumn

reportsthenumber

ofplants in thiscategory.

Detailsonthedatasources

and

summary

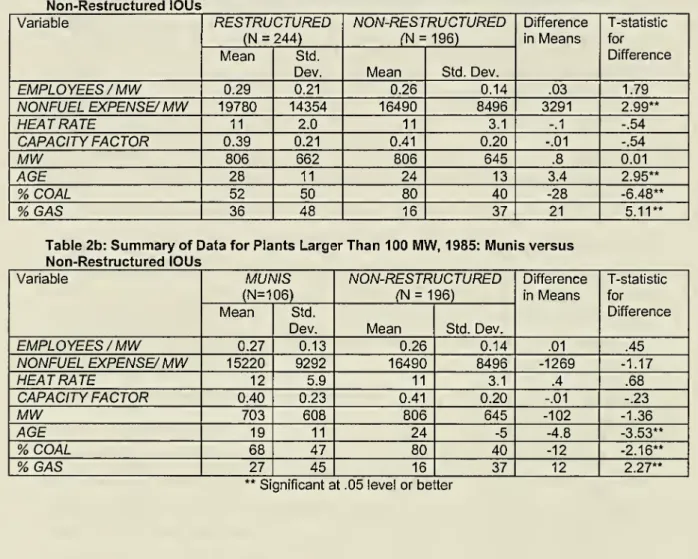

statisticsareprovidedinthe appendix. Tables2aand

2b

reportsummary

statistics forplant-leveldatain 1985across threecategories: investor-ownedplants instatesthatlaterrestructure,investor-ownedplantsin states thatdonotrestructure,

and

non-IOU

plants.We

choosethisdatetoensurethatcomparisonsaremade

prior toany

significantchangesacrossstates inthecompetitive or regulatoryenvironment,evenprior torestructuring

initiatives.

From

thesetables,itappearsthattheplants fromthesegroupsarenotrandom

drawsfrom

thesame

population.The

firstthree variablesmeasure employees

andnon-fuel operating expenses, scaledby

theplant'scapacity,and

fuel useinmillionsofBritishthermalunits(mmBtus),

scaledbytheplant'soutput. In 1985, beforestate-levelrestructuring initiativeswere

considered,plants in states thateventually restructuredhadhigherintensitiesof

employees

andnon-fueloperatingexpenses,althoughthe differenceissignificantonlyfornon-fuelexpenses.

The

firsttwo rows

inTable2b

show

thatmunicipally-ownedplantshadsignificantlyhigheremployment

andnon-fuel input use thanplants innon-restructuring states.The

differences inheatrates andcapacityfactors arenotsignificantin eitherofthe tables.

The

lastfour variables in bothtablesdescribe the stockofplants inthetwo

typesofstates.Although

plants areverysimilarinsizeacross IOUs,

MUNIs

plants areconsiderablysmaller.IOU

plantsinrestructuring33

Forthetablesandthe regression analysisthatfollows, plants areassignedtothestate inwhichthey are regulated.

A

plantlocatedinonestatemay

beowned

byacompanywithexclusive serviceterritory inadifferentstate,andthatsecondstateisthestatebywhichtheregulatorypolicyismeasured.

Some

plantsare

owned

byacompanywithserviceterritoryinmorethanonestateandsome

plants areowned

byseveralcompaniesthatareregulatedbydifferentstates.Intheregression analysis,

we

foundthatseparately characterizing"mixed"regulationand "shared"plantshad very littleimpactonourresults.34

Thereisonaverageabouta 2.6-yearlagbetweentheinitiationofhearingsandthepassageofthe law.

We

have experimented withanumberofalternativemeasures ofrestructuringactivity,including variablesthatbegin withhearings regardlessofrestructuringoutcomes,thosethatmeasureyears since hearingswere

statestendedtobeolder,

more

likelytousegas, andless likely tousecoal,thanIOU

plants innon-restructuringstates.

MUNI

plantstendedtobe younger, less likely tousecoal,andmore

likely tousegas,than

IOU

plantsin non-restructuringstates.The

regression analysiswillcontrolforthese differencesdirectly orwiththeuseof plant-epocheffects.

Ifinvestor-ownedutilitiesachievedefficiency

improvements

when

facingimpending

restructuringofthe generationsector,one

would

expecttoseearelativedecreaseinthe costofgenerationforaffectedcompanies, andlittledifferenceinthechangeintransmissionand distributioncosts

between

the affectedandnot affectedstatessince restructuringprogramsleave transmissionand

distribution comparatively untouched. Ifrestructuringdidnotaffectoperating efficiencyinthegenerationsector,we

mightexpecteither (1)thechangeingenerationexpenseswould

notbestatisticallydifferentbetween

restructuringand

non-restructuringcompanies,or(2)we

would

see thesame

patternof changeincostsforthetransmissionanddistributionsectors asforthegenerationsector.35

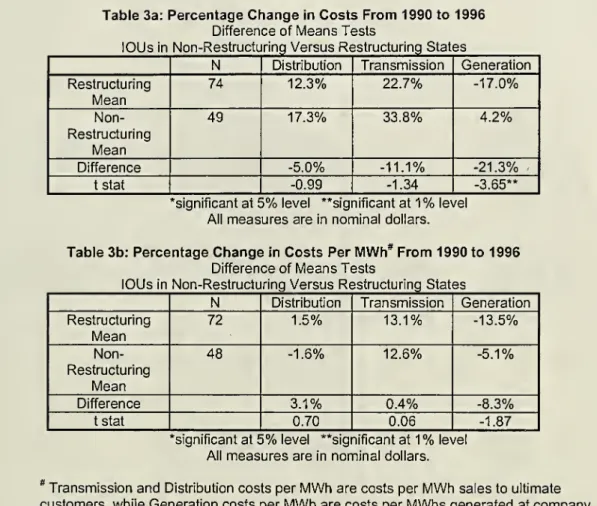

Table3a

and

3b

display the differenceinmean

tests forinvestor-ownedutilitiesinrestructuringandnon-restructuring statesforachange incosts

between

1990and 1996.Table 3areportsthepercentage

change

intotalcosts foreachcategory ofcost,and Table3b

reportsthepercentage changeincostsperMWh.

The

largerdecreaseingenerationcostsatrestructuringcompanies

is significantatthe1%

level,andtheresult forgenerationcostsperMWh

issignificantatthe6%

level.

The

difference incosts forcompaniesinrestructuringandnon-restructuringstatesisnotsignificant for eitherthetransmission ordistribution costs.

These

aggregatestatisticsprovidepreliminarysupportfortheexpectationthattheportionoftheutility

company

facedwith competition(thegeneratingsector)responded witha decreasein costs,whileother sectorsand

companies

notfacedwith competitiondid notsharethisresponse.4.

The

EffectsofRestructuringon

InputUse

initiated for statesthateventuallyrestructured,andthepresenceofrestructuring-associatedratefreezes.

None

oftheseseemtochangemateriallytotheconclusionswe

drawbelow.35

Fortheanalysiscomparingcostsofgeneration,transmission,anddistributionservices,

we

relyondata reportedannuallybyutilitycompaniestotheFederalEnergy RegulatoryCommission(FERC)

intheFERC

Form

1,page320,321,and322respectively.We

use abalancedsamplecomposedofallcompanies with data reportedforallthree sectorsinboth 1990 and1996. Thisamountsto49companiesin statesthatdid notderegulateand74instatesthatdidderegulateforthecomparisonofcosts,and 48and 72respectivelyforthecomparison ofcostsper

MWh.

UsingcostsperMWh

necessitatestheexclusionofafewcompaniesforwhich

MWh

datawasnot availableinone ofthetwoyears.Following equation(II),

we

estimatetheinfluenceofrestructuringon

theuseofinputN

(EMPLOYEES,

NONFUEL

EXPENSE,

andBTUs)

withthefollowing basic regressionmodel:(Rl) ln(Nirt)

=

^

n\n(NETMWh

M

)+

tfhiQPRICE"*

)+

&A

GE

ilt+

fak

FGD

ilt+

(pr NIOU*RESTRUCTURED

+

yMUNI

1993.m9

+

Oj N+

5t N+

p\ N slrt A+

eirt Nwhere

we

allowfornon-unitycoefficientsontheoutputterm(PiN

)forallequationsand

on

the input priceterm(p2N

on

WAGE)

intheEMPLOYEES

equation,36 andinclude controlsfortwo

important plantcharacteristics thatvaryovertime:

AGE

andFGD

(scrubber). otjN

isa

time-invariantfixedeffect forinput

N

atplant-epochi,which

may

containastate-specificandownership-specificerror that willnotbeseparately identified. Theseplant-specificeffects

controlfor

much

oftheexpectedvariation ininputuseacrossplants arisingfrom heterogeneoustechnologies,stateorregional fixedfactors,andbasic efficiencydifferences.

They

alsocontrolfordifferencesinthe plant

mix

betweenrestructuringandnon-restructuringstatesby comparing

eachplanttoitselfovertime,

removing

anytime-invariant planteffects.As

aHausman

testrejectstheexogeneityofplanteffects, allreportedresultsincludeplant-epochfixed-effects.37 5t N

isanindustry-leveleffectinyeart,

which

controlsforsystematicchangesininputdemand

across allplantsovertime.£irt

N

is

assumed

tobeatime varyingmean

zeroshock forinputN

atplant-epochi inregimer attimet. Thisshockis unlikelytobe independent over timeforagivenplant. Thereis likely tobe

persistencein inputshocks,particularly for labor,

from

yeartoyear. Indeed,estimated rhosbasedon

assumed

first-order serialcorrelationareinthe .65rangeforlabor inputsandinthe.33 rangefornon-fuel expenses. Itisunlikelythatthe correlation isassimpleasafirst-orderautogressive process,however.

The

physicaloperationofpower

plants islikelytoinducesome

correlationatlongerdifferences. For example,routinemaintenancecycles

may

involvescheduled shutdownsbutincreased laborandnonfuelexpenses everythreeorfouryears.

We

have exploredGLS

specificationsbasedon an assumption offirst-orderautoregressiveerrors, andtheresultsarequite similartothose reportedinthetablesbelow. Ratherthan

impose

thisassumption, however,

we

choosetoestimatethemodel

withoutaGLS

correction, and simply 36Recallthat

we

donothave apriceassociatedwithnonfuel expenses,andthataccordingtoequation (El),fuelpricesshouldnot enterintothefuelinput function.

We

experimented withusingavariablemeasuringthepriceofagiven plant's fuel relative tothepricesofotherfuels inthesameregionasaninstrumentfor

output but the variablehadno powerinthefirststage.

37

ThisuseoffixedeffectsissimilartotheworkofJoskowand Schmalensee(1987),

who

usedgeneratingunit-leveldatatoexplore the relationshipbetweenoperatingperformanceandunit characteristics. Our

report standarderrors thatare correctedfora general patternofcorrelationover timewithina

givenplant.38

Inputuseover timewillvary withthe levelofplantoperation,

which

ismeasured

inthese specificationsasthe net generationby

theplant inmegawatt-hours(NET

MWh).

We

treattheendogeneityand

measurement

problems describedearlierby instrumentingforoutput withstatedemand

(thelog oftotalstateelectricitysales, aconsumptionratherthanproductionmeasure).Thisinstrumentaffectsthe likelihoodthatagivenplantinthestate willbedispatched

more

overtheyear,butis not influenced

by

the characteristicsofthe plantor thechoicesofindividual plant operators.We

consider specificationsthatincludeinteractionsofIOU

ownership withthe threeprimaryrestructuring indicatorvariablesdescribedinsection3:

RESTRUCTURED,

LA

W

PASSED,

and

RETAIL ACCESS.

Inthe input regressions,a negativecoefficientonthe restructuring variableswould

implyincreased input efficiency associatedwiththeregulatory reform.The

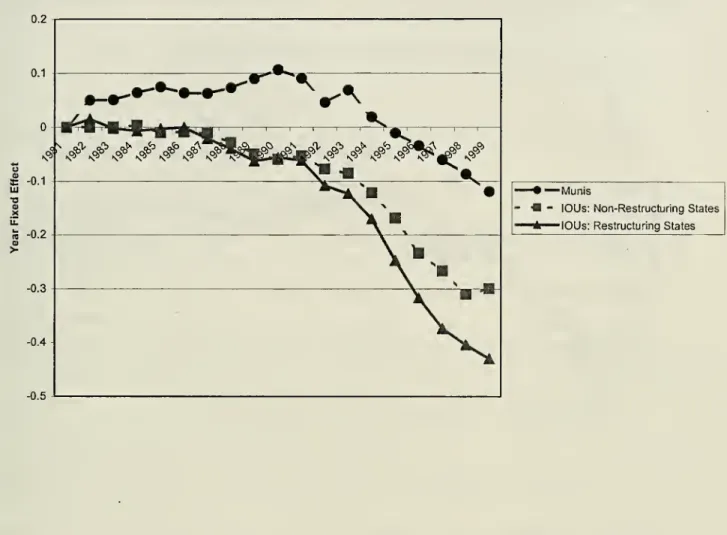

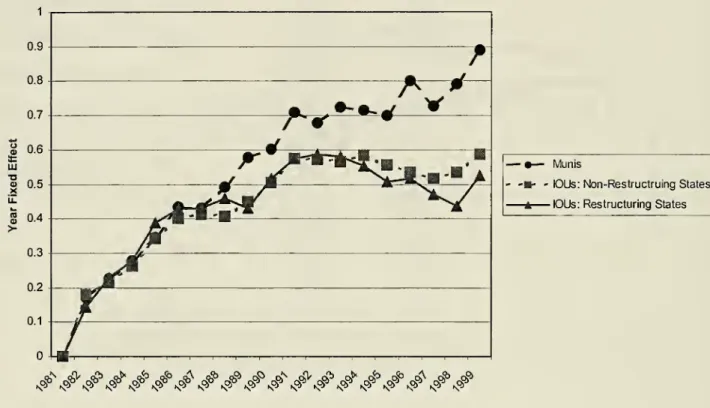

coreresultsfortheinput analysis are presentedinTables4for

EMPLOYEES,

5forNONFUEL

EXPENSES

and

6forBTU.

We

firstdiscuss theresultsforemployment

and nonfuelexpenses,andthen discuss theresultsfor fuel use.Column

1 of tables4and5reportsasimpleOLS

formulationthatexcludesanycontrolforoutput. In thiscolumn,

IOU*RESTRUCTURED

captures themean

differentialininputusefor investor-ownedplants in states thateventuallypass restructuringlegislation,measured

overthe periodfollowing thefirstrestructuringhearings,relative toIOU

plants innon-restructuringstates. This correspondstothemean

within-plantshiftin inputuse, independentofoutput.The

resultssuggeststatistically and economicallysignificantdeclinesininputs duringrestructuring.

Employment

declinesby almost6%

(2%)

andnonfuelexpensesdeclineby

almost13%

(2%),39relative to

IOU

plantsinregimesthathavenotrestructured. Controlling forplant outputreducestheestimatedimpactofrestructuringby

more

than one-quarter,thoughtheeffectsremainlargeandstatisticallydistinguishablefromzero (see

column

2 of eachtable),at-4%

(2%)

foremployment

and-10%

(2%)

fornonfuel expenses.40Measuring

restructuring effectsfromthefixedeffectsareactuallyfinerthanplant-level, as

we

permita,tochange withunitadditions or retirementsandothersignificantchangesin ratedplantcapacity.

38

Reportedstandarderrorsarecalculatedusingthe clusteroptioninStata.

39

We

use [exp(<prN

)-l]*100toapproximatetheimpliedpercentageeffectof

IOU*

RESTRUCTURED

oninputuse.

40

NotethattheCobb-Douglasfunctionalform assumptionsuggeststhatthe coefficientonoutputshouldbe

one,substantially largerthan thecoefficientsestimatedinthese regressions. If

we

imposethisconstraint,theeffectofrestructuringisestimatedtobepositiveandsignificant.