HD28

.M41A

A

Behavioral

Analysis

of

Learning

Curve

Strategy

John

D.

Sterman,

Rebecca

Henderson,

Eric

D.

Beinhocker

and

Lee

I.Newman

A

BEHAVIORAL

ANALYSIS

OF

LEARNING

CURVE

STRATEGY

John

D.

Sterman*,

Rebecca

Henderson*,

Eric D.

Beinhocke^^

and Lee

INewman^

Abstract

Priorresearch

on

firm strategyin thepresenceof

learning curves suggeststhatiflearningishighly appropriable, early entrants

can

achievesustained competitiveadvantageby

rapidly buildingcapacity

and

by

pricingaggressively topreempt

competition.However

these studies allpresume

(1) rational actors

and

(2) equilibrium,implying

marketsclearatall pointsintime.We

considertherobustnessoftheaggressive strategy in thepresence of(1)

boundedly

rational agentsand

(2) acapacity acquisition lag.

Agents

areendowed

with highlocal rationalitybutimperfectunderstanding ofthe feedback structure ofthe market; they use intendedlyrational heuristics to

forecast

demand,

acquire capacity,and

set prices.These

heuristics aregrounded

inempirical studyand

experimental test.Using

asimulationoftheduopoly

casewe

show

theaggressive learningcurve strategy

becomes

suboptimalwhen

themarket

isdynamically

complex.

When

capacitycannot be adjustedinstantaneously, forecasting errors leadingtoexcess capacity

can

overwhelm

the costadvantage conferred

by

the learning curve.We

explorethesensitivity ofthe results tothefeedback

complexity

ofthemarket

and

therationality oftheagents' decisionmaking

procedures.The

results highlight thedanger

ofextrapolatingfrom

equilibriummodels

ofrationalactors totheformulation ofstrategic prescriptions

and

demonstratehow

disequilibrium behaviorand

bounded

rationalitycan be incorporatedintostrategic analysisto

form

a 'behavioralgame

theory'amenable

to rigorous analysis.

'

Sloan

School

ofManagement,

Massachusetts

Institute ofTechnology

^

McKinsey

&

Company

Pleasedirect

correspondence

toJohn

Sterman

attheMIT

SloanSchool

ofManagement, 50

Memorial

Drive,E53-351, Cambridge,

MA

02142,

orto<jsterman@mit.edu>.

1.

Introduction

Learning

curveshave

been

identified in awide

variety ofindustries(Duttonand

Thomas,

1984),

and

an extensivetheoreticalliterature has exploredtheirstrategic implications.A

learningcurve createsa positivefeedback loop

by

which

a small initialmarket

shareadvantage leadstogreaterproduction experience,

lower

unit costs,lower

pricesand

still greatermarket

shareadvantage. In general, the literaturesuggeststhat inthepresence oflearningcurves

-

and

when

learning is privatelyappropriable

- fmns

should pursue an aggressive strategy inwhich

they seekto

preempt

their rivals,expand

outputand

reducepricebelow

the short-runprofitmaximizing

level(Spence, 1981;

Fudenberg and

Tirole, 1983, 1986; Tirole, 1990). Intuitively,such

aggressivestrategiesare superior

because

they increase bothindustrydemand

and

theaggressive firm'sshareofthat

demand,

boosting cumulativevolume,

reducing futurecostsand

building sustainedcompetitive

advantage

until the firmdominates

themarket.The

desirability of aggressivestrategiesin industrieswithlearningcurves hasdiffused

widely

inbusiness education, the popular businessliterature,

management

texts,and

publicpolicy debates (Rothschild 1990,Hax

and

Majluf

1984;Oster, 1990; Porter, 1980;

Krugman,

1990).and

learningcurve strategiesappear

tohave

ledtosustained

advantage

inindustriessuch

as synthetic fibers, bulk chemicalsand

disposable diapers(Shaw

and

Shaw

1984;Lieberman

1984,Ghemawat

1984,Poner

1984).However

inmany

industries, includingtelevisions,VCRs,

semiconductors, toysand

games,

lightingequipment,

snowmobiles,

hand

calculators,tennisequipment,

bicycles,chainsaws,

running

shoesand

vacuum

cleaners,aggressive pricingand

capacityexpansion

have

ledtosubstantialovercapacity

and

pricewars

thathave

destroyedindustry profitability (Beinhocker,1991; Salter, 1969; Porter, 1980; Saporito, 1992;

The

Economist,

1991;Business

Week,

1992).Existing

models

thatconsiderthecompetitive imphcations ofthe learning curveutilizethetraditional

assumption

thatmarkets clearatallpointsintime.Market

clearing inturn implies thatafirm's production capacity

and

other resourcescan be

adjusted instantaneouslytoequilibriumlevels, or, ifthere are capacity adjustmentlags, thatfirms

have

perfect foresightsuch

thattheycan

asit is needed. Neither

assumption

is valid: it takestime tobuildnew

factories,expand

existingones,

and

decommission

obsoleteones

(Mayer

1960,Jorgenson

and Stephenson

1967),and

forecastingovertypical planning horizons

remains

difficultand

error-prone(Armstrong

1985,Makridakis

etal. 1982,Makridakis

etal. 1993).The

presumption

in theliterature is thatcapacityadjustment

and

forecasterrorcorrection are fastrelative tothedynamics

ofthe learning curve sothatthe

assumption

ofperfectmarket

clearingis areasonable approximation.Inthis paper

we

show

thatrelaxing theassumptions

of instantaneousmarket

clearingand

perfect foresight leads, ina variety ofplausible circumstances,tocompetitive

dynamics

significantly different

from

those predictedby

much

ofthe existing literature.We

begin withareview

oftheliteratureon

strategy inthepresence oflearning curves.We

thendevelop

amodel

inwhich

the assumptions ofmarket

clearingand

rationalityarereplacedby

adisequihbrium,behavioral

framework

inwhich

fums

face lags in adjustingcapacityand

useboundedly

rationaldecisionheuristics to setprices

and

forecastdemand.

We

usethemodel

toexploretheimpact of anaggressive learning-curve strategyin a varietyof environments.

When

thedynamics

ofthemarket

are sufficiently slow,delays ininformationacquisition,decision

making,

and system

response are sufficiently short,and

thecognitivedemands

on

thefirms aresufficiently low,behavioral theory yieldspredictions observationally indistinguishable

from

those of equilibrium models.However

inmore dynamic

environments,inwhich

boundedly

rational forecastingtechniques

become

less accurate, the aggressivelearningcurve strategiesprescribedinthe

game

theory literaturebecome

inferior, asaggressiveexpansion

leadstoexcesscapacity.

We

closewithimplications forthestudyofstrategic competitioningeneral,arguingthatthe neoclassical assumptions of equilibrium

and

rationalitymay

inmany

realisticcircumstancesprove

tobe

adangerous

guidetoactionand

aweak

basisforempirical research.2.

Models

ofLearning

Curve

Strategy

Learning

curvesare a familiarphenomena.

Numerous

empiricalstudieshave

documented

theirexistence in a

wide

variety ofindustries, asHax

and Majluf

(1984, 112) note, "rangingfrom

Spence

(1979)examines

theeffectof competitiveasymmetries on

investmentdecisionsingrowth

marketswhere

there are learningeffects.He

notes thatlearningcurves allow forcreation ofasymmetric advantage and

thus createan

incentive topreempt

rivals.Spence

(1981) furtherquantifies optimal production policy

under

alearning curve, finding thatiffinnscan

perfectlyappropriate all thebenefitsoflearning,

and

ifthey canbe

sure ofafirstmover

position, then theyshould

expand

outputbeyond

the short-run profitmaximizing

level inordertocapturelearning-induced

costadvantage.Fudenberg and

Tirole (1986)and

Tirole (1990)present adynamic

analysisof a

duopoly

with alearning curve.Under

quantity competition they findthatanaggressive strategy

always

dominates.Under

pricecompetitionthe aggressive strategysucceeds indeterringrivalentry

and

in causingrival exit,butwhen

two

existingplayers preferaccommodation

thereis

no

clearlydominant

strategy apriori.Other

studieshave

examined

the sensitivity ofthese results todifferingdemand

conditionsand

appropriability assumptions.Majd

and Pindyck

(1989)show

that uncertaintyin future pricesreducesthe optimal expansion of output

beyond

the staticequilibriumlevel.Ghemawat

and

Spence

(1985)show

thatwhen

theeffects oflearningspillover

to competitorsthe incentives toexpand

output are also reduced. Similarconclusions arefound

in theliteratureon

theeffects oflearning

on

international trade(Krugman,

1987).Kalish (1983) addresses the interaction

between

learningand

productdiffusiondynamics

(word

ofmouth,

saturation).Word

ofmouth

creates ashadow

benefitofcurrent salesthatreinforces the incentive tocut price

and

expand

production as currentoutputbuilds theinstalledbase of

customers

who

in turnconvey

informationon

the benefitsoftheproducttothosewho

have

not yet purchased, accelerating product adopfion.

In

sum,

the literature suggeststhat iflearning is appropriable, ifprice is not highlyuncertain,

and

ifrivalscan be

reliedon

tobehave

rationally, then firms should pursue anaggressivestrategy of preemption, higher output

and lower

prices. Thisrecommendation

hasdiffused

widely

inbusiness education, the popular businessliterature,and

public policy debatesthe firm's capacity is

always

equaltodemand, implying

either thatthere areno

capacity adjustmentdelaysorthatfirms

have

perfect foresight so thattheycan forecastdemand

sufficiently far inadvance

toensurethattheyalways have

exactly the correct capacity.3.

A

Boundedly

Rational,

Disequilibrium

Model

To

explore therobustness ofthelearningcurve literature tothe assumptions ofperfectforesight

and

instantaneousmarket

clearing,we

developed

adisequilibrium, behavioralmodel

ofcompetitive

dynamics

inthepresence oflearning.Following

Kalish(1983),we

assume

that themarket goes

througha life-cycleof growth, peak,and

saturation. In contrast tothe literature,we

assume

capacity adjusts with alag,and

that firmshave

onlya limited ability toforecast futuresales.

These

assumptions areconsistent with a longtraditionof experimentaland

empiricalevidence

(Brehmer

1992,Collopy

and

Armstrong

1992, Diehland Sterman

1995,Kampmann

1992,

Mahajan

et al. 1990, Paichand

Sterman

1993, Parker 1994.Rao

1985,Sterman

1989a,1989b, 1994). In

models assuming

instantaneousmarket

clearingand

perfect foresight,themarket

clearing price can be derivedasanecessary property ofequilibrium, giventhe capacity decision.

However

in disequilibrium settings,bothpriceand

capacity targetsmust be

determined.Here

we

draw

on

the literature citedabove and

thewell-establishedtraditionofboundedly

rationalmodels,and

assume

that firms setprices with intendedlyrational decisionheuristics(Cyertand

March,

1963/1992;

Forrester 1961;Simon

1976, 1979, 1982;Morecroft

1985).The model

is formulatedincontinuous time as a setof nonlineardifferentialequations.Since

no

analytic solution tothemodel

isknown,

we

usesimulation toexplore itsdynamics'

While

themodel

portraysan

industry with an arbitrarynumber

of firms i=

{ 1, ..., n},we

restrictourselves to n

=

2 inthesimulationexperiments below.We

beginby

laying out the equationsdescribingthe

dynamics

ofdemand.

These

arebased

on

thestandardBass

diffusionmodel

(Bass,1969;

Mahajan

etal. 1990).We

then describe the physicaland

institutionalstructure ofthefirm,including orderfulfillment,

revenue

and

cost,thecapacity acquisition lag,and

the learning curve.Finally

we

discuss firmstrategy. Thissection is theheartofthemodel

and

contains thekey

Industry

Demand

The

total industryorderrate, Q", is thesum

of

theinitialand

replacement purchase rates,Q'

and

(^

(time subscripts are omittedforclarity):qo

=

Q'+

Q«. (1)Initialorders are given

by

theproduct oftherateatwhich

households

choose

to adopttheproductand

thus enter themarket and

theaveragenumber

ofunits ordered per household, |J.The

adoptionrate is therate

of

change

ofthenumber

ofadopters,M,

thus:Q'

=

|i(dM/dt). (2)Households

aredivided intoadopters oftheproduct,M,

and

potential adopters, N.Following

thestandard

Bass

diffusionmodel

adoption arisesthrough anautonomous

component

and

throughword

ofmouth

encounters with thosewho

alreadyown

theproduct:dM/dt =

N(a

+

pM/POP)

(3)where

a

is a constant fractional propensity for potential adopterstoadopt, (3 is thefractional rateatwhich

potential adopterschoose

toadopt given thattheyhave

an encounter with anadopter,and

theratio

N4/POP

isthe probability thatagivennonadopter

encountersan adopter(POP

isthetotalnumber

of households).The

number

ofpotential adopters remaining,N,

is thedifferencebetween

thenumber

ofpeople

who

will ever adopttheproduct,M*,

and

thenumber

thathave adopted

theproduct todate:N

=

MAX(0, M*

-M)

(4)where

theMAX

functionensures thatN

remains

nonnegativeeven

inthecasewhere

M*

dropsbelow

M

(as couldhappen

ifthe pricesuddenly

roseafterM

=

M*).The number

of peoplewho

willeventuallychoose

toadopt,M',

istheequilibrium industrydemand

and

isa function ofthe price oftheproduct.For

simplicitywe

assume

alineardemand

curve

between

the constraints<

M*

< POP:

M*

=

MAX(0,

MIN(POP, POP'

+

a(P"''" - P'))) (5)where

a

is theslopeof

thedemand

curve, P"^'" is thelowestpricecurrently available in themarket,The

replacement orderrate, Q"^, isthediscardrateofoldunits, D.summed

overall firmsinthe industry.

For

simplicitywe

assume

exponential discardsfrom

the installed baseofeach

finn:Q'

=

li Di. (6)Di

=

5li (7)where

I,isthe installedbase of firmi'sproductand 5

isthe fractionaldiscardrate.The

installedbaseis increased

by

shipments, Qj,and

decreasedby

discards:li

=

1(Q. - D,)dt+

lio. (8)Each

firm receives ordersO,

equal toa shareofthe industry orderrate.The

firm'sordershare. S^j, is

determined

by

alogitmodel

inwhich

product attractiveness.A, depends on

bothprice

and

availability. Availabilityismeasured by

thefirm'saveragedelivery delay,given (byLittle's

Law)

by

theratioof backlog, B,to shipments, Q):Oi

=

S°iQ°

(9)SOi

=

Ai/IjAj

(10)A

i=

[EXP(epPi/P*)][EXP(ea(Bi/Q,)/T)). (11)Both

priceand

deliverydelay are normalizedby

reference values(P*and

x', respectively)in thedetermination ofattractiveness.

The

parametersEpand

£a are the sensitivitiesofattractiveness toprice

and

availability, respectively.Note

thatbecause

thisis a disequilibrium model, ordersand

shipments

need

notbe equal.Market

share, definedaseach

firm'sshare ofindustry shipments.Si

=

Q/Z,Qj, will ingeneral equalthe firm's ordershare only in equilibrium.The

Firm

Firm

profitsarerevenue, R, less total cost,C

(the firmindex i is deleted forclarity). Totalcost consists offixed cost

Cf

plus variable costs Cy:7i

=

R-(Cf

+

Cv). (12)Because

ittakestimetoprocessand

fillorders, the priceoftheproductmay

change between

thetime

customers

placean orderand

receive the product.We

assume

customers

pay

theprice inaverage value

each

orderinthe backlog.The

average value ofeach

orderinthebacklog

is thetotalvalue oftheorder book,

V.

dividedby

thenumber

ofunitson

order:R

=

Q(V/B).

(13)The

valueoftheorderbacklog accumulates

the valueofnew

orders lessthe revenues received forordersshipped:

V

=

l(PO-R)dt

+

Vo. (14)Fixed

costsdepend on

unit fixedcosts, Uf,and

current capacity, K; variablecostsdepend on

unitvariablecosts, Uy,

and

production,Q.

Both

fixedand

variable costsper unit fallas cumulativeproduction experience, E, grows, accordingto a standardlearning curve.

Thus

Cf=UfK

(15)Cv =

UvQ

" (16)Uf-Ufo(E/Eo)T^

(17)Uv

=

Uvo(E/E())y (18)E

= lQdt + Eo

(19)where

Ufoand Uvo

are the initialvaluesof

unit fixedand

variablecosts, respectively,Eq

istheinitial level of production experience

and

y

is the strengthofthe learning curve.For

simplicitywe

assume

the firm maintainsno

inventoriesand

makes

all producttoorder."

Shipments

thusequal production,which

is theminimum

ofdesired production,Q',and

capacity, K. Desired production is given

by

thebacklog, B,and

thetargetdeliverydelay x*.Backlog accumulates

orders,O,

less production:Q

=

MIN(Q*,

K). (20)Q*

=

B/x*

(21)B

=

J(0

-Q)dt

+ Bo

(22)Capacity adjuststothetarget level

K* with an

average lagX. Specifically,we

assume

K

adjusts toK'

with athird-orderErlang lag, corresponding wellto the distributed lagestimated in investmentfunction research (Jorgenson

and Stephenson

1967):where

£

is theErlanglag operator.For

simplicity the lagissymmetric

forthecasesofincreasingand

decreasingcapacity.Firm

Strategy

Under

thetraditionalassumptions

ofperfect rationalityand

equilibrium,each

firm's targetcapacity

and

pricing behaviorwould

be givenby

thesolutiontothedifferentialgame

definedby

thephysical

and

institutional structureofthemarket

presentedabove.However,

in reality firmsdo

notdetermine theirbehavior

by

solvingdynamic programming

problems

ofsuch

complexity

(e.g.Camerer

1990, 1991).Business

schoolsdo

notteach futuremanagers

how

to formulateand

solvedynamic

programming

problems

when

setting strategy. Rather, firms use intendedly rationalheu-risticstoset prices

and

acquirecapacity,and

the analyticmodels

intheliteraturereachthemanagerial audience in the

form

ofrules ofthumb.

In thecaseofthelearning curve,books and

consultants prescribe rules

such

as"By

slashing pricesbelow

costs,winning

the biggest shareof

industry

volume,

and

acceleratingits cost erosion,acompany

[can] getpermanently

ahead

ofthepack...[and build] an unchallengeable long-termcost

advantage"

(Rothschild 1990, 181). hi thisspirit,

we

model

target capacityand

price withrealisticboundedly

rational heuristics,heuristicswhich

allow us to capturedifferent strategiesformanaging

the productlifecycleand

learningcurve, including the 'marketshareadvantage leadsto

lower

costs leads togreatermarket

shareadvantage' logic derived

from

the analytic literature. Inparticular,we

assume

the firm forecastsfuture

market

demand

and

then determineswhat

shareofthatdemand

itwould

liketocommand.

Target capacity therefore consistsofthe product ofthe firm's target

market

share, S*,and

itsforecast ofindustry

demand,

D'^,adjustedby

thenormal

rateofcapacity utilization u':K*

-

MAX[K"'",

S*D7u*]

(24)where K"""

is theminimum

efficientscaleofproduction.Because

ofthe capacity acquisitiondelay the firmmust

forecastdemand

A.yearsahead.We

assume

firms forecastby

extrapolating recent trends inobserved

industrydemand

(CoUopy

and

orderrate,

D^

aivdexponentially extrapolate the recentgrowth

in industry orders,g^

over

theforecasthorizon X^:

D'

=

D'EXP(?ifg')

(25)d(D')/dt

= (O

- D'Vx" (26)g'

=

ln(D',/D',.;,.)/?i^ (27)where

X^isthe historical horizonused

tocompute

theexpectedgrowth

rate indemand

G^.The

instantaneous, currentvalueofindustry ordersis not availableto firms

because

ittakes time tocollect

and

report the data,so the forecast isbased

on

the reported orderrate, given hereby

first-order exponential

smoothing

ofactual industryorders with asmoothing

time ofx^(Sterman 1987

provides empirical evidence consistentwith

such

forecastingprocedures forbothlong-termenergy

demand

forecastsand

short-terminflation forecasts).The

firm's targetmarket

share, S*,depends

on

its strategy.We

considertwo

strategies,'aggressive'

and

'conservative'. In the aggressive strategy,the firm followstherecommendation

ofthe learningcurveliterature

by

seeking amarket

share largeenough

tomove

thefirmdown

itslearningcurve fasterthan its rivals. Incontrast, the conservative firmseeks

accommodation

withits rivals

and

sets amodest market

share goal.We

alsoassume

firmsmonitor

theactions oftheircompetitors.The

aggressive strategyseekstoexploit the learningcurve notonly

by

settingan

aggressivemarket

share goal but alsoby

taking advantage offimidity, delayorunderforecasting

on

the partofits rivalsby

opportunisficallyincreasing itstarget

when

itdetects sufficient uncontesteddemand.

The

conservativestrategyseeks

accommodation

withits rivals, butfears overcapacityand

will cede addifional shareto avoidit.

Thus

targetshare is givenby

{

MAX(S""",

S") ifStrategy=

Aggressive

S*

=

<

(28)^j^^gmax

gu^jj:Strategy

=

Conservativewhere

S"^'"and

S"'''"are theminimum

and

maximum

acceptablemarket

share levels fortheexpectsto

be

uncontested.Expected

uncontesteddemand

is the differencebetween

the firm'sforecast ofindustry

demand

and

theirforecastof competitorcapacity.Expected

uncontestedmarket

shareis givenby

theexpected uncontesteddemand,

D", as afractionoftheprojectedindustry

demand:

S"

=

MAX(0,

D"/D'). (29)The

MAX

function maintains nonnegativity forS"even

when

thereis excessindustry capacity.Expected

uncontesteddemand

is thefirm's forecastofindustrydemand

lessthesum

ofthefmn's

estimatesofexpected competitorcapacity, K*^, adjusted

by

thenormal

capacity utilization rate u*:D"

=

D'

- u*Sj K'j, j^i. (30)In the basecase

we

make

thestrongassumption

that firms accuratelymonitor

theircompetitor'scapacity plans.

However,

we

assume

there is ashortdelay ofx'^ years required forthe firmtocarryoutthecompetitive intelligencerequiredtoestimate thecompetitor's targetcapacity

(exponential

smoothing

isassumed), soexpected competitor capacityK^

evolvesas:d(K'j)/dt

=

(K*j - K'j)/x'. (31)To

model

the price decision,we

assume

thatdue

toadministrativeand

decisionmaking

lags, price, P. adjusts toa targetlevel P*, with an adjustment time x'':

dP/dt

=

(P* - P)/x^ (32)The

pricesetting ruleassumes

the firmdoesnothave

theabilitytodeterminethe optimalpriceand

instead

must

searchfor anappropriate price level.We

assume

firms usethe anchoringand

adjustmentheuristic to

form

thetarget price.The

current priceforms

theanchor,which

is thenadjustedin responsetoconsiderationsofcost,

demand/supply

balance,and market

share,forming

a hill-climbingheuristic in

which

thefirm searchesforbetterpricesin theneighborhood

ofthecurrentprice, usingcosts,

demand/supply

balance,and market

share toassess the gradient.For

simplicity

we

assume

the target priceis a multiplicativelyseparable functionofthe variousadjustment factors,

and

thateach

adjustmentis linear inthe input variables. Finally,thefurnwillneverprice

below

unit variable costU^,.Thus

a'

>

0;a'

>

0; a'<

0. (33)The

threeadjustment terms capturethe firm'sresponse to unit costs, theadequacy

ofitscapacity to

meet

demand, and

itsmarket

sharerelativetoits target share.The

adjustmentparameters

a

determine thesensitivity ofpricetoeach

adjustmentpressure.The

firstterm, theadjustment forunit costs,

moves

target pricetowards

a base price P*^ givenby

unitcostsand

thenormal

profitmargin

m*:P^

=

(l+m*)(Uv

+Uf).

(34)The

firmalso respondstotheadequacy of

itscurrent capacity,measured by

thedesiredrateof production

Q*

dividedby

'normal production', definedas theproduction rate givenby

currentcapacity

and

thenormal

capacityutilization fraction u*.When

this ratioexceeds

unity, thefirm hasinsufficientcapacity

and

increases priceabove

the current level;excess capacity creates pressure tolower

price.Finally, thefirm attempts topricestrategically insupportofitscapacity goals

by

adjustingprices

when

thereisagap

between

itstargetmarket

share S*and

its current shareS.When

thefirmfinds itdesiresa greater share than itcurrently

commands,

itwilllower

price; converselyifmarket

shareexceeds

itstarget itwillincrease price,trading off theexcessmarket

share for higherprofits

and

signalingrivals its desiretoachieve a cooperativeequilibrium.The

price formulationis consistent withthe behavioralmodel

ofpriceinCyertand

March

(1963/1992), experimental evidence

(Kampmann

1992),and econometric

evidencefrom

a similarmodel

ofinterest rate settingbehavior (Hines 1987). Paichand

Sterman

(1993) createdaproductlifecycle simulation

microworld

similartothepresentmodel

asan

experimental system,and

estimatedasimilar

model

forpricingwhich

capturedthepricingbehavior ofthesubjects well.'4.

Results

We

beginby

confirmingthatunder

condifionsofperfect foresightand

instantaneousmarket

clearing the

model

reproducesthe conclusions oftheexisting literature.We

then exploretheeffectivenessofthelearningcurve strategy asthese

assumptions

aregradually relaxedby

exploringFor

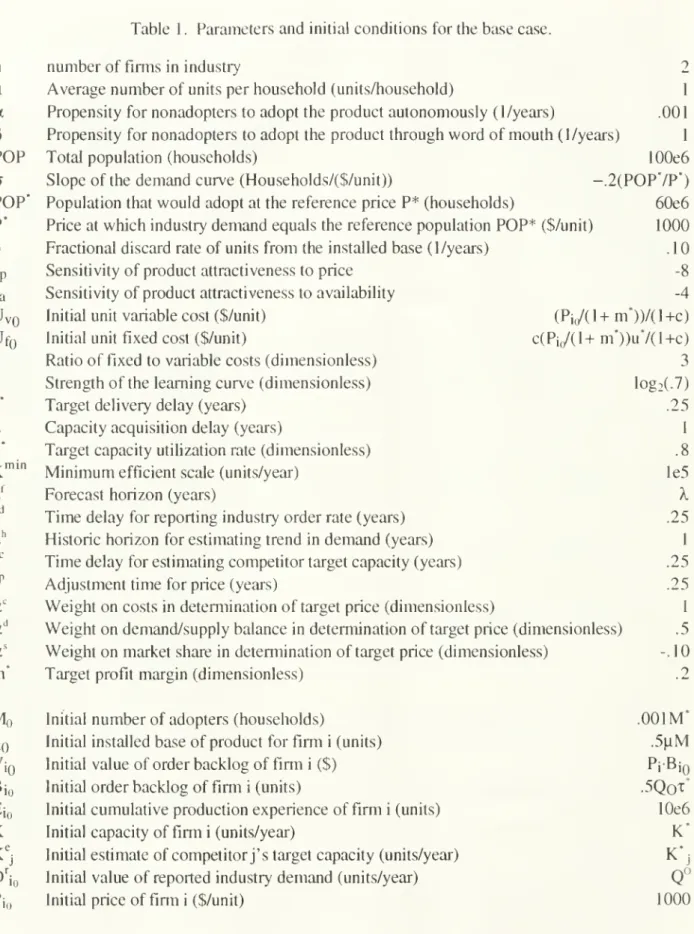

thebase case themodel

is calibratedtocapture thedynamics of

typicalconsumer

electronics items suchas

camcorders

(table 1).As

scalingparameterswe

setthe initial priceat$1000/unit,

and

thepotential size ofthemarket

at the initial priceto60

millionhouseholds,each

seeking[i

=

1 unit.The

product isassumed

tobe durable, with a10%/year

replacementrate.We

assume

a70%

learningcurve (costsfall30%

foreach

doubling of cumulativeproduction), atypical value fora

wide

range ofproducts.The

ratiooffixedto variable costs is 3:1.The

sensitivityof ordersharetoprice is high(Ep

-

-8),implying

products areonlymoderately

differentiated

by

non-price factors, ana

fortioriassumption

thatfavors the effectiveness ofthelearning curve strategy.

We

assume

short delaysof onlyone

quarteryearforthe reportingofindustry orders

and

theestimation ofcompetitortarget capacity. Ingeneral these parameters favorthesuccess ofa learning curve strategy

(we

presentsensitivity analysis below).We

examine

the behaviorofthemarket

forvaluesoftheword

ofmouth

parameter .5<

(3<

2.5. This range generates product lifecycle

dynamics

thatspan

much

ofthe variation inobserved

diffusion rates (Parker 1994,

Klepper

and

Graddy

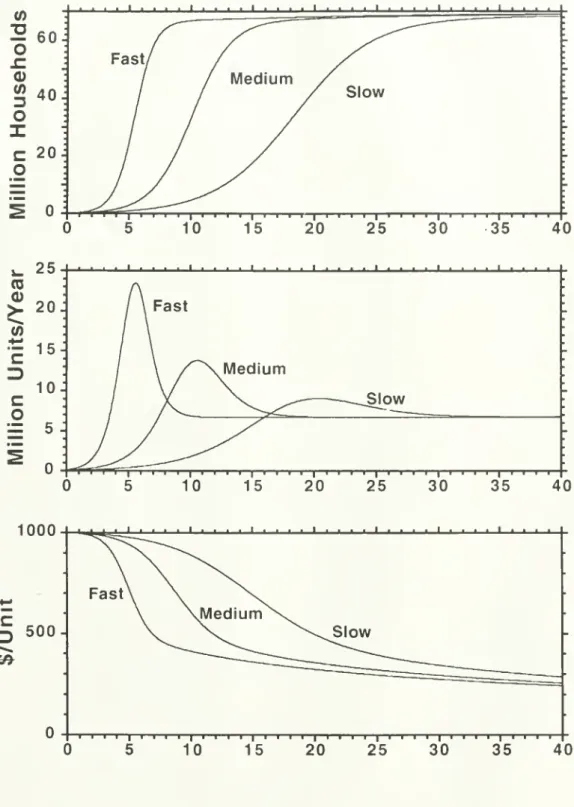

1990).For

illustration,we

define threescenarios fortheevolution ofindustry

demand:

Fa.st,Medium,

and Slow,

definedby

valuesof(3=

2, 1,

and

.5, respectively. Figure 1shows

theevolution ofthe industryorder rate generatedby

thedemand

sectorofthemodel

foreach

scenario,assuming no

capacity constraintsand assuming

thatprices follow unitcosts

down

the learningcurve (the targetmarket

shares forboth firms=

.5). Allexhibit aperiodofrapid

growth

followedby

apeak and

decline tothe equilibrium,replacement rateof

demand.

The

stronger theword

ofmouth

feedback,the greater thedynamic

complexity

ofthemarket: thefaster thegrowth, the earlier

and

higherthepeak

rate oforders,and

the larger thedecline

from peak

toequilibriumdemand.

Demand

in theslow

scenariopeaks

afterabout20

years,while in thefast scenario, the

peak

comes

atabout year6.Even

fasterdynamics have been

documented, such

as blackand

whitetelevisions, calculators,and

many

toysand games,

oftenwith only

a few

yearsfrom

boom

tobust.For each

ofthethreemarket

scenarios identifiedabove

we

testthe effectiveness oftheparameters

and

initial conditions, sotheplayingfield is level.Only

the strategyeach

uses forcapacity planning

and

pricingmay

differ.Note

in particularthatthe forecastingprocedure usedby

each

firm is identical,sothetwo

fimishave

consistent beliefs aboutindustrydemand

and

competitorcapacity. In theaggressive strategy, thefirm seeks at least

80%

ofthe market, largeenough

toprovidethefirm withasignificant advantage incumulative productionand

drive thelearning curvein its favoryet not so large as to invite antitrust action (theaggressive playerwill

increase its

market

sharegoalabove

80%

ifitperceivesthere is additional uncontesteddemand).

The

conservative playeris willingtosplit themarket

withits rival, but willcede

ifitperceivesa50%

sharewould

result inexcesscapacity.To

testwhether

themodel

reflectsthe competitivedynamics

analyzed inthe existingliterature,

we

beginby

assuming

that capacitycan instantly adjusttothe level requiredtoprovidethetarget rate ofcapacityutilizationat alltimes:

K

=

Q7u*.

(23')The

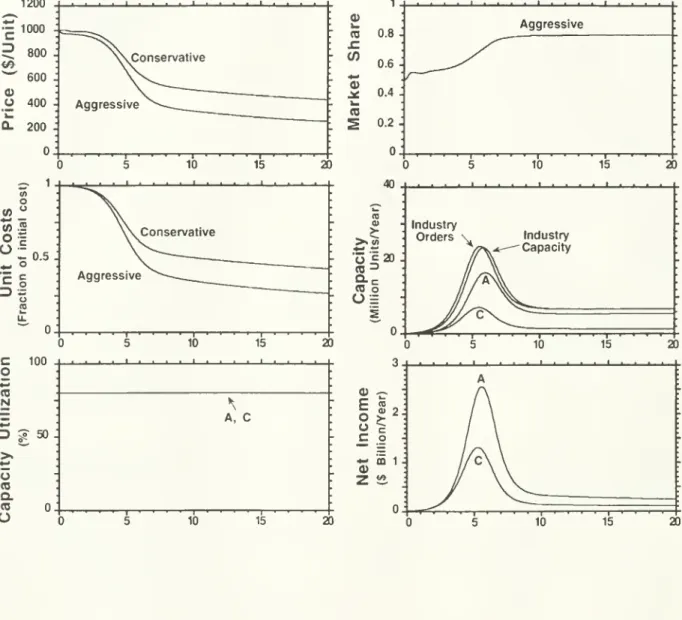

'perfect capacity' case correspondstotheequilibriumassumption

thatthemarket

always

clears,either

because

capacitycanbe

adjusted instantly, orbecause

agentshave

rafionalexf)ectations

and

perfect foresight sothattheycan perfectly anticipate the capacity acquisition lag.The

market always

clearswithno

unintendedbacklog

accumulations,and

capacity utilizationalways

equalsthe target rate. Pricesthusrespond

onlyto unit costsand

thegap between

the firm'starget

and

actualmarket

share.The

price rule yieldsbehaviorconsistent with therecommendations

intheliterature: the aggressiveplayerwill respondtotheinitial

gap between

targetand

actualmarket

shareby

reducingpricebelow

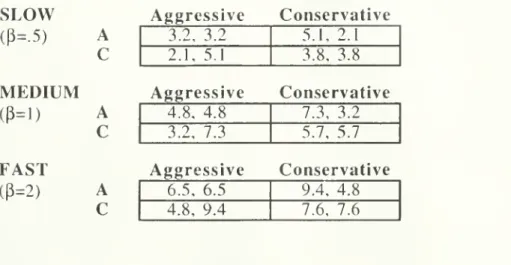

the short-termequilibrium.Table

2shows

discounted cumulativeprofits forthe threemarket

scenarios.(Throughout

thepaper

we

use a discountrateof4%/year and

simulate themodel

for40

years.The

results arerobust to rates

from

toat least20%/year.) In allcases theresult is a prisoner'sdilemma.

Even

though

the payofftothe cooperative,conservative strategy [C,C]maximizes

the net presentvalueof cumulativeprofit forboththeindividual firms

and

the industry,each

player has astrategiccontinue toplay theconservativestrategy.

However,

afirmthat finds itselfplaying conservativewhile the otherpursuesthe learningcurve strategy

would

improve

theirpositionby

defecting, so[A,

A]

is thedominant

strategy. Aggressivelyexploiting the learningcurve is thedominant

strategyiffirms

must

irrevocablyand

independentlychoose

theirstrategy atthebeginning oftheindustry, ifthefirmcancredibly

commit

totheaggressive strategyand

persuade its rival toacquiesce, orifthefirst

mover

gains sufficientadvantage

before rivalscan

respond.The

fasterthedynamics

ofthemarket

unfold, the greaterindustry profits are forany

strategy

combination

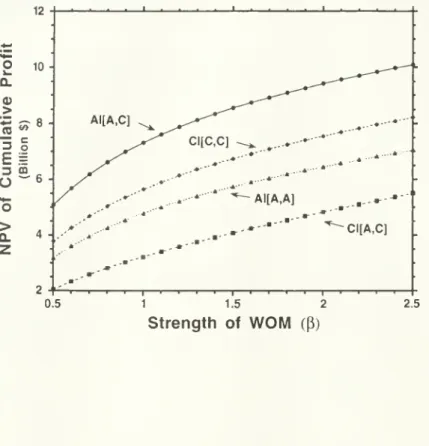

(figure2

shows

the relativepayoffsinthemarket

clearingcaseas functionsof

theword

ofmouth

parameter

[3). Strongerword

ofmouth

bringspeople intothemarket

sooner,hence

boosting cumulative profit. Consistent with Kalish(1983), theadvantage

oftheaggressivestrategy,

and

thus thestrategic incentivetodefect, increaseswiththespeed oftheproduct lifecycle.Similarly, sensitivityanalysis

shows

thatthe stronger the learning curve, the greateris thestrategicincentivetoplay theaggressive strategy.

These

resultsshow

themodel

conforms

tothegame-theoretic resultwhen

we

assume

instantaneous

and

perfect capacityadjustment.An

appropriablelearningcurvemakes

it optimaltoexpand

capacityand

pricebelow

the short-run profitmaximizing

level.The

stronger the learningcurve, the greater the incentive topursuetheaggressivestrategy. Likewise, thefasterthe

growth

ofthe market, thegreateris the

advantage

ofthe aggressivestrategy.We

now

examine

thecasewhere

thefirm faces thecapacityadjustmentlagand must

therefore forecast industry

demand

and

competitorresponses, as specifiedby

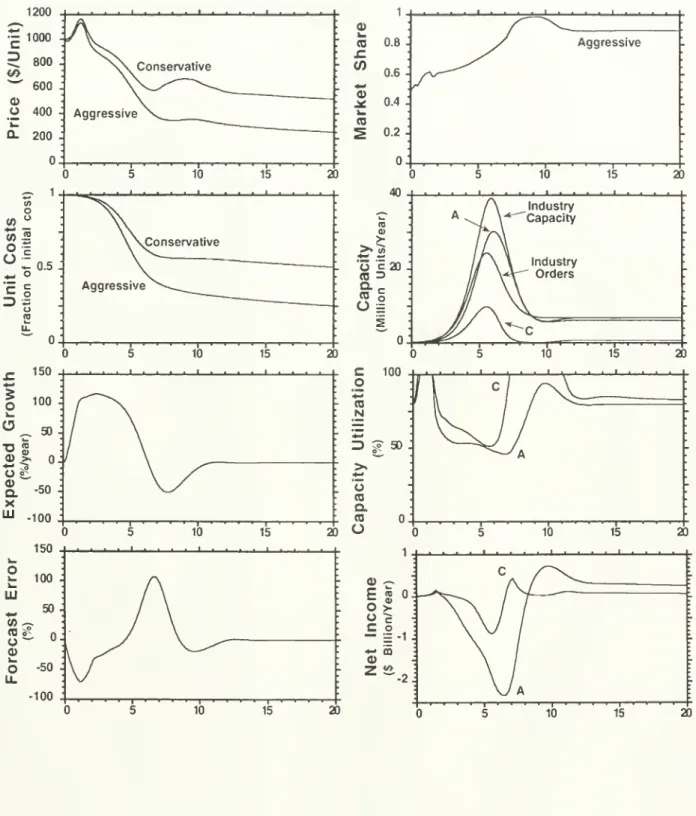

thebehavioral rulesinequations 23-34. Figure 3

shows

thepayoffsastheydepend on

theword

ofmouth

parameter;table 3

shows

the payoff matricesforthe different scenarios.The

capacity adjustmentlagand

behavioral decision rulesdramaticallyalterthepayoffstothe different strategies.

As

longas themarket

dynamics

aresufficiently slow, the firm's capacity forecasts are accurateenough

and

theaggressive strategydominates.

However,

formarket

dynamics

fasterthan those givenby

acriticalvalue ofthe

word

ofmouth

parameter, P*^'^^=1.3, theconservative strategydominates

theincentivetodefect,

and

[C,C]

becomes

the uniqueNash

equiUbrium.Note

thepenaltyimposed

when

both firmsplaythe aggressive strategy ismuch

greaterthan in themarket

clearing case.To

identifywhy

the payoffschange

so dramaticallywhen

theequilibriumand

perfectforesight

assumptions

are relaxed, figure4a

shows

thedynamics

ofthe [A,C]

case forthe fastmarket

scenario, while figure4b shows

thesame

scenario forthecasewhere

capacity adjustsinstantaneously. In bothcases,the aggressive firm

immediately

perceives agap between

its initialshare of

50%

and

its goal of80%,

and

cuts price, hi thecase withthe capacity lag, theaggressivefirmalsosets target capacityto

80%

ofits forecast ofindustrydemand.

The

demand

forecastextrapolates the rapidly risingindustry orderrate. Afterabout

one

year, thefirmexpectsindustrydemand

togrow

ata rate inexcess of 100%/year, causingtarget capacity toincrease wellabove

thefirm's currentcapacity requirements

and

swellingthe supplyline ofcapacityon

order.Due

to thecapacityacquisifion lag

and

thedelay in perceiving industry orders,bothfirmsreach full capacityutilization afterabout .5years. Capacity

remains

inadequate until year about 1.5.During

thistime, excessbacklogs

accumulate

and customers

are forcedto wait longer thannormal

fordelivery.The

capacitycrunch

causes bothfirmstoboostpricesabove normal

levels,though

theaggressivefirmcontinues toprice

below

theconservative firm.Such

transient price bubbles are oftenobserved

during thegrowth

phases of highly successful products, as occurredforexample

with

radios,black

and

white television,and

colortelevisions(Dino

1985)and

more

recentlywith 1Mbit

DRAM

chipsand Harley-Davidson

motorcycles.Beginning

in about year2,and

acceleratingdramaticallyafterabout year4,the market,though

growing, experiences a decline in the fractionalgrowth

rate.As

thedataare reported, thefirm lowersits forecast

of

futuregrowth

rates, butdue

to the lagsin thereporting ofindustryorders, inassessingthe

growth

ratefrom

historicalorderrates,and

in adjustingcapacity tothetarget, actualcapacitybegins toovershoottherequiredlevel,

and

capacityutilization fallsbelow

normal.

As

industry orderspeak and

decline, shortlybefore year6, both firmsfind theirforecastshave

gone

badlywrong,

leavingthem

with excesscapacity.The

aggressive firmsuffersthe most,duringthe

same

periodbeen growing

atanadditional ratetoincrease itsmarket

share (notethattheaggressor's capacity

peaks

lateraswell as higher than thatoftheconservative firm).As

boom

becomes

bust, theaggressive fimi finds capacity utilization dropsbelow

50%. The

conservativefirmalsoexperiencesexcess capacity, butthe

magnitude and

duration oftheproblem

issignifi-cantlylesssince theconservative player has

been

steadilygivingup market

shareduringthegrowth

phase, partially offsettingits excessivelyoptimistic forecasts.The

patternofcapacityovershootis

widespread

inmaturing

industries (Porter 1980),and

was

frequentlyobserved

inPaich

and

Sterman's (1993) experimental product lifecycle task,even

when

subjectshad

experi-ence

with thedynamics.As

aresultoftheexcesscapacity generatedby

the saturationofthemarket,both firmsexperiencea periodoflosses as revenues

drop

below

fixedcosts.The

lossesoftheaggressive firm,

however,

are substantially largerthan those oftheconservative firm.The

aggressor generates a net lossof

more

than$2

billionperyearas industry salespeak around

year6.

Though

the aggressive firm earns superiorprofits afteryear8 these fail tocompensate

foritsearlier losses, leavingitwith discounted cumulative profits of-$1.7billion

by

year40.The

failureoftheaggressivestrategywhen

themarket

dynamics

are rapid isnotdue

tothefailureofthe learning curvetoconfercost advantage

on

theaggressive firm.As

inthe perfectcapacity case, the aggressive strategyachieves its intended goal:

low

pricesand

rapidexpansion

quickly givethe aggressor acost

advantage

which

steadilywidens

as the industrymoves

throughits lifecycle. Indeed,at the

end

ofthe simulation, theaggressive firm has unitcostsonly42%

asgreat asits rival, a largeradvantage thanit

enjoyed

in the perfectcapacity case.The

failureoftheaggressivestrategy is

due

entirely tothecombination

ofthe capacityadjustment lagwithabound-edlyrational forecastingheuristic.

When

capacity adjusts perfectly theaggressive strategyalways dominates

theconservativestrategy

and

fastermarket

evolutionincreases the advantage oftheaggressive strategy(figure 2).Incontrast,

when

firms facea capacity adjustmentlag, the costsof

excess capacityinduced

by

forecast error increase withthe speed oftheproductlifecycle. Eventually,the costs of excess

inferior(figure 3).

As

thedynamic

complexity

ofthemarket

environment

grows, oras thecapacity acquisition lag increases, the likelihoodofsignificant capacity overshoot grows,

and

anaggressive strategy

becomes

significantly lessprofitable than theconservative strategyeven

ifa

firmis ableto

commit

to an aggressivestrategysecure intheknowledge

thatits rivalwillcede.Sensitivity

Analysis

Before

drawing

any

general conclusionsfrom

theresultsitis importanttoexplorethedegree to

which

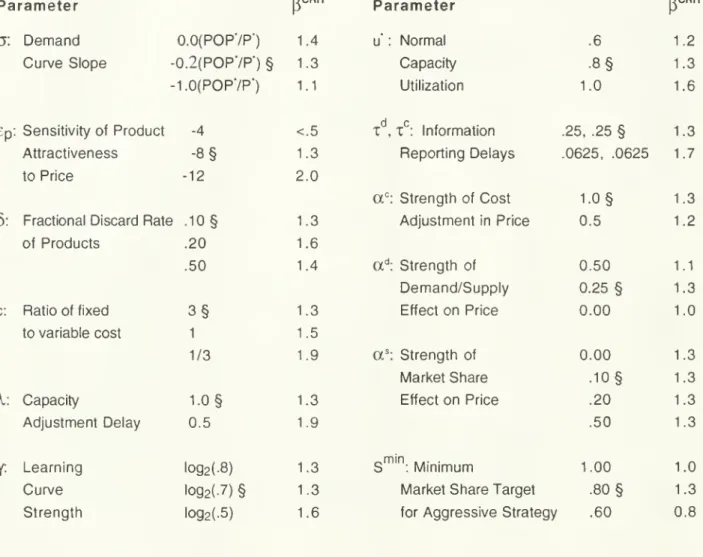

they are sensitive toassumptions. Despitesubstantial variationsinkey

parameters(table 4),the critical valueofthe

word

ofmouth

parameterabove

which

thelearning curve strategybecomes

inferior, P^"^'^,remains

inthe rangefrom

2.0to lessthan .5,corresponding

to salespeaks

from

five totwenty

years afterproduct launch, well withintherangedocumented

fornumerous

real products (Parker 1994).We

have

made

anumber

ofassumptions

thatreducethe attractiveness ofa

learningcurvestrategy. First,to theextent capacitycan be

used

tomake

followon

productsthe costsofcapacityovershoot will

be

mitigated.Second,

we

assume

there areno

economies

ofscope

allowingfollow-on or related products toshare inthe benefitsoflearning.

To

the extent learningcan be

passed

on

toother products,thereby conferringadvantage

to them, the costsof capacity overshootare offset

even

ifcapacity is not fungible with successorproducts. Third,we

assume

there areno

returnsto scaleor other positive

feedback

processessuch

asnetwork

externalities. Additionalpositive feedbacksor other sources of increasingreturns favortheaggressorjustas a stronger

learningcurve increases the

advantage

ofthe aggressive strategy (seee.g.Arthur

1989). Fourth,we

assume

thereisno

growth

in the underiying poolofpotential customers. This toowould

reducethe severity ofthe saturation peak. Fifth,

we

assume

a durable product.More

frequentrepurchasesreducesthe

dynamic

complexity

ofthemarket

and

themagnitude

ofthe declinefrom

peak

toreplacement sales rates.One

ofourkey

behavioralassumptions

is that firms forecastindustrydemand

by

extrapolating past

demand

and have

no

advance

knowledge

ofthe market'ssaturation point. In thesaturation. Clearly, betterforecasting

would

favortheaggressivelearning curve strategy, asshown by

theresultsofthemarket

clearing case.The

evidence

is notencouraging. InPaichand

Sterman's (1993) experimental version ofthe present

model,

subjects consistently failed to forecastthesalespeak, leadingtoexcesscapacity

and

large losses similartothosesimulatedhere- even

afterextensiveexperience with the task. Outsidethe laboratory,a

wide

range ofnew

productdiffusion

models have been developed

which, in principle, allow forecastingofthe salespeak

(Parker

1994 and

Mahajan

etal.1990

reviewtheextensive literature). In practice,diffusionmodels

oftenmiss the turning point as well, since,asMahajan

etal. (1990) write,"by

thetimesufficientobservations

have

developed

for reliableestimation, it istoo latetousethe estimates forforecastingpurposes."

Rao

(1985)examined

theabilityoften

popularmodels

to predictsalesoftypical durable goods.

Mean

absolutepercent forecast errorsaveragedmore

than40%

across allmodels and

products.The

extrapolativemodels

generallyoutperformed

thediffusion models.On

theotherhand

anumber

ofourassumptions

tendto increase theadvantage of anaggressive strategy.

We

assume

learning is perfectly appropriable, increasing theabilityoffirmstogain sustained cost advantage.

We

assume

market

shareis quiteelastic sothatmodestly lower

pricesbring significant share advantage, strengthening thepositive feedbacks created

by

thelearn-ing curve.

We

alsoassume

that productionadjusts instantaneously atconstant marginalcost (untilcapacity utilization reaches

100%), and

that capacitycan beadjusted continuouslywith an averagelagofjust

one

year, lessthan the typical lagsestimatedin theliterature.There

areno

capacityadjustmentcostsorexit costs.

A

longer capacity lagormore

realistic adjustmentcostswould

sig-nificantly increase the

magnitude

and

cost offorecasterrors.We

omit

balancesheetconsiderationsand

thus the risk of bankruptcy: aggressive firmsthatultimatelydo

wellmight

notsurvive thelossesofthetransition

from

boom

tobust,again favoringthe aggressive strategy.The

informationon

which

the firm bases its decisions is free ofnoise,measurement

error, bias, or otherdistortion.We

assume

firmscan

base their forecastson

industry orders,reported with onlyaone

-quarteryearlag,

when

inmost

industriesorderdata are unavailableand

firmsmust

relyon

estimatesofindustrydemand

(orders) withcapacity(which

may

constrainshipments

below

therateofincoming

ordersduring periods ofrapid

demand

growth).Most

importantly,we

assume

thatthecompetitor'splanned

capacitytargetis fullyknown

with onlya short delay.Relaxing

any

oftheseassumptions

strengthensourresults

and

causestheaggressive strategytobe

dominated

by

theconservativestrategy at

lower

ratesofmarket

growth and

for lessdurable products.The

assumption

thatfirmsknow

their rivals'planned

capacity levels bears closerexamination. Extensive experimental studies

(Sterman

1989a, 1989b, Paichand

Sterman

1993,Diehl

and Sterman

1995,Kampmann

1992)show

inawide

range ofexp)erimental markets thatpeople ignore or give insufficient

weight

tothe supply line ofpending

capacity or production.The

tendency

toignorethesupply line (andmore

generally, failing toaccount fordelays,e.g. Brehm.er1992) isrobust: itoccurs

even

in settingswhere

thecontentsof

thesupply lineare availablecostlessly

and

atall times, areprominently

displayed,and

are highlydiagnostic,and

where

subjects

had

financial incentives toperform

well. Failuretoaccount fortime delaysand

supplylines appearstobe

common

in realmarkets

as well. Studiesshow

few

real estatedevelopers, forexample,

takeaccountofthe supplyline ofprojectsunder

development

(Thornton 1992,Bakken

1993), leadingtoperiodic overbuilding. Figure5

shows

the payoffs inthecasewhere

we

assume

firms

do

notaccount forthesupply lineofpending

capacity but instead usethecompetitors'current capacity to estimate uncontested

demand:

K'j

=

Kj. (31')When

thesupplyline is ignoredtheaggressive strategyis inferiorforall themarket environments

tested. Ignoringthesupply lineensuresthatduringthe

growth

phaseeach

firmerroneouslybelievesits rivalis

expanding

capacitymuch

less thanit actually is,and

overestimates uncontesteddemand.

The

aggressive playeropportunisticallyincreases its targetcapacitystillfurtherand

theconservative playerfailsto

cede

sufficiently, leadingtoamuch

largerovershootofcapacityand

much

larger losseswhen

themarket

saturates.The

aggressive strategy isdominated

by

theconservative strategy

even

intheslow

scenariowhere

demand

forthe productpeaks

20

yearsafter5.

Discussion

and

Conclusions

Priorresearch has

shown

thatunder

assumptions

of equilibriumand

perfect rationality, theoptimal strategy fora firmfacing a learning curveis toaggressively

preempt

competitors, cuttingprice

and

boosting outputbeyond

the staticoptimum

levels.We

have

shown

thatunder

amore

realistic set

of

assumptions,thenormative resultcan

be reversed.When

there arecapacityadjustment lags,

commonly

usedforecasting heuristics leadtocapacity overshootas amarket

saturates. Investingin additional capacity

and lower

prices to achievelearning benefitsisonlyoptimal

when

thedynamic

complexity ofthemarket,and hence

the riskofcapacityovershoot, islow. In thesecircumstances fully

and

boundedly

rationaldecisionmaking

converge.However,

asthe

dynamic

complexity

ofthemarket

increases,disequilibriumeffectsand

systematicdecisionmaking

errorsbecome

more

important,and

cause the predictions oftherationalmodel

to fail.These

conclusions are consistentwith experimentaland

empirical evidence.The

resultspredictthatlearningcurvestrategies will

perform

bestinindustrieswhere

there isslow

demand

growth

(orwhere

customer awareness

ofthe product category is alreadyhigh),theproduct has ahighrepeatpurchaserate

and

is fairly undifferentiated,orwhere

capacitycan beadjusted rapidly atlow

cost. Observationsthat learningcurve strategiesgenerally led tosustainedadvantage inindustries

such

as synthetic fibers, bulk chemicals,and

disposable diapers(Shaw

and

Shaw

1984,Porter 1984,

Lieberman

1984,and

Ghemawat

1984

respectively) arebroadly consistentwiththisprediction. Similarly, ourresultspredict

poor

performance

foraggressive strategies in industrieswith high

word

ofmouth,

durable, differentiated products, orlong capacity adjustmentdelays.The

overcapacity,excess inventory,and

pricewars observed

in industriessuch

as televisionsand

VCRs,

toysand games,

lightingequipment,

snowmobiles,

hand

calculators,tennisequipment,

bicycles, chain saws, semiconductors,

and running

shoes citedearliersupport thisproposition.The

resultshave

implicationsboth forpracticingmanagers and

forthe larger issueofthemodeling

toolsmost

appropriate for the study ofstrategicbehavior.The

recommendation

topursue alearningcurve strategy

must always be

treated withcaution. Currenttextsand

theoryrecommend

aggressivepreemption

inthepresence ofstrong, appropriable learning curvesor otherpositivefeedbacks thatconferincreasingreturns.

Our

resultsshow

thatfirmsmust

also determinewhether

they are vulnerabletocapacityovershoot orunderestimationof competitorcapacityplans.A

firmelectingtopursue a learningcurve driven strategymust

devotesignificant effort tounderstandingthe

dynamics

ofmarket

demand

sothatitisnotcaughtunprepared

by

market

satu-ration. It

must

clearlyand

credibly signalits capacity intentionsina rapidlygrowing market

sothatlessaggressiveplayers will not unintentionally overbuild.

To

prevent competitoroverbuilding, itmay

find itoptimal toshareits forecastsand market

intelligencewithrivals.Experience

and

experimentalstudies suggestthat thisisboth hard

medicine

totakeand

difficulttocarry outsuccessfully. Rather,it appearsthat

when

highdynamic

complexity

increases the riskofcapacityovershoot, firms should consider conservative strategies

even

inthe presence oflearningcurvesand

othersources ofincreasingreturns,allowinglesssensible rivals to play theaggressivestrat-egy, then

buying

these rivalsatdistress priceswhen

theyfail duringthe transitionfrom

boom

tobust.

Jack

Tramiel

followedjustsuch

astrategy, purchasingAtarifrom

Warner Communications

afterthe

peak

inthevideogame

market

for$160

million inunsecured

debtand

no

cash,whileWarner

took a$592

millionwriteoffofAtari assetson

topof$532

million in Atari losses.On

the methodologicalfront, ourresultssuggest thattheequilibriumand

rationalityassumptions

ofgame

theoryand

microeconomics

arenot robust.More

realisticphysical,institutional

and

behavioralassumptions

can reverse the neoclassical resultand

reveals amuch

more complex

relationbetween

thelearning curve, thedynamics

ofdemand

and

firmstrategy.When

thesystem

dynamics

are sufficiently slow, the delaysin informationacquisirion,decision

making

and system

response sufficiently short,and

the cognitivedemands on

theagentssufficiently low, behavioraltheorieswill yield predictions observationally indistinguishable

from

thoseof equilibrium models.

However,

incases of highdynamic

complexity,boundedly

rationalpeoplecan

and

do

behave

significantly differently.The

case ofthe learningcurve inadynamic

market

shows

these differencescan

matter greatly,and

theirimpact

canbe

examined

rigorously.D-4354 22

differencesinavariety

of

other contexts.Such

cases arelikelyto includesettings inwhich

therearelong time delays

between

actionand

effectorin the reportingofinformation,where

there arepositive feedback processes (increasingreturns),

and

where

there are significant nonlinearities(Stemian

1994,Arthur

1994). Likelyexamples

include markets such as shipbuilding, real estate,paper,

and

many

othersplagued

by

chroniccyclicality,and

industries withnetwork

externalitiesand

standard formation issuessuch

astelecommunications

and

software.We

suggestthecombination

ofgame

theoreticreasoningwith behavioralsimulationmodels

can help createameaningful

'behavioralgame

theory'(Camerer

1990, 1991),thatis, a behaviorallygrounded,empirically testable,

and

normatively usefultheory of disequilibriumdynamics

in strategic settings.NOTES

1

The model

is solvedby

Eulerintegration withatimestepof .0625 years.The

results are notsensitivetothe use of smaller time stepsorhigher-orderintegration

methods.

2. Includinginventories

would

substantially destabilize thesystem (Sterman

1989b); omittinginventoriesisthus

an

a

fortioriassumption.3. Paich

and

Sterman

(1993) estimatedaslightly differentform

ofthemodel,

inwhich

therewas

no market

share effect.They

found

the cost effectwas

very strong, whilethe response totheReferences

Armstrong,

J.S. (1985)Long

Range

Forecasting.2nd

ed.John

Wiley

&

Sons,New

York.

Arthur,

W.

Brian, (1989)"Competing

Technologies, Increasing Returns,and Lock-In by

Historical Events,"

Economic

Journal, 99, 116-131.Arthur,

W.

Brian, (1994) IncreasingReturns

and

Path

Dependence

in theEconomy.

Ann

Arbor:University of

Michigan

Press.Bakken,

Bent, (1993)"Learning

and

TransferinDynamic

DecisionEnvironments," Unpublished

Ph.D.

thesis,MIT

Sloan

School

ofManagement.

Bass, F.

M.

(1969)A

New

Product

Growth Model

forConsumer

Durables.Management

Science. 15,

215-227.

Beinhocker, E. (1991)

"Worlds

ofWonder

(A)and

(B)."MIT

SloanSchool

ofManagement

Case

Study. Availablefrom

Prof.John Sterman, Cambridge,

MA

02142.

Brehmer,

B. (1992)Dynamic

DecisionMaking:

Human

ControlofComplex

Systems.Acta

PsychologicaSl,

21 1-241.Business

Week

(1992) "L.A.Gear

StillLooks

Like

anAlso-Ran."

December

21, p. 37.Camerer,

C.F. (1990) "BehavioralGame

Theory." Insights in DecisionMaking:

A

Tribute toHillelJ. Einhorn., Hogarth,

R.M.,

Ed.,The

University ofChicago

Press,Chicago.

Camerer,

C. F. (1991)"Does

StrategyResearch

Need

Gaine Theory?"

StrategicManagement

Journal, 12 (Winter, special issue) 137-152.

Collopy, F.,

and Armstrong,

J. S. (1992) Expert opinionsabout extrapolationand

themystery of

the

overlooked

discontinuities. InternationalJournal of

Forecasting. 8,575-582.Cyert,

R.M.

and March,

J.G. (1963)A

Behavioral

Theory of

theFirm. Prentice Hall, NJ.Diehl, E.,

&

Sterman,J. D. (1995) Effects ofFeedback

Complexity on

Dynamic

DecisionMaking.

OrganizationalBehavior

and

Human

Decision Processes,62(2), 198-215.Dino, Richard (1985) Forecasting the Price Evolution of

New

Electronic Products.Journal of

Forecasting. 4, 39-60.

Dutton, J.M.

and

Thomas,

A. (1984) "Progress Functions asa Managerial

Opportunity."Academy

of

Management

Review,

9,235-247.

The

Economist.

(1991) "Japan'sChip

Makers:

FallingOff

theLearning Curve."

Feb. 23, 64-66.Forrester,J.

W.

(1961) IndustrialDynamics.

Cambridge

MA:

The

MIT

Press.Fudenberg,

D.and

Tirole, J.J. (1983)"Learning

by Doing

and

Market

Performance." BellJournal of Economics,

14,522-530.

Ghemawat,

P. (1984) "CapacityExpansion

in theTitanium Dioxide

Industry."Journal of

Industrial

Economics.

33, 145-163.Ghemawat,

P.and

Spence,M.

(1985) "LearningCurve

Spilloversand

Market

Performance."Quarterly

Journal

ofEconomics,

100, 839-852.Hax,

A.C,

and

Majluf, N.S. (1984) StrategicManagement:

An

IntegrativePerspective.Prentice-Hall,

Englewood

Cliffs, NJ.Hines, J. (1987)

Three

essays in behavioraleconomic

modeling.Unpublished

Ph.D.dissertation,

MIT

SloanSchool

ofManagement.

Jorgenson, D.,

and

Stephenson, J. (1967)The

Time

Structure of InvestmentBehavior

inUnited

States

Manufacturing, 1947-1960.

Review

of

Economics and

Statistics. 49, 16-27.Kalish, S. (1983)

"Monopolist

PricingwithDynamic

Demand

and

Production Cost."Marketing

Science, 2, 135-159.

Kampmann,

Christian(1992)"Feedback

Complexity and Market Adjustment

in ExperimentalEconomics," Unpublished

Ph.D. Thesis,MIT

Sloan School

ofManagement.

Klepper, S.

and Graddy,

E. (1990)"The

Evolution ofNew

Industriesand

theDeterminants

ofMarket

Structure." RAJ^IDJournal of Economics,

21, 27-44.Krugman,

P. (1987)"The

Narrow

Moving

Band,

theDutch

Disease,and

theCompetitive

Consequences

ofMargaret

Thatcher:Notes

on Trade

in the Presence ofDynamic

ScaleEconomies." Journal of

Development

Economics.

27, 41-55.Krugman,

P. (1990) Rethinking International Trade.MIT

Press,Cambridge,

MA.

Lieberman,

M.B.

(1984)"The Learning

Curve

and

Pricingin theChemical

ProcessingIndustries."

RAND

Journal of Economics. 15,218-228.

Mahajan,

v., Muller, E.,and

Bass, F. (1990)"New

Product DiffusionModels

in Marketing:A

Review

and

DirectionsforResearch."Journal of

Marketing, 54, 1-26.Majd,

S.,and

Pindyck, R.S. (1989)"The Learning

Curve

and Optimal

PricingUnder

Uncertainty."

RAND

Journal of Economics,

20,331-343.

Makridakis, S. et al. (1982)

The

accuracy ofextrapolation(time series)methods:

resultsofaforecastingcompetition.

Journal of

Forecasting, 1, 111-153.Makridakis, S.,et. al. (1993)

The

M2

competition: areal time judgmentallybased

forecastingstudy. International

Journal of

Forecasting, 9, 5-22.Mayer,

T. (1960) Plantand

equipment

lead times. Journal of Business. 33, 127-132.Morecroft,J. (1985) Rationalityin theanalysis of behavioral simulation models.

Management

Science 3l{7),

900-916.

Oster,

S.M.

(1990)Modern

CompetitiveAnalysis.Oxford

University Press,New

York.

Paich. M.,