#pe****t

>*

l

UBRAfflBS)

&

Vk

V

Jo

Digitized

by

the

Internet

Archive

in

2011

with

funding

from

Boston

Library

Consortium

Member

Libraries

HB31

!.M415

working

paper

department

of

economics

DEWEY

)iASYMMETRIC

BUSINESS CYCLES:

THEORY

AND

TIME-SERIES

EVIDENCE

Daron

Acemoglu

Andrew

Scott 95-24Aug. 1995

massachusetts

institute

of

technology

50 memorial

drive

Cambridge,

mass.

02139

ASYMMETRIC

BUSINESS CYCLES:

THEORY

AND

TIME-SERIES

EVIDENCE

Daron

Acemoglu

Andrew

ScottMASSACHUSETTSINSTITUTE ,

--.•ogy

95-24

ASYMMETRIC

BUSINESS CYCLES:

THEORY AND

TIME-SERIES

EVIDENCE

Daron Acemoglu

Department

ofEconomics

Massachusetts

Institute ofTechnology

and

Andrew

ScottInstitute of

Economics

and

Statisticsand

AH

Souls College,Oxford

UniversityAugust 1995

JEL

Classification:E32

Keywords:

Asymmetries,

Cyclical Indicator, Intertemporal Increasing ReturnsRegime

Shifts,Temporal

Agglomeration,Unobserved Components.

Abstract

We

offera theory ofeconomic

fluctuationsbasedon

intertemporal increasingreturns: agentswho

have been

active in the past face lower costs of action today. This specification explains theobserved persistence in individual

and

aggregate output fluctuationseven

in the presence of i.i.d shocks, essentially because individuals respond to thesame

shock

differentlydepending

on

theirrecent past experience.

A

feature of ourmodel

is that outputgrowth

follows anunobserved

components

process with specialemphasis

on

an underlyingcyclical indicator.The

exactprocess foroutput, thesharpness ofturning points

and

thedegree ofasymmetry

aredeterminedby

theform

thatheterogeneity takes.

We

suggesta generalformulationformodels

withlatentcyclicalvariableswhich, under certain assumptions, reduces to anumber

of state spacemodels

thathave been

successfullyusedto

model

U.S.GNP.

Using

ourgeneralformulationwe

findthatallowingforricher heterogeneityenables us to obtain a better fit to the data

and

also that U.S. business cycles are asymmetric, with thisasymmetry

manifesting itselfas steep declines into recession.We

estimate a strongly persistentcyclical

component

which

is not wellapproximated

by

discreteregime

shifts norby

linear models.Our

estimates ofthe relative size ofintertemporal returnsneeded

to explain U.S.GNP

vary buton

the

whole

are notimplausibly large.We

oweaspecialdebttoJamesHamiltonwhoseinsightfulcommentsimproved anearlierversionofthispaper.We

alsothankPhilippeAghion, Charlie Bean, RicardoCaballero, PaulDavid, Steve Durlauf, Vittorio Grilli, Christopher Harris, Rebecca

Henderson, Per Krusell, Jim Malcomson, John Moore, Chris Pissarides, Danny Quah, Kevin Roberts, Donald Robertson, variousseminarparticipantsandtwoanonymousrefereesforusefulcomments.Remainingerrorsare theauthors'responsibility.

1. Introduction

Aggregate economic

fluctuations are characterizedby

successive periods of highgrowth

followed

by

consecutive periods oflow

activity.The

transitionsbetween

these periods ofhighand

low growth

areoftenmarked

by

sharpturning pointsand

considerable evidencesuggests thatatthesemoments

the stochastic properties oftheeconomy

change

and

display asymmetries, see inter alia,Neftci (1984),

Diebold and

Rudebusch

(1989),Hamilton

(1989)and

Acemoglu

and

Scott (1994).The

importance oftracking these

movements

inthebusinesscycleisreflectedintheconsiderableattention paid to a variety ofcoincidentand

leading indicators (e.g. Stockand

Watson

(1989),and

the papers in Lahiriand

Moore

(1991)).A

naturalway

tomodel

temporal agglomeration1and asymmetries

ineconomic

fluctuations is toassume

non-convexities, such as discrete choice or fixed costs at the individual level, because such non-convexitiesimply

thatindividualsconcentrate their activity in a particular period. It is thisimplication

which

hasbeen

analyzed with considerablesuccess in the(S,s) literature.However,

whilethepresence of fixed costs can account for the discreetness of

economic

turning points, it does notnaturally leadto persistence -

once

an individual undertakes an action they are less likely todo

soin the near future.

The

key

reason is that although the presence offixed costs leads to increasingreturns, these are infratemporal; the full extentof

economies

ofscale arisingfrom

fixed costs can beexploited within a period2.

As

aconsequence

persistence in aggregate fluctuations relieson

aggregation across heterogeneous agents: either

more

agents investing in the past increases theprofitability of investment for others (e.g.

Durlauf

(1991)and

(1993)) or aggregate shocks affectagents differently, leading to a

smoothed

response over time (e.g. Caballeroand Engel

(1991)).This paper

emphasizes

analternativeexplanationofpersistentindividualand

aggregate outputfluctuations

by

suggesting that fixed costs introduce intertemporal increasing returns, that is, the returnsfrom

an activity thisperiodare higheriftheactivityoccurredlastperiodand

asaconsequence

an agent

who

was

active in the recentpast ismore

likely to be activenow.

In the presence of suchintertemporal linkages temporal agglomeration arises

from two

sources; active agents maintaining ahigh/low activity level in successive periods because ofintertemporal increasing returns

and

agents acting together, either inresponseto acommon

shock

orbecause ofstrategic complementarities.We

show

how

amodel

of theformer

explains anumber

of empirical features of business cyclefluctuations

and

also offer aframework which

enables aneconomic

interpretation ofunobserved

component

models

of U.S. outputwhich emphasize

the underlying cyclical indicator.The

relevance ofintertemporal increasing returnsdepends

on

(i)whether

individual behavior ispersistentand

(ii)whether

firm'stechnologyand

costs containimportantintertemporal aspects.The

1

We

use thisterm, following Hall (1991), for thebunching ofhigh economicactivity overtime.2

To

overcome this problem empirical implementations of (S,s) models sometimes include time-to-build considerations or decreasingreturns at highlevelsofinvestment, e.g.Caballero and Engel (1994).answer

to these questions will varydepending

upon

the type of activityunder

consideration. For instance, in the case ofradical changes in the capital stock, e.g.Cooper

and

Haltiwanger's (1993) automobile retooling, intertemporal effects are unlikely to be important,and

this is supportedby

thelack of persistence in these cases.

However,

Section 2 surveysmicro

evidence that firm level investmentis persistentand

findingsfrom

technology studies,themanagement

scienceliteratureand

organizational theory

which

supports the notion thatmany

important discrete decisions (e.g. investment innew

technology, product development, innovation, maintenance) exhibitsome

degree ofintertemporal increasingreturns.These

empirical findingsmotivatethetheoreticalmodel

of Section3 in

which

a firm has to decide each periodwhether

to undertakebothmaintenance

and

investment.Maintenance

ismodelled

as havingtwo

effects: (i) increasing the productivity of existing technologiesand

(ii)facilitating theadoption ofnew

innovations.The

interaction ofthesetwo

rolesleads to intertemporal increasing returns: firms find it profitable to maintain the

newly

adoptedtechnologies

and

this in turn reducesthe costs of adoptingfutureinnovations.As

aresult, investmentcosts are lower

when

the firm has invested last period,and

a naturalasymmetry

is introduced inindividual behavior; inresponse toa range ofshocks, the agents will finditprofitable to investonly ifthey

have

invested inthe recent past.Section

4

examines

the aggregateeconomic

fluctuations impliedby

individual levelintertemporal increasing returns,

and

illustrateshow

ourmodel

accounts for themain

features of temporal agglomerationand asymmetric

fluctuations: the significanceand

persistence ofa cyclicalcomponent

in output fluctuations,and

the importance of turning pointsand

business cycleasymmetries.

An

importantfeature of ourmodel

is itstractability.Not

only canwe

characterizehow

the persistence of business cyclesand

the sharpness of turning points are determined butwe

alsomake

directcontact withanumber

ofeconometric studieswhich

relyupon

anunobserved

component

model

of output growth, e.g.Harvey

(1985),Watson

(1986), Clark (1987). This generality enablesus to nest a variety ofdifferent types ofbusiness cycle asymmetries.

And

thistheme

ispursued

inSection 5 where, in the context of our model,

we

examine

the circumstancesunder

which

turning pointsbetween

booms

and

recessions aremost marked,

sothatoutputgrowth

approximates ashiftingregime

process as in the discrete stateMarkov model

popularizedby

Hamilton

(1989). In all these exercises,we

findthattheform

ofheterogeneity (thedistributionofidiosyncratic shocks)is themain

determinant ofthe time-series properties,

and

also oftheasymmetric

nature offluctuations.Section

6

takes ourmodel

to data. First,we

look at the connectionbetween

our theoreticalmodel and

anumber

of estimatedregime

shiftmodels

to infer the size of intertemporal increasing returns necessary toexplain U.S. business cycles.However,

thereal advantage of our formulation is its ability to nest differentunobserved

component

models

withdifferent specifications regarding theform

of heterogeneity.We

thus estimatetwo

versions of our generalmodel

on

U.S. data. Thisexercise yields a

number

ofinteresting results. First,we

findthata versionof ourgeneralmodel

with normally distributed idiosyncratic shocks does considerably better than the version with uniformlydistributed shocks, but this latter is precisely

what

previous empiricalwork

has used. Therefore, ourmodel

offers an alternativetime-series representationgrounded

ineconomic

theory thatoutperformsa

number

of popular models.Moreover,

the differencebetween

the versions can be heuristicallythought to be the importance of

asymmetry

terms in the version withnormal

shocks. Thus, ourinvestigation also establishes that U.S. business cycles are

asymmetric

and

illustrates that theseasymmetries manifest themselves

by

sharpdownswings

ineconomic

activitywhich

cannot be capturedby

linear models.Since our formulation is derived

from an

underlyingeconomic

model,we

also use the estimation results tomake

inferences about the nature ofthe aggregateeconomy.

For

instance,we

find thatthe cyclicaldynamics

of the U.S.GNP

cannotbe

characterized as discrete shiftsbetween

differentregimes, which, inourtheoretical

model

impliesthatthe idiosyncratic uncertaintyisplaying an important role in the propagation ofeconomic

shocksand

this is alsoconfirmed

by

the fact thatwe

estimate the variance ofidiosyncratic shocks tobe

larger than that of the aggregate shock.We

also again find that the size of non-convexity impliedby

the estimation result ismodest and

thatoverall the

model

provides agood

fit to the data.2. Individual Persistence

and

Intertemporal

IncreasingReturns

Our

interest intemporal agglomeration focusesattentionon problems

inwhich

fixed costs areimportant

and

so agentshave

tomake

a discrete choice aboutwhether

or not toperform

a certainactivity.

A

crucial feature of our analysis will be the investigation ofhow

an agent's current qualitative choice (i.e.whether

or not toperform

a certain activity) influences thesame

decisiontomorrow.

In the standardcase, an activity thatrequiresa fixed costwillbe

bunched

withinaperiod of time, essentially because fixed costsimply

the existence of infratemporal increasing returns to scale. This observation lies at the heartof (S,s)models

(e.g. Scarf (1959))and

implies that a briefperiod ofactivity is followed

by

periods of inactivity at the individual level.However,

while there is considerable evidence supporting (S,s)models

(e.g. Bertolaand

Caballero (1990), Caballeroand

Engel

(1994),Doms

and

Dunne

(1994), Cooper, Haltiwangerand

Power

(1994)), there is also substantialevidence thatfirm levelinvestmentdecisions are characterizedby

significantpersistence.For

instance, usingUK

firm level data,Bond

and

Meghir

(1994) find significant autoregressiveeffects in investmentbehavior.

They

estimate equations for theinvestment-capital ratioand

findI/K,=

a

+

0.856 I,.1

/K

t.,(l-0.122 It.,/Kt. 1)+pZ,+

etwhere

Z

t is a vector of firm relevant variablesand

e,is a white noise disturbance. Evaluating the quadratic

term

at itssample

mean

yields anAR(1)

coefficient of

around

0.75.Bond

et al (1994) estimateAR(1)

and

AR(2)

models

using Belgian,French,

German

and

UK

firm panel data finding strongly significant investmentlags, with thesum

oftheautoregressive coefficients

around

0.3.Even

the evidence inDoms

and

Dunne

(1994) revealsthat there is significant investment occurring in

most

years of thesample

foreach

firmand

that concentrated investment bursts are spread over several years.These

findings suggest that whileinfratemporal

economies

ofscale (lumpiness) are important theremay

alsobe

intertemporal linkageswhich

can profitably be exploited. This raises the question,what form

of investment produces these intertemporal linkages?The

most

obviousform

ofintertemporaleconomies

of scale is learning-by-doing,whereby

past experiences increase productivity or reduce costs.

More

explicitly, consider the casewhere

incorporating

new

knowledge

is aslow

and

costly process, limiting the degree towhich

productive investments can be undertaken within a period.However,

themore

familiaran individual is with themost

recenttechnology vintages, thecheaperitis to adoptthelatestversion.In contrastan individual not using themost

recent vintage faces compatibilityproblems

when

dealing with the frontiertechnology.

The

result will be that only limitedinnovativemoves

aretaken withineach

period, withcost incentives

making

forward stepsmore

likely tocome

from

active agents.The

idea thatintertemporal linkages

might

lead agents to take a sequence of small investment steps is givenempirical support in studies of technological innovation. In this literature a distinction is

drawn

between

incrementalimprovements

ofanexistingtechnologyand

radicalimprovements

which

destroy the existing technologyand

start an alternative production or organizationalmethod,

e.g.Tushman

and

Anderson's

(1986) "incrementalchange"

versus "technological discontinuities".There

is widespreadagreement

that the less spectacular incrementalchanges

account formost

of the productivity gains (seeAbernathy

(1980),Myers

and Marquis

(1969)and

Tushman

and

Anderson

(1986)).

More

importantly for our paper, there is also a consensus that incremental innovations aremore

likely tocome

from

firmswho

have been

active at the earlier stages of product development.In

Freeman's

(1980, p.168)words

"theadvance of

scientificresearchis constantlythrowingup

new

discoveries

and

opening

up

new

technicalpossibilities,a firm which

isable tomonitor

thisadvancing

frontier

by one

means

or anothermay

beone of

thefirst to realizea

new

possibility".Arrow

(1974)and

Nelson

and Winter

(1982) alsoemphasize

the advantages possessedby incumbent

innovators in being able to furthercope

with incremental changes.For

instance,Nelson

and Winter

stress theimportance of engineers understanding

new

technologies, suggesting that firmswho

innovatehave

an advantage in doing so again.

Abernathy

(1980, p.70), using evidencefrom

industries diverse as automobiles, airlines, semi-conductorand

light bulb manufacturing, notes that"Each

ofthemajor

companies seems

tohave

made

more

frequent contributions ina

particulararea"

suggesting that previousinnovationsinafieldfacilitatefutureinnovations.One

possibleexplanationofthese findings are fixed effects:some

firmsmay

simplybe

good

at innovating in certain areas.However,

the industrywide

work

of Hirsch(1952),Lieberman

(1984)and

Bahk

and Gort

(1993)suggeststhatmore

thanjust individual fixed effects is operating. In the remainder ofthis paper

we

shall focuson

thisform

of investmentand

its implications for aggregate fluctuations.3. Individual

Behavior

in thePresence

ofIntertemporal

IncreasingReturns

(i)

The Environment

We

assume

thatagents (orfirms) are risk-neutraland

forwardlooking,and

seek tomaximize

their return (either profit or utility).The

key

decision iswhether

or not to invest in order to benefitfrom

technological progress.More

explicitly, each period anew

technologybecomes

available. This technology has a stochastic productivity that is revealed at the beginning of the period.The

agentdecides

whether

to adoptthis technologyor not,for instancewhether

toinstall anew

software. Ifthetechnology is adopted, the productivity ofthe agentincreases permanently, starting

from

the currentperiod3.

To

obtain the highest returnfrom

this innovation,its compatibilitywith existing technologiesneeds to be monitored. Inparticular, at the

end

ofthe installation period there is the option to gain additional productivityfrom

the innovationby

maintenance

4 (e.g. fine-tuning).Under

theseassumptions the firm's output is

y,=>Vr

a

o + (a

i+M/>V

a: 2y/(1 -m

/)0)

where

a,,, a,and

o^ are positive parametersand

s,and

m, are binary decision variables that equal 1ifinvestment (s

t)

and maintenance

(n\) are undertaken this period,and

equal zerootherwise. If the

new

technology is adopted (st=l), the productivity ofthefirm is higherpermanently.

When

there isno maintenance

effort attheend

oftheperiod(m

t=0), this increase inproductivity is not as large asit could be (a,-0C2+ut instead ofo^+u,). Deterministic depreciation is denoted

by

Oq (our results areunchanged

ifdepreciationis avoidedwhen

m,=l).We

assume

thatu,isaseriallyuncorrectedrandom

shock

to the productivityof investment with distributionfunctiondenotedby

F(.).Maintenance

costs areassumed

to be equal to a positive constant,y

(i.e.C

tm

=y^).

A

distinctivefeature of(1) is thatas in (S,s) models, our focus is

on

decisions thathave

a discrete nature, e.g.whether

to adopt the recenttechnologyvintage orwhether

tomaintainexistingmachines.The

discrete natureofthe choiceexplains

why

theproductivityshock

in (1)is multiplicativewiththeinvestmentdecision; productivityshocks are associated with

one

vintage oftechnologyand

thereforeonly affect outputwhen

thenew

technology is adopted.

In this model,

maintenance

also has an additional role other than ensuring themaximum

performance

ofthe latestinnovation.More

specifically,we

assume

investment costs are given by:c

r(YrY2™,-i>,

(2)where

bothy,and

y

2 are positive so thatwhen

equipment

is maintained thefirm's investment costsnextperiodare lower.

Here

y

2 is the extrainvestmentcost incurredby

a plantwhich

didnotmaintainTime-to-build considerationscaneasilybeincorporatedinthe returnfunction andonly servetochangethetiming ofreturns.

4

last period. In terms of our

computing

example, all existingbugs

in thesystem

need

to beremoved

to ensure the optimal implementation ofthe

new

software, implying that next period the instalment of anothernew

program

is less costly. In contrast, if thecomputer

is not maintained, technical assistanceis necessary both atthe beginning oftheperiodfor installation (toremove

bugs)and

attheend

ofthe period (for fine tuning to increase productivity ifso decided).Each

periodthefirm decideswhether

toinvest(st

=0

or 1)and

alsowhether

tomaintain(m,=0

or 1).

Denoting

the discount factorofthe representative firmby P and

theper periodreturnby

r(.),we

have: r(s lvjn

lv;m

tij_v

y

ltj _v

u

lv)= >'/y-ra

o + (a

i+M/^-

a

^v<

1"m

^"

Y

om

<v-(YrY2

m

/+;-i>y/+;and

themaximization problem

ofthe firm at time tis:max

E,{Jl^r(s

lv

^n

tv;m

l+j_^

H

.v

u

t^

}(4)

subject to (1)

and

taking y,.,,u

t, m,., as given. Inperiodt+j, the statevariables are m,^.,,ut+j, yt+j .,and

the choice variables are s

I+j

and m,

+j.Whether

the firm invests inany

perioddepends

on

ut. In contrast, the return tomaintenance

only

depends

on whether

or not investment occurs. Ifno

current investment is undertaken, the onlybenefit of

maintenance

is the costreduction that it brings in the following periodifinvestment thenoccurs. Incontrast, ifthereis current investment, future productivity alsoincreases

by

ctj.As

aresultthere are three possibilities regarding maintenance: (i)

always

maintain (ii) never maintain, (iii) maintainonlywhen

there isinvestment.Because

we

wish

tomake

maintenance

adecisionofthefirmrather than a fixed characteristic,

we

concentrateon

(iii).To

thisend

we

assume

5:

Assumption

A:

0Y <

Y

<A_

(5)H

2 °1-/3

The

first inequality can be understoodby

noting thatPy

2 is the

maximum

benefitfrom maintenance

in the absence of current investment: if there is investment next period costs are

lower by

y

2,otherwise there is

no

benefit. Therefore, the first part of the inequality impliesmaintenance

is notAssumption

A

is stronger thanwe

require but simpler to understand than the necessary condition,worthwhilejust toobtain future cost savings. In thepresence ofcurrent investment, the

minimum

gainfrom

investment is the present value of the productivity increasedue

to maintenance, (^/(l-P). Consequently the second part of the inequality states thateven

without future cost savings, it isprofitable to maintain ifthere is current investment. Itfollows that

when

(5) holds,we

can limitour attention to the casewhere

the firm only maintainswhen

it invests, thusm

t=s„

and

the per periodreturn simplifies to:

Kv^iVJ^^

a

i^"Mv^

(6)where 5

=Y +

Yiand 5

l=y

2-

Assumption

A

therefore enables us to write ourproblem

in away

which

focuses

on

the intertemporal increasing returns arisingfrom

the interactiveterm

5,st+jst+j.,.

More

generally, (6) canbe

interpreted as the period return for a firmwhich

benefitsfrom lower

currentinvestment costs, ifit invested last period.

Under

this interpretation ourmodel

captures the idea thatfirms

who

areused

to adapting to a changingenvironment

facelower

costs offurther changes.(ii)

Optimal

Decision RulesUsing

(6) themaximization

problem

attimet can bewrittenin adynamic

programming

form

with the value function V(.) satisfying: V(y

t

_^

t_vu)=sup

{/-(^;y/.1^.

1,u/)+/3£;/K(y

/.1

-a

0+(a1+v/>s^^

/+1)} (7) Solving the agent's optimizationproblem

we

obtain (proofin the appendix):Proposition 1:

The

value functions

r

\and

^(yM

^

M

,u><V<^

M

+<to-i+

te

*/"^<«V w

rVi

(8)

s=0

and

Vfy,.^,.^,)^^,-!

if

K^Qo-to^

is the unique function that satisfies (7) (<|)'s denote constant coefficients).

To

understandthedichotomous

natureofthevaluefunction,considerthecasewhere

theagent doesnot invest (st=0).

The

disturbanceu

tisirrelevant tofutureprofitsand

withno

investment costs,itdoes notmatter

whether

thefirm invested/maintainedlastperiodand

so the valuefunctiondepends

only

upon

y,.,.However,

ifthefirminvests the valuefunctiondepends

linearlyupon

y

t.„ st.j

and u

t.The

optimal choice of st

depends

on whether

the investment shock, u„ isabove

a certain criticalvalue.

Shocks

below

this value lead to insufficiently high productivity tobe

embodied

in the firm'stechnology.

The

critical valuedepends on

st.,

due

to the intertemporal non-separability in the costiff the difference

between

the lefthand

side of (7) evaluated at s,=land

is positive.Using

theAppendix and

(8), the agent invests iff(Jg oo <">0

[1-/8

/

^a'xl^o,^

/

dF(u

hl)+J-

/

WM

^(u,J]

+SlVl+r

U,>0

(9) It is this inequalitywhich

implicitly defines the coefficients coand

co, in (8) (see(A3)

in theAppendix).

The

intuition behind thisexpression is agood

way

ofillustratingthemain

featuresof our model.The

firm iscomparing

the strategy s,=l with st

=0

6

. Ifs

t

=l

production increasesby

oc,+utforall periods

compared

to s,=0,which

has a net present value (including costs) of(i-/?)>

1+u,)-(S-SrVi)

(10

>Any

further benefitsfrom

choosing st

=l

depend upon

future values of ut.There

are threepossible cases:

(i) Ifut+1

e

(-oo,(0-C0i) the agentwill not invest regardless ofst

and

there areno consequences

beyond

(10).(ii) Ifut+1

e

[cOq-co^cOo) the household's t+1 investment decisiondepends

upon

st.

The

shock

is only favorable

enough

forinvestmentifthehousehold benefitsfrom

costsavingsarisingfrom

pastinvestment i.e. st+1

=l

ifst=l

and

st+I=0

otherwise. In this case, investingtodaymeans

a difference inexpected discounted value next period of

u° <->o

P

{

dF(u

m

)x{(l-P)\a

+f

u^dFiu^y^-SJ}

(11)u -u)[

where

the first integral represents the probability thatut+1e

[co -cO|,co )and

thesecond

is theexpected value ofu,+1 conditionalon

ut+1e

[o) -a),,{0 ).Ifbothut+1and u

t+2 fallin theregion [(%-<»,, co ) thissame

additional benefitaccrues in t+2, suitably discounted. In otherwords, s

t+2 only equals 1

when

st+1=l,which

in turn will only be the casewhen

st=l.

As

{ut} isassumed

an i.i.dsequence

this additionalbenefit att+2 is (1 1) multiplied

by

pProb(co-a>,<ut+1<a> ).A

similar logic holds forallfutureperiodsand

summing

over time yields{1-0

/

dF(u

hl )} lx[{p

/

iF(u

M)}x{^

+5

r

S

}+J-

/

u^dFiu,^)]

(12)Ourresults are unchanged ifm, and s,lie in thecontinuum [0,1] rather than takediscrete values.In this case, if (9) holds as a strict inequality agents choose one corner, s,=l and

m

t=l; if(9) is strictly negative, st=m

t=0. If(9)holdsasanequality agentsare indifferentbetween anychoicethathasm,=st.If in thiscase

we

imposethattheagentchooses s,=m,=l our results holdexactly.

Equation (12) is the net expected value of all future investment projects the firm benefits

from

only ifitinvests today. Ifthe firm does not investattimet,and

future shocks fall in the region [co -co,,to ), the firm will not invest in the future.However,

if the firm invests today thesame

sequence of shocks leads the firm to invest

and

reap the benefits givenby

(12).Thus

there is an importantasymmetry

in theway

firmsrespond

to investment shocks in highand low

activity states,and

as aconsequence

the marginal propensity to invest variesbetween

these states. This statedependence

relies entirelyon

0),>0,which from (A3)

intheappendixisequivalentto8,>0, orinotherwords, the presence of intertemporal increasing returns.

(iii)Finally, ifut+1

e

[co .°°). theshock

is so favorable agents invest regardless ofwhether

they benefitfrom lower

costs.However,

while investment decisions are thesame

irrespective ofs,.„ costs are not. If s

t

=

1 the cost of choosing st+1=l

islower by

8„

which

has expected present value of(38,(l-F(co )).The same

benefit accrues att+2, ifboth u,+1e

[©

-co,,co )and u

t+2e

[co ,°°), withexpected value of f3

2

8

1[F(a) )-F(co -co,)][l-F(aj)], with similar expressions holding for t+3, etc.

Summing

over time givesWq CO {1-/3

/

dF(u

t

JY^jdF{u

tJ

(13)

"o-"i "o

This expression represents the reduction in future costs arising

from

current investmentand

again reflects thepersistence in s„ capturedby

the integralbetween

(£>q-(jsx

and

u).

The

sum

of(10), (12),and

(13) is equal to (9)and

characterizes the optimal decision rule of households.The

most

important feature ofthedecision rule,summarized by

(9), is thedependence

of current actions

on

past decisions.Due

to intertemporal increasing returns, shocks in the range [co ,co -a>,) lead toinvestment ifreceivedby

an agentwho

hasbeen

active in the past (s,.,=l) but notfor an agent

who

has not invested at t-1,making

individual behaviorpersistent.4. Cyclical Fluctuations in the

Aggregate

Economy

(i) Characterizing

Output

FluctuationsWe

now

turn to the implications of individual level intertemporal increasing returns for aggregateeconomic

fluctuations.We

assume

theeconomy

consists of acontinuum

of agents,normalized to 1, each of

whom

faces the technology described above.Because

the intertemporal increasing returns are internal to the firm,we

allow forcorrelationbetween

the different investmentdecisions (denoted s,' for agenti) ofheterogenous agents

by assuming

the existence ofan aggregateproductivity

shock v

t. Heterogeneity is firstintroduced via an idiosyncratic shock, £,' such thateach

agent receives a

shock

u^Vj+e,'.We

assume

that £,' isdrawn

from

acommon

distribution function G(.) (with associated density function g(.))and

that v, is i.i.d with distribution function, H(.),and

density function, h(.). Finally,

we

assume

£,'is uncorrectedbetween

individualsand

overtime.Both

investment decisions.

The

decisionrule ofthe individual is giveninsection 3and

takes theform

ofinvestiffut

'>(0 -cOjS,.,'. Conditioning

on

the aggregate shock, this can be written as, invest iff:€

t

>w

-(i>

1s;_

r

vt(i4)

where

coand

to, are definedby

the distribution ofut\

F(.). Investment decisions vary

among

firmsdue

to the idiosyncratic shock, requiring stto be indexed

by

i. DefiningS

tas theproportionofagentsthat invest in period t (equivalently, the aggregate propensity to invest),

we

have:Proposition 2:

Aggregate

output follows the processAy

/=|Ay/^=a°+a

15

/+f

u/di ie[s'=i\ oo "nV, (15) =a°+(a1+v /)V

/

«8(*>k+

S„

f

eg(e)dewhere

S,={1-G(<vvJ>(1-S

m

M1^(<V

w

i^,)>*m

(l6)={l-G(<D

-v,)}+{GK-v>G(Q

-<Dr

v,)}SM

To

understand (16), note that of the S,., firmswho

invested last period only those with anidiosyncratic

shock

greaterthan cOo-co^v, will investnow.

Therefore, themeasure

offirmswho

investin

two

successive periods is (l-G(co -co,-vt))St.1.

Of

the (1-S,.,) firmswho

did not invest only thosewith anidiosyncratic

shock

greaterthanco-vtwilldo

sonow

and

theirmeasure

is(l-G(co -v,))(l-St. 1).Therefore, as

shown

in Fig.l,S

t is a

weighted

average of pointson

the distribution function ofidiosyncratic shocks,

where

the location of these pointsdepends

upon

the aggregateshock

and

theweights

depend

on S

t.,.(ii)

The Nature of

Business Cycle FluctuationsProposition 2 outlines an

unobserved

components

model

forGNP,

as thelaw

ofmotion

foroutputconsists of both a

measurement

equation, (15),and

a state equation, (16).The

importance ofthe state equation is that

due

its non-linear nature, it enables us to explain theasymmetries

and

thetemporal agglomeration discussedinthe introduction.

S

trepresents the average

number

offirmswho

are investing

and

ismost

naturally interpreted as the cyclicalcomponent

ofoutput,which

is crucial ingeneratingoutputfluctuations(e.g.Watson

(1986),Hamilton

(1989)). VariationsinS

tnotonlyalterthe

growth

rate of output via (15), but also provide persistence because S, follows a time varyingAR(1)

process withautoregressive coefficientequal toG(o) -v,)-G(to -co1-vt). Persistence iscaused by

shocks in the region [co -u)„a) ): in the case

where

st'=0 a value ofu

t+1 in this regionmeans

it isoptimal for s

l+1'=0,

whereas

with st'=l, st+I'=lwould

be optimal. Therefore, agentswho

invested last periodhave

a higher propensity to invest this period than thosewho

did not. In the aggregate thisimplies that i.i.d shocksare converted into persistentcyclical fluctuations.

The

autoregressive natureofthe cyclical

component

S,reliesupon

8, being non-zeroand

sodepends

entirelyon

intertemporalincreasing returns, if

8,=0

S, is white noise.The

need

foranunobserved

components

approach arisesfrom

the fact that monitoring outputgrowth

requires tracking thenumber

ofagentswho

are/are notinvesting. This is

needed

because each type of agent responds to shocks differently, eachgroup

displaying persistence in their behavior.

As

a result, it is not sufficient to monitor only the shockswhich

impacton

theeconomy,

but alsowho

willbe

affectedby

them.The

AR

parameter in (16) is in general time varyingand

this feature enables us to account forthe empirical findings ofbusiness cycle asymmetries; essentially, the impacteffect of aggregate shockson

output varies over the business cycle. Referringback

to Fig.l,changes

in vt shift the

position of the

two

points along the horizontal axis: ahigh vt shifts the chord

AB

down

and S

t willbe higher.

However,

the exact impact that vt has

depends

upon

both S,.,and

the cross sectionaldistributionofshocks, i.e.

upon

both the slopeofthe chordAB

(which is determinedby

G(.)and

Vj)and

theweightson

thetwo

points(determinedby

S,.,).As

aresult,the non-linear autoregressiveform

of(16) is a source of path

dependence

in ourmodel

as well as persistence; ashock which changes

S

t_, both affectsS

t through theAR

coefficient but also alters theway

that theeconomy

responds tofuture shocks

due

to the interactionbetween

vt

and S

t_,.However,

undertheassumption of uniformlydistributedidiosyncraticshockstheseasymmetric

interactions

between S

t_,and

vtare absent. In this casetheAR

coefficient in(16) is constantand

(15)and

(16) approximate the standard "return to normality" state space model, variants ofwhich have

been

used to successfullymodel

U.S.GNP

by Harvey

(1985),Watson

(1986)and

Clark (1987)7.More

generally, (15)and

(16) allow for anumber

of alternativecomponent

basedmodels which

accountfora

wide

range ofasymmetries and

cyclical fluctuations.Each

ofthesedifferentmodels

ofthe cycle arise

from

alternative assumptionson

the distribution of idiosyncratic shocks.However,

although our

model

allows an important role for heterogeneity,we

do

notneed

tomonitor

complicated

changes

in the cross-sectional distributions tokeep

track ofthe state of theeconomy:

what

matters for business cycles is not the exact relative position ofeach

agent over time but thedistributionfunction for idiosyncraticshocks

around

particular ranges.The

latterserves asasufficientstatistic for all distributional issues, considerably simplifying the analysis of the next subsection.

The uniform distribution case only approximatesthe return to normality model due to the non-normality of the

measurement equation disturbanceand because, if v, is such thateither o^-v,or a^-Wi-v,is outside the support of

£j, theautoregressivecoefficient is no longerconstant. 11

Motivated

by

these observations,we now

turn to investigatehow

the degree of intertemporal increasing returnsand

heterogeneity interact to determine the time series properties ofthe aggregateeconomy, and

ofspecifically the cyclicalcomponent

S

t .

(Hi) Determinants

of

theTime

SeriesPropertiesof

the Business CycleThe

non-linear natureof ourmodel means

there isno

unique definitionofpersistence, butone

candidate is the degree ofserial correlation in S, conditional

upon

vt:Given

G(.) is a distribution functionwe

have:Corollary1:Business cycle persistenceis non-decreasingin8,,thedegree ofintertemporal increasing

returns.

Persistence is

due

to the fact thatsome

agentshave

shocks in the interval [(D-g>i> co)

and

invest in this period only because investment costs are

lower due

to recent high activity.As

co, determines themeasure

of these marginal agents,and

is itself a positive function of8„

serialcorrelation is strengthened

when

intertemporal increasing returns are higher.To

illustratehow

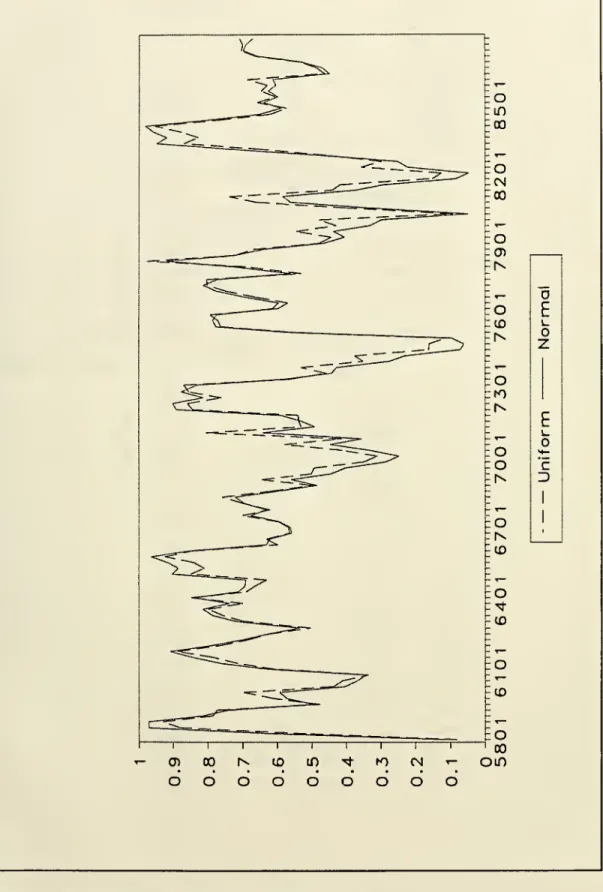

the nature ofthe business cycle varies with differentdegrees ofincreasing returnsconsiderthefollowingillustrativesimulation.Assume

aggregateand

idiosyncraticuncertaintytobe equally important with both havinga variance of0.25, the former being normally

and

the latter uniformly distributed,and

letthegainsfrom

learning-by-doing, a,, be equalto 1.52 (see Section 6.1 for a justification of this choice). Figs. 2and

3show

the cyclicalcomponent

arisingfrom

theseassumptions for the case 5,/5=l/3

and

1/2.Given

the strong pathdependence

in oursystem

Figs.2and

3 aredrawn

for thesame

(suitablyscaled)sequence

ofrandom

shocks.Both

figuresillustratehow

intertemporal increasing returns convert i.i.d shocks into cyclical fluctuations,

however,

the cyclical indicatorisfarmore

persistentinFig.3than inFig.2.The

increasedlearning-by-doingpersuadesfirmstocontinuetoinvest

even

inthepresenceofmediocre

productivity shocks, significantly reducing the noise in the cyclicalcomponent.

To

understandtheimpact ofdistributional affectson

the cyclicalcomponent

we

turntoamore

generalmeasure

of persistence than (17),which

was

defined conditionalon

a given value of vt.Integrating across all possible values of the aggregate shock,

we

arrive at a globalmeasure

ofpersistence;

H-zrkww

(18)as

M

Taking

a first-orderTaylor expansion ofP

around

m,,themean

ofv,which

isassumed

zero,we

obtainBy

definition the second term is zero,and

ifwe

take a further first-order Taylor expansion ofG(.)around co ,

P

can beapproximated

by

g(oo )co,.Thus

we

can stateCorollary 2:

For

given (0and

co,, an increase in g((0 ) will increase P.The

intuitionbehind thiscorollaryis againrelatedtothefact that individual persistence arisesfrom

shocks in the region [co , (Oq-co,). In the aggregateeconomy

the distribution of idiosyncraticshocks is important because it determines the density ofagents

who

arearound

this critical region.For our global

measure

ofpersistence, g(co )co, is ameasure

ofthenumber

ofsuch marginal agents, so that the higher is g(co ) the greater is serial correlation. Corollary2

therefore implies thatspreads of g(.) around co (which will often beproduced

by

increases in heterogeneity, representedby

increases in the variance ofe') will reduce persistenceto theextent they

lower

thenumber

ofagentsin the region [co , co -co,).

The

intuition of Corollary 2, that the persistence in thedynamics

ofthiseconomy

are linked to theform

of the distribution ofthe idiosyncratic shocks, is important for ourresults in section6,

where

we

will investigate theempiricalperformance

ofdifferent versionsofthisgeneral

models

distinguishedby

theform

ofthe heterogeneityand

thusby

the degree ofasymmetry

in the

law

ofmotion

for output growth.Now,

to further analyze theimpact of aggregate uncertaintyon

the business cyclewe

take asecond-order Taylor expansion of (17)

around

u^ followedby

an additional first-order Taylor expansionaround

co . This gives:P^Gi^yGi^-^yigX^yg'^o-^Wariy,)

s

%o)^(

fflo-

u

i)V'W

u

M)

so

we

have;Corollary

3: Increases in the variance of aggregate shocks reduce (increase) the persistence of the cyclicalcomponent

if g(.) isconcave

(convex)around

oo .Corollary 3 states the surprisingresult thatfor a large class ofidiosyncratic distributions, the

more

volatile are aggregate investment shocks, theless importantis thebusiness cycle- inthe sense thatthecyclicalcomponent becomes

lesspersistentand

aggregate outputfluctuations are increasingly driven directlyby

vt

and

notby

the state equation.The

intuition behind this is thatwhen

g(.) isconcave around

a>, increased volatility of the aggregateshock

leads to the critical investmentthresholdbeing located at points with

low

density. In contrast, in thecase of aconvex

g(.) functionat co ,

more

aggregate variability will take us to values ofthe density function that areon

averagehigher

and

thus increase serial correlationdue

to the increased weight of marginal agents.(iv) Structural Heterogeneity

The

purpose of this subsection is toshow

thatwhen

we

extend ourmodel

to allow for different types of heterogeneity across agents, the importance of the cyclicalcomponent

and

thedegree ofnon-linearities associated with thebusiness cycle

may

be enhanced. In particularwe

show

that increasing the dispersion of agents can,

under

certain conditions, increase theamount

ofpersistenceprovided

by

our cyclical indicator.Given

that {St} represents the extent ofco-movement

between

agents, this is a surprising resultwhich

re-iterates the limitations of representative agent models.We

have

so far only consideredwhat

may

betermed

stochastic heterogeneity using theterminology of Caballero

and Engel

(1991), thatisheterogeneity intheform

ofidiosyncratic shocks.Whereas

in practice, agents also differ significantly in theirtechnological possibilities/preferences aswell astheopportunities theyface,oftencapturedin

microeconometric

work

by

theinclusionoffixedeffects.

To

include these influenceswe

considerstructuralheterogeneityby

allowinginvestmentcost functions to be firm specific.We

assume

agent i has investment costs givenby

8

Using

the solution outlined in Section 3each

agentinvests iffeJ^Oo-w^i-v,

(22

)where

the distribution function of co ' is T(.) with support setU

and

is determinedfrom

thedistributionofthecostparameter,

8

'.Increases inthedegree ofstructuralheterogeneityareequivalentto mean-preserving spreads of IX).

The

law

ofmotion

for S, isnow

^KlA

1){/(l-

G

("i.-v/)yr(a)i

))}+

5

/.1

{/(l-G(a)i

)-o>1-v/)yr(a>i

))}u

u

(23)={/(l-G(o);-v

/ ))dr(a>;)}+5

M

{/{G(a);-v

/)-G(a)^-(o1-v/)Mr(a);)}

u

u

Applying

thesame

two

successive Taylor expansions as in the last subsection, our globalmeasure

ofpersistence

becomes

P~f„

[^-Gtoj-aOWui-tt!/,,

S(*>uW<d

) (24)Corollary

4: Ifg(.) isconvex

(concave),mean

preserving spreads ofT(.) increase (decrease) P.The intertemporal increasing returnsparameter, 5,, can similarlybe

made

individual specific.Therefore,anincreased dispersionofagentsinthe

form

ofgreaterstructural heterogeneitycan interact with stochastic heterogeneity to increase the persistence generated through the cyclicalcomponent.

The

intuition here is that if g(.) is convex, the averages of neighboring points will be higherthan g(.) itself. Since thehigheris g(.) thehigheris themeasure

ofagents inthe criticalregionwhere

investmentis only profitablewhen

costs are low, in the case ofconvex

g(.), the presence ofstructural heterogeneity leads toa

more

serially correlatedprocess for {St}.We

cantherefore see thata mean-preserving spread (an increase in structural heterogeneity),

by

extending the cross sectionaldistribution of co ' to regions of

g(.) that are higher, increases persistence in the

economic

state. Converselywhen

g(.) is globally concave, an increase in structural heterogeneity will reducepersistence.

The

message from

this section is clear, farfrom removing

the non-linear nature of the business cycle, heterogeneitieshave

akey

determining influenceon

economic

fluctuations.5.

Regime

Shifts inEconomic

FluctuationsOne

oftheattractions offixed costmodels

is thatthe discrete individual behavior they imply canexplain the sharpnessofbusiness cycle turning points.While

our generalmodel

implies thatthecyclical

component

is always serially correlated, it does notimpose any

conditionson

the nature ofturning points.

A

number

of studies (e.g.Hamilton

(1989),Acemoglu

and

Scott (1994),Suzanne

Cooper

(1994),Diebold

and

Rudebusch

(1994))have

achievedempirical success inmodelling outputfluctuations

by assuming

the business cycle to be characterizedby regime

shifts, that isby

abruptmoves

from

recession toexpansion (or viceversa). In the next subsectionwe

investigate the factorswhich

determinethenatureofturning pointsinourmodel,establishing thecircumstancesunder

which

models

withregime

shifts serve as agood

approximation.(i)

The Nature of

Turning PointsTo

analyze this issuewe

use ourbasicmodel

with only stochastic heterogeneity,and

focuson

the probability ofa given S, occurring conditionalupon

S,.,,which

is :p(

5|5>

*G2

(25)(i-s^K-

v)+s'sK-<v

v )where

p(S|S')denotesthedensityofS

tconditionalon

S,.,=S'and

v, iswritten as an implicitfunctionofS,

by

(16).The

extreme

case ofregime

shifts corresponds to the casewhere S

t=0

or 1 so that p(S|S')has its

mass

concentrated attwo

particular points. Similarly inmore

general characterizations, ifp(S|S') has

marked

peaks, then transitionsbetween

different states takeon

the characterofregime

shifts.

A

necessary (but not sufficient) condition for p(S|S') tohave

itsmass

concentrated intwo

different intervals is that it should be non-unimodal. Thus, if

we

can

establishp"(S

|S') is positiveatp'(S |S')=0,

we

willhave

located alocalminimum

which

implies p(S|S') cannotbe

singlepeaked.From

(25)we

have:While no

general statement can bemade

regarding the transitionbetween

stateswe

have

the following:Proposition3:

The

conditional density ofS,isnon-unimodal

ifg(e)ismore

concave

thanh(v) in theneighborhood

of p'(S |S')=0.Proposition 3 suggests turning points tendtobe abrupt

when

g(.) islocallymore

concave

thanh(.).

Though

this is not a necessary condition, naturallywhen

g(.) has itsmass

concentrated at aparticular point, it willtend tobe

more

concave. This can be seenin Fig.l. Ifthe idiosyncraticshock

is uniformly distributed, G(.) is a straight line

and

output growth,though

persistent, is distributeduniformly along the

continuum

(a^OofCC,).However,

if the distribution function is concentrated inthe middle (as in Fig.l)

economic

statesbecome more

distinct in the sense that the conditionaldistribution of {S,} is concentrated in particular intervals of(0,1).

As

a consequence, turning points aremore

likely to approximate the discreetness ofregime

shifts.To

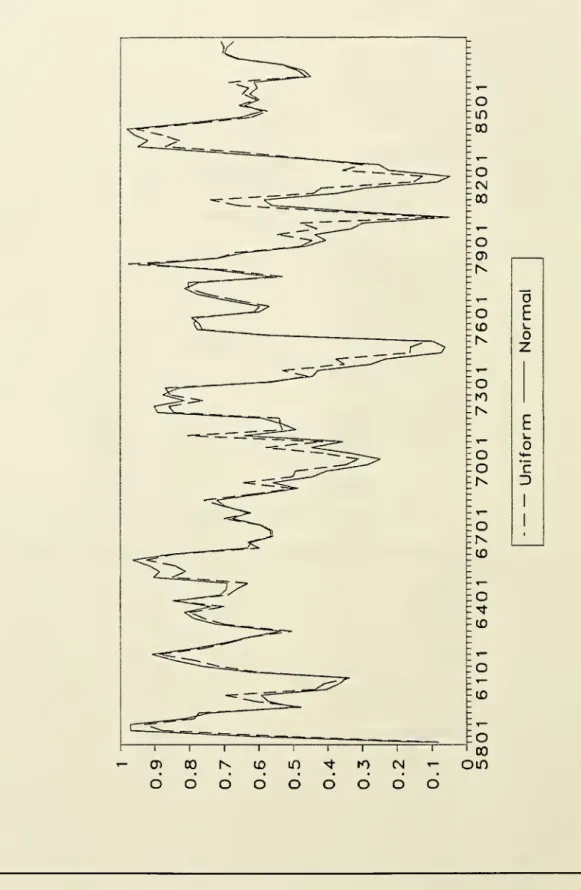

investigate furtherthispoint,we

utilize a simulations approach. Recall thatFig.3showed

the case

where

8,/8=l/2

and

the aggregateand

idiosyncratic shockswere

equally uncertain with a variance of0.25. Fig.4

maintains the degree ofincreasing return at thesame

level but increases the variance ofthe idiosyncraticshock

to 2.5.The

very different cyclical patterns inthetwo

figures are readily apparent: inFig.3, there arenever lessthan60%

ofagents investing so thateven

inrecession largenumbers

of agents are still active,and

turning points are extremely sharp, particularly the observations ataround

37 and

73. Incontrast, the greater importance ofidiosyncratic shocks adds a considerableamount

of noise to the cyclical indicator in Fig.4.And

while the turning points atobservations

37

and 73

can still be detected, they represent onlytwo

ofseveral observationswhere

the cyclical

component

changes direction.The

above

resultsand

discussionshow

again that theform

of heterogeneity is crucial, this timeindetermining thesharpness ofturning pointsand

they alsosuggestthatthe limitingcasewhere

aggregate uncertainty is

much

more

important than idiosyncratic uncertainty is useful to analyze as abenchmark.

(ii)

A

Model

ofRegime

ShiftsProposition 3

and

related simulations suggest that themore

concentrated the idiosyncraticdistribution the

more

appropriateis aregime

shiftcharacterization. Further, Corollary2

implies thatincreasesinheterogeneity

may

reducethepersistenceofcyclical fluctuationsby

reducing g(o)).Thissuggests that the business cycle will display

extreme

regime

shiftsand

possess a highly persistent cyclicalcomponent

in a version ofourmodel

withno

heterogeneity. In this subsectionwe

focuson

such a

model by

setting ut'=vt.

The

particularinterest in this special case is thatit offers a theoreticaljustification for the widely used discrete

Markov

state space models.Because

themodel

only contains an aggregate shock, the laws ofmotion

for the aggregateeconomy

are thesame

as those for the individual firm.From

our results of Section 3(ii)and

introducing the notation

Prob[S

t

=l\S

t^\]=p

Prob[S

t

=Q\S

t_^]=q

we

have

Proposition4:

The

stochastic process for thechange

in aggregate output isAY,=-a

0+(a1+v,)S, (28)where S

tis aMarkov

chain with transition matrixp

M

T

(29)and

p=

f

dH(v)

,q=fdH(y)

(30) <>„-&>,As

in themodel

with heterogeneity, cyclical fluctuations are the result ofrandom

shockshitting the

economy. These

shocks are propagatedby

intertemporal increasing returns in amanner

which

requires a state space formulation for output growth.The

distinguishing feature of (28)-(30) is that fluctuations take theform

ofshiftsbetween

distincteconomics

states. Ineach

ofthese statesthe

economy

behaves

differently, notonly does thegrowth

rate differ (oc,?K))but ifp*l-q

then sodo

the durations of

booms

and

recessions, featurescommon

with themodel

ofHamilton

(1989)which

closely corresponds to (28)-(30).

This

regime

shiftmodel

alsoshares anumber

ofsimilaritieswiththemodel

ofDurlauf (1993)who

also explicitlymodels

the transitionbetween

states of the business cycleand

focuseson

technology adoption. In both

models

this choice involves a non-convexityand

intertemporal increasing returnstoscalewiththeend

resultbeingthatwhitenoise productivity shocksareconverted into serially correlated output fluctuations.Both

models

also suggest a strong role for pathdependence, in (28)-(30) shocks

which

shift theeconomy

from one

state to another are highlypersistent as they affect the

way

theeconomy

responds to future shocks.However,

akey

differencebetween

oursand

Durlauf

swork comes

in theform

thattheintertemporal non-separability takes. InDurlauf

smodel

the intertemporal linkage arises throughlocalizedtechnological spill-overs; in otherwords

firmshave

a higher propensity to invest if their neighbors invested in the recent past.The

impact of this externality is the focus ofDurlauf

s paper.Due

to the externalityDurlauf

smodel

generates multiple long run equilibria in the sense that the stochastic process for output is non-ergodic.However,

in our model, because increasing returns to scale are internal,and

this not onlyimplies thatthe equilibriumpath is uniquely determined, i.e. given v,

and

{S,.,,St.2,..},we

know

withcertainty in

which

state theeconomy

will be, but also that {AY,} isalways

ergodic.6.

Econometric

Evidence

In this section

we

use the econometric results of other researchers as well asmaximum

likelihood estimates of our

own

generalmodel

of Section4

to assesswhat

scale of intertemporal increasing returnsand

what form

of heterogeneity are necessary to account for the business cyclesin the U.S.

We

also use the analysis ofSections 3and

5 to inferfrom

our estimates the exactform

of U.S. business cycle

asymmetries

and

the relative importance of idiosyncraticand

aggregatesources ofuncertainty.

(i)

Regime

ShiftModels

Hamilton

(1989) estimates atwo

state discreteMarkov model

forUS

GNP

which

is nearlyidentical to (28)-(30)

and

finds p=0.9,q=0.76

and

oc,=1.52.To

calculate the implied degree ofintertemporal increasing returns

we

solve theequations in(A3) intheappendix

usingtheseestimated parametervaluesand

making

assumptions regardingthedistributionand

variance of aggregateshocksplus the

magnitude

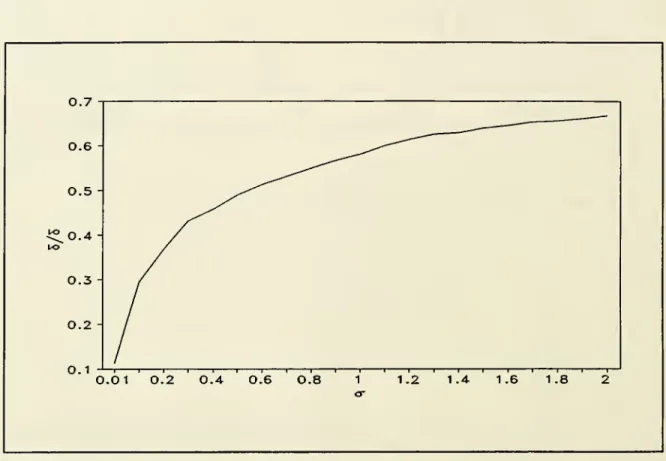

of the learning-by-doing effects (6,/8 )9

. Fig.5

shows

different combinations of5,/5

and

o

2vwhich

generatep=0.9 and

q=0.76

when

aggregate shocks are normally distributed.To

obtain the

same

persistence inS

t, ahigher variance requiresmore

increasingreturns.The

reasonforthis isthatthe greater the variance ofshocks, the

more

likely agents are toreceive a futureshock

lessthan (Do-CD,. This lessens the expected future benefits

from

increasing returnsand

makes

agents both less likely to investand

less likely toremain

investingonce

theyhave done

so.Thus

withincreasing returns of22%

(8,/8=0.22) toproduce

the appropriate values ofp and q

we

requirea

2v=0.05, butwhen

G^O.Ol

we

need

only 8,/8=ll%.

As

well asproviding persistence, intertemporal increasing returns generate considerable amplification ofthe productivity shock.For

thecasewhere

8,/8=0.22

and

^=0.05,

even though

cV

a

i=

0.03, the variance ofAY

t is equal to 0.634. Relying onlyon

aOq does not influence the values of cOq and go, and so (without loss ofgenerality) it is set to ensure the model

matches

mean

US

output growth.single productivity

shock

to drive output fluctuations,we

need

implausibly large learning-by-doing effects of53%

to explain Hamilton's results.But

with an additional additive disturbance in (1), asassumed by Hamilton and

all econometric implementation ofunobserved

component

models, his results can be explained with very smallamounts

ofintertemporal increasing returnsand

aggregateuncertainty.

Results

from

alternative studies confirm this finding that only small scale intertemporal increasing returns are necessary to generate empirically observedregime

shift behavior.Suzanne

Cooper

(1994) usesmonthly

industrial productionfrom

1931 to estimate a transition matrix similarto (28).

To

match

her estimates of the transition probabilities (p=0.55and

q=0.46) while alsomatching

the variance ofUS

GNP

growth

(again without resorting toany

additional productivity disturbances other than a unique aggregate shock),we

need

the saving in fixed costs arisingfrom

learning-by-doing to

be

onlyaround

3%

(i.e. 5[/5 =0.03).Diebold

and

Rudebusch

(1994) estimate equations analogous to (28) usingUS

industrial production (allowing for a timedependent

T).Assuming

onlyone

disturbanceand

using theirestimated standard error forAY,

to calibrateo

v2 (anunderestimate as this implicitly sets S,=l for all t),

we

find 8,/8=0.8%

is sufficient to explain their results.(ii)

The General Unobserved

Components

Model

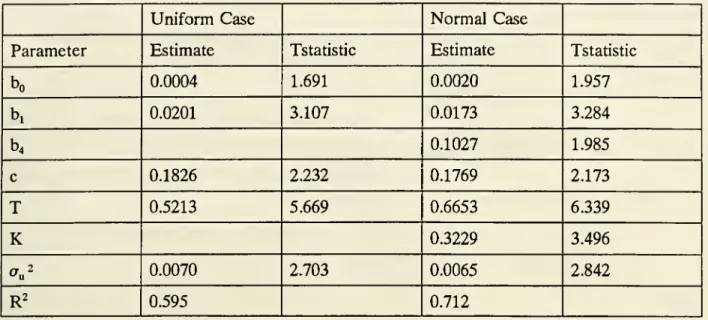

Inthissubsection

we

use (15)and

(16) toobtain estimatesof ourstructuralparameters.These

equations represent a general statespace

model

and

requireassumptions regarding thedistribution ofidiosyncratic shocks before they can

be

estimated.We

examine

these equationsassuming

first thatidiosyncraticshocks are uniformly distributed

and

then thatthey are normallydistributed.As

well as enablingus toassess therobustnessof ourestimatesofstructuralparameters theseassumptions allowus to

examine

the importance ofasymmetries

in U.S. output fluctuations.As

discussed above, theassumption of

uniform

idiosyncratic shocksremoves any

asymmetry

inthestateequation.Estimating(15)

and

(16) under different distributional assumptions therefore enables a simple heuristic test oftheimportance of asymmetries in U.S. business cycles.

Assuming

thatidiosyncratic shocks are uniformly distributed over therange [-a,a], (15)and

(16) can

be

written as „ a-oin o>, v, (31) ' l2a

1 2aM

2a

=c+ rs,_1+u

twhere

thecoefficients ty arefunctions ofthestructuralparameters u) ,co„ a, o^,and

a,and

asidefrom

the squared disturbance in the

measurement

equation this is the standard return to normalitymodel

(e.g.