HD28

•M414

no.

9/

WORKING

PAPER

ALFRED

P.SLOAN

SCHOOL

OF

MANAGEMENT

ARBITRAGE

WITH

HOLDING

COSTS:

A UTILITY-BASED

APPROACH

by

Bruce

Tuckman

and

Jean-Luc

Vila

Latest

Revision:

December

1991

Working

Paper

No.

3364-91-EFA

MASSACHUSETTS

INSTITUTE

OF

TECHNOLOGY

50

MEMORIAL

DRIVE

ARBITRAGE

WITH

HOLDING

COSTS:

A

UTILITY-BASED

APPROACH

by

Bruce

Tuckman

and

Jean-Luc

Vila

Latest

Revision:

December

1991

M

l.T.LIBRARIES

11M*

Arbitrage

With

Holding

Costs:A

Utility-BasedApproach

by

Bruce

Tuckman

Stern

School

of Business,New

York

Universityand

Jean-Luc

VilaSloan School of

Management,

M.I.T.This version:

December,

1991We

would

like to thank participants in theN.Y.U. and

CornellFinance Seminar

Series,participants in the 1990

AFA

and

AFFI

meetings,and

ananonymous

referee for helpfulcomments

and

suggestions.Abstract

Unit

time costs, or holding costs, are incurred inmany

arbitrage contexts.Well

known

examples

include losing the use of short saleproceeds

and

lending funds atbelow market

rates inreverse repurchase agreements. This

paper

analyzes the investmentproblem

of a risk aversearbitrageur

who

faces holding costs.The

proposed

model

allows prices to deviatefrom

their"fundamental" values without allowing for riskJess arbitrage opportunities. After characterizing an

arbitrageur's optimalstrategy, the

model

isexamined

in thecontextoftheTreasury

bond

market.The

analysis reveals that holding costs are an important friction in this

market and

that theycan

beArbitrage

With

Holding

Costs:A

Utility-BasedApproach

Financial

economists

have

made

great use of the notion of arbitrage in frictionless markets.Researchers

define arbitrage as a set oftransactionswhich

costs nothingand

yet riskJessly providespositive cash flows.

They

thenassume

that arbitrage opportunitiesnever

existand

derive preciseimplications

about

the relative prices of traded securities.The

presence

ofmarket

frictionscomplicates thestory. In the simplestof models, trading costsmake

it impossible to riskJessly exploit small price deviationsfrom

arbitrage-free relationships.Therefore,

when

market

pricesdo

not admit riskless arbitrage opportunities, arbitrageursdo

nothing.When

market

pricesdo

admitsuch

opportunities, arbitrageurs bet all theyhave

on

the sureproposition that prices will

be back

in line at the maturity date of the underlying securities.While

this simplemodel

can explain the empirical regularity of price deviationsfrom

"fundamental value,"1

more

careful portrayalsofmarket

frictionsmake

for richermodels

ofarbitrageactivity.

Brennan

and Schwartz

(1990), forexample,show

that trading costsand

position limits in thestock index futures

market

canmake

it valuable to close a position before maturity.As

a result, itmay

beworthwhile

toopen

a positioneven

when

the costs ofopening

it plus the costs ofclosing itat maturity

exceed

the price deviationfrom

fundamental

value. Thispaper

contributes to the theoryof arbitrage pricingwith

market

frictions intwo

ways. First, it focuseson

asomewhat

ignored aspectof true-to-life arbitrage activity,

namely

unit time costs, or holding costs.Second,

it builds amodel

which

rules out riskless arbitrage opportunities withoutremoving

all incentives to exploitmarket

mispricings.

As

a result, risk averse arbitrageursdo

not sit idly by or bet all the have.They

take afinite, risky position if the mispricing is large

enough

and

adjust its size as the mispricing changes.This behavior is consistent with the casual empirical observation that professional arbitrageurs

Thephrase "fundamentalvalue'is10 mean the arbitrage-tree pricewhen there areno market frictions. Innosense dowe mean

2

routinely find

and

takeadvantage

ofdeviationsfrom fundamental

values.Section I describes

how

holding costscan

transform riskless arbitrage opportunities intopotentially profitable but risky investment projects. It

then

argues that holding costs are importantin

many

different arbitrage contexts.Section II presentsa

model

ofarbitrageactivity.The

scene

issetwithaholdingcost structureand

an

exogenous

mispricing process that, in combination,do

notadmit

riskless arbitrageopportunities.

The

paper

then derives the partial differential equation governing a risk aversearbitrageur's optimal,

dynamic

strategy.For

the case of negative exponential utility it isshown

that1) arbitrageurswill hold a position if

and

only if the potential gains are largeenough,

2) the positionisfinite,

and

3) arbitrageurswilltake a positioneven

withan

instantaneouslynegativeexpected

returnsince

any

future losses willbe

accompanied

by greater arbitrage opportunities.Section III

examines

the model's assumptions in the context of the U.S.Treasury

bond

market, estimatesthe

parameters

ofthemodel,and

numericallysolvesthepartialdifferentialequationofsection II using those parameters.

The

data support the contention that holding costs are quiteimportant, relative to trading costs, in preventing riskless arbitrage.

The

data also support theassumption

ofan autoregressive processfor the deviationof pricesfrom fundamental

value. Finally,the numerical solutions reveal an "option effect"

and

a "risk effect" in the determination ofpositionsize

and

allow foran

assessment of the relativeimportance

ofthetwo

effects.Section

IV

concludesand

discussesavenues

for future research. In particular, thiswork

canbe

viewed

as a first step towards building an equilibriummodel

ofarbitrage activity in the presenceof holding costs.

Such

amodel

holds thepromise

of being able to provide tighter pricebounds

3

I.

Holding Costs

and

Risky

ArbitrageConsider

two

portfolios,A

and

B,which

provide identical cash flowsover

time and, at thetime of the last cash flow,

must have

identicalmarket

prices. Nevertheless, forsome

reason, themarket

prices ofthe portfolios,P

A

and

P

B, differ by anamount

x.Assuming

thatP

A

>

P

B, investorsin frictionless

markets

will short portfolioA

and purchase

portfolio B, realizing x todayand

incurringno

future cash inflows oroutflows.Although

thispaper

couldhave

assumed

that institutionswere

such

as to allow the arbitragejust described, the

model

to be presented in section II buildson

amore

realistic description ofshortsale agreements. In order to short portfolio A, an investor

must

borrow

the securitiesfrom

somewhere.

Furthermore,

the lender of the securities will require collateral in order toensure

theeventual return ofhis securities. Therefore, the arbitrage

must be

arrangedas follows: lendP

A

dollarsto the holder ofthesecurities (or, equivalently. post

an

interest-bearing securityworth

P

A

), take thesecurities in

A

as collateral, sell these securities forP

A

,borrow P

B

,

and purchase

portfolio B. In thismore

realisticsetting, the investor neitherpays nor receivesany

money when

establishing his position,but realizes the future value ofx

upon

closing the position.In frictionless markets, investors

would

wish to arbitragead

infinitum, leading to theconclusion that, in equilibrium,x

must

equal 0. Introducing holding costschanges

arbitrage behaviorin

two

important ways. First, the no-riskless arbitragecondition only requires that xbe

no

larger thanthe present value of the

accumulated

holding costs,from

theopening

of the position to the timewhen

thetwo

portfolio pricesmust

be equal.Second,

for smallerx, investors face a risky investmentopportunity: ifx falls to quickly

enough,

then the costs ofeffecting the arbitrage willbe

smalland

the transaction will

have proved

profitable. If,on

the other hand, xdoes

not fall quicklyenough,

theaccumulated

costs willwipe

out the realized gains.4

commodity

willusually incur unit time costssince investorsmust

oftensacrifice theuse ofatleast partof the short sale proceeds.2 In the case of stocks, it is true that institutions with large client bases

can take short positions almostcostlessly. Nevertheless, smaller firms

engaged

in arbitrage activitydo

incur holding costs

when

short-selling stocks.3Second,

trading in futuresmarkets

may

generateholding costs since at least part of

margin

depositsmay

not earn interest.4 Third,banks

making

markets

in forward contracts often charge a perannum

rate over the life of the contract.5 Fourth,deviations

from

desired investment strategiescaused

by having tomeet

collateral requirements canbe

thought

of as unit time costs.6The

model

ofthispaper

focuseson

holding costsand

ignores trading costs for anumber

ofreasons. First, despite their ubiquitousness, holding costs

have

not receivedmuch

scholarly attention.Second, trading costs

would

obscure the qualitative nature of this paper's results.Trading

coststransformstrategies

which

continuouslyadjustholdingsinto strategieswhich

discretelyadjustholdings,where

the frequency of adjustment decreases in the trading costs. Since this effect hasbeen

studiedelsewhere,7 there is little

danger

that focusingon

holding costs willprove

misleading. Third, whilethe trading costs ofprofessional traders

and

arbitrageurscan be

extremelysmall, theabove examples

and

the discussion to follow reveal that their holding costsneed

notbe

trivial.One

ofthe easiest contextsinwhich

toestablishboth

theimportance

ofholding costs relativeto trading costs

and

the absolutemagnitude

of holding costs is theTreasury

bond

market.The

major

" Forthe case of stocks,see. forexample.Cox

and Rubinstein (1985), pp. 98-103.

We

wouldliketo thankBillyRaoofSusquehanna InvestmentGroupforthiscomment.4

See.for example.Duffie (1989). pp. 58-68.

5

See.for example.Anderson(1987), p. 198.

6

We

would liketothankPeterCarrforthissuggestion.

See. for example.Dumasand Luciano (1990). Hodgesand Neuberger (1989), and Fleming.Grossman. Vila, and Zanphopoulou

5

trading costs in this market,

namely

bid-ask spreadsand brokerage

fees, are typically small, totallingabout

3/32 ofone

percentand

1/128 ofone

percent, respectively.8The

major

holding costs in thegovernment

bond

market

are reverse spreads. Recall thatbonds

are sold shortthrough

reverserepurchase

agreements

inwhich

the short sellerlendsmoney

and

takes thesecurityhe wants

toshortas collateral.

The

reverse spread is defined as the differencebetween

the lending rateon

generalcollateral

and

the lending rateon

specific collateral. In other words, the reverse spread is the rateavailable

when

any Treasury

bond

willserve ascollateralminus

the rate availablewhen

onlya specificTreasury

bond

will serve as collateral. This spread is usually positive9because

the difficulties infinding the

owner

ofa particularbond

and

the likelyattempts of otherwould-be

shorters to find thesame bond

translates into an opportunity losson

themoney

lentthrough

reverses.Stigum

(1983)reports average spreads of

.25%

to .65%.10Now,

tocompare

themagnitudes

of trading costsand

holding costs, consider shorting

$100

face value of a parbond

and

maintaining the position untilmaturity.

The

trading costscome

toabout

10 cents and, with a spread of .5%, the holding costsexceed

the trading costs for maturities longer thanabout

2 1/2months.

The

price data presented insection III

show

that, for all but the shortest maturities, holding costsdo

more

than trading costs toinhibit riskless arbitrage activity.

Two

recent empirical papers serve as excellent motivations for the present analysis. Cornelland Shapiro

(1989)document

both

the persistent mispricing of a particularTreasury

bond

and

theattempts ofarbitrageurs, facing holdingcosts, to profit

from

thatmispricing.Amihud

and

Mendelson

(1990), studying the effects of liquidity by

comparing

the prices ofmatched-maturity

Treasury billsand

notes, find that notes arecheap

relative to billsand proceed

toexamine whether

these price8

See Stigum(1990). pp.649-650 and p.669.

9

See Stigum(1990). pp. 596-597.

10

6

differences can

be

exploited. Considering only trading costs, as captured by the bid-ask spreadand

brokerage

costs, riskless arbitrage opportunitiesseem

rampant.

Adding

holding costs,however, most

of these

money

machines break down.

11Another

motivationforthe analysis of holdingcostsstems

from

therelativelyrecentliteratureabout the source of

market

mispricings.Some

authors (e.g.De

Long

et al. (1990)and

Lee

et al.(1991))

have

hypothesized that investors' shortterm

horizons allow for persistent deviationsfrom

fundamental

values. Thispaper

reveals that holding costs, in effect, generate myopia.Even

though

arbitrageurs

have an

investment horizon equal to the maturity of the underlying securities, holdingcosts discourage the

maintenance

of long-term arbitrage positions. Therefore, holding costsmay

beviewed

as a particularway

toendogenize

investor impatience.II.

The Model

This section

models

the behavior of risk averse arbitrageurswho

incur holding costsand

observe prices that deviate

from

fundamental

value.To

allow for the possibility of arbitrageopportunities, begin by

assuming

that thereexisttwo

portfolios.A

and

B,which

are characterizedbyidentical cash flows

through

theircommon

maturitydate, T.i: Let their date-t pricesbe

P*

and

P^,respectively.

Let x,

=

P*-P^

denote

the differencebetween

the prices of these portfolioson

date t.While

it

would

be

ideal toendogenize

the stochastic process governing theevolution ofxt,

this

paper

followsThe authors actuallyconsiderthe bid-ask spread and then add both brokerage costs and holdingcosts. Nevertheless, because

brokeragecosts are so small in thismarket, the resultstated in thetext holds aswell.

While thisassumptionseemsinnocuous enough, it doesruleout concurrent investmentsin othernskyassets.This simplification

allows the model to abstract from the portfolio effects which would arise from holding othernsky assets in addition to an arbitrage

7

others13 in talcing the process as

exogenous

in order to focuson

the investmentproblem

facingarbitrageurs.

The

assumed

evolution ofx, should exhibit the following properties:1) x

T

=

0, i.e. the price deviation disappears at maturity.2) x, is

never

so large as to admit riskless arbitrage opportunities.3) x, tends towards zero.

4)

The

larger the absolute value ofx,, the fasterxt tends

toward

zero.The

lasttwo

properties attempt to infuse the process with an equilibrium flavor. Property 3)captures the idea that deviations are transient. Property 4) reflects the notion that larger deviations

will

be

exploitedmore

readily, and. as a result, tend to vanish at a faster rate than smallerdeviations.In order to find a process

which

satisfies (1)and

(2). begin bydetermining

the permissiblerange ofx

t

.

Along

the lines of the motivations discussed insection I. letc>0

be

the holding cost perunit time per portfolio unit.14 Also, let r

denote

the arbitrageur's cost of capital.Then,

the presentvalue cost of maintaining a unit short position

from

date t until maturity isT

J"

ce-

r(s-l)ds . t

Letting t

=

T-t. the time to maturity,and

denoting this cost function by s(t),s(t)=

f

(l-e"") (1)If the absolute value ofx exceeds s(t) at any time, then a riskless profit could

be

made

through thearbitrage described at the start of the previous section. Therefore, to guarantee that |x,|

<

s(t).generate the process x, in the following way:

See. forexample.Brennanand Schwartz(1990). Recently.Holden (1990) has endogenizedamispncing process byassumingthai aclientele effect splits themarket and that eachsegment is periodically hit by liquidityshocks.

14

Inthe context of the U.S.Treasury market,the holding costcanchangeasthe arbitrageursrolloverexpiringrepurchase agreemenis Itseems best,however, to postpone modellingc until it isendogenized to reflect the collectiveactivityof arbitrageurs. Furthermore, in

ordertomodelthe nskless arbitrageboundaryinasimpleway.ithas furtherbeen assumedthat theholding cost isper portfoliounit. In

8

x,

=

s(t)4>(z,) (2)where

z, isan

underlying state variableand

<J> is a functionfrom

(-°o,+

«>) to (-1,1)which

preservesthe sign of z

and

increases in z. Notice that this setup also ensures that xT

=

since s(0)=

0.The

process for x,can be

made

to satisfy properties 3)and

4) listedabove

if zt is

an

autoregressiveprocess.

To

thisend,assume

that thestatevariable evolves according to anOrnstein-Uhlenbeck

processdz,

=

-pz, dt+

odb, (3)where

db, is theincrement

of a standardBrownian

motion.Now

consider an investorwho

notices that xt is not equal to zero. If

P^

exceeds P^,for

example,

he

will shortsome

quantity, It, of A, lend

I,P*

borrow

ItP^,

and

buy

I, units of B. If, for

convenience, I, isdefined asthe negativeofthe positionsize

when

P^

exceedsP*

then the evolutionofthe investor's wealth.

W,

canbe

written asdW,

=

rW

tdt+

I, [rP? - rP? -dP*

+

dP*]

- c|I t |dt=

rW

tdt+

I, [rx,dt - dx,] -c|I,|dt. (4)The

firstterm

represents the interestreceivedfrom

previouslyaccumulated

wealth.The

second term

gives the interest gain plus thecapital gain orloss

from

the arbitrage position.The

lastterm

reflectsthe holding cost incurred for shorting I, units of portfolio

A

or B.15

Assuming

that the arbitrageur willmaximize

the expected utility of his terminal wealthcompletes

the model's specification.More

formally, hemaximizes

e ru(w

T

)]While equation(4)assumesthaithearbitrageursholding cost equalsthatwhichsetsthenskless arbitragebounds,theproblemcould

besetupsothat the arbitrageurhada highercost.An equilibriummodel,then, mightinclude several classes of arbitrageurs, eachwith

9

for

some

von

Neumann-Morgenstern

utility function,U.

16The

first step in solving for the optimal investment policy {I,} is to rewrite the wealthequation (4) in terms oftheunderlying statevariable, z.

Using two transformed

variables,w

t

=

W^

17and

i, = I,s(t)(|)'(z)erT, (4)can be

rewritten asdw

t=

i, [u(z,t)dt+

odb

t] (5)where

H(z,t)=

pz

-+

o

: <(>7<l>'+

c(<t>-€)/s4>' (6)and

e is the sign of it , i.e. 1 if i t>0, if i t =0,

and

-1 if i,<0.Let V(w,z.t)

=

max

E

T{U(W

T) },where

E

Tdenotes

the expectation at t.By

the principleofoptimality in

dynamic programming,

V(w,z,t)

=

max,E

T[V(w+dw,z+dz.T+dT)]

(7)By

Ito'sLemma,

V(w+dw,z+dz,t+dT)

=

V(w,z,t)+

V

w

dw +

V

zdz

+

V

Tdr

+

T

V^ldw)

2+

+ V^dz)

2+

V^dwdz

(8)where

subscriptsdenote

partial derivatives. Substituting (3), (5)and

(8) into (7)and

takingexpectations gives

=

max, {(uV^V^i+jV^on

2 } -pzV

z -V

T+

+V

H

o

2 (9)Solving (9) numerically is by

no

means

a trivial exercise.Imposing

theboundary

conditionsV(w,

+

oc,-c)=V(w,-oo,t)=

U(

+

»)does

not characterize the function V(-)because

thegrowth

conditions for large |z|

have

notbeen

specified.Furthermore,

for arbitrary functionsU

and

4>, it isOnemight arguethatbecause anarbitrage positionbased ondeviationsfrom fundamentalvalue carriesnomarket risk,discounted

expectedreturn evaluates theopportunitycorrectly. Tworepliesseemappropriate: 1)Evenifinvestors areriskneutral with respect tothe

riskofthis type of arbitrage, leverage constraintscan inducerisk aversion. Grossmanand Vila (199H showthat the possibility thatan

investors futureopportunityset willbelimnedbyborrowingrestrictionscausesnskneutral investorstodisplaysomeriskaversion.Since leverage constraintsprobably applytomost potentialarbitrageurs,thisconsiderationcouldjustifytheassumptionofnskaversion. 2)The

most importantarbitrageurs areprobablyjudged onihepertormanceoftheirarbitrageportfolios,asopposedtotheperformanceotsome

diversified portfolio oflonger-term holdings. In thatcase, thevwill be nskaverse with respect to thensksof arbitrage so longas there

10

not at all clear that there exists a

bounded

solution for V.Appendix

1 finds thegrowth

conditionsfor the case of a

CARA

utility functionand

<J>(z)=

z/(l+z

2

) 1/2

and

proves that abounded

solutionexists. This section continues, therefore, by specializing the

model

to this case.Letting

U

=

- e"aw forsome

positive constant a implies thatV(w,z,t)

=

**"*<**)

(10)for

some

function F.17Using

(10) to calculate the partial derivatives ofV

in terms of the partialderivatives of

F

and

substituting into (9) yields the following partial differential equation:F

T=

max, { (u+

o 2F

z)ai-+o2(ai)2 } -pzF

z+

-Vo^-F,

2 ) (11)The

appropriateboundary

conditionsfor equation(11)can be

derived as follows.When

x=0.

V(w,z,t)

must

equalU(w)

=

-e"aw, so F(z,0)=

0.Furthermore,

asmentioned

above,V(w,

+

oo,-c)=

V(w,-oo,T)

=

U(«)

since, asthe mispricingapproaches

the risklessarbitragebound,

thevalue functionshould

approach

itsmaximum.

Since thismaximum

is zero, F(«,t)=

F(-»,t)=

<*>.Equation

(11) willbe

solved numerically in the followingsection.The

analysis hasproceeded

far

enough, however,

to derivesome

properties ofan arbitrageur's optimal investment policy in thepresence of holding costs.

These

properties are presented in proposition 1.PROPOSITION

1:An

arbitrageur followingtheoptimal

dynamic

strategy impliedby

equation (11)and

itsboundary

conditionsi) will take a position if

and

only if the mispricing, x, is largeenough,

ii) will take a finite position,

and

iii)

may

take a position even if the instantaneous expected returnfrom

the position isnegative.

Becausetheutilityfunction exhibits constant absolutenskaversion,it isseparablein the value ofwealthandthe value of arbitrage

11

Proof:

See appendix

1.The

firstand second

partof proposition 1 tell a storyconsistentwith casualempiricismabout

arbitrage activity.

While

price deviationsfrom fundamental

valuesencourage

arbitrage activity, riskaversion

and

holdingcostspreventinvestorsfrom

takinginfinitepositions.Consequently,the arbitrageactivity of these investors

might

notbe

greatenough

to force pricesback

into line. This raises thepossibility that consistent arbitrage activity

can be

sustained in equilibrium.The

third partof proposition 1 reveals an interestingfactabout

theoptimalinvestment policy.The

intuition parallels that ofMerton's

(1973) intertemporalCAPM

with opportunity set changes.CARA

investors like to hold assetswhich

are negatively correlated with favorablechanges

in theiropportunityset. Here, arbitrageurs

do

loseiftheabsolute value ofxrises, but then theyhave

a betterarbitrage opportunity available to them. Consequently, they are willing to take

an

arbitrage positioneven

ifit isexpected

to lose over the next instant.III.

An

Application to theTreasury

Bond

Market

There

aremany

redundant

securities in theTreasury

bond

market, i.e. there aremany

bonds

whose

cash flows canbe

replicated by buyingand

holding a portfolio of other bonds.One

class ofsuch redundancies is

formed

by three Treasurybonds

ofthesame

maturity. Iftheircoupons

are Cj,c

:.

and

c3, with c

x

>

c2>

c3, then a portfoliocomposed

of(Cj^VCCj-Cj)

units ofthe firstbond

and

(c

1-c2)/(c1-c3) units of the third

bond

exactly replicates the cash flows ofone

unit of thesecond

bond.18All

Treasury

tripletswhich

tradedfrom January

1960toDecember

1990

were

identifiedfrom

18

12

the

CRSP

data files.Those

containing callablebonds

or flowerbonds

were

discarded. Ifmore

thanthree

bonds

of thesame

maturity tradedon

a particular date, the threemost

recently issuedwere

selected as the triplet for that date.

A

detailed list of the42

tripletsforming

the data set is given inAppendix

2.Month-end

bid priceswere

obtainedfrom

CRSP

for all triplets.19Define

P

2 to be the priceof the

second

bond

in the tripletand

P

R

tobe

the price of its replicating portfolio.Define

themispricing, x, as in the text, i.e.

P

2-Pr-

For

the opportunity cost offunds, r, thispaper

uses a 3-yearTreasury

rateasreported by Moody's, but the resultswould

notsubstantiallychange

forother choicesofr.

Without

data available for holding costs, itseems

reasonable tochoose

anumber

from

therange

.25%

to.65%,

cited above.According

to the theory described in the previous section, holdingcostsshould

be

largeenough

sothatno

pricedeviationsexceed

theriskless arbitragebound,

s(t).As

it turns out, there are

some

violations in the data seteven

atc=.65%.

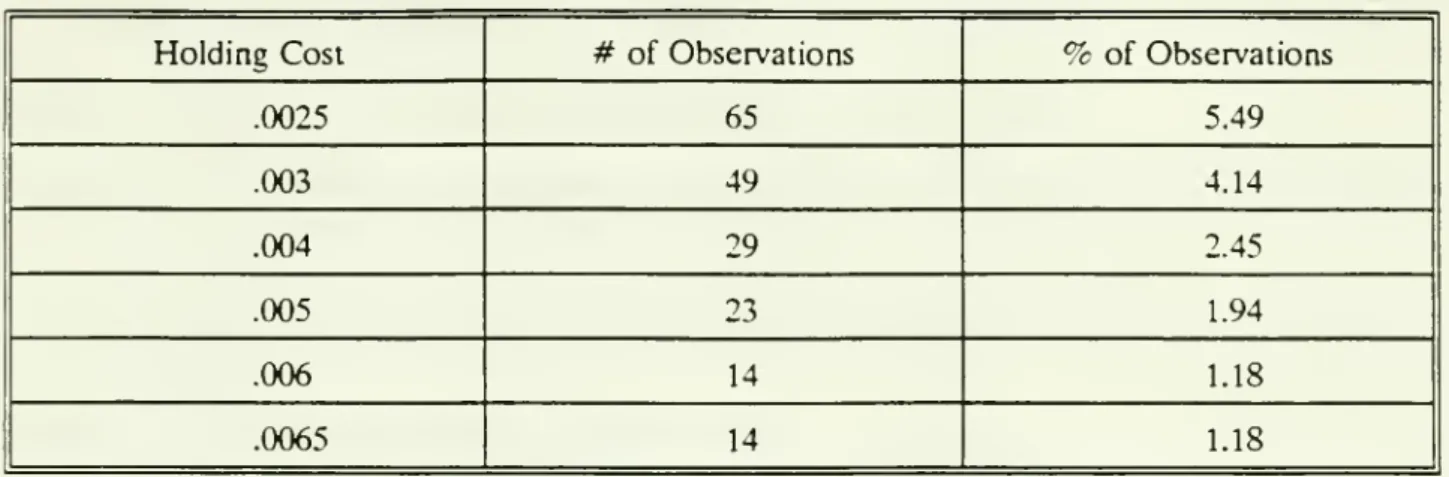

Table

I reports thenumber

and percentage

of observationswhich

violates theno

arbitrage conditions for different levels oftheholding cost.

INSERT

TABLE

ITable

I reveals that amodel

of holding costs alonecompares

most

favorablywith amodel

oftrading costs alone.

The

brokerage

costs estimate of1/128%,

for both the longand

short legs ofthearbitrage, plus a typical bid-ask spread of

3/32%

cited above,would

result in 419, or35.39%,

pricedeviations

which exceed

the level of trading costs. So, holding costsseem

tobe

quite important,relative to trading costs, in foiling riskless arbitrage activity.

Of

course, amodel

which

incorporatesboth holdingcosts

and

trading costsdoes

best.With

c=

.006and

these tradingcosts, forexample, only,only 4 observations, or .34%, violate the riskless arbitrage bounds.

19

13

Returning

to themodel

of this paper, itseemed

reasonable to settleon

c=

.006. This levelisin the

range

ofpriorbeliefsand

generatesrelativelyfew

violations oftheriskless arbitrage bounds.Using

this level of holding costsand

ignoring trading costs, figure 1 plots the individual mispricingsas a function of the riskless arbitrage

bound,

s(t).The

two

rays are the linesx=s

and

x=-s.:oThe

plot providessome

additional evidence that holding costs are important inhibitors ofarbitrageactivity. Inthe

model

presentedearlier, mispricingscan

takeon

any

valuebetween

s(t)and

-s(t). Consequently,

one

would

expect the variability of the mispricings to increase in s.Looking

atfigure 1. this

seems

to be the case.More

precisely, the standard deviation ofx isabout

.09 fors<l,

.31 for

Ks<2,

.29 for2<s<3,

and

.43 fors>3.

The

next step in applying themodel

to the data athand

is to estimate itsparameters

pand

o. Recalling that d)(z)

=

z/(l+z

2)1/2,one

can

use (2) to transform xand

svalues into values of theunderlying state variable, z.

Then, changes

in z canbe

regressedon

z in order to estimate theparameters

of the z process given by (3).21The

results of the regression are reported in table II.INSERT

TABLE

IIThe

estimate of p is significantly negative, confirming the autoregressive nature of thedeviation process."

The

partial differential equation in (11)can

now

be solved numerically.Converting

theparameters

estimatedfrom monthly

data toan

annual basis gives values ofabout

5.42and

.88 for pand

a. respectively.The

holding cost, c,was

set to .6%, asdiscussed above.The

opportunity cost offunds, r.

was

taken tobe

9%,

a value close to thesample

average. Finally, the original maturity ofin

' Figure

1 alsoshowsthat the pricedeviations aremoreoftennegativethannot. Inother words,the priceof the replicating portfolio usuallyexceedsthe price of the middle bond. Thisisconsistent with a taxtimingoptionora taxclienteleeffect.See Constanunides and

Ingersoll (1984).Lilzenbergerand Rolfo(1984),and Schaefer(1982).

"'* Theobservations forwhich

|x|>s were dropped from thesamplesincez is undefined in thesecases.

—

Regressing changesinxonxalso givesa significantlynegative coefficient Therefore, the functional formof$isnot responsiblefor14

the triplet

was

set at 5 years.The

relevant range for the underlying state variable, z, turns out tobe

well within (-2,2). Inother words, valuesofz

which

are larger inabsolute valuecorrespond

to mispricingswhich

are largerthan those

which appear

in the data set.Figure 2 graphs theoptimalposition sizeasa function ofzfor

two

different times to maturity.As

predicted by Proposition 1, part i), for small mispricings it is notoptimal to take a position. Ifthemispricing is large

enough,

however, position size increases in the absolute value of z.Figure 2 reveals that positionsize is not

monotonic

in time to maturity.There

aretwo

effectsat

work

here. First, since positions ofpotentially longer maturities are likely to incur larger holdingcosts, investors

would

takeon

smaller positions. This mightbe

called a risk effect.Second,

sincepotentially longer horizons are likelyto provide better arbitrageopportunities in the future, investors

would

be

willing to takeon

larger positions. Thismight

be

calledan

option effect,and

is related tothe

hedging

properties ofan

arbitrage position raised by claim 3.When

z is large, realization ofcurrent arbitrage profits is relatively

more

important than thepromise

offuture mispricings, so therisk effect should dominate.

When

z is small,however,

the potential of future arbitrage profits isrelatively

more

importantand

the option effect should dominate. Consequently, asshown

in thefigure,

when

|z| is large the position size with 3.04years to maturity is greater than the position sizewith 5 years to maturity.

When

|z| is small the position size with 5 years to maturity is the largerof the two.

Although

notshown

in the figure, thehedging

effect described in part iii) of Proposition 1can

be

examined through

the numerical solutions.With

3.04 years to maturity for example, anarbitrageur will take a position

even

when

|z|<.04.The

instantaneous expected returnfrom

theFrom equation (11). one only need solve for ai.wherea is the coefficient of absolute nsk aversion. Therelore.without loss ot

15

position is positive,

however,

onlywhen

|z|>.2. In terms ofthe dollar mispricing, x, the arbitrageurwill take a position

even

for a mispricing of less than6

cents for every$100

face valuebought

orshorted.

The

expected

return over the next instant is positive,however,

onlywhen

the mispricingexceeds 31 cents

on

the$100

position.A

similarcomparative

static mighthave

arisen with respect to o.Larger

values ofomake

thearbitrage position riskier but raise the likelihood of future profit opportunities.

One

might reason,as before, that the risk effect

would

dominate

for large mispricings while the option effectwould

dominate

for small mispricings.As

it turns out,however,

theparameters determined

by the datagenerate position sizes

which

increase in a: the option effectdominates

for all relevant levels ofmispricing.

The

certaintyequivalent ofarbitrage activitycanbe

defined as theamount one would

pay tobecome

an

arbitrageurin a particulartriplet.24 Figure 3 graphs this certaintyequivalent as a functionof z for three different times to maturity.

As

expected, the certainty equivalent increases in theabsolutevalue ofz.

More

interestingly, the certaintyequivalent increases in time to maturity. It mighthave

been

the case that the risk effectwould

cause the certainty equivalent to fall with time tomaturity since longer maturities run the

chance

of incurring larger holding costs.Once

again,however,

for theparameters

in the Treasury market, the option effect reigns.rv.

Conclusion

and

Suggested Extensions

This

paper

models

the effectofholdingcostson

the activities ofriskaverse arbitrageurs.The

exogenous

mispricing processwas chosen

to allowprices to deviatefrom fundamental

value withoutallowing for riskless arbitrage opportunities. Solving for the optimal investmentpolicyofarbitrageurs

16

in such

markets

reveals behavior consistent with the casual empirical observation that professionalarbitrageurs consistently take limited arbitrage positions.

Furthermore,

a risk effectand an

optioneffect

were

identified as driving thecomparative

statics of optimal position sizeand

of thevalue ofbeing

an

arbitrageur.Data

from

theTreasurybond

market supported

theimportance

of holdingcostsin arbitrage activity, provided

parameter

estimates of the model,and

led tosome

insightsabout

therelative

importance

ofthe riskand

option effects.Two

pathsoffutureresearchemerge

from

thisanalysis. First, there is aneed

tocollectbetterdata

about

the size of holding costs in the variousmarkets

mentioned

in section I. Second, theanalysis of this

paper

concentratedon

the investmentproblem

facing arbitrageurs.The

next stepwould

be

tomodel

the factors generating price deviationsfrom

fundamental

valueand

thusendogenize

the deviation process. Thisavenue

of researchwould

clearly benefitfrom

some

17

Appendix

1Proof

ofPROPOSITION

1Recall that the

Bellman

equation associated with theCARA

arbitrageur's optimizationproblem

isF

T=

max, { (u+

o

2F

z)ai4o

2(ai)2 } -pzF

z+

lo^-F,

2 ) (11) withu

given by u(z,t)=

pz

- 4-o2<t>74>'+

c(<(>-€)/s4>' (6)and

with e being the sign of i.The

boundary

conditions areF(z,0)

=

0;(Al)

F(

+

oo,T)=

F(-«,t)=

+».

(A2)

Unfortunately, condition

(A2)

is not preciseenough

to characterize the value function F(v).Indeed

itmay

be

possible, a priori, that the arbitrageur reachesan

unbounded

value ofF

for everyz. It is therefore necessaryto

show

thatF

can be

bounded

by thevalue function ofa controlproblem

which

admitsan

explicit solution.This willbe

done

laterby the choice ofa particularfunction 4>.For

the

moment,

assume

that the functionF

and

its derivatives are well definedand

that <\> is asmooth

increasing

mapping

from

(-°°.«>) into (-1.+

1) such that 4>(-z)=

-<J>(z).The

symmetry

of theproblem

yields thatF(-z,t)

=

F(z,t)(A3)

so that

F

z(0,t)=

for every t.(A4)

We

cannow

proceed

with the proof of Proposition 1.18 i(z,x)

=

i L (z,t) ifi L(z,t)>0

(A5a)

i(z,t)=

i s (z,t) ifi s (z,-c)<0(A5b)

i(z,t)

=

otherwise(A5c)

with i L (z,t)

=I-£.z-I*_-i.J_i^

+

F

7when

i>0;(A5d)

aa

2 2 tf 2 s(t) 4/ i s(z,t)

=I-P-z

-1*1

+^_L1^

*F

wheni<0.

(A5e)

a

o

2 2<j/ 2 s(t) <j/

From

(A4), it follows thati

L

(0,t)

<

0; is

(0,-r) >0.

(A6)

Therefore

i(0,t)=0and, bycontinuity, theoptimal investmentdecision forsmall mispricingsis totakeno

position. This proves i).Proof of

ii): ii) followsfrom (A5)

above.Proof

ofHi):From

thesymmetry

of F(z,t) with respect to z it follows thatF

z(z,t) has the

same

signas z. i.e. arbitrageurs are better offwith large |z|.

As

a result,i

=

u/o2

+

F

zcan be positive

even

ifu

is negativeand

vice versa.Boundedness

ofF(z,r)and

growth conditions:As

mentioned

above,growth

conditions for large z arecritical for the numerical analysis. If4>(z)=z/(l+z2)1/2 then

i \ 3 2 z r 1+z

2

A7

,u(z,t) =

pz

+-a'

. .(A7)

2 1+z2

l-e

_rT f. 2To

provide thebounds and growth

conditions of the value function, consider a class of control19

value function

V

M

<

->(w,z,t)

=

max,E[U(W

T

)]subject to the

dynamics

dw,

=

it (M(t)z,dt

- odb,)

and

dz,=

-pz,dt+

odb, tsT.The

functionV

M()can be

explicitly derivedand

is of theform

V

m

<>(w,z,t)=

-exp

{-aW-F

M

()(z,t)}where

F

M() is quadratic with respect to z:F

m

«(z.t)

=1k

2(t)z

:

-K

1(t)z

^KoCt).

By symmetry

Kj(t)=0.The

functionsK

;(t)

and

K^t)

solve the ordinary differential equationsdK«

i ,dIC

i,

J^

= 'o'K.

and

—:

= _LM(x)

2 *2(M(t)-

P))IC,(t)(A8)

dt

2dt

a-and

are easy to calculate.Returning

to the original problem, observe that there exists a positive constantM,

such that|u(z,t)| s M|z|, for every z.

(A9)

Recalling that i,

and

z,must have

thesame

sign, it follows that for every policy i tdw

(=

i, [u(z,,i)dt -odb

t] <.Mi

t z,dt - oi tdb

t .(A10)

Hence

V(w,z.t) ^V

m

(w.z,t)<

U(«).It follows that the control

problem

faced by the arbitrageur isbounded

and

admits asmooth

value function.

(See

Vilaand

Zariphopoulou

(1989)on

proving the regularity ofthe value functionin a similar context.)

Growth

conditions can be derived by considering thedominant term

in u(z,t) for large z.From

(A7)

it follows that for large z, u is approximately linear in z i.e.u(z,t) -

(p-

L_)z

=R(t)z

.(All)

20

Let t"

be such

thatR(t')=0.

Then

under

certainparameter

restrictions, easily satisfied by thedata,for every -est*

and

every z theexpected

gain u(z,t)i is nonpositive for every arbitrage position i. Itfollows that the function F(z,t) = 0, for tst*.

For

t;>t\growths

conditions are obtained byconsidering the function

V

M(T)(w,z,t) withM(t)

=max

{R(t);0}.

Therefore

the numerical analysisused

thegrowth

condition1 ->

22

References

Amihud,

Y.,and Mendelson,

H., (1991), "Liquidity, Maturity,and

the Yieldson

U.S.Treasury

Securities," Journal

of

Finance,46

(4), pp. 1411-1425.Andersen,

T., (1987),Currency

and

Interest-RateHedg

in g.New

York

Institute of Finance.Brennan,

M.,and

Schwartz, M., (1990), "Arbitrage in StockIndex

Futures,"Journal ofBusiness,vol.63(1), pt. 2, pp. s7-31.

Constantinides,

G. and

Ingersoll, J., (1984), "OptimalBond

Trading

with Personal Taxes." Journalof

FinancialEconomics,

13, pp. 299-335.Cox. J.,

and

Rubinstein, M., (1985),Options Markets

. Prentice-Hall, Inc.De

Long,

J. B.,A

Shleifer, L.H.Summers,

and

R. J.Waldmann,

1990,Noise

trader risk in financial markets.Journalof

PoliticalEconomy

98, 703-738.Dumas,

B.,and

Luciano, E., (1991),"An

Exact Solution to the PortfolioChoice

Problem

Under

Transactions Costs,"Journal

of

Finance, 46(2), pp. 577-595.Duffle, D., (1989), Futures

Markets

, Prentice-Hall. Inc.Fleming, W.,

Grossman,

S.,Vila,J.L.,Zariphopoulou,

T,

(1989),"Optimal

PortfolioRebalancing

with Transaction Costs," unpublished manuscript.Grossman,

S.,and

Vila, J.L., (1989), "OptimalDynamic

Trading

withLeverage

Constraints."Journalof

Financialand

Quantitative Analysis, (forthcoming).Hodges,

S..and

Neuberger,

A,

(1989) "Optimal Replication ofContingent

ClaimsUnder

Transactions Costs,"

The Review

of Futures Markets, vol. 8(2), pp. 222-242.Holden.

C,

(1990),"A Theory

of ArbitrageTrading

in FinancialMarket

Equilibrium," DiscussionPaper #478,

Indiana University.Lee,

CM.,

A

Shleiferand

R. H. Thaler. 1991, InvestorSentiment and

theClosed-End

Fund

Puzzle.Journal

of

Finance, 46, 75-109.Litzenberger, R.,

and

Rolfo,J., (1984),"ArbitragePricing, Transactions Costsand

Taxation ofCapital Gains,"Journal of FinancialEconomics,

13. pp. 337-351.Merton,

R., (1973),"An

Intertemporal Capital Asset PricingModel,"

Econometrica, vol. 41. pp. 867-887.23

of Paul H. Cootner. Sharper, W.,

and

Cootner,C,

eds., Prentice Hall. pp. 159-178.Schwartz, E.. Hill, J.,

and

Schneeweis, E., (1986), Financial Futures,Richard

Irwin. Inc.Stigum, M., (1983),

The

Money

Market, 2nd

edition,Dow

Jones-Irwin.Stigum, M., (1990),

The

Money

Market,

3rd edition,Dow

Jones-Irwin.Vila, J.L.,

and

Zariphopoulou.

T., (1989),"Optimal

Consumption

and

PortfolioChoice

with24

Table

IFrequency

of riskless arbitragebound

violations as a function of the level ofholding costsTable

I reports thenumber

and

percentage of observationswhich

violates theno

arbitragecondition |x,|<s(t) for different levels of the holding cost.

There

are1184

observations in all.25

Table

IIOLS

regression resultsfrom

estimating the processdz

=

-pzdt+

odb

withmonthly

observations.Zt+l " *!

=

P2!+

€tp

=

-.452The

regressionmodel

is:with 1125 observations.

The

estimated value of p is:with a standard error of.0257.

The

R

squared

is:R

2=

.216

The

estimated value ofa

is taken to be the standard error of the residuals:Figure 1

$ Mispricing per

$100 Face

Value

co rb ro CO

-Figure 2

Position Size

inFace

Value

(Thousands)

a*

o

en

O

o

CO

o

O

O

O

O

CO

O

O

cn

O

(J)O

c

D

Q. CD<

5' CO C/5 r+ 0) CD<

Q) Q)' C£ CON

Figure 3

Date

Duef

-fr-*,11 UBRARItS