POPULAR AND DEMOCRATIC REPUBLIC OF ALGERIA

MINISTRY OF HIGHER EDUCATION AND SCIENTIFIC RESEARCH

UNIVERSITY OF ORAN ES-SENIA

FACULTY OF LETTERS, LANGUAGES AND ARTS

DEPARTMENT OF ANGLO-SAXON LANGUAGES

SECTION OF ENGLISH

Ecole Doctorale 2008

MAGISTER THESIS IN AMERICAN CIVILISATION

THE GREAT DEPRESSION OF 1929

IN THE UNITED STATES OF AMERICA:

Causes, Effects and Recovery.

Presented by:

Lahcene Batoul Sofya

Members of the Jury:

President: Dr Belmekki Kacem

(University of Oran)

Supervisor: Dr Rachida Yacine

(University of Oran)

Examiner: Dr Fewzia Bedjaoui

(University of Sidi Bel Abess)

Academic Year

2009/ 2010

In memory of my grand-mothers, Hadria and Houaria

DEDICATION To those I love most:

My beloved parents;

My very dear son, Wassim; and my husband, Nabil; And very affectionately;

My sisters and brothers; My nieces and nephews;

My aunt Aicha; my uncle Mohammed;

AKNOWLEDGEMENTS

I owe special thanks to many people for the assistance they gave me in achieving this work. I am deeply grateful to my supervisor Doctor R. Yacine without whom it could not be possible to write this thesis. I would like to thank her for her continuous support, valuable pieces of advices and precious guidance throughout my research.

I am also greatly indebted to all my teachers for their constant efforts and encouragements during the university course.

My sincere thanks go to my friends who helped me in the elaboration of this work.

m ” ” d

ÉäÜÓáÉíÏÇÜÕÊÞ?Ç ÉãÒ?Ç Ñå ÇÙã æ ÈÇÈÓà áæÍ áãÚáÇ ÇÐå ÑæÍãÊí

1929

ÇåÊÐÜÎÊÇíÊáÇ ÈíáÇÓ?Ç æ ÞÑØáÇ ìáÅ ÞÑØÊíÇãß ¡ÉíßíÑã?Ç ÉÏÍÊãáÇ ÊÇí?æáÇ áÎÇÏ

æ ÉãÒ?Ç åÐå ÉåÌÇæãáÉíßíÑã?Ç ÉãæßÍáÇ

æ íÏÇÜÕÊÞ?Ç äÇÏÜíãáÇ íÜÝÇÜåÊÇÝáÎã

íÚÇãÊÌ?Ç

.

áæÜØáÇÑÜÙäÉíßíÑã?Ç ÉÏÍÊãáÇ ÊÇí?æáÇ ÇåÊÝÑÚ ÉãÒà ãå à ÉãÒ?Ç åÐå ÏÚÊ

Y U Yi nw Tc Z Tg \ c U[g

1929

O

1939

U[

[TYWxp T

ÇåÊÇÝáÎã ÉåÌÇæã íÝÉíßíÑã?Ç ÉÏÍÊãáÇ ÊÇí?æáÇ

.

-åÐå íÝÉãÒ?Ç ÊØÈÊÑÇ

f Tg» T » l [TYWx» p U VUW

l LXgxWY gT

íÐÜáÇ æãäáÇ ÏÚÈÇÑíÈßÇÏÇÓßÉÑíÎ?Ç åÐå ÊÝÑÚ ËíÍ ÉíßíÑã?Ç ÊÇÌÊäãááíÌÑÇÎáÇ

íÊáÇ ÉíßÑãÌáÇ ÊÇíÇãÍáÇ ìáÅ ÉÝÇÖ?ÇÈÊÇíäíÑÔÚáÇ á?Î íßíÑã?Ç ÏÇÕÊÞ?Ç åÝÑÚ

ZTgi T T wYUl Li T¿ gTU[r ~i

.

-?Ç ÈÇÈÓ-?Ç ÊäÑÊÞÇ

» ~Yp i WTZUW

i Ur TgTj[ U LYU ¿ TxWYgUp [

ÇÜåäà ÉÜÌÑÏ ìáÅ ÇÑíÈß ÇÚÇÝÊÑÇ ãåÓ?Ç ÑÇÚÓà ÊÝÑÚ ËíÍ ¡ßÑæíæíäÊíÑÊÓáææ

äíãå ÇÓãáÇ Ó?ÝÅìáÅ ÊÏà æ ÇåáíÎÇÏã ÊÞÇÝ

.

-ÊÇßÑÜÔáÇ Ó?ÜÝÅ¡ÑÇÚÓ?Ç ÖÇÝÎäÇ ¡ÌÇÊä?Ç ãÎÖÊíÝÉãÒ?Ç Ñå ÇÙã ÊáËãÊ

Yi U‘[T YwUp T

¡ÉáÇØÈáÇ ÑÇÔÊäÇ ¡áÇãÚáÇ ÏÑØ ¡äíÍ?ÝáÇ æ ÉíáÇãáÇ ÊÇÓÓÄãáÇ

ÉíæÑÞáÇ ÉÑÌåáÇ ËæÏÍ ìáÅ ÊÏà æ ÊÇÑå ÇÙã æ ÊÇÈÇÑÙÅÈãÇíÞáÇ ¡ÑæÌ?Ç ÖÇÝÎäÇ

.

áÜÌà äÜã ÉãÇå ÉíÏÇÕÊÞÇæ ÉíÓÇíÓÊÇÑÇÑÞÐÇÎÊÇìáÅ ÉãÒ?Ç åÐå ÊÏà Çãß

ßíÑã?Ç ÚãÊÌãáÇ æ ÏÇÕÊÞ?Ç äã áßìáÚ ÇåÊÇÝáÎã ÉÏÍ äã ÝíÝÎÊáÇ

.

ABSTRACT

The Great Depression was the worst and longest economic collapse experienced by the industrialised countries. However, the depression’s impact on nations was different in various ways and degrees of intensity. In the United States of America, apart from the Civil War, the Great Depression was the most serious crisis that the country has faced. Indeed, the US nation had already experienced several depressions before, yet, none of them was as severe and as long lasting as the Great Depression. The downturn began in 1929 and lasted a whole decade during which large numbers of people lived in poverty and misery.

At first, economists and leaders thought that it was a correction of the market not worst than the precedent ones. Yet, data soon proved that this optimism was wrong. Moreover ,the crisis which resulted from a complex process involving both economic factors and political decisions marked the beginning of government intervention in economy and society as a whole; a new pattern in the United States where individualism and the free enterprise were the masters of the American life .

CONTENTS

LIST OF TABLES

ABSTRACT

Pages

INTRODUCTION

……..………....…1

CHAPTER ONE: FROM PROSPERITY TO THE GREAT CRASH..4

1-The 1920s Economy Under the Republican Leadership...5

2 -Flaws in the Economic Foundations ...16

a / Unequal Distribution of Wealth and Income...16

b/ Unequal Distribution of Corporate Power……... .18

c/ Foreign Balance of Payments…...…...…….. .. 19

d/ Bad Banking Structure ...21

3- The Stock Market Boom and Crash …...………..….…... 22

CHAPTER TWO: THE GREAT DEPRESSION...32

1-Links between the 1929 Crash and the Great Depression...32

2-The Banking Crisis of 1929-1933...42

CHAPTER THREE:THE GOVERNMENT RESPONSETO THE

CRISIS

………...…64

1-President HOOVER’S Response ……….……..64

2-The Election of 1932 ………..………..75

3-President ROOSEVELT’S Response………..…….…..80

a/ The First New Deal: 1933-1935...81

b/ The Second New Deal: 1935-1937...91

CONCLUSION

………101

APPENDICES

………..104

APPENDIX 1: 1931 Hoover on Government in Business….……104

APPENDIX 2:1933 F.D .Roosevelt’s First Inaugural Address...105

APPENDIX 3:1935 F.D. Roosevelt on Social Security………..…...110

APPENDIX 4: The National Labour Relations Act, July 5, 193

…...112

LIST OF TABLES

Table 1:

The Amount of Radio Sale during the Twenties………..…….9Table 2:

The Decline of Farm Prices After WWI...11Table 3:

Call Loans Interest Rate at New York Stock Exchange………...28Table 4:

The Increase of the Stock’s Prices in New York Stock Exchange...30Table 5:

Number of Bank Failures: Great Depression...47Table 6:

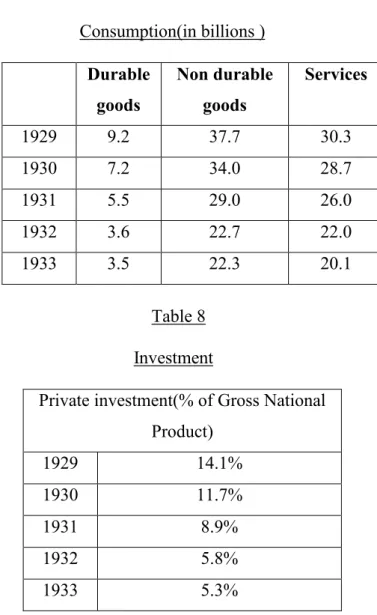

The drop in prices………..54Table 7:

Consumption (in billions)………...59INTRODUCTION

Booms and recessions are a permanent feature of the business cycle in capitalist economies. Capitalism is defined as an economic system in which a country’s trade and industry are organized and controlled by the owners of capital ,the chief element being competition ,profit, supply and demand.1Under capitalism the government does not interfere in economics, it rather adopts a laissez faire policy.

From a purely economic point of view, a depression is a prolonged period of recession, or a significant and prolonged downturn in the economy which is characterised by declining business activities, falling prices, rising unemployment and increasing inventories.

Throughout its history, the United States economy has undergone periods of boom and bust, with short and sharp economic downturns. In fact, the last three decades of the 19th century in America had been a period of frequent economic recessions. However, the Great Depression that began with the 1929 stock market crash and lasted until 1939 was an unprecedented economic downturn which surpassed all previous economic crises of its kind. Indeed what happened after 1929 was much more different; all economic indicators fell to unprecedented levels to reach bottom in 1933 and did not reach their 1929 until the advent of the Second World War.

Moreover, no recession had hit American people as the Great Depression did. Millions of Americans who had been raised on the belief that hard work and discipline, and thrift would reward them, were suddenly unemployed. Shocked by their fall upon hard times which was actually due to events largely out of their control, they started to _________________________

1-Oxford Advanced Learner’s dictionary of Current English, A.S., Hornby, seventeenth impression,

call into question the adequacy of self-sufficiency and individualism; two inherent qualities in the American life.

In addition, the reaction to this cataclysm brought permanent policy changes. The Republicans and Democrats have dominated American politics since the 1860s, Most elected officials were members of one of these parties. With their pro-business policies the Republicans dominated politics during all the 1920s,a period characterised by an extraordinary prosperity. Herbert Hoover, first as Secretary of Commerce an then as president from 1929 to 1933 symbolised the republican commitment toward unlimited prosperity which took root in a vast industrial expansion. Yet, the advent of the1929 crisis marked the end of this prosperous decade and destroyed the public confidence in the Republican Party whose response to the downturn was viewed as inadequate and totally indifferent toward individual suffering.

The Democrats, then , capitalised on the crisis and the failure of the Republicans to regain the control of the nation through the election of Franklin Delano Roosevelt in 1932.The two parties has different approaches in dealing with the crisis.

Generally, Republicans have tended to support limiting federal powers and protecting the authority of state and local governments, to take a conservative approach to taxation and spending, and to oppose government interference with free enterprise. In contrast, Democrats have tended to take a more expansive view of the powers of the federal government into what historically had been private decision making, to support raising and spending money to address social ills on a national basis, and to favour federal regulation as a means to improve business practices and economy as a whole.

To explain the Depression contemporary economists were divided. While , some observers called the Depression an inevitable failure of capitalism and attributed the recession to the self-equilibrating powers of the market, arguing that it was simply a question of time before wages and prices adjusted fully enough for the economy to return to full employment , others argued that the Depression was the result of overinvestment during the 1920s and that the best remedy for the situation was to let the Depression run its course so that the economy could be purified from the negative effects of the false expansion.

Recent researches, however, stress that the Great Depression is probably one of the most misunderstood events in American history. It is generally cited as being the result of unregulated capitalism, and that only a massive economic regulations and other government interventions, can avoid such downturns. In addition among the misconceptions surrounding the Great Depression are that the stock market crash of 1929 was the only cause of the downturn of the following decade.

This work is an attempt to explain the mechanism of the Great Depression and its impact on the American society. It will try to provide an answer to the following questions: How did the Roaring Twenties shape the causes and effects of the crash? Was the Crash of Wall Street the only cause of the Depression? If not what were then the other causes of the Depression? How were the American people impacted by this downturn? What were the policies undertaken by the government to lift the United States out of Depression? And to which extent did these policies change the structure of the economic and social policies in the United States?

In this respect the research paper will be divided into three chapters .Chapter one will give a portrait of the American economy and society during the decade that preceded the stock market crash i.e. the twenties .The second chapter will show how the 1929 stock market crash and other economic factors interacted to pave the way to the Great Depression as well as its impact on the American economy and society. The third chapter will be devoted to the response of the government to the crisis. It will first examine how President Hoover reacted to the crisis and then it will examine President Roosevelt’s New Deal and the attempts of his administration to overcome the Depression. It will be also an attempt to analyse and debate upon the efficiency of the two governments’ responses.

CHAPTER ONE

THE ROARING TWENTIES:

From Prosperity to the Great Crash

When studying the Great Depression and its effects on the United States, many historians choose the first World War as a starting point of their research. The reason for that is the importance of the repercussions of the conflict on the economies of the countries involved in it among which the U.S.A.

Participation in the war had made the United States a major player in the world economy; the foundations of large-scale corporate and modern state were firmly established1.

The “Roaring Twenties”, unlike World War I, were not only a decade of brisk economic growth and expansion, but also an era of important social changes. Americans went toward greater individualism. The emphasis was on getting rich and enjoying new ways of life, new inventions, and new ideas. The traditional values of rural America were being challenged by the spirit of the “Jazz Age”2, symbolized by what many considered the shocking behaviour of young women

________________________

1-James, A. Henretta et al , America’s History ,volume 2 , Worth publisher ,New York ,third edition,

1997,p .739.

2-In music the twenties were notable for the rise of jazz “the most important musical expression that

America has achieved ”.It has originated among black musiciens in the south particularly in New Orleons...The new music first became widely known when jazzmen moved with the general black migration northward during and after World War I . The great trumpet player Louis (Satchmo)

Armstrong,for example,went from New Orleons to Chicago in 1922 to join a band that helped spread jazz through phonograph recordings. Frank, Freidel, America in the the Twentieth Century ,Alfred A.Knopf, INC ,New York ,fourth edition ,1976,pp128-129.

who wore short skirts and makeup, smoked, and drank.

On the other hand, falling farm prices ,labour agitations (because of low wages and unemployment), insufficient consumption , the closing of foreign market ,and the overextension of credit as well as a big bull market1were all symptoms of a sick and unstable economy .

1-The 1920s Economy Under the Republican Leadership:

In order to deal with the American economy during the twenties, a brief survey of the Republican ascendancy during that era imposes itself. After the physical and political collapse of Woodrow Wilson (President of the USA from 1912 to 1920) the Republicans were in a position to regain the White House.

In 1920, the Democratic platform led by Governor James M. Cox of Ohio with the Assistant Secretary of the Navy Franklin D.Roosevelt called for the ratification of the Wilsonian programme which meant the participation of the United States in the League of Nations whereas the Republicans led by warren G. Harding (1865-1923) and Calvin Coolige(1872-1933) promised a return to “normalcy” ( meaning normality) which meant a return to the good old days when the government didn’t bother the businessmen with unnecessary regulations, but provided them with fat tariffs2.

In fact ,Harding caught the mood of that times and expressed it clearly when he pronounced his famous sentences :

America’s present need is not heroic but healing; not nostrums but normalcy; not revolution but restoration...not surgery but serenity3

The country wanted to get back to business and to have a rest from World War I disruptions. Consequently W.G. Harding and C .Coolidge won at the election of 1920

________________________

1-A bull market is market characterized by rising prices (The opposite, a market characterized by falling

prices, is called a "bear market."). S.E.,Steigeler and Glyn, Thomas A Dictionary of Economics and Commerce, Great Britain , Laurence Urdang Association LTD , 1976, p 54 .

2- Frederick Lewis , Allen , Only Yesterday , Bantom Book ,INC,New York, Eleventh edition ,1959, p 29

by a margin of sixteen million to nine million marking a new Republican era that would last twelve years.

The newly elected President surrounded himself with, what he thought, the best qualified men to help him guide the government. He named Charles Evans Hughes at the head of the State Department, Albert B. Fall Secretary of the Interior, Henry C. Wallace was the link between farmers and government agencies, and Andrew Mellon1was named Secretary of the Treasury. Yet the most active member of Harding’s administration was the Secretary of Commerce Herbert Hoover 2.However , the Harding’s cabinet was known as one of the most corrupt administrations .Many of the political associates of the President were involved in what later will be known as the “Harding Scandals”.

Among the politicians implicated in these scandals was Charles Forbes , the director of the newly established Veterans Administration of 1921, who had stolen $250 in federal funds .Another scandal ,and the most famous ,was the one over the Teapot Dome3 . In the summer of 1923, when a senate investigation uncovered this scandal, Harding was seriously ill and depressed . He never had to face or to explain this corruption for he died in August of the same year .

_______________________

1

-No appointment could have been more reassuring to old Guard Republicans .Mellon came from Pennsylvania and his outlook was entirely predictable . He belived in a high tariff ,low taxation ,the greatest freedom to get and spend wealth ,and in having a friendly government in Washington to back up big business leadership when necesary . He had no time for labour unions ,no interest in farmers ,no concern for consumers . As to the business cycle ,he was a fatalist ,regarding booms and slumps as natural phenomena which it was a waste of effort to try to control... He persisted at the treasury throught the twenties –indeed until 1932. So he became an obvious target for the wrathof all those who blamed the Republican administrations of the twenties for the Great Depresion . Hugh , Brogan , the Penguin History of The United States of America ,Penguin Books, London ,third edition, 2001,p 492

2- Herbert Hoover (1874-1964): was born in a lower village in 1874,and he grew up in Oregano . He

enrolled at Stanford University when it opened in 1891, graduating as mining engineer.After the USA entered the war President Wilson appointed Hoover Head of the Food Administration .He succeeded in cutting consumption in foods needed overseas and avoided rationing at home . After the Armistice, Hoover , a member of the Supreme Economic Council and Head of the American Relief Administration organized shipments of food for starving millions in Central Europe .After capably serving as Secretary of Commerce under President Harding and Coolidge, Hoover became the Republican Presidetial nominee in 1928 . Encyclopedia Encarta ,United kingdom,Deluxe edition , C.D.Rom ,2001

3

-The most spectacular fraud involved the rich naval oil reservesat Teapot Dome ,Wioming ,and Elk Hills ,California. Secretary of the Interior Fall persuaded Harding to transfer the oil reserves to his department,then secretly leased them to Harry F.Sinclair and Edward L.Doheny. .Fall wha had been in financial straits became ,suddenly affluent .An investigation headed by Senator Thomas J.Walsh of Montana during the fall and winter of 1923 uncovered the reason .Sinclair had loaned Fall $308,000,in cash and government bonds and a herd of cattle of his ranch;Doheny had loaned him $100,000,more. In 1929 Fall was cinvicted of bribery ,fined $100,000,and sentensed to a year in federal penitentiary . Frank, Freidal, Op.cit.,p.141.

After Harding‘s death, Vice President Calvin Coolidge moved to the White House. Just like Harding, Coolidge largely believed that prosperity resulted from the least possible government intervention in business and economy. However, where Harding had tried to balance the interest of both labour, agriculture and industry ,Coolidge focused only on the industrial development putting aside labour and agriculture. In fact Coolidge had embraced the orthodox creed of business. “The business of America is business” he said, “the man who builds a factory builds a temple .And the man who works there worships there”1.

During the 1924 election Coolidge succeeded to distance himself from the Harding Scandals .He also took the initiative of leading the Republican Party and became the party nominee for the Presidency.

To run the 1924 election, the Democrats had to choose between Governor Alfred E.Smith of New York who had the support of northern urban politicians, and WilliamG.Mc Adoo of California who had the support of western and southern Democrats. Finally the delegates chose John W.Davis, a Wall Street lawyer who had served as a West Virginia congressman and an ambassador to Great Britain.

Besides, a third party was leading a vigorous campaign. This was the Progressive party led by Senator Robert M.La Follette who had the support of both the reformers, the labour leaders and the Socialist party .The Progressive platform called for the nationalisation of railroads, public ownership of utilities, and the right of congress to overrule Supreme Court decisions .It also favoured the election of the president directly by people (voters) rather than the electoral college. During the campaign Coolidge focused on La Follette arguing that he was a dangerous radical who would turn America into a “communistic and socialistic state”2. Finally , the Republicans won the election with Coolidge receiving the majority of both popular and electoral college votes .

When W.G. Harding died business was already booming .Yet the American ________________________

1- Kenneth.C, Davis , Don’t Know Much About History ,Avon books, New York ,1990.p.252 . 2- George B.,Tindall, and David E., Shi , America. p.688 .

industry knew its brief triumphal march during the seven fat years from 1923 through 19291. Therefore, America seemed to prosper under the Republican leadership. Nevertheless, the “Coolidge prosperity” was mainly the result of the new and big industries that largely spread during the twenties.

As a result, this decade was an era that marked the shift of the United States from the nineteenth-century Industrial Revolution symbolized by railroads to the twentieth century revolution in technology.

The first, and probably the most important, innovation that defined that shift was the invention and development of the automobile and the airplane .The growth of the automobile industry led to a multitude of changes in the American economy .The mass market for cars pushed the auto-makers for instance: General Motors ,Ford and Chrysler in the front line of American business .By 1929 the automobile industry was the largest of the country . The production of cars had risen from 1,905,500 in 1920 to 4,455,100 in 19292.

Another point was that the automobile industry stimulated many other industries. Since the demand for materials which went to the making of automobiles was growing up, both steel, petroleum, chemical, rubber and glass industries expanded and profited from this boom .Consequently ,in 1929 , 3,7 million workers directly or indirectly owed their jobs to the automobile3.

The second industry that developed during the twenties was the construction industry. As business men called for bigger and better offices and more urban population called for new apartments big investments were made in this field, providing more employment and stimulating the American economy as well.

In addition, the automobile industry and the new way of life that it engendered stimulated construction. In fact, the 1920s building boom was the first to respond to the potential of the automobile. As other lands were now accessible, the American people ________________________

1

- Frederick Lewis, Allen , Op.cit., p.138.

2-Hugh , Brogan , Op.cit.,p. 494.

looked for new ways of life, far from the urbanised and industrialised cities. Thereby, by the middle years of the decade there was a boom of suburban lands outside nearly every American city. Yet, this growth was not limited to the suburb; another example of real-estate exchange and construction developments was the Florida boom. The increase of construction projects in this state reflected what was happening in all the country, nevertheless, the Florida boom is considered as the most spectacular of a series of land and building booms during the post war decade.1In fact the construction boom was of such a proportion in this state that it transformed its whole local economy .

The radio industry had also flourished during the twenties .It was probably less important than the automobile industry. Nevertheless from the first broadcasting to the public in1920 to the end of the decade, the sale of radio and accessories knew an important increase. The following table shows the important increase in radio sales during the decade:

Table 1

The Amount of Radio Sale during the Twenties

Source : Frederick Lewis, Allen , Op.cit. p. 116.

Note : In 1927 ,there was a dip in national prosperity which systematically affected the sale of almost every popular commodity among which radio2.

________________________

1-Frederick Lewis, Allen , Op.cit.,p.201. 2

-Economic growth during this period was mitigated only somewhat by three recessions. According to the National Bureau of Economic Research (NBER) business cycle chronology, two of these recessions were from May 1923 through July 1924 and October 1926 through November 1927. Both of these recessions were very mild and unremarkable. In contrast, the 1920s began with a recession lasting 18 months from the peak in January 1920 until the trough of July 1921. Christina D. ,Romer , World War I and the Postwar Depression: A Reappraisal Based on Alternative Estimates of GNP found in : Journal of Monetary Economics 22, no. 1 ,1988 , pp 91-115.

Year The amount of radio sales

1922 $ 60,000,000 1923 $ 136,000,000 1924 $ 358,000,000 1925 $ 430,000,000 1926 $ 506,000,000 1927 $ 425,600,000 1928 $ 650,550,000 1929 $ 842,548,000

In addition to automobile, construction and radio, other industries and therefore products were introduced into the American market. Among these were: refrigerators, cigarettes, chemical preparations, and electrical devices of various sorts. Another giant business of the twenties was Hollywood, stimulated by the popularity of the cinema, this newly born business also took wing .

However, while the automobile, construction, and radio industries were booming, negative patterns still existed in the American economy. For instance, the situation in the pre- war industries was considerably bad. The railroad industry, for instance, was hard hit because the railway was replaced by the roads.

Then the textile firms left New England for cheaper labour market in the south but continued to suffer from a decrease in demand and overproduction .Mining workers were working for very low wages in exchange for high production however, Coal mining was especially hit because of the competition of new energy sources like hydroelectric power, fuel oil and natural gas with coal.

Moreover, agriculture, which represented one quarter of the American economy, had a lot of difficulties. American farmers were already in an economic recession during the 1920s, therefore they did not profit from the prosperity of the decade. Some scholars agree that the fall in prices that affected agriculture after WWI was the worst collapse yet experienced by American farmers, and throughout the rest of the decade agriculture remained depressed relative to the nonfarm economy .The following table shows how farm prices were constantly below the costs of living throughout the twenties :

Table2

The Decline of Farm Prices after WWI

Index of farm prices

Index of the cost of living 1914 105 100 1916 100 103 1918 190 135 1920 200 190 1922 115 170 1924 114 175 1926 160 180

Source: Data are from David, Orden, International Capital Markets and Structural Adjustment in U.S. Agriculture ,found in : American Journal of Agricultural Economics, Vol. 72, No. 3 (Aug., 1990), pp. 749-754 Published by: Blackwell Publishing on behalf of the Agricultural & Applied Economics Association ,Stable URL: http://www.jstor.org/stable/1243049, figure 1,p.751.

What happened was that the USA increased her agricultural output during World War I in order to sustain the allies. Even in the post –war era, she continued to supply the European needs by using several extensive and brutal methods of the land exploitation .1

Yet, The collapse of farm prices during 1920-21 marked the beginning of a long period of decline in the agricultural sector. The factors primarily responsible for the post-war price deflation were over stimulated agricultural production resulting from high prices during the war and good crop conditions in 1920, and the decline of the European demand for American agricultural goods.

________________________

1

As a response to this recession an emergency legislation restoring tariffs to their high pre-war levels was enacted in June 1921. This post-war tariff legislation raised domestic farm prices. Nevertheless this policy had a depressing effect on farmers because it slowed down agricultural exports.

Besides, the USA was not the only country with a food surplus. By the late of the decade, European agricultural products reappeared in the international market. Consequently, farmers found themselves competing in an over-supplied international market. This accumulation of unsold stocks accentuated the fall of prices. As a result the price of wheat dropped 40%,corn prices fell 32% and hog prices 50 %.1 Thereby, as prices fell ,farmers were often unable to sell their products for a profit.

These new circumstances became essential factors in shaping the agricultural policy. Thus, in the absence of a government subsidy and a tariff reductions, it was urgent to seek relief in specific measures of support for agriculture. To obtain higher prices and incomes, farmers, who were seen as the least organized group in an economy becoming affected more and more by collective action, sought improved credit agencies, lower costs for farm-to-market transportation, strengthened cooperative marketing, and extension of the War Finance Corporation to provide export credits and credit assistance to farmers.

To ameliorate the farmers’ situation, the Farm Bureau Federation sought government Price support through the parity price of the McNavy-Haugen bill2. This was all in vain for although Congress passed it in both 1927 and 1928, President Coolidge vetoed it as being preferential legislation contrary to the principles of laissez faire .

Yet even the farmers shared the business outlook of the era .Many farms ,mainly corporations, became larger, more efficient, and more mechanized .By 1930 about ________________________

1

- James A., Henretta et al , Op.cit., p.741.

2

-One price-raising scheme was that the price for corps shold be raised to a “fair axchange value” based on the price of the corps during ten prewar years as compared with the general average of all prices during the same period .The means of obtaining parity for farmers would be for the government to buy up the surplus at the high American price and sell it abroad at whatever it would bring on the world market. Frank, Freidal, Op.cit., p.150.

13 percent of all farmers had tractors1 . Thus, The large landowners who use expensive machinery enjoyed satisfactory incomes.

Meanwhile ,though the income of most Americans increased during that time ,the income of the small farmers drastically declined. The poor farmers suffered to such a degree that for the first time in American history the farm population began to shrink. It was approximately 1,500,000 smaller in 1930 than it had been in 19202. Hundreds of thousands of farmers and their families abandoned their lands seeking for better conditions of life in the cities.

The big business of the era invaded the domestic market with vast quantities of consumer goods. As a matter of fact the decade of the 1920s saw major innovations in the consumption behaviour of the Americans.

On one hand, many goods which were available only for the affluent, became accessible to the working classes. On the other hand, the development of credit instalment during this period led to a considerable growth in the purchase of automobiles, refrigerators, radios and other such durable goods. These new ways of consumption fed the optimism of investors and gave them an excessive confidence in prosperity.

It is important here to underline the role of the Secretary of Commerce Herbert Hoover in the standardization of the products through his trade-association movement. Hoover’s aim was to stabilize business and guide Americans to higher standards of living.

In this respect, Hoover sought to design a fiscal and monetary strategy to counter fluctuations in aggregate economic activity. Working with a group of economists, Hoover developed a macroeconomic policy based on high wages and a fair distribution of income, a free exchange of technical information between industry and the government, public works during times of economic downturn, and a high tariff1 to protect American manufacturers and farmers.

________________________

1

- George B., Tindall and David E.,Shi,Op.cit.,p.692.

Accordingly, he used these associations in gathering information on everything: sales, purchases, production and prices so that this information allowed his department to establish plans with more confidence. Thereby, predictable coasts, prices, and markets contributed in more stable employment and wages and consequently in increasing consumption.

It was obvious that the Republican administrations of both Harding and Coolidge favoured business at the expense of agriculture. However, the economic policy that they undertook, for instance tax cuts and the high tariffs1, were not without a negative effect on United States export and the economy as a whole.

To sustain business and stimulate consumption, Secretary of the Treasury Mellon promoted a large policy of tax cuts. Consequently the rate on personal income decreased from 65% to 20% 2. Moreover the Revenue Act of 1926 3 had largely contributed in the concentration of wealth in the hands of the wealthy people ;a negative aspect of the US economy that will be seen later on .

In addition to Mellon’s policy, the enactment of the Fordney –McCumber tariff in 1922 by the congress created other complications. This tariff was meant to protect agriculture as well as chemical and metal industries from foreign competition. Nevertheless, the Tariff gave more protection to industrials than to farmers .It worked on the principle of compensation: when foreign firms had costs of production lower than their American competitors, the tariff should be high enough to offset the differential4. Thereby, the imposed trade barriers on imports led to a restriction of competing import and therefore to higher prices in the domestic market .By the late of the decade, about sixty countries had followed the American example in raising their tariffs.

________________________

1

-A tariff is a tax or duty on imports and during that period ,many countries relied on heavy customs-tariffs to protect their industries by restrecting supplies coming from abroad . D,.,Beggs,S.,Fisher, ,R.,Dornbusch , Economics, U. K, McGraw –Hill Book, LTD, 1984 ,p.719.

2

- GeorgeB., Tindall, and David E., Shi , Op.cit.,p.683.

3-The Revenue Act extended further benefits to high income groups by lowering estate taxes and

repealing the gifttax.Ibid .p.683.

While America was prospering under Coolidge leadership the later chose not to run for President in 1928 .As a matter of fact, Hoover, the third giant of the Republican administration, led an active campaign for the Republican nomination .Thus, his popularity as head of the Food Administration during the WWI and as Secretary of Commerce under Harding and Coolidge made that he easily won the nomination. In his acceptance speech for the Republican party nomination for the presidency, Hoover had said:

We in America today are nearer to the final triumph over poverty than ever before in the history of any land...given a chance to go forward with the policies of the eight years ,we shall soon with the help of God be in sight of the day when poverty will be vanished from this nation”1

Through this speech ,it was obvious that Hoover’s platform was a continuity to the Republican policy of the era which meant that it took credit for prosperity, for instance ,tax and debts reduction and higher tariff ,and completely rejected the McNavy-Haugen programme of farmers.

For his part, Governor Alfred E.Smith of New York faced no effective opposition within the Democratic party and won the nomination. The Democratic platform did not propose a significant departures from the position of the Republican party. However it included a plank offering farmers the McNavy-Haugen plan .

More important Smith promised to relax the Volstead act for enforcing the Eighteenth Amendment and thus brought the Prohibition2 to the forefront of the campaign. Yet, the major handicap to Smith remained his Catholicism for many Protestant Americans were not ready to have a Catholic President.

________________________

1-Frank, Freidal, Op.cit.,p.161. 2

- Proposed by congress during WWI the Eighteenth Amendment to the Constitution prohibited “the manufacture ,sale,or transportation of intoxicating liquors”within the United States .It also cut off the import and export of beer ,wine,and hard liquor .In January 1919,the amendment became part of the constitution when Nebrasca voted in favour of ratification-only Rhode Island and Connecticut failed to ratifay the amandment-and ayear after it became the law of the land when Congress passed the Volstead Act to enforce the law . Kenneth.C .,Davis , Op.cit., p.256.

Thus, in the election Hoover won in the third consecutive Republican landslide receiving 58% of the popular vote to Smith’s 41%, and 444 electoral votes to 87 for Smith1,and above all vindicated the Republican prosperity .

Indeed when Americans elected Herbert Hoover President, the mood of the general public was one of optimism and confidence in the United States economy. Most people believed that if they voted for a Republican , national prosperity would continue indefinitely.

Nevertheless, the Democrats’ defeat marked important political changes for the party was in the way of having a new identity as the party of the urban masses, unhappy farmers and ethnic groups .

2 -Flaws in the Economic Foundations:

While the Americans were enjoying the prosperous years of the Roaring Twenties, many weaknesses remained present within the American economy.

The misdistribution of wealth in the 1920s existed at many levels. Money was distributed unequally between the rich and the middle-class, between industry and agriculture within the United States, as well as between the United States and Europe. In addition, the bank system of that time was neither strong nor prudent to accompany the economic and social changes of the era .

a / Unequal distribution of wealth and income:

Despite rising wages overall, the unequal distribution of wealth remained a characteristic feature of the American economy during the twenties .

A major reason for this large and growing gap was that during the years between 1922 and 1929 , the physical production of the agricultural ,manufacturing ,mining , and ________________________

1

construction industries increased 34% and between 1920 and 1930, output per man hour increased by 21%1. However, the decline of labour union2after WWI made that wages were gradually rising, but not as fast as production and productivity. Thereby, as production costs fell quickly, wages rose slowly, and prices remained constant, the benefit of the increased productivity went into corporate profits. Consequently, there were some extremely rich people, and huge numbers of extremely poor people. The following statistics illustrates the growing gap in income of the era:

in 1929,according to the Brookings Institution, only 2,3 per cent of Americans families had income over $10,000 a year. Only 8 per cent had incomes of over $5,000.No less than 71%had incomes of less than $2,000 .More than 42%had incomes of less than $1,500 .And more than 21% had incomes of less than $1,000 a year . That same top 0.1% of Americans in 1929 controlled 34% of all savings, while 80% of Americans had no savings at all3. Thus, in the 1920s, 5% of people who received incomes got 30% of the total of all incomes4.

In addition, as it has been mentioned before, the federal government also contributed to the growing gap between the rich and middle-class. The administrations of both Harding and Coolidge favoured business, and as a result the wealthy who invested in these businesses. As a matter of fact, the rich were getting richer much faster than the poor were getting less poor5.

Moreover, while new industries were prospering in the 1920s, others , agriculture in particular, were considerably declining. Consequently, the average annual income for all Americans was much higher than the average annual income for

________________________

1

- Frederick Lewis, Allen , The Big Change :America Transforms Itself 1900-1950,Harper and Row, Publishers, NewYork and Evanston ,1952,p.139.

2

-After an angry wave of strikes immediately after the war ,unionism languished; total trade-union membership in the United States dwindled from over five millions in 1920 to less than four millions in 1927 and three and third millions in 1931. Frederick Lewis, Allen , The Big Change , p.140.

3

- “At 1929 prices,” said the Brookings economists , “a family income of $2,000 may be regarded as sufficient to supply only basic necessities .” One might reasonably interpret this statement to mean that any income below that level represented poverty .Practically 60% of American families were below it –in the golden year 1929! Frederick Lewis, Allen, The Big Change , p.144.

4

- Dietmar, Rothermund , The Global Impact of the Great Depression 1929-1939, routledge , 1996,p.48.

someone working in agriculture. In 1929 the yearly income of a farmer averaged only $273 , when it was $750 in other occupations1.

It is important to understand that for an economy to function properly; total demand must equal total supply. Meanwhile the economic prosperity of the 1920s was dependent on the high investment and luxury spending of the wealthy. However, both the high spending and high investment of the time were susceptible to economic fluctuations. They were much less stable than people's expenses on daily necessities like food, clothing, and shelter.

The car industry, for instance, was the leading industry but as cars were expensive the demand of them was limited by the consumers’ purchasing power. In addition as they were very durable consumer goods there was also a saturation of the market.

Consequently, Americans produced too much and bought too little .This imbalance between production and consumption had a negative impact on economy. For what happened in the 1920s was that there was an oversupply of goods while the purchase power of people was declining.

b/ Unequal distribution of corporate power.

Misdistribution of wealth in the United States was not limited to only socioeconomic classes, but to entire industries.

As it has been mentioned before, most of the industries that were prospering in the 1920s were in some way linked to the automobile industry or to the radio industry. Consequently this led to an unequal distribution of wealth between the different industries and the concentration of the capital in few ones. Thus, the American economy was essentially dependent upon automobile and radio industries. This meant that if those industries were to slow down or stop, the entire economy would be affected.

________________________

1

Another feature of the twenties was the business consolidations and mergers. During WWI, many small companies which produced the same or related products merged into huge corporation .The purpose of such a movement was to reduce and eliminate competition and also to control prices and production.

Nevertheless, the mergers that occurred in the twenties were not supposed to eliminate competition but rather the incompetence, somnambulance ,naiveté, or even the unwarranted integrity of local management1.

As a result local companies were combined and united in great regional or national corporations .In the case of public utilities, this was achieved through the holding companies2.This movement of consolidation was also noticed at the financial level .

Thereby ,by the end of the decade 200 of the biggest corporations controlled almost half the nonbanking corporate wealth in the United states ,1% ,or 250 of American banks controlled almost half the nation’s banking resources3and chain stores sold more than a quarter of the nation’s food and general merchandise4.

Thus these mergers helped to sustain the trend toward concentration of business and wealth which meant that if just a few companies or banks went under, the whole economy would suffer.

c/Foreign balance of payments:

It is of equal importance also to take into account the new international order of the era and its implications in the new American economy . During the First World War, European economies had been greatly destroyed. Meanwhile America had financed the war and was issuing loans for its reconstruction. ________________________

1- John kenneth, Galbraith, The Great Crach 1929,Avon books,fourth edition, 1979, p.39.

2-These bought control of other holding companies which controlles yet other holding companies,which

in return ,directly or indirectly through yet other holding companies ,controlled the operating companies .Everywhere local power ,gas,and water companies passed into the pocession of a holding-company system.Ibid,pp39-40.

3-James A.,Henretta et al , Op.cit., pp. 744-745. 4-Freidal,Frank,Op.cit.,p148.

This capital export made that the United States had emerged from the war as the major creditor and financier of the European countries. Therefore, these new conditions gave the most important role to America in the world market.

In fact, Germany had to pay reparations to the Allies; France and Great Britain had to repay wartime loans to the United States. Yet these payments relied mainly on American private loans to Germany. Nevertheless, this solution was not appropriate1. According to economists, it would have been better if America had helped the development of European countries by importing their goods.

American loans to Germany during the 1920s financed reparation payments that in turn serviced war debts of the Allies. The private loans cycled back through reparation and debt payments made it difficult for European countries to sell their goods in the US market which in return did not provide large markets but U.S. exports, but the capital outflow was sufficient to finance a small U.S. trade surplus.

However, this cycle could not go on indefinitely for European repayment of war debts necessitated a U.S. trade deficit. But American interests, including many farm groups, were myopic on trade issues and resisted importation of European goods which made it difficult for European countries to pay their war debts.

In 1924, France, Great Britain and Germany joined with the United states , in the Dawes Plan2to improve and promote European financial stability .Nevertheless,

________________________

1

- In his book"The Economic Consequences of the Peace" John Maynard Keynes had already

pronounced that this policy was unsustainable for Germany and counter- productive for the world. Andre Gunder Frank ,Crash Course, Source: Economic and Political Weekly, Vol. 22, No. 46 (Nov. 14, 1987), pp. 1942-1946 Published by: Economic and Political Weekly Stable URL:

http://www.jstor.org/stable/4377724 Accessed: 24/06/2009 07:12

2-The Dawes Plan ,named after the American, General Charles G. Dawes ,who on April 9,1924,had

headed committee of experts which recommended that Germany currency would be stabilised on a gold basis ad that Germany had to pay an annual sum of reparations rising from 1,000 million marks in the first year to 2,500 million marks in the fifth year .In addition an international loan of 800million marks was recommended. Britain and France agreed that the Daw Plan should be put into operation and that an inter- allied conference would be held to settle the procedure. The United States, Belgian, Italian, Japanese and certain other governments were invited to attend the conference which was opened in London on July,1924.After some difficulties, a sufficient agreement was reached and the conference was closed on August,1924. David , Thomson, England in the Twentieth Century, Great Britain, Penguin Books LTD,p.100.

this single initiative was not enough for such an achievement .

In addition, as the international trade was regulated by gold, the Republican administrations of the 1920s insisted on payments in gold bullion. Since the European gold had flowed into the U.S. in great quantity, the world's gold supply came to be limited and by the end of the 1920s, the United States itself controlled much of the world's gold supply. Then, because the value of the countries’ currencies was related to the amount of their reserves of gold, it was difficult for European countries to pay their debts for they couldn't send more gold without completely ruining their currencies. Consequently they had to pay their debts in goods, services and Dollars.

Besides, the high tariff policy of the Republican administration prevented the European countries from selling their goods in the United States and thus from getting enough money to buy American products or to pay their debts.

As a result, the debts’ payment went through huge total of private American loans to Germany .Thus, the European countries were paying the war debts with the money that Americans were lending to the German. Thereby, what seemed like a beginning of recovery from the Great War was in fact an immense accumulation of debts, which, by the late 1920s, made the international economy and mainly the financial sector extremely unstable.

d/ Bad banking structure:

Many financial and economic historians have stressed that bank involvement in industrial and commercial finance during the twenties was not insignificant, and that it evolved in parallel to the rapid economic development that the USA were undergoing.

During this time, banks were opening at the rate of four to five per day. Through such a period of imbalance, the American economy tended to rely upon two things in order to keep prosperity: luxury spending and investment from the rich, and credit. The latter was either for consumption, for industries or, more important, for buying actions in the stock market .This meant that the solution to the problem of the vast majority of the population not having enough money to satisfy all their needs was to let those who wanted goods buy products on credit.

Thus the concept of buying now and paying later made that the majority of durable consumer goods were bought on credit. As a result, between 1925 and 1929 the total amount of outstanding instalment credit more than doubled.

Meanwhile, banks were opening without federal or state restrictions to determine how much start-up capital a bank needed to open. Thus, most of these banks were highly insolvent.Moreover, banks did not work together with the Federal Reserve System (Fed)1. Instead of being used to strengthen the central bank so they could ,in

time of trouble come to the rescue of their weaker partner, they remained isolated the ones from the others. Indeed, the vast wealth of cash and credit was dissipated into thousands upon thousands of small, amateurishly managed, and largely unsupervised banks and brokerage houses2.

Consequently, even during the days of Coolidge prosperity banks closed at the rate of two per day. This meant that every year a considerable portion of American earnings and savings went down. In the first six months of 1929, 346 banks failed in various parts of the country with aggregate deposits of nearly $115million3.

3- The Stock Market Boom and Crash:

The “Bull Market” was another aspect of the American economy during the twenties. Thus, Wall Street, home of the New York Stock Exchange4was a symbol of the prosperity of the era. Some economists stressed that the boom of the stock market during that days was nothing else than the result of the economic growth that the

________________________

1

-The Federal Reserve System is the US central bank which was established in 1914 as a result of the 1907 crisis when the National Monetary Commission was set up to find out what was wrong with the American banking system .Its report in early 1912 led directly to the establishment of the Federal Reserve System. W.J.,Baumol and A.S.,Blinder,Economics :Principles and Policy ,USA,Harcourt Brace

Jovanovich ,INC,1982,p269.

2- Hugh, Brogan, Op.cit.,p.507. 3

- John kenneth, Galbraith , Op.cit.,p.159.

4

- The New York Stock Exchange is a highly organized market for dealing are also jobbers ,each jobber dealing with a particular group of securities such as mining shares, industrial etc .The broker having received instructions from his client ,approaches a jobber and asks his price. The jobber without knowing whether the broker will buy or sell quotes two prices-buying and selling prices –the difference being the jobber’s turn of profit .The existence of stock exchange means that is generally possible to buy or sell at any time at the market price .Robin,Almot ,Guide to World Markets,London ,BoxtreeLimited,1992,p10.

country was undergoing.

For his part, J.K.Galbraith and other scholars argue that a bubble in the stock market was formed during the rapid economic growth of the 1920s.In this respect, they emphasize the irrational element-what they called the mania-that induced the public to invest in the bull market.

The rise in the stock market, according to Galbraith, depended on "the vested interest in euphoria [that] leads men and women, individuals and institutions to believe that all will be better, that they are meant to be richer and to dismiss as intellectually deficient what is in conflict with that conviction."1This strong desire of buying stocks and making profits was then fuelled by an expansion of credit in the form of brokers' loans that encouraged investors to make more and more transactions .

Indeed ,the widespread belief that any one could get rich led many Americans into the stock market . A financier captured this attitude in an article that he entitled “Every one Ought to Be Rich”. “Invest $15 a month in sound common stock”, he advised ,and in twenty years the investment will grow to $80,000”2.

The freeing of capital from government use to commercial use after WW I caused commodity prices to go up. As a result, rising prices typified the stock market of the twenties. In 1920, Benjamin Strong of the US Federal Reserve Bank of New York raised interest rates sharply to prevent inflation3. This led to an economic recession and the stock market to fall. Yet the stabilisation of prices that followed made more money available and thus the stock market began to set up again.

Then, an international event that also contributed in providing the stock market with funds was the coming back of Great Britain to the Gold Standard4.

________________________

1- John kenneth, Galbraith , Op.cit.,p.53. 2

- James A., Henretta et al , Op.cit., p.770.

3

-Inflation is a condition where the volume of purchasing power is persistently running ahead of the utput of goods and services available to consumers and producers ,with the result that there is a persistent tendancy for prices and wages to rase that is for the value of the money to fall .J.L.,Hanson ,A Dictionay of Economics and Commerce,London ,McDonalds &Evans LTD ,1974,p.270.

4

-The gold standard is the monetary unit which consists of a fixed weight of gold at a definite fineness;the price of gold ,therefore ,in terms of national currency is fixed ;and there is acomplete freedom to buy or sell gold ,to import it or export it . G.F., Stanlake,Introductory Economics ,London,Longman group, LTD, 1989, p.296.

In1925,Great Britain , under the aegis of the Chancellor of the Exchequer Winston Churchill, decided to reinstate the Gold Standard at pre –WWI relationship between gold, dollars and the pound ,which meant an overvaluation of the pound. Thus with moral support from the US Treasury, Strong chose to help strengthen the value of the Pound by depressing the value of the US Dollar ($4,86 for 1 pound) . This action undermined the British economy for the costly pound and the post-war inflation led to trade deficits and substantial gold outflows towards the United States.

In the meantime , the low prices of American goods made the USA a rich place in which to buy and invest .Consequently ,this attracted more foreign investors which in return provided more capital and caused the stock market to boom. Yet 1927 was the turning point of the increase of the stock prices as well as the number of the new investors .This was mainly due to the easy money policy undertaken by the Federal Reserve to help the depressed Europeans.

In fact during this year England ran in troubles with her Gold Standard and pleaded -with Germany and France- for easier money in New York .As a matter of fact the Federal Reserve lowered the rediscount rate1 of the New York Federal Reserve Bank from 4 to 3,5 %. Adolph C.Miller, a member of the Federal Reserve Board, described this as “the greatest and boldest operation even undertaken by the Federal Reserve System, and...(it) resulted in one of the most costly errors committed by it or any other banking system in the last 75 years”2.

Consequently the funds that the Federal Reserve made available served either to invest in common stock or to finance the purchase of common stock by others . This helped in fuelling the speculation and according to all evidence the situation got completely out of control.3

In addition , from 1925 , industry was over-producing and thus generating more ________________________

1- The rediscount rate is the rate at which member commercial banks borrow from the reserve banks of

their district so that they may accommodate more borrowers than their own resources permit . John kenneth, Galbraith , Op.cit., pp.9 and 27.

2

- Testimony before senate committe ,Quoted by Lionel Robins,the Great Depression,New York, Macmillan,1943,p.53.

3

profits that business leaders reinvested in factories and new machinery. Thus ,by investing their over-production profits in new production , companies hired more workers, which, in turn, fuelled even greater overproduction. As a result, the increased production gave the companies an aura of financial soundness, which encouraged Americans to buy more stock.

Besides, the stock market did not attract only financiers and businessmen but even average Americans. In order to make profits, many people pulled out their savings from banks and put them into stocks and utilities .Some went as far as mortgaging their homes to raise more money for investment. The following passage pictures this diversity :

The rich man's chauffeur drove with his ears laid back to catch the news of an impending move in Bethlehem Steel; he held 50 shares himself on a twenty- point margin. The window-cleaner at the banker's office paused to watch the ticker, for he was thinking of converting his laboriously accumulated savings into a few shares of Simmons.. Edwin Lefevre (an articulate reporter on the market at this time)told of a broker's valet who made nearly a quarter of a million on the market, a trained nurse who cleaned up thirty thousand following the tips given her by grateful patients; and of the Wyoming cattleman, thirty miles from the nearest railroad, who bought or sold a thousand shares a day.1

Nevertheless, economic historians estimate that a relatively small number of Americans, about one and a half million out of a population of approximately 120million2, had investments in the market at any one time. Yet, the constant influx of new investors coming in and old investors moving out ensured that new money was always floating around.

In addition, the employed devices in speculating3were not always honest. For example

_________________________

1

- Frederick Lewis , Allen, Only Yesterday ,p.233.

2

-John Kenneth, Galbrath,Op.cit.,p.68.

3-Speculation is the purchase of a security ,currency or commodity in the hope that its price will rise and that profitable resale will thereby be possible ,usually in the short run. S.E.,Steigeler and Glyn, Thomas, Op.cit., p 372.

it was usual that both officers of a given company, brokers and speculators worked in stock- market pools in which they drove up the price of the company’s stock and then sold it to outside investors at artificially inflated prices , making profits at the expense of those officers’ own stockholders and leaving the new buyers with over priced stock .

Meanwhile, those new investors bought millions of shares of stock “on margin”. the purchase of common stocks with bonds or debentures allowed the investors to have all of the increase in value with minimal personal outlay .In effect, this practice functioned the same way as buying a car on credit . Investors had to pay only 10% and borrowed 90% of the share value from banks, hoping to pay back the loan and the brokers’ rate with the profit they would make on the sale. If the stock prices increased thus the investor would realise a considerable benefit.

To provide money, the New York banks were borrowing huge amounts of money from the Federal Reserve to carry the speculative superstructure. Accordingly, the amount of money loaned to brokers to carry margin accounts for traders had risen from $2,818,561,000 to $3, 558, 355,0001.

Moreover, since the federal government of that time did not impose any regulating rules on buying and selling shares of stock, corporations began printing up more and more common stock. As many investors in the stock market practiced "buying on margin", this investment strategy turned the stock market into a speculative game, in which most of the money invested in the market didn't actually exist for many transactions as well as profits were not real but only on paper.

In addition, most people did not even check the fundamentals of the companies they were putting their money in, thousands of fraudulent companies were formed for the purpose of taking money from naïve investors.

Another crucial point was that national banks were prohibited from lending more than 10 percent of their capital and surplus to one customer. The effect of this regulation on banks' lending capacity was amplified by strict federal and state limits on branch _______________________

banking that restricted banks' ability to grow. These restrictions were not compatible with the financial needs of the new enterprises.

As a matter of fact, firms turned to financing their investments out of retained earnings and bond and stock issues. As both old and new corporations issued equities to finance new plant and equipment, commercial banks did purchase more bonds, but they could not legally trade or acquire equities. The solution that banks adopted was to set up wholly-owned securities affiliates, which permitted them to enter all aspects of investment banking and the brokerage business .

By doing so bankers abandoned their traditional role as the guardians of the nation’s wealth and enjoyed the 1920s bull market by creating securities affiliates to sell shares and bond to the public and by speculating on their own behalf. Thus, they became a source of encouragement to those who believed in the permanence of the boom.

Most important, they increased their role as brokers between the saving public and industry. Banks were familiar with their borrowers and conditioned to monitor their activities. However, many of the new investors they served lacked experience in buying stock and monitoring firms, thus creating a favourable condition for a bubble.

Then, banks allowed Wall Street investors to use the stocks themselves as collateral. This meant that stocks were pledged as securities for the repayment of the loans . Nevertheless this practice was full of risk for if the stocks dropped in value, investors could not repay the banks, and thus the banks would be left holding worthless collateral.

Thereby it was under these circumstances that analysts and politicians started to argue that the U.S. stock market had entered a "New Era" where stock values and prices would always go up.

When Ben Strong died in October 1928, George Harrison, his successor immediately lobbied for higher interest rates to cool the speculative fervour and suggested that the Federal Reserve banks ought not to lend their clients money for stock

market operations. This policy in return led to an important increase of the credits’ interest rate. The following table shows it:

Table 3

Call Loans Interest Rate at New York Stock Exchange January 1925 3,32 January 1928 4,24 September 1928 7,26 March 1929 9,80 June 1929 7,83 July 1929 9,41 September 1929 8,62 Source:Lionel,Robins,op.cit.,p.255.

However, this attempt to curb speculation remained insignificant for the Wall Street stock exchange had already taken on a dangerous aura of invincibility, leading investors to ignore less optimistic indicators in the economy.

Accordingly , stock prices rose so rapidly that they ceased to have much relation to the actual earning power of the corporations .The standard Statistics index of common stock prices averaged 100 during the year 1926;by June ,1927, it had reached 144; by June ,1928,it had got to 148, by June ,1929,to 191 and in September ,1929 to the dizzy height of 2161.

Thus, the Big Bull market and the speculative mania that characterised the stock exchange of the twenties were nothing but the result of economic, cultural, psychological and political factors that paved the way to such a boom.

Yet, few people imagined that the peak in stock prices had been actually reached, nevertheless, for economists, the great bull market of the late 1920s was a classic example of a speculative “bubble” scheme, because it expands until it bursts.

_________________________

Indeed early in September1929 the stock market broke but investors as well as financiers thought that the market was just readjusting itself and that there was no need for alarming people. However the expected recovery did not come. In addition, , the

Federal Reserve's index of industrial production dropped in July 1929. In August and September, other indices began to fall. This mixed news and rising interest rates led stockholders to revise their expectations and start to buy their actions. Thus, the accumulation of hundreds of thousands of shares of stock in the hands of traders whose margins were exhausted or about to be exhausted generated a wave of selling.

Accordingly, on “Black Thursday” October, 24th, 1929, 12,894,650 shares changed hands, and many of them at very low prices1.

There were some attempts to stabilize the market , for example ,a combine of bankers led By J.P.Morgan and company(a leading bank in New York at that time) set up a pool of cash to prop up prices but this attempt to inspire confidence failed .

Thus “Black Tuesday” October ,29th ,1929 was the most devastating day in the History of the New York stock market , 16,410,030,shares were sold and for two weeks the market continued to drop until prices reached their lowest level on the thirteenth of November of the same year2 . The following table shows the considerable decrease of stock prices throughout that period:

________________________

1- John Kenneth, Galbraith , Op.cit., p. 87.

Table 4

The increase of the stocks’ prices in New York Stock Exchange

High price: Sep,3,1929

Low price: Nov,13,1929

American Can 1817/8 86

American Telephone & Telegraph 304 1971/4

Anaconda Copper 1311/2 70

General Electric 3961/4 1681/8

General Motors 723/4 36

Montgomery Ward 1377/8 491/4

New York Central 2563/8 160

Radio 101 28

Union Carbide & Carbon 1377/8 59

United States Steel 2613/4 150

Westinghouse E& M 2897/8 1025/8

Woolworth 1003/8 521/4

Electric Bond & Share 1863/4 501/4

Source: Frederick Lewis , Allen, Only Yesterday , p.241.

The main and immediate consequence of the 1929 Stock Market Crash was that within few days the wealth of a large part of the country which had been concentrated in wild speculation and highly inflated stock prices, simply vanished . F.l.Allen summed up the situation when he wrote:

The disaster which had taken place may be summed up in a single statistic. In a few short weeks it had blown into thin air thirty billion dollars – a sum almost as great as the entire cost of the United States participation in the (first)World War , and nearly twice as great as the entire national debt.1

It can be conclude ,then, that the twenties were a period of a revolution in manners and morals as well as an excessive economic boom. Nevertheless, many observers agreed that the inept financial system, the deficitary foreign trade, the uncompetitive industry and the depressed agriculture were all symptoms of the serious illness of the American economy.

_________________________

1

The Big Bull Market as an integral institution of capitalism and the American system, was one of the best leading indicators of the 1920s economy .Yet , the bases on which it worked were not sound enough to avoid the cataclysm of October, 29th,1929 .

Thus the Stock Market Crash was the alarm and the crucial question was whether the crisis of Wall Street could be limited there without spreading to the real economy i.e jobs ,income and production .Yet ,the close connection and interaction between the financial sector and real economy made the spreading of the crisis to the whole economy unavoidable .