HAL Id: halshs-01256759

https://halshs.archives-ouvertes.fr/halshs-01256759v2

Submitted on 31 Dec 2018

HAL is a multi-disciplinary open access

archive for the deposit and dissemination of

sci-entific research documents, whether they are

pub-lished or not. The documents may come from

teaching and research institutions in France or

abroad, or from public or private research centers.

L’archive ouverte pluridisciplinaire HAL, est

destinée au dépôt et à la diffusion de documents

scientifiques de niveau recherche, publiés ou non,

émanant des établissements d’enseignement et de

recherche français ou étrangers, des laboratoires

publics ou privés.

How Shared Capitalism Affects Employee Withdrawal:

An Econometric Case Study Of A French-Listed

Company

Nicolas Aubert, Xavier Hollandts

To cite this version:

Nicolas Aubert, Xavier Hollandts. How Shared Capitalism Affects Employee Withdrawal: An

Econo-metric Case Study Of A French-Listed Company. Journal of Applied Business Research, Clute

Insti-tute, 2015, �10.19030/jabr.v31i3.9226�. �halshs-01256759v2�

1

How shared capitalism affects employee withdrawal:

An econometric case study of a French-listed company

1AUBERT Nicolas23

HOLLANDTS Xavier, Kedge Business School4

Nicolas Aubert: Professor, Aix-Marseille University (France).

is a Professor of finance at Aix-Marseille University University (CERGAM, EA 4225) and an Affiliate Professor at Inseec. His main research interests include corporate governance, employee ownership and company based savings plans. He is a research fellow at the French Institute of Corporate Governance (IFGE/EM Lyon). His research has been published in Journal of financial services research, Finance, Economic Modelling.

Xavier Hollandts: Associate Professor, Kedge Business School (France).

Ph.D in Management Science, he’s associate professor at Kedge Business School (France). Research fellow of CRCGM and IFGE (France). His main research’s interest is on corporate governance and more precisely on the impact of employee participation on corporate strategy and performance. His research has been published in French-language journals (Management International, Revue Française de Gestion, Revue Française de

Gouvernance d’Entreprise) and international journals (Corporate Governance, Journal of Institutional Economics). Since 2012, he’s co-head of Alter-Governance Chair (CRCGM).

1 The authors wish to thank Thibault Daudigeos for helping us collecting the data.

2 Aix-Marseille University (CERGAM EA 4225), 13540, Puyricard, France , niaubert@gmail.com. Corresponding author.

3

French corporate governance institute.

2

How shared capitalism affects

employee withdrawal: An econometric case study of a French-listed

company

Abstract

The academic literature emphasizes that shared capitalism positively affects employees’ attitudes at work. This paper investigates that issue by testing the relationship between shared capitalism and withdrawal behaviors (turnover and absenteeism). Recent literature interprets shared capitalism as a gift exchange between employers and employees. This paper builds on that literature. The analysis, based on an econometric case study, focuses on a five-year panel dataset of more than 800 subsidiaries belonging to a unique French-listed company. Our results show that only long-term shared capitalism translates into better withdrawal behaviors.

Keywords: Shared capitalism, employee ownership, profit sharing, turnover, absenteeism. JEL: J33, J54, J63, L74, L85, M52

3

INTRODUCTION

It is often argued that employee participation in a firm’s financial performance aligns the interests of the employees with those of the employer. This would lead to better corporate performance through fewer withdrawal behaviors, namely, turnover and absenteeism, among others. Direct employee participation in a firm’s financial performance can take several forms, including profit sharing, gain sharing, employee ownership and broad-based stock options. Freeman et al (2010) define these practices as “employment relations where the pay or wealth of workers is directly tied to workplace or firm performance” and call them shared capitalism. They restrict this term to “plans that tie worker pay or wealth to the performance of their own workplace, whether at the level of the work group, establishment, or company” (p. 5). This definition excludes individual performance-based pay. Shared capitalism is widespread in several Western countries. According to Freeman et al (2010), almost half of American private-sector employees participate in shared capitalism. In the United Kingdom, 62% of employees are covered by at least one of the programs that comprise shared capitalismBryson and Freeman, 2010).

The literature underlines that, due to the combined effects of various HRM outcomes, shared capitalism positively affects corporate performance: the employee-owners are more satisfied, more involved and more motivated, and they develop a feeling of psychological ownership (Pierce et al, 1991) that improves their attitudes at work. From a collective point of view, shared capitalism has a positive impact on individual and collective outcomes, such as staff turnover and absenteeism. Recent attempts to investigate how shared capitalism affects absenteeism and turnover include Blasi et al (2010) and Kruse et al (2012). Blasi et al (2010) find that shared capitalism decreases turnover but increases absenteeism. Kruse et al (2012) also find that shared capitalism decreases turnover. In France, Brown et al (1999) investigate the relationship between profit sharing, employee ownership and absenteeism and find that whether they are separated or combined, profit sharing and employee ownership are associated with lower absenteeism. Fakhfakh (2004) emphasizes that employee ownership reduces voluntary quits, whereas pure profit sharing has no effect on this variable. Previous researchers’ conclusions are not unanimous regarding the effects of different forms of shared capitalism on withdrawal behaviors, namely, turnover and absenteeism.

This paper investigates the relationship between three shared capitalism practices and employees’ withdrawal behaviors, using a five-year panel dataset of more than 800 subsidiaries of a unique, French-listed corporation. By testing the relationship between turnover, absenteeism and shared capitalism in France, this paper is innovative in three ways. First, this paper tests how three shared capitalism practices—out of the four mentioned by Freeman et al (2010)—are related to turnover and absenteeism. Before Freeman et al (2010), shared capitalism was not systematically regarded as a unified management practice. Consequently, many empirical studies investigated the relationship between one specific form of shared capitalism and corporate performance. For instance, the literature investigated separately how employee ownership, profit sharing or gain sharing affects performance. Second, this paper tests the studied relationships in France, a country in which shared capitalism has been promoted since the 1960s. In 2010, more than half of the French private-sector workforce (excluding agricultural workers) had access to shared capitalism (DARES, 2012). This proportion is even higher than that reported by Freeman et al (2010). France also is a singular case because it is the only country in the world in which profit sharing is mandatory for all companies employing more than 50 people. Lastly, our empirical design is based on a recent approach, namely, an econometric case study. Following the suggestion of Jones et al (2010), this research design allows us to make a more in-depth test of the various forms of shared capitalism.

In this paper, we look at more than 800 subsidiaries belonging to a single, French-listed company over a five-year period. Our results demonstrate that shared capitalism decreases absenteeism and turnover and constitute a first step toward showing that employee ownership has an overall positive impact on a firm. This paper is organized as follows. Section 1 presents a literature review investigating the relationship between shared capitalism, absenteeism and turnover. It also formulates research hypotheses. Section 2 presents our empirical approach, which is based on an econometric case study of the subsidiaries of a French-listed company. Section 3 presents our results. Section 4 discusses those results and presents the perspectives created by this research. Section 5 is the conclusion.

LITERATURE REVIEW

Shared capitalism implements collective performance pay systems in the workplace. Shared capitalism results in employers and workers sharing in the benefits of increased production. However, Kruse et al (2010) mention two main reasons why shared capitalism is often criticized. First, shared capitalism results in free-riding behaviors: workers are not motivated to make a full effort at an N-person firm when in the end they only receive 1/Nth of the payoff for their effort. Second, shared capitalism puts a larger proportion of employees’ wealth and income at risk. Profit sharing and gain sharing affect employees’ income, and employee ownership affects their wealth. The first concern can be compensated for through employees’ mutual monitoring and improved

4

cooperation (Freeman et al, 2010). The second concern can be addressed by portfolio diversification (Markovitz et al, 2010) and/or a combination of various forms of shared capitalism, such as profit sharing and stock options (Blasi et al, 2010).

Despite these strong arguments, no theory won unanimity among the empirical researchers investigating the output of shared capitalism until recently. After a vast investigation of shared capitalism in the US economy, Kruse et al (2010, p. 378) conclude, “Our overall interpretation builds on the ideas of reciprocity and gift exchange, and the body of theory and research on bundles of high performance work practices”. Since then, Kruse et al (2012), Bryson and Freeman (2012) and Pendleton (2011) explicitly mention gift exchange and reciprocity as theoretical backgrounds that explain shared capitalism outputs. Bryson and Freeman (2012) investigate how employee stock purchase plan (ESPP) participation affects employees’ behaviors. Engelhardt and Madrian (2004) in the US and Rapp and Aubert (2011) in France emphasize that the decision to participate is affected by liquidity constraint, imperfect knowledge of the plan, asset choice and transaction costs. Bryson and Freeman (2012) offer another interpretation. Because stocks frequently are offered by the employer at a discounted price, they claim, an ESPP creates a gift exchange between workers and employers. They find that workers who have purchased shares at subsidized prices work harder for longer hours and have lower quit and absence rates than workers who do not join the plan; however, employees who are plan members are no more involved in co-monitoring the performance of fellow employees than are non-plan members. From this perspective, the link between shared capitalism and employees’ withdrawal can be viewed as a gift exchange involving reciprocity between an employer and its employees. Akerlof (1982) introduced the concept of gift exchange in economics to explain involuntary unemployment. He says that “On the worker’s side, the “gift” given is work in excess of the minimum work standard; and on the firm’s side the “gift” given is wages in excess of what these women could receive if they left their current jobs. As a consequence of worker sentiment for one another, the firm cannot deal with each worker individually, but rather must at least to some extent treat the group of workers with the same norms, collectively” (p. 544). Where shared capitalism exists, a gift exchange takes place between the worker and the employer. The employer gives the worker a share in the success of the business. The worker reciprocates this gift with a better attitude and behavior in the workplace, resulting in increased firm performance. Gift exchange also explains why collective incentives work.

The employees’ perception that the gift exchange is fair should decrease employees’ withdrawal by improving their attitudes in areas such as motivation, satisfaction, involvement and commitment. Mobley (1982) regards employee turnover and absenteeism as measuring employees’ withdrawal behaviors. However, turnover and absenteeism are not similar. These two phenomena demonstrate different stages of employee withdrawal. Mobley (1977) notes that absenteeism is one of the first phases of an employee’s process of progressive withdrawal, which may finally result in his voluntary departure. From this point of view, an employee’s withdrawal has several stages. Absenteeism is one of the first stages and leaving is the last.

On the empirical side, several studies investigate the relationship between various forms of shared capitalism and employees’ withdrawal. In an attempt to review the literature on employee financial participation, Pérotin and Robison (2003) conclude, “Schemes that offer a larger financial involvement have higher productivity effects. Cash profit-sharing schemes seem to have a short-term effect, whereas share schemes, which are more long-term oriented, probably have a more sustained effect.” Indeed, employee ownership is specifically mentioned because it engages employees and employers in a longer-term relationship. In the shared capitalism literature, some studies focus on employee ownership with the overall idea that long-term forms of shared capitalism could significantly decrease withdrawal behaviors. Kaarsemaker (2006) offers an exhaustive literature review of the empirical knowledge of the link between employee ownership and employees’ withdrawal. He finds that 59 studies worldwide are dedicated to understanding how employee ownership affects employees’ attitudes and behaviors. Ten out of these 59 studies look at turnover and absenteeism, and seven of them conclude that employee ownership affects turnover and/or absenteeism. Fakhfakh (2004), Brown et al (1999) and Festing et al (1999) collect data in France and investigate both profit sharing and employee ownership. Focusing on several European countries, Festing et al (1999) find that profit sharing negatively affects turnover and absenteeism, but their findings regarding employee ownership are not straightforward. Brown et al (1999) show that companies with employee ownership have significantly lower absentee rates than companies without employee ownership. In the study by Brown et al (1999), absenteeism decreases 14% at companies that provide only employee ownership, whereas the combination of profit sharing and employee ownership lead to an 11% decrease. When only profit sharing is implemented, the decrease in absenteeism is 7%. Fakhfakh (2004) shows that employee ownership always has a negative effect—that always is strongly significant—on employee voluntary quits. This association is not significant for profit sharing. This effect is all the more interesting in that it falls between the two extremes of employee withdrawal behavior: the initial stage (absenteeism) and the terminal stage (staff turnover). In the US context, Blasi et al (2010) find that shared capitalism affects workplace performance. Shared capitalism is linked to lower turnover. However, shared capitalism is inversely related to absenteeism. All of these results interact with other workplace practices such as high-performance policies, low levels of supervision and fixed pay at or above market levels. For instance, the

5

puzzling result pertaining to absenteeism disappears when controlling for its interactions with high-performance policies and closeness of supervision. Previous studies suggest that different forms of shared capitalism affect employees’ behaviors differently. Additionally, shared capitalism seems to be closely related to other workplace practices.

Taking into account the theoretical and empirical literature on the relation between employee ownership and absenteeism and turnover, we formulate the following hypotheses:

Hypothesis 1: There is a negative relationship between shared capitalism and turnover. Hypothesis 2: There is a negative relationship between shared capitalism and absenteeism. DATA AND METHODS

Data

Jones et al (2006) explain that “econometric case studies employ econometric methods and focus on a single organization, where the unit of analysis is typically some subunit of the organization (e.g., plant, production line, team or individual). It is a quite recent empirical approach that has crucially been influenced by the development of personnel economics”. This method is very appropriate to our empirical data. Indeed, we use a five-year panel (from 2003 to 2007) of 840 subsidiaries of a single, French-listed company. The subunit of the organization is the subsidiary. Although all of the French subsidiaries have access to the same employee ownership plan, each subsidiary’s manager is free to determine that subsidiary’s compensation policy mix. We voluntarily exclude foreign subsidiaries because shared capitalism plans are very different from one country to another, especially with respect to tax incentives. Such differences make comparisons very difficult. For instance, profit sharing is mandatory when a company has more than 50 employees. The 840 French subsidiaries that we studied hired 105,000 employees in 2007. By the time the data were collected (2008), the company had hired 158,000 employees around the world and had operations in five sectors: road, concession, energy, construction and real estate. The company studied had the 18th-highest total market capitalization on the Paris Stock Exchange and the top market capitalization in its industrial sector.

Employee ownership was introduced at the company in 1995. A representative of the employee-owners has held a seat on the board of directors since 2002. On average during the 2003-2007 period, employee ownership represented 9% of the shareholders’ equity. ESPPs are frequent in this company. They occur three or four times per year. Three employees out of four are employee-owners (72% in 2007). All of the ESPPs have been fully subscribed or oversubscribed. From 2003 to 2007, these transactions took place in a very favorable context; during this period the company stock price experienced an average annual increase of 25%. In France, amounts invested in an ESPP cannot be withdrawn during the first five years of the employee’s investment Early withdrawals are only possible in specific situations, such as layoff, divorce, bankruptcy, the purchase of a principal residence or the birth of a new child. French law authorizes a maximum 20% discount on the price of each stock purchased by a company’s employees. For the studied company, employee ownership gives rise to a strong feeling of belonging to the group, even though the company’s subsidiaries vary greatly in size. At the end of 2007, the average portfolio value was 10,110 Euros. Therefore, employee ownership is a significant part of the company’s compensation policy. In 2007, 326 million Euros were paid to 84% of the company’s French employees through gain-sharing and profit-sharing bonuses. This amount represents 1.5% of the French subsidiaries’ turnover.

Methods

Estimation model

The estimation model depends closely on the data. The distribution between 2003-2007 makes necessary the use of a panel data estimation model. Because the Hausman test is significant and indicates significant differences between random-effect and fixed-effect models, we use robust fixed-effect models to test our statistical models.

Dependent variables: withdrawal behaviors

Our study is interested in the relationship between shared capitalism and withdrawal behaviors. To measure withdrawal behaviors, we use two variables for each subsidiary and for each year: (i) turnover and (ii) absenteeism. Both variables measure employees’ withdrawal behavior. Staff turnover is measured by counting voluntary departures over the year, excluding departures due to retirement, the end of a fixed-term contract, the end of a training course or involuntary causes (illness, death, work accidents in the workplace and occupational diseases) (Fakhfakh, 2004). Absenteeism is measured by the days of absence for each subsidiary (Brown et al, 1999).

6

Our hypotheses suggest that shared capitalism has an impact on withdrawal behaviors. For each subsidiary and for each year, shared capitalism5 is measured using three variables: (1) employee ownership as the monetary value of the stocks held by all of the employees in a given subsidiary; (2) profit sharing as the annual monetary value of profit-sharing bonuses granted by the subsidiary to all of its employees; and (3) gain sharing as the annual monetary value of gain-sharing bonuses paid by the subsidiary to all of its employees.

Control variables

We include several control variables that affect withdrawal behaviors in the subsidiaries. Wilson and Peel (1990) and Fakkfakh (2004) state that the variables influencing withdrawal behaviors can be classified into five groups: the characteristics of the work, the characteristics of the compensation, the size of the company, the technological characteristics and the economic environment. The characteristics of the work in a given subsidiary are described in terms of the number of white-collar employees and average seniority. The characteristics of the compensation are described in terms of the total gross annual salary paid by the subsidiary to its employees. The subsidiary’s size is measured by the number of employees that it has. The technological characteristics are described using dummy variables that indicate whether a given subsidiary belongs to one of the following six sectors: road, concession, energy, construction, real estate and the head office. Each dummy variable takes a value of one if it belongs to the sector and zero if it does not.

5

Our measure of shared capitalism includes only three shared capitalism arrangements out of the four mentioned by Kruse et al (2010) because the studied firm does not use broad-base stock options.

7

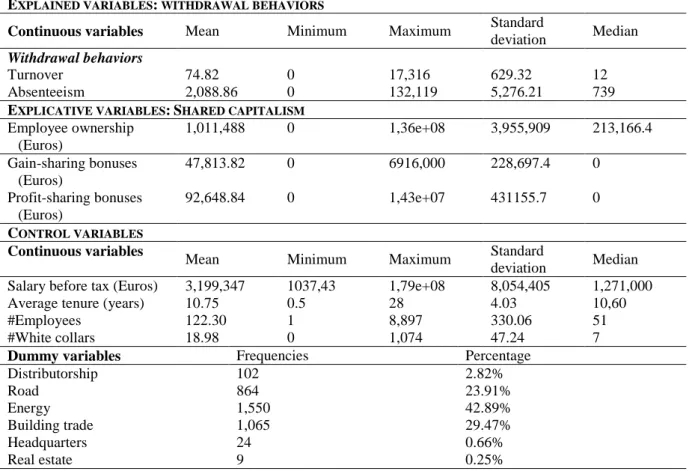

Table 1. Descriptive statistics

EXPLAINED VARIABLES: WITHDRAWAL BEHAVIORS

Continuous variables Mean Minimum Maximum Standard

deviation Median

Withdrawal behaviors

Turnover 74.82 0 17,316 629.32 12

Absenteeism 2,088.86 0 132,119 5,276.21 739

EXPLICATIVE VARIABLES:SHARED CAPITALISM

Employee ownership (Euros) 1,011,488 0 1,36e+08 3,955,909 213,166.4 Gain-sharing bonuses (Euros) 47,813.82 0 6916,000 228,697.4 0 Profit-sharing bonuses (Euros) 92,648.84 0 1,43e+07 431155.7 0 CONTROL VARIABLES Continuous variables

Mean Minimum Maximum Standard

deviation Median Salary before tax (Euros) 3,199,347 1037,43 1,79e+08 8,054,405 1,271,000 Average tenure (years) 10.75 0.5 28 4.03 10,60 #Employees 122.30 1 8,897 330.06 51 #White collars 18.98 0 1,074 47.24 7

Dummy variables Frequencies Percentage

Distributorship 102 2.82% Road 864 23.91% Energy 1,550 42.89% Building trade 1,065 29.47% Headquarters 24 0.66% Real estate 9 0.25%

8

Table 2. Correlation matrix

1 2 3 4 5 6 7 8 9 10 11 12 13 14

1. Absenteeism 1

2. Turnover 0.66*** 1

3. Employee ownership 0.62*** 0.56*** 1

4. Gain sharing (Euros) 0.65*** 0.52*** 0.67*** 1

5. Profit sharing (Euros) 0.77*** 0.76*** 0.69*** 0.60*** 1

6. Salary before tax (Euros) 0.82*** 0.71*** 0.66*** 0.62*** 0.64*** 1

7. White collar employees 0.58*** 0.46*** 0.67*** 0.57*** 0.44*** 0.77*** 1

8. Tenure (years) 0.04** -0.03** 0.02 0.01 0.01 0.00 -0.02 1 9. Employees 0.74*** 0.77*** 0.55*** 0.54*** 0.55*** 0.86*** 0.71*** -0.03* 1 10. Distributorship 0.25*** 0.3099*** 0.14*** 0.14*** 0.26*** 0.11*** 0.05*** -0.07*** 0.16*** 1 11. Road 0.08*** -0.03** -0.02 -0.03** -0.01 0.02* -0.05*** 0.26*** 0.02 -0.12*** 1 12. Energy -0.18*** -0.07*** -0.09*** -0.04** -0.08*** -0.13*** -0.1*** -0.05*** -0.14*** -0.18*** -0.45*** 1 13. Building trade 0.04** 0.01 0.04*** 0.02 0.01 0.07*** 0.12*** -0.16*** 0.07*** -0.13*** -0.34*** -0.52*** 1 14. Headquarters -0.01 -0.01 0.05*** -0.01 -0.01 0.03** 0.02* 0.08*** -0.01 -0.01 -0.04** -0.06*** -0.04*** 1 15. Real estate -0.01 0.00 0.06*** 0.08*** 0.03** 0.00 0.04** -0.02 0.00 -0.01 -0.03** -0.04*** -0.03** 0.00

9

Descriptive statisticsThe descriptive statistics and the correlations between the variables included in the regressions are displayed in tables 1 and 2. Table 1 shows that our sample is heterogeneous. There are large dispersions in staff turnover (Mean: 74.82, SD: 629.32) and absenteeism (Mean: 2,088.86, SD: 5,276.21). Although the size of some subsidiaries’ staff approaches that of a large group (Maximum staff: 8,897), some subsidiaries operate more like sole proprietors. We notice a great variability in gross annual salary (Mean: 3.19 million Euros, SD: 8 million Euros), profit-sharing bonuses (Mean: 92,648 Euros, SD: 431,155 Euros) and gain-sharing bonuses (Mean: 47,813 Euros, SD: 228,697 Euros). Finally, the employees of the studied company have spent a relatively short but homogeneous average time with the company (Mean: 10 years, SD: four years).

Table 2 displays the correlations between the variables included in the regression models. We note that the value of several coefficients is above 0.5. The variables concerned are the profit-sharing bonuses, #Employees and #White collars. These high coefficients suggest the presence of multicollinearity. The presence of possible multicollinearity problems among the explanatory variables has been tested in each of the models by means of variance inflation factors. The variables’ multicollinearity problems can cause instability in the regression coefficients. The variance inflation factor (VIF) measures the collinearity problem among the variables. In our case the average VIF is under 3.5. Craney and Surles (2002) consider the multicollinearity problems as arising when the VIF value is above 10.

RESULTS

Table 3. Relationships between shared capitalism and turnover

Model 1 Model 2 Model 3 Model 4

Employee ownership -4.43e-05*** -4.63e-05***

(1.40e-05) (1.22e-05)

Gain-sharing bonuses -5.42e-05 0.000171** (0.000108) (6.74e-05) Profit-sharing bonuses -0.000275 -2.52e-05

(0.000424) (0.000153) Gross salary 5.33e-06 -1.97e-05 -9.83e-06 3.55e-07

(8.13e-06) (2.08e-05) (3.12e-05) (1.49e-05) Average tenure -0.417 -0.725 -1.621 -0.734 (1.352) (1.242) (1.732) (1.436) #Employees 0.777 0.940*** 0.907*** 0.823*** (0.0499) (0.222) (0.224) (0.0568) #White collars 3.068 0.660 0.0578 2.470 (2.229) (1.586) (1.696) (1.835) Constant -35.77 21.56 41.26 -19.54 (42.62) (40.59) (44.03) (41.14) Number of observations 2,887 2,882 2,882 2,877 Number of subsidiaries 840 840 840 840 R-squared overall 0.32 0.44 0.14 0.30 F 64.96*** 19.44*** 20.25*** 85.49*** Notes: Employee ownership, profit-sharing bonuses, gain-sharing bonuses and gross salary are the total amount spent by a subsidiary in Euros. Average tenure is measured by the average number of years that employees have spent in a given subsidiary. #Employees and #White collars indicate, respectively, the numbers of employees and white-collar employees working for the subsidiary. Robust standard errors are reported in parentheses: * significant at 10%, ** significant at 5% and *** significant at 1%. To improve clarity and because they remain constant during the five-year period, we do not report coefficients that are associated with particular sectors.

10

How does shared capitalism affect turnover?Table 3 displays the results of the regression analyses for the two dependent variables investigated. The aim of this paper is to study the relationship between shared capitalism and withdrawal behaviors. Models 1 through 4 test the relationship between profit sharing, gain sharing, employee ownership and staff turnover.

We find that employee ownership is negatively and significantly associated with turnover (model 1). Models 2 and 3 show that the coefficients associated with gain sharing and profit sharing are not significant. Model 4 indicates that employee ownership has a significant and negative effect on staff turnover even when it is combined with the two other forms of shared capitalism. The coefficient associated with gain sharing becomes significant and positive, whereas the coefficient reported for profit sharing remains not significant. Because the relation between employee ownership and staff turnover is negative, this first result partially corroborates our Hypothesis 1.

Table 4. Relationships between shared capitalism and absenteeism

Model 5 Model 6 Model 7 Model 8

Employee ownership -0.000103* -0.000116*** (5.52e-05) (4.29e-05) Gain-sharing bonuses -0.00135 -0.000835 (0.000926) (0.000834) Profit-sharing bonuses 0.000570 0.00124* (0.000685) (0.000740) Gross salary 0.000352** 0.000338** 0.000265** 0.000333** (0.000139) (0.000161) (0.000124) (0.000133) Average tenure 12.85 12.88 13.60 17.53 (23.34) (23.80) (23.43) (21.14) #Employees -0.363 -0.392 0.171 -0.461 (0.892) (1.217) (1.236) (0.838) #White collars 23.83 22.99 18.92 29.76 (20.97) (22.52) (20.40) (23.22) Constant 509.5 527.9 634.0 340.1 (491.2) (556.3) (505.3) (559.8) Number of observations 2,793 2,789 2,789 2,785 Number of subsidiaries 816 816 816 816 R-squared overall 0.65 0.64 0.69 0.68 F 3.36** 2.22* 2.25** 2.93***

Notes: Employee ownership, profit-sharing bonuses, gain-sharing bonuses and gross salary are the total amount spent by a subsidiary in Euros. Average tenure is measured by the average number of years that employees have spent in a given subsidiary. #Employees and #White collars indicate, respectively, the numbers of employees and white-collar employees working for the subsidiary. Robust standard errors are reported in parentheses: * significant at 10%, ** significant at 5% and *** significant at 1%. To improve clarity and because they remain constant during the five-year period, we do not report coefficients that are associated with particular sectors.

How does shared capitalism affect absenteeism?

Models 5 through 8 test the relationship between shared capitalism and absenteeism. Employee ownership is negatively related to absenteeism, but the significance is very low (model 5). Models 6 and 7 show that the coefficients associated with gain sharing and profit sharing are not significant. Model 8 reports the combined effects of the three forms of shared capitalism. Employee ownership remains negatively related to absenteeism, but it has a higher significance. Profit sharing is positively associated with absenteeism, but it has a very low significance. Gain sharing is not significant. Again, these results partially corroborate our Hypothesis 2. To complete previous tests, we ran additional models to test the impact of increased participation in an ESPP on withdrawal behaviors.

11

Additional test: How does an ESPP affect employee withdrawal?Within the studied company, employees primarily acquire shares through an ESPP. Several factors can contribute to either encourage or deter employee participation in such a program. In an ESPP, an employer offers its employees the opportunity to buy company stock at a discounted price. The discount represents a gift that can be accepted or rejected by each employee. Bryson and Freeman (2012) find that employees who accept this gift by participating in the ESPP are entering in a gift-exchange relationship. They reciprocate the employer’s initial gift by adopting more favorable behaviors in the workplace. We investigate this assumption by testing how ESPP participation affects employees’ withdrawal (models 9 & 10). An additional dummy variable is created measuring whether the number of shares acquired by the employees through the ESPP increases or not. The dummy variable takes a value of one if the employees increase the number of their shares; if the employees do not increase the number of their shares, the dummy variable takes a value of zero. We use the number of shares instead of the amount of employee ownership to exclude variations among the portfolios due to increases in stock prices.

With respect to absenteeism, our results confirm the view developed by Bryson and Freeman (2012). Subsidiaries in which employees have increased their investment in company stocks through the ESPP have lower absenteeism (model 10). This assumption is not confirmed for turnover (model 9).

Table 5. Relationships between ESPP participation and employees’ withdrawal Model 9 Model 10

Turnover Absenteeism ESPP participation 1.623 -117.0**

(2.088) (56.82) Gross salary -2.15e-05 0.000296**

(2.08e-05) (0.000136) Tenure (years) -0.765 10.41 (1.200) (24.74) Employees 0.958*** 0.0645 (0.235) (1.231) White collars 0.452 17.80 (1.376) (20.07) Constant 25.78 748.3 (37.40) (470.6) Number of observations 2,887 2,793 Number of subsidiaries 840 816 R-squared overall 0.44 0.120 F 24.30*** 2.39**

Notes. ESPP participation takes a value of one if the participation in the subsidiary is positive and zero if it is not. Gross salary is the total amount spent by a subsidiary in Euros. Average tenure is measured by the average number of years that employees have spent in a given subsidiary. #Employees and #White collars indicate, respectively, the numbers of employees and white-collar employees working for the subsidiary. Robust standard errors are reported in parentheses: * significant at 10%, ** significant at 5% and *** significant at 1%. To improve clarity and because they remain constant during the five-year period, we do not report coefficients that are associated with particular sectors.

To test the sensitivity of our results to the method of estimation, we checked the stability of our results when the dependent variables were shifted by one year. This shift permits an eventual simultaneity of data bias to be neutralized. We found that our results remain stable except for the relationship between employee ownership and turnover, which becomes insignificant. We also replaced the amount of employee ownership with the number of employee owners for a given subsidiary. This confirms the negative relationship between employee ownership and absenteeism. The coefficient associated with the number of employee owners is not significant when turnover is the dependent variable. Another concern is the distribution of the dependent variables. Indeed, the dependent variables are count variables (specifically, the number of days of absences and the number of voluntary quits). Poisson regressions are recommended in this instance. We did not find that running all of the analyses using Poisson regression models affects our results. Only models 5 and 6 (absenteeism) are affected.

12

Employee ownership, which was weakly significant, is no longer significant. Gain sharing becomes significant at the 10% level.6

DISCUSSION

The aim of this paper is to test the impact of different forms of shared capitalism on withdrawal behaviors. We find that our research hypotheses are corroborated to a great extent. Shared capitalism is a concept with several dimensions. We chose to measure three out of the four forms of shared capitalism. Profit sharing and gain sharing allow us to capture short-term shared capitalism policies, whereas employee ownership is a long-term shared capitalism policy. Our measure of employee ownership (total amount of employee ownership in Euros) enabled us to capture both the intensity and the duration of the employees’ investments. The major point of our study is to note the different impacts of short-term and long-term forms of shared capitalism. Taken together, our results show that, unlike short-term forms of shared capitalism, employee ownership always has a significant and negative effect on withdrawal behaviors.

Our overall results are in line with Blasi et al (2010) and Kruse et al (2012) concerning the impact of employee ownership turnover, but we also find that long-term shared capitalism in the form of employee ownership can have a significant (and negative) impact on absenteeism.

Our results call for several comments. The results show that employee ownership always has a strong impact on withdrawal behaviors, from the initial stage of withdrawal to turnover. We test the impact of employee ownership both separately and combined with other forms of shared capitalism. When all forms of shared capitalism are combined, our results highlight the contrasting impacts of short-term and long-term forms of shared capitalism. More precisely, model 4 suggests that employee ownership has a strong and negative impact on turnover, whereas gain sharing has a small but positive impact on turnover. Model 8 suggests that employee ownership has a negative impact on absenteeism, but profit sharing has a positive impact. When we test the isolated impact of profit sharing and gain sharing, we find that they have no significant impact on withdrawal behaviors. Whatever the specification of our model, the results highlight the significant (and negative) impact of employee ownership on turnover and absenteeism. This major result shows that, to some extent, long-term shared capitalism seems to initiate a stronger association between an employer and its employees. By contrast, our results show that short-term forms of shared capitalism (namely, gain sharing and profit sharing) have no significant impact on withdrawal behaviors. The literature reports these dissimilar impacts, especially the difference between the impact of profit sharing and that of employee ownership. For instance, Bryson and Freeman (2012), Blasi et al (2010), Brown et al (1999) and Fakhfakh (2004) report differences between employee ownership and profit sharing. This research stream suggests that short-term forms of shared capitalism have no impact on long-term behaviors such as withdrawal. Because withdrawal behaviors are progressive in nature, it seems quite logical to find an association only with the long-term form of shared capitalism. Gain-sharing and profit-Gain-sharing bonuses are defined on a short-term horizon. Gain Gain-sharing and profit Gain-sharing are yearly programs: they cannot produce a significant impact on withdrawal behaviors, which are more progressive and could take more than a year. By strongly associating employees with the firm, employee ownership seems to be an especially accurate method of addressing the problem of withdrawal behaviors.

Our article suggests that the gift-exchange approach (see section 1) is relevant to explain such behaviors. The gift-exchange approach suggested by Kruse et al (2012), Bryson and Freeman (2012) and Pendleton (2011), among others, receives strong support from our study. Employee ownership is more complex than gain sharing and profit sharing, and it allows the firm to build a closer relationship with employees.7 Employees consider the opportunity of employee ownership (and the associated discount) as a gift and tend to give a reciprocal “gift” to the firm, translated, for example, into lower turnover and absenteeism rates. In addition, our test of an ESPP’s impact on withdrawal behaviors gives additional support to this view by suggesting that employees respond to their employer’s gift of a discount on company stock (or the equivalent in free shares) by agreeing to participate. In fact, the results from model 10 also suggest that there is a more significant effect on absenteeism when employee ownership is measured in terms of ESPP participation (table 4 vs table 5). Our interpretation of this result considers that the decision to increase the employee ownership stake is more important than the total amount invested. This can be viewed as a gift exchange between employer and employees. Our results suggest, consistent with Bryson and Freeman (2012), that employees reciprocate the company’s initial gift of a discount on company stock.

Further, it should be remembered that employee ownership is a collective incentive scheme. Our hypotheses are corroborated by the amount of employee ownership of the subsidiary. In this respect, it should be made clear

6 The results of all additional analyses are available from the authors on request.

7 It should be noted that there are strong links between gain sharing/profit sharing and employee ownership. However, our study and the literature show that the longer the form of shared capitalism, the better the results for firms.

13

that the two dimensions of withdrawal behaviors implicate different phenomena. Mobley (1977) notes that absenteeism is one of the first phases of a process of progressive withdrawal by the employee, which can have as a final result his departure on his own initiative. From this point of view, an employee’s withdrawal has several phases. Absenteeism is one of the first and leaving is the last. This analysis may explain the differences in the results obtained—namely, that employee ownership has a weaker effect on staff turnover than it does on absenteeism. From a broader point of view, employee ownership is a powerful means of retaining employees and increasing the fidelity of human capital, and it acts as a “stabilizing force” (Blair et al, 2000). We choose to measure employee ownership by the total amount of employee ownership in Euros. This enables us to measure both the intensity and the duration of the investments the employees made. Replacing this monetary measure of employee ownership with the number of employee owners affects our results regarding turnover. Our results also confirm the view that employee ownership should be regarded as a gift exchange. Indeed, the amount invested reflects both the intensity of employees’ investment in their company and their willingness to engage in a long-term relationship. The results that we find by analyzing the number of employee owners is different because the number of employee owners can be very high even though each individual employee may have a very low stake.

Some limitations of this study include the measures that we used and the characteristics of the data. As far as the data are concerned, their characteristics make it difficult to generalize our results. One of the specificities of our sample comes from the sector analyzed. The main activities of the company studied mostly belong to the construction sector. This sector is characterized by precarious working conditions, strong labor mobility and weak qualifications. In this context, employee ownership has a different meaning than in other sectors, such as services or innovating businesses, as noted by Blair et al (2000).

CONCLUSION

This paper studies the relationship between different forms of shared capitalism and employees’ withdrawal measures. The analyses addressed more than 800 subsidiaries of a French listed company over a five-year period. We show that employee ownership is negatively and significantly associated with turnover and absenteeism, whereas gain sharing and profit sharing are not. From a managerial point of view, our results suggest that companies wishing to promote shared capitalism should first try a long-term form of shared capitalism and employee investment. In pursuing this goal, however, the risk to the employees of losing their investments should not be underestimated. Both our contribution and its limits call for new lines of research. The number of studies on the effects of employee ownership in France is small. However, employee ownership is encouraged by numerous tax incentives; thus, many companies make important efforts to develop it. One might have expected that the empirical evidence for its beneficial effects would be more plentiful. Therefore, these studies must be conducted in different contexts, incorporating particularly the fundamental concept of employee involvement in decision making. One suitable methodological direction, as suggested by Jones et al (2006), could be to develop more econometric case studies in order to take advantage of more in-depth research designs.

14

References

Blair, Margaret M., Kruse, Douglas L. and Blasi, Joseph R. (2000) Employee Ownership: An Unstable Form? Or a Stabilizing Force?. In Margaret M. Blair and Thomas A. Kochan (eds.), The New Relationship: Human Capital in the American Corporation. Washington D.C: The Brookings Institution.

Blasi, Joseph R., Conte, Michael, and Kruse, Douglas L. (1996). Employee Stock Ownership and Corporate Performance Among Public Companies. Industrial and Labor Relations Review, 50(1) 60-79.

Blasi, Joseph R., Kruse, Douglas L. and Markovitz, Harry M. (2010). Risk and Lack of Diversification under Employee Ownership and Shared Capitalism. In Kruse, Douglas L., Freeman, Richard. B., Blasi, Joseph. (Eds), Shared capitalism at work: employee ownership, profit and gain sharing, and broad-based stock options, NBER and University of Chicago Press, Chicago, IL.

Blasi, Joseph R., Freeman, Richard B., Mackin, Christopher and Kruse, Douglas L. (2010). Creating a bigger pie: The Effects of Employee Ownership, Profit Sharing, and Stock Options on Workplace Performance in Kruse Douglas L., Freeman Richard B., Blasi Joseph R. (Eds), Shared capitalism at work: employee ownership, profit and gain sharing, and broad-based stock options, NBER and University of Chicago Press, Chicago, IL.

Brown, Sarah, Fakhfakh, Fathi and Sessions, John G. (1999). Absenteeism and Employee Sharing: an Empirical Analysis Based on French Panel Data, 1981-1991. Industrial and Labor Relations Review, 52(2) 234-251. Bryson, Alex, and Freeman, Richard B. (2012). Company Share Plans - Gift or Incentive? Evidence from a Multinational Corporation. American Economic Association annual meeting.

Craney, Trevor A. and Surles, James G. (2002). Model-dependent Variance Inflation Factor Cutoff Values.

Quality Engineering, 14(3) 391–403.

Engelhardht, Gary V. and Madrian, Brigitte C. (2004). Employee Stock Purchase Plans. National Tax Journal, 57(2) 385-406.

Fakhfakh, Fathi. (2004). The Effect of Profit Sharing and Employee Share Ownership on Quits: Evidence from a French Panel Firms, Employee Participation, Firm Performance and Survival. Advances in the Economic Analysis of Participatory and Labor Managed Firms, 8 129-147.

Festing Marion, Groening, Y., Kabst, R. and Weber, W. (1999). Financial Participation in Europe - Determinants and Outcomes. Economic and Industrial Democracy, 20(2) 295-329.

Freeman, Richard B., Kruse, Douglas L., Blasi, Joseph R. (2010). Worker Response to Shirking under Shared Capitalism. In Kruse, Douglas L., Freeman, Richard B., Blasi, Joseph R. (Eds), Shared capitalism at work:

employee ownership, profit and gain sharing, and broad-based stock options, NBER and University of Chicago Press, Chicago, IL.

Hsieh, An-Tien, and Liu, Li-Ling. (2006). The Re-examination of the Relationship Between Employee Stock Ownership and Voluntary Employer Change Intention in Taiwan. International Journal of Human Resource Management, 17(1) 174-189.

Jones, Derek C., Kalmi, Panu and Kauhanen, Antti. (2006). Human Resource Management Policy: New Evidence from an Econometric Case Study. Oxford Review of Economic Policy, 22(4) 526-538.

Jones, Derek C., Kalmi, Panu, and Kauhanen, Antti. (2010). How Does Employee Involvement Stack Up? The Effects of Human Resource Management Policies on Performance in a Retail Firm. Industrial Relations, 49(1) 1–21.

Kaarsemaker Eric C.A. (2006). Employee Ownership and its Consequences: Synthesis-generated Evidence for the Effects of Employee Ownership and Gaps in the Research Literature. University of York.

Kruse, Douglas L. (2002). Research Evidence on the Prevalence and Effects of Employee Ownership. Journal of Employee Ownership, Law and Finance, 14(4) 65-90.

Kruse, Douglas L. and Blasi, Joseph R. (1997). Employee Ownership, Employee Attitudes, and Firm Performance: A review of the evidence. In Mitchell, Daniel J. B., Lewin, David. and Zaidi, Mahmood (Eds), Handbook of Human Resource Management, JAI Press.

Kruse, Douglas L., Freeman, Richard B., and Blasi, Joseph R. (2010). Shared capitalism at work: employee ownership, profit and gain sharing, and broad-based stock options, NBER and University of Chicago Press, Chicago, IL.

Kruse, Douglas L., Blasi, Joseph R., and Freeman, Richard B. (2012). Does linking worker pay to firm performance help the best firms to do even better, NBER Working paper n°17745. Cambridge, MA: National Bureau of Economic Research.

Mobley, William H. (1977). Intermediate Linkages in the Relationship between Job Satisfaction and Employee Turnover. Journal of Applied Psychology, 62(2) 237-240.

Mobley, William H. (1982). Some unanswered questions in turnover and withdrawal research. Academy of Management Review, 7(1) 111-116.

Pendleton, Andrew. (2011). Employee Stock Ownership as a Gift Exchange. 2011-2012 Beyster Symposium & Mid-Year Fellows Workshop in Honor of Louis O. Kelso, 8-11 December.

15

Pérotin, Virginie and Robinson, Andrew. (2003). Employee Participation in Profit and Ownership, European Parliament, working paper SOCI 109.

Pierce, Jon L., Rubenfeld, Stephen and Morgan Susan. (1991). Employee Ownership: a Conceptual Model of Process and Effects. Academy of Management Review, 16(1) 121-144.

Rapp, Thomas and Aubert, Nicolas. 2011. Bank Employee Incentives and Stock Purchase Plans Participation. Journal of Financial Services Research, 40(3) 185-203.

Wilson, Nicholas and Peel, Michael. J. (1990). The Impact on Absenteeism and Quits of Profit-Sharing and Other Forms of Employee Participation. Industrial and Labor Relations Review, 44(3) 454-468.