no

1'

MIT LIBRARIES

DEWEY)'

3

9080 03316 3293

\o-0l

Massachusetts

Institute

of

Technology

Department

of

Economics

Working

Paper

Series

Competing

Engines

of

Growth:

Innovation

and

Standardization

Daron

Acemoglu

Gino Gancia

Fabrizio

Zilibotti

Working

Paper

10-7

April 23,

20

10

Room

E52-251

50

Memorial

Drive

Cambridge,

MA02142

This paper can be

downloaded

without chargefrom

theCompeting

Engines

of

Growth:

Innovation

and

Standardization*

Daron

Acemoglu

Gino Gancia

Fabrizio

ZilibottiMIT

CREi

and

UPF

University

of

Zurich

April

2010

Abstract

We

study adynamic general equilibrium model where innovation takes theformoftheintroduction

new

goods,whose production requires skilledworkers.Innovation is followed by a costly process of standardization, whereby these

new

goods are adapted to be produced using unskilled labor.Our

framework highlights anumber

ofnovel results. First, standardization is both an engineof growth and a potential barrier to it.

As

a result, growth in an inverse U-shaped function ofthe standardization rate (and of competition). Second,we

characterize thegrowth and welfare maximizingspeed ofstandardization.

We

show

how

optimalIPR

policies affecting the cost ofstandardization vary withthe skill-endowment, the elasticity of substitution between goods and other

parameters. Third,

we

show that the interplay between innovation andstan-dardization

may

lead to multiple equilibria. Finally,we

studythe implications of our model for the skill-premium andwe

illustrate novel reasons for linking North-South trade to intellectual property rights protection.JEL

classification: F43, 031, 033, 034.Keywords: growth, technology adoption, competition policy, intellectual

propertyrights.

*We

thank seminar participants at theSED

Annual Meeting (Boston, 2008), Bank of Italy,theKielInstitute, CERGE-EI, University ofAlicanteand theREDg-Dynamic General Equilibrium

MacroeconomicsWorkshop (Madrid, 2008) forcomments. Gino Ganciaacknowledgesfinancial

sup-port from the Barcelona GSE, the Government of Catalonia and the

ERC

GrantGOPG

240989. Fabrizio Zilibotti acknowledgesfinancialsupport from theERC

Advanced Grant IPCDP-229883.Digitized

by

the

Internet

Archive

in

2011

with

funding

from

1

Introduction

The

diffusion ofnew

technologies is often coupled with standardization ofproduct

and

process innovations.New

technologies,when

first conceivedand

implemented,are often

complex

and

require skilled personnel to operate.At

this stage, their usein the

economy

is limitedboth by

the patents of the innovatorand

the skills thatthese technologies require. Their widespread adoption

and

use first necessitates thetasks involved in these

new

technologies tobecome more

routineand

standardized,ultimately enabling their cheaper production using lower-cost unskilled labor.

How-ever, such standardization not only

expands

output but also implies that the rentsaccruing to innovators will

come

toan end. Therefore, the process ofstandardizationis

both an

engine ofeconomic growth and

apotential discouragement to innovation.In this paper,

we

study this interplaybetween

innovationand

standardization.The

history ofcomputing

illustrates the salient patterns of this interplay.The

use of silicon chips

combined

with binary operations were the big breakthroughs,starting the

ICT

revolution.During

the first 30 years of their existence,computers

could only

be

usedand produced by

highly skilled workers.Only

a lengthy processofstandardization

made

computers

and

silicon chipsmore

widely availableand

more

systematically integrated into the production processes, to such a degree that

today

computers

and

computer-assisted technologies are used at every stage ofproduction with workers ofvery different skill levels.At

thesame

time that the simplification ofmanufacturingprocesses allowed

mass

productionofelectronicdevicesand

lowprices,,competition

among

ICT

firms intensifiedenormously,firstamong

fewindustry leadersand

thenmore

broadly at a global scale.In our model,

new

products are invented via costlyR&D

and

can first bepro-duced

onlyby

skilled workers. This innovation process is followedby

acostlyprocessof standardization,

whereby

the previouslynew

goods areadapted

tobe

produced

using unskilled labor.1

Free entry into standardization

makes

it a competingprocess;standardization will be undertaken

by

newcomers,which

may

then displaceincum-bent producers.

By

shiftingsome

technologies to low-skill workers, standardizationalleviates the pressure

on

scarcehigh-skill workers, thereby raising aggregatedemand

This view hasaclear antecedent in Nelson andPhelps (1966), which we discussfurther below. See also Autor, Levy and Murnane (2003) on the comparative advantage of unskilled workers in routine, or in our language "standardized," tasks.

We

can also interpret innovation as product innovation and standardization as process innovation. Evidence that firms engaging in product innovation (e.g., Cohen andKlepper, 1996) are smaller andmoreskillintensivethanfirms engagingand

fostering incentivesforfurtherinnovation. Yet, the anticipation ofstandardization also reduces the potential profitsfrom

new

products, discouraging innovation.This

implies that while standardization

—

and

the technology adoption that it brings—

isan

engine ofeconomic

growth, it can also act as a barrier togrowth

by

potentiallyslowing

down

innovation.Our

baselineframework

provides asimplemodel

for the analysis ofthis interplay.Under

some

relatively mild assumptions,we

establish the existence of a uniquebal-ance

growth path

that is saddle-path stable.We

show

that equilibriumgrowth

isan

inverseU-shaped

function ofthe "extent ofcompetition" capturedby

the cost ofstandardization.

When

standardization is very costly,growth

is relatively slowbe-cause

new

products use skilled workers for a long whileand

this reducestheir scale ofproduction

and

profitability.On

the otherhand,when

standardization isvery cheap,growth

isagain relativelyslow, this timebecauseinnovators enjoy ex postprofitsonlyfora short while. Thisinverse

U-shaped

relationshipbetween

competitionand growth

is consistent with the empirical findings in

Aghion

et al. (2005),and

complements

the theoretical channel highlighted in

Aghion

et al. (2001, 2005),which

is drivenby

the interplay of their "escape competition"

mechanism

and

the standard effects ofmonopoly

profitson

innovation.In our model, the laissez-faire equilibrium is inefficient for

two

reasons. First, asin

many

models

ofendogenous

technology, there is an appropriability problem:both

innovating

and

standardizing firms are able to appropriate only a fraction of thegain inconsumer

surplus createdby

their investmentand

thismakes

thegrowth

rate toolow. Second, there is a

new

form

of "business stealing" effect,whereby

the costlystandardization decisions reduce the rents of innovators.2

The

possibility that the laissez-faire equilibrium is inefficientand

thatgrowth

ismaximized by

intermediatelevels of competition implies that welfare

and growth maximizing

policies are notnecessarily those that provide

maximal

intellectual property rights (IPR) protectionto innovators.

Under

theassumption

that agovernment

can affectmarkups

and

the cost of standardization by regulating

IPR

protection,we

characterizegrowth

and

welfaremaximizing

combinations ofIPR

and

competition policies.Contrary

tomost

ofthe literature, the optimal policy is not the result of atrade-offbetween

the static cost ofmonopoly

power

and dynamic

gains. Rather, in ourmodel an

excess2Another form

ofbusiness stealing, studied extensively in Schumpeterian models ofvertical

in-novation (e.g.,Aghionand Howitt 1992), iswhenamonopolyis destroyedbynewfirmsintroducing a "better" version of an existing products.

We

suggest that standardization is also an important sourceofbusiness stealing.of property right protection

may

harm

growth

by

increasing the overload on skilledworkers,

which

are in short supply.When

the discount rate is small,we

find thatgrowth and

welfaremaximizing

IPR

policy involves lower protectionwhen

R&D

costs (fornew

products) are lower,when markups

fornew

products are higherand

when

theratio of skilledto unskilledlabor supply is greater.

The

latter comparative static result is a consequence of thefact that

when

there is a large supply of unskilled labor, standardizationbecomes

more

profitableand

thus innovators require greater protection againststandardiza-tion.

We

alsoshow

thatwhen

competition policy as well asIPR

policy can be used, the optimal combination of policies involvesno

limitson

monopoly

pricing fornew

products, increased competition for standardized products

and

lowerIPR

protectionthan

otherwise. Intuitively, lowerIPR

protection minimizes wasteful entry costs,but

this

may

lead to excessive standardizationand

weak

incentives to innovate.To

max-imize

growth

or welfare, this lattereffect needs to be counteractedby

lowermarkups

for standardized products.

We

alsoshow

that trade liberalization in less-developedcountries

may

create negativeeffectson growth by

changing the relativeincentives toinnovate

and

standardize. However, ifincreasedtrade openness is coupled by optimalIPR

policy, it always increases welfareand

growth.Finally,

we

show

that underdifferentparameterconfigurations ordifferentassump-tions

on

competitionbetween

innovatorsand

standardizers, anew

typeof multiplicity ofequilibria (ofbalancedgrowth

paths) arises.When

toomuch

ofthe resources oftheeconomy

are devoted to standardization, expected returnsfrom

innovation are lowerand

this limits innovative activity. Expectation of lower innovation reduces interest ratesand

encourages further standardization. Consequently, there exist equilibria with different levels (paths) of innovationand

standardization. It is noteworthythatthis multiplicity does notrely

on

technologicalcomplementarities (previously studiedand emphasized

in the literature),and

hasmuch

more

ofthe flavor of "self-fulfilling equilibria,"whereby

therelativepriceschangeinorder tosupport equilibriaconsistentwith initial expectations.

Our

paper is related to several different literatures. In addition to the endoge-nousgrowth and

innovation literatures (e.g.,Aghion and

Howitt, 1992,Grossman

and

Helpman,

1991,Romer,

1990, Segerstrom,Anant

and

Dinopoulos, 1990, Stokey,1991), there are

now

severalcomplementary frameworks

for the analysis oftechnol-ogy

adoption.These

can be classified into three groups.The

first includesmodels

based

on

Nelsonand

Phelps's (1966) important approach, with slow diffusionofthe workers

employed by

the technology adopting firms. Thisframework

isincor-porated into different types of

endogenous

growth

models, for example, inHowitt

(2000),

Acemoglu,

Aghion

and

Zilibotti (2006),and

Acemoglu

(2009,Chapter

18).Several papers provide

more

microeconomic

foundations for slow diffusion.These

include,

among

others, Jovanovicand

Lach

(1989), Jovanovicand Nyarko

(1996),Jo-vanovic (2009)

and

Galorand Tsiddon

(1997),which

model

eithertheroleoflearning orhuman

capital in the diffusion of technologies.The

secondgroup

includespa-pers emphasizing barriers to technology adoption. Parente

and

Prescott (1994) isa

well-known example.

Acemoglu

(2005) discusses thepoliticaleconomy

foundations ofwhy

some

societiesmay

choose to erect entry barriers against technology adoption.The

final group includesmodels

inwhich

diffusion of technology is sloweddown

orprevented because of the inappropriateness of technologies invented in one part of the world to other countries (see, e.g.,

Acemoglu

and

Zilibotti, 2001, Atkinsonand

Stiglitz, 1969,

Basu and

Weil, 1998and

David, 1975).Gancia

and

Zilibotti (2009)propose a unified

framework

for studying technology diffusion inmodels

ofendoge-nous

technical change.Our

approach

emphasizing standardization is different from,though

complementary

to, all three groups ofpapers.Our

paper

is also related toKrugman's

(1979)model

ofNorth-South

tradeand

technologydiffusion,

whereby

theSouth

adoptsnew

products withadelay.Krugman,

inturn,

was

inspiredby

Vernon's (1966)model

oftheproduct cycleand

hisapproach

has

been

further extendedby

Grossman

and Helpmarf

(1991)and

Helpman

(1993).3Our

approach differsfrom

all thesemodels

because innovationand

standardizationmake

different use ofskilledand

unskilled workersand

becausewe

focuson

a closedeconomy

general equilibrium setup ratherthan

the interactionsbetween

technolog-ically

advanced

and backward

countries as in these papers.A

new

implication ofour alternative set of assumptions is that, differently

from

previous models,growth

is

an

inverse-U function of standardization.More

importantly,none

of theabove

paper characterizes the optimal

IPR

policyand

how

it varies with skill abundance.Grossman

and

Lai (2004)and

Boldrinand

Levine (2005) study the incentives thatgovernments have

toprotect intellectual property ina tradingeconomy.

Their frame-work, however, abstractsfrom

the technology adoption choiceand from

the role ofskill

which

are central to our analysis.Finally,our

emphasis on

theroleofskilledworkers in theproductionofnew

goods

and

unskilled workers inthe production ofstandardizedgoods

makes

our paper also3

Similar themes are also explored in Bonfiglioli and Gancia (2008), Antras (2005), Dinopoulos

related to the literature

on

technological changeand

wage

inequality; see,among

others,Acemoglu

(1998, 2003), Aghion, Howittand

Violante (2002), Caselli (1999),Galor

and

Moav

(2000),Greenwood

and Yorukoglu

(1997),and

Krusell,Ohanian,

Rios-Rull

and

Violante (2000).The

approach

in Galorand

Moav

(2000) isparticu-larly related, since their notion of ability-biased technological change also generates

predictions for

wage

inequality similar to ours,though

theeconomic

mechanism and

other implications are verydifferent.

The

rest ofthepaper is organized as follows. Section2 builds adynamic model

ofendogenous growth

throughinnovationand

standardization. Itprovides conditionsfortheexistence, uniqueness

and

stability ofadynamic

equilibriumwith balancedgrowth

and

derives an inverse-U relationshipbetween

the competitionfrom

standardizedproducts

and

growth. Section3 presents the welfareanalysis. Afterstudyingthe firstbest allocation, it characterizes

growth

and

welfaremaximizing

IPR

and

competition policies as function of parameters.As

an application oftheseresults,we

discusshow

trade liberalization in less developed countries affects innovation, standardization

and

the optimal policies. Section 4shows

how

a modified version of themodel

may

generate multiple equilibria

and

poverty traps. Section 5 concludes.2

A Model

of

Growth

through

Innovation

and

Standardization

2.1Preferences

The economy

is populatedby

infinitely-lived householdswho

deriveutility fromcon-sumption

C

tand

supply labor inelastically. Households arecomposed by two

typesof agents: high-skill workers, with aggregate supply

H,

and

low-skill workers, with aggregate supply L.The

utility function of the representative household is:U=

/

e~pt

log

C

tdt,Jo

where

p>

is the discount rate.The

representative household sets aconsumption

plan to

maximize

utility, subject to an intertemporal budget constraintand

aNo-Ponzi

game

condition.The

consumption

plan satisfies the standard Euler equation:^=r

t-p,

(1)where

rt is the interest rate. Time-indexes are henceforth omittedwhen

this causes2.2

Technology

and

Market

Structure

Aggregate output, Y, is a

CES

functiondenned

over ameasure

A

ofgoods

availablein the economy.

As

inRomer

(1990), themeasure

ofgoods

A

captures the level oftechnological

knowledge

that grows endogenouslythrough

innovation. However,we

assume

that,upon

introduction,new

goods

involvecomplex

technologies thatcan

only

be

operatedby

skilled workers. After a costly process of standardization, the production process is simplifiedand

thegood

can thenbe produced by

unskilledworkers too. Despite this

change

in the production process,good

characteristicsremain

unaltered sothat all varieties contribute tofinal output symmetrically.Thus,

Y

is defined as: / fA

$=i\

«=* / [Al «=i l' A» «=i \«^

Y =

ZU

V

di)= z

(A

x

L,i di+

j

oxfr

dij , (2)where

Ah

is themeasure

ofhi-tech goods,Al

is themeasure

of low-tech (standard-ized)goods

and

A =

A

H

+ A

L. e>

1 is the elasticity ofsubstitutionbetween

goods.The

term

Z =

A

c~l is a normalizingfactor that ensures that output is linear intech-nology

and

thusmakes

the finalgood

production function consistent with balancedgrowth

(without introducing additional externalities inR&D

technology aswe

willsee below).

To

see why, note that with this formulationwhen

X{—

x, aggregateproductivity,

Yj

(Ax), is equal toA

—

as inAK

models.4From

(2), the relativedemand

forany two goods

i,jE

A

is:/ \ ~1/e

'"

' * »

. (3)

We

chooseY

tobe

thenumeraire, implying that theminimum

cost ofpurchasing one unit ofY

must be

equal to one:Each

hi-techgood

isproduced by

a monopolist with a technology that requiresone unit of skilled labor per unit of output.

Each

low-techgood

isproduced

by

a4

Thecanonical endogenous growth models that do not feature the

Z

term and allow for a^

2(e.g., Grossman and Helpman, 1991) ensure balanced growth by imposing an externality in the innovation possibilities frontier

(R&D

technology). Having the externalityin the production goodmonopolist withatechnologythat requiresoneunit oflaborper unit of output. Thus,

the marginal cost is equal to the

wage

of skilled workers,w

H

, for hi-tech firmsand

the

wage

of unskilled workers, wl, for low-tech firms. Since high-skill worker canbe

employed by

both high-and

low-tech firms, thenwh

>

wl-When

standardization occurs, there aretwo

potential producers (a high-and

alow-tech one) for the

same

variety.The

competitionbetween

these producers isdescribed

by

a sequential entry-and-exit game. In stage (i) a low-tech firm can enterand produce

a standardized version ofthe intermediate variety. Then, in stage (ii),the

incumbent

decideswhether

to exit or fight the entrant. Exit isassumed

tobe

irreversible, i.e.,

when

a hi-tech firmleaves themarket

it cannot go backto itand

thelow-tech firm

becomes

a monopolist. If theincumbent

does not exit, thetwo

firmscompete

d laBertand

(stage (hi)).We

assume

that all firms entering stage (iii)must

produce

(and thuspay

the cost ofproducing) at least £>

units ofoutput (without this assumption, stage (ii)would

be vacuous, asincumbents

would

have a "weaklydominant"

strategyofstaying inand

producingx

—

in stage (iii)).Regardless of the behavior of other producers or other prices in this economy, a subgame-perfectequilibrium ofthis

game

must

havethe followingfeatures: standard-ization in sector j willbe

followedby

the exit of the high-skillincumbent whenever

Wh

>

wl- Iftheincumbent

didnot exit, competition in stage (iii)would

result in allofthe

market

being capturedby

the low-tech firmdue

to its cost advantageand

theincumbent would

make

a losson

the £>

units that it is forced to produce. Thus, as long as the skillpremium

is positive, firms contemplating standardization canig-nore

any

competitionfrom

incumbents. However, ifw

H

<

w

Lincumbents

would

fightentrants

and

candominate

themarket. Anticipating this, standardizationisnotprof-itable in this case

and

will not take place. Finally, in the casewhere

wh —

wl, thereis a potential multiplicity of equilibria,

where

theincumbent

is indifferentbetween

fighting

and

exiting. Inwhat

follows,we

will ignore this multiplicityand

adopt the tie-breaking rule that in this case theincumbent

fights (wemodify

thisassumption

in Section 4).

We

summarize

themain

results of this discussion in the followingProposition.

Proposition

1 Inany

subgame-perfect equilibrium of the entry-and-exitgame

de-scribed above, there is only one active producer in equilibrium.

Whenever

wh

> wl

allhi-techfirms facing the entry of a low-tech competitor exit the market.

Whenever

In the rest of the paper,

we

focuson

the limiteconomy

as £—

> 0.5 Since inequilibrium there is only

one

active producer, the price ofeachgood

will alwaysbe

a

markup

over the marginal cost:Ph

=

(1 Jw

H

and

p

L=

( 1j

w

L. (5)

Symmetry

and

labormarket

clearing pindown

thescale ofproduction ofeach firm:xl

=

-7-and

x

#

=

T~>

(6)-Ax,

Ah

where

recall thatH

is thenumber

of skilled workersemployed by

hi-tech firmsand

L

is the remaining labor force.Markup

pricing implies that profits are a constantfraction of revenues:

PhH

.PlL

nH

=

^

and

*

l=

7a

l(7)

At

this point, it is useful to define the following variables:n

=

An/

A

and

ft.=

H/L. That

is,n

is the fraction of hi-techgoods

over the totaland h

is the relativeendowment

of skilled workers.Then,

usingdemand

(3)and

(6),,we

can solve for relative prices as:ȣ

=

(

^v

1/e=

(

h^-^y

1A (8)Pl

\xlJ

\n

Jand

fc^

. (9)n

)Intuitively, the skill

premium

wh/w

ldepends

negativelyon

the relative supply ofskill (h

=

H/L)

and

positivelyon

the relativenumber

of hi-tech firmsdemanding

skilled workers.

Note

thatwh =

wl

at:n

mins

h+1

Forsimplicity,

we

restrict attention toinitial states oftechnology such thatn

>

n

min.As

an

implication of Proposition 1, ifwe

startfrom

n

>

n

mm

, the equilibrium willalways

remain

in the intervaln

€

[nmm

,l].We

can therefore restrict attention tothis interval, over

which

skilled workers never seekemployment

in low-tech firms. 5Thefocusonthelimiteconomyisforsimplicity.

We

couldalternativemodelthegamedifferently,Using (7)

and

(8) yields relative profits:^

/l_-n

1-1/6(10)

This equation

shows

that therelative profitability ofhi-tech firms, tth/^l, is increas-ing in therelative supply ofskill,H/L,

because ofa standardmarket

size effectand

decreasing in the relative

number

of hi-tech firm, Ajj/Al.The

reason for the lattereffect is that a larger

number

offirms of a given type implies stiffer competition forlabor

and

alower equilibrium firm scale.Next, to solve for thelevel ofprofits,

we

first usesymmetry

into (4) to obtain:A

PL

A

(l-n)

(

_l

P

-Ph l-e+

n

1/(6-1)and

;n)

1—

n

+

n

Ph_Pl

l-e 1/(6-1)Using these together with (8) into (7) yields:

H

Tiff eL

KL

e iM

-

-

in

I -(-

-

1n

i E-] n<--1 ,and

:i-n)$=i

(12)Note

that, for a given n, profits per firm remain constant. Moreover, the followinglemma

formalizessome

important properties ofthe profit functions:Lemma

1Assume

e>

2. Then, forn €

[nmm

,l]:dn

Moreover,

ni

is a convexfunction ofn.<

and

—

—

>

0.9n

(13)Proof.

See theAppendix.

The

condition e>

2 is sufficient—

though

not necessary—

for the effect ofcompe-tition for labor to

be

strongenough

to guarantee that an increase in thenumber

ofrest of the paper,

we

assume

that the restrictionon

e inLemma

1 issatisfied.62.3

Standardized

Goods, Production and

Profits

Substituting (6) into (2), the equilibrium level of aggregate output can be expressed

as:

Y

= A

(l-n)<L—

+n*H—

, (14)dY

A

l-W\

r £-1(

L

\

£-1" edn

e—

1\n)

U-»J

showing

that output is linear in the overall level oftechnology, A,and

is a constant-elasticity function ofH

and

L.From

(14),we

have that(15)

which

implies that aggregate output ismaximized

when

nj

(1—

n)—

h. Intuitively, production ismaximized

when

the fraction ofhi-techproducts is equal tothe fraction ofskilled workers in the population, so thatx

L=

xH

and

prices are equalized acrossgoods.

Equation

(14) is important in that it highlights the value oftechnology diffu-sion:by

shiftingsome

technologies to low-skill workers, standardization "alleviates"the pressure

on

scarce high-skill workers, thereby raising aggregatedemand.

It alsoshows

that the effect of standardizationon

production, for given A, disappears asgoods

become more

substitutable (high e). In thelimit as e—

> oo, there isno

gain tosmoothing consumption

across goods (xl=

xh)

sothatY

onlydepends

on

aggregateproductivity A.

Finally, to better understand the effect of technology diffusion

on

innovation,it is also useful to express profits as a function of Y.

Using

(2)-(4) to substitutei-2

Ph

— A

<'(Y/xh)

into(7), profits of ahi-tech firm can be written as:

A

similar expression holds for ttl. Notice that profits are proportional to aggregatedemand,

Y. Thus, as long as faster technology diffusion (lower n) throughstandard-ization raises

Y,

it also tends to increase profits.On

the contrary, an increase in6

An

elasticityofsubstitution between productsgreater than 2 is consistent with mostempirical evidencein this area. See, for example, Broda and Weinstain (2006).

n

>

n

mm

reduces the instantaneous profit rate of hi-tech firmsd%H

n

1dY

n

e—

1dn

txh edn

Y

<

0. (17)2.4

Innovation

and

Standardization

We

model

bothinnovation, i.e., the introduction of anew

hi-techgood,and

standard-ization, i.e., the process that turns anexisting hi-techproductintoalow-techvariety, as costly activities.We

follow the "lab-equipment"approach

and

define the costs ofthese activities in terms of output, Y. In particular,

we

assume

that introducinga

new

hi-techgood

requires fxH

units ofthe numeraire, while standardizingan

existinghi-tech

good

costs \xL units ofY

.We

may

think of fiL as capturing the technicalcost ofsimplifying the production process plus

any

policy induced costsdue

toIPR

regulations restricting the access to

new

technologies.Next,

we

defineV#

and

Vl asthe net present discountedvalue ofa firmproducinga hi-tech

and

a low-tech good, respectively.These

are givenby thediscountedvalue oftheexpected profit stream earned by each typeoffirm

and

must

satisfy the followingHamilton- Jacobi-Bellman equations:

rV

L=

nL+ V

L (18)rV

H

=

tth

+ V

h

-

mV

H

,

where

m

isthearrival rateofstandardization,which

isendogenous

and depends on

theintensityofinvestmentinstandardization.

These

equationssay that theinstantaneous profitfrom

running a firm plusany

capital gain or lossesmust be

equal to the returnfrom

lending themarket

value of the firm atthe risk-free rate, r.Note

that, at a flowrate

m,

a hi-tech firm is replacedby

a low-tech producerand

the valueVh

is lost.Free-entry in turn implies that the value of innovation

and

standardization canbe

no

greater than their respective costs:V

H

<

fiH

and

v

l<

Ml-If

V

H <

fiH

(Vl<

Ml)' trien the value ofinnovation (standardization) is lowerthan

2.5

Dynamic

Equilibrium

A

dynamic

equilibrium is a time path for (C, Xi, A, n, r,pA

such that monopolistsmaximize

the discounted value of profits, the evolution of technology isdetermined

by

free entryin innovationand

standardization, thetimepath

for pricesis consistentwith

market

clearingand

thetimepath

forconsumption

is consistent with household maximization.We

willnow

show

that adynamic

equilibriumcanbe

represented as asolution to

two

differential equations. Let us first define:C

Y

A

X

=A

; y=A>

9=A"

The

first differential equation is the lawofmotion

ofthe fraction of hi-tech goods, n.This is the state variable ofthe system.

Given

that hi-techgoods

are replacedby

alow-tech

goods

at theendogenous

ratem,

theflow ofnewly

standardized products isAl

—

tuAh-

Prom

thisand

the definitionn

=

(A

—

Al)/A we

obtain:h

=

(1—

n) g—

ran. (19)The

seconddifferential equationis thelawofmotion

of x- Differentiatingx

and

usingthe

consumption

Euler equation (1) yields:Z

=

r-p-g

(20)X

Next, to solve for g,

we

use the aggregate resource constraint. In particular,consumption

is equal to productionminus

investment in innovation, /j,h

A,and

instandardization, /iLA^. Noting that

A/

A =

gand

A

L/A

=

mn, we

can

thus write:X

=

y~

Vh9

~

^L

mn

Substituting for g

from

this equation (i.e., g—

(y—

iiLmn

—

x)I^h)

in^° (19)and

(20) gives the following

two

equationdynamical system

in the (n,x) space:x

=

r-

p

V„

—

(21)

n

\n

J fiH

V/W

as functions of

n

from

the Hamilton-Jacobi-Bellman equations. First, note that, ifthere is positive imitation

(m

>

0), then free-entry impliesV

L—

fiL.Given

thatfi

L

is constant,

Vl must

be constant too,Vi

=

0. Likewise, ifthereispositiveinnovation(g

>

0), thenV#

=

0. Next, equations (18) can be solved for the interest rate in thetwo

cases: r=

ttlMl

ifm

>

tth r=

m

if g>

0. MffWe

summarize

these findings in the following proposition.(23)

(24)

Proposition

2A

dynamic

equilibrium is characterized by (i) theautonomous

systemofdifferential equations (21)-(22) in the (n,x) space where

y

=

y(n)=

(l-n)'LV +

n

«#V

i \(^(n)

n

H

(n) r=

r (n)=

max

< ,n

{Ml

/%

( ifr>

*Lin)m

=

m

(n)=

^ 1 ?/(n)-x if r ^ nH^

—

m

anrf 7T/y(n)

and

ttl(n) are given by (12), (ii) apair ofinitial conditions, noand

Aq,and

(Hi) the transversality conditionlim^oo

exp (—

f

Q rsds) f

'

Vidi

=

0.2.6

Balanced

Growth

Path

A

Balanced

Growth

Path

(BGP)

isadynamic

equilibrium such thath

=

rh=

and,hence, theskill

premium

and

theinterestrateareata steady-statelevel.An

"interior"BGP

is aBGP

where, in addition,m

>

and

g>

0.Equation

(19) implies thatan

interiorBGP

must

featurem

ss—

g(1—

n)jn

=

(r—

p) (1—

n)jn.To

find theassociated

BGP

interest rate,we

use thefree-entryconditionsfor standardizationand

innovation. Using (12), the following equation determines the interestrateconsistent

with

m

>

0: Tl (n)=

Ik

Ml

L

(25)n

i i -1(l-n)*=*

Next, thefree-entry conditionfor hi-tech firms, conditional

on

theBGP

standardiza-tion rate, determines theinterest rate consistent with the

BGP:

r%(n)

=

—

-m

ss=

n—

+

(l-n)p

(26) M// /Ah i £-1H

/%

en

i n*-1+

(1—

n)p.The

curves rjfs (n)and

r^ (n) can be interpreted as the (instantaneous) returnfrom

innovation (conditional

on

h

=

0)and

standardization, respectively. In the space (n,r), theBGP

value ofn

can befound

as their crossing point: in other words, along aBGP,

both

innovationand

standardizationmust be

equally profitable.'We

summarize

the preceding discussion in the following proposition:Proposition

3

An

interiorBGP

is adynamic

equilibrium such thatn

—

n

sswhere

n

sssatisfies

r L (n°°)

=

r™(n

s°), (27)and

r L(nss)and

rjy (nss

) are given by (25)

and

(26), respectively.Given

n

ss, the

BGP

interest rate is rss—

ttl(nss)/p

L,and

the standardization rate ism

ss

=

(rss—

p) (1—

n

ss)/n

ss , wheren^

is as in (12) [evaluated atn

—

n

ss J. Finally,Ah,

A

L,Y

and

C

allgrow

at thesame

rate, g ss=

rss—

p.To

characterize the set ofBGP,

we

need

to study the properties of 77,(n)and

rStf(n).

Due

to theshape

of itl, rL (n) is increasingand

convex. Provided thatp

is not too high,

r^

(n) isnon-monotonic

(first increasingand

then decreasing)and

concave in n.8

The

intuition for thenon

monotonicity is as follows.When

n

ishigh, competition for skilled workers

among

hi-tech firms brings tthdown

and

thislowers the return to innovation. Moreover,

when

n

ishigherthan

hj (h+

1) aggregateproductivity

and

Y

are low, because skilled workers have toomany

tasks toperform,while unskilled workers too little. This tends to reduce ttjj even further.

When

n

is low, ix

H

is high, but the flow rate of standardization is high as well (since, recall,m

ss=

g

(1—

n)jn)and

this bringsdown

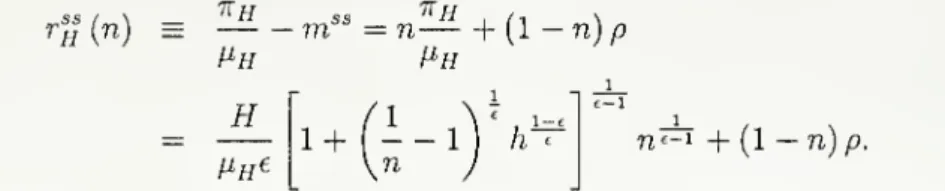

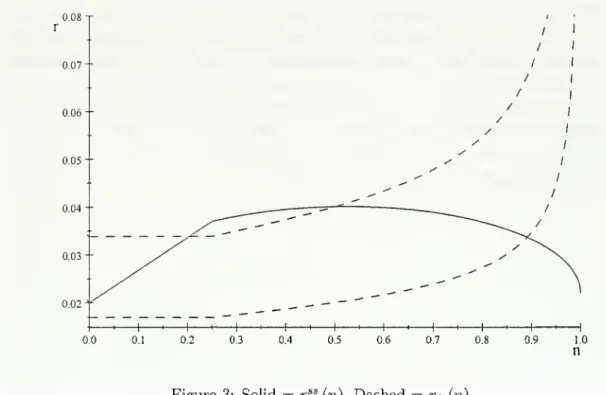

the return to innovation.Figure 1

shows

theBGP

relationshipbetween

rand

n.Note

that, as long asm

>

0, the equilibriummust

lieon

the (dashed) rL(n) curve.An

interiorBGP

must

7

Itcan alsobe verifiedstraightforwardly that the allocationcorrespondingto this crossingpoint

satisfies the transversality condition.

8

A

0.06

t

05-- 0.04-0.03" 0.02-0.3 0.4 0.5 0.6 0.7 0,9 1.0 nFigure 1: Solid

=

r^

(n),Dashed

=

r L (n)also lie

on

the (solid)r#

(n) curve. Thus, the interiorBGP

value ofn

isidentifiedby

the intersection.

The

following assumptions guarantee the existenceand

uniqueness of aBGP,

and

thatsuchBGP

is interior.Assumption

1 :<

p<

H/

(/%e).

This condition is standard: it guarantees that innovation is sufficiently profitable

to sustain

endogenous

growth

and

that the transversality condition is satisfied.Assumption

2 ; [iH

< ^

LTT7

—A__.

Assumption

2 ensures that rff (nmm

)>

rL (nmin

) , ruling out the uninteresting

case in

which

standardization is alwaysmore

profitable than innovationwhen n

isexpected to stay constant,

and

guarantees that theBGP

is interiorand

unique.We

state the existence

and

uniqueness of theBGP

in a formal proposition.Proposition 4

SupposeAssumptions

1-2 hold.Then

there exist a uniqueBGP

equi-librium.Proof.

See theAppendix.

Proposition 4 establishes the existence

and

uniqueness of aBGP

equilibrium,denoted

by

(nss,x

ss)-The

next goal is to prove the (local) existenceand

uniquenessof a

dynamic

equilibrium converging to thisBGP.

Unfortunately, the analysis ofdynamics

is complicatedby

several factors. First, thedynamic system

(21)-(22) ishighly nonlinear. Second, it

may

exhibit discontinuities in the standardization rate(and thus in the interest rate) along the equilibrium path. Intuitively, at (nss,xss)

thereis

both

innovationand

standardization (otherwisewe

could nothave

n

=

0). Itis relatively easy to prove that, similar to

models

ofdirected change (e.g.,Acemoglu

2002

and

Acemoglu

and

Zilibotti2001), thereexistsadynamic

equilibrium convergingto the

BGP

featuring either only innovation(when

n

<

n

ss) or only standardization

(when

n

>

n

ss). This implies that

when

theeconomy

approaches theBGP

from

the left, the standardization rate

and

the interest rateboth

jump

once theBGP

isreached. In particular,

when n

<

n

ss, there is

no

standardization, thus,m

—

0, whilein

BGP

we

havem

>

0. Since throughout there is innovationand

thus the valueof hi-tech firms

must remain

constant atVh

=

Affi there canbe

no

jump

in r+

m.

Consequently, there

must be an

exactly offsettingjump

in interest rate rwhen

theBGP

is reachedand

the standardization rate,m,

jumps.9However, it turns out to be

more

difficult to prove that there existno

otherdynamic

equilibria. In particular,we

must

rule out the existence of equilibrium trajectories (solutions to (21)-(22)) converging to (nss,xss) with both innovationand

standardizationoutof

BGP.

Numerical

analysissuggests thatno

suchtrajectoryexistsas longas

Assumptions

1and

2 are satisfied. Inparticular, thesystem

(21)-(22)under

thecondition that

m

=

tth (n) /fJ-H~

n

L{n)/Ml

(i-e-i underthe condition that thereisboth

innovationand

standardization) isglobally unstablearound

(nss,x

ss

)-

However,

we

can only provethisanalyticallyunder

additional conditions. Inparticular,we must

impose

the followingparameter

restriction:10Proposition

5Suppose

thatAssumptions

1and 2 and

(28) hold.Then

thereex-9Note

that the discontinuous behavior of the standardization rate and interest does not imply any jump in the asset values,

Vh

and/or Vl- Rather, therate ofchange ofthese asset valuesmay

jump locally.

10

This restriction ensures that n

mm

=

h/(1+

h) be not too small, which is key in the proof strategy (see Appendix). For example, when e=

2, it requires nmin=

hj(1+

h)>

0.28 and whenists p

>

such that, for p<

p, the interiorBGP

is locally saddle-path stable.In

particular, if

n

to is in the neighborhood ofitsBGP

value,n

ss ,

and

n

to>

n

ss [resp.,n

to<

n

ss], then there exists a unique path converging to the

BGP

such thatforsome

finite t

>

t ,we

have r&

[t ,t\,m

T>

0, gT=

and

h

T<

[resp.,m

T=

0, gT>

and

h

T>

0],and

theeconomy

attains theBGP

at t (i.e., for all r>

t,we

have

n

T=

n

ss ,m

T—

m

ss ,and

gT=

g ss ).Proof.

See theAppendix.

2.7

Growth

and

Standardization:an Inverse-U Relationship

How

does thecost of standardization,p

L, affecttheBGP

growth

rate, gss

?

Answering

this question is important

from both

a normativeand

a positive perspective. First,policies such as

IPR

protection are likely to havean

impacton

the profitability ofstandardization. Therefore,

knowing

the relationshipbetween

standardizationand

growth

is a keystep for policy evaluation. Second, the difficulty to standardizemay

vary across technologies

and

over time.The

cost of standardization affects rr, (n), but not rjf (n). Thus, increasing thecost of standardization

amounts

to shifting the tl(n) curve in Figure 1and

thereforetheintersection,

form

n

=

n

mm

(lowp

L) ton

—

> 1 (highp

L).The

effecton

thegrowth

ratedepends

in turnon

the relationshipbetween

gssand

n:g

°°(n)=

r%(n)-p

=

n(^M-p

This expression highlights the trade-off

between

innovationand

standardization: ahigh standardization rate (and thus a low n) increases the instantaneous profit rate

ir

H

(n), but lowers theexpected profit duration. Taking the derivativeand

using (17)yields:

dg

ss (n)_

7iH

(n)n

dn H

(n)dn

p

H

p

H

dn

KHJn)

^

|dY{n)

n

epH

\dn

Y

(n)From

(15),8Y

(n)/dn

=

atn

=

n

min. Forn

>

n

min

,

we

have8Y

(n)/dn

<

withlim,,-,!

dY

(n)/dn

=

—

oo. Thus:dg

ss (n)dn

H

+

L

dg

ss (n)=

pand

lim—

=

—

oo. n=nmi„P

H

eProvided that p

<

^-§,

gss(n) isan

inverse-U function of n. Intuitively, atn

=

1the

wage

of unskilled workers is zeroand

hence the marginal value of transferringtechnologies to

them

(in terms of higher aggregatedemand

and

thus also profits)is infinite. Instead, at

n

=

n

min, aggregate outputY

ismaximized and

marginalchanges in

n

have

second ordereffectson

aggregate production. Moreover, giventhatfuture profits are discounted, the

impact

of prolonging the expected profitstream

(high n)

on

innovation vanishes ifp

is high.When

p<

jpjj,growth

ismaximized

atn*

6

(nmin,1) that solves:ejjjj

_

dY(n*)

n*P

n

H

(n*) dn*Y(n*Y

{'

The

condition p< ^-§

is satisfiedwhenever

Assumption

1 (whichwe

imposed

above

and which

guarantees g>

0)and

e<

1+

1/h, i.e., if skilled workers are sufficiently scarce. It is also satisfiedwhen

pand

pH

are sufficiently low.Now

recalling that inBGP

n

isan

increasing function of fiL

,we

have the following result (proof in thetext):

an

inverse U-shaped function ofthe cost of standardization.Proposition 6

Let g33 be theBGP

growth rateand assume

p< ^-^

. Then, g 3Sis

Figure 1 provides a geometric intuition. Starting

from

a very highn

L such thatrff (n) is inits decreasing portion, a decrease in \xL

moves

theequilibrium to the leftalong theschedulerfj (n) . This yields a lower

n

ss

and

thus highergrowth. Therefore,in this region, a decreasein

p

L increases growth. However, afterthemaximum

oftheT"H (n) schedule is passed, further decreases in

p

L reducen

and

growth.Proposition 6 also has interesting implications for the skill

premium.

Recall that,in this model, the skill-premium is the

market

value of being able to operatenew

technologies

and produce

hi-tech goods. For this reason, it is increasing in thefrac-tion of hi-tech firms (see equation (9)). Since

growth

isan

inverse-U function of n,the

model

also predicts a inverseU-shaped

relationshipbetween

growth

and

wage

inequality, as

shown

in Figure 2. Intuitively, a very high skill-premium couldbe

asign that standardizationis so costly toslow

down

growth.A

very lowskillpremium,

however,

might be

a sign of too fast standardizationand

thusweak

incentives to innovate.0.021 " 0.020" """"

^^^^

0.019-/

^\

/

^\

0.018-^

0.017-0016-1 1 1 i 1 1 h--H 1 1 1 1 1 1 1 1 1 1 1 1 1 1.0 12 1.4 1.6 1.8 2.0 2.2 2.4 26 2.8 , , 3,0wh/wl

Figure 2:

Growth

and

the SkillPremium

3

Welfare

Analysis

and

Optimal

Policies

We

now

turn tothenormativeanalysis.We

startby

characterizing theParetooptimalallocation for a given /j,L, representing the technical cost of standardization. This

allowsusto identifytheinefficiencies that arepresentinthe decentralized equilibrium.

Next,

we

focuson

theconstrained efficient allocation thatagovernment

could achievewith a limited set of instruments. In particular,

we

allow thegovernment

to increasethe cost of standardization above fiL through

IPR

regulationsand

to influence thelevel of competition. Finally,

we

briefly discusshow

North-South

trade affects the optimal policies.3.1

Pareto Optimal

Allocation

The

Pareto optimal allocation is the one chosenby

a social planner seeking tomax-imizethe utility of the representative agent, subject to theproduction function (14)

and

for given costs of innovation,fj,

H

,and

standardization, \iL.The

current valueHamiltonian

for theproblem

is:where

Ijjand

1^ are investment in innovationand

standardization, respectively.The

control variables are I

H

and

II, whilethe state variables areA

and Al,

with co-statevariables£

H

and

£ L, respectively.Prom

thefirst order conditions, the Pareto optimaln

solves:—

—

9Y

1dA~^~dA~

L]r

L( }

That

is, the planner equates the marginal rate of technical substitutionbetween

hi-tech

and

low-tech products to their relativedevelopment

costs.The

Euler equationfor theplanner is:

C

_dYJ_

C~

dAfj,H

P

'By

comparing

these results to those in the previous section,we

can see that thedecentralized equilibrium is inefficient for

two

reasons.First, there is astandard appropriability

problem

whereby

firms only appropriateafraction of the value ofinnovation/standardization so that

R&D

investment is toolow.

To

isolate this inefficiency, consider the simplest caseL

=

0, so that there isno

standardizationand

Y

=

AH,

7r#=

H/e. In this case, the social returnfrom

innovation is

H

while the private return is only r=

H/e

<

H.

The same

form

ofappropriability effect also applies

when

L

>

0.Second, there istoo

much

standardizationrelative toinnovationdue

toa businessstealing externality: the social value of innovation is

permanent

while the privatebenefit is temporary.

A

particularly simple case to highlight this inefficiency iswhen

e

=

2 so that (30) simplifies to:n

_

h

fVL

+

V

H

^

1-n

VVh

In the decentralized equilibrium, instead, the condition r L (n)

=

r"

(n) yields:H-

=

hm

+

rJ /j,h

Clearly,

n

is too low in the decentralized economy.To

correct the first inefficiency, subsidies to innovation (and standardization) areneeded.

On

the other hand, the business stealing externality can be correctedby

introducing alicensing policy requiring low-tech firms to

compensate

the losses theyimpose

on

hi-tech firms. In particular,suppose

that firms that standardizemust

conditions together with the Hamilton-Jacobi-Bellman equations (18) become:

ith

~

m

(VH

-

I2f)V

H

=

=

nH

.Clearly, the business stealing effectis

removed

when

fi'lc=

fiH

, thatis,when

low-techfirms

compensate

the hi-tech produces for the entire capital loss fiH

.We

summarize

these results in the proposition (proofin thetext).11

Proposition

7The

Pareto optimal allocation canbe decentralized using a subsidy to innovationand

a license fee imposed onfirms standardizingnew

products.3.2

Constrained

Efficiency:Optimal

fiLProposition 7

shows

how

thePareto optimalallocationcanbedecentralized. However,the subsidies to innovation require

lump-sum

taxesand

in addition, thegovernment

would need

to setup

and

operate asystem

of licensing fees. In practice,both

ofthesemight be difficult.12 Motivated

by

this reasoning,we

now

analyzea constrainedefficient policy,

where

we

limit the instruments of the government. In particular,we

assume

that thegovernment

can only affect the standardization cost throughIPR

regulationsrestrictingthe access to

new

technologies,and

askwhat would

theoptimalpolicy be in this case.13

More

precisely,we

find the (constant) \x*L thatmaximizes

11

Notethat there is no staticdistortion due tomonopoly pricing. This is because inour model

all firms only use inelasticallysupplied factors (skilled and unskilled labor). Thus, markups donot distortthe allocation. Inamoregeneralmodel,subsidies toproductionwouldalsobeneededcorrect for thestatic inefficiency.

12

Somereasonsemphasizedinthe literaturewhylicensing

may

failincludeasymmetricinformationand bilateral monopoly (e.g., Bessen and Maskin, 2006). See also Chari et al. (2009) on the

difficulties ofusing market signals todetermine the value of existing innovations.

13

We

donotconsiderpatentpoliciesexplicitly foranumberofreasons. Patentsare oftenperceived as offering relatively weak protection ofIPR, less than lead time and learning-curve advantage in

preventing duplication. Patents disclose information, the application process is often lengthy and

cannot prevent competitorsfrom"inventingaround"patents. Overall, Levinetal. (1987)foundthat patents increase imitation costs by 7-15%. This support our approach ofmodeling IPRprotection as anadditional cost.

BGP

utility: OOmax

pW

=

pi

ln(-J+ln(A

e9t ) o ~pt dt (31)=

ln&"

+—

•The

optimal policymaximizes

a weightedsum

oftheconsumption

leveland

itsgrowth

rate. In turn, gss(p,L)

=

n

[~kh(n) IPh

~

p] evaluated at then

(p L) that solves (27)and

x

ss=

y(n

)~

9 (Pl) Ip-h+

Ml

U

—

n

)L evaluated at thesame

77. In general,problem

(31) does not haveaclosed-formsolution. Nonetheless,we

canmake

progressby

consideringtwo

polar cases.3.2.1

Optimal/Growth Maximizing

Policy: p—

*As

p

—

> 0, theoptimalpolicy is tomaximize

gss. Forthiscase,

we

have simpleanalyticresults.

Manipulating

the first order condition (29), the optimal n* is implicitlydefined by:

Note

that theLHS

isdecreasingin n,from

infinityto zero,whiletheRHS

isincreasingin n, ranging

from

minus

infinity to 1/e. Thus, the solution n* is always interiorand

unique. Using the implicit function

theorem

yields:9_f±

=

t^l

>0

and

^A

=

(1_

n

* )(1_

e+

n

.e)>0

(33) oe n* e—

1ah

n*because,

from

(32), en*—

e+

1=

e(n*)7 (1—

n*)~

r

h^

>

0.That

is, the optimalfraction of hi-tech

goods

is increasing in the relative skill-endowment

and

in theelasticity ofsubstitution across products.

Once

we

have n*,we

can use the indifference conditionbetween

innovationand

standardization,

W-

=

^

tt-, to solve for the p*L that

implements

n*.When

p—

>and

77i

=

g(1—

n)jn

we

obtain:^

=

^I^fi^/,^

=

^I

(34)7rL /ijr

n

\

n

)

p

Ln

relative

R&D

costs (hh/^l)' and

the standardization risk faced by hi-tech firms(captured

by

the factor 1/n).Note

that a decline in the relative skill supply, h, leadsto a

more

than proportional fall inn

because tth/^l fallsand

m

rises. SubstitutingL^L-h)

£from

(32)we

can find the optimal standardization cost as:„!-«,(»•-

l+

i)"'

=

r

-f^.

(35,This expression has the advantage that it only

depends

on

h through n*and

canbe

used to study the determinants ofthe optimal policy. Differentiating (35)

and

using(33),

we

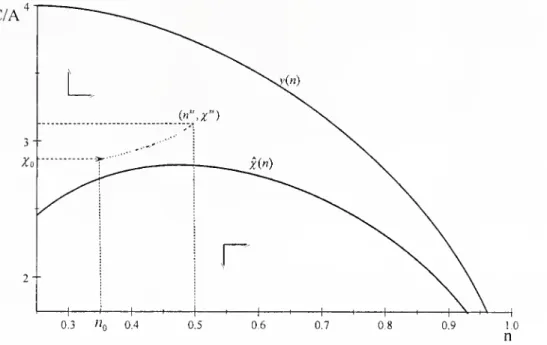

obtain the followingproposition (proof in the text).Proposition

8 Consider the case p—

> 0.BGP

welfareand

growth aremaximized

when

the cost of standardizationp

L satisfies (35)and

n* is the solution to (32).The

following comparative static results hold:

dfij h

~dh^l

d/i*L e n*e—

1=

1-en*(l-n*) <

>

0. de fi*L e-

1The

resultssummarized

in this proposition are intuitive.Changes

in the cost ofinnovationshouldbe followed

by

equal changesinthecost ofstandardization, so as tokeepthe optimal

n

constant.A

decline intherelative supplyof skilled workersmakes

technologydiffusion relatively

more

important. However, the incentive to standardizeincreases so

much

(both because of the change in instantaneous profitsand

becausethe equilibrium

m

increases too) that the optimal policy is tomake

standardizationmore

costly. Thus,somewhat

surprisingly, a higherabundance

of unskilled workercalls for stronger

IPR

protection. Finally, given that e>

2, a lower elasticity ofsubstitution

makes

the diffusion oftechnologies to low-skill workersmore

importantfor aggregate productivity

and

reduces the optimal IPR, p*L.

lA

3.2.2 Optimal Policy: high p

To

understandhow

the optimal policy changes with the discount rate,we

considerthe other polar case. In particular,

assume

that p—

->^—.

As we

will see, this is14