Digitized

by

the

Internet

Archive

in

2011

with

funding

from

Boston

Library

Consortium

Member

Libraries

DEWEY

u

+15

.6M"

-6

Massachusetts

Institute

of

Technology

Department

of

Economics

Working

Paper

Series

The

Economic

Impacts

of

Climate

Change:

Evidence from

Agricultural

Profits

and

Random

Fluctuations

in

Weather

Olivier

Deschenes

Michael

Greenstone

Working

Paper

04-26

July

2004

Room

E52-251

50

MemorJal

Drive

Cambridge,

MA

021

42

This

paper can be

downloaded

without

charge from

the SocialScience

Research

Network

Paper

Collection atMASSACHUSETTS

INSTITUTEOF

TECHNOLOGY

DEC

720M

The Economic

Impacts

of

Climate

Change:

Evidence

from

Agricultural

Profitsand

Random

Fluctuations

inWeather*

Olivier

Deschenes

University

of

California, SantaBarbara

Michael Greenstone

MIT

and

NBER

July

2004

*

We

thank

David

Bradford

for initiating a conversation that ultimately led to this paper.Hoyt

Bleakley,

Tim

Conley,

Enrico

Moretti,Marc

Nerlove,

and

Wolfram

Schlenker

provided

insightful

comments.

We

are also grateful forcomments

from seminar

participants atMaryland,

Yale, the

NBER

Environmental

Economics

Summer

Institute,and

the"Conference on

Spatialand

Social Interactions inEconomics"

at the Universityof

California-Santa Barbara.Anand

Dash,

BarrettKirwan,

Nick

Nagle,

and

William

Young,

provided

outstanding researchassistance. Finally,

we

are indebted toShawn

Bucholtz

at theUnited

StatesDepartment of

Agriculture for

generously

generating theweather

data.Greenstone

acknowledges

generous

The

Economic

Impacts

ofClimate

Change:

Evidence

from

Agricultural

Output and

Random

Fluctuations

inWeather

ABSTRACT

This

paper measures

theeconomic

impact of

climatechange

on

US

agricultural land.We

replicate the previous literature's

implementation

of

thehedonic

approach

and

find that itproduces

estimatesof

the effectof

climatechange

that arevery

sensitive to decisionsabout

theappropriate control variables,

sample

and

weighting.We

find estimatesof

thebenchmark

doubling

of greenhouse

gaseson

agricultural land values thatrange

from

a declineof $420

billion

(1997$)

toan

increaseof

$265

billion, or-30%

to19%.

Despite

its theoretical appeal,the

wide

variabilityof

these estimates suggests thatthehedonic

method

may

be

unreliablein thissetting.

In light

of

the potentialimportance

of

climatechange,

thispaper

proposes

anew

strategy todetermine

itseconomic

impact.We

estimate the effectof weather

on

farm

profits, conditionalon

county

and

stateby

year

fixed effects, so theweather parameters

are identifiedfrom

thepresumably

random

variation inweather

across counties within states.The

resultssuggest

that thebenchmark change

in climatewould

reduce

the valueof

agricultural landby

$40

to$80

billion, or

-3%

to-6%,

but the nullof

zero effectcannot

be

rejected. In contrast to thehedonic

approach,

these results are robust tochanges

in specification.Since farmers can

engage

in amore

extensive setof

adaptations inresponse

topermanent

climate changes, this estimate islikely

downwards

biased, relative to the preferred long run effect.Together

the point estimatesand

signof

the likely bias contradict thepopular

view

that climatechange

willhave

substantialnegativewelfare

consequences

fortheUS

agricultural sector.Olivier

Deschenes

Department of

Economics

2127

North

HallUniversity

of

CaliforniaSanta

Barbara,CA

93106-9210

email: olivier(2)econ.

ucsb.edu

Michael Greenstone

MIT,

Department

of

Economics

50

Memorial

Drive,E52-391B

Cambridge,

MA

02142

and

NBER

Introduction

There isa

growing

consensusthatemissions of greenhousegases duetohuman

activity will leadtohighertemperaturesand increasedprecipitation. It is thoughtthatthesechangesinclimatewill impact

economic

well being. Since temperature and precipitation are direct inputs in agricultural production,many

believethatthe largest effects willbe in thissector. Previousresearch onthebenchmark

doublingof atmospheric concentrations ofgreenhouse gases is inconclusive about the sign and

magnitude

ofitseffect

on

the value ofUS

agricultural land(Adams

1989;Mendelsohn,

Nordhaus, andShaw

1994 and

1999; Schlenker,

Hanemann,

andFisher 2002).Most

previous researchemploys

eitherthe production function or hedonic approach to estimatetheeffectofclimatechange.1

Due

toits experimental design, the productionfunction approach providesestimates of the effect of weather

on

the yields of specific crops that are purged of biasdue

todeterminantsofagricultural outputthatare

beyond

farmers' control(e.g., soilquality). Itsdisadvantageisthatthese experimental estimates do notaccountforthe full rangeof compensatoryresponsesto changes

in weather

made

by profitmaximizing

farmers. Forexample

in responseto achange in climate, farmersmay

alter their use of fertilizers,change

theirmix

ofcrops, or even decide to use their farmland foranother activity (e.g., a housing complex). Since farmer adaptations are completely constrained in the

production function approach, it is likely to produce estimates of climate change that are biased

downwards.

The

hedonicapproach attempts tomeasure

directly theeffectofclimate on landvalues. Its clearadvantage isthat ifland marketsare operating properly,prices will reflectthe presentdiscountedvalueof

land rents into the infinite future. In principle, this approach accounts for the full range of farmer

adaptations.

The

limitationisthatthevalidityofthisapproach requires consistentestimationoftheeffectofclimate on landvalues. Sinceat leastthe classic

Hoch

(1958 and 1962) andMundlak

(1961)papers, ithas been recognized that

unmeasured

characteristics (e.g., soil quality) are an important determinant ofoutput and land values in agricultural settings.2 Consequently, the hedonic approach

may

confound

climatewithotherfactorsandthesignand magnitude oftheresultingomittedvariables bias is

unknown.

In light ofthe importance ofthe question, this paper proposes a

new

strategy to estimate theeffects ofclimate change on the agricultural sector.

We

use a county-level panel data file constructedfrom the Censuses ofAgriculture to estimatethe effect of weather

on

agricultural profits,conditional on1

Throughout

"weather" refers to the state ofthe atmosphere at a given time and place, with respecttovariables such as temperature and precipitation. "Climate" or "climate normals" refers to a location's

county and state by year fixed effects. Thus, the weather parameters are identified from the

county-specific deviations in weather about the county averages after adjustment for shocks

common

to allcounties in a state. This variation is

presumed

to be orthogonal to unobserved determinants ofagriculturalprofits, so it offers a possible solution tothe omitted variables bias problems that appear to

plaguethehedonic approach. Its limitation isthatfanners cannot

implement

thefull range ofadaptationsin response to a single year's weather realization, so its estimates ofthe impact ofclimate

change

arebiased

downwards.

Our

analysis begins with a reexamination ofthe evidencefrom

the hedonic method.There

aretwo

important findings. First, the observable determinants of land prices are poorly balanced acrossquartiles of the long run temperature

and

precipitation averages. Thismeans

that functional form assumptions are important in thisapproach. Further, itmay

suggestthat unobserved variables are likely tocovary withclimate.Second,

we

replicate the previous literature's implementation of the hedonic approachand

demonstratethat it produces estimates ofthe effect ofclimate

change

thatare very sensitive todecisionsaboutthe appropriate control variables,sample and weighting.

We

find thatestimatesoftheeffectofthebenchmark

doubling of greenhouse gasseson

the value of agricultural land rangefrom

-$420 billion(1997$) to

$265

billion (or-30%

to 19%),which

is an even wider range than has been noted in thepreviousliterature. Despite its theoretical appeal, the

wide

variability ofthese estimates suggests thatthehedonic

method

may

beunreliablein thissetting.3The

resultsfrom

our preferred approach suggest that thebenchmark

change in climatewould

reduceannualagricultural profitsby $2 to$4 billion,but thenull effectofzerocannotberejected.

When

thisreduction in profits is

assumed permanent

anda discount rateof5%

isapplied,theestimates suggestthat the value ofagricultural land is reduced

by

$40

to$80

billion, or-3%

to-6%.

Notably,we

findmodest

evidencethat farmersare abletoundertake a limitedset ofadaptations (e.g., increased purchasesoffeed, seeds, and fertilizers) in response to weather shocks. In the longer run, they can engage in a

wider variety ofadaptations, so our estimates are

downwards

biased relative to the preferred long runeffect. Together the point estimates and sign ofthe likely bias contradict thepopular

view

that climatechangewillhavesubstantialnegativeeffects

on

theUS

agricultural sector."

Mundlak

focusedon

heterogeneity in the skills of farmers,however

he recognized that thereare

numerous

other sources offarm-specific effects. InMundlak

(2001), he writes,"Other sourcesoffarm-specific effects aredifferencesin landquality, micro-climate,

and

soon"

(p. 9).This finding is consistent with recent research indicating that cross-sectional hedonic equations are

misspecified in a variety ofcontexts(Black 1999; Blackand Kneisner 2003;

Chay

and Greenstone 2004;In contrast to the hedonic approach, these estimates ofthe

economic

impact ofglobalwanning

are robust. For example, the overall effect is virtually

unchanged

by adjustment for the rich set ofavailable controls,

which

supports the assumption that weather fluctuations are orthogonal to otherdeterminants of output. Further, the qualitative findings are similar whether

we

adjust for year fixedeffects or state

by

year fixed effects (to control for unobserved time-varying factors that differ acrossstates). Thisfindingsuggests thattheestimates aredueto outputdifferences, not price changes. Finally,

we

find substantial heterogeneity in the effect ofclimate change across the United States.The

largestnegative impacts tend to be concentrated in areas of the country

where

fanning requires access toirrigationand fruits andvegetables arethepredominantcrops(e.g.,CaliforniaandFlorida).

The

analysis is conducted with themost

detailedand

comprehensive data available onagricultural production, soil quality, climate, and weather.

The

agricultural production data is derivedfrom the 1978, 1982, 1987, 1992, and 1997 Censuses ofAgriculture andthe soilquality data

comes

fromtheNational ResourceInventory datafilesfromthe

same

years.The

climateand weatherdataare derivedfromtheParameter-elevation Regressions on Independent Slopes

Model (PRISM).

Thismodel

generatesestimates ofprecipitation and temperature at small geographic scales, based

on

observationsfrom

themore

than 20,000 weather stations in the National Climatic Data Center'sSummary

of theMonth

Cooperative Files during the 1970-1997 period.

The

PRISM

data are used byNASA,

theWeather

Channel, and almostallother professional weatherservices.

The

paperproceeds asfollows. Section I motivatesourapproach anddiscusseswhy

itmay

be anappealing alternative to the hedonic and production function approaches. Section II describes the data

sourcesandprovides

some

summary

statistics. Section IIIpresents theeconometric approachand SectionIV

describes the results. SectionV

assesses themagnitude

of our estimates ofthe effect of climatechange anddiscusses a

number

ofimportant caveatstothe analysis. SectionVI

concludesthepaper.I.Motivation

This paper attemptsto develop areliable estimate oftheconsequences ofglobal climate change

inthe

US

agricultural sector.Most

previous research onthistopicemploys

eithertheproductionfunction or hedonic approach to estimatethe effect ofclimate change. Here,we

discuss these methods' strengthsand weaknessesand motivate ouralternativeapproach.

A. Production Function

and Hedonic Approaches

to ValuingClimateChange

The

production function approach relies on experimental evidence ofthe effect of temperatureprovides estimates ofthe effectof weather on the yields ofspecific crops that are purged ofbias dueto

determinantsofagricultural outputthat are

beyond

farmers' control (e.g., soil quality). Consequently, itis straightforward to use the results ofthese experiments to estimate the impacts ofa given

change

intemperatureorprecipitation.

Its disadvantageis thatthe experimental estimates areobtained in alaboratory setting

and

donotaccountfor profit

maximizing

farmers'compensatory

responsesto changes in climate.As

an illustration,consider a permanent and unexpected declinein precipitation. Inthe short run, farmers

may

respond byincreasing the flow of irrigated water or altering fertilizer usage to mitigate the expected reduction in

profits

due

tothedecreased precipitation. Inthemedium

run, farmers canchooseto plant differentcropsthat require less precipitation.

And

in the long run, farmers can convert their land into housingdevelopments, golf courses, or

some

other purpose. Since even short run fanner adaptations are notallowed intheproduction function approach, it producesestimates ofclimate change that are

downward

biased. Forthisreason,itis

sometimes

referredto asthe"dumb-farmer

scenario."In aninfluentialpaper,

Mendelsohn,

Nordhaus, andShaw

(MNS)

proposed the hedonic approachas a solution to the production function's shortcomings

(MNS

1994).The

hedonicmethod

aims tomeasure

the effectofclimatechange

by

directlyestimating theeffectof temperature andprecipitationon

thevalue ofagricultural land. Itsappeal is that ifland markets are operating properly, priceswill reflect

the present discounted value ofland rents into the infinite future.

MNS

write the following about thehedonic approach:

Instead of studyingyields

of

specific crops,we

examine

how

climate in differentplacesaffects thenet rentor value

of

farmland.By

directlymeasuring

farmprices orrevenues,we

account for the direct impactsof

climate on yields ofdifferent crops as well as theindirect substitution

of

different inputs, introductionof

different activities,and

otherpotentialadaptationsto differentclimates (p. 755, 1994).

Thus

the hedonic approach promises an estimate ofthe effect ofclimatechange

that accounts for thecompensatory

behaviorthatunderminestheproductionfunctionapproach.To

successfullyimplement

the hedonic approach, itis necessaryto obtain consistent estimates ofthe independent influence ofclimate

on

landvalues andthis requiresthat all unobserved determinants oflandvaluesareorthogonal toclimate.4

We

demonstratebelow

thattemperature andprecipitation normalscovary with soil characteristics, population density, per capita income, latitude, and elevation. This

means

that functional form assumptions are important in the hedonic approach andmay

imply thatIn Rosen's (1974) classical derivation ofthe hedonic model, the estimates ofthe effect ofclimate

on

land prices canonly be usedto valuemarginalchanges in climate. It is necessarytoestimatetechnology

parameters to obtainvalue non-marginal changes.

Rosen

suggests doing this ina second step. Ekeland.Heckman,

andNesheim

(2004) outline amethod

to recover these parameters in a single step.MNS

implicitly

assume

thatthe predicted changes intemperature andprecipitationunderthebenchmark

globalunobserved variables are likely to covary with climate. Further, recent research has found that cross-sectional hedonic equations appeartobe plagued

by

omittedvariables bias in avariety ofsettings (Black1999;Black and Kneisner 2003;

Chay

and

Greenstone 2004; Greenstone and Gallagher2004).5 Overall,it

may

be reasonabletoassume

thatthe cross-sectional hedonicapproach confoundsthe effectof

climatewithotherfactors(e.g., soilquality).

This discussion highlights that for different reasons the production function and hedonic

approaches are likely to produce biased estimates of the

economic

impact of climate change. It isimpossible to

know

themagnitude

ofthe biases associated witheitherapproach and in the hedonic caseeven thesignis

unknown.

B.A

New

Approach

to ValuingClimateChange

Inthispaper

we

propose analternative strategy toestimatethe effectsofclimatechange.We

usea county-level panel data file constructed

from

the Censuses ofAgriculture to estimate the effect ofweather

on

agricultural profits, conditionalon

county and stateby

year fixedeffects. Thus, the weather parameters are identified from the county-specific deviations inweather about the county averages afteradjustment forshocks

common

to all counties in a state. This variation ispresumed

tobe orthogonal tounobserved determinants ofagricultural profits, so it offers a possible solution to the omitted variables

biasproblemsthatappeartoplaguethehedonicapproach.

This approach differs from the hedonic one in a

few

key ways. First, under an additiveseparability assumption, its estimated parameters are purged ofthe influence of all unobserved time

invariant factors. Second, it is not feasible to use land values as the dependent variable oncethe county

fixed effects are included. This is because landvalues reflect longrun averages ofweather, not annual

deviations

from

theseaverages, andthereis no timevariation insuchvariables.Third, although the dependent variable is not land values, our approach can be used to

approximatethe effectofclimatechangeon agriculturallandvalues. Specifically,

we

use the estimatesofthe effect of weather onprofits and the

benchmark

estimates ofauniform 5degreeFahrenheit increase intemperature and

8%

increase in precipitation to calculate the expectedchange

in annual profits(IPCC

1990;

NAS

1992). Since the value ofland is equal tothe present discounted stream ofrental rates, it isstraightforward to calculate the change inland values

when

we

assume

thepredicted change in profits ispermanent

andmake

anassumption aboutthe discountrate.5

For example, the regression-adjusted associations

between

wages

andmany

jobamenities and housingprices andair pollution are

weak

andoften havea counterintuitive sign (Blackand Kneisner 2003;Chay

Before proceeding, itis importantto clarify

how

shortrun variation in weatheraffects the profitsofagricultural producers

and

underwhich

conditionsthis variation canbe used tomeasure

the effects ofclimate change. Consider the following simplified expression for the profits of a representative

agriculturalproducer:

(1) 7i

=

p(q(w))q(w)-

c(q(w)),where

p, q,andc, denoteprices, quantities, andcosts,respectively. Pricesandtotalcosts areafunction ofquantities. Importantly, quantities are a function ofweather, w, because precipitation and temperature

directly affect yields.

Now

considerhow

the representativeproducer'sprofitsrespondtoachange inweather:(2)

d%

13w

=

(dpIdq) (dq1dw)

q+

(p-

3c/<5w)dqIdw.The

first term is thechange

in prices due tothe weather shock (through weather's effect on quantities)multipliedbytheinitial level ofquantities.

The

second termis thedifferencebetween

priceand marginalcost multipliedby the

change

inquantitiesduetothechange inweather.Sinceclimate

change

isapermanent

phenomenon,

we

would

liketo isolatethe longrunchange

in profits. Consider the differencebetween

the first term in equation (2) in the shortand

long run in thecontextofachangeinweatherthatreduces output. Intheshortrun, supplyislikely to beinelastic (dueto

the lag

between

plantingand

harvests),which

means

that(dpI5q)shortRun>

0. This increaseinprices willhelptomitigatefarmers' lossesduetothe lowerproduction.

However,

thesupplyofagriculturalgoods

ismore

elastic inthe long run, so it is sensibletoassume

that (dp I3q)Long Run is smaller inmagnitude

and perhaps even equal to zero. Consequently,the firsttermmay

be positive inthe short run but small, orzerointhe longrun.

Although our empirical approach relies

on

short run variation in weather, itmay

be feasible to abstractfrom

the change in profitsdueto pricechanges (i.e., the first term). Recall, the price level is afunctionofthetotalquantityproduced intherelevantmarketina givenyear.

By

usingapanelofcounty-level data and including county and state by year fixed effects,

we

rely on across county variation incounty-specific deviations in weather within states. This

means

that our estimates are identified fromcomparisons ofcounties that had positive weather shocks with ones that

had

negative weather shocks,within the

same

state. Put inanotherway,thisapproachnon-parametrically adjusts forall factors thatarecommon

across counties within a state by year, such as crop price levels. Ifproduction in individualcounties affectsthe overall price level,

which

would

bethe case ifafew

counties determine cropprices,or there are

segmented

local marketsfor agricultural outputs,then this identificationstrategy will notbeabletoholdprices constant.

The

assumption that our approach fully adjusts for price differencesseems

reasonable formost

across the country and not concentrated in a small

number

ofcounties. For example,McLean

County,Illinois and

Whitman

County,Washington

arethe largest producers ofcorn and wheat, respectively, butthey only account for

0.58%

and1.39%

oftotal productionofthese crops intheUS.

Second, our resultsare robust to adjusting for price changes in a

number

of different ways. In particular, the qualitativefindings are similarwhether

we

control forshocks with yearorstateby yearfixed effects.6Returning to equation (2), consider the second term,

which

is the change in profitsdue

to theweather-inducedchangeinquantities.

We

would

liketoobtainanestimateofthistermbasedon longrunvariation in climate, sincethis is theessenceofclimate change. Instead, ourapproach exploits short run

variation in weather. Since farmers have a

more

circumscribed set ofavailable responses to weathershocks than tochanges inclimate, it

seems

reasonable toassume

that (3c /3q)shortr«

>

(3c/ 3q)Long Run.7

For example, fanners

may

be able to change a limited set of inputs (e.g., theamount

of fertilizer orirrigation) in responseto weathershocks.

But

in responseto climate change, they canchange theircropmix

and even converttheir landtonon-agricultural uses (e.g.,tracthousing). Consequently,ourmethod

to

measure

theimpactofclimatechange islikely tobedownward

biasedrelativetothepreferred longruneffect.

In

summary,

the use of weather shocks to estimate the costs ofclimate changemay

provide anappealing alternative tothe traditional production function and hedonic approaches. Its appeal is that it

provides a

means

to control for time invariant confounders, while also allowing for farmers' short runbehavioral responses to climate change. Its

weakness

is that it is likely to producedownward

biasedestimatesofthelongruneffectofclimatechange.

II.

Data

Sourcesand

Summary

StatisticsTo

implement

the analysis,we

collected themost

detailed and comprehensive data availableon

agricultural production, temperature,precipitation, andsoil quality. This sectiondescribes thesedataand

reports

some

summary

statistics.A.

Data

Sources6

We

explored whether itwas

possible todirectly control for prices.The

USDA

maintains datafileson

croppricesatthestate-level, but unfortunately these datafiles frequentlyhave missingvalues andlimited

geographic coverage. Moreover,thestate by yearfixedeffects providea

more

flexibleway

tocontrolfor state-level variation in price,because they control forall unobserved factors thatvary at thestateby yearlevel.

7

Itis also possiblethat inputprices

would

increasein responsetoa shortrun weathershockbutwould

beAgriculturalProduction.

The

dataon

agricultural productioncome

from

the 1978, 1982, 1987,1992, and 1997 Censuses ofAgriculture.

The Census

has been conducted roughly every 5 years since1925.

The

operators ofall farms and ranchesfrom which

$1,000 ormore

ofagricultural products areproduced andsold,or normally

would

have been sold,during the censusyear, are requiredto respondtothe census forms. For confidentiality reasons, counties are the finest geographic unit of observation in

thesedata.

In

much

ofthe subsequentregression analysis,county-level agricultural profits arethe dependentvariable. This is calculated asthe

sum

ofthe Censuses' "NetCash

Returns from Agricultural Sales for theFarm

Unit"across all farms ina county. This variable is the differencebetween

the market value ofagriculturalproducts sold

and

totalproductionexpenses. Thisvariablewas

not collected in 1978 or 1982,sothe 1987, 1992,and 1997 dataarethebasis forouranalysis.

The

revenuescomponent

measures the gross market value before taxes of all agriculturalproducts sold or

removed from

thefarm, regardless ofwho

received thepayment. Importantly, itdoesnotinclude

income

from participation in federal fannprograms

8, labor earnings off the farm (e.g.,income

from

harvesting adifferent field), orincome from

nonfarm

sources. Thus, it isameasure

ofthe revenueproducedwith theland.

Total production expenses are the

measure

ofcosts. It includes expendituresby

landowners,contractors, and partners in the operation ofthe farm business. Importantly, it covers all variable costs

(e.g., seeds, labor, and agricultural chemicals/fertilizers). It also includes measures of interest paid on

debts andthe

amount

spenton

repair and maintenance ofbuildings,motor

vehicles,and

farmequipment

used forfarm business.

The

primarylimitation ofthismeasure

ofexpenditures isthat itdoesnot accountfor the rental rate ofthe portion ofthe capital stock that is not secured by a loan so it is only a partial

measure

offarms' costofcapital. Justaswiththerevenuevariable,themeasure

of expenses is limitedtothosethat areincurredinthe operationofthefarm so,forexample, any expenses associatedwith contract

work

forotherfarmsisexcluded.9 Data on production expenseswere

not collected before 1987.The

Census data also containsome

other variables that are used forthe subsequent analysis. In particular, there are variables formost

ofthe sub-categories ofexpenditures (e.g., agricultural chemicals,fertilizers, and labor).

These

variables areusedtomeasure

the extentofadaptation to annual changes inAn

exceptionisthatitincludesreceiptsfrom

placingcommodities intheCommodity

Credit Corporation(CCC)

loanprogram.These

receipts differfrom

otherfederalpayments

because farmers receivethem

inexchange

forproducts.The

Censuses contain separate variables for subcategories of revenue (e.g., revenues due to crops anddairy sales), but expenditures are not reported separately for these different types of operations.

Consequently,

we

focuson

total agriculture profits and do not provide separate measures ofprofits bytemperature and precipitation.

The

data also separately report thenumber

of acres devoted to crops, pasture, andgrazing.Finally,

we

utilize the variableon

the value of land and buildings to replicate the hedonicapproach. Thisvariable isavailableinall fiveCensuses.

Soil Quality Data.

No

study ofagricultural land valueswould

be complete without dataon soilquality

and

we

rely on the National Resource Inventory (NRI) for our measures ofthese variables.The

NRI

is a massive survey of soil samples and land characteristics from roughly 800,000 sites that isconducted in

Census

years.We

follow the convention in the literature and use the measures ofsusceptibility to floods, soil erosion (K-Factor), slope length, sand content, clay content, irrigation, and

permeability as determinants oflandpricesand agriculturalprofits.

We

createcounty-level measures bytaking weighted averages from the sites that are used for agriculture,

where

the weight is theamount

ofland thesamplerepresents inthe county. Since thecomposition ofthe landdevoted toagriculturevaries

within counties across Censuses,

we

use these variablesas covariates.Although

these dataprovidearichportrait of soil quality,

we

suspect that they are not comprehensive. It is this possibility of omittedmeasures ofsoil qualityandotherdeterminantsofprofits thatmotivate ourapproach.

Climate Data.

The

climate and weather data are derived from the Parameter-elevationRegressions on Independent Slopes

Model

(PRISM).

10 Thismodel

generates estimates ofprecipitationand temperature at 4 x 4 kilometers grid cells forthe entire

US.

The

data that are usedto derive theseestimates are from the

more

than 20,000 weather stations in the National Climatic Data Center'sSummary

oftheMonth

Cooperative Files.The

PRISM

model

is used byNASA,

theWeather

Channel, and almostallother professional weatherservices. It isregardedasoneofthemost

reliableinterpolationproceduresforclimaticdataona small scale.

This

model

anddata areusedtodevelopmonth

byyear measures ofprecipitationand temperaturefortheagricultural landin each countyforthe 1970

-

1997 period. Thiswas

accomplishedby overlayinga

map

ofland useson

thePRISM

predictions foreach grid cell and then by taking the simple averageacross all agricultural land grid cells."

To

replicate the previous literature's application ofthe hedonicapproach,

we

calculated the climate normals as the simple average of each county's annual monthly temperature and precipitation estimatesbetween

1970 andtwo

years before the relevantCensus

year.Furthermore,

we

follow theconvention inthe literature and include the January, April, July,andOctoberestimates inourspecificationssothere isa single

measure

of weather from each season.10

PRISM

was

developedby

the Spatial Climate Analysis Service atOregon

State University for theNational Oceanic and AtmosphericAdministration. Seehttp://www.ocs.orst.edu/prism/docs/przfact.html

B.

Summary

StatisticsTable 1 reports county-level

summary

statisticsfrom thethreedata sources for1978, 1982, 1987,1992,

and

1997.The

sample is limited to the 2,860 counties in our primary sample.12Over

the period,the

number

of farms per county declined from approximately 765 to 625.The

totalnumber

of acresdevoted to farming declined by roughly

8%.

At

thesame

time, the acreage devoted to croplandwas

roughly constant implying that the decline

was

due to reduced land for livestock, dairy, and poultryfarming.

The

mean

average value of land and buildings per acre in theCensus

years rangedbetween

$1,258

and

$1,814(1997$)in thisperiod,withthehighestaverageoccurringin 1978.13

The

secondpanel details annual financial information about farms.We

focuson

1987-97, sincecomplete data is only available for these years.

During

this period themean

county-level sale ofagricultural products increased

from

$60

to$67

million.The

share of revenuefrom

crop productsincreased

from 43.5%

to50.2%

in thisperiod.Farm

production expensesgrew from $48

million to $51million.

Based

on the"net cash returns from agriculturalsales"variable,which

isourmeasure

ofprofits,the

mean

county profit from farming operationswas

$11.8 million, $11.5 million,and

$14.6 million(1997$)or $38, $38,and

$50

per acre in 1987, 1992,and 1997, respectively.The

third panel lists themeans

of the available measures of soil quality,which

arekey

determinantsoflands'productivityinagriculture.

These

variables are essentiallyunchanged

across yearssince soil and land types at a given site are generally time-invariant.

The

small time-series variation inthese variables is dueto changes in the composition oflandthat is used for farming. Notably, the only

measure

ofsalinity is from 1982, sowe

usethismeasure

forallyears.The

final panels report themean

ofthe 8primary weathervariablesforeach yearacross counties.The

precipitation variables aremeasured

in inches and the temperature variables are reported inFahrenheit degrees.

On

average, July is the wettestmonth

and October is the driest.The

averageprecipitation in these

months

in the five census years is 3.9 inches and 2.0 inches, respectively. It isevidentthatthereislessyear-to-year variation in the national

mean

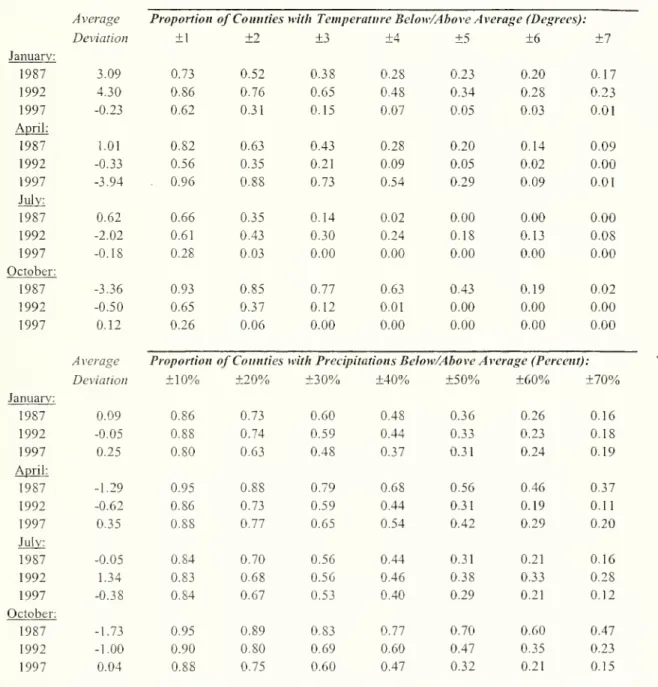

of temperaturethan precipitation.Table 2 explores the

magnitude

ofthe deviationsbetween

counties' yearly weather realizationsand their longrun averages.

We

calculatethe longrun average (climate) variables asthe simpleaverageofall yearly county-level

measurements

from 1970 throughtwo

years before theexamined

year.Each

row

reportsinformation on thedeviationbetween

the relevant yearby month'srealization of temperatureor precipitation andthe correspondinglongrun average.

11

We

are indebtedtoShawn

BucholtzattheUSDA

forgenerouslygeneratingthisweatherdata.12

The

sample

is constructedto have abalanced panel ofcountiesfrom

1978-1997, withnone

ofthe keyvariables missing.

Our

resultsarerobusttoalternativesampledefinitions. Observations from Alaska andHawaii

were

excluded.13

All dollar valuesare in1997 constantdollars.

The

firstcolumn

presents the yearly average deviation for the temperature and precipitationvariables across the 2.860 counties in our balanced panel.

The

remainingcolumns

report the proportionofcounties with deviations at least as large as the one reported in the

column

heading. For example,consider the January 1987 row.

The

entries indicate that73%

ofcounties had amean

January 1987temperature that

was

at least 1 degreeabove

orbelow

their long run average January temperature(calculatedwiththe 1970-85 data). Analogously inOctober 1997, precipitation

was

10%

above orbelow

thelongrunaverage(calculatedwithdata

from

1970-1995)in95%

ofallcounties.Our

baseline estimatesofthe effectofclimatechange follow theconvention intheliteratureandassume

a uniform (across months) five degree Fahrenheit increase in temperature and eight percentincrease in precipitation associated with a doubling of atmospheric concentrations ofgreenhouse gases

(IPCC

1990;NAS

1992).14

It

would

be idealifameaningful fraction ofthe observationshave deviationsfrom long run averages as large as 5 degrees and

8%

ofmean

precipitation. Ifthis is the case, ourpredicted

economic

impactswillbe identifiedfromthe data, ratherthanby

extrapolationdueto functionalform assumptions.

In both the temperature and precipitation panels, it is clear that deviations ofthe magnitudes

predicted by the climate change

models

occurin the data. It isevidentthat forall fourmonths

there willbe little difficulty identifying the

8%

change in precipitation.However

in the cases oftemperature,deviations as large as +/- 5 degree occurless frequently, especially in July. Consequently, the effects of

thepredictedtemperaturechanges inthese

months

willbeidentifiedfrom asmallnumber

ofobservationsand functional form assumptionswillplay alarger rolethan isideal.

15

III.

Econometric

StrategyA. The

Hedonic Approach

This section describes the econometric

framework

thatwe

use to assess the consequences ofglobalclimatechange.

We

initially considerthehedoniccross sectionalmodel

thathas been predominantin the previous literature

(MNS

1994&

1999; Schlenker,Hanemann,

and Fisher 2002). Equation (3)provides a standard formulationofthismodel:

14

Mendelsohn,

Nordhaus, andShaw

(1994 and 1999) andSchlenker,Hanemann,

and Fisher (2002)alsocalculate the effect of global climate change based on these estimated changes in temperature and

precipitation.

15

In

some

models,we

will include state by year fixed effects and in these specifications functional form assumptions willbe evenmore

important.(3) yet

=

Xct'P+

2, e, f,(W

ic)+ E*

SM=

a

c+

uct,where

yct isthevalue ofagricultural landper acre in county c in yeart.The

tsubscript indicates that thismodel

couldbeestimatedin any yearforwhich

dataisavailable.X

ct is a vectorof observable determinants of farmland values.A

tsubscript is includedon

theX

vector, because itincludes

some

time-varying factors that affect land values.W

ic represents aseries ofclimate variables for county c.

We

followMNS

and let i indicate one ofeight climatic variables. Inparticular, there are separate measures of temperature and total precipitation in January, April, July, and Octoberso there isone

month

from each quarteroftheyear.The

appropriate functional form for each ofthe climate variables is

unknown,

but inourreplication ofthehedonic approachwe

followtheconventionin the literature and

model

the climatic variables with linear and quadratic terms.The

last term inequation(3)isthe stochastic error term, sct,thatis comprised ofapermanent,county-specific

component,

ctc,and an idiosyncraticshock,uct.

The

coefficient vector is the 'true' effect ofclimateon

farmland values and its estimatesareused to calculatethe overall effectofclimate change associatedwiththe

benchmark

5-degree Fahrenheitincrease in temperature and eight percent increase in precipitation. Since the total effect of climate

change is a linear function of the

components

ofthe 6 vector, it is straightforward to formulate andimplement

testsofthe effectsofalternativeclimatechange scenarioson agricultural land values.We

willreportthe standarderrors associated withthe overall estimate ofthe effect ofclimatechange.

However,

thetotal effect ofclimate

change

isa function of 16 parameter estimateswhen

the climate variables aremodeled

with a quadratic, so it is not surprising that statistical significance is elusive. This issue ofsamplingvariabilityhas generally been ignoredintheprevious literature.16

Consistent estimation ofthe vector 6,and consequently ofthe effect ofclimate change, requires

that

E[fi(W

ic) EctlX

ct]=

for each climate variablei. This assumption will be invalid ifthere are

unmeasured permanent

(ac) and/or transitory (uct) factors that covary with the climate variables.To

obtain reliableestimates of8,

we

collectedawide

range ofpotential explanatory variables including allthesoilquality variables listed inTable 1, aswell asper capita

income and

populationdensity.17We

alsoestimate specificationsthatincludestate fixedeffects.

16

Schlenker,

Hanemann,

andFisher(2002)isanotable exception.1

Previous research suggests that urbanicity, population density, the local price of irrigation, and air

pollution concentrations areimportant determinantsoflandvalues (Cline 1996; Plantinga,Lubowski, and

There arethree furtherissues about equation(2) thatbearnoting. First, it islikely that the error

terms are correlated

among

nearby geographical areas. For example, unobserved soil productivity islikely tobe spatially correlated. In thiscase,the standard

OLS

formulasfor inferenceare incorrect sincethe error variance is not spherical. In absence of

knowledge on

the sources and the extent ofresidualspatial

dependence

inlandvaluedata,we

adjustthestandarderrors for spatialdependence

of anunknown

form

following the approachofConley

(1999).The

basicideaisthatthespatialdependence

between two

observationswilldecline as the distance

between

thetwo

observationsincreases.18Throughout

the paper,we

present standard errors calculated withthe Eicker-White

formulathatallows forheteroskedasticity ofanunspecifiednature, inadditiontothose calculatedwiththe

Conley

formula.Second, it

may

be appropriate to weight equation (3). Since the dependent variable iscounty-level farmland values per acre,

we

think there aretwo complementary

reasons to weightby

the squareroot of acres of farmland. First, the esiimates of the value of farmland from counties with large

agricultural operations will be

more

precisethan the estimates from counties with small operations andtheweightingcorrects forthe heteroskedasticityassociated withthe differences inprecision. Second,the

weighted

mean

ofthe dependent variable isequal tothe national value of farmland normalizedby

totalacresdevotedtoagriculture inthecountry.

MNS

estimatemodels

that use the square rootsofthe percent ofthecounty in croplandand

totalrevenue from crop sales as weights, respectively.

We

also present results based on these approaches, althoughthe motivation for these weightingschemes

is less transparent. For example, they both correctforparticular forms ofheteroskedasticity but it is difficulttojustifythe assumptions aboutthe

variance-covariance matrix that

would

motivate these weights. Further, although these weightsemphasize

thecountiesthatare

most

importanttototalagricultural production,they do soinan unconventionalmanner.Consequently, the weighted

means

ofthe dependent variable with these weights have a non-standardinterpretation.

Third toprobe the robustnessofthehedonic approach,

we

estimateit withdatafrom

each oftheCensus years. Ifthis

model

is specified correctly,the estimates will be unaffectedby

theyear inwhich

the

model

is estimated. Ifthe estimates differ across years, thismay

be interpreted as evidencethat thehedonic

model

ismisspecified.Stavins2002; Schlenker,

Hanemann,

and Fisher2002;Chay

and Greenstone 2004).Comprehensive

dataonthe priceofirrigation andairpollutionconcentrations

were

unavailable.8

More

precisely, theConley

(1999) covariance matrix estimator is obtainedby

taking a weighted average of spatial autocovariances.The

weights are given by the product ofBartlett kernels intwo

B.

A

New

Approach

One

ofthis paper's primary points is that the cross-sectional hedonic equation is likely to bemisspecified.

As

a possible solutiontothese problems,we

fit:(4) yct

=

occ+

y,+

X

c/(3+ S

: 6, f,(Wlct)+

uct.There are a

number

of important differencesbetween

equations (4) and (3). For starters, the equationincludes a full set of county fixed effects,

a

c.The

appeal of including the roughly 3,000 county fixedeffects is that they absorb all unobserved county-specific time invariant determinants ofthe dependent

variable.19

The

equation also includes year indicators, y,, that control for annual differences in thedependent variable that are

common

across counties.As

discussed above,we

also report results fromspecifications

where

we

replace theyearfixedeffectswithstateby

yearindicators.The

inclusion ofthe county fixedeffects necessitatestwo

substantive differences in equation (4),relativeto(3). First, since thereis

no

temporal variation inW

jc,itis impossibleto estimate the effect ofthe long run climate averages. Consequently,

we

replace theclimate variableswith annualrealizationsofweather,

W,

ct. Thus,theequation includesmeasures ofJanuary, April, July and October temperature andprecipitation inyeart.

We

allow fora quadratic ineach ofthesevariables.Second, the dependent variable, yct, is

now

county-level agricultural profits, instead of landvalues. This isbecause landvalues capitalize longrun characteristics ofsites and, conditional

on

countyfixedeffects, annual realizations ofweather should notaffect land values.

However,

weather does affectfarm revenues and expenditures and their difference is equal to profits.

The

associationbetween

theweather variables and agricultural profits

may

be dueto changes in revenues or operating expendituresand

we

show

separate results for each of these potential outcomes. Further,we

use the separatesubcategoriesof farm expenditures (e.g., labor, capital, and inputs) asdependent variablestoexplore the

rangeofadaptations availableto farmers inresponsetoweathershocks.

The

validity ofany estimateoftheimpactofclimatechange

basedon

equation(4) rests cruciallyon the assumption that its estimation will produce unbiased estimates ofthe 8 vector. Formally, the

consistencyof each8j requires E[fj(Wict)uct|

X

ct,a

c, y,]=0.By

conditioningon thecounty and year fixedeffects, 6 is identified from county-specific deviations in weather about the county averages after

controlling for shocks

common

to all counties in a state. This variation ispresumed

tobe orthogonal tounobserved determinants ofagricultural profits, so itprovides apotential solutiontotheomittedvariables

biasproblemsthatappeartoplaguetheestimation of equation(3).

A

shortcomingofthisapproach isthatonethe coordinates exceeds apre-specified cutoffpoint.

Throughout

we

choosethe cutoff pointsto be 7degreesoflatitudeandlongitude, correspondingtodistancesof about

500

miles.the inclusion of these fixed effects is likely to

magnify

the importance of misspecification due tomeasurement

error,which

generally attenuates the estimated parameters.IV. Results

Thissection isdividedintothree subsections.

The

firstprovidessome

suggestiveevidenceon

thevalidity ofthe hedonic approach and then present results

from

this approach.The

second subsectionpresents results

from

the fittingof equation(4),where

county-level agricultural profits arethe dependentvariableand the specification includes a full set of countyfixed effects. It also probes the robustness of

these results.

The

third andfinal subsection againfits equation(4), buthere the dependentvariables arethe separate determinants ofprofits.

The

aim

is to understand the adaptations that farmers are able toundertake inresponsetoweathershocks.

A.Estimates ofthe

Impact of

ClimateChanges

from

theHedonic

Approach

As

the previous section highlighted, the hedonic approach relieson

the assumption that theclimate variables are orthogonal to unobserved determinants of land values.

We

begin by examining whetherthese variables are orthogonal to observable predictors of farm values.While

this is not a formal test ofthe identifying assumption, there are at leasttwo

reasons that itmay

seem

reasonabletopresume

that thisapproach willproduce validestimates ofthe effects ofclimatewhen

theobservables arebalanced. First, consistent inferencewill not

depend

on functional form assumptions(e.g., linear regression adjustment

when

the conditional expectations function is nonlinear) on therelations

between

the observableconfoundersand

farm values. Second, the unobservablesmay

bemore

likelytobe balanced(Altonji, Elder,and

Taber

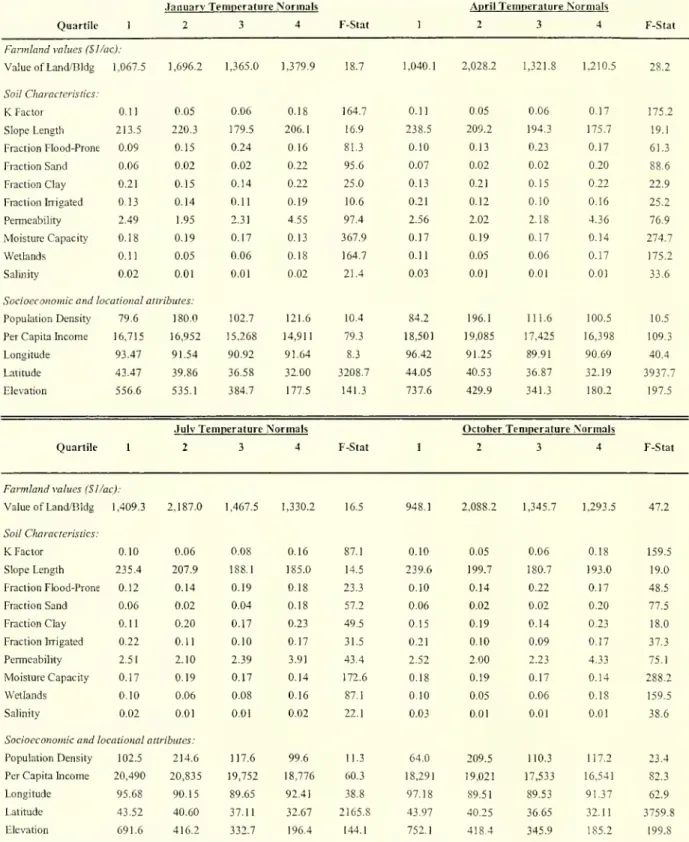

2000).Table

3A

shows

the association of the temperature variables with farm values and likelydeterminants offarm values and

3B

does thesame

for the precipitation variables.To

understand thestructureofthe tables, consider the upper-left cornerof Table 3A.

The

entries inthe first fourcolumns

arethe

means

of farmlandvalues,soil characteristics,and socioeconomic andlocational characteristicsby

quartile of the January temperature normal,

where

normal refers to the long run county averagetemperature.

The means

arecalculated withdatafromthe five Censusesbut areadjustedforyeareffects.Throughout

Tables3A

and 3B, quartile 1 (4) refers to counties with a climate normal in the lowest(highest) quartile,so, forexample,quartile 1 counties forJanuary temperaturearethecoldest.

19

Interestingly, the fixed effects

model

was

first developed byHoch

(1958 and 1962) andMundlak

(1961)toaccount forunobservedheterogeneityinestimatingfarm production functions.

The

fifthcolumn

reports the F-statistic from atest that themeans

are equal across the quartiles.Since thereare five observations per county, thetest statistics allowsfor county-specific

random

effects.A

value of2.37 (3.34) indicates that the null hypothesis canbe rejected atthe5%

(1%)

level. If climatewere randomly

assigned across counties, therewould

be veryfew

significant differences.It is immediately evident that the observable determinants of farmland values are not balanced

across thequartiles ofweathernormals. In 120 (119) ofthe 120cases,the null hypothesisofequality of

the sample

means

ofthe explanatory variables across quartiles can be rejected at the5%

(1%)

level. Inmany

cases the differences inthemeans

are large, implying thatrejectionofthenull isnot simply duetothe sample size. For example, the fraction ofthe land that is irrigated and the population density (a

measure

ofurbanicity) in the county areknown

to be important determinants of the agricultural landvalues and their

means

vary dramatically across quartiles ofthe climate variables. Overall, the entriessuggest that the conventional cross-sectional hedonic approach

may

be biased due to incorrectspecificationofthe functional

form

of observedvariables and omitted variables.With

these results in mind, Table 4 implements the hedonic approach.The

entries are thepredicted change in land values from the

benchmark

increases of5 degrees in temperaturesand

8%

inprecipitation from 72different specifications.

Every

specificationallows fora quadratic ineach ofthe 8climate variables.

Each

county's predictedchange

is calculated as thesum

ofthe partial derivatives offarm values with respect to the relevant climate variable at the county's value ofthe climate variable

multiplied by the predicted change in climate (i.e., 5 degrees or 8%).

These

county-specific predictedchangesare then

summed

across the2,860countiesinthesample

and

reported inbillionsof1997 dollars.For the year-specific estimates, the heteroskedastic-consistent (White 1980) and spatial standard errors

(Conley 1999) associated with each estimate are reported in parentheses. Forthe pooled estimates, the

standarderrorsreportedinparenthesesallowforclusteringatthecountylevel.20

The

72 sets of entries are the result of 6 different data samples, 4 specifications, and 3assumptions about the correct weights.

The

data samples are denoted in therow

headings. There is aseparate

sample

for each oftheCensus

years and the sixth is the result of pooling data from the fiveCensuses.

Each

ofthe foursetsofcolumns

corresponds toadifferentspecification.The

firstdoesnot adjustfor any observable determinants of farmland values.

The

second specification follows the previousliterature and adjusts for the soil characteristics in Table 2, as well as per capita

income

and populationdensity

and

its square.MNS

suggest that latitude, longitude, and elevation (measured at countycentroids)

may

be importantdeterminantsofland values, so thethirdspecification addsthese variables to20

Sincethepooledmodelshavea largernumberofobservations, thespatial standarderrorswerenot estimated

because oftheircomputationalburden.

the regression equation.21 2'

The

fourth specification adds state fixed effects.The

exact controls arenotedinthe

rows

atthebottom ofthe table.Within each set of columns, the

column

"[1]" entries are the result of weighting by the squareroot offarmland. Recall, this

seems

like themost

sensible assumption about the weights. In the "[2]"and "[3]" columns, the weights are the square root ofthe percentage of each county in cropland and

aggregate valueofcroprevenueineachcounty.

We

initially focuson

the first five rows,where

the samples are independent.The most

striking featureoftheentries isthetremendousvariationintheestimatedimpact ofclimatechange onagriculturalland values. For example, the estimates range

between

positive$265

billion and minus$422

billion,which

are19%

and-30%

ofthe totalvalue oflandand structuresin this period.An

especially unsettlingfeature ofthese results is that even

when

the specification and weighting assumption are held constant,the estimated impact can vary greatly depending on the sample. For example, the estimated impact is

roughly

$200

billion in 1978 but essentially$0 in 1997, with specification #2 andthe square root oftheacres of farmlandas the weight. This finding is troubling becausethere is

no

ex-antereason to believethat the estimate from an individual year is

more

reliable than those from other years.23 Finally, it isnoteworthythat the standard errors are largest

when

the square root ofthe crop revenues is the weight,suggestingthatthisapproachfitsthe dataleastwell.

Figure 1 graphically

summarizes

these60 estimates ofthe effectofclimatechange. This figureplots eachofthe point estimates, along with their +/- 1 standard errorrange.

The

widevariability oftheestimates is evident visually and underscores the sensitivity ofthis approach to alternative assumptions

and data sources.

An

eyeball averaging technique suggests that together they indicate a modestlynegativeeffect.

Returning to Table 4, the last

row

reports the pooled results,which

provide amore

systematicmethod

tosummarize

the estimates from each ofthe 12 combinations ofspecifications and weighting1

This specification is identical to

MNS'

(1994) preferred specification, except that it also controls forlongitude.

The

resultsare virtually identicalwhen

longitudeisexcluded.2

We

suspect that controlling for latitude is inappropriate, because it is so highly correlated withtemperature. Forinstance,Table 3

A

demonstratesthatthe F-statisticsassociatedwith thetestofequalityofthe

means

oflatitudeacross thetemperature normalsare roughly an orderof magnitudelargerthan thenextlargest F-statistics. This suggeststhat latitudecaptures

some

ofthe variation thatshouldbe assignedto the temperature variables and thereby leads to misleading predictions about the impact of climate

change. Nevertheless,

we

reportthe resultsfromthis specificationforcomparability withMNS'

analysis.13

We

testedwhetherthe marginal effects ofthe climate variables are equal acrossthe datafrom the fivecensuses

when

the specification and weighting procedure are held constant. Innearly all cases, the nullhypothesisofequalityofthemarginal effectsisrejectedbyconventional criteria.

procedures.24

The

estimated change in property valuesfrom

thebenchmark

globalwarming

scenarioranges from -$248 billion (witha standard errorof $21 1 billion) to

$50

billion (with a standard error of$43 billion).

The

weighted average ofthe 12 estimates is -$35 billion,when

the weights arethe inverseofthe standarderrors ofthe estimates.

Thissubsection has produced

two

important findings. First, the observable determinants oflandprices are poorly balanced across quartiles of the climate normals. Second, the hedonic approach producesestimates oftheeffectofclimatechange thatare sensitive to specification,weighting procedure, and sample and generally are statistically insignificant. Overall, the

most

plausible conclusions are that eithertheeffect iszero orthismethod

isunableto produceacredible estimate. In lightofthe importanceofthe question, itis worthwhileto consider alternative

methods

to valuetheeconomic

impact ofclimatechange.

The

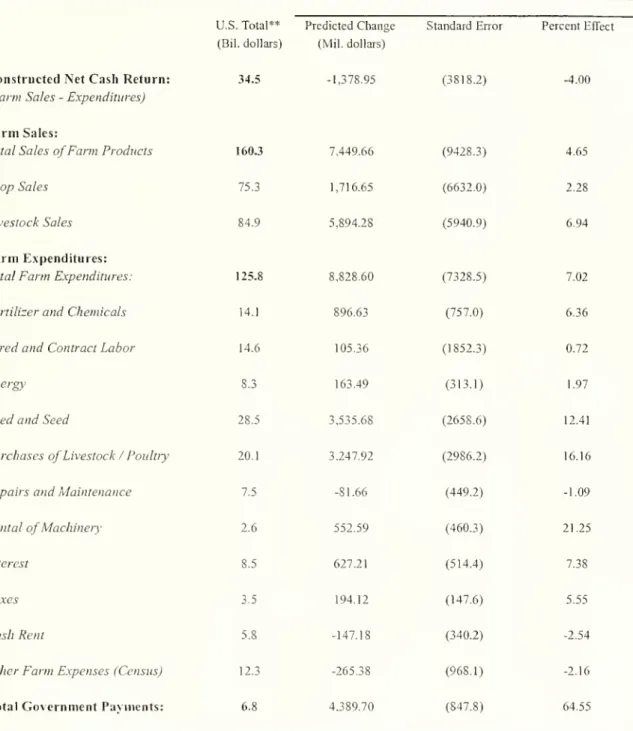

remainderofthepaperdescribes theresults from ouralternativeapproach.B.Estimates ofthe

Impact

of ClimateChange

from

Local Variation inWeather

We

now

turn to our preferred approach that relieson

annual fluctuations in weather about themonthly county normals of temperature and precipitation to estimate the impact ofclimate

change on

agricultural profits. Table 5 presents the results

from

the estimation of four versions of equation (4),where

the dependent variableis county-level agriculture profits (measured in millions of 1997$) and theweather measures are the variables ofinterest.

The

weather variables are allmodeled

with a quadratic.The

data fortheseand

the subsequenttablesarefrom

the 1987, 1992, and 1997 Censuses,since theprofitvariableisnot availableearlier in earlierCensuses.

The

specification details are notedatthe bottom ofthetable.Each

specification includes a fullsetof county fixedeffects ascontrols. In

columns

(1) and(2), the specification includes unrestrictedyeareffects and these are replaced with state

by

year effects incolumns

(3) and (4).25

Additionally, the

columns

(2) and (4) specifications adjust for the full set of soil variables listed in Table 1, while thecolumns

(1)and(3)estimatingequationsdo notinclude thesevariables.The

first panel of the table reports the marginal effects and the heteroskedastic-consistentstandarderrors (inparentheses) of each oftheweather measures.

The

marginal effectsmeasure

the effectofa 1-degree(1 inch)

change

inmean

monthly temperatures(precipitation) at the climatemeans

on totalagricultural profits,holding constant the otherweathervariables.

The

second panel reports p-valuesfrom

separate F-tests that the temperature variables, precipitation variables, soil variables, and county fixed

effectsare jointly equalto zero.

Inthe pooled regressions, the intercept andthe parameters

on

all covariates, except the climate ones,The

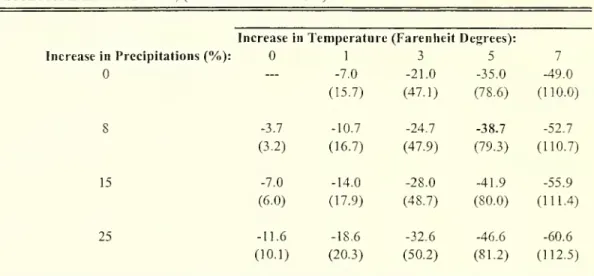

third panelofthetable reportsthe estimatedchangein profits associatedwith thebenchmark

doublingof greenhouse gases

and

theEicker-White and Conley

standarderrorsofthisestimate. Justas inthe hedonic approach,

we

assume

a uniform 5 degree Fahrenheit and8%

precipitation increases. Thispanel alsoreports theseparateimpacts ofthechanges intemperature andprecipitation.

When

thepointestimates aretakenliterally, itisapparentthatthe impactofauniformincrease intemperature and precipitation will have differential effects throughout the year. Consider the marginal

effects

from

thecolumn

(4) specification,which

includes the richest set ofcontrols. For example, a5-degree increase inApril temperatures is predicted to decrease

mean

county-level agricultural profitsby

$1.35 million,

compared

to annualmean

countyprofits of approximately $12.1 million.The

increase inJanuary temperature

would

reduce agricultural profits by roughly $0.70 million, while together theincreases inJuly andOctober temperature

would

increasemean

profitsby

$1.45 million.The

increase inprecipitation in January

and

July is predicted to increase profits, while the October and April increasewould

decreaseprofits.26When

these separateeffectsareaddedup

andthetotalsummed

overthe2,860US

counties inoursample, the net effect of the 5 degree increase in temperature and

8%

increase in precipitation is todecrease agricultural profits

by

$1.9 billion,which

is5.3%

ofthe $36.0 billion in annual profits.The

predicted change in precipitationplaya small roleinthisoverall effect, underscoringthatthetemperature

change is the potentially

more

harmful part ofclimate change for agriculture.These

predicted changesare a function of 16 estimated parameters, so it is not especially surprisingthat the estimated decline is

not statistically different

from

zero, regardless of whether the heteroskedastic-consistent standard errorsor larger spatial standard errors are used tojudge statistical significance. Further, separate tests cannot

reject thateither the change in temperatureor the

change

in precipitation have no impact on agricultural profits.There are a

few

other noteworthy results. First, the marginal effects in (1) and (2) differ fromthose in (3) and (4)

which

indicates that there are state-level, time-varying factors that covary with thecounty-specific deviations in weather.

The

changes in the marginal effects are occasionally large, buttheytend to cancel each otherout.27 For example,the overall predicted change inprofits is -$3.5 billion

in

column

(2), but the differencewiththe-$1.9billioneffect incolumn

(4)ismodest

inthecontext ofthe25

A

controlfortotal acresof farmland isincluded inall fourspecifications, so theresults reflecttheeffectof weatherconditional

on

total farmland.26

Although

none

ofthe marginal effects are individually statistically significant,thejoint hypothesis thatthe temperature effects are equal to zero is easily rejected. Tests ofthe precipitation marginal effects

reachidenticalconclusions.

27

For example,the October temperature marginal effect is -0.70 in the

column

(2) specification and0.22in