Comonotonic Measures of Multivariate Risks

Texte intégral

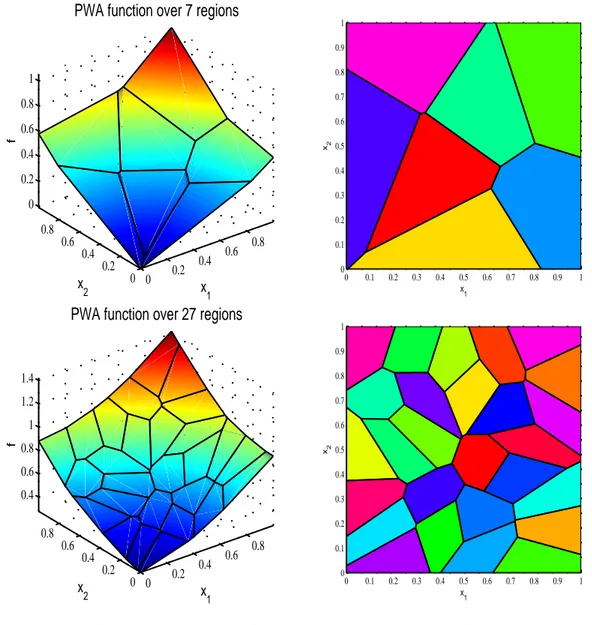

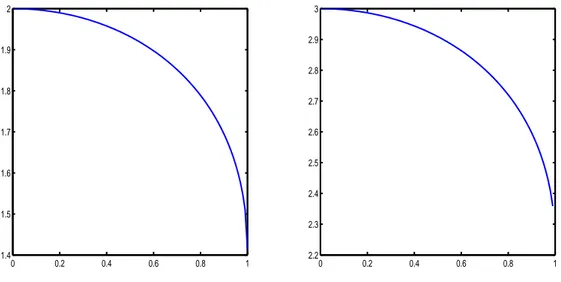

Figure

Documents relatifs

In this context, we assume that the components of the random vector X are independent (non necessarily identically distributed) and regularly varying at infinity.. Then the vector X

The comparison between the asymptotic optimal allocation, in the case of sub-exponential and exponential distributions, underscores the impact of the risks nature on the behavior of

Multivariate risk measures, Solvency 2, Risk management, Risk theory, Dependence modeling, Capital allocation, Multivariate expectiles, Elicitability, Coherence properties,

These properties are therefore desirable from an economic point of view, the fact that they are satisfied by the proposed optimal allocation implies that this allocation method may

Dynamic risk measures, in discrete or continuous time, will simply denote sequences of conditional risk measures, adapted to the underlying filtration.. So the first step will be

Knook LME, Konijnenberg AY, van der Hoeven J, Kimpen JLL, Buitelaar JK, van Engeland H, de Graeff-Meeder ER (2011) Psychiatric disorders in children and adolescents

In this section, we survey some areas for applications of linear portfolios that exist in the financial literature. Delta Approximation of a Portfolio.. The entries of the δ vector

A MULTIVARIATE GENERALIZATION OF KUSUOKA’S THEOREM In this section, we recall the existing axiomatization leading to the representation result of Kusuoka (2001), where risk measures