APPLICATIONS FOR PAPER HONEYCOMB TECHNOLOGY

BY

MOHAMED AL-SAYED KAMALEDIN Master of Business Administration

The American University in Cairo (2002)

Master of Science, Construction Management

The American University in Cairo (2000)

Bachelor of Science, Construction Engineering

The American University in Cairo (1998)

SUBMITTED TO THE MIT SLOAN SCHOOL OF MANAGEMENT

IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF BUSINESS ADMINISTRATION

AT THE

MASSACHUSETTS INSTITUTE OF TECHNOLOGY JUNE 2018

2018 Mohamed Al-Sayed Kamaledin. All rights reserved.

The author hereby grants to MIT permission to reproduce and to distribute publicly paper and electronic copies of this thesis document

in whole or in part in any medium now known or hereafter created.

Signature redacted

Signature of Author:

-MIT Sloan School of Management May 11, 2018

Certified by:

Signature redacted

Duncan Simester NTU Professor of Marketing

Signature redacted

Thesis SupervisorAccepted by:

Johanna Hising DiFabio MASSACHUSETTS INSTITUTE Director, MIT Sloan Fellows Program

F j MIT Sloan School of Management

APPLICATIONS FOR PAPER HONEYCOMB TECHNOLOGY by

MOHAMED AL-SAYED KAMALEDIN

Submitted to MIT Sloan School of Management on May 11, 2018 in Partial Fulfillment of the Requirements for the Degree of

Master of Business Administration

ABSTRACT

Paper Honeycomb technology was invented as another means of constructing light-weight, durable, and affordable products that could serve both home and industry. Since the technology became popular after appearing in its first market, it has taken on one market after another, even while identifying more opportunities to adapt this technology for other uses. To date, there are applications in packaging, construction, marketing promotions, cars, aircrafts, and lately, in furniture.

This thesis focuses specifically on new market opportunities for the paper

honeycomb technology, especially its use in furniture. I test different hypotheses on both the demand side and the supply side of the market. Then I identify attractive new markets by evaluating several marketing strategies in a value framework of create-capture-deliver.

Thesis Supervisor: Duncan Simester

ACKNOWLEDGEMENTS

I am grateful to my thesis advisor, Duncan Simester for his great support and insights.

Thanks to my lovely wife for her support and patience throughout our life. I would not have been made it here without her backing.

Quiet thanks to the souls of my parents who, although no longer with me, gave me a tremendous passion for learning.

Thanks to our daughter Dana and son Omar for their contributions to making this year so special and rich.

Mohamed Al-Sayed Kamaledin Cambridge, Massachusetts May 11, 2018

TABLE OF CONTENTS

Acknowledgements ... 3

L ist o f F ig u res ... 5

Chapter 1 Brief History and Background... 6

Chapter 2 Potential M arkets for Paper Honeycomb... 9

Chapter 3 Target Customers and M arkets... 15

Chapter 4 The Create-Capture-Deliver Framework... 20

Chapter 5 The Firm's Competitive Advantages and Its Competition... 26

Chapter 6 Conclusion ... 37 R eferen ces... 3 9

LIST OF FIGURES

Fig. 1. Close-up of paper honeycom b ... 6

Fig. 2. Honeycomb used by auto manufacturers to strengthen shelves and com partm ent covers... 13

Fig. 3. Fully assem bled sofa... 14

Fig. 4. Sales of ten leading furniture stores in the US (2014, $US millions)... 27

Fig. 5. Home furnishings retailers and general furniture merchandisers (2016, %)... 28

CHAPTER 1

BRIEF HISTORY AND BACKGROUND

Since ancient times, man has continually searched for efficient materials to fulfill his physical needs. For millennia, humans have sought stronger, lighter materials with minimal cost and requiring less energy to produce.

It was the small bumblebee that showed man the honeycomb-that intricate

hexagonal structure that is home to a queen and her colony of bees. Who knows what man or woman braved the possible stings of bees to investigate that structure? But when they did, it revealed one of the most stable structures in the geometric/ symmetrical world. With that discovery came the idea to duplicate that shape and find other uses for it.

Fig. 1. Close-up of paper honeycomb

The first production of paper honeycomb goes back to 1901 where Hans Heilbronn patented his invention in a paper factory that produced decorative applications.' Around the same time, Octave Chanute, an inventor who, late in his life, became a mentor to the Wright Brothers, constructed his first aircraft structure using paper honeycomb because of its light weight and high compression strength. The concept proved to be so successful that scientists used it to reconstruct buildings after World War II, especially when other materials, like wood and cement, were scarce.2 Due to its unique strength-to-weight property, plus its cost-effectiveness, more and more industries have started to use honeycomb concepts in different applications.

Properties of Honeycomb Paper

At the technical level, the honeycomb structure has proved to be an optimum replacement for several well-known materials. Some of these unique are the following, which have made honeycomb paper a successful replacement for other traditional materials:

1. High strength-to-weight ratio: high compression strength; lightweight. Can replace wood in many packaging applications yet weighs four to five times less than wood. 2. Shock and vibration absorption: protects products from shock or vibration damage

during transportation and distribution. A related form is often found in packaging for delivery products.

3. Flexible: can be easily shaped and cut; can be opened and closed like accordions with minimum effort.

"History of Sandwich Construction and Honeycombs." EconHP Holdings. Available from: http://www.econhp.com/ history/. Accessed 26 April 2018.

4. Cost efficient: cheaper than more dense materials such as wood and plastic.

Technically, honeycomb performs best when it is made from recycled paper rather than virgin paper, since glue absorption is higher in recycled paper. When the honeycomb structure absorbs the glue, it becomes stronger.

5. Light weight: its lighter weight saves costs of handling and shipping.

6. Sustainability: produced from recycled paper, honeycomb paper can itself be recycled (i.e., a closed loop). The energy needed for its production is less than its counterpart in wood making. The glue used is an organic, starch-based type compared to the synthetically produced glue in comparable wood products.

CHAPTER 2

POTENTIAL MARKETS FOR PAPER HONEYCOMB

Since the introduction of honeycomb technology, people have begun to discover new applications that utilize the honeycomb structure because of its physical properties as

described earlier.

This is a new idea, and will be the focus of this thesis. Paper honeycomb technology can be used to provide the main inner structure for furniture that mimics real wood furniture that has covers, foam, and cushions. At present, this is an untapped area, and based on current research, no company has entered this market. Integrating paper honeycomb with other materials to provide comfortable furniture is, for the moment, a completely empty field.

Why Choose a Honeycomb Structure for Furniture?

The structure of honeycomb is a niche material that has its own unique

characteristics. The idea of using it in the production of furniture has not yet been attempted, which makes it an opportunity ripe for exploration. Using paper honeycomb as the structure inside furniture is a new market in which I see an opportunity.

The furniture market was commoditized many years ago. The way it is manufactured is now virtually the same everywhere. Differentiation arises mainly in the form of design, quality, and price. Product differentiation comes primarily from branding, which focuses on changing the shape, materials, and therefore the price.

Structural innovation has also been tapped. The concept of fully foldable furniture for bulky items like sofa, beds, and tables is still in its very early stages. However, using honeycomb in furniture may lead to a game changer in this ancient industry. It is an opportunity that needs an entrepreneur willing to tackle the idea and explore all the possibilities.

Advantages

Paper honeycomb brings with it unique advantages that are apparent in furniture that utilizes the honeycomb structure. These advantages include:

* Low production cost and low material cost offer a cost advantage for paper honeycomb products compared to traditional wood products.

* Flexibility and foldability, working in tandem, make honeycomb unique. * Honeycomb is more cost effective compared to its wood-based furniture

counterparts.

* Consumer buying habits are changing at an accelerated rate, especially since online selling has become a major channel for purchasers of the new generations. Having foldable and flat-pack products gives many consumers instant fulfillment.

Lightweight, foldable products can be brought home without waiting for shipping and delivery. The new honeycomb products can help meet these expectations. * The foldability of honeycomb products is an advantage when it comes to shipping.

Honeycomb's dimensions fit within the dimensions required by express couriers. There is no need to use large trucks, which means this type of furniture can be shipped faster and more economically.

* Sustainability of honeycomb products is a key differentiator in the target market, which I define as the generations beginning in the 1980s with Gen Y and the

Millennials, and coming forward. Customers in these generations are more likely to look for the eco-friendly aspects of products; they have more awareness of

environmental and sustainability issues, which matches the innovative techniques used to produce this kind of furniture.

* The environmental effects can be seen in the five phases of the product lifecycle: material, production, distribution, use, and recovery. Using recycled materials avoids using real wood which in turn saves trees and protects the Earth from deforestation. Production is simpler with paper honeycomb compared to normal woodwork and needs less energy and few or no chemicals. Distribution savings are excellent since less volume and weight saves in the CO2 footprint of products. Foldable furniture is durable enough that customers do not need to buy furniture regularly. In many cases, regular furniture gets damaged after one or two moves which leads customers to buy new furniture. Finally, foldable furniture can be easily recycled by being pulled apart and placed in recycle bins "on the curb," not in the landfill.

* The habit of changing furniture has become a trend in the newer generations, who tend toward a much more dynamic lifestyle a tendency to change furniture more frequently than the older generations. To the new generations, comfort means more than fluffy furniture; it means being convenient in looks, assembly, disassembly, moving, functionality, affordability, and customized to their lifestyle.

Potential Markets

While there are a number of potential markets, each one has its own characteristics and specifications that have developed over time. Some of the most important markets are:

" Packazing Industry: Honeycomb can replace some types of foam in so-called

"white" industries.3 It can also be used as protective boards, edge protectors, box making, and for recyclable paper pallets. White goods industries started to use honeycomb paper boards as a replacement for extruded polystyrene, which is considered an environmentally unfriendly product.

* Doors and boards. The honeycomb core replaces the inner wood panels in the

manufacture of doors, filling the hollow space in the doors to give them strength and structural stability.

* Structural partitions. Honeycomb partitions are used to replace as a wood in the

space industry.

" Automotive and Aviation: Sometimes used for car seat backing, for strengthening car walls, or compartment covers.

3 A new environmentally defined category called "White Industries" covers 36 sectors that are virtually non-polluting. 6 March 2016. See: http://www.dailypioneer.co-n/todays-newspaper/white-industries-a-new-category.html. Accessed 26 April 2018.

Fig. 2. Honeycomb used by auto manufacturers to strengthen shelves and compartment covers.

* Pop-up and POS stands and displays: Paper honeycomb boards are a great

replacement for wooden boards as they are disposable and cheaper.

* Flexible furniture: A new trend is flexible, foldable and lightweight paper furniture.

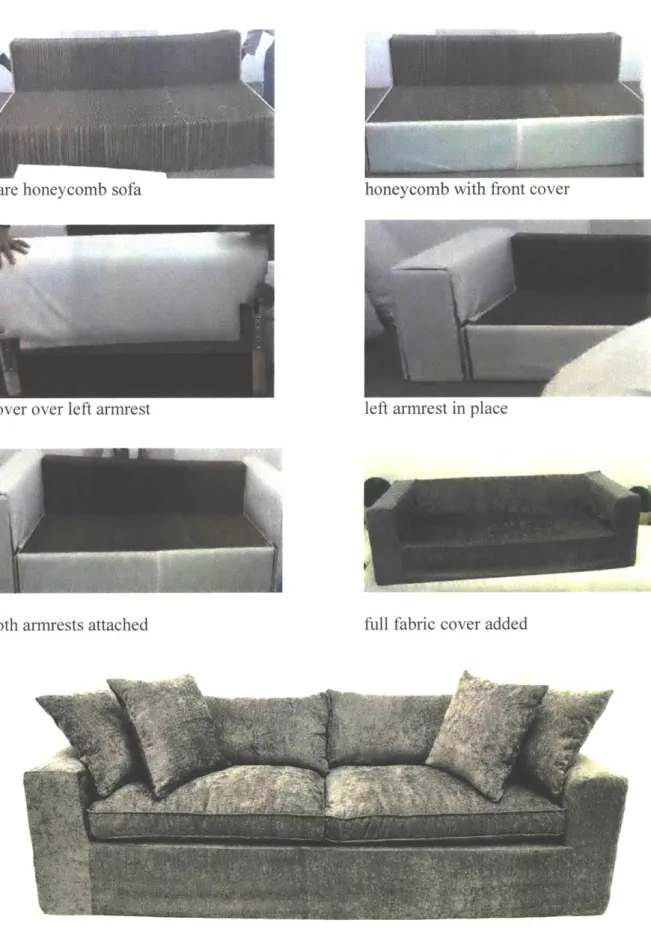

Some companies have produced paper furniture, but it is less comfortable and the more "homey" look and feel (see Figure 3).

honeycomb with tront cover

cover over left armrest left armrest in place

both armrests attached full fabric cover added

Fig. 3 A fully assembled sofa bare honeycomb sofa

CHAPTER 3

TARGET CUSTOMERS AND MARKETS

I have identified several potential markets for honeycomb furniture, which are discussed below.

Frequent Movers

This is a big segment in the US market, one in which some 35 million people move every year to another area.4 In terms of households, I make the assumption that every household has 2.5 members,5 which means the US has 35 million people /2.54 = 13.78 million households moving annually. Assuming even 2% of this number buy new furniture every year, spending an average of $1,000 per household, this totals 2% x 13.78M x $1000

= $275 million per year.

Frequent movers typically range in age from 20 upward. Their reasons for moving vary widely-personal, social, professional, or because of natural disasters. Included in this market are university students who typically move 2-3 times during their university

experience. There are 20.4 million students enrolled in US universities: 15 million in public

4 Ihrke, David. "United States Mover Rate at a New Record Low." U.S. Census Bureau. 23 January 2017. Available from: https://www.census.gov/newsroom/blogs/rando-n-samplings/2017/01/mover-rate.html.

Accessed 27 April 2018.

5 Statista Statistics Portal. "Average number of people per household in the United States from 1960 to

2017. 2018. Available from: https://www.statista.com/statistics/ I 83648/average-size-of-households-in-the-us/.

universities and 5.4 million in private universities.6 This number is estimated to increase year over year. International students usually come for study programs that range from one to four years, six years in case of Ph.D. programs.

Specialty Markets

* Camping and Outdoor Living. Camping is a large market, and one that continues

to grow. It includes traditional tent campers who want sturdy but inexpensive and foldable furniture to make a campsite feel more homey. The number of campers is even larger than frequent movers, numbering 47 million campers in 2017.7

* Recreational Vehicles and Nomads. The number of people choosing to travel in

recreational vehicles (RVs) in the US increases every year. The number of RV-owning households has grown to 8.9 million, up from 7.9 million in 2005; 8.5% of U.S. households own RVs.8 Many RV owners are older people and retirees, many of whom have pensions, retirement savings, and disposable income. While

RVs are generally well furnished, gross vehicle weight is always a consideration. Honeycomb furniture is lightweight and foldable, which makes it an excellent addition for inside use; outside, perhaps in a screen tent, there are many uses for honeycomb chairs, tables, and other lightweight furniture. Further, some people

6 Statista Statistics Portal. "U.S. college enrollment statistics for public and private colleges from 1965 to

2014." Available from: https://www.statista.com/statistics/183995/us-college-enrollment-and-projections-in-public-and-private-institutions/. Accessed 27 April 2018.

7 Statista Statistics Portal. Number of people who went camping within the last 12 months in the United

States (spring 2008 to spring 2017). Available from: https://www.statista.com/statistics/227417/number-of-campers-usa/. Accessed 27 April 2018.

8 Recreational Vehicle Industry Association (RVIA). "New RVIA Research Shows Record Level of RV

simply like to move frequently, looking for excitement and new adventures. This is a growing niche market that needs to be investigated further.

* Sustainability and Eco-Friendly Custonmers._This segment is growing as

awareness of sustainability issues and their value have increased. Among 66% of survey respondents willing to pay more for sustainable and eco-friendly products, more than 50% are influenced by sustainability factors, such as a product being made from natural and/or organic ingredients (69%), a company being

environmentally friendly (58%), and a company being known for its commitment to social value (56%).9 This segment is expected to increase in numbers, which makes it a potential market for honeycomb furniture.

Military Personnel

Military people (from all branches) move frequently from one area to another, typically once every two or three years. The total number of military personnel who move every year is about 200,000. The period from May 15 through August 31 is the peak move season, with more than 65% of moves occurring during that time.10

Young Professional in Studios or Small Apartments

This is a growing segment that includes millennials and the generations following. This market is attractive since trends show that these new generations change jobs

Nielsen Insights. "The Sustainability Imperative." 2015. Available from: http://www.nielsen.comi/ us/en/insights/reports/2015/the-sustainability-imperative.html. Accessed 27 April 2018.

10 Samuelson, H. Sam. "Peak Moving Season is Here: Make Move Plans Now." Military.com website.

Available from: https://www.military.com/money/pcs-dity-move/peak--noving-season-here-make-move-plans-now.html. Accessed 27 April 2018.

frequently, far more than earlier generations. CNN indicated: "The new normal is for Millennials to jump jobs four times in their first decade out of college. That's nearly double the bouncing around the generation before they did."" Newer generations are expected to

change jobs at an even faster rate.

Events, Exhibitions, Weddings, Trade Fairs

This is a good niche market. It can be quantified and is easy to reach. The purchase behaviors in these businesses are more sophisticated, as participants in these markets engage in several complex purchase processes. However, repeat purchases are not as high as for frequent movers. Foldable pieces and lightweight furniture can save on storage space and costs, as well as the manpower needed for assembly. However, event managers also expect their furniture to have a long life cycle. More research is needed to learn more about this

market.

Home Staging Market

This is another niche market where foldable furniture could be a great solution when frequent moving and staging is needed. Staging requires finding the right color, design, and dimensions for every house; it also means carrying a huge inventory of furniture pieces and renting warehouses to store them when not in use. Many trucks may be needed to carry pieces to and from homes that are being staged .Thus, foldability of furniture, plus the ease of changing furniture colors and styles, would make a significant contribution to solving

Long, Heather. "The new normal: 4 job changes by the time you're 32." CNN Money, April 12, 2016. Available from:

these problems. The market size for stagers is not known precisely, but it would likely be a function of the number of real estate brokers, which is around two million.12

The Target Market: Frequent Movers

With small tweaks, honeycomb could sell in a wide range of different markets. However, it has a unique problem: which market(s) will recognize the value of this

furniture, and what will potential customers be willing to pay? Honeycomb furniture has so many positive features and benefits that it is hard to select a single right market to focus on first. With the benefits of being foldable, foldable to a small size, easy to ship, easy to assemble/disassemble and dispose of, buyers will be the ultimate consumer for furniture distributor and/or retailers.

Studying these markets, I believe the frequent movers market is most appealing in terms of volume and the characteristics of the potential customers. In terms of volume, more than 8.5 million households in the US move every year. The nature of the market itself is interesting, since it has different sub-segments and is (most importantly) continually renewable, as every year there are new movers, which makes this market attractive. The essential benefits of honeycomb furniture, which match all the customers in this segment, are easily identified. The questions are: how to create and extract value from this market, and how to deliver value to other parties in the value chain. The following paragraphs will apply the create-capture and deliver framework.

12 Quick Real Estate Statistics. Available from: https://www.nar.realtor/research-and-statistics/quick-real-estate-statistics. Accessed 27 April 2018.

CHAPTER 4

THE CREATE-CAPTURE-DELIVER FRAMEWORK

One of the basic concepts of marketing strategy for a firm is the Create-Capture-Deliver framework, defined as:

- Create value for a product

-Capture that value in the competitive market

-Deliver value by partnering with other players in the value chain.

This chapter describes how the framework can be applied to the honeycomb furniture technology.

CREATE VALUE

There are numerous benefits that can be tapped to create value in the frequent movers market. However, two benefits are the most critical, based on market research conducted on frequent movers: affordability and foldability. I discuss each of these benefits below.

Affordability. The affordability of honeycomb furniture is achieved in a few different ways: " Using a low-cost material like paper helps reduce the manufacturing cost.

" Being foldable will reduce cost items like shipping since more sofas can be shipped in honeycomb containers compared to the normal heavy containers.

The furniture market for customers seeking affordable options has been relatively commoditized. The main differentiator is price, followed by considerations of brand, design, and quality.

* More affordable furniture catches the interest of customers and they become willing to listen to other features of the product.

* The customer of this furniture will save transportation cost during the buying and moving of this furniture.

* Installing honeycomb furniture saves the need to hire a technician to assemble it. The time and effort saved can be converted into savings that can be used for other purchases.

Foldability. The foldability characteristic of honeycomb furniture creates great convenience, as outlined below.

The furniture can be easily shipped by normal delivery couriers because the product fit within the allowable delivery dimensions. This makes delivery faster. It can be delivered any time during the day, unlike traditional furniture delivery services that need to fit within the schedules of truck shipping companies.

Being foldable means that customers can move the furniture into their apartments faster and easier without the help of a team of people.

Easy to assemble and disassemble is an advantage when furnishing and/or packing a house. Compare this benefit to the flat-pack furniture sold by competitors, where customers must exert considerable effort and time to assemble furniture pieces using a variety of different tools and following often-confusing assembly directions.

Multiple functions and variable-size furniture allow customers to use available space more efficiently.

As new generations move toward not owning a private vehicle, and instead rely on ride-sharing cars with Uber and Lyft as their main transportation means, foldable furniture fit better into this aspect of their lifestyle.

CAPTURING VALUE

There are several methods for capturing value from the value chain, which I discuss in the sections below. The innovative nature of the product is the main value to be captured.

Sell Directly to Customers

Direct sales can happen either by selling online or by establishing a brick-and-mortar store. Selling online is an inexpensive way for many businesses to test a market due to the low cost of establishing and running the business. Some cost is inevitable due to the need to rent a warehouse and stock it with products. This is the recommended way to begin before mass production is established. Slow penetration into the market is advisable at the

beginning, to test the market and tune production according to customer purchases, tastes, and reviews.

Sell Business to Business (B2B)

In this scenario, the manufacturer targets furniture stores as buyers, and the store in turn sells to its customers. The main advantages are volume and fast growth. The store has a

market already developed, so sales volume and growth of sales should occur naturally as returning customers see the new product(s).

The drawback is a decrease in profit margin since the store will squeeze price to make it attractive to reach the end consumer, with a target price determined ahead of time.

In addition, the manufacturer brand may be diluted since the store may insist on adding its own brand to the products. This affects the original brand and devalues the manufacturer's negotiating power over the long term. Building the brand would require a huge effort and substantial marketing resources in the beginning in order to attract more customers.

B2B sales may also entail considerable expenditure on trade fairs and marketing in order to find buyers willing to carry and sell the furniture.

Establishing a Brick-and-Mortar Store

This entails creating a physical store location where people can come in and test the furniture before buying it. The main advantage is that customers who test this innovative product will soon trust it. The main disadvantages are the cost to establish and run the store, and the localized nature of a storefront, with a much smaller catchment of customers it would serve.

To overcome these issues, storefronts would be needed in several locations, which could put a financial burden on the startup at the beginning.

Another option would be to utilize brick-and-mortar stores only as showrooms where people can try, test, and ask questions, combined with online selling in order to acquire

more data about clients and build a customer database that can be analyzed and used in the future.

Licensing the Product

It is the easiest option for the firm since it would not need to make other investments in things like stores, marketing, sales, operations, and other business issues. However, this path is risky, especially in furniture, because it is almost impossible to track the sales of

licensees. Further, the high cost of filing a utility patent, or filing a lawsuit in case of patent infringement, and time wasted in the courts. Licensing could also bring the risk of future claims and conflicts if designs were changed in the future.

Making the Go-to-Market Strategy Decision

The Go-to-Market strategy I chose is built on two of the major benefits discussed earlier: affordability and foldability. Selling via an online channel seems the most suitable method, one that is cost effective and faster to market. Other reasons include:

* Social media and online marketing make it easier to target frequent movers most efficiently. Frequent movers can be targeted in potential new places. Social media can also deliver the sales message to this segment.

* I recommend using competitors' drawbacks as our main advantage for the new products, exploiting those benefits to frequent movers.

* Social media influencers play an important role when customers compare value. The next strategy to be taken will be based on the outcomes of the first three years. A decision can then be taken whether or not to expand the same products to other target

segments, or to expand the furniture lines and designs but remain focused on the same frequent movers segment.

CHAPTER 5

THE FIRM'S COMPETITIVE ADVANTAGES AND ITS COMPETITION

The value chain in the furniture industry starts with furniture manufacturers, the moves to furniture stores, retailers (on-line and off-line), distributors (of varying sizes), and finally, to consumers. To manage this value chain, I have studied potential competitors, which I have identified as follows:

1. Furniture manufacturing facilities (white-label manufacturers) 2. Horizontal competitors-Top ten furniture stores by sales:

" Ashley Furniture " IKEA

" Williams Sonoma (and its affiliates: Pottery Barn, PB Teen, Pottery Barn Kids, West Elm, Williams-Sonoma, Rejuvenation and Mark and Graham)

" Berkshire Hathaway Furniture (and its affiliates: Nebraska Furniture Mart, R.C. Willey, Star Furniture and Jordan's Furniture. Nebraska Furniture Mart, Star Furniture and Jordan's)

" Raymour & Flanigan

* La-Z-Boy Furniture Galleries " American Signature

* Crate & Barrel (and affiliates CB2, Land of Nod) " High-end suppliers like Baker, Ralph Lauren, Harrods.

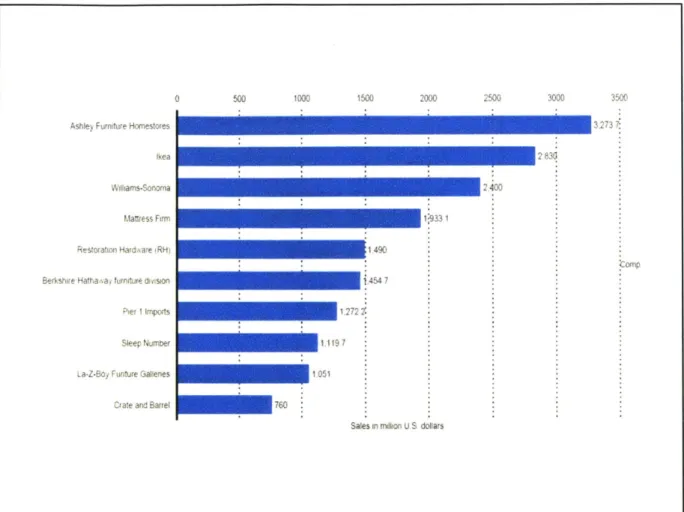

Figure 4 below shows horizontal competitors by sales.

Ashley Fumdtuwe Homestofes

Ikea

Wjliiarns-Sornma

laltres Firm

Restoration Hardoware iRH)

Berkshee Hathacay furniture divsion

pler 1 Imports

Sleep Number

La-Z-Boi Funture Gallenes Crale and Barrel

l 500 1000 1500 2000 2500 30M 3500 3.273-1 2830 2,400 1.454 7 1.1197 1.051 760

Sales in illion U S doliars

Fig. 4. Sales of ten leading furniture stores in the US (2014, $US millions)

Note: ranked by estimated sales of furniture, bedding, and accessories Source: Statista, the Statistics Portal

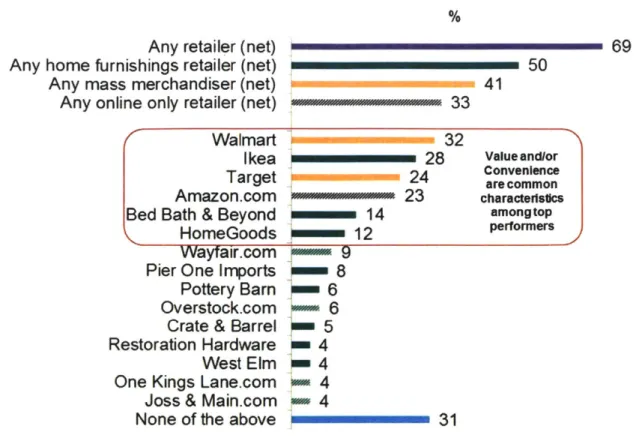

In the US market, furniture competitors can be divided into two main categories: physical stores and online stores. The category of physical stores is still larger, but is already beginning to decline as new generations (including frequent movers) continue to buy more and more items online. Although the online selling is still smaller, it has the potential of higher growth in the coming years. Figure 5 illustrates furniture competition in the US market in 2015.

Any retailer (net) Any home furnishings retailer (net) Any mass merchandiser (net) Any online only retailer (net)

Walmart Ikea Target Amazon.com Bed Bath & Beyond HomeGoods Wayfair.com Pier One Imports Pottery Barn Overstock.com Crate & Barrel Restoration Hardware West Elm One Kings Lane.com Joss & Main.com None of the above

32 28 24 23 - 14

j

n 12 Um 9 i 8 )= 6 1 m 6 =5 -Wm 4 -4 -4 14 ymmmmmmmmma31Fig. 5. Home furnishings retailers and general furniture merchandisers (2016, %)

Source: Statista Statistics Portal.

https://www-statista-com.libproxy.mit.edu/study/12289/furniture-retail-in-the-us.

Online sales are approximately 12% of total furniture sales (see Figure 6). The market is expected to increase steadily in the coming years, which likely will have a severe negative impact on physical stores. Online competition can be considered a real threat for physical stores, making online sales a good channel for targeting the frequent movers market characterized as millennials and the younger generations thereafter.

69 50 41 33 Value andlor Convenience are common characteristics amongtop performers

13.9% 12.5% 12% E 0.0% 2016 2017 2018- 2019" 2f2- 2021 2022-Yew

Fig. 6. Projected online furniture sales in the US market (2016-2022)

Note: numbers include furniture and home furnishings

Source: Statista Statistics Portal, https://www-statista-com.libproxy.mit.edu/study/12289/furniture-retail-in-the-us

Strategic Resources as a Competitive Advantage

It is important to analyze the strategic resources that the firm has over its competitors. This will help to identify its competitive edge, and whether or not the advantages are sustainable, especially in light of the main two features: affordability and foldability.

Affordability as a Value Feature

* Ownership and control of production facilities is a strong strategic resource. It gives the furniture manufacturer a considerable cost advantage in terms of not paying the

costs associated with original equipment manufacturers (OEM) and brokers, if any. By owning facilities in a country where production costs are low (e.g., Egypt) and controlling the entire value chain, the manufacturer enjoys a cost advantage, leaving room to move prices up or down as needed.

* Control of production and innovation also facilitates operations, and speeds up development and production. Owning the production facility limits the need for external suppliers, and results in more control of timely deliveries as well as quality control - all of which can be converted to cost savings and contribute to a strong profit margin.

* Competitors have not developed a similar furniture concept yet since our firm introduced its line of honeycomb furniture to the market. Existing honeycomb

factories produce packaging materials but none have developed a full production line for complete furniture. To date, honeycomb paper furniture is only produced in small studios and not in big factories.

* Human capital is another strategic resource. The manufacturing company has invested funds and time into a team that has the knowhow and technical skills. It would take competitors considerable time to build the knowhow and expertise required to produce these innovative products.

* Owning an online retail shop is a strategic resource that supports the affordability of the furniture products, and gives it the ability to control the end consumer price. Because the manufacturer controls its store, margins can be kept at the desired level based on the pricing strategy thus capturing the margin away from vertical

Foldability as a Value Feature

" The unique honeycomb technology innovation is the main differentiator for the firm. The uniqueness of the product, combined with a pending patent, are the keys to preventing competitors from entering the market for some time into the future. " Internally developed equipment and machinery should keep competitors far behind

for some time.

" Branding the products as fully foldable is a valuable resource for product

differentiation. There is no other product in the market that is fully foldable, which helps customers see the value of the the firm's products over its competitors. " Filing a utility patent for this innovation constitutes a strong barrier against

competitors. The existence of the patent leads to two issues. First, competitors may try to avoid the specific innovation or work around it. Having no competition would help the company. Attempting to work around the patent would actually create "buzz"' about the innovation, which I would view as free marketing. The second scenario would involve competitors attempting to mimic the innovation. In this case, a legal dispute may arise, possibly creating social media coverage which, again, could provide free marketing.

" Human capital is a strategic resource. The current production team has considerable know-how, which is a major point of strength. The team has worked together for more than ten years in a culture of collaboration, which gives the firm a strong

strategic resource.

" The switching cost in this industry is very low as customers can easily search online for furniture. The current values that competitors offer to customers are not strong

enough to retain their customer loyalty. Frequent movers can switch easily to foldable furniture once they see the differentiation and value offered by our firm over competing products.

DELIVERING VALUE

Partnering could provide significant value to the firm if it is done correctly, with the right partner, at the right time. The larger question is: who should the company partner with in the first three years? To answer this question, the company's negotiation power should be tested first against potential partners in the value chain. I have identified the players listed

below as the most likely partners in the furniture value chain:

" Branded furniture stores like IKEA, Ashley Furniture, William Sonoma " Furniture distributors: Online distributors like Wayfair, Overstock, Amazon Home.

* Brick-and-Mortar distributors: Walmart, Target, Macy's, Bob's Discount Store, Jordan's Furniture, and small and medium local furniture stores.

0 Other complementary institutions that provide additional services, such as banks, credit institutions, and online financial platforms.

" Media home products influencers " End users.

Since this analysis covers the first three years of the firm's operations, the next question to consider is which potential partners are likely to own the most customers during this time period?

Branded furniture stores in the market already serve our target market of frequent

movers. IKEA and Ashley Furniture dominate the frequent movers market since both produce affordable and relatively foldable furniture 3 of medium durability and relatively fast delivery time. IKEA enjoys a strong reputation and maintains 276 stores in 25

countries,14 and opened its first US stores in 1985. However, they do not have a large base of loyal customers because they compete first on price then by the shopping experience and then by design. On the other hand, our firm has just started, and there is no success record that would make it competitive in any aspect, hence, it has no negotiating power.

Accordingly, I believe partnering with other branded stores is not an option during the first three years of our operation.

Online sales channels like Wayfair, Overstock, Houzz, Z Gallery, and Amazon

Home, own the markets for younger age customers and frequent movers. These stores provide considerable convenience, a variety of furniture, and a range of prices in addition to online shopping and fast delivery. Trend comparisons indicate that the online channel will dominate the market and maintain its customer base because their market share is expanding compared to that of the brick-and-mortar stores as more and more customers become

comfortable with online purchasing. Online channels have also made the ease of acquiring and returning products much more convenient. Therefore, I conclude that they are the furniture giants of the future. For our firm, partnering with big online distributors is not an option due to a lack of negotiation power.

13 Some may argue that IKEA's furniture is not really collapsible or foldable, since many of its products are known for their complexity (and accompanying aggravation) when attempting to assemble them.

Brick-and-mortar furniture distributors can be divided into big name brands like

Macy's and Jordan's Furniture, and the small and medium local distribution stores in smaller cities. The big name stores own their customers not as a brand but as a customer base due to the convenience they provide to their customer. Partnering with them is almost impossible and even if attempted would be under unfavorable conditions. On the other hand, small furniture distributors could be valuable partners, at least in the beginning. Because they are smaller, they would rather carry inventory on consignment. Displaying innovative

furniture without the burden of carrying costs would be a less-expensive way to partner. For the firm, such a partnership would be a cheap way to market its product and obtain feedback from consumers regarding the new product. Small furniture distributors could be the most

suitable selling channel, in addition to online stores.

Competition After Year 4

It is difficult to create a marketing strategy for the firm in this period. Any startup has its own story and circumstances that will shape its strategy going forward after year three Several factors could affect the long-term strategy, such as sales, cash flow, team decisions, offers to acquire, legal claims, options available, and any potential venture capital possibilities. Due to the number of uncertainties in the furniture business after three years, it is impossible to predict the market. Accordingly, I suggest that the firm should continue with the strategy it followed during the three-year window.

Following the strategies outlined in the framework I have analyzed, I believe the firm should investigate the current expected uncertainties and assumptions and determine a

strategy for mitigating the associated risks. To this end, I have identified hypotheses (uncertainties) on the demand side and on the supply side.

Demand-Side Hypotheses

" Will our identified target market of frequent movers accept the honeycomb-structure innovation? Will frequent movers wait for first buyers to make a buying decision, or will those first movers try it themselves directly?

" Is the switching cost between brands low enough that frequent movers will switch? The firm needs to test if frequent movers are loyal to certain brands or loyal to the physical store shopping experience. The firm should also test data related to online purchases of furniture through its website and other online shops.

* Does lowering prices compared to those of competitors drive frequent movers to buy the paper honeycomb furniture rather than products from well-established furniture

manufacturers like IKEA? At this time, there is no real clue whether customers would move to another brand of furniture for reasons of price advantage. Market research conducted on a small sample of MIT students showed that price is the most important factor, followed by looks and comfort. However, actual sales should be the only governing factor of whether the price is too high or too low.

Supply-Side Hypotheses

* Will the firm maintain low production costs and keep a healthy margin? Several uncertainties may occur during the course of meeting production and supply deadlines: the materials used for the firm's products need to comply with US laws and labeling

regulations. Fire retardant materials may affect the cost and hence the margin. More study and cost analysis are needed to explore this risk.

* Horizontal Competitors: Will competitors stay away from copying our technology or developing a competing innovation? If our product proved to be successful and more customers moved toward it, how would competitors react? And when? This is a vague question with little or no answer, as no one can predict what a competitor's response might be. They might stay away and not respond, but if their market share becomes threatened, competitors may move forward with other options such as decreasing their prices, copying the product, or finding a newer technology. Some competitors may seek value by delivering rather than competing with the product. The main question will be: does the firm need their partnership in order to create more value?

All of these questions remain, and more information is needed in order to make a clear and logical response.

CHAPTER 6 CONCLUSION

Honeycomb technology is used in several different industries and there are undoubtedly more opportunities waiting to be discovered. The unique properties of this technology can be used in new untapped areas, including furniture. Multiple segments have

already recognized the value of the honeycomb technology, including the furniture industry. After analyzing various markets by volume and need, I identified frequent movers as the beachhead market. Two primary values were seen as the most valuable benefit to

frequent movers: affordability and foldability.

The strategic resources of the firm were discussed, including the advantages and disadvantages of each vis-A-vis its competitors. Based on my analysis, a go-to-market strategy was articulated for the first three years of the firm's operations.

I used the Create-Capture-Deliver framework to structure a discussion of the firm's value. It became clear that the firm has little or no power to negotiate in the first three years. It should not try to approach branded furniture stores or online furniture stores during that time. Some small, local furniture distributors might be persuaded to accept partnering with the firm. The firm's strategy for the years after year 3 would be based on the results of the first three years and market dynamics at that time.

Some additional questions would make useful topics for future research and investigation, as well as more data to sharpen a go-to-market strategy.

I recommend that cash flow finance be studied by the firm in order to survive and manage during the first three years. However, this topic is beyond the scope of this thesis. An independent analysis is recommended to complete the full picture of the strategy of the firm in its new and first venture.

REFERENCES

History of Sandwich Construction and Honeycombs." EconHP Holdings. Available from: http://www.econhp.com/ history/. Accessed 26 April 2018.

Ihrke, David. "United States Mover Rae at a New Record Low." U.S. Census Bureau. 23 January 2017. Available from: https://www.census.gov/newsroom/blogs/random-samplings/2017/01/mover-rate.html. Accessed 27 April 2018.

Long, Heather. "The new normal: 4 job changes by the time you're 32." CNN Money, April 12, 2016. Available from: http://money.cnn.com/2016/04/12/news/economy/

millennials-change-jobs-frequently/index.html. Accessed 27 April 2018. Nielsen Insights. "The Sustainability Imperative." 2015. Available from:

http://www.nielsen.com/us/en/insights/reports/2015/the-sustainability-imperative.html. Accessed 27 April 2018.

Paper Honeycomb. Wikipedia. Available from: https://en.wikipedia.org/wiki/ Paper-honeycomb. Accessed 26 April 2018.

Quick Real Estate Statistics. March 2018. Available from: https://www.nar.realtor/research-and-statistics/quick-real-estate-statistics. Accessed 27 April 2018.

Recreational Vehicle Industry Association (RVIA). 2011. "New RVIA Research Shows Record Level of RV Ownership." Available from: http://www.rvia.org/

?ESID=trends. Accessed 27 April 2018.

Samuelson, H. Sam. "Peak Moving Season is Here: Make Move Plans Now." Military.com website. 2018. Available from:

https://www.military.com/money/pcs-dity-move/peak-moving-season-here-make-move-plans-now.html. Accessed 27 April 2018.

Statista Statistics Portal. "Average number of people per household in the United States

from 1960 to 2017. 2018. Available from: https://www.statista.com/statistics/ 183648/average-size-of-households-in-the-us/. Accessed 27 April 2018.

Statisia Statistics Portal. "U.S. college enrollment statistics for public and private colleges

from 1965 to 2014." 2015. Available from: https://www.statista.com/statistics/ 183995/us-college-enrollment-and-proj ections-in-public-and-private-institutions/. Accessed 27 April 2018.

Siatista Statistics Portal. Furniture retailers in the US. Available from:

https://www-statista-com.libproxy.mit.edu/study/12289/furniture-retail-in-the-us/. Accessed 27 April 2018.

Slatista Statistics Portal. Number of people who went camping within the last 12 months in the United States (spring 2008 to spring 2017). 2017. Available from:

https://www.statista.com/statistics/227417/number-of-campers-usa/. Accessed 27 April 2018.

Statista Statistics Portal. US furniture and home furnishings retail e-commerce sales,

2016-2022. 2018. Available from: https://www.statista.com/statistics/278896/us-furniture-and-home-furnishings-retail-e-commerce-sales-share/. Accessed 28 April 2018. Unruh, Gregory. "No, Consumers Will Not Pay More for Green." 28 January 2011.

Available from: https://www.forbes.com/sites/csr/2011/07/28/no-consumers-will-not-pay-more-for-green/#46993fi43b28. Accessed 27 April 2018.

White Industries: A New Category. March 2016. http://www.dailypioneer.com/todays-newspaper/white-industries-a-new-category.html. Accessed 26 April 2018.