Accelerating Time-to-Market in the Global Electronics Industry

ByElena Jean Folgo

Sc.B. Mechanical Engineering, Brown University (2000)

Submitted to the MIT Sloan School of Management and the Engineering Systems Division in Partial Fulfillment of the Requirements for the Degrees of

MASSACHUSETTS I

Master of Business Administration OF TEHNOL

and

JUN 2 5

20

Master of Science in Engineering Systems

LIBRARI!

In conjunction with the Leaders for Manufacturing Program at theMassachusetts Institute of Technology

June 2008

© 2008 Massachusetts Institute of Technology. All rights reserved.

Signature of Author

Certified by

Department of Engineering Systei6'& MIT Sload School of Management M4y 9, 2008 Deborah J(,Nightin kle, Thjis Supervisor Professor of Practice, Aeronautics & Astro~a1tics and Engineering Systems Certified by

Certified by

Accepted by_

Accepted by

EIte Rebentisch, Thesis Supervisor Research Associate, Center for Technology, Policya2• Industrial Development

/ Donald Rosenfield, Thesis Reader (Management)

.

- Rnir Lecturer, and Director, LFM Fellows Program Richard Larson Professor ot Engineering Systems Division Chair, Engineering Systems Division Education Committee

/ Debbie Berechman

Executive Director of MBA Program, MIT Sloan School of Management

,Y

08

ES

#vk:S! iWVL• Certified byAccelerating Time-to-Market in the Global Electronics Industry

ByElena Jean Folgo

Submitted to the MIT Sloan School of Management and the

Engineering Systems Division on May 9, 2008 in Partial Fulfillment of the Requirements for the Degrees of Master of Business Administration and

Master of Science in Engineering Systems

ABSTRACT

In today's electronics industry, fast time-to-market (TTM) and time-to-profit (TTP) is key to customer satisfaction and firm competitiveness. Optimizing the product development and new product introduction (NPI) process is particularly critical for products in dynamic market

segments such as consumer electronics and telecommunications. This analysis will utilize a case study to define the current state of the development process for a top electronics manufacturing services (EMS) player conducting original design manufacturing (ODM) projects in a dynamic market. The analysis will identify process and organizational improvements that will eliminate product development waste in support of accelerating TTM and TTP using an enterprise perspective.

Thesis Supervisor: Deborah J. Nightingale

Title: Professor of Practice, Aeronautics & Astronautics and Engineering Systems Thesis Supervisor: Eric Rebentisch

Acknowledgments

This thesis would not have been possible without the support of my sponsor company. The energy and commitment of the employees at this company continues to amaze me. Thank you for making my seven months educational, productive, and fun.

I had the great fortune of working with Eric Rebentisch, Deborah Nightingale and Warren

Seering on this project. They all provided a tremendous amount of help and guidance throughout the internship and the writing of this thesis.

To my friends in the LFM class of 2008: Each and every one of you has touched my life over the past two years. I could not have chosen a more outstanding group of people to learn and grow with at MIT.

To my parents, Rosanne and Anthony Micich: Thank you for your support and encouragement throughout this challenging chapter of my life.

To my husband, hero, and protector, Eugene Louis Folgo III: Thank you so much for

encouraging me to come to LFM and for your love, patience and guidance during my time at MIT. I couldn't have done this without you.

Biographical Note

Elena Folgo spent her childhood in Phoenix, Arizona. She received a Bachelor of Science degree from Brown University in Mechanical Engineering with a focus in Energy Conversion and Fluid and Thermal Sciences in the year 2000.

Prior to MIT, Elena worked for six years at Honeywell Engines, Systems & Services in Phoenix, Arizona. There, she held positions as a systems integration engineer and an engineering project manager and worked with a variety of aerospace and defense products. Elena plans to participate in the Accelerated Leadership Program (ALP) at Intel® Corporation in Santa Clara, CA upon successful completion of the Leaders for Manufacturing (LFM) program.

Table of Contents

Acknowledgments ... 5 Biographical Note... ... 7 Table of Contents ... ... 9 Table of Figures ... ... 11 Table of Tables ... ... 131. Introduction and Summary ... ... 15

1.1. The Electronic M anufacturing Services (EM S) Industry ... ... 15

1.2. The Significance Tim e-to-M arket... 17

1.3. OEM -EM S Collaboration ... ... 17

1.4. Key Players ... 18

1.5. Hon Hai Precision Industry Co. (Ltd.)... 18

1.6. The Client Company... ... 19

1.6.1. The Client Company Product Life Cycle Process (PLC) ... 20

1.6.2. The ODM Business Developm ent Process ... ... .. 21

1.7. Background and Scope ... ... 22

2. Literature Review ... ... 25

2.1. The Product Developm ent Process for Electronics Products ... 25

2.2. Speed in Product Development... 26

2.3. W aste in Product Developm ent ... 26

2.4. Architecting the Enterprise for Strategic Advantage ... 26

3. M ethodology... ... 29

4. A Case Study ... 31

4.1. Enterprise Overview ... ... 31

4.2. Product Development Process Overview... 32

4.3. The Project ... 33

4.3.1. Developm ent Cycle Tim es... 34

4.3.2. Scheduled and Unscheduled Activities... 35

4.3.2.1. Design Change Activity... 35

4.3.2.2. Concept/Prototype Phase ... 36

4.3.2.3. Engineering Validation ... 36

4.3.2.4. Design Validation ... 37

4.3.2.5. Production Validation and Volum e Production Ramp ... 37

4.3.3.1. Project Organization ... ... 38

4.3.3.2. Project Planning ... ... 40

4.3.3.3. Requirem ents M anagem ent ... 40

4.3.3.4. Custom er Support ... 41

5. Enterprise Architecture Analysis ... ... 43

5.1.1. Strategy ... 43 5.1.2. Process ... 43 5.1.3. Product/Services ... ... 44 5.1.4. Organization... 45 5.1.5. Know ledge ... ... 46 5.1.6. Inform ation ... ... 47 5.1.7. Policy/External Factors ... 48

6. Product Development Waste in the Current State ... 50

6.1. Scatter ... 50 6.2. H and-O ff ... ... ... 51 6.3. W ishful Thinking ... ... 52 7. Recom m endations ... 53 7.1. Process ... 53 7.2. Organization... ... ... 54 7.3. Know ledge ... 54 8. Conclusion ... ... 55 Endnotes ... 57

Table of Figures

Figure 1. Client Company Organizational Structure ... ... 20

Figure 2. ODM Business Unit Incubation Process ... ... 20

Figure 3. Quick-Build Spiral Product Development Cycle ... 20

Figure 4. Enterprise Conceptual Diagram ... 32

Figure 5. Business Unit Product Life Cycle Process ... ... 32

Figure 6. Engineering and Manufacturing Change Orders by Development Phase ... 35

Table of Tables

Table 1. Eight Enterprise Views (Nightingale and Rhodes)... ... 27

T able 2. L ist of Interview ees ... ... 30

Table 3. Actual Cycle Time by Phase Compared to Plan... ... 34

1. Introduction

and Summary

1.1.

The Electronic

Manufacturing

Services (EMS) Industry

The Electronics Manufacturing Services (EMS) industry is comprised of companies that provide materials procurement, manufacturing, printed circuit board (PCB) assembly, product testing, supply chain management, and aftermarket services for Original Equipment

Manufacturers (OEM) on a contract basis. The EMS business model emerged in the 1970s as outsourcing "non-core" activities became a profitable practice for OEMs in the electronics industry. This practice was made profitable by contract manufacturers that leveraged

economies of scale in manufacturing and procurement to deliver electronic manufacturing and assembly services to OEMs at lower cost than the OEMs could achieve themselves. Over time, contract manufacturing companies moved up the value chain, providing value-added services such as testing, supply chain management, logistics and repair services to respond to market needs. By the 1990s, OEMs came to rely on the services provided by EMS companies to remain competitive as cost pressures intensified, manufacturing processes became more complex, and product lifecycles got shorter. From the OEM perspective, outsourcing manufacturing to EMS providers frees up capital, reduces labor costs, and improves productivity for OEMs, and it enables OEMs to focus on their core competencies of R&D, marketing and design.

EMS is characterized as a growth industry. According to Technology Forecasters, Inc, 2006 industry revenue grew 7.7% over 2005'. This is compared to historical growth rates of 20% to 25% in the 1980s and 1990s. During the 1990s, EMS companies often achieved scale and

global footprint by acquiring operations from their OEM customers, and acquisition accounted for the growth observed in the industry. EMS companies continue to provide more services in search of greater margins and higher growth. The largest area of growth in contract

manufacturing is in the area of Original Design Manufacturing (ODM), where a design is created in-house and then sold to OEMs. Typically ODM work is centered on products that are becoming commoditized, such as cellular phone handsets and desktop computers, for which costs can be reduced by designing for manufacturability (DFM). ODM has been

identified as a high-growth area, partially due to its heavy use in high-growth industries such as mobile phones and notebooks.

Revenue in this sector depends on the willingness of OEMs to outsource their supply chain management, manufacturing, and design activities. The primary factors that affect EMS market growth include OEM outsourcing trends and end-user market growth. Outsourcing is expected to continue in the future as a business practice; however, many OEMs have

outsourced that majority of their value chain to EMS providers already. EMS companies mainly serve the consumer electronics and telecommunications market and their growth is largely tied to the growth of that sector. Industrial, automotive, aerospace and medical sectors are today considered "niche" for EMS providers, but these areas could provide growth

opportunities as new outsourcing decisions get made.

Overall, costs in the industry are highly dependent on labor in low-cost regions and materials costs. Labor comprises a large portion of the expenses for EMS providers, so they are

sensitive to cost increases in this area. Asia is the primary region for manufacturing and assembly due to the advantages of low-cost labor and low material prices. Competition for skilled employees in low-cost regions tends to drive wages up over time. Larger EMS providers develop long-standing relationships with suppliers by bringing consistently high

sales volumes to them. However, even large EMS companies can struggle with high materials costs when entering into a new region or a new market because the game is relationship-based.

Competition is fierce because the barriers to entry are so low. There are thousands of EMS providers globally. OEMs can also easily bring these sections of the value chain back in-house, if they so choose. There are relatively few customers in the computer and

telecommunications industry that can promise the volumes required to sustain the EMS business model. Customers currently retain the power to negotiate heavily on price. Most large EMS providers have a presence in Asia, Western Europe, and the Americas in order to retain the flexibility to easily move manufacturing from one region to another. Because

margins are low, EMS providers are particularly sensitive to materials and labor cost increases, and they are heavily affected by reductions in sales volumes. Successful EMS companies

quickly achieve scale and global footprint so they can produce in high volumes to satisfy customer needs.

However, the landscape is changing. First, consolidation is anticipated in the future as the industry matures. In October 2007, the number two industry player Flextronics International, Ltd. acquired the number three player, Solectron. The next largest player now has only one-third of the annual revenue of the new Flextronics, and as such the other players will have to consolidate to compete with the scale and global footprint required to be competitive with incumbents. Second, companies that focus on ODM as their primary business model have successfully captured market share, specifically in the consumer electronics market.

Manufacturing expertise allows ODMs to offer OEMs customized solutions and also design-in low cost features. Although the focus of EMS companies will remain in manufacturing

process excellence and supply chain management, offering design services is viewed as a necessity to thrive in the future with ODMs in the market.

1.2.

The Significance Time-to-Market

Time-to-market (TTM) and Time-to-Volume (TTV) are large factors in competitive advantage for an EMS provider, especially in dynamic market segments such as consumer electronics and telecommunications. TTM/TTV is particularly important for new products because getting to market faster than the competition enables OEMs to capture market share. Introducing a new product faster typically increases overall sales volume because obsolesce happens at the same time as it would have if the product was introduced later. For many new products, OEMs may enjoy premium pricing and cost advantages from the manufacturing learning curve. OEMs that outsource manufacturing and design rely on EMS providers to drive toward accelerated TTM, particularly in the area of new product introduction (NPI).

1.3.

OEM-EMS Collaboration

As EMS manufacturers continue to offer complimentary services at all levels of the value chain, collaboration between with EMS providers has become an important factor for OEMs as they strive to reach cost and TTM goals. EMS providers have worked to understand the

strategic needs of their customers, and OEMs have developed manufacturing support organizations to support EMS providers. Product complexity, demand variability, design maturity and the related after-sales services provided, required cycles times and delivery requirements are all factors that determine the level of collaboration required to meet joint goals. Industry experts expect the Solectron acquisition to trigger consolidation in the EMS/ODM industry, providing a greater incentive for OEMs to create strategic, longer-term partnerships with key providers.

The lowest price mentality is prevalent in OEM companies and the build-to-spec/respond to every request for proposal (RFQ) mentality is embedded in the EMS culture. Although OEMs and EMS companies understand the benefits of collaboration, OEMs often push to squeeze the margins of the EMS providers by competitive bidding or adding requirements after projects have started and EMS providers respond by hiding information or by overstating their capabilities when entering into contracts. This behavior prevents gains from collaboration, resulting in sub-optimal performance for both parties.

1.4. Key Players

There are thousands of EMS providers worldwide. Taiwan-based Hon Hai Precision Industry Co. (Ltd.), commonly known as Foxconn, is the EMS industry leader, although it is often considered an ODM company. Singapore-based Flextronics International became the second largest EMS provider after the acquisition of Solectron, Inc. Other notable players include Florida-based Jabil Circuit and California-based Sanmina-SCI, Canada-based Celestica and Luxemburg-based Elcoteq, each of which has less than 10% market share2. The following

section focuses on the top industry player and the client company.

1.5.

Hon Hai Precision Industry Co. (Ltd.)

In 2007, Hon Hai, commonly known as Foxconn, achieved a market capitalization of $43 billion and operates on a massive global scale3. In China alone, the company employs 450,000

workers in almost a dozen provinces3, accounting for 80% of its production capacity. Over 90% of the company's revenue comes from mobile phones, flat-panel TVs and computers with

customers such as Cisco, Nokia, Dell, Apple and Hewlett Packard. Foxconn has benefited from strategic relationships with growing PC OEMs Apple and Hewlett Packard2. Between 2006 and 2007, Foxconn grew its revenue 45% and it is expected to grow its annual revenue by 30% over the next two years2.

Since 2002, Foxconn was consistently ranked top ten in the Business Week Info Tech 100, a ranking of the top performers in the tech industry. It was ranked the 10th largest tech company by Business Week in 2007 annual sales directly behind Microsoft4. The company also

consistently ranks as one of the top patent earners in Taiwan and is one of the fastest

manufacturers in terms of Time-to-Market. Foxconn relentlessly focuses on cost reduction and as a result often offers quotations 10% to 20% below major competitors. The focus on low-cost is pervasive throughout the company culture. Another key aspect of the culture is that of hard work with long hours and top-down decision making and management consistent with Taiwanese-run contract manufacturing firms.

1.6. The Client Company

The Client Company* has a market capitalization of greater than $5B and also operates on a global scale. The company participates in all the major EMS market segments, including mobile, computing, consumer digital, and infrastructure, as well as niche segments such as industrial, auto, and medical. The top 10 customers comprise no more than 60% of the company's revenue base.

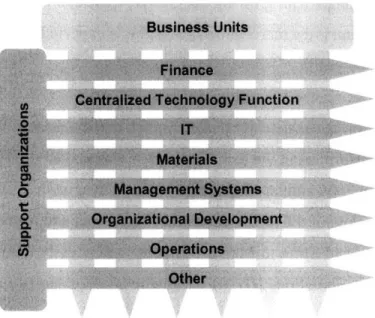

Like many EMS providers, the company grew largely by acquisition throughout the 1990s. In 2006, the company was reorganized from a region-based organizational structure to one focused around market segments and product lines. Under the region-based structure, resources were organized around the major regions of the world (i.e. Americas, Asia, and Europe). The new organizational structure features a matrix where businesses are run as P&L centers, with the support of centralized functions (e.g. finance, HR) that run across the business units, as depicted in Error! Reference source not found..

Figure 1. Client Company Organizational Structure

This shift has enabled the Client Company to gain synergies in SG&A expenses and to effectively scale operations across market segments. It also provides customers with one interface worldwide, instead of different representatives for each region. Challenges related to process ownership, resource allocation across businesses, and effective vertical integration still exist in the organization. The Client Company is aggressively pursuing an ODM portfolio, and for this task it heavily relies on a centralized organization called the Centralized Technology Function (CTF).

The Client Company culture can be characterized by customer focus, results orientation, frugality, lack of bureaucracy, and entrepreneurial energy. The espoused values of the company relate to collaboration, customer focus, execution, continuous improvement, and business success.

1.6.1.

The Client Company Product Life Cycle Process (PLC)

The Client Company Product Life Cycle (PLC) is the top-level business process that guides the Client Company's business activities. It encompasses business development as well as

process lies within the centralized Organizational Development organization, in the PLC group. In general, the process is largely undocumented and in a constant state of flux. At the time of this study, the process had been rolled out company-wide at a macro-level with descriptions of the top-level steps, functional checkpoints, and phase gate requirements. Some business units within the company had adopted the process and tailored it to their individual needs. The tailored PLC process should be different for ODM work than the process for EMS work because it includes conceptual development and engineering design activities for product development.

1.6.2. The

ODM

Business Development Process

The primary responsibility for development of ODM platforms falls under the Centralized Technology Function. The CTF's primary responsibility is to develop technology roadmaps that meet current and future customer needs in conjunction with driving industrialization and product and process development to support these roadmaps. As part of this responsibility, development teams within the group focus on innovation and platform development based on

agreed-upon customer needs. Then, the company approaches customers with the developed platform. Once a customer agrees to an ODM contract, the Client Company moves into the product development cycle to refine the product based on customer-specific needs.

Meanwhile, the CTF works closely with platform developers and the PLC group to tailor the corporate level PLC process to the needs of the fledgling business unit. As the customer-base grows for a particular platform, the Client Company may develop that platform into a product line, still under the umbrella of the CTF. If the business becomes sustainable and

large enough, it is spun off into its own P&L business entity within the Client Company.

Figure 2. ODM Business Unit Incubation Process

1.7.

Background and Scope

As EMS providers begin to offer design services to OEMs, the ability to effectively collaborate with OEMs becomes highly important. This is especially true for dynamic segments where TTM is a key strategic objective. However, collaboration efforts for ODM projects (projects for which the EMS provider is responsible for both design and manufacturing) often fall short of what is necessary to successfully meet cost and schedule goals.

The entrepreneurial mindset associated with growth through acquisition tends to make process implementation difficult within EMS organizations. Razor-thin margins coupled with

tremendous growth opportunities render investment in process development unattractive to business managers. To complicate the problem, EMS providers must acquire talent from OEM and ODM companies as they strive to provide flexible design services. Collaboration between business, engineering, and manufacturing inside the EMS company for ODM projects requires new skills, processes, and structures that are not yet fully understood by existing and new employees and it is typically executed in a globally dispersed environment. As a result,

product development cycles tend to take longer and cost more than expected, even during short lifecycle projects. EMS companies that are in the process of acquiring ODM talent are also in a growth phase and are focused on allocating resources toward revenue generating projects rather than for process development and improvement.

This study explores the current state EMS providers conducting ODM projects in dynamic market segments and identifies improvement areas in support of the strategic goal of achieving

fast TTM through a demonstrative case study at the Client Company. In Chapter 2, a literature review outlines concepts of lean product development and enterprise architecting that will be

used to analyze the current state of a business unit within the Client Company. Chapter 3 outlines the methodology by which research was conducted for this project. Chapter 4 describes a business unit within the Client Company, presents a case study to illustrate the effectiveness of the current-state, outlines potential causes for project delays and presents a root cause analysis for the specific case. Chapter 5 describes the enterprise using an enterprise architecture framework. Chapter 6 draws on the case study and enterprise architecting analysis to identify waste in the product development process. Recommendations are presented in Chapter 7, and conclusions are presented in Chapter 8.

2. Literature Review

2.1.

The Product Development Process for Electronics Products

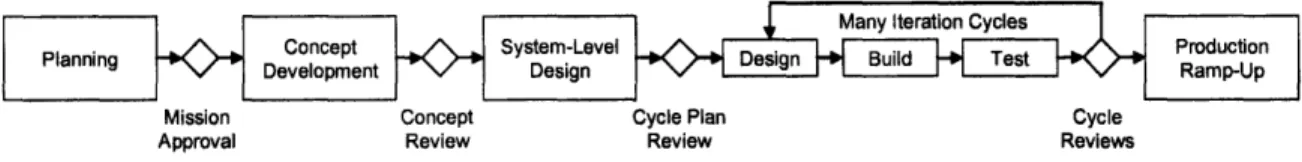

Almost every company has a documented product development process. According to Ulrich and Eppinger in Product Design and Development, the product development process for many electronics products falls under the category of "quick-build" products and often follows a spiral product development process5. Under this process, the system-level design is first decomposed into high-, medium-, and low-priority features. Then, the product is developed by a series of design-build-integrate-test activities, beginning with high priority features for the first prototype and continuing to develop prototypes until time or budget runs out. The generic

spiral development process flow is depicted in Error! Reference source not found.Error! Reference source not found. below.

Many Iteration Cycles

Planning Concept System-Level Production

Mission Concept Cycle Plan Cycle

Approval Review Review Reviews

Figure 2. Quick-Build Spiral Product Development Cycle

This characterizes the product development process that is currently being followed in the studied enterprise.

Many sources cite the fact that Toyota is able to develop new products faster, at lower cost, and with higher quality than its competitors. Toyota has historically developed new products in a fraction of the time it takes its competitors to develop similar products. The first time a development team tries to use lean methods, a 30% to 50% time reduction is feasible and

further reductions become possible with experience6. Toyota's lean product development system has three mutually supportive subsystem elements: skilled people, tools & technology, and process7. The unique aspect of the lean product development system is that the focus is shifted away from the documented process and toward the day-to-day activities by which a finished product is developed.

2.2.

Speed in Product Development

Development speed is commonly measured by the time between mission approval and the end of production ramp. In Lean Product and Process Development, Dr. Allen Ward argues that speed in product development should refer solely to the rate at which the organization learns during development in order to gain competitive advantage through the development process6.

For the purposes of this analysis, product development cycle time will be evaluated using the common metric.

2.3. Waste in Product Development

Product development waste is associated with inefficiencies in knowledge capture and barriers to information flows. There are three primary categories of product development waste: scatter, hand-off, and wishful thinking. Scatter is defined as "actions that make knowledge ineffective by disrupting its flow," and "disrupts the subtle interactions required for

teamwork6." Handoff occurs when knowledge, responsibility, action and feedback are separated6. Handoff is a problem in organizations because it "results in decisions being made by people who do not have enough knowledge to make them well or the opportunity to make them happen6." Wishful thinking is defined as making "decisions without data or operating blindly6." Included in this category is discarding knowledge gained through product

development cycles. The case study and the enterprise architecture analysis are used as tools to identify product development waste in the studied enterprise.

2.4.

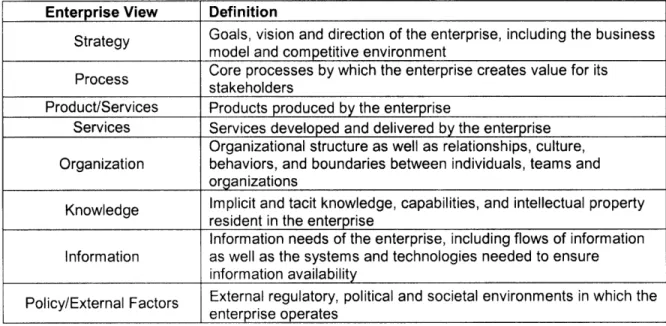

Architecting the Enterprise for Strategic Advantage

The Toyota product development system is based on the assumption that there lies an intimate

connection between the organization and its environmentError! Bookmark not defined. The concept of Enterprise Architecting can be used to characterize the elements of this connection.

Enterprise Architecting is defined as "applying holistic thinking to design, evaluate and select a preferred structure for a future state enterprise to realize its value proposition and desired behaviors." (Nightingale and Rhodes, 2007) The state of the enterprise contained in this case

study will be conducted by holistically evaluating the enterprise according to the eight enterprise views described in Table 1.

Enterprise View Definition

Strategy Goals, vision and direction of the enterprise, including the business model and competitive environment

Core processes by which the enterprise creates value for its

Process stakeholders

Product/Services Products produced by the enterprise

Services Services developed and delivered by the enterprise

Organizational structure as well as relationships, culture,

Organization behaviors, and boundaries between individuals, teams and

organizations

Knowledge Implicit and tacit knowledge, capabilities, and intellectual property

resident in the enterprise

Information needs of the enterprise, including flows of information Information as well as the systems and technologies needed to ensure

information availability

Policy/External Factors External regulatory, political and societal environments in which the enterprise operates

Table 1. Eight Enterprise Views (Nightingale and Rhodes)

Understanding the strategic objectives of the enterprise, the organization can be evaluated using these views to generate an understanding of the current state as well as potential future states. Future states can be evaluated against an agreed-upon set of criteria to select the one that best fits the enterprise's future goals.

3. Methodology

First, a basic understanding of the key issues that affect TTM for the Client Company was gained through discussions with corporate top management at the Client Company. Second, a strategic business unit was selected, in which TTM was a particularly important issue and in which a significant amount of ODM work was conducted. A project was identified that would enable direct observation of an NPI in progress carried through to volume production. Related projects within the same business unit were also identified for comparison purposes.

Direct observation of work at manufacturing assembly facilities and engineering design centers in Asia and the USA that were associated with the chosen business unit was conducted.

Operations at a central tooling facility that designs and manufactures injection molds for the company, including those for the product featured in the selected project, were also directly observed. Interviews of key employees associated with the project, as well as facility leadership and support functions, were conducted in accordance with Committee On the Use of Human Experimental Subjects (COUHES) standards. Access to the customer was limited in this case. The majority of the questions asked were related to the NPI in progress related to the chosen case study. In cases where employees had experiences with similar products, they were asked to compare experiences they were having on the current project with those on other projects. The five-why approach was used to determine root causes in the interviews when a particular issue was identified, and follow-up questions were asked of other interviewees who were cognizant of the same issue. The focus of these interviews was to identify project delays during NPI and the potential causes of these delays.

Project-related documentation, including schedules, reports, contracts and pertinent e-mail communications was collected and reviewed and cross-referenced against documented business processes and process reviews. This information provided an account of the timing of actual events on the project and insight into process adherence and schedule fidelity. A report from a post-mortem review conducted by the project team after production ramp served as a basis for the analysis conducted in the case study.

Interviews were conducted with members of the business unit and corporate organizations to identify systemic concerns across the business unit and the company. For a list of interviewees, see Table 2.

Chief Technology Officer

CTF VP Platform Realization

VP Assembly Technology Development Organizational SVP Organizational Development

o Development Sr. Director, PLC

0 General Manager

O IBusiness Development/Planning

Tooling Manager

Quality Manager/Lean Champion

Senior Project Manager

General Manager Quality Director PCB Assembly NPI Manager

Operations Manager Factory Program Managers

President

Leadership Team

•: Sr. Director of Operations

D Engineering Design Center Directors

Mechanical Engineering Director

-" CAD Design Team Manager

Reliability/Quality Engineering Manager Engineering Account Managers

Organizations Engineering Program Managers Lead Engineers

Electrical Lead Engineer Sr. Design Engineer

Sr. Reliability Engineer

4. A Case Study

The purpose of this case study is to examine the current state of the product development process in a new ODM business unit. First, observations and data for a selected ODM project are

presented. Second, a root cause analysis is presented for the specific case, focused on project delays.

4.1.

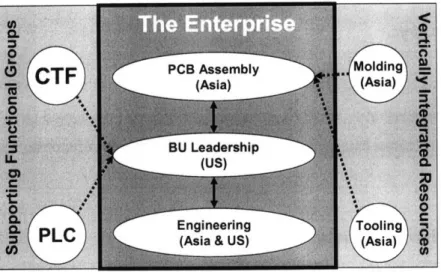

Enterprise Overview

The enterprise chosen for the case study was a recently developed unit on the cusp of being spun off into its own independent segment. Although it sat under the CTF umbrella at the time of the study, business-unit leadership was in place and the unit operated as a P&L center. At the time of the study, the business unit had achieved volume production for only a handful of products over its 18-month lifetime. However, it was growing quickly and there were several products for various customers in the pipeline. The ODM product platform for this segment represents a highly commoditized electronic component for the computing and

telecommunications sectors that is integral to the OEM product. The average life cycle for the OEM product is 6 to 9 months.

The enterprise has three design centers and one assembly plant. Two of the design centers, located in different regions within Asia are responsible for the simple and intermediate product architectures. The third design center, located in the USA is responsible for high-end product architectures and platform development. The printed circuit board (PCB) assembly plant is located approximately 60 miles from one of the Asian design centers. The tooling and injection-molding facilities are vertically integrated resources outside the business unit and function as internal suppliers to the assembly plant. The CTF and the PLC groups support the business unit leaders as necessary. The tooling facility and the injection-molding facility are

also located Asia, in the same region as the assembly plant and design center. A conceptual diagram of the enterprise is depicted in Error! Reference source not found..

Figure 3. Enterprise Conceptual Diagram

4.2. Product Development Process Overview

The business unit life cycle process is divided into two macro phases: product development and program production. The product development macro phase includes

opportunity/feasibility, concept/prototype, engineering validation testing (EVT), design validation testing (DVT) and production validation testing (PVT). The program production phase includes production ramp, rolling production, and phase-out. Time-to-Market is

measured from the beginning of the concept/prototype phase (project kickoff) to the end of the production ramp phase (volume production release). The product life cycle process is depicted in Error! Reference source not found..

--- Time-to-Market

---Concept/ Engineering Design Production Ramp Prototype Validation Validation Validation Up

EVT DVT PVT

I L Project Award & Volume Production - Ramp QuoteRamp

Quote Kickoff Release Down

Approval

Figure 4. Business Unit Product Life Cycle Process

There are two major milestones in the life cycle, one at quote approval and one at ramp down. Each development process begins and ends with a gate checkpoint depicted by a diamond in the process diagram. A gate checkpoint is defined as a key decision point in a project at which time senior management decides whether to proceed with the project. The possible outcomes of these decisions are go, cancel, hold or restart the project.

Time-to-Market is measured as the time between project award and volume release, and thus, these phases are the focus of this study. The validation steps represent sets of design-build-test iterations. At the end of the concept/prototype and each validation phase, a prototype is

delivered to the customer along with test results for approval. If the prototype meets customer requirements for the phase, the Client Company will move to the next phase.

Each phase has a defined set of inputs and outputs and a list of activities for consideration. Gate exit checklists containing the inputs, outputs and project activities are reviewed and approved by senior management at the beginning of the project. The phase coordinator decides which inputs, outputs, and activities are relevant for a given project. Coordination during each phase is conducted by one of three groups according to where the bulk of the tasks lie. The opportunity/feasibility phase is coordinated by the Account Manager.

Concept/Prototype through PVT is coordinated by the Engineering Program Manager. Rolling production and phase out are coordinated by the Factory Program Manager. Account

Managers typically reside in the USA. The Engineering Program Manager sits in the facility that does the design work for the project, and the Factory Program Manager sits in the assembly facility in Asia.

4.3. The Project

The selected project was an ODM project for a customer that was new to the Client Company and of strategic importance to the company as a whole. The product platform, a commodity electronics component external to the OEMs end product, was already developed prior to project kickoff. The development effort required mechanical and electrical design and PCB layout to satisfy customer interface requirements, as well as the design of an injection molded enclosure. The customer brought on the Client Company as a second source. The customer's primary source was well into volume production. This product could be bought off-the-shelf at the time the Client Company began their development of the product. The customer supplied the Client Company with a weekly demand forecast, which was a percentage of total future demand after production ramp, in addition to a defined set of electrical and mechanical requirements.

4.3.1.

Development Cycle Times

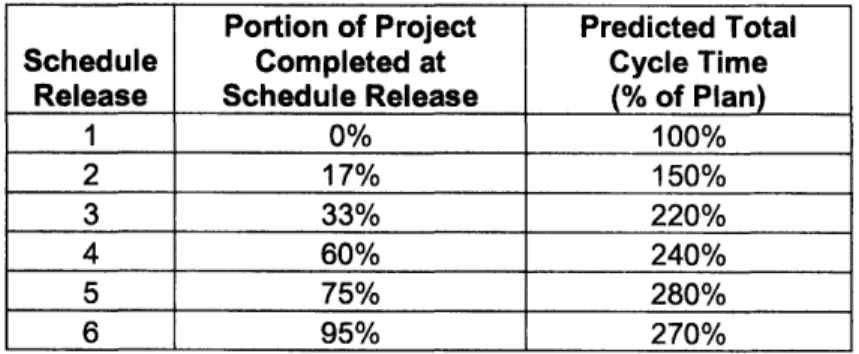

The actual development cycle time, or TTM, for this project was 272% of schedule from project kickoff to volume production release, indicating that a large amount of the project activity was unplanned. Because the concept/prototype phase was added after the initial engineering review with the customer, it could be argued that the overall baseline should include the time for the phase. In this case, the actual TTM for the project was 180% of schedule. Table 3 compares the actual cycle time of each phase to the planned cycle time.

Table 3. Actual Cycle Time by Phase Compared to Plan

The development schedule was readjusted frequently during the program. Table 4 shows how the predicted total development cycle time was adjusted each time the program schedule

was released. Two major schedule corrections were made during the EVT phase, one of which was made mid-phase. At the same time as the mid-phase adjustment for EVT, the scheduled time for DVT was shortened. The schedule for DVT was extended twice during the phase, once in the beginning and once mid-phase. The last release of the schedule shows PVT taking less than half the time as originally planned.

Portion of Project Predicted Total Schedule Completed at Cycle Time

Release Schedule Release (% of Plan)

1 0% 100% 2 17% 150% 3 33% 220% 4 60% 240% 5 75% 280% 6 95% 270%

Table 4. Predicted Total Cycle Time at Selected Schedule Releases

Phase % of Plan Concept Unplanned EVT 657% DVT 210% PVT 43% Per Customer Ramp Schedule

4.3.2. Scheduled and Unscheduled Activities

The original schedule included one design-build-test cycle for each of EVT, DVT, and PVT and no time was planned for pre-EVT work. At kickoff, the customer agreed to the prototype delivery schedule provided at the time of the quote, which was based on the documented set of technical requirements. The prototype delivery schedule dictated dates on which a set of prototypes would be delivered to the customer along with design and test documentation. These dates reflected the end of each of the EVT, DVT, and PVT prototype builds. The kickoff schedule release reflected the agreed-to prototype delivery schedule and accounted for only one prototype design-build-test cycle for each phase. The following section discusses, phase by phase, the major sources of delay that occurred and direct reasons for these delays based on interviews conducted with team members.

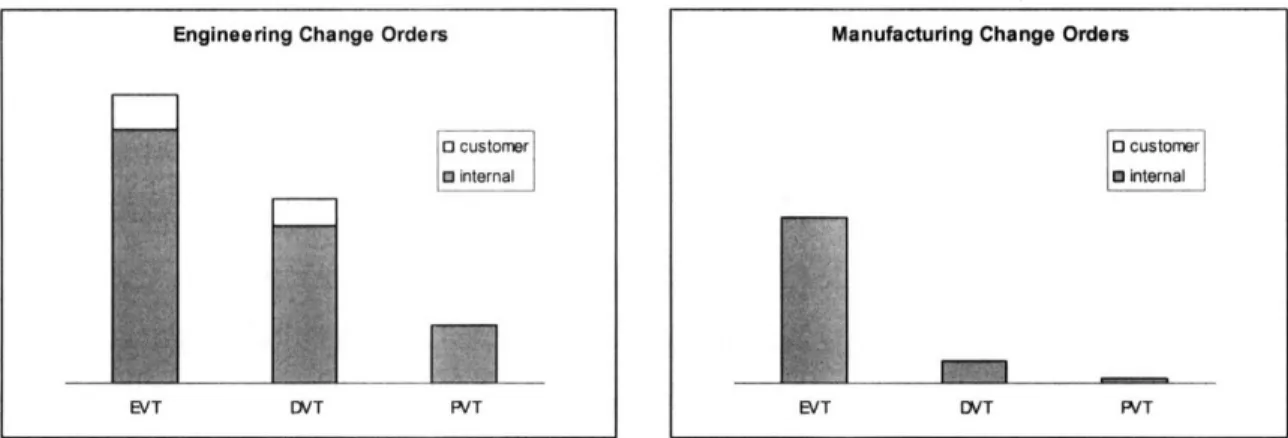

4.3.2.1. Design Change Activity

Many of the design changes were generated by the internal team. Error! Reference source not found. breaks down the number of engineering and manufacturing change orders that occurred, by phase. The number of changes declined by phase as expected. However, project team members were surprised by the number of internally generated changes overall when shown this data, as their perception was that most changes were in fact customer-driven.

Engineering Change Orders Manufacturing Change Orders

71_

0 customer

; internal U internal

EVT DVT PVT EVT DVT PVT

Figure 5. Engineering and Manufacturing Change Orders by Development Phase

I I I I

I

I

Concept/Prototype Phase

The business review and meeting with the customer after the project kickoff revealed a requirements shift: that EVT prototype samples be built with hard tooling as opposed to soft tooling for the injection molded enclosure as planned. To satisfy the customer's request, the Client Company team scheduled a prototype build using soft tooling. Soft tooled prototypes would be approved by the customer before moving to the EVT phase. All planned hard-tooling activities were shifted to the EVT phase so that customer feedback from the prototype samples could be incorporated into the hard tooling design. The electrical design progressed as planned. This shift caused prototype tooling to become pacesetting activity for the remainder of the project.

The Client Company's common practice is to use soft tooling for EVT and to develop hard tooling during the EVT phase in time to be used for DVT prototypes. The NRE for hard tooling, once developed, can be amortized over the volume production of the product. OEMs sometimes require suppliers to hard-tool earlier in the development process than is required to meet the volume production schedule. It is more costly to modify a hard tool than it does a soft tool, and doing so implies a larger schedule impact. OEMs believe this provides an incentive for the ODM design team to lock down the final design earlier in the process. Soft tooling typically requires less nonrecurring engineering (NRE) than does hard tooling. EMS/ODMs prefer to develop hard tooling later in the process to minimize total NRE as the design team incorporates design improvements learned through prototype development and testing.

4.3.2.3. Engineering Validation

There were three build cycles for the injection molded parts during EVT. Customer feedback from the prototype samples was incorporated into the tool design as well as the mechanical design of the non-enclosure pieces before EVT commenced. The primary reason for design rework during this phase was that the injected-molded components did not meet customer requirements, some of which the engineering team at the Client

Company characterized as subjective. Incorporating feedback from the customer required additional clarification and further definition of requirements over and above what was

defined in the initial requirements document. Once the subjective requirements were defined as objective requirements, the team discovered that the actual customer expectation for the injection molded components was more stringent than indicated in the requirements document. The tool traveled back and forth between the injection molding facility and the tooling facility many times, over 30 in total, to achieve a passable level. At least two days were lost for each instance that the tool traveled due to traveling time.

4.3.2.4. Design Validation

There were two design-build-test cycles for the system design during this phase. The impetus for the second cycle came from the customer. The customer had developed a new complimentary product and asked the Client Company to add a component to the design in order to allow compatibility with the new complimentary product. Due to spacial

limitations in the design, the Client Company had to modify other components in the design to accommodate the new part. This two-week schedule setback was a fraction of the setbacks associated with the tooling iterations. However, had the product been developed according to schedule, production ramp for the initial design would have already occurred and the modified product could have been an opportunity for a new contract with this customer.

4.3.2.5. Production Validation and Volume Production Ramp

Because the issues with mechanical, electrical design and the PCB layout were resolved while the injection-molding issues were being worked, production validation took less time than originally anticipated. All the materials were available for production ramp because they were ordered early in the development process. In general, the customer sets the rate at which the Client Company can ramp to production, a rate that is typically slower than the Client Company has the process capacity to achieve. Production ramp commenced according to customer requirements.

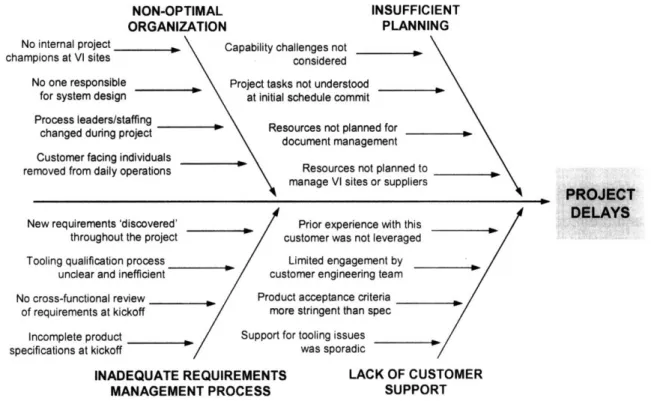

4.3.3. Root Cause Analysis for Project Delays

Because TTM is a strategic objective, the root cause analysis focuses on the items that contributed to project delays on the program. After the project was completed, the team

conducted a post-mortem project review to determine why the program experienced schedule delays, budget overruns and process breakdown. The review was facilitated by a member of the corporate PLC group and included the key project and business-unit stakeholders. Issues related to project delays identified during this review are presented in the cause-and-effect diagram depicted in Error! Reference source not found.. This diagram is commonly referred to as a "fishbone" and it represents the relationship between a problem and its potential causes. The head of the fish represents the problem that is being evaluated, and each "bone" is a line that contains a list of potential causes grouped by category.

NON-OPTIMAL INSUFFICIEI

ORGANIZATION PLANNINC

No internal project , Capability challenges not champions at VI sites considered

No one responsible Project tasks not understood

for system design at initial schedule commit

Process leaders/staffing

changed during project . Resources not planned for document management Customer facing individuals

removed from daily operations Resources not planned to manage VI sites or suppliers

New requirements 'discovered' Prior experience with this throughout the project customer was not leveraged Tooling qualification process Limited engagement by

unclear and inefficient customer engineering team

No cross-functional review Product acceptance criteria

of requirements at kickoff more stringent than spec Incomplete product Support for tooling issues

nnr.ificntitnn at kicrknff was sooradic

NT

PROJECT

DELAYS

INADEQUATE REQUIREMENTS LACK OF CUSTOMER

MANAGEMENT PROCESS SUPPORT

Figure 6. Case Study Root Cause Analysis

The key issues are grouped under four major categories: organization, project planning,

requirements management, and customer support. The following analysis explains these issues in detail.

4.3.3.1. Project Organization

No project champions existed at the vertically integrated (VI) sites, i.e. molding and tooling. The engineering and factory program managers were able to draw on resources at

each of the sites in order to accomplish project goals, but no one was dedicated to the job from beginning to end. This became an issue when the injection-molding tool was

traveling between the sites to be adjusted to meet requirements. A program manager at the tooling facility reported that in one instance "the tool sat on [the injection molding plant's] doorstep for up to three days before anyone touched it".

There is no one responsible for system-level design. Again, engineering program management was able to draw on experienced and capable engineers from various functional departments. However, functional engineers were sometimes new to the organization and did not have integration experience. When integration issues arose, the program manager was called upon to resolve the issues. Design integration occurred after functional designs were completed so related adjustments were iterative instead of

concurrent. This led to a number of engineering design changes late in the process, during the design validation testing phase.

Process leaders were discontinuous through the project as part of the process design. The process dictates that the engineering program manager leads the project beginning in the concept phase, which the design team is chosen. As the process leader for the

feasibility/opportunity portion of the process, the account manager had communications with the customer that affected the engineering and factory team before they were formed. Team member turnover also occurred during the course of the project. In each instance, project-related knowledge was lost. Decisions were made, specifically with regard to tool design, that would have been made differently if the team was privy to knowledge held by team members that had moved on to other projects. As a result, tool rework was necessary.

Account managers remained in contact with the customer throughout the project, but were based in the U.S., in addition to the lead engineers who possess platform knowledge and who were often the more senior members of the design organization. Any time the engineers in Asia had a question, they used email or telephone to communicate it to lead

engineers, account managers or business unit leaders in the U.S. Customer information was relayed back to team members in the same fashion. In the dynamic environment,

sometimes key individuals found out information at different times depending on whether they were included in particular emails.

4.3.3.2. Project Planning

The capability to meet customer requirements for injection-molded was not fully

understood when the schedule was created. The organization had to develop that capability empirically during the product development effort through trial-and-error. Resources were not allocated from the assembly plant to manage these issues and when they were called upon to coordinate between the VI sites and solve these issues, their capacity to perform project-related duties was reduced. The time required for other tasks related specifically to ODM work were also not fully understood by the development team. For example, sub-tier suppliers are typically managed by the customer for EMS projects, however, now this relationship must be managed by the Client Company.

A new documentation initiative was put in place before this program, requiring all engineering changes be document-controlled at EVT start. Discipline in documentation was enforced more heavily on this project than in the past. This key initiative is part of moving toward knowledge capture and management, but the engineers did not anticipate

the time it would take them to document their work. In addition to coping with an aggressive development schedule, the engineers found it difficult to keep up with the resultant workload. The factory noted that their requests for DFM-related engineering changes were not returned promptly and that engineering change orders (ECOs) often contained mistakes.

4.3.3.3. Requirements Management

At project kick-off, there was no cross-functional review of the requirements even though the process called for it. The design team discovered that the requirements for the product were incomplete well into the development effort, after the prototype delivery dates were promised to the customer. Turnover over the course of the project and customer

interactions that resulted in undocumented requirements changes, requirements slipped through the cracks.

Sometimes requirements were 'discovered' throughout the project. With respect to the injection-molding issue, the customer clarified a key injection-molding requirement during the development process but the information did not reach the tooling design team. A member of the manufacturing team noted, "I don't know who knew this requirement

changed, but this would have been a lot easier if we had designed the tool properly in the first place." The tool could have been designed differently from the outset to satisfy the more stringent requirement. Because the true requirements for the injection-molded

components were learned through trial and error during product development, the development team reworked the mold until the components met the customer's requirements.

The tooling qualification process between the injection-molding facility and the tooling facility was unclear and inefficient. As a result the balance between the molding process specifications and tooling design and development could not be managed properly.

Particular testing and analyses to be conducted by the tooling facility to facilitate molding process design was not carried out. Responsibility for meeting end-product requirements was not clearly assigned. The ambiguity in this part of the process complicated the rework activities associated with meeting end-product requirements.

4.3.3.4. Customer Support

The design team reported that the customer did not provide support for the level of

development issues the Client Company was experiencing. However, the customer did not allocate engineering resources to support the Client Company because the company was a second source and thus they did not expect the company to have capability problems. Unplanned capability development coupled with little support from the customer contributed to the nature of the tooling issues and also to the multiple customer-initiated iterations on the injection-molded components.

The customer did provide ad-hoc engineering support for the molding and tooling issues. However, the customer's engineering team did not share best-practices toward meeting

their relatively subjective requirement with the Client Company. Some employees from other business units have had experience with this customer before, but it was not

leveraged on this project. Therefore, the time associated with the experimental nature of meeting this customers' requirements was not calculated into the original schedule.

5. Enterprise Architecture Analysis

The following section examines the current state of the enterprise using the enterprise views as defined by Nightingale and Rhodes. The focus of this analysis is to highlight enterprise issues associated with TTM during development and NPI of the product.

5.1.1.

Strategy

The primary objective of corporate headquarters is revenue growth and therefore it is the primary objective of the business unit. This enterprise aspires to be the leading provider of its product across the industry. Currently it is specifically targeting the high-growth telecommunications, computing and mobile-device segments. Fast TTM is critical to achieve a competitive advantage in this environment. Low cost is also a key factor because the product is considered a commodity to OEMs. As the organization grows, scalability and repeatability are important strategic considerations.

The enterprise supports an ODM business model and contributes to the Client Company's vertical integration initiative. Prior to market entry by the Client Company, very little design or manufacturing process innovation had been developed for this product industry-wide and there was one major ODM player that held the majority of the market for this component. The business employs internal tooling and molding facilities whenever possible in support of the corporate strategic goal of vertical consideration. Strategic decision making occurs at the top levels of the enterprise. Although business units retain a lot of latitude in decision

making, the CEO has the power in the organization. Strategic meetings between engineering, operations, and manufacturing leadership occur on an ad-hoc basis, as issues arise. In

addition, the enterprise leadership participates in a bi-annual company-wide leadership summit.

5.1.2. Process

Because the enterprise is currently in a growth mode, the majority of the processes by which the enterprise creates value for its stakeholders are not currently documented. Prior to launch

of the first product, the CTF worked closely with cross-functional teams within the enterprise to develop a tailored product life cycle process. In general, the process is designed to be collaborative across functions, sites, and departments. The process requires participation of employees globally across the business unit. Senior leadership owns the process. They may opt to utilize resources from the PLC group to develop and improve the tailored process.

The documented development process is not available on the company intranet. It is frequently out-of-date because the true process evolves each time a product development cycle is completed and the organization learns. The development process is documented as a PowerPoint file on a central server. Process documentation includes functional

responsibility, inputs, outputs and activities for consideration for each phase. The document is visibly posted in engineering facilities and supplied via email to new engineers hired to work at the company. Other than performance to schedule, development process

performance is not measured by the organization.

Because process flows are not documented in the product life cycle process and project tasks required for phase gate exit are not always enforced by management. Also, roles and

responsibilities are not clearly defined and documented. Entry from one phase to the next often does not signify a particular design progress level; rather it indicates that the customer has approved the prototype supplied to them at the end of the phase. Often, the factory proceeds to the next phase even though the design is not as mature as they expect it to be. These issues have caused miscommunication on task responsibilities. Customer deliverables are sometimes overlooked as a result of these miscommunications.

5.1.3. Product/Services

The organization employs a platform strategy with steady improvements of the platform. To its customers, the enterprise provides integrated design, testing, manufacturing and supply chain services for its products. The design capability enables OEMs to leverage the product platforms already developed by the Client Company to minimize design variation, accelerate

TTM, and to utilize DFM and realize cost benefits. The Client Company's manufacturing organizations support the flexible, high-volume production environment for these products.

The 6 to 9 month lifecycle for this product is getting shorter as the organization learns. Unencumbered by capital that supports antiquated manufacturing processes technology, the

Client Company was in a position to develop a product platform that leverages its expertise in advanced packaging technology and manufacturing excellence to develop a

technologically superior and lower cost product. It includes internal electronic circuitry and some versions contain an injection-molded external enclosure.

5.1.4. Organization

In general, the organizational culture would be characterized as evolving, globally dispersed, highly entrepreneurial and flat. The development organization is highly flexible and is able to respond easily to short-term market dynamics as well as long-term market needs. In order

to obtain design expertise and to keep up with growth, the company continues to hire

engineering talent from existing ODM and OEM companies. Most engineers had been with the company for less than 2 years but had been in the industry for over 8 years.

Manufacturing talent came from other product areas and business units within the Client Company who were mostly familiar with the EMS model.

Day-to-day operational decisions are made locally and information is passed on an informal basis. Program-level decisions often involve the site leaders and senior leadership.

Communication is typically done via email because every product team is dispersed globally. Teams are highly self-directed. Senior leadership is quick to step in when a problem arises and there is a clear decision making hierarchy in this case. Even the smallest issues tend to be elevated to senior leadership.

The organization is largely functional in nature. Design, manufacturing, tooling, molding and assembly are all done within the four walls of the Client Company for each customer, in accordance with the Client Company's vertically-integrated ODM strategy. Although organization charts exist, the organization is growing and changing so quickly that they are

-45-often outdated. Turnover frequently occurs during programs. There is no responsible person or design team that leads the project from beginning to end. There is no responsible team that is in close communication from beginning to end.

The business unit president is based in the U.S. He is focused on working closely with the CTF management to determine the strategic direction of the organization. Reporting to the president are two key leaders: The Sr. Director of Operations, based in the USA and the General Manager who is based at the PCB assembly facility. Like much of the leadership at the Client Company, both hold multiple "full-time jobs on a part-time basis." They are both heavily involved both in setting the strategic direction of the organization, developing program management talent across the enterprise, and providing leadership direction on key accounts. The Sr. Director of Operations travels to the various sites extensively, including the vertically integrated support sites, namely tooling and injection molding. When problems arise on key accounts, both leaders are typically knowledgeable about technical operational issues and are heavily involved with problem resolution and communication with the customer. Many of the lead engineers and account managers reside in the USA while the engineering program managers and functional engineers reside in Asia.

The engineering program management function is not well-defined and does not have organizational control over the resources assigned to his project. This individual also tends to be a very experienced engineer. In the entrepreneurial environment, he will contribute where his skills are most useful, and as such he will be involved with system level design integration, chasing parts, and problem resolution. All of these unplanned activities serve as interruptions to the program manager, taking his attention away from program management.

5.1.5. Knowledge

Currently, knowledge management processes are informal and undocumented. The culture around sharing knowledge is very open and there are few boundaries to new knowledge. A lesson learned is likely to be acted upon and incorporated if one can find it. Only

experienced engineers are hired for development activities, and some of the most experienced and knowledgeable engineers tend to take the role of engineering program