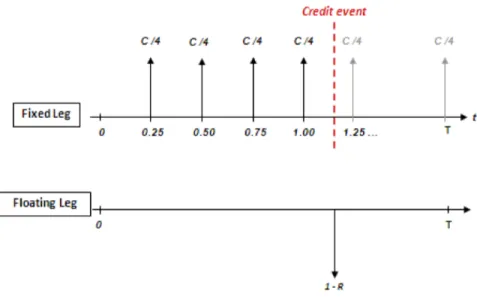

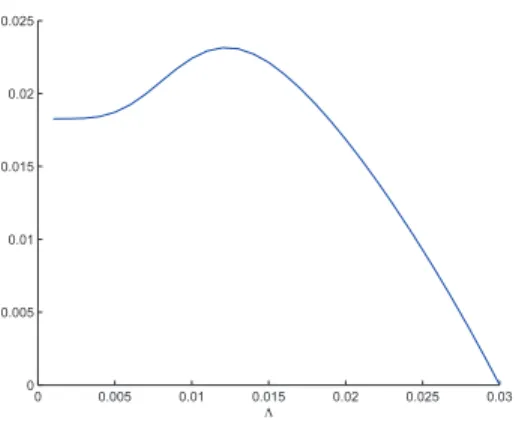

Pricing of Corporate Loan : Credit Risk and Liquidity cost

Texte intégral

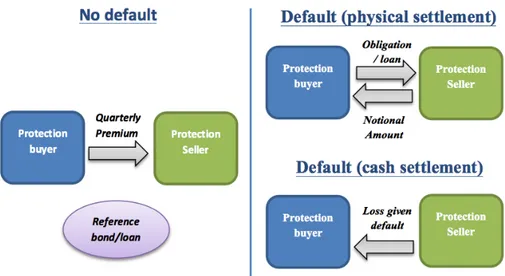

Figure

Documents relatifs

Comvariance was first introduced to economics by Deardorff (1982), who used this measurement to correlate three factors in international trading. Furthermore, we

Comvariance was first introduced to economics by Deardorff (1982), who used this measurement to correlate three factors in international trading. Furthermore, we

Variable definitions: W_MARGIN = net interest income/total earning assets; N_MARGIN = (interest from loans/net loans) – interest expenses/total liabiities; LIQUIDITY it =

Apis mellifera / Aethina tumida / biological vector / deformed wing virus / honeybees / small hive

This article is aimed at defining the absorption costing rule as deriving from a principal-agent formulation of two tier or- ganizations : (i) the upstream unit fixes the

Constatant l’absence de salarié élu de la Direction départementale des Alpes- Maritimes, les membres du CSE nouvellement élus et la Direction ont décidé, lors des

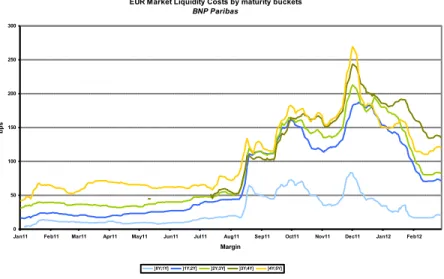

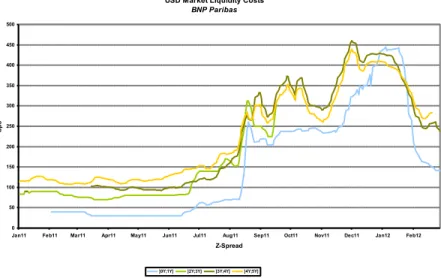

The creation and management of liquidity is crucial for banks and financial institutions during financial difficulties.They need liquidity for payment of customer

Nev- ertheless, this work was influential as it firmly established MITL as the most important fragment of Metric Temporal Logic over dense-time having a feasible