Vertical ownership and export performance : firm-level evidence from France

Texte intégral

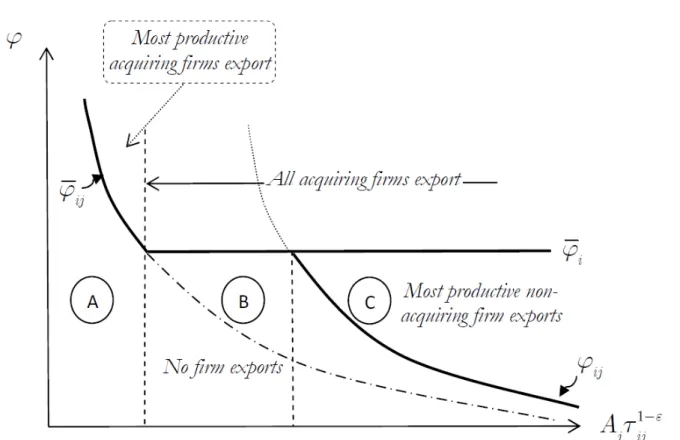

Figure

Documents relatifs

According to the results in the bottom panel of Table 6, at least two out of the four measures of the financial stance are significant and present the expected sign, for each of

La nuit se veut de nous tous et enfin et je le sais et c’est ça et je le sens et je le crois et surtout et je sais tout de toi et cela me suffit et pars maintenant et tout de

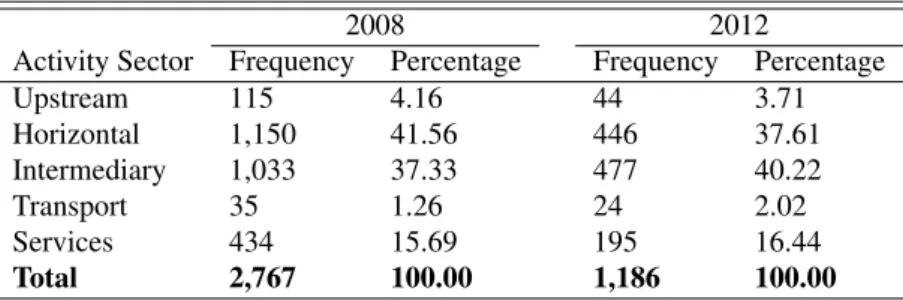

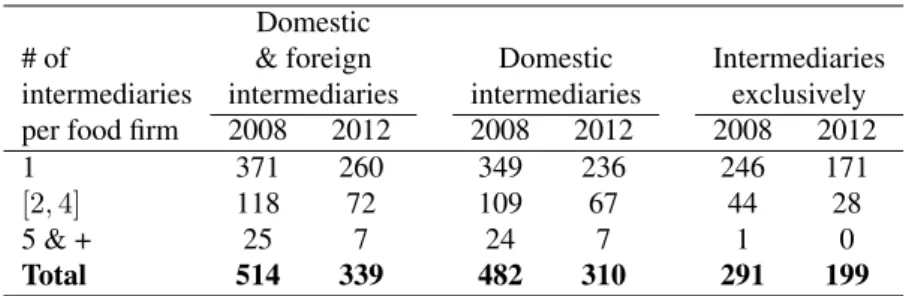

Recent empirical works of the French National Institute of Statistics and Economic Studies (INSEE) highlight main sector-based differences in the organization of

Aphidius ervi attacks a number of aphid species on economically important crops such as legumes and cereals, widely reported as an effective biological control agent of both the

These categories differ from one culture to another, basically, cultural background defines their non-verbal communication as many forms of non-verbal communications

Hence, share price volatility is a concern for shareholders (not only for firms with one blockholder) and mid-sized blockholders do play a role in determining a firm risk.. This

The table shows the regression results of ownership concentration in the sample of non-financial firms listed on the Warsaw Stock Exchange, measured by the logistic transformation

Using a large annual data base of French firms (1994-2000), this article examines the determinants of a workforce reduction of publicly-listed and non-listed companies and