Developing high-frequency equities trading models

Texte intégral

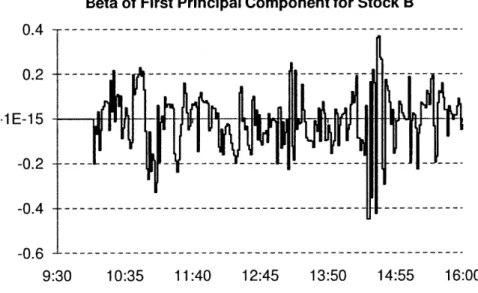

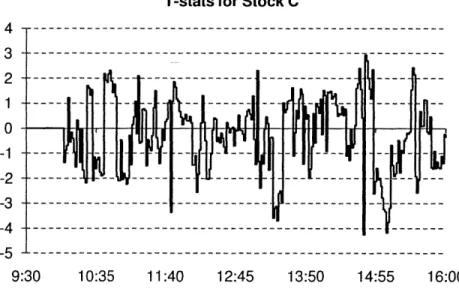

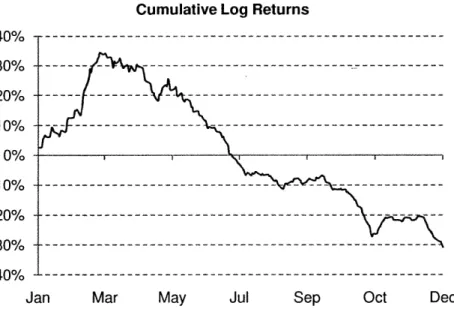

Figure

Documents relatifs

Laboratoire de Physique des Milieux Ionisds (*), Facultd des Sciences, Universitd de Nancy I, B.P. An exhaustive classification of the density perturbations and magnetic

However, it would be interesting to provide an abstraction to the user to express software visualizations and a set of useful recurrent visualization used in software

Nous avons choisis plusieurs dispositifs pour vérifier cela. Nous avons fait passer six tests formatifs dans deux classes différentes. Chacune des deux classes a effectué trois tests

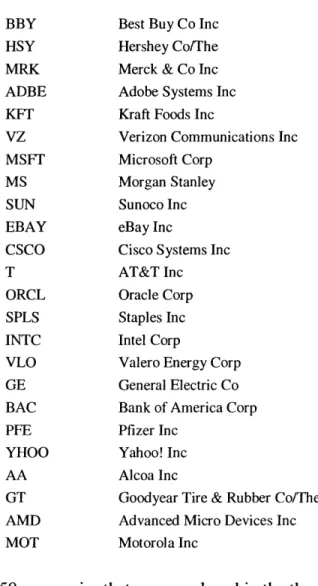

The agent may submit at any time limit buy/sell orders at the current best bid/ask prices (and then has to wait an incoming counterpart market order matching her limit), but

When dealing with fast pressure changes, cycling loading and cavern stability, the onset of tensile stresses and salt dilation at the cavern wall must be discussed..

Afzal and Mansoor [13] investigated the effect of a 72 h cell phone exposure (900 MHz) on both monocotyledonous (wheat) and dicotyledonous (mung bean) plants seeds: germination was

Thus, initial vaccine trials were based on soluble monomeric gp120 often derived from culture-adapted HIV-1 strains which, as we know today, due to its non-native conformation are