Consumption Heterogeneity

in

Macroeconomics and Public Finance

by

Alan Olivi

Submitted to the Department of Economics

in partial fulfillment of the requirements for the degree of

Doctor of Philosophy

at the

MASSACHUSETTS INSTITUTE OF TECHNOLOGY

June 2019

@

Massachusetts Institute of Technology 2019. All rights reserved.

Signature redacted

A uthor ...

...

Department of "comics

ry

May

15,

2019

Certifiedby...Signature

redacted...

-- Ivan Werning

Robert M. Solow Professor of Economics

A

Thesis Supervisor

Certified by...

Signature redacted

...

Robert Townsend

Elizabeth & James Killian Professor of Economics

Signature

redacted

T

"Pervisor

Accepted by ...

...

Ricardo Caballero

Ford International Professor of Economics, Department Committee on

MASSACHUSETTS INSTITUTE

Graduate Theses

QFTECHNOWGY

JUN 1 4 2019

Consumption Heterogeneity

in

Macroeconomics and Public Finance

by

Alan Olivi

Submitted to the Department of Economics on May 15, 2019, in partial fulfillment of the

requirements for the degree of

Doctor of Philosophy

Abstract

This thesis consists of three chapters on households' consumption. In the first chapter we study the canonical consumption-savings income-fluctuations problem with incomplete markets and show theoretically how to recover households' preferences and beliefs from their consumption and savings decisions. The main innovation is to show how to use the transitory component of income as an instrument that shifts current consumption without changing beliefs about future stochastic changes in consumption. As such, the transitory component of income, affects consumption growth through an intertemporal smoothing motive with no immediate effect on precautionary savings. With the precautionary motive neutralized, comparing changes in consumption and savings in response to temporary shocks allows us to identify the curvature of marginal utility: when savings respond more than consumption to transitory changes in income, the relative prudence is higher. Additionally, the transitory component makes it possible to identify an effective discount rate, which in turns makes it possible to control the degree of households' impatience. The curvature of marginal utility and the effective discount rate are sufficient to understand how preferences restrict consumption choices through the Euler equation. To then recover beliefs, we assume that beliefs are independent of exogenous changes in assets. This gives us an additional instrument to identify beliefs since the belief system then has to be consistent with the implied savings patterns as assets vary. These two instruments allows us to non parametrically recover preferences and beliefs in a very general framework: we can accommodate multiple consumption items (both durable and non-durable), multiple assets (liquid and illiquid, risky or not), habits, endogenous labor supply and so on.

The second chapter builds on the first. We investigate empirically, in data from the PSID and the SIPP, how households' expectations deviate from rationality. Our estimation shows that households are overconfident and overoptimistic. The main source of overconfidence is that households underestimate the frequency of shocks and their optimism is driven by an underappreciation of negative shocks. However, these biases are not homogeneous in the

population: they are amplified for lower income households while higher income households' perceptions are closer to rational expectations. These results explain not only the quantitative magnitude of undersaving and overreaction to income shocks, but also why higher income households accumulate disproportionately more wealth. We then explore how these beliefs affect the design of unemployment insurance and the transmission of countercyclical income risk to aggregate demand.

In the third chapter, written with Xavier Jaravel, we investigate how to design optimal income redistribution policies when the price of goods is depends on the size of the corresponding markets and different households consume different goods. We introduce Increasing Returns to Scale (IRS) and heterogeneous spending patterns (non-homothetic preferences) into the canonical tax problem of Mirrlees. In this environment, any change in tax policy induces a change in labor supply, hence a change in market size, which translates endogenously into a change in productivity; this productivity response affects consumer prices and sets off another round of labor supply changes, market size changes, productivity changes, further labor supply changes, and so on. We show theoretically how to characterize these general equilibrium effects and we quantify their importance for the optimal tax schedule. The calibrated model matches empirical evidence on IRS as well as the tax schedule, earnings distribution and spending patterns observed in the United States. We establish three main results: (1) the optimal average tax rate is substantially lower on average, falling from about 45% under Constant Return to Scale (CRS) to about 35% with IRS (because IRS increase the efficiency cost of taxation); (2) with IRS and homothetic utility, optimal marginal tax rates are much less progressive than under CRS, and they become regressive above the 65th percentile of the income distribution (because IRS increase the efficiency cost of taxation relatively more for the rich); (3) with IRS and non-homothetic utility, optimal marginal tax rates become more progressive (intuitively, the planner internalizes that the productivity increase that could result from a tax break to the rich has low social value if the rich spend their marginal dollar on products that the poor do not consume much of). These findings indicate the importance of endogenous productivity and non-homotheticities for optimal taxation.

Thesis Supervisor: Ivin Werning

Title: Robert M. Solow Professor of Economics Thesis Supervisor: Robert Townsend

Acknowledgments

I am indebted to my advisors Ivan Werning, Robert Townsend, Nikhil Agarwal and Jonathan

Parker.

I cannot thank Ivin enough. He let me explore when I needed it and then spent an unreasonable amount of time questioning every aspect of my ideas, never settling for half thought answers. He managed to never make it feel pressuring so that it was a constant emulation. But more than the invaluable depth of his insights, it is the human aspect of his advising that I will remember: his willingness to stay late at night to talk and help me prepare a presentation, the continuous checking-in, the encouraging emails and so on. Ivin truly is the ideal advisor.

I am also incredibly grateful to Rob Townsend. He seems to always be available for his

students. I have spent hours in his office and his unfailing enthusiasm about economics was infectious. Rob is also extremely kind and supporting, he was reassuring and even praising when I had doubts and willing to help with even the smallest problems. Nikhil joined my committee rather late and it is even more amazing to me that his help was so crucial. Even though my research is almost completely disconnected from his, his insights and advice were some of the sharpest. This is not only because Nikhil is a truly brilliant person, but also because he was extraordinarily dedicated. Jonathan Parker was the most organized person in my committee and I absolutely benefited from him to structure and frame my ideas.

I also want to thank the MIT staff, Kim, Maren, Deb, Emily and especially Gary without

whom it is not clear I would have ever graduated.

These six years in Cambridge would have been dreadful without the support of my fellow MIT graduate students and my roommates, and I would like to thank in particular Alonso and Amanda, Chishio, Ali, Francine, Nathan, Masao, Vu and Bao. I am especially grateful to Roman, Esmeralda and Gabrielle for their love and friendship.

Contents

1 Revealed Preferences and Beliefs from Consumption-Savings Decisions:

Identification Results 13 1.1 Introduction . . . . 13 1.2 Environment. . . . . 19 1.2.1 Income Process . .. . . . . 19 1.2.2 Belief System . . . . 26 1.2.3 Life-cycle Problem . . . . 31 1.3 Identification . . . . 33 1.3.1 Identification of preferences . . . . 35 1.3.2 Identification of beliefs . . . . 45 1.4 Conclusion . . . . 52 1.5 Appendix . . . . 63

1.5.1 Derivation of the Main Formula . . . . 63

1.5.2 Details on Section 3.1 . . . . 67

1.5.3 Proof of Proposition 3 . . . . 68

1.5.4 Details on Section 3.2 . . . . 69

1.5.5 Some Extensions . . . . 71

2 Revealed Preferences and Beliefs from Consumption-Savings Decisions: Empirical Investigation 75 2.1 Introduction . . . . 75

2.2 Empirical Model and Estimation ...

2.2.1 Empirical specification . . . .

2.2.2 Data . . . .

2.2.3 Estimation of the Income process . . . . 2.2.4 Estimation of the Policy Rules . . . . 2.2.5 Estimation of preferences and beliefs . . . .

2.3 Results . . . .

2.3.1 Utility function . . . .

2.3.2 Beliefs . . . .

2.4 Comparison with Rational Expectations . . . .

2.4.1 Welfare . . . .

2.4.2 Consumption and asset accumulation over implications for wealth inequality . . . . 2.4.3 Reaction to income shocks . . . . 2.4.4 Reaction to future shocks: precautionary savings

2.4.5 Baily-Chetty Revisisited . . . . 2.5 Conclusion . . . .

3 Optimal Taxation and Demand-Led Productivity

3.1 Introduction . . . . 3.2 Theory . . . . 3.2.1 Model . . . . 3.2.2 Demand Side . . . . 3.2.3 Commodity Taxation . . . . 3.2.4 Costs of Transfers . . . .. 3.2.5 Optimal Income Taxation . . . .. 3.2.6 Comparative Statics . . . ..

3.3 Quantitative Analysis . . . ..

the life-cycle and 81 81 87 89 93 95 98 98 101 119 120 122 . . . . 125

over the business cycle 128

. . . 134 . . . 140

151

152 156 156 158 163 165 168 173 1763.3.1 Perturbation Approaches . . . 176

3.3.2 Optimal Non-Linear Tax Schedule . . . 181

List of Figures

1-1 Example of Transitory Change 24

Size of Income Changes . . . .

Random Arrival of Shocks . . . . Relative Risk Aversion . . . . Comparison with CRRA . . . . Subjective Expectations by Permanent Income . . . . Subjective Expectations by Age . . . .

Perceived Arrival Rate of Shocks . . . . Perceived Distribution of Persistent Shocks . . . . Perceived Distribution of Persistent Shocks by Permanent Perceived Distribution of Temporary Shocks . . . . Perceived Probability of Persistent Income Changes . . . Perceived Probability of Persistent Income Changes . . .

Beliefs by Age . . . .

Predicted Marginal Utility Growth . . . . Change in the Perceived Arrival Rate . . . . Change in the Perceived Mean of Persistent Shocks . . .

Change in the Perceived Mean of Temporary Shocks . . Impact of the 3 Main Transformations . . . .

2-19 Change in the Perceived Variance of Persistent Shocks

. . . . 83 . . . . 84 . . . . 99 . . . 100 . . . 102 . . . 103 . . . 104 . . . 105 Incom e . . . 106 . . . 107 . . . 109 . . . 111 . . . 113 . . . 114 . . . 115 . . . 116 . . . 117 . . . 117 118 2-1 2-2 2-3 2-4 2-5 2-6 2-7 2-8 2-9 2-10 2-11 2-12 2-13 2-14 2-15 2-16 2-17 2-18 24

2-20 2-21 2-22 2-23 2-24 2-25 2-26 2-27 2-28 W elfare Loss . . . . Perceived Welfare Gain . . . . Life-Cycle Wealth and Consumption . . . . Wealth Accumulation by Permanent Income . . . . Consumption and Savings Response to Transitory Shocks . Consumption and Savings Response to Persistent Shocks . Ex ante Response: Lower Mean of Shocks . . . . Marginal Propensity to Consume and Risk Valuation . . .

Ex ante Response: Persistence of Adverse Shocks . . . . .

. . . . 120 . . . . 122 . . . . 123 . . . . 124 . . . . 126 . . . . 127 . . . . 129 . . . . 131 . . . . 133

3-1 Costs of $1 Tax Break across the Income Distribution with Increasing Returns to Scale . . . 200

3-2 Amplification of Behavioral Responses . . . 201

3-3 Value of $1 Transfer across Income Groups with Non-Homotheticities . . . 201

3-4 Sensitivity Analysis . . . 202

3-5 Optimal Marginal Tax Rates with Homotheticities and CRS/IRS . . . 203

3-6 Optimal Marginal Tax Rates with Non-Homotheticities and IRS . . . 204

3-7 Prices at Optimum with Non-Homotheticities and IRS . . . 205

Chapter 1

Revealed Preferences and Beliefs from

Consumption-Savings Decisions:

Identification Results

Abstract. What can we robustly infer about preferences and beliefs from observing saving choices? To answer this question, we study the canonical consumption-savings income-fluctuations problem with incomplete markets in the standard Subjective Expected Utility framework. We cast the model in continuous time and allow for general processes for income, a non-parametric specification of utility, and general beliefs. Agents can learn over time, change their beliefs with macroeconomic conditions, and, most importantly, be systematically biased in essentially unrestricted ways. Our main theoretical results provide a novel set of non-parametric identification conditions showing moments of the data that directly reveal preferences and beliefs.

1.1

Introduction

What do we learn about households' preferences and beliefs from their consumption and savings decisions? The answer to this question has important implications for a wide variety

of economic problems, ranging from the optimal design of social insurance to the effect of macroeconomic policies. The prevailing practice in the literature has been to assume that agents have rational expectations and, to a lesser extent, that preferences are homogenous and belong to a parametric family. Under these assumptions, both risk and time preferences can be estimated from choice data. Parametric restrictions are, however, not justified from economic theory' and the reliance on rational expectations is questionable. Indeed, failures of the rational expectations hypothesis are now well documented, from the work of Flavin (1981) to the recent behavioral literature. Unfortunately, there is no existing alternative approach.

In this paper, we investigate how to infer both preferences and beliefs by observing consumption and savings decisions. We study the canonical income fluctuations problem with incomplete markets and focus our analysis on the Subjective Expected Utility model. Our goal is to elicit households' perceptions of income risk. We work in a non parametric framework, allowing general processes for income and utility but also allowing the discount rate to be heterogeneous in the population and to vary stochastically. Crucially, we do not impose that the income process perceived by the agent coincides with the one measured by the econometrician. Agents can learn over time, change their beliefs with macroeconomic conditions, and, more generally, be systematically biased.

Our main contribution is to theoretically show that under minimal conditions, we can recover both preferences and beliefs. Our identification results provide a novel set of moments of the data that directly reveal the utility function, the heterogeneous discount rate, and the perceived income process. Although we present our approach in the benchmark consumption saving model with one good and one risk free asset, the idea developed in the paper are very general and easily accommodate more complex versions of the model (multiple goods and in particular endogenous labor supply or durable consumption, multiple assets, liquid or illiquid, risky or not some form of habits and so on).

The core idea for identification is that how much the agent saves tells us how much risk

IThey also potentially translate into misleading conclusions: to give a recent example, Straub (2018) shows that the standard specification of preferences yields counterfactual predictions on the joint distribution of consumption and permanent income.

she expects. When agents expect large income losses, they insure themselves by accumulating assets. The question, then, is whether or not this relation can be inverted. Knowing the parameters of the income fluctuation problem - and in particular beliefs about the risk distribution - we can compute the optimal consumption function. Assuming that we have correctly estimated the consumption function, can we then recover the perceived distribution of risk? The main difficulty is that preferences matter and are intertwined with beliefs in the Euler equation: the saving rate can be high because the probability of income loss is high or because the agent is particularly patient or risk-averse.

To deal with this issue and to infer preferences,2

we would ideally have an instrument that shifts current consumption without changing beliefs about the consumption loss - or gain

-that would occur after a shock. We show -that the transitory part of the income process precisely fulfills this role. To give an analogy, past income shocks do not matter for current consumption, conditional on the information set of households and on their current wealth. The logic is similar: by definition, a transient shock changes the total amount of available resources without changing the distribution of income after future shocks.3 Moreover, it does not immediately change the wealth of the agent. Suppose, then, that we temporarily change the income level of some agents and, importantly, that they perceive that this change is transitory. Since neither wealth nor the distribution of future income shocks is initially impacted by transitory shifts in income, it does not change what households plan to consume after a new shock occurs, at least in the short run. The transitory component of income, therefore, affects consumption growth through an intertemporal smoothing motive - how to allocate the additional resources before a new shock occurs - with no immediate effect on precautionary savings. The precautionary motive can then be differenced out of the Euler equation through variation in the temporary component. With the precautionary motive neutralized, comparing changes in consumption and savings in response to temporary shocks allows us to identify the curvature of marginal utility: when savings respond more than consumption to transitory changes in income, the

2

The preferences parameters here are the utility function and the discount factor. 3

relative prudence is higher.

Varying the transitory component also makes it possible to identify an effective discount

rate, which in turns makes it possible to control the degree of households' impatience. In the

time interval between two shocks, the discount rate determines consumption growth through a sufficient statistic that includes the arrival rate of shocks. This sufficient statistic is what we call the effective discount rate. It can be inferred via the response of consumption to transitory shocks when agents are not initially saving: their marginal utility is then constant around this time, so that intertemporal smoothing is determined purely by time preferences, through the effective discount rate. Small responses of consumption growth to temporary shocks, for example, indicate that the effective discount rate is small, so that agents are either patient or expect the probability of shocks to be small.

The next step is to recover expectations. We show that the curvature of marginal utility and the effective discount rate are sufficient to understand how preferences restrict consumption choices through the Euler equation. Given that preferences can be estimated with no further assumption on the belief system, we are able to express direct restrictions on beliefs. Knowing agents' preferences, the saving rate gives us the ex ante value of the perceived income shocks at a given level of consumption. To generate variation in the sensitivity of consumption to perceived income fluctuations (and thus on the ex ante saving rate) without changing the underlying perceived risk, we assume that beliefs are independent of exogenous changes in assets. This gives us an additional instrument to identify beliefs: the belief system has to be consistent with the implied savings patterns as assets vary. Exogenously increasing the initial wealth of agents gives them the opportunity to insure themselves against fluctuations, and thus consumption becomes less dependent on certain moments of the subjective income distribution. The moments agents decide to smooth are the ones we will be able to identify.4 These moments are the only ones that matter, in the sense that- from the agent's point of

4

To give a more concrete example, suppose that the perceived distribution of income is Gaussian. If households with higher levels of wealth only react to the expected growth of income and households with lower levels of wealth also react to the expected variance, we can use the savings of the wealthier households to recover the mean and the savings of the poorer households to calculate the variance.

view-they are sufficient statistics of the perceived income process to formulate an optimal consumption plan. Once beliefs are recovered, the utility function and the heterogeneous discount rate can be fully inferred.

To summarize, variation in the transitory component does not affect consumption after future shocks, which allows us to almost completely recover preferences independently of beliefs. In contrast, variation in assets changes the future distribution of consumption without changing the distribution of underlying income risk, which then enables us to identify beliefs. We finally use those beliefs to fully characterize preferences.

Importantly, our identification strategy is constructive and therefore provides a novel sets of moments to empirically estimate preferences and beliefs. To estimate preferences independently of beliefs we simply need an instrument deterministically shifting the flow of income without shifting the perceptions of the agent about the distribution of income after future shocks. Many quasi experimental settings would provide these types of instruments: for example exogenous variations in unemployment benefits - that exist because of discontinuities in UI receipts across different households, see for example Landais and Spinnewijn (2019)

- provides temporary variation in the level of iricome which is understood as temporary by households. Similarly the effect on consumption of exogenous variation in wealth, through lottery gains or unexpected appreciation in housing price can be used to directly estimate beliefs. These ideas are here formally presented in a simple consumption savings model, but are extremely general. Households can be partially inattentive to the transitory shift in income for example, and their decision problem can be arbitrarily complex: the same strategy can be used when households face many intratemporal decisions (how much to invest in their durable stock, how much labor to supply etc.), have access to more complex saving technology (liquid and illiquid assets risk free assets, risky investments etc.), or when preferences change intertemporally (habit formation, taste shocks etc.). As such the ideas developed in this paper should prove useful to better understand the underlying decision problem of households.

In spite of their omnipresence in economics, there are surprinsingly few results on the identification of dynamic consumption savings problems under uncertainty. Parametric identification of preferences was established by Hansen and Singleton (1982) using the structure of the Euler equation. More recently, several strategies have been established to non parametrically identify preferences, in asset pricing models, under rational expectation, for example Escanciano et al. (2015) and Chen et al. (2014). The former uses the fact that the Euler equation constitutes a Fredholm equation of the second kind to recover preferences while the later more standardly uses a non parametric instrumental variable framework. These papers first necessitate to know choices of the agent everywhere on the state space. In addition, it is essential for identification that the Euler equation holds almost surely and to have a constant and homogeneous discount rate. These assumptions might prove problematic in the context of the standard consumption savings problem with income fluctuations where binding borrowing constraints are essential to replicate observed consumption patterns. Our paper first make important contributions to the identification of preferences. Since we use local variation in consumption to transitory shifts in income (only two points are needed to identify the local curvature of marginal utility and our effective discount factor), our strategy can easily deal with binding borrowing constraints and arbitrary heterogenous and stochastic discount rate. But more importantly, since our strategy only use one dimension of the consumption function to identify preferences, we are left with many degrees of freedom to characterize expectations. We therefore also contribute to this literature by demonstrating how to fully use the information contained in the Euler equation to not only identify preferences non parametrically, independently of the expectation operator, but also to provide restrictions on belief systems that are consistent with consumption. The fact that the identification is non parametric is then critical: since both beliefs and preferences are latent parameters, imposing a shape on one of them could introduce consequential bias in the other. The method that we propose only relies on observed choices and therefore complement the growing literature,

starting with Manski (2004), that uses surveys to directly elicit agents' expectations. Surveys undoubtedly provide valuable qualitative information, but it is less clear whether they can

provide a sound foundation for quantitative analysis.5

Our paper is organized as follows: Section 1 lays out our framework and discusses the main identifying assumptions. We define the income process, the corresponding belief system, and the agent problem. Section 2 presents our identification results. The identification strategy is in two steps and we first show how to recover preferences and then how to characterize beliefs. The appendix presents several extensions of the framework.

1.2 Environment

We begin by laying out a general continuous time framework that will allow us to recover agents' preferences and risk perceptions. The continuous time assumption is not crucial; it mainly simplifies the derivation of the identifying moments. The first subsection describes the income process. For the sake of generality, the income process is slightly abstract, although we do provide concrete examples in a subsection. The second section presents the belief system of the agent, and the third section describes the full planning problem.

1.2.1

Income Process

We start with the description of current income. The non linear framework developed in ABB allows us to specify income as a time dependent function of 1) a vector of observable characteristics Xt;6 2) a vector of latent fixed characteristics 0; 3) it a finite set of observable

5

Surveys make it possible to recover a few moments of the perceived risk distribution, typically the probability that income increases at different time intervals. Even in the simple case of the income-fluctuations problem with quadratic utility, consumption depends on the expected discounted flow of income and thus requires knowledge of the perceived mean of income at all time intervals.

6Xt does not have to be deterministic but is assumed to be predictable, which informally means that there is no immediate uncertainty about it. Experience, for instance is stochastic but predictable.

states, such as unemployment or part time work; 4) a vector of persistent components r7t; and 5) a transitory component ct. Let yt denote the logarithm of income, and we then have:

yt = Ht(X, 6, it, qt, ct)

This representation is meant to nest the standard formulations of income and convey clearly the fact that the identification will not rely on the particular form chosen to describe earnings. The heterogeneous income profile model,7 for example, is a particular case with an additive structure:

yt = gt(Xt) + ft(X, 0) + rt + et

with g a deterministic trend common to all agent and ft a (deterministic) life-cycle component of earnings that is individual specific.

We specify the stochastic evolution of income as a piece-wise deterministic Markov process (PDMP). Informally, the process has, in an arbitrary time interval, a countable number of discontinuities (or jumps) and evolves in a deterministic way between them. This description might appear arbitrary and too restrictive at first sight. After all, income could follow a continuous stochastic process in the interval between two jumps - a diffusion, for example. However, this would be at odds with the empirical behavior of income. In the data, income is very stable with infrequent discontinuities: our sample shows that 70% of all households have constant income for at least eight consecutive months over a three-year period. Including a diffusion component would produce too much volatility since almost all Brownian paths are of

7

unbounded variation on every time interval.89

The income process is Markovian on the state space E in Rd, with denoting a typical element of E. The state space includes the five components determining current earnings but could also contain additional variables, typically lags of the persistent components, which are informative about future income. The evolution of income is described by three objects. First, between two jump times, the process is described by a deterministic flow: 0( ) E E is the

deterministic drift between the jumps if the state is E E. 0 is assumed to be regular enough

so that there exists a unique solution to the following initial value problem:

In an AR(1) process, the shocks vanish at rate p. In this framework, this is captured by the function 7p: when the state space is limited to one persistent component and 0(77) = -py, we directly have trlt = -p7t. 10

The stochastic evolution is given by a marked point process (Ta, ), where (Tn),;>O, is the increasing sequence of jump time points and , is the post jump state. The jump times follow an inhomogeneous Poisson process with intensity" A ( P) > 0 and the distribution of post jump states is given by a stochastic kernel p( , I ' ). The arrival rate and the stochastic kernel depend only on some elements of t, the state vector at time t. These elements are denoted P, and they live in the subset EP C E. The variables in P are therefore the sole predictors of the

stochastic evolution of the process. 8

The disproportionate volatility introduced by continuous stochastic processes is actually more general: it is indeed known that continuous strong Markov processes, whose paths are of bounded variation over finite intervals, are totally deterministic. See 4inlar and Jacod (1981). Therefore, PDMPs appear as the only natural class to represent income, given its empirical regularity.

9

Most households are wage earners, but this probably would not be the case for business owners.

'0Given that V) can depend on an arbitrary set of states i, it can also depict more complex patterns: if one of the components 77 is meant to capture productivity, a decreasing 4' characterizes the decay of skills in the state i corresponding to non-employment and, conversely, learning by doing -with an increasing 4 -when the agent is employed.

'The intensity of the process is a deterministic function of the state, it could be made stochastic to describe Hawkes type process.

Together with the drift $, the intensity and the kernel complete the characterization of income's dynamic. In state ( and for a small time interval dt, 6 increases by 4'(6)dt in the absence of shock; the probability that any shock occurs is given by A(6P)dt, and the probability that the process jumps in the set B c - is given by g(B

I

6P). The evolution of the process isbest summarized by its infinitesimal generator," A. For an arbitrary function

f

defined on the evolution of f(6) is given by:Af(6)

=

Vf -0(6) + A(6P)

(f(6')

-

f(6)) p (d6'

I

6P)

In particular, log-income evolves according to:

Ayt = VHt - 0(6) + A(6P)

J

(Ht(Xt, 6,J, 7', c') - Ht(Xt,0,

i, r, c)) p(dr', de',j P)This specification of income is slightly abstract but has the advantage of being very flexible. In particular, when calendar time belongs to EP, the income process can vary with the business cycle; through observable components Xt and the latent type 0, life cycle dynamics can be captured; income can indeed grow at different rates and become more or less volatile with age, education, past work history, or the unobserved ability of the agent; the states i make it possible to model important events, such as unemployment or disability, in addition to various persistent and transitory shocks.

At this stage, the process is left unrestricted. We now characterize precisely the transitory component. The transitory component is not predictive of the distribution of income after a

future shock.

Assumption Al. yt depends non trivially on at least one variable E, a transistory component,

such that e V BE and for any e'

c

R, any P, {E', E} C E. The intensity A and the stochastickernel [-t(. I |P) do not depend of t. Therefore, for any n > 0, t > T':

I(tI T- ET-) E t -)

And in particular:

E(Yt I n, ET-) E(Yt

I_'-The assumption gives us a predictor of the dynamic of the Markov process along the deterministic paths that is completely uninformative of its behavior after a jump, and thus of the purely stochastic evolution of income. This component is what we call the transitory part of income. As we will show, this assumption is important to isolate an instrument which affects agents' choices and which does not change their perception of future risks. It is a rather weak assumption that is commonly made in models of earnings dynamic.1 3

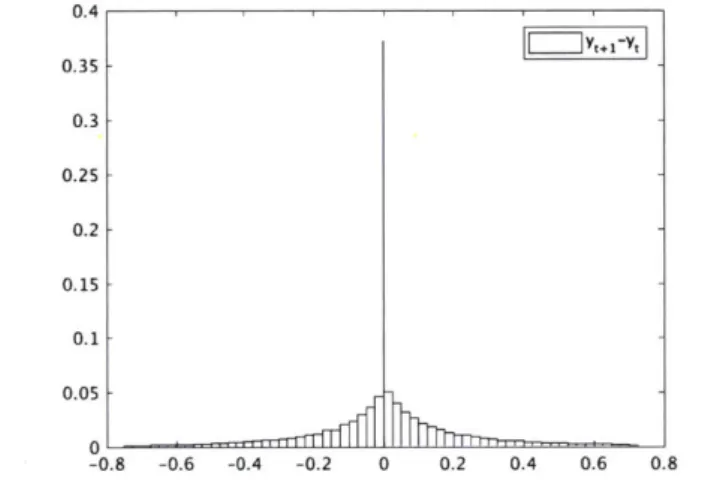

An intuitive way to understand our definition of the transitory component is to consider the standard setting where earnings change every period (usually a quarter or a year) and are the sum of two components, a transitory and a persistent one. From one period to the next, the distribution of income is then independent from the value of the transitory component during the current period. In our setting, we have an equivalent definition of the transitory component, but the time periods are of stochastic length. The following figure provides a simple illustration where 6 denotes the transitory component and r1 the persistent one:

(The 1)

(T12,E 2)

T1 T2

(ThZE2)

T, T2

FIGURE 1-1: Example of Transitory Change

Many income changes are of stochastic in nature: employees might have to work overtime until a project is over or until production needs are satisfied, they might have to take an uninsured sick leave and so on. The leading examples are unemployment shocks. In this case, the transitory component would be the amount of benefits that household receive during their unemployment spell: benefits shift income during the spell without changing the distribution of reemployment wages and therefore the evolution of the process.

Examples

To fix ideas, we show in the following examples how the framework accommodates some simple processes.

Example 1. Suppose that log income follows a simple AR(1) process. Let - =? = {},qER;

the notation above: HIt(Xt, 0, it, n, ct) = rt ' rN ) = e P72t

1

1 ((' -)7) 2 Ayt -= -pr/t + A (77' - Tjt) e 2C,2 dr/'Since the stochastic kernel is not restricted to continuous distributions, the framework allows for multiple shocks as illustrated in the following example:

Example 2. Suppose that we have two transitory shocks vanishing at different rates. We have

i = { H, L}, with PH > PL, the two rates at which the shock vanishes in the respective states.

The shocks are iid with density $H- and OL, and they arrive with rate A H and AL. In that case

we have c

{, { H, L}}1, =-P = 0. In our framework this gives:

Ht (Xt,1 0,1 it, IT, Et) =Et

(*t, i) = -piEt

H L

'j ) = )NH A~= OH (CE + 6(j=L) AL OL (E'

(=H ) H L AH +L

AyMei -it+O (yt (c', H) - yt (6t, ')) OH (e) Vd

+ A L f yt (c', L) - yt(Et, i)) #L (E) Vd

We now present an example to illustrate the limits of our Assumption Al. The assumption does not allow for shocks that affect the persistent part of earnings without changing this

transitory component, and in that sense it is not completely standard. We illustrate this point in

Example 3. Suppose that income is the sum of a transitory and a persistent component. In

that case, we have yt = H (7t, Et) = 77t + ct. Purely transitory shocks arrive at rate AE, with

distribution v, and a shock to both components arrives at rate An distributed according to I/. In that case the infinitesimal genrator of the process is:

At y(n, 6) =A., (y(rn, 6') - y(7, c)) v(dc' q, t)

+ A

J

(Y', ')

-y(n, c)) i (d', d'

I

,

t)

and the stochastic kernel is given by:

Tht 6=~(~ A, (6

+1) An

AE

[+ ?6An

which is clearly independent of E.

However; with a purely persistent shock, the infinitesimal generator becomes:

Aty(7, 6) =A, (y(TI, 6') - y(,q, E)) v(dc'

I

y, t)+ Af(y(, c) - y(,q, E)) Fj(dr/' 1r7, t)

and the stochastic kernel is now defined as:

[(','| T, t) =(1=7) , ( A, v(E' 1 /, t) + 6(E /=/)

(

r( , t)which now depends on E through 6 .

1.2.2

Belief System

In this section, we present our belief system. We first explain why we can consider a belief system with the same structure as the income process (Assumption A2). We then present our main identifying assumption (Assumption A3). It states that agents are able to disentangle the transitory component from the rest of income and that they recognize that it has no predictive power on the distribution of income after future shocks.

Structure of Beliefs

Our intention is to recover agents' expectations based on their observed choices. This requires some restrictions on the belief system. Suppose that current income yt is known, but perceived future realizations at t, {#}syt are generated by a process that potentially differs from the one measured by the econometrician. At t, when agents choose their current consumption ct,

they also anticipate their future consumption flow

{

}y>t, which depends on the predicted realizations{sb>t.

A crucial condition to learn about the agents' expectations is that theanticipated consumption plan at t, {'}s>t can be inferred.1 4 But the only variable observed at a date t1 > t after a realization {ys}t,<s<t, is the actual consumption ct1. To be able to

equalize the sequence {,}s>t with the observed sequence {cs}syt, it is necessary to assume that the beliefs are dynamically consistent. This means that, at any ti > t, after the realization

{y

}ti,< t, beliefs about future income{

1},1>t are the same as the beliefs at t conditional onthe realization {QS}tti:st ={Ys},1tSt.

To obtain dynamic consistency, we assume that the perceived process is Markovian on some observable state space =15: we then have, for any set A E R, Pr(ys E A |t 1, t) = Pr(Q, c

A I ti) = Pr(y,

c

A | Note that we can also assume without loss of generality that the true state of the process is observed and that the agent knows how current income depends on the state variables; that is, the function Ht is known.16 This is a harmless assumption since the agent does not know the informational content in .Next, we assume that the perceived process is also piece-wise deterministic. If the perceived process had a diffusion component -for example a signal about rt with a brownian noise

-on which agents n-on trivially based their decisi-ons, their c-onsumpti-on flow would inherit this diffusion component and would therefore be excessively volatile compared to the true income process. As consumption is typically smoother than income, it is legitimate to assume that the

14

1f not, we can always assume that the agents think that their future consumption will be equal to observed

current consumption, which rationalizes any choice.

15

If the state space contains all past history of income realizations, this is not a restriction once dynamic

consistency is assumed.

161t is indeed possible to extend the state space to

x and have the support of the perceived distribution of ( on { s.t. y( ) = y( )}.

perceived process has the same stochastic structure as the true process.

To sum up:

Assumption A2. The perceived process

{Q}

is a PDMP on some state space B E. It isdefined by a deterministic flow : F-+ BE, an arrival rate A : -P -+ R, and a stochastic

kernel A from Et to E. As before, BP denotes the set of variables of E that agents perceive as

informative about future earnings. The infinitesimal generator is given by A, and for any f on

Af(j)

= Vf-

b( ) + A( P)J

(f

(') - f(0) #(dj' I P)In particular; perceived income evolves according to:

Z~t

=

V Ht

4-()

+ A( )

J

(Ht(Xt, 0, j, ', C')

-

Ht(Xt, 0, i, , E)) A (d

1', d', j |P)

Having established our concept for beliefs, we can now undertake the main purpose of the paper: finding the set of {',

A,

A} that is consistent with agents decisions.As such, this framework for beliefs is very general: the only restriction is on dynamic consistency. Rational expectations is a special case, with B B, $P =E, i =

4,

A = A,and A = M. Including a fixed state, corresponding to the prior, and the past history of state

variables makes it possible to capture learning. Although the state space of the agent contains beliefs can still be misspecified. For example, agents could think that persistent shocks are transitory if q ( $P. More generally, beliefs can be arbitrarily biased and therefore cover any form of bounded rationality: agents can be overoptimistic, understate the probability of shocks, exhibit loss aversion, beliefs can be anchored to past values etc. Note, however, that beliefs do not have a "structural" interpretation: for example if the recovered beliefs exhibit less volatility than measured beliefs, it could be because agents are biased or because they have more information on their earnings than the econometrician does. Finally, since the process

can vary with business cycles, the framework allows us to understand how beliefs change with macroeconomic conditions and consequently how changes in income through general equilibrium mechanisms are perceived by households."

Observability of the transitory component

The main identifying assumption is the equivalent of Al for beliefs:

Assumption A3. The agent knows that the component e defined in A] is transitory: c g E'. In

addition, for any e' E R, and for any P, {c', P} E E. The intensity A and the stochastic kernel

|P) do not depend of t. Therefore, for any n > 0, t > ':

E( , Ecfl) - '( n)

And in particular:

E(yt|g Etn) = (yt|j.

The notation I(- -) indicates that expectation is taken with the process defined in A2.

This assumption is more fundamental for identification than is Al: what will matter is that the household believes that the component c is not predictive of future earnings. If one were able to isolate a transitory component E of the perceived process, it could equivalently be used, even in the case were j actually contains information on the stochastic evolution of "true" income process. It would, however, be difficult to find this component ex nihilo, assuming that the transitory part of income is known to be transitory is a natural starting point.

Presuming that households are able to identify the transitory part of their income is a potentially strong restriction. It posits that not only do agents know enough about the structure of their income to isolate what comes from e, but that they are also able to disentangle the

17

Perceptions of general equilibrium effects is crucial to understand the impact of monetary policy as shown in Farhi & Werning (2017).

persistent and transitory part of new shocks. This merits further discussion.

The first part can actually be weakened. We do not need that agents base their decisions on the precise value e, but only on a function e(E, a, ) that is increasing in e. As we will see in the identification section, this is because our identifying moments formally are of the form = 7 with

f,

g observed and -y, the object of interest. So even if the agent is inattentive to the current value of e and only perceives e(c, a, ), our moments are unchanged. As such, our identification is robust to some forms of missperception and mismeasurements of c.The second part of the restriction - that the agent perceives the transitory component as transitory - is difficult to directly verify. However, empirical studies partially confirm the hypothesis: it is usually found that the response of consumption to transitory shocks differs from the reaction to persistent shocks and that households are more insured against the former.18 Households are, therefore, to a large extent able to differentiate transitory from persistent shocks. In addition, in Guvenen and Smith (2010),19 in which agents learn to distinguish their deterministic income growth from shocks, assuming that E is unobserved generates responses to shocks that are too large and that do not fit the data. Similarly Jorgensen and Druedahl (2018) show using the PSID and a Bayesian learning model that households know almost perfectly the transitory component of their income from the more persistent components.

The assumption also imposes a restriction on the state space EP. Conditioning on the state P should not kill variation in e. This prevents us from including the entire past history of the transitory component {S},<t as it would pin down et. It is, however, possible to include moments of the past c history, the variance of past shocks, for example, or even the past unordered sequence of E shocks. Note that in the assumption, conditioning on p does not prevent any variation in E. The assumption could be weakened to allow only "sufficient"

18 ee Blundell, Pistaferri & Preston (2008), for example.

9From their paper: "The assumption that e is observable can be justified on the grounds that purely transitory shocks are likely to be easier to distinguish from persistent ones, because the latter are more easily confused with the trend. Furthermore, we have also estimated a version of this model where E was unobservable and found that the current specification fits the data better. One reason for the poorer fit of the specification with unobservable E is that consumption responds too much to transitory shocks (compared to the response implied by the data), since the individual cannot tell it apart from persistent shocks."

variation in c20 and thus enable us to specify a larger state space. In practice, the perceived distribution of transitory shocks does not significantly deviate from the one measured in the data, even when we control for age or income, which indicates that learning does not play an important part.

1.2.3

Life-cycle Problem

In the benchmark specification, we consider a standard income-fluctuation problem: the agent starts with initial wealth ao andworks until T, at which date she receives a continuation payoff IF (ar, fT) that encompasses the value of retirement and potential bequest motives. She saves in the risk-free bond at, subject to potential borrowing constraints denoted by Ft(at, ).

Expectations are taken with respect to the process defined in A2, and they are denoted by

E(-

| ) .The agent's problem is given by:max

E

e (dtu(ct, c)dt + T (aT, T) |,ao s.t. (1.2.1) {ct~t>OOT

it Y + rtat - ct (1.2.2)

0 ;> t(at, ) (1.2.3)

The agent rationally chooses present and future consumption under potentially irrational beliefs, which will provide the structure needed for identification. The discount factor p is not assumed to be homogeneous and depends on the same variables as beliefs so that we do not confound impatience with irrational bias. The utility function depends on consumption and potentially on vector of time invariant characteristics ' - that can be observed or latent. As usual, the constraints imposed on agents' choices are more clearly seen in the dynamic programming formulation of the problem. First, the Hamilton-Jacobi-Bellman equation is given

20

by:

p

(

,) Vt(a,()

max (u(c, c)+

OaVt(a,

)et

+

AtVt(a,

)

0aVt(at, ) u'(Yt + rat, c) if Ft(at, t) = 0

The HJB equation is satisfied everywhere on the interior of the state space, where the borrowing constraint does not bind, and the boundary condition ensures that the constraint is never violated. We implicitly assume that calendar time is part of BtP so that the time derivative is included in the infinitesimal generator.

To avoid technical difficulties, we assume 1) that a classical solution of the Hamilton-Jacobi-Bellman equation exists, and 2) that at

V -

. The first assumption simply allows us to avoid dealing with viscosity solutions of the PDE. In practice, the measured consumption function and the recovered utility will be sufficiently smooth for the assumption to be verified ex-post. With the second assumption, the continuous time Euler equation does not depend on the value function, which simplifies the derivation of identifying moments.2 1Then, taking the derivative of the HJB with respect to a and using the first order condition u'(c) = aVt, we obtain the following Euler equation:

(P

(

tg)

-rt + t

U'(Ct, C U"(Ct,0

C)et +

vct

-k

=t(.24

(1.2.4)

At fu' (c (at,+, t+) , c) A (d~t+

We used the fact implied in the first order condition that the policy function c(-) is Markov on the state space {at, t

}.

In the rest of the paper, we investigate what restrictions this equation imposes on {p, U,I, A}.

21

The framework is kept simple for ease of exposition. The agent's problem can be extended along many dimensions. The agent can be allowed to save in high-return illiquid assets; the consumption good can be decomposed into durables and nondurables with potential transaction costs; some form of habits and taste shocks can be included, and we can also consider endogenous labor supply. As will become clear in the following section, the crucial characteristic of the agent problem is that utility is time separable with respect to future variables. We present the additional results in the appendix. We record the main restrictions on the optimal control problem in the following assumption:

Assumption A4. There exists a belief system

{A,

A} that conforms to assumption A2 and aset of preferences {p, u} such that the observed consumption plan is chosen optimally in 2.2.1.

Furthermore, at EP and u(.) is time separable with respect to future variables.

1.3 Identification

The main difficulty in inferring risk perceptions from agents' decisions is that choices depend both on preferences and beliefs: agents can save "more" because they expect particularity bad shocks in the future or because they are very risk averse. Our identification strategy deals with this issue in the following way: first we recover the shape of the utility function and an "effective discount factor" from choices that are independent from beliefs. While the utility function and the discount factor will not be entirely pinned down, the recovered properties of the agent preferences will be enough to impose direct restrictions on the set of beliefs consistent with the consumption function. Under these restrictions, we will be able to specify the full set of beliefs and preferences rationalizing the observed consumption patterns.

As mentioned before, our goal is to recover the set of {p, u, A,

/}

consistent with agents' decisions. We will suppose that the policy function c(.) as well as the state space B and the true income process have already been measured and are taken as given. ABB provides a flexible non-parametric framework to estimate and identify the policy function and the income process.For our purpose, recovering the true income process is only relevant because it allows us to identify its latent structure - in particular the transitory and persistent component - and, more importantly, how it impacts consumption. More generally, if a variable non trivially affects beliefs, it will be an input of the policy function: inferring the determinants of consumption22 makes it possible to specify the state space E. In accordance with A3 and A4, the state space

_P can then be taken without loss of generality to be {c, a}.e-

Assumption A5. The income process described by E, EPI

4,

Aand p; the consumption functionc(.), the law of motion of assets it, and the two state spaces B and t" are taken as given.

For simplicity, we assume in the main text that

4

=4.

The identification of4

will be presented in the appendix.Assumption A6. 4 = V)

Planned consumption growth along the deterministic paths is therefore known and we

denote it by d. More precisely, we have d = OaCtat + Vct _ Ot.

In this section we will prove the following theorem:

Theorem 1. Under assumptions Al-A6 and an additional completeness condition on a

risk-adjusted distribution of the state variables, u, p and the belief system

{A,

A} are identified.To guide the reader, here is an outline of the procedure:

First, under assumption A2 and using the consumption response to transitory shocks, we will show that the effective discount factor p - rt +

A,

as well as an auxiliary function ft, such that u = 1 + roft - where ro is an unknown constant - are identified (Proposition 1 and 2)Second, we will show that the Euler equation can be expressed in terms of f, p - rt

+

A and

beliefs. Proposition 3 shows that we have moments to characterize beliefs that depend only on 22

known quantities. Those moments relate the behavior of savings at different levels of assets to the beliefs of the agent.

Third, Corollary 2 provides a completeness condition under which the moments derived in Proposition 3 are sufficient to fully identify beliefs. As a consequence, the discount factor and the constant Ko are known and preferences are identified as well.

1.3.1

Identification of preferences

The set of moments identifying preferences is given by the reaction of consumption and consumption growth to transitory shocks. They take the following form:

-

/C

(1.3.1)where c, Cd,

A

and p are evaluated at an arbitrary {a, 6, P}. From this expression, the curvatureof marginal utility and the effective discount rate are given by the coefficients of the regression of 66 d on 6 conditional on {c, P}. To give more economic content to this identifying set of

Occ C

moments,we provide some informal heuristics based on the evolution of consumption along deterministic paths of the perceived income process. The formal proofs are in the appendix.

Identification of the utility function

In a riskless environment, when the discount rate is known, observing how agents smooth their

consumption flow enables us to completely recover the utility function. Indeed, suppose that we observe a consumption path {ct}t;>o and the corresponding consumption growth {t'}t;o

-the variations in consumption could be due to a time varying interest rate, for example. The standard Euler equation is then:

U'(Ct) = eft T(p-rs)dsu'(cT)

<-> (p - rt) U'(Ct) = (Ct)d

The equation directly gives us the intertemporal elasticity of substitution: EIS(ct) =

(p - rt)- Ct. Since marginal utility can be arbitrarily normalized at some consumption level

co, utility is then known in the space spanned by {ct}t>O.23

This strategy cannot directly be used in a stochastic environment because of the risk of income loss. Consumption growth incorporates a precautionary motive and is no longer directly related to the intertemporal elasticity of substitution. More precisely, dropping the dependence on c for simplicity and integrating 1.5.9 between t and t + At for an unconstrained agent,24 we have the usual Euler equation:

U'(Ct) =

~(e-fi+AtA

(p-rt)dt u I(ct+AtA-r)I

at, )Here T is the hitting time associated with the borrowing constraint. Informally, taking the time interval At small enough that the agent does not hit the borrowing constraint between t and t + At25 and small enough that the probability of multiple shocks arriving is negligible (that is, taking At

<

At), we can rewrite the equation as:2623

1f utility is analytic it is then known everywhere. 24

See Farhi, Olivi, and Werning (2018) for a justification. 2 5

as at is continuous such a At always exists.

26The probability that no shock arises in the time interval is given by e , the probability of a jump can then

be taken as 1 - e-At since the chance of multiple jumps is negligible. As 1 - e-At is small, the variation of

marginal utility, no shock

+ e--(p-rt)At e- At)

i

(U'(ct,)I

at, t marginal utility, after shockThe first line is similar to the riskless case, it determines intertemporal smoothing along the deterministic path, but in this case savings also compensate for the potential utility loss given

by the second line. The term t (U'(ct+)

I

at, t is problematic because it depends on the beliefs of the agent, which are unknown. Ideally, we would have a degree of variation that affects intertemporal smoothing without changing the precautionary motive. We could then infer utility in a manner similar to the deterministic case. Under assumption A3, the transitory component precisely allows us to isolate the intertemporal substitution motive. Indeed,A

does not depend on c and we have:(U'(ct,) I at, t) =

Z'(c(at,

j) I at, t, ct)= U'(c(at, d)) I at, t' )

= '(c(at, t,)) I at, tp, E/

We can then consider two identical agents who receive at time t purely transitory shocks ci and E2. The intertemporal motive imposes that both agents choose consumption and consumption growth so that average marginal utility grows at rate p - rt, taking into account