HAL Id: hal-01937039

https://hal.archives-ouvertes.fr/hal-01937039

Submitted on 27 Nov 2018HAL is a multi-disciplinary open access archive for the deposit and dissemination of sci-entific research documents, whether they are pub-lished or not. The documents may come from teaching and research institutions in France or abroad, or from public or private research centers.

L’archive ouverte pluridisciplinaire HAL, est destinée au dépôt et à la diffusion de documents scientifiques de niveau recherche, publiés ou non, émanant des établissements d’enseignement et de recherche français ou étrangers, des laboratoires publics ou privés.

Dynamic relationships between world prices of cakes,

corn-gluten-feed and cassava

Yves Dronne, Christophe Tavéra

To cite this version:

Yves Dronne, Christophe Tavéra. Dynamic relationships between world prices of cakes, corn-gluten-feed and cassava. [Research Report] INRA Station d’Economie et Sociologie rurales. 1988, 27 p. �hal-01937039�

1.N.R.A. · RENNES 8DEC

1988

CTYD8806 ÉCONOMIE RURALE

~Al~/1-l!S~-e

DYNAMIC RELATIONSHIPS BETWEEN WORLD PRICES OF CAKES, CORN-GLUTEN-FEED AND CASSAVA

Y. DRONNE

C. TAVERA

Institut National de la Recherche Agronomique

Station d'Economie et de Sociologie Rurales de Rennes

Novernber 1988

1

DOCUMENTATION ÉCONOMIE'RURALE RENNES

f

I . INTRODUCTION

Soybean - which dominated the world oilseed-protein market for

a long time - is still playing a special role in the somewhat

conflictual EC-US trade relationships since the end of world war II.

After ratification of the Dillon Round agreement in 1962, the

EC elaborated an oilseed-protein market organisation which

simultaneously allows free imports for oilseeds and oilmeals and

maintains support to rapeseed and sunflowerseed domestic producers

through the fixation of annual objective and intervention prices.

Those prices being most of the time higher than corresponding

world prices, crushing subsisdies equal to the gap between

domestic and Rotterdam border prices were distributed by FEOGA and permitted the preference for Community products. At the beginning of the 1970's there was a change in the world market structure due to the expansion of soybean seeds produced by Brazil and Argentin. At the opposite of US and international crushing firms which had

chosen to directly export seeds to West Europe where they were

crushed into oil and cakes in order to avoid stocks then costly

export programs (as with PL 480 for instance) Brasilian firms

decided to crush themselves and to experts soybeanseed cakes and oil to various world markets and mainly to EC markets.

The competitiveness of Brasilian and Argentin firm on those markets directly led to lower US cake experts and to a reduction in crushing margins of EC firrns. As a result those firms reduced their new investment and tried to partly diversify their activity between soybeanseed crushing on one side and sunflowerseed and

rapeseed crushing on the other side.

world scene there was also an increase in EC domestic production for rapeseeds and soybeanseeds in the late 1970 's due to the stimulating EC oilseeds support system. Technical improvements on oilseeds production and efforts made by the Community in order to stabilize the domestic cereal production made the EEC oilseeds market regime even more encouraging for EC oilseeds producers.

As a result the EC oilseeds protein sector became in the early 80' s a very important sector which plays a crucial role on the world market. While the Communi ty is today the first oilseeds, cakes and oil world importer and one of the first three greatest world crushers, i t is also one of the most important rapeseed and sunflowerseed world producer and one of the biggest exporter for soybeanseed and rapeseed oil.

During the past years the United States often criticized the EC oilseeds market regime and more or less successfully fighted against some of the adjustements of the EC support system. The most important dispute appeared in December 1987 with the complaint made in GATT against EC by the American Soybean Association (ASA} which accused the Community to deliberatly restrict the import and the utilization of US soybeanseeds and soybean cakes. According to the ASA, those behaviors are in contravention with the Dillon Round Agreements and the EC oilseeds support policy has to be removed. The Communi ty for i ts part claimed the reduction in US experts was mainly due to the competi tion of the South-American producers in the soybean cake sector, to the increase in other cakes irnported from third world countries (coprah from he Philippines and Indonesia, sunflower and flax frorn Argentin, rapeseed from China and India, palm from Malaya} and to the stagnation of the EC soybeanseed chrushing acti vi ty due to restricted crushing rnargins. The Communi ty also claims that EC still remains one of the world greatest imp0rters for oilseeds products and that the rapid expansion of rapeseed and sunflowerseed domestic production is now fully controlled via the

Maximal Guaranteed Quantities mechanism since crushing subsidies only permitted to assure the preference for EC domestic products. Those politics only had a minor impact on domestic markets and had no effect at all on world markets due to the quasi nul l i ty of export restitutions.

As can be seen the two positions are clearly conflictual. According to the US, the EC policy greatly restrained quantities of soybean products imported from US since about 20 years and especially since 1980.

At the opposite, for the EC, the Community oilseeds system was quasi neutral since the quantities of cakes demanded by EC increased faster than the EC domestic oilseed production during the last seven years. A related issue is that the EC domestic prices for the various oilseed products quickly reflect the corresponding world market situation.

The aim of this study is to shed more light on this controversy by focusing on causali ty relationships between the prices of the major animal feed ingredients on the Rotterdam market. Causality will be both analysed in a limited information bivariate framework and in a full information multivariate framework according to the lines proposed by Caines-Keng and Sethi

(1981). Both bivariate and multivariate causality results will be

related but preference will be given in the comment to causal relationships obtained within the multivariate framework.

The remainder of the paper is organized as follows the The theorical general background is presented in Section 2.

background and the empirical methodology are

presented in Section 3 and section 4.Section 5 evaluates our empirical results while Section 6 concluding comments.

respectively reports and offers some

II.

BACKGROUNDFigure 1 présents the EC animal feed sector demand for cakes,

gluten feed and Cassava for year 1987.

Figure 1. 1987.

Structure of EC cake consumption (EC-12 for year

all quantities are expressed in MMT).

Net Coke Imports

Soybeon 8.07

Sunf'lower 0 . 9

Rope 0. 4

Other 6. 23

Imported gluten f'eed EC

Cokes produced with

imported seeds Soybeon Sunf'lower Rape Other 10. 0 0. 1 o. 1 0. 7 3 4 . 8 - - - ) A ni mol Feed

1

Imported Cossovo1

~ 6.741

Cokes produced with

EC domestic seeds Soybeon Sunflower Rope Ot her 1 . 1 1.7 2.6 o. 2

---Whereas some srnall quanti ties of soybean cakes are directly bought by cattle breeders, the animal feed ingredients retained for this study are essentially bought on the Rotterdam market by the EC compound feed sector. They al together account for nearly

44. 8 % of totally produced compound feed while cereals account for

32. 8 % of this production. The industries of the animal feed

sector use linear programming models in order to determine how much of the various feed ingredients they need for producing every

kind of ration. These models take into account nutritional

contents of

ingredient.

every ingredient, and market prices for each

Ration formulae are more and more quickly adapted to price variations, at least several times a month.

While cereal prices vary a lot across the various EC countries due to local market situations and MCAs, import prices for cakes and cereal substitute products are rather similar within every EC country. Rotterdam is the most important EC importing zone for

major feed ingredients soybean meals, cassava, gluten feed or

other meals such as coprah, palm. It is located very close to the main EC industries which crush both imported soybean seeds and domesticaly produced seeds such as rape seeds and sunflower seeds.

Due to such a situation, Rotterdam (CAF or Fob ex Mill) prices (or sometimes Hamburg prices) are used as referring prices for all EC transactions even when exchanged quantities do not physically transit by Rotterdam.

Prices for these products on every EC market can thus be

correctly calculated from corresponding Rotterdam prices and

transportation costs. As can be seen on Figure 1 the EC compound

feed sector is directly related to four other sectors :

- cakes importers (essentially ~oybean cake importers) at first.

Apart from the cereal sector, this constitutes the most important sector with an amount of cake imports close to 15 million tonnes which mainly corne from Brazil.

the EC crushing

million tonnes) and

sector which only uses especially US soybean

imported seeds is

seeds ( 11

sector.

- Gluten feed and Cassava importers constitute the third sector.

Imports for these products are close to 11. 5 million tonnes and are respectively provided by US for Gluten feed and Thailand for Cassava.

- The last sector is the EC crushing industry which uses seeds

produced within EC. This is the only sector concerned with the EC

oilseeds policy. It thus receives a crushing subsisdy,

representing the difference between the world price and the EEC target price for oilseeds. Al thougth the amount of EC domestic seeds crushed (5.6 million tonnes) by this sector is much smaller than the amount of imported seeds crushed by the first described sector, this fourth sector plays a dominant role on the markets for sunflower and rape cakes.

II.

THEORETICAL BACKGROUNDIn this section price relationships among the various animal feed ingredients are derived from the production program of the EC crushing industry.

Let us assume that the EC crushing sector has a short run cost

minimization behavior i t minimizes the variable cost of

producing the vector of outputs Qc condi tional on the vector of

quasi-fixed inputs Z and given prices p for variable inputs X.

X

Then, there exists a restricted cost function, dual to the

underlying transformation function

RC = min X [p'. X X F ( Qc, X, Z)

=

0 ] ( 1) ( 1 ' )Assuming RC statisfies the usual regularity conditions (1) the Shepard' s lemma can be used in order to deri ve the condi tional demand function for a variable input :

D = âRC(.)/âp

=

D (p ; 0X , X- X, X

1 1 1

(2)

for i

=

CGF, soybean meal, rape meal and sunflower meal and fore

= (Qc, z)(1) RC is non-decreasing in variable input prices, non-decreasing

in output, non-increasing in quasi-fixed factors, positively

linear homogeneous, concave, continous· in variable input prices

It may be assumed, at least as a first approximation that feed

ingredients quantities supplied on the Rotterdam market are

function of their own price in the short run according to :

s

x. =s

x.l. l.

( p ) x.

l.

(3) for every product i

By assuming that these markets are in equilibrium we thus have

e

(4) for every iSince 0 is assumed fixed, linearization of this market clearing

condition around the approximation point gives

dp x. l. = I a . . . dp . •..t· l.J XJ Jr l. with a .. l. J D

= (

E • • l. Js

D . )/[(p ./p .)(c .. Xl. XJ Xl. l.l.s

Xl..

(5) for every i D - C •• l. l. • D . ) Xl.J

D Swhere c . . , c . . are respectively the demand and supply

elastici-l.J l.J

ties for product i with respect to the price for product j.

Equation (5) may be rewritten in term of price growth rates

dp ./p .) as Xl. Xl. P xi = jI f i /3 ij · p xj wi th /3 • • l. J D S = [(c . . . D . )/(E .. l.J Xl. l.l.

s

Xl..

(5') for every i D - C • • l. l. • D Xl. . ) ] . (p . = Xl.If we further assume every product is close

that the own price supply elasticity for to zero in the short run (l ~.= 0),

11

coefficients of equation (5) and (5') reduce to

D D D D

a . . = [-(p . l . . )(p .. l . . )] and /3 .• = [-(l . . /l . . ) ] . Both may be

1J X1 1J XJ 11 1J 1J 11

positive or negative according to wether products are substitutes

D D

(l . . < 0) or complements (l . .

>

0).1J 1J

In this respect, if we assume that Rotterdam prices for feed ingredients are primary influenced by variations in quanti ties demanded by the compound feed sector in the short-run, i t is possible to clarify substitut ion - complementari ty relationships among these products by estimating a reduced form system such as

(5) or (5') . This is precisely the case with VAR models.

In this paper, we choose to estimate such a system with a VAR methodology. This amounts to assume that relationships such as (5) are not instantaneously fully realized and that i t takes time for a variation in the price of product i to be transmitted to price of product j . This leads to a dynamic reformulation of equations

(5) in the following form

dp . = I a .. (L) dp . + ut X1 ji i 1J XJ for every i where a . . 1J ( L) autoregressive are lag coefficients polynomials. of a VAR However are not since the directly interpretable, substitution-complementarity relationships will be analysed on the basis of the dynamic multipliers derived from the VAR rnodel.

III.

EMPIRICAL METHODOLOGY AND DATADuring the last years, lots of agricultural specific problems {lead-lag relationships between wholesale and retail prices of agricultural products ; dynamic relationships between the price of a given commodity on different markets, etc) have been treated by using bivariate causality analysis. However the main inconvenient wi th such a method is tha t causali ty is only examined wi thin a restricted information space. Most of the time, considering a bigger information set reveals a different causal ordering than the one obtained with a bivariate procedure (1).

Generally multivariate causality analysis are made by using a VAR model which includes the overall set of available time series :

(1)

where zt is am components stationary stochastic process, Ut is a m components inovation process and D(L) is matrix, the elements of which are p order lag polynomials.

The results of F tests for the null hypothesis that coefficients on lags associated with particular variables are zero in each of the autoregressive equation together with the decomposition of the r - periodes-ahead forecast errer variance of the model furnish a natural measure of the degree of endogeneity-exogeneity of each variable.

If litterature suggests several technics in order to determine

the autoregressive order of the VAR, their application is

restricted to the cases where every variable enters the model with the same lag order. However, this restriction can not only reduce the efficacity of the autoregressive order determination procedure

but i t can also lead to a biased value of the estimated

autoregressive order (Akaike 1970). Further more, another point is that when every variable is allowed to influence other variables

with the same delay - and this is the case with traditional VAR

models - the number of parameters quickly exhaus ts degrees of

freedom.

The Caines-Keng and Sethi modelling methodology allows to identify the coefficients of the D(L) matrix without imposing the equali ty of lags on each variable and wi thout appealing to a priori economic knowledge : all the information used in this model building method is derived from the data at hand.

This methodology is a sequential procedure based on Granger's

concept of causali ty and Akaike 's final prediction error

criterion. It leads to a reduction in the number of parameters to be estimated by allowing each variable both to enter the model with a specific autoregressive order and to be explained by a sub-space of the whole set of available variables.

The Caines-Keng and Sethi procedure involves five steps

(1) For each pair of stationary processes(X,Y) we first construct an optimal bivariate autoregressive model on the basis of the Akaike's FPE criterion.

(2) From such bivariate models, we then determine for each process X a set of n causal - in the Granger sense - variables (y1, . . . ;yn) . The FPE obtained for each causal variable yi in previously

estimated bivariate models (X,Yi) i = 1 n are now used to rank these causal variables (with respect to X) in the order of increasing FPE.

( 3) For each caused process X, the optimal uni varia te autoregressive model is first constructed using FPE criterion. The X' s multiple causal variables are then included one at a tirne according to their causal ranks (détermined in the previous step). At each step, FPE cri terium is used to de termine the optimal orders of the model.This third step leads to the optimal ordered univariate multivariable autoregressive model of X against its causal variables.

(4) All the optimal univariate autoregressives model are now estimated as a system with the FIML method.

(5) Severa! diagnostic checks are finally performed treating the tentatively identified system as the maintained hypothesis.

The final model is then used to de termine the endogenei ty, exogeneity or independance relations between the variables and to calculate the dynamic multipliers coresponding to each causal relationship.

When causality links are not rejected by the data, calculation of associated dynamic multipliers is a mean to quantify such relationships among time series and to better investigate the dynamic proporties of the model.

Dynamic multipliers summarize in q simple way the overall set of interactions that may exist among the endogeneous (caused)

variable X and the exogenous (causal) variable Yi. However, since in this analysis all predetermined variables are lagged endogenous variables dynamic multipliers are calculated assuming a one time stochastic shock occurs through the error term. They are thus

calculated from the vectorial moving average form of the VAR

-1

zt

=n

(L).ut

(2)In this paper, only "long-run" (which might better be called

"total") multipliers will be presented. They provide a rneasure of

the total impact on the expected variable X ·of a change in

variable Yi when a new equilibriurn is reached. More precisely if

IM(rn). x,y1 is the impact multiplier which shows the impact of a .

one-time change in variable Y1in tirne ton the expected change in

variable X in tirne (t+rn)

ô E [ à X ( t +m) ) IM(rn)i=

x,y ( 3)

then the corresponding long-run multiplier LMxyi represents the

total variation in the expected value of X as rn approaches

infinity: LM i= lirn xy rn~ 00 = I h=l ôE [8X ( t+rn)) IM(h)i x,y 00 = ~ h=l ôE [8X ( t+h))

In an atternpt to measure the speed of adjustement of variable

periods (weeks) i t takes for the sum of impact mul tipliers to stabilize within 5 percent of the long-run multiplier (1).

Data used in this study are weekly Rotterdam (CIF) prices for

soybean meal (44 % protein), cassava) corn-gluten feed and

Argentin sunflower cake (37-38 % protein) . Concerning rape meal we

use the FOB ex Mill Hamburg price. All prices are cash and $US per MT. Data are weekly and for january, 1, 1981 to july, 16, 1987. A first order differenciation of the data was necessary in order to remove any linear time trends and to achieve stationarity.

(1) This measure of the speed of adjustment is also used by Grant and al (1983) and Boyd and Brorsen (1986). It may reflect the degree of ineeficiency of the considered markets in terms of the

time i t takes for information to pass from one market to the

other. It also provides an indication on the more or less

proximity between markets due to distance between markets or

IV. EMPIRICAL RESULTS

In this paper we present causality results obtained with both

the traditional bivariate approach and the Caines-Keng-Sethi

procedure. However only resul ts obtained wi th this last rnethod will be cornrnented due to their capacity to ernbody the whole set of available information.

A detailed presentation of causality results is given in Annex. Table Al reports statistics derived frorn bivariate analysis while results of the Caines-Keng-Sethi procedure are presented in table A2.

Causal links obtained with bivariate analysis reveal a quasi

general interaction of price series. However lots of these

relationships disappear with the Caines-Keng and Sethi procedure

which leads to the following causal structure (at the 5 %

confidence level).

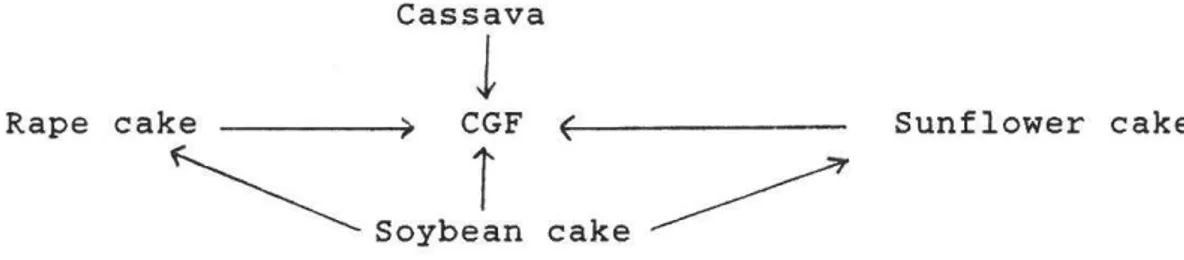

Figure 2. causal relationships between the prices of animal feed ingredients.

Cassava

J

Rape c a k e - - - , CGF

f - - - -

Sunflower cake~

SoybL

cake~

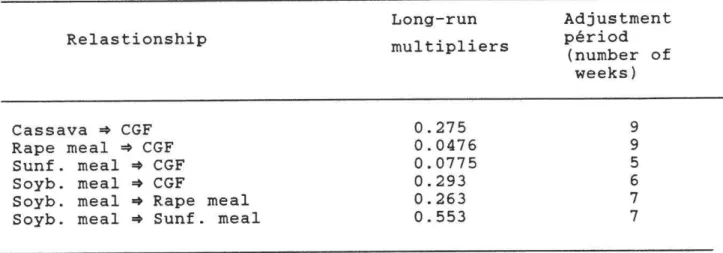

The long-run rnultipliers and the speeds of adjustrnent attached to this figure are reported in table 1.

Table 1. Long-run multipliers and adjustment périods between the prices for animal feed ingredients

Relastionship

Cassava.,. CGF Rape meal.,. CGF Sunf. meal.,. CGF Soyb. meal => CGF

Soyb. meal ~ Rape meal Soyb. meal.,. Sunf. meal

Long-run multipliers 0.275 0.0476 0.0775 0.293 0.263 0.553 Adjustment périod (number of weeks) 9 9 5 6 7 7

It clearly appears on figure 2 that the prices for cassava and for soybean meal are exogenous while the price for CGF is led by all other prices.

More precisely, figure 2 reveals a three level market

structure. Within each of the extreme levels are respectively

found cassa va which is a purely energetic product wi th a quasi zero percent protein content then soybean meal which is the most

protein rich product (nearly 44 %) used in animal feed.

The three products figuring at the intermediate floor are feed ingredients characterized by a medium protein content: 23-24

% for CGF, 34 % por rape meal and 37-38 % for sunflower meal.

According to their net energetic contribution to pork and ruminant feed, Cassava and soybean meal are rather energy rich products. They are at least richer than rape and sunflower meals which contain a high degree of cellulose.

ruminant feed - is lower than energetic contents of barley or

wheat by respectively 3 and 11 %. Due to its energetic protein

composition CGF is a dual purpose ingredient in animal feed.

The causal structure presented on figure 2 is fully compatible

with an examination of the nutritional compositions of each

product. The import price for soybean cake directly causes - with

relatively high associated multipliers - the price for CGF and for

other cakes. Concerning this point, we must note that we do not

obtain the same results as Boyd and Brorsen who found an

instantaneous feeback relationship between the Rotterdam price for Soybean meal and CGF wi th an associated correlation coefficient

close to O. 45 which indicates that these two products behave as

substitutes. Althougth we reach the same conclusion concerning substituability-since we estimated a positive multiplier - we also obtain (with both methods) a significant one way causality running from Soybean meal to CGF and a multiplier near 0.3 (the bivariate approach leads to a multiplier of O. 39 which is cl oser to the correlation coefficient of Boyd and Brorsen).

Figure 2 clearly shows that the market for soybean meal

behaves as a leader market among the markets for protein rich products. Especially, causal relationships running from soybean

cake prices to prices for rape cake and sunflower cake are

feedback free. This seems to be fully consistent wi th the EC argument that the EC curshing subsidies have no effect at all on

the import price for soybean cakes cursher subsides are

calculated in such a way that the decrease in soybean cake import prices cannot be explained by a delibarate eut in prices set by EC crushers. Prices for EC domestic cakes thus only passively follow world prices for soybean cakes.

Another point highlighted by figure 2 is that whereas

gluten feed, rape meals and sunflower meals are rather similar products according to their protein content and the sectors where

they are used, there is no causal relationship running from gluten feed prices to the prices for rape meals and sunflower meals. Such one way causal links might reveal some degree of preference for

Communautary-commodi ties. A reduction in the price for CGF then

leads to an increase in the demand for this product without ultimately reducing the prices for the two other cakes. This may be due to the fact that rape cake and sunflower cake remain highly

competitive.

Interpreting long-run multipliers is a more difficult task. If the various cakes were used in animal feed solely on the basis of

their specific protein content, an increase in the price for

soybean meal (which has a protein content of 44 %) should lead to a

1/0.44

=

2.27 $ increase in the price of protein. As a result theoppotunity cost of rape meal, sunflower meal and CGF would

rnecanically increase by respectively 0.77 $ (2.27 x 0.34), 0.86 $

(2.27 x 0.38) and 0.54 $ (2.27 x 0.24).

The estirnated long-run mul tipliers are all lower than these values. This seems to confirrn the idea that due to the fact that the ratio of the price of energy to the price of protein is

higher within EC than on the world markets, energy plays an

important part in the deterrnination of the prices of the various animal feed ingredients. The price of soybean meal itself is deterrnined partly by its energy content and partly by its protein

content. As a consequence, by modifiying the marginal value of

protein and energy, an increase in the price for soybean rneal has a net impact on each product which is function of both its energy and protein content. This may be an explanation for both the somewhat low values of our rnultipliers and for the fact that CGF appears more influenced by soybean meal than by rape meal since whereas CGF contents less protein than rape i t ' s energy content is higher than for rape.

Supply effects may partly also be responsible for the low values of the calculated multipliers compared to protein contents of the concerned meals. An analysis of price movements based on the protein contents of feed ingredients amounts to assume that

supply for these products is constant. In this case, price

movements are thus only impulsed by demand variations. However it

is fully conceivable that our long-run mul tipliers incorpora te both demand and supply effects. As can be seen with formula (5) a

(5'), assuming positively sloped supply curves (c~. > 0) instead

l. l.

of constant supply (c~ .= 0) clearly reduces the sizes of the aij

l. l.

or /3ij coefficients. Values of long-run mul tipliers may thus be

determined by both the compound feed sector demand and the

producer supply for feed ingredients.

The one way causal link running from the import price for cassava to the import price for CGF may be surprising at first sight since the first of these products is used for porks while the second one is used for cattle feed. However these two products

are quasi essentially energetic products. Their prices are thus

strongly related to the marginal cost of energy which is in EC greatly determined by the price for cereal.

The multipliers attached to the relationships cassava-CGF and

soybean meal - CGF are both positive and nearly of the same

magnitude. This seems to confirm the fact that CGF plays a double game within animal feed. It is both a substitute for soybean meal and a substitute for energetic products.

As a results both the European view, according to which CGF is a CSP (cereal substitute product), and the US thesis which holds that CGF is a protein rich product and a substitute for EC soybean meal, appear as only partial views. Reality seems to lie between these two polar views.

the price of cereals. This is a serious limit to our study since cereals amount to nearly 30 % of the typical animal feed ration.

As was seen above, the price for energy and protein constitute

the two main transmission mechanism among the prices of animal feed ingredients. However cereal price plays a central role in the determination of the marginal value for energy. It may thus be the case that the relationships we find between cassava and gluteen feed is only artificial and is due to the absence of cereal price in our model. Taking into account such a price would then probably wipe off the cassava-gluten feed relationship and replace i t by relationships running from cereal prices to the prices for cassava

and gluten feed. In this case, multipliers derived frorn such

relationships should be relatively high due to the high energy content of these three products.

Since i t seems convenient to assume that world prices for

these products are not only determined via their energy protein content but also by monetary factors, we have to note that several causality tests between the prices for these product and the $/Ecu exchange rate were also performed.

The expected relationship running from the Ecu value of the$ to the price for soybean meal was always rejected by the data. The only causal link obtained lies from the $/Ecu exchange rate to the price for CGF with an estimated multiplier close to 0.08 and a

nine weeks adjustment period. This resul t is not surprising at

all. CGF is essentially produced by US and 95 % of this production

is imported by EC. As a result every variation in the EC dernand

for US soybean meal induced by a modification of the $/Ecu

exchange rate must have a non negligible effect on the Rotterdam price for CGF (According to our results a decrease in the value of $ by 1 Ecu seems to lead to an increase in the Rotterdam price for CGF by 0.081 Ecus) .This result confirms previous results from Boyd

and Brorsen that the Rotterdam price for gluten feed causes the Chicago price for this product and that price for gluten feed is

thus discovered on the demand side of the gluten feed world market(l)

IV. CONCLUDING REMARKS

The dynamic relationships we found between the Rotterdam price of oilcakes, CGF and Cassava shed some light on the co-behavior of

these products and of the corresponding market. If we admit that

short-run price variations for those products are mainly due to

shifts in the EC crushing industry demand, then calculated lon-run

multipliers highlight the substitution complementarity

relationships between the retained products wi thin animal feed. These results provide a complementary approach to the analysis of nutritional compositions. Whereas nutritional compositions keep on playing an essentiel part in the associations of the various animal feed ingredients, the fact that within EC the price of energy has a greater influence on the cost of feed rations than the price of protein together with the wide range of substitutes

commodi ties available to feed compounders make i t difficul t to

have a precise idea of the degree of degrees of

substitutuability-complementarity between the various "feed

ingredients".

Substitution relationships we obtained between the various cakes are all consistent wi th what might suggest an analysis of nutritional compositions. Concerning CGF, i t was found that this product plays a double game within the compound feed process. It is both a substitute for soybean meal due t o i t s protein content and a substitute for cassava due t o i t s energy content.

As a result, even if we believe in the US view which claims

that CGF is mainly a high protein feed substi tute and that CGF

irnports do not displace EC grain nor contribute to EC grain

surpluses, our result seem to show that CGF also behaves as an energy substitute. This conclusion is fully consistent with the EC point of view which contents thats CGF is essentially a CSP.

An interesting future research on this subject could include a

reexamination of causali ty relationships with a wider data set

including the EC domestinc prices for the main cereal

products.

During the last fifteen years, the rise in EC imports for

cassava, CGF and soybean meal together with the simultaneous

growth in domestic cereal production exacerbated the internal CAP

contradictions and the need for a "more balanced protective

structure" (1). Variations in Rotterdam prices for the main

imported {or exported) commodities are influenced by forces coming

from both EC and world markets. An analysis of dynamic

relationships between these prices is thus a good way to better understand market interactions and to appreciate the opportunity of a given Commission's proposal.

ANNEX DETAILED PRESENTATION OF CAUSALITY RESULTS.

Table Al. causali ty period obtained wi th feed ingredients

resul ts , long-run mul tipliers and adjustment bivariate analysis of the prices of animal

modèl

Akoi k e ' s Null hypot.he- Long-run Adjust.ment.

<X, y ) optimal FPE ( y) si s : X no t. mult.ipliers Period

X coused by y LM log XY col culot.ed F' ( 1 ) st.ot.i st. i c ( 2) ( 3 ) ( 4 ) <Cos. Soyb.) ( 1 • 1 ) 23,124 0,983 X X <Cos. R ope) ( 1 , 1 ) 23,004 2 , 608 X X <Cos. CGF) ( 1 , 17) 21, 224 3 , 649 • - 0 , 0 04• 8 <Cos. Sunf.) ( 1 , 3) 22, 194 6 , 766• 0 , 126• 2 <Soyb. R ope) ( 6 , 10) 32,003 2, 249 • • 0 , 047• • 17 <Soyb. Coss. ) < 6, 6 ) 31, 89 1 2 , 61 2 • • - 0, 0 6 9 • • 13 (Soy b. CGF) ( 6' 1 ) 32, 409 1, 120 X X <Soyb. Su nf. ) ( 6, 1 ) 32,169 3 , 36 4• • · 0, 178• • · 6 <Rope. Soy b. ) ( 1 , 1 ) 93, 164 11,6 10• 0 , 286 6 (Rope. Coss) ( 1 , 2) 93,694 2, 0 34 X X <Rope. CGF) < 1 ' 1 ) 96,271 1, 811 X X (Rope. Sun f) ( 1 , 1 ) 94, 611 6 , 9 68• 0 , 30 2• 3 < CGF. Soy b. ) ( 4 , 4 ) 101, 63 6,034• o, 398• 8 < CGF. Coss) < 4 , 7 ) 88, 322 10 , 390• 0 , 466• 9 < CG F. R ope) ( 4 , 3) 103 , 78 3 , 9 36• 0 , 126• 6 < CGF. Sun f) ( 4 , 2) 101,62 8, 2 3 • 0, 326 • 6 <Sunf. Soy b) < 1 , 4 ) 20 , 189 6 , 643 • 0 , 627 • 6 <Sunf. Rope) < 1 , 1 ) 21, 6 16 0 , 794 X X <Sunf. CG F') ( 1 , 6 ) 21, 404 2,042• • - 0 , 00 2• • 6 <Sunf. Coss) < 1 , 2) 21, 4 30 1, 973 X X

Cas price of Cassava, Soyb price of soybean meal Rape

price of rape meal CGF price of corn gluten feed Sunf

price of Sunflower meal.

•

reject.ion of t. h e nu 1 1 hypot.hesis 0 t. t. h e 1 percent. signifi cont. level••

rej ect.ion of t. h e null hypot.hesi s at. t. h e 6 percent. significont. l evel•••reject.ion

( 1) FPR (Y)

X

of t. h e null hypot.hesi s Q t. t. h e 10 percent. significant. is the value of the FPE corresponding to the optimal lagon variable Y in the equation for variable X.

(2) This colum gives the calculated value of the Fisher statistic under the null hypothesys that the sum of coefficients of the lags of variables Y in the X equation is null.

( 3) LMXY is the long-run multiplier effect of variable Y on variable X. It is only presented when Y is found to cause X.

(4) Number of weeks needed for realization of 95 % of the adjustment of X to a shock on Y.

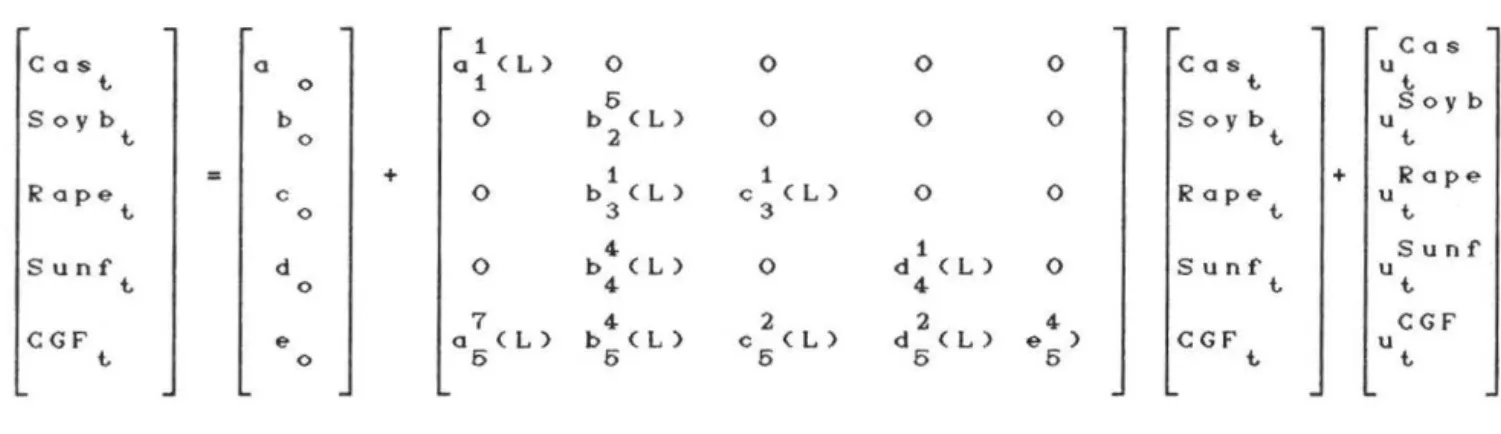

Table A2. Model finally retained for the prices of feed ingredients

at the end of the Caines - Keng and Sethi approach.

1 Cos Cos 0 Q <L> 0 0 0 0 Cos u t, 0 1 t, t, 6 Soyb Soyb b 0 b < L) 0 0 0 Soybt, u t, 0 2 t, + 1 1 + Rope Rope C 0 b < L > C < L) 0 0 Ropet, u t, 0 3 3 t, 4 1 Sunf S u nf d 0 b < L > 0 d < L ) 0 S unf u t, 0 4 4 t. t. 7 4 2 2 4 CGF CGF e 0 ( L) b < L) C < L ) d < L ) e ) CGF u t. 0 6 6 6 6 6 t, t, k

AKAIKE H. Annals of 163-180.

REFERENCES

(1970). "Autoregressive model the Insti tute of Statistical

fitting for control. Mathematics - 22 - p.

BOYD S.M. - B.W. BRORSEN (1986) . "Dynamic price relationships for US and EC corn gluten feed and related markets". European Review of Agricultural Economies - 13 - p. 199-215.

CAINES P.E. - CW. KENG - SP. SETHI (1981) "Causality Analysis and Multivariate Autoregressive Modeling with an Application to Supermarket Sales Analysis". Journal of Economie Dynarnics and Control - 3 - {August) p. 267- 98.

CCE (1988) La situation de l'agriculture dans la Communauté -Rapport annuel 1987.

CHOW, GREGORY C. (1975) Analysis and control of dynamic systems. New-York : Wiley.

GRANGER C.W.J. (1980) Viewpoint. Journal of 329-352.

"Testing for causali ty" A Economie Dynamics and contrôl

personal

2 p.

GRANT W.R. - A.W. NGERGE - B.W. BRORSEN - J.P. CHAVAS (1983) "Grain price interrelationships" Agricultural Economies research 35(1) p.1-9.

GUYOMARD H. the case of published in Sociology.

(1988). "Quasi-fixed factors and production theory : self-employed labor in French agriculture". To be

Irish Journal of Agricul tural Economies and Rural

ISTA (1988) 0 i l world Annual.

MAHE L.P. (1984). "A lower but more balanced protection for European Agriculture". European Review of Agricultural Economies. Vol 11 (2) - p. 2176234.

USDA (1988) World oilseeds situation and market highlights. Foreign Agricultural Service (different issues).