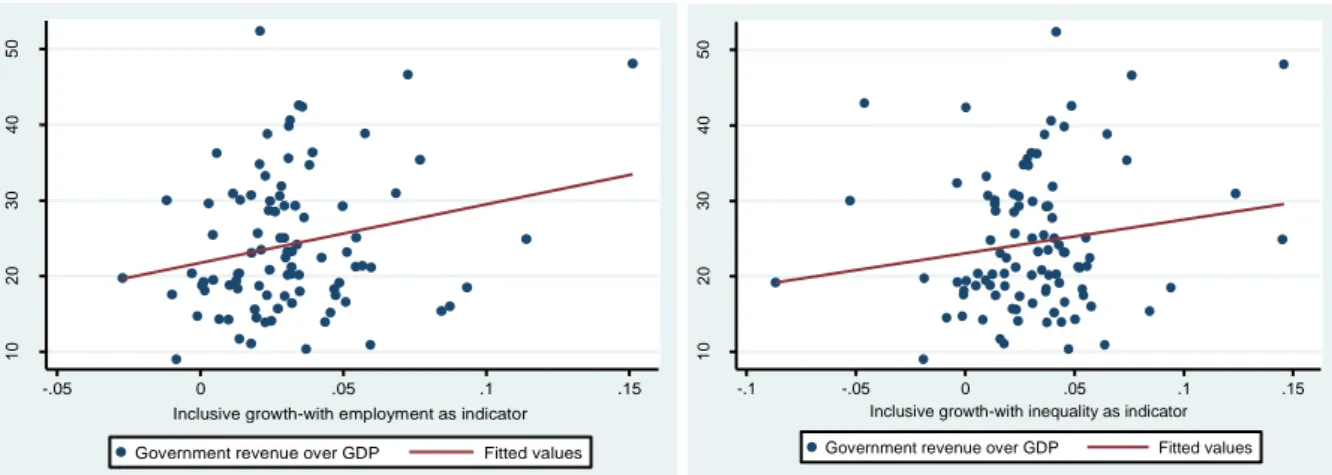

How Does Inclusive Growth Boost Tax Revenue Mobilization?

Texte intégral

Figure

Documents relatifs

One crucial aspect of our vote encryption verification constructions, and of electronic voting in general, is the proof that the vote encryption is well-formed, i.e. the proof that

The data allow us to evaluate individual relationships, the number of positive and negative ties individuals have, and the overall structure of the informal social network within

To avoid this loss, agents can jointly produce public goods when they attain the threshold level of cost of producing the public goods.. Specifically, public goods are provided if

Through a comparison of social welfare given the strategies chosen by local governments, the author shows that whatever the quality and cost of public goods, a local government

Erhard Friedberg and I came to the issue of the intervention of the State in higher education after a first comparative empirical study on two French and two German universities

This effect simultaneously (i) reinforces the positive effect of the insurance mechanism at the individual’s level as the probability to end up with the sucker’s payoff is

In order to disentangle the effect of the sucker’s payoff aversion from other factors on the level of contributions, we design a public good game where participants are

In treatment Assurance, subjects have the same payoff function as in Reference except that another payoff function (alternative payoff) substitutes to it if the