Digitized

by

the

Internet

Archive

in

2011

with

funding

from

Boston

Library

Consortium

Member

Libraries

DEWEY

\4f

1

Massachusetts

Institute

of

Technology

Department

of

Economics

Working Paper

Series

Comparative

Advantage and

the

Cross-Section

ot

Business

Cycles

Aart

Kraay,

The

World

Bank

Jaume

Ventura,

MIT

Working

Paper

98-09Revised

January

2001

Room

E52-251

50

Memorial

Drive

Cambridge,

MA

02142

This

paper can

be downloaded

withoutcharge from

the SocialScience Research Network Paper

Collection at http://papers.ssrn.com/paper.taf7abstract id-=1371

75

MASSACHUSETTSINSTITUTE

OFTECHNOLOGY

OCT

l 6 2001*\

Massachusetts

Institute

of

Technology

Department

of

Economics

Working

Paper

Series

Comparative

Advantage

and

the

Cross-Section

of

Business

Cycles

Aart

Kraay,

The

World

Bank

Jaume

Ventura,

MIT

Working

Paper

98-09Revised

January

2001

Room

E52-251

50

Memorial

Drive

Cambridge,

MA

02142

This

paper

can

be

downloaded

withoutcharge

from

the SocialScience

Research Network

Paper

Collection at http://papers.ssrn.com/paper.taf7abstract id-=1371

75

Comparative

Advantage

and

the

Cross-section

of

Business Cycles

Aart

Kraay

Jaume

Ventura

The

World

Bank

M.I.T.December 2000

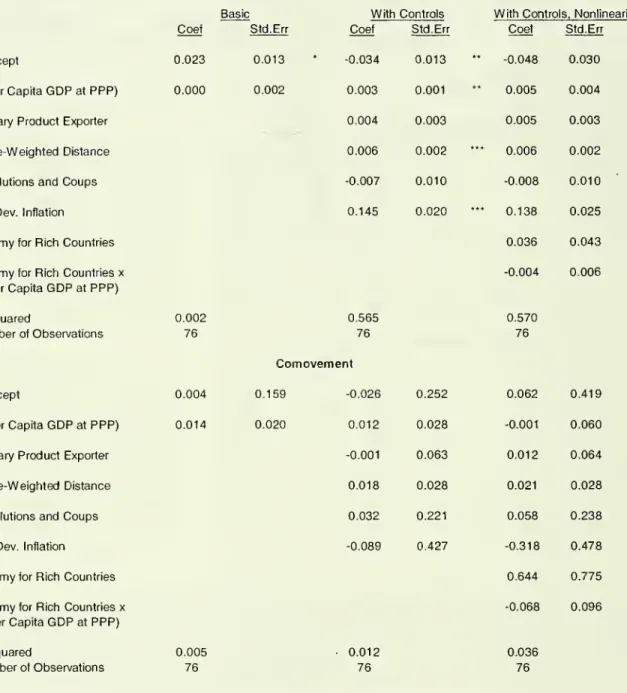

Abstract: Business cycles are both less volatile

and

more

synchronizedwith theworld cycle in rich countriesthan in poor ones.

We

developtwo alternativeexplanations

based on

the ideathat comparativeadvantage causes

rich countriesto specialize in industries thatuse

new

technologies operated by skilledworkers, while poorcountries specialize in industries thatuse

traditional technologiesoperated by unskilled workers. Sincenew

technologies are difficultto imitate, the industries of richcountries enjoy

more

marketpower

and

facemore

inelastic productdemands

than those of poorcountries. Since skilled workers are less likelyto exitemployment

as aresult of

changes

ineconomic

conditions, industries in rich countriesfacemore

inelastic labour suppliesthan thoseof poor countries.

We

show

that eitherasymmetry

in industry characteristicscan

generate cross-country differences inbusiness cyclesthat resemble those

we

observe inthe data.We

aregrateful toDaronAcemogluandFabrizio Perriforusefulcomments.Theviews expressed hereBusiness cyclesare notthe

same

in richand

poor countries.A

firstdifferenceis thatfluctuations in per capita

income

growth are smallerin rich countries than inpoorones, in the top panelof Figure 1,

we

plotthe standarddeviation of per capitaincome

growth against the level of (log) percapitaincome

for a largesample

ofcountries.

We

referto this relationship asthevolatility graphand

notethat it slopesdownwards.

A

second

difference isthat fluctuations in per capitaincome

growth aremore

synchronizedwith the world cycle in rich countries than in poor ones. Inthe bottom panel of Figure 1,we

plotthecorrelation of percapitaincome

growth rateswith world average percapita

income

growth, excluding thecountry in question,against the level of (log) percapita

income

forthesame

set ofcountries.We

refertothis relationship as the

comovement

graphand

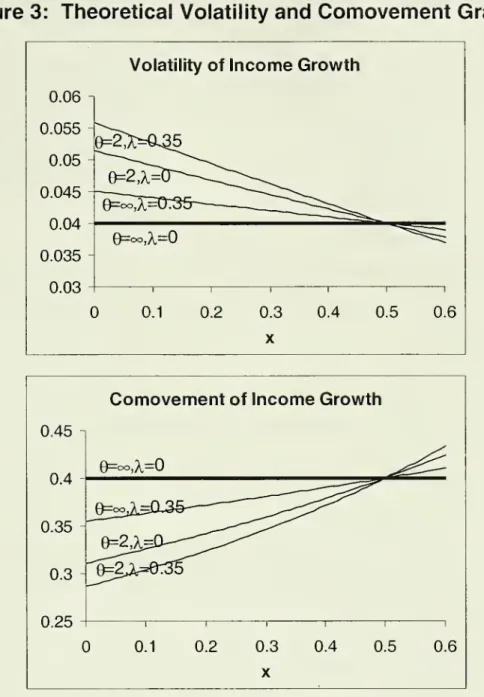

notethatit slopes upwards. Table 1,

which is self-explanatory,

shows

thatthese facts applywithin differentsub-samples

ofcountries

and

years.1Why

are businesscycles less volatileand

more

synchronized with theworld cycle in rich countriesthan in poorones?

Part oftheanswer must be

that poor countries exhibitmore

politicaland

policy instability, they are lessopen

ormore

distantfromthe geographicalcenter,and

they alsohave

a highershare oftheireconomy

devoted tothe production of agricultural productsand

theextraction of minerals. Table 1shows

that, ina statistical sense, thesefactors explain a substantial fraction of thevariation in thevolatility ofincome

growth, althoughtheydo

not explainmuch

ofthe variation in thecomovement

ofincome

growth.More

importantfor our purposes, the strong relationshipbetween income

and

the propertiesof business cycles reported in Table 1 is still present afterwe

controlfor these variables. In short, theremust be

otherfactors behind the strong patterns depicted in Figure 1beyond

differences in political instability,

remoteness

and

theimportance of natural resources.Withthe exceptionthatthecomovementgraphseemsto bedriven bydifferencesbetween rich and

poorcountriesandnot within eachgroup.AcemogluandZilibotti (1997)alsopresent thevolatilitygraph.

Theyprovideanexplanationforitbased ontheobservationthatrichcountrieshavemorediversified

In this paper,

we

develop two alternative but non-competing explanationsforwhy

businesscycles are less volatileand

more

synchronizedwith the world in richcountriesthan in poor ones. Both explanations rely

on

the idea that comparativeadvantage

causes

richcountries to specialize in industries that requirenew

technologies operated by skilledworkers, while poorcountries specialize in industries that requiretraditional technologies operated by unskilled workers. This pattern of specialization

opens up

the possibilitythat cross-country differences in businesscycles are the result of

asymmetries

between

these typesof industries. In particular,both ofthe explanations

advanced

here predict that industries thatuse

traditionaltechnologies operated by unskilled workers will

be

more

sensitive to country-specific shocks. Ceteris paribus, these industrieswill not onlybe

more

volatile but alsoless synchronizedwith the world cycle since the relative importanceof global shocks islower.

To

the extentthatthe business cyclesof countries reflectthose of theirindustries, differences in industrial structurecould potentially explain the patterns in

Figure 1

.

One

explanation ofwhy

industries reactdifferentlytoshocks

isbased on

the ideathatfirms usingnew

technologies facemore

inelastic productdemands

than those using traditional technologies.New

technologiesare difficultto imitate quicklyfortechnical reasons

and

alsobecause

of legal patents. This difficulty confersa costadvantage on

technological leaders that sheltersthem

from potential entrantsand

gives

them

monopoly power

inworld markets. Traditionaltechnologies are easiertoimitate

because

enough

timehas

passed

sincetheir adoptionand

alsobecause

patents

have

expired orhave

been

circumvented. This impliesthatincumbent

firms face tough competition from potential entrantsand

enjoy little orno

monopoly power

inworld markets.

The

price-elasticityof productdemand

affectshow

industries react to shocks.Consider, for instance, theeffects of country-specific

shocks

thatencourage

production in all industries. In industries that

use

new

technologies, firmshave

monopoly power and

face inelasticdemands

for their products.As

a result,competition from

abroad and

therefore face elasticdemands

for their products.As

aresult, fluctuations in supply

have

little orno

effecton

their pricesand

industryincome

is

more

volatile.To

the extentthat thisasymmetry

in thedegree

of product-marketcompetition is important,

incomes

of industries thatuse

new

technologies are likelytobe

lesssensitive to country-specificshocks

than those of industries thatusetraditional technologies.

Another explanation for

why

industries react differentlyto shocks isbased on

the idea that the supplyof unskilledworkers is

more

elastic than the supplyof skilledworkers.

A

firstreason for thisasymmetry

is that non-market activities are relativelymore

attractive tounskilled workerswhose

marketwage

is lowerthan thatof skilledones.

Changes

in labourdemand

might inducesome

unskilledworkersto enterorabandon

the labourforce, but are notlikelyto affect theparticipation of skilledworkers.

A

second

reason fortheasymmetry

in labour supply across skill categoriesis the imposition ofa

minimum

wage.

Changes

in labourdemand

might forcesome

unskilledworkers inand

outofunemployment,

butare not likelyto affecttheemployment

of skilled workers.The

wage-elasticityofthe labour supply alsohas

implicationsforhow

industries react toshocks. Consider again the effects of country-specific shocksthat

encourage

production in all industriesand

therefore raisethe labourdemand.

Since the supply of unskilledworkers is elastic,these shocks lead to large fluctuations inemployment

of unskilledworkers. In industries thatuse

them,fluctuations in supply are therefore magnified by increases inemployment

thatmake

industryincome

more

volatile. Sincethe supply of skilledworkers is inelastic, the

same

shockshave

littleorno

effectson

theemployment

of skilledworkers. In industries thatuse

them, fluctuations in supply are not magnifiedand

industryincome

is less volatile.To

the extentthatthisasymmetry

in the elasticityof laboursupply is important,incomes

ofindustries that use unskilled workersare likelyto

be

more

sensitive to country-specificshocks

than those of industries that use skilledworkersTo

studythesehypotheses

we

constructa stylized world equilibriummodel

of the cross-section of business cycles. Inspired bythework

of Davis(1995),we

consider insection

one

a world in which differences in both factorendowments

a laHeckscher-Ohlin

and

industrytechnologies a la Ricardocombine

todetermine a country's comparativeadvantage

and, therefore, the patterns of specializationand

trade.

To

generate business cycles,we

subjectthisworldeconomy

to the sort of productivity fluctuations thathave

been

emphasized

by Kydlandand

Prescott (1982).2Insection two,

we

characterize the cross-section of business cyclesand

show

how

asymmetries

in the elasticityof productdemand

and/or labour supplycan be

used

to explain the evidence in Figure 1. Using availablemicroeconomic

estimatesof the keyparameters,

we

calibratethemodel

and

find that: (i)The

model

exhibits slightly less than two-thirdsand

one-third ofthe observed cross-country variation in volatilityand

comovement,

respectively;and

(ii)The

asymmetry

in the elasticityof productdemand

seems

tohave

a quantitatively stronger effecton

theslopes of the volatilityand

comovement

graphs, than the elasticity in the labour supply.We

explore these results further in sections threeand

four. In section three,we

extendthemodel

to allow formonetary

shocks

thathave

real effectssince firms facecash-in-advance constraints.We

use

themodel

to studyhow

cross-country variation inmonetary

policyand

financialdevelopment

affectthe cross-section of business cycles.Once

thesefactorsare considered, the calibrated versionof themodel

exhibits roughly thesame

cross-countryvariation in volatilityand

about40

percent of thevariation in

comovement

asthedata. In sectionfour,we

show

that the two industryasymmetries

emphasized

here lead toquite different implications forthecyclical behaviorof the termsof trade.

When we

confront these implicationswiththedata, thepicture that

appears

isclearand

confirms our earliercalibration result.Namely, the

asymmetry

intheproduct-demand

elasticityseems

quantitativelymore

importantthan theasymmetry

in the labour-supplyelasticity.2

Ourresearch isrelatedtothelarge literature onopen-economyrealbusinesscyclemodelsthat

studieshowproductivityshocks are transmittedacrosscountries.See Baxter (1995)and Backus,

Kehoeand Kydland (1995)fortwo alternativesurveysof thisresearch.

We

differfromthisliteratureintwo respects. Instead ofemphasizingtheaspects inwhich businesscycles aresimilaracrosscountries,

The

main

theme

of this paperis thatthe properties of business cycles differacrosscountries

because

theyhave

differentindustrial structures.There

aremany

determinantsof theindustrial structure of a country.

We

focus hereon perhaps

themost

importantofsuch

determinants, that is, a country's ability totrade. In sectionfive

we

explorefurtherthe connectionbetween

internationaltrade, industrial structureand

the nature of businesscycles.We

introducetrade frictions in theform of "iceberg"transport costsand

studyhow

globalization(modeled

here as parametric reductions in transport costs)changes

the nature of thebusiness cycles thatcountries experience. Iftransport costs are high enough, all countries

have

thesame

industrial structure

and

the cross-section of business cycles is flat.As

transportcostsdecline, the prices of products in which a countryhas comparative

advantage

increase

and

sodoes

their share in production.As

a result, industrial structures diverge.One

shouldtherefore expect globalization to lead to business cyclesthat aremore

different acrosscountries.1.

A

Model

of

Trade

and Business

Cycles

Inthis section,

we

present a stylizedmodel

ofthe worldeconomy.

Countries thathave

bettertechnologiesand

more

skilledworkersare richer,and

alsotend to specialize in industries that use these factors intensively. Thatis, thesame

characteristics thatdeterminethe

income

of a country also determine its industrialstructure.

Our

objective isto develop a formalframework

that allowsus to thinkabouthow

cross-countryvariation in industrial structure,and

therefore income, translatesintocross-country variation in the propertiesof the business cycle.

We

considera worldwith a continuum ofcountries withmass

one;one

finalgood and

twocontinuums

of intermediates indexed by ze[0,1],whichwe

refertoas the a-and

(3-industries;and

two factorsof production, skilledand

unskilledworkers.There

is freetrade in intermediates, butwe

do

not allowtrade inthe final good.To

simplifythe

problem

further,we

also rule out investment. Jointly, these assumptions imply that countriesdo

notsave.Countries differ in theirtechnologies, their

endowments

of skilledand

unskilledworkers

and

their level of productivity. In particular,each

country is definedby atriplet (n,5,7t),

where

\iisa

measure

ofhow

advanced

thetechnology ofthe country is, 5is the fraction ofthe population that isskilled,and

n isan

index of productivity.We

assume

thatworkers cannot migrateand

that cross-countrydifferences in technology arestable, sothat \i

and

5are constant. Let F((i,5)be

theirtime-invariantjoint distribution.

We

generate businesscycles byallowing the productivity indexn

to fluctuate randomly.Each

countryis populated by acontinuum

ofconsumers

who

differ intheirlevel of skills

and

their personal opportunity cost of work, or reservationwage.

We

think ofthis reservation

wage

as thevalueof non-market activities.We

indexconsumers

by ie[1,»)and

assume

thatthis index is distributed accordingto thisPareto distribution: F(i)

=1-i

_x, with X>0.A

consumer

with index imaximizes

thefollowing expected utility:

(1) Ejufc(i)

WVe-.dt

o v

';

where

U(.) isany

well-behaved utilityfunction; c(i) is consumption of thefinalgood

and

l(i) isan

indicatorfunction thattakes value 1 if theconsumer

works and

otherwise. Let r(|i,5,7i)

and

w(fx,8,7t)be

thewages

ofskilledand

unskilled workers in a(H,5,7t)-country. Alsodefine pF(n,8,7t) astheprice of the final good.

The

budgetconstraint is simply pF •c(i)=

w

•l(i) for unskilledworkersand

pF •c(i)= r•l(i) forskilled ones.

The consumer

works

ifand

only ifthe applicable realwage

(skilledorunskilled)

exceeds

a reservationwage

of i" 1of skilled

and

unskilled workersthat are employed.Under

theassumption that thedistribution of skills

and

reservationwages

are independent,we

have

that(2) (3) f - \

vPf,

u=

\ (1-5)'w^

K^J

1-5

if r<

pF if r>

p F ifw

<

pF ifw

>

p FIfthe real

wage

ofany

type of workeris less than one, theaggregate labour supplyof this type exhibits awage-elasticityof X. This elasticitydepends

onlyon

the dispersion of reservationwages.

Ifthe realwage

ofany

type ofworker reachesone,theentire labour forceof this typeis

employed and

the aggregate laboursupply for thistypeof workersbecomes

vertical. Throughout,we

consider equilibria in which thex

real

wage

for skilled workersexceeds

one,—

>

1 , whilethe realwage

forunskilledPf

w

workers is less than one,

—

<1 . That is, all countries operate in thevertical regionPf

of their supplyof skilledworkers

and

the elastic region of theirsupplyof unskilledworkers. This assumption generates

an

asymmetry

inthe wage-elasticity of the aggregate laboursupply across skill categories. Thiselasticityis zero for skilledworkers

and

X>0

for unskilledones.As

X-^0, thisasymmetry

disappears.Each

country containsmany

competitivefirms in thefinalgoods

sector.These

firms

combine

intermediatestoproduce

thefinalgood

according tothiscostfunction:Thisisthecaseinequilibriumifskilled(unskilled)workersaresufficientlyscarce (abundant) inall

(4) B(pa(z),p p(z))

=

V 1-v "1 M) "1 1-eJPa(zr

dz

Jp

P(z) 1- e dz _0 .0The

elasticity ofsubstitutionbetween

industries is one, while theelasticityofsubstitution

between any two

varieties withinan

industry is9, with 6>1.

Sincethereare always

some

workersthat participatein the labourforce, thedemand

forthefinal product is always strongenough

to generate positive productionin equilibrium.

Our assumptions on

technology implythatfirms in the finalgood

sector

spend

a fraction vof theirrevenues

on

a-productsand

a fraction 1-von

(3-products. Moreover, the ratioof spending

on

any

two a-products zand

z' is given byPa(z) P.(z')

1-e

;

and

the ratioof spendingon

any

two (3-products zand

z' isPp(z)

Pp(z')

1-e

where

pa(z)and

p (z) denote theprice of varietyz of the a-and

(3-products,respectively. Define Pn

and

Pp asthe ideal price

indices forthe a-

and

(3-industry, i.e.P

a=

Jp

a(z) 1- 9 -dzand P

R =Jp

p(z) 1- e -dz 1 1-e;

and

define thefollowingnumeraire rule:

(5) 1

=

P«v

-Pp"v

Sincefirms inthefinal

goods

sector are competitive, they set price equals cost. This implies that:(6) pF

=1

Sinceall intermediates aretraded

and

the lawofone

price applies, the pricepower

parity applies.An

implication of this isthat theassumption

thatthe finalgood

is nottraded is not binding.Each

country also containstwo intermediate industries.The

a-industry uses sophisticated production processes that require skilled workers.Each

variety requires a differenttechnology that isowned

byone

firm only.To

produce

one

unitofany

variety ofa-products, thefirm that

owns

the technology requirese"

units of skilledlabour.

As

mentioned, the productivityindexn fluctuatesrandomly

and

is not under thecontrol ofthefirms. Let nbe

themeasure

of a-productsin which thetechnologyis

owned

by a domestic firm.We

can

interpretn

as a natural indicator ofhow

advanced

the technologyof a country is. Itfollowsfrom ourassumptions on

thetechnology

and

market structurein thefinalgoods

sector thattheelasticityofdemand

forany

varietyof a-product is 0.As

a result, allfirms in the a-industry facedownward-sloping

demand

curvesand behave

monopolistically. Their optimal pricing policyis to set amarkup

over unitcost. Let pjz) bethe price ofthevariety z of the a-industry.Symmetry

ensures all thefirmslocated in a (|i,8,7i)-country setthesame

pricefor theirvarieties of a-products, p

a(ja,8,7r):

(7) paa =

re"

6-1

As

usual, themarkup depends on

the elasticityofdemand

for their products.The

(3-industryuses traditional technologiesthat are available to all firms in allcountries

and can be

operated by both skilledand

unskilledworkers.To

produce one

unit of any varietyof (3-products firms require e" units of labourof

any

kind. Sincewe

have

assumed

that inequilibrium skilledwages

exceed

unskilledwages,

onlyunskilled workers produce (3-products. Sinceall firms in the (3-industry

have access

to thesame

technologies, they all faceflat individualdemand

curvesand behave

competitively.

They

set priceequal to cost. Letp (z)be

the price ofthevariety z ofthe (3-industry.

Symmetry

ensures that all firms in the P-industryof a (n,5,7r.)-countrysetthe

same

price forall varieties of (3-products, p^n,S,n):(8) pp =w-.e-"

With this formulation,

we

have

introducedan

asymmetry

in the price-elasticity of productdemand.

This elasticity is in the a-industryand

infinity inthe (3-industry.As

0^co

; this

asymmetry

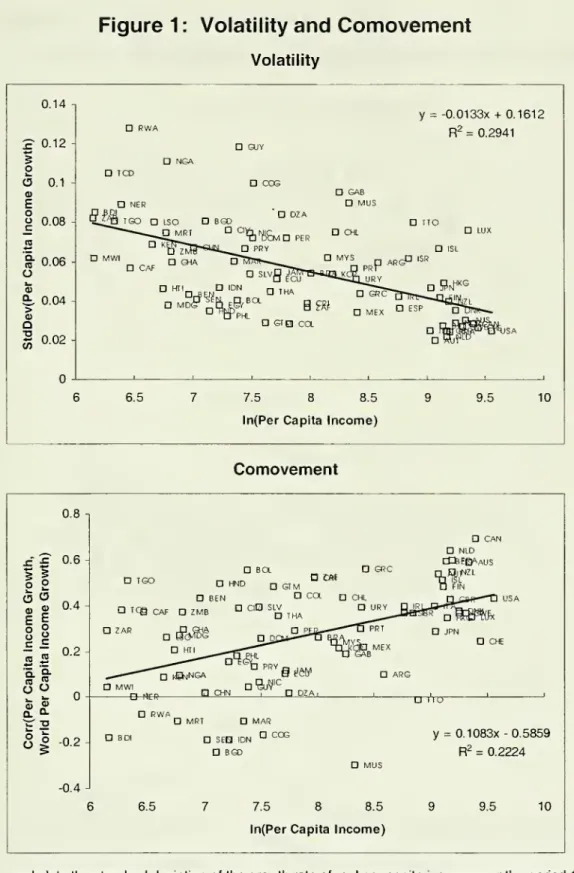

disappears.Business cycles arise as

n

fluctuates randomly.We

refer tochanges

inn as

productivity shocks.

The

index%

is thesum

of a globalcomponent,

n,and

a country-specificcomponent,

n-Y\.Each

of thesecomponents

isan

independent Brownianmotion reflected

on

the interval [-1,1] withchanges

thathave

zero driftand

instantaneous variance equalto r\a2

and

(1-r|)rj2 respectively, with%

>0, 0<r|<1and

a>0. Letthe initial distribution of country-specific

components

be

uniformly distributedon

[-n,7i]and

assume

this distribution is independentof other countrycharacteristics.

Under

theassumption

thatchanges

in these country-specificcomponents

are independent across countries,we

have

thatthe cross-sectionaldistribution of 71-n istime invariant.4

We

refer tothisdistribution as G(7i-n). Whilen

has

been

definedas

an

index of domesticproductivity,n

serves asan

indexof worldaverage

productivity.The

parametera

regulates thevolatilityofthedomestic shocks.The

instantaneous correlationbetween

domestic shocks, dn,and

foreign shocks, dn,is therefore Jr) .

5

The

parameter

ti therefore regulates the extentto which thevariation in domestic productivity is

due

to global or country-specificcomponents,

i.e.whetherit

comes

fromdn

or d(7i-n). Figure 2shows

possiblesample

pathsofn

underthree alternative

assumptions

regardingt|.4

SeeHarrison(1990),Chapter5.

Thisistrueexceptwheneithernor

n

areattheir respectiveboundaries.These arerareevents sinceA

competitive equilibrium ofthe worldeconomy

consistsof asequence

of pricesand

quantitiessuch

thatconsumers and

firmsbehave

optimallyand

marketsclear.

Our assumptions

ensurethat a competitive equilibrium existsand

is unique.We

provethis byconstructing theset of equilibrium prices.In thea-industry, different products

command

different prices.The

ratio ofworld

demands

forthe(sum

of all) a-products of a (^,5,7i)-countryand

a(n',d',n')-country,

—

P.W

,must

equal the ratio of supplies isse'

se

Pa(z')

condition plus Equation (2)

and

the definition of Pa

we

find that: . Usingthis (9) Pav

aH

1 ^9 n-nwhere

*¥„=

IW

1 e-18

—

9 (n-n)dF-dG

v.Since the distribution functions F(u.,8)

J

and

G(n-n) aretime-invariant, x¥

a is aconstant. Sinceeach

country isa "large" producer of itsown

varieties of a-products, the price ofthesevarietiesdepends

negatively

on

the quantityproduced. Countrieswithmany

skilled workers (high 8)with relatively high productivity (high 7i-n) producing a small

number

of varieties (low|i) produce large quantitiesof

each

variety ofthe a-productsand

as a result, face low prices.As

9^>°°, the dispersion in theirprices disappearsand

pra(z)—>pa

.

Inthe (5-industryall products

command

thesame

price. Otherwise, low-pricevarieties of (3-products would not

be

produced. Butthis is nota possible equilibrium given the technology described in Equation (4). Therefore, itfollows that:(10) Pp

Finally,

we

compute

the relativeprice of both industries.To

do

this, equatev

the ratio of world spending in the a-

and

(3-industries, ,to the ratio of thevalue1-v

ffp

as-e"dFdG

of their productions,

^

. Using Equations (2)-(3)and

(5)-(10),we

j

jPpue

n

dFdG

then find that:

(11)

P

1 f v%

\~

1-v

W

n 1+X.-V—

-—

n 1+Xv •e*where

y

p=

JJ(1-5)-e

(1+X)(n_n)dFdG

,

and

is constant. IfX>0, high productivity isassociated with high relative pricesfor a-products as theworld supplyof (3-products

is high relativeto thatof a-products. This increasein the relative supplyof (3-products

is

due

to increases inemployment

of unskilledworkers.As

A.-^0, the relative prices ofboth industries are unaffected bythelevel of productivity.

What

are the patterns oftrade inthisworldeconomy?

Lety(n,§,7i)and

x(n,5,Tr)

be

theincome

and

theshare of the a-industry in a (n,5,7i)-country, i.e./ \ d •s•o

71

y

=

(pa •s+

pp

•

u}

e"and

x=

—

. Notsurprisingly, countrieswith bettertechnologies (high n)

and

more

human

capital (high 5)have

highvalues for both yand

x.We

therefore refer to countries with high values ofxas

rich countries. Sinceeach

countryproduces an

infinitesimalnumber

of varieties of a-productsand uses

allof

them

in the production offinal goods, all countries exportalmost all of theirproduction of a-products

and

importalmost all of the a-productsused

in thedomestic production of final goods.As

a

shareof income, these exportsand

imports are xand

v, respectively.

To

balancetheir trade, countrieswithx<v

export (3-productsand

v-x

and

x-v, respectively. Therefore, the share of trade inincome

is max[v,x].As

usual, thistrade canbe

decomposed

into intraindustry trade, min[v,x],and

interindustrytrade,Ix-v| .

The

former consistsof trade in productsthathave

similarfactor proportions.

The

laterconsistsof trade in productswith different factorproportions.

The

model

thereforecaptures in a stylizedmanner

three broad empirical regularities regarding the patterns of trade: (a) a largevolume

of intraindustry tradeamong

rich countries, (b) substantial interindustrytradebetween

richand

poorcountries,

and

(c) littletradeamong

poorcountries.2.

The

Cross-section

of

Business

Cycles

Inthe world

economy

described in the previoussection, countries are subjecttothe

same

type of country-specificand

globalshocks

to productivity.Any

differencein the properties oftheir business cycles

must be

ultimately attributed to differencesin theirtechnology

and

factorproportions. This is clearly asimplification. Inthe realworld countriesexperience differenttypesof

shocks

and

also differ inways

thatgo

beyond

technologyand

factor proportions. With thiscaveat in mind, in this sectionwe

ask:How

much

of the observed cross-countryvariation in business cycles could potentiallybe

explained bythesimplemodel

of theprevious section?Perhaps

surprisingly, the

answer

isbetween

one

and

two thirds ofall the variation.The

first steptowards answering this question isto obtainan

expression thatlinks

income

growth tothe shocksthat countries experience. Applying Ito'slemma

tothe definition of y

and

using Equations (2)-(11),we

obtain the(demeaned)

growthrate of

income

ofa (n.,5,7t)-countryas

a

linearcombination of country-specificand

global shocks: (12)

dlny-E[dlny] =

x-—

+(1-x)-(1+X)d(7t-n)+

1+ xdn

1+X-v

15Equation (12) provides a complete characterization ofthe businesscycles experienced by a (u.,5,7i)-countryas afunction ofthe country's industrial structure,

as

measured

byx. Equation (12)shows

that poorcountries aremore

sensitive to3dlny

country-specific shocks, i.e.

ad(Ti-n)

is decreasing in x. Equation (12) also dn=o

shows

thatall countries are equally sensitive to global shocks, i.eadn

independentof x.

We

nextdiscuss the intuition behind these results.is d(;t-n)=o

Why

are poorcountriesmore

sensitiveto country-specificshocks?

Assume

that

X-^0

and

9^°°

>so

thatthea-and

(3-industryface both perfectly inelasticfactorsupplies

and

perfectly elasticproductdemands.

Inthiscase, aone

percent country-specific increase in productivityhas

noeffects onemployment

or product prices.As

aresult, production

and income

also increase byone

percent. This iswhy

3dlny

ad(Ti-n)

=

1 if A.-^0and

6^^.

If A,is positive, a country-specific increase indn=o

productivityof

one

percent leadstoan

increase inemployment

of A. percent in the(3-industryand, as a result, production

and income

increase bymore

thanone

percent. Thisemployment

response magnifiesthe expansionary effects of increasedproductivity in the (3-industry.

As

a result, theshock

has

stronger effects in poor 3dlnycountries, i.e.

3d(7t-n)

=

1+

(1—x)-A, if8—

>°°. If6 is finite, a country-specific dn=oincrease in productivity of

one

percent leads toa 0"1percent

decrease

in prices inthea-industries. Thisprice

response

counteracts the expansionaryeffects of increased productivity inthea-industry. Consequently, theshock

hasweaker

effects in richBdlny countries, i.e.

x

=

1—

ifX=0. IfX>0 and

9 isfinite,we

have

that both theemployment

and

priceresponses combine

tomake

poor countries reactmore

tocountry-specific shocks, i.e.

dd(Ti-n)

—

1=

x+

(1-x) (1+

X) is decreasing in x.Why

areall countries equally responsiveto globalshocks?

This result restson

theassumption thattheelasticity of substitutionbetween

a-and

(3-productsisone. Consider a global increase in productivity.

On

theone

hand, production of p-productsexpands

relativeto the production of a-productsasmore

unskilled workers are employed. Ceteris paribus, thiswould

increase the share ofworldincome

thatgoes

tothe p-industry,and hence

poorcountries, aftera positive global shock. But theincrease in relative supply lowers the relative price of p-products. This reduces theshare ofworldincome

thatgoes

to the P-industry,and hence

poorcountries, after a positive global shock.The

assumption

ofaCobb-Douglas

technologyfortheproduction ofthe final

good

implies that thesetwoeffectscanceland

theshare ofworld spending in the a-

and

P-industries remains constant overthe cycle. Therefore,in our

framework

differences in industrial structuredo

notgenerate differences inhow

countries react to global shocks.6

We

are readytouse

themodel

to interpretthe evidence in Figure 1. DefinedlnY

as

theworld average growth rate, i.e.dlnY =

jj dlny

dFdG

. Then, it followsfrom Equation (12) that:

(13)

dlnY-E[dlnY]

=

1

+

X

dn

1

+ A-v

Sincethe lawof large

numbers

eliminates the country-specificcomponent

ofshocks

in the aggregate, the worldeconomy

exhibits mildercyclesthatany

ofthe countriesthat belong to it.7

6

WhiletheCobb-Douglasformulation isspecial, itisnotdifficulttograsp whatwould happenifwe

relaxed it. Iftheelasticity ofsubstitutionbetween industrieswerehigherthan one, poorcountrieswould

be moresensitivetoglobalshocksthanrichcountriesastheshareofworld incomethatgoestothe

|3-industry increasesafterapositiveglobalshock and decreasesafteranegative one. Iftheelasticity of substitutionwere lessthan one, the oppositewould betrue.

7

Once again,this resultrestsontheCobb-Douglas assumption. Iftheelasticityofsubstitutionbetween

a-and|3-productswere higherthan one, the very richcountries mightexhibitbusinesscyclesthatare

milderthan thoseoftheworld.

Let V(n,8,7i)

denote

the standarddeviation ofincome

growth of a(u.,5,7t)-country,

and

let CQx,5,7c)denote

thecorrelation of itsincome

growth with worldaverage income

growth.These

are the theoretical analogs to thevolatilityand

comovement

graphs

in Figure 1. Using Equations (12)-(13)and

the propertiesoftheshocks,

we

find that:(14)

V

=

o-. (15)C

=

x.^I

+

(1-x)-(1+

X) -i2 (1"T1)+ '^+x

^ -\+ X-v

1+

1-v

f\

x.®^

+

(1-x)-(1+

X) •(1-71)+

1+ A

1+ X-v

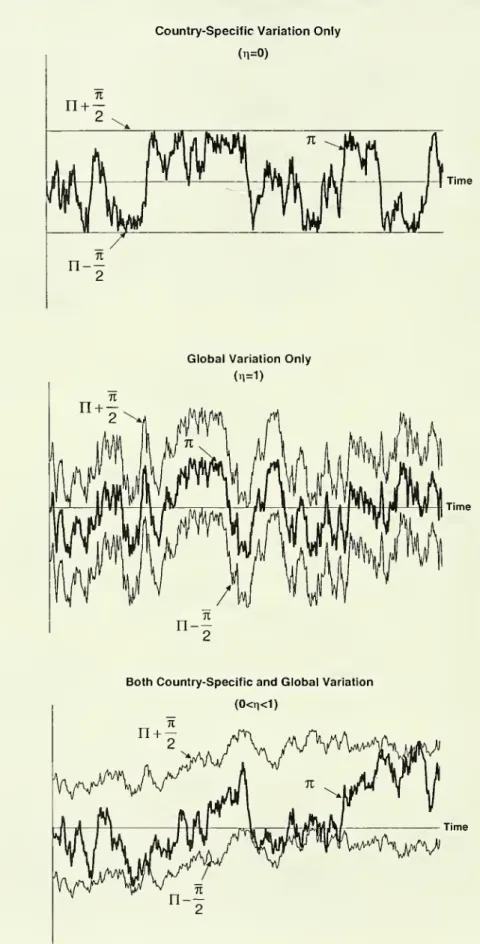

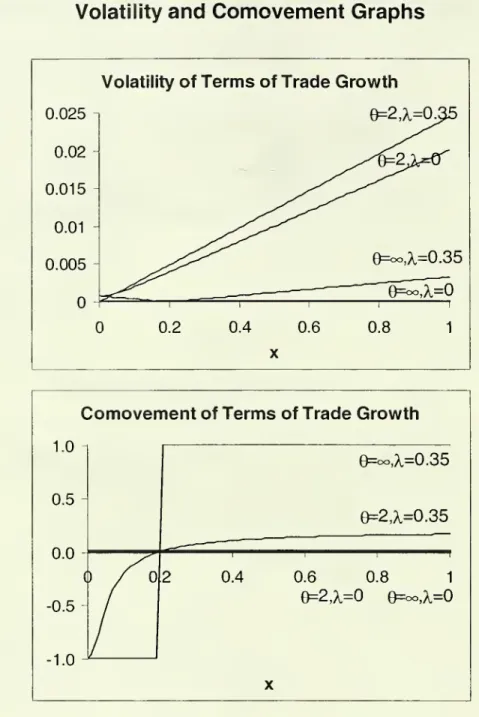

TlFigure 3 plotsthe volatility

and

comovement

graphs

asfunctionsof x, fordifferentparameter values. Exceptin the limiting

case where

bothX=0

and

0=<~, thevolatilitygraph is

downward

slopingand

thecomovement

graph isupward

sloping.The

intuition is clear:As

a result ofasymmetries

in theelasticity ofproduct-demand

and

labour supply, the a-industryis less sensitive to country-specificshocks

thanthe(3-industry. This

makes

the a-industry lessvolatileand

more

synchronizedwith theworld cyclethan the (3-industry. Sincecountries inherit the cyclical properties of their

industries, the

incomes

of rich countries are also lessvolatileand

more

synchronized with the world cyclethan thoseof poorcountries.The

magnitude

of these differencesis

more

pronounced

asX

increases and/or 6 decreases.A

simple inspection of Equations (14)and

(15) revealsthat there existvarious combinations ofparameters

capable of generating approximatelythe data patterns displayed in Figure 1and

Table 1. Inthis sense, themodel

is able to replicate theevidencethat motivated the paper. Butthis is a very

undemanding

criterion.One

canimpose

more

disciplineby

restrictingthe analysis tocombinations of parameter values thatseem

reasonable.To

do

this,we

nextchoose

valuesfor a, r\, vand

abusinesscycles varies with X

and

9. Needlessto say,one

shouldbe

cautious todraw

strong conclusionsfrom a calibration exercise likethis in a

model

asstylizedas

ours.As

noted above, in the realworld countries experience differenttypesofshocks

and

alsodiffer in

ways

thatgo beyond

technologyand

factorproportions. Moreover,availableestimates of the key parameters

X

and

9arebased on

non-representativesamples

ofcountriesand

industries, sothat caution is in orderwhen

generalizing to the largecross-section of countrieswe

study here. Despite these caveats,we

shallsee that

some

useful insights canbe

gained fromthis exercise.To

determinethe relevant rangeof variationforx,we

use dataon

trade shares.The

model

predicts thatthe share of exports inincome

in rich countries is x.Sincethis share is

around 60

percent inthe richest countries in our sample,we

use

0.6 as a reasonable upper

bound

for x.The

model

also predicts that v is theshare of exports inincome

in poor countries,and

that in these countries x<v. Sincethe shareof exports in

GDP

isaround 20

percent inthe poorestcountries in oursample,we

choose

v=0.2and

use0.1 as alowerbound

forx.The

choice ofrjand

r\ ismore

problematic, since there are

no

reliableestimates of the volatilityand

cross-country correlation of productivitygrowth for this large cross-section of countries.We

circumventthis

problem

by choosinga and

r| tomatch

theobserved level of volatilityand

comovement

ofincome

growthforthetypical rich country, given the rest of our parameters.8 Thismeans

thatthis calibration exercisecan

only tell us aboutthemodel's abilityto

match observed

cross-country differences involatilityand

comovement

ofincome

growth.The

top-left panel ofTable 2 reportsthe resultsof this calibration exercise,and

selectedcases

areshown

in Figure 3.The

first row reportsthe predicted difference in volatilityand

comovement

between

the richest country(with log per capitaGDP

of around 9.5)and

the poorestcountry (with log percapitaGDP

of around 6.5),based on

the regressionswith controls in Table 1.The

remainingrows

In particular,a andr|arechosentoensurethatV=0.04 andC=0.4,forx=0.5,v=0.2andthe given

choicesforAand9.

report the difference involatility

and

comovement

between

the richest (x=0.6)and

poorest (x=0.1) countries thatthe

model

predicts fordifferent valuesofX

and

0.These

valuesencompass

existingmicroeconomic

estimates. Available industry estimates ofthe elasticity of exportdemand

range from 2to 10 (see Treflerand

Lai (1999), Feenstra, (1994)), whileavailable estimatesforthe labour supply elasticity ofunskilled workers range from 0.3 to 0.35

(See

Juhn,Murphy and

Topel (1991)).The

table also reports thevaluesfora

and

r\that resultfrom the calibration procedure.Table 2

shows

that, using values for8and

X of9=2 and

A.=0.35, themodel

can accountfor nearlytwo-thirds ofthe cross-country difference in volatility

between

rich

and

poorcountries (-0.016versus -0.026),and

slightly lessthan one-third ofthe cross-country differences incomovement

(0.129 versus 0.382).These

values forthe parameters are within the rangesuggested by

existingmicroeconomic

studies. Iftheindustry

asymmetries

areassumed

tobe even

stronger, say 9=1.2and

X=0.7, the predicted differences in volatilityand

comovement

are closerto their predicted values.These

resultsseem

encouraging.The

two

hypotheses put forward herecan

accountfora sizeable fraction of cross-country differences in business cycles

even

insuch

a stylizedmodel as

ours. Moreover,we

shallsee

in the next section that a simple extension ofthemodel

that allowsformonetary shocks

and

cross-country differences in thedegree

offinancialdevelopment

canmove

thetheoretical predictions closerto the data.A

second

resultin Table 2 isthattheasymmetry

in theelasticity of productdemand seems

quantitativelymore

importantthan theasymmetry

in theelasticity ofthe labour supply. Within the range of

parameter

values considered in Table2,changes

in 9have

strong effectson

the slopeof the two graphs, whilechanges

inX

to

have

little orno

effect.To

the extentthatthis range of parameter valueswe

consider is the relevant one, this calibration exercise suggeststhat the

asymmetry

inasymmetries

in the elasticity of productdemands

constitutesthemore

promising hypothesisofwhy

business cycles are different across countries.We

return to thispoint in section four

where

we

attemptto distinguishbetween hypotheses by

3.

Monetary

Shocks and

Financial

Development

Our

simple calibration exercise tells us thatthe two industryasymmetries

can

account for almosttwo-thirds of the cross-country differences in volatility,

and

nearly one-third ofthe cross-country variation incomovement.

One

reaction tothisfinding isthatthe

model

is surelytoo stylized tobe

confronted with the data. Afterall,most

of our modelling choiceswere

made

tomaximize

theoretical transparency ratherthanmodel

fit.Now

thatthe mainmechanisms

have

been

clearlystatedand

the intuitionsbehind

them

developed, it is timeto buildon

the stylizedmodel

and

move

closertoreality by adding details. This is the goal of this section,

where

we

show

thatbyintroducing

monetary

shocksand

cross-countryvariation infinancialdevelopment

helps to significantlynarrowthe

gap

between model and

data. This is not the onlyway

to narrow this gap, butwe

choose

to followthis routebecause

the elementsthatthis extension highlights areboth realistic

and

interesting in theirown

right.We

now

allow countriesto differalso in theirdegree offinancialdevelopment

and

theirmonetary

policy.Each

country is therefore defined by a quintuplet,(|j.,5,7:,k,i),

where

k is ameasure

ofthedegree

of financial development,and

i isthe interest rateon

domestic currency.We

assume

thatk is constant over timeand

re-define F(^,5,k) asthe time-invariantjointdistribution of \i, 8

and

k.We

allowforan

additional source of business cyclesby letting ifluctuate randomly.

We

motivate the use ofmoney

byassuming

thatfirms facea cash-in-advance constraint.9 In particular, firmshave

touse cash

or domestic currency in ordertopay

afraction k of their

wage

bill before production starts, with0<k<1

.The

parameter

ktherefore

measures

how

underdeveloped are credit markets.As

k^O

in all countries,we

reach the limit inwhich credit marketsare so efficientthatcash

is neverused.SeeChristiano,Eichenbaum andEvans (1997)fora discussionof relatedmodels.

This is the

case

we

have

studied so far. In thosecountrieswhere

k>0, firms borrowcash

from thegovernment

and

repaythecash

plus interest after production iscompleted

and

output is sold toconsumers.

Monetary

policy consists of settingthe interest rateon cash

and

thendistributing the proceeds in a

lump-sum

fashionamong

consumers.

As

iscustomary

in the literature

on

money

and

business cycles,we

assume

thatmonetary

policy israndom.

10 In particular,we

assume

thatthe interest rate is a reflecting Brownian motionon

the interval [i,T], withchanges

thathave

zerodrift, instantaneousvariance §2,

and

are independent acrosscountriesand

also independentofchanges

in n. Letthe initialdistribution of interest ratesbe

uniform in [t,T]and

independentofthe distribution of othercountry characteristics. Hence, the cross-sectional distribution of i, H(i),

does

notchange

overtime.The

introduction ofmoney

leads onlyto minorchanges

in thedescription ofworld equilibrium in section one. Equations (2)-(3) describing the labour-supply

decision

and

the numeraire rule in Equation (5) still apply. Sincefirms in thefinalsector

do

notpay

wages,

their pricingdecision is still given by Equation (6).The

cash-in-advance constraintsaffect thefirms in the a-

and

(3-industriessince theynow

face financing costs in addition to labour costs.

As

a result, the pricing equations (7)-(8)have

tobe

replaced by:11(16) pa

=—

-r-e-™

e-1

(17) pp

=w-e"

10

Thissimplification isadequate ifonetakes the viewthatmonetarypolicy hasobjectivesotherthan

stabilizingthecycle. Forinstance,iftheinflationtaxisusedtofinancea publicgood, shockstothe

marginal valueof thispublicgoodare translatedintoshockstotherateofmoneygrowth. Alternatively,if

acountryiscommittedtomaintainingafixed parity,shockstoforeign investors'confidence inthe

country aretranslatedintoshockstothe nominalinterestrate, asthe monetaryauthoritiesusethe latter

tomanagetheexchangerate.

11

Note that

changes

in theinterest rate affectthe financing costs of firmsand

are therefore formally equivalenttosupplyshocks such as

changes

in production or payroll taxes. Formally, this isthe onlychange

required.A

straightforward extensionof earlier

arguments

shows

that Equations(9)-(11) describing the set of equilibriumprices arestill valid provided

we

re-defineT

p =

J||(1-5)e

(1+A)(7t"n)"Kl

dFdGdH,

which converges to the earlier definition of

Y

B inthe limiting

case

in which k-^0 in all

countries.

Financing costs are not a directcost forthe country

as

awhole

but only a transferfrom firms toconsumers

via the government. Consequently,income

and

the/ \ p -s-e"

shareof the a-industry are still defined

as

y=

\pa s+

pp•u) e

and

x=

—

,

respectively.

Now

rich countries arethosethathave

bettertechnologies (high n),more

human

capital (high 5)and

better financialsystems

(low k).Remember

that,ceterisparibus, a highvalue for u.

and

S lead to a high valueof x. This iswhy

havebeen

referring tocountries with high values for xas rich.However,

we

have

now

that a low valuefor k leads to both higherincome and

a lower value for x.The

intuition issimple:

A

high valueof k is associatedwith higher financing costsand

thereforeaweaker

labourdemand

forall typesof workers. Inthe market for skilledworkers, thisweak

demand

is translated fully into low inwages

and

hasno

effects in employment.The

size of the a-industry istherefore notaffected by cash-in-advance constraints. Inthe marketfor unskilled workers,this

weak

demand

is translated into both lowerwages

and employment.

The

latter implies a smaller (3-industry. Despite this,we

shallcontinueto referto countries with highervalues ofxas rich. That is, it

seems

tousreasonable to

assume

thattechnologyand

factor proportionsaremore

important determinantsofa country's industrial structurethan thedegree

offinancial development.We

are readyto determinehow

interest-rateshocks

affectincome

growthand

the cross-section of businesscycles. Applying Ito's

lemma

tothedefinition ofy,we

find this expression forthe

(demeaned)

growth rate ofincome

forthe (|n,5,7t,K,i)-country: (18) dlny-E[dlny]= x.®-l

+

(1-x)-(1+

X)d(7t-n)+

1+

dn-(1-x)A-K-di

J \+

Xv

Equation (18), which generalizes Equation (12), describes the business cycles of a (|j,,S,7i,K,i)-country

as

a

function of its industrial structure.The

firsttwo

termsdescribe the reaction of thecountryto productivity

shocks

and have

been

discussed at length.The

third term isnew

and

shows

how

the country reactsto interest-rate shocks. In particular, itshows

that interest-rateshocks

have

largereffects incountriesthatare poor

and have

a lowdegree

offinancial development. That is,3dlny 9di

is decreasing in x

and

increasing in k (holding constantx). d(rc-n)=odn=o

An

increase in the interest rate raisesfinancing costs in the a-and

(3-industries. This increase is larger in countries with low

degrees

offinancialdevelopment

(high k). Justbecause

ofthis, poorcountries aremore

sensitive to interest-rateshocks

than rich countries. But there is more. Inthe a-industry,the supply of labour is inelasticand

the additional financing costs are fullypassed

toworkers in theform of lower

wages.

Production is therefore notaffected. Inthef3-industry, thesupplyof labour is elastic

and

theadditional financing costs are onlypartially

passed

towages.

Employment

and

production thereforedecline. In theaggregate, production

and income

decline after a positive interest-rate shock. But ifthe

asymmetry

in the laboursupply elasticity is important, this reaction shouldbe

stronger in poorcountries that

have

larger (3-industries. This provides asecond

reason

why

poorcountriesaremore

sensitiveto interest-rate shocks than richcountries.

The

introduction of interest-rateshocks

provides two additional reasonswhy

through their industrial structure

and

anotheris aconsequence

of their lack offinancial development. Both of theseconsiderations reinforcethe results of the

previous model.

To

see

this, re-definedlnY =

f|fdlny

dFdGdH.

Equation (13) still

applies since

monetary

shocks

arecountry-specificand

the lawof largenumbers

eliminatestheir effectsin the aggregate. Then, rewrite the volatilityand

comovement

graphs asfollows: (19)

V=

a

2 (20)C

=

a

2 .x-iLl

+

(1-x).(1+

A.) (1-T1)+

1+X

f 1 +x

^ \ 1+ X-v

1+

X-v

2 12 Tl+r-K^-(i-xr-A.'

x.8_1

+(1_x).(1+X) (1-tl)+

'1+X

^ 1+

X-v

2 ,,-2 I* „\2 t2 •Tl+r-K^-(1-Xr-X'

jThese

equations are natural generalizations of Equations (14)-(15).They

show

that, ceteris paribus, countrieswith lowfinancialdevelopment

willbe

bothmore

volatile

and

less correlated with the world.They

alsoshow

thenew

channel throughwhich industrial structure affectsthe business cycles ofcountries.

With these additionalforces present, the

model

isnow

abletocome much

closertothe observed cross-countryvariation involatilityand

comovement

using values for9and X

that are consistentwith availablemicroeconomic

studies. This isshown

in the bottom panelof Table 2,where

we

assume

thatthe standard deviation ofshocks

tomonetary

policy is 0.1and

thatk=1 in the poorest countries in oursample and

k=0.5 in the richest countries. For9=2 and

X=0.35, the extendedmodel

now

delivers cross-country differences in volatilitythatare nearly identical totheones

we

estimated in Table 1 (-0.024versus -0.026),and

cross-country differences incomovement

arenow

40

percentof thosewe

observe in reality(0.165 versus 0.382). Looking furtherdown

thetable,we

can further improvethe fitof themodel

in thecomovement

dimension byconsideringmore

extreme parametervalues.However,

this is achievedat the cost of over-predicting cross-country differences in volatility.

We

could tryto furthernarrowthegap between

theoryand

databyconsidering additional extensions to the model. But

we

think thatthe results obtained sofar are sufficientto establish that thetwo hypotheses considered herehave

the potential to explain at least in partwhy

business cycles are different in richand

poor countries. This isour simple objective here.4.

The

Cyclical

Behavior

of

the

Terms

of

Trade

From

the standpoint of the evidence reported in Table 1and

the theorydeveloped in the previous sections, the two industry

asymmetries

studied hereare observationally equivalent.However,

usingmicroeconomic

estimates for9and X

as additional evidence to calibrate the model,we

found that theasymmetry

in theelasticityof product

demand

seems

amore

promising explanation ofwhy

businesscycles aredifferent across countriesthan the

asymmetry

in theelasticity of the labour supply. Inthis section,we

show

that thesetwoasymmetries have

differentimplications forthe cyclical properties of theterms of trade,

and

then confronting these implications with thedata.The

evidenceon

thecyclical behavior of theterms oftrade is consistent with the results ofour calibration exercise. Namely, a strong

asymmetry

inthe elasticityof productdemand

helps themodel

provide amore

accurate description of theterms oftrade datathan a strong

asymmetry

in theelasticityof the labour supply.

We

firstderivethe stochastic process forthetermsof trade.Let T((i,5,7t,k,i)denote the

terms

of trade of a (|a,5,7r,K,i)-country. Using Equations (9)-(11),we

findthatthe (detrended) growth rate in theterms of trade is equalto:12

12

Itispossibletodecomposeincomegrowthintothegrowth ratesofproductionandtheterms oftrade.

Thegrowth rateofproduction(or

GDP

growthrate)measuresincomegrowththat isdueto changesinproduction, holding constantprices.Thegrowthrate ofthetermsoftrademeasuresincome growththat

isduetochanges in prices,holdingconstant production.

We

followusualconvention anddefinethetermsoftradeofa countryasthe ideal priceindexofproductionrelativetotheideal price indexof

expenditure.Thegrowth rateofthetermsoftradeisequaltotheshareofexportsin incometimesthe

(21)

dlnT-E[dlnT] =

--d(7i-n)+

(X v

^

-dn

9 1

+ A-V

Equation (21) describes thecyclical behaviorof thetermsof trade as

a

function ofthe country's industrial structure. It

shows

that positive country-specificshocks

to productivity affect negativelytheterms of trade,and

thiseffectis larger (inadlnT

absolute value) the richer is the country, i.e. is negative

and

dn=o ad(Tt-n)

decreasing in x. Equation (21) also

shows

that positiveglobalshocks

to productivityworsen

the termsof trade of poor countriesand

improve thoseof rich countries, i.e. ~\f-iI—T

is negative if

x<v

and

positive ifx>v. Finally, Equation (21)shows

thatd(n-n)=0

adn

interest-rate shocks

have no

effectson

theterms of trade.We

discusstheintuitionbehind these results in turn.

Country-specific

shocks

to productivityhave no

effecton import pricesbecause

countries are small. But theydo

affectexport prices. Consider a positive country-specificshock

to productivity. In the a-industry, firms react to theshock

by producingmore

ofeach

variety theyknow

how

to produce. Sincethis set is small, the increase inthe production ofeach

varietyis large. Since domesticand

foreignvarietiesare imperfect substitutes, the increase in production lowers the price ofthe country's a-products. Inthe P-industry, firms

know

how

to produceall varieties.They

react totheshock

byspreading their productionamong

a largenumber

ofvarieties(or byforcing

some

firms abroad todo

this).As

a result, the increase in the production ofeach

varietyis infinitesimally smalland

theprices of the country's p-products are not affected. In the aggregate, theterms of tradeworsen

as a result ofthe shock. But if the

asymmetry

in theelasticity of productdemand

is important, the termsof trade shoulddeterioratemore

in rich countries.Global shocks influence all countries equally and, consequently, they

do

not affect the prices ofdifferentvarieties of a-and

P-products relativeto theircorresponding industryaggregates. Consider a positive global

shock

to productivity.We

saw

earlierthatthisshock

lowers the price of all (3-products relative to alla-products

(See

Equation (11)).The

reason is simple: In both industries, the increasein productivity leads to a directincrease in production. But if the

asymmetry

in theelasticity ofthe labour supply is important, the increase in productivity raises

employment

of unskilled workersand

leads to afurther increase in theproduction of(3-products.

As

theworld supplyof (3-products increases relative to that of a-products,their relativeprice declines. This is

why

theterms oftrade of net exporters of|3-products, x<v, deteriorate, while theterms oftrade of net importers of p-products, x>v, improve.

Finally, Equation (21) states that country-specific interest-rate

shocks

have no

effects

on

theterms oftrade.These

shocks

do

not affect import pricesbecause

the country issmall. Buttheydo

not affect export prices either.As

discussed earlier,interst-rate

shocks

do

not affect the production of a-products.As

a result, theydo

not affect theprices ofdomesticvarieties relativeto the industryaggregate. Interest-rateshocks

affect the production of (3-products.However,

firms in the p-industrycannotchange

their prices intheface of perfectcompetition from firms abroad.Therefore, country-specificmonetary

shocks

do

notaffect the termsof trade.Equation (21)

makes

clearhow

thetwo industryasymmetries

shape

thecyclical behaviorofthe terms oftrade. Inthe

absence

ofasymmetries

in the elasticityofthe labour supply,

A—

>0, only country-specificshocks

affecttheterms

oftrade. Inthe

absence

ofasymmetries

in the elasticityof productdemand,

8-^°=, only globalshocks

affect theterms of trade. Thishas

implications forthevolatilityand

comovement

graphs fortheterms of trade. LetV

T(fi,5,Tr,K,i)denote

the standard deviation of the(detrended) growth of termsof trade of a (|a,8,7t,K,i)-country,and

letC

J(\i,5,n) denote its correlation with worldaverage

income

growth. Using Equations(22)

V

T=a-.

(23)C

T = (1-il)+ V(x-v)-A

1+

A.v

Tl "l+

X-v

V?

'ix-v)X^

fl-<1-1>

+

1+

X-v

•TlTo

understandthe intuition behind theseformulae, it is useful toconsidertwoextreme

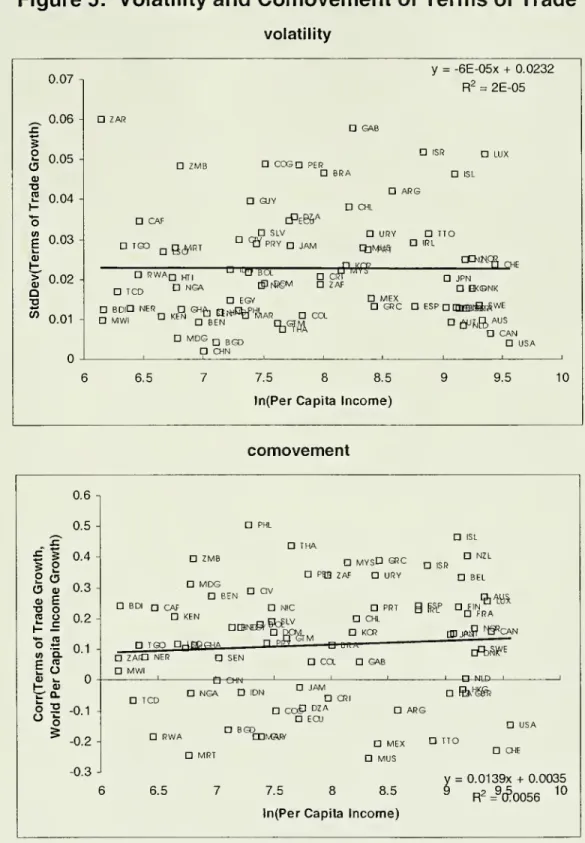

cases. Both are illustrated in Figure 4, which plots the volatilityand

comovement

graphsof theterms oftrade asfunctions of x, fordifferent parameter values.Assume

firstthatthe only reasonwhy

business cycles differacross countriesisthe

asymmetry

in the elasticityof productdemand,

i.e. A=0.Then,V

T=

—

•a

•y/l-'nand

C

T

=

.The

volatilitygraph isupward

sloping. Sinceall theG

volatility in prices is

due

tochanges

in thedomestic varieties of a-products, the terms of trade aremore

volatile in rich countrieswhere

theshare ofthe a-industry is large.The

comovement

graph isflat at zero. Whilethe termsof trade respond onlyto country-specific shocks, worldincome

responds onlyto global shocks.As

a resultboth variablesare uncorrelated.

Assume

nextthat the only reasonwhy

business cycles are differentacrosscountries is the

asymmetry

in the elasticityofthe labour supply, i.e. 0^><». Then, T lx-v|-X i— T 1-1 if x <vV

=J !cr-AH

an

dC

=

i .The

volatilitygraph looks likea

V, with1+

A.v

[ 1 if x>

va

minimum

when

x=v. Since all the volatility in prices isdue

tochanges

intheaggregate industry prices, theterms oftrade are

more

volatile in countrieswhere

the share of interindustrytrade in overall trade is large, i.e. | x-v|is large.These

are thevery rich